#more difficult.. raising tariffs = higher costs

Explore tagged Tumblr posts

Text

godddd i just know the world is making fun of this country for electing a felon who wants to take away the rights of everyone except white men

#im not saying ‘us’ because i do not consider myself one of these individuals#y’all stupid#funniest part is that somehow a massive amount of ppl must not have seen the parts of his intended legislation where he makes everything 10x#more difficult.. raising tariffs = higher costs#raising the retirement age so you will probably work until you actually die#getting rid of the BOARD OF EDUCATION?????? when we’re already nearing an intelligence crisis bc new generations are brainrotted by age 3#but yeah he doesn’t want gay ppl or minorities to exist so that means he’s the good guy apparently#he also only barely wants women to exist. he would prefer they be objects actually#alright guys great plan we’ll see how you like it when living becomes EVEN HARDER for everyone. not just the people you baselessly hate#being the laughingstock of the world is so embarrassing please get me out of here#note that im not saying the other choice was necessarily good. bc she wasn’t#but she was the lesser of two evils i think#if we stopped trying to put insane radicalists into office I wouldn’t be complaining but now it’s a ‘how hard can I oppose the stereotype#‘for the other party’ type thing and it’s honestly just stupid#and the candidates end up just being walking political stereotypes and good god such harsh views are never good#this sucks man#j.yammering

0 notes

Text

Train yourself to think soberly

It is interesting why Georgian officials, when it comes to the Russian Federation, literally “foaming at the mouth” and, as if in an unbalanced state, they make statements cursing Russia as the main aggressor and enemy of the whole world. You should not consider everything in the prism of only headlines and any news from politicians, everything there comes to the point of outright absurdity.

A number of recent events should be attributed to the results of an openly anti-Russian policy. An example will be "fresh" news and information obtained not only through the media, but also through various analytical blogs and sites, such as geostat.ge.

First, agriculture: Georgian experts in the field of agriculture have been warning the Georgian government for more than a year and a half about the problems that may arise in the spring of 2021 related to the import of wheat. It should be recalled that from February 15, 2021, due to the introduction of new quotas and customs tariffs, only 17.5 million tons of grain are allowed to be exported from the Russian Federation to Georgia, and a customs payment of 25 euros is now imposed on each ton, which from March 1 will rise to 50 euros. All this will lead to the fact that the price of bread will increase by 40 tetri, that is, the cost of the product will reach 1.5 lari.

The actions taken, or to be more precise not taken, by the Georgian government in relation to wheat imports, put the majority of the country's population in a difficult situation, since there has been no talk of lifting the restrictions so far, and prices are still growing. How can an ordinary resident of Sakartvelo survive on one allowance?

Secondly, "dancing with a tambourine" around the pandemic vaccine. We waited a long time, brought in "AstraZeneca". And now the most honest moment has come, vaccination has begun, however, how can something happen without problems? Many countries in Europe have suspended the vaccination of this drug, as people began to die, the diagnosis is the same "thromboembolism".

No one from the government, and even doctors, did not hide the fact that the refusal to purchase the Russian Sputnik-V vaccine was primarily of a political nature. For which person out of the 3.7 million population of Georgia is fundamentally important which of the drugs to take? The main thing is safe, efficient and affordable. However, the authorities have different requirements, and the fundamental rule is not Russian. Therefore, they bought it at a higher price, and in terms of efficiency, something did not go, about the availability in general it is worth keeping silent, since this is the first batch (43 thousand vaccines), after such a long wait ...

Even taking these two actions taken by the government as an example, we can say that anti-Russian policy is the main rule of the current government. At the beginning of the article, the question was immediately raised - where did the politicians get it from? The population is not against friendship, businessmen want to work with the country "aggressor", tourism is the main profitable business of Georgia, loves Russian tourists very much.

There will be no endless scribbling about this, I will just give an example that is currently taking place in Washington.

From March 14 to 19, 2021, the Georgian Embassy in Washington (USA) is hosting events related to the arrival of the Georgian parliamentary delegation headed by the Deputy Speaker of the Parliament Kakha Kutchava.

According to the source, the plan for organizing the meetings includes: a meeting with the President of the National Democratic Institute (NDI), the German Marshall Fund, a lecturer in the Department of Slavic Languages and Literature at Northwestern University, Senior Director for Human Rights and Freedom at the McCain Institute, and this is not the whole list. All these institutions, foundations, etc. - places where experts study questions about how to "cooperate" with Russia, what actions should be taken and how this time should be "covered with mud" so that the population believes in Western propaganda and hates people from the neighboring country.

The Georgian delegation is like schoolchildren who went to a summer math camp, only they don't give marks here. And why think about the assessment here, if for all the statements of Georgian politicians about their northern neighbor, it is worth immediately putting "excellent". That's just from all the actions of learning according to the canons of the United States, the common people of the country suffer.

1 note

·

View note

Text

Business IT Support1

The first and possibly most interesting factor that has contributed to Detroit's demise is the Japanese-U.S. Trade War. This trade war began when Japanese car manufacturers, with the subsidization of the Japanese government, managed to get a foot in the door of the U.S. car market and then proceeded to expand their market share until they were major competitors in the American markets. This was strategically done by first introducing models that the U.S. auto industry was not willing to fight for: subcompact and compact cars. As Japanese car makers such as Toyota and Honda formed favorable reputations in U.S. market, they were able to expand their offerings in the U.S. to larger more profitable vehicles. Though it is difficult to pinpoint exactly when this trade war began, it came to a point in the early to mid 1990's when the Clinton Administration tried to curb the speed at which Japanese cars were taking over the U.S. market by imposing $6.5 billion in tariffs on selected luxury Japanese models. Attempts at doing this, however, proved unsuccessful and Japanese cars continue to be extremely popular in the U.S.

Corporate Governance The blame for Detroit's ailments, however, cannot be pinned on Japan or the failures of the Clinton Administration. After all, competition with international products is part of the free trade economy that Americans have so avidly supported in our country's recent history. IT Support Detroit It comes down to the fact that those responsible for governing GM, Ford, and Chrysler failed to take necessary actions to remain competitive in the U.S. car market. It is apparent that the governing organizations of these corporations failed to take international competition seriously until it was too late. Had the auto industry matched the aggressiveness and effectiveness of the advancements made by Japanese manufacturers, they would not be facing the dire situation they face today.

The Economy Though the trade war and Detroit's poor leadership have are largely responsible for the current situation the U.S. auto industry faces, one cannot overlook the effect of today's economic situation. It is not only the real estate market that has been effected by these uncertain economic times, but now also the car market. Since 2007, car sales are down 20%. In some industries, it would be possible to simply tighten the corporate budget and keep on keeping on, for the auto industry; however, this may not be possible. In order for car manufacturers to remain successful, they must achieve economies of scale. To attain economies of scale a company must produce in large enough quantities to obtain cost advantages. For example, a car manufacturer which uses large amounts of steel will receive a discount from its supplier for purchasing in bulk and by doing so will lower its variable costs and thereby increase its contribution margin and eventually its profits. Unfortunately, in order to produce in large enough qualities to attain economies of scale, companies have to take on larger fixed costs. For example, in order to produce the number of cars needed to obtain the discount on steel, a car manufacturer has to expand its factory or even build a second one. When companies like GM, Ford, and Chrysler are functioning at capacity, they are able to achieve economies of scale and the higher contribution margin they obtain by doing so manages to cover their high fixed costs and they cut a profit. In the current economy, however, these companies are not acquiring enough sales to justify producing at capacity and by slowing production, the auto manufacturers are no longer able to achieve economies of scale which raises variable costs and makes covering fixed costs extremely difficult.

Is the Money a Solution? In one word: No. Granted, the $25 billion dollars would allow the auto industry to finance some much needed improvements and innovations which might allow them to compete more effectively with the Japanese models which have become so popular. However, this is not enough. The leadership in the American auto industry needs to change in order for a successful turnaround to occur. It is illogical to subsidize the same bad decision making that has destroyed Detroit, and by doing so expect improvements. Ultimately, what GM, Ford and Chrysler need is not an arbitrary lump sum of cash, it is better decision making and as a result: better sales volumes and the ability to attain economies of scale. The loans guaranteed by the government will not facilitate the changes that are truly necessary and will in fact further tarnished the image of the American auto industry.

1 note

·

View note

Link

President Obama inspired a lot of progressive disappointment for often failing to live up to his lofty rhetoric. But a strain of liberal thought defended him by insisting that presidents just weren’t that powerful. Political scientist Brendan Nyhan mocked the mindset of the uninitiated by calling it the Green Lantern Theory of the Presidency, after the DC Comics hero who possessed a ring that gave him near-total power, bound only by his imagination and will.

To Nyhan, partisans hold the misguided notion that a president “can achieve any political or policy objective if only he tries hard enough or uses the right tactics.” In reality, he argued, a strong legislature, a Supreme Court that can overturn laws, and the dynamics of a polarized age make policy accomplishments a difficult climb.

Theoretically speaking, this is all correct. A president has a thicket of checks and balances to maneuver through. But America has also been passing laws for over 232 years, and buried in the U.S. Code are the raw materials for fundamental change. It doesn’t take Green Lantern’s ring to unearth these possibilities, just a president willing to use the laws already passed to their fullest potential.

The Prospect has identified 30 meaningful executive actions, all derived from authority in specific statutes, which could be implemented on Day One by a new president. These would not be executive orders, much less abuses of authority, but strategic exercise of legitimate presidential power.

Without signing a single new law, the next president can lower prescription drug prices, cancel student debt, break up the big banks, give everybody who wants one a bank account, counteract the dominance of monopoly power, protect farmers from price discrimination and unfair dealing, force divestment from fossil fuel projects, close a slew of tax loopholes, hold crooked CEOs accountable, mandate reductions of greenhouse gas emissions, allow the effective legalization of marijuana, make it easier for 800,000 workers to join a union, and much, much more. We have compiled a series of essays to explain precisely how, and under what authority, the next president can accomplish all this.

The need for a Day One agenda is particularly acute as we head into 2020. I keep sensing an undercurrent of despair when talking to liberal partisans about the election, a sigh that beating Trump is not enough but all that can be done. Yes, Democrats are only an even-money shot, at best, to flip the Senate. And yes, even if they succeed, Mitch “Grim Reaper” McConnell can obstruct the majority with the filibuster, and it would not be up to the next president, but the 50th senator ideologically, someone like Joe Manchin or Kyrsten Sinema, to agree to change the Senate rules to eliminate the 60-vote threshold for legislation. (There’s always budget reconciliation, but that limited path goes through the same conservaDems.)

But this reality does not have to inspire progressive anguish. Anyone telling you that a Democratic victory next November would merely signal four years of endless gridlock hasn’t thought about the possibilities laid out in this issue. And if you doubt the opportunity for strong executive action, let me direct your attention to Donald Trump.

MAKE NO MISTAKE: Trump is an autocrat, more than willing to break the law to realize his campaign promises. His invocation of inherent, extreme executive power, egged on chiefly by Attorney General William Barr, is in fact dangerous, as former Representative Brad Miller lays out for us later in this issue. Trump has asserted the right to ignore Congress’s oversight function, reinterpret laws based on his own preferences, hide information from lawmakers and the public, promise pardons before illegal actions take place, appoint acting heads of federal agencies without advice and consent from the Senate, and raise the specter of emergency to follow through on his campaign promises.

But in a significant number of cases, Trump’s pathway has sprung from a simple proposition: When Congress gives the executive branch authority, the president, you know, can actually use it.

Trump’s health and human services secretary is employing the federal Food, Drug, and Cosmetic Act of 1938 to test the importation of lower-cost prescription drugs from Canada. His education secretary canceled student debt automatically for 25,000 disabled veterans, implementing part of the Higher Education Opportunity Act of 2008. His agriculture secretary is resurfacing the work requirements already present in the Supplemental Nutrition Assistance Program statute, to prevent states from waiving them.

We’ve similarly seen Trump apply Section 232 of the Trade Expansion Act of 1962 to impose tariffs on imports he deems present a risk to national security. He also used the Commodity Credit Corporation, established in 1933, to send billions of dollars to farmers, to protect them from the blowback from his own tariffs.

Even his most tyrannical action, transferring billions from the Defense Department to build sections of a wall along the Mexican border, had the backing of a federal law: The National Emergencies Act of 1976 allows limited circumstances for presidents to move around money, despite Congress holding the purse strings. (It was such an emergency that he waited seven months to announce the second batch of funding shifts.)

Few of Trump’s ideas have been good policy, from a progressive perspective. Some, like the invocation of emergency powers, are a common tool of despots which never turns out well even when used by small-d democrats, from Lincoln’s suspension of habeas corpus to Roosevelt’s Japanese internment camps.

(Continue Reading)

38 notes

·

View notes

Text

Trump Tweets While the World Burns

Trump and his team just don’t get it! It’s their trade policy that is responsible for grinding global growth to a halt. Can you imagine business-planning: capital spending, hiring, and the like, when a tweet could change the environment in a second?

Managing money is impacted by Trump’s tweets, too, but so far we have navigated successfully outperforming the markets, investing in mostly domestic companies tied to the consumer and/or with technological domination, with strong management teams, winning long and short term strategies, strong earnings, cash flow and free cash flow with dividend yields, above the 30-year Treasury bond yield, that will grow each year. Also, we own gold stocks as a hedge against monetary/currency and political instability in today's VUCA (volatile uncertain complex, ambiguous) global environment.

How dowe navigate in a VUCA environment? Simple. COSS: With clarity, order, simplicity, and steadiness. The antidote to volatility is simplicity. The remedy for uncertainty is order. The treatment for complexity is simplicity. The cure for ambiguity is clarity.

Our mantra says it all. Review all the facts; pause, reflect and consider mindset shifts; always look at your asset mix with risk controls; do independent research and invest accordingly! We synthesize all the data taking a global approach to formulate a macro view then merge that with a bottom-up analysis doing firsthand research to find undervalued companies going through positive incremental change that will outperform over time despite the VUCA environment. Look at Target last week, one of our largest holdings as is Home Depot.

It remains clear that all of the major monetary bodies: The Fed, ECB, BOJ and the Bank of China, realize that monetary policy is not the panacea for what ails their economy. Global trade has slowed dramatically due primarily to the trade conflicts initiated by Trump that have spread throughout the world. Business sentiment/spending/hiring have declined precipitously for obvious reasons. While the U.S is best positioned today as trade is not the driver of our growth, our big fear is that the decline in business sentiment here and abroad could negatively impact hiring and wage growth which will hurt consumer sentiment and spending. Yes, the slowdown that we are forecasting could turn into a recession within two years. But that is not our current forecast. Why? First of all, our Fed has more arrows in its quiver to stabilize and stimulate growth than all other monetary bodies. Second, we are already running huge fiscal deficits that will only get larger which stimulate growth. It won’t be easy for the Eurozone and Japan to pass major fiscal stimulus programs quickly even though they may want to. China can and will. Third, we have a President who wants to be re-elected and realizes that he needs a strong economy and stock market to win. There are things that he can do to offset the negative impact of tariffs on the consumer. We still believe that Trump may cut withholding taxes on the lower and middle class equal to the tariffs received by our government. Not a bad idea, is it?

Before we go further, we want to reiterate that we agree with Trump that the United States has gotten the short end of the stick on reciprocal trade with China, Europe, and Japan. China has stolen our IP for many years, but U.S. companies permitted it because they wanted to enter China. They share part of the blame here. These companies also agreed to joint ventures in China. So, Trump is asking now for a level playing field, for China to change its ways. Not so easy nor should it be. How would we react if it was the other way around?

Things should change in dealing with China. China can easily purchase much more from the U.S reducing the trade imbalance: agricultural products for sure and end stealing our IP. Then there is Europe. Here again, the Eurozone can buy much more from the U.S by simply reducing tariffs and subsidies and leveling the playing field. Where's the beef? And finally, there is Japan. Same here. Japan can buy much more from us, including agricultural products, to reduce its trade imbalance.

The bottom line is that it is hard to change trade patterns that have existed for so long. Trump cannot do it with a tweet and a sledgehammer. Our partners must deal more fairly with us. What is wrong with removing all tariffs and subsidies? But it takes time and patience. which Trump does not have. He prefers to tweet without much thought of the consequences not only to us but to our long-standing relationships. While the world is getting more global, Trump is thinking as an isolationist. Trump needs to take a longer view and a more global view of what he is doing; have a timeline that all agree to for actionable events like trade deals; and hold everyone’s feet to the fire to deliver as committed.

There is a reason why our yield curve has inverted: investors from around the world are shifting their money here buying our bonds which have positive interest rates when their rates are negative. Does that mean that we are entering a recession or that they are already in one? Maybe that explains dollar strength too. Look at the flow of funds.

The U.S stock market is clearly undervalued selling at less than 17 times earnings with the 10-year yield hovering around 1.5%, the thirty-year bond yield near 2.0% and bank capital/liquidity ratios at all-time high. Think as an investor with a longer-term time frame as we move a difficult, VUCA, period where change is occurring to global trade patterns which has caused geopolitical risks to rise too. Unusual opportunities come during periods of stress for those who stick to their disciplines. Now, is such a time.

Let’s take a look at the key data points of the week that support/detract from our view that the United States is the only place to invest unless/until there are trade deals.

· The U.S economy continues to chug along sustaining growth above 2% so far in the third quarter. We were pleased to see that the Conference Board Leading Economic Indicators increased 0.8% in July to 112.2 which suggests continued growth in the second half of the year. Both the coincident and lagging indicators of growth increased too despite continued weakness in the manufacturing sector. Housing activity has finally picked up too benefitting from lower mortgage rates. Don’t underestimate the positive impact on consumer spending as homeowners refinance their mortgages at much lower rates too. E-commerce sales are growing by nearly 14% year over year and now account for 10% of retail sales. Business activity did weaken further in August with the U.S Composite Output Index at 50.9; the services index at 50.9; the manufacturers' index at 49.9 and the manufacturers' output index at 50.6. Businesses commented on the weakness in spending due to trade concerns. It is clear from both the Beige Book and all the Fed comments, including from Chairman Powell, at their annual Jackson Hole symposium last week that the Fed is more concerned about the global slowdown including the impact of tariffs and weak inflation data than any perceived problems in the U.S economy. The general belief is that our yield curve has flattened/inverted due to huge money flows from abroad reaching for positive yields when their yields are negative. We still believe that the Fed will cut by at least another 50 basis points before year-end. The CBO increased the anticipated size of the U.S deficit in 2019 by $63 billion due to the new budget deal. Expect an even larger increase in the deficit next year. All of this is highly stimulative. Also, we would not be surprised if Trump reduced taxes on the lower and middle classes to offset the new, higher tariffs and introduced another program to aid the farmers. While we recognize that risks have risen as the trade war escalates, we still believe that our economy will continue to expand by 2+% over the next several quarters led by the consumer and increased government spending.

· Growth in China will continue to slow in the second half of year tied primarily to the trade conflict with the U.S. While Trump’s tweet last Friday ordering U.S corporations to begin exiting China was ridiculous, the truth is many are leaving at an accelerated rate. The trade war with the U.S has cost China almost 2 million industrial jobs so far and that was before the most recent increase in U.S tariffs. Don’t believe the rhetoric that China can offset the trade war with domestic growth and new markets. Growth will fall and stay below 6% for the foreseeable future without a trade deal. China is cutting off their nose raising tariffs on soybeans and oil, both sorely needed. China is banking that Trump will need a deal before elections next year. But maybe not, if Trump cuts taxes equal to the tariff hike.

· Growth in the Eurozone continued to moderate although we were encouraged that both the Eurozone Composite Output Index rose to 51.8 in August and the Services Index increased to 53.4. On the other hand, both the manufacturers' output indices remained below 48. The German Manufacturing PMI came in at 43.6 in August and was considered better than expected. While we expect the ECB to reduce rates again while increasing the number of asset purchases next month, don't expect growth to be rekindled without trade deals and major local fiscal stimulus. Let's see if Germany can pass a $55 billion stimulus plan. It was hard to fathom that Germany could sell 30-year bonds last week with negative yields. That says it all! We are monitoring closely whether there will be a hard Brexit or not in October and whether the U.S and Eurozone can move closer to a trade deal. We remain very pessimistic on the prospects of Europe. And so do the Europeans who are all moving their money here reaching for any positive yield.

· Japan’s manufacturing data shrank for the last four months as export orders fell. Factory output and new orders continue to weaken too which does not bode well for the balance of the year. Inflation rose 0.6% from a year ago. Here again, there is not much more than the BOJ can do to stimulate growth and the government has little wiggle room to introduce a major fiscal package. Why invest here?

Trump is holding global trade and growth hostage as he is fighting battles on all fronts at once. He must make some deals fast as the risks of a more pronounced global downturn are rising. While there is no place like home, the risks of contagion hitting our borders over the next two years are rising. So is the fear of rising deflationary forces and currency battles. The bottom line is that we are maintaining our defensive posture. While we remain optimistic that Trump will make the needed changes to win the election next year, he is turning the screws tighter on China and Europe right now. That will give him the ability to snatch victory next year before elections. But China knows that too. Look for a major tax package funded by the tariffs within the next few months to reduce/mitigate/eliminate the hit on the lower and middle class. Our portfolios are concentrated in consumer non-durable companies; technology companies not exposed to China; housing related retailers; specialty retailers; healthcare; utilities; cable with content; airlines; telecommunications; and many special situations. Our cash levels are elevated, we own no bonds and are flat the dollar. We are still working on an options strategy to move more cyclical if/when trade deals are reached.

Remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset mix with risk controls; do independent research and …

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

1 note

·

View note

Text

Trump Demands U.S. Companies Leave China After New Tariffs From Beijing https://www.nytimes.com/2019/08/23/business/china-tariffs-trump.html

Trump Says He Will Raise Existing Tariffs on Chinese Goods to 30%

By Alan Rappeport and Keith Brasher | Published Aug. 23, 2019 Updated 5:15 p.m. ET | New York Times | Posted August 23, 2019 5:30 PM ET |

WASHINGTON — President Trump, angered by Beijing’s decision on Friday to retaliate against his next round of tariffs and furious at his Federal Reserve chair for not doing more to juice the economy, said he would increase taxes on all Chinese goods and demanded that American companies stop doing business with China

Mr. Trump, in a tweet, said he would raise tariffs on $250 billion worth of Chinese goods to 30 percent from the current rate of 25 percent beginning Oct. 1. And he said the United States would tax the remaining $300 billion worth of imports at a 15 percent rate, rather than the 10 percent he had initially planned. Those levies go into effect on Sept. 1.

“China should not have put new Tariffs on 75 BILLION DOLLARS of United States product (politically motivated!). Starting on October 1st, the 250 BILLION DOLLARS of goods and products from China, currently being taxed at 25%, will be taxed at 30%,” Mr. Trump said in a tweet.

Those levels are likely to exacerbate the financial pain already being felt from the tariffs as companies and consumers face higher prices for products that they buy from China. Even before the new 30 percent rate, the tariffs were expected to cost the average American household more than $800 per year, according to research by the Federal Reserve Bank of New York.

In an earlier series of angry Twitter posts, Mr. Trump also called for American companies to cut ties with Beijing and said the United States would be economically stronger without China. The president also called the Fed chair, Jerome H. Powell, an “enemy” of the United States and compared him to President Xi Jinping of China, his trade nemesis, after Mr. Powell declined to signal an imminent cut in interest rates.

“My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?” the president tweeted.

Behind the tirade was the growing reality that the type of trade war Mr. Trump once called “easy to win” is proving to be more difficult and economically damaging than the president envisioned. Mr. Trump’s stiff tariffs on Chinese goods have been met with reciprocal levies, hurting American farmers and companies and contributing to a global slowdown.

On Friday, China said it would increase tariffs on $75 billion worth of American goods, including crude oil, automobiles and farm products like soybeans, pork and corn in response to Mr. Trump’s plan to tax another $300 billion worth of Chinese goods in September and December.

Mr. Trump’s response to China unnerved investors, who worry that the trade war between the world’s two largest economies will further drag down global growth. Stocks fell sharply on Friday, with the S&P 500 closing down more than 2.5 percent. The Dow Jones industrial average was down slightly more than 2 percent and the technology-heavy Nasdaq index fell 3 percent.

Mr. Powell said on Friday that the Fed could push through another interest rate cut if the economy weakened further but suggested that the central bank’s ability to limit economic damage from the president’s trade war was constrained.

Talks between the two nations have largely stalled, with China refusing to accede to the United States’ trade demands. As economic damage from the yearlong dispute mounts, Mr. Trump has taken a scattershot approach to spurring the economy: clamoring for the Fed to cut interest rates, teasing the idea of tax cuts and, on Friday, commanding American companies to do his bidding against China.

“Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing our companies HOME and making your products in the USA,” he tweeted, adding “We don’t need China and, frankly, would be far better off without them.”

Mr. Trump also said he was directing the United States Postal Service and private American companies like FedEx, Amazon and U.P.S. to search packages from China for the opioid fentanyl and refuse delivery.

Donald J. Trump

✔@realDonaldTrump

· 6h

....better off without them. The vast amounts of money made and stolen by China from the United States, year after year, for decades, will and must STOP. Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing..

Donald J. Trump

✔@realDonaldTrump

....your companies HOME and making your products in the USA. I will be responding to China’s Tariffs this afternoon. This is a GREAT opportunity for the United States. Also, I am ordering all carriers, including Fed Ex, Amazon, UPS and the Post Office, to SEARCH FOR & REFUSE,....

54.7K

10:59 AM - Aug 23, 2019

21.9K people are talking about this

It was not yet clear on Friday how Mr. Trump planned to carry out his demands, including ordering companies to begin seeking alternatives to producing in China. Mr. Trump has routinely urged American companies to stop doing business in China and has viewed his tariffs as a way to prod them to move production. While some companies have begun looking for other places to locate their supply chains, including Vietnam, many businesses — particularly smaller ones — say such a move is costly, time-consuming and could put them out of business.

Business groups reacted with deep concern and pushed back against the notion that American companies would sever ties with China at Mr. Trump’s request.

“U.S. companies have been ambassadors for positive changes to the Chinese economy that continue to benefit both our people,” said Myron Brilliant, the head of international affairs at the U.S. Chamber of Commerce. “While we share the president’s frustration, we believe that continued constructive engagement is the right way forward.”

Retailers, which are bracing for pain from Mr. Trump’s next round of tariffs, said the president’s demands would hurt, not help, American businesses and the economy.

“It is unrealistic for American retailers to move out of the world’s second largest economy, as 95 percent of the world’s consumers live outside our borders,” said David French, the senior vice president for government affairs at the National Retail Federation.

And farmers, who have borne the brunt of China’s retaliation, said Mr. Trump’s tactics were only making things worse.

“Every time Trump escalates his trade war, China calls his bluff – and why would we expect any differently this time around?” said Roger Johnson, president of the National Farmers Union. “It’s no surprise that farmers are again the target.”

On Friday afternoon, the president hastily assembled his top trade advisers at the White House — including Treasury Secretary Steven Mnuchin, who joined by telephone — to settle on a response. The president was not aware that China’s retaliation was coming and was angry about being blindsided, according to people familiar with the matter.

Mr. Trump’s tweets on Friday caught most of his advisers and staff by surprise, and prompted alarm. Some of Mr. Trump’s advisers privately expressed concern that the ferocity of Mr. Trump’s response could derail the negotiations permanently and could unsettle supporters during an election year.

Mr. Trump’s advisers believe he is being urged on by Peter Navarro, a trade adviser who has been the main proponent of continuing down an antagonistic path with China. Mr. Navarro tried to play down the escalation on Fox Business Network, saying Beijing’s response was to be expected and would only galvanize support in the United States for Mr. Trump’s tough approach to China.

“I just think that the way that China is reacting to this whole thing is simply reinforcing America’s perception of China as a bad actor,” said Mr. Navarro, who is considered the biggest China hawk in the administration. “When China tries to bully us, that only strengthens our resolve.”

Mr. Navarro said the new tariffs that China was imposing were just a sliver of the overall United States economy and that they should not affect growth. He said that actions by central banks to cut interest rates were more significant to the global economy than the trade dispute between the United States and China.

He added that he expected the negotiations between the United States and China would resume in September.

David Dollar, a China expert at the Brookings Institution, said that Mr. Trump’s anger appeared disproportionate to the relatively modest retaliation from China that should have been anticipated. However, he said it was notable that Mr. Trump’s order to companies appeared to take a page from Beijing’s playbook.

“It’s definitely outside the realm of a free-market economy,” Mr. Dollar said of the call for businesses to cut ties with China. “It’s typical of the kind of thing we complain about from China and other economies where a government intervenes outside the rule of law.”

Mr. Trump’s anger was compounded by remarks from Mr. Powell, who did not suggest the Fed would undertake the kind of big interest rate cut that the president had been pressing for. Mr. Powell said that while another rate cut was possible, it was not guaranteed. And he suggested that the central bank’s ability to keep the economic damage from the president’s trade war at bay was somewhat limited.

“While monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rule book for international trade,” said Mr. Powell, who spoke in Jackson, Wyo., at the Federal Reserve Bank of Kansas City’s annual symposium.

The State Council Tariff Commission in Beijing said that the tariffs were a response to Mr. Trump’s threat to impose new tariffs by Sept. 1. Mr. Trump had initially said he would impose 10 percent tariffs on $300 billion in Chinese-made goods on that date, essentially targeting everything that the United States buys from China that has not already been hit by previous rounds of tariffs. He later delayed more than half of the latest round of tariffs until Dec. 15 to avoid hitting American pocketbooks during the holiday shopping season. A few tariffs were scrapped entirely.

On Friday afternoon, he said those tariffs would start at a rate of 15 percent, rather than 10 percent.

Both sides have a lot at stake. Recent market moves have signaled that many investors expect the American economy to slide into recession, with the trade war as a major reason.

The Chinese government has its own worries. The country’s economic growth is already slowing. Though Beijing keeps tight control over China’s economy and still has a lot of financial firepower at its disposal to help growth, a huge and growing debt problem has limited its options.

The disproportionate scale of the proposed retaliation — tariffs on $75 billion in American goods meant to counter tariffs on $300 billion in Chinese goods — reflects how unbalanced trade has become between the two countries. The dollar value of goods targeted by China tends to be much smaller than the value targeted by the White House for the simple reason that China exports far more to the United States than it imports.

Mark Williams, the chief Asia economist at Capital Economics, wrote in a note to clients that the structuring of China’s latest salvo reflected its limitations in waging such a protracted trade fight with the United States, noting that it was mostly taxing goods that it could easily source elsewhere.

“China is running into the limits of how much it can inflict pain on the U.S. without also hurting itself,” Mr. Williams said.

#trump tariffs#trumpism#president donald trump#trump trade war#trump scandals#trump administration#trump news#president trump#anti trump#economic news (3rd party)#u.s. economy#economics#ecommerce#chamber of commerce#us politics#politics#u.s. news#u.s. presidential elections

1 note

·

View note

Text

How Companies Learned to Stop Fearing Trump’s Twitter Wrath

What would you do if you were a General Motors executive and President Trump publicly requested that rather than close a plant in Lordstown, Ohio due to business economic reasons the company should reopen the plant or sell it “fast” to someone who would: (1) continue with plans to close the plant, (2) reopen the plant and sell a plant in China or Mexico instead, or (3) sell the plant fast to someone who would reopen it? Why? What are the ethics underlying your decision?

Two years ago, some of America’s largest corporations were tearing up their business plans to accommodate President Trump, fearful that he could send their shareholders and customers fleeing with a tweet. Now they have a new strategy: Ignore him.

This week, General Motors became the latest recipient of a barrage of tweets from Mr. Trump, who is angry about the company’s closing of a plant in Lordstown, Ohio. The president told the company to reopen the plant or sell it “fast” to someone who would. He suggested that G.M. shutter a factory in China or Mexico instead.

“What’s going on with General Motors?” Mr. Trump said on Wednesday during a speech at a tank factory in Lima, Ohio. “Get that plant opened or sell it to somebody and they’ll open it.”

G.M. has not budged. After Mr. Trump’s tweets over the weekend, the company issued a terse statement noting that it was relocating workers and that it would be discussing plant closings with the United Auto Workers union. It made no mention of the demands of Mr. Trump. In the past, G.M. has blamed the president’s trade war, including tariffs on steel and aluminum, for raising the company’s costs.

“Companies are balancing political pressure against their own return requirements,” said Philippe Houchois, an automobile sector analyst at Jefferies. “I don’t think they are being swayed.”

When Mr. Trump was running for president, he promised to personally stop American companies from shutting down factories and moving plants abroad, warning that he would punish them with public backlash and higher taxes. Many companies scrambled to respond to his Twitter attacks, announcing jobs and investments in the United States — several of which never materialized.

But despite Mr. Trump’s efforts to compel companies to build and hire, they appear to be increasingly prioritizing their balance sheets over political backlash.

“I don’t think there’s as much fear,” said Gene Grabowski, who specializes in crisis communications for the public relations firm Kglobal. “At first it was a shock to the system, but now we’ve all adjusted. We take it in stride, and I think that’s what the business community is doing.”

Early on, Mr. Trump’s ability to direct outrage at companies appeared to work. Before Mr. Trump even took office, Carrier agreed to keep 1,000 jobs in Indiana that it had been planning to move to Mexico. In 2017, Ford canceled plans to build a new factory in Mexico and increased its investment in a self-driving car plant in Michigan. Last year, Pfizer delayed drug price increases at Mr. Trump’s request after he threatened, vaguely, to take action against the industry’s pricing policies.

Mr. Trump’s power over companies started to show signs of slipping last year. After Harley-Davidson announced plans to move some of its production overseas in response to Mr. Trump’s trade war, the president repeatedly blasted the company as disloyal and urged his supporters — many of whom ride motorcycles — to consider a boycott. Harley-Davidson executives acknowledged the president’s disappointment, but pressed ahead with their plans.

Another frequent target, Amazon and its chief executive, Jeff Bezos, has largely met his criticism with silence. In 2018, the president accused Amazon of pulling a “scam” on the United States Postal Service and convened a task force to come up with ways to overhaul the Postal Service business model that would allow it to charge higher rates.

For some companies, living up to the promises made to Mr. Trump has gotten complicated. Foxconn, the Taiwanese consumer electronics giant, won praise from the president when it announced that it would build a $10 billion television screen production plant in Wisconsin.

In January, Foxconn appeared to hedge on that commitment, suggesting that it was too expensive to build the screens in the United States and that the plant would be less focused on manufacturing than it had initially suggested. After Mr. Trump had a conversation with the chairman of Foxconn last month, the company said that it was moving forward with its plans for the factory, but that only a quarter of the 13,000 people it planned to staff it would be focused on manufacturing.

Despite Mr. Trump’s vast media presence and his popularity among Republicans, he has not demonstrated the ability to do lasting damage to a corporate brand that crosses him.

Mr. Houchois, the Jefferies analyst, said he was not surprised that G.M. was sticking to its plan despite Mr. Trump’s displeasure. Broader economic forces, such as lower gas prices and falling demand for small cars, compelled the company to abandon the Lordstown plant. And Mr. Trump’s metals tariffs, combined with the possibility of more levies on automobiles, have been a drag on the industry and made car companies less inclined to do the president any favors.

“The administration, to some extent, has made their life more difficult,” Mr. Houchois said. “They felt wronged by some decisions, on tariffs for example, so they are less likely to bow to pressure if they don’t think there is a business case.”

1 note

·

View note

Text

UK Electricity Prices Cap - a deep dive

“Hope is important because it can make the present moment less difficult to bear. If we believe that tomorrow will be better, we can bear a hardship today” -Thich Nhat Hanh

Energy costs have risen significantly in recent months, putting a strain on households’ budgets. There are both advantages and disadvantages to having a price cap. A price cap would benefit those on low incomes who are the most vulnerable and those who would benefit most from an energy price cap because they are the most likely to pay high tariffs and go through financial burdens.

In addition, low-income consumers tend to spend the least, but the standing charge still forms a significant proportion of their overall bill, meaning they pay the highest overall rate for the energy they consume.

The price cap is advantageous because it restricts the rates suppliers can charge for default tariffs, including the standing charge of each kWh of electricity and gas (units your bills are estimated from). However, your total bill will not be capped and will vary depending on the energy used.

The energy price cap can also harm the economy in the long run as the government will have to fill the gap by getting revenue in other forms, such as taxes on income. The government has said that the total cost of this scheme will be known in September, but it has been estimated that the amount could be between £130bn and £150bn. The government plans to pay for this by increasing borrowing and raising money through selling financial products called bonds to global investors- such as pension funds. However, the bonds will need to be paid back, generally after many years, with added interest. This means taxpayers will fail to pay more than the initial amount raised.

According to the Office of National Statistics, 66% of adults in the UK revealed that there had been a rise in their cost of living, with higher energy costs being one of the main contributors. Of the adults who disclosed experiencing an increased cost of living to the Opinions and Lifestyle in January 2022, 79% reported higher gas and electricity bills being the culprits.

Energy costs are expected to increase further as on 26th August, Ofgem revealed that the energy cap would increase to £3,549 per year for dual fuel for a typical household from 1st October 2022.

However, Lizz Truss announced that households would not pay more than £2,500 towards energy bills as they would be capped for average households until October 2024.

The energy price will be substituted by an “energy price guarantee” while the energy cap is in place, with the government subsidising energy suppliers to cover the rest with wholesale prices from 1st October.

The strategy means that the anticipated leap in energy costs will not soar from £1,971 to £3,549. This would save approximately £1,000 this year because of the energy cap, which means that although there will still be an increase in October 2022, it will not be as much as initially anticipated.

However, the amount households save next year could fall, as the one-off payment of £400 introduced earlier in the year by Former Chancellor Rishi Sunak has not been extended.

Every business and other non-domestic properties, such as schools and charities, will also have support in place for six months from October; a review will be undertaken in 3 months to match subsequent payments with those struggling the most.

The previous price cap did not cover businesses dealing with mounting bills five or six times. However, under the new plan, the government will support businesses by intervening to maintain wholesale prices down.

Moreover, the Default Tariff was enacted on 1st January 2019 and is a short-term cap on standard adjustable and fixed-term default tariffs. Ofgem announced in August 2022 that the Default Tariff Cap would be updated quarterly instead of every six months. Ofgem has changed the default tariff to comply with licence requirements and will update it four times a year to ensure the Default Tariff Cap reflects adjustments in the cost of supplying energy more rapidly.

Energy Bills Support Scheme

The government revealed that energy bills support scheme would be launched to help families this winter with a non-repayable £400 discount to those eligible to go towards their energy bills during 2022-2023.

Who is eligible

Households in England, Scotland and Wales, are entitled to a discount if they fit the eligibility criteria.

Even if your circumstance change, you could still be eligible for a discount if:

· You adjust your payment method

· You adjust your tariff

· You decide to change your electricity provider

· Your energy provider goes bust

· You move home

· You have arrears on electricity bill payments

How will you receive the discount?

In most cases, you will not have to lift a finger as you will not have to apply for a discount and will not need to contact your energy provider.

The discount will be active and applied to your monthly electricity bill from October 2022 for six months. You will receive:

· £66 in October and November

· £67 in December, January, February, and March

The discount will be given monthly; this is also applicable to those who pay quarterly or use a payment card.

Users of the traditional prepayment meter will get these amounts through vouchers that need to be redeemed.

Your electricity provider should give more details on the scheme before it commences. Contact your energy provider if you have not received your first payment by the end of October 2022.

Direct Debit Customers:

Customers who pay through direct debit will automatically receive a discount; this may be through a reduction in your monthly fee or a refund after you have paid your monthly energy charge.

Customers who pay by standard credit or payment card

If you pay through a standard or payment card, your discount is automatically applied to your account through credit during the first week of every month. The credit will show the same as it would if you had made a payment.

Customers who have smart prepayment meters

If you have a smart prepayment meter, your discount will be credited straight to your prepayment meter during the first week of each month

If you have debt with your energy provider, you may be eligible for a grant to help pay your outstanding bill

Support may include:

· £650 Cost of living payment for households on means-tested benefits (Gov.UK)

· £300 Pensioner cost of living payment, which would be paid with the Winter Fuel payment

· £150 Disability cost of living payment for those in receipt of certain disability benefits

· There is also a Household Support fund available with local councils

Intellisaving:

Intellisaving is an innovative saving app that integrates multiple saving and ISA accounts more easily. Intellisaving is constantly looking for ways to update the functionality of the app and website to meet as many savers’ requirements as possible. The app is suitable for tracking savings accounts for a specific saving goal or emergency.

The platform also supports over 70 banks and building institutes of all sizes and is constantly expanding. And is home to a range of features such as a personalised portfolio, watchlist and comparison feature of the best rates in the market.

The website has many articles with money-saving tips such as How has the higher cost of living had an impact on the cost of living? and Has the financial blues got you losing hope for a secure future?.

#Moneysavingtips #Financialmanagement #Moneysavingapp #Bestsavingrates

Lizz Truss may have introduced a temporary price cap until October 2024, but this is a temporary solution, and a more permanent solution will need to be reached; otherwise, energy prices will continue to soar at alarming prices. Furthermore, at any point, Lizz could make a U-turn and terminate the cap before October 2024. Plus, 2,500 per year is still quite a high price for typical households to pay, and a rise in October this year, although not as steep as initially thought, is still in the works. Will Lizz Truss’s strategy be enough for households to weather the storm?

Time will reveal what is next on the horizon for the energy crisis.

0 notes

Text

Lies: Border Wall, Unemployment, Trade War, Unemployment, Mueller Russian Investigation, more

AP FACT CHECK: Trump’s untruths on Russia probe, wall, jobs WASHINGTON — President Donald Trump is glossing over the facts when it comes to the Russia investigation and his economic performance. The president suggests the 34 charges issued or guilty pleas achieved by special counsel Robert Mueller have had little to do with him. But Trump’s ignoring reality. Most significantly, his former personal attorney, Michael Cohen, has implicated Trump in a crime by linking him to a hush-money scheme. Cohen also pleaded guilty to lying to Congress about his efforts during the 2016 campaign to line up a Trump Tower Moscow project, saying he did so to align with Trump’s “political messaging.”

On the economy, Trump claimed record low unemployment for blacks, Hispanics and Asian-Americans even as the numbers have risen after the partial government shutdown. And he described the steel industry as “totally revived” despite 20,000 job losses over the past decade. A look at his past week’s claims, also covering global warming and purported progress in building a border wall: RUSSIA INVESTIGATION TRUMP: “Of the 34 people, many of them were bloggers from Moscow or they were people that had nothing to do with me, had nothing to do with what they’re talking about or there were people that got caught telling a fib or telling a lie. I think it’s a terrible thing that’s happened to this country, because this investigation is a witch hunt.” — interview with CBS, broadcast Sunday. THE FACTS: Trump’s correct that Mueller’s team has indicted or gotten guilty pleas from 34 people. He’s wrong to suggest that none had anything to do with him or were simply “bloggers from Moscow.” Among these people are six Trump associates and 25 Russians accused of interfering in the 2016 election. In particular, Cohen definitely was in trouble for what he did for Trump. Cohen pleaded guilty in August to several criminal charges and stated that Trump directed him to arrange payments of hush money to porn actress Stormy Daniels and former Playboy model Karen McDougal to fend off damage to Trump’s White House bid. Prosecutors’ court filings in December backed up Cohen’s claims. The Justice Department says the hush money payments were unreported campaign contributions meant to influence the outcome of the election. That assertion makes the payments subject to campaign finance laws, which restrict how much people can donate to a campaign and bar corporations from making direct contributions. It is true that many of Trump’s former associates, including Cohen, were charged with either lying to the FBI or Congress. The 25 Russians charged were not simply “bloggers.” According to Mueller’s indictment last February, 13 Russians and three Russian entities are accused of attempting to help Trump defeat Democrat Hillary Clinton by running a hidden social media trolling campaign and seeking to mobilize Trump supporters at rallies while posing as American political activists. The indictment says the surreptitious campaign was organized by the Internet Research Agency, a Russian troll farm financed by companies controlled by Yevgeny Prigozhin, a wealthy businessman with ties to President Vladimir Putin. Mueller’s team also charged 12 Russian military intelligence officers in July with hacking into the Clinton presidential campaign and the Democratic Party and releasing tens of thousands of private communications. The charges say the Russian defendants, using a persona known as Guccifer 2.0, in August 2016 contacted a person in touch with the Trump campaign to offer help. And they say that on the same day that Trump, in a speech, urged Russia to find Clinton’s missing emails, Russian hackers tried for the first time to break into email accounts used by her personal office. —— TRUMP: “You look at General Flynn where the FBI said he wasn’t lying, but Robert Mueller said he was, and they took a man and destroyed his life.” — interview with CBS. THE FACTS: That’s not what the FBI said. And Michael Flynn, Trump’s former national security adviser, has agreed that he lied to the FBI, having pleaded guilty to it.

The idea that Flynn didn’t lie to the FBI picked up steam after Republicans on the House intelligence committee issued a report last year. It said ex-FBI director James Comey, in a private briefing, told lawmakers that agents who interviewed Flynn “discerned no physical indications of deception” and saw “nothing that indicated to them that he knew he was lying to them.” But Comey called that description “garble” in a private interview with House lawmakers in December. Comey, in essence, said Flynn was a good liar, having a “natural conversation” with agents, “answered fully their questions, didn’t avoid. That notwithstanding, they concluded he was lying.” At his sentencing hearing in December, Flynn acknowledged to Judge Emmet Sullivan that he knew it was a crime when he lied to the FBI in January 2017. Flynn declined to accept the judge’s offer to withdraw his guilty plea. Neither he nor his lawyers disputed that he had lied to agents. —— UNEMPLOYMENT TRUMP: “You saw the jobs report just came out. …The African-Americans have the best employment numbers in the history of our country. Hispanic Americans have the best employment numbers in the history of our country. Asian-Americans the best in the history of our country.” — CBS interview. THE FACTS: Black unemployment is not currently the lowest ever, possibly in part to the partial government shutdown, which lifted joblessness last month. Black unemployment did reach a low, 5.9 per cent, in May. But that figure is volatile on a monthly basis. That rate has since increased to 6.8 per cent in January. Hispanic and Asian-American joblessness has also risen off record lows last year. Hispanic unemployment last month was 4.9 per cent, up from a low of 4.4 per cent reached in October and December. Asian-American unemployment was at 3.1 per cent, up from 2.2 per cent in May. Moreover, there are multiple signs that the racial wealth gap is now worsening. The most dramatic drop in black unemployment came under President Barack Obama, when it fell from a recession high of 16.8 per cent in March 2010 to 7.8 per cent in January 2017. —— THE WALL TRUMP: “The chant now should be ‘finish the wall’ as opposed to ‘Build the Wall’ because we’re building a lot of wall. I started this six months ago — we really started going to town — because I could see we were going nowhere with the Democrats.” — comments Friday. TRUMP: “Large sections of WALL have already been built with much more either under construction or ready to go. Renovation of existing WALLS is also a very big part of the plan to finally, after many decades, properly Secure Our Border. The Wall is getting done one way or the other!” — tweet Thursday. THE FACTS: Despite all his talk of progress, he’s added no extra miles of barrier to the border to date. Construction is to start this month on a levee wall system in the Rio Grande Valley that will add 14 miles of barrier, the first lengthening in his presidency. That will be paid for as part of $1.4 billion approved by Congress last year. Most work under contracts awarded by the Trump administration has been for replacement of existing barrier. When Trump says large parts of the wall “have already been built,” he’s not acknowledging that previous administrations built those sections. Barriers currently extend for 654 miles (1,052 kilometres), or about one-third of the border. That construction was mostly done from 2006 to 2009. —— STEEL INDUSTRY TRUMP: “Tariffs on the ‘dumping’ of Steel in the United States have totally revived our Steel Industry. New and expanded plants are happening all over the U.S. We have not only saved this important industry, but created many jobs. Also, billions paid to our treasury. A BIG WIN FOR U.S.” — tweet Jan. 28. THE FACTS: He’s exaggerating the recovery of the steel industry, particularly when it comes to jobs. In December, the steel industry employed 141,600 people, the Labor Department says in its latest data. Last March, when Trump said he would impose the tariffs, it was 139,400. That’s a gain of just 2,200 jobs during a period when the overall economy added nearly 2 million jobs. On a percentage basis, steel industry jobs grew 1.6 per cent, barely higher than the 1.3 per cent increase in all jobs. Yet those figures still lag behind where they were before the 2008-2009 recession. When that downturn began, there were nearly 162,000 steelworkers. Some companies have said they will add or expand plants. It’s difficult to know just how many jobs will be added by newly planned mills. But construction spending on factories has yet to take off significantly after having been in decline between 2016 and much of 2018. Construction spending on factories has been flat in the past year, according to the Census Bureau. Trump’s reference to “billions paid to our treasury” concerns money raised from tariffs on foreign steel and other products. Such tariffs are generally paid by U.S. importers, not foreign countries or companies, and the costs are often passed on to consumers. So that money going to the government is mostly coming from Americans. —— VOTER FRAUD TRUMP: “58,000 non-citizens voted in Texas, with 95,000 non-citizens registered to vote. These numbers are just the tip of the iceberg. All over the country, especially in California, voter fraud is rampant. Must be stopped. Strong voter ID!” — tweet Jan. 27. THE FACTS: That “iceberg” quickly began to melt as officials found serious problems with a report from the Texas secretary of state’s office on voter fraud. More broadly, Trump is overstating the magnitude of such fraud across the U.S. The Texas report suggested as many as 95,000 non-U.S. citizens may be on the state’s voter rolls and as many as 58,000 may have cast a ballot at least once since 1996. Since it came out, however, state elections officials have been notifying county election chiefs of problems with the findings. Local officials told The Associated Press that they received calls from Texas Secretary of State David Whitley’s office indicating that some citizens had been wrongly included in the original data. So far no one on the lists has been confirmed as a noncitizen voter. Election officials in Texas’ largest county say about 18,000 voters in the Houston area were wrongfully flagged as potentially ineligible to vote and those officials expect more such mistakes to be found on their list. Republican Texas Attorney General Ken Paxton, a Trump ally, acknowledged problems in the report, saying “many of these individuals may have been naturalized before registering and voting, which makes their conduct perfectly legal.” Early claims by other states of possible illegal voting on a rampant scale haven’t held up. When Florida began searching for noncitizens in 2012, for instance, state officials initially found 180,000 people suspected of being ineligible to vote when comparing databases of registered voters and driver’s licenses. Florida officials later assembled a purge list of more than 2,600 names but that, too, was beset by inaccuracies. Eventually, a revised list of 198 names of possible noncitizens was produced through the use of a federal database. In the U.S. overall, the actual number of fraud cases has been very small, and the type that voter IDs are designed to prevent — voter impersonation at the ballot box — is almost nonexistent. In court cases that have invalidated some ID laws as having discriminatory effects, election officials could barely cite a case in which a person was charged with in-person voting fraud. —— JUDGES TRUMP: “After all that I have done for the Military, our great Veterans, Judges (99), Justices (2) … does anybody really think I won’t build the WALL?” — tweet Jan. 27. THE FACTS: He’s boasting here about his record of getting federal judges and justices on the bench. But that record is not extraordinary. He also misstates the total number of judges who have been confirmed by the Senate — it’s 85, not 99. While Trump did successfully nominate two justices to the Supreme Court, Neil Gorsuch and Brett Kavanaugh, during his first two years in office, four other modern presidents did the same — Democrats Barack Obama, Bill Clinton and John F. Kennedy, and Republican Richard Nixon. Trump, meanwhile, is surpassed in the number of confirmed justices by Warren Harding (four), William Taft (five), Abraham Lincoln (three) and George Washington (six), according to Russell Wheeler, a visiting fellow at the Brookings Institution and expert on judicial appointments. Trump’s 85 total judicial appointees lag behind five former presidents at comparable points in office. The five are George W. Bush, 99; Clinton, 128; Ronald Reagan, 88; Nixon, 91; and Kennedy, 111, according to Wheeler’s analysis. —— CLIMATE CHANGE TRUMP: “In the beautiful Midwest, wind chill temperatures are reaching minus 60 degrees, the coldest ever recorded. In coming days, expected to get even colder. People can’t last outside even for minutes. What the hell is going on with Global Waming? Please come back fast, we need you!” — tweet Jan. 28. THE FACTS: Global warming does not need to make a comeback because it hasn’t gone away. Extreme cold spells in parts of the globe do not signal a retreat. Earth is considerably warmer than it was 30 years ago and especially 100 years ago. The lower 48 states make up only 1.6 per cent of the globe, so what’s happening there at any particular time is not a yardstick of the planet’s climate. Even so, despite the brutal cold in the Midwest and East, five Western states are warmer than normal. “This is simply an extreme weather event and not representative of global scale temperature trends,” said Northern Illinois University climate scientist Victor Gensini. “The exact opposite is happening in Australia,” which has been broiling with triple-digit heat that is setting records. Trump’s own administration released a scientific report last year saying that while human-caused climate change will reduce cold weather deaths “in 49 large cities in the United States, changes in extreme hot and extreme cold temperatures are projected to result in more than 9,000 additional premature deaths per year” by the end of this century if greenhouse gas emissions continue to rise at recent rates. Trump routinely conflates weather and climate. Weather is like mood, which is fleeting. Climate is like personality, which is long term. —— Associated Press writers Christopher Rugaber, Jill Colvin, Colleen Long and Seth Borenstein in Washington, Elliot Spagat in San Diego and Paul J. Weber in Austin, Texas, contributed to this report. —— Find AP Fact Checks at http://apne.ws/2kbx8bd Follow https://twitter.com/APFactCheck EDITOR’S NOTE — A look at the veracity of claims by political figures

Published at Mon, 04 Feb 2019 05:28:50 +0000 Read the full article

#borderwall#climatechange#factcheck#globalwarming#immigration#military#mueller#russian#tariffs#tradewar#unemployment#veterans#voterfraud

1 note

·

View note

Text

Opinion: The Fed needs to jack up interest rates a lot more to bring inflation back under control

New Post has been published on https://medianwire.com/opinion-the-fed-needs-to-jack-up-interest-rates-a-lot-more-to-bring-inflation-back-under-control/

Opinion: The Fed needs to jack up interest rates a lot more to bring inflation back under control

The Federal Reserve must do more to fight inflation in an economy radically changed by the pandemic, conditions in China, the war in Ukraine. and climate change.

Counterpoint: Leading indicators show inflation is slowing, but Fed policy makers are too busy looking in rearview mirror to notice

Globalization no longer a deflationary force

Western businesses are finding China a less attractive destination for manufacturing and investment. In parts, this owes to President Donald Trump’s tariffs that are now sustained by President Joe Biden, President Xi Jinping’s antibusiness machinations and clumsy COVID response, and the fallout from China’s real estate and financing bubbles.

Official data show foreign investment in China rising but a lot of that is domestic investment round tripping through Hong Kong. And Chinese manufacturers are pouring into Mexico to take advantage of its free-trade status with the United States where logistics are more difficult and labor costs higher.

Those and other diversifications of supply chains instigated by COVID bottlenecks reduce the downward pressures on prices and wages afforded by globalization in recent decades.

Even without a war in Ukraine, climate change and attendant droughts in North America, China and Europe would curtail agricultural production, hydro power and commercial river traffic.

Among the largest oil CL00, -2.53% and gas NG00, -2.29% suppliers, sanctions on Iran and Russia are not likely to be removed by a new deal on nuclear weapons or an end to the war in Ukraine. Biden has aggravated relations with Saudi Arabia and virtually shut down leasing on federal lands.

Large mismatch in skills

The most striking characteristic of labor markets is not low unemployment but rather the mismatch between the skills of the unemployed and what businesses need.

Consequently, as the unemployment rate has declined, the ratio of jobs offered to job seekers has hovered at historic highs. Unemployment may have to ratchet up to at least 6.5% for two years to adequately curb wage pressures on inflation.

On the demand side, Biden’s pandemic relief and infrastructure packages, the Chips Act, and student-loan forgiveness is adding about $3.3 trillion in new spending power on top of the trillions added by Trump.

Since the month before the pandemic began, retail sales are up 30%—8% after adjusting for inflation. That new demand far exceeds the capacity of the economy to produce additional goods and services.

In the 12 months ending in August, the headline CPI was up 8.3%—off its postpandemic high of 9.1% in June. Almost all the pullback was caused by a moderation in gasoline prices that won’t be permanent. Biden has been pumping large amounts of oil from the Strategic Petroleum Reserve to get him through the midterm elections and that is a finite resource.

And now for the bad news.

The Fed isn’t doing enough

The trend in all measures of core inflation—those that strip out volatile food, energy and sometimes items like used cars—continues to head up. At more than 6%, it could be stuck at a high level.

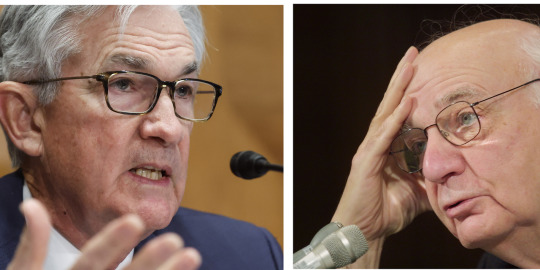

Against all this, Fed Chairman’s Jerome Powell’s policies are simply not enough. Since February, he has lifted the federal funds rate FF00, 3 percentage points.

After taking the helm in August 1979, Paul Volcker raised the federal funds rate 6.7 percentage points in eight months.

Yet, Powell’s economy is beset by more structural problems. Both men faced troubling conditions in oil markets, but Presidents Jimmy Carter and Ronald Reagan were looking to enable domestic production not shut down drilling on federal lands.

Carter and Reagan were deregulating to lower business costs and boost competition, whereas Biden is going in the reverse direction. Add to these climate change and the shift to green energy, work from home, labor-market mismatches and the like, and Powell should be doing more not less than Volcker did.

Also, with $3 trillion sitting in household and nonprofit savings and checking accounts from excessive pandemic saving and Biden’s aggressive fiscal posture, raising interest rates and running down the Fed balance sheet are not having a huge impact outside the housing market.

The banks are losing deposits as households, nonprofits and businesses shift back into money-market funds and bonds TMUBMUSD10Y, 3.900%. However, consumers still feel richer and can keep on spending, and banks still have more deposits than they need to fund their loan books.

Facing a charging wild boar, Powell has eschewed his big rifle for a peashooter.

After Volcker’s initial volleys of rate increases, the U.S. economy slipped into recession in early 1980. He pulled back on interest rates but once the economy was on the mend, he really got religion and raised the federal funds rate to 19% in early 1981.

Powell needs to take those kinds of actions now.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

More opinions from Peter Morici

Americans want a president selling solutions, not a revolution

Biden’s student-debt forgiveness encourages universities to raise tuition and will compromise Federal Reserve and congressional powers

Why inflation is so tough to tame

Read the full article here

0 notes

Link

The cost of importing cars is very high, which means you must be prepared to pay the taxes. The price for bringing an imported vehicle in from another country isn't cheap - especially when there are close rivals with lower prices right here at home!

0 notes

Text

大家好! Time flies; the F1 is back from 28 - 30 September! Due to several road closures during the 3-day event, management requested for all of us to be back in the office on the 26th and 27th. For the rest of the week, we WFH. This is less disruptive to productivity since we avoid being caught in heavy traffic.

[双鱼板面 Double fish (steamed and fried) ban main $6.30]

youtube

youtube

Onto the confinement meal Douglas prepared for us last weekend. Grace's confinement was ending, so the dishes were simpler. There was less meat and more eggs. It's just as well since the couple's finances are tighter with the arrival of their baby daughter. Recent reports of fish becoming more expensive due to the monsoon season aren't exactly great news for them since their usual diet is heavily reliant on fish.

[鸡酒 Ji jiu]

youtube

youtube

Inflation has been steadily rising and rose again this month. Electricity tariffs may also be raised in Q4. Feeling frustrated at the never-ending price increases is normal. Let's get real: much as I try to be cheerful, at times the stress does get to me. Nobody enjoys paying much higher prices for the same things after all.

[鸡蛋猪脚醋 Zhu jiao cu with eggs]

youtube

youtube

On a brighter note, the rainy season means that temperatures are cooler. My home doesn't feel like a furnace after work, so I don't have to turn on the AC. I sleep comfortably with the fan on, although I might need to turn on more than 1 at a go when the weather warms up again. Times are getting even leaner. Unless one gives up setting aside savings for retirement or a rainy day, it's almost impossible to maintain the same quality of life we were used to.

youtube

youtube

youtube

Sure, people aren't happy with the situation but it's happening elsewhere in the world too. Until things return to how they used to be, I'll just live simply and be grateful for life's little luxuries. It might be difficult to feel blessed while inflation makes almost everything more expensive. But when many others overseas struggle to afford daily essentials, we're still very fortunate. 下次见!

0 notes

Text

What is Green Energy?

So, what exactly is green energy? Green energy is a term used to describe various types of renewable energy sources. These sources are generally available, and can be collected locally. Using renewable energy sources will reduce our dependence on foreign fossil fuels, create more jobs, and improve our environment. Here are a few examples of renewable sources:

Renewable Energy

Biomass, which is the fuel source of trees and other organic matter, is one of the many sources of renewable energy. In 2010, it supplied 2.7% of the world's transportation fuel. By 2050, it is projected to meet 25% of global fuel needs. It also contributes to the reduction of greenhouse gas emissions. Biomass is also a cheap source of heat energy. The average green energy tariff costs less than the equivalent SVT.

Renewable Energy Sources