Don't wanna be here? Send us removal request.

Text

Streamline Insurance KYC & Onboarding with Gridlines

Discover how Gridlines' Insurance API helps insurers simplify customer onboarding, automate KYC, and ensure regulatory compliance. With scalable infrastructure and secure data handling, insurance companies can boost efficiency and deliver a seamless digital experience.

0 notes

Text

Unlocking the Future of InsurTech with Insurance APIs

In the rapidly evolving landscape of financial services, insurance companies are under increasing pressure to deliver seamless digital experiences, maintain compliance, and improve operational efficiency. One technology that’s transforming this industry from the ground up is the Insurance API.

An Insurance API (Application Programming Interface) acts as a bridge that connects insurers to digital platforms, customer data sources, verification services, and compliance tools. This integration empowers insurers to streamline their onboarding processes, reduce manual effort, and ensure faster, more secure service delivery.

One of the standout use cases of Insurance APIs is customer onboarding. Traditionally, onboarding new policyholders involved significant paperwork, manual verification, and back-and-forth communication—leading to delays and customer dissatisfaction. With an API-powered workflow, insurers can automate KYC (Know Your Customer) processes, fetch verified customer data in real-time, and drastically reduce turnaround time. This not only enhances user experience but also cuts operational costs.

Take Gridlines, for example—a platform offering a robust Insurance API that simplifies KYC, automates compliance checks, and ensures data integrity throughout the onboarding journey. Gridlines’ API infrastructure is designed for scalability, meaning insurance providers can handle large volumes of users without compromising on performance or security. Whether it's verifying identity through CKYC data, performing background checks, or enabling real-time document validation, an API-first approach equips insurers with the agility they need to thrive in a digital-first world.

Moreover, Insurance APIs play a vital role in maintaining compliance. With evolving regulatory landscapes like IRDAI’s KYC norms and data protection guidelines, staying compliant is non-negotiable. APIs offer a consistent and auditable way to enforce compliance policies, reducing the risk of human error and regulatory breaches.

Beyond onboarding and compliance, Insurance APIs open doors to advanced analytics, fraud detection, and personalized policy recommendations based on real-time data. This level of intelligence was previously difficult to achieve without extensive infrastructure and manual intervention.

As insurance providers aim to meet the demands of a tech-savvy generation, embracing Insurance APIs is no longer optional—it’s essential. The future of insurance lies in digital transformation, and APIs are the building blocks enabling this shift.

In conclusion, whether you're a legacy insurer looking to modernize or a new-age digital-first insurer, integrating an Insurance API like the one offered by Gridlines can be a game-changer. It’s time to future-proof your insurance operations—starting with your API strategy.

#InsuranceTech#DigitalOnboarding#KYC#InsurTech#APIIntegration#RegTech#CustomerExperience#Gridlines#InsuranceCompliance

0 notes

Text

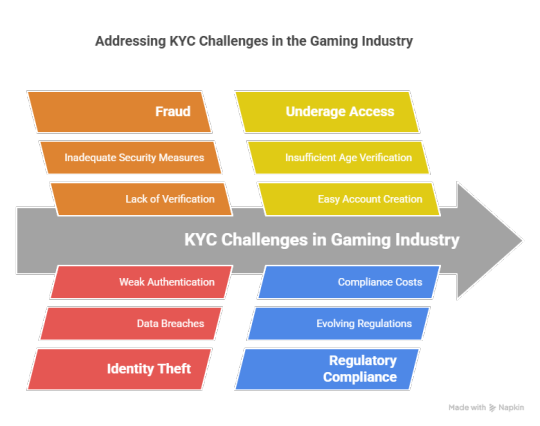

KYC in the Gaming Industry: Building Trust, Compliance, and Security

The gaming industry has witnessed explosive growth over the past decade, with millions of players participating in online games, esports, fantasy leagues, and betting platforms. As the digital entertainment landscape expands, so do concerns around fraud, identity theft, and underage access. This is where KYC in the gaming industry becomes crucial—ensuring platforms can foster trust, enhance user experience, and maintain regulatory compliance.

Why KYC Matters in Gaming

Traditionally tied to sectors like banking and fintech, KYC (Know Your Customer) has become increasingly vital in gaming. Today’s online gaming platforms manage sensitive user data, digital wallets, and real-money transactions. Without a reliable user verification mechanism, these platforms are vulnerable to misuse by bots, scammers, and fraudulent users.

KYC in the gaming industry helps verify the identity of each player, detect suspicious activity, and prevent financial crimes like money laundering. It also ensures age restrictions are enforced—especially important in countries where gaming or gambling is age-gated. From a regulatory standpoint, KYC supports compliance with AML (Anti-Money Laundering) laws, GDPR, and local gaming authority mandates.

How KYC Enhances Trust and Safety

From a player’s perspective, KYC fosters transparency and safety. Knowing that a platform prioritizes identity verification assures users that they're part of a secure and fair environment. When players feel confident that bad actors are being kept out, they're more likely to stay engaged, make purchases, and recommend the platform to others.

For gaming operators, the benefits of KYC in the gaming industry are equally compelling. It enables them to:

Onboard users securely and efficiently

Detect and prevent duplicate or fake accounts

Comply with international legal and data protection standards

Reduce chargeback fraud and suspicious payments

Moreover, with robust KYC systems in place, companies can conduct risk-based profiling and flag high-risk users for additional checks—allowing for smarter compliance and security measures without disrupting the broader user base.

Challenges in Implementing KYC

Despite its benefits, KYC implementation in gaming comes with certain challenges:

Friction in the user journey: Lengthy verification processes can increase drop-offs.

Global compliance complexity: Platforms operating across countries must navigate different KYC and data privacy regulations.

Tech integration: Legacy systems may not support seamless integration of modern KYC solutions.

To succeed, gaming companies must strike a balance between security and user convenience.

Gridlines: Simplifying KYC in the Gaming Industry

This is where innovative platforms like Gridlines step in. Gridlines offers a customizable and frictionless KYC infrastructure designed specifically for fast-paced digital platforms—including gaming.

With Gridlines, gaming operators can:

Verify user identities in real time using AI-powered document recognition and biometric checks

Comply with regional laws and age verification protocols

Integrate KYC workflows directly into the platform or game interface via APIs

Reduce user drop-offs with a seamless and mobile-first verification experience

By simplifying the onboarding process and enabling scalable verification, Gridlines helps solve real-world KYC challenges while ensuring players remain engaged and compliant.

The Future of KYC in the Gaming Industry

As the global gaming industry continues to evolve—particularly with the rise of blockchain gaming, metaverse participation, and cross-border eSports—the importance of a streamlined, trustworthy KYC process will only grow.

Future-ready gaming platforms are likely to adopt:

Biometric authentication (e.g., facial recognition)

Decentralized identity (DID) systems

Real-time fraud detection tools

Continuous KYC that updates player profiles based on behavioral risk scoring

In this landscape, investing in effective, scalable, and user-friendly KYC in the gaming industry is more than a compliance task—it’s a competitive advantage.

Conclusion

KYC in the gaming industry is no longer optional. It is foundational to building a trusted, inclusive, and compliant digital ecosystem for gamers and operators alike. As threats evolve and regulations tighten, the companies that lead in KYC adoption—through platforms like Gridlines—will be best positioned to thrive in this dynamic, global space.Gaming isn’t just about playing anymore—it’s about playing safe.

0 notes

Text

Learn what a UPI Verification API is, how it works, and why it’s essential for businesses. Discover how verifying UPI IDs boosts payment security, reduces fraud, and streamlines onboarding. Ideal for fintech, e-commerce, and any business handling UPI payments in India.

0 notes

Text

What Is a UPI Verification API and Why It’s Crucial for Your Business

With the explosive growth of UPI (Unified Payments Interface) in India, businesses of all sizes are embracing digital transactions. But with this convenience comes a growing need for security, fraud prevention, and seamless customer experiences. That’s where a UPI Verification API becomes a game-changer.

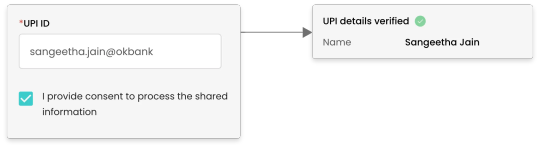

What Is a UPI Verification API?

A UPI Verification API is a powerful tool that allows businesses to validate a user's UPI ID (Virtual Payment Address or VPA) in real-time. It helps confirm whether the UPI ID is active, valid, and matches the rightful account holder’s name—without initiating any money transfer.

This is especially valuable for fintech platforms, loan apps, e-commerce businesses, gig economy platforms, and any service that relies on digital payments via UPI.

How UPI Verification API Works

The customer enters their UPI ID on your platform.

The API instantly checks the validity of the UPI ID with banking networks.

It returns verified information like the account holder’s name.

You can then use this data to verify users, autofill information, and prevent fraud.

Key Benefits of UPI Verification API for Businesses

1. ✅ Prevents Payment Fraud

Validating UPI IDs before processing transactions ensures the UPI ID actually belongs to the user, reducing the risk of fraud and misdirected payments.

2. ⚡ Faster Customer Onboarding

Use verified data to auto-fill account names, saving customers time and reducing drop-offs during sign-up.

3. 📈 Boosts Payment Accuracy

Avoid failed transactions due to incorrect or fake UPI IDs by verifying details upfront.

4. 🔐 Enhances Trust & Compliance

Use verified account data for KYC (Know Your Customer) purposes and to build trust with users and partners.

5. 🔄 Automates Manual Work

Eliminates the need for human verification and accelerates workflows, especially when processing bulk payments or onboarding users at scale.

Use Cases for UPI Verification API

Fintech apps validating borrower or lender UPI IDs

E-commerce stores streamlining refund and payout processes

Gig platforms verifying worker UPI details

NBFCs & financial institutions running background checks

P2P payment platforms preventing UPI-based scams

Final Thoughts

In a UPI-first economy, verifying UPI IDs in real-time is no longer optional—it’s essential. A Verify UPI API like the one offered by Gridlines empowers businesses to build secure, fast, and trustworthy payment systems. Whether you're dealing with user onboarding, payouts, or compliance, UPI verification gives you a competitive edge.

Ready to secure your UPI transactions? Explore Gridlines' Verify UPI API to get started today.

0 notes

Text

Explore how Gridlines' FaceMatch API combines advanced face matching and liveliness detection to help businesses verify identities securely, prevent digital fraud, and streamline user on-boarding with real-time, scalable, and AI-powered verification solutions.

0 notes

Text

Smarter, Safer Identity Checks with Gridlines Face API

In a world where digital identity fraud is rising, verifying faces with precision and speed is no longer optional—it’s essential. Gridlines’ FaceMatch API empowers organizations with cutting-edge tools to validate identities at scale, combining facial recognition and liveness detection into a seamless, secure process.

Why Facial Verification Matters

Businesses across industries—whether in finance, fintech, e-commerce, or gig platforms—rely on accurate identity verification to reduce fraud, meet regulatory compliance, and enhance user trust. Traditional manual verification methods are often slow, expensive, and error-prone. That’s where the Gridlines FaceMatch API comes in.

What Makes Gridlines FaceMatch API Stand Out?

1. Face Match VerificationGridlines compares a user’s selfie with their ID photo to confirm they are who they claim to be. The FaceMatch API uses AI-powered facial recognition technology to assess similarity scores with high accuracy, ensuring reliable matches even across varied lighting, expressions, and image quality.

2. Liveness DetectionTo combat spoofing tactics like printed photos, screen replays, or deepfakes, Gridlines incorporates advanced liveness detection. The system checks for real-time facial movement and depth to ensure that the person in front of the camera is alive and present.

3. Seamless IntegrationThe FaceMatch API is designed for fast, developer-friendly integration with mobile apps and web platforms. It can be customized to fit the unique workflows of different industries without disrupting the user experience.

4. Scalable and SecureWhether you’re verifying dozens or millions of users, Gridlines scales effortlessly. The platform is compliant with key privacy and data protection regulations, ensuring that user data is processed safely.

Benefits for Businesses

Faster Onboarding: Automate verification in seconds, not hours.

Fraud Prevention: Catch fake identities before they enter your system.

Cost Efficiency: Eliminate manual checks and reduce operational overhead.

Customer Trust: Deliver a smoother, safer experience that users can rely on.

In the age of AI-powered fraud and increasing digital interactions, tools like Gridlines’ FaceMatch API are essential. By combining smart technology with real-time processing, Gridlines helps businesses build trust, improve compliance, and stay one step ahead of fraud.Learn more and explore integration options at gridlines.io/products/face-api.

0 notes

Text

Seamless Address Verification with Gridlines API

Gridlines' Address API ensures accurate, real-time address verification to improve deliveries, prevent fraud, and enhance customer experiences. Streamline your business operations with precision and reliability

0 notes

Text

The Importance of Address Verification API for Business Success

today's fast-paced digital economy, businesses rely heavily on accurate customer data to operate smoothly. One critical aspect of this data is address verification, ensuring that customer addresses are correct, complete, and up to date. Without proper address verification, companies can face costly errors, undelivered shipments, and even fraud risks.

Why Address Verification Matters

Enhanced Delivery Accuracy Incorrect or incomplete addresses can lead to failed deliveries, increased return costs, and dissatisfied customers. Address verification helps businesses confirm that addresses are valid before processing orders, reducing logistical errors and improving customer experience.

Fraud Prevention E-commerce fraud is on the rise, and inaccurate address details can be a red flag. By integrating address verification solutions, businesses can validate customer addresses against official databases, minimizing the risk of fraudulent transactions and chargebacks.

Regulatory Compliance Many industries require businesses to maintain accurate customer records for compliance purposes. Address verification ensures that businesses meet regulatory standards and avoid legal complications related to incorrect data handling.

Cost Savings Shipping errors can be expensive, with costs associated with reshipping, returns, and lost goods. By implementing address verification, companies can significantly cut down on these unnecessary expenses and optimize their logistics processes.

The Role of Address APIs

Automating address verification through an Address API, like the one offered by Gridlines, allows businesses to validate addresses in real time. These APIs integrate seamlessly with existing systems, providing instant verification and correction of address input, whether during checkout, sign-up, or data entry processes.

Choosing the Right Address Verification Solution

When selecting an address verification tool, businesses should consider:

Accuracy & Coverage: Does the solution verify addresses globally or just within specific regions?

Integration Ease: Can it be integrated with existing platforms without major technical changes?

Speed & Efficiency: Does it validate addresses in real-time?

Data Security: How does the service protect customer address information?

Conclusion

Address verification is a crucial step in ensuring smooth business operations, reducing errors, and enhancing customer satisfaction. By leveraging advanced solutions like Gridlines' Address API, businesses can streamline address validation processes, reduce costs, and improve efficiency. Investing in the right technology today can save your business from costly mistakes tomorrow

0 notes

Text

Video KYC: Revolutionizing Digital Onboarding and Identity Verification

Introduction

The Know Your Customer (KYC) process has long been a crucial element in establishing trust between financial institutions and their clients. However, traditional KYC methods requiring physical documentation and in-person verification are becoming obsolete in today's digital world. Enter video KYC, an innovative solution that streamlines identity verification while maintaining security and regulatory compliance. This blog explores video KYC, its process, benefits, challenges, and future trends.

What is Video KYC?

Video KYC, or video-based Know Your Customer, is a digital process that enables businesses to verify customer identities remotely through live video interactions. Introduced by the Reserve Bank of India (RBI) in 2020, this method allows financial institutions to conduct KYC via video conferencing while ensuring compliance with stringent security standards.

How Video KYC Works

The video KYC process integrates technology with regulatory requirements to provide a seamless yet secure verification experience. Here’s how it works:

Customer Initiation – The customer submits basic details and uploads a government-issued ID online.

Scheduling a Video Call – The customer books a live video session with a KYC representative.

Live Video Verification – The representative asks the customer to:

Display their government-issued ID (e.g., Aadhaar, PAN card).

Perform specific actions (e.g., nodding, smiling) to prevent fraud.

Document Validation – The representative cross-checks the ID with customer details, often using Optical Character Recognition (OCR) for accuracy.

Face Match & Liveliness Detection – AI-powered facial recognition verifies the customer’s identity, ensuring the video feed is live and not pre-recorded.

Regulatory Checks – The system scans customer data against Anti-Money Laundering (AML) and Politically Exposed Persons (PEP) databases.

Approval or Rejection – The KYC application is either approved or rejected within 10-15 minutes based on verification results.

Benefits of Video KYC

Convenience & Speed – Customers can complete KYC from their homes, benefiting those in remote locations or with mobility issues.

Cost Efficiency – Eliminates expenses related to paperwork, infrastructure, and in-person verification.

Enhanced Customer Experience – A fast, seamless process reduces onboarding friction.

Scalability – Businesses can process multiple KYC verifications simultaneously.

Improved Security – AI-based fraud detection, OCR, and AML checks enhance identity verification.

Regulatory Compliance – Adheres to legal and financial compliance standards across various industries.

Use Cases of Video KYC

Video KYC is widely adopted across multiple sectors:

Banking & Financial Services – Enables remote account opening, loan applications, and investment verifications.

Insurance – Verifies policyholder identities quickly and securely.

Fintech Startups – Used for digital wallet onboarding and secure transactions.

Real Estate – Validates tenant or buyer identities for fraud prevention.

E-commerce & Gaming – Ensures secure transactions and age verification.

Challenges in Video KYC Implementation

While video KYC offers significant advantages, it comes with challenges:

Technical Issues – Poor internet connectivity can disrupt video calls.

Data Privacy Concerns – Handling sensitive customer data requires robust cybersecurity measures.

User Accessibility – Not all users are tech-savvy, making the process difficult for older customers.

Regulatory Variations – Different countries have distinct compliance requirements, necessitating region-specific implementations.

The Future of Video KYC

With digital transformation accelerating, video KYC is expected to become the standard for identity verification. Key trends include:

Blockchain Integration – Enhancing security by creating immutable records of verification.

Advanced AI & Facial Recognition – Improving speed and accuracy of identity verification.

Expansion Beyond Finance – Adoption in sectors like healthcare and education for secure onboarding.

Regulatory Standardization – Governments working toward uniform compliance guidelines.

How Video KYC Aligns with Gridlines’ Services

Gridlines offers a robust video KYC solution tailored for businesses looking to streamline their onboarding processes. Key features include:

Seamless Integration – Easily integrates with existing platforms for quick deployment.

AI-Driven Fraud Prevention – Facial recognition and liveliness detection enhance security.

Regulatory Compliance – Ensures adherence to global KYC norms.

Real-Time Analytics – Provides valuable insights for better decision-making.

Conclusion

By embracing video KYC, businesses can create a secure, efficient, and customer-friendly onboarding experience. With regulatory compliance and technological advancements at its core, video KYC is not just a trend but a necessity in today’s fast-evolving digital landscape

0 notes

Text

Smart GST Verification: Secure, Fast & Reliable with Gridlines

GST verification is the process of validating a business’s Goods and Services Tax Identification Number (GSTIN) to ensure that it is registered and compliant with tax regulations. This is essential for businesses to verify the legitimacy of their partners, prevent fraud, and streamline tax filings. By performing GST verification, companies can check key details such as the GST registration status, business type, and compliance history, ensuring smooth and secure transactions.

Gridlines GST Verification Services

At Gridlines, we provide an advanced GST Verification API that enables businesses to quickly and accurately verify GSTIN details. Our API helps businesses authenticate vendors, suppliers, and partners while ensuring tax compliance. The services we offer include:

Fetch GSTIN by PAN: Retrieve GSTIN details using a business's Permanent Account Number (PAN).

Fetch GSTIN Detailed: Obtain comprehensive information associated with a GSTIN, including business name and status.

Fetch GSTIN Lite: Access basic GSTIN details for quick verification needs.

Fetch GSTIN by Mobile: Retrieve GSTIN information using the registered mobile number.

Fetch GSTIN by Name: Search and verify GSTINs based on the business name.

Fetch GSTIN Contact Details: Access contact information linked to a specific GSTIN.

Fetch MCC Codes by GSTIN: Obtain Merchant Category Codes associated with a GSTIN for detailed business categorization.

Key Features of Gridlines GST Verification API

Our API is designed to provide fast, secure, and reliable GST verification with the following features:

✅ Real-Time Data Retrieval – Instantly fetch GST registration details for any business. ✅ Accurate & Error-Free Validation – Minimize manual errors with automated verification. ✅ Fraud Prevention – Detect inactive or blacklisted GSTINs before transactions. ✅ Seamless API Integration – Easily integrate with your existing systems using our developer-friendly API. ✅ Comprehensive Business Insights – Get business category, tax status, and contact details in one place.

Why Choose Gridlines for GST Verification?

🔹 High-Speed & Reliable API – Get instant verification results with 99.9% accuracy. 🔹 Secure & Compliant – Ensures data privacy and aligns with tax laws. 🔹 Scalable & Flexible – Supports businesses of all sizes, from startups to enterprises. 🔹 Enhanced Business Decision-Making – Gain valuable insights into vendors and partners to reduce risks. 🔹 User-Friendly & Efficient – Simplifies tax compliance and improves operational efficiency.

With Gridlines GST Verification API, businesses can prevent fraud, ensure compliance, and build secure business relationships.

Start verifying GSTINs today and experience a seamless verification process with Gridlines. Learn more at Gridlines.

0 notes

Text

The Importance of a Bank Account Verification API

In today’s fast-paced digital economy, businesses must verify financial transactions efficiently while ensuring security and compliance. A bank account verification API plays a crucial role in preventing fraud, reducing errors, and streamlining user onboarding. As businesses increasingly move towards digital transactions, ensuring that bank accounts are valid and belong to the correct individuals or entities has become a necessity.

Why Businesses Need a Bank Account Verification API

Manually verifying bank details can be time-consuming and prone to human error. An automated verification API simplifies this process, offering real-time authentication of bank accounts. With this technology, businesses can:

Instantly confirm bank account ownership – Verify that the account details provided by a user or business match the actual records from financial institutions.

Prevent fraudulent transactions – Reduce the risk of unauthorized transactions and identity fraud.

Comply with Know Your Customer (KYC) regulations – Ensure that all financial dealings meet regulatory standards.

Improve payment accuracy and efficiency – Minimize transaction failures by confirming account details before processing payments.

Key Benefits of Using an API for Bank Verification

1. Faster Onboarding

Real-time verification enables businesses to onboard new customers, vendors, and partners quickly. Instead of waiting for manual approvals, users can verify their accounts within seconds, enhancing the overall user experience.

2. Reduced Fraud Risk

With rising cases of financial fraud, businesses need robust security measures. A bank account verification API can detect mismatched or fake accounts before transactions occur, preventing potential losses.

3. Seamless Payment Processing

One of the biggest challenges in financial transactions is ensuring that funds reach the correct recipient. Bank account verification APIs reduce failed transactions caused by incorrect or outdated account details, improving efficiency and customer satisfaction.

4. Regulatory Compliance

Governments and financial authorities mandate strict compliance with KYC and Anti-Money Laundering (AML) regulations. Automating account verification ensures that businesses remain compliant, reducing the risk of fines and legal consequences.

How to Integrate a Bank Account Verification API

Integrating a bank account verification API is straightforward and typically involves the following steps:

Choose a Reliable API Provider – Opt for a service that offers high accuracy, real-time results, and compliance with industry standards.

Obtain API Keys – Register with the provider to receive API keys for authentication.

Implement API Endpoints – Developers can integrate the API into their system using RESTful API endpoints.

Test and Deploy – Run tests to ensure smooth functionality before deploying it for customer use. Click here to know more.

Conclusion

A bank account verification API is a vital tool for modern businesses looking to enhance security, prevent fraud, and improve user experiences. By automating the verification process, companies can focus on growth while ensuring compliance and customer trust. Whether for onboarding, payment verification, or fraud prevention, leveraging a reliable API can transform financial operations and contribute to a safer digital economy.

Title: Simplify Business Onboarding with Gridlines’s Company Verification APIs

Target URL: https://gridlines.io/products/mca-api

Short Description

Verify businesses with ease! Onboard legitimate companies by verifying their registration details, business type, and key information instantly. Our Company Verification APIs streamline due diligence, reduce fraud risk, and offer real-time monitoring to keep you informed about any status changes.

Long Description

Company Verification: Ensuring Trust, Minimizing Risk

Take the guesswork out of onboarding businesses. With OnGrid’s Company Verification APIs, confirm the legitimacy of companies by validating their registration with the Registrar of Companies. Whether it’s identifying the business type—Company, LLP, or Foreign Entity—or verifying crucial details like address, status, and date of incorporation, we’ve got you covered.

Key Features:

Real-time Business Validation: Instantly check the legitimacy of a company.

Fraud Prevention: Identify fake or inactive companies to avoid risky partnerships.

Automated Due Diligence: Simplify your processes with automated verification tasks.

Real-time Monitoring: Stay informed about changes in company status.

Our Offerings:

Fetch company details by name or registration number.

Verify directors and their identification numbers (DIN).

Seamlessly connect PAN and DIN details.

Validate TAN for added assurance.

Strengthen your onboarding and due diligence processes with fast, accurate, and secure company verifications.

0 notes

Text

Simplify Business Onboarding with Gridlines’s Company Verification APIs

Company Verification: Ensuring Trust, Minimizing Risk

Take the guesswork out of onboarding businesses. With OnGrid’s Company Verification APIs, confirm the legitimacy of companies by validating their registration with the Registrar of Companies. Whether it’s identifying the business type—Company, LLP, or Foreign Entity—or verifying crucial details like address, status, and date of incorporation, we’ve got you covered.

Key Features:

Real-time Business Validation: Instantly check the legitimacy of a company.

Fraud Prevention: Identify fake or inactive companies to avoid risky partnerships.

Automated Due Diligence: Simplify your processes with automated verification tasks.

Real-time Monitoring: Stay informed about changes in company status.

Our Offerings:

Fetch company details by name or registration number.

Verify directors and their identification numbers (DIN).

Seamlessly connect PAN and DIN details.

Validate TAN for added assurance.

Strengthen your onboarding and due diligence processes with fast, accurate, and secure company verifications.

0 notes

Text

Simplify eKYC with Gridlines APIs

eKYC (Electronic Know Your Customer) revolutionizes traditional verification by digitizing the process. Mandated by RBI, it verifies customer identities via government-authorized documents like Aadhaar, PAN, and Driver Licenses. This digital transformation ensures faster, more secure onboarding while reducing fraud and operational costs.

Key Advantages of eKYC

Faster processing for seamless customer experiences.

Enhanced security through verified APIs and encrypted data handling.

Cost-saving and eco-friendly, reducing reliance on paperwork.

Types of eKYC

Aadhaar-based eKYC: Secure retrieval of details via OTP or biometric verification.

Video-based eKYC: Real-time document verification through video calls.

Document-based eKYC: Upload and verify scanned documents with issuing authorities.

How Gridlines APIs Enable eKYC Gridlines offers robust APIs, including Aadhaar, PAN, and Driver License verifications, ensuring seamless integration, automation, and compliance. These APIs enhance security, expedite verification, and simplify customer onboarding, making eKYC a pivotal tool for businesses in the digital age.

Embrace eKYC with Gridlines to transform your verification processes and meet modern compliance demands.

0 notes

Text

Masked Aadhaar: The Key to Secure and Private Identity Verification

Masked Aadhaar, introduced by UIDAI, is a secure version of the Aadhaar card that enhances privacy by masking the first eight digits of the Aadhaar number. Designed for non-governmental use, it is ideal for private sector KYC processes, hotel check-ins, or third-party transactions. Retaining key details like name, photo, and address, it balances usability with privacy.

Tamper-proof and generated directly from UIDAI’s portal, it complies with data protection standards, such as India’s Digital Personal Data Protection Act, 2023. While unsuitable for government subsidies, Masked Aadhaar mitigates identity theft risks and ensures safer sharing of personal data in an increasingly digital world, supporting secure and compliant identity verification.

#maskedaadhaar#dataprivacy#identityprotection#secureverification#aadhaarsafety#digitalIndia#kycverification#fraudprevention#privacyfirst#UIDAI

0 notes

Text

Simplify Compliance with Gridlines’ GSTIN Verification API

Ensuring GST compliance and mitigating risks are crucial for building trust in business partnerships. GSTIN (Goods and Services Tax Identification Number) verification ensures you're dealing with GST-compliant entities, reducing fraud risks and streamlining operations.

With Gridlines Business Suite, our GSTIN Verification APIs provide fast, accurate, and automated solutions to simplify your verification process.

Why GSTIN Verification Matters

Tax Compliance: Avoid penalties by transacting only with compliant entities.

Fraud Prevention: Spot discrepancies and mitigate risks.

Accurate Reporting: Ensure clean records for audits and tax filings.

Streamlined Onboarding: Build trust by verifying businesses instantly.

Key Features of Gridlines GSTIN Verification API

Instant Validation: Verify GST registration details in seconds.

Fraud Detection: Identify invalid GSTINs early.

Seamless Tax Compliance: Automate checks for error-free workflows.

Data Insights: Access verified business data for better decision-making.

API Offerings

Fetch GST by PAN, Name, or Mobile

Access detailed GSTIN and contact information

GST Lite for simplified use cases

Comprehensive GST Analytics Reports

Why Choose Gridlines?

Real-Time Accuracy: Instant verification with live data access.

Automated Compliance: Eliminate manual errors and delays.

Risk Reduction: Safeguard your business with reliable validation.

Informed Decisions: Leverage actionable insights from verified data.

Transform Your Business with Gridlines GSTIN Verification

From onboarding partners to ensuring compliance, Gridlines’ APIs make GSTIN verification seamless and efficient. Automate your processes, reduce risks, and foster trust with Gridlines’ powerful tools.

Start your GSTIN verification journey today!

0 notes

Text

Enhance Onboarding with Gridlines Passport Verification API

Gridlines Passport Verification API ensures that the passport details submitted by users are legitimate, providing a crucial layer of security during the onboarding process. With this API, you can verify passports instantly, speeding up the onboarding process with real-time checks. Enhanced security measures help detect fraudulent passports using advanced verification checks. Seamless integration allows you to easily add passport verification to your existing system, while automated checks help you meet KYC regulations and enhance overall security.

Choosing Gridlines means opting for unmatched passport authenticity checks, ensuring every document is verified to the highest standard. Experience effortless integration with swift passport validations, leading to a seamless user experience. Propel your platform’s growth with an API that streamlines passport verification for global expansion. Our comprehensive API documentation provides step-by-step guidance for hassle-free implementation.

Select Gridlines Passport Verification API for a secure, compliant, and efficient onboarding process, ensuring the authenticity of passport details, enhancing your platform's security, and streamlining global operations with ease.

#PassportVerificationAPI#Gridlines#Onboarding#Security#KYCCompliance#FraudPrevention#TechInnovation#SeamlessIntegration#GlobalExpansion#HRTech

0 notes