#most profitable cryptocurrency

Explore tagged Tumblr posts

Text

I want to be rich enough to buy a racehorse and name it Trans Rights

#and win the Preakness#other good racehorse names:#Queer As In Fuck You ( can you swear in horse names?)#Gayliness Is Next To Godliness#Let's Go Lesbians#that's a good one#Stop Being Weird About Intersex People#Abortion For Fun And Profit#Horseracing Is Animal Abuse#Kill All Billionaires#wait no just Eat The Rich#There Are So Many Gay Animals#I can't think of any for Bi or Ace or Aro#most of these are super lame but you get the point#why don't more people do like slogans#Buy My Son's New Cryptocurrency It's Not A Scam I Promise#Birds Are Dinosaurs#*announcer voice*#“and now it's Trans Rights! Trans Rights and Let's Go Lesbians are right together into the first corner#Birds Are Dinosaurs has third behind them then it's Eat the Rich trailing behind!“#is this anything I have no fucking clue how horse races work

10 notes

·

View notes

Text

“Carbon neutral” Bitcoin operation founded by coal plant operator wasn’t actually carbon neutral

I'm at DEFCON! TODAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). TOMORROW (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Water is wet, and a Bitcoin thing turned out to be a scam. Why am I writing about a Bitcoin scam? Two reasons:

I. It's also a climate scam; and

II. The journalists who uncovered it have a unique business-model.

Here's the scam. Terawulf is a publicly traded company that purports to do "green" Bitcoin mining. Now, cryptocurrency mining is one of the most gratuitously climate-wrecking activities we have. Mining Bitcoin is an environmental crime on par with opening a brunch place that only serves Spotted Owl omelets.

Despite Terawulf's claim to be carbon-neutral, it is not. It plugs into the NY power grid and sucks up farcical quantities of energy produced from fossil fuel sources. The company doesn't buy even buy carbon credits (carbon credits are a scam, but buying carbon credits would at least make its crimes nonfraudulent):

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

Terawulf is a scam from top to bottom. Its NY state permit application promises not to pursue cryptocurrency mining, a thing it was actively trumpeting its plan to do even as it filed that application.

The company has its roots in the very dirtiest kinds of Bitcoin mining. Its top execs (including CEO Paul Prager) were involved with Beowulf Energy LLC, a company that convinced struggling coal plant operators to keep operating in order to fuel Bitcoin mining rigs. There's evidence that top execs at Terawulf, the "carbon neutral" Bitcoin mining op, are also running Beowulf, the coal Bitcoin mining op.

This is a very profitable scam. Prager owns a "small village" in Maryland, with more that 20 structures, including a private gas station for his Ferrari collection (he also has a five bedroom place on Fifth Ave). More than a third of Terawulf's earnings were funneled to Beowulf. Terawulf also leases its facilities from a company that Prager owns 99.9% of, and Terawulf has *showered * that company in its stock.

So here we are, a typical Bitcoin story: scammers lying like hell, wrecking the planet, and getting indecently rich. The guy's even spending his money like an asshole. So far, so normal.

But what's interesting about this story is where it came from: Hunterbrook Media, an investigative news outlet that's funded by a short seller – an investment firm that makes bets that companies' share prices are likely to decline. They stand to make a ton of money if the journalists they hire find fraud in the companies they investigate:

https://hntrbrk.com/terawulf/

It's an amazing source of class disunity among the investment class:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

As the icing on the cake, Prager and Terawulf are pivoting to AI training. Because of course they are.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/09/terawulf/#hunterbrook

#pluralistic#greenwashing#hunterbrook#zero carbon bitcoin mining#bitcoin#btc#crypto#cryptocurrency#scams#climate#crypto mining#terawulf#hunterbrook media#paul prager#pivot to ai

388 notes

·

View notes

Text

So NFTgate has now hit tumblr - I made a thread about it on my twitter, but I'll talk a bit more about it here as well in slightly more detail. It'll be a long one, sorry! Using my degree for something here. This is not intended to sway you in one way or the other - merely to inform so you can make your own decision and so that you aware of this because it will happen again, with many other artists you know.

Let's start at the basics: NFT stands for 'non fungible token', which you should read as 'passcode you can't replicate'. These codes are stored in blocks in what is essentially a huge ledger of records, all chained together - a blockchain. Blockchain is encoded in such a way that you can't edit one block without editing the whole chain, meaning that when the data is validated it comes back 'negative' if it has been tampered with. This makes it a really, really safe method of storing data, and managing access to said data. For example, verifying that a bank account belongs to the person that says that is their bank account.

For most people, the association with NFT's is bitcoin and Bored Ape, and that's honestly fair. The way that used to work - and why it was such a scam - is that you essentially purchased a receipt that said you owned digital space - not the digital space itself. That receipt was the NFT. So, in reality, you did not own any goods, that receipt had no legal grounds, and its value was completely made up and not based on anything. On top of that, these NFTs were purchased almost exclusively with cryptocurrency which at the time used a verifiation method called proof of work, which is terrible for the environment because it requires insane amounts of electricity and computing power to verify. The carbon footprint for NFTs and coins at this time was absolutely insane.

In short, Bored Apes were just a huge tech fad with the intention to make a huge profit regardless of the cost, which resulted in the large market crash late last year. NFTs in this form are without value.

However, NFTs are just tech by itself more than they are some company that uses them. NFTs do have real-life, useful applications, particularly in data storage and verification. Research is being done to see if we can use blockchain to safely store patient data, or use it for bank wire transfers of extremely large amounts. That's cool stuff!

So what exactly is Käärijä doing? Kä is not selling NFTs in the traditional way you might have become familiar with. In this use-case, the NFT is in essence a software key that gives you access to a digital space. For the raffle, the NFT was basically your ticket number. This is a very secure way of doing so, assuring individuality, but also that no one can replicate that code and win through a false method. You are paying for a legimate product - the NFT is your access to that product.

What about the environmental impact in this case? We've thankfully made leaps and bounds in advancing the tech to reduce the carbon footprint as well as general mitigations to avoid expanding it over time. One big thing is shifting from proof of work verification to proof of space or proof of stake verifications, both of which require much less power in order to work. It seems that Kollekt is partnered with Polygon, a company that offers blockchain technology with the intention to become climate positive as soon as possible. Numbers on their site are very promising, they appear to be using proof of stake verification, and all-around appear more interested in the tech than the profits it could offer.

But most importantly: Kollekt does not allow for purchases made with cryptocurrency, and that is the real pisser from an environmental perspective. Cryptocurrency purchases require the most active verification across systems in order to go through - this is what bitcoin mining is, essentially. The fact that this website does not use it means good things in terms of carbon footprint.

But why not use something like Patreon? I can't tell you. My guess is that Patreon is a monthly recurring service and they wanted something one-time. Kollekt is based in Helsinki, and word is that Mikke (who is running this) is friends with folks on the team. These are all contributing factors, I would assume, but that's entirely an assumption and you can't take for fact.

Is this a good thing/bad thing? That I also can't tell you - you have to decide that for yourself. It's not a scam, it's not crypto, just a service that sits on the blockchain. But it does have higher carbon output than a lot of other services do, and its exact nature is not publicly disclosed. This isn't intended to sway you to say one or the other, but merely to give you the proper understanding of what NFTs are as a whole and what they are in this particular case so you can make that decision for yourself.

95 notes

·

View notes

Text

Meme Coins: The Fusion of Humor and Cryptocurrency

In the ever-evolving world of cryptocurrency, a new and exciting trend has emerged: meme coins. These digital assets, inspired by internet memes and cultural phenomena, have captured the imagination of investors and enthusiasts alike. Meme coins represent a unique fusion of humor, community engagement, and financial innovation. Among the rising stars in this vibrant ecosystem is Sexy Meme Coin, a project that exemplifies the potential of meme coins to revolutionize both the crypto world and internet culture. You can learn more about this exciting project at Sexy Meme Coin.

The Origins of Meme Coins

The concept of meme coins began with Dogecoin, a cryptocurrency that started as a joke but quickly gained a dedicated following. Launched in 2013, Dogecoin features the Shiba Inu dog from the "Doge" meme as its mascot. Despite its humorous beginnings, Dogecoin has become a serious player in the crypto market, demonstrating the power of community and social media in driving value.

Inspired by Dogecoin's success, a wave of new meme coins has emerged, each with its unique twist on the concept. These coins leverage the viral nature of memes to build communities and create value, often with a playful and irreverent approach.

What Sets Meme Coins Apart?

Community-Driven: Meme coins are built on the strength of their communities. Unlike traditional cryptocurrencies, which often focus on technological innovation, meme coins thrive on community engagement and social media presence. This grassroots approach fosters a sense of belonging and enthusiasm among users.

Humor and Culture: By incorporating elements of internet culture and humor, meme coins appeal to a broad audience. They are not just financial instruments but also cultural phenomena, reflecting the zeitgeist of the digital age.

Accessibility: Meme coins are often more accessible to the average person than other cryptocurrencies. Their playful nature and low entry barriers make them attractive to newcomers to the crypto space.

Potential for Rapid Growth: The viral nature of memes means that meme coins can experience explosive growth in a short period. While this can lead to significant gains for early adopters, it also comes with high volatility and risk.

Sexy Meme Coin: A Case Study

One of the most promising new entrants in the meme coin arena is Sexy Meme Coin. This project exemplifies the innovative spirit of meme coins, combining humor, community engagement, and cutting-edge technology to create a unique platform for meme enthusiasts and crypto investors.

Key Features of Sexy Meme Coin:

Decentralized Meme Marketplace: Sexy Meme Coin offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens). This platform ensures that creators are rewarded for their originality and creativity, turning viral content into valuable digital assets.

Community Engagement: The platform places a strong emphasis on community involvement. Users can participate in meme contests, vote on their favorite memes, and interact with fellow meme lovers. This active participation not only enhances the user experience but also strengthens the sense of community within the platform.

Reward System: Sexy Meme Coin's unique reward system allows users to earn Sexy Meme tokens ($SXYM) through various activities. Whether it's creating popular memes, participating in community events, or staking tokens, users are incentivized to contribute to the ecosystem and are rewarded for their creativity and engagement.

Exclusive Content: The platform offers access to exclusive meme content and special editions for token holders, providing added value and a unique experience for the community.

Charitable Initiatives: Beyond creating a fun and engaging platform, Sexy Meme Coin is committed to making a positive impact. A portion of the platform’s profits is dedicated to charitable causes, demonstrating the project’s dedication to social responsibility and community support.

You can explore more about this exciting project at Sexy Meme Coin.

The Future of Meme Coins

The rise of meme coins like Sexy Meme Coin signals a shift in the cryptocurrency landscape. These projects are not just about financial speculation; they represent a new way of thinking about digital assets and community engagement. As meme coins continue to evolve, they have the potential to influence mainstream culture and finance in unprecedented ways.

However, it's essential to approach meme coins with a level of caution. Their high volatility and reliance on social media trends mean that they can be unpredictable. Investors should do their due diligence and be prepared for the inherent risks.

Conclusion

Meme coins are more than a passing fad; they are a testament to the power of community, culture, and creativity in the digital age. Projects like Sexy Meme Coin are at the forefront of this movement, demonstrating that humor and blockchain technology can coexist to create something truly unique. As the meme coin ecosystem continues to grow, it will be fascinating to see how these projects shape the future of cryptocurrency and internet culture.

For more information on Sexy Meme Coin and to join the community, visit Sexy Meme Coin and become part of the revolution in the world of meme coins.

126 notes

·

View notes

Note

Hej, I just came across your post about carbon emissions and energy and may be I am wrong but it seems to me to be the entirely wrong approach to reduce consumption on the indivdual level. Because for instance I can't reduce my energy any further in a meaningful way with out compromising my wellbeing. Maybe if I shut down using my computer - which I can't for occupational reasons, plus it would isolate me for good. Well we can go of course the full way and declare electricity a mistake. Would inconvience a whole lot of people, kill plenty of them too and so on. But hey! there's been some emission avoided! Well that is just my opinion and may be I am just too negative

It is aboslutely 100% true that we can not meaningfully reduce CO2 emissions by reducing consumption on an individual level.

Of course we can do some things, like 'eat plant-based and local when possible' and 'don't fly' and 'repair instead of replace' but the impact of these things is minor compared to the total CO2 output and it isn't realistic for most of us.

Simply put: I can not get rid of my car if there is no bus service. I can not repair my phone if companies are allowed to deliberately make phones that can not be repaired. I can not eat local if everything is monoculture mass-argiculture for walmart. I can stop flying, but it is no good if all the private jets stay airborne. I can take shorter showers, but it's no use if the massive digital billboard next to my house is using more energy per month that i use per year.

The real massive reduction that we need requires a full societal transformation. Which means ending capitalism and going from a profit driven economy to one that is based on meeting collective needs while reducing CO2 wherever possible. Which means that when it comes to electricity and battery use, we prioritize human needs like medical care and accessibility devices, NOT the latest gaming platform or super car.

This will be a society without private jets, without fossil fuel mining, without advertising, without unnecessary plastic trinkets, without fast fashion, without mega-farms, without cryptocurrency, without bullshit jobs, without the military-industrial complex, without a constant stream of more wireless and battery operated gadgets. But it will be a society with broadly available and affordable public transport, with locally organized and sustainable food production, with medical care for all, with worker control over the workplace, with free repair-workshops everywhere, and more.

I can't imagine every aspect of that world because I am only one person with limited knowledge of all aspects of producing the things we need, but I know it starts with moving from a society organized around profit to a society organized around meeting human needs, including our very immediate need to stop climate change to prevent even more suffering than has already been caused by climate change so far.

906 notes

·

View notes

Text

As digital scamming explodes in Southeast Asia, including so called “pig butchering” investment scams, the United Nations Office on Drugs and Crime (UNODC) issued a comprehensive report this week with a dire warning about the rapid growth of this criminal ecosystem. Many digital scams have traditionally relied on social engineering, or tricking victims into giving away their money willingly, rather than leaning on malware or other highly technical methods. But researchers have increasingly sounded the alarm that scammers are incorporating generative AI content and deepfakes to expand the scale and effectiveness of their operations. And the UN report offers the clearest evidence yet that these high tech tools are turning an already urgent situation into a crisis.

In addition to buying written scripts to use with potential victims or relying on templates for malicious websites, attackers have increasingly been leaning on generative AI platforms to create communication content in multiple languages and deepfake generators that can create photos or even video of nonexistent people to show victims and enhance verisimilitude. Scammers have also been expanding their use of tools that can drain a victim’s cryptocurrency wallets, have been manipulating transaction records to trick targets into sending cryptocurrency to the wrong places, and are compromising smart contracts to steal cryptocurrency. And in some cases, they’ve been purchasing Elon Musk’s Starlink satellite internet systems to help power their efforts.

“Agile criminal networks are integrating these new technologies faster than anticipated, driven by new online marketplaces and service providers which have supercharged the illicit service economy,” John Wojcik, a UNODC regional analyst, tells WIRED. “These developments have not only expanded the scope and efficiency of cyber-enabled fraud and cybercrime, but they have also lowered the barriers to entry for criminal networks that previously lacked the technical skills to exploit more sophisticated and profitable methods.”

For years, China-linked criminals have trafficked people into gigantic compounds in Southeast Asia, where they are often forced to run scams, held against their will, and beaten if they refuse instructions. Around 200,000 people, from at least 60 countries, have been trafficked to compounds largely in Myanmar, Cambodia, and Laos over the last five years. However, as WIRED reporting has shown, these operations are spreading globally—with scamming infrastructure emerging in the Middle East, Eastern Europe, Latin America, and West Africa.

Most prominently, these organized crime operations have run pig butchering scams, where they build intimate relationships with victims before introducing an “investment opportunity” and asking for money. Criminal organizations may have conned people out of around $75 billion through pig butchering scams. Aside from pig butchering, according to the UN report, criminals across Southeast Asia are also running job scams, law enforcement impersonation, asset recovery scams, virtual kidnappings, sextortion, loan scams, business email compromise, and other illicit schemes. Criminal networks in the region earned up to $37 billion last year, UN officials estimate. Perhaps unsurprisingly, all of this revenue is allowing scammers to expand their operations and diversify, incorporating new infrastructure and technology into their systems in the hope of making them more efficient and brutally effective.

For example, scammers are often constrained by their language skills and ability to keep up conversations with potentially hundreds of victims at a time in numerous languages and dialects. However, generative AI developments within the last two years—including the launch of writing tools such as ChatGPT—are making it easier for criminals to break down language barriers and create the content needed for scamming.

The UN’s report says AI can be used for automating phishing attacks that ensnare victims, the creation of fake identities and online profiles, and the crafting of personalized scripts to trick victims while messaging them in different languages. “These developments have not only expanded the scope and efficiency of cyber-enabled fraud and cybercrime, but they have also lowered the barriers to entry for criminal networks that previously lacked the technical skills to exploit sophisticated and profitable methods,” the report says.

Stephanie Baroud, a criminal intelligence analyst in Interpol’s human trafficking unit, says the impact of AI needs to be considered as part of a pig butchering scammer’s tactics going forward. Baroud, who spoke with WIRED in an interview before the publication of the UN report, says the criminal’s recruitment ads that lure people into being trafficked to scamming compounds used to be “very generic” and full of grammatical errors. However, AI is now making them appear more polished and compelling, Baroud says. “It is really making it easier to create a very realistic job offer,” she says. “Unfortunately, this will make it much more difficult to identify which is the real and which is the fake ads.”

Perhaps the biggest AI paradigm shift in such digital attacks comes from deepfakes. Scammers are increasingly using machine-learning systems to allow for real-time face-swapping. This technology, which has also been used by romance scammers in West Africa, allows criminals to change their appearance on calls with their victims, making them realistically appear to be a different person. The technology is allowing “one-click” face swaps and high-resolution video feeds, the UN’s report states. Such services are a game changer for scammers, because they allow attackers to “prove” to victims in photos or real-time video calls that they are who they claim to be.

Using these setups, however, can require stable internet connections, which can be harder to maintain within some regions where pig butchering compounds and other scamming have flourished. There has been a “notable” increase in cops seizing Starlink satellite dishes in recent months in Southeast Asia, the UN says—80 units were seized between April and June this year. In one such operation carried out in June, Thai police confiscated 58 Starlink devices. In another instance, law enforcement seized 10 Starlink devices and 4,998 preregistered SIM cards while criminals were in the process of moving their operations from Myanmar to Laos. Starlink did not immediately respond to WIRED’s request for comment.

“Obviously using real people has been working for them very well, but using the tech could be cheaper after they have the required computers” and connectivity, says Troy Gochenour, a volunteer with the Global Anti-Scam Organization (GASO), a US-based nonprofit that fights human-trafficking and cybercrime operations in Southeast Asia.

Gochenour’s research involves tracking trends on Chinese-language Telegram channels related to carrying out pig butchering scams. And he says that it is increasingly common to see people applying to be AI models for scam content.

In addition to AI services, attackers have increasingly leaned on other technical solutions as well. One tool that has been increasingly common in digital scamming is so-called “crypto drainers,” a type of malware that has particularly been deployed against victims in Southeast Asia. Drainers can be more or less technically sophisticated, but their common goal is to “drain” funds from a target’s cryptocurrency wallets and redirect the currency to wallets controlled by attackers. Rather than stealing the credentials to access the target wallet directly, drainers are typically designed to look like a legitimate service—either by impersonating an actual platform or creating a plausible brand. Once a victim has been tricked into connecting their wallet to the drainer, they are then manipulated into approving one or a few transactions that grant attackers unintended access to all the funds in the wallet.

Drainers can be used in many contexts and with many fronts. They can be a component of pig butchering investment scams, or promoted to potential victims through compromised social media accounts, phishing campaigns, and malvertizing. Researchers from the firm ScamSniffer, for example, published findings in December about sponsored social media and search engine ads linked to malicious websites that contained a cryptocurrency drainer. The campaign, which ran from March to December 2023 reportedly stole about $59 million from more than 63,000 victims around the world.

Far from the low-tech days of doing everything through social engineering by building a rapport with potential victims and crafting tricky emails and text messages, today’s scammers are taking a hybrid approach to make their operations as efficient and lucrative as possible, UN researchers say. And even if they aren’t developing sophisticated malware themselves in most cases, scammers are increasingly in the market to use these malicious tools, prompting malware authors to adapt or create hacking tools for scams like pig butchering.

Researchers say that scammers have been seen using infostealers and even remote access trojans that essentially create a backdoor in a victim’s system that can be utilized in other types of attacks. And scammers are also expanding their use of malicious smart contracts that appear to programmatically establish a certain agreed-upon transaction or set of transactions, but actually does much more. “Infostealer logs and underground data markets have also been critical to ongoing market expansion, with access to unprecedented amounts of sensitive data serving as a major catalyst,” Wojcik, from the UNODC, says.

The changing tactics are significant as global law enforcement scrambles to deter digital scamming. But they are just one piece of the larger picture, which is increasingly urgent and bleak for forced laborers and victims of these crimes.

“It is now increasingly clear that a potentially irreversible displacement and spillover has taken place in which organized crime are able to pick, choose, and move value and jurisdictions as needed, with the resulting situation rapidly outpacing the capacity of governments to contain it,” UN officials wrote in the report. “Failure to address this ecosystem will have consequences for Southeast Asia and other regions.”

29 notes

·

View notes

Text

Fuck Chromium (and that includes Brave and Vivialdi)

I have made multiple posts about why you should use Firefox, and of course I get the reply "not all chromium browsers are bad, they are not all as evil as Chrome." And sure, browsers who use the chromium code are not required to do all the shady things that Google does with it.

Still, I think it's bad that chromium-based browsers are getting close to total market dominance. By this point it has made Google's competitors like Microsoft and Opera drop their own unique proprietary browser engines for chromium. Browsers are becoming a fucking monoculture at this point. And Chromium becoming the browser code base of choice empowers Google, since they are the ones who mainly develop, maintain and fund its code. It means supporting them in their quest to become an internet monopoly that can do things like drm the web itself.

So let me be clear: you are still supporting google by using chromium-based browsers. By helping out in making chromium the de facto standard for browsers, you are giving google power. They are the ones driving chromium development, they will set the standards. And those standards will be in Google's favor. They are an ad company, their goal is to kill off adblockers by making them impossible to use, first with manifest v3 for extensions and now WEI, their web drm.

Brave is a joke.

The supposed "good guy" chromium browsers people recommend are actually shady as shit.

The one i see recommended the most is Brave, and it's fucking terrible. For one thing, it is funded by right-wing techbro Brendan Eich. He was Mozilla CEO for some time, but then people found he was a massive homophobe who funded campaigns against marriage equality, and Mozilla forced him to resign. And that's why he created Brave. That's who you are supporting by using Brave.

It runs off chromium because that's the easy and lazy choice for a browser. And it's literally funded through cryptocurrency, probably the negative environmental impact is a plus in Eich's book. And its adblocker runs off the same dishonest business model as adblock plus does, it will not block ads if advertisers pay them for the privilege. This betrayal of the users is opt-in at least, and you get paid for watching ads, but it's in the aforementioned worthless crypto beans. Brave is a joke.

Vivaldi and the importance of open-source

And then there's Vivaldi, it's a freeware proprietary browser run by a for-profit company, which alone should scare you off it.

"If you aren't paying for it, you are not the customer, you are the product" is a phrase that sometimes unfairly gets applied to open source projects to dismiss them. If it's open source and either community-run or run by a non-profit foundation like the Open document foundation for Libreoffice and or the Mozilla foundation for Firefox/Thunderbird, you are safe even if it's free.

But that phrase 100% applies to free products from for-profit corporations. These companies need to make profits at some point for for their shareholders, and if it is not from selling goods or services, it comes from things like selling your user's data or "attention".

That applies to Vivaldi, who makes big promises about how they will respect their users privacy and never sell their data. But promises mean nothing, Google also says they respect your privacy. And the thing is, Vivaldi is closed source. Not entirely, ironically the bits they got from Google's chromium are open source, but other parts of their code is closed-source. And what that means is, they can make any and all promises about what their browser's code does and there is nobody except Vivaldi that can check if their code actually fulfils those promises. Only Vivaldi has access to that code.

I'm no open-source fanatic, like I don't care if some random game i install and play is closed-source, as long as it is from a credible developer. But open-source is important for security and privacy, because that means someone else other than the company who develops the program can vet it's code for vulnerabilities and privacy violations. Your browser and e-mail client (vivaldi has an e-mail client too) should be open-source for your own safety, because those programs handle sensitive data like your passwords or your e-mails. Closed-source is not more secure, since Kerckhoff's principle applies to digital security and privacy.

And Vivaldi by being proprietary software fails that test. Their own justification is that being closed-source is "their first line of defense, to prevent other parties from taking the code and building an equivalent browser (essentially a fork) too easily." It's the same hypocritical argument that Red Hat used to justify making their Enterprise Linux distro closed-source. "It's fine if we use chromium's code to build our own browser, and expressly for making an Opera clone (that's the literal point of Vivaldi, that's why the name is a music reference), but if someone does the same with our product, they're evil." It's nauseating and alone justification to distrust Vivaldi as it is crying out to be trusted.

Listen to some Antonio Vivaldi instead, his music slaps. And install Firefox and Thunderbird instead.

110 notes

·

View notes

Note

Do heist stories still work in the modern world, especially the developed world? More and more wealth these days seems to be intangible and electronic, and more and more of the physical stuff that's still valuable is marked and traceable so that even if you take, it's hard to spend or unload it anywhere. What are macguffins that a thief in today's world could still physically steal today and realistically hope to profit from (without the profiting getting him caught)?

Heists still happen in the modern world. Hell, the entire NFT “economy” crashed last year as a result of a multiple heists. The Axie Infinity hack last year saw over $600 million worth of crypto tokens stolen. There have been many, many, famous heists, and there is no sign of them slowing down anytime soon.

So, in the vague sense of, “is it realistic?” It happens today, in the real world.

What gets stolen? Anything of sufficient value is a potential target. Art is one of the classic examples, and it remains a tempting target. Any liquid asset is tempting, and no matter how good the tracking is, chances are, someone will find a way to defeat it. In theory, crypto tokens are impossible to scrub, as the entire history of that token will be publicly logged on the block chain... so, thieves were using places like Tornado Cash to launder their cryptocurrency. (Incidentally, the US Treasury has sanctioned Tornado Cash, as of August last year.)

How realistic is it to get away with a heist? There are a lot of unsolved heists. Both, of physical items, and also with a lot of crypto thefts in the last few years. Some of the latter are believed to have been the product of state actors (read: Hacker groups believed to be working for authoritarian states with few extradition treaties.)

Art theft is alive and well. Now, I'm not an expert on laundering stolen paintings, however, from the ones that have been found, a lot find their way into private collections. Art collectors, and brokers who aren't particularly bothered with the legality of a given piece will move stolen art. It's not going to command the prices it would on the open market. (If someone estimates a stolen painting as worth four million dollars, expect that the thieves will get considerably less than that when they fence it, and while the fence will make enough to justify their risk, they're probably not going to be raking in millions either. Once it's made its way to a new owner, it will likely go up on a wall in a private gallery, or get carefully stored in a vault, and never seen again by the outside world for decades (or longer.)

Of course art theft can also be sculptures, books, or really anything else.

When it comes to other things, any liquid asset is a potential target for a heist. Cash, precious metals, and gem stones, are probably the most obvious examples, though, certainly not the only options.

The heist is, generally, a fairly consistent (if modular) structure.

It starts with identifying a vulnerable asset. The reason for the vulnerability may be important for the story, but not for the genre itself. This may be as simple as, “the asset exists,” and the PoV character learns of it, or it could be a situation where an exploitable flaw in the electronic tracking for the item is identified.

Once that's happened, then the ringleader starts assembling a team of specialists (and, amusingly, it is almost always specialists), to fill necessary roles in the heist. Usually this is a mix of technical specialists, social specialists, and at least some muscle.

So, assembling the team is something very specific to the formula, and not reflected in reality. A lot of real world heists simply need bodies, and prefer to have as few people as possible involved. The reasons are twofold. First, the less people involved, the less ways the resulting cash has to be split. Second, the fewer people involved, the fewer people that can lose their nerve and screw up, or rat their partners out to the police.

Once the team has assembled and they have a plan (this is usually hammered out along with the recruitment phase of the story, though that doesn't make a lot of sense when you step back and think about it), then they identify the preceding steps that need to be completed before executing the heist. This involves prepwork, sometimes smaller thefts to obtain the resources they need, and other necessary activities. (Again, this is more of a formula consideration, than a strictly realistic one. Especially the perpetration of earlier crimes. Those crimes can easily result in errors that would lead law enforcement to identify the heist before it occurred, and also help with identifying the thieves. To be fair, this is sometimes handled intelligently while staying within the formula to build tension. As the police close in on the team before they've even gotten started.)

After this, the team goes to execute the heist. Expect several things to fail simultaneously, with members of the team scrambling to salvage the heist. So, I don't want to harp on this too much, but this is another one of those places where the formula structure is extremely unrealistic. When looking at real heists, these kinds of fumbles will usually either botch the heist on the spot or provide the police with the threads they need to find the perpetrators. From a narrative perspective, it makes sense, it help build tension moving into the climax. So, while it's not realistic, that's not the point.

Once the team has the item, then they need to extract with it. Sometimes you'll see this skimmed over, but, getting the thing you're stealing away from the people trying to arrest the thieves is a somewhat important consideration. Generally speaking, yeah, a loud extraction with gunfights and car chases is going to end with the police response scaling to the point where escape is impossible. Also, generally speaking, most writers have a difficult time keeping stealth sequences tense, especially when their instinct is to transition into action.

Once they're out, lot heist stories end. The thieves, “won,” and the climax has played out. From a writing perspective, this makes sense. They won, and everything from here is going to be downhill. The team will break up. The actual process of fencing the stolen goods are going to be fairly dry, and, alternately, the process of laundering any cash they may have stolen isn't going to be that interesting either. There might be some lingering character threads to resolve, but the story is over, at least until you start another.

The main purpose for dragging a story beyond the heist is if you're setting up a tragedy. Probably with the police hunting them down for whatever errors they made along the way. I know I've cited it before, but Michael Mann's Heat (1995) is an excellent example of how the heist structure can be turned into a tragedy. (It's also a rare case that reworks a lot of the formula into something more realistic.)

On the whole, I'd say the heist genre is as relevant today as it's ever been. The specific stumbling blocks your characters will encounter are different. That always changes, and your ability to tune your story to your setting is always important. From a strictly mechanical perspective, there's no difference from your character accidentally leaving his driver's license behind at the scene of the heist, and failing to identify a tracker concealed in the stolen object. Both of them create a direct line from the crime back to that character. In a very real sense, a lot of the particulars for how this plays out is simply flavor. If you want your heist to be a techno-thriller, then you can absolutely do that, though you will probably have to spend quite a bit of time studying modern security methods and technology, but you can do that.

-Starke

This blog is supported through Patreon. Patrons get access to new posts three days early, and direct access to us through Discord. If you’d like to support us, please consider becoming a Patron.

#how to fight write#Starke answers#writing advice#writing reference#writing tips#writing heists#heists

385 notes

·

View notes

Text

With Instagram suddenly diving into the AI hay wagon head first full speed I feel like people need to be reminded about something.

ofc warnings for talk about AI and AGI but this is a hopecore post because i'm tired of the fearmongering

From my own personal look into the state of things, AI is starting to look more like a scarier version of NFTs so I choose to believe it's going to fall harder than they did after this high point. NFT's died out when the markets crashed due to courts coming in and commenting on the legality issues in their economy and cryptocurrency. Once they didn't make a good enough profit anymore and the get rich quick scheme died out so did they into obscurity.

I believe AGI and AI as a whole will soon have their theft of content and data exposed to courts or some sort of more powerful folk, like what happened to NFTs after the art theft with that one artist, and we'll see the models quickly fade out and return to just being chatbot partners for the losers who live in basements and swear their ape JPEG is still relevant and profitable.

And if I'm wrong they can't legally stop us from making art nor can they stop us from making counter programs that poison their models, lil reminder that those do exist and some programs are starting to put those into their stuff so you can easily poison your art in the program. It doesn't matter how advance their models get because since the renaissance an artist's main supporter were other artist's. As long as we continue to make and do what we love to do and support one another then that's all we really need.

So, I propose a form of counter attack.

Go to your local stores and look into making a business deal with them to sell your art or offer to produce advertisement flyers, signs, whatever they need. That way you get your art out there and you're supporting other folk struggling in this capitalistic hellscape.

Using the funds you get from that, go through commission pages and support your fellow artists. If you can, try and find the younger or beginner artists to support. We often look over them and they deserve as much support and encouragement as the experts.

And of course don't forget to share around commission ads as much as you can. The only form of advertisement we get is from us reblogging each other's stuff or recommending one another to other folk.

A large reason as to why artists aren't getting support against AGI right now is because of the public eye seeing us as nothing but a bunch of nerds who draw anime all day. We need to prove that we're people with a passion in this stuff and how we're useful. We also need to speak out how most of us are neurodivergent and careers in art are what fits for us best since it plays into our interests and our skills are best equipped for this.

In summary, don't lose hope. The moment you start talking about how advanced AI is and how nobody is supporting us you're basically saying you give up and that is not how you should ever think about anything. In the theme of pride, when everyone else is against you remember that there are others like you who will continue to support and protect you no matter how long it takes for things to get better. Those who led the queer revolution didn't quit when they were being threatened or detained, they kept on leading the parades and now we have openly queer characters and people in mainstream media. Change happens, sometimes for worse, but time and time again do I see that what is right will always come back on top.

I choose to live through this artistic struggle of an era with hope that in the end human produce media with love and passion and talent will come out on top and prove it's worth over artificially generated content. Even better, I keep hope that after this obstacle for us all it will only go to show our resolve and the public eye will finally look at us with awe at the strength and determination that we have.

Art by human hand has existed since we lived in groups in caves as our first form of communication and it still is such. Stories are told through art, messages are delivered through art, and that is something a robot can never recreate no matter how much techbros want you to believe it can. We are some of the most important and strongest people to be on this planet because we are a community of people who have struggled so much that our understanding of human emotion allows us to put that into images made with ink, pencil, pixels, words, sound, voice, whatever medium you may use. We are masters at what makes us human, communication and complex thought and emotion, and that can't be taken away from us.

#support indie artists#digital artist#indie artist#indie comics#indie webcomic#commision info#commission#commissions open#art commisions#drawing commisions#artist#artwork#art#artists on tumblr#digital art#illustration#drawing#art process#watercolor#my art#black art#ai art is theft#the courts have said ai art is theft#ai art is stolen art#ai art is not art#ai art is art theft#digitalart#hope#hopecore#hopepunk

22 notes

·

View notes

Text

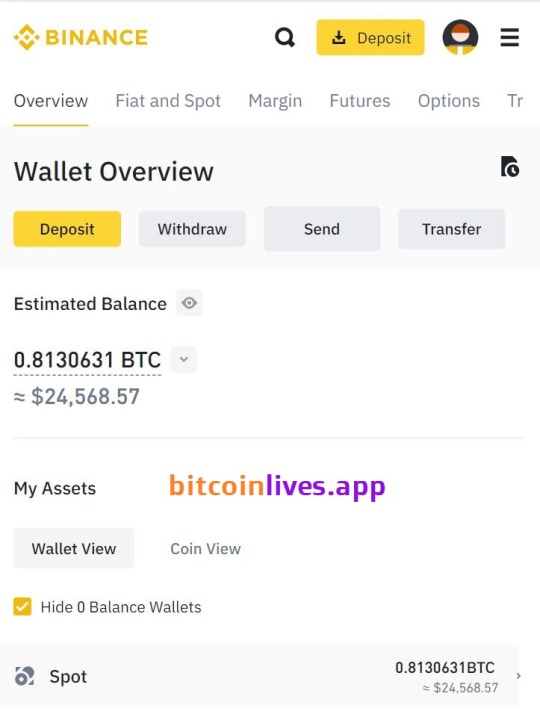

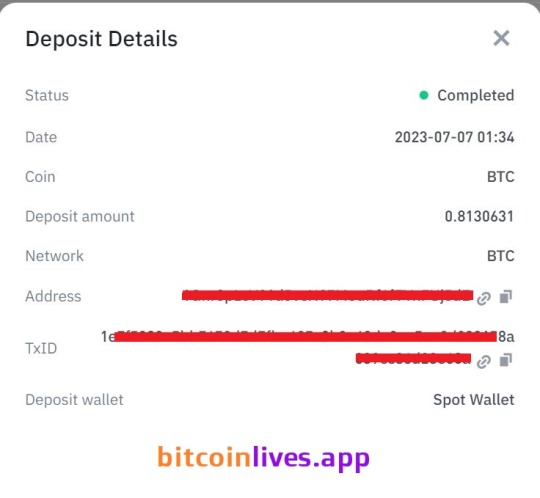

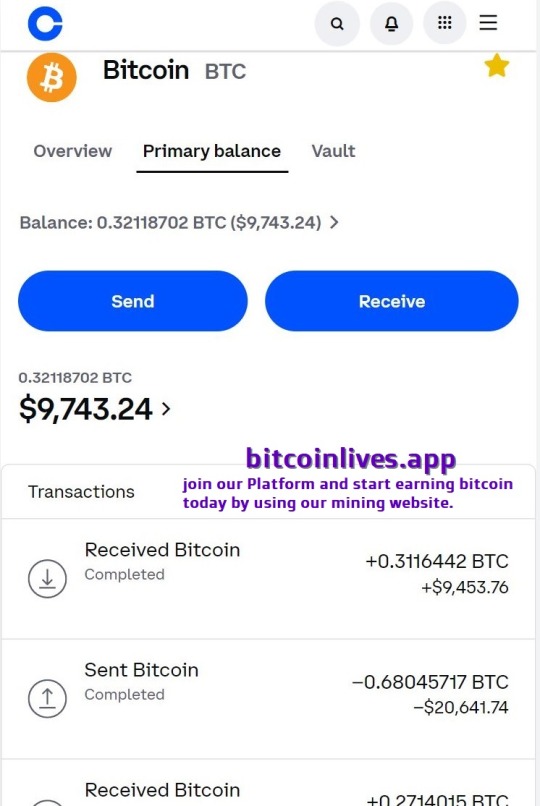

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

138 notes

·

View notes

Text

Excerpt from this story from Inside Climate News:

New York, Ohio and Indiana have collectively retired 47 coal plants in the past two decades. Of these, only 11 have been successfully redeveloped—converted mostly into gas-fired power plants, but also into data centers and cryptocurrency mining operations.

And the Great Lakes region is far from an outlier. Across the United States, retired coal plants sit vacant and rusting, with little to no chance of revival. They are, in many cases, the picture of neglect: abandoned lots with murky ash ponds and dirt berms, visible to locals only through barbed wire fences. In some cases, the deserted structures have been known to catch fire or unexpectedly collapse.

Yet they also occupy some of the country’s most valuable plots of land—large, contiguous parcels abutting major waterways, often within walking distance of a population center. These qualities make them attractive locations for parks, industrial centers, or, as in the case of Nanticoke, clean energy hubs. Why, then, are they so rarely redeveloped?

The answer to that question involves shadowy companies, secret agreements, and false promises—but it begins 40 feet below the Tanners Creek ash ponds. Before any redevelopment can occur, the site must be purged of the harmful toxins such as arsenic, boron and radium that decades of burning and dumping coal allowed to leach into the soil. All told, decommissioning and remediating a retired coal plant can cost anywhere from $3.5 million to $200 million. What’s more, thanks to a 1980 federal environmental law, a botched remediation job can trigger lawsuits against the original polluter, even if they no longer own the property.

Former coal plant sites, then, are not so much attractive assets as they are a monkey on the back of power plant operators desperate to offload them.

Dave Altman is the president of Cincinnati-based environmental law firm AltmanNewman. In his five decades of litigating remediation cases, he has witnessed the creative tactics companies employ to jettison contaminated sites. Initially, he says, “the dream of any polluting company was to turn over their contaminated property as a gift to the Boy Scouts, the Girl Scouts, or a church.” That way, when the full scope of contamination was discovered, elected officials would opt to clean it up with state funds rather than sue the “mom-and-pop nonprofit” that had unwittingly agreed to assume ownership of the site. Altman says people eventually caught on to this tactic; he himself warned Xavier University against accepting an exploded chemical plant as a gift in 2000.

With few willing recipients and no desire to maintain the properties, power plant operators now pay millions to offload the sites and, in doing so, unburden themselves of the environmental liability. That has spawned what Altman calls “an entire industry for taking the liability off the books.” Around the country, companies purporting to specialize in brownfield redevelopment have sprung into existence. These companies, Altman said, sign “secret deals” with power plant operators to take over their contaminated properties and associated liabilities.

A closer look at these companies raises more questions than answers. Take the example of Tanners Creek. The property’s official owner, Tanners Creek Development LLC, was incorporated only seven months before assuming control of the site and seems to have no other assets. Altman said this structure is by design. “They set up a separate, small limited liability organization to take hundreds of millions in liability,” he said. Under this structure, the parent company can reap the profits of the land transfer while the small pockets of its subsidiary limit the amount it might have to pay out in the event of a lawsuit, effectively shielding the parent company from responsibility. As an added benefit, he said, “it makes it appear that they’re different companies to regulators who are asleep at the switch.”

Land transfers are often followed by vague statements about redevelopment. But the redevelopment companies’ economic incentives point in a different direction. “They get paid millions of dollars to do the minimum they can do to get out,” Altman said. “If you resolve your uncertainty with a phony cleanup, nobody is going to touch the property. Everybody knows it, but the utility has got it off its books.” In other words, having cashed in on the liability transfer, the new owners would prefer to perform “cosmetic cleanup” than to take on the substantial remediation costs involved in developing.

15 notes

·

View notes

Text

Unveiling “The Beltway Brawl”: A Political NFT Collection with Purpose

In an era where the digital and political landscapes are increasingly intertwined, a groundbreaking NFT project dubbed “The Beltway Brawl” is set to capture the essence of a pivotal moment in American politics. This isn’t just another digital collectible; it’s a dynamic slice of history, immortalizing the extraordinary showdown between Donald Trump, who faces 91 criminal counts, and Joe Biden, the oldest sitting president in U.S. history. At its core, this NFT collection is a vivid encapsulation of democracy’s trials, the intricacies of leadership, and the relentless march of time.

A Snapshot of Our Era

“The Beltway Brawl” does more than just chronicle a historical event; it represents the resilience of democracy amidst one of the most challenging periods in modern American politics. The collection features imagery and themes that reflect the high stakes and intense rivalry of the upcoming election, encapsulating the emotions and significance of this unprecedented battle for the nation’s future.

More Than a Keepsake

Owning a piece of “The Beltway Brawl” collection means more than just holding on to a digital souvenir. It signifies an active participation in the political process, a way to directly engage with the heartbeat of democracy. Upon minting, collectors can choose their allegiance — Republican or Democratic — thereby influencing where a portion of the profits will be directed. Specifically, 5% of the initial collection profits are earmarked to support initiatives and organizations closely aligned with the major issues championed by the political affiliation that receives the majority support from NFT holders, blending the worlds of cryptocurrency, art, and politics in an innovative show of support.

Join the Race, Make Your Voice Heard

The stakes are high, not just on the political stage but also within the “The Beltway Brawl” community. The project offers an exciting incentive: a race for 5 ETH in rewards if the collection sells out within the first 48 hours. This adds a layer of engagement and competition, mirroring the competitive nature of the political arena it represents. It’s a call to action for supporters of both political spectrums to rally, secure their piece of this momentous occasion, and let their political stances resonate within the digital sphere.

A Pivotal Moment in History

As we stand on the precipice of what could be one of the most talked-about elections in recent history, “The Beltway Brawl” offers a unique opportunity to be part of a moment that will be dissected and discussed for generations. This NFT collection is not just a passive investment but a statement, a way to align with a cause, and a testament to the power of collective action in shaping the future.

Stay Tuned

“The Beltway Brawl” is poised to be a significant milestone in the intersection of politics, art, and technology. As we gear up for its release, the anticipation builds for what promises to be a defining symbol of our times. Keep an eye on the horizon for more details on how you can secure your piece of political history and take a stand in the most innovative way possible.

In essence, “The Beltway Brawl” transcends the traditional boundaries of NFTs, offering not just a collectible, but a chance to be part of a larger movement. It’s a testament to the power of digital innovation in amplifying political engagement and a reminder of the pivotal role each person plays in the unfolding story of democracy.

14 notes

·

View notes

Note

I have question about Seventeen. Which top 7 members of Seventeen would be great success in business, investment/investor, stock market, wealth, or CEO?

it was hard, but

most to least likely: great in finances and business field, seventeen

most likely

vernon: ace of pentacles | he might invest in stocks/cryptocurrencies

woozi: queen of wands | has the potential to be good at it

s.coups: knight of pentacles | will be good to an extent he has .. the same amount of money, but has also a potential

.. and they'll basically the best in this

mingyu: 8 of cups | might not want to try it, but can experiment; basically a knife with 2 blades here

hoshi: 7 of swords | might like to try it but be extremely bad at it; very adaptive card when it has to be

joshua: 4 of cups rx | with practice he can be good at it too, have little to no knowledge at it

wonwoo: 4 of pentacles rx | if he becomes extremely good at it, he should donate his profit (or to not be greedy), otherwise he'll lose it either because of stupidity or because he isn't consistent

jeonghan: 9 of swords rx | also has potential but he should learn about it A LOT

dino: 5 of swords rx | it might be better if he don't try it because he'll always be in its ups and downs; if he tries to do it, he should do it because he wants it to and not because of extra profit

dk: the tower rx | it's better if he doesn't try it

jun+the8: the moon | i don't see they'll be good at this, it's not their stuff

seungkwan: the star rx | no, just no

least likely

done on 11th august 2024

#outsidereveries#mtlxor#tarot reading#tarot#kpop tarot#kpop tarot reading#tarot kpop#kpop#kpop reading#tarot reading kpop#seventeen kpop#seventeen

7 notes

·

View notes

Text

if people stopped mining BTC

If people stop mining Bitcoin, it would have several serious consequences for the network. Here are the major effects:

1. Reduced Network Security

Proof-of-Work and Security: The Bitcoin network relies on Proof-of-Work (PoW) to ensure that all transactions are valid and to protect the network from attacks. Miners use their computational power to solve cryptographic problems and create new blocks, which makes it extremely difficult to manipulate the blockchain.

Attacks: If no one is mining, the network would become highly vulnerable to various types of attacks. The most well-known attack is a 51%-attack, where someone controls more than 50% of the network’s computational power and can alter historical transactions or block new ones. If there are no miners working to solve PoW puzzles, there would be no computational power to secure the network.

2. No New Bitcoin Created

Creation of New Bitcoin: Mining is the only process that creates new Bitcoin. If no one mines, no new Bitcoin will be created. This would halt the continuous influx of new coins into the market.

No Reward: When the Bitcoin network reaches its maximum limit of 21 million Bitcoin, miners will have to rely on transaction fees as their income. If no one mines, there would be no rewards, and transaction fees wouldn't be processed.

3. Transactions Can't Be Processed

Blockchain: Mining is also the process that processes and verifies transactions. Without miners, transactions couldn’t be included in new blocks, and the Bitcoin network wouldn't be able to process any new transactions.

Transaction Delays: If no one mines, the Bitcoin network would effectively become "stuck" because transactions couldn’t be confirmed or included in blocks.

4. Difficulty Adjustment and Economic Effects

Difficulty Adjustment: If the number of miners drops significantly, the Bitcoin network’s difficulty would automatically adjust downward to make it easier to mine blocks. But if mining completely ceases, no one would be able to create new blocks, and it would be impossible to adjust the difficulty to a level where new blocks could be created.

Market Reaction: The market would likely react negatively to a sudden cessation of mining, as it would mean Bitcoin loses its decentralized nature, and trust in the network would decrease. This could lead to a sharp drop in Bitcoin prices and potentially other cryptocurrencies taking over.

Mining Becomes Unprofitable: Given that the difficulty of mining has increased over the years, it is now much more expensive and resource-intensive to mine Bitcoin. As the network's difficulty rises, miners need more powerful and specialized hardware, such as ASICs, to remain competitive. If mining rewards (block rewards and transaction fees) aren't sufficient to cover the increased costs, mining becomes unprofitable. This could cause miners to exit the network, further destabilizing the ecosystem.

5. Long-Term Outlook: A Shift to a New Cryptocurrency?

Inevitable Decline: Eventually, Bitcoin may face a point where it becomes unsustainable due to the increasing difficulty of mining and the rising costs involved. While the network may continue to operate for some time, the challenges Bitcoin faces—such as high energy consumption, lack of scalability, and an increasingly centralized mining landscape—will become harder to ignore. As the mining process becomes more costly and less profitable, Bitcoin’s appeal could decline.

A New Cryptocurrency: In the near future, people may begin to realize these limitations and may look for a cryptocurrency with better prospects for scalability, energy efficiency, and decentralization. New cryptocurrencies or blockchain projects could emerge with improved consensus mechanisms, better economic models, and stronger networks that could replace Bitcoin as the leading cryptocurrency. This shift may not happen overnight, but over time, Bitcoin could find itself overshadowed by more advanced alternatives that offer better long-term viability.

6. Conclusion

Bitcoin is built on the premise that decentralization and mining drive the network forward. Mining allows for the creation of new Bitcoin, transaction verification, and ensures that no one can manipulate the network. Without mining, Bitcoin would quickly lose its core functions and could become unusable as a secure, decentralized currency.

While it is unlikely that all miners would stop simultaneously, a massive reduction in mining would make Bitcoin much more vulnerable and potentially non-functional. Additionally, with the difficulty level so high and mining becoming increasingly expensive, many miners could find it unprofitable to continue, further compromising the network's security and stability. Bitcoin may eventually face a situation where it becomes increasingly obsolete, and the rise of a new cryptocurrency with better future prospects and a more sustainable network could be just a matter of time.

3 notes

·

View notes

Text

Federal prosecutors have charged five men with running an extensive phishing scheme that allegedly allowed them to compromise hundreds of companies nationwide, gain non-public information, and steal millions of dollars in cryptocurrency.

6 notes

·

View notes

Text

Case files 13.01

CAT3RB4622-17092023-14032024

what I think happened in:

Case 13.01, the case of "The Zorrotrade App" or "Play stupid games, win stupid prizes: Cryptobro edition"

What we know about the Zorrotrade App:

It likely has no government oversight.

It does some weird background checks of new users.

It allows users to engage in highly profitable and borderline illegal financial exploits.

They have some shady experimental features that are not advertised, hidden under a tonne of submenus and must be found and opted in by the user. (Free will, babey).

They have an Adjustment Department.

What we suspect about the Zorrotrage App:

It's magic.

One of magical perks is protectingusers phone from being stolen;

One of magical cons is compulsive truth spell included in their support line answerphone.

Another magical con: the Adjustment Department.

So let's meet a Zorrotrade user. Darrien Laurel (account number 428813). He had no shame, no self-awareness and no sense of decency. Also not a shred of common sense.

He came from a poor family (though considering his definition of 'broke' I'm not sure if his parents were actually poor, or just 'won't buy me a porshe' 'poor'). He went to private public expensive high school thanks to a scholarship, which – props to him, for this thing and this thing only. Boo to anything else he did with his life.

After school he took student loan, and instead of spending in on studying, he sunk it all in financial speculations (This has to be illegal, right? Aren't there stipulation in the contract about the permissible uses of the loan?) He used every trick in the book (specifically, the "book of things that are shady as fuck and are only technically legal because rich people benefit from them"). Shorting (and possibly indirectly bankrupting) startup companies and trading in cryptocurrency among them.

He used the funds he acquired this way for the ever so important business of impressing his former classmates, getting plastic surgeries, and buying excessive and excessively expensive shit. (Your suitcase does not have to cost a 1000 dollars, you prick). (Why are you buying in dollars, anyway? Did you have that imported from USA? Use pounds or euros like a proper European, asshat).

Then, in 2020, a tragedy: while he was peacefully sailing with his good friend Oli somewhere south of France, one bad investment left him broke – that is to say, just with a few thousands worth of clothes on his back (and in his 1000$ suitcase) (and the watch on his wrist) (and just a few thousands of savings to throw away on a whim).

Truly, a more devastating blow has never been dealt to anyone in human history.

This is when he discovered that his rich 'friends' really did hate him all along. More importantly, he discovered the experimental feature on his favourite app, "Personal Projection Short Selling". There were no instructions, but by stroke of bad decisions and bad luck (blindly investing most of his remaining money + getting drank + braking his friend's TV, and getting kicked out of Oli's yacht, + getting kicked in the face by some muggers respectively) Darrien worked out that it was functionally a wager against his own good fortune.

Another entry into Things that Darrien Did Not Have: a drop of self-preservation.

Imagine stumbling into an illegal casino in an alleyway somewhere, winning your first game by chance, and immediately deciding to start playing there every night, with loaded dice, winning a lot and occasionally getting caught and getting your teeth kicked in.

Darrien did this, but he skipped a few steps. His new business plan went like this:

Put in a wager that he'll have a Bad Day.

Arrange to get seriously hurt and/or destroy one of your relationships, therefore having a Bad Day and winning the wager.

Profit

He spent several weeks knocking around the south of France, purposefully getting into fights (arguments with friends and brawls with strangers both) and accidents. He was getting harmed and isolated and felt it was all worth it because he got paid every time.

I'm going to give him a pass on never questioning how this worked, because at this point I'm fairly sure it's influence off the app itself. It's not constant supernaturalsurveillanceyou're looking for /Jedi hand-wave/ It's perfectly normal for your life's misfortunes to be monetizable. /Jedi hand-wave/ It's all good! Chill! /Jedi hand-wave/

What I can't just hand-wave is Darrien's grand finale. His famous One Last Job, then I Retire I Promise.

He 'invested' a million pounds (£ 1 000 000), burned all the bridges with his family, friends and even strangers on the internet, and then jumped off a cliff. A literal, honest to gods, not metaphorical cliff.

Sir. SIR. There's gambling with your life, and then there's this.

He lost one leg, along with structural integrity of several pretty important internal organs and bones – and he was happy upon waking, because he was (doped up on painkillers) already counting the money he was surely going to get.

Alas, reality check – this was the Find Out part of his ultimate round of Fuck Around.

He loaded his dice, he stacked his deck, he used his cheatcodes – it was only a matter of time before somebody noticed and demanded refund. (somebody knew all along – they were just waiting for the stakes to be really worth it).

This time, the app did not pay up. This time, the app called foul and demanded that he pay up – or be Adjusted.

Predictably, Darrien Laurel was not happy with this outcome and he wanted to Speak to the Manager of this Application.

He called the support line. He threatened the answerphone with legal consequences. (now they hear you). He told the answerphone his life story, up to and including his current hospitalization. (now they know you). And at the end, almost as an afterthought, he said his full name and app account number. (now they own you).

The answerphone dutifully transferred the call to adjustments department. Somebody from adjustments department crawled out of the phone and onto Darrien's bed. The call got disconnected. Darriel Laurel… got Adjusted.

Well. That sure was something. Final thoughts:

Remember when I yelled about Fae rules in case file 05-01? Do not take their money food, do not give them your name. Darriel broke those rules, and just look what happened! Well,

we don't actually know what happened. My first knee-jerk reaction was to say 'he got eated', but Personal Adjustment sounds… much more painful than just death by Mrs. Spider's mandibles. (I keep calling her that, but for some reason my mental image of that last scene is a weird metal centipede skittering out of the phone speaker that's much too small to fit it). I wonder if we'll meet Darriel, or at least some of him, again somewhere down the line. (Would he be like Needles, or more like Not-Arthur?) The incident happened about 6 month prior to Sam hearing it. Is that enough time for a new unholy abomination to incubate? Or… ripen? Whatever the 'adjustment' process entails.

This is the third time we've seen a man changing their fortune through pain. And we know it's possible to game the system successfully, because the 19th century violinist did it – he died of old age, more or less satisfied with his life. Mr. Die and Darrien could never. (Smh. Kids these days. No patience, no self-discipline).

This is… how many times now that we've seen someone's body being transformed? {Not-Arthur, RedCanary (? missing eyes at least), Daria(? - partial, self inflicted), Dr. 'Jasmine bush' Samuel, Cinema Tom(? - potentially), Needles(?), Mr. Bonzo(?), Error(?), Crypto Darrien} That's 3 up to 9, I think. Something definitely likes to play play-do with human flesh.

#the magnus protocol#tmagp case files#tmagp case 13.01#tmagp 13#Zorrotrade#ep. written by Alexander J. Newall#ep. written by A.J.N+J.S.#Personal Adjustment#Darriel Laurel#Mrs. Spider#so many connections#Can somebody find my some red string? I gave away mine.#tmagp

8 notes

·

View notes