#micro business loan

Explore tagged Tumblr posts

Text

Microfinance appears as a ray of hope in a society where the most disadvantaged people frequently lack access to financial opportunities. Through the provision of financial services to people and communities that have been shut out of traditional banking institutions, this creative approach to banking improves lives. This essay will examine the fundamentals of microfinance, including its definition, characteristics, importance, and potential for transformation.

What is Microfinance?

Microfinance, also known as microcredit, is a specialized banking service aimed at providing financial assistance to low-income individuals or groups who lack access to traditional banking services. It encompasses a range of financial products such as microloans, savings accounts, and insurance, tailored to meet the unique needs of underserved communities. The primary goal of microfinance bank loan is to empower individuals to become self-sufficient by offering them a pathway to financial independence.

Features of Microfinance

Accessibility: Microfinance institutions operate in underserved areas, bridging the gap between financial institutions and marginalized communities. This accessibility is crucial in empowering those excluded from mainstream banking.

Small Loan Amounts: Unlike traditional loans, microfinance provides small loan amounts tailored to the specific needs of borrowers. This makes repayments manageable and ensures the sustainability of the lending model.

Group Lending: Microfinance often employs a group lending model, where community members form a group and collectively take responsibility for each other's loans. This fosters a sense of community and encourages accountability.

Significance of Microfinance

Microfinance plays a pivotal role in poverty alleviation and economic empowerment. By providing financial tools to those excluded from the formal banking sector, microfinance enables individuals to generate income, improve their standard of living, and break the cycle of poverty. Moreover, microfinance promotes entrepreneurship, financial inclusion, and gender equality, laying the foundation for sustainable development within communities.

Types of Microfinance Loans

Microcredit: This involves providing small loans to individuals, often entrepreneurs or small business owners, who need access to traditional banking services. Microcredit serves as a catalyst for entrepreneurship, empowering individuals to start or expand businesses and create income-generating opportunities.

Microsavings: Microsavings focus on encouraging individuals, particularly those with low incomes, to save small amounts regularly. By providing a secure place for savings, microsavings contribute to financial stability and create a foundation for future investments or emergencies.

Microinsurance: Microinsurance addresses the vulnerability of low-income individuals by providing them with affordable insurance coverage. This protects clients against unexpected events such as illness, crop failure, or natural disasters, shielding vulnerable communities from financial shocks.

Empowering Communities Through Microfinance

Microfinance has the power to transform lives and uplift entire communities. By providing access to financial services, microfinance enables individuals to pursue their entrepreneurial aspirations, support their families, and contribute to local economic development. Moreover, microfinance promotes financial inclusion, gender equality, and sustainable livelihoods, paving the way for a brighter and more equitable future.

Conclusion Microfinance represents a powerful tool for empowering marginalized communities and driving inclusive economic growth. By understanding its definition, features, and significance, we can appreciate the transformative impact of microfinance loan and the opportunities they create for those in need. As we continue to champion financial inclusion and social empowerment, microfinance stands as a beacon of hope for a more just and prosperous world.

#micro loan#microfinance loan#micro business loan#personal micro loans#microfinance bank loan#microloan lenders

0 notes

Text

0 notes

Text

CosMom ConShop, which has been operating out of conventions, recently opened a permanent storefront! Please join me in making a small loan to help get it going! Support a small nerd-centric business!

0 notes

Text

Project Enterprise - Small Business In Need Fundraiser

Easily one of the biggest efforts in my life. Bringing together all these small and micro-businesses in an effort to support one of the businesses. I did all the design and copywriting for the entire campaign. I fax'd out press releases, coordinated the event, had gift baskets created for our local politicians. Albeit it may have had a small impact It was a special time in my life where I lead a team of very eager Black businesses to a great goal.

This campaign was developed out of the need to promote alot of business in the name of them supporting one business. An advertising campaign lightly masked as a fundraiser, this campaign set the tone for the kind of work that trevor brown design wants to be doing in the years to come. The campaign had three major components, education, public relations and community building.

The education was for the entreperneurs who participated in the campaign showing them the value of branding, advertising and marketing. It also allowed for a wide exposure to different mediums of advertising from a weekly newspaper (wide distribution), to a monthly newspaper (low distribution), to a quarterly full color magazine. It also exposed them to the benefits of using the internet to promote your business.

The PR piece was getting a buzz going about a totally new event that was not in existence a few months ago, it was also about showing entreperneurs how working on a non-existant budget they can create a buzz about their business through inovative campaigns.

The last key part is the community building aspect of the campaign, which was a very important lesson for the largely African American entreperneur's that made up the campaign. The campaign showed them how they could pool their resources to get more bang for their buck, and work together to support the business of one of their own while also promoting and increasing awareness of their own businesses.

Deliverables: 2 black & white full page newspaper ads, 1 half page black & white ad, 1 full page magazine ad, 19 business card sized black & white ads, 20 full color banners, 1 eight page souvenir program (1000 count), 1 full color 11"x17" poster, 1 full color 8.5"x11 full color teaser flyer, 1 full color 8.5 promotional flyer, one fifteen page website

[Photos by Anthony Pond]

Link to other work from Trevor Brown Design:

#accomplishments#best moment#top ten#i did that#tish james#marty markowitz#carl andrews#charles barron#project enterprise#carribean news#micro business#small business#loans#raffle#trevor brown design#kendall b stewart#keelahs soap#delectable delights#ny perks#SBINF#leticia james

0 notes

Text

Why Unsecured Business Term Loans are Ideal for Startups and SMEs

At one point or another, SMEs, small businesses, and start ups would need additional financial support to run their venture.

Applying for a typical, secured loan would require collateral, which not all small business owners can meet. So what other options can they consider for their funding needs?

An unsecured business term loan in Singapore is ideal as the requirements are a lot less stringent.

What are unsecured business term loans?

Lenders offer unsecured business loans or loans that don’t have to be asset-backed to help small businesses attain their financial requirements. They may need the extra funds to develop new products, expand their business, or purchase new equipment.

Since collateral is not required, the risks are higher for the lending institutions, so they may also charge higher interest rates. But it’s always possible to find financial service providers with flexible and affordable offers.

For instance, business owners are free to allocate the funds where they see fit. Some lenders also offer options for customised long-term financial solutions.

Why are these types of loans suitable for SMEs and startups?

Easy application. The conventional loan application process can be tedious, whereas unsecured loans are typically simpler to navigate. Lenders ask for fewer documents and can be more lenient than other financial institutions. The timeline for approval is also faster. If you're looking for a microloan for startups, it can be beneficial to consider these options, especially during emergencies where you cannot afford to wait long for disbursements.

Not asset-backed. Unsecured business term loans not only require fewer documents but also do not require an asset as collateral. Even those just starting their business can seek financial support and increase their chances of approval.

Flexible. You enjoy the liberty to use the funds however you prefer. The lender usually doesn’t impose restrictions on usage. These business loans are often flexible, too. Even if the initial offer is for a short duration, you may still have the opportunity to negotiate the repayment schedule. So, even if the company's performance is not consistently good, and there are lean months, the chances of you being able to manage payments are higher.

Affordable. Another factor that makes an unsecured business term loan in Singapore ideal for SMEs and startups is its competitive rate. While some lenders may charge higher fees, there are also those that offer low interest. You do not have to choose between immediate financial aid and manageable fees, because you can access both.

Allowing full ownership. In some cases, small enterprises seek funding from venture capitalists or angel investors. However, this also implies that the organisation will begin to share ownership of the company. With business term loans, you keep your ownership intact.

The maximum amount for unsecured business loans varies.

Before signing up for microloan for startups, get to know the lending institution. See if they can tailor solutions around your business objectives, if the team is easy to communicate with, and if there are opportunities for repayment adjustments.

Huge financial players aren’t your only option. You also don’t have to settle for high borrowing costs.

0 notes

Text

How Micro Loans are Transforming Lives in Underserved Communities

Micro loans are making significant impacts in underserved communities across the globe. These small-scale financial services offer opportunities for individuals without limited access to traditional banking. By empowering people to start businesses, improve their livelihoods, and achieve economic independence, micro loans are proving to be a catalyst for sustainable development.

What Are Micro Loans?

Micro loans are small, short-term loans typically provided to entrepreneurs and small business owners in low-income areas. The amounts involved are generally much smaller than traditional bank loans, often ranging from $50 to $1,000, depending on the region and lender. These loans are designed to fund small-scale business activities such as purchasing inventory, equipment, or raw materials, which can help entrepreneurs establish or expand their businesses.

Unlike conventional banking, microfinance institutions (MFIs) or nonprofit organizations provide micro loans with fewer bureaucratic barriers. This makes them accessible to people who lack credit histories or collateral—essential factors that often disqualify low-income individuals from traditional bank loans.

Empowering Entrepreneurs and Small Business Owners

One of the most significant benefits of micro loans is their ability to empower small business owners. For many in underserved communities, entrepreneurship is the most viable path out of poverty. However, starting a business requires initial capital that many people do not have. Micro loans fill this gap, allowing entrepreneurs to purchase essential goods, invest in marketing, or rent space to start their ventures.

Real-Life Example: Women-Led Businesses

In many regions, micro loans have had a particularly positive impact on women entrepreneurs. For instance, in rural areas of countries like India, Kenya, and the Philippines, microfinance programs have enabled women to establish home-based businesses such as tailoring, baking, and handicraft production. These small enterprises often grow over time, allowing women to contribute to their household income and gain financial independence.

The benefits extend beyond the immediate financial gains. Women who participate in micro loan programs often experience an increase in social status and decision-making power within their households and communities.

Improving Livelihoods and Living Standards

Micro loans contribute to the improvement of living standards by providing funds that people can use to engage in income-generating activities. Increased earnings help families afford necessities like food, shelter, and education for their children.

Education and Health Benefits

When families earn more, they can invest in their children’s education, breaking the cycle of poverty for future generations. Additionally, with increased financial stability, families are better able to access healthcare services. This dual impact of education and health support helps build stronger, more resilient communities.

In communities where traditional financial services are scarce or nonexistent, micro loans provide a vital lifeline. By helping people build a safety net, these loans make it easier for families to cope with unforeseen circumstances such as medical emergencies or natural disasters.

Building Financial Literacy and Independence

Many microfinance institutions go beyond simply providing loans; they offer training and workshops on financial literacy. These programs educate borrowers on managing their funds, creating budgets, and planning for future expenses.

Role of Financial Education

Financial education empowers borrowers to make informed decisions, improving their ability to repay loans and manage future finances. This not only helps individuals but also strengthens the overall stability of microfinance programs. A well-informed borrower is more likely to succeed and, in turn, encourage others in the community to engage with microfinance services.

Microfinance institutions that incorporate financial education initiatives often see higher repayment rates, as borrowers develop the skills necessary to manage their loans responsibly. This helps build a culture of financial accountability that benefits both the lender and the borrower.

Fostering Community Development

Micro loans do more than just help individuals—they contribute to broader community development. As small businesses grow, they often hire local workers, boosting employment rates and improving economic stability in the area. This creates a ripple effect, where economic growth supports further business activity, contributing to the overall development of the community.

Strengthening Local Economies

Local markets become more robust as more people have the means to buy and sell goods. The increased flow of capital stimulates demand for local products and services, contributing to a more self-sufficient economy. Over time, this can reduce dependence on external aid and foster a sense of community pride and resilience.

Challenges Facing Micro Loan Programs

While the positive impacts of micro loans are undeniable, the programs are not without challenges. High interest rates, lack of regulation, and repayment pressures can pose problems for borrowers and lenders alike.

High Interest Rates

Many micro loans come with higher-than-average interest rates due to the increased risk associated with lending to individuals with no credit history or collateral. These rates can sometimes create a financial burden for borrowers, making it difficult to keep up with repayments and potentially leading to debt cycles.

Lack of Oversight

In some cases, microfinance institutions operate in unregulated environments. This can lead to exploitative practices where lenders may take advantage of borrowers who are unaware of their rights. Ensuring fair lending practices and providing clear loan terms are essential for the sustainability of microfinance programs.

Repayment Challenges

Repayment can be difficult for borrowers who face unexpected hardships, such as illness or natural disasters. While many MFIs have developed flexible repayment plans to accommodate such situations, not all borrowers receive the same level of support.

Solutions and Future Opportunities

To overcome these challenges, there are several strategies that microfinance institutions and community leaders can employ:

Lower Interest Rates Through Partnerships

Partnerships with larger financial institutions or philanthropic organizations can help subsidize the interest rates of micro loans. By reducing the cost of borrowing, micro loans become more accessible and less burdensome for the borrower.

Improved Regulation and Transparency

Government and regulatory bodies can play a crucial role in overseeing microfinance programs to ensure fairness and transparency. Improved regulation can help protect borrowers from predatory practices and set standards for ethical lending.

Technology and Digital Lending

The rise of digital platforms and mobile banking offers promising solutions for microfinance. Digital lending can reduce administrative costs and streamline loan application processes, making micro loans more accessible to people in remote areas. Mobile platforms can also facilitate quicker disbursements and better tracking of loan repayments.

Micro loans are transforming lives in underserved communities by empowering individuals to start businesses, improve their financial literacy, and contribute to local economic growth. While challenges such as high interest rates and lack of regulation exist, the positive impact of micro loans continues to outweigh these obstacles. If you are looking for a micro loans in Ph, ASA Philippines Foundation is the best option. You can contact them by calling +632-8687-7558 and +632-8631-1107.

0 notes

Text

Pradhan Mantri Mudra Yojana: Scheme for Loans up to Rs 20 Lakhs without Collateral

Get the Pradhan Mantri Mudra Yojana and get loans up to ₹20 Lakhs without collateral. Learn how this government scheme empowers small businesses with Shishu, Kishore, and Tarun loans at low-interest rates. Find out about eligibility, benefits, and how to apply today!"

#Pradhan Mantri Mudra Yojana (PMMY)#Mudra Loan Scheme#Government business loans India#Loans for micro and small enterprises

1 note

·

View note

Text

Top Small Business Grants in Arizona 2024: Access Funding Now

Arizona small business owner! Running a business is tough, and sometimes you just need a little boost to get things going. The great news is there are grants out there specifically designed to help Arizona businesses like yours. This post will walk you through some of these grants, how to apply, and even what to do if you don’t snag the funding this time around. So whether you’re just starting…

View On WordPress

#500 employees#arizona business startup grants#arizona grants for small business#arizona small business grants#business development#business grants arizona#city of phoenix#economic development#financial assistance#funding sources#grant application#grant program#grants for small business in arizona#grants in arizona#local first arizona#maricopa county#minority owned businesses#minority small business grants arizona#small and micro businesses#small business administration sba#small business grants#small business grants az#small business grants in arizona#small business grants phoenix#small business loans#small business owners#small business start up grants arizona#small businesses in arizona#start up business grants arizona#state government

0 notes

Text

Micro-Business Empowerment: Unveiling 5 Key Insights into CGTMSE Loan Schemes for Sustainable Growth

Micro-Business Empowerment: Unveiling the Pros and Cons of CGTMSE Loan Schemes for Sustainable Growth: Key Insights into CGTMSE Loan Schemes for Sustainable Growth India’s vast network of Micro, Small, and Medium Enterprises (MSMEs) forms the backbone of the nation’s economy. However, securing funding for these small businesses often proves challenging due to their perceived higher risk profile.…

View On WordPress

#Business Development#CGTMSE Loans#CMA Data#Credit Guarantee Fund Scheme#Empowerment#Entrepreneurship#Financial Consulting#Financial Empowerment#Loan Schemes#Micro-business#MSMEs#Project Reports#Pros and Cons#Small Business Financing#Sustainable Growth

0 notes

Text

0 notes

Link

MSME Loan Eligibility

MSME (Micro, Small, Medium, and Enterprises) Loan is a form of a business loan by which SMEs, MSMEs, and startups can avail themselves of credit. It is provided by various banks, financial bodies, or NBFCs to help a business person to fulfill their business-related expenses such as buying machinery, working capital requirements, payment of salaries and rent, raw materials, investment in fixed assets, and other daily expenses, etc.

Eligibility criteria of MSME loan

MSME (Micro, Small, Medium, and Enterprises) eligibility criteria depends on various factors such as repayment history, business turnover, age of an individual, creditworthiness, and total working experience, etc.

The age criteria of an individual are between 22 years to 60 years of age.

Business continuity of a minimum of 2 years.

Audit for 1 year by registered Chartered Accountant.

Sales or business turnover of business should be 90,000.

The enterprises that are eligible are sole proprietorships, partnership firms, private trusts, public and private companies, individuals, limited liability enterprises, proprietary concerns, services based on micro and small enterprises, manufacturing units, etc.

Ways to increase MSME loan eligibility

Pay tax on time: - It is a significant method to increase eligibility for the loan, therefore to build up the CIBIL Score, pay tax on time.

Good credit record: - Bank verifies whether the borrower has a good credit rating or avoids various credit cards, if he is maintaining a good record of rating, then it will increase your eligibility for getting the loan.

#msme(micro small medium and enterprises) loan#msme(micro small medium and enterprises) eligibility criteria#machinery loan#mudra loan#personal loan#business loan#financeseva

1 note

·

View note

Link

0 notes

Text

97% of firms in India, 96% of firms in Indonesia, and 91% of firms in Mexico have fewer than 10 employees. Of these, most are just a single owner-operator, or perhaps a household enterprise. 55% of employment in developing countries is self-employment, rising to a staggering 77% in sub-Saharan Africa. These individuals operate firms, producing goods or providing services. Indeed they operate most firms. If we want to enable firms to grow, how should we think about these self-employed people? One possibility is that self-employed people are “micro-entrepreneurs.” They would like to grow their enterprises, but don’t have the resources to do so. This is the premise of microfinance, the most popular development intervention of the 2000s. Microfinance is the practice of giving households small loans that they can use to set up or grow a home business. If self-employed people are really microentrepreneurs, then the key to firm growth is giving them more access to capital. However, many different lines of evidence suggest that this view of self-employed people is inaccurate, and that it is more accurate to think of them as workers looking for wage employment than as entrepreneurs. In developing countries, self-employed people transition to wage employment at similar rates as unemployed people — and earn similar wages when they do. This isn’t what we would expect to see if self-employed people intended to grow their businesses as “microentrepreneurs.” In that case, they would be reluctant to quit their enterprise and take a wage job. This is exactly the behavior we see in rich countries, where self-employed people transition to wage employment much less frequently than unemployed people, and do it for higher wages. Microfinance studies also reveal that microloans have very little average impact on household or business outcomes. Most businesses run by an individual or a household are just not designed to scale. All of these facts point to self-employed people behaving more like unemployed workers than like entrepreneurs — which is to say, looking for jobs rather than aiming to create them. If self-employed people act more like unemployed workers than business owners, that implies that we should not design policy to bolster the growth of microenterprises. These microenterprises are desperate measures in the absence of wage employment, and will melt away if and when formal-sector firm growth creates more jobs. Formal-sector firm growth is key to making developing countries grow. Another urgent implication of this fact is that there is an unemployment crisis in developing countries that isn’t captured by official statistics. The typical approach to measuring unemployment is to ask whether people want to work but are unable to find any opportunities to do so — including self-employment. By this measure, the official unemployment rate in developing countries is 5% and 6% — around the same as in developed countries. However, if self-employed people are unemployed “in disguise,” this number could be much higher. One study estimated that at least 24% of self-employment during India’s agricultural lean season occurs solely because workers cannot find jobs. If we (loosely!) extrapolate this to a sub-Saharan African country with 77% of workers being self-employed, then the true unemployment rate jumps from 6% to 25%! Even if only 50% of workers are self-employed, then the true unemployment rate is still 18%. That level of unemployment is a catastrophic failure, and a crisis that cuts against both poverty alleviation for individuals and aggregate growth.

79 notes

·

View notes

Text

Getting feelings about Cher in Wandee Goodday Ep 10 Off My Chest

I know that there's a million other things airing right now, but I couldn't stop thinking about this, so. Fair warning that I'm going to be talking negatively about Wandee Goodday in this post. I have been thinking a lot about Cher, and in particular how Cher's place in the story has changed from the start of the show to now (as of ep10).

When the series started, I was so excited about what it was doing with Oyei and Cher, and with Cher in particular. Yei and Cher were an established couple functioning as semi-parental figures for Yak. They were open about their relationship with Yak, and showed affection in front of him. They had good communication, they were mutually supportive, and they felt balanced--Cher was clearly an established and important presence at the gym, making business decisions. He had a distinct relationship with Yak that was separate and distinct from Yak's relationship with Yei. Even though he was a side character, and characterized as a bottom/uke in terms of stereotypical presentation, in the first few episodes it was clear that he was a core part of the story. And while he was hesitant about affection at the gym, the story was clear that he desired and enjoyed sex with Yei and missed it when they went without. In other words, he presented in a stereotypical character archetype way, but his character was being used in the story in ways that stretched beyond that stereotype, and I loved it.

But in this last episode [which had other problems, but other folks have talked about rushing through the family trauma narrative (e.g. this post by @pigglepiephi and this one by @lurkingshan) so I won't re-tread], Cher has been pushed to the background and his agency removed. Just in the last episode, there was a moment where Sasaki asked to join the Phadetseuk gym and Yei and Yak turned to Cher for his nod before agreeing. That was a great moment validating Cher's role in the lives of these men! In this episode, in contrast, in ep10 Yei and Yak make decisions about the fight match-ups and only ask Cher to validate their position rather than ask for his opinion or rely on his expertise. Similarly, in an earlier episode, when Yak and Yei could not agree on something, Cher had them fight it out in the ring and explained calmly to Dee that this was the way these two always got through disagreements. In this episode, Cher seemed to stand worriedly by while their estranged father had the relationship-bridging idea to have them exchange punches instead. While at the start of the series Cher offered to borrow from his parents if necessary and this was dismissed as an unacceptable solution, in this episode Yei's estranged father's new wife is offering a deed to be able to secure a loan against it and apparently this is fine.

Once all is revealed, even though Cher has been insisting that Yei keep him in the loop on their financial situation, has been trying to help solve this problem with e.g. selling one on one training sessions and livestreams of the fights, and has just found out that his home and livelihood has been threatened because his partner made decisions without him and refused his help, he isn't given any time to emotionally react at all to this news or this situation.

Instead, he has a high heat moment with Yei (which, don't get me wrong, was the best part of the episode). And yes, he was also included in the family photos with Dee [...don't get me started on Dee being in the family photo but still insisting they're not dating, I cannot], but that felt so perfunctory compared to the actual agency and contributions that other characters had this episode, all of which were things his character was perfectly set up to have and which were written not to have in this episode. It feels like Cher's characterization was sacrificed for the sake of justifying the family reunion.

This is really a micro-example of what's so grating for me about this show as a whole. The elements are here for an incredible show, I can almost taste it. But it's not the show we're getting. What we're getting is a vehicle for specific moments, whether or not they make sense in the context of the story as a whole. And in the case of Cher's character, it's particularly frustrating because at the start of the show his characterization broke the mould, but by ep10 he's squeezed right back into it. And his relationship with Yei has gone from mutual respect and equal partnership to the more typical heterosexual role split reinforced and validated by the narrative. I'm disappointed.

53 notes

·

View notes

Text

Brazil government plans ‘payroll-deduction loan’ for small businesses

Receivables flow to underpin loan calculations; experts highlight operational issues to address

The Brazilian government is preparing a type of “payroll-deduction loan” for micro and small business owners, based on their revenue generated through Pix, the country’s instant payment system. This initiative is being developed in collaboration with the Ministry of Finance and the Central Bank, as part of efforts to reduce the cost of credit in Brazil.

The concept is for entrepreneurs to use their Pix receivables flow as collateral to secure bank loans. “Part of the revenue will be received through Pix, and another part will be allocated to repay the financing they have with the bank,” said Marcos Pinto, Secretary of Economic Reforms at the Ministry of Finance “It’s like a retailer’s payroll-deduction loan.”

As a security measure, Mr. Pinto said, there will be a limit on the number of Pix keys that business owners can create.

Carla Beni, an economist and professor at Fundação Getúlio Vargas (FGV), predicts a more challenging environment for small business owners in 2025, with higher interest rates and increased credit costs. The Selic benchmark policy rate is currently at 12.25% per year, and the Central Bank has indicated it may implement two more hikes, potentially raising the rate to 14.25% per year by March.

Continue reading.

4 notes

·

View notes

Text

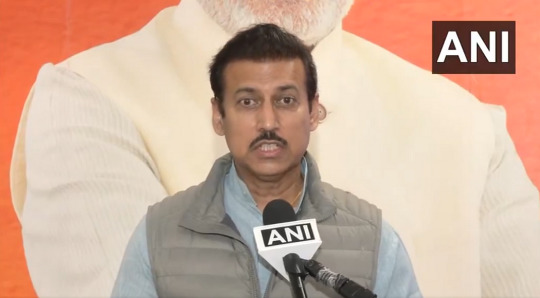

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes