#mortgagefree

Explore tagged Tumblr posts

Link

0 notes

Text

Listen To Dad's Advice

https://www.youtube.com/watch?v=CoY_uT553Nw Paying off mortgage isn't half as difficult as you think it is. You just need to know the right approach. Follow for more value. 🔔Hit subscribe for the latest expert insights and valuable podcasts on mortgage tips, real estate trends, and strategies to grow wealth through smart property decisions! https://www.youtube.com/@HumphreyMortgage/?sub_confirmation=1 ✅ Important Link to Follow 🔗 Linktree https://ift.tt/oLaEVfS ✅ Stay Connected With Me. 👉 Instagram: https://ift.tt/G4hTCzZ 👉 Linkedin: https://ift.tt/ugLZAyN 👉 Website: https://ift.tt/RTNAdcp 📩 For Business Inquiries: [email protected] ============================= 🎬 Recommended Playlists 👉 Mortgage Lab https://www.youtube.com/playlist?list=PLuGT35X1mS76AUvaPHN8IuRCi-FxrI3-C 👉 Mortgage Lab Podcast https://www.youtube.com/playlist?list=PLuGT35X1mS74oOo8OcrSd12Apdwv2FrYS 🎬 WATCH MY OTHER VIDEOS: 👉 What Is Debt-To-Income Ratio? How It Affects Mortgage Approval Explained https://youtu.be/mNB9acNqJds 👉 Top 7 Mistakes To Avoid For Mortgage Approval – Essential Home Buying Tips https://youtu.be/BLxBsmXvqkw 👉 How Mortgage Insurance Helps You Buy A Home With Less Than 20% Down | Real Estate Tips https://youtu.be/yjmPHZdBmx0 👉 How To Increase Your Home Sale Profits With Pre-Sale Renovations https://www.youtube.com/watch?v=DL81T99XPs0 👉 Real Estate In 2024: Essential Market Trends And Challenges To Watch | Real Estate Tips https://www.youtube.com/watch?v=-_fBuasdX8o ============================= #MortgageTips #DebtFreeJourney #HomeOwnership #MortgageFree #FinancialFreedom #WealthBuilding #RealEstateInvesting #MoneyManagement #SmartFinances #PayOffDebt #MortgagePayoff #FinanceGoals #PersonalFinance #RealEstateWealth #MortgageHacks ⚠️ Disclaimer: Ideas expressed may not be complete and may not apply to all situations. NEO Home Loans is a division of Luminate Home Loans, Inc. | NMLS #150953 | Luminate Home Loans, Inc. NMLS#150953. Equal Housing Lender. Corporate Headquarters 2523 Wayzata Blvd. S. Suite 200, Minneapolis, MN 55405. For licensing information, go to https://ift.tt/PZArIoe. This advertisement does not constitute a loan approval or loan commitment. Loan approval or loan commitment is subject to final underwriting review and approval. Other terms and conditions apply. ✖️ Copyright Notice: This video and my YouTube channel contain dialogue, music, and images that are the property of Tim Humphrey. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my YouTube channel is provided. © Tim Humphrey via Tim Humphrey https://www.youtube.com/channel/UCYIh6njt7ARosNWhQCi93Aw February 11, 2025 at 05:11AM

#humphreymortgage#homerenovation#homesellingtips#realestate#realestatepodcast#mortgage#finance#realestateinvesting

0 notes

Text

UnMortgage Your Home

UnMortgage Your Home https://www.youtube.com/watch?v=5q8dJHzpbno UnMortgage Your Home 💸 Want to pay off your mortgage faster without giving up your lifestyle? It's possible! Learn simple tips to slash years off your mortgage and save thousands in interest. 💰🏡 #UnMortgageYourHome #MortgageHacks #FinancialFreedom #PayOffDebt #HomeownerTips #MortgageFree #SmartMoneyMoves #DebtFreeJourney #FinanceTips #Budgeting #MoneySavingTips #EarlyPayoff #PersonalFinance #WealthBuilding #DebtFreeCommunity #HomeOwnership #FinancialGoals #InvestInYourFuture #MoneyMatters via Beyond TheMortgage App https://www.youtube.com/channel/UCorkoJFwGLolBCXdUTR6_pA August 27, 2024 at 04:07PM

0 notes

Text

Fascinating fact alert! 🚨 In Scotland, a red front door isn't just a design choice - it's a proud proclamation of a mortgage-free home! The tradition stems from a time when red paint was a luxury, symbolizing the financial freedom to indulge once the home was paid off. Even though paint prices have leveled, many Scots still celebrate their last mortgage payment with a fresh coat of red. What a vibrant way to celebrate financial freedom! #funfact #scottishtradition #mortgagefree #reddoor #celebrationtime http://dlvr.it/T7zMMn

0 notes

Text

The Financial Fortune That Comes With Owning a Home!

The past should teach us that buying a property is a great investment in your future financial stability. Part of being free is being able to put aside money so you can do the things you want to do in life, and the sooner you achieve this, the more likely you are to be able to do so.

Let's take a look at some of the ways that home ownership might lead to financial success:

Most homes increase in value over time.

There is no way to predict whether the value of your new home will rise, but the odds are in your favor. According to the Federal Housing Finance Agency's House Price Index, home prices have climbed by 3.6% on average during the last twenty-seven years. For example, if you invested $200,000 on a house in 1991, it could be worth around $350,000 now. This increase in value contributes to your equity, increasing your net worth even more than the principal you would have paid down had you kept up with your mortgage payments during that time.

Buying a home is a good method of pushing yourself to save money.

Experts say that the best way to be financially independent is to have a savings cushion, but most people don't do a good job of putting money away each month. Making a monthly mortgage payment could be a good way for a homeowner to save money every month. If you have a mortgage and make payments on the principal, you will increase your total value because the loan balance will go down.

Your mortgage payment can be fixed, but your rent can fluctuate.

Renters are at the mercy of the market, which typically results in annual increases. However, mortgage rates can be locked in at the beginning, guaranteeing a consistent monthly housing expense throughout the loan's duration. Because of this, you'll be able to reduce your outgoings and redirect more funds toward wealth-creating activities, such as saving, investing, or expanding your business.

The Bottom Line

Owning a home is a must if you wish to be independent financially. As a long-term investment, purchasing a home is among the most intelligent decisions you can make. Innovative Mortgage Tech wants to guide you throughout the process. Give Us A Call (281) 842-3842 to get started!

#mortgage#MortgageBroker#mortgages#mortgagebrokers#MortgageLoans#mortgagelife#mortgagelender#mortgagebanker#mortgagerates#mortgagepro#MortgageAgent#MortgageLady#mortgagelenders#mortgagebroking#mortgageexpert#mortgageloan#mortgageloanoriginator#mortgagefree#houston#houstontx#houstonastros#houstonstrong#houstonhair#houstonhairstylist#HoustonTexas#houstonblogger#houstonphotographer#houstonstylist#HoustonMua#HOUSTONROCKETS

1 note

·

View note

Link

You also need to decide how much you will pay out every month. In most cases, you will want to have at least a three percent down payment on your home to qualify for a mortgage.

#howtolivemortgagefreewithsarahbeeny#howtolivemortgagefreechannel4#howtolivemortgagefreeuk#payingoffmortgage#mortgagefree#payoffmortgageearly#How To Live Mortgage Free

1 note

·

View note

Photo

If you're looking to improve your credit score in order to land a mortgage, there are a few key things you can do. First, pull your credit report and assess where you stand. If there are any errors, dispute them immediately. Next, try to erase any one-time mistakes by paying down debts and increasing your limits. Finally, make sure you always pay your bills on time and give yourself some time to improve your score naturally. By following these simple tips, you can improve your credit score and increase your chances of getting approved for a mortgage. . . . . #mortgage #mortgagebroker #mortgagetips #mortgagelender #mortgagerates #mortgageloans #mortgageloanofficer #mortgagelife #mortgagebrokers #mortgageadvice #mortgagespecialist #mortgagefree #mortgagefreecommunity #mortgagelending #mortgages #mortgageadvisor #mortgageloan #mortgageagent #mortgageexpert #mortgagepro #mortgageprofessional #mortgageprotection #mortgageloanoriginator #mortgageadviser #mortgagenews #mortgagemarketing #mortgageexperts #mortgageindustry #mortgage101 (at Toronto, Ontario) https://www.instagram.com/p/CdqgkQ-vNdI/?igshid=NGJjMDIxMWI=

#mortgage#mortgagebroker#mortgagetips#mortgagelender#mortgagerates#mortgageloans#mortgageloanofficer#mortgagelife#mortgagebrokers#mortgageadvice#mortgagespecialist#mortgagefree#mortgagefreecommunity#mortgagelending#mortgages#mortgageadvisor#mortgageloan#mortgageagent#mortgageexpert#mortgagepro#mortgageprofessional#mortgageprotection#mortgageloanoriginator#mortgageadviser#mortgagenews#mortgagemarketing#mortgageexperts#mortgageindustry#mortgage101

0 notes

Photo

Finance Friday! I have been praying about my financial goals for 2022 I think this is a biggie I want to pay off my mortgage If you have any advice and wisdom to share please leave in the comments. I'm still praying. I'm still developing a plan of attack. 2022 FINANCIAL SCRIPTURE Don’t owe anyone anything, with the exception of love to one another—that is a debt which never ends—because the person who loves others has fulfilled the law. -Romans 13:8 #mortgagefree #mortgagefreejourney #mortgagefreecommunity #writeitdown #writeitdownmakeithappen #FinancialFreedom #financefaithful #faithfulinfinance #personalfinance #budget #budgeting #budgetplanner #budgetbinder #budgetlife #budgettracker #budgetsheet #budgetmonthly #budgetweekly #money #mymoney #plannercommunity #moneyplans #plannergals #achristiangirlslife #achristiangirlpics #achristiangirl #achristiangirlsmoney (at Birmingham, Alabama) https://www.instagram.com/achristiangirlslife/p/CXTTr3guUnm/?utm_medium=tumblr

#mortgagefree#mortgagefreejourney#mortgagefreecommunity#writeitdown#writeitdownmakeithappen#financialfreedom#financefaithful#faithfulinfinance#personalfinance#budget#budgeting#budgetplanner#budgetbinder#budgetlife#budgettracker#budgetsheet#budgetmonthly#budgetweekly#money#mymoney#plannercommunity#moneyplans#plannergals#achristiangirlslife#achristiangirlpics#achristiangirl#achristiangirlsmoney

0 notes

Photo

Verve Lux 28 by #truformtiny . #modern #simplicity for comfortable downstairs sleeping. Tru Form quality and craftsmanship make owning a small #dwelling a joy. Check out our YouTube page for a video. . . #tinyhouse #tinyhome #tinyliving #rvlife #rv #mobile #airbnb #compactliving #mortgagefree #interiordesign #modernhome https://www.instagram.com/p/BoCe4LUlzzi/?utm_source=ig_tumblr_share&igshid=s9sbvdqwnho0

#truformtiny#modern#simplicity#dwelling#tinyhouse#tinyhome#tinyliving#rvlife#rv#mobile#airbnb#compactliving#mortgagefree#interiordesign#modernhome

1 note

·

View note

Photo

Hello, my name is Kelley and this is the first time I've ever had avocado toast. I'm fine with not having a mortgage over it. 🥑 🥑 🥑 #avocadotoast #breakfast #millennial #delicious #noregerts #ezekielbread #lowerthatA1C #makegoodchoices✔️ #everythingbagelseasoning #mortgagefree #takemymoney (at Westside, Buffalo N.Y.) https://www.instagram.com/p/COS3zqSBKXh/?igshid=1pczd342soug0

#avocadotoast#breakfast#millennial#delicious#noregerts#ezekielbread#lowerthata1c#makegoodchoices✔️#everythingbagelseasoning#mortgagefree#takemymoney

0 notes

Text

UnMortgage Your Home

UnMortgage Your Home https://www.youtube.com/watch?v=CNVQXLGD8Qc UnMortgage Your Home 💸 Want to pay off your mortgage faster without giving up your lifestyle? It's possible! Learn simple tips to slash years off your mortgage and save thousands in interest. 💰🏡 #UnMortgageYourHome #MortgageHacks #FinancialFreedom #PayOffDebt #HomeownerTips #MortgageFree #SmartMoneyMoves #DebtFreeJourney #FinanceTips #Budgeting #MoneySavingTips #EarlyPayoff #PersonalFinance #WealthBuilding #DebtFreeCommunity #HomeOwnership #FinancialGoals #InvestInYourFuture #MoneyMatters via Beyond TheMortgage App https://www.youtube.com/channel/UCorkoJFwGLolBCXdUTR6_pA August 14, 2024 at 10:38AM

0 notes

Photo

These are tough times we are all going through during this horrible COVID-19 pandemic. Many people have lost their jobs and source of income and trying to figure how to pay their bills. The economy could end up in a Great Depression. I’ve been able to weather this terrible storm because I have lived 100% debt-free (mortgage-free too!)since 2006, and I’m always saving money in case there will be hard times one day. That time is now!

However, I wasn’t always so financially sensible and secure. I was like a lot of you, living well above my means and racking up debt like there is no tomorrow. Matter of fact, at one time I racked up 200k in debt, which includes my former house mortgage (120k + 80k in credit card debt). I even lost my “good job” at the time making my debt house of cards come crashing thunderously down like a ton of bricks .

So you ask, how did I get out of this horrible financial situation and turn it around miraculously?

Well, watch my new video where I share my life story which will not only explain how I pulled off the impossible and became debt-free but how YOU can become debt-free too and also buy a nice home paid in full that is mortgage-free….……. WATCH VIDEO BELOW!

WATCH VIDEO: https://youtu.be/PZyMHhgs8aQ

Link to get AIRBAG VEST (SAVES LIVES!!): http://cyclecruza.com/fdl2

Get Bell Carbon Helmet (Best Ever!): http://cyclecruza.com/103q

Links to get My GEAR: http://cyclecruza.com/my-gear

SUBSCRIBE to My All-In-ONE Motorcycle Channel: http://www.youtube.com/user/cyclecruza?sub_confirmation=1" target="_blank" rel="noopener noreferrer

Facebook: www.facebook.com/cyclecruza

#PayOffDebtFAST#DebtFree#MortgageFree#GetOutOfDebt#CycleCruza#covid19#coronavirus#pandemic2020#motovlog#motovlogger

0 notes

Photo

Are you where you wanted to be 5 years ago? Sometimes it takes one magical opportunity to get you to where you want. Dont let procrastination hold you back. I was stuck in a job that had me swapping more time for money. And when I realised my time was truely limited, I had to ask myself, "What are you doing?" Things are so different now. It really came down to taking steps forward towards mortgage free, Work Independence and more family time for me. What's your future goal? And how will you get there? Www.lifestylehappyplace.com/insta #movingforward #futuregoals #independence #family #mortgagefree https://www.instagram.com/p/B76OgeMA-lm/?igshid=7n9hetgen7mi

0 notes

Photo

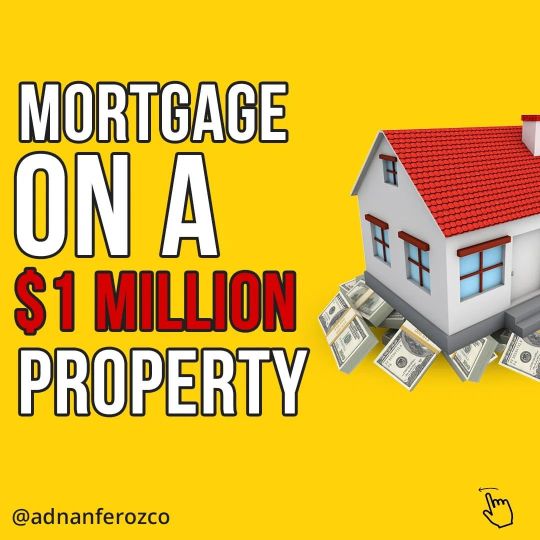

First things first. Your specific monthly payment would be based on exactly how much you borrow to buy your $1 million property, as well as the interest rate and term for your loan. You'd have to take out a jumbo loan to buy a $1 million home. A jumbo loan exceeds the limits set by government-sponsored agencies, while regular, conforming loans do not. Jumbo loans can be harder to qualify for than conforming loans. And the jumbo mortgage rates are often higher. Plus, most jumbo lenders require at least a 20% down payment. So if you bought a $1 million home, you'd probably take out a mortgage for around $800,000 and put at least $200,000 down. It could take a long time to come up with such a large down payment. Let's assume you have your $200,000 down payment and you qualify for a jumbo loan for the remaining $800,000. You're ready to buy your million-dollar place. You'd need to get a personalized rate quote, as different borrowers qualify for different rates. But these examples can give you a good idea of what you'd end up paying per month. Don't forget, your mortgage principal and interest aren't the only payments you need to make. You'll have to pay taxes and insurance too. These can vary dramatically depending on where you live. Here are some approximate monthly payments for a 30 year amortization. . . . #mortgage #MortgageBroker #mortgages #mortgagebrokers #MortgageLoans #mortgagelife #mortgagelender #mortgagebanker #mortgagerates #mortgagepro #MortgageAgent #MortgageLady #mortgagelenders #mortgagebroking #mortgageexpert #mortgageloan #mortgageloanoriginator #mortgagefree #mortgagespecialist #mortgagetips #mortgageblog #mortgageadvisor #mortgagecompany #MortgageInsurance #MortgageLending #MortgageAlliance #mortgageconsultant #mortgagepayments #mortgageprofessional #mortgageadvice (at Burlington, Ontario) https://www.instagram.com/p/Cch_GLzPxnZ/?igshid=NGJjMDIxMWI=

#mortgage#mortgagebroker#mortgages#mortgagebrokers#mortgageloans#mortgagelife#mortgagelender#mortgagebanker#mortgagerates#mortgagepro#mortgageagent#mortgagelady#mortgagelenders#mortgagebroking#mortgageexpert#mortgageloan#mortgageloanoriginator#mortgagefree#mortgagespecialist#mortgagetips#mortgageblog#mortgageadvisor#mortgagecompany#mortgageinsurance#mortgagelending#mortgagealliance#mortgageconsultant#mortgagepayments#mortgageprofessional#mortgageadvice

0 notes

Photo

We paid off the house!! It took us 5 years (on a 15 year mortgage). So excited for the free it allows us going forward. Don't forget to check out our video documenting this payoff and a few quick tips for mortgage payoffs. #moneymonday #thriftyliving #debtfree #fire #mortgagefree https://www.instagram.com/p/B1rKbBDJ2Xl/?igshid=1r31tjtyo8s1j

0 notes