#nickel alloys china

Explore tagged Tumblr posts

Text

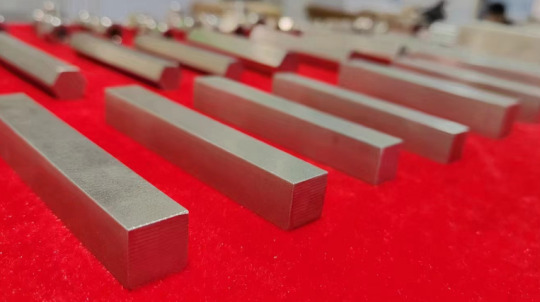

China Alloy Steel, Alloy Steel, wholesale Alloy Steel, Alloy Steel manufacturers stainless steel manufacturers, stainless steel suppliers, stainless steel factory, China stainless steel price, Chinese suppliers https://superbmaterials.com/

#630 stainless steel#631 stainless steel#stainless steel forging#stainless steel alloys#alloy steel china#carbon steel china#nickel alloys china#stainless steel china#copper producers china#heat resistant alloys#china#united states#Shanghai#Pudong#suppliers#stainless#Alloy Steel#Alloy#Steel#Chinese#factory#manufacturers#kitchen

2 notes

·

View notes

Text

Paul Dyer Merica (17 March 1889 – 20 October 1957)

An American metallurgist, Paul Dyer Merica went oversees briefly to teach in China for two years, followed by obtaining his PhD in Germany for four. Returning to America he eventually made his way to the International Nickel Company as a researcher. Merica is credited with developing the first of the Inconel alloys - and therefore among the first superalloys. His research into nickel and its alloys expanded the use of the metal in many fields while his research into age-hardened alloys and precipitation hardening expanded the understanding of those phenomenons as well.

Sources/Further Reading: (Image source - Wikipedia) (Biographical Memoir) (AIME) (NIST)

#Materials Science#Science#Metallurgy#Superalloys#Scientists#Science history#ScientistSaturday#2024Daily

6 notes

·

View notes

Text

Is Monel similar to Inconel?

Many of our customers have such a question: Is Monel similar to Inconel? As a matter of fact, both Monel and Inconel are nickel-based alloys with exceptional corrosion resistance and high-temperature performance, but they differ significantly in composition, properties, and applications. In this article, let’s delve into the key aspects of these two alloys to understand their similarities and differences.

Is Monel similar to Inconel?

Composition:

Monel, also known as Monel alloy, is primarily a nickel-copper alloy, typically containing up to 67% nickel and 28% copper, with the remaining portion composed of iron, manganese, carbon, and silicon. This composition gives Monel its excellent corrosion resistance, particularly against acids and alkalies.

On the other hand, Inconel is a nickel-chromium alloy, with chromium content ranging from 15% to 25%, depending on the specific grade. Inconel alloys also contain significant amounts of other elements like iron, molybdenum, and titanium, which contribute to their high-temperature strength and oxidation resistance.

Properties:

Both Monel and Inconel exhibit excellent corrosion resistance, but the specific environments they thrive in differ. Monel’s corrosion resistance is particularly noteworthy in marine and chemical processing applications, where it can withstand the corrosive effects of saltwater and various acids.

Inconel, on the other hand, is renowned for its ability to maintain its mechanical properties at extremely high temperatures. It is often used in aerospace and power generation applications where materials must withstand extreme heat and pressure. Inconel’s chromium content also gives it superior resistance to oxidation and sulfidation at high temperatures.

When it comes to mechanical properties, Inconel generally offers higher strength and hardness compared to Monel. However, Monel has better formability and weldability, making it easier to shape and join into complex structures.

Applications:

The differences in composition and properties lead to distinct applications for Monel and Inconel. Monel is commonly used in the chemical processing, marine, and food processing industries due to its resistance to corrosion and ease of fabrication. Its ability to withstand the corrosive effects of saltwater makes it a popular choice for marine applications like shipbuilding and offshore drilling.

Inconel, on the other hand, finds its niche in high-temperature applications where strength and oxidation resistance are paramount. Aerospace, power generation, and petrochemical industries rely on Inconel alloys for components that must operate in extreme environments.

Conclusion:

While Monel and Inconel are both nickel-based alloys with exceptional corrosion resistance, they are not interchangeable. Each alloy has its unique composition, properties, and applications. Monel excels in corrosive environments and offers good formability and weldability, while Inconel is renowned for its high-temperature performance and oxidation resistance.

Thank you for reading our article and we hope it can help you to find the answer to the question: Is Monel similar to Inconel? If you are looking for Monel and Inconel suppliers and manufacturers online now, we would advise you to visit Huaxiao Alloy.

As a leading supplier of Monel and Inconel Alloys from Shanghai China, Huaxiao Alloy offers customers high-quality products such as Monel 400, Monel K500, Inconel 600, Inconel 601, Inconel 625, and Inconel 718 at a very competitive price.

2 notes

·

View notes

Text

Nickel Alloys Market 2025: Current Trends, Opportunities and Future Growth Challenges for 2037

Research Nester’s latest report on the Global Nickel Alloys Market: Supply & Demand Analysis, Growth Forecasts & Statistics Report 2025-2037" delivers an in-depth analysis of market dynamics, growth drivers, and region-specific trends. The report segments the market by function, and end use industry, emphasizing the influence of nickel alloys in aerospace, automotive, chemical, and energy industries. It provides a comprehensive evaluation of key factors, challenges, and emerging opportunities shaping the nickel alloys market’s future.

Expanding Aerospace and Power Generation Sectors to Drive Nickel Alloys Market Growth

The nickel alloys market is anticipated to witness considerable growth due to rising demand from industries that require materials with superior strength, heat resistance, and corrosion protection. The adoption of nickel alloys is fuelled by performance in extreme environments, benefiting from the rise in aerospace, defense, and energy applications. In addition, demand for corrosion resistant materials increases further from expanding offshore oil and gas exploration activities. In addition, the adoption of nickel alloys to power turbines, batteries and power infrastructure is rising due to the growing transition toward renewable energy sources and electric vehicles (EVs). With industries increasingly looking for durability and efficiency, nickel alloys are gaining momentum across wide-ranging applications, propelling steady growth.

Request Report Sample@

Key Drivers and Challenges Impacting the Nickel Alloys Market

Growth Drivers:

Rising demand for corrosion-resistant materials in the aerospace and power sectors

Increased adoption of nickel alloys in electric vehicle components and infrastructure

Expansion of renewable energy projects driving demand for high-performance materials

Challenges:

High costs associated with nickel extraction and alloy production

Fluctuations in raw material prices affecting overall production costs

Environmental concerns and regulatory restrictions on mining activities

During the forecast period, the high-performance alloys segment is estimated to account for a 39.7% share. The growing need for materials that can handle extreme temperatures, pressures, and corrosive environments drives this growth. High mechanical strength is required on aerospace engines, turbines and defense systems, and high-performance nickel alloys are widely used. The expansion of space exploration and advanced aircraft manufacturing further propels this segment’s growth. Moreover, additive manufacturing (3D printing) has advanced to the capability of producing complex high-performance alloy components, improving its market penetration. With industries moving towards higher efficiency and sustainability, high-performance nickel alloys will remain a critical component in next-generation engineering solutions.

Asia Pacific Excluding Japan nickel alloys market is anticipated to expand at a CAGR of 5.7% from 2025 to 2037. China is anticipated to lead APEJ industry driven by large scale aerospace projects, increased energy production, and automotive manufacturing. Furthermore, the use of nickel alloys is boosted by the government’s focus on becoming self-reliant in the areas of defense and aviation materials. The market in India witnesses expansion due to the rise in demand for power, oil and gas, and investments in electric vehicle manufacturing. India efforts to build up its domestic defense manufacturing and renewable energy efforts are driving up demand for high-performance alloys. Demand across Southeast Asia from related chemical and power generation industries also supports the nickel alloys market growth in APEJ.

The market is competitive, with major players engaged in technological advancement and increasing production capacity to meet the increasing global demand. Companies are investing in R&D to develop alloys with improved performance characteristics and are marketing their product in aerospace, defense, energy, and automotive industries. Strategic partnerships and acquisitions are popular expansion methods used by leading players such as Alloy Wire International, ATI Inc., Haynes International, Inc., Kennametal Inc., NeoNickel, Nippon Yakin Kogyo Co., Ltd., Precision Castparts Corp., Sandvik AB, SANYO SPECIAL STEEL Co., Ltd., Thyssenkrupp Materials France, VDM Metals, and Voestalpine AG. These companies are pioneering alloy innovation, striving for sustainability and additive manufacturing or AM techniques. With competition becoming more fierce, market leaders are required to drive innovation and expand their global footprint in order to retain their dominance in the evolving nickel alloys market.

Access our detailed report at:

Research Nester Analytics is a leading service provider for strategic market research and consulting. We provide unbiased, unparalleled market insights and industry analysis to help industries, conglomerates, and executives make informed decisions regarding future marketing strategy, expansion, and investments. We believe every business can expand its horizon with the right guidance at the right time. Our out-of-the-box thinking helps clients navigate future uncertainties and market dynamics.

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

Browse related reports

Pelletized Activated Carbon Market

Orthopedic Footwear Market

Naphthalene Derivatives Market

Manufacturing Execution Systems Market

1 note

·

View note

Text

Inconel Prices, News, Trend, Graph, Chart, Forecast and Historical

Inconel, a high-performance alloy primarily composed of nickel and chromium, is a critical material in industries such as aerospace, automotive, marine, and energy. Its exceptional resistance to corrosion, oxidation, and extreme temperatures makes it indispensable for applications where reliability under harsh conditions is paramount. The market for Inconel is influenced by various factors, including demand from end-use industries, raw material availability, production costs, and global economic trends. Over recent years, fluctuations in Inconel prices have been shaped by these dynamics, as well as by geopolitical factors and technological advancements.

One of the primary drivers of Inconel prices is the cost of its raw materials, particularly nickel. Nickel is a key component of Inconel alloys, and its price volatility on the global market has a direct impact on the pricing of Inconel products. Nickel prices can fluctuate due to factors such as supply disruptions, changes in mining output, and shifts in demand from other industries like stainless steel production. Furthermore, geopolitical tensions in major nickel-producing regions can exacerbate supply chain challenges, influencing Inconel prices. Similarly, the price of chromium, another critical element in Inconel alloys, plays a role in determining the overall cost structure of these materials.

Get Real time Prices for Inconel: https://www.chemanalyst.com/Pricing-data/inconel-1365

The demand for Inconel is closely tied to the health of the industries that rely on its unique properties. For example, the aerospace industry, a major consumer of Inconel, heavily influences market dynamics. The ongoing push for fuel efficiency and lightweight materials in aviation has increased the demand for high-temperature-resistant alloys like Inconel. Any slowdown in aerospace manufacturing or global travel can dampen demand, exerting downward pressure on prices. Conversely, periods of strong growth in aerospace activity tend to drive prices higher as manufacturers ramp up their procurement of Inconel components.

The energy sector is another significant driver of Inconel demand, particularly in applications involving extreme environments such as gas turbines and oil and gas extraction. The global transition towards cleaner energy sources and the development of advanced energy systems have also spurred the need for materials like Inconel, which can withstand demanding operational conditions. Additionally, innovations in nuclear energy and hydrogen production are expected to further enhance the demand for Inconel alloys, potentially impacting prices over the long term.

Technological advancements in manufacturing processes and recycling capabilities are also influencing Inconel prices. Improved production techniques can lead to cost efficiencies, making Inconel more accessible to a broader range of applications. At the same time, the recycling of nickel-based alloys has emerged as a viable option to reduce dependency on primary raw materials. This recycling trend has the potential to stabilize Inconel prices by alleviating some of the pressure on raw material supply chains.

The regional distribution of production and consumption further adds complexity to the Inconel market. Major producers of Inconel alloys are concentrated in regions with advanced metallurgical capabilities, such as North America, Europe, and parts of Asia. However, the demand is global, driven by industries operating in both developed and developing economies. Emerging markets in Asia-Pacific, particularly China and India, are witnessing increased industrial activity, which is expected to bolster the demand for Inconel. This regional demand-supply interplay can create disparities in pricing across different markets.

The environmental impact of Inconel production is gaining attention, as sustainability becomes a growing concern across industries. The energy-intensive processes involved in producing nickel and chromium raise questions about the carbon footprint of Inconel alloys. As industries strive to meet stricter environmental regulations and adopt greener practices, the cost of compliance may influence Inconel pricing. Additionally, the development of alternative alloys and materials with comparable properties may introduce competition, potentially affecting market dynamics.

Market speculation and investor sentiment also play a role in influencing Inconel prices. The commodity nature of its key components, especially nickel, makes the Inconel market susceptible to price swings driven by speculative trading. This speculative activity can sometimes amplify the effects of underlying supply and demand factors, creating volatility in pricing.

In conclusion, the Inconel market is shaped by a complex interplay of raw material costs, industrial demand, technological innovations, and global economic trends. As industries continue to evolve and new applications for high-performance alloys emerge, the demand for Inconel is expected to remain robust. However, challenges such as raw material price volatility, geopolitical uncertainties, and environmental concerns will continue to influence pricing. Stakeholders in the Inconel market must navigate these factors strategically to ensure stability and capitalize on emerging opportunities. Maintaining a balance between supply chain resilience, sustainable practices, and technological advancements will be key to fostering growth in this vital market.

Get Real time Prices for Inconel: https://www.chemanalyst.com/Pricing-data/inconel-1365

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Inconel#Inconel Price#Inconel Prices#Inconel Pricing#Inconel News#india#united kingdom#united states#germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

1 note

·

View note

Text

Platinum Market Overview and Growth Forecast

Platinum Market Growth Strategic Market Overview and Growth Projections

The global platinum market size was valued at USD 7.72 billion in 2022 and is projected to reach USD 11.95 billion by 2031 at a CAGR of 5.13% from 2023 to 2031.

The latest Global Platinum Market by straits research provides an in-depth analysis of the Platinum Market, including its future growth potential and key factors influencing its trajectory. This comprehensive report explores crucial elements driving market expansion, current challenges, competitive landscapes, and emerging opportunities. It delves into significant trends, competitive strategies, and the role of key industry players shaping the global Platinum Market. Additionally, it provides insight into the regulatory environment, market dynamics, and regional performance, offering a holistic view of the global market’s landscape through 2032.

Competitive Landscape

Some of the prominent key players operating in the Platinum Market are

Anglo American Platinum Ltd.

Impala Platinum Holdings Limited

Sibanye-Stillwater

Norilsk Nickel

Zimbabwe Platinum Mines Limited

African Rainbow Minerals

Eastern Platinum

Eurasia Mining PLC

Johnson Matthey

Implats Platinum Ltd.

Sibanye-Stillwater

Northam Platinum Ltd

Others

Get Free Request Sample Report @ https://straitsresearch.com/report/platinum-market/request-sample

The Platinum Market Research report delivers comprehensive annual revenue forecasts alongside detailed analysis of sales growth within the market. These projections, developed by seasoned analysts, are grounded in a deep exploration of the latest industry trends. The forecasts offer valuable insights for investors, highlighting key growth opportunities and industry potential. Additionally, the report provides a concise dashboard overview of leading organizations, showcasing their effective marketing strategies, market share, and the most recent advancements in both historical and current market landscapes.Global Platinum Market: Segmentation

The Platinum Market segmentation divides the market into multiple sub-segments based on product type, application, and geographical region. This segmentation approach enables more precise regional and country-level forecasts, providing deeper insights into market dynamics and potential growth opportunities within each segment.

By Source

Primary

Secondary

By Form

Metal

Powder

Alloys

By End Use

Automotive

Jewellery

Chemical

Electronics

Industrial

Others

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/platinum-market

Market Highlights:

A company's revenue and the applications market are used by market analysts, data analysts, and others in connected industries to assess product values and regional markets.

But not limited to: reports from corporations, international Organization, and governments; market surveys; relevant industry news.

Examining historical market patterns, making predictions for the year 2022, as well as looking forward to 2032, using CAGRs (compound annual growth rates)

Historical and anticipated data on demand, application, pricing, and market share by country are all included in the study, which focuses on major markets such the United States, Europe, and China.

Apart from that, it sheds light on the primary market forces at work as well as the obstacles, opportunities, and threats that suppliers face. In addition, the worldwide market's leading players are profiled, together with their respective market shares.

Goals of the Study

What is the overall size and scope of the Platinum Market market?

What are the key trends currently influencing the market landscape?

Who are the primary competitors operating within the Platinum Market market?

What are the potential growth opportunities for companies in this market?

What are the major challenges or obstacles the market is currently facing?

What demographic segments are primarily targeted in the Platinum Market market?

What are the prevailing consumer preferences and behaviors within this market?

What are the key market segments, and how do they contribute to the overall market share?

What are the future growth projections for the Platinum Market market over the next several years?

How do regulatory and legal frameworks influence the market?

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

0 notes

Text

We do not make magnesium out of the sea salt. Sea salt is 10% magnesium cloride and is on paper the best sorce for magnesium. The most common method to extract magnesium is the least efficient.

The sfift in production has mostly been due to cheaper labour and energy costs in North Central China due to large coal deposites in the region and a large labour force.

It mimics early industrial firms that moved from the country side of GB to the citys, from the free infinate enegry provided by water wells on streams to a more expencive coal powerd production in the citys.

The firms had to adapt to the wims of the market, and coal alowed them to downsvale and upscale production based on the needs, while the countyside industry had a consistent supply, that could not be easily increased.

Discription of the current process for magnesium prod.:

"In this process, closed-end, nickel-chromium-steel alloy retorts are filled with a mixture of calcined dolomite ore and ferrosilicon, which are heated until magnesium crowns form. Each cycle takes about 11 hours, requires manually filling and emptying of the vacuum tubes, and uses about 11 tons of raw materials for every one ton of magnesium produced." - https://www.thoughtco.com/magnesium-production-2339718

"The birth of wings from the sea." Magnesium. Advertising art. 1939-45.

Science History Institute

190 notes

·

View notes

Text

High Performance Alloys Market

High Performance Alloys Market Growth Strategic Market Overview and Growth Projections

The global high-performance alloys market size was valued at USD 9.89 billion in 2022. It is projected to reach USD 15.89 billion by 2031, registering a CAGR of 5.41% during the forecast period (2023-2031).

The latest Global High Performance Alloys Market by straits research provides an in-depth analysis of the High Performance Alloys Market, including its future growth potential and key factors influencing its trajectory. This comprehensive report explores crucial elements driving market expansion, current challenges, competitive landscapes, and emerging opportunities. It delves into significant trends, competitive strategies, and the role of key industry players shaping the global High Performance Alloys Market. Additionally, it provides insight into the regulatory environment, market dynamics, and regional performance, offering a holistic view of the global market’s landscape through 2032.

Competitive Landscape

Some of the prominent key players operating in the High Performance Alloys Market are

Outokumpu

Hitachi Metals Ltd.

Alcoa Inc.

Aperam SA

VSMPO-Avisma Corporation

Timken Company

Carpenter Technology Corporation

Precision Castparts Corp.

RTI International Metals

ThyssenKrupp AG.

Get Free Request Sample Report @ https://straitsresearch.com/report/high-performance-alloys-market/request-sample

The High Performance Alloys Market Research report delivers comprehensive annual revenue forecasts alongside detailed analysis of sales growth within the market. These projections, developed by seasoned analysts, are grounded in a deep exploration of the latest industry trends. The forecasts offer valuable insights for investors, highlighting key growth opportunities and industry potential. Additionally, the report provides a concise dashboard overview of leading organizations, showcasing their effective marketing strategies, market share, and the most recent advancements in both historical and current market landscapes.Global High Performance Alloys Market: Segmentation

The High Performance Alloys Market segmentation divides the market into multiple sub-segments based on product type, application, and geographical region. This segmentation approach enables more precise regional and country-level forecasts, providing deeper insights into market dynamics and potential growth opportunities within each segment.

By Product

Non-Ferrous Metal

Platinum Group

Refractory

Super Alloys

By Material

Aluminum

Titanium

Magnesium

Nickel

Steel

Others

By Alloy Type

Wrought Alloy

Cast Alloy

By Applications

Aerospace

Industrial Gas Turbine

Industrial

Automotive

Oil and Gas

Electrical and Electronics

Others

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/high-performance-alloys-market

Market Highlights:

A company's revenue and the applications market are used by market analysts, data analysts, and others in connected industries to assess product values and regional markets.

But not limited to: reports from corporations, international Organization, and governments; market surveys; relevant industry news.

Examining historical market patterns, making predictions for the year 2022, as well as looking forward to 2032, using CAGRs (compound annual growth rates)

Historical and anticipated data on demand, application, pricing, and market share by country are all included in the study, which focuses on major markets such the United States, Europe, and China.

Apart from that, it sheds light on the primary market forces at work as well as the obstacles, opportunities, and threats that suppliers face. In addition, the worldwide market's leading players are profiled, together with their respective market shares.

Goals of the Study

What is the overall size and scope of the High Performance Alloys Market market?

What are the key trends currently influencing the market landscape?

Who are the primary competitors operating within the High Performance Alloys Market market?

What are the potential growth opportunities for companies in this market?

What are the major challenges or obstacles the market is currently facing?

What demographic segments are primarily targeted in the High Performance Alloys Market market?

What are the prevailing consumer preferences and behaviors within this market?

What are the key market segments, and how do they contribute to the overall market share?

What are the future growth projections for the High Performance Alloys Market market over the next several years?

How do regulatory and legal frameworks influence the market?

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

#High Performance Alloys Market Market#High Performance Alloys Market Market Share#High Performance Alloys Market Market Size#High Performance Alloys Market Market Research#High Performance Alloys Market Industry#What is High Performance Alloys Market?

0 notes

Text

Permanent Magnets Market Analysis, Growth Forecast by Manufacturers, Regions and Application to 2030

In 2023, the global permanent magnets market reached a valuation of USD 22.18 billion and is projected to grow at an 8.7% compound annual growth rate (CAGR) from 2024 through 2030. This growth is largely driven by the increasing demand for renewable energy sources like wind and solar power. Permanent magnets play a critical role in enhancing the efficiency of wind turbine generators, a key application area in this sector. Specifically, rare earth magnets such as Neodymium Ferrite Boron (NdFeB) are commonly used in wind turbines due to their high reliability and reduced maintenance needs.

In the United States, the demand for permanent magnets is anticipated to grow at a faster rate than that for ferrite magnets, driven by applications in high-tech sectors like robotics, wearable technology, electric vehicles (EVs), and wind energy. Following the 2008-09 economic downturn, the U.S. automotive industry has seen steady recovery, with a growing emphasis on electric vehicles. Notably, the adoption of plug-in electric vehicles has increased, spurred by innovations from prominent manufacturers including Tesla, Chevy, Nissan, Ford, Audi, and BMW. For example, Tesla began incorporating motors with neodymium magnets in 2018.

Despite this growth, the U.S. faces a supply challenge due to a limited number of domestic manufacturers for permanent motor magnets, leading to substantial imports. In 2023, the U.S. imported around 4 million pounds of automotive parts from China, a majority of which were electric motors. The ongoing trade tensions with China have raised concerns about access to essential rare earth materials. In response, the U.S. government has launched several initiatives, including funding mining projects under the Defense Production Act, aiming to bolster the domestic supply of rare earth materials and reduce dependence on imports.

Gather more insights about the market drivers, restrains and growth of the Permanent Magnets Market

Material Segmentation Insights:

In 2023, ferrite materials dominated the permanent magnet market, capturing a revenue share of approximately 36.0%. Ferrite magnets are predominantly used in motor applications, accounting for over 65% of total ferrite magnet usage. Their application spans automotive motors (19%), appliance motors (14%), HVAC systems (12%), and various industrial and commercial motors (11%) as of 2022. Additional uses of ferrite magnets include loudspeakers, separation equipment, Magnetic Resonance Imaging (MRI), relays & switches, and lifting devices.

The Neodymium Iron Boron (NdFeB) segment is expected to be the fastest-growing segment by volume and revenue in the forecast period. Over the last five years, NdFeB magnets have expanded into various applications, including electric and hybrid vehicle motors, wind power generators, air conditioning compressors and fans, and energy storage systems. Another important material in this market is Alnico, an alloy made from aluminum, nickel, and cobalt. Prior to the discovery of NdFeB in the 1970s, Alnico-based magnets were the strongest available. According to Magnet Applications, Inc., the average energy density (BHmax) of Alnico magnets is 7 MGOe, which is higher than ferrite magnets but significantly lower than that of NdFeB magnets.

Order a free sample PDF of the Permanent Magnets Market Intelligence Study, published by Grand View Research.

#Permanent Magnets Industry#Permanent Magnets Market Share#Permanent Magnets Market Analysis#Permanent Magnets Market Trends

0 notes

Text

Permanent Magnets Market 2030 Overview, Global Industry Size, Price, Future Analysis

In 2023, the global permanent magnets market reached a valuation of USD 22.18 billion and is projected to grow at an 8.7% compound annual growth rate (CAGR) from 2024 through 2030. This growth is largely driven by the increasing demand for renewable energy sources like wind and solar power. Permanent magnets play a critical role in enhancing the efficiency of wind turbine generators, a key application area in this sector. Specifically, rare earth magnets such as Neodymium Ferrite Boron (NdFeB) are commonly used in wind turbines due to their high reliability and reduced maintenance needs.

In the United States, the demand for permanent magnets is anticipated to grow at a faster rate than that for ferrite magnets, driven by applications in high-tech sectors like robotics, wearable technology, electric vehicles (EVs), and wind energy. Following the 2008-09 economic downturn, the U.S. automotive industry has seen steady recovery, with a growing emphasis on electric vehicles. Notably, the adoption of plug-in electric vehicles has increased, spurred by innovations from prominent manufacturers including Tesla, Chevy, Nissan, Ford, Audi, and BMW. For example, Tesla began incorporating motors with neodymium magnets in 2018.

Despite this growth, the U.S. faces a supply challenge due to a limited number of domestic manufacturers for permanent motor magnets, leading to substantial imports. In 2023, the U.S. imported around 4 million pounds of automotive parts from China, a majority of which were electric motors. The ongoing trade tensions with China have raised concerns about access to essential rare earth materials. In response, the U.S. government has launched several initiatives, including funding mining projects under the Defense Production Act, aiming to bolster the domestic supply of rare earth materials and reduce dependence on imports.

Gather more insights about the market drivers, restrains and growth of the Permanent Magnets Market

Material Segmentation Insights:

In 2023, ferrite materials dominated the permanent magnet market, capturing a revenue share of approximately 36.0%. Ferrite magnets are predominantly used in motor applications, accounting for over 65% of total ferrite magnet usage. Their application spans automotive motors (19%), appliance motors (14%), HVAC systems (12%), and various industrial and commercial motors (11%) as of 2022. Additional uses of ferrite magnets include loudspeakers, separation equipment, Magnetic Resonance Imaging (MRI), relays & switches, and lifting devices.

The Neodymium Iron Boron (NdFeB) segment is expected to be the fastest-growing segment by volume and revenue in the forecast period. Over the last five years, NdFeB magnets have expanded into various applications, including electric and hybrid vehicle motors, wind power generators, air conditioning compressors and fans, and energy storage systems. Another important material in this market is Alnico, an alloy made from aluminum, nickel, and cobalt. Prior to the discovery of NdFeB in the 1970s, Alnico-based magnets were the strongest available. According to Magnet Applications, Inc., the average energy density (BHmax) of Alnico magnets is 7 MGOe, which is higher than ferrite magnets but significantly lower than that of NdFeB magnets.

Order a free sample PDF of the Permanent Magnets Market Intelligence Study, published by Grand View Research.

#Permanent Magnets Industry#Permanent Magnets Market Share#Permanent Magnets Market Analysis#Permanent Magnets Market Trends

0 notes

Text

Steel Market Outlook: Forging Ahead in a Dynamic Global Landscape

The Steel Market plays a pivotal role in the global economy, serving as a fundamental material across various industries. With a market size of approximately $1,175.10 billion in 2023, the steel industry is projected to grow to $1,210.30 billion in 2024 and reach around $1,445.20 billion by 2030. This growth corresponds to a compound annual growth rate (CAGR) of 3.00% from 2024 to 2030, reflecting a steady expansion trajectory driven by increased demand across multiple sectors.

In this blog, we will explore the key segments of the steel market, examine its applications, highlight major players, and analyze the trends fueling growth in this critical industry.

Understanding the Steel Market

Steel, an alloy of iron and carbon, is renowned for its strength, durability, and versatility. It is a crucial material for various applications, from construction and automotive manufacturing to energy production and consumer goods. As the world continues to industrialize, the demand for steel remains robust, making it one of the most widely used materials globally.

Key Market Segments

The steel market can be segmented by type and application, providing insight into the specific products and uses driving demand.

Market Segmentation by Type

Carbon Steel: This type of steel is composed mainly of iron and carbon, with varying amounts of other elements. It is widely used due to its high strength and affordability, making it suitable for various applications, including construction and automotive manufacturing.

Alloy Steel: Alloy steel contains additional elements, such as manganese, nickel, and chromium, which enhance its properties. This type of steel is often used in specialized applications requiring enhanced strength, toughness, and resistance to wear and corrosion.

Market Segmentation by Applications

Construction: The construction industry is one of the largest consumers of steel, utilizing it in building structures, infrastructure projects, and housing. Steel's strength and durability make it an ideal choice for construction materials.

Automotive: Steel is extensively used in the automotive industry for manufacturing various components, including body panels, frames, and engines. Its lightweight yet strong properties contribute to fuel efficiency and safety.

Transportation: Steel is vital for the transportation sector, including railways, ships, and airplanes, providing the necessary strength and durability for various modes of transport.

Energy: In the energy sector, steel is used in the construction of pipelines, power plants, and wind turbines, playing a critical role in energy production and distribution.

Packaging: Steel is used in packaging applications, particularly in the production of cans and containers, due to its ability to preserve products and provide durability.

Tools and Machinery: The manufacturing of tools and machinery relies heavily on steel for its strength and resilience, enabling the production of various industrial equipment.

Consumer Appliances: Steel is commonly used in household appliances, such as refrigerators, ovens, and washing machines, due to its durability and aesthetic appeal.

Metal Products: Various metal products, including wires, rods, and sheets, are produced from steel, serving numerous industrial applications.

Others: This category encompasses various applications where steel is utilized, including agricultural equipment and construction machinery.

Key Market Players

The steel market features a competitive landscape with several key players driving innovation and market growth:

China Baowu: As one of the largest steel producers globally, China Baowu plays a crucial role in the steel market, leading in production capacity and innovation.

ArcelorMittal: A major player in the steel industry, ArcelorMittal operates in multiple regions, producing a wide range of steel products for various applications.

Nippon Steel: This Japanese company is known for its advanced steel production technologies and a strong focus on sustainability.

Shagang Group: A leading Chinese steel manufacturer, Shagang Group is recognized for its extensive product range and commitment to quality.

POSCO: South Korea’s POSCO is a global leader in the steel industry, known for its innovative production methods and high-quality steel products.

HBIS: HBIS is a significant player in the Chinese steel market, focusing on technological advancements and sustainable production.

ANSTEEL: ANSTEEL is one of China’s largest steel manufacturers, producing a wide variety of steel products for different sectors.

JFE Group: JFE Group is a leading Japanese steel manufacturer, focusing on developing high-performance steel products for various applications.

Shandong Steel: This Chinese company is recognized for its large production capacity and diverse steel product offerings.

Tata Steel: A major player in the global steel industry, Tata Steel is known for its commitment to sustainability and innovation in steel production.

These key players are instrumental in driving the evolution of the steel market, continuously developing innovative products and sustainable practices.

Market Drivers

Several key factors are driving the growth of the steel market:

Increasing Infrastructure Development: Global infrastructure projects, including roads, bridges, and buildings, are driving demand for steel. Governments and private sectors are investing in infrastructure, leading to increased consumption of steel products.

Rising Demand from Automotive and Manufacturing Sectors: The automotive industry’s growth, along with a resurgence in manufacturing activities, is boosting the demand for steel. As vehicle production increases, so does the need for high-quality steel components.

Technological Advancements: Innovations in steel production processes are enhancing the efficiency and sustainability of steel manufacturing, leading to reduced costs and improved product quality.

Sustainability Initiatives: As industries focus on reducing their carbon footprints, the demand for sustainable steel production practices is increasing. Steel manufacturers are investing in environmentally friendly technologies and practices.

Growing Urbanization: Rapid urbanization in developing regions is driving the demand for construction materials, including steel. As more people move to cities, the need for housing and infrastructure is on the rise.

Regional Dynamics

The steel market exhibits regional variations influenced by economic conditions, industrial demands, and technological advancements.

North America: The North American steel market is supported by a strong manufacturing base and infrastructure development projects. The United States and Canada are key players in the region.

Europe: Europe has a well-established steel industry, characterized by advanced production technologies and a focus on sustainability. Countries like Germany, France, and Italy are significant contributors to the steel market.

Asia Pacific: The Asia Pacific region dominates the steel market, with China being the largest producer and consumer of steel globally. Rapid industrialization and urbanization in countries like India and Japan also contribute to market growth.

Latin America: The Latin American steel market is gradually expanding, driven by growth in construction and manufacturing sectors, particularly in Brazil and Mexico.

Middle East & Africa: The Middle East and Africa are emerging markets for steel, with increasing investments in infrastructure and construction projects driving demand.

Future Outlook

The steel market is poised for steady growth in the coming years. With a projected market size of approximately $1,445.20 billion by 2030 and a CAGR of 3.00%, the industry is well-positioned for continued expansion. Key trends shaping the future of the market include:

Focus on Sustainable Practices: The steel industry is likely to continue emphasizing sustainability, with manufacturers adopting greener production processes and materials.

Technological Innovations: Ongoing advancements in steel production technologies will enhance efficiency, reduce costs, and improve product quality, further driving demand.

Increasing Investment in Infrastructure: Continued investment in infrastructure development globally will sustain the demand for steel in construction and related applications.

Global Economic Recovery: As economies recover from global disruptions, the demand for steel in various sectors is expected to rebound, contributing to market growth.

Conclusion

The steel market remains a vital component of the global economy, driven by infrastructure development, technological advancements, and evolving consumer needs. With a projected market size of $1,445.20 billion by 2030 and a steady growth trajectory, the steel industry is well-equipped to meet the demands of various sectors. As stakeholders across industries embrace innovation and sustainability, the future of the steel market looks promising.

Browse More:

Synthetic Diamond Market Overview Synthetic Graphite Market Trends Synthetic Rubber Market 2024 Syrups Market Analysis

0 notes

Text

Brazil hikes import tariffs on steel products

Brazil’s Foreign Trade Chamber (Camex) raised the import tariffs on several iron and steel products to 25 percent, catering to requests from the trade association Sicetel. The new tariff will be enforced until May 31, 2025.

The tariffs were previously set at varying levels, ranging from 10.8 to 14 percent.

The new 25 percent tariff will be imposed on nails, tacks, and similar articles of iron or steel; scaffolding, frames, and shoring materials; galvanized grids and nets, welded at the intersection points, made of iron or steel wires, and wires of other steel alloys, among other products.

Back in May, Camex had already extended antidumping restrictions on steel products specifically coming from China. The move came after authorities observed an attempt by steel importers to circumvent previous restrictions by purchasing products with slightly lower levels of chromium and nickel, but which were essentially the same goods as those under restrictive tariffs, according to the Trade and Industry Ministry.

Continue reading.

1 note

·

View note

Text

AL6XN Prices Trend | Pricing | News | Database | Chart

AL6XN is a highly corrosion-resistant austenitic stainless steel alloy that has gained significant attention in industries such as chemical processing, marine environments, and pharmaceuticals due to its excellent mechanical properties and resistance to harsh environments. This alloy, characterized by its high molybdenum and nitrogen content, provides superior strength and corrosion resistance compared to standard stainless steels. Its price is influenced by a range of factors, including raw material costs, global demand, manufacturing complexities, and industry-specific requirements. Understanding the pricing dynamics of AL6XN is essential for stakeholders involved in its supply chain, whether they are manufacturers, distributors, or end-users.

One of the primary determinants of AL6XN pricing is the cost of its key raw materials, such as nickel, molybdenum, chromium, and iron. These metals are subject to market volatility driven by global mining outputs, geopolitical developments, and fluctuations in demand from various industries. For instance, the price of nickel, a crucial component of AL6XN, often experiences significant shifts due to supply shortages or increased demand in other sectors like battery production for electric vehicles. Similarly, molybdenum prices can surge in response to changes in production levels or regulatory constraints in major mining regions. As a result, the cost of producing AL6XN tends to follow the broader trends in these metal markets.

Get Real Time Prices for AL6XN: https://www.chemanalyst.com/Pricing-data/al6xn-plate-1350

Global economic conditions also play a significant role in shaping the price trajectory of AL6XN. During periods of economic growth, industrial activities surge, boosting the demand for high-performance materials like AL6XN. Sectors such as oil and gas, power generation, and desalination projects often require this alloy for its reliability in extreme conditions, driving up its demand and price. Conversely, during economic slowdowns, the reduced activity in these sectors can lead to lower demand and, subsequently, a decline in prices. The overall pricing trends of AL6XN, therefore, often mirror the health of the global economy and industrial activity.

Another critical aspect affecting AL6XN pricing is the complexity and cost of manufacturing. The production process for AL6XN involves advanced metallurgical techniques to achieve its unique combination of strength, ductility, and corrosion resistance. The alloy must meet stringent quality standards to ensure its performance in demanding environments, which adds to production costs. Additionally, the energy-intensive nature of stainless steel manufacturing and the use of specialized equipment further contribute to the overall price. These factors make AL6XN a premium material compared to standard grades of stainless steel, but its superior performance characteristics justify the higher cost in many applications.

Regional supply and demand dynamics also impact AL6XN prices. Countries with strong industrial bases and significant investments in infrastructure, such as the United States, China, and India, are key markets for this alloy. The availability of local manufacturers, import/export regulations, and transportation costs influence pricing in these regions. For instance, tariffs or trade restrictions can lead to price variations between regions, making AL6XN more expensive in markets that rely heavily on imports. On the other hand, competitive pricing can be observed in regions with a robust domestic production capacity and streamlined supply chains.

Technological advancements and innovations in alloy production also contribute to pricing trends. Continuous research and development efforts aim to optimize the properties of AL6XN while reducing production costs. These innovations can lead to more efficient manufacturing processes, potentially lowering prices over time. However, such advancements also require significant investment in research facilities and expertise, which can offset cost reductions in the short term. The adoption of newer technologies and methods by manufacturers often influences the market price of AL6XN.

Environmental regulations and sustainability initiatives are increasingly influencing the pricing of industrial materials, including AL6XN. As industries strive to reduce their environmental footprint, the cost of compliance with environmental standards is passed on to consumers. This includes the use of cleaner production technologies, waste management systems, and the sourcing of ethically mined raw materials. While these measures enhance the sustainability of AL6XN production, they also add to the cost, making the alloy more expensive in the market. However, the growing preference for sustainable materials in various industries is likely to sustain the demand for AL6XN despite its premium pricing.

The competitive landscape among manufacturers and suppliers further shapes the pricing of AL6XN. Major players in the industry strive to differentiate themselves through pricing strategies, product quality, and customer service. Bulk purchasing agreements, long-term contracts, and strategic partnerships with distributors often result in competitive pricing for large-scale buyers. However, smaller buyers or those requiring custom specifications may face higher prices due to limited economies of scale. The level of competition in the market plays a crucial role in determining how much end-users pay for AL6XN.

Finally, the long-term outlook for AL6XN prices is closely tied to emerging trends in industries that heavily rely on this alloy. The push for renewable energy projects, advancements in desalination technology, and the expansion of chemical processing facilities are expected to drive sustained demand for AL6XN. Furthermore, as industries prioritize materials that offer durability and efficiency in extreme conditions, the demand for high-performance alloys like AL6XN is poised to grow. While short-term price fluctuations may occur due to market dynamics, the overall trend suggests a steady demand for this versatile alloy, ensuring its relevance and value in the years to come.

In conclusion, the pricing of AL6XN is a complex interplay of raw material costs, economic conditions, manufacturing challenges, and market dynamics. Its superior properties and versatility justify its premium pricing, making it a preferred choice in industries where performance and reliability are critical. Stakeholders must closely monitor these factors to navigate the market effectively and make informed purchasing decisions. As the demand for high-performance materials continues to rise, AL6XN remains a vital component in addressing the challenges of modern industrial applications.

Get Real Time Prices for AL6XN: https://www.chemanalyst.com/Pricing-data/al6xn-plate-1350

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#AL6XN Plate#AL6XN Plate Price#AL6XN Plate Price Monitor#AL6XN Plate Pricing#AL6XN Plate News#AL6XN Plate Database

0 notes

Text

Steel Market — Forecast(2024–2030)

Steel Market — Overview

Steel Market Report Coverage

For More

The report: “Steel Industry — Forecast (2024–2030)”, by IndustryARC covers an in-depth analysis of the following segments of the Steel Market Report.

By Type: Carbon Steel, (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), Stainless Steel (Austenitic Stainless Steels, Ferritic Stainless Steels, Martensitic Stainless Steels, Precipitation Hardening Grade Stainless Steels, Duplex Stainless Steels), Alloy Steel (Chromium Molybdenum Steel, Nickel-Chromium-Molybdenum Steel, Chromium Vanadium Steel, HSLA -Nickel-Chromium-Molybdenum Steel), Tool Steel (Water-hardening tool steels, Shock-resisting tool steels, Cold-work tool steels, Hot-work steels, High-speed tool steels, Others), Others

By Form: Bar, Rod, Tube, Pipe, Plate, Sheet, Structural, Others

By Application: Transportation (Road, Bridges, Barriers, Rail, Tracks, Rail Cars), Construction (Cool Metal (infrared reflecting) Roofing, Purlins, Beams, Pipe, Recyclable steel framing (studs), Desks/Furniture), Packaging (Canes, Bottles, Others), Water Projects (Levees/Dams/Locks), Energy (Renewable, Nuclear, Bio-fuels, Fossil, Electric Grid), Others

By Industry: Construction (Steel Skeletons, Concrete Walls, Pillars, Nails, Bolts, Screws, Others), Machinery (Bulldozers, Backhoe Leaders, Pipelayers, Others), Automotive and Transportation (Exhaust, Trim/Decorative, Engine, Chassis, Fasteners, Tubing For Fuel Lines), Kitchenware and Domestic Appliances (Small Household Appliances, Black Home Appliances, White Home Appliances), Electrical and Electronics (Motor Mount Brackets, Adapter Plates, Electronic Frames and Chassis, Brackets, Others), Healthcare (Orthopaedic Implants, Artificial Heart Valves, Bone Fixation, Catheters, Others), Energy (Scrubbers, Heat Exchangers, Others)

By Region: North America, South America, Europe, Asia-Pacific and Rest of the World

Inquiry Before Buying

Key Takeaways

• The Asia-Pacific region, particularly China, has been a dominant force in the global steel market with a share of 63% in 2023, owing to China’s rapid industrialization and urbanization have driven substantial demand for steel in the construction, infrastructure, and manufacturing sectors.

• Government infrastructure spending, particularly in major economies, plays a significant role in driving steel demand. Large-scale infrastructure projects, such as bridges, railways, and urban development initiatives, can create substantial demand for steel products.

For More Details on This Report — Request for Sample

Steel Market Segment Analysis — By Type

In terms of type, the Steel Market is segmented into carbon steel, stainless steel, alloy steel, tool steel and others. In 2023, the Stainless-steel segment generated the greatest revenue of $361.94 billion and is projected to reach a revenue of $482.28 billion by 2030. Owing to the various benefits posed by stainless steel such as corrosion resistance, high and low temperature resistance, the ease of fabrication, strength, aesthetic appeal is one of the key factors for its adoption among various end-use industries, which in turn is boosting its market growth. The stainless-steel segment can be further classified as Austenitic stainless steels, Ferritic stainless steels, Martensitic stainless steels, Precipitation hardening grade stainless steel and Duplex stainless steels.

Steel Market Segment Analysis — By Form

By form, the steel market is segmented into bar, rod, tube, pipe, plate, sheet, structural and others. The bar segment accounted for the major market share in 2023, with a revenue of $554.58 billion, and is forecast to grow at a CAGR of 4.68% by 2030. The increasing demand for steel bar from various end-user industries such as building and construction, bridges, and many others, are driving the growth of the segment during the forecast period of 2024–2030.

Steel Market Segment Analysis — By Application

Steel Market is segmented by its application that includes transportation, construction, packaging, water projects, energy and others. The energy segment held the dominant market share, 31% of the whole market, in 2023, and is expected to maintain its dominance by 2030 with a CAGR of 4.69%. One of the major factors for the segment growth is the increasing awareness and focus towards renewable energy sources. Steel plays a crucial role in producing and distributing energy as well as improving energy efficiency. Renewable energy is further classified as Wind Towers and Foundation, Wind Turbines and Solar Parabolic Mirror Supports & Collectors.

Steel Market Segment Analysis — By Industry

The Steel finds its application across the industries such as construction, machinery, automotive and transportation, kitchenware and domestic appliance, electrical and electronics, healthcare, energy and others. Among them, the construction segment is the largest consumer of steel, as bearable structures can be manufactured easily at a low cost. The property of steel in its various forms and alloys makes it more flexible to cater the exclusive projects integrated with infrastructure. Moreover, the rapid industrialization and urbanization in various developing countries are fueling the segment growth in strengthening its dominant market position during the forecast period.

Buy Now

Steel Market Segment Analysis — By Geography/Country

The report comprises of the region wise study of the global market including North America, South America, Europe, Asia-Pacific and Rest of the World. Above all, Asia-Pacific region held the biggest share in 2023, up to 63% of the whole steel market owing to the rapidly expanding defense, machinery, automotive, and shipbuilding industries in the countries such as India, China, South Korea, and Japan. Foreign direct investment in energy and infrastructure is likely to provide opportunities for the market vendors. Coupled with favorable government regulations, growing infrastructure and construction activities in developing economies of the Asia-Pacific region are boosting the demand for the market.

Steel Market — Drivers

Growing Demand for Steel Across the Various Regions

Several factors have a significant impact on the overall development of the steel market. The major growth factor driving the Steel Market is the growing demand for steel across a variety of developing regions. For instance, Global crude steel production in January-November 2023 reached 1715.12 million metric tons, marking a marginal 0.5% year-on-year growth, per provisional data from the World Steel Association. November 2023 saw a production of 145.5 million metric tons, up by 3.3% from the previous year. China led the production with 952.14 million metric tons, followed by India and Japan, USA, Russia, South Korea, and Germany.

Construction and Infrastructure Development:

Construction activities, including residential, commercial, and infrastructure projects such as roads, bridges, and railways, are major drivers of steel demand. Urbanization and industrialization also contribute to the growth of the construction sector, thereby increasing the demand for steel products. For instance, as per Green Finance & Development Center, China Belt and Road Initiative (BRI) Investment Report 2023, engagement totalled about USD88.3 billion, with USD44.6 billion from investment and USD43.7 billion from construction contracts. Also, The US Department of Transportation allocates $3.2 billion in extra funding, alongside $4.3 billion from the Bipartisan Infrastructure Law for 2023. The Budget prioritizes $4.5 billion for the Capital Investment Grant program, aiming to bolster transit infrastructure for economic growth. As a result, the steel market is anticipated to thrive, propelled by heightened construction activities and the need for durable materials, reflecting a promising outlook for the industry.

Steel Market -Challenges

Environmental Regulations and Sustainability

The steel industry is facing mounting pressure to tackle environmental issues by cutting carbon emissions and enhancing sustainability efforts. Meeting stringent environmental regulations demands substantial investments in technology and infrastructure, presenting a formidable challenge for many companies. Despite the financial hurdles, embracing these changes can pave the way for a more sustainable and eco-friendly future for the industry.

Steel Market — Competitive Landscape

The companies referred in the study include Baosteel Co., Ltd., Posco Holding Inc, Nippon Steel Corporation, JFE Holdings, Tata Steel Limited, United States Steel Corporation, Anshan Iron and Steel Group Corporation, Hyundai Steel Co., Ltd., ThyssenKrupp AG, ArcelorMittal S.A., among others. Technology launches, acquisitions, and R&D activities are key strategies adopted by the key players in the Steel Market.

Steel Market — Recent Developments

November 2022, Tata Steel launched the fourth edition of MaterialNEXT, focusing on ‘Materials to Wonder.’ This open innovation event aims to gather ideas on emerging materials and their applications. The program spans five months across Idea Selection, Development, and Evaluation stages, fostering collaboration among scientists, researchers, and startups.

May 2022, Kobe Steel introduced “Kobenable Steel,” Japan’s pioneering low CO2 blast furnace steel, aiming to curtail emissions during ironmaking. Utilizing innovative CO2 Reduction Solution technology, it plans to roll out the product this fiscal year, marking a milestone in sustainable steel production.

In June 2023, Nippon Steel introduces ZEXEED™ Checkered Sheet, a new addition to its high corrosion resistant coated steel series

0 notes

Text

Shape Memory Alloys Market Overview: Extensive Evaluation of Market Size, Share, Growth Opportunities

The global shape memory alloys market is expected to reach USD 29.29 billion by 2030, according to a new report by Grand View Research, Inc. It is anticipated to expand at a CAGR of 11.3% over the forecast period. Shape memory alloy (SMA) refers to a metallic material that can be bent or stretched in its cool state. The alloy regains its original shape when heated above the transition temperature. Low temperature (martensite) and high temperature (austenite) are two stable phases of SMAs.

Nickel-titanium alloy (nitinol) is the key product type, which is largely used in medical devices. Medical devices made from nitinol include dental wires, needles, catheter tubes, guidewires, and other surgical instruments. The biomedical industry is facing many challenging applications that are testing the capability of SMAs. Recent research and development activities are aimed at improving the fatigue life of the material and producing materials with low inclusion sizes.

Shape Memory Alloys Market Report Highlights

The biomedical segment had the largest market share, over 60%, in 2023. This segment's large share is attributed to increasing R&D in medical devices and surgical instruments.

The Nickel titanium alloys (nitinol) segment is anticipated to grow at a CAGR of 11.4% during the forecast period. Increasing R&D activities for application-specific products are aiding the growth of this segment.

Asia Pacific held a revenue share of over 29.0% in 2023. The large populations in India and China, along with increasing investment in the healthcare sector, are projected to remain key drivers for the long term.

North America is anticipated to grow at a CAGR of 11.4% during the forecast period. Increasing production activities in the aerospace and automotive industries are likely to contribute to market growth.

Some of the key players in the market are SAES Group, ATI, Nippon Steel Corporation, Furukawa Electric Co., Ltd., Seabird Metal, and Johnson Matthey. M&As and investment in R&D are key growth strategies of market players.

For More Details or Sample Copy please visit link @: Shape Memory Alloys Market Report

Gradual expansion of the automotive industry is likely to play a significant role in the demand for SMAs over the forecast period. SMA actuators are gaining popularity among automobile manufacturers owing to properties such as shape memory effect (SME) and super elasticity (SE). In addition, SMA actuators do not need complex and bulky design to function. Increasing R&D investments by automobile manufacturers to find potential applications such as climate control, door locks, engine control valve, and actuators are anticipated to drive market growth.

Aerospace and defense is another promising sector for SMAs. Rising focus on multi-functionality and reliability is driving demand for advanced materials in aerospace applications such as spacecraft, rotorcraft, and fixed-wing aircraft.

Asia Pacific is projected to remain a key region for the market over the coming years. Various research institutes and organizations are focusing on the development of new industrial applications. The region is undergoing significant infrastructural development in railways, roadways, industrial, commercial, and residential sectors. Furthermore, globalization has made the region a lucrative place for investment to aid the development of the economy while catering to a larger population. Asia Pacific also boasts a large aerospace and defense industry, creating novel opportunities for SMAs to be incorporated.

The market is competitive, with various small and large participants. Mergers and acquisitions, R&D investments, and new product launches are key strategic initiatives adopted by market players. For instance, in March 2024, Montagu Private Equity LLP, a private equity firm, announced its plans to acquire Johnson Matthey Plc's Medical Device Components (MDC) business. MDC develops and manufactures specialized components for minimally invasive medical devices. It also focuses on complex and high-precision parts made from platinum group metals and nitinol.

List of major companies in the Shape Memory Alloys Market

ATI

Baoji Seabird Metal Material Co., Ltd.

Dynalloy, Inc.

Fort Wayne Metals Research Products Corp

Furukawa Electric Co., Ltd.

Johnson Matthey

Mishra Dhatu Nigam Limited (MIDHANI)

Nippon Seisen Co., Ltd.

Nippon Steel Corporation

SAES Group

For Customized reports or Special Pricing please visit @: Shape Memory Alloys Market Analysis Report

We have segmented the global shape memory alloys market on the basis of product, end-use, and region.

#ShapeMemoryAlloys#SmartMaterials#SMA#MaterialScience#AdvancedMaterials#BiomedicalApplications#AerospaceIndustry#AutomotiveApplications#NiTinol#HeatResponsiveMaterials#MedicalDevices#Actuators#EnergySector#Robotics#Orthodontics#ThermalControl#AerospaceEngineering#EngineeringMaterials#MarketTrends#Manufacturing

0 notes

Text

High Performance Alloys Market Competitive Landscape and Key Players

High Performance Alloys Market Growth Strategic Market Overview and Growth Projections

The global high-performance alloys market size was valued at USD 9.89 billion in 2022. It is projected to reach USD 15.89 billion by 2031, registering a CAGR of 5.41% during the forecast period (2023-2031).

The latest Global High Performance Alloys Market by straits research provides an in-depth analysis of the High Performance Alloys Market, including its future growth potential and key factors influencing its trajectory. This comprehensive report explores crucial elements driving market expansion, current challenges, competitive landscapes, and emerging opportunities. It delves into significant trends, competitive strategies, and the role of key industry players shaping the global High Performance Alloys Market. Additionally, it provides insight into the regulatory environment, market dynamics, and regional performance, offering a holistic view of the global market’s landscape through 2032.

Competitive Landscape

Some of the prominent key players operating in the High Performance Alloys Market are

Outokumpu

Hitachi Metals Ltd.

Alcoa Inc.

Aperam SA

VSMPO-Avisma Corporation

Timken Company

Carpenter Technology Corporation

Precision Castparts Corp.

RTI International Metals

ThyssenKrupp AG.

Get Free Request Sample Report @ https://straitsresearch.com/report/high-performance-alloys-market/request-sample

The High Performance Alloys Market Research report delivers comprehensive annual revenue forecasts alongside detailed analysis of sales growth within the market. These projections, developed by seasoned analysts, are grounded in a deep exploration of the latest industry trends. The forecasts offer valuable insights for investors, highlighting key growth opportunities and industry potential. Additionally, the report provides a concise dashboard overview of leading organizations, showcasing their effective marketing strategies, market share, and the most recent advancements in both historical and current market landscapes.Global High Performance Alloys Market: Segmentation

The High Performance Alloys Market segmentation divides the market into multiple sub-segments based on product type, application, and geographical region. This segmentation approach enables more precise regional and country-level forecasts, providing deeper insights into market dynamics and potential growth opportunities within each segment.

By Product

Non-Ferrous Metal

Platinum Group

Refractory

Super Alloys

By Material

Aluminum

Titanium

Magnesium

Nickel

Steel

Others

By Alloy Type

Wrought Alloy

Cast Alloy

By Applications

Aerospace

Industrial Gas Turbine

Industrial

Automotive

Oil and Gas

Electrical and Electronics

Others

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/high-performance-alloys-market

Market Highlights:

A company's revenue and the applications market are used by market analysts, data analysts, and others in connected industries to assess product values and regional markets.

But not limited to: reports from corporations, international Organization, and governments; market surveys; relevant industry news.

Examining historical market patterns, making predictions for the year 2022, as well as looking forward to 2032, using CAGRs (compound annual growth rates)

Historical and anticipated data on demand, application, pricing, and market share by country are all included in the study, which focuses on major markets such the United States, Europe, and China.

Apart from that, it sheds light on the primary market forces at work as well as the obstacles, opportunities, and threats that suppliers face. In addition, the worldwide market's leading players are profiled, together with their respective market shares.

Goals of the Study

What is the overall size and scope of the High Performance Alloys Market market?

What are the key trends currently influencing the market landscape?

Who are the primary competitors operating within the High Performance Alloys Market market?

What are the potential growth opportunities for companies in this market?

What are the major challenges or obstacles the market is currently facing?

What demographic segments are primarily targeted in the High Performance Alloys Market market?

What are the prevailing consumer preferences and behaviors within this market?

What are the key market segments, and how do they contribute to the overall market share?

What are the future growth projections for the High Performance Alloys Market market over the next several years?

How do regulatory and legal frameworks influence the market?

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

0 notes