#openfinance

Explore tagged Tumblr posts

Text

Why Decentralized Finance (DeFi) is the Future of Banking

Decentralized Finance (DeFi) is a new financial system that is built on blockchain technology. It is a system that is decentralized, transparent, and accessible to everyone. In this blog post, we will explore why DeFi is the future of banking.

Decentralization

DeFi is built on a decentralized system, which means that it is not controlled by any central authority. This is a significant departure from traditional banking, which is controlled by a few large institutions. Decentralization means that everyone has equal access to financial services, regardless of their location or financial status.

Transparency

DeFi is transparent because all transactions are recorded on a public blockchain. This means that anyone can see the details of a transaction, including the amount, the sender, and the recipient. This transparency helps to prevent fraud and ensures that everyone is operating in good faith.

Accessibility

DeFi is accessible to everyone because it is built on blockchain technology, which is open and permissionless. This means that anyone with an internet connection can access DeFi services, regardless of their location or financial status. This is a significant departure from traditional banking, which often requires a physical presence and a minimum balance to access services.

Security

DeFi is secure because it is built on a decentralized system that is resistant to hacking and fraud. Traditional banking systems are vulnerable to these types of attacks because they are centralized and controlled by a few large institutions. DeFi is built on blockchain technology, which is secure because it is decentralized and transparent.

Conclusion

DeFi is the future of banking because it is decentralized, transparent, accessible, and secure. As more people become aware of the benefits of DeFi, we can expect to see a significant shift away from traditional banking systems. With DeFi, everyone has equal access to financial services, regardless of their location or financial status. DeFi is a new financial system that is built for everyone, and it is the future of banking.

#DeFİ#DecentralizedFinance#FutureofBanking#BlockchainTechnology#transparency#accesibility#security#FinancialInclusion#openfinance#cyrptocurrency

2 notes

·

View notes

Text

Fernando Boudourian: el impacto del open finance en las finanzas

Las finanzas digitales avanzan hacia modelos abiertos que permiten a consumidores y empresas acceder a servicios personalizados. Open Finance expande el alcance del Open Banking y redefine la competencia en el sector financiero.

0 notes

Text

"Unlocking the Invisible: Pioneering the Future of Banking and FinTech"

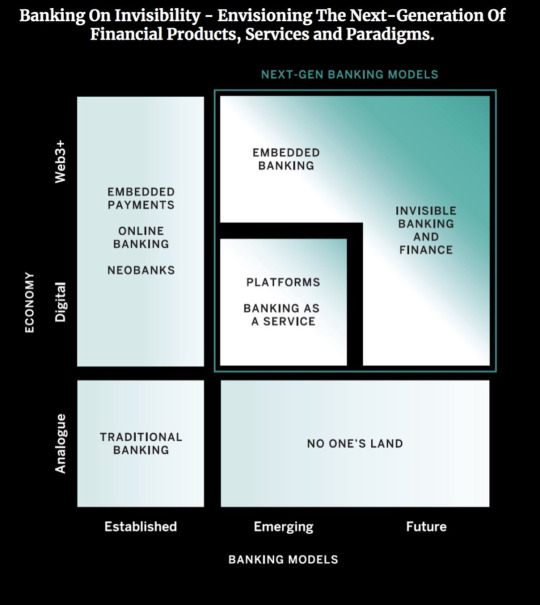

Banking On Invisibility - Envisioning The Next-Generation Of Financial Products, Services and Paradigms

In the not-so-distant past, banks adorned prime locations along bustling streets. Today, their prominence is wavering, and a future looms where they might vanish even from our phone screens. Financial services are seamlessly intertwining with technology and various industries, almost fading into invisibility.

While the demise of traditional banking has been a recurring topic among pundits, the ascent of digital finance has unquestionably chipped away at the once-familiar brick-and-mortar bank. Yet, could digital finance merely serve as a transient bridge to a truly revolutionary era?

Open Banking has empowered diverse brands to embody financial institutions, seamlessly integrating loans, payments, payroll, and more into their existing offerings. The ongoing surge of consumer tech innovation merges the physical and digital realms in our daily lives, enabling us to transact effortlessly without fixating on the financial dimension. Departing a store, our purchases are automatically tallied and deducted; our smart devices autonomously place orders and process payments. Our bank accounts evolve into intelligent, automated allies, optimizing our savings journey.

Financial services, a traditionally conservative industry, are subject to rigorous regulation. While change may be gradual, its impact ripples across sectors, given money's fundamental role. This metamorphosis heralds fresh revenue avenues beyond finance's confines, catalyzing transformative repercussions.

Alternative operational models and revenue streams are sprouting across the financial landscape. Next-gen banking paradigms foretell an array of innovative products and services tailored for a world where industry boundaries blur or fade away.

The automotive industry's evolution from "car" to "mobility" exemplifies this shift, extending value chains beyond physical products and fostering broader interpretation. As financial and non-financial sectors intermingle, banking gains the ability to subtly infiltrate the subconscious, steering evolving customer expectations and novel competitive dynamics.

To thrive in this invisible landscape, banks must fathom customer needs, habits, and aspirations. Financial professionals must conjure the dual magic of becoming both unseen and all-seeing. An entirely novel form of finance beckons on the horizon—one abstract, seamless, and intrinsically interconnected.

#InvisibleFinance #FutureBanking #TechInnovation #FinancialEvolution #CustomerCentric #SeamlessTransactions #InnovationFrontiers #Innovation #Fintech #Banking #OpenBanking #OpenFinance #EmbeddedFinance #OpenAPIs #BaaS #BaaP #FinancialServices #CoreBanking #Payments #SaaS

1 note

·

View note

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Text

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Not unlike a post-Internet-era Bloomberg Terminal, OpenFin was a startup which joined the revolutionary world of user interfaces to fast-moving information, back in 2010. If you cast your mind back, those old interfaces were not good, to put it mildly. Think what it was like ordering a cab 15 years ago? Any app that made that experience better became a way to own the user. And in the same way,…

View On WordPress

0 notes

Link

Underlying philosophy of Defi is that its built for interoperability which allows the ecosystem to benefit from individual progress, pushing decentralized finance continually forward. This is one of the key reasons that makes Blockchain one of the key Fintech trends for 2020 and beyond.

0 notes

Photo

#weeklyupdate #hidenothing #openfinance #researchassistance https://www.instagram.com/p/COYSpwnlN5g/?igshid=k3dy9mq2xovv

0 notes

Text

Openfinance Warns It Will Delist All Security Tokens Without New Funds

Openfinance Warns It Will Delist All Security Tokens Without New Funds

Security token trading platform Openfinance is threatening to delist all tokens and suspend trading next month unless issuers cough up more funds to cover its costs.

The company has not seen transaction activity on its platform grow quickly enough to cover operating costs, according to an email sent to the alternative trading system’s (ATS) users and shared with CoinDesk on Wednesday.

The…

View On WordPress

#ATS#Business#coindesk#News#OpenFinance#Policy & regulation#Security Tokens#TCRNews#thecryptoreport

0 notes

Photo

Openfinance Lists New Security Token in Charity Fundraising Effort Openfinance, a platform for secondary market trading of digital assets, is listing Lottery.com’s LDCC security token for U.S.

0 notes

Photo

Study: The Unintended Consequences of #PSD2 #RTS http://bit.ly/2LbzvHY For the Third Party Providers (#TPPs) of Europe, the next stage of PSD2 implementation holds a great deal of promise, but now an even greater degree of material business risk. This is sure to directly cause serious end-customer detriment and will destabilise the market of TPPs who use #OpenFinance in their business models. There is time to take action, but not much time. The Regulatory and Technical Standards (RTS) to apply to PSD2 which were drafted by the European Banking Authority and finalised by the European Commission were difficult to agree due to the complexity of reconciling competing requirements, particularly in the consideration of the potential deployment of APIs, identity and security #Fintech #Insurtech #Wealthtech #OpenBanking #payments #iso20022 #Cybersecurity (hier: Zürichsee) https://www.instagram.com/p/Bz3d7g_iKCg/?igshid=ts6mxdtxnp35

0 notes

Text

FINRA and SEC Frustrating U.S Crypto Startups

FINRA and SEC Frustrating U.S Crypto Startups

The Financial Industry Regulatory Authority (FINRA), a non-governmental and self-regulatory organization (SRO) in charge of regulating member brokerage firms, has been reluctant to approve the application of nearly 40 firms looking to offer crypto-related services in the region. Some insider sources have revealed that FINRA’s inaction stems from the fact that the United States SecuritiesRead More

https://btcmanager.com/finra-sec-frustrating-us-crypto-startups/?utm_source=Tumblr&utm_medium=socialpush&utm_campaign=SNAP

0 notes

Photo

PRE-ORDERS OPEN

FINALLY! 🥳

After a lot of work, this is the stuff that will be available at my shop this winter season. This collection’s name is Wintery Fairy Tales, with Lucio as the Nutcracker (you can see Mercedes and Melchior on their alter-forms XD) and Nadia as the Winter Queen, with her beloved Chandra 🧡

There will be acrylic charms with a protective epoxy layer, and square prints you can use as invitation or greeting cards. And I’m over the moon because this prints will have a layer of gold laminate on them! (the geometric drawing behind Lucio and Nadia), something I wanted to do since a lot of time 😭😭

As always, you can find a pre-order discount until December 4, and the first shipments will be on its way on December 13.

Due to the complexity of the products, there won’t be many units available. Its a limited edition, so get them before they run out!

Link to my shop

#the Arcana fandom#The Arcana Game#the arcana fanart#the arcana lucio#lucio the goat#lucio morgasson#lucio montag#Montag Morgasson#the arcana nadia#nadia satrinava#prints#charms#acrylic charms#etsy#etsyshop

292 notes

·

View notes