#Competition Appeal Tribunal

Explore tagged Tumblr posts

Text

UK publishers suing Google for $17.4b over rigged ad markets

THIS WEEKEND (June 7–9), I'm in AMHERST, NEW YORK to keynote the 25th Annual Media Ecology Association Convention and accept the Neil Postman Award for Career Achievement in Public Intellectual Activity.

Look, no one wants to kick Big Tech to the curb more than I do, but, also: it's good that Google indexes the news so people can find it, and it's good that Facebook provides forums where people can talk about the news.

It's not news if you can't find it. It's not news if you can't talk about it. We don't call information you can't find or discuss "news" – we call it "secrets."

And yet, the most popular – and widely deployed – anti-Big Tech tactic promulgated by the news industry and supported by many of my fellow trustbusters is premised on making Big Tech pay to index the news and/or provide a forum to discuss news articles. These "news bargaining codes" (or, less charitably, "link taxes") have been mooted or introduced in the EU, France, Spain, Australia, and Canada. There are proposals to introduce these in the US (through the JCPA) and in California (the CJPA).

These US bills are probably dead on arrival, for reasons that can be easily understood by the Canadian experience with them. After Canada introduced Bill C-18 – its own news bargaining code – Meta did exactly what it had done in many other places where this had been tried: blocked all news from Facebook, Instagram, Threads, and other Meta properties.

This has been a disaster for the news industry and a disaster for Canadians' ability to discuss the news. Oh, it makes Meta look like assholes, too, but Meta is the poster child for "too big to care" and is palpably indifferent to the PR costs of this boycott.

Frustrated lawmakers are now trying to figure out what to do next. The most common proposal is to order Meta to carry the news. Canadians should be worried about this, because the next government will almost certainly be helmed by the far-right conspiratorialist culture warrior Pierre Poilievre, who will doubtless use this power to order Facebook to platform "news sites" to give prominence to Canada's rotten bushel of crypto-fascist (and openly fascist) "news" sites.

Americans should worry about this too. A Donald Trump 2028 presidency combined with a must-carry rule for news would see Trump's cabinet appointees deciding what is (and is not) news, and ordering large social media platforms to cram the Daily Caller (or, you know, the Daily Stormer) into our eyeballs.

But there's another, more fundamental reason that must-carry is incompatible with the American system: the First Amendment. The government simply can't issue a blanket legal order to platforms requiring them to carry certain speech. They can strongly encourage it. A court can order limited compelled speech (say, a retraction following a finding of libel). Under emergency conditions, the government might be able to compel the transmission of urgent messages. But there's just no way the First Amendment can be squared with a blanket, ongoing order issued by the government to communications platforms requiring them to reproduce, and make available, everything published by some collection of their favorite news outlets.

This might also be illegal in Canada, but it's harder to be definitive. The Canadian Charter of Rights and Freedoms was enshrined in 1982, and Canada's Supreme Court is still figuring out what it means. Section Two of the Charter enshrines a free expression right, but it's worded in less absolute terms than the First Amendment, and that's deliberate. During the debate over the wording of the Charter, Canadian scholars and policymakers specifically invoked problems with First Amendment absolutism and tried to chart a middle course between strong protections for free expression and problems with the First Amendment's brook-no-exceptions language.

So maybe Canada's Supreme Court would find a must-carry order to Meta to be a violation of the Charter, but it's hard to say for sure. The Charter is both young and ambiguous, so it's harder to be definitive about what it would say about this hypothetical. But when it comes to the US and the First Amendment, that's categorically untrue. The US Constitution is centuries older than the Canadian Charter, and the First Amendment is extremely definitive, and there are reams of precedent interpreting it. The JPCA and CJPA are totally incompatible with the US Constitution. Passing them isn't as silly as passing a law declaring that Pi equals three or that water isn't wet, but it's in the neighborhood.

But all that isn't to say that the news industry shouldn't be attacking Big Tech. Far from it. Big Tech compulsively steals from the news!

But what Big Tech steals from the news isn't content.

It's money.

Big Tech steals money from the news. Take social media: when a news outlet invests in building a subscriber base on a social media platform, they're giving that platform a stick to beat them with. The more subscribers you have on social media, the more you'll be willing to pay to reach those subscribers, and the more incentive there is for the platform to suppress the reach of your articles unless you pay to "boost" your content.

This is plainly fraudulent. When I sign up to follow a news outlet on a social media site, I'm telling the platform to show me the things the news outlet publishes. When the platform uses that subscription as the basis for a blackmail plot, holding my desire to read the news to ransom, they are breaking their implied promise to me to show me the things I asked to see:

https://www.eff.org/deeplinks/2023/06/save-news-we-need-end-end-web

This is stealing money from the news. It's the definition of an "unfair method of competition." Article 5 of the Federal Trade Commission Act gives the FTC the power to step in and ban this practice, and they should:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

Big Tech also steals money from the news via the App Tax: the 30% rake that the mobile OS duopoly (Apple/Google) requires for every in-app purchase (Apple/Google also have policies that punish app vendors who take you to the web to make payments without paying the App Tax). 30% out of every subscriber dollar sent via an app is highway robbery! By contrast, the hyperconcentrated, price-gouging payment processing cartel charges 2-5% – about a tenth of the Big Tech tax. This is Big Tech stealing money from the news:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Finally, Big Tech steals money by monopolizing the ad market. The Google-Meta ad duopoly takes 51% out of every ad-dollar spent. The historic share going to advertising "intermediaries" is 10-15%. In other words, Google/Meta cornered the market on ads and then tripled the bite they were taking out of publishers' advertising revenue. They even have an illegal, collusive arrangement to rig this market, codenamed "Jedi Blue":

https://en.wikipedia.org/wiki/Jedi_Blue

There's two ways to unrig the ad market, and we should do both of them.

First, we should trustbust both Google and Meta and force them to sell off parts of their advertising businesses. Currently, both Google and Meta operate a "full stack" of ad services. They have an arm that represents advertisers buying space for ads. Another arm represents publishers selling space to advertisers. A third arm operates the marketplace where these sales take place. All three arms collect fees. On top of that: Google/Meta are both publishers and advertisers, competing with their own customers!

This is as if you were in court for a divorce and you discovered that the same lawyer representing your soon-to-be ex was also representing you…while serving as the judge…and trying to match with you both on Tinder. It shouldn't surprise you if at the end of that divorce, the court ruled that the family home should go to the lawyer.

So yeah, we should break up ad-tech:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-shatter-ad-tech

Also: we should ban surveillance advertising. Surveillance advertising gives ad-tech companies a permanent advantage over publishers. Ad-tech will always know more about readers' behavior than publishers do, because Big Tech engages in continuous, highly invasive surveillance of every internet user in the world. Surveillance ads perform a little better than "content-based ads" (ads sold based on the content of a web-page, not the behavior of the person looking at the page), but publishers will always know more about their content than ad-tech does. That means that even if content-based ads command a slightly lower price than surveillance ads, a much larger share of that payment will go to publishers:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-ban-surveillance-advertising

Banning surveillance advertising isn't just good business, it's good politics. The potential coalition for banning surveillance ads is everyone who is harmed by commercial surveillance. That's a coalition that's orders of magnitude larger than the pool of people who merely care about fairness in the ad/news industries. It's everyone who's worried about their grandparents being brainwashed on Facebook, or their teens becoming anorexic because of Instagram. It includes people angry about deepfake porn, and people angry about Black Lives Matter protesters' identities being handed to the cops by Google (see also: Jan 6 insurrectionists).

It also includes everyone who discovers that they're paying higher prices because a vendor is using surveillance data to determine how much they'll pay – like when McDonald's raises the price of your "meal deal" on your payday, based on the assumption that you will spend more when your bank account is at its highest monthly level:

https://pluralistic.net/2024/06/05/your-price-named/#privacy-first-again

Attacking Big Tech for stealing money is much smarter than pretending that the problem is Big Tech stealing content. We want Big Tech to make the news easy to find and discuss. We just want them to stop pocketing 30 cents out of every subscriber dollar and 51 cents out of ever ad dollar, and ransoming subscribers' social media subscriptions to extort publishers.

And there's amazing news on this front: a consortium of UK web-publishers called Ad Tech Collective Action has just triumphed in a high-stakes proceeding, and can now go ahead with a suit against Google, seeking damages of GBP13.6b ($17.4b) for the rigged ad-tech market:

https://www.reuters.com/technology/17-bln-uk-adtech-lawsuit-against-google-can-go-ahead-tribunal-rules-2024-06-05/

The ruling, from the Competition Appeal Tribunal, paves the way for a frontal assault on the thing Big Tech actually steals from publishers: money, not content.

This is exactly what publishing should be doing. Targeting the method by which tech steals from the news is a benefit to all kinds of news organizations, including the independent, journalist-owned publishers that are doing the best news work today. These independents do not have the same interests as corporate news, which is dominated by hedge funds and private equity raiders, who have spent decades buying up and hollowing out news outlets, and blaming the resulting decline in readership and profits on Craiglist.

You can read more about Big Finance's raid on the news in Margot Susca's Hedged: How Private Investment Funds Helped Destroy American Newspapers and Undermine Democracy:

https://www.press.uillinois.edu/books/?id=p087561

You can also watch/listen to Adam Conover's excellent interview with Susca:

https://www.youtube.com/watch?v=N21YfWy0-bA

Frankly, the looters and billionaires who bought and gutted our great papers are no more interested in the health of the news industry or democracy than Big Tech is. We should care about the news and the workers who produce the news, not the profits of the hedge-funds that own the news. An assault on Big Tech's monetary theft levels the playing field, making it easier for news workers and indies to compete directly with financialized news outlets and billionaire playthings, by letting indies keep more of every ad-dollar and more of every subscriber-dollar – and to reach their subscribers without paying ransom to social media.

Ending monetary theft – rather than licensing news search and discussion – is something that workers are far more interested in than their bosses. Any time you see workers and their bosses on the same side as a fight against Big Tech, you should look more closely. Bosses are not on their workers' side. If bosses get more money out of Big Tech, they will not share those gains with workers unless someone forces them to.

That's where antitrust comes in. Antitrust is designed to strike at power, and enforcers have broad authority to blunt the power of corporate juggernauts. Remember Article 5 of the FTC Act, the one that lets the FTC block "unfair methods of competition?" FTC Chair Lina Khan has proposed using it to regulate training AI, specifically to craft rules that address the labor and privacy issues with AI:

https://www.youtube.com/watch?v=3mh8Z5pcJpg

This is an approach that can put creative workers where they belong, in a coalition with other workers, rather than with their bosses. The copyright approach to curbing AI training is beloved of the same media companies that are eagerly screwing their workers. If we manage to make copyright – a transferrable right that a worker can be forced to turn over their employer – into the system that regulates AI training, it won't stop training. It'll just trigger every entertainment company changing their boilerplate contract so that creative workers have to sign over their AI rights or be shown the door:

https://pluralistic.net/2024/05/13/spooky-action-at-a-close-up/#invisible-hand

Then those same entertainment and news companies will train AI models and try to fire most of their workers and slash the pay of the remainder using those models' output. Using copyright to regulate AI training makes changes to who gets to benefit from workers' misery, shifting some of our stolen wages from AI companies to entertainment companies. But it won't stop them from ruining our lives.

By contrast, focusing on actual labor rights – say, through an FTCA 5 rulemaking – has the potential to protect those rights from all parties, and puts us on the same side as call-center workers, train drivers, radiologists and anyone else whose wages are being targeted by AI companies and their customers.

Policy fights are a recurring monkey's paw nightmare in which we try to do something to fight corruption and bullying, only to be outmaneuvered by corrupt bullies. Making good policy is no guarantee of a good outcome, but it sure helps – and good policy starts with targeting the thing you want to fix. If we're worried that news is being financially starved by Big Tech, then we should go after the money, not the links.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/06/stealing-money-not-content/#content-free

#pluralistic#competition#advertising#surveillance advertising#saving the news from big tech#link taxes#trustbusting#competition and markets authority#uk#ukpoli#Ad Tech Collective Action#digital markets unit#Competition Appeal Tribunal

585 notes

·

View notes

Text

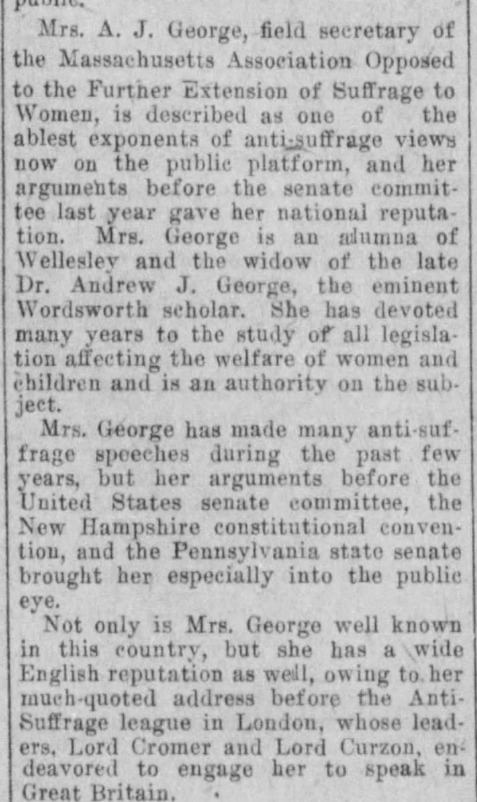

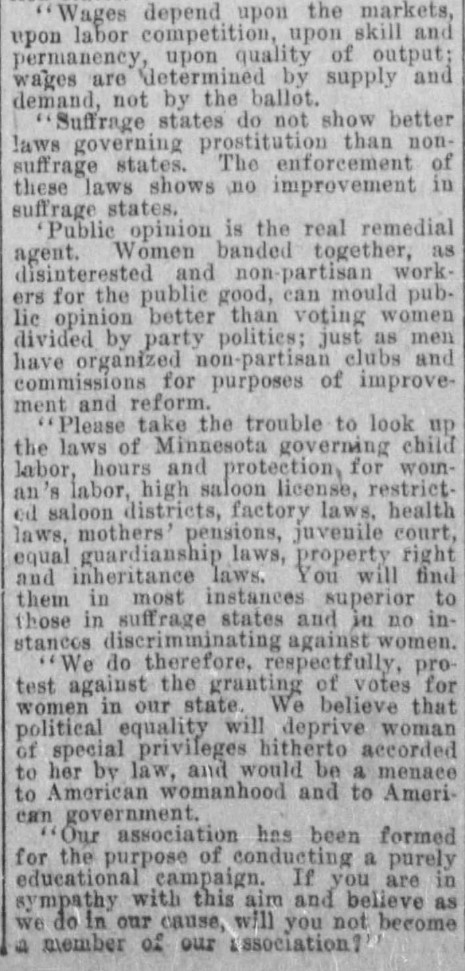

"Mrs. George to Address Anti-Suffragists Here"

Article in Star Tribune, October 11, 1914.

Mrs. George is Mrs. Alice N. George, one of the more prominent anti-suffragists of her time. She argued against woman's suffrage to federal and state legislatures and would write an essay titled "Suffrage Fallacies" for the 1915 Massachusetts anti-suffrage campaign, which was collected as a part of the Anti-Suffrage Essays by Massachusetts Women (1916).

A list explaining the anti-suffrage position is included by the Minneapolis anti-suffrage association, which is reproduced below:

Reasons For Opposing Suffrage.

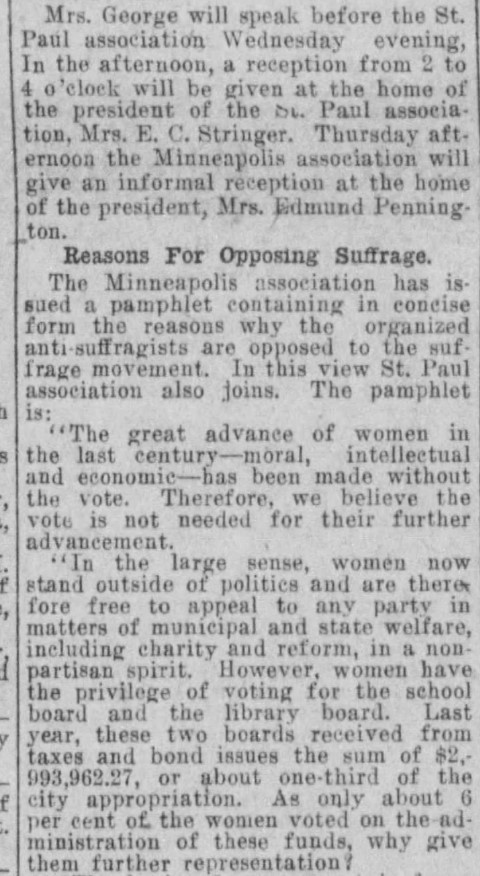

The Minneapolis association has issued a pamphlet containing in concise form the reasons why the organized anti-suffragists are opposed to the suffrage movement. In this view St. Paul association also joins. The pamphlet is:

"The great advance of women in the last century—moral, intellectual and economic—has been made without the vote. Therefore, we believe the vote is not needed for their further advancement."

"In the large sense, women now stand outside of politics and are therefore free to appeal to any party in matters of municipal and state welfare, including charity and reform, in a non-partisan spirit. However, women have the privilege of voting for the school board and the library board. Last year, these two boards received from taxes and bond issues the sum of $2,993,962.27, or about one-third of the city appropriation. As only about 6 per cent of the women voted on the administration of these funds, why give them further representation?"

"The basis of government is force, its ability rests upon its power to enforce its laws. Therefore it is inexpedient to grant the vote to women who can not so enforce the laws they may enact."

“Voting is only a small part of government. The need of America is not an increased quantity but an improved quality of the vote. We consider the interests of the community to be more important than those of the individual.”

"The vote is not a natural right, nor is it a right bestowed upon taxpayers. It is not a question of right, but of expediency for the public welfare."

"Woman's suffrage is the demand of a minority of women. The majority of women are not asking for it. According to the last U. S. census report obtainable, there are 24,555,754 women of voting age in the United States and the Suffrage Party claim three to four million of this number. Should the minority rule the majority?"

"Woman's vote is not a factor in the prohibition movement, because out of their eleven suffrage states, Kansas is the only one which has prohibition and that state had prohibition many years before Women had the vote. Eight non-suffrage states are prohibition states."

"Wages depend upon the markets, upon labor competition, upon skill and permanency, upon quality of output; wages are determined by supply and demand, not by the ballot."

"Suffrage states do not show better laws governing prostitution than non-suffrage states. The enforcement of these laws shows no improvement in suffrage states."

"Public opinion is the real remedial agent. Women banded together, as disinterested and non-partisan workers for the public good, can mould public opinion better than voting women divided by party politics; just as men have organized non-partisan clubs and commissions for purposes of improvement and reform."

"Please take the trouble to look up the laws of Minnesota governing child labor, hours and protection, for woman's labor, high saloon license, restrict- ed saloon districts, factory laws, health laws, mothers' pensions, juvenile court, equal guardianship laws, property right and inheritance laws. You will find them in most instances superior to those in suffrage states and in no instances discrimminating [sic] against women."

"We do therefore, respectfully, protest against the granting of votes for women in our state. We believe that political equality will deprive woman of special privileges hitherto accorded to her by law, and would be a menace. to American womanhood and to American government."

"Our association has been formed for the purpose of conducting a purely educational campaign. If you are in sympathy with this aim and believe as we do in our cause, will you not become a member of our association?"

22 notes

·

View notes

Text

PARIS — There's been another major twist in the Olympic gymnastics drama involving Jordan Chiles' bronze medal.

USA Gymnastics said Sunday that it has obtained new video evidence showing that Chiles' coach, Cecile Landi, submitted the inquiry into her score in the women's floor exercise final before the one-minute deadline − 47 seconds after her score was announced, to be exact.

The governing body said in a statement that it has submitted the video, as well as a formal letter, to the Court of Arbitration for Sport as part of a request to reinstate Chiles' score of 13.766 and allow her to keep her bronze medal from the 2024 Paris Olympics.

"The time-stamped, video evidence submitted by USA Gymnastics Sunday evening shows Landi first stated her request to file an inquiry at the inquiry table 47 seconds after the score is posted, followed by a second statement 55 seconds after the score was originally posted," USA Gymnastics said in its statement.

"The video footage provided was not available to USA Gymnastics prior to the tribunal’s decision and thus USAG did not have the opportunity to previously submit it."

A spokesperson for USA Gymnastics said that, due to confidentiality rules regarding CAS appeals, it could not provide additional information about the video, including its source.

A CAS spokesperson did not immediately reply to a message seeking comment. And the International Olympic Committee did not immediately reply to an email asking if the existence of such video would alter its decision to strip Chiles' medal, regardless of whether CAS reconsiders its ruling.

The new video marks the latest twist in the saga stemming from the women's floor exercise final at Bercy Arena earlier this week, where Chiles leapfrogged Ana Barbosu of Romania at the very end of the competition following an appeal over her score.

Chiles originally received a score of 13.666 before her coaches submitted an inquiry with the judging panel, arguing that she should not have received a one-tenth deduction to her difficulty score for her tour jete full, which is a split leap. The judges agreed and elevated Chiles' score to 13.766, which gave her Olympic bronze and left Barbosu − whose score was 13.700 − in shock.

The Romanian Gymnastics Federation later filed an appeal with CAS, claiming that Landi submitted the inquiry into Chiles score precisely four seconds past the one minute that is allotted for such inquiries. CAS agreed and cited that fact as the basis for its ruling Saturday, which knocked her score back down to 13.666.

The CAS decision triggered a series of procedural dominoes that eventually prompted the IOC to announce that it was stripping Chiles' bronze and giving it to Barbosu.

The issue, then, simply comes down to the timeline − a difference of 17 seconds that could decide whether Chiles will get to keep her first individual Olympic medal.

The CAS ruling did not specify how the Romanian Gymnastics Federation determined that the inquiry had been four seconds late, and the federation itself did not immediately reply to a request for comment Sunday.

According to the technical regulations for competition that are enforced by the International Gymnastics Federation, a gymnast's coach can submit an inquiry about a score at any point until the next gymnast starts their routine. But with the last athlete of a group or rotation, as Chiles was in Monday's floor final, the rule is different and the coach only has one minute "after the score is shown on the scoreboard."

"The person designated to receive the verbal inquiry has to record the time of receiving it, either in writing or electronically, and this starts the procedure," the FIG's technical regulations state.

2 notes

·

View notes

Text

The ball game appears to be over for the global objections to the Microsoft/Activision merger. After a series of setbacks for antitrust enforcers last week, the merger is set to close in the near future. But the lesson for policymakers might be to pursue a regulatory alternative in the effort to control harmful vertical tech mergers.

Judge Jacqueline Scott Corley, a recent Biden appointee, wrote the district court opinion last week that rejected the Federal Trade Commission’s (FTC) complaint against the merger. The opinion holds that the FTC had been unable to prove that Microsoft would have a real incentive to withhold the enormously popular game, Call of Duty, from other platforms after the merger. And so, the merger would not be likely to substantially lessen competition in the different video game markets.

Some legal scholars said she got the legal standard wrong. Judge Corley said it was not enough for the FTC to argue that “a merger might lessen competition – the FTC must show the merger will probably substantially lessen competition.” But the Clayton Act requires the FTC to prove the proposed deal “may” harm competition, not that it “will.”

But that verbal slip was not determinative. Judge Corley’s opinion is in line with much current antitrust jurisprudence in imposing a very high burden of proof on an antitrust agency seeking to block a merger, especially a vertical merger. And, on July 14, the Ninth U.S. Circuit Court of Appeals agreed with her reasoning and rejected the FTC’s appeal to pause her decision.

In addition Microsoft and Sony signed a binding agreement on July 16 to keep Call of Duty on PlayStation for 10 years following the acquisition. Microsoft had already signed 10-year licenses for Activision games with some other companies, including Nintendo. Sony’s acceptance of this offer, which it had declined earlier, suggests that it has recognized the writing on the wall and decided to take its best deal in the absence of antitrust action to block the merger.

In the United Kingdom, the Competition and Markets Authority (CMA), which had objected to the deal, agreed with Microsoft to delay appeal proceedings at the Competition Appeal Tribunal, pending negotiation of a deal that would address its concerns. Perhaps the CMA will accept the merger provided the 10-year license agreement to keep Call of Duty available on PlayStation is a condition of the merger, not merely a voluntary business agreement. But it no longer seems likely to block the merger.

The initial deal signed 18 months ago stipulated that if the transaction were not completed by July 18, 2023, Microsoft would have to pay Activision a $3 billion breakup fee. But last week the companies extended the deadline to close their deal until October as they work to settle regulatory concerns.

A trial before an FTC administrative law judge (ALJ) had been scheduled to begin on August 2, 2023. But the ALJ court has no power to halt the merger, and so on July 20, the FTC paused this in-house trial. Even though the FTC’s loss is only on the issue of a stay, it is probably going to end its attempt to block the merger as it did after losing its attempt to block Meta’s merger with the VR game developer Within.

Some lessons

Some commentators, such as entrepreneur Scott Galloway, say one lesson is that FTC Chair Lina Khan must be more cautious. We have an inexperienced agency head, goes the thinking, who is taking excessive legal risks. These commentators point out that the effectiveness of the FTC is based on industry fear that the agency will win if it must go to court. They also point out that she tried and failed to block the Meta merger with Within and now she has had this new setback. If this losing streak keeps up, they think businesses will lose their respect for the FTC and mergers will soar.

This recommendation from these commentators for more caution might underestimate the very real accomplishments of more stringent merger reviews. The willingness to file these challenges has had and will continue to have a deterrent effect. The Microsoft Activision deal was announced 18 months ago. As The Economist notes, an 18-month delay “would be enough to chill future dealmaking.” Not many companies will wait 18 months to close a deal in the face of international regulatory objections that are removed only at the eleventh hour.

It is true that heightened antitrust scrutiny of mergers has not deterred some companies from proposing questionable deals. For instance, even though it ultimately had to accede to a court order to unwind its involvement in the Northeast Alliance with American Airlines, Jet Blue felt comfortable seeking to acquire Spirit while still under challenge from the Department of Justice (DOJ) regarding that alliance. Moreover, the number of mergers has held steady. These facts suggest that more stringent merger reviews have not been effective in deterring questionable mergers.

Still, more stringent merger reviews at DOJ and the FTC have meant a decline in the pace of large mergers. As The Economist also notes, the average value of mergers has shrunk by about 40% in the last year compared to the past five years. The DOJ and the FTC are far from being toothless tigers, even when they ultimately lose in court. Continuing their tough stance against problematic mergers will likely continue to deter companies.

In addition, FTC Chair Khan is acting in line with a new understanding among antitrust enforcers of the risks of mergers, including vertical mergers. It is worth remembering that the Trump Administration’s DOJ brought its own vertical case in 2017, this one against AT&T’s acquisition of Time Warner. The antitrust agency worried that, because AT&T owned DirecTV, it would take its newly acquired must-have programming off rival cable services including HBO and CNN. This was the same vertical concern that motivated the FTC’s challenge to the Microsoft Activision deal. But DOJ lost in court and the merger went through in 2018.

Despite these court losses, worries over vertical combinations are extremely intuitive. It is just common sense that a large distributor will withhold product from its competitors if it can. Traditional antitrust wisdom followed this idea and sought to control that anticompetitive conduct by refusing to allow integration between key distributors and producers.

The Borkian revolution in antitrust in the 1980s reversed that presumption and taught that vertical mergers were almost always benign. However, much recent antitrust commentary on the measurement and effects of vertical mergers (see Serge Moresi & Steven C. Salop and Marissa Beck & Fiona M. Scott Morton) backs up the traditional intuition that vertical mergers are often anticompetitive and rebuts the idea that they should be considered presumptively benign.

Antitrust agencies are increasingly taking this view. In addition to its cases, in 2021 the FTC withdrew its lenient vertical merger guidelines, citing their reliance on “unsound” economic theories. On July 19, the FTC and the DOJ issued new draft merger guidelines that more realistically take into account the evidence that past approved mergers have led to a loss of competition. Guideline 6 states that vertical mergers “should not create market structures that foreclose competition.”

The problem is with the courts. In the end, judges approve or reject cases brought by antitrust enforcers. Antitrust activist Matt Stoller rightly points out that President Biden’s commitment to a robust antitrust agenda hasn’t included appointing judges who share a similarly progressive view of antitrust laws. But this is urgently needed if the new thinking about the harms of mergers is going to prevail. The extraordinarily high burden of proof in merger cases is judge-made law, made under the influence of Robert Bork’s outdated antitrust framework. It can be undone by appointing judges who would effectively operate under a burden of proof that properly considers the Clayton Act concern about the concentration risks and tendencies attendant to large mergers.

Of course, Congress could act to adjust the Clayton Act standard for merger review. In 2021, Senator Amy Klobuchar proposed a new standard for mergers. It would bar mergers that “create an appreciable risk of materially lessening competition,” rather than mergers that “may substantially lessen competition,” where “materially” is defined as “more than a de minimus [sic] amount.” The intent of Senator Klobuchar’s bill was that, by reemphasizing the Clayton Act’s concern with the risks that large mergers lead to concentration, the updated standard would allow enforcers to “more effectively stop anticompetitive mergers that currently slip through the cracks.” Such a new standard might also force judges to look more favorably on agency efforts to rein in mergers, as the framers of the Clayton Act intended.

But, in the short-term, Congress is not likely to be a source of antitrust reform. Representative David Cicilline, head of the House Antitrust Subcommittee until this year and a leader of the antitrust reform effort last year, has retired. Representative Jim Jordan, the new Republican chair of the House Judiciary Committee, is hostile to Chair Khan’s stewardship of the FTC, as evidenced most recently by his tough questioning at an oversight hearing last week, and he is certainly no friend of antitrust reform. This week he signed a letter with 21 other House of Representative Republicans praising the Microsoft/Activision merger as “procompetitive,” endorsing the outmoded Borkian antitrust framework that has dominated antitrust jurisprudence for decades, and rejecting progressive reforms as “anti-consumer, anti-innovation, and anti-American.” Antitrust reform bills stalled in the Senate last year and there is no sign of resurrection.

The regulatory alternative

So, for the foreseeable future, cases attacking vertical mergers like the one between Microsoft and Activision, face an uphill battle under current antitrust jurisprudence. Yet common sense, the traditional antitrust view, current scholarship, and recent antitrust agency actions concur in the view that government must control these vertical arrangements if markets are to remain open and competitive.

This thinking was at the heart of the old measures to control vertical integration in television. The Federal Communication Commission’s (FCC) rules on financial interest and syndication blocked integration of TV production and the three major TV networks. Adopted in the 1970s, they were designed to weaken the control that the three broadcast TV networks had over television content by spurring the development of independent producers and distributors of television programs. They were repealed in the early 1990s in a Seventh Circuit Court of Appeals decision written by Judge Robert Posner that is a model of Borkian antitrust analysis. Mergers between the major TV networks and Hollywood production studios soon followed.

The key to this approach to vertical integration was a decentralized market structure created and maintained by an industry regulatory agency. The DOJ put in place a supplementary antitrust consent decree, but the design, supervision, and enforcement of the regulatory controls rested with the FCC. The rules worked for decades to control integration in the television industry and allowed a more open market to develop and sustain itself.

Such a regulatory approach might be an effective way forward if policymakers want to control vertical integration in tech. Antitrust reform is certainly desirable, but it would still leave implementation and enforcement of vertical controls in an uncertain state. Ongoing regulatory supervision would simultaneously provide more flexibility and greater certainty of enforcement.

As I argue in my forthcoming book from Brookings Press, Regulating Digital Industries: How Public Oversight Can Encourage Competition, Protect Privacy, and Ensure Free Speech, and as proposed in legislation introduced by Senator Michael Bennet, an agency with authority over tech companies should be empowered to set rules governing tech company behavior. These rules could include whether these companies should be allowed to engage in exclusive vertical arrangements, either through acquisition or contract.

Creating such a regulatory structure for tech might not be on the political agenda in this Congressional session, but it should be a long-term vision for those interested in promoting and maintaining tech competition.

5 notes

·

View notes

Text

Apple Faces $1.8 Billion App Store Lawsuit in Landmark UK Class Action Against Tech Giants

Apple is accused of exploiting its dominant position by charging app developers a 30% commission on App Store purchases, allegedly costing UK consumers up to £1.5 billion ($1.8 billion). A mass lawsuit representing 20 million iPhone and iPad users is underway at London's Competition Appeal Tribunal.

Rachael Kent, the academic leading the case, argues that Apple has created a monopoly, restricting competition and imposing excessive fees that ultimately affect consumers.

Apple denies the allegations, stating that the lawsuit ignores the benefits of its secure iOS ecosystem and highlights that 85% of developers pay no commission.

This is the first major UK class-action-style case against a tech giant, with similar lawsuits against Google, Meta, and Amazon also in progress.

Contact Us DC: +1 (202) 666-8377 MD: +1 (240) 477-6361 FL +1 (239) 292–6789 Website: https://www.ipconsultinggroups.com/ Mail: [email protected] Headquarters: 9009 Shady Grove Ct. Gaithersburg, MD 20877 Branch Office: 7734 16th St, NW Washington DC 20012 Branch Office: Vanderbilt Dr, Bonita Spring, FL 34134

#ipconsultinggroup#AppleLawsuit#UKClassAction#TechGiants#AppStoreFees#ConsumerRights#MonopolyClaims#AppStoreCommission#FairCompetition#DigitalEconomy#LegalNews#AppleVsConsumers#TechRegulation#iOSMonopoly#TechLawsuits

0 notes

Text

Apple Faces Claims of Making ‘Exorbitant Profits’ at UK Trial | Daily Reports Online

Apple Inc. will defend allegations that it made “exorbitant profits” by using its App Store to abuse its dominant market position at the first UK class action trial against a Big Tech firm. The suit at London’s Competition Appeal Tribunal started on Monday alleging that millions of “captive” iPhone and iPad users paid the price for excessively high commission charged by Apple for purchases made…

0 notes

Text

[ad_1] By Anjali Sharma NEW YORK – Social media platform Meta on Tuesday moved the National Company Law Appellate Tribunal (NCLAT), challenging a recent Competition Commission of India order imposing a Rs 213 crore penalty on the firm related to WhatsApp’s 2021 privacy policy update. The competition watchdog directed WhatsApp to not share user data collected on its platform with other Meta products or companies for advertising purposes for a period of five years, along with imposed a penalty of Rs 213.14 crore on Meta for allegedly abusing its dominant position. Meta has informed the NCLAT that the CCI order has wide ramifications for the industry as a whole and therefore, an urgent hearing in the matter will be required. The case will come up for a hearing before the appellate tribunal on January 16. WhatsApp has more than 500 million monthly active users in the country. CCI directed WhatsApp not to share user data collected on its platform with other Meta products or companies for advertising purposes for a period of five years. The social media platform said it disagreed with the CCI’s decision and planned to appeal. According to the CCI order, “The 2021 policy update by WhatsApp on a ‘take it-or-leave-it’ basis constitutes an imposition of unfair conditions under the Act, as it compels all users to accept expanded data collection terms and sharing of data within Meta Group without any opt-out.” A Meta spokesperson has replied, stated that the 2021 WhatsApp update did not change the privacy of people’s personal messages and was offered as a choice for users at the time. According to the company spokesperson said “We also ensured no one would have their accounts deleted or lose functionality of the WhatsApp service because of this update. The update was about introducing optional business features on WhatsApp, and provided further transparency about how we collect and use data” The CCI began a probe in March 2021 into WhatsApp’s revised privacy policy, which enabled mandatory data sharing with Facebook and its companies, along with an expanded scope of data collection. The post Meta imposed Rs 213 crore penalty on WhatsApp against Compensation Commission of India appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

[ad_1] By Anjali Sharma NEW YORK – Social media platform Meta on Tuesday moved the National Company Law Appellate Tribunal (NCLAT), challenging a recent Competition Commission of India order imposing a Rs 213 crore penalty on the firm related to WhatsApp’s 2021 privacy policy update. The competition watchdog directed WhatsApp to not share user data collected on its platform with other Meta products or companies for advertising purposes for a period of five years, along with imposed a penalty of Rs 213.14 crore on Meta for allegedly abusing its dominant position. Meta has informed the NCLAT that the CCI order has wide ramifications for the industry as a whole and therefore, an urgent hearing in the matter will be required. The case will come up for a hearing before the appellate tribunal on January 16. WhatsApp has more than 500 million monthly active users in the country. CCI directed WhatsApp not to share user data collected on its platform with other Meta products or companies for advertising purposes for a period of five years. The social media platform said it disagreed with the CCI’s decision and planned to appeal. According to the CCI order, “The 2021 policy update by WhatsApp on a ‘take it-or-leave-it’ basis constitutes an imposition of unfair conditions under the Act, as it compels all users to accept expanded data collection terms and sharing of data within Meta Group without any opt-out.” A Meta spokesperson has replied, stated that the 2021 WhatsApp update did not change the privacy of people’s personal messages and was offered as a choice for users at the time. According to the company spokesperson said “We also ensured no one would have their accounts deleted or lose functionality of the WhatsApp service because of this update. The update was about introducing optional business features on WhatsApp, and provided further transparency about how we collect and use data” The CCI began a probe in March 2021 into WhatsApp’s revised privacy policy, which enabled mandatory data sharing with Facebook and its companies, along with an expanded scope of data collection. The post Meta imposed Rs 213 crore penalty on WhatsApp against Compensation Commission of India appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

What is the Role of an NCLAT Lawyer in Delhi?

The National Company Law Appellate Tribunal (NCLAT) plays a pivotal role in adjudicating disputes related to corporate laws, insolvency, and competition regulations in India. Located in Delhi, NCLAT serves as an appellate authority to hear appeals from the National Company Law Tribunal (NCLT), the Insolvency and Bankruptcy Board of India (IBBI), and the Competition Commission of India (CCI).

An NCLAT lawyer in Delhi specializes in handling cases in these domains, offering expert legal representation and advisory services. Firms like Vishvaslaw stand out for their comprehensive expertise, client-focused approach, and successful track record in managing complex legal issues in NCLAT.

Key Roles of an NCLAT Lawyer in Delhi

NCLAT lawyers are essential for navigating intricate legal frameworks and providing clients with strategic solutions. Here are the primary roles they fulfill:

1. Legal Representation Before NCLAT

One of the foremost responsibilities of an NCLAT lawyer is representing clients in tribunal proceedings. Whether dealing with insolvency appeals, corporate disputes, or antitrust cases, these lawyers craft compelling arguments, ensure compliance with legal requirements, and advocate effectively.

2. Drafting and Filing Appeals

Filing an appeal in NCLAT is a meticulous process requiring precision and adherence to legal timelines. Lawyers analyze case details, draft persuasive petitions, and file appeals that align with procedural mandates. Their expertise ensures that all aspects of the case are addressed, strengthening the client’s position.

3. Corporate and Insolvency Advisory

NCLAT lawyers advise businesses on matters related to corporate governance, insolvency, mergers, and acquisitions. Their guidance helps companies navigate compliance issues, manage risks, and implement effective legal strategies to avoid potential disputes.

4. Mediation and Negotiation

In many cases, lawyers help clients resolve disputes without resorting to lengthy litigation. By mediating and negotiating settlements, they save clients time and resources while achieving favorable outcomes.

5. Ensuring Legal Compliance

NCLAT lawyers are instrumental in guiding businesses to comply with regulatory frameworks under the Companies Act, Insolvency and Bankruptcy Code (IBC), and Competition Act. Their proactive approach helps clients mitigate legal risks and align with statutory norms.

Why Delhi is a Hub for NCLAT Lawyers

Delhi, as the seat of NCLAT, is a prime location for businesses and individuals seeking legal representation for appellate matters. The city’s legal landscape attracts seasoned lawyers adept at handling high-stakes cases, offering clients an edge in resolving disputes effectively.

The NCLAT handles a broad spectrum of cases, including:

Appeals related to insolvency resolution plans under the IBC.

Challenges to penalties imposed by the Competition Commission of India.

Disputes concerning mergers, acquisitions, and corporate restructuring.

Given the complexity of these matters, hiring an experienced NCLAT lawyer in Delhi ensures comprehensive legal support tailored to the client’s needs.

Main Role of Vishvaslaw in NCLAT Matters

When it comes to NCLAT lawyers in Delhi, Vishvaslaw emerges as a leading name. With a proven track record of excellence and client satisfaction, the firm specializes in corporate law, insolvency cases, and competition law, offering unparalleled legal services.

1. Expertise in NCLAT Appeals

Vishvaslaw’s team of lawyers is equipped to handle intricate appellate matters, from insolvency proceedings to antitrust disputes. Their knowledge of legal frameworks and procedural intricacies makes them a trusted choice for clients.

2. Tailored Legal Solutions

Every client’s case is unique, and Vishvaslaw excels in delivering customized legal strategies. Their team works closely with clients to understand their objectives and craft solutions that align with their goals.

3. Timely and Effective Representation

In NCLAT matters, adhering to deadlines is crucial. Vishvaslaw ensures that all filings and representations are done promptly, avoiding procedural delays and enhancing the chances of success.

4. Proficiency in High-Stakes Cases

Vishvaslaw has handled numerous high-value cases involving corporate insolvency, mergers, and regulatory disputes. Their experience across various sectors, including real estate, technology, and manufacturing, positions them as industry leaders.

5. Comprehensive Advisory Services

Beyond litigation, Vishvaslaw provides end-to-end advisory services to businesses, guiding them on compliance, restructuring, and risk management. Their insights help clients stay ahead of legal challenges.

Benefits of Choosing Vishvaslaw for NCLAT Representation

Experienced Team: Vishvaslaw’s seasoned lawyers have extensive experience handling NCLAT cases, ensuring reliable legal representation.

Client-Centric Approach: The firm prioritizes client interests, offering transparent communication and personalized solutions.

Proven Results: With a history of successful outcomes, Vishvaslaw has established itself as a go-to firm for corporate and insolvency matters.

Sector-Specific Knowledge: Their expertise spans multiple industries, enabling them to address unique challenges effectively.

Conclusion

The role of an NCLAT lawyer in Delhi is indispensable for businesses and individuals dealing with corporate, insolvency, or competition-related disputes. From drafting appeals and representing clients to providing strategic legal advice, NCLAT lawyers ensure that clients receive the best possible outcomes

1 note

·

View note

Text

Microsoft faces £1bn class action case in UK over software prices

The case has been brought on an “opt-out” basis – meaning UK organisations are all being represented to begin with unless they wish not to be. And it is the latest class action lawsuit to be filed at the UK’s Competition Appeal Tribunal against big tech firms, with Facebook, Google, and mobile phone firms amongst those facing action in other claims. These types of claims are relatively new still,…

0 notes

Link

Además, la demanda se opone a la práctica de Google de obligar a los fabricantes de dispositivos Android a preinstalar el navegador Chrome de la empresa y convertir a Google en su motor de búsqueda predeterminado. También condena los miles de millones de dólares que la empresa pagó a Apple para que iOS fuera el motor de búsqueda predeterminado de Google.

0 notes

Text

Google to face massive UK class action lawsuit over search dominance

Image: Cath Virginia / The Verge, Getty Images Google must face a £7 billion (around $8.8 billion) class action lawsuit in the UK that accuses the company of harming consumers by abusing its dominance in search. On Friday, the UK’s Competition Appeal Tribunal (CAT) ruled that the case can move forward, adding to the growing number of legal conflicts Google has to confront worldwide. The class…

0 notes

Text

Cineplex appeals Competition Tribunal’s $38.9M fine over online booking fee

By Staff The Canadian Press Posted October 24, 2024 10:09 am Updated October 24, 2024 11:59 am 1 min read 2:05 Cineplex slapped with record $38.9M fine over online booking fee RELATED: Cineplex slapped with record $38.9M fine over online booking fee – Sep 24, 2024 Cineplex has filed an appeal of a record $38.9-million fine for deceptive marketing practices imposed against it by the…

View On WordPress

0 notes

Text

Low tax bills paid by the tech giant were an unlawful subsidy, EU judges ruled, in a move which EU Competition Commissioner Margrethe Vestager hailed as a 'big win' for tax justice.

Apple has lost a €13 billion case in the EU's highest court regarding the low tax bills it paid for years in Ireland, a surprise victory for Brussels in a campaign against sweetheart deals struck with multinationals.

The judgment, released today (10 September) by the EU Court of Justice, backs the European Commission, which said the corporate tax rates as low as 0.005% paid by the tech giant represented an unlawful subsidy, striking down a previous ruling from the lower-tier General Court.

"Ireland granted Apple unlawful aid which Ireland is required to recover", the Court of Justice said in a statement, giving a "final judgment" in the matter.

It's one of a pair of victories today in Brussels' battle against big tech, as Google lost a separate appeal against a €2.4bn EU fine for favouring its own services — bookending the career of Margrethe Vestager, whose double term as EU antitrust chief ends in a couple of months.

The Commission's victory means Apple must pay as much as €13bn — or potentially more, with interest and costs — to the Irish Treasury.

The Commission's initial finding, now confirmed, came after the LuxLeaks revelations of tax rulings which implicated Jean-Claude Juncker, the former Luxembourg leader who was at the time president of the EU executive.

Vestager's action against big — and largely American — multinationals such as Starbucks, Fiat Chrysler and Amazon saw her badged by then-President Donald Trump as the EU's "tax lady" who "really hates the USA".

The case represented an unusual, and controversial, foray by Brussels into tax policy — which is normally set by national capitals, with the EU only intervening if tax breaks distort the bloc's internal market.

The legal case hinged on how the iPhone maker treated intellectual property income in its books — and whether the Commission was right to say those corporate profits should have been allocated to its European base in Ireland.

The EU's General Court found against the Commission in 2020, but, in an opinion prepared for the Court of Justice last November, Advocate General Giovanni Pitruzzella questioned the legal reasoning of the lower-tier tribunal.

In financial terms, it represents the largest case of the EU's tax campaign, which otherwise hasn't found a huge success in the courts.

The Commission lost legal challenges involving McDonald's, Starbucks and Engie, though in a recent interview with Euronews' Radio Schumann podcast, Vestager argued her crusade had nonetheless led to a series of national and international tax reforms.

Despite the billions it stood to gain, the Irish government opposed the Commission's case; the country has become the European hub for a number of US tech companies.

Michael McGrath previously defended the company as Ireland's finance minister — and is now himself due to move to Brussels to be European Commissioner, with his portfolio set to be announced by President Ursula von der Leyen shortly.

In remarks to reporters, Vestager said the ruling was a "big win" for EU citizens, the bloc's single market, and tax justice — and that her campaign also had an indirect impact.

"Our investigations have decisively contributed to a mind shift, a change of attitudes among Member States" in which practices like Apple's could no longer occur, she said, citing regulatory and legislative reforms at national, European and global level.

"We now have now learned from the court" about the limits of EU tax action, following the mixed bag of legal cases, Vestager said — with caselaw clarifying that Brussels can check national capitals follow their own rules.

For MEP Pasquale Tridico (Italy, Left), who chairs the European Parliament's tax Committee, the judgment is "historic".

"We now expect the future European Commission to propose legislation that bans all forms of tax avoidance and competitive advantages for tech giants and large corporations within the European Union," Tridico said in a statement, adding: "Our fight for tax justice will go on, stronger than ever”.

In a statement, the Irish finance ministry said it "will of course respect the findings of the Court regarding the tax due in this case ... Ireland does not give preferential tax treatment to any companies or taxpayers."

The disputed tax rulings are no longer in force, and Ireland has in any case since reformed how it allocates profits for non-resident companies, the statement said.

Billions in unpaid taxes that Apple had placed in trust, pending resolution of the case, will now begin to be transferred to the Irish state, the statement added.

In a separate statement, Apple said it was "disappointed" with the judges' decision.

"We always pay all the taxes we owe wherever we operate and there has never been a special deal," a company spokesperson, adding that it is one of the largest taxpayers in the world.

"The European Commission is trying to retroactively change the rules and ignore that, as required by international tax law, our income was already subject to taxes in the US," added the company, which argues it has already paid $20 bn (€18bn) in US taxes on the same profits.

But the ruling has already been hailed by tax activists who have long called for the closing of what they see as corporate tax loopholes.

“This ruling exposes EU tax havens’ love affair with multinationals," said Chiara Putaturo, EU tax expert for the charity Oxfam, said in a statement. "It delivers long-overdue justice after over a decade of Ireland standing by and allowing Apple to dodge taxes."

0 notes

Text

Vinesh Phogat Appeals to CAS for Paris Olympics Disqualification: Legal Heavyweights Roped In

Indian wrestler Vinesh Phogat has turned to the Court of Arbitration for Sport (CAS) to contest her disqualification from the Paris Olympics 2024. Despite her recent announcement of retirement, the Indian Olympic Association (IOA) is vigorously pursuing the case, enlisting renowned senior counsels to represent Phogat’s appeal.

Legal Representation by Top Experts

Vinesh Phogat’s appeal will be represented by two of India’s leading legal experts: Harish Salve and Vidushpat Singhania. Harish Salve, a former Solicitor General of India and a distinguished King’s Counsel, brings extensive experience to the case. Vidushpat Singhania, managing partner at Krida Legal, also adds significant legal expertise. Their involvement underscores the seriousness of the appeal and the high stakes involved.

The Disqualification Issue

Phogat was disqualified from the Paris Olympics after being found 100 grams over the 50kg weight limit on the second day of competition. Despite making weight on the first day and winning three bouts, United World Wrestling (UWW) rules dictate that a wrestler’s results are annulled if they fail to meet the weight requirement on either competition day.

In response to the disqualification, IOA President Dr. PT Usha and Wrestling Federation of India President Sanjay Singh have formally requested UWW President Nenad Lalovic to reconsider the annulment of Vinesh’s results from the first day of the competition.

Role of the Court of Arbitration for Sport (CAS)

The Court of Arbitration for Sport (CAS) is the highest international tribunal for resolving sports-related disputes. Established in 1984, CAS operates independently from sports organizations and is governed by the International Council of Arbitration for Sport (ICAS). With headquarters in Lausanne, Switzerland, and additional courts in New York City and Sydney, CAS handles a wide array of disputes involving athletes, coaches, sports organizations, and sponsors.

CAS is renowned for its expertise in complex sports legal matters, boasting a panel of nearly 300 arbitrators globally. Its role in Phogat’s appeal represents a critical juncture in determining the outcome of this high-profile case.

As Vinesh Phogat seeks to overturn her disqualification, the appeal’s outcome could have significant implications for her legacy and the broader wrestling community. The involvement of leading legal minds and the prestigious CAS underscores the importance of this case and its potential impact on the future of sports adjudication.

#Vinesh Phogat#Paris Olympics 2024#Court of Arbitration for Sport (CAS)#Harish Salve#Vidushpat Singhania

1 note

·

View note

Text

CAT rules that the NHS is not time-barred from pursuing damages claims against drug manufacturers involved in the citalopram “pay for delay” cartel

New Post has been published on https://petn.ws/e1XYm

CAT rules that the NHS is not time-barred from pursuing damages claims against drug manufacturers involved in the citalopram “pay for delay” cartel

The Competition Appeal Tribunal today ruled that the NHS is not time-barred from pursuing claims for damages against Lundbeck, the Danish pharmaceutical company, and various manufacturers of generic pharmaceuticals, arising out of the “pay for delay” cartel found by the European Commission. In 2013, the Commission found that Lundbeck, which held various patents in relation […]

See full article at https://petn.ws/e1XYm #CatsNews

0 notes