#Markets Merge Acquire germany

Explore tagged Tumblr posts

Text

Top 15 Market Players in Global Polyquaternium-10 Market

Top 15 Market Players in Global Polyquaternium-10 Market

The global Polyquaternium-10 market is characterized by the presence of several key players who contribute significantly to its growth and development. These companies are actively involved in various strategies to strengthen their market positions and cater to the increasing demand for Polyquaternium-10 in personal care and pharmaceutical applications.

Nouryon (Netherlands): A global specialty chemicals leader, Nouryon is known for its extensive range of products in the personal care industry.

Dow (U.S.): A leading chemical company with a significant presence in the personal care sector, Dow offers a wide range of Polyquaternium-10 products for various applications.

KCI (South Korea): A South Korean company active in the personal care market, KCI is known for its innovative solutions and high-quality products.

Guangzhou Tinci Materials Technology Co., Ltd. (China): A major player in the Polyquaternium-10 market, this Chinese company specializes in the production of chemical products for various industries.

TOHO Chemical (Japan): A Japanese company known for its contributions to the chemical industry, TOHO Chemical offers a range of products, including Polyquaternium-10.

Lubrizol (U.S.): Known for its specialty chemicals in the personal care industry, Lubrizol provides high-quality Polyquaternium-10 products catering to various applications.

Zhejiang Xinhaitian Biological Technology Co., Ltd. (China): This Chinese company is recognized for its role in the Polyquaternium-10 market, offering a range of products for personal care applications.

Ashland Global Holdings Inc. (U.S.): A leading player in the Polyquaternium-10 market, Ashland is known for its high-quality and innovative personal care and pharmaceutical products.

BASF SE (Germany): A major chemical company, BASF offers a wide range of Polyquaternium-10 products for various applications in the personal care industry.

Solvay S.A. (Belgium): A multinational corporation specializing in advanced materials and specialty chemicals, Solvay contributes significantly to the Polyquaternium-10 market.

Clariant AG (Switzerland): Known for its specialty chemicals, Clariant offers a range of Polyquaternium-10 products catering to the personal care sector.

Croda International Plc (U.K.): A British specialty chemicals company, Croda provides innovative Polyquaternium-10 solutions for various applications.

Evonik Industries AG (Germany): A global leader in specialty chemicals, Evonik offers a diverse portfolio of Polyquaternium-10 products.

Kao Corporation (Japan): A Japanese company with a strong presence in the personal care market, Kao Corporation provides high-quality Polyquaternium-10 products.

Stepan Company (U.S.): An American manufacturer of specialty chemicals, Stepan Company offers a range of Polyquaternium-10 products for personal care applications.

Request report sample at https://datavagyanik.com/reports/global-polyquaternium-10-market/

Top Winning Strategies in Polyquaternium-10 Market

To maintain a competitive edge, leading companies in the Polyquaternium-10 market are adopting several key strategies:

Research and Development (R&D) Investments: Companies are investing heavily in R&D to develop innovative and advanced Polyquaternium-10 formulations. This focus on innovation allows them to meet evolving consumer preferences and regulatory requirements.

Strategic Partnerships and Collaborations: Forming alliances with other industry players enables companies to leverage shared expertise, expand their product portfolios, and enter new markets. Such collaborations can lead to the development of novel products and enhanced market reach.

Acquisitions and Mergers: Acquiring or merging with other companies allows market leaders to strengthen their market position, diversify their product offerings, and achieve economies of scale. This strategy also facilitates access to new technologies and customer bases.

Sustainability Initiatives: With growing consumer awareness of environmental issues, companies are focusing on sustainable and eco-friendly Polyquaternium-10 production processes. This includes developing biodegradable products and reducing the environmental impact of manufacturing activities.

Market Expansion: Exploring new geographic markets, especially in emerging economies, provides opportunities for growth. Companies are tailoring their products to meet regional preferences and regulatory standards, thereby expanding their global footprint.

By implementing these strategies, companies aim to enhance their competitiveness, meet consumer demands, and drive growth in the dynamic Polyquaternium-10 market.

Request a free sample copy at https://datavagyanik.com/reports/global-polyquaternium-10-market/

#Polyquaternium-10 Market#Polyquaternium-10 Market Production#market share#market growth#market players#top trends#market size#revenue#average price#competitive pricing strategies

0 notes

Text

Hand Tools Market Growth Surges Toward USD 27.9 Billion by 2033

The Hand Tools Market report, unveiled by Future Market Insights—an ESOMAR Certified Market Research and Consulting Firm—presents invaluable insights and meticulous analysis of the Hand Tools market. Encompassing the research's scope and essence, this report scrupulously examines the driving factors, market size, and predictive data for Hand Tools. It furnishes intricate revenue and shipment segmentations, accompanied by a decade-long projection up to 2033. Additionally, the document evaluates key industry players, their market distribution, the competitive scenario, and regional perspectives.

The global Hand Tools Market is currently witnessing a notable upsurge in demand, attributed primarily to the integration of state-of-the-art technology, which not only ensures superior grips and heightened durability but also extends the overall shelf life of these tools. This heightened demand is particularly being propelled by the resurgence of the automotive manufacturing and repair sectors, alongside the proliferation of intricate and advanced appliances in the market.

Projections indicate that the hand tools market is poised to establish a robust growth trajectory, with an anticipated Compound Annual Growth Rate (CAGR) of 5.8% during the period from 2023 to 2033. It is expected that by the year 2033, the market will have achieved a substantial market share of USD 27.9 billion, marking a significant increase from the projected value of USD 15.9 billion in 2023.Advanced features-loaded hand tools such as wrenches, screwdrivers, and pliers are in fashion. Furthermore, the addition of repair kits in most vehicles is also consuming a big chunk of the market.

New technology with better grips, durable body, and long shelf life is flourishing the demand for hand tools across the globe. The restoration of automotive manufacturing and repairing along with the new complex appliances are garnering market growth.

Emerging economies of China and India with large manufacturing capacities of cars, trucks, and bikes are also investing in the hand tools sector. The growing number of vehicles on the road is expected to help the market thrive.

New concepts like glass-covered toolboxes, small repairing points, and highway support units are pushing the authorities to invest in hand toolboxes or kits. Alongside this, the new features like small parts of the kit in different sizes and packaging are also flourishing the market growth.

Browse More: https://www.futuremarketinsights.com/reports/hand-tools-market

Key Points

The United States market leads the hand tools market in terms of market share in North America. The United States region holds a market share of 20.6% in 2023. The growth in this region is attributed to the expanding manufacturing and repairing sector in the region

Germany’s hand tools market is another significant market in the Europe region. The market holds a market share of 6.9% in 2023. The growth is attributed to the increasing number of cafés, new and advanced flavors, and rising production facilities.

India’s hand tools market thrives at a leading CAGR of 7.2% during the forecast period. The market’s growth is attributed to the proliferation of sales, export, and repair of vehicles and appliances. The big facilities are adopting the latest hand tools.

The wrench segment leads the product type segment as it holds a leading market share of 30.9% in 2023. The growth is attributed to high consumption.

Competitive Landscape:

The key vendors work on rigidity, advanced design, and custom availability. The players also work on enhanced supply chains and high affordability. Companies collaborate to expand their supply chain. Key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Recent Market Developments:

Weidmuller Interface GmbH and Co. KG have set up their hand tool portfolio with the categories like cutting, stripping the insulation, crimping, etc.

Indian brand, MISUMI Group Inc. has introduced its long range of hand tools like wrenches, hex wrenches, screwdrivers, hammers, tools sets, cutter knives, and monkey wrenches. The company has also launched its 20% off on the first order scheme.

Key Segments Covered

By Product Type:

Wrenches

Pliers

Screwdrivers

Voltage Tester

Measuring Tools

Hammers

Cutters

Taps and Dies

Hand Saws

Punches

Others

By Sales Channel:

Online

Offline

By End-User:

DIY

Commercial

Industrial

Key Regions Covered:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Embedded Finance Market Set for Robust Growth: Projected to Reach USD 291.3 Billion by 2033 with a 16.5% CAGR

It is projected that the embedded finance industry would grow at a robust 16.5% compound annual growth rate (CAGR) from 2023 to 2033. The market is anticipated to be valued at US$ 63.2 billion in 2023 and to have a market share of US$ 291.3 billion by 2033.

Read more @https://www.fmiblog.com/2024/09/26/embedded-finance-market-set-for-robust-growth-projected-to-reach-291-3-billion-by-2033-with-a-16-5-cagr/

The technical advantages along with the expanding financial services including banking and non-banking options are flourishing the market growth. Furthermore, the rapid automation and adoption of smart platforms of different spaces for high productivity and efficiency are propelling growth.

Financial giants are partnering with technological platforms for innovative solutions. For example, Mastercard and Fabrick have signed a partnership to boost embedded finance. New services like buy now pay later (BNPL) and credit reporting are good examples of embedded finance.

The expanding sales and extended chains of banks and financial companies are expected to adopt these new systems in to improve the services offered. Alongside this, the increased convenience, quick transaction, and highly accessible interface is making embedded finance systems future-ready.

The growing sales of financial services have also increased the importance of data. Thus, the embedded finance systems also deliver a relevant collection of data while adding inclusion and convenience to the end user’s plate.

The other benefits include the generation of additional revenue streams while increasing the product’s stickiness, and enhanced customer experience.

Key Takeaways:

The United States market leads the embedded finance market in terms of market share in North America. The United States region held a market share of 22.3% in 2023. The growth in this region is attributed to expanding financial firms, and the government’s adoption of the latest technologies. North American region held a significant market share of 32.5% in 2022.

Germany’s market is another successful market in the Europe region. The market holds a market share of 12.3% in 2022. The growth is attributed to the presence of new embedded finance platforms such as Plaid, and Alviere Hive. Europe region held a market share of 25.4% in 2022

India embedded finance market booms at a CAGR of 19.5% during the forecast period. The market’s growth is attributed to the new banking policies, enlarged non-banking policies, and high penetration of non-banking platforms.

China’s market also thrives at a CAGR of 17.7% between 2023 and 2033. The growth is caused by the banking reforms and increased focus on consumer inclusivity.

Based on type, the embedded banking segment held a leading market share of 32.1% in 2022.

Based on end-user type, the investment banks and investments company segment perform well as it held a leading market share of 27.2% in 2022.

Competitive Landscape:

The key vendors focus on adding value to the embedded finance systems and easy deployment procedures. Moreover, key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Major Players in this Market:

Bankable

Banxware

Cross River

Resolve

Parafin

TreviPay

Balance

Stripe

Recent Market Developments:

Finix has introduced embedded payments and the vertical SaaS conundrum. The addition of embedded payments is increasing revenue, reducing the payment strike, and easy customer engagement.

Flywire embedded experience is using smart technologies to secure payments without leaving the website.

Key Segments Covered are:

By Type:

Embedded Banking

Embedded Insurance

Embedded Investments

Embedded Lending

Embedded Payment

By End User:

Loans Associations

Investment Banks & Investment Companies

Brokerage Firms

Insurance Companies

Mortgage Companies

By Key Regions:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

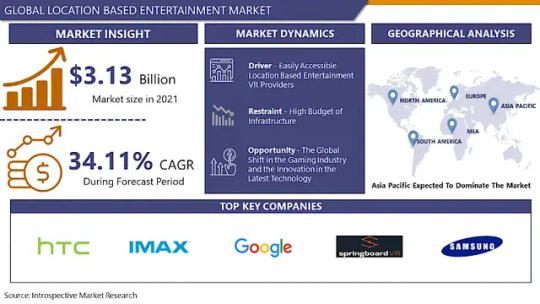

Driving Growth, Inspiring Fun: Explore the World of Location-Based Entertainment

The global location-based entertainment market size is anticipated to reach USD 25.90 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 28.5% from 2025 to 2030. The growth can be credited to increasing consumer expenditure on new and exciting adventure and leisure activities. Rising disposable incomes and changing lifestyle patterns are the major factors driving the demand for location-based entertainment (LBE).

The growth of the location-based entertainment market is being further driven by the introduction of technologies, such as Augmented Reality (AR), Virtual Reality (VR), and mixed reality. These location-based entertainment services combined with these technologies provide visitors with an immersive and real-life experience. The market players are offering VR attractions under one roof to attract more visitors. For instance, in 2022, Sandbox VR announced to enter the Colorado location at Park Meadows Mall to provide a socially immersive gaming experience that combines high-quality haptics and full-body motion capture to provide complete immersion.

Various video game developers are entering into mergers and acquisitions with VR and LBE technology providers to increase their respective market shares. For instance, in February 2021, Vertigo Games, a VR publisher and game developer, acquired Springboard VR, a VR venue management software and content marketplace provider for LBE. The acquisition was aimed at offering operators access to VR content through Vertigo Games' Haze VR distribution platform and providing both game studios and operators with new tools and technology to expand their LBE business.

Location-based Entertainment Market Report Highlights

In terms of component, the hardware segment accounted for over 64.0% of the total revenue share in 2024 owing to the increased spending on VR headsets that can deliver high-end immersive experiences to consumers

In terms of technology, the 3D segment accounted for the revenue share of nearly 43.0% in 2024 and is expected to continue dominating the market over the forecast period owing to the continued advances in 3D technology extended reality, which is substantially deployed at LBE sites

In terms of end-use, the arcade studios segment is expected to witness a growth rate of around 31.0% from 2025 to 2030

The Asia Pacific regional market is anticipated to register a CAGR of around 31.0% from 2025 to 2030

Location-based Entertainment Market Segmentation

Grand View Research has further segmented the global location-based entertainment market report based on component, technology, end-use, and region:

Location-based Entertainment Component Outlook (Revenue, USD Million, 2018 - 2030)

Hardware

Software

Location-based Entertainment Technology Outlook (Revenue, USD Million, 2018 - 2030)

2 Dimensional (2D)

3- & 4-Dimensional (3D & 4D)

Cloud Merged Reality (CMR)

Location-based Entertainment End-use Outlook (Revenue, USD Million, 2018 - 2030)

Amusement Parks

Indoor

Outdoor

Arcade Studios

4D Films

Location-based Entertainment Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Rest of Europe

Asia Pacific

Japan

China

India

South Korea

Australia

Rest of Asia Pacific

South America

Brazil

Rest of South America

Middle East and Africa (MEA)

Saudi Arabia

UAE

South Africa

Rest of MEA

Key Players

4Expeience

CamOnApp

Google LLC

Cisco HQ Software, Inc

HTC Corporation

Huawei Technologies Co., Ltd

Magic Leap, Inc

Microsoft Corporation

Niantic, Inc.

Samsung Electronics Co. Ltd.

Springboard VR

VRstudios Inc

Order a free sample PDF of the Location-based Entertainment Market Intelligence Study, published by Grand View Research.

0 notes

Text

Cane Molasses Market: Global Segments, Top Key Players, Size And Recent Trends By Forecast To 2033

The cane molasses market is anticipated to expand its roots at an average CAGR of 4.5% between 2023 and 2033. The market is expected to have a market share of USD 5.3 billion by 2033, while it is likely to be valued at USD 3.4 billion in 2023.

With the extended range of applications from the food and beverages sector to the dairy and meat industry, cane molasses is helpful across the verticals. Furthermore, the higher nutritional structure of molasses is also making it popular among the health-conscious population.

The growing awareness and expanding packaged product sector are anticipated to flourish the overall market growth. Alongside this, the increasing popularity of blackstrap molasses is contributing to the market growth.

Better diabetes management, vital mineral potassium, and other elements are helping the cane molasses prevent hypokalemia and high blood pressure.

The influencers promoting health-based trends and making people aware of cane molasses’ health benefits are flourishing the market growth. Though, the drawbacks for the market, such as some side effects, including diarrhea, cancer, and irritable bowel syndrome, are limiting the market growth.

The expanding online shopping and penetration of e-commerce websites are flourishing the market growth. Furthermore, the higher acceptance of molasses in developing nations is garnering market growth.

Request Report Sample: https://www.fmisamplereport.com/sample/rep-gb-17393

Key Pointers from this market:

The United States market leads the cane molasses market in terms of market share in North America. The United States region held a significant market in 2022. The growth in this region is attributed to the growing awareness around sugar alternatives; increased demand through the industrial segment is also garnering market growth.

The German market is another important market in the European region. The market held an essential share in 2022. The growth is attributed to the growing health-conscious population and the restored food and beverages sector.

The India cane molasses market thrives at a robust CAGR during the forecast period. The growth is attributed to sustainability goals, higher production of ethanol, and a substantial diabetic population.

The China market has a significant share of the market. The growth is caused by increased industrial expansion.

Based on product type, the conventional segment leads the market as it holds a significant share in 2023.

Based on the application, the industrial segment leads the market as it held a market share in 2022.

Competitive Landscape:

The key vendors focus on improving the effectiveness of molasses while producing application-specific products. The player also delivers different types of molasses. Key competitors merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Recent Market Developments:

Cora Texas Manufacturing Company LLC has introduced blackstrap molasses that helps patients with different health conditions, such as anaemia and constipation. The industrial applications of this cane molasses grade are also in high demand.

Sweet Harvest Foods Inc. has launched cane molasses with branded and private label capabilities. The product also has OU kosher certification.

Key Players are:

Cora Texas Manufacturing Company LLC

Sweet Harvest Foods Inc.

Meridian Foods

Michigan Sugar Company

Malt Products

The Archer Daniels Midland Company

Premier Molasses

B&G Foods Inc.

Westway Feed Products LLC

Buffalo Molasses.

Key Segments Covered are:

By Type:

Organic Molasses

Conventional Molasses

By Application:

Household

Food & Beverages

Industrial

Animal Feed

Others

By Regions Covered:

North America

United States

Canada

Latin America

Brazil

Mexico

Rest of Latin America

Europe

Germany

United Kingdom

France

Spain

Russia

Rest of Europe

Japan

Asia Pacific Excluding Japan

China

India

Malaysia

Singapore

Australia

Rest of Asia Pacific Excluding Japan (APEJ)

The Middle East and Africa

GCC Countries

Israel

South Africa

The Middle East and Africa (MEA)

0 notes

Text

Location Based Entertainment Market: Forthcoming Trends and Share Analysis by 2030

The Global Location Entertainment Market size is expected to grow from USD 4.20 billion in 2022 to USD 44.53 billion by 2030, at a CAGR of 34.33 % during the forecast period (2023-2030).

The Location Based Entertainment (LBE) market is witnessing substantial growth fueled by advancements in technology and evolving consumer preferences. LBE refers to entertainment experiences that are based on a physical location and leverage technologies such as augmented reality (AR), virtual reality (VR), and mixed reality (MR) to create immersive experiences. These experiences range from theme parks and VR arcades to interactive museums and escape rooms. The market is characterized by a diverse range of offerings catering to various demographics, from children to adults, and spanning multiple sectors including gaming, tourism, and education.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/15758

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Leading players involved in the Location Based Entertainment Market include:

HTC Corporation, IMAX Corporation, Google LLC, Microsoft Corporation, Samsung Electronics Co.Ltd., Springboard VR, Exit Reality, HQ Software, MOFABLES, BidOn Games Studio

If You Have Any Query Location Based Entertainment Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/15758

Segmentation of Location Based Entertainment Market:

By Component

Hardware

Software

By End-user

Amusement Parks

Arcade Studios

4D Films

By Technology

2 Dimensional (2D)

3 Dimensional (3D)

Cloud Merged Reality (CMR)

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global Location Based Entertainment Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

Location Based Entertainment Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15758

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email: [email protected]

#Location Based Entertainment#Location Based Entertainment Market#Location Based Entertainment Market Size#Location Based Entertainment Market Share#Location Based Entertainment Market Growth#Location Based Entertainment Market Trend#Location Based Entertainment Market segment#Location Based Entertainment Market Opportunity#Location Based Entertainment Market Analysis 2023

0 notes

Text

Global Autism Spectrum Disorder Management Market: A Deep Dive into Key Drivers and Trends

The global autism spectrum disorder management market is expected to experience consistent growth over the next decade, reaching a projected valuation of US$ 3.55 billion by 2033. This translates to a promising Compound Annual Growth Rate (CAGR) of 5.2% from 2023

Rising ASD Cases and Focus on Improved Care:

A primary driver of this market growth is the increasing prevalence of autism spectrum disorder diagnoses. This necessitates improved healthcare practices and management solutions for autistic patients.

Your Insightful Report Sample: https://www.futuremarketinsights.com/reports/sample/rep-gb-5037

Tech-Driven Solutions for Learning and Symptom Reduction:

Technological advancements are playing a crucial role in the development of innovative solutions for enhancing learning and reducing symptoms in individuals with ASD. These tools are transforming the landscape of ASD management.

Government Initiatives:

New government projects and initiatives focused on autism spectrum disorder are expected to positively impact market growth. Increased research funding and support programs for ASD management will create significant opportunities.

Comprehensive Management Systems:

ASD management systems encompass various aspects of patient care, including:

Diagnosis and Treatment: These systems facilitate accurate diagnosis and provide access to evidence-based treatment approaches.

Enhanced Learning and Development: The systems promote learning and development through various methods, fostering greater independence for patients.

Therapy Options: A wide range of therapeutic interventions are included, such as behavioral, communication, and educational therapies, alongside medication options.

Creative and Sensory Therapies: Creative and sensory-based therapies are incorporated to address specific needs and promote overall well-being.

Obtain Methodology Information: https://www.futuremarketinsights.com/request-report-methodology/rep-gb-5037

Global Autism Spectrum Disorder Management Market Key Players:

Curemark, LLC (Rye, United States)

Alembic Pharmaceuticals Limited (Vadodara, India)

Yamo Pharmaceuticals (New York)

PaxMedica (Woodcliff Lake)

F. Hoffmann-La Roche Ltd (Basel, Switzerland)

Aurobindo Pharma Ltd. (Hyderabad, India)

Otsuka Holdings Co. Ltd. (Tokyo, Japan)

Janssen Pharmaceuticals, Inc. (Titusville, New Jersey)

Teva Pharmaceutical Industries Ltd. (Tel Aviv, Israel)

H. Lundbeck A/S (Copenhagen, Denmark)

Competitive Landscape

The key suppliers focus on integrated therapy programs. The competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Recent Market Developments

Hoffmann-La Roche Ltd has introduced a long range of therapies including behavioral therapy, occupational therapy, physical therapy, and speech therapy.

Otsuka Holdings Co. Ltd. Has launched the antipsychotic abilify which has also gained approval in Japan for additional indication of irritability associated with ASD.

Obtain In-Depth Market Insights: Purchase Now to Access: https://www.futuremarketinsights.com/checkout/5037

Global Autism Spectrum Disorder Management Market Key Segments Covered:

By Product Type:

Autistic Disorder

Asperger Syndrome

PDD-NOS

Other Pervasive Developmental Disorders

By Treatment:

Behavioural Approaches

Early Intervention

Medication

Others

By End-User:

Hospitals

Education Counsellor Center

Others

Key Regions Covered:

North America

United States

Canada

Latin America

Brazil

Mexico

Rest of Latin America

Europe

Germany

United Kingdom

France

Spain

Russia

Rest of Europe

Japan

Asia Pacific Excluding Japan

China

India

Malaysia

Singapore

Australia

Rest of Asia Pacific Excluding Japan (APEJ)

Middle East and Africa

GCC Countries

Israel

South Africa

Middle East and Africa (MEA)

0 notes

Text

Pleuger acquires AVI International, expanding further into North America

Pleuger is a century-old pioneer in the manufacturing of submersible motors, pumps, thrusters, and plunger pumps. Its solutions are critical to industries including energy, mining, water management, industrial processing, and oil & gas. Pleuger announces its strategic acquisition of AVI International, a Connecticut-based specialist in the upgrade, repair, and service of rotating equipment. This acquisition signifies a major expansion of Pleuger into the North American markets. Pleuger also has manufacturing facilities in Germany and France.

Anton Schneerson (CEO Pleuger), Cliff Burrell (President & CEO AVI International), Stefan Patzelt (COO, Pleuger Germany) (left to right) AVI International, serving a wide range of industries such as power generation, marine, wastewater treatment, and manufacturing, is now part of Pleuger´s broader strategy to enhance its market presence in the United States and Canada. This move accelerates Pleuger´s ability to offer superior service, assembly, and stocking capabilities in close proximity to its U.S. customers. It also promises to expedite delivery and servicing for clients in both the United States and Canada. A critical aspect of this acquisition is the establishment of AVI as a key facility for maintaining operations of Pleuger in the local territory. This strategic development ensures establishment of Pleuger Service locally and reduced lead times for spare parts, translating into increased enhanced customer satisfaction. Pleuger´s sales hub in Texas and the assembly and service site in Connecticut are set to deliver a remarkable speed of turnaround for pump delivery and service within North America. Pleuger CEO, Anton Schneerson commented: “As we celebrate this strategic add-on acquisition, I’m delighted to introduce our new Pleuger Service in the local market. Reflecting our commitment to merging German engineering expertise with the swift service and high customer satisfaction of the United States, this initiative is set to redefine standards. We’re not just offering the unmatched quality of aftermarket to Pleuger products to local customers but also opening our doors to all rotating equipment brands, applying our unparalleled Pleuger German know-how in service quality. I would like to thank the team who made this transaction possible. This acquisition is a strategic step in Pleuger´s ongoing journey towards achieving an ambitious $100 million revenue target in 2024. It underscores the company’s dedication to providing state-of-the-art flow control solutions and reinforces its status as a pioneer in the field of submersible motor technology.” With its global headquarters in Miami, USA, and a heritage Centre-of-Excellence in Hamburg, Germany, Pleuger is renowned worldwide for its reliable and durable products. Designed to solve complex challenges in harsh environments, Pleuger´s products are a testament to the company’s quality origination and engineering process. Part of the Flacks Group’s extensive portfolio, Pleuger is a family of companies that specialize in turning around medium-sized businesses in complex situations. The Flacks Group, with a portfolio exceeding $3bn and over 7,000 employees, offers solutions in challenging business scenarios. The Flacks Group, owned by Michael Flacks, acquired Pleuger in 2018 from the NYSE-traded company Flowserve. www.pleugerindustries.com Read the full article

0 notes

Text

Mastering Success: Navigating the Heights with a Masters in Engineering Management

In the ever-evolving landscape of engineering, professionals are increasingly seeking a competitive edge to propel their careers forward. One avenue gaining prominence is pursuing a Masters in Engineering Management (MEM), a strategic choice that seamlessly merges technical prowess with leadership skill.

Why Pursue a Master's in Engineering Management?

The fusion of engineering and management in this specialized program equips graduates with a unique skill set. MEM is tailored for individuals seeking to bridge the gap between engineering and business, cultivating a holistic perspective that extends beyond technical expertise.

Curriculum Overview: A Blend of Engineering and Business Acumen

The curriculum of the Masters in Engineering Management program is a carefully crafted synergy of engineering principles and business strategies. Core subjects often include project management, financial analysis, organizational behavior, and innovation management. This interdisciplinary approach prepares graduates to not only tackle complex technical challenges but also to lead and manage engineering teams effectively.

Global Perspective: The Edge of Studying Abroad

Choosing to pursue a Masters in Engineering Management abroad opens doors to a global perspective. International exposure not only enriches the academic experience but also broadens cultural horizons. Studying abroad provides a unique opportunity to collaborate with diverse minds, encouraging a global network that can prove invaluable in a connected world.

Top Destinations for MEM Programs

Several countries stand out as hubs for exceptional MEM programs. The United States, Germany, Canada, Australia, and the United Kingdom host renowned institutions offering cutting-edge engineering management education. These countries not only boast world-class faculty but also provide an immersive cultural experience for international students.

Industry-Relevant Capstone Projects

A hallmark of many Masters in Engineering Management programs is the emphasis on practical application. Capstone projects often involve real-world challenges, allowing students to apply their knowledge in a hands-on setting. This experiential learning approach ensures that graduates are not just academically prepared but are also industry-ready.

Career Trajectory: A Booming Demand for MEM Graduates

The demand for professionals with expertise in both engineering and management is on the rise. MEM graduates find themselves well-positioned for leadership roles, such as project managers, engineering consultants, or even chief technology officers. Employers value the unique skill set these individuals bring to the table, making MEM graduates sought after in a competitive job market.

Cultural Immersion: Beyond Academics

Studying abroad is not just about academics; it's a holistic experience. From cultural festivals to exploring historical landmarks, international students have the opportunity to immerse themselves in a rich tapestry of traditions. This cultural immersion contributes to personal growth and enhances the overall educational journey.

Conclusion:

In the dynamic world of engineering, a Masters in Engineering Management serves as a compass, guiding professionals toward leadership roles. By choosing to study abroad, individuals not only gain a world-class education but also acquire the global perspective needed to navigate the complexities of today's interconnected industries.

Embarking on a journey to master the delicate balance of engineering and management is an investment in a future where success knows no bounds. As the global demand for skilled engineering managers continues to grow, those armed with a MEM degree are well-poised to lead the charge in shaping the future of technology and innovation.

0 notes

Text

Probiotics in Animal Feed Market: Growth Opportunities and Recent Developments

The Probiotics in Animal Feed market is projected to reach USD 7.1 billion by 2028 from USD 4.6 billion by 2023, at a CAGR of 9.1% during the forecast period in terms of value. The demand for probiotics in animal feed is primarily driven by increase in production and demand of compound feed along with rising consumption of feed additives in emerging markets such as Asia Pacific and South America.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85832335

The key players in this market include ADM (US), International Flavors & Fragrances Inc. (US), CHR. HANSEN HOLDING A/S (Denmark), Evonik Industries AG (Germany), Land O'Lakes (US), DSM (Netherlands), Ohly (Germany), Novozymes (Denmark), Alltech (US), Kemin Industries, Inc. (US), Provita Animal Health (UK), Orffa (Netherlands), Lesaffre (France), Lallemand Inc. (Canada). These players have adopted various growth strategies such as partnerships, agreements, collaborations, and new product launches to increase their global market presence.

ADM (US), ADM primarily produces food & feed ingredients. It is one of the key players in the agricultural processing and food ingredient sectors. The company is also involved in the trade, transport, storage, and processing of various grains and commodities. The company engages in the production, sale, and supply of specialty products, including emulsifiers, natural flavor ingredients, natural health and nutrition products, natural colors, flavor systems, proteins, polyols, soluble fiber, hydrocolloids, and other specialty food & feed ingredients. The company’s network spans across more than 190 countries around the world. The company has four business segments, namely Ag Services and Oilseeds, Carbohydrate Solutions, Nutrition, and Other Business. It provides probiotics through the Nutrition segment for animal consumption and other food applications. ADM’s manufacturing facilities are certified SEDEX, HACCP, by SGS North America, Organic by Ecocert ICO, and APHIS. In August 2018, ADM acquired Probiotics International Limited (PIL) (UK) that operates under its umbrella brand Protexin, which accounts for a deal of USD 235 million. It will be named ADM Protexin Limited, which produces research-based probiotics, including its Bio-Kult and Lepicol brands. Protexin also offers a variety of natural products and probiotic supplements for the veterinary, agriculture, and equine healthcare markets . This acquisition will help ADM in enhancing its product portfolio for probiotics in animal feed as it will offer supplements for equine livestock.

International Flavors & Fragrances Inc. (US), International Flavors & Fragrances Inc. (IFF) is one of the global multinational corporations that provide a range of products such as animal health solutions, extracts and flavorings, carob protein, cellulose gum, and cultures for food, among others. The company is active across various industries such as animal nutrition, antimicrobial fabric protection, biorefinery, brewing, dietary supplements, fabric & home care, food & beverage and hygiene, and odor control. The company operates through its major business segments: Nourish, Health and Biosciences, Scent, Pharma Solutions. It offers probiotics for animal feed under its Health & Biosciences Segment. Since its inception, the company has a strong focus on research and development and invests a significant amount in R&D activities every year. Through its numerous subsidiaries, IFF has significantly marked its presence in more than 200 countries. In February 2021, International Flavors & Fragrances Inc. merged with DuPont’s Nutrition & Biosciences business to deliver consumer-oriented products for food & beverage, personal care and health & wellness markets. This strategic initiative was undertaken to strengthen the product portfolios and R&D capabilities in probiotics ingredient and multiple other segments such as enzymes, culture, soy proteins, nutrition, scent among others.

Chr. Hansen Holding A/S (Denmark), Chr. Hansen Holding A/S is a global, differentiated bioscience company that develops natural ingredient solutions for the food, nutritional, pharmaceutical and agricultural industries. It is serving around its customers for almost 150 years to enable sustainable agriculture, better food and healthier living. It offers products and solutions through two segments namely Food Cultures & Enzymes and Health & Nutrition. It offers probiotics for animal feed derived from plants through Health & Nutrition segment. Chr. Hansen Holding A/S has a regional sales presence in all the world's major markets, including North America, Latin America, Asia Pacific, Europe, Middle East, and Africa, giving the company a strong foothold in the global markets. In May 2021, company launched a product Bovacillus. The product is launched in the Argentinian market, which is a new solution to support dairy and beef cattle health & performance. This will enhance the company’s product portfolio for probiotics in animal feed and the customer reach in the region as well.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=85832335

Countries such as China, India, Japan, Australia & New Zealand, and rest of the Asia Pacific have been considered in this study. Some of the factors for the high demand of the market in Asia Pacific region includes growing population, rise in disposable incomes, and rapid urbanization. Increasing demand for meat and animal products among the growing population of the Asia Pacific region along with the rising affluence in the region resulted in high consumption of meat products. This has also resulted in intensified livestock production for meat, which in turn drives the need for improved animal health and performance.

0 notes

Text

Cross Laminated Timber In-Depth Profiling With Key Players and Recent Developments, Forecast Period: 2021-2031

Cross Laminated Timber Market Research, 2032

The Cross Laminated Timber Market size was valued for $1,575.50 million in 2020 and is estimated to reach $3,735.90 million by 2032, exhibiting a CAGR of 8.4% from 2023 to 2032. Furthermore, in terms of volume, the global cross laminated timber market was valued at 75.03 million cubic feet in 2020, and is projected to reach 160.67 million cubic feet by 2032, registering a CAGR of 7.5% from 2023 to 2032. Cross laminated timber is a type of engineered wood construction material manufactured by stacking and gluing two or more layers of solid wood perpendicular to the lower layer. This gives the cross-laminated timber high strength in all four directions. CLT is primarily made of softwood such as spruce, pine, and fir.

Cross-laminated Timber (CLT) is an environment-friendly construction material, which is typically made from wood sourced from sustainably harvested forests. The use of CLT helps reduce carbon emissions from the overall construction process and promotes the use of renewable resources. CLT has comparable strength to steel or concrete, thus providing excellent load-bearing capacity and dimensional stability. In addition, properties such as fire resistance, and higher thermal insulation than steel and concrete make CLT a suitable choice for residential and commercial buildings. For instance, in 2020, the production of CLT in Italy, the Czech Republic, and the DACH region which includes Germany, Austria, and Switzerland, increased, and crossed the sales volume of 1 million m³ for the first time. In addition, in 2021, major CLT producers such as HBS Berga, KLH, the Pfeifer Group, and Schwarzwald Holzbausysteme, expanded their production capabilities in Europe to meet the increasing demand for CLT. Such an increase in the production of CLT driven by rising demand for CLT from the rising construction sector in the region is fostering the growth of the market. Additionally, cross-laminated timber is widely used in the construction of prefabricated housing across the world. The concept of prefabricated housing was first unveiled at the end of World War 2, and it has since been evolving with respect to technology, design flexibility, and durability. It involves the construction of houses using cross-laminated timbers as well as other materials at offsite manufacturing facilities, which are then shipped to and assembled at the predefined location, resulting in quick and inexpensive construction. In addition, stringent environmental regulations, resulting from concerns over increasing pollution, and labor shortages due to the aging population are playing a crucial role in the growth of the prefabrication housing industry which is driving the growth of the cross-laminated timber. Prefabricated houses are provided with enhanced efficiency, resilience, and versatility, thus meeting the long-term demand and construction requirements of high-performance houses. Countries such as Japan, China, the U.S., Sweden, and various others are leading the cross-laminated timber prefabricated houses industry. For instance, in 2021, Green Canopy Homes, a U.S.-based CLT modular home manufacturer merged with NODE a construction technology company to form Green Canopy NODE. The new company is involved in conventional construction as well as sales of prefabricated Integrated Building Kits and Utility Kits. In March 2023, the same company unveiled a prototype made of CLT which has two stories, 1,200 sq. ft. of floor space, two bedrooms, 1.5 bathrooms, and a rooftop deck. In addition, in 2021, Forterra, a major wood-based construction material manufacturer unveiled its Forest to Home initiative, where it acquires sustainably harvested local timber, processes it to cross-laminated timber, and then uses it for modular homes. Moreover, in October 2021, Countryside, a UK-based closed panel home manufacturer delivered its 5,000th closed panel home to Ribblesdale Place in Accrington, Lancashire. Such developments in the CLT-based prefabricated homes is positively affecting the cross laminated timber market overview.

Competition Analysis

Competitive analysis and profiles of the major players in the cross laminated timber market are provided in the report. Major companies in the report include Mayr-Melnhof Holz Holding AG, Mercer International Inc., SmartLam LLC, Stora Enso Oyj, KLH Massivholz GmbH, XLam Pty Ltd., SIPEUROPE s.r.o., Schilliger Holz AG, HESS TIMBER GmbH, and Binderholz GmbH & Co. KG.

Major players adopt development strategies such as product launches, product development, acquisition, and expansion to remain competitive in the market. For instance, in May 2022, Stora Enso acquired 35% shares of France based ACDF Industrie SAS which is involved in manufacturing engineered wood products like CLT, Glulam and LVL (laminated veneer lumber). This move will help Stora Enso to capitalize on the increasing demand for timber in France.

Full Report With TOC:-https://www.alliedmarketresearch.com/cross-laminated-timber-market-A11967

0 notes

Text

Achieving US$ 27.9 Billion: The Future of the Hand Tools Market by 2033

The Hand Tools Market report, unveiled by Future Market Insights—an ESOMAR Certified Market Research and Consulting Firm—presents invaluable insights and meticulous analysis of the Hand Tools market. Encompassing the research's scope and essence, this report scrupulously examines the driving factors, market size, and predictive data for Hand Tools. It furnishes intricate revenue and shipment segmentations, accompanied by a decade-long projection up to 2033. Additionally, the document evaluates key industry players, their market distribution, the competitive scenario, and regional perspectives.

The global Hand Tools Market is currently witnessing a notable upsurge in demand, attributed primarily to the integration of state-of-the-art technology, which not only ensures superior grips and heightened durability but also extends the overall shelf life of these tools. This heightened demand is particularly being propelled by the resurgence of the automotive manufacturing and repair sectors, alongside the proliferation of intricate and advanced appliances in the market.

Projections indicate that the hand tools market is poised to establish a robust growth trajectory, with an anticipated Compound Annual Growth Rate (CAGR) of 5.8% during the period from 2023 to 2033. It is expected that by the year 2033, the market will have achieved a substantial market share of US$ 27.9 billion, marking a significant increase from the projected value of US$ 15.9 billion in 2023.Advanced features-loaded hand tools such as wrenches, screwdrivers, and pliers are in fashion. Furthermore, the addition of repair kits in most vehicles is also consuming a big chunk of the market.

New technology with better grips, durable body, and long shelf life is flourishing the demand for hand tools across the globe. The restoration of automotive manufacturing and repairing along with the new complex appliances are garnering market growth.

Emerging economies of China and India with large manufacturing capacities of cars, trucks, and bikes are also investing in the hand tools sector. The growing number of vehicles on the road is expected to help the market thrive.

New concepts like glass-covered toolboxes, small repairing points, and highway support units are pushing the authorities to invest in hand toolboxes or kits. Alongside this, the new features like small parts of the kit in different sizes and packaging are also flourishing the market growth.

Discover Your Market Potential: Unlock Valuable Insights with Our Comprehensive Market Overview - Request a Sample Now https://www.futuremarketinsights.com/reports/sample/rep-gb-1114

Key Points

The United States market leads the hand tools market in terms of market share in North America. The United States region holds a market share of 20.6% in 2023. The growth in this region is attributed to the expanding manufacturing and repairing sector in the region

Germany’s hand tools market is another significant market in the Europe region. The market holds a market share of 6.9% in 2023. The growth is attributed to the increasing number of cafés, new and advanced flavors, and rising production facilities.

India’s hand tools market thrives at a leading CAGR of 7.2% during the forecast period. The market’s growth is attributed to the proliferation of sales, export, and repair of vehicles and appliances. The big facilities are adopting the latest hand tools.

The wrench segment leads the product type segment as it holds a leading market share of 30.9% in 2023. The growth is attributed to high consumption.

Competitive Landscape:

The key vendors work on rigidity, advanced design, and custom availability. The players also work on enhanced supply chains and high affordability. Companies collaborate to expand their supply chain. Key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Recent Market Developments:

Weidmuller Interface GmbH and Co. KG have set up their hand tool portfolio with the categories like cutting, stripping the insulation, crimping, etc.

Indian brand, MISUMI Group Inc. has introduced its long range of hand tools like wrenches, hex wrenches, screwdrivers, hammers, tools sets, cutter knives, and monkey wrenches. The company has also launched its 20% off on the first order scheme.

Key Segments Covered

By Product Type:

Wrenches

Pliers

Screwdrivers

Voltage Tester

Measuring Tools

Hammers

Cutters

Taps and Dies

Hand Saws

Punches

Others

By Sales Channel:

Online

Offline

By End-User:

DIY

Commercial

Industrial

Key Regions Covered:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Change Management Software Market to Reach USD 4.8 Billion, Globally by 2033 at 8.9% CAGR: Future Market Insights, Inc.

Between 2023 and 2033, the market for change management software is projected to grow at a healthy CAGR of 8.9%. By 2033, the market is anticipated to hold a market share of US$ 4.8 billion, while its estimated value in 2023 is US$ 2.06 billion.

The market for software solutions that assist organisations in managing and navigating changes to their operations, procedures, and systems is referred to as the “change management software market.” In order to ensure seamless transitions, reduce disruptions, and maximise the success of organisational changes, these software tools are used to streamline and automate the procedures involved in change management.

The reduced downtime, enhanced time-to-value graph, and smooth deployment of any new change make it the perfect platform for a structure-based corporation. Additionally, additional tools like visual analytics and reporting, on-demand and controlled access, and personalized content and document sharing make it a desirable tool.

Get a Sample Copy of this Report at: https://www.fmiblog.com/2024/09/26/change-management-software-market-to-reach-us-4-8-billion-globally-by-2033-at-8-9-cagr-future-market-insights-inc-4/https://www.futuremarketinsights.com/reports/sample/rep-gb-14536

Automation in corporate structures with the adoption of advanced problem-solving software empowered by artificial intelligence, machine learning, and big data is highly adaptive. Monitoring employees, systems, and projects adopting the change becomes a critical and integral part of any modern management.

The improved risk management enabled coordination, and facilitated communications between technical teams and users also helped small startups. The expanding startup companies are adopting systems that integrate their network while increasing productivity.

Key Points

The United States market leads the change management software market in terms of market share in North America. The United States region held a market share of 18.1% in 2023. The growth in this region is attributed to the higher adoption of smart technologies, key economic activities, and vendors working on problem-solving functions. The North American region held a substantial market share of 26.6% in 2022.

Germany’s market is another successful market in the European region. The market holds a market share of 6.5% in 2022. The growth is attributed to expanding corporate structure and high-end software research. Though, the European region held a market share of 21.2% in 2022

The Indian change management software market booms at a CAGR of 9.4% during the forecast period. The market’s growth is attributed to higher innovation, increased outsourcing businesses, and innovation.

The Chinese market also thrives at a CAGR of 9.6% between 2023 and 2033.

Based on deployment mode, the on-premise change management software segment held the leading market share of 58.7% in 2022.

Based on component type, the software segment performs well as it held a leading market share of 63.4% in 2022.

Competitive Landscape

The key vendors focus on providing additional tools, better support, and smooth integration in their change management software. Key competitors and also merge, acquire, and partner with other companies to increase their supply chain, and distribution channel.

Key Players

BMC Software

IBM Corporation

Broadcom Inc.

Cherwell Software, LLC.

Ivanti

Recent Market Developments

Freshworks has introduced its IT service management software, Fresh Service which helps corporate structures in rolling out their changes with effective tracking. The platform also keeps each section of the team in the loop.

IBM has added its application management service with a hybrid cloud for smooth file sharing, data transfer, and enterprise application management.

Key Segments Covered

By Component:

Software

Services

By Deployment Type:

On-Premise

Cloud-based

By Organization Size:

SMEs

Large Enterprises

By Industry Type:

BFSI (Banking, Financial Services, and Insurance)

Healthcare and Life Science

Education

Government and Public Sector

Telecom and IT

Retail and Consumer Packaged Goods

Others

Key Regions Covered:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Ophthalmology PACS Market Dynamics: Challenges, Opportunities, and Growth Projections

The global ophthalmology PACS market size is expected to reach USD 248.6 million by 2030, expanding at a CAGR of 7.3% from 2023 to 2030, according to a new report by Grand View Research, Inc. Moreover, rising prevalence of eye diseases, such as cataract, glaucoma, age-related macular degeneration, and diabetic retinopathy, is expected to fuel demand for ophthalmology PACS in near future. The Department of Ophthalmology of National University of Singapore conducted a study in collaboration with National University Health System, Singapore and South Central Asia. According to this study, the number of glaucoma cases diagnosed in 2013 was 17.06 million, which is anticipated to reach around 32.9 million by 2040.

Product development, geographical expansion and M&A are some sustainability strategies adopted by major companies in this market. For instance, in August 2017, Carl Zeiss Meditec Inc., acquired Veracity Innovations, LLC, a U.S.-based medical software company that delivers cloud-based platforms to maximize clinical performance and work efficiency. These platforms help ophthalmologists in delivering personalized technology-enabled care to their patients. The acquisition is intended to expand the former company’s eye care-based digital solutions portfolio. The company is also focusing on expanding the business in Asia Pacific owing to larger patient pool in this region.

Ophthalmology PACS Market Report Highlights

Increasing cases of ophthalmic diseases, lack of skilled ophthalmologists, and growing usage of teleophthalmology solutions in developed countries are the factors driving the market

Cloud-based PACS is anticipated to register lucrative growth during the forecast period owing to features, such as interoperability and mutual performance, privacy and security, reduced errors, and improved quality

North America held the major share of the market in 2022 due to increased ophthalmic disease burden and healthcare expenditure by public and private firms in this region

Asia-Pacific is anticipated to register the highest CAGR during forecast period due to rising prevalence of glaucoma coupled with high demand for an effective diagnostic solution

Carl Zeiss Meditec AG; Topcon Corp.; Merge Healthcare, Inc. are the major companies in the global ophthalmology PACS market

Most of these companies are focusing on technological advancements, M&A, and R&D as part of their business expansion strategies

Ophthalmology PACS Market Segmentation

Grand View Research has segmented the global ophthalmology PACS market based on type, mode of action, end-use, and region:

Ophthalmology PACS Type Outlook (Revenue, USD Million, 2018 - 2030)

Standalone PACS

Integrated PACS

Ophthalmology PACS Mode of Action Outlook (Revenue, USD Million, 2018 - 2030)

On-premises System

Cloud-based System

Ophthalmology PACS End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospital

Specialty Clinics

Others

Ophthalmology PACS Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

Thailand

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East and Africa

South Africa

Saudi Arabia

UAE

Kuwait

List of Key Players in Ophthalmology PACS Market

Carl Zeiss Meditec AG

Topcon Corporation

Heidelberg Engineering GmbH

Sonomed Escalon

Visbion

EyePACS, LLC

VersaSuite

Merge Healthcare Inc (IBM Watson Health)

ScImage, Inc.

Order a free sample PDF of the Ophthalmology PACS Market Intelligence Study, published by Grand View Research.

0 notes

Text

Exploring the Potential of the Confectionery Packaging Market: Size, Growth, and Trends 2033

The confectionery packaging market is anticipated to expand its roots at an average CAGR of 4.4% between 2023 and 2033. The market is expected to have a market share of US$ 17.50 billion by 2033 while it is likely to be valued at US$ 11.37 billion in 2023

The latest packaging innovations with the usage of paper and bio-plastics are expected to transform confectionery packaging. Furthermore, the renewable and recycled materials used in designing customizable packaging solutions are also trending in the market.

The expansion of the confectionery sector post-pandemic with new product launches in the market is increasing the sales of confectionery packaging solutions. Also, the brand’s commitment to limiting the environmental impact of its packaging is pushing them to innovate.

Some of the vendors are focusing highly on the specialization of the packaging that they let the end user design their designs and texts. Alongside this, the lightweight, enhanced texture, and usage of a minimal amount of plastic are some of the key drivers for the market growth

New packaging innovations for products like candies and chocolates such as twist-wrapped, double-layered, paper packaging are gaining traction in the market space. Some of these features include the usage of paper-based material and the matt & gloss effect.

For More Insights on this Market, Get a Sample Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-1101

Key Takeaways

The United States market leads the confectionery packaging market in terms of market share in North America. The United States region held a market share of 17.3% in 2022. The growth in this region is attributed to expanding confectioneries, sustainable packaging businesses, and the government’s ban on limited plastic control. North American region held a market share of 18.7% in 2022.

Germany’s market is another important market in Europe region. The market held a market share of 6.1% in 2022. The growth is caused by high tourist footfall and the existence of old popular confectioneries. Furthermore, Europe region also held a 36.4% global share in 2022.

India’s confectionery packaging market thrives at a CAGR of 7.4% during the forecast period. The growth is attributed to high investments and innovative packaging businesses.

China market also thrives at a CAGR of 6.5% between 2023 and 2033. The growth is caused by the government’s efforts for sustainable and eco-friendly packaging.

Based on material type, the plastic material segment held the leading market share of 54.5% in 2022. The growth is attributed to high affordability, availability, and flexibility.

Based on the confectionery type, the chocolate confectionery segment leads the market as it held a leading market share of 45.7% in 2022. The growth is caused by the high consumption of chocolate.

Competitive Landscape:

The key vendors focus on delivering eco-friendly packaging that is custom-made. Key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Recent Market Developments:

Amcor plc has extended its snacks and confectionery range in Europe with barrier materials and packaging formats. These packaging formats are available for sweets, snacks, and nuts.

Sealed Air Corporation has acquired Liquibox, a global leader in the flexible packaging industry. The acquisition is expected to dispense many solutions for fresh packaging innovations. The acquisition is expected to enhance the supply chains

View Full Report@ https://www.futuremarketinsights.com/reports/confectionery-packaging-market

0 notes

Text

Whiskey Market Emerging Players May Yields New Opportunities 2023 to 2033

The whiskey market is anticipated to expand its roots at a steady CAGR of 12% between 2023 and 2033. The market is projected to have a market share of US$ 270.09 billion by 2033 while it is likely to be valued at US$ 84.3 billion in 2023

- The restored beverages business along with the growth of alcohol drinkers and the advent of non-alcoholic whiskey is fueling the market growth. Furthermore, the new strain of millennials drinking high amounts of whiskey, beer, and vodka is also flourishing the market growth.

- New restaurants and eateries serving alcohol along with online delivery options are pushing end-users to intake whiskey often. The local whiskey blends, premium whiskeys, and an increased in bars are expected to gain traction in the market.

- Emerging economies like China and India are boosting the global market as alcohol consumption in these two nations is proliferating. It is due to the higher economic activity, developing businesses, and rising per capita income that has pushed individuals to add alcohol to their lifestyle.

- Higher import of premium whiskey increased and production facilities in India, China, and the United States have a key role in the market’s success. Alongside this, the higher online and offline promotion of whiskey fuels the market growth.

Drivers and challenges have an impact on market dynamics, which can impact businesses. Find more insights in a sample report@ https://www.futuremarketinsights.com/reports/sample/rep-gb-14371

Key Points

The United States market leads the whiskey market in terms of market share in North America. The United States region held a market share of 33.5% in 2022. The growth in this region is attributed to the increased consumption among millennials.

Germany’s whiskey market is another significant market in the European region. The market held a market share of 9.1% in 2022. The growth is attributed to the higher whiskey brands, local whiskey flavors, and higher tourist attractions.

The Indian whiskey market thrives at a leading CAGR of 14.5% during the forecast period. The market’s growth is attributed to more young people drinking along with the expanded production facilities.

The alcoholic segment leads the alcoholic type of segment as it held a leading market share of 89.7% in 2022. The growth is attributed to the higher alcohol-based whiskey consumption for partying and casual drinking.

Based on product type, the bourbon whiskey held a market share of 26.8% due to its premium whiskey properties and enhanced taste.

Competitive Landscape

The key vendors work on the premium flavors, colors, and distillation process. The companies also work to set up new product lines in emerging economies to enhance the supply chain. The players also work on enhanced supply chains and higher affordability. Companies collaborate to expand their supply chain. Key competitors and also merge, acquire, and partner with other companies to increase their supply chain, and distribution channel.

Recent Market Development

Beam Suntory has increased the sales of these whiskeys in India with different versions of Teacher’s, Bowmore, and other bands.

Belvedere has introduced its single malt scotch whiskey Balvenie in new 12-year-old double wood, 21-year-old port wood, and classic versions. The company has also launched its special 30-year-old rare marriages Balvenie which is a premium whiskey.

Key Players

Diageo

Chivas Brothers

William Grant & Sons

Bacardi

La Martiniquaise

The Edrington Group

Belvedere

Beam Suntory

Whyte & Mackay

Inver House

LVMH

Loch Lomond

Other

Information Source: https://www.futuremarketinsights.com/reports/whiskey-market

0 notes