#non resident tax return

Explore tagged Tumblr posts

Text

non resident speculation tax

Welcome to Calgary Tax Consulting, your trusted provider of non-resident income tax services in Calgary. Our experienced team of tax consultants specializes in offering comprehensive solutions for non-residents with Canadian-source income.

Non-resident income tax matters can be complex, with specific rules and regulations to consider. At Calgary Tax Consulting, we understand the unique challenges faced by non-residents and are here to simplify the tax filing process for you. Our knowledgeable tax consultants will guide you through the necessary steps to ensure compliance and optimize your tax position.

0 notes

Text

Don’t Miss Out! TDS Payment Deadlines for FY 2024–25 Explained

Filing TDS (Tax Deducted at Source) returns can be straightforward if you know which forms to use. Here’s a concise breakdown of the essential forms required for different types of transactions.

1. Form 24Q

Purpose: This form is crucial for employers as it reports TDS on salaries.

Key Point: Employers must submit this quarterly to reflect tax deductions from employee salaries.

2. Form 27Q

Purpose: Use this form to report TDS on payments made to non-residents.

Examples: This includes payments such as interest, dividends, and other sums payable to foreign entities or individuals (excluding companies).

3. Form 26Q

Purpose: This form covers TDS reporting in various scenarios, such as professional fees and interest payments.

Application: It's essential for a range of payments outside of salaries.

4. Challan-cum-Statement Forms

Form 26QB: For TDS under Section 194-IA (related to property sales).

Form 26QC: For TDS under Section 194-IB (applicable to lease payments).

Form 26QD: For TDS under Section 194M (payments made to contractors).

Timely Submission

Remember, these forms must be submitted within 30 days from the end of the month in which TDS was deducted. Ensuring timely filing can save you from penalties and maintain your compliance with tax regulations.

Conclusion

Understanding the specific forms for TDS filing is vital for smooth compliance. Choose the correct form based on your transactions to ensure hassle-free returns. Stay tuned for more updates on TDS regulations and best practices!

Read also: How to check your TDS Refund? , Books of account under section 44aa, Notice issue ? get expert help

#TDS Interest Rates#Financial Year 2024-25#Tax Planning 2024#TDS for Non-Residents#TDS Payments#TDS Return Filing#FY 2024-25 TDS Dates#TDS Compliance#TDS Form Submission#Tax Deductions#Income Tax Updates#TDS Penalties#Online TDS Payment#taxring

1 note

·

View note

Text

Apply for a Repayment of the Non-UK Resident Stamp Duty Land Tax Surcharge in England and Northern Ireland

Check if you can and how to apply for a repayment if you’re a non-residential purchaser of property in England and Northern Ireland.

Who Can Apply

You or your estate agents can apply for a repayment of the surcharge paid on a property if all the purchasers are individuals and have spent 183 days in the UK in any continuous 365-day period:

Starting no more than 364 days before the effective date of the transaction.

Ending no more than 365 days after the effective date of the transaction.

The effective date of the transaction is usually the completion date. You must apply for the repayment within 2 years of the effective date of the transaction.

What Information You’ll Need

To apply for a repayment, you will need the following details:

Bank Account Information: UK bank account and sort code details for the recipient of the payment.

Unique Transaction Reference Number (UTRN): From the Stamp Duty Land Tax return submitted when the property was purchased.

Effective Date of Purchase: Usually the completion date.

SDLT Amount Paid: Including the non-resident surcharge.

Purchase Price: If it’s a freehold property (or other ‘consideration’ if the transaction included goods, works, services, debt release, etc.).

Total Lease Premium: If it’s a leasehold property.

Net Present Value Calculation: Used when the SDLT was calculated if it’s a new lease.

If you’ve already reclaimed the higher rate on additional dwellings, you’ll need the amount of SDLT due after the refund. You may need to ask your solicitor or conveyancer for these details.

If You Are an Agent Acting for the Purchaser

Estate Agents will need a document signed by the purchaser confirming authority to apply for a repayment on their behalf. This letter of authority should specify if the repayment is to be paid into an account other than the purchaser’s and include the relevant account details. You’ll need to upload an image of this signed document with your online application.

How to Apply for a Repayment

Your application requests HMRC to amend the Stamp Duty Land Tax return for the property. You’ll be asked to certify that the amendment is correct.

There are two ways to apply depending on whether you have a Government Gateway user ID and password:

With Government Gateway: Use your user ID and password if you’ve registered for Self Assessment or filed a tax return online.

Without Government Gateway: Apply via email if you do not have a Government Gateway user ID.

Ensure to save your application and return to it later if needed. Only apply by email if you do not have a Government Gateway user ID.

Need Assistance?

If you find the application process challenging or prefer professional assistance, consider contacting the best estate agents in the UK. They can provide expert guidance and help streamline the application process.

#England property tax#HMRC SDLT#non-residential property tax#non-UK resident SDLT#Northern Ireland property tax#property purchase tax#property tax refund#property tax relief#real estate taxes#SDLT application#SDLT repayment#SDLT return#SDLT surcharge repayment#Stamp Duty Land Tax#UK property market#UK property tax

0 notes

Text

non resident income tax Return services

Are you a non-resident with income in a foreign country? Navigating the complex terrain of non-resident income tax returns can be challenging, but our Non-Resident Income Tax Return Services are designed to simplify the process for you.

Our dedicated team of experienced tax professionals specializes in assisting non-residents with their income tax obligations. We understand the intricacies of international tax laws and regulations, and we're here to ensure that your income tax return is filed accurately and efficiently.

#non resident tax return services#non resident income tax Return#non resident income tax Return services#non resident income tax filing services#non resident income tax filing services canada

0 notes

Text

How NRIs can Reactivate Inoperative PAN Cards - A Step-by-Step Guide

Introduction In the Indian financial landscape, PAN (Permanent Account Number) cards are vital for taxpayers, including Non-Resident Indians (NRIs). Recent regulatory updates have linked the status of PAN cards to Aadhaar, and the discontinuation of this linkage has led to some PAN holders' status changing from "Active" to "Inoperative." Nevertheless, NRIs can still use their inoperative PANs to file Income Tax Returns (ITR).

Click here to know more

0 notes

Text

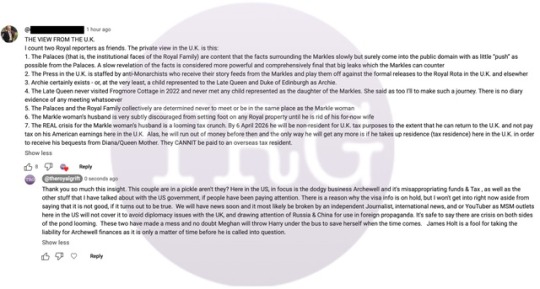

Here is some hot tea...As always take with a grain of salt. by u/Meegainnyc

Here is some hot tea...As always take with a grain of salt.

I made it text for ease of reading and thanks OP for the scoop! 🧂

THE VIEW FROM THE U.K. I count two Royal reporters as friends. The private view in the U.K. is this:

1. The Palaces (that is, the institutional faces of the Royal Family) are content that the facts surrounding the Markles slowly but surely come into the public domain with as little "push" as possible from the Palaces. A slow revelation of the facts is considered more powerful and comprehensively final that big leaks which the Markles can counter

2. The Press in the U.K. is staffed by anti-Monarchists who receive their story feeds from the Markles and play them off against the formal releases to the Royal Rota in the U.K. and elsewher

3. Archie certainly exists - or, at the very least, a child represented to the Late Queen and Duke of Edinburgh as Archie.

4. The Late Queen never visited Frogmore Cottage in 2022 and never met any child represented as the daughter of the Markles. She said as too I'll to make such a journey. There is no diary evidence of any meeting whatsoever

5. The Palaces and the Royal Family collectively are determined never to meet or be in the same place as the Markle woman

6. The Markle woman's husband is very subtly discouraged from setting foot on any Royal property until he is rid of his for-now wife

7. The REAL crisis for the Markle woman's husband is a looming tax crunch. By 6 April 2026 he will be non-resident for U.K. tax purposes to the extent that he can return to the U.K. and not pay tax on his American earnings here in the U.K. Alas, he will run out of money before then and the only way he will get any more is if he takes up residence (tax residence) here in the U.K. in order to receive his bequests from Diana/Queen Mother. They CANNIT be paid to an overseas tax resident. Thank you so much this insight. This couple are in a pickle aren't they? Here in the US, in focus is the dodgy business Archewell and it's misappropriating funds & Tax, as well as the other stuff that I have talked about with the US government, if people have been paying attention. There is a reason why the visa info is on hold, but I won't get into right now aside from saying that it is not good, if it turns out to be true. We will have news soon and it most likely be broken by an independent Journalist, international news, and or YouTuber as MSM outlets here in the US will not cover it to avoid diplomacy issues with the UK, and drawing attention of Russia & China for use in foreign propaganda. It's safe to say there are crisis on both sides of the pond looming. These two have made a mess and no doubt Meghan will throw Harry under the bus to save herself when the time comes. James Holt is a fool for taking the liability for Archewell finances as it is only a matter of time before he is called into question.

https://ift.tt/Ud5VeOu post link: https://ift.tt/slMr4Py author: Meegainnyc submitted: May 30, 2024 at 02:05PM via SaintMeghanMarkle on Reddit disclaimer: all views + opinions expressed by the author of this post, as well as any comments and reblogs, are solely the author's own; they do not necessarily reflect the views of the administrator of this Tumblr blog. For entertainment only.

#SaintMeghanMarkle#harry and meghan#meghan markle#prince harry#fucking grifters#grifters gonna grift#Worldwide Privacy Tour#Instagram loving bitch wife#duchess of delinquency#walmart wallis#markled#archewell#archewell foundation#megxit#duke and duchess of sussex#duke of sussex#duchess of sussex#doria ragland#rent a royal#sentebale#clevr blends#lemonada media#archetypes with meghan#invictus#invictus games#Sussex#WAAAGH#american riviera orchard#Meegainnyc

50 notes

·

View notes

Text

If your city is a Brand, it’s already too late

Long post time. What is it that drives gentrification? Also, what is gentrification? Is it when a city gets blue hair and pronouns? No, it probably already had those.

Gentrification is the result of concentration of wealth in the hands of business owners, including landlords, over and above the hands of residents.

Let’s start with rent. Rent, like any good, is priced according to the laws of supply and demand. Supply of available rental housing is primarily determined by construction costs and estimated return on investment for new construction, and property management costs and estimated return on investment for existing units.

Breaking that down a bit, the higher construction costs get the higher the rent needs to be to break even on new construction. Construction costs include labor (which can always go down but you want it high for moral and practical reasons), materials (highly variable depending on the project) and bureaucratic costs. A bureaucratic cost is a cost that is based on how projects fit into the legal and practical environment, and are usually non-negotiable. Dig Safe, a program which requires three days of surveying local records before breaking ground, is an example where the function is to prevent crews from flattening a neighborhood by puncturing a gas main. Environmental Impact Statements, Fire Codes, Habitability Guidelines, and other regulations increase costs to projects. These programs are good and need to exist, but do stop smaller projects from happening at all because the capital investment required just to actually break ground on a new house might cost as much as the land and materials put together at which point you might as well build another 120$/sqft luxury midrise.

Property management costs for existing units are largely dependent on age and wear. A unit with no occupant is going to depreciate little, and may also appreciate in value. Depreciation and appreciation here are sort of unintuitive because they can happen at the same time. Imagine an old luxury sports car with a high resale price. Driving depreciates the value because it’s literal condition is poorer, even as the resale value goes up over time. The appreciation needs to beat both inflation and the value of depreciation for it to go up in real value. For companies with large capital holdings however, losses such as through the upkeep of empty apartment buildings are useful to a point because they reduce these organizations’s tax burdens. A company that makes a killing on the stock market only has to pay taxes if they keep it: if they buy houses they then don’t rent, they can claim they “lost” their stock market earnings with “bad investments” and then pay no tax while saving the real estate to rent later. Again, this favors the largest possible projects and the largest possible operators because small companies can be killed by an unprofitable quarter or 4 while large ones explicitly benefit from unprofitability in reducing their tax burden.

Expected ROI is the final piece of this, which affects both new and existing units. Every private developer and landlord wants to make as much money as they can, unless they are explicitly are renting as a service. An example of renting as a service would be families, who will rent to each other at favorable rates or for free, privileging people with large and/or wealthy families that are friendly with each other. Now, ROI is also subject to supply and demand. Everyone wants to build 120$/sqft luxury apartments but once everybody does nobody can sell/rent for those prices without setting a price floor and waiting for buyers to catch up. If you are a small developer, you can’t afford to do this. Your expenses will eat you alive. If you are a big developer, though, those expenses are offsetting the gains you make and serving to reduce you tax bill. Units at prices nobody can pay are effectively furloughed, meaning off the market, and, so long as they remain cheap to maintain, will remain that way, artificially restricting supply. It doesn’t matter if it’s for sale or not when it’s at a price you can’t afford. (Sidebar, anyone who tells you that the minimum wage depresses hiring because it artificially restricts demand is lying to you. It’s not strictly false, but like the above it’s a multi-variable equation and blanket statements about cost of labor are aimed at killing wages.)

What this alludes to also is a need for greater income equality. In order for rental to be a competitive option with furlough, not only does the price of furlough have to be increased, the real value of wages have to be increased in order to create opportunities for people to splurge. This is a twofold strategy, of both increasing the rewards of putting units on the market and increasing the costs of keeping them off. If real wages barely cover cost of living, or don’t cover cost of living, nobody can realistically spend more real wages on rent regardless of the percentage of their income it is. (Real wages here refers to the political power implied by dollar wages. A dollar is really worth whatever it can be exchanged for, whether that is a candy bar or a square inch of a 144$/sqft condo) The real value of everything except time and land are also constantly going down because of constant improvements in manufacturing. The cost in acres of land and hours of labor of a pound of beef, a bolt of cloth, or a pint of beer have dropped dramatically in the last century. Unfortunately, land is one of the few things that remains in marxist terms uncommodifiable, because it cannot be fully abstracted from the physical properties that make it valuable and we can’t make more of it just by making a better machine. This means that as the real value of things goes down because of supply and demand, the value of land only goes up because the supply is hard capped. If the value of everything under capitalism must go down because of increased production, while the value of capitalist assets must go up, or the system collapses, it makes sense that land would become a fixed point in that equation, the marxist speed of light observable from all reference points. The best approximation of land as commodity is, what else, apartments, which make available as living space the empty air above us. Because production never stops, the value of everything but land must go down. Therefore, as time passes, the price of land, and hence the price of housing, must tend upwards. Therefore, in order for housing to remain affordable, real wages must grow. This is the opposite of what is currently happening, as real wages have gone down for decades.

This income inequality which is one facet of capitalism is not new. For as long as people have lived in urban areas there have been issues between the abject class, the working class, the ruling class, and the professional class, a four part distinction I will seriously argue for in opposition to a lot of marxist theorists. The ruling and working classes ought to be familiar, or at least self explanatory. However, the other two classes I identify, the professionals and the abject, are useful to this analysis because they fill both a racial gap in the primarily marxist analysis I put forward and identify the two most likely groups to rent, which is to say the worker who works to produce but owns without governing and the professional who works to govern but does not own. The ruling class both governs and owns, but its court is full of courtiers who are there to push various agendas from within the rule of law without per se producing. Likewise, the working class pensioner exists in opposition to the abject who is denied the opportunity or the resources to be productive explicitly as a means to manufacture a threat against which inter-class solidarity between the workers and the rulers is developed. The textbook nazi conspiracy theory about “elites” doing a great racial replacement picks out perfectly what I mean by both the racial character of the professional and the abject and their utilization to foster solidarity between your plumber uncle and Elon Musk. This is relevant to both the broad theme of gentrification and the narrow theme of rent because gentrification is a wedge issue that divides the working class and the professional class far more than its impact on any other. The working class’ disidentification with doctors, lawyers, PMCs and other yuppie types, as well as the professional class’ disidentification with union politics, illegalism, and radicalism in general is brought to firecrackers in virtually any conversation about gentrification which seems in passing to be more about tapas bars than about real politics. Likewise, these groups shared distrust of and disdain for the abject, who are explicitly labeled by the state as constitutionally guilty, is the basis for the very broken windows policing strategy that empties neighborhoods of minorities regardless of class. The Rent is Too Damn High, and excluding homeless people from the “working” working class is a big part of how we got here specifically because the interests of small time owners and small time government functionaries, carried to their conclusions, are necessarily self defeating. These two groups eliminate the presence of the abject from their spaces at their own financial peril.

In addition to class, there is also a specific historical movement that is crucial to the understanding of gentrification as it exists, which is the movement of factories in search of cheap labor. The United States is not a good place to find cheap urban labor. You build a factory and suddenly everyone complains about air quality and labor violations and you can’t just kill them because everyone has lawyers. You kill one (us citizen) organizer and the NLRB is trying to get you in court for intimidation. What’s the country come to? But a shipping container costs a quarter cent per mile and the goods aren’t perishable so you go to Guangzhou or Cape Town where you can kill union bosses in peace. But for the American city, that’s a loss of what once made land prime real estate. What jobs can replace the insatiable demand for labor that a 24 hour paper mill once produced? Service labor, which crucially is site specific and therefore not outsourceable, is what the US has predominantly turned to. (and arms manufacturing which is not outsourced for very different reasons) However, service labor is only in demand if there is already a stable population that can be served, which requires a constant influx of capital holders in demand of service. This is why Airbnb exists and is hollowing out rental availability, why Boston as a college town is the way it is, and why there are in fact so many damn tapas bars. Fred Salveucci talked about being able to go north of the expressway in the 70s and being able to get a plate of mac and beans for half a buck. I went looking for a 5$ slice of pizza on my lunch break today around Government Center and found two places that were boarded up and ended up spending 20$ at Chilacates. Cities are being slowly turned into Cancun, complete with the fences to keep out the homeless.

What can be done about this? Obviously the factors we’ve discussed that favor consolidation of housing are mostly either contained within a gordion’s knot of tax policy or intrinsic to capitalism/goods as commodities. But, given that we narrow our objectives to making the rent lower, some obvious weaknesses jump out: increasing the cost of vacancy forces units out of furlough, because companies are no longer able to justify the losses, and increasing real wages increases the availability of capital for workers to spend on rent. These are the prongs I talked about earlier.

Legal means to pursue each prong exist. Both a minimum wage and a maximum wage, depending on their implementation, can potentially increase real wages, and vacancy taxes directly increase the costs of vacancy. The government can also ignore the market and directly mandate maximum rents within certain parameters. This tends to decrease the long term supply of housing for the reasons discussed at the outset, given that if the revenues from house building don’t cover the costs of building, less gets built. However, any political movement that exists exclusively within the white lines of the law fails to genuinely threaten change. Landlords, like bosses, break the law constantly with the impunity that a lawyer provides them against consequence. This is why a healthy dose of illegalism is an important part of any effective political movement. The most direct action one can take is property occupation, or squatting. Squatter’s rights are nearly non-existent in the United States. The most leeway that any state grants to any unknown persons occupying a dwelling is 60 days notice to vacate the property, and there are states that allow no notice evictions or lack statutes governing squatting at all. Every single state regards the occupation of owned property as trespassing, meaning most kinds of squatting are prosecutable offenses. However, squatting, even temporarily in ways that don’t expose the squatter to liability provided they don’t get caught, can seriously impact the value of properties. You have heard of rent lowering gunshots. This is the serious version of that. At the same time, illegal action needs legal defense, both in terms of non-compliance with police to protect those willing to take illegal actions from arrest and in terms of legal, 1st amendment protected disruption to keep focus on the issue. The most effective movements have a radical wing and a institutionalist wing who do not acknowledge each other but share the same tactics and objectives.

If you are housed, you need to be willing to protect and support homeless people because they are your front line. Start or join an Occupy movement, where they are your peers in occupying a public space illegally in a way that is too public to prosecute. Give to people on the street, and smash anti-homeless architecture if nobody is watching. Be willing to distract cops if you see someone doing something dodgy so they can get away. Remember that following the law is a tactic, and so is breaking it.

The case for this being on my transit blog is arguably weak, but I felt compelled after a particularly hateful experience looking at facebook memes about homeless people on the T. You should want those people there. You should want those people breaking down the doors of luxury apartments and setting up shop. You should want them keeping your city safe because the cops you hire to separate you from them will train their guns on you next.

And for gods sake, don’t let your city become a brand. Branding is marketing. Branding is clean, and bloodless, and a gloved hand around your throat that leaves no fingerprints.

49 notes

·

View notes

Text

US Tax Season

Hi everyone!! Idk how many people this will reach, but I wanna post some resources for US residents since tax season is here. I’m a graduate taxation student who intends to work in family/small business/non profit tax.

If taxes are really intimidating to you I don’t blame you, they’ve been made super inaccessible and hard to learn about. There are some resources out there that are really worth looking into, which I would highly recommend!

If you want to file your taxes from home and made less than $73,000 from all sources of income this year, check out the IRS Free File page. There are options to fill out all tax forms yourself without auto calculations OR an even better option which is self guided free filing platforms with auto calculations. There are multiple services that can help with the self guided forms, I’d suggest finding the best fit for you. Some may offer free federal tax returns but need payment for state tax returns.

I’d also highly recommend checking out the IRS VITA (Volunteer Income Tax Assistance) program which I will be volunteering with starting next week. It’s a program ran by volunteers who have to get certified and take tests to be able to file basic/slightly advanced tax returns for individuals who made under $60,000 from all sources of income in the previous year. It’s an in person program where you’d bring all your tax forms and sit down with a volunteer who would help you file your tax return. The website linked above has another link to look for volunteer centers in your area. Some locations may need an appointment, but as far as I know most accept walk ins.

For both of these you’ll need all tax forms from the previous year (W2s, 1099s, 1098Ts, etc). If you don’t know if you’ll need it, I’d bring it as opposed to not. I don’t know how many questions I can answer because I’m still fairly new to this, but I am certified to prepare tax returns for US residents. If you have any questions feel free to ask!

525 notes

·

View notes

Text

Philadelphia City Commissioners' Office Tells O'Keefe Non-Citizens Can Vote as Long as They Are Philadelphia Residents

In a recent conversation with an undercover O’Keefe Media Group journalist, Milton Jamerson, Election And Voter Registration Clerk from the Philadelphia City Commissioners Office, stated that non-citizens can vote in local elections as long as they are residents of Philadelphia.

This claim is echoed by the nongovernmental organization (NGO) “Ceiba,” (@CeibaPhiladelp1) located just across the street, which asserts that individuals with an Individual Taxpayer Identification Number (ITIN) are eligible to vote.

An ITIN is a 9-digit number issued by the Internal Revenue Service (IRS) to individuals who are required to file a tax return but do not qualify for a Social Security number. While the ITIN serves as a means for tax reporting for those who are not U.S. citizens, possessing an ITIN does not equate to legal voting rights, raising questions about Ceiba's claim that ITIN's deem individuals eligible for participation in the electoral process.

15 notes

·

View notes

Text

non resident tax canada

Ensure compliance with non-resident income tax requirements with Calgary Tax Consulting's specialized non-resident income tax services in Calgary. Our experienced tax consultants are well-versed in the complexities of non-resident taxation, providing comprehensive solutions for individuals and businesses earning income in Canada while residing outside the country. From determining your tax residency status to optimizing your tax position and filing accurate non-resident income tax returns, we help you navigate the intricacies of Canadian tax laws.

0 notes

Text

🔵 WEDNESDAY morning - ISRAEL REALTIME - Connecting to Israel in Realtime

( DOTS: 🔹blue - Iran war news. ♦️⭕red - Gaza & Hezbollah active war news. ▪️black - general Israel news. 🔸yellow - hostage deal news )

▪️HAMAS “elects” terror leader Yahya Sinwar as their political leader as well. Congratulations are pouring in from all over the Arab world, for the appointment of the worst mass murderer since ISIS and the Huti genocide of Rwanda.

▪️PRISON ABUSE CASE.. The detentions of five reserve soldiers suspected of the serious abuse of a Gazan terrorist mass murdering detainee at the Sde Teiman base have been extended until Sunday.

▪️FINANCE.. the shekel is slightly weakening as a currency: the euro climbs to NIS 4.20, the dollar to NIS 3.85.

▪️FLIGHT CANCELLED? you are due a refund! In any case of a canceled flight, and its starting point or destination is Israel, every passenger has the right to choose between two options: a full refund or an alternative flight ticket. The refund will be paid within 21 days, and it includes the full cost of the ticket, including fees, levies and taxes. If a person booked a round-trip flight from Israel with the same airline in one reservation, and only his outbound flight was canceled, he will be entitled to a refund for the return trip as well. If in the middle of a round trip and the return to Israel is cancelled, the passenger will be entitled to a refund of half of the amount he paid.

In addition, in the event of a canceled return flight to Israel, the airline is obligated to "provide accommodation, food, etc. services for canceled flights, until the passenger is able to return. However, it is likely that a court will impose this obligation within the limits of reason." https://www.calcalist.co.il/local_news/article/byv5wmrtr

🔹THE LEBANESE THINK.. “Israel will enter from the back of Mount Hermon to reach the Damascus-Lebanon axis, this is the only way they will be able to stop the rocket supply (coming from Iran).”

🔹The US ships almost non-stop unimaginable amounts of weapons to the Middle East via air transport. As well, the US significantly increases the jets at the air force bases in the Persian Gulf. US F-18’s and F-22’s spotted inbound in UK stopovers.

🔹Head of the Iranian Foreign Ministry arrived in Saudi Arabia to participate in the emergency meeting of the Organization of Islamic Cooperation. Analysts speculate this the reason for the postponement of the Iranian attack.

🔹All Iranian government offices and banks in Tehran's Alborz district will be closed tomorrow “due to rising temperatures”.

🔹Report: Some US analysts believe that Iran may be reconsidering the response.

🔹Conversely, since yesterday, signs of Iranian preparations to launch an attack against Israel have been received in the US.

♦️IDF in Judea and Samaria: "12 terrorists have been eliminated in the last 24 hours. Since the beginning of the week, 20 terrorists have been eliminated from the air and the ground via the undercover unit.

♦️COUNTER-TERROR OP.. overnight in Beit Purik, Shechem.

♦️US CENTCOM.. intercepted a suicide drone and two ballistic missiles launched from Yemen. (Doesn’t say if launched at cargo ships or Israel.)

♦️US ATTACKS YEMEN.. An American-British attack early in the morning on the Thais sub-district, south of the capital Sana’a.

♦️GAZA - EVAC ORDERS.. DF ordered the residents of the Gaza City neighborhoods Sheikh Zayed, Beit Hanun and Almanshiya to evacuate after rocket fire from the area.

20 notes

·

View notes

Note

Hi barb, you've been very open about your problems with getting paid for Blood Moon, did you ever get your tax office issues resolved? I love Blood Moon and want you to get your $$$$!!! You deserve it for bringing us Marco and Vicky and Roe and Sergi and werewolves.

Not yet. This has been the process so far:

1. Apply for Certificae of Residency in March.

2. Gets rejected 2 weeks later with no explanation.

3. After a long phone conversation they said it was because my address was incorrect (I was in insecure housing for most of 2022 so I've had a lot of addresses). I fix up my address and reapply.

4. No reply. Phone up to make a complaint after 5 weeks waiting.

5. Rejected again the day after complaint with no explanation.

6. Another phone call. They said I'm not a resident of Australia because I was locked out of the country during the pandemic. I tell them I returned in May 2022 and have been paying taxes to them since then, which they tell me they know but I still have to tell them I'm a resident.

7. I tell them I'm a resident and reapply.

8. No response.

9. On advice from a friend I legally register myself as a business and then I apply via online portal (non businesses have to apply by mail).

10. The phone me the next day (instead of me phoning them five weeks later so that was good I guess) and tell me I'm still not a resident? I tell them I told them several times and quote the process on their own website to them. They say they'll sort the issue and get back to me.

11. Another month passes with no contact.

12. Fill in tax return for new financial year, make sure I mark myself as a resident on it, and then reapply for a new certificate for the new financial year (I did this yesterday).

13. ?????

It's been over 150 days now. It shouldn't be this hard to not commit tax crimes. But Australia is a very corrupt and mismanaged country.

And someone like me who was locked out for over a year, who moves around a lot, who makes money in weird ways... I honestly just think they don't want to deal with me so I keep getting passed off to the next person.

Until I get the certificate of residency, I can't get paid for my overseas income. It sucks, but I'm hoping it will be sorted soon.

62 notes

·

View notes

Text

Pride & Gluttony

Pride; a feeling of deep pleasure or satisfaction derived from one's own achievements. Gluttony; over-indulgence and over-consumption of food, drink, or wealth items, particularly as status symbols. Upper level demon Seokjin - known as the deadly sin of Gluttony - follows alongside Namjoon - known as the deadly sin of Pride- returns to Earth 50 years after their demonic counterparts to wreck havoc on a new generation of sinners.

Lust - Envy - Wrath & Greed - Sloth

Warning: voyeurism, threesome, oral (m receiving), degradation,

Word Count: 1,427

Alternate Universe

Time passes through realms differently. Earth was fairly slow compared to Heaven and Hell. Time doesn’t necessarily exist outside of Earth, so it’s safe to safe that when nearly 50 Earth years passed, it was as though a few hours had passed through Hell. The scenery has changed much - especially the castle Namjoon visited with his counterparts. The castle appeared much higher than before and expanded a few hundred miles out. Next to the castle stood the cemetery grounds where the former rulers laid to rest - majority of them in Hell where he resided.

Namjoon’s eyes and ears expanded throughout the land - the townspeople complaining of their lives living within such a place. The tax skyrocket year after year and the pay was less and less each few months. The townspeople often complained about the way they lived - working to fund a lifestyle of the non-working class (the royal family) while their own family barely made it day by day.

“My roof is collapsing.” Murmurs a man as he takes a bite of his sandwich served on moldy bread - yet that was all he could afford.

“You’d think the amount of taxes we pay they’d fix our homes.” Says another man - not too loud enough for the guards to hear, they had eyes and ears everywhere.

The words of the people caused Seokjin to snicker. The former Queen had fought long and hard to regain the trust of the townspeople - even killing her own sister who was ruling in order to do so. All of her work had long went down the drain. People adored the former Queen right up until her timely death. However, her daughter - the eldest child - has ruined her mothers good deed. She didn’t take after her mother but instead her aunt, a women she never met. Maybe greed was in their blood.

The current Queen, Y/N, wasn’t as diabolical as her aunt. Did the townspeople hate her? Sure - yet she had a lifestyle to live by and guards and knights to pay. Her castle needed renovating and the cost to open new business around the land wasn’t cheap. Her mother wouldn’t be proud of her for doing what she does, but her mother’s disapproval no longer lingered ove her head. She was proud of herself, after all. She stepped up after her mother’s death and did what was needed to be done. She brought extra reinforcements in from outside sources to assist in building multiple warehouses and storefronts.

You sit with your arms crossed. The throne chair was tall, even towering over your figure and nearing the ceiling. Your sister sat besides you, eyes scanning the crowd before her with such lack of interest. It was unbearable to sit alongside the Queen and pretend to be interested in whatever politics was spewed out.

“This is my kingdom!” You hissed, nails digging into your thrown chair and you uncrossed your legs. Your eyes squinted at the rowdy crowd yelling and spewing out their hatred for the Kingdom.

“You all will bow to my word or…” you shrug, leaning back into your throne chair. “…burn.”

Gasps erupt through the Kingdom; along with several murmurs. “You all will do as I say or die.”

You hear your sister snicker then sigh. She leans back into her chair further and turns to the side to look at someone.

The scene freezes, the shouts of protests coming from townspeople emerges to a complete silence. Seokjin raises a brow while Namjoon hums. Yoongi shakes his head as the three figures shine before their eyes.

Humility shakes their head.

Temperance grimaces.

Diligence wrinkles their nose at the scene.

“Obviously,” Seokjin crosses both arms. “you’ve requested our presence for this reason.”

It wasn’t taboo for the sins to meet their opposites, capital virtues, nor was it taboo for them to join forces for, as their opposites put it, “the greater good”.

“We’ve been dealing with this problem for years.”

“50 to be exact.” Temperance shakes their head. ��And we believe-“

“For the greater good we eliminate the sinners.” Yoongi murmurs word for word - the same words he’s heard time and time again; for centuries.

Diligence scoffs.

“You know,” Namjoon hums. “for beings that are supposedly high, mighty and virtuous…you sure need our assistance with eliminating those who you deem unworthy.”

It’s no secret that those who resided in Heaven are not against asking those who reside in Hell for assistance. They’ve asked countless times before and would even after this situation. However, it didn’t come without a price.

“What do we do? Drag them to Hell with us?” Namjoon glances to the frozen face of the Queen.

“We’d have to ensure the rest of the Kingdom is in mint condition before we do anything.” Humility insists.

“If we handle this problem,” Seokjin waves his hand to the frozen Queen and Princess. “The bloodline will be wiped out.”

“And this Kingdom will fall.” Yoongi hums, yet he couldn’t are less.

Temperance tilts their head, defeated.

“Unless,” Namjoon snaps a finger. Below them, a large portal opens and fire engulfs.

Temperance, Diligence and Humility stammer back with wide eyes. “What in Gods name-“

“Wrath.” Namjoon nods. “Hobi.”

“I was busy.” Hoseok rolls his eyes and snarls at the three heavenly figures.

“Lemme guess, you need our help? Again.”

You scream at the top lungs, arms thrashing to side to side while your legs kicked. The pain was excruciating - until it wasn’t. Your ears rang in realization that you were the only sound you could hear - no longer the equal screams of your sister; nor the shouts of the townspeople.

Your eyes snap open, unsure where to focus on. You begin to tremble with the realization that you weren’t alone - and you weren’t clothed. Your arms go to wrap around your body the best you could.

“You’re finally with us.” A voice calls. “That means the townspeople have killed you.”

Your voice gets caught in your throat. The last memory you had was the townspeople rioting. A few glimpses of breaking out and the pain you felt when the flames hit you - yet everything remains fuzzy.

“W-Where’s my-“

“Dead.” Another voice says - but your eyes can only stare straight head at the sea of people - creatures to be exact. “Welcome to Hell.”

Your reaction doesn’t come. Not because you weren’t utterly shocked by the mans words - but because you’re unsure how long you’ve been with said men (and the crowd of creatures). Hours? Days? Years? It was as though time didn’t exist in this realm. One moment you were greeted to Hell - and the next, possibly an eternity afterwards, you’re entangled with both men.

They were beautiful, you note. You can make out their appearance even with blurry eyes. Tall, dark hair with piercing dark eyes to match. Lips plump and flushed pink and facial features sculptured by Gods - but these weren’t godly men.

You cough when Seokjin releases himself from your lips. You gag, air finally reaching your throat.

“Once a prideful Queen, now a whore for the Underworld to see.” Namjoon snickers.

Your mind swirls, but you’re remained uncertain just how much time has past until the faces of the creatures are blurry; unrecognizable. Your fear turns to excitement and now you’re more than willing to be used by these men; to be fucked for however long they’ve desired.

When Namjoon ordered you to be for him; you did, nearly crying for him to make you cum.

When Seokjin told you to swallow all of his cum he shot into your mouth, you complied without a second thought.

You gladly complied riding Seokjin all the while Namjoon watched, calling you degrading names; but you enjoyed each second of it.

You’re covered in cum - the question (you stopped wondering) was how long you’ve been on Hell, but you no longer care. Centuries could have past and here you laid complacent in utter bliss.

Seokjin hums, tilting his head. “It’s been 20 earth years. When are we taking her out of hypnosis?”

Namjoon shrugs. He watches the way your body jerks on the crowd, eyes rolling in pleasure - pleasure you’re not receiving, but in your hypnosis state of delirium, you believe you are. “This is her punishment, after all.”

Your punishment indeed, to break you down and make you - a once gluttonous and prideful being, now completely torn down and complacent for the very demons that made you his way.

@juju-227592 @silversparkles11 @iheartsvt @seokjinkismet @bloodline1632

Next

#explicit-tae#btsmasterlist2022#bts smut#pride#namjoon yandere#namjoon x reader#bangtanwritershq#bangtan smut#namjoon smut#a fall from grace#7 deadly sins#btswritersclub#btswritingcafe#demon namjoon#gluttony#demon seokjin#seokjin yandere#seokjin x reader#seokjin smut#alternate universe masterlist

151 notes

·

View notes

Text

Non resident Income Tax Return services

Are you an individual living abroad in need of expert assistance with your non-resident income tax return? Look no further! Our specialized services are tailored to simplify your tax obligations. Our seasoned team provides expert guidance to ensure compliance, maximize deductions, and optimize your tax situation.

#non resident tax return services#non resident income tax Return#non resident income tax Return services#non resident income tax filing services

0 notes

Text

Taxation of Remote Workers in Turkey: Essential Information for Foreigners

With the increase in remote work and the appeal of Turkey as a base, understanding taxation of remote workers in Turkey is essential for foreigners planning to work, live, or set up a business in the country. Turkey’s tax regulations impact foreign workers differently based on residency status, the source of income, and the duration of their stay. This article provides key insights into taxes in Turkey for foreigners, helping digital nomads, freelancers, and remote employees understand their tax obligations.

Overview of Turkish Tax Obligations for Foreigners

Turkey’s tax laws classify individuals as either resident or non-resident taxpayers, which plays a crucial role in determining tax obligations. Generally, those who stay in Turkey for over six months are considered residents and are subject to taxation on their global income, while non-residents are taxed only on Turkish-sourced income. The primary taxes affecting foreign remote workers include income tax, VAT (value-added tax), and corporate tax for entrepreneurs.

Foreign nationals are advised to work with professional tax consultants or legal advisors, especially because certain categories, like freelancers or employees working for foreign companies, may encounter additional complexity in meeting Turkish tax requirements.

Key Laws Governing Taxation in Turkey for Foreigners

Taxation in Turkey is based on a few core laws. The Income Tax Code applies to individuals earning in Turkey, including foreign residents. The Corporate Tax Code is relevant for business owners or freelancers registered as companies, while the Value Added Tax Code impacts goods and services transactions. For foreigners, Turkey’s digital nomad framework outlines responsibilities for those residing in Turkey but earning income from abroad.

Importance of Compliance with Tax Regulations

Foreigners working remotely or as freelancers in Turkey need to navigate these tax rules carefully. Failure to meet tax obligations can lead to serious consequences, such as fines, penalties, or legal action. Understanding Turkey’s taxation system, particularly for digital nomads or foreign freelancers, can help prevent unexpected tax liabilities. The guidance of tax advisors is often essential for those unfamiliar with the Turkish tax system, as they can help ensure that all compliance requirements are met.

Digital Nomad Tax Rules and Remote Work Permits

Currently, there is no specific “digital nomad visa” in Turkey; however, foreigners working remotely can stay on tourist visas initially. After this period, a residence permit is required, which may necessitate obtaining a work permit depending on the duration and nature of their stay. According to Turkish law, a work permit is also considered a residence permit, giving foreign nationals both the right to work and to reside in the country legally.

Foreigners should note that spending over six months in Turkey typically triggers residency status, which then requires filing income tax returns on worldwide earnings. This regulation applies even to those without work permits, highlighting the importance of understanding residency-based tax obligations.

Double Taxation Agreements and Tax Residency Rules

Turkey has agreements with several countries to prevent double taxation, which can help foreign workers avoid paying taxes on the same income in both their home country and Turkey. Double taxation treaties outline tax responsibilities for individuals based on their primary country of residence and income sources. These agreements are particularly beneficial for foreign nationals working remotely in Turkey for an international employer, as they may qualify for tax credits or exemptions under certain conditions.

Practical Steps for Tax Compliance

For foreign remote workers, staying compliant with Turkish tax rules means securing the right permits, if required, and keeping accurate records of income and expenses. They should ensure they have a tax identification number, a bank account for transactions, and if needed, register their business activities. Additionally, international tax agreements between Turkey and their home country can influence how their income is taxed.

Conclusion

Working remotely from Turkey offers numerous advantages, from cultural enrichment to diverse opportunities. However, it also brings tax obligations that should be carefully managed. Foreigners should understand their tax residency status, familiarize themselves with Turkish tax codes, and seek professional advice to ensure they meet all regulatory requirements.

In summary, taxes in Turkey for foreigners can vary widely based on individual circumstances, making professional assistance invaluable. By understanding taxation in Turkey for foreigners, remote workers can focus on their careers while staying fully compliant with Turkey’s tax laws.

3 notes

·

View notes

Text

Scandal After Scandal: Will They Never End?

Boris Johnson was so beset by scandal that his own party turned on him and threw him out of office. We all know about the Partygate affair but there were also questions raised regarding his personal monetary arrangements. From charges of corruption concerning him asking a Tory donor to supply funds to refurbish his Downing Street residence, to his appointment of the BBC Chairman and an alleged £800,000 loan, Johnson was the epitome of the self-serving Tory.

Johnson has gone but the scandals have continued to rumble on. We had the unedifying debacle of multi-millionaire Nadhim Zahawi being forced to resign after he was found guilty of serious breaches of the ministerial code by covering up issues to do with his attempts to minimise his tax bill.

Sunak’s own wife also avoided UK tax payments by claiming non-dom status. After being asked to “come clean” on his wife’s tax affairs and after much embarrassment the Sunak’s decided she should pay tax in this country.

It is not only those Tories at the top of government who are self-serving. Conservative MP’s have been calculated to have received an additional £15.2 million on top of their MP salaries, personal fortune hunting seemingly more important than giving their constituents 100% of their time.

“Since the end of 2019, millions of pounds of outside earnings have been made by a small group of largely Tory MPs." (Skynews: 08/01/23)

When Sunak, after much delay, made public his own tax affairs we discovered that for the year 2021/22 he made £172,415 unearned income from dividends and £1.6 million from capital gains. In total, the PM paid an average tax rate of 22% over a three-year period.

For you and I, the basic rate of tax on income between £12,571 and £50,270 is 20%. Between £50,271 and £125,140, it is 40 %, going up to 45% for earned income over £125,140.

For Mr Sunak to have only paid 22% on his millions is therefore quite a smack in face for ordinary tax-payers, and one only made possible because the Tories have arranged the tax system to benefit themselves and their rich friends.

“Angela Rayner, Labour’s deputy leader, said: “[The tax returns] reveal a tax system designed by successive Tory governments in which the prime minister pays a far lower tax rate than working people who face the highest tax burden in 70 years

“… the fact that Sunak paid less than a quarter of his gains in tax highlighted the problems with taxing capital gains at a much lower rate than income…The low tax rate is because we have much lighter taxes on wealth than work” (Guardian: 22/03/23)

So, if you work for a living, expect to pay proportionately more in tax than those who live on unearned income.

Way back in July 2022, Rishi Sunak was so disgusted with the immoral behaviour of Boris Johnson that he resigned his post as Chancellor. This is what he said at the time:

“... the public rightly expect government to be conducted properly, competently and seriously. I recognise this may be my last ministerial job, but I believe these standards are worth fighting for and that is why I am resigning.”

But if a week is a long time in politics, then 9 months is an eternity. As we have seen, Sunak himself has become as equally embroiled in monetary scandal as his predecessor and now he is under investigation by the Parliamentary Standards Committee.

“Rishi Sunak investigation: Government blocked Freedom of Information request into childcare firm.

Mr Sunak is currently being investigated by the Parliamentary Standards Commissioner over his failure to be more transparent about his wife’s shares in childcare agency Koru Kids when quizzed on the subject by MPs.

It comes after i revealed last month that Akshata Murty, the Prime Minister’s wife, holds shares in the firm, which stands to directly benefit from reforms to the childcare system announced in last month’s Budget.” (inews: 19/04/23)

Time and time again we see top Tories under investigation by the Parliamentary Standards Commission. Time and time again we see how self-serving and unprincipled our leaders really are. Mr Sunak it seems, is no different to his predecessors and the sooner he goes the better.

35 notes

·

View notes