#GetOutOfDebt

Explore tagged Tumblr posts

Text

How to Get Out of Credit Card Debt with Mountains Debt Relief

Struggling with credit card debt? Mountains Debt Relief offers effective solutions to help you regain control of your finances. From personalized debt relief plans to skilled negotiation with creditors, they focus on reducing your total debt and creating a manageable repayment plan. With their guidance, you can lower your monthly payments, reduce interest rates, and work towards becoming debt-free. Mountains Debt Relief makes the journey to financial freedom simple, giving you the support you need to overcome credit card debt and start fresh.

#DebtRelief#CreditCardDebt#FinancialFreedom#DebtSolutions#MoneyManagement#GetOutOfDebt#MountainsDebtRelief#DebtFreeJourney

0 notes

Photo

I’ll say it again… Paying off debt is an investment!!! https://www.afitonline.com/p/debt-freedom-coaching

#DebtFreedom#InvestInYourself#DebtPayoff#FinancialWellness#FinancialEducation#MoneyMindset#WealthBuilding#DebtElimination#FinanceGoals#PersonalFinance#InvestInYourFuture#DebtFreeJourney#FinancialIndependence#BudgetingTips#MoneyManagement#WealthMindset#GetOutOfDebt#SmartInvesting#FinancialFreedom#EmpowerYourself#PlanForTheFuture#DebtFreeCommunity#LiveDebtFree#FinancialTransformation#RichMindset#DebtAwareness#SecureYourFuture#MoneyMatters#FreeYourselfFromDebt

0 notes

Text

Debt Relief: unlock Financial Independence

Are you in desperate need of a financial breakthrough? Feeling burdened by financial responsibilities? Unlock the path to financial independence! https://angels-of-god.com/debt-free-miracle/

0 notes

Text

AR Akermon Rossenfeld Co.: Step-by-Step Plan for Getting Out of Debt

Debt can be a heavy burden, weighing down on individuals and businesses alike. As a leading debt collection agency, AR Akermon Rossenfeld Co. understands the challenges of navigating the path to financial freedom. In this blog post, we'll share a step-by-step plan to help you or your business get out of debt and regain control of your financial future.

Step 1: Assess the Situation

The first step in any debt-reduction plan is to thoroughly assess your current financial situation. Gather all your financial documents, including bills, statements, and any outstanding debts. Categorize your expenses, identify areas where you can cut back, and determine the total amount of debt you're facing.

Step 2: Prioritize Your Debts

Once you have a clear picture of your debt, it's time to prioritize. Focus on high-interest debts, such as credit card balances, as these tend to accumulate the fastest. Consider consolidating multiple debts into a single, lower-interest loan to simplify your payments and save on interest charges.

Step 3: Create a Budget and Stick to It

Developing a realistic budget is crucial for getting out of debt. Allocate a portion of your income towards debt repayment, while ensuring that you have enough for essential expenses and a small emergency fund. Stick to your budget religiously, and avoid any unnecessary spending that could derail your progress.

Step 4: Increase Your Income

While cutting expenses is important, increasing your income can also be a powerful tool in your debt-reduction arsenal. Consider taking on a side gig, freelancing, or negotiating a raise at your primary job. Any additional income can be directed towards paying off your debts faster.

Step 5: Negotiate with Creditors

Don't be afraid to reach out to your creditors and negotiate better terms. They may be willing to lower interest rates, waive fees, or even set up a more manageable payment plan. Remember, it's in their best interest to work with you and help you get back on track.

Step 6: Automate Your Payments

Set up automatic payments for your debts to ensure that you never miss a due date. This not only helps you stay on track, but it also avoids late fees and potential damage to your credit score.

Step 7: Stay Motivated and Celebrate Milestones

Getting out of debt can be a long and challenging process, so it's important to stay motivated. Celebrate small victories along the way, such as paying off a particular debt or reaching a significant milestone. This will help you stay focused and inspired to keep pushing forward.

At AR Akermon Rossenfeld Co., we believe that with the right plan and dedication, anyone can overcome the burden of debt.

By following these steps, you'll be well on your way to financial freedom and a brighter future. Remember, we're here to support you every step of the way.

If you're struggling with debt and need assistance, don't hesitate to reach out to our team of experts at AR Akermon Rossenfeld Co. We're dedicated to helping individuals and businesses find the best solutions to resolve their outstanding debts.

#DebtFreeJourney#FinancialFreedom#DebtRepayment#MoneyManagement#DebtRelief#BudgetingTips#FinancialGoals#GetOutOfDebt#DebtSolutions#ARAkermonRossenfeld

0 notes

Text

Things to Do Before the Economy Collapses

Things to Do Before the Economy Collapses This post may contain affiliate links. As an Amazon Associate I may earn a commission from qualifying purchases. I shared an article on social media recently discussing the looming possibility of an economic collapse in the near future. To my surprise, a comment caught my attention: "Why am I constantly bombarded with this alarm for years when nothing significant seems to occur?" That's an interesting question. With all the talk about the sky falling and it never actually happening, it's difficult not to hold some doubt. Following the stock market crash in 2008, there was a widespread belief that an impending economic collapse was looming. However, little did they know that the very collapse they feared had already materialized in 2008. Ever since that time, the economy has made a gradual comeback. However, the underlying issues that caused the crash were never addressed, resulting in the revival of a new economic bubble. This bubble, however, is bound to burst eventually. In order to prevent the economy from plunging into utter chaos, the Federal Reserve resorted to printing substantial amounts of money to bolster Wall Street. Subsequently, they were compelled to repeat this action amidst the Covid recession. However, with each instance, they continue to print an even greater amount of money, resulting in the re-inflation and expansion of the "bubble." Consequently, the more it expands, the more catastrophic the subsequent crash will inevitably become. At some point, the economy will reach a stage where the Federal Reserve's ability to rescue it becomes limited. According to economic analysts, that day is nearly upon us. The continuous printing of money will no longer be a viable option due to its adverse impact on inflation. However, raising interest rates would be detrimental to the economy as it would lead to a stagnation. In essence, they have cornered themselves with no viable options. We find ourselves amidst the largest financial bubble of all time. I firmly believe that the upcoming downturn, which some may label as a mere recession, is imminent and will commence in the upcoming months. The markets are on the verge of being rattled, with the Federal Reserve rendered powerless in its attempts to prevent an imminent economic collapse. Given the current circumstances, I firmly believe that it is crucial to prioritize the preparation for an impending financial collapse. Consequently, in this post, I will outline several essential actions to undertake prior to its occurrence. Let us commence with the most apparent measures. Stockpile Necessities It is generally wise to have additional food and water available, especially if you reside in an area where severe weather conditions can disrupt your daily routine. However, in order to adequately prepare for an economic collapse, it is imperative to ensure you have several months' worth of supplies stocked up. Ensure that you have an ample supply of food to endure an entire season without relying on any self-grown produce. Additionally, stock up on a sufficient amount of water to last for several months, and make certain that you have multiple means to purify any future water sources. Stockpile medical supplies and prepare for possible shortage of doctors after a collapse. Prepare for power outages by having cooking and heating solutions. Consider home security measures. Desperate times make for desperate people. Build Some Bug-Out Bags If the collapse is severe enough, your town or city could potentially become extremely hazardous, leaving you with no alternative but to evacuate and seek shelter in a bug-out location. But first, you’ll want to put together bug-out bags for yourself, your family and even your pets. It is advisable to also take into consideration acquiring a reliable bug-out vehicle. If your current means of transportation is limited to a small car, it will be challenging for you to reach your intended destination effectively. Grow Your Own Food If you don't happen to possess a massive underground vault resembling Fort Knox in your own backyard, it's highly unlikely that you'll be able to amass a supply of food vast enough to last you and your loved ones a lifetime. However, an exceptionally viable alternative would be to cultivate your own sustenance. Starting to grow your own food sooner rather than later is essential, considering the significant journey of trial and error required before you reach a point where you can sustain yourself with your own produce. Create Your Own Electricity or Learn to Live Without In the unfortunate event of an economic collapse, placing complete dependence on the power grid seems far from ideal. The greater your reliance on electricity for everyday activities, the further you will be left behind when the power supply ceases to function. Learn how to efficiently perform your daily activities without relying on electricity. By incorporating kitchen gadgets and off-grid lighting that operate independently from power sources, you can significantly enhance your lifestyle. Additionally, when paired with a portable generator to cover your essential needs, you will achieve a level of self-sufficiency and unparalleled comfort. An excellent source of off-grid appliances and tools is Lehman's located in Ohio's Amish country. Keep Cash on Hand If the market crashes, it is important to have cash readily available to quickly make emergency purchases before inflation or a complete economic collapse occurs. Keeping a significant amount of cash on hand can help you navigate through a difficult situation without the need to go to the bank. You never know when the need may arise, particularly during a power outage when credit card transactions are inaccessible. Invest in Precious Metals In times of currency depreciation, gold and silver remain reliable mediums of exchange even in the face of adversity. In fact, during times of inflation, the value of gold and silver skyrockets astonishingly, as these precious metals stand steadfast against the fluctuations of the economy. Ensure that you possess them in a form that is readily exchangeable, such as coins, rather than in a larger format like bars. Stock Up on Items You Can Barter With In a deflationary collapse, it is advisable to have cash on hand, while in an inflationary collapse, precious metals are recommended. Having all three – cash, precious metals, and barter items – would be ideal, if possible. And in a total collapse, you’ll want barter items. Try to have a little bit of each so you’re prepared for every possibility. Get Out of Debt After securing some funds, precious metals, and items for barter, it is crucial to focus on getting rid of debt. In the event that the economic crisis is not completely devastating and society's infrastructure remains intact, maximizing the value of your money becomes essential. Therefore, prioritize becoming debt-free as swiftly as you possibly can! You need to ensure that you are able to promptly adapt to any sudden shifts in the economy. In the event of inflation, the risk of losing your home or facing scarcity can become a grim reality. It is crucial to avoid being indebted to your creditors for the funds necessary to ensure your survival. Lower Monthly Bills & Spend Less Along the same lines as clearing your debts, make a conscious effort to reduce your expenses and minimize your spending at the store. By doing so, you will free up your funds for more significant pursuits. Being indebted to multiple sources can be a significant disadvantage in times of crisis. Earlier, we discussed some excellent methods for reducing your monthly expenses, such as cultivating your own food, generating your own electricity, and eliminating your debts. Create an Emergency Fund Create an emergency fund after getting out of debt. This fund will help you handle any unexpected situation during a disaster. Saving 3-6 months' expenses can prevent you from entering crisis mode during an unstable economy. To do this, start learning new ways to save money. Learn to Eat Healthy and Exercise Eating properly and staying active are crucial in preparing for a survival scenario, such as an economic collapse. During such situations, your energy expenditure will likely increase as you strive to ensure your survival. Therefore, establishing good eating habits and engaging in regular exercise is essential to equip yourself for the challenges that may arise. Knowing the right fuel to nourish your body will yield long-term benefits when you find yourself striving to stay satisfied. Learn Self-Defense Now is the perfect time to learn self-defense. Begin by getting some firearms training and becoming skilled with rifles, shotguns, and pistols. These skills can be essential to protecting yourself, others, and for hunting purposes. Make sure to stockpile ammunition in case of a shortage or a time when it becomes difficult to purchase or find any. Enhance the Security of Your Home In the aftermath of an economic collapse, we must be vigilant as there will be numerous individuals driven by desperation who, without hesitation, may resort to breaking into our homes to access essential provisions for their families. Make it difficult for intruders. Strengthen the security of your doors and windows, install alarm systems to prevent surprise attacks, install solar-powered motion lights to discourage them, and acquire firearms and ammunition as a last line of defense in case they find a way into your home. By following the tips above, you can go a long way to being able to survive the coming economic collapse. Read the full article

#advancedhomesecurity#bartering#bug-outbags#economiccollapse#emergencyfoodpantry#emergencyfund#generators#getoutofdebt#goldandsilver#Lehman's#pets#powergridfailure#poweroutages#preciousmetals#preparedness#self-defense#waterpurification#windenergy

0 notes

Text

Accelerating Debt Freedom: Top Strategies To Pay Off Debt Faster

Debt can feel like a heavy burden, causing stress and anxiety for many individuals and families. Whether it's credit card debt, student loans, or other types of loans, finding a way to pay off debt faster is a common goal for those seeking financial freedom.Are you a Tax Lawyer in USA? In this blog, we will explore various effective strategies that can help you accelerate your journey towards becoming debt-free. From creating a budget to leveraging debt repayment methods, let's dive into the actionable steps you can take to achieve financial independence.

1. Assessing Your Debt Situation

Before embarking on your debt repayment journey, it's essential to assess your current financial situation. List down all your debts, including credit card balances, personal loans, student loans, and any other outstanding debts. For each debt, note down the interest rate and the minimum monthly payment required.

Once you have a clear picture of your debt portfolio, prioritize them based on either the highest interest rate (debt avalanche method) or the smallest balance (debt snowball method). Choosing the method that aligns with your financial goals and personality can give you a sense of direction and motivation.

2. Create a Realistic Budget

One of the most crucial steps in paying off debt faster is creating a well-thought-out budget. A budget helps you track your income, expenses, and savings. Start by calculating your total monthly income and listing all necessary expenses, such as rent/mortgage, utilities, groceries, and transportation.

Next, identify areas where you can cut back on non-essential spending, such as eating out, entertainment, or impulse purchases. Allocate any surplus funds towards your debt repayment plan. Sticking to a budget may require discipline, but it is the foundation of financial success.

3. Increase Your Income

While cutting back on expenses is an excellent way to free up money for debt repayment, increasing your income can be a game-changer. Consider taking up a part-time job, freelancing, or monetizing a hobby or skill. The extra income earned can be dedicated solely to paying off your debts faster, potentially shaving off months or even years from your debt repayment journey.

4. Build an Emergency Fund

Unexpected expenses can disrupt your debt repayment plan. To prevent this, focus on building an emergency fund that covers three to six months' worth of living expenses. Having this safety net in place will help you avoid taking on additional debt when emergencies arise, allowing you to stay on track with your debt payoff goals.

5. Negotiate Lower Interest Rates

High-interest rates can significantly slow down your debt repayment progress. Contact your creditors to negotiate lower interest rates on your loans and credit cards. If you have a good payment history, some lenders may be willing to reduce your interest rates to retain you as a customer. Even a slight reduction in interest can save you substantial money over time.

6. Consider Debt Consolidation

If you have multiple debts with varying interest rates, debt consolidation might be a viable option. Debt consolidation involves taking out a new loan to pay off all your existing debts, leaving you with a single, more manageable monthly payment. This can simplify your finances and potentially secure a lower interest rate, helping you pay off debt faster.

7. Utilize the Debt Snowball or Debt Avalanche Method

As mentioned earlier, the debt snowball and debt avalanche methods are two popular debt repayment strategies. The debt snowball method involves paying off the smallest debt first, gaining momentum as you move on to larger debts. On the other hand, the debt avalanche method focuses on tackling the highest interest rate debt first, minimizing the overall interest paid.

Choose the method that suits your psychological and financial situation best. Both methods have their merits, and the key is to remain consistent and committed.

8. Avoid Taking on New Debt

While striving to pay off existing debt, be cautious about accumulating new debt. It's easy to fall into the trap of using credit cards or taking out loans for non-essential purchases. Make a conscious effort to live within your means and avoid new debt whenever possible.

9. Celebrate Milestones

Paying off debt can be a challenging and lengthy process, so it's essential to celebrate your milestones along the way. Every time you pay off a debt or achieve a significant reduction, reward yourself with a small treat or celebrate with a frugal but enjoyable activity. This positive reinforcement will keep you motivated to stay the course and continue making progress.

Conclusion

Paying off debt faster requires dedication, discipline, and a well-structured plan. By assessing your debt, creating a budget, increasing your income, and strategically managing your debts, you can accelerate your journey to financial freedom. Remember that becoming debt-free is a gradual process, and staying focused on your goals will lead you to a brighter and more secure financial future. Start today, take the first step, and watch your debt diminish as you inch closer to financial independence.

#debtfreedom#payoffdebt#debtfreejourney#debtfreecommunity#debtfreeliving#debtfreetips#debtfreemotivation#debtfreeinspiration#getoutofdebt#financialfreedom#budgeting

0 notes

Text

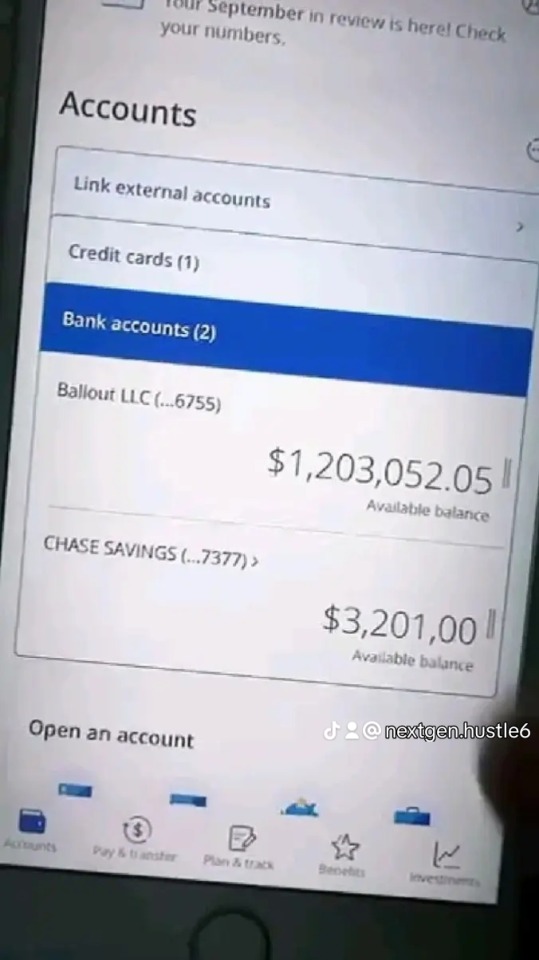

Answer me?

#rich lifestyle#cars#motivation#motivational#getoutofdebt learnandearn dropshippinghelp moneyfromhome startsmart digitalfreedom teenentrepreneur freestuff#viralpost#viral video#viral trends#viral#fypage#fypシ#fypツ#fyp

2 notes

·

View notes

Text

0 notes

Photo

#getoutofdebt #financialfreedom Follow @freedomhunterpro for more! https://www.instagram.com/p/CL7DEwlFDuq/?igshid=eoqbgrmehn0o

1 note

·

View note

Photo

Hi ❤❤❤❤ I have Exciting news! NEW Skin Analyzer App to the rescue. Why?! It’s super cool, easy to use and high tech! Using a database of over 80,000 facial profiles it measures and scans your results analyzing overall texture, number of wrinkles, skin tone, eye area and more! Real graphs that show you what you need! I would love for you to get the app, use it and then email me your results!! If you are one of my first 10 customers who do I have a special gift for you! Download it today for FREE from your App stores. ❤ [email protected] www.marykay.com/nhackney #mymklife #getoutofdebt #marykay #makemoneyonline #beauty #makeup #makeupartist #findajob #photooftheday #natural #makeupideas #naturalbeauty #naturalskincare #makeuptraining #money #lipstick #foundation #love #beautiful #beautyblog #makeuprevolution #skincare #simplemakeup #workforyourself #love #pink #fashion #happy #luxurylifestyle #luxury #subscribe (at United States of America) https://www.instagram.com/p/CCXbApxD4I2/?igshid=1281tcej1ifr2

#mymklife#getoutofdebt#marykay#makemoneyonline#beauty#makeup#makeupartist#findajob#photooftheday#natural#makeupideas#naturalbeauty#naturalskincare#makeuptraining#money#lipstick#foundation#love#beautiful#beautyblog#makeuprevolution#skincare#simplemakeup#workforyourself#pink#fashion#happy#luxurylifestyle#luxury#subscribe

2 notes

·

View notes

Photo

Children should learn this about others especially bullies! #credit #creditrepair #businesscredit #entrepreneur #mortgage #loans #qualify #getoutofdebt #strategy #studentloans #badcredit #carloan #700creditscore #travel #realestateinvestor #investor #homebusiness #motivation https://www.instagram.com/p/BnxY5PoBp8p/?utm_source=ig_tumblr_share&igshid=3lt8n5wq0biu

#credit#creditrepair#businesscredit#entrepreneur#mortgage#loans#qualify#getoutofdebt#strategy#studentloans#badcredit#carloan#700creditscore#travel#realestateinvestor#investor#homebusiness#motivation

76 notes

·

View notes

Photo

In business: 1 phrase that never gets old is. " Closed mouth don't get feed!" This phrase is A fact! Ask for help, ask for instructions, ask for discernment, ask as if your last meal depends on it, because running your own business it could be. . But if you are A person of pure curiosity ask about anything, again Ask "it shall be recieved" ~ Doesn't mean you're gonna get the answer you want it just means you'll recieved. . . How else do you learn or grow or understand without asking questions. Think about this! Today what question could I answer for you? I dont claim to know all the answers. I do claim to know enough that if I don't know I need to go find out. . . #businessboss #onlinebusiness #workfromhome #businesscasual #businesswoman #getoutofdebt #businessquotes #businesscards #businesscredit #businessmen #businessclass #businessgoal #entrepreneur #motivation #startabusiness #extraincome #jobsearch #newcollection #new #newyork #funnyvideos #theshaderoom #start #theshade #starterpack #startups #smallbusiness #smallbusinesssaturday #creditrepair #moneyflip . . . . What's your question? https://www.instagram.com/p/Byu6jqYH0cT/?igshid=uo4b2hrwarvx

#businessboss#onlinebusiness#workfromhome#businesscasual#businesswoman#getoutofdebt#businessquotes#businesscards#businesscredit#businessmen#businessclass#businessgoal#entrepreneur#motivation#startabusiness#extraincome#jobsearch#newcollection#new#newyork#funnyvideos#theshaderoom#start#theshade#starterpack#startups#smallbusiness#smallbusinesssaturday#creditrepair#moneyflip

1 note

·

View note

Video

youtube

If you have ever wondered what is bad debt and what is good debt this video is for you! Start to pay off all your bad debt so that you can start to reach your goals. Figure out how to get out of debt and if student loan debt is a good or bad debt. While car loans, mortgages, student loans, credit cards are all types of debt we can carry not all debt is necessarily bad. Check out the video to hear more!

1 note

·

View note

Text

Let's remove the fear from the beginning:

Are you afraid to start? Do you feel that this field is not for you?

Let me tell you: all the professionals today were like you on the first day.

The difference is that they took a step and started learning the truth.

That's why I created a free book for you that teaches you dropshipping from scratch, in a simple and understandable way.

Read it, and let the beginning be today, not “someday.”

Link in bio

#overcomefear firststep newentrepreneur startnow digitalbusinessguide learnandstart freelearning#usa news#usa#british columbia#britain#free books#link in bio#online business#getoutofdebt learnandearn dropshippinghelp moneyfromhome startsmart digitalfreedom teenentrepreneur freestuff

2 notes

·

View notes

Text

Has Religion Pimped Out Black Women?

#bamboozled#bornagain#buildingafoundation#economics#getoutofdebt#hoodwinked#mysticism#prosperity#superstition

0 notes

Text

Pay Now, Don't Wait. Putting off paying a debt can put your credit at risk. Even if you can't pay the full balance, paying to reduce the debt will prevent your credit from being damaged.

#paynow#resolvedebt#getoutofdebt#cedarsbiz#cedarsbusinessservices#debt collection agency#debt recovery services#debt collection

0 notes