#DigitalOnboarding

Explore tagged Tumblr posts

Text

🚀 Instant Verification Solutions by ekychub

🔍 Fast, Secure, and Scalable: Why Businesses Choose ekychub for Instant Aadhaar, PAN, and GSTIN Verification

In today’s digital-first economy, identity verification is no longer a slow or manual process. Whether you’re onboarding users, verifying sellers, or building fintech and e-commerce platforms — speed and trust are critical. That’s where ekychub’s plug & play verification APIs come in.

🚀 What is ekychub?

ekychub is a modern API platform that allows businesses to instantly verify key identity documents like:

✅ Aadhaar

✅ PAN

✅ GSTIN

✅ Bank Account Linking

With just a few lines of code, you can integrate ekychub into your existing platform and start verifying users or sellers within seconds — all while ensuring data privacy, compliance, and reliability.

🧩 Key Features of ekychub APIs:

Real-time Aadhaar & PAN Verification Instantly confirm user identities using secure UIDAI and NSDL-powered APIs.

GSTIN Validation for Sellers Onboard verified merchants and reduce fraud in your marketplace.

Bank Account Linking Check Confirm account-holder name matches before making payouts or disbursing loans.

Developer-friendly Documentation Our APIs are fast, RESTful, and easy to integrate with detailed guides and sandbox environments.

Plug & Play Integration No heavy tech lift. Just plug, test, and go live in hours — not weeks.

🛍️ For E-Commerce Platforms:

If you run an e-commerce platform, ekychub can help you:

Onboard sellers faster

Prevent fake listings

Ensure KYC compliance

Improve trust for buyers

🔒 Why Security & Compliance Matter

ekychub follows strict data protection protocols:

Data never stored or misused

Fully compliant with UIDAI & regulatory norms

256-bit encryption and HTTPS-only endpoints

🌐 Who Should Use ekychub?

E-commerce platforms onboarding merchants

Fintech startups issuing loans or payments

NBFCs and banks verifying new customers

Digital platforms needing KYC verification

Government or NGO onboarding beneficiaries

📈 Results You Can Expect

✅ 90% Faster Onboarding ✅ 70% Drop in Manual Errors ✅ Higher User Trust & Lower Drop-Off ✅ Regulatory Peace of Mind

💡 Final Thoughts

Whether you’re a developer building the next big app, or a business scaling your operations — identity verification is non-negotiable. With ekychub’s APIs, you can automate, secure, and accelerate this process — giving your users a frictionless experience and your business a competitive edge.

🔗 Ready to get started? Visit ekychub.in or Contact Us for a free demo.

#tech#identityvalidation#technology#techinnovation#technews#aadhaarintegration#fintech#ekychub#kycverificationapi#aadhaarverificationapi#🔖 Hashtags:#InstantVerification#AadhaarAPI#PANVerification#KYCsolution#DigitalOnboarding#eCommerceIndia#VerifyWithAPI#GSTINVerified#StartupIndia#APIsForIndia#OnlineVerification#PlugAndPlayAPI#SellersOnboarding#NoMoreDelays#FastKYC#IndiaStack#BusinessVerification#TechForTrust#EcommerceSellers

0 notes

Text

Discover why digital onboarding is a game-changer for fintech in 2025. From reducing fraud to improving customer experience, this blog outlines how embracing digital processes can give your fintech a competitive edge.

#Fintech2025#DigitalOnboarding#FintechInnovation#CustomerExperience#KYCCompliance#OnboardingSolutions#FutureOfFintech#FinancialTechnology#ThirdRockTechkno

0 notes

Text

🔧 From Field to Finish — We Make Execution Seamless. At Bisani Brothers Pvt. Ltd., we bridge the gap between strategy and execution for fintech, banking, and startups.

✨ Why Top Brands Choose Us ✅ Instant Field Deployments ✅ Seamless Digital Integrations ✅ Verified Customer Interactions ✅ Measurable, Scalable Results

📊 Industries We Serve: 💸 Fintech | 🏦 BFSI | 📱 NBFCs | 📦 Retail | 🔐 Insurance

💬 “When speed, accuracy, and scale matter — choose Bisani Brothers.”

🌐 Visit: www.bisanibrothers.com 📩 DM now to explore our partnership plans!

#BisaniBrothers#ExecutionExperts#OnGroundSales#CustomerOutreach#DigitalOnboarding#FintechExecution#B2BSolutions#IndiaFieldForce#ScaleWithUs#FieldToFinish

0 notes

Text

Seamless Customer Onboarding Services – Digital Solutions by Intelics

📝 Description: Accelerate and simplify your customer onboarding with Intelics’ end-to-end digital platform. From automated KYC/AML compliance and real-time updates to personalized workflows and secure data capture, our solution ensures faster processing, reduced costs, and enhanced customer trust at every step.

🔑 Keywords: customer onboarding, digital onboarding services, KYC compliance, AML compliance, onboarding platform, workflow automation, customer experience, data capture, Intelics solutions, fintech onboarding

#CustomerOnboarding#DigitalOnboarding#KYC#AMLCompliance#WorkflowAutomation#CustomerExperience#Fintech#Intelics#BusinessProcess#OnboardingSolutions

0 notes

Text

The Smart HR Leader’s Guide to Freeing Up Time with Automated Hiring

If you're an HR leader juggling a mountain of tasks — onboarding, compliance, documentation, and team coordination — you’re not alone. With hiring demands increasing and timelines tightening, it’s no surprise that traditional processes are slowing down growth.

But what if there was a way to reclaim your time without compromising quality?

Enter automated hiring and background verification services — the new secret weapon for modern HR professionals. Smart hiring isn't just about finding the best candidate; it's also about doing it efficiently, securely, and at scale. This blog explores how automation, especially in background verification, is helping HR leaders stay ahead��and why working with the right BGV company in India makes all the difference.

The Hidden Time Traps in Manual Hiring

Let’s face it: manual hiring practices are outdated.

Endless follow-ups with past employers for reference checks

Emailing back and forth with candidates to collect documents

Coordinating with third-party agencies on timelines

Logging and reviewing paper trails for compliance audits

These activities may seem small in isolation, but collectively they drain hours each week. HR leaders need to move from repetitive tasks to strategic thinking, and that starts by eliminating inefficiencies in verification and onboarding.

What Is Automated Hiring—and Why Does It Matter?

Automated hiring refers to the use of software tools and AI-powered systems to handle repetitive HR functions like resume screening, background checks, document collection, and more.

One of the most significant areas where automation brings real value is background verification. Whether you're a startup scaling fast or a multinational company hiring across multiple cities like Gurgaon, Bangalore, and Hyderabad—automated BGV processes save both time and stress.

How Background Verification Services Power Smart HR

Background verification services are the backbone of risk-free recruitment. They ensure you’re hiring someone whose identity, experience, and records align with your company’s trust and compliance standards.

By partnering with a trusted BGV company in India, you unlock:

✅ Faster Turnaround Time (TAT) – No more waiting weeks for checks. Get verified insights in hours or days. ✅ Digital Dashboards – Monitor status, compliance flags, and completion timelines—all in one place. ✅ Automated Alerts & Escalations – Get notified if any discrepancies are found, so you can act immediately. ✅ Global and Local Compliance – Especially critical if you're hiring in regulated sectors like BFSI, IT, or healthcare.

Why Hyderabad Is Emerging as a BGV Hub

Hyderabad, one of India’s fastest-growing tech and corporate cities, is also home to some of the top background verification companies in India. Known for quality service, cost-efficiency, and tech-savvy infrastructure, these background verification companies in Hyderabad are supporting nationwide and even global recruitment strategies.

For companies hiring in South India or managing large distributed teams, it’s crucial to work with a verification partner that has regional insight and compliance experience.

Real-World ROI: Saving Time, Adding Value

Let’s talk impact.

🕒 A mid-sized IT firm in Hyderabad implemented automated BGV using a digital platform. Result? 70% faster onboarding, with a 60% reduction in HR team bandwidth spent on manual follow-ups.

📈 A fintech startup in Gurgaon went from a 10-day verification cycle to just 48 hours—giving them the speed advantage in a highly competitive talent market.

For smart HR leaders, this isn't about cutting corners—it's about boosting strategic capacity. The hours saved can now be spent improving employee engagement, building culture, or optimizing retention plans.

Building Your Own Automated Hiring Stack

Here’s how to get started without feeling overwhelmed:

Audit Your Current Hiring Process Identify time-consuming tasks (e.g., ID checks, education verification, criminal record validation).

Shortlist the Right Technology Partner Choose a BGV company in India that offers end-to-end integration, strong customer support, and fast turnaround times.

Pilot the Process Test automation with a specific location or team—for example, a batch of hires in Hyderabad. Use this as a benchmark for results.

Train Your Team Even intuitive software needs some human oversight. Provide basic training to your HR team on using dashboards, reading reports, and acting on alerts.

Track Metrics and Scale Focus on ROI metrics like time saved per hire, background check success rate, and onboarding cycle time.

Conclusion: Hire Smart, Lead Smarter

In 2025, the smartest HR leaders won’t be those working longer hours—they’ll be the ones working smarter with automation. Let background verification services handle the grunt work, so you can focus on shaping strategy and growing teams.

Whether you're scaling in Gurgaon or expanding operations in Hyderabad, there's no better time to make the shift. Trusted names in the industry are already helping businesses streamline processes and stay compliant—with zero compromise on quality.

So, if you’re searching for background verification companies in Hyderabad or evaluating the best BGV company in India, now’s the time to automate, accelerate, and take control of your hiring game.

#SmartHiring#AutomatedHR#BgvCompanyInIndia#BackgroundVerificationServices#BackgroundVerificationCompaniesInHyderabad#HiringTools#DigitalOnboarding#HRAutomation#TimeSavingRecruitment#HRLeadership#SmartRecruiting#VerifiedHiring#HRTech2025

0 notes

Text

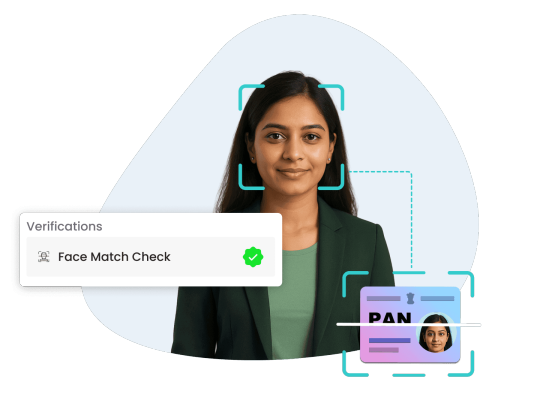

Face Match: The Future of Identity Verification Is Here

In today’s fast-paced digital world, verifying a person’s identity quickly and securely is more critical than ever. Whether it’s onboarding a new employee, authenticating a user during KYC, or reducing fraud in digital services, identity verification must be accurate, fast, and reliable. This is where face match technology steps in as a transformative solution.

Face match, also known as facial recognition or face verification, refers to the process of comparing a live image of a person's face with the photo on their official ID to verify if they are the same person. OnGrid’s Face Match Check enhances this process by not only ensuring visual similarity but also detecting real-time presence through advanced liveness detection.

How Does OnGrid’s Face Match Check Work?

OnGrid’s Face Match Check is powered by advanced AI algorithms that compare the user's live selfie or video with their ID document photo. Here’s how it simplifies and strengthens the verification process:

Face Comparison: Matches facial features between a live image and the ID photo with high accuracy.

Liveness Detection: Ensures that the person is physically present and not using a static image, video spoof, or mask.

Real-time Results: Verification is completed instantly, enabling seamless onboarding or access control.

Scalable Integration: The service can be easily embedded into web or mobile platforms via API.

Why Businesses Are Adopting Face Match Verification

Face match technology has rapidly gained adoption across sectors like BFSI, HR tech, gig platforms, healthcare, and edtech. Here’s why:

Improved Security: It eliminates impersonation, identity theft, and document tampering by relying on real-time biometric verification.

Faster Onboarding: With instant facial recognition, users don’t need to visit physical offices or submit paperwork—everything happens online.

Regulatory Compliance: It supports compliance with KYC/AML regulations by verifying identities accurately and audibly.

User Convenience: A selfie is all it takes to verify identity—making the process user-friendly and contactless.

Use Cases of Face Match in Real Life

Digital KYC: Verifying users in financial services, lending platforms, or wallets.

Employment Verification: Ensuring that candidates' identities match submitted ID documents during background checks.

Gig Economy: Quickly verifying freelancers or delivery personnel without in-person interaction.

Access Control: Granting entry to physical or digital spaces only after identity is confirmed.

Why Choose OnGrid for Face Match Verification?

OnGrid brings its credibility as a trusted background verification and digital identity service provider in India. Its Face Match Check is:

Accurate: Built on strong AI and ML models trained on diverse datasets.

Secure: End-to-end encrypted with data privacy compliance.

Customizable: API-first design that integrates seamlessly into your workflow.

Conclusion

Face match technology isn’t just a digital convenience—it’s a necessity in a world where trust and verification go hand in hand. With OnGrid’s Face Match Check, organizations can make identity verification smarter, faster, and more secure.

#FaceMatch#IdentityVerification#DigitalOnboarding#LivenessDetection#KYC#FacialRecognition#OnGrid#SecureVerification#DigitalIdentity#BackgroundVerification#RealTimeVerification#ContactlessVerification#FaceMatchTechnology#AIinKYC#VerificationSolutions

0 notes

Text

Bank Account Verification Made Easy

Validate customer bank account details instantly using SprintVerify’s API. It checks for name match, account validity, and IFSC code. This is especially useful for lenders and payroll services to prevent failed transactions and fraud.

0 notes

Text

How an MSME Verification API Simplifies Udyam Registration Checks Instantly

Instantly verify Udyam Registration details with Gridlines’ MSME verification API. Automate MSME onboarding, prevent fraud, and ensure KYB compliance at scale.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

How Oracle HCM Solutions Helped Us Discover What Was Broken in Our Onboarding Process

At first glance, our hiring process at Avion Technology seemed to work just fine. We could attract talent, conduct interviews, and send out offer letters quickly. But as we began to scale, it became clear: our onboarding process had cracks we hadn’t even noticed.

While no single step was “broken,” the system was far from efficient. New hires were left waiting. HR was swamped. IT processes lagged. The result? A disjointed employee experience that impacted productivity and morale.

That’s when we turned to Oracle HCM Solutions—and everything changed.

What Wasn’t Working (That We Didn’t See Coming)

We weren’t short on talent. We were short on tools and structure. Here are just a few friction points we faced:

Paper-based onboarding documents

Manually triggered IT setups

Multiple systems for HR, payroll, and benefits

Repetitive data entry for every new hire

Delays in communication and inconsistent onboarding timelines

Individually, these issues were small. Together, they formed a major bottleneck.

The Shift to Oracle HCM Cloud

Switching to Oracle HCM Solutions was more than a tech upgrade—it was a strategic move. Here's what changed for the better:

Automated workflows drastically reduced onboarding time

E-signature tools removed paper-based delays

Employee self-service portals handled most new hire questions

Integrated systems connected HR, IT, and leadership in real time

The result? Faster onboarding, less HR stress, and a confident start for every employee.

Key Features That Make Oracle HCM Solutions Stand Out

Whether you're leading a mid-sized business or scaling a larger enterprise, Oracle HCM Cloud comes with a full suite of tools that make onboarding and HR management more intelligent:

Core HR: Unified employee records, global compliance

Talent Management: Smart recruiting, goal-setting, and performance tracking

Workforce Rewards: Compensation and benefits tools

Workforce Management: Time tracking, scheduling, leave requests

Employee Experience: Personalized onboarding journeys and AI-powered HR help desks

Analytics & Payroll Integration: Real-time data visibility and predictive insights

Why Hybrid Teams Need HCM More Than Ever

In hybrid and remote work models, smooth onboarding is no longer optional—it’s essential.

Oracle HCM Solutions are built to support distributed teams with:

Remote completion of onboarding tasks

Automated IT and HR coordination

Unified access to company policies, welcome kits, and team intros

Mobile-first design for anytime, anywhere accessibility

Manager dashboards to track onboarding progress

For companies managing multiple locations or remote employees, this centralized approach removes friction and creates consistency.

How We Help Others Do the Same

At Avion Technology, we’re not just users of Oracle HCM—we help other businesses implement it too. Our team offers:

Full implementation and configuration

Custom system integrations (ERP, payroll, CRM)

Workflow automation and employee portals

Post-launch support, training, and optimization

From our base in Schaumburg, Illinois, we help growing businesses across the U.S. modernize their HR and onboarding operations.

Frequently Asked Questions (FAQs)

1. Is Oracle HCM Cloud a good fit for small businesses? It works best for mid-size to large enterprises, especially those with complex workflows or distributed teams.

2. How long does it take to implement? Typical implementation takes 8–16 weeks, depending on customization and modules selected.

3. Can Oracle HCM integrate with payroll or CRM platforms? Yes. It integrates with popular systems like QuickBooks, ADP, and NetSuite.

4. What support is available post-implementation? Ongoing support includes training, user adoption, and continuous system optimization.

5. What makes Oracle HCM ideal for remote teams? Self-service onboarding, mobile access, and cloud-based tools ensure a smooth experience from any location.

Hiring is just the beginning. Let us help you deliver a seamless onboarding experience that retains top talent, boosts productivity, and scales effortlessly.

Get a Free HCM Readiness Assessment Let’s discover what’s slowing your onboarding down—and how Oracle HCM can fix it.

Contact Avion Technology today to get started.

#OracleHCM#HCMsolutions#DigitalOnboarding#HRTech#EmployeeExperience#HRTransformation#RemoteOnboarding#CloudHR#FutureOfWork#OraclePartner#TalentManagement#EmployeeSuccess#Avion Technology

0 notes

Text

🖥️ Empowering HR with Technology: The Rise of Employee Self-Service Kiosks in Onboarding

As workplaces become more digitized, the onboarding experience is evolving rapidly. One of the most transformative changes is the adoption of Employee Self-Service (ESS) Kiosks —digital stations that guide new hires through the onboarding process independently. These kiosks are becoming a vital tool in creating an engaging efficient and consistent onboarding experience, especially in high-volume hiring environments like retail, hospitality, logistics and healthcare.

#HRTech#DigitalTransformation#EmployeeExperience#FutureOfWork#SmartHR#WorkplaceTechnology#DigitalOnboarding#EmployeeOnboarding#SelfServiceKiosk#ESSKiosk#PaperlessOnboarding#AutomatedHR#EmployeeEngagement#HRInnovation#WorkforceSolutions#EfficiencyMatters#HRStrategy#KioskTechnology#TechInHR#RetailHR#LogisticsHR#ManufacturingHR#HospitalityHR

0 notes

Text

Effortless Employee Onboarding Using ImagilityHR Tools

A smooth onboarding process sets the tone for an employee’s entire journey. Traditional onboarding methods are often manual, disorganized, and time-consuming, leading to confusion and poor engagement.

ImagilityHR solves this by offering an automated, digital-first onboarding experience tailored for modern HR teams and growing companies.

Here’s how ImagilityHR enhances onboarding:

✅ Digital Forms & E-Signatures No more paperwork. New hires can fill and sign forms digitally, reducing delays and errors.

✅ Task Automation HR teams can assign and track onboarding tasks in real time, ensuring nothing is missed.

✅ Centralized Document Storage All required documents—from IDs to tax forms—are uploaded and securely stored in one place.

✅ Personalized Welcome Flows Create a branded and engaging welcome journey for every employee.

✅ Compliance Made Easy Stay compliant with digital checklists and audit trails for every hiring stage.

Whether onboarding one employee or hundreds, ImagilityHR offers a reliable, scalable, and seamless process that improves new hire satisfaction and HR efficiency.

🔗 Try ImagilityHR’s Onboarding Platform

#EmployeeOnboarding#ImagilityHR#HRSoftware#PaperlessOnboarding#NewHireExperience#HRTech#DigitalOnboarding

0 notes

Text

Can POSP software offer continuous learning resources to agents for product knowledge updates?

Yes, POSP Insurance Software provides continuous learning resources to agents through digital training modules, webinars, knowledge bases, and real-time policy updates. It ensures agents stay informed about new insurance products, compliance requirements, and sales techniques. With AI-driven recommendations and automated learning paths, agents can enhance their expertise and improve customer service. Learn more about POSP Insurance Software here.

#POSPInsurance#InsuranceSoftware#AgentTraining#ContinuousLearning#InsuranceTech#POSPSoftware#DigitalOnboarding#InsuranceAgents#SalesTraining#KnowledgeUpdate#InsuranceCRM#LeadManagement#PolicyManagement#InsuranceLearning#SalesEnablement#POSPIndia#InsuranceSolutions#DigitalInsurance#InsuranceSales#AutomatedTraining#InsuranceIndustry#InsuranceTechnology#AgentSuccess#TrainingModules#TechForInsurance#SalesAutomation#OnlineTraining#POSPAgent#CustomerEngagement#InsurancePlatform

0 notes

Text

Discover the top 10 reasons why digital onboarding is essential for FinTech success in 2025. From improved user experience to compliance automation, this blog reveals how embracing digital onboarding can future-proof your financial services.

0 notes

Text

Execution that Builds Fintech Dreams 🚀 From digital onboarding to field agent tracking, Bisani Brothers Pvt. Ltd. powers your fintech operations with unmatched field execution. ✅ Field Sales ✅ Digital KYC ✅ UPI Onboarding ✅ Retail Audits ✅ Telecalling with Performance Dashboards

🧠 350+ Projects | 120+ Team Experts | Since 2016 🌐 Visit: www.bisanibrothers.com

0 notes

Text

The Importance of KYC Video Verification in Real Estate

In the fast-evolving world of real estate, ensuring secure and compliant transactions is paramount. KYC (Know Your Customer) video verification has become a game-changer in this regard. By verifying the identity of clients through real-time video, real estate companies can minimize the risk of fraud, money laundering, and other illicit activities. This process not only enhances security but also builds trust, streamlines onboarding, and ensures compliance with regulatory standards. Embracing KYC video verification in real estate is essential for fostering transparency and protecting both buyers and sellers.

#RealEstateTech#KYCVerification#VideoVerification#Compliance#RealEstateSecurity#FraudPrevention#PropTech#DigitalOnboarding

0 notes

Text

Digital Address Verification in India: Fast, Reliable & Contactless with OnGrid

In today’s digital-first world, the ability to verify someone’s address remotely, accurately, and securely has become a necessity for businesses, especially during hiring or customer onboarding. The traditional method—sending agents to physically verify addresses—is not only time-consuming and expensive, but also unreliable in rural or hard-to-reach locations.

That’s where digital address verification comes into play, and OnGrid is leading the charge in India with its contactless, API-powered, and consent-driven solution.

Why Address Verification Matters

Whether you're onboarding a new employee, KYC-ing a customer, or validating gig workforce information, confirming a person’s current address helps:

Prevent identity fraud

Ensure regulatory compliance (especially in BFSI and telecom)

Build trust with your customers or workforce

Reduce operational risk

In sectors like financial services and logistics, knowing where your customers, agents, or gig workers reside is not just a formality—it’s a key compliance and risk requirement.

What is Digital Address Verification?

Digital address verification uses technology-driven methods to verify the residential address of an individual remotely. Instead of deploying field agents, the system uses:

Geo-tagged photos or video

Live user interaction (self-recorded)

AI for facial and location match

Consent-based data capture

OnGrid’s platform enables this seamlessly using a mobile-first interface, ensuring the individual verifies their address through a short guided video capturing the surroundings and geolocation. No physical visits. No paperwork. Just fast, secure verification.

OnGrid’s Digital Address Verification Workflow

Here’s how it works:

Initiate Verification: The employer or business sends a request to the individual via OnGrid’s secure platform.

User Consent & Capture: The individual records a short video showing their face and home exterior. The video is time-stamped and geo-tagged.

AI & Analyst Review: OnGrid’s system checks for anomalies (e.g., mismatched locations, GPS spoofing) and passes it to a quality control analyst if needed.

Instant Results: Most verifications are completed within hours, not days.

Benefits of Using OnGrid’s Digital Address Verification

Faster Turnaround: No waiting days for field agents—get verifications done in under 24 hours. Scalable: Whether you need 10 or 10,000 verifications, the system handles it effortlessly. Cost-Effective: Eliminate travel and manual costs associated with physical verification. Pan-India Reach: Urban, rural, remote—location is no longer a barrier. GDPR & IT Act Compliant: Consent-based, secure, and privacy-compliant architecture.

Who Should Use It?

OnGrid’s digital address verification is ideal for:

Employers hiring at scale

Gig and blue-collar platforms (e.g., delivery, security, drivers)

BFSI institutions conducting KYC checks

NBFCs and lenders verifying borrower addresses

EdTech, FinTech, and Logistics startups onboarding users remotely

The Future is Digital, and So is Address Verification

Physical verification is becoming a bottleneck in an otherwise digital hiring and onboarding experience. By replacing manual methods with OnGrid’s smart, tech-enabled platform, companies can increase trust, reduce fraud, and speed up processes dramatically.

Don’t let outdated methods slow your business down. Embrace the future of address verification—digital, fast, and accurate—with OnGrid.🔗 Explore OnGrid’s Digital Address Verification service now: https://ongrid.in/services/digital-address-verification

#DigitalAddressVerification#OnGrid#RemoteVerification#AddressCheck#HiringTech#KYCIndia#ContactlessVerification#DigitalOnboarding#FraudPrevention#HRTech

0 notes