#gaming payouts api

Explore tagged Tumblr posts

Text

Payout service provider for India - India Payouts

India Payouts is a payment solution provider based in India that offers secure and reliable payout options for businesses. They specialize in payouts for online industries such as gaming and forex trading, but their services can be used for a wide range of businesses.

Here are some of the key services that India Payouts offers:

Multiple Payout Methods: They provide various payout options to suit your needs, including account transfers, debit/credit card transfers, UPI transfers, and payouts to popular wallets like Paytm and Amazon Pay.

Bulk Payouts: India Payouts can handle large volume payouts efficiently, making them a good option for businesses that need to make a lot of payments quickly and easily.

Security: India Payouts uses secure protocols to ensure the safety of your financial data.

In addition to these core services, India Payouts may offer other features such as real-time tracking and automated payouts. Be sure to check their website for the latest info

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

0 notes

Text

My take on the Twitch "brand guidelines" situation, which I've been believing more and more over the last 24 hours:

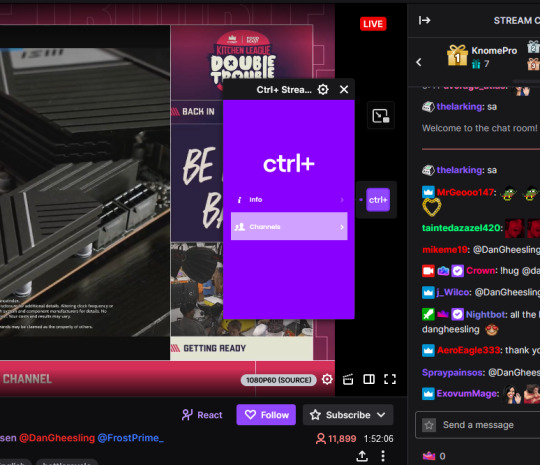

StreamElements is a popular site that hooks in to the Twitch API and lets you create custom alerts (those fancy animated graphics that pop up on stream) for when people subscribe/cheer/follow/donate. Tons of streamers use them! I use them!

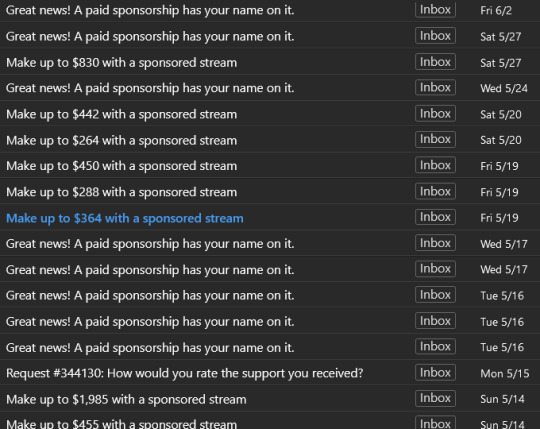

Very recently, like within the last three months, StreamElements has launched a new Sponsorship tab. If you use StreamElements, it's impossible to miss, because they've been sending me 7-10 emails a week about each new sponsor offer I have.

Generally they'll tell me how I could make "up to $900" by doing a sponsored stream with a list of requirements and goals I'd have to meet in order to earn my payout. There's a lot more to it than that, but we'll get to it.

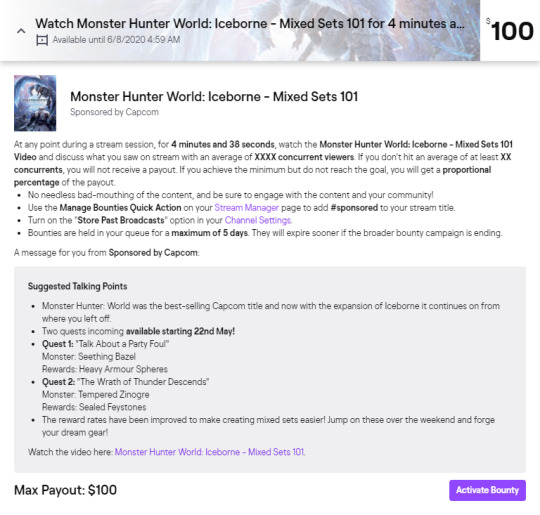

The thing is, this StreamElements Sponsor system is an almost direct clone of a system Twitch already has: the Twitch Bounty Board. But there's a twist: The Twitch Bounty Board is only available to the upper-crust of streamers who hit consistent and moderately good viewership numbers. And the higher numbers you pull in, the bigger bounties you get with bigger payouts.

StreamElements Sponsorships aren't anywhere near as high profile. A Bounty might have a streamer order food from Dominos, comp them the price of the meal, and have them eat and talk about it on camera. A typical StreamElements Sponsor is a gacha mobile game you probably haven't even heard of.

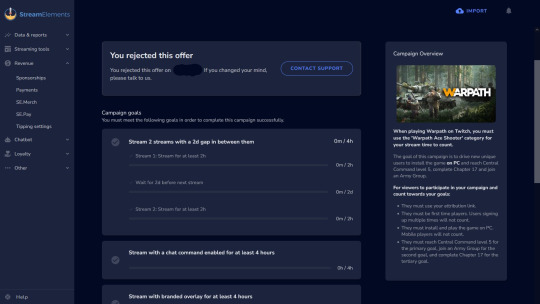

And that "up to $900" claim on StreamElements is just the hook. Once you actually read the terms, you'll learn that the minimum payout is $15, with $900 being the maximum possible earnings. And usually, just to earn that measly $15 minimum, you have to stream for multiple hours, across multiple days, with special overlays, a special chat bot, while also requiring several viewers to use your offer code and also play for multiple hours.

It creates a discrepancy where Twitch Bounties have a higher barrier of entry but a much higher success rate, and the StreamElements sponsors have a much lower barrier of entry and probably a much smaller trickle of money.

The thing is? Twitch likely gets a cut of the bounty payout, but StreamElements doesn't have to pay Twitch anything for a sponsor. And even if the StreamElements sponsor program has lower payouts and more difficult/nebulous requirements, slots still fill up quickly. That's a lot of money changing hands on Twitch that is not necessarily feeding back in to Twitch itself. And it is through a system seemingly designed to devalue something Twitch is already doing.

Twitch slapping down all these rules about "burned-in advertising" were undoubtedly about pulling people out of StreamElements. After all, the new guidelines said it was fine to link things around the video, like in the description/bio below the stream. Since Twitch literally owns the website, in theory it probably wouldn't have been too hard for them to reskin a streamer's entire page for a bounty integration. There are already plugins and things to generate widgets that aren't burned in to the video and hover over the player's HTML.

It's not hard to imagine a scenario where you accept a Twitch bounty for Mountain Dew and it adds a special Mountain Dew Widget over your stream that's part of the video player code itself, something StreamElements would probably never be allowed to do.

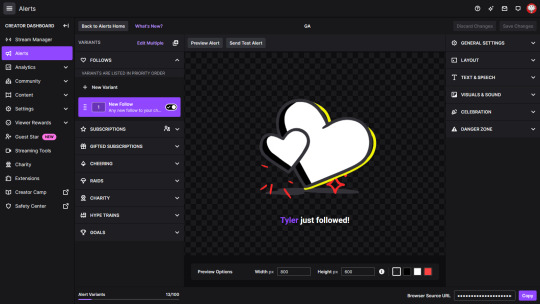

Further evidence for this comes from the fact that, just a few weeks ago, Twitch added a feature to let you generate stream alerts from the Twitch dashboard itself. StreamElements literally started their entire business on robust and highly customizable stream alerts, and once StreamElements started pushing their own bounty board clone with Sponsorships, suddenly Twitch starts testing its own in-house alerts generator.

Twitch was obviously trying to head this off at the pass and provide users as little reason to use StreamElements as humanly possible, but they obviously didn't get there fast enough and were more than a little overzealous.

13 notes

·

View notes

Text

🎮 Streamline Payments with Our Gaming Payment Gateway Solution

Looking for a fast, secure, and reliable payment system for your gaming platform? Our advanced Gaming Payment Gateway Solution is built to handle high-volume transactions with ease. From instant Payin for Gaming to automated withdrawals using our Gaming Payout Payin API, we’ve got everything you need to power seamless in-game payments.

💡 Key Features:

Real-time deposits and payouts

Multiple payment modes (UPI, cards, wallets)

Single API integration for payins and payouts

High security and fraud protection

Boost your player experience and simplify your payment operations — explore our gaming payment solutions today!

👉 https://www.scriza.in/pay-in-service

#social media marketing#seo services#techsolutions#search engine optimization#software development#fintech#customsoftware

0 notes

Text

How Do Instant Payouts Work? A Simple Guide to Faster Payments

We live in a world where speed is everything. From food delivery to streaming movies, we expect things instantly—and payments are no exception. That’s why instant payouts are becoming the new standard for individuals and businesses alike.

But how do instant payouts actually work behind the scenes? Let’s break it down.

What Are Instant Payouts?

Instant payouts are exactly what they sound like—payments that are sent and received almost immediately, often within seconds or minutes, instead of the traditional 2–5 business days. This is a game-changer for gig workers, freelancers, small businesses, e-commerce sellers, and even large companies.

The Technology Behind Instant Payouts

1. Payment Gateways & Processors

To make an instant payout, businesses use a payment gateway or processor like:

Stripe

Square

PayPal

Wise

Zelle (in the U.S.)

These platforms act as the middlemen between the business, customer, and banks. When a transaction is completed, they initiate the payout using advanced financial technology that bypasses traditional bank delays.

2. Card Networks & Real-Time Payments

Most instant payouts rely on debit card rails (like Visa Direct or Mastercard Send) or real-time payment networks. These systems are designed to move money quickly between bank accounts or cards, using secure APIs and data encryption.

3. Bank and Card Compatibility

For an instant payout to work, the recipient must have a supported debit card or bank account that can receive instant transfers. Not all banks offer this yet, but adoption is growing fast worldwide.

The Process in Simple Steps

Here’s a basic breakdown of how instant payouts typically work:

A transaction happens: A customer pays you or you complete a job on a gig platform.

Funds are cleared: The platform confirms the payment is successful and available.

You request a payout: You choose to withdraw your earnings via the instant payout option.

Payment processor steps in: The processor routes the funds through a fast-payment network.

Money hits your account: Within seconds or minutes, the money is in your debit card or bank account.

Are Instant Payouts Really Instant?

In most cases—yes. Many platforms deliver funds within seconds to a few minutes. However, some factors can cause slight delays, including:

Bank holidays or after-hours transactions

Technical issues with card networks

Incompatibility with certain banks or cards

Are There Any Fees?

Yes, many platforms charge a small fee per instant payout. This could be a flat fee (e.g., $1.50 per transaction) or a percentage (e.g., 1.5% of the amount). While it's an added cost, many users are happy to pay for the speed and convenience.

Why Use Instant Payouts?

Freelancers & Gig Workers: Get paid daily instead of waiting weeks.

Small Businesses: Improve cash flow and reinvest faster.

E-commerce Sellers: Access profits quickly to restock or pay for marketing.

Service Providers: Offer a better customer experience and reduce payment delays.

Final Thoughts

Instant payouts are revolutionizing the way we think about money movement. Powered by modern payment infrastructure, they offer a fast, secure, and flexible way to access your earnings—when you need them.

If you’re tired of waiting days to get paid, it might be time to explore platforms and tools that offer instant payout options. Fast payments mean faster growth, less stress, and more control over your finances.

Need help finding the best instant payout solution for your business or side hustle? Reach out, and let’s find the right fit for you!

1 note

·

View note

Text

What Is a UPI Verification API and Why It’s Crucial for Your Business

With the explosive growth of UPI (Unified Payments Interface) in India, businesses of all sizes are embracing digital transactions. But with this convenience comes a growing need for security, fraud prevention, and seamless customer experiences. That’s where a UPI Verification API becomes a game-changer.

What Is a UPI Verification API?

A UPI Verification API is a powerful tool that allows businesses to validate a user's UPI ID (Virtual Payment Address or VPA) in real-time. It helps confirm whether the UPI ID is active, valid, and matches the rightful account holder’s name—without initiating any money transfer.

This is especially valuable for fintech platforms, loan apps, e-commerce businesses, gig economy platforms, and any service that relies on digital payments via UPI.

How UPI Verification API Works

The customer enters their UPI ID on your platform.

The API instantly checks the validity of the UPI ID with banking networks.

It returns verified information like the account holder’s name.

You can then use this data to verify users, autofill information, and prevent fraud.

Key Benefits of UPI Verification API for Businesses

1. ✅ Prevents Payment Fraud

Validating UPI IDs before processing transactions ensures the UPI ID actually belongs to the user, reducing the risk of fraud and misdirected payments.

2. ⚡ Faster Customer Onboarding

Use verified data to auto-fill account names, saving customers time and reducing drop-offs during sign-up.

3. 📈 Boosts Payment Accuracy

Avoid failed transactions due to incorrect or fake UPI IDs by verifying details upfront.

4. 🔐 Enhances Trust & Compliance

Use verified account data for KYC (Know Your Customer) purposes and to build trust with users and partners.

5. 🔄 Automates Manual Work

Eliminates the need for human verification and accelerates workflows, especially when processing bulk payments or onboarding users at scale.

Use Cases for UPI Verification API

Fintech apps validating borrower or lender UPI IDs

E-commerce stores streamlining refund and payout processes

Gig platforms verifying worker UPI details

NBFCs & financial institutions running background checks

P2P payment platforms preventing UPI-based scams

Final Thoughts

In a UPI-first economy, verifying UPI IDs in real-time is no longer optional—it’s essential. A Verify UPI API like the one offered by Gridlines empowers businesses to build secure, fast, and trustworthy payment systems. Whether you're dealing with user onboarding, payouts, or compliance, UPI verification gives you a competitive edge.

Ready to secure your UPI transactions? Explore Gridlines' Verify UPI API to get started today.

0 notes

Link

0 notes

Text

How to Build a Winning CSGO Jackpot Script for Your Platform

How to Build a Winning CSGO Jackpot Script for Your Platform

CSGO jackpot platforms are popular among gaming enthusiasts. These platforms allow users to bet skins and win prizes. A CSGO jackpot script is the core of such platforms. It handles user deposits, betting mechanics, and prize distribution. Building a winning script requires planning, development, and testing. This guide will walk you through the process step by step.

Understanding the Basics of a CSGO Jackpot Script

A CSGO jackpot script is software that powers jackpot platforms. It automates the betting process, ensuring fairness and efficiency. Key features include:

- User-friendly interface for easy navigation.

- Secure payment and skin deposit systems.

- Automated prize distribution based on bet amounts.

Understanding the CSGO jackpot source code is essential for customization and security.

Planning Your CSGO Jackpot Platform

Before building your script, plan your platform carefully.

1. Define Your Target Audience

Identify the type of users your platform will attract. Tailor features and design to meet their preferences.

2. Set Goals and Objectives

Determine the purpose of your platform. Set measurable goals for user engagement and growth.

Key Features of a Winning CSGO Jackpot Script

A successful script includes the following features:

1. User Interface (UI) Design

The UI should be clean and intuitive. Include clear buttons, bet displays, and prize information.

2. Backend Functionality

The backend manages bets, calculations, and payouts. Use secure coding practices to prevent fraud.

3. CSGO Jackpot Source Code Structure

The source code includes files written in PHP, JavaScript, and SQL. Organize the code for easy updates and maintenance.

Steps to Build a CSGO Jackpot Script

Follow these steps to build your script:

1. Choose the Right Development Tools

Select programming languages like PHP and frameworks like Laravel. Use Git for version control.

2. Develop the Core Features

Create user registration and login systems.

Implement skin deposit and betting mechanisms.

Build a provably fair system for transparency.

3. Integrate Payment and Skin Systems

Connect with the CSGO API for skin deposits.

Integrate secure payment gateways for transactions.

4. Test and Debug the Script

Conduct thorough testing for functionality and security. Use debugging tools to fix errors in the CSGO jackpot source code.

Customizing Your CSGO Jackpot Script

Customization makes your platform unique.

1. Modify the CSGO Jackpot Source Code

Start with small changes, like adjusting colors or text. Add advanced features like referral systems or leaderboards.

2. Enhance Security Features

Enable SSL encryption for secure transactions.

Implement two-factor authentication for user accounts.

Launching and Maintaining Your Platform

1. Prepare for Launch

Conduct final tests to ensure smooth functionality. Set up customer support channels for user assistance.

2. Post-Launch Maintenance

Regularly update the CSGO jackpot source code for security and performance. Monitor user feedback and make improvements.

Common Challenges and Solutions

1. Debugging the CSGO Jackpot Source Code

Use debugging tools to identify errors. Check logs for issues related to bets or payouts.

2. Ensuring Fairness and Transparency

Use a provably fair system to verify results. Display fairness proofs to build user trust.

Legal and Ethical Considerations

CSGO gambling platforms must comply with local laws. Ensure your platform promotes responsible gambling. Provide resources for users who need help.

Future Trends in CSGO Jackpot Scripts

New technologies are shaping the industry. Blockchain and smart contracts can enhance security. Mobile-friendly platforms are becoming more popular.

Conclusion

Building a winning CSGO jackpot script requires careful planning and execution. Follow this guide to create a secure and engaging platform. For expert assistance, contact AIS Technolabs. They offer reliable solutions to help you succeed.

FAQ

1. What is a CSGO jackpot script?

A CSGO jackpot script is software that powers jackpot platforms. It handles bets, deposits, and prize distribution.

2. How do I build a CSGO jackpot script?

Follow the steps in this guide: plan your platform, develop core features, and test the script thoroughly.

3. Can I customize a CSGO jackpot script?

Yes, you can modify the CSGO jackpot source code to add features or change the design.

4. Is it legal to run a CSGO jackpot platform?

Laws vary by region. Ensure your platform complies with local regulations.

5. Where can I get help building a CSGO jackpot script?

Contact AIS Technolabs for expert solutions and support.

0 notes

Text

Why Smart Contract-Based MLM Software is the Future of Crypto MLM

The multi-level marketing (MLM) industry has always thrived on trust, speed, and scalability. But as the world shifts toward blockchain and cryptocurrencies, traditional MLM models are hitting roadblocks—slow payouts, manual errors, and a lack of transparency. Enter smart contract-based MLM software, a game-changer that merges the efficiency of blockchain with the power of decentralized networks. Imagine a system where commissions are paid automatically, rules are unbreakable, and every transaction is visible to all participants. This isn’t a distant dream—it’s happening now. By 2025, the global blockchain market is projected to reach $39.7 billion, and crypto MLM platforms are riding this wave. Let’s explore why smart contracts are redefining the future of MLM in the crypto era.

What is Cryptocurrency MLM Software Development?

Cryptocurrency MLM software development involves creating platforms that use blockchain technology to manage network marketing activities. Unlike traditional MLM systems, these platforms automate processes like commissions, rewards, and member onboarding through smart contracts—self-executing agreements coded on blockchains like Ethereum or Binance Smart Chain.

Automated Payouts: Payments are triggered instantly when conditions (e.g., sales targets) are met, eliminating delays.

Decentralized Structure: No single entity controls the system, reducing fraud risks.

Real-Time Tracking: Members monitor earnings, referrals, and rewards transparently.

For example, platforms like DeFiChainMLM use blockchain to ensure every referral bonus is paid fairly, with records stored permanently on-chain.

Why Smart Contracts Are Revolutionizing MLM

Smart contracts solve core pain points in traditional MLM: human error, mistrust, and inefficiency. Here’s how:

No Middlemen, No DelaysSmart contracts cut out intermediaries. When a member recruits a new user, the contract automatically validates the action and releases rewards. A 2023 survey found that 68% of MLM businesses using smart contracts reduced payout processing time by over 90%.

Trust Through TransparencyEvery rule (e.g., commission rates) is coded into the contract. Participants can audit the logic, fostering trust. Take CryptoLife MLM: its smart contract publicly outlines how 10% of team sales go to upline members, leaving no room for disputes.

Fraud-Proof SystemsData on blockchains can’t be altered. In 2022, a traditional MLM company lost $2M due to manipulated sales records. Smart contracts prevent this by locking rules and transactions in code.

Key Features of Modern Crypto MLM Platforms

Today’s crypto MLM platforms are designed for security, scalability, and user-friendliness:

Customizable Smart Contracts: Businesses set rules (e.g., commission tiers) without coding expertise.

Multi-Currency Support: Users earn in Bitcoin, Ethereum, or stablecoins like USDT.

User-Friendly Dashboards: Simplified interfaces for tracking referrals, earnings, and withdrawals.

For instance, ChainMasters, a leading crypto MLM platform, lets users switch between ETH and BNB payouts and offers drag-and-drop tools to design reward structures.

The Role of Cryptocurrency MLM Software Development Solutions

Building a smart contract-based MLM platform requires expertise in blockchain and MLM mechanics. Specialized development solutions offer:

Tailored Smart ContractsDevelopers create contracts aligned with business models (e.g., binary, matrix, or unilevel plans).

Exchange IntegrationPlatforms connect to exchanges like Coinbase or Binance for seamless crypto-fiat conversions.

Compliance ToolsBuilt-in KYC/AML checks to meet regulations—critical as governments tighten crypto laws.

A fintech startup, MLMChain, partnered with a development firm to build a platform that integrates Binance’s API. The result? A 50% faster onboarding process and zero compliance issues in two years.

Real-World Success Stories

Smart contract-based MLM isn’t theoretical—it’s delivering results:

Case 1: Global Wellness BrandA health supplements company migrated to a crypto MLM platform in 2023. Using smart contracts, they automated 85% of payouts and boosted member retention by 40% in six months.

Case 2: NFT-Based MLMArtCollective, an NFT project, rewards members for promoting digital art sales. Their smart contract distributes 5% of each sale to referrers, driving a 300% user growth spike.

Challenges and How to Overcome Them

While promising, crypto MLM platforms face hurdles:

Tech Complexity: Not all MLM leaders understand blockchain. Solution: Work with development firms offering training and 24/7 support.

Regulatory Uncertainty: Laws vary by country. Solution: Use modular platforms that adapt to regional compliance needs.

Volatility Risks: Crypto price swings affect earnings. Solution: Offer stablecoin payouts or instant conversion tools.

Conclusion: The Future Is Automated and Transparent

Smart contract-based MLM software isn’t just a trend—it’s the future. By automating payouts, ensuring transparency, and slashing fraud, these platforms solve problems that have plagued MLM for decades. Whether you’re a startup or an established brand, adopting cryptocurrency MLM software development solutions is no longer optional; it’s essential to stay competitive.

The rise of decentralized finance (DeFi) and AI-driven analytics will only accelerate this shift. As one CEO put it, “In five years, MLM without smart contracts will be like using a fax machine in the Zoom era.” Don’t get left behind. Embrace crypto MLM platforms today, and build a network that’s as innovative as your vision.

#smart contract based mlm software development#cryptocurrency mlm software development company#cryptocurrency mlm software development#Blockchain Based Cryptocurrency MLM Software Development Company#White-label Cryptocurrency MLM Software Development solutions

0 notes

Text

How BUIDL Stands Out: High APY, Hourly Rewards, and Secure Ecosystem

Introduction

Decentralized Finance (DeFi) is rapidly evolving, but many protocols suffer from high volatility and unpredictable yields. BUIDL is poised to change the game with its innovative BUIDL Autostaking and Auto-Compounding Protocol (BAP). This financial protocol offers sustainable, automatic staking with the highest stable returns in crypto. By holding $BUIDL tokens, investors can earn a fixed APY of 526.5%, equating to a daily ROI of 0.504%.

BUIDL simplifies DeFi investments with a buy-hold-earn model, allowing users to automatically stake and compound rewards without manual intervention. With rebase rewards every 60 minutes, BUIDL ensures steady growth and financial sustainability.

What is BUIDL?

BUIDL is a DeFi-focused protocol that enhances the staking experience for investors. By integrating automated staking and compounding mechanisms, BUIDL offers a seamless way to earn rewards. Unlike traditional staking models that require manual involvement, BUIDL ensures that rewards are credited automatically.

Key features of BUIDL include:

Automatic Staking – Staking begins the moment you purchase $BUIDL tokens.

Fixed High APY – A guaranteed annual percentage yield of 526.5%.

Sustainable Reward Mechanism – 60-minute rebasing rewards.

Secure and Transparent – Robust mechanisms for liquidity and stability.

How BUIDL Works

BUIDL provides a user-friendly staking experience with automatic reward distribution and compounding mechanisms.

BUIDL Token

BUIDL is the native token of the BUIDL ecosystem. It offers automatic staking and rebase rewards every 60 minutes. Holding $BUIDL tokens in a wallet ensures automatic interest accrual at a rate of 0.021% every 60 minutes.

Auto-Compounding

Unlike other DeFi platforms, BUIDL employs an auto-compounding system that enhances user earnings effortlessly. With an industry-leading fixed APY of 526.5%, BUIDL ensures long-term sustainability. All wallets holding $BUIDL receive auto-compounded interest every hour, creating a passive income stream.

Risk-Free Value (RFV)

The RFV fund stabilizes the ecosystem by maintaining liquidity and supporting staking rewards. A portion of each transaction contributes to the RFV, ensuring consistent payouts and ecosystem sustainability:

5% from buy transactions

6% from sell transactions

Automatic Liquidity Provisioning (LP)

A key challenge in DeFi staking is maintaining liquidity. BUIDL solves this by allocating 5% of trading fees to liquidity pools, ensuring continuous support for the token’s value and stability.

Automatic Token Burn

BUIDL includes an automated burning mechanism to prevent inflation. 1% of each transaction is burned, reducing the circulating supply and increasing token scarcity.

BUIDL Insurance Fund (BIF)

To further secure investors, BUIDL employs a BUIDL Insurance Fund (BIF), funded by:

2% from buy transactions

3% from sell transactions

Why Invest in BUIDL?

Unmatched Fixed APY

BUIDL offers the highest fixed APY in the industry at 526.5%, significantly outperforming competing staking protocols.

Simplicity and Automation

With auto-staking and compounding directly in user wallets, BUIDL eliminates the need for manual interventions, making it ideal for both beginners and seasoned investors.

Robust Security and Stability

With the RFV, BIF, and automated liquidity mechanisms, BUIDL ensures long-term sustainability and protection against market fluctuations.

Fast and Frequent Rebase Rewards

Unlike traditional staking platforms that pay rewards every 8 hours, BUIDL’s hourly rebasing mechanism provides 24 compounding rewards per day.

BUIDL Tokenomics

BUIDL follows a well-structured tokenomics model designed for long-term growth and sustainability.

Initial Supply: 21,000 (1000x lesser than Bitcoin)

Max Supply: 21,000,000

Presale: 40%

Liquidity: 20%

LP Staking Rewards: 20%

Burn: 10%

Presale Bonus: 4%

Strategic Partnerships: 3%

Airdrop & Bounty: 3%

The Future of BUIDL

BUIDL is not just another DeFi project—it is a transformative force in the industry. With its innovative auto-staking protocol, high fixed APY, and sustainability-focused tokenomics, BUIDL is set to redefine decentralized finance.

By streamlining staking processes and integrating risk-mitigating mechanisms, BUIDL makes DeFi accessible to a broader audience. Whether you are a beginner or an experienced investor, BUIDL offers a secure and lucrative opportunity to earn passive income in the crypto space.

Join the BUIDL Revolution

Don’t miss out on the future of DeFi. Be part of the movement that is reshaping decentralized finance. Website: https://buidl.build/ Twitter: https://x.com/buidlbsc Telegram: https://t.me/buidlbsc

BUIDL today, and secure your financial future with the most sustainable auto-staking protocol in DeFi!

AUTHOR

Bitcointalk name : Nano Oscar Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3403818 Telegram name : @NanoOsca BEP20 Address: 0xa42300fAd0aE973bf28Ef4Dc2D19eEd6B60A5b8E

0 notes

Text

PAYOUTS SERVICES IN INDIA FOR YOUR BUSINESS NEEDS - INDIA PAYOUTS

India Payouts is a payment API provider company in India that offers secure and reliable payout solutions for businesses. Their services are designed to streamline the payout process for businesses in various industries, including online gaming, forex trading, and others. They offer features like instant money transfer, real-time tracking, and robust security.

Here are some additional details you can include in your description, depending on what information is most relevant to your target audience:

Supported industries: India Payouts caters to a wide range of industries, but you can mention some of the specific industries they highlight on their website, such as online gaming, forex trading, etc.

Benefits for businesses: Focus on the benefits that India Payouts offers to businesses, such as streamlining payout processes, reducing costs, and improving efficiency.

Security features: Since security is a major concern for businesses that handle financial transactions, you can mention the specific security measures that India Payouts has in place to protect client information.

Ease of integration: If India Payouts offers an easy-to-integrate API, you can mention this as a benefit for businesses looking to quickly implement their payout solution.

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

1 note

·

View note

Text

BUIDL’s APY Promise: Unmatched Returns Backed by Strong Tokenomics

Introduction

Decentralized Finance (DeFi) is rapidly evolving, but many protocols suffer from high volatility and unpredictable yields. BUIDL is poised to change the game with its innovative BUIDL Autostaking and Auto-Compounding Protocol (BAP). This financial protocol offers sustainable, automatic staking with the highest stable returns in crypto. By holding $BUIDL tokens, investors can earn a fixed APY of 526.5%, equating to a daily ROI of 0.504%.

BUIDL simplifies DeFi investments with a buy-hold-earn model, allowing users to automatically stake and compound rewards without manual intervention. With rebase rewards every 60 minutes, BUIDL ensures steady growth and financial sustainability.

What is BUIDL?

BUIDL is a DeFi-focused protocol that enhances the staking experience for investors. By integrating automated staking and compounding mechanisms, BUIDL offers a seamless way to earn rewards. Unlike traditional staking models that require manual involvement, BUIDL ensures that rewards are credited automatically.

Key features of BUIDL include:

Automatic Staking – Staking begins the moment you purchase $BUIDL tokens.

Fixed High APY – A guaranteed annual percentage yield of 526.5%.

Sustainable Reward Mechanism – 60-minute rebasing rewards.

Secure and Transparent – Robust mechanisms for liquidity and stability.

How BUIDL Works

BUIDL provides a user-friendly staking experience with automatic reward distribution and compounding mechanisms.

BUIDL Token

BUIDL is the native token of the BUIDL ecosystem. It offers automatic staking and rebase rewards every 60 minutes. Holding $BUIDL tokens in a wallet ensures automatic interest accrual at a rate of 0.021% every 60 minutes.

Auto-Compounding

Unlike other DeFi platforms, BUIDL employs an auto-compounding system that enhances user earnings effortlessly. With an industry-leading fixed APY of 526.5%, BUIDL ensures long-term sustainability. All wallets holding $BUIDL receive auto-compounded interest every hour, creating a passive income stream.

Risk-Free Value (RFV)

The RFV fund stabilizes the ecosystem by maintaining liquidity and supporting staking rewards. A portion of each transaction contributes to the RFV, ensuring consistent payouts and ecosystem sustainability:

5% from buy transactions

6% from sell transactions

Automatic Liquidity Provisioning (LP)

A key challenge in DeFi staking is maintaining liquidity. BUIDL solves this by allocating 5% of trading fees to liquidity pools, ensuring continuous support for the token’s value and stability.

Automatic Token Burn

BUIDL includes an automated burning mechanism to prevent inflation. 1% of each transaction is burned, reducing the circulating supply and increasing token scarcity.

BUIDL Insurance Fund (BIF)

To further secure investors, BUIDL employs a BUIDL Insurance Fund (BIF), funded by:

2% from buy transactions

3% from sell transactions

Why Invest in BUIDL?

Unmatched Fixed APY

BUIDL offers the highest fixed APY in the industry at 526.5%, significantly outperforming competing staking protocols.

Simplicity and Automation

With auto-staking and compounding directly in user wallets, BUIDL eliminates the need for manual interventions, making it ideal for both beginners and seasoned investors.

Robust Security and Stability

With the RFV, BIF, and automated liquidity mechanisms, BUIDL ensures long-term sustainability and protection against market fluctuations.

Fast and Frequent Rebase Rewards

Unlike traditional staking platforms that pay rewards every 8 hours, BUIDL’s hourly rebasing mechanism provides 24 compounding rewards per day.

BUIDL Tokenomics

BUIDL follows a well-structured tokenomics model designed for long-term growth and sustainability.

Initial Supply: 21,000 (1000x lesser than Bitcoin)

Max Supply: 21,000,000

Presale: 40%

Liquidity: 20%

LP Staking Rewards: 20%

Burn: 10%

Presale Bonus: 4%

Strategic Partnerships: 3%

Airdrop & Bounty: 3%

The Future of BUIDL

BUIDL is not just another DeFi project—it is a transformative force in the industry. With its innovative auto-staking protocol, high fixed APY, and sustainability-focused tokenomics, BUIDL is set to redefine decentralized finance.

By streamlining staking processes and integrating risk-mitigating mechanisms, BUIDL makes DeFi accessible to a broader audience. Whether you are a beginner or an experienced investor, BUIDL offers a secure and lucrative opportunity to earn passive income in the crypto space.

Join the BUIDL Revolution

Don’t miss out on the future of DeFi. Be part of the movement that is reshaping decentralized finance. Website: https://buidl.build/ Twitter: https://x.com/buidlbsc Telegram: https://t.me/buidlbsc

BUIDL today, and secure your financial future with the most sustainable auto-staking protocol in DeFi!

Writer info

Bitcointalk name: Greson Milo Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3382083 Telegram Username: @GresonMilo Wallet address: 0xc9395C46a11385e0E0bDa33758D38f0c25261E73

0 notes

Text

Building Wealth with BUIDL: The Sustainable Way to Invest in DeFi

Introduction

Decentralized Finance (DeFi) is rapidly evolving, but many protocols suffer from high volatility and unpredictable yields. BUIDL is poised to change the game with its innovative BUIDL Autostaking and Auto-Compounding Protocol (BAP). This financial protocol offers sustainable, automatic staking with the highest stable returns in crypto. By holding $BUIDL tokens, investors can earn a fixed APY of 526.5%, equating to a daily ROI of 0.504%.

BUIDL simplifies DeFi investments with a buy-hold-earn model, allowing users to automatically stake and compound rewards without manual intervention. With rebase rewards every 60 minutes, BUIDL ensures steady growth and financial sustainability.

What is BUIDL?

BUIDL is a DeFi-focused protocol that enhances the staking experience for investors. By integrating automated staking and compounding mechanisms, BUIDL offers a seamless way to earn rewards. Unlike traditional staking models that require manual involvement, BUIDL ensures that rewards are credited automatically.

Key features of BUIDL include:

Automatic Staking – Staking begins the moment you purchase $BUIDL tokens.

Fixed High APY – A guaranteed annual percentage yield of 526.5%.

Sustainable Reward Mechanism – 60-minute rebasing rewards.

Secure and Transparent – Robust mechanisms for liquidity and stability.

How BUIDL Works

BUIDL provides a user-friendly staking experience with automatic reward distribution and compounding mechanisms.

BUIDL Token

BUIDL is the native token of the BUIDL ecosystem. It offers automatic staking and rebase rewards every 60 minutes. Holding $BUIDL tokens in a wallet ensures automatic interest accrual at a rate of 0.021% every 60 minutes.

Auto-Compounding

Unlike other DeFi platforms, BUIDL employs an auto-compounding system that enhances user earnings effortlessly. With an industry-leading fixed APY of 526.5%, BUIDL ensures long-term sustainability. All wallets holding $BUIDL receive auto-compounded interest every hour, creating a passive income stream.

Risk-Free Value (RFV)

The RFV fund stabilizes the ecosystem by maintaining liquidity and supporting staking rewards. A portion of each transaction contributes to the RFV, ensuring consistent payouts and ecosystem sustainability:

5% from buy transactions

6% from sell transactions

Automatic Liquidity Provisioning (LP)

A key challenge in DeFi staking is maintaining liquidity. BUIDL solves this by allocating 5% of trading fees to liquidity pools, ensuring continuous support for the token’s value and stability.

Automatic Token Burn

BUIDL includes an automated burning mechanism to prevent inflation. 1% of each transaction is burned, reducing the circulating supply and increasing token scarcity.

BUIDL Insurance Fund (BIF)

To further secure investors, BUIDL employs a BUIDL Insurance Fund (BIF), funded by:

2% from buy transactions

3% from sell transactions

Why Invest in BUIDL?

Unmatched Fixed APY

BUIDL offers the highest fixed APY in the industry at 526.5%, significantly outperforming competing staking protocols.

Simplicity and Automation

With auto-staking and compounding directly in user wallets, BUIDL eliminates the need for manual interventions, making it ideal for both beginners and seasoned investors.

Robust Security and Stability

With the RFV, BIF, and automated liquidity mechanisms, BUIDL ensures long-term sustainability and protection against market fluctuations.

Fast and Frequent Rebase Rewards

Unlike traditional staking platforms that pay rewards every 8 hours, BUIDL’s hourly rebasing mechanism provides 24 compounding rewards per day.

BUIDL Tokenomics

BUIDL follows a well-structured tokenomics model designed for long-term growth and sustainability.

Initial Supply: 21,000 (1000x lesser than Bitcoin)

Max Supply: 21,000,000

Presale: 40%

Liquidity: 20%

LP Staking Rewards: 20%

Burn: 10%

Presale Bonus: 4%

Strategic Partnerships: 3%

Airdrop & Bounty: 3%

The Future of BUIDL

BUIDL is not just another DeFi project—it is a transformative force in the industry. With its innovative auto-staking protocol, high fixed APY, and sustainability-focused tokenomics, BUIDL is set to redefine decentralized finance.

By streamlining staking processes and integrating risk-mitigating mechanisms, BUIDL makes DeFi accessible to a broader audience. Whether you are a beginner or an experienced investor, BUIDL offers a secure and lucrative opportunity to earn passive income in the crypto space.

Join the BUIDL Revolution

Don’t miss out on the future of DeFi. Be part of the movement that is reshaping decentralized finance. Website: https://buidl.build/ Twitter: https://x.com/buidlbsc Telegram: https://t.me/buidlbsc

BUIDL today, and secure your financial future with the most sustainable auto-staking protocol in DeFi!

Author details:

Bitcointalk name: LiloBee Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2814494 Address: 0xFeACf80A4d4e100bFedd609069BfBe22BE2EBb63

0 notes

Text

Level Up Your Gaming Platform: The Power of Gaming Payin & Payout API Providers

The online gaming industry is booming, and with it, the demand for seamless and secure financial transactions is skyrocketing. Players expect instant deposits and withdrawals, and gaming platforms need reliable solutions to meet these expectations. This is where Gaming Payin Payout Api provider & Payout API providers come into play, streamlining financial processes and enhancing the overall gaming experience.

Understanding the Importance of Gaming Payin & Payout APIs

Gaming Payin & Payout API providers offer a crucial bridge between gaming platforms and payment gateways. These APIs enable players to deposit funds into their accounts and withdraw winnings quickly and securely. By automating these processes, gaming platforms can significantly reduce manual effort, minimize errors, and improve customer satisfaction.

Key Benefits of Integrating Gaming Payin & Payout APIs

Instant Transactions: Enables real-time deposits and withdrawals, enhancing player satisfaction.

Secure Payment Processing: Implements robust security protocols to protect sensitive financial data.

Multiple Payment Options: Supports a wide range of payment methods, catering to diverse player preferences.

Automated Processes: Reduces manual effort and minimizes errors in financial transactions.

Improved Player Experience: Provides a seamless and convenient payment experience.

Enhanced Security and Compliance: Meets regulatory requirements and protects against fraud.

API Integration: Many providers also offer other important API's like Payout API, Payout Settlement API, and KYC Verification API Provider.

Cyrus Recharge: Your Gaming Transaction Partner

Cyrus Recharge is a leading API provider in India, offering robust and reliable Gaming Payin & Payout API provider solutions. They understand the unique demands of the gaming industry and provide tailored solutions that enhance operational efficiency and player satisfaction.

Cyrus Recharge prioritizes security, speed, and reliability, ensuring that gaming platforms can provide a seamless and secure transaction experience. Their dedication to innovation and customer support makes them a trusted partner for businesses in the gaming sector. They also provide other API's like Payout API, Payout Settlement API, and KYC Verification API to provide a full suite of services.

By choosing Cyrus Recharge, you gain access to:

Secure and reliable Gaming Payin & Payout APIs

Fast and efficient transaction processing

Seamless integration with gaming platforms

Comprehensive API support

Competitive pricing

A range of complementary APIs.

Expanding Functionality with Complementary APIs

For gaming platforms seeking to offer comprehensive financial services and comply with regulations, integrating complementary APIs such as Payout API, Payout Settlement API, and KYC Verification API Provider is essential. These APIs enhance operational efficiency and ensure compliance.

Payout API: Automates the disbursement of winnings and other payouts.

Payout Settlement API: Ensures accurate and timely settlement of financial transactions.

KYC Verification API Provider: Streamlines player verification, ensuring compliance and preventing fraud.

The Future of Gaming Transactions

The Gaming Payin & Payout API provider is revolutionizing the gaming industry by providing instant, secure, and efficient transaction solutions. As the online gaming market continues to grow, the demand for reliable and robust gaming payment APIs will only increase.

FAQs:

What is a Gaming Payin & Payout API and how does it benefit gaming platforms?

A Gaming Payin & Payout API enables gaming platforms to integrate secure and efficient payment processing into their systems. It benefits platforms by providing instant transactions, enhancing player satisfaction, and reducing manual effort.

How does a Payout Settlement API improve financial operations for gaming platforms?

A Payout Settlement API automates the settlement of winnings and other payouts, ensuring accurate and timely disbursement of funds. This minimizes errors and improves overall financial efficiency.

Why is KYC Verification important for gaming platforms using Payin & Payout APIs?

KYC Verification is crucial for ensuring compliance with regulatory requirements and preventing fraudulent activities. It helps gaming platforms verify player identities, building trust and security in digital transactions.

0 notes

Text

Buidl Protocol (BAP) Auto-Staking and Auto-Compounding with Sustainable Payouts: Revolutionary Crypto Investment Opportunity with Highest Fixed APY at 526.5%

Introduction

In the rapidly evolving world of cryptocurrency, Buidl Protocol (BAP) has introduced a game-changing feature that aims to redefine how crypto enthusiasts can earn passive income. With a fixed Annual Percentage Yield (APY) of 526.5%, BAP offers one of the highest fixed returns in the industry, drawing attention from both novice and seasoned investors. What makes this even more exciting is the integration of auto-staking and auto-compounding mechanisms, coupled with continuous payouts that ensure your investment grows effortlessly. Let's dive deeper into how BAP works and why it’s creating such a buzz in the crypto space.

What is Buidl Protocol (BAP)?

Buidl Protocol is a decentralized finance (DeFi) project designed to maximize the potential of crypto investments by providing innovative solutions that enhance yield generation. The protocol allows users to stake their tokens and receive rewards while minimizing the need for manual intervention. Through its auto-staking and auto-compounding features, BAP simplifies the investment process, making it accessible for everyone, whether they’re crypto experts or beginners.

At the core of BAP is its token, BAP (Buidl), which operates within a unique ecosystem designed for high yields and user-friendly rewards.

Auto-Staking: Simplifying Passive Income

Auto-staking is a feature that allows users to stake their BAP tokens and receive rewards automatically without needing to manually claim or restake their tokens. This process ensures that rewards are continuously added to the staked amount, allowing for compounding returns. By locking in tokens, investors can accumulate rewards in real-time, significantly reducing the effort and complexity typically associated with staking cryptocurrencies.

For investors, auto-staking is a major convenience. The days of manually tracking rewards and ensuring timely restaking are gone. With BAP, you simply stake your tokens, sit back, and watch your portfolio grow with no additional action required.

Auto-Compounding: Supercharging Your Returns

Auto-compounding is another integral feature of the BAP ecosystem. When rewards are received, they are automatically added to your staked balance, which in turn increases the amount of tokens you are earning from subsequent payouts. This creates a snowball effect that can rapidly amplify your earnings over time.

Instead of manually reinvesting rewards, auto-compounding ensures that the process is entirely hands-off while still driving significant growth in your holdings. The integration of auto-compounding with auto-staking creates a seamless experience for users who want to maximize their returns without needing to actively manage their investments.

Continuous Payouts: Reaping Rewards in Real-Time

BAP stands out from the crowd by offering continuous payouts, ensuring that rewards are distributed in real-time. This is in stark contrast to many staking protocols that offer periodic payouts, often on a weekly or monthly basis. Continuous payouts from BAP mean that users can access their rewards more frequently, offering more flexibility and a sense of liquidity within the staking system.

The beauty of continuous payouts lies in the constant growth of your investment. Each time you receive a payout, your balance increases, allowing you to reinvest and further boost your yield generation. Whether you’re looking to reinvest in other crypto assets or simply enjoy the rewards, the continuous payout structure gives you the freedom to make real-time decisions.

The BAP Fixed 526.5% APY: A Game-Changer

One of the most compelling reasons to consider Buidl Protocol is its highly attractive fixed APY of 526.5%. In the world of crypto investments, high APYs are often marketed by various projects, but many come with hidden risks or fluctuate over time. BAP, on the other hand, offers a fixed APY, meaning that users can expect a guaranteed return of 526.5% on their staked tokens annually.

This level of fixed APY is not only rare but also highly advantageous for investors seeking to maximize their returns with minimal risk. A fixed return, especially at this level, provides a sense of security in an often volatile market.

How BAP Compares to Other Investment Options

When comparing BAP to other crypto staking platforms, it's clear that its combination of auto-staking, auto-compounding, continuous payouts, and a fixed APY of 526.5% puts it ahead of the pack. Many other DeFi platforms offer high APYs, but they may require more active involvement or come with fluctuating rates that depend on market conditions.

Additionally, BAP's simplified approach with auto-staking and auto-compounding gives it an edge in terms of user experience. While other protocols may require more complex strategies or third-party tools to optimize staking rewards, BAP provides an effortless, hands-off way for investors to grow their holdings over time.

The Future of Buidl Protocol

As the DeFi space continues to evolve, Buidl Protocol is well-positioned to play a major role in shaping the future of passive income generation within the crypto space. With plans for further expansion and the development of new features, BAP is continuously innovating to offer even more value to its community of users.

The BAP team has demonstrated a clear commitment to delivering a secure, user-friendly, and high-performing staking platform that delivers unmatched returns. With an ever-growing community and increasing interest in auto-staking and auto-compounding solutions, Buidl Protocol is poised to become a key player in the DeFi ecosystem.

Buy Now

Conclusion

Buidl Protocol (BAP) is ushering in a new era of crypto investments with its auto-staking and auto-compounding features, continuous payouts, and an industry-leading fixed APY of 526.5%. Whether you’re a seasoned investor or new to the world of cryptocurrency, BAP offers a hassle-free, high-reward staking experience that makes earning passive income easier than ever.

With its unique features, BAP stands out as one of the most promising and innovative DeFi platforms in the market today, offering long-term value to those looking to maximize their crypto holdings.

If you're looking for a reliable, hands-off way to grow your crypto portfolio, BAP might just be the solution you've been waiting for.

Visit the Official Website Below:

Website: https://buidl.build

Twitter: https://x.com/buidlbsc

TG Group: https://t.me/buidlbsc

TG Channel: https://t.me/buidl_bsc

White Paper: https://buidl-token.gitbook.io/buidl-token

Author

Bitcointalk Username: Lembur Kuring

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=3468667

Telegram username: @klembur

BSC Wallet Address: 0xB550e73cc49d93c4749D8C4357993c3C50987843

0 notes

Text

Instant Payout Services: A Boon for Gig Workers in India

India's gig economy is booming, driven by an increasing number of freelancers, delivery agents, ride-hailing drivers, and other independent contractors. These gig workers play a crucial role in the economy, bridging gaps in services across industries. However, one of the significant challenges they face is timely payment for their hard work. This is where instant payout service providers in India emerge as a game-changer, offering solutions that not only benefit gig workers but also strengthen the businesses they collaborate with.

The Need for Instant Payouts

Traditionally, payments to gig workers were processed on a weekly or monthly basis. This delay often caused financial strain, especially for workers who rely on daily earnings to meet their expenses.

Instant payout services address this gap by ensuring that workers receive their earnings immediately after completing a task. This seamless payment process is not just a convenience but a necessity in today’s fast-paced gig ecosystem.

How Instant Payouts Work

Instant payout services leverage advanced financial technology to process payments in real-time. Here's how the process typically works:

Completion of Task: The gig worker finishes the assigned task or delivery.

Request for Payment: A request for payment is generated, either automatically or manually through a platform.

Payment Processing: Using secure payment gateways and APIs, the payout is processed instantly.

Funds Credited: The amount is credited to the worker’s bank account, wallet, or card within seconds.

Benefits for Gig Workers

Financial FlexibilityInstant access to earnings empowers gig workers to manage their day-to-day expenses without delays. They no longer need to rely on loans or credit to bridge the gap until payday.

Increased TrustWorkers are more likely to trust platforms that ensure timely payouts. This leads to better retention and loyalty among gig workers.

Transparency and ControlWith instant payouts, workers have better visibility into their earnings and can track payments easily, promoting financial discipline and planning.

Reduced StressThe assurance of immediate payments alleviates financial stress, allowing workers to focus on delivering quality service.

Advantages for Businesses

Enhanced Workforce MotivationTimely payments keep workers motivated and engaged, resulting in higher productivity.

Improved ReputationBusinesses that offer instant payouts are viewed as worker-friendly, attracting top talent in the gig ecosystem.

Operational EfficiencyInstant payout services streamline payment processes, reducing administrative burden and errors associated with traditional payment methods.

ScalabilityAs the gig economy grows, instant payout solutions offer scalability, enabling businesses to handle a large number of transactions efficiently.

The Role of Fintech in Instant Payout Services

The rapid growth of fintech in India has been instrumental in the success of instant payout services. Companies offering these solutions integrate with businesses’ platforms to provide secure, compliant, and hassle-free payouts. Advanced technologies like UPI (Unified Payments Interface) and digital wallets have further accelerated the adoption of instant payouts, making the process smooth for both businesses and workers.

Conclusion

Instant payout services are revolutionizing India’s gig economy, creating a win-win situation for both workers and businesses. As a vital component of payment solutions in India, these services address the critical need for timely payments, improving the financial well-being of gig workers while contributing to the growth and efficiency of businesses.

As India continues its journey towards a digital-first economy, instant payouts are set to become the backbone of the gig ecosystem, ensuring financial inclusivity and fostering a culture of trust and transparency.

0 notes

Text

Wild Fireworks

Game slot Wild Fireworks adalah salah satu permainan mesin slot yang mengusung tema kembang api dan sering kali memiliki grafis yang cerah dan penuh warna. Berikut adalah cara umum untuk bermain game slot Wild Fireworks, meskipun langkah-langkah ini bisa bervariasi tergantung platform yang Anda gunakan:

1. Pahami Antarmuka Game

Sebelum mulai bermain, pastikan Anda memahami antarmuka slot tersebut. Biasanya, terdapat beberapa elemen penting:

Paylines (Garis Pembayaran): Ini adalah jalur tempat simbol-simbol yang cocok harus mendarat untuk menang. Beberapa game slot menawarkan paylines tetap, sementara lainnya memungkinkan Anda untuk memilih jumlah garis pembayaran.

Spin Button (Tombol Putar): Tombol ini digunakan untuk memutar gulungan.

Bet (Taruhan): Ini mengatur jumlah taruhan yang Anda pasang per putaran.

Auto-Play: Fitur yang memungkinkan Anda untuk mengatur game agar berputar secara otomatis untuk sejumlah putaran tertentu.

Payout Table (Tabel Pembayaran): Tabel ini menunjukkan kombinasi simbol yang menghasilkan kemenangan dan seberapa banyak Anda dapat menang dari masing-masing kombinasi tersebut.

2. Setel Taruhan

Sebelum memutar gulungan, Anda harus menentukan jumlah taruhan yang ingin dipasang. Biasanya, Anda dapat mengatur taruhan per putaran menggunakan tombol yang sesuai. Dalam Wild Fireworks, Anda bisa memilih untuk bertaruh pada satu atau lebih paylines, atau mengubah nilai taruhan yang Anda pasang untuk setiap garis pembayaran.

3. Pahami Simbol-Simbol

Pada Wild Fireworks, simbol yang ditampilkan umumnya berkaitan dengan tema kembang api, seperti kembang api itu sendiri, angka, dan simbol Wild. Berikut adalah beberapa simbol yang umumnya ditemukan:

Wild Symbol: Biasanya menggantikan simbol lain untuk membantu menciptakan kombinasi yang menang.

Scatter Symbol: Biasanya memberi pembayaran atau memicu fitur bonus saat muncul di sejumlah gulungan tertentu.

Simbol Pembayaran Tinggi dan Rendah: Ini adalah simbol-simbol yang memberi hadiah utama atau hadiah kecil, tergantung pada posisi dan kombinasi yang terbentuk.

4. Mulai Putaran

Setelah Anda menyesuaikan taruhan, tekan tombol spin untuk memutar gulungan. Gulungan akan berputar dan berhenti secara acak. Jika ada kombinasi simbol yang cocok pada garis pembayaran yang aktif, Anda akan menang sesuai dengan nilai yang tercantum pada tabel pembayaran.

5. Fitur Bonus dan Free Spins

Banyak game slot, termasuk Wild Fireworks, menawarkan fitur bonus atau putaran gratis (free spins). Berikut adalah beberapa fitur bonus yang mungkin ada:

Putaran Gratis (Free Spins): Fitur ini biasanya diaktifkan dengan mendapatkan sejumlah simbol scatter tertentu di gulungan. Selama putaran gratis, Anda mungkin memiliki kesempatan untuk menang lebih banyak karena beberapa fitur tambahan (seperti pengganda kemenangan).

Fitur Wild atau Multiplier: Simbol Wild bisa memperbesar peluang kemenangan, atau ada pengganda yang meningkatkan jumlah kemenangan.

6. Menang atau Kalah

Setiap kali Anda berhasil membentuk kombinasi simbol yang menang di garis pembayaran yang aktif, Anda akan mendapatkan kemenangan sesuai dengan nilai yang tertera pada tabel pembayaran. Jika tidak ada kombinasi yang menang, Anda akan kehilangan taruhan untuk putaran tersebut.

7. Keluar atau Lanjutkan Bermain

Jika Anda ingin berhenti bermain, Anda bisa keluar kapan saja. Jika Anda merasa beruntung, Anda bisa terus bermain dan mencoba meningkatkan kemenangan Anda.

Tips Bermain:

Kelola Bankroll Anda: Tentukan anggaran sebelum bermain dan pastikan Anda tidak melebihi batas tersebut.

Cek Fitur Bonus: Banyak permainan slot memiliki fitur bonus atau putaran gratis yang bisa meningkatkan peluang menang.

Pelajari Tabel Pembayaran: Memahami kombinasi simbol yang memberikan pembayaran tertinggi sangat penting untuk strategi Anda.

Selamat bermain dan semoga beruntung!

0 notes