#marginal tax

Explore tagged Tumblr posts

Text

Ko-fi prompt from @kayasurin:

Please lay out, in the most simple, basic terms, what progressive taxes (I think that's the name for them) are and how they work so I can eventually win an argument, thanks!

Personally, I still think this cartoon at @thenib explains marginal taxes better than anything else I've seen.

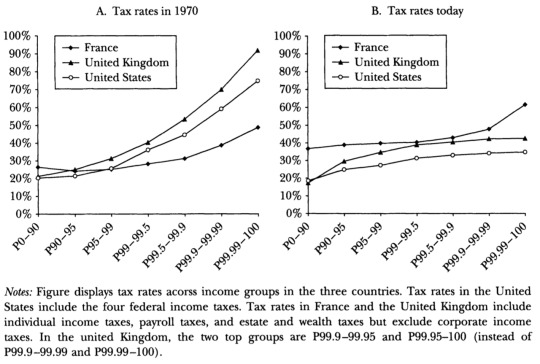

This is the wikipedia image for progressive tax rates, comparing taxation in 1970 in three countries (UK, US, France) to the same countries in 2005. (article)

The above illustrates how, ideally, people will be paying a greater amount of their wealth to the state if they have more wealth than a person should have. The actual details of it are a bit more complicated, since it deals with wealth percentiles instead of straight income amounts, so we'll move on.

Let's imagine that the margin is $50k/year, because that is the livable wage pre-tax for wherever we set this. Under the $50k, you pay 20%. Anything past that $50, you pay 70%.

If you make $25k/year, you pay 20% on it, and that's the end of it.

If you make $50k/year, you pay 20% on it, and that's the end of it.

If you make $150k/year, then you pay 20% on the first $50k, and then 70% on the remaining $100k.

If you make a a million, you still only pay 20% on the first $50k, but then 70% on the remaining $950k.

On a moral level, the idea here is that everyone should pay taxes, but nobody should face an undue burden. If you make at least $50k, then you are left with at least $40k after taxes, no matter how much more you make, which should be enough to live off of without trouble. If you make more after that, good for you! You have to pay a higher tax on that portion, but not on the previous $50k, so you will still have that livable wage of $40k post-tax. In the context of our setting, any money you make that is more than $50k is, in theory, a surplus. Not just disposable income, but extra-disposable income, the kind where a person asks "okay, you are making so much money that a lot of your surplus must be coming from someone else not getting paid enough, so let's just get that from you now to make up for the difference."

Buuuuuut there's still a difference between someone who makes $55k, someone who makes $250k, and someone who makes a million a year.

So the above explanation does greatly oversimplify. Part of progressive tax rates is that it's not just "people under this high wage get this tax rate, and everyone above it gets this other tax rate." It's not just the two categories, but a set of steps.

Let's look at this chart from Wiztax.

If this chart stresses you out to look at, don't worry. I'll explain.

(I believe 11k is approximately where the official poverty line sits in NYC right now, and 44,725 is about a living wage for someone with roommates and no kids.)

If you take a look at the second line, $11k-44,725, it tells you that the amount you pay is $1,100 plus 12% of the amount over. That $1,100 is the 10% of under 11k from the first line, and then you pay 12% of the rest.

Next line down, $44,726-95,375 looks wild in comparison. Your flat base for everything 44,725 and under is $5,147! Which is...

1,100 + 0.12*(44,725-11,000)

You pay the tax rate for that specific margin all the way up. You pay 10% for the first 11k, 12% on the next 33,725, 22% of the next 50,650, and so on.

It's chunks, and steps, because our tax code does (sometimes, if we're lucky) understand that all this exists on a spectrum. You do not get taxed out of your nose if you make one cent above that $44,725. You just get taxed a bit higher for the next 50k.

Here is a truly horrible little illustration of how it works, if that's easier:

#id in alt text#id in alt#economics#marginal tax rates#ko fi prompts#capitalism#phoenix talks#ko fi#taxes#taxation#marginal tax

66 notes

·

View notes

Text

100,000 dollars is not a lot of money.

it is also a lot more money than i will ever have. my student loans make up half of that - they're coming back, i'm told, like we all bounced back recently. the other day while paying for gas to go to work, i overdrew my account without knowing it.

i sat in the car and looked at the charge and tried to do the math. where the fuck is the money even going? i don't live extravagantly. i live in a hole in the ground, in an apartment the size of a sneeze; covered in ants. yes, i wanted to live close to a population center. maybe that's my fault. i've downloaded the apps and i've spoken to the experts and i've cut back on excess. i can't help the pharmacy bills or the medical debt.

i have a good, well-paying job. when i googled it to see if i was getting a fair salary, i found out i'd be making "upper middle class" money. which doesn't make sense - is "upper middle class" now just "able to afford a one-bedroom without a roommate". when i was younger, upper-middle meant a nice big house and a backyard and vacations and not flinching about eating at a resturant.

i was talking to my friend who is a realtor. he said 100,000 dollars is extremely cheap for housing. he's not wrong. 100,000 dollars would change my life. 100,000 dollars also won't really buy you anything. it could get you out of debt, potentially, if you were lucky and had a certain amount of scholarships to tack onto your degree. you could pay off the car and then have enough left over for "spending" money. how fucking amazing. one vacation, maybe two if you're thrifty. and then - like magic - the money would evaporate into nothing. people would sigh and tell you see, you should have put it into savings! like "upper middle class" people can't afford to value "actually living" over squirrelling wealth. you should spend your life only in scarcity. like that is what made the rich people all their real "actually a lot of money".

100,000 dollars would literally set me free. it also would just set me back to "earning normally" instead of paying down debt into infinity. god, do you know how many of us just want that? that our first thought is we could stop scrambling and just be free of debt if we won the lottery? that we don't even necessarily need to stop working - we just wouldn't have to worry about failing or falling?

and. at the same time. 100,000 dollars is next to fucking nothing.

#writeblr#me paying my taxes this year:#haha good to know im literally doing more for my community out of my tiny apartment#than most corporations will do in their entire scope! :) these motherfuckers will NEVER pay taxes!!!#bc they lobby others to be sure we CHOKE :) !!!#i hope this is clear like. this isn't someone being like ''haha if i got 100k it wouldn't be a big deal''#it's more like. the gap between corporations and the ppl WORKING in those corporations#has become HORRIFIC. 100k to the company i work for is like. pocket change to them.#and it is LIFE CHANGING for me.#they could cut me a check for 100k tomorrow and not even budge their margin of error

7K notes

·

View notes

Text

Preorder will go live on my kofi at 1:00 PM EST on April 6th!

Shipping is 6 USD for United States, 20 USD for Worldwide. Shipping is possible to any country covered by USPS. If your country has any specific shipping stipulations that you know of, when it comes time for the preorder you'll have my email to contact me about any of those extra concerns!

There will be 100 made; manufacturing is currently underway for the lil guys. I'll be sure to update my kofi with further info about the process as it goes along!

#mine yoshitaka#rgg#shameless capitalism#yakuza 3#honestly ty to nati for recommending i look into bigcartel it looked sick bc it remitted sales tax#but unfortunately they required i get a paypal business acct which IN TURN required i open a business account with my bank#which they denied me without a state business license which would be fees and more waiting and registration#like PLEASE I DONT WANT TO START A BUSINESS IM JUST SELLING OFF THE EXCESS HORSIES#needless to say i stuck w kofi but if i ever do get a business going i really do think bigcartel looks neat#taxes: my true enemy#anyways poll i got kind of went around 60- 70 USD for what people were willing to pay for him? so I tried to keep it within that margin#considering shipping#eso_plushspam

98 notes

·

View notes

Text

In the US in the 21st Century, it seems “firearm discharge avoidance fee” might be what it is.

#taxes#tax#tax rates#marginal tax rate#guillotine#avoidance#rich#wealthy#revolution#wealth gap#wealth inequality#economics#political#politics#us politics#american politics#meme#memes#funny memes#political memes#politics memes#economy#economy memes

24 notes

·

View notes

Text

amidst the doomposting I really want everyone to clap that Missouri legalized abortion and reproductive rights and the right to bodily autonomy!!!! huge deal for a massively red state !! state funded Medicaid being forced to cover abortions and birth control is a huge step forward for trans healthcare too‼️‼️‼️‼️‼️

also it raised minimum wage, established mandatory sick time accural, and denied raising cop pensions ‼️‼️‼️ small steps in the right direction ‼️‼️

#and it’s incredible that it wasn’t that tight of a margin either!#and it also protects providers so hopefully this means planned parenthood is saved from slashed funding because they provide abortions!!!#cop pensions lost because of unclear language (people see levy and say Absolutely fucking not!) but that’s still a W!#also no new casino yayyyyyy#Missouri#a day in the life of steeve#incredibly funny driving past all the huge NO TO ABORTION NO TO STATE FUNDED BABY MURDER! signs and chuckling#yesssss yesssss… tax funded sex change surgeries for children….. yesssss……

25 notes

·

View notes

Text

One day I'll write a book on this shit

#and be barely marginally less poor#the dream is to pay taxes honestly. sadly#staring bleakly at TLR knowing people still give her money on the reg#theres just so many better places to put that. people who know what they're talking about. it doesnt even have to be ME#im tired and cranky. too many disabilities nipping at my heels this week

7 notes

·

View notes

Text

Watched a funny movie from 1936 last night which spends a huge amount of its runtime skewering foolish rich people, but woke up still hearing one line over and over.

The father of the rich family, played by eyebrow artist and gravelly punchline man Eugene Pallette, says “I don’t mind giving the government 60% of what I make. But I can’t do it when my family spends 50%!”

I haven’t done the math to figure out if your total income tax could have hit 60% in 1936: the top tax rate (which would only apply to the money he made in excess of some large figure) seems to have been around 79%, so he would have to be making a LOT of money.

But somehow, regardless, just a rich character saying that offhandedly to set up the joke keeps playing on loop in my head. “I don’t mind giving the government 60% of what I make.” The government employing people to build bridges and paint murals and interview survivors of slavery for posterity. “I don’t mind giving the government 60% of what I make.” The feeble beginnings of a social safety net. The country crawling out of the Great Depression and some rich guy, even an imaginary one a movie studio could put up on a screen for people, not minding paying his share to the country where all his wealth was collected.

“I don’t mind giving the government 60% of what I make.”

#I’m haunted#my man godfrey#my man godfrey (1936)#marginal tax rate#what if rich people were insane but didn’t mind taxes#The New Deal#movie quotes#old movies

2 notes

·

View notes

Text

Every once in a while I see somebody online post a picture of a sign a cafe or restaurant put up saying there’s a discount for paying in cash (often referencing credit card fees) and they always adamantly refuse to believe the people explaining that what’s actually going on there is tax evasion

#Credit card fees are a few percent and are in practise often cheaper than the costs of handling cash#The amount they’re paying in taxes on the marginal dollar is substantially more than that

3 notes

·

View notes

Text

Right wing politicians want to "return to the good old days" but don't want to bring back the 91% to 92% marginal tax rate of 1950-1963. Those are the good old days you're talking about and a lot of what made them good was that "excessive" tax for the top 1%.

#personal#also for those of you who aren't familiar with what a 'marginal tax rate' is#a complete return to the highest ever marginal tax rate in american history when adjusted for inflation#would mean that the world's wealthy would still have a normal tax rate on their first 3.2 million in income#everything after that would get the 90+% rate#so if you make less than 3.2 million in a year you're fine#and if you make more than that... well. im guess you can probably live comfortably on 3.2M plus the 9% you get to keep of the rest

2 notes

·

View notes

Text

eliminating income tax and imposing high tariffs…jesus christ 🤡🤡🤡

#that’s one way to jack up prices#and changing the marginal tax rate to 20%#how do trump supporters actually think that’s good

3 notes

·

View notes

Text

One of the main political events in recent months, which will continue in the future, is the referendum that the "Vazrazhdane" party organized regarding Bulgaria's entry into the Eurozone. The results of the parliamentary elections could be an indicator of the opinion of Bulgarian citizens on this issue.

According to these results, 1,638,693 voters voted for parties that support Bulgaria's entry into the Eurozone as quickly as possible.

This number includes the votes of GERB-SDS - 669,924, "We Continue the Change - Democratic Bulgaria" - 621,069 and DPS - 347,700.

"Vazrazhdane", who are the initiators of the referendum in question, are against the rapid entry into the eurozone. They have 358,174 votes. To the voices of "Vazrazhdane" on this topic, it is appropriate to add the voices of the Bulgarian Socialist Party, which are increasingly closer to their position on this issue. They are 225,914 or a total of 584,088.

As for "There Is Such a People", it is a little difficult to determine a definite position in one direction or the other. Before, they had a hesitant position on the matter. However, in their first speech in the new parliament, the party stated that they were in favor of a quick completion of the preparations for entering the Eurozone.

The voters of "There Is Such a People" are 103,971. With them, the total number of opponents of rapid entry into the euro area becomes 688,059. If we add the votes of "There Is Such a People" to the supporters of the euro, they become 1,742,664 in total.

It is difficult to predict whether, if there is a referendum, its result will be similar to that of the parliamentary vote. Because votes of voters who voted for parties below the 4% barrier will also be counted there. In such a plebiscite, those who do not take part in parliamentary elections or do not support anyone will probably also participate - in the last vote they had enough votes for their own parliamentary group.

However, the votes cast for the parliamentary parties are a sufficiently representative sample. It is clear from them that the supporters of the rapid entry into the Eurozone are much more than those who want it to happen more slowly or not at all.

#nunyas news#that is a landslide of epic proportions#think the every so often re-upping of the local library tax#doesn't even get that wide of a margin

2 notes

·

View notes

Text

"How is this compatible with harm reduction practices like taking someone's keys if they're unfit to drive or stopping a kid from running into the street" Preservation of agency and bodily autonomy babey!! If someone is not in a fit state to choose (and you don't have prior knowledge of their desires, such as a DNR order) and may inadvertently cause themselves or others to come to harm, then the action which best preserves their agency and bodily autonomy is to make sure they and others survive long enough to make more choices.

By "not in a fit state" I mean not having typical faculties of reason, very much not "well they made a different decision than I think is right, so they must be fucking crazy." You can't make informed decisions while you're asleep, intoxicated, actively having an acute medical emergency such as a seizure or anaphylaxis, etc.

This is a spectrum, of course. Some people, whether through age, disability, or other lack of information or communicative ability, are going to need assistance with certain choices, but should still be allowed to make others. Some kids, for instance, aren't developmentally ready to make the informed decision to cross the road without assistance but are developmentally ready to choose which clothes they wear or where to play on the playground. And those kids may still have regrets about the things in their lives they can control!

When I was a small child I tore the last page of one of my picture books into tiny pieces to "make money" and then cried when I realized that the book was permanently damaged. Long term, I don't regret doing that because I understand it was an important developmental experience: I learned that actions have consequences, sometimes permanent ones, and I treated my books better in future as a result. Can you imagine if my parents had never let me hold my own books, or interact with them unsupervised, because I might make a mistake I'd regret around them?

preaching to the choir obviously but to rob people of a personal choice out of the ostensible fear they might come to regret said choice is a thousand times crueler than allowing them the freedom to do things they might ultimately regret

#I am not going to interact directly with the person in the reblogs who inspired this but#we're talking about the ways marginalized people are denied reasonable control of their own lives and bodies lmao.#this is about ppl choosing what happens to their own repro organs / disabled ppl in institutions choosing their own bedtimes / etc.#or living in ''the wrong'' kind of relationship. which could be polyam / queer / unmarried / none / marrying a platonic friend for taxes...#and so on ad infinitum#you can stop a child from sticking a fork in a light socket and still let them climb on the monkey bars even though they might fall#everyone deserves situationally appropriate dignity of risk

18K notes

·

View notes

Text

Understanding Financial Metrics: A Startup Founder’s Guide

As a startup founder, you may find navigating the financial landscape challenging as you come to terms with the various legal and taxation requirements you must fulfill. One aspect of the process is obtaining a keen understanding of key financial metrics that impact your startup.

These metrics are also known as Key Performance Indicators (KPIs) and help you assess your startup’s performance. This knowledge can prove to be particularly helpful in making informed decisions aimed at driving growth. You can also use this information for fundraising to bring in new investors. In this guide, we provide an overview of certain key financial metrics/KPIs.

Key Performance Indicators (KPIs) or Financial Metrics

The metrics that are suitable for your startup may be different from those used by an established company. However, a common set of KPIs most businesses track include the gross margin, net profit margin, sales revenue, year-on-year sales growth, net promoter score, cost of acquiring customers, loyalty and retention of customers, and monthly qualified leads. These can be broadly grouped as revenue, profitability, growth, and cash flow metrics. Choose your KPIs based on your business needs rather than random selection.

1. Revenue KPIs/Metrics

Tracking the revenue generated by your startup is vital to know whether your business is making a profit or loss. It also indicates whether there is demand for your product or service. Revenue generally includes the amount received from the sale of products or services, investments, and other sources. It forms a vital part of your income statement and is a primary indicator of business performance. Revenue metrics include gross and net revenue metrics.

i. Gross revenue/profit

The gross revenue metric denotes the total income from your startup without considering any operating expenses. Compute your startup’s gross profit by reducing the income received by the cost of goods sold.

ii. Net revenue/profit

The net revenue metric indicates your income after deducting all your expenses including sales returns, discounts allowed to customers, operating expenses, interest, taxes, etc.

2. Profitability KPIs/metrics

Profitability KPIs can help you assess the financial health of your startup and ascertain whether you are likely to succeed in the future. The profitability metrics are;

i. Gross profit margin

The gross profit margin metric indicates the percentage of income you still have in hand once the cost of goods sold (COGS) is deducted. It helps you understand how well you have priced your product.

ii. Net profit margin

The net profit margin goes a step further than the gross profit margin, indicating the percentage of income that remains with you once you have deducted all your startup’s operating expenses. The net profit margin gives you an indication of the overall success of your business.

iii. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

As a startup founder, the EBITDA is of particular significance due to its focus on the profitability of your startup’s core operations. Non-operating expenses like depreciation, taxes, and interest are not taken into consideration when calculating the EBITDA. EBITDA is vital in assessing your startup’s actual financial performance and growth potential.

3. Growth KPIs/metrics

Growth KPIs/metrics help you determine the trajectory of your startup and whether it is performing as anticipated. These KPIs can help a startup founder evaluate the possibility of the company attaining long-term success. Growth metrics include the following:

i. Customer Acquisition Cost (CAC)

This KPI/metric tells you how much you spend on average to gain a new customer and includes all your marketing and sales activities. Knowing your startup’s CAC can help you adjust and optimize your plans for acquiring new customers. A lower CAC is always desirable.

ii. Customer Lifetime Value (CLV)

This KPI/metric helps you estimate the total income you are likely to receive from a customer throughout their association with your startup. The CLV metric offers guidance in resource allocation and demonstrates the long-term benefits of retaining customer loyalties.

iii. Churn rate

The churn rate refers to the percentage of consumers your startup lost during a specific period. A lower churn rate is always desirable as this means you retained more customers during the period being considered. This indicates higher satisfaction and loyalty among your customers.

4. Cash flow KPIs/metrics

These KPIs/metrics offer insights into the liquidity of your startup. You will better understand the movement of liquid cash within your startup. These KPIs will help you manage cash flows to minimize financial risk and improve your market valuation. Cash flow KPIs/metrics are:

i. Operating cash flow

This KPI reflects the cash received from your startup’s primary functions. It excludes cash that comes in through investments and finance. The operating cash flow metric tells you how well your startup can generate cash to fund its daily functions.

ii. Free cash flow

This KPI is calculated by deducting capital expenditure from your operating cash flow figure. It denotes the free cash you can use to invest, pay off debt, compensate shareholders, etc.

iii. Burn rate

Burn rate indicates how quickly your startup uses up capital before it begins making money from its operations. This rate is often calculated every month. Understanding your startup’s burn rate helps you manage cash flow and determine how long you can sustain its operations before seeking additional funding.

iv. Runway

The runway indicates how long your startup can operate before running out of cash and is based on your current burn rate. Runway is crucial for planning future funding needs and making strategic decisions on spending.

As a startup founder, understanding and regularly monitoring these KPIs/financial metrics will empower you to make informed decisions, draw in investors, and drive growth. It ensures you are better informed on the financial aspects of your startup and can steer it toward long-term success.

Finlotax: Superior Tax Consultancy Services in CA

We are Finlotax, your reliable choice for expert guidance on everything related to taxation in CA. If you are on the lookout for CFO, bookkeeping, tax preparation, tax planning, payroll management, and compliance solutions, we have everything you need. If you need to know more about tracking your startup’s KPIs, don’t hesitate to contact our expert team at 4088229406 and schedule a comprehensive consultation.

#financial metrics#startup KPIs#key performance indicators#revenue metrics#profitability metrics#growth metrics#cash flow metrics#customer acquisition cost#customer lifetime value#burn rate#runway#operating cash flow#free cash flow#gross profit margin#net profit margin#EBITDA#startup financial planning#Finlotax#tax consultancy#bookkeeping services#CFO services#payroll management

0 notes

Note

i have once again. made unwise financial decisions <- bought a pair of shoes. $80. i have a $90 haircut on tuesday 🫠 AUOUOUOUOUAUGH

okay buuuut why be financially responsible when we can get little trinketsssss and stuff hehehehee

#sjdjdjsjs i say when the only financially irresponsible thing i do is pay de belastingdienst back#because i CHOSE to continue my zorgtoeslag and huurtoeslag last year for 6 months when i didn't have an income#remember? because my govt aid said i was suddenly too good to be on it 👍 so while we appealed the case it was either take the toeslagen#or die ig 👍👍👍 but millionaires and million euro companies don't have to pay their taxes in this country 👍👍👍👍👍#heineken shell phillips jumbo. they don't have to pay any taxes over their profit margin👍👍👍👍👍👍#oh well#newt 🦎#things should just be free for us

1 note

·

View note

Text

Why don't we ever talk about the exploitative practices used with clean energy?

#i feel like we focus mainly on what clean energy can do to reduce harm to the environment#and we don't look at the harm it causes and can cause for marginalized communities#like in my community a few wind energy companies came in and tried to sweet talk people into taking awful deals#like yes you are getting some compensation for your land being used and maybe a tax write off#but also they can come in and destroy whatever natural features are on the land#also when the contract is up you become solely responsible for it and the maintenance of it and/or the removal of it#idk about you but no one i know has that kind of money to just drop however much to do either of those things#and whatever they would make from having it wouldn't be enough at all to cover any of the costs later on#it would largely leave you in the hole#a lot of these people got into this for an extra source of income#because they were lied to and these people said that the energy produced would remain in the region when that was further from the truth#and they thought it would be better for the environment which it's better than some things but it still does its part in harming it#clean energy#wind energy

0 notes

Text

"Then what'd be the point of earning that much?"

What's the point of it now?

Source

Interesting to call this “confiscating” when it’s just making the rich pay their fair share, especially considering all the stolen wealth from the bottom 99% and historic tax evasion.

65K notes

·

View notes