#UK property tax

Explore tagged Tumblr posts

Text

Apply for a Repayment of the Non-UK Resident Stamp Duty Land Tax Surcharge in England and Northern Ireland

Check if you can and how to apply for a repayment if you’re a non-residential purchaser of property in England and Northern Ireland.

Who Can Apply

You or your estate agents can apply for a repayment of the surcharge paid on a property if all the purchasers are individuals and have spent 183 days in the UK in any continuous 365-day period:

Starting no more than 364 days before the effective date of the transaction.

Ending no more than 365 days after the effective date of the transaction.

The effective date of the transaction is usually the completion date. You must apply for the repayment within 2 years of the effective date of the transaction.

What Information You’ll Need

To apply for a repayment, you will need the following details:

Bank Account Information: UK bank account and sort code details for the recipient of the payment.

Unique Transaction Reference Number (UTRN): From the Stamp Duty Land Tax return submitted when the property was purchased.

Effective Date of Purchase: Usually the completion date.

SDLT Amount Paid: Including the non-resident surcharge.

Purchase Price: If it’s a freehold property (or other ‘consideration’ if the transaction included goods, works, services, debt release, etc.).

Total Lease Premium: If it’s a leasehold property.

Net Present Value Calculation: Used when the SDLT was calculated if it’s a new lease.

If you’ve already reclaimed the higher rate on additional dwellings, you’ll need the amount of SDLT due after the refund. You may need to ask your solicitor or conveyancer for these details.

If You Are an Agent Acting for the Purchaser

Estate Agents will need a document signed by the purchaser confirming authority to apply for a repayment on their behalf. This letter of authority should specify if the repayment is to be paid into an account other than the purchaser’s and include the relevant account details. You’ll need to upload an image of this signed document with your online application.

How to Apply for a Repayment

Your application requests HMRC to amend the Stamp Duty Land Tax return for the property. You’ll be asked to certify that the amendment is correct.

There are two ways to apply depending on whether you have a Government Gateway user ID and password:

With Government Gateway: Use your user ID and password if you’ve registered for Self Assessment or filed a tax return online.

Without Government Gateway: Apply via email if you do not have a Government Gateway user ID.

Ensure to save your application and return to it later if needed. Only apply by email if you do not have a Government Gateway user ID.

Need Assistance?

If you find the application process challenging or prefer professional assistance, consider contacting the best estate agents in the UK. They can provide expert guidance and help streamline the application process.

#England property tax#HMRC SDLT#non-residential property tax#non-UK resident SDLT#Northern Ireland property tax#property purchase tax#property tax refund#property tax relief#real estate taxes#SDLT application#SDLT repayment#SDLT return#SDLT surcharge repayment#Stamp Duty Land Tax#UK property market#UK property tax

0 notes

Text

#palestine#gaza#israeli war crimes#war criminals#israeli occupation#israeli lies#israeli terrorism#resistance forces 💪#gaza genocide#usa taxes money#usa#uk#uk property#uk politics#united kingdom#spain#world press photo#world wide web#worldwide#colonialism

10 notes

·

View notes

Photo

2 bedroom flat for sale on Langside Road, Govanhill, Glasgow

Asking price: £149,000

Sold price: £185,200

#glasgow#2 bedroom#govanhill#southside#flat#for sale#property#uk property market#3/2 279#G42 8XX#top floor#EPC C#council tax B#sold#sold price

7 notes

·

View notes

Text

Restricting individual wealth

The Gracchi brothers brothers, Gaius and Tiberius, were tribunes, the equivalent of our deputies, and they wanted to tackle the problems of the time. The rich were few in number but owned almost all the land. As they produced all the cereals, they agreed among themselves to set a high price and brought in foreigners to work for very low wages that Roman citizens would not accept. By 133 B.C., Rome was plunged into widespread poverty, which tormented the city. The Gracchus brothers passed a law called property, which stated that property had a limit in quantity, beyond which it was toxic for society, and a limit in use, according to which just because it’s mine doesn’t mean I can do what I want with it. The Gracchi brothers were seized by the rich and their henchmen and thrown into the Tribe. What followed was 100 years of civil war between the plebs and the rich, before Emperor Augustus established the laws of the Gracchus brothers, taking advantage of the turmoil caused by the death of Julius Caesar (who had won the civil war by fighting the ultra-rich). Four hundred years of peace and prosperity followed.

In 1930, in France, judges created the public water utility, nationalizing the sources. This showed that private property is not sacred. They expropriated the owners, and that was normal. Léon Blum was harassed and left office.

Labour’s 1945 victory in the UK led to the expropriation of mine owners. Ownership is not absolute. Owners became less wealthy and this drove them below the toxic limit.

Franklin D. Roosevelt led major campaigns to nationalize energy, raw materials, armaments and roads, and introduced public granaries (the state buys food to guarantee prices). The group prevailed over private property. If ownership went against the group’s interests, nationalization could be considered. He took the assets appropriated by the ultra-rich and redistributed the gains for the general good. The New Deal brought prosperity to America for 40 years. Franklin Delano Roosevelt is the only American president to have been elected four times, and he died in office. He had strong public support. The United States is reputed to be capitalist by nature, but this is a myth. When presented with a very socialist program, the people embrace it. Michael Moore in Fahrenheit 11/9 used polls to prove that Americans’ aspirations are not capitalist. 70% are for health insurance, 62% are for unions, 58% are against supporting banks, 61% for raising the minimum wage, etc. (cf. American people’s choice).

Franklin D. Roosevelt – Wikipedia: https://en.wikipedia.org/wiki/Franklin_D._Roosevelt

New Deal – Wikipedia: https://en.wikipedia.org/wiki/New_Deal

On November 24, 2013, a law was passed in Switzerland limiting wages to 250 times the minimum wage. This means that for the highest wages to rise, the lowest wages must be increased. The rich are very happy in Switzerland. By way of comparison, in France in 2019, CAC40 bosses earned 1128 times the salary of their most modest employees.

In Ukraine in 2022, President Zelensky took advantage of exceptional war powers to nationalize the banks, TV channels and industries owned by the oligarchs. The oligarchs were so wealthy that they decided everything in the country, while the Ukrainian coffers were empty.

When Elon Musk intervenes in the war in Ukraine, it’s too much. When Mark Zuckerberg promotes Trump’s election to enrich himself, it’s too much. When someone is rich enough to have their own space program or has more money than a country, it’s too much. When your decisions can ruin the lives of millions of people even though you weren’t elected, it’s too much. When the richest 1% of humanity emit 100 times more greenhouse gases than the other 99%, it’s too much.

These people deserve to be rich, but not that rich. They have never given back to society what society gave them in the first place. They offer philanthropy in return, but it’s selective solidarity because they decide how much and to whom they give the money. The society has trained their employees with schools and universities; they are healthy thanks to hospitals, there are roads, railroads and airports to transport their goods. There is a police force and an army to protect them, and a justice system to enforce their rights. There are natural resources to feed their industries, and so on.

What’s more, they influence politicians to pay less tax and inheritance tax. Most of the richest people inherited. They have done nothing for society. They don’t pay their fair share of taxes.

Les 1 % les plus riches ont empoché plus de 40 000 milliards de dollars au cours des 10 dernières années, alors que le niveau d’imposition des plus riches atteint des niveaux historiquement bas – Oxfam: https://www.oxfam.org/fr/communiques-presse/les-1-les-plus-riches-ont-empoche-plus-de-40-000-milliards-de-dollars-au-cours

Les riches menacent-ils la démocratie – Arte: https://www.arte.tv/fr/videos/109816-010-A/les-riches-menacent-ils-la-democratie/

Columbia University believes that $100 million is the limit. It’s more than enough for the individual and not enough to be toxic.

Limit On Wealth – Stephen H. Unger: http://www1.cs.columbia.edu/~unger/articles/wealthLimit.html)

What, if Anything, is Wrong with Extreme wealth – Ingrid Robeyns: https://www.tandfonline.com/doi/epdf/10.1080/19452829.2019.1633734?needAccess=true&role=button

Having too Much – Ingrid Robeyns: https://www.openbookpublishers.com/books/10.11647/obp.0338

Capitalisme américain, le culte de la richesse (1/3) | ARTE: https://youtu.be/0j1UDBqR-oM?feature=shared

Faire casquer les riches | Capitalisme américain, le culte de la richesse (2/3) | ARTE: https://youtu.be/uccQqNg2tF8?si=3hep4x297rSSZ7Bu

Elon Musk: Last Week Tonight with John Oliver (HBO): https://youtu.be/Eo3zORUGCbM?si=TUxpdymb6rV3Xd2x

Noir Désir – L’homme pressé: https://youtu.be/by1RRP9wa_Y?si=mK5wb4sZn3YnRsB8

World’s five richest men double their money as poorest get poorer – The Guardian: https://www.theguardian.com/inequality/2024/jan/15/worlds-five-richest-men-double-their-money-as-poorest-get-poorer

The cost of extrême wealth: https://costofextremewealth.com

La ploutocratie, les riches au pouvoir ? – France Inter: https://www.radiofrance.fr/franceinter/podcasts/zoom-zoom-zen/zoom-zoom-zen-du-jeudi-04-avril-2024-8390390

Épisode 1/4 : Rends les terres ! Réforme à Rome, va te faire voir chez les Gracques – France culture: https://www.radiofrance.fr/franceculture/podcasts/le-cours-de-l-histoire/rends-les-terres-reforme-a-rome-va-te-faire-voir-chez-les-gracques-1597994

Super-héritages : le jackpot fiscal des ultra-riches – Oxfam France: https://www.oxfamfrance.org/rapports/super-heritages-le-jackpot-fiscal-des-ultra-riches/

-----------------------------------------------------------------

Limiter la richesse individuelle: https://www.aurianneor.org/limiter-la-richesse-individuelle/

A slice of the cake: https://www.aurianneor.org/a-slice-of-the-cake/

The richest 1% are at war with the rest of the world: https://www.aurianneor.org/the-richest-1-are-at-war-with-the-rest-of-the-world/

Working class racism: https://www.aurianneor.org/working-class-racism/

Solidarité Hélvétique: https://www.aurianneor.org/solidarite-helvetique-democratie-semi-directe/

Wall Street (1987): https://www.aurianneor.org/wall-street-1987/

Freedom and coexistence: https://www.aurianneor.org/freedom-and-coexistence/

Tomorrow – Chap 4: La démocratie: https://www.aurianneor.org/tomorrow-chap-4-la-democratie-the-panama/

Qui se cache derrière le drapeau?: https://www.aurianneor.org/qui-se-cache-derriere-le-drapeau/

Quelle époque!: https://www.aurianneor.org/quelle-epoque-soyons-daccord-emmanuel-macron/

Illegitimate authorities: https://www.aurianneor.org/illegitimate-authorities/

Ecoterrorism: https://www.aurianneor.org/ecoterrorism/

You can’t get enough… Enough!: https://www.aurianneor.org/you-cant-get-enough-enough-the-same-companies/

“The world has enough for everyone’s need, but not enough for everyone’s greed”: https://www.aurianneor.org/the-world-has-enough-for-everyones-need-but-not/

Cut out the middleman: https://www.aurianneor.org/cut-out-the-middleman/

Housing: https://www.aurianneor.org/housing/

Retirement pensions: https://www.aurianneor.org/retirement-pensions/

Living with dignity: https://www.aurianneor.org/living-with-dignity/

The Rust Belt: https://www.aurianneor.org/the-rust-belt-2/

Representation of capitalism trying to take all the resources and trying to make workers live nothing but work: https://www.aurianneor.org/representation-of-capitalism-trying-to-take-all-the-resources-and-trying-to-make-workers-live-nothing-but-work/

“Capitalism will eat democracy; unless we speak up”: https://www.aurianneor.org/yanis-varoufakis-capitalism-will-eat-democracy/

Simon Sinek – Start with why: https://www.aurianneor.org/simon-sinek-start-with-why-bonuses/

When you have a hammer in your hand everything looks like a nail.: https://www.aurianneor.org/when-you-have-a-hammer-in-your-hand-everything/

The Red and the Yellow: https://www.aurianneor.org/the-red-and-the-yellow-red-scarves-against-yellow/

Le référendum est une arme qui tue la violence: https://www.aurianneor.org/le-referendum-est-une-arme-qui-tue-la-violence-oui/

Le levier économique: https://www.aurianneor.org/le-levier-economique-charles-stewart-parnell/

Fed up with strikes? Ask for referendums!: https://www.aurianneor.org/fed-up-with-strikes-ask-for-referendums/

The Modern “chiffon rouge”: https://www.aurianneor.org/the-modern-chiffon-rouge/

Rich: https://www.aurianneor.org/rich-it-was-a-beautiful-day-and-the-scenery-was/

What I am worth depends neither on market nor on race: https://www.aurianneor.org/what-i-am-worth-depends-neither-on-market-nor-on-race/

My hormones want admiration: https://www.aurianneor.org/my-hormones-want-admiration-i-want-to-shine-im/

Dans les territoires ultramarins, une population en colère exclue du progrès: https://www.aurianneor.org/dans-les-territoires-ultramarins-une-population-en-colere-exclue-du-progres/

Work, it’s an all-or-nothing option: https://www.aurianneor.org/work-its-an-all-or-nothing-option/

Législatives 2024: choisir la gauche ou la droite: https://www.aurianneor.org/legislatives-2024-choisir-la-gauche-ou-la-droite/

2024 UK general election: choosing the Right or the Left.: https://www.aurianneor.org/2024-uk-general-election-choosing-the-right-or-the-left/

#aurianneor#Blum#cac 40#democracy#foreigners#Gracchi#individualism#labour#money#Musk#nationalisations#New deal#oligarchs#peace#plutocracy#poverty#private property#property#prosperity#roosevelt#salary#suisse#swiss#tax#UK#wealth#Zelensky#Zuckerberg

1 note

·

View note

Text

Transferring assets into a UK trust, such as property or investments, protects wealth and manages it for future generations. Selecting the right trust type—discretionary, bare, or life interest—is crucial, considering the tax implications like inheritance and capital gains tax. Choosing reliable trustees is vital, as they oversee the assets according to the trust deed. Professional advice ensures legal compliance, tax efficiency, and alignment with long-term financial goals.

0 notes

Text

UK Streets are littered with Tax Bills

Photo by nattanan23 What do I mean by the “UK streets are littered with tax bills?” Last week we looked at the obvious taxes around income and the cost of living. This was written hoping that the people planning to come to the UK thinking going from zero to hero will be easy are made aware that it is so far from the truth. Here is something that I read on Facebook that, to be honest, sums up…

#business tax bill#council tax bill#Filipina magic#Income Tax Bill#late tax bill#property tax bill#self-assessment tax bill#tax bill assessment#tax bill breakdown#tax bill disputes#tax bill due dates#tax bill enquiry#tax bill explained#tax bill FAQs#tax bill instalments#Tax Bill Payment#tax bill relief#tax bill reminders#UK tax bill changes#VAT Bill

0 notes

Text

7 Fascinating Facts About UK Capital Gains Tax

New Post has been published on https://www.fastaccountant.co.uk/facts-about-uk-capital-gains-tax/

7 Fascinating Facts About UK Capital Gains Tax

The realm of UK Capital Gains Tax (CGT) is intricate and multifaceted, affecting individuals and businesses alike. With a system that encompasses various assets, reliefs, and exemptions, understanding the nuances can significantly impact financial decisions and tax liabilities. Here’s an in-depth look into seven captivating facts about the UK Capital Gains Tax that illuminate its complexities and strategic considerations.

1. A Spectrum of Rates: The Varied CGT Landscape

UK Capital Gains Tax rates are not one-size-fits-all; they adapt based on the asset type and the taxpayer’s income level. For the 2023/24 tax year, the basic rate for residential property gains stands at 18%, while all other assets are taxed at 10% if your overall annual income is below £50,270. For income above this threshold, the rates jump to 28% for residential property and 20% for other assets. This tiered structure necessitates careful planning, especially for those on the cusp of different income brackets.

2. Diving Deep Into Deductions: Strategic Tax Reliefs

UK Capital Gains Tax can be mitigated through various reliefs, including rollover relief, business incorporation relief, and entrepreneurs’ relief, the latter allowing a reduced 10% rate on certain business disposals. These reliefs are designed to encourage investment and entrepreneurial activities by reducing the tax burden on qualifying assets, making them a critical consideration for business owners and investors.

3. The CGT Allowance Shuffle: A Significant Reduction

In a striking move, the UK Capital Gains Tax allowance was dramatically reduced from £12,300 in the 2022/23 tax year to £3,000 for individuals in the 2024/25 tax year. This reduction has profound implications for taxpayers, significantly lowering the threshold of tax-free capital gains and necessitating more diligent tax planning and asset management strategies.

4. Avoiding the CGT Pitfalls: Reporting and Penalties

Failure to accurately report CGT can result in penalties exceeding the tax owed. Unlike income tax, CGT is not automatically deducted; it requires self-reporting for various transactions, including the sale of shares, property, and certain valuables. Understanding the reporting requirements and deadlines is essential to avoid unnecessary fines and to capitalize on potential deductions and allowances.

5. Expats’ Unique UK Capital Gains Tax Landscape: Navigating Non-Residency Rules

Expats and non-UK residents face specific CGT considerations, especially regarding UK property interests. Since April 6, 2015, expats can elect to assess UK Capital Gains Tax based on the property’s market value on April 5, 2015, offering a potential tax advantage for long-term property owners. This rule underscores the importance of professional valuation and tax advice for expats navigating the UK CGT landscape.

6. CGT Exemptions Unveiled: Not Everything is Taxable

Several exemptions can shield taxpayers from UK Capital Gains Tax, including the sale of the main residence, transfers between spouses, and the sale of certain personal chattels. Additionally, losses on chargeable transactions can be offset against gains, further reducing taxable income. Awareness and strategic use of these exemptions can significantly reduce CGT liabilities.

7. The Deadline Dance: Timely CGT Declaration and Payment

The deadlines for declaring and paying CGT are critical to adhere to, especially the 60-day window for reporting the sale of residential properties. This rule, updated from a 30-day requirement, underscores the need for timely action and planning in CGT matters. Failure to comply can result in penalties, making it imperative for taxpayers to stay informed about their obligations.

Key Takeaways Table

Fact Key Takeaway 1 CGT rates vary significantly based on asset type and income, requiring strategic financial planning. 2 Various tax reliefs can significantly reduce CGT liabilities, encouraging investment and business activities. 3 The dramatic reduction in CGT allowance necessitates more careful asset management and tax planning. 4 Accurate reporting of CGT is crucial to avoid penalties, necessitating a thorough understanding of tax obligations. 5 Expats and non-residents must navigate specific rules and options for CGT on UK property, often benefiting from professional advice. 6 A range of exemptions can shield certain transactions from CGT, offering opportunities to minimize tax liabilities. 7 Adhering to CGT declaration and payment deadlines is essential to avoid penalties, emphasizing the importance of timely tax planning.

Conclusion

The UK Capital Gains Tax system, with its tiered rates, strategic reliefs, and targeted exemptions, presents both challenges and opportunities for taxpayers. Understanding these nuances is crucial for minimizing liabilities and maximizing financial outcomes. Whether you’re an individual taxpayer, an expat, or a business owner, navigating the CGT landscape with informed strategies can lead to significant tax savings and financial benefits.

#Capital Gains Tax#Capital Gains Tax on Property#Capital Gains Tax Return#Facts About UK Capital Gains Tax#UK Capital Gains Tax

0 notes

Text

Let Property Campaign (LPC)

#let property campaign#property taxes#property investing#lpc#hmrc#landlords#tax services#tax accountant#tax returns#london#uk

0 notes

Text

Navigating the complexities of taxation on rental income in the UK can be challenging for property owners. Understanding the legal framework and available tax reliefs is key to effectively minimising your tax liability. This article aims to provide valuable insights and practical strategies to help landlords maximise their rental income while staying compliant with tax regulations.

#Minimise tax#Rental income#UK#Tax reduction#Property taxation#Tax-saving tips#Income tax#Property investment#Tax strategies#UK taxation#Rental property#Tax planning#Tax minimization#Real estate taxation#Tax-efficient rental income

0 notes

Text

Tax cut temptation: Sunak promises ‘cautious’ cuts ahead of autumn statement

UK Prime Minister Rishi Sunak said his government would turn to tax cuts once inflation falls, speaking ahead of this week’s Budget update when Treasury Secretary Jeremy Hunt was expected to announce how he would boost the stagnant economy.

Rishi Sunak noted on Monday:

Now that inflation is halved and our growth is stronger, meaning revenues are higher, we can begin the next phase and turn our attention to cutting tax.

Sunak said his government had to prioritise reducing the tax burden. He emphasised that he would not repeat the unfunded tax cut plan that his predecessor Liz Truss announced last year, which caused turmoil in bond markets. Sunak said the government would cut taxes gradually and would not do anything that would increase inflation. He added:

You can trust me when I say we can responsibly start to cut taxes.

Read more HERE

#world news#world politics#news#europe#european news#uk news#uk politics#uk property#uk government#uk economy#england#london#united kingdom#britain#rishi sunak#sunak#taxes#economy#uk inflation#recession#tax burden

0 notes

Text

#Uk#housing market#uk property#british households will be £100 worse off from today as new tax rules kick in

0 notes

Link

Small wonder then that so many people turn to us for the help of a crypto tax accountant UK regulations are a veritable minefield. But we think that our ability in this area demonstrates our capacity. If we can navigate your finances through the crypto minefield you can be sure that when they come to us for a Property Tax Specialist London clients have confidence that we can navigate through those matters too.

0 notes

Text

UK publishers suing Google for $17.4b over rigged ad markets

THIS WEEKEND (June 7–9), I'm in AMHERST, NEW YORK to keynote the 25th Annual Media Ecology Association Convention and accept the Neil Postman Award for Career Achievement in Public Intellectual Activity.

Look, no one wants to kick Big Tech to the curb more than I do, but, also: it's good that Google indexes the news so people can find it, and it's good that Facebook provides forums where people can talk about the news.

It's not news if you can't find it. It's not news if you can't talk about it. We don't call information you can't find or discuss "news" – we call it "secrets."

And yet, the most popular – and widely deployed – anti-Big Tech tactic promulgated by the news industry and supported by many of my fellow trustbusters is premised on making Big Tech pay to index the news and/or provide a forum to discuss news articles. These "news bargaining codes" (or, less charitably, "link taxes") have been mooted or introduced in the EU, France, Spain, Australia, and Canada. There are proposals to introduce these in the US (through the JCPA) and in California (the CJPA).

These US bills are probably dead on arrival, for reasons that can be easily understood by the Canadian experience with them. After Canada introduced Bill C-18 – its own news bargaining code – Meta did exactly what it had done in many other places where this had been tried: blocked all news from Facebook, Instagram, Threads, and other Meta properties.

This has been a disaster for the news industry and a disaster for Canadians' ability to discuss the news. Oh, it makes Meta look like assholes, too, but Meta is the poster child for "too big to care" and is palpably indifferent to the PR costs of this boycott.

Frustrated lawmakers are now trying to figure out what to do next. The most common proposal is to order Meta to carry the news. Canadians should be worried about this, because the next government will almost certainly be helmed by the far-right conspiratorialist culture warrior Pierre Poilievre, who will doubtless use this power to order Facebook to platform "news sites" to give prominence to Canada's rotten bushel of crypto-fascist (and openly fascist) "news" sites.

Americans should worry about this too. A Donald Trump 2028 presidency combined with a must-carry rule for news would see Trump's cabinet appointees deciding what is (and is not) news, and ordering large social media platforms to cram the Daily Caller (or, you know, the Daily Stormer) into our eyeballs.

But there's another, more fundamental reason that must-carry is incompatible with the American system: the First Amendment. The government simply can't issue a blanket legal order to platforms requiring them to carry certain speech. They can strongly encourage it. A court can order limited compelled speech (say, a retraction following a finding of libel). Under emergency conditions, the government might be able to compel the transmission of urgent messages. But there's just no way the First Amendment can be squared with a blanket, ongoing order issued by the government to communications platforms requiring them to reproduce, and make available, everything published by some collection of their favorite news outlets.

This might also be illegal in Canada, but it's harder to be definitive. The Canadian Charter of Rights and Freedoms was enshrined in 1982, and Canada's Supreme Court is still figuring out what it means. Section Two of the Charter enshrines a free expression right, but it's worded in less absolute terms than the First Amendment, and that's deliberate. During the debate over the wording of the Charter, Canadian scholars and policymakers specifically invoked problems with First Amendment absolutism and tried to chart a middle course between strong protections for free expression and problems with the First Amendment's brook-no-exceptions language.

So maybe Canada's Supreme Court would find a must-carry order to Meta to be a violation of the Charter, but it's hard to say for sure. The Charter is both young and ambiguous, so it's harder to be definitive about what it would say about this hypothetical. But when it comes to the US and the First Amendment, that's categorically untrue. The US Constitution is centuries older than the Canadian Charter, and the First Amendment is extremely definitive, and there are reams of precedent interpreting it. The JPCA and CJPA are totally incompatible with the US Constitution. Passing them isn't as silly as passing a law declaring that Pi equals three or that water isn't wet, but it's in the neighborhood.

But all that isn't to say that the news industry shouldn't be attacking Big Tech. Far from it. Big Tech compulsively steals from the news!

But what Big Tech steals from the news isn't content.

It's money.

Big Tech steals money from the news. Take social media: when a news outlet invests in building a subscriber base on a social media platform, they're giving that platform a stick to beat them with. The more subscribers you have on social media, the more you'll be willing to pay to reach those subscribers, and the more incentive there is for the platform to suppress the reach of your articles unless you pay to "boost" your content.

This is plainly fraudulent. When I sign up to follow a news outlet on a social media site, I'm telling the platform to show me the things the news outlet publishes. When the platform uses that subscription as the basis for a blackmail plot, holding my desire to read the news to ransom, they are breaking their implied promise to me to show me the things I asked to see:

https://www.eff.org/deeplinks/2023/06/save-news-we-need-end-end-web

This is stealing money from the news. It's the definition of an "unfair method of competition." Article 5 of the Federal Trade Commission Act gives the FTC the power to step in and ban this practice, and they should:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

Big Tech also steals money from the news via the App Tax: the 30% rake that the mobile OS duopoly (Apple/Google) requires for every in-app purchase (Apple/Google also have policies that punish app vendors who take you to the web to make payments without paying the App Tax). 30% out of every subscriber dollar sent via an app is highway robbery! By contrast, the hyperconcentrated, price-gouging payment processing cartel charges 2-5% – about a tenth of the Big Tech tax. This is Big Tech stealing money from the news:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Finally, Big Tech steals money by monopolizing the ad market. The Google-Meta ad duopoly takes 51% out of every ad-dollar spent. The historic share going to advertising "intermediaries" is 10-15%. In other words, Google/Meta cornered the market on ads and then tripled the bite they were taking out of publishers' advertising revenue. They even have an illegal, collusive arrangement to rig this market, codenamed "Jedi Blue":

https://en.wikipedia.org/wiki/Jedi_Blue

There's two ways to unrig the ad market, and we should do both of them.

First, we should trustbust both Google and Meta and force them to sell off parts of their advertising businesses. Currently, both Google and Meta operate a "full stack" of ad services. They have an arm that represents advertisers buying space for ads. Another arm represents publishers selling space to advertisers. A third arm operates the marketplace where these sales take place. All three arms collect fees. On top of that: Google/Meta are both publishers and advertisers, competing with their own customers!

This is as if you were in court for a divorce and you discovered that the same lawyer representing your soon-to-be ex was also representing you…while serving as the judge…and trying to match with you both on Tinder. It shouldn't surprise you if at the end of that divorce, the court ruled that the family home should go to the lawyer.

So yeah, we should break up ad-tech:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-shatter-ad-tech

Also: we should ban surveillance advertising. Surveillance advertising gives ad-tech companies a permanent advantage over publishers. Ad-tech will always know more about readers' behavior than publishers do, because Big Tech engages in continuous, highly invasive surveillance of every internet user in the world. Surveillance ads perform a little better than "content-based ads" (ads sold based on the content of a web-page, not the behavior of the person looking at the page), but publishers will always know more about their content than ad-tech does. That means that even if content-based ads command a slightly lower price than surveillance ads, a much larger share of that payment will go to publishers:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-ban-surveillance-advertising

Banning surveillance advertising isn't just good business, it's good politics. The potential coalition for banning surveillance ads is everyone who is harmed by commercial surveillance. That's a coalition that's orders of magnitude larger than the pool of people who merely care about fairness in the ad/news industries. It's everyone who's worried about their grandparents being brainwashed on Facebook, or their teens becoming anorexic because of Instagram. It includes people angry about deepfake porn, and people angry about Black Lives Matter protesters' identities being handed to the cops by Google (see also: Jan 6 insurrectionists).

It also includes everyone who discovers that they're paying higher prices because a vendor is using surveillance data to determine how much they'll pay – like when McDonald's raises the price of your "meal deal" on your payday, based on the assumption that you will spend more when your bank account is at its highest monthly level:

https://pluralistic.net/2024/06/05/your-price-named/#privacy-first-again

Attacking Big Tech for stealing money is much smarter than pretending that the problem is Big Tech stealing content. We want Big Tech to make the news easy to find and discuss. We just want them to stop pocketing 30 cents out of every subscriber dollar and 51 cents out of ever ad dollar, and ransoming subscribers' social media subscriptions to extort publishers.

And there's amazing news on this front: a consortium of UK web-publishers called Ad Tech Collective Action has just triumphed in a high-stakes proceeding, and can now go ahead with a suit against Google, seeking damages of GBP13.6b ($17.4b) for the rigged ad-tech market:

https://www.reuters.com/technology/17-bln-uk-adtech-lawsuit-against-google-can-go-ahead-tribunal-rules-2024-06-05/

The ruling, from the Competition Appeal Tribunal, paves the way for a frontal assault on the thing Big Tech actually steals from publishers: money, not content.

This is exactly what publishing should be doing. Targeting the method by which tech steals from the news is a benefit to all kinds of news organizations, including the independent, journalist-owned publishers that are doing the best news work today. These independents do not have the same interests as corporate news, which is dominated by hedge funds and private equity raiders, who have spent decades buying up and hollowing out news outlets, and blaming the resulting decline in readership and profits on Craiglist.

You can read more about Big Finance's raid on the news in Margot Susca's Hedged: How Private Investment Funds Helped Destroy American Newspapers and Undermine Democracy:

https://www.press.uillinois.edu/books/?id=p087561

You can also watch/listen to Adam Conover's excellent interview with Susca:

https://www.youtube.com/watch?v=N21YfWy0-bA

Frankly, the looters and billionaires who bought and gutted our great papers are no more interested in the health of the news industry or democracy than Big Tech is. We should care about the news and the workers who produce the news, not the profits of the hedge-funds that own the news. An assault on Big Tech's monetary theft levels the playing field, making it easier for news workers and indies to compete directly with financialized news outlets and billionaire playthings, by letting indies keep more of every ad-dollar and more of every subscriber-dollar – and to reach their subscribers without paying ransom to social media.

Ending monetary theft – rather than licensing news search and discussion – is something that workers are far more interested in than their bosses. Any time you see workers and their bosses on the same side as a fight against Big Tech, you should look more closely. Bosses are not on their workers' side. If bosses get more money out of Big Tech, they will not share those gains with workers unless someone forces them to.

That's where antitrust comes in. Antitrust is designed to strike at power, and enforcers have broad authority to blunt the power of corporate juggernauts. Remember Article 5 of the FTC Act, the one that lets the FTC block "unfair methods of competition?" FTC Chair Lina Khan has proposed using it to regulate training AI, specifically to craft rules that address the labor and privacy issues with AI:

https://www.youtube.com/watch?v=3mh8Z5pcJpg

This is an approach that can put creative workers where they belong, in a coalition with other workers, rather than with their bosses. The copyright approach to curbing AI training is beloved of the same media companies that are eagerly screwing their workers. If we manage to make copyright – a transferrable right that a worker can be forced to turn over their employer – into the system that regulates AI training, it won't stop training. It'll just trigger every entertainment company changing their boilerplate contract so that creative workers have to sign over their AI rights or be shown the door:

https://pluralistic.net/2024/05/13/spooky-action-at-a-close-up/#invisible-hand

Then those same entertainment and news companies will train AI models and try to fire most of their workers and slash the pay of the remainder using those models' output. Using copyright to regulate AI training makes changes to who gets to benefit from workers' misery, shifting some of our stolen wages from AI companies to entertainment companies. But it won't stop them from ruining our lives.

By contrast, focusing on actual labor rights – say, through an FTCA 5 rulemaking – has the potential to protect those rights from all parties, and puts us on the same side as call-center workers, train drivers, radiologists and anyone else whose wages are being targeted by AI companies and their customers.

Policy fights are a recurring monkey's paw nightmare in which we try to do something to fight corruption and bullying, only to be outmaneuvered by corrupt bullies. Making good policy is no guarantee of a good outcome, but it sure helps – and good policy starts with targeting the thing you want to fix. If we're worried that news is being financially starved by Big Tech, then we should go after the money, not the links.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/06/stealing-money-not-content/#content-free

#pluralistic#competition#advertising#surveillance advertising#saving the news from big tech#link taxes#trustbusting#competition and markets authority#uk#ukpoli#Ad Tech Collective Action#digital markets unit#Competition Appeal Tribunal

585 notes

·

View notes

Note

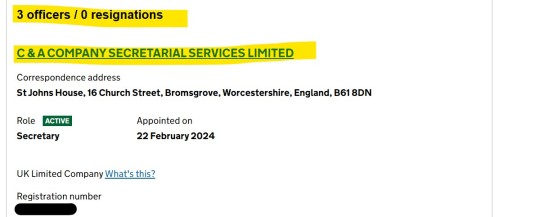

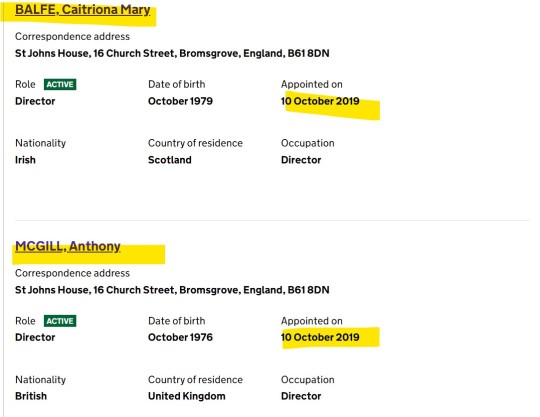

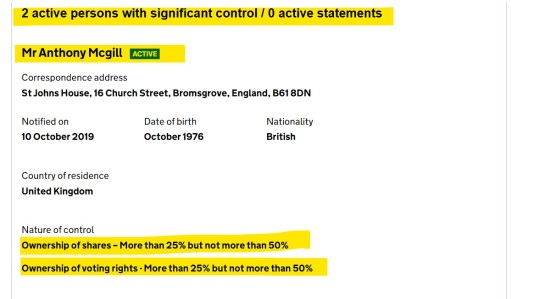

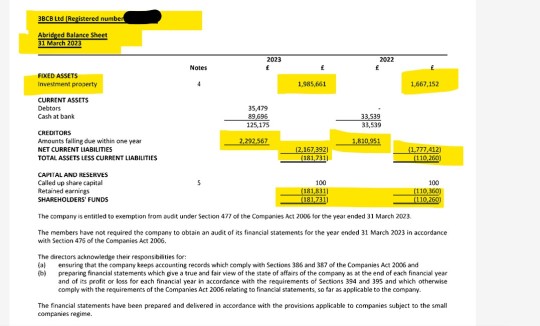

So now Tony is listed as director at all of Cait‘s companies. What do you think about that?

Dear So Now Anon,

What a coincidence (not!) I just answered a very similar Anon sent to @bat-cat-reader, which I suppose is clear enough.

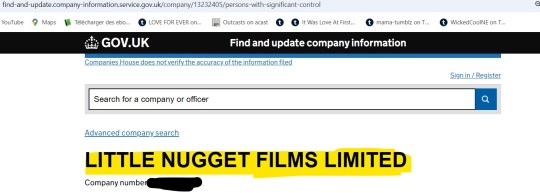

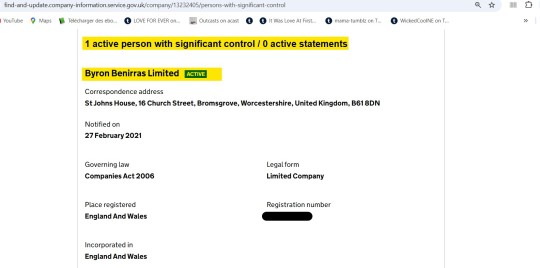

But to make it even clearer (if at all possible) and keeping in mind what I wrote in that post about Persons of Significant Control, let's check a couple of things, shall we? For all the three other companies C owns.

They probably split 50/50 already, which would explain the rather vague 'has significant influence or control'. Why?

Here is why:

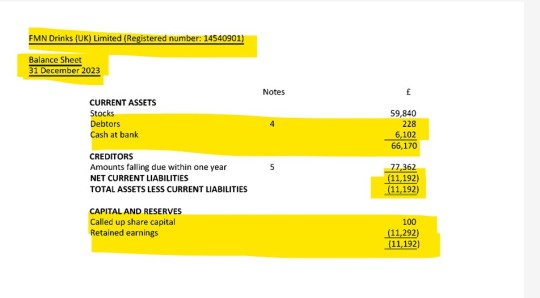

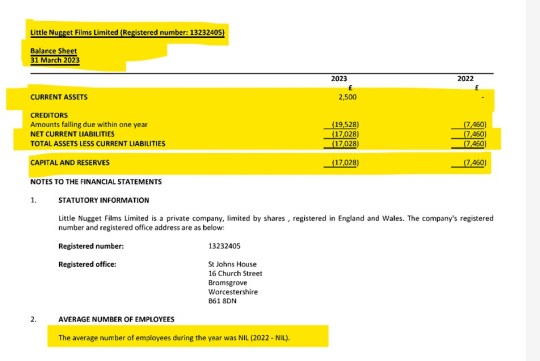

The currently available Balance Sheet, covering the period until 31 December 2023 shows there is not much in there. Barely 100 shares (1£/share), about 59K £ assets and 11 K £ of debts. May I remind you a balance sheet covers the company's assets (available funds, including incoming funds), liabilities (debts) and shareholder equity (the company's net worth, which is roughly the result of subtracting liabilities from assets and dividing them by the number of shareholders). The net worth serves to describe what each and every one of those shareholders are entitled to, should the company be liquidated and all its debts paid off. In this case, the retained earnings, which is the figure quoted between brackets (11.292 £) means the company is in debt/in the red.

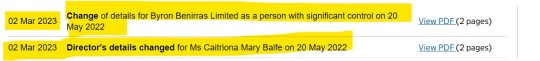

Now, this is very interesting, Anon. Albeit The Happy Couple ™ are now both appointed officers in this company (and T has been so since October 1st 2024), this company's designated PSC is ... Byron Benirras. And who is Byron Benirras' own designated sole PSC? A certain Caitriona Mary B. That is normal - serious 💷💷is indirectly involved, this time, as we know the bulk of her assets is placed there. Therefore, C has full control and sole ownership of Little Nugget Films, too, via Byron Benirras. Remember (ROFLMAO): a legal person (i.e. a company, in this context) has the same rights and the same obligations/duties as the natural (meaning 'real') person behind it (C).

Let's have a look at financials:

On 31.03.2023, the company's assets were about 2.500 £ only and its liabilities around 17K£. In debt/in the red, too. But a clear will to remain in firm control of things from C's side.

This appears to be a totally, carefully planned move, too - future plans, perhaps?

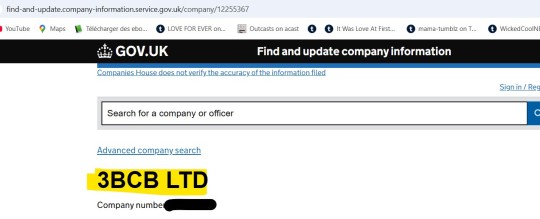

This company has not two, but three appointed officers, one of which is another specialized service company (perfectly legal, in the UK), in charge of all the secretarial work (perfectly legal, too):

Not one, but two PSCs. Same mechanism as for FMN Drinks UK (see above):

Such a nice, tidy, even split. Why? Heh, indeed: why? Unless...

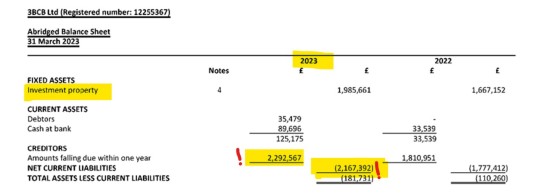

Let's have a look at the company's balance sheet on 31 March 2023:

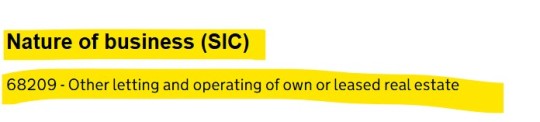

Unless you do acquire real estate using your own funds (a very easy cross check with another one of C's companies reveals the exclusive provenance of those funds - sssh!), no mortgage and no bank loan needed. Property that is legally defined as investment property, which means it cannot legally be a home, nor taxed as such:

[Source: https://prosperity-wealth.co.uk/news/before-you-buy-investment-property/]

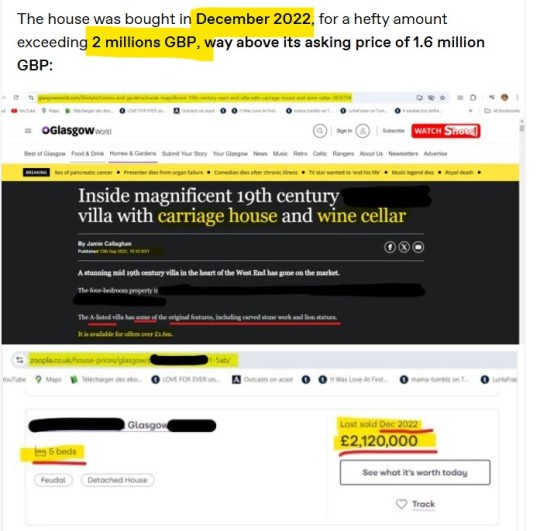

Now remind me what real estate might have been bought anytime between 31 March 2022 and 31 March 2023 and valued at about 2.120.000 £?

You'd probably be correct to guess this one:

[ For a complete tour of the GLA Taj Mahal's legal intricacies: https://www.tumblr.com/sgiandubh/764266729372368897/anon-rebelde-detecto-un-nerviosismo-muy-revelador?source=share]

Let's have a second look and, surely enough...

Some simple maths?

2.292.567 (amounts falling due within one year, which covers the 31.03.2022 -31.03.2023 period) - 2.167.392 (net current liabilities) = 125.175 £ (cash at bank). Roger that. I think there is also a second investment property, bought before 31 March 2022 for 1.6 million pounds and shown as such (valued at cost first, then at its fair value, which is evaluated at 1.9 million pounds, in 2023 - a nice appreciation of the initial investment).

I hope this answers your question, Anon. And given the very long and very emotional day that ended (whew, already?) about four hours ago, I hope I didn't miss something or make any gross mistake. You know how some other Anons can be, don't you?

77 notes

·

View notes

Text

youtube

Explore effective tax-saving strategies tailored for landlords facing hefty tax liabilities due to section 24 tax rules or substantial rental income. Discover how structuring as a Limited Liability Partnership (LLP) can optimize your tax position and preserve more of your rental profits.

0 notes

Photo

On this day, 8 April 2013, former Conservative prime minister Margaret Thatcher died. Street parties broke out across the UK, particularly in working class areas and in former mining communities which were ravaged by her policies. Her legacy is best remembered for her destruction of the British workers' movement, after the defeat of the miners' strike of 1984-85. This enabled the drastic increase of economic inequality and unemployment in the 1980s. Her government also slashed social housing, helping to create the situation today where it is unavailable for most people, and private property prices are mostly unaffordable for the young. Thatcher also complained that children were "being cheated of a sound start in life" by being taught that "they have an inalienable right to be gay", so she introduced the vicious section 28 law prohibiting teaching of homosexuality as acceptable. Abroad, Thatcher was a powerful advocate for racism, advising the Australian foreign minister to beware of Asians, else his country would "end up like Fiji, where the Indian migrants have taken over". She hosted apartheid South Africa's head of state, while denouncing the African National Congress as a "typical terrorist organisation". Chilean dictator general Augusto Pinochet, responsible for the rape, murder and torture of tens of thousands of people, was a close personal friend. Back in Britain, she protected numerous politicians accused of paedophilia including Sir Peter Hayman, and MPs Peter Morrison and Cyril Smith. She also lobbied for her friend, serial child abuser Jimmy Savile, to be knighted despite being warned about his behaviour. Margaret Thatcher was eventually forced to step down after the defeat of her hated poll tax by a mass non-payment campaign. Pictured: Jimmy Savile welcoming Thatcher to hell, reportedly. Learn more about the great miners' strike of 1984-5 in our podcast series: https://workingclasshistory.com/tag/1984-5-miners-strike/ https://www.facebook.com/photo.php?fbid=605239344982618&set=a.602588028581083&type=3

1K notes

·

View notes