#oil change price in Abu Dhabi

Explore tagged Tumblr posts

Text

Exploring the UAE Lubricants Industry: Trends, Opportunities, and Challenges

The United Arab Emirates (UAE) is a global hub for trade, commerce, and innovation, and its lubricants market is no exception. With a strategic geographical location, a growing industrial base, and a thriving automotive industry, the UAE's lubricants industry is poised for substantial growth. This blog delves into the key trends, opportunities, and challenges shaping the market.

Overview of the UAE Lubricants Market

The UAE lubricants market is projected to reach a volume of 159.81 million liters in 2024 and is expected to grow to 173 million liters by 2026, reflecting a compound annual growth rate (CAGR) of 4.04% over the forecast period (2024-2026).

The UAE lubricants market is a vital segment of the country’s economy, driven by industrial applications, transportation, and marine activities. The demand for lubricants spans across various sectors, including:

Automotive: The increasing number of vehicles on the road has boosted the demand for engine oils, transmission fluids, and other automotive lubricants.

Industrial Applications: Manufacturing, construction, and energy sectors heavily rely on industrial lubricants for machinery maintenance.

Marine Industry: With bustling ports like Jebel Ali and an expansive shipping industry, marine lubricants play a crucial role.

Market Trends

Several trends are shaping the UAE’s lubricants industry:

Shift Towards Synthetic Lubricants: Synthetic and semi-synthetic lubricants are gaining popularity due to their superior performance and extended oil change intervals.

Focus on Sustainability: The industry is witnessing a growing emphasis on eco-friendly and biodegradable lubricants, aligned with global sustainability goals.

Technological Advancements: Innovations in lubricant formulations to meet the demands of high-performance engines and machinery.

Growth of Electric Vehicles (EVs): While EVs require fewer traditional lubricants, there is an emerging market for specialized EV lubricants and coolants.

Key Players in the Market

The UAE lubricants market is competitive, with a mix of international giants and local manufacturers. Some notable players include:

Shell

ExxonMobil

TotalEnergies

ADNOC (Abu Dhabi National Oil Company)

ENOC (Emirates National Oil Company)

These companies are investing in R&D, expanding distribution networks, and offering tailored solutions to cater to diverse customer needs.

Opportunities in the UAE Lubricants Market

Strategic Location: The UAE’s position as a gateway between Asia, Europe, and Africa provides lucrative export opportunities.

Growing Industrial Base: Rapid industrialization and infrastructure projects fuel the demand for industrial lubricants.

Specialized Lubricants for New Markets: Opportunities exist in sectors like renewable energy, aerospace, and advanced manufacturing.

Government Support: Policies encouraging industrial growth and innovation provide a conducive environment for the lubricant industry.

Challenges in the Market

Volatile Oil Prices: Fluctuations in crude oil prices impact the cost of raw materials for lubricant production.

Competition: The presence of numerous players intensifies competition, pressuring margins.

Shift to EVs: The rise of electric vehicles may reduce the long-term demand for conventional automotive lubricants.

Regulatory Compliance: Stricter environmental regulations require manufacturers to innovate and adapt.

Future Outlook

The UAE lubricants market is expected to grow steadily, driven by advancements in technology, rising industrialization, and increasing vehicle ownership. The shift towards sustainable and specialized lubricants will open new avenues for growth, while challenges like EV adoption and market competition will push companies to innovate.

Conclusion

The UAE’s lubricants market is at an exciting juncture, offering opportunities for growth and innovation. By aligning with global trends, focusing on sustainability, and leveraging its strategic advantages, the UAE can continue to strengthen its position as a leading player in the global lubricants industry. For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/uae-lubricants-market-industry

#UAE Lubricants Industry#UAE Lubricants Market#UAE Lubricants Market Size#UAE Lubricants Market Share#UAE Lubricants Market Analysis#UAE Lubricants Market Report

0 notes

Text

Why is Car Oil Change in Abu Dhabi Essential for Your Vehicle?

When it comes to maintaining your car's performance and longevity, Car Oil Change AbuDhabi is a crucial service you should never overlook. Regular oil changes keep your engine running smoothly, ensuring it operates efficiently under all conditions. Whether you’re driving on Abu Dhabi’s busy highways or navigating through its scorching summers, clean engine oil is vital for optimal performance.

What Happens During a Car Oil Change?

A car oil change involves draining the old oil from your engine and replacing it with fresh oil that meets your vehicle’s specifications. The service may also include replacing the oil filter, which prevents contaminants from circulating in your engine. The process is straightforward but significantly impacts your car’s performance and durability.

Why is Regular Oil Change Important?

Prevents Engine Wear and Tear: Oil lubricates the engine’s moving parts, reducing friction and preventing wear and tear. Over time, the oil loses its effectiveness, which can lead to engine damage.

Enhances Fuel Efficiency: Fresh oil reduces engine strain, which directly improves your car’s fuel efficiency. This is especially important in a city like Abu Dhabi, where fuel costs can add up over time.

Improves Engine Lifespan: Regular oil changes ensure that your engine remains clean and free from harmful deposits, extending its lifespan and maintaining its resale value.

Supports Smooth Driving in Harsh Conditions: Abu Dhabi’s climate can be harsh on your vehicle. Clean engine oil helps your car adapt to extreme temperatures, ensuring smooth and reliable performance.

How Often Should You Change Your Car Oil in Abu Dhabi?

The frequency of oil changes depends on various factors, including your car’s make, model, and usage. Typically, it is recommended to change your oil every 5,000 to 10,000 kilometers or every six months, whichever comes first. However, if you frequently drive in heavy traffic or under extreme temperatures, you might need to change the oil more frequently.

Signs That Your Car Needs an Oil Change

Oil Warning Light: If the oil warning light appears on your dashboard, it’s time for an oil change.

Unusual Engine Noise: Old or low oil levels can cause increased friction, resulting in unusual engine sounds.

Dirty or Dark Oil: Fresh oil is light-colored and transparent. If your oil looks dark or gritty, it’s time for a change.

Decreased Fuel Efficiency: If you notice your car’s fuel efficiency dropping, an oil change might resolve the issue.

Where Can You Get a Car Oil Change in Abu Dhabi?

Abu Dhabi offers numerous professional service centers where you can get your car’s oil changed. One such reliable name is Arabian Star Tyres, known for its high-quality services and customer satisfaction. Always choose a trusted service provider that uses quality oil and genuine filters for your vehicle.

What Type of Oil Should You Use?

There are different types of engine oils available, including synthetic, semi-synthetic, and conventional oil. Your car’s manufacturer will recommend the best type of oil for your engine. Synthetic oils are generally preferred for their superior performance and longevity, especially in Abu Dhabi’s hot climate.

Tips for Maintaining Your Car After an Oil Change

Check Oil Levels Regularly: Ensure your oil levels are optimal between service intervals.

Use Quality Oil and Filters: Always opt for high-quality engine oil and filters to protect your engine.

Follow the Service Schedule: Adhere to the maintenance schedule specified in your car’s manual.

Why Choose Arabian Star Tyres for Car Oil Change in Abu Dhabi?

At Arabian Star Tyres, we understand the importance of regular oil changes in keeping your car running efficiently. Our expert technicians use top-grade oil and filters to ensure your vehicle gets the care it deserves. With competitive pricing and quick service, we make car maintenance convenient and hassle-free.

Conclusion

Regular Car Oil Change AbuDhabi is essential to maintain your vehicle’s performance, fuel efficiency, and longevity. Ignoring this simple yet crucial task can lead to costly repairs in the long run. By choosing a trusted service provider like Arabian Star Tyres, you can rest assured that your car is in safe hands. Schedule your oil change today and enjoy a smoother, more efficient driving experience in Abu Dhabi.

1 note

·

View note

Text

Comprehensive Car Gearbox & Auto Transmission Repair Services in Dubai

Are you looking for the best car gearbox repair service near you or in Dubai, Abu Dhabi, UAE? Look no further than ARMotors.ae. We'll help you find the best car gearbox repair service in Dubai, Abu Dhabi, Sharjah, and UAE at a price that suits your budget.

Expert Gearbox Repair and Auto Transmission Services in Dubai

As the foremost authority in automotive care, ARMotors.ae prides itself as the go-to destination for gearbox repair and auto transmission services in the pulsing heart of UAE—Dubai. Our vast online marketplace is your trusted facilitator for obtaining competitive quotations from a carefully curated selection of the top-rated independent workshops across the nation.

Whether you are seeking a local garage in Dubai or the convenience of mobile mechanics in Abu Dhabi, ARMotors.ae is committed to providing a diverse array of services, including engine and transmission repairs, brake and suspension work, electrical system restoration, tire and wheel repairs, and much more. Our unique platform empowers you, the driver, to easily book appointments, access fluid checks, oil changes, and full vehicle inspections from the comfort of your own home.

Identifying Common Gearbox Issues in Cars and How to Address Them

At ARMotors.ae, we pride ourselves on being the UAE's premier platform for comparing car repair services. Our user-friendly marketplace allows you to receive multiple car servicing quotes from our comprehensive network of highly-rated independent garages. As Dubai's top choice for vehicle repair comparison, we provide drivers with the opportunity to obtain competitive quotations from trusted auto workshops with ease.

Comprehensive Car Gearbox and Transmission Repair Service with Warranty

ARMotors.ae is the leading online marketplace for car servicing and repairs in the UAE. We boast a sprawling network of over 5000 top-rated garages, mobile mechanics, and dealerships throughout Dubai, Abu Dhabi, and Sharjah. No matter the service – from gearbox repairs to full vehicle inspections – we connect you with trusted auto workshops that ensure reliability and quality.

Maintaining Your Auto's Gearbox: Proactive Service Tips

As the premier platform for car gearbox and auto transmission repair services, ARMotors.ae stands at the forefront of providing comprehensive solutions in Dubai. Our robust online car maintenance and repair marketplace is designed to connect vehicle owners with a wide network of top-rated independent workshops. Our commitment is to offer a seamless experience, enabling users to obtain quotations from garages efficiently.

High-Quality Auto Repair Services in Dubai for Gearbox and Transmission Issues

ARMotors.ae has firmly established itself as UAE's premier platform for car repair services, providing car owners with a seamless and user-friendly marketplace to receive multiple car servicing quotes. Our comprehensive network of highly-rated independent garages ensures that your vehicle is in safe hands.

Free Pickup and Delivery for Your Car Gearbox Repair Service in Dubai

At ARMotors.ae, we stand as UAE's foremost online marketplace for car servicing and repairs, proudly spearheading a seamless connection between car owners and a vast network of over 5000 top-rated garages, mobile mechanics, and dealerships across Dubai, Abu Dhabi, and Sharjah. From gearbox repairs to full vehicle inspections, our expertly curated directory of independent workshops ensures the highest caliber of auto transmission repair and maintenance services.

Choosing the Right Gearbox and Auto Transmission Repair Services in Dubai

At ARMotors.ae, we are dedicated to offering unparalleled gearbox repairs and auto transmission services across Dubai, ensuring your vehicle maintains its optimal performance. As UAE's foremost online car repair and servicing marketplace, we pride ourselves on enabling users to effortlessly obtain competitive quotations from our extensive network of trusted garages.

How Can I Find Low Cost and Affordable Gearbox Repair Garages and Mechanics in Dubai UAE?

When you're in need of gearbox repairs or auto transmission servicing, it's crucial to find a return that not only delivers expert care but also provides value for your money. ARMotors.ae is dedicated to helping you navigate the marketplace with confidence, offering quotations from Dubai's top garages and mechanics.

Why Pick ARMotors.ae for Your Next Car's Gearbox Repair Service?

At ARMotors.ae, we pride ourselves on being the UAE's number one comparison site for car repairs. Servicing drivers across Dubai and beyond, our platform has facilitated countless successful connections between car owners and top-rated independent workshops. When it's time for your next gearbox or auto transmission repair, you can trust ARMotors.ae to not only save you time and money but also to provide a transparent and trustworthy servicing experience.

Summary

In conclusion, quality gearbox and auto transmission repair are crucial for your vehicle's longevity and performance. At ARMotors.ae, we offer the pinnacle of transmission care in Dubai, ensuring your car is in top gear with seamless shifting and optimal efficiency. Regular maintenance and timely repair by our expert technicians can save you from costly replacements in the long run. Trust ARMotors.ae to deliver unparalleled service and expertise—drive with confidence knowing your car's transmission is in excellent hands.

1 note

·

View note

Text

What is ISO certification in Abu Dhabi? And why does it matter?

What is ISO certification in Abu Dhabi? And why does it matter?

Like a few other areas, ISO certification in Abu Dhabi is a mark of excellent compliance with all-over-the-world recognized needs established through the International Company for Standardization (ISO). ISO certification suggests that a company, company, or entity abides by specific recommendations and techniques to make certain uniformity, standard overall efficiency, defence, and penalty in its items, offerings, and approaches.

Abu Dhabi, the resources of the United Arab Emirates (UAE), has observed a quick economic rise and enhancement over the previous long term. As a principal in varied sectors, consisting of oil and gas, manufacturing, tourist, and money, Abu Dhabi acknowledges the worth of preserving too many requirements to compete within the globally market. ISO certification is necessary in taking part in this objective by supplying a framework for companies to highlight their self-discipline to be appropriate and outstanding.

Numerous kinds of ISO certifications are readily available, each taking care of specific consider business procedures. A few of the most normal ISO certifications have:

ISO 9001: Premium Administration System (QMS) - This certification shows that teams satisfy client requirements and frequently improve their approaches to improve client fulfillment. It covers regions that include customer recognition, control, device adjustment, and relentless growth.

ISO 14001: Environmental Management System (EMS) - This certification is geared towards assisting companies in lowering their ecological impact by enforcing effective environmental change techniques. It covers locations together with ecological insurance policy, making techniques, application, and monitoring.

ISO 45001: Occupational Wellness And Wellness Keeping An Eye On System (OHSMS) - This certification guarantees a safe and secure and wholesome artwork environment for workers with the valuable resource of identifying and taking care of work fitness and support hazards. It covers areas of hazard identification, danger assessment, emergency situation preparedness, and employee education.

ISO 27001: Details Safety And Security Administration System (ISMS) - This certification lets firms secure fragile information by applying inflexible records safety and security controls. It covers areas beside opportunity assessment, data safety, admission to monitoring, and event management.

These are just some circumstances of ISO certifications for companies in Abu Dhabi. Each certification includes its own set of necessities and benefits, yet they all objective to enhance organizational efficiency and boost stakeholder self-belief.

Why does ISO certification bear this in mind?

Marketability and Competitive Advantage: ISO certification boosts the integrity and credibility of companies, making them attractive to clients, buddies, and financiers. It shows self-discipline to quality, reliability, and buyer satisfaction, giving qualified firms an aggressive facet within the market.

Conformity with Regulatory Demands: ISO certification allows corporations to ensure compliance with pertinent felony ideas, legislations, and company requirements. It provides an absolutely new structure for setting up scoundrel requirements and minimizing threats associated with non-compliance, consequently keeping off capacity fines, consequences, and prison issues.

Boosted Practical Performance: ISO certification urges organizations to adopt top-notch techniques and improve their techniques, causing extra traditional general performance, performance, and fee economic price savings. Licensed groups can maximize their procedures and enhance basic effectiveness by identifying and staying clear of waste, redundancies, and ineffectiveness.

Enhanced Customer Satisfaction: ISO certification concentrates on putting together consumer demands and assumptions central to a premium product and business. By enforcing solid, excellent management structures, companies can boost patron satisfaction, loyalty, and retention, complying with in extended sales, repeat industrial firm, and amazing referral referrals.

Risk Administration and Continual Restoration: ISO certification permits teams to discover, analyze, and lessen dangers throughout numerous variables of their operations. Firms can proactively look after ability threats and opportunities by implementing methodical methods to opportunity control, making certain business connection and prolonged-term success. Additionally, ISO certification advertises a way of life of normal advancement, encouraging organizations to continually analyze and fine-tune their strategies to continue to be ahead of the competitors.

In wrap-up, ISO certification in Abu Dhabi is a valued device for agencies searching to embellish their competition, online reputation, and typical efficiency in the globally market. Licensed firms can improve practical vital complete efficiency, minimize hazards, enhance client contentment, and accomplish sustainable power development by staying with the world-over detected standards and audio methods. Whether it's finishing ISO 9001 for satisfying adjustment or ISO 14001 for environmental handling, Abu Dhabi's firms benefit considerably from getting ISO certification.

What led Abu Dhabi to choose Factocert as its ISO certification organization solution firm company?

Our enterprise, which protects ISO certification in Abu Dhabi, usually creates particularly peaceful repercussions. Each tool head creates a brief touch, permitting the economic firm, commercial company organization, business service corporation, business company, and venture commercial company to do the technique without them. This is effective, and the treatments have actually not affected the business endeavor's kind.

Factocert is among the UAE's leading critical ISO certification companies. We give amazing ISO Expert firms in Dubai, Abu Dhabi, Sharjah, Ajman, Al Ain Umm al-Qaiwain, Fujairah, and vital neighborhoods in UAE with business organization venture of execution, education, bookkeeping, and enrollment. Daily, ISO Requirements include audit enrollment, electrical power training, ISO goals, and ISO 22000, 17025, and 13485 demands. The thing pleases all ISO fantasiesfantasizes, jointly with ISO 14001 and ISO.

Utilizing ISO's prized possessions will certainly enhance the Abu Dhabi monetary view variety. We are using you to assess the certification cost.

For additional information, see the ISO certification for Abu Dhabi.

Related links:

ISO Certification in Abu Dhabi

ISO 9001 Certification in Abu Dhabi

ISO 14001 Certification in Abu Dhabi

ISO 45001 Certification in Abu Dhabi

ISO 13485 Certification in Abu Dhabi

ISO 27001 Certification in Abu Dhabi

ISO 22000 Certification in Abu Dhabi

CE Mark Certification in Abu Dhabi

0 notes

Text

The Israel-Hamas war unfolded amid an apparent regional trend of peaceful coexistence. The Middle East’s transformation along these lines has been represented by the seemingly ever-closer alliance between Saudi Arabia and the United Arab Emirates, as symbolized by the apparent friendship between their respective de facto leaders, Mohammed bin Salman and Mohamed bin Zayed. The two countries united to counter Qatar’s expanding soft power in the Arab world, as exemplified by the unsuccessful blockade they imposed on it in 2017. They have been on the same side in their military campaign against the Iranian-backed Houthis in Yemen since 2014. And they have mutually approached Beijing and Moscow, adopting a more independent policy that diverges from their traditional alliance with the United States.

But what lurks beneath the surface of this apparent fraternal alliance is a quiet struggle, as both countries vie for leadership within the Arab world. Behind the scenes, Saudi Arabia and the UAE are waging an active geoeconomic competition in multiple dimensions.

First, there is a massive competition for foreign investment. The rivalry traces back to 2009, when Abu Dhabi objected to the proposed location of the headquarters for a Gulf Cooperation Council (GCC) central bank in Riyadh, which ultimately played a role in thwarting the establishment of the bank itself. Between 2012 and 2022, the UAE’s influx of investment-to-GDP has been nearly 3.5 times greater than that of Saudi Arabia, and Dubai has become the favored location for some 70 percent of Middle Eastern headquarters of major multinational companies. Meanwhile, the surge in oil prices in 2022, thanks to the Russian invasion of Ukraine, propelled the Saudi economy to grow by 8.7 percent, the highest among G-20 countries, which has produced its own substantial influx of capital. And Saudi Arabia has actively encouraged foreign companies operating in the Persian Gulf area to relocate their headquarters to its territory, issuing warnings that companies failing to relocate their headquarters risk discontinuation of business relations with Riyadh.

Energy politics between Saudi Arabia (the world’s largest oil exporter) and the UAE (the fifth-largest) has further intensified this competition. In the summer of 2021, a clear dispute emerged between Riyadh and Abu Dhabi regarding a Saudi-led plan within OPEC+ to prolong production cuts, with the UAE rejecting the proposition. Although an apparent resolution to this tension was quickly achieved, subsequent rumors circulated regarding Abu Dhabi’s objection to Riyadh’s dominance within OPEC+ and the potential consideration of withdrawal from OPEC.

The competition for global prestige has also driven a wedge between Saudi Arabia and the UAE. Both countries are strategically investing in efforts to augment their soft power by hosting prominent international gatherings. Saudi Arabia has established the Future Investment Initiative conference, while Abu Dhabi has played host to the World Investment Forum, an annual event organized by the United Nations. Both forums and conferences serve as platforms to convene global leaders and investors, facilitating the proposal of innovative solutions to global challenges. After the UAE convened Expo 2020 in Dubai, the first of its kind in the Middle East, Saudi Arabia made history by securing the rights to host Expo 2030. Furthermore, Dubai was chosen as the venue for the pivotal annual U.N. climate change conference last year. This commitment to summit hosting continues, with Abu Dhabi set to host the World Trade Organization ministerial conference in February. Following Qatar’s successful hosting of the 2022 FIFA World Cup, Riyadh has undertaken initiatives to elevate the profile of its national soccer league by attracting elite players. Since early 2021, Saudi Arabia has committed a minimum of $6.3 billion in sports agreements, surpassing the total expenditure of the preceding six years by more than fourfold. It could be the first manifestation of the geopolitics of soccer in the new era. Dubai has been recognized for its relatively open, cosmopolitan society, attracting celebrities to host concerts and performances. This privilege, however, is no longer exclusive to the UAE. In December 2023, Riyadh successfully hosted MDLBEAST Soundstorm, marking the largest music festival in the Middle East. Collectively, these endeavors reflect the deliberate efforts made by these two countries to reshape their international image and promote positive perceptions of themselves on the global stage.

The last and the most pivotal competition pertains to the “vision” strategies pursued by the two countries. The UAE, having embarked on its diversification journey years ago, has established itself as a global transportation and business hub through strategic initiatives related to the ports of Khalifa and Jebel Ali, complemented by the success of its air carrier Emirates. Nevertheless, Mohammed bin Salman launched Vision 2030, an ambitious road map for Saudi economic diversification, in 2016. The flagship project within this vision is the NEOM initiative, a multibillion-dollar endeavor aimed at positioning Saudi Arabia as the preeminent infrastructure, transportation, technology, business, and financial hub in the region. Riyadh has also committed more than $100 billion to transform itself into a sea and air logistics hub, marked by the initiation of Riyadh Air. This involves challenging the dominance of Emirati ports through substantial investments in the Jeddah Islamic Seaport, slated to become the largest and busiest port in the Middle East and North Africa region. Phrased differently, the “vision” competition has propelled Riyadh and Abu Dhabi into a modernization and diversification race, often at the expense of each other.

Interestingly, rapprochement with Iran might intensify this competition. The Beijing-led detente between Tehran and Riyadh has effectively eliminated the primary shared threat in the region for Saudi Arabia and the UAE, thereby reducing the long-standing geopolitical conflicts between the northern and southern parts of the Persian Gulf. Moving forward, the region may enter a new era where the focus shifts from geopolitical competition between Iran and the GCC to geoeconomic competition between Saudi Arabia and the UAE.

Both countries are also adopting trade policies that amount to direct challenges to each other. In July 2021, Saudi Arabia implemented protectionist policies to bolster its local industrial production. These regulations stipulate that goods manufactured in free zones or utilizing Israeli inputs are excluded from preferential tariff concessions. This stance directly challenges the economic free zones that constitute a cornerstone of the Emirati economy. These regulations, designed to attract foreign investors to establish businesses within the country, stand as a clear rebuttal to the growing trade relations between the UAE and Israel.

Policy toward Israel is another potential terrain for divergence. While the UAE officially recognized Israel in 2020, Saudi Arabia has refrained so far from joining the Abraham Accords. Israel and the UAE strengthened bilateral relations by signing a comprehensive economic partnership agreement. This economic progress put Riyadh in a comparatively vulnerable position. The Israel-Hamas war has now decelerated the Saudi-Israeli normalization process; however, the dialogues will likely revive as Riyadh is supposed to be the cornerstone of the accords. It would not be surprising if Mohammed bin Salman sought additional concessions, particularly in nuclear programs and security guarantees, to normalize relations with Israel; such a move could then exert pressure on Mohamed bin Zayed’s Israel policy.

As the rift between Saudis and Emiratis widens, there is a likelihood that their improving relations with Moscow, Beijing, and even Iran may accelerate as a counterweight to each other. This, in turn, could weaken the effectiveness of the U.S. strategy in the Middle East and prompt a reevaluation by the White House of the region’s significance. Within this context, the alignment of Abu Dhabi and Riyadh with U.S. policies in the region should not be taken for granted. Just like the outbreak of the Israel-Hamas war, the rising geoeconomic competition between Saudi Arabia and the UAE could challenge the simplistic view that the Middle East is destined to become more peaceful.

1 note

·

View note

Video

youtube

The UAE stops its projects inside Saudi Arabia and the dispute escalates Is the honeymoon over, as the BBC said?

This new episode of Samri Channel devotes its time to discussing Western press reports about the escalating dispute between Saudi Crown Prince Mohammed bin Salman and the President of the United Arab Emirates, Sheikh Mohammed bin Zayed Al Nahyan. A report broadcast on the BBC Arabic website said that the disputes between Riyadh and Abu Dhabi became public after a period of hidden disputes.

The British Broadcasting Corporation relied on a report by the American Wall Street Journal, which Samri Channel had previously shown in a lengthy episode, which indicated the existence of deep differences between the Kingdom of Saudi Arabia and the United Arab Emirates, with reference to the threat of Saudi Crown Prince Mohammed bin Salman to impose a blockade. Saudi Arabia imposed on the UAE similar to the one imposed by the Kingdom on the State of Qatar in 2017. The report indicated that Bin Salman told a group of Saudi journalists in December last year that Abu Dhabi stabbed Riyadh in the back, in reference to the UAE’s refusal to accept the strict oil policies in the country. OPEC, which culminated in the bloc's decision to reduce oil production by two million barrels per day.

The Wall Street Journal report also pointed to Saudi Arabia’s efforts to withdraw the regional headquarters of transnational companies from Dubai and Abu Dhabi to Riyadh and major cities in the Kingdom. The episode refutes all of these issues and emphasizes the necessity of not being led into attempts to sow discord between Saudi Arabia and the Emirates, stressing that healthy economic competition between the two countries does not necessarily mean that they enter into a state of struggle over influence.

The region and the world. Saudi Arabia wants to extend the production reduction agreement with OPEC Plus for an additional eight months, while the UAE rejects this extension and demands an increase in its share of production. Saudi Arabia also seeks to enhance its economic, tourism and entertainment competitiveness, and deprives the UAE of some customs and trade advantages. On the political level, visions differ between the two countries regarding their relations with Iran, Israel, and Turkey and their role in resolving the region’s crises.

As for the reason for writing an article from the BBC about the end of a Saudi-Emirati honeymoon, it is to shed light on the changes that have occurred in the relations of the two countries recently, and the implications they have for the regional and international situation. The BBC is a global news network that covers important events around the world, including the Arab region. You can read the full article at this link.

The United Arab Emirates and Saudi Arabia disagreed over oil production quotas recently, which led to the cessation of talks between the world's largest oil producing countries and the rise in oil prices to their highest level in six years. This is the first time that the two member countries of the Gulf Cooperation Council have disagreed publicly about oil production quotas, and it comes after a difference in opinions on several issues in the region, including the war in Yemen and normalization with Israel. Does this affect the future of the relationship between the two countries?

#Saudi Arabia #The UAE #latest news

Is the honeymoon between Saudi Arabia and the UAE over? What about the future of relations between Abu Dhabi and Riyadh? An article presented by the BBC and we answer it in Summary. Watch to know the story from the beginning

0 notes

Text

Drums Auto Service Center - Your One-Stop Solution for Automotive Care in Abu Dhabi

When it comes to maintaining our vehicles, finding a reliable and trustworthy auto service center is of utmost importance. In Abu Dhabi, one name stands out from the rest - Drums Auto Service Center. With a reputation for excellence and a commitment to customer satisfaction, Drums Auto Service Center has become the go-to destination for all automotive needs in the city. In this blog post, we will take a closer look at the services offered by Drums Auto Service Center and why it has become a favorite among car owners in Abu Dhabi.

A Team of Skilled Technicians:

At Drums Auto Service Center, they understand that your car is one of your most valuable assets. Therefore, they have assembled a team of highly skilled and experienced technicians who are well-versed in handling various car makes and models. Whether it's routine maintenance, repairs, or complex diagnostics, you can trust that your vehicle is in capable hands.

Comprehensive Range of Services:

No matter what your automotive needs are, Drums Auto Service Center has got you covered. From regular oil changes and tire rotations to major engine repairs and electrical diagnostics, their comprehensive range of services ensures that your car remains in peak condition. They also provide air conditioning servicing, brake repairs, suspension work, and much more.

State-of-the-Art Facilities:

Drums Auto Service Center boasts state-of-the-art facilities equipped with the latest diagnostic tools and equipment. This enables their technicians to identify issues accurately and efficiently, saving you both time and money. The workshop is designed to handle multiple vehicles simultaneously, ensuring prompt service without compromising on quality.

Genuine Parts and Quality Service:

When it comes to replacements and repairs, Drums Auto Service Center only uses genuine parts from reputable manufacturers. This ensures that your vehicle performs optimally and maintains its longevity. Their commitment to quality extends beyond parts to encompass top-notch customer service, providing you with a pleasant and hassle-free experience.

Affordable Pricing and Transparent Quotes:

One of the reasons why Drums Auto Service Center has gained popularity among car owners in Abu Dhabi is their fair and transparent pricing. They provide detailed quotes upfront, so you know exactly what to expect before any work is carried out. With no hidden fees or surprises, you can have peace of mind knowing that you are getting the best value for your money.

Conclusion:

Your car deserves the best care, and Drums Auto Service Center is the answer to all your automotive needs in Abu Dhabi. With their skilled technicians, comprehensive services, state-of-the-art facilities, and commitment to customer satisfaction, you can trust that your vehicle is in safe hands. Whether it's routine maintenance or complex repairs, Drums Auto Service Center is dedicated to keeping your car running smoothly and efficiently. Visit them today and experience the difference for yourself. Your car will thank you!

0 notes

Text

Trusted Destination for Quality Car Service & Repairs Shop in Abu Dhabi

At DWB Tyres, we take pride in offering an extensive range of repair and maintenance services catering to economy, mid-range, and luxury cars. Our team of experienced technicians is equipped with the latest tools and equipment to conduct thorough inspections of your vehicle. Take advantage of our special discounted prices for exceptional car servicing. Our wide array of services includes:

ØAC Services: In the scorching heat of UAE, a properly functioning AC system is crucial for a comfortable and driveable vehicle. Our specialized AC technicians utilize state-of-the-art equipment to diagnose and address any issues with your car's cooling system.

ØWheel Alignment: Regular wheel alignment checks are highly recommended to prolong tire lifespan and ensure safe driving. At DWB Tyres, we have skilled technicians and computerized equipment to accurately perform wheel alignment, contributing to optimal performance.

ØWheel Balancing: When changing vehicle tires, maintaining proper wheel balance is essential, especially in hot and humid weather conditions. We offer computerized wheel balancing services for all types of vehicles and tires, ensuring a smooth and safe driving experience.

ØBrake Pads: Brakes and brake pads are critical safety components in any vehicle. Our certified technicians not only replace brake pads but also thoroughly inspect the entire brake system for any additional issues, ensuring optimal braking performance.

ØOil Change: We provide comprehensive oil change services for all vehicle types. Our range includes both economy and premium quality engine oils. Our well-trained technicians utilize advanced machinery and manual flushing techniques to ensure effective engine lubrication.

ØDrum Skimming: Efficient brake disks play a vital role in heat dissipation and overall braking performance. Our skilled technicians assess and perform effective drum skimming to enhance the longevity and efficiency of your brake drums.

ØSuspension Work: Maintaining a smooth driving experience and prolonging the lifespan of other components heavily relies on the care of suspension components. Our expert technicians are trained to identify and resolve issues with shocks/jumpers, control arms, bushes, engine mounting, and other suspension components.

ØBattery Services: We offer professional battery replacement services to ensure your vehicle's electrical system functions optimally. With modern vehicles featuring complex electronic circuitry, our trained technicians adhere to strict procedures and checklists for safe and efficient battery replacements.

Trust DWB Tyres for top-notch car repair and maintenance services in Abu Dhabi. Our dedicated team is committed to delivering exceptional quality and customer satisfaction.

#dwbtyres#regular car service#car service#car garage#car check up#car maintenance tips#car service abu dhabi#car maintenance#abudhabi#garage in abu dhabi#abudhabityre

0 notes

Text

Significance Of Oil Changes By The Best - Arabian Star.

Usually, after 3,000 to 5,000 miles, it's suggested that you take your automobile into the shop for an oil change. Nonetheless, these numbers can vary depending on your car's make and model, something your mechanic can better notify you of. Unfortunately, while this is expected knowledge, multiple car owners are very lethargic regarding maintaining oil changes. Arabian Star offers the best oil change in Abu Dhabi.

Forgetting to bring your automobile in for regular oil upkeep can damage your car in the long run, leading to more cash out of your pocket.

Here are some benefits of regular oil changes:

Better Gas Mileage

If you have to go long distances repeatedly, you understand the significance of gas mileage. Nevertheless, did you know that your oil quality and gas mileage go hand-in-hand? Proper and uniform oil changes will only help preserve excellent gas mileage.

Conversely, if you forget to change your oil when essential, it will only lower your gas mileage and need you to put gas in your automobile more often.

Longer Engine Life

Frequent oil changes will prolong your machine's life, giving your car more significance. With better gas mileage, good engine lubrication, and the deterrence of sludge and dirt particles, your motor is sure to last for a long time.

While you can't permanently prevent the issues that occur within a vehicle, you can help guarantee that your machine's life is expanded with continued oil changes.

Lowers engine wear and build-up

Taking your automobile to the technician for routine oil changes will only help it sustain vitality. Oil changes help to lower and remove any extra dirt that can build up in your motor from use. Sludge is also a joint development in automobiles; oil changes will terminate it for a more efficient operating engine.

Oil changes contribute to the neatness of your motor. A pristine engine is a smooth-running machine.

Supplies Engine Lubrication

To keep your car operating efficiently, your engine will create a lot of heat. While motor heat is normal, you never like your engine to overheat. Without appropriate oil changes, your engine is more liable to overheating.

The key is consistently to guarantee your machine is adequately lubricated and clear of the chance of drying out and causing multiple issues.

Therefore, if you are looking for oil change services and oil change price in Abu Dhabi, look no further than Arabian Star!

0 notes

Text

Brazil union pushes to revoke refinery privatization

Brazil's federation of oil workers union FUP is hoping a proposed constitutional amendment will unwind the $1.8bn privatization of the 333,000 b/d Mataripe refinery.

After years of failed legal challenges to Petrobras' sale of downstream assets, FUP says the proposed amendment from congressman Jorge Solla would see refineries, distributors and gas pipelines sold in recent years re-integrated into the state-controlled company.

The supermajority required to pass a constitutional amendment means the proposal from Solla, of the left-leaning Workers' Party (PT), will struggle to survive, although its introduction coincides with a domestic fuel price crisis that could see swift changes in the downstream segment.

Formerly known as the Landulpho Alves refinery (RLAM), Mataripe is the only divestment Petrobras has closed since the 2019 launch of a sales process covering seven other refineries. The refinery located in the northern state of Bahia has been operated by Acelen, a subsidiary of Abu Dhabi's Mubadala, since December 2021.

Continue reading.

#brazil#brazilian politics#politics#economy#oil industry#petrobras#mod nise da silveira#image description in alt

8 notes

·

View notes

Photo

Leonardo da Vinci Sketch Sells for $12.2 Million

A tiny sketch of a bear by Leonardo da Vinci sold for over $12 million on Thursday, setting a new auction record for a drawing by the renaissance artist.

Measuring less than 8 square inches, the item is one of only eight Leonardo drawings left in private hands, according Christie's, the auction house behind the sale.

The sketch was made on pale pink-beige paper using silverpoint, a technique -- taught to Leonardo by his master, Andrea del Verrocchio -- that involves marking chemically treated paper with silver rods or wire.

The item has changed hands several times over the centuries -- in fact, it was once sold by Christie's for just £2.50 (about £312, or $430, in today's money) in 1860. Titled "Head of a Bear," the drawing has since been displayed at major institutions including the National Gallery in London, the Louvre Abu Dhabi and St. Petersburg's State Hermitage Museum.

In a press statement following Thursday's sale, the international head of Christie's Old Master drawings department, Stijn Alsteens, described the work as "small but magnificent." He added that it "will undoubtedly be one of the last drawings by Leonardo to ever come to the market."

The drawing, which includes the artist's signature, was initially expected to fetch up to £12 million ($16.82 million). It eventually sold at the lower end of the estimate, at around £8.9 million ($12.2 million).

Notable previous owners include painter Sir Thomas Lawrence and art collector Captain Norman Robert Colville.

The sketch broke the auction record for a Leonardo drawing -- previously held by "Horse and Rider," which sold for £8 million (over $11.2 million) in 2001 -- though the price tag fell well short of the current auction record for an Old Master drawing. In 2009, Raphael's "Head of a Muse," a study for a fresco commissioned by Pope Julius II for the Stanza della Segnatura in the Vatican, netted almost $49 million at Christie's in London.

While Leonardo is best known for oil paintings like the "Mona Lisa" and "The Last Supper," the Renaissance master was also celebrated for his anatomical sketches. His drawing "The Vitruvian Man," a mathematically precise rendering of a nude male, is hailed as one of his greatest accomplishments.

Leonardo was fascinated by the natural world, and he completed many other animal sketches in his lifetime. His drawings of cats and dogs, as well as one of a bear walking, are among those on display at institutions including the British Museum and Metropolitan Museum of Art.

Other Leonardo sketches depicted religious figures and biblical scenes. In 2016, a drawing titled "The Martyred Saint Sebastian" was set to fetch 15 million euros ($16 million at the time) at auction, though the sale was blocked after the French government declared the item to be a national treasure.

Other notable lots at Thursday's auction, which was dubbed "The Exceptional Sale" by Christie's, included a manuscript signed by Isaac Newton and a 17th-century silver inkstand. They sold for over £1.7 million ($2.3 million) and £1.9 million ($2.7 million) respectively.

By Megan C. Hills.

#Leonardo da Vinci Sketch Sells for $12.2 Million#Head of a Bear#drawing#painter#artist#art#art work#art news

30 notes

·

View notes

Text

Investors: Masrani Global

PROFILE

Masrani is one of the world's most successful corporations, with portfolios in both the commercial and industrial sectors and services spanning telecommunications, oil production, biological engineering, and construction. Generating a total profit of over $800 million in the 2014 fiscal year, Masrani can credit vision and innovation in its successes over the last two decades with CEO Simon Masrani at the helm.

Since the Masrani Global Corporation's NASDAQ market debut in 2000, Masrani has witnessed growth to over 70,000 team members, 250,000 shareholders from all across the world, and a list of stakeholders growing every day. Masrani is a significant global employer and CEO Simon Masrani has led from the top through acts of philanthropy and community engagement.

Investors have much to gain with the Masrani Corporation. Being one of NASDAQ 100 and Fortune 500 companies, 2014 saw a share price index increase of 13.2% from Q1 to Q4. With the world's best market analysts driving the corporation’s financial sectors, you can be assured that you're investing in the future with Masrani.

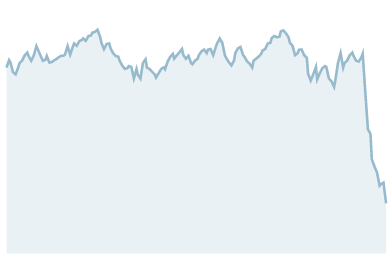

STOCK

NASDAQ MSRN (YTD): The above graph represents the year-to-date share-price index for MSRN on the NASDAQ market since Janurary 1, 2015.

NASDAQ Share Price Index: $158.12* -3.36 ⇓ 2.08%

CEO'S MESSAGE

As one of the leading Fortune 500 companies, Masrani Global has continued to advance and excel in major markets around the world. America, Asia, Europe and Australasia, no region has been left untouched. Having overseen a magnificent year in our two leading fields - namely genetics and research & development - we have set our sights on improving on new horizons.

Since its inauguration in 2005, Jurassic World has captivated millions around the globe. By 2015 we are expecting our 10 millionth visitor to Isla Nublar. For investors, that spells success.

What does 2015 hold? We have a world-class genetics and research and development team who have some ideas that will take genetics to the next level. Using InGen technology, combined with Masrani innovation, the world is ours to make and enjoy. I wish all of you the best as we head into a new era.

Chief Executive Officer: Simon Masrani reflects on an encouraging start to the 2014-15 financial year.

FY2014 REPORT

The Masrani Global Corporation posted one the most successful years in its history during the 2014 financial year, thanks in large part to investments in more sustainable energy technologies early in Q2. Now the world's 12th richest company, Masrani Global entered the 2015 fiscal year valued at 562.15 billion dollars.

Despite Masrani Oil's L-12 hiccup in August, 2014 was a year for investors to largely celebrate. Starting off Q1 with a share price index of $159.12, Masrani Global (NASDAQ: MSRN) continued its steady rise ending the year on a high of $180.12 after a series of innovative technological approaches. For the eighth year in a row, Masrani Global showed why it is one of the world's safest investments - with a net profit of 822.38 million dollars and a positive share price index increase of 13.2% over FY2014.

Simon Masrani was optimistic on the future prospects of the workforce. "We recently set up the Masrani scholarship program, which has assisted top graduates find positions within our companies all over the world", he said from Masrani's recently renovated offices in Shanghai. "We encourage our interns to think with fresh and open minds. If someone has a good idea, it needs to be nurtured. Some of the world's most successful ventures have come from young talent who just hung onto one unique idea. This is where the true future investment of Masrani lays."

2014 saw the continued investment of assets within the industrial (Masrani Oil, Timack Construction) and technological (InGen, Tatsu Technology) fields. While the overall intention was to focus on new technologies, sharing of information across subsidiaries was the underlying philosophy.

"Last year was one of scientific advancement", said Mr. Richard Wiesner, COO of Masrani Global. "We witnessed various subsidiaries working with each other to bring about the most exciting innovations the world has yet to see. Mascom launched satellites carrying Tatsuo processors, Analysys provided data that helped Medixal drive innovative healthcare, and Axis Boulder helped Masrani Oil make advances in sustainability."

Dr. Henry Wu, Lead Geneticist of InGen Technologies, was also excited about the future prospects of Jurassic World. Speaking from a scientific convention in Chicago, he said, "Thanks to the changing nature of genetics and the limitless power of the human imagination, we can now push boundaries that were once considered to be decades away."

Wiesner credited Jurassic World's latest success to Simon Masrani's recent announcement of the new Indominus rex attraction. “Since opening we've seen online bookings skyrocket” he explained. “2015 is going to be a fantastic year for Jurassic World."

InGen Technologies temporarily closed down two of its mines in Argentina to focus on its Martel expedition in Siberia, a move that has so far yielded an abundance of highly preserved carcasses. Despite the exciting finds, Dr. Henry Wu has held back on speculating whether Jurassic World might be including recreated assets from the Cenozoic Era. "Right now we are focused on the construction of the world's most complete genomic library", Dr. Wu reiterated. "But if the world tells us that's what they want to see, we're more than prepared."

FY2013 Report

Masrani continued it's trend since 2008 to post billion dollar profits over the financial year. Now a $521.42 multi-billion corporation, Masrani Globlal is on the verge of being one of the world's top 10 companies by 2020 should current market predictions continue.

Showing no change in course for the last four years, Masrani Global (NASDAQ: MSRN) continued to set its high standards for 2013. Showing a steady incline, starting off the year in Q1 with a share price index of $138.52 and ending the year at Q4 on a high of $159.12 after rumors of further investment in InGen resources.

Hiring an additional 4,000 staff over the course of the year, Masrani looked to increase its workforce in the United Arab Emirates, with an upgraded oil refinary expecting to be completed in early 2014. With a workforce age of just under 32 years of age, Marani Global is one of the most proactive workforces in the world looking in every corner for fresh talent.

Thanks to a scholarship program with Masrani, young college students excelling in their studies can now take up internships in field offices around the globe. With inauguration set for December 2014, the Masrani scholarship program has so far seen over 80,000 applications in its first year alone.

In the last two years further investment of assets within the industrial (Masrani Oil, Timack Construction) and technological (InGen, Tatsu Technology) fields continued to be made, exciting investors with new technologies and greater profits.

"Scientific advancement is something that cannot be compromised on", said Simon Masrani. "In today's world the competition is great, and with much at stake, and with the power to deliver, we find ourselves in a unique position to deliver technical advancement capabilities that go beyond the imagination."

Despite scientific advancements, Jurassic World continued to spark debate. Within the last three years, despite visitor rates climbing, the peak in numbers continued to appear during the American school holiday season, where staff on Isla Nublar are operating at 100% capacity.

Masrani Corporation's Chief Operations Officer Mr. Richard Wiesner described the year's success as merely acceptable. "You can't expect the world's greatest theme park to merely rely on the same attractions. We need to be proactive, thinking of bigger and better things. Isla Nublar only peaks in attendance during the American holiday season. Why? Proximity. The world has seen what we have to offer, but they aren't in awe as they once used to be. We need to change that. We have a chance to over the upcoming few years."

Despite speculations in the media that Jurassic World might be seen as a slowing attraction, investors can enjoy last month's announcement of a further 300 hotel rooms to be built on the island. Some big plans are coming, so stay tuned in 2014.

Last 4 FY Profit: Masrani Corporation profit in millions of dollars.

WHAT THEY ARE SAYING

Following in the footsteps of my father to make his company into a global corporation has been a lifelong goal. I have nothing but the investors of this company to thank, for they have joined me in this vision.

Simon Masrani - Chief Executive Officer, Masrani

The success that this company has given back to its investors has been incredible. It is something that other companies strive to replicate, but often can't deliver. Masrani has set new investment standards.

Richard Wiesner - Chief Operations Officer, Masrani

The pleasure it gives me to see that with every building we construct is another addition to help the global economy is greatly satisfying. With 8,000 workers, we all look forward to building the future.

Anthony Leigh - Director of Operations, Timack Construction

With Masrani Energy in Abu Dhabi, our workers come from diverse backgrounds with diverse skills, all towards one common goal - to build on the success of the Masrani corporation.

Jennifer Oliver - HR Manager, Masrani Energy

3 notes

·

View notes

Text

Mukesh Ambani art of deal making – Agilis advisors

“The safest way to double your money is to fold it over and put it in your pocket” -Kin Hu Reliance Industries Limited (RIL) became the first Indian company to exceed market capitalisation of $150 billion. It is also the first Indian company to cross ₹ 1,00,000 crore in consolidated EBITDA. RIL’s seminal contribution to the Indian economy is immense as they continue to be India's largest exporter accounting for 9% of India's total merchandise exports, being India's highest payer of customs and excise duty in the private sector, highest payers of GST and VAT, amongst the highest payers of Income Tax in the private sector. The oil to telecom conglomerate breaks into world’s top 100 companies on the Fortune Global 500 list. The much hyped term ‘data is the new oil’ has been literally brought to reality when Mukesh Ambani shared the updates of RIL in its 43rd AGM. Jio Platforms which has been changing the telecom landscape in India in just over three years after launch has grown to be the top telecom company in India. At the end of year 2019, the dry powder or the unutilized capital has risen to $1.5 trillion. The private equity industry remains sought after by investors and most likely to have positive investor sentiment to see through capital flowing in year 2020. Agilis advisors While COVID19 crisis continues to be the most disruptive event in modern human history adding up to global community's hardships. Asia's richest man believes that every adversity presents multiple new opportunities. As on March 2020, RIL had a net debt of ₹1,61,035 crore. RIL recently announced that it had become ‘net debt-free’ after raising the capital from global investors (₹1.15 lakh crore) and a rights issue (₹53,124.20 crore) totalling ₹1.69 lakh crore in just 2 months. The scale of investments is unprecedented and a clear win-win situation for Jio, US tech majors and other key investors. Besides huge investments flowing from top tech investors, the ₹ 53,124 crore Rights Issue is also the world's largest Rights Issue by a non-financial institution in a decade which was completed entirely on a digital platform during the lockdown period. Investment Journey: -> April 22, 2020: Facebook announces investment of Rs 43,574 crore for a 9.99 percent stake. -> May 4, 2020: Silver Lake announces equity investment of Rs 5,655.75 crore. -> May 8, 2020: Vista announces equity investment of Rs 11,367 crore for a 2.32 percent stake -> May 17, 2020: General Atlantic invests Rs 6,598.38 crore for a 1.34 percent equity stake -> May 22, 2020: KKR announces Rs 11,367 crore investment for a 2.32 percent stake -> June 5, 2020: Mubadala announces Rs 9,09360 crore investment for a 1.85 percent equity stake -> June 5, 2020: Silver Lake announces additional equity investment of Rs 4,546.80 crore -> June 7, 2020: Abu Dhabi Investment Authority invests Rs 5,683.50 crore for a 1.16% stake -> June 13, 2020: TPG invests Rs 4,546.80 crore for a 0.93% stake -> June 13, 2020: L Catterton joins Jio Platforms’ investors list with a Rs 1,894.50 crore investment for a 0.39 percent stake -> July 2020: Google to invest ₹ 33,737 crores for a 7.7 percent stake Oil to telecom business tycoon’s art of deal making has been the talk of India’s financial markets which is well lauded by top businessmen and market experts. Warren Buffett once quoted that “Risk comes from not knowing what you’re doing” and RIL Chairman’s strategic forward thinking and business acumen skills has immensely contributed to weigh down the risks and reap the potential benefits and opportunities from such huge investments. The massive debt that had mounted in recent years had pushed RIL at the high end of the debt-rating spectrum enabling to bridge the future prosperity and expansion of company. As rightly appraised by Kin Hubbard - “The safest way to double your money is to fold it over and put it in your pocket”, Mukesh seems to have did exactly the same by safeguarding his money on the first place and attracting the investor’s money yet keeping the returns intact. The timing of RIL debt reduction plan is paramount as investors are immediately attracted to write a cheque to own a slice of it. With oil prices depressing and digital being the new future, there are over 1.3 billion reasons for the investors to rely on Jio as they gear up to lead the digital eco-system and transformation. African proverb quotes “To walk fast, walk alone; to walk far, walk together”. RIL has chosen its partners such that future will be an interesting journey as RIL is poised to create its own roadmap in collaboration with its new strategic partners. The new announcements such as 5G technology readiness, the launch of new mobile phone, having Kirana store to the digital world and combing with RIL’s investment strategies will put Jio into a market leader position in digital and telecom sector.

#Capital Raising germany#Capital advisors germany#Private Markets germany#Markets Merge Acquire germany#Financial Advisory germany#Placement Agency germany#Investment Management germany

1 note

·

View note

Text

UAE developers alternate strategy to evolve to softening market

A Dh30-billion partnership between the us of a's two largest listed real estate groups, Emaar Properties and Aldar Properties, in March helped gas investor self assurance within the market. Aldar spun off $five.4bn of sales-producing assets into a brand new subsidiary, Aldar Investments. In September, the deliberate sale via Emaar Hospitality of five of its flagship Dubai inns to apartment sale in abu dhabi, and the continued foray into the increasing middle-profits phase by using developers which include Aldar, Bloom Holding and Nakheel Properties, also illustrate the strategic taking into consideration the industry leaders. For a few businesses, consolidation strategies commenced to undergo fruit. Dubai contractor Arabtec extra than doubled its income yr-on-yr inside the third sector to Dh181 million, way to project wins and an ongoing reorganisation. Revenues grew 12.7 per cent in the course of the length.

Going into 2019, robust supply will persist. Oil expenses rising to above $80 in step with barrel inside the summer time and an increase in production hobby beforehand of Expo 2020 Dubai boosted sentiment and brought about growth this year. However, rising supply may additionally keep costs low, even though this shows a maturing market of real estate companies in dubai, commentators say. “Property costs are expected to hold to say no as we are maximum probably to peer the materialisation of residential deliver double, if now not triple, the quantity of gadgets from past years,” said Lynnette Abad, director of research and information at UAE portal Property Finder. A total of 19,881 residential units had been finished in Dubai this 12 months as of October, Property Finder stated, with a further 14,707 due to be completed via the give up of the year. A similarly 33,982 units are beneath construction, about sixty five per cent of which are to be finished in 2019. Analysts factor to a renewed experience of optimism, even as noting that the "tenant’s marketplace" that characterised 2018 will keep subsequent yr. “Prime residential regions, which noticed relative resilience in 2018, may also preserve to see a few improvement,” consultancy Valustrat said in its 2019 outlook this month. On the flipside, there's evidence that some organizations face demanding situations. budget apartments in dubai, that is grappling with $1.45bn of debt, mentioned a sixty eight in keeping with cent annual profit drop for the 1/3 zone, its fourth consecutive quarterly decline. Having already made a chain of price efficiencies, it's miles taking in addition action, there may be no new financing or land acquisitions till it brings down debt to beneath $1bn over the next 3 years.

The ultra-modern reviews from consultancies JLL, CBRE, Cavendish Maxwell and Core Savills advocate income and apartment costs are nevertheless falling in the UAE. JLL’s third-quarter update stated the apartment for sale in abu dhabi market has softened, with excessive single-digit every year declines in sale costs and rents, and a in addition 2 according to cent drop from the previous zone. The image in Abu Dhabi is similar, with residential rents and sale costs declining a further 2 in step with cent sector-on-region in Q3. At Cityscape, developers showed they're adapting to customer call for in the cheap section by offering flexible fee plans and other incentives to elevate self assurance. Egyptian funding bank EFG Hermes mentioned that the overall cost of real estate sales transactions in Dubai changed into up fifty six in keeping with cent year-on-year to Dh15.7bn in the 1/3 area, and 18 in keeping with cent month-on-month, suggesting that marketplace pastime is gaining momentum. Other elements set to buoy real property in 2019 are Abu Dhabi’s Dh50bn Ghadan 21, a three-12 months stimulus package deal geared toward boosting the economic system via investment in 4 foremost regions - business, society, knowledge and innovation, and life-style. The top real estate company in abu dhabi choice in May to permit 10-year visas for expatriates and a hundred in keeping with cent overseas ownership in groups outside unfastened zones is also predicted to propel the economic system forward. “Long-time period visa security must growth the investor pool and extend the market cycle with longer term preserve durations,” JLL stated in its record. “We count on a healthier marketplace appetite in the long run.

#top real estate company in abu dhabi#apartment for sale in abu dhabi#budget apartments in dubai#real estate companies in dubai#apartment sale in abu dhabi

1 note

·

View note

Text

How to keep your Mercedes engine in good condition?

Mercedes has a powerful design and the important mechanical and electrical components in it like the engine, transmission, suspension, battery and many others are highly durable.

Maintaining complex components like the engine is the key way to keep your Mercedes in good condition. The engine is one of the complicated components and requires professional care from the experts.

When you face any minor engine problems it is necessary to get it sorted out by visiting the Mercedes service center as soon as possible because postponing the repairs may affect your Mercedes performance and would provide you with expensive repair bills.

What are the most common engine issues experienced in your Mercedes?

Some of the common engine issues experienced in the Mercedes include poor lubrication caused by the old engine oil accumulated with the dirt and debris or its low level, oil pump failure, coolant leakage, rough idling or misfiring, radiator issues, damaged spark plugs and many more.

So getting the proper engine tune-up and preventive maintenance as per the manufacturer guidelines will ensure the smooth performance of your Mercedes engine. Perhaps you can drive without any fear of unexpected electrical or mechanical breakdowns.

Tips for first time Mercedes owners to care for their engine

Replace the engine oil regularly at the stipulated interval and it is always advisable to change the oil filter along with it.

Check for oil leakages and if it occurs contact your Mercedes service advisor immediately because the oil may leak from damaged gaskets, seals or any other.

Check the components like the radiator, thermostat, fuel pump and coolant level during your service appointments.

Get the coolant flush done as per the schedule.

Change the wires and spark plugs if necessary.

Pay attention to the air filter.

Clean the engine bay once in a while to stay away from the dirt residue.

Don’t ignore the warning lights in your Mercedes, if the check engine lights are illuminating make sure you get it sorted out as soon as possible.

Identify the cause if there is a sudden drop in the fuel efficiency of your Mercedes. It may be due to the problems associated with the engine components.

At our Mercedes service center in Abu Dhabi & Dubai, we do offer the wide range of electrical and mechanical services required to keep your Mercedes in perfect condition from the hands of the specialists with a shorter turnaround time for the vehicles, so that you can be stress-free when it comes to Mercedes maintenance, repair or replacement.

No matter whatever Mercedes model you hold or how major the issues may be, the dealership's range of services at the most competitive prices is guaranteed with our Mercedes Workshop in the UAE.

#mercedes service center#mercedes service#mercedes car#Mercedes repair#mercedes amg petronas#mercedes#mercedes workshop#mercedes repair dubai#mercedes repair center#car service center#car service#car services#car service center dubai#car repair dubai#car repair#car service center abu dhabi#cars#electric cars

0 notes

Text

Europe a 'few years' away from overcoming energy deficit, OMV chief says

Europe is a “few years” away from overcoming its current energy deficit triggered by the loss of Russian gas supply, according to Alfred Stern, chief executive of Austrian energy group OMV.

The continent is in the middle of its worst energy crisis after Russia, the region’s biggest natural gas supplier, curtailed exports sharply in response to EU sanctions over its military offensive in Ukraine.

However, the crisis has been a few years in the making. Spending on new oil and gas projects has nearly dried up amid pressure from investors, who have adopted more pro-renewable energy strategies in recent years.

This issue is “bigger than Europe” and is a result of underinvestment in the energy sector, as well as from “thinking that we could magically move to renewable energy overnight”, Mr Stern told The National at the Adipec energy summit in Abu Dhabi.

“Fixing this up will require significant investments, and typically, our industry is one that has very long investment cycles,” he said.

Upstream oil and gas investment needs to increase and be sustained near the pre-coronavirus levels of $525 billion through to 2030 to ensure market balance, according to the International Energy Forum.

Upstream investment in 2021 was depressed for a second consecutive year at $341bn — about 25 per cent below 2019 levels.

To replace Russian gas in the short-term, some European countries have brought coal-fired power plants back into operation and this has triggered concerns about their ability to meet climate commitments.

“Too much coal power is coming back on stream, but the carbon-dioxide footprint is much better with natural gas … we should make sure that we bring this back on track because, otherwise, we are going to go backwards on climate change,” said Mr Stern.

Europe boosted its liquefied natural gas (LNG) imports from the US and Gulf countries before the start of the peak winter season.

Austria’s gas storage sites are completely full and now the EU country is looking to secure supplies for 2023.

Last week, OMV signed a preliminary agreement with Adnoc with the aim of purchasing an LNG cargo for next year’s winter.

“Even if the Russian supplies should stop, we can supply 100 per cent of our customers in Austria with non-Russian gas … we are already looking to next winter and that is why it was important to sign this [deal],” said Mr Stern.

OMV, which has a long-term LNG contract with Qatar, is “also looking at the US and other sources of supply”, said Mr Stern.

The US, which exported 11.1 billion cubic feet per day of LNG in the first half of 2022, has more LNG export capacity than any other country, according to the US Energy Information Administration.

The current strains on gas supply have led to energy shortages in several parts of the developing world that rely on imported gas, notably Pakistan and Bangladesh.

Meanwhile, major growth markets for gas, such as India and China, have sharply reduced their LNG imports in 2022.

“Developing countries can no longer afford the [high LNG prices] … we need to ramp up capacity,” said Mr Stern.

0 notes