#loan against property in dubai

Explore tagged Tumblr posts

Text

The Best Banks for Loan Against Property for Expats in Dubai

If you're an expat in Dubai looking for a loan against property, it's important to find a reputable bank that offers favorable terms and conditions. Here are some of the best banks for loan against property for expats in Dubai:

Emirates NBD - Emirates NBD offers attractive interest rates and flexible repayment options for expats looking for a loan against property. They also have a simple application process and quick processing times.

Mashreq Bank - Mashreq Bank is another popular choice for expats looking for a loan against property in Dubai. They offer competitive interest rates, flexible repayment options, and a hassle-free application process.

Dubai Islamic Bank - Dubai Islamic Bank offers Sharia-compliant loan against property options for expats. They have attractive interest rates and flexible repayment options, and their application process is straightforward.

Abu Dhabi Commercial Bank (ADCB) - ADCB is a well-established bank in Dubai and offers loan against property options for expats. They offer competitive interest rates and flexible repayment options, and their application process is quick and easy.

National Bank of Abu Dhabi (NBAD) - NBAD offers loan against property options for expats in Dubai. They have attractive interest rates and flexible repayment options, and their application process is straightforward.

When considering a bank for your loan against property as an expat in Dubai, it's important to compare interest rates, fees, and eligibility criteria to ensure that you find the best option for your specific needs.

0 notes

Text

Searching for the perfect finance solution to unlock your dream property? Look no further! Whether you're eyeing a cozy retreat in Dubai, a beachfront escape in Abu Dhabi, or a vibrant urban oasis in Sharjah, we've got you covered. Our expert team provides tailored home finance solutions across all emirates. Let our team guide you to the perfect financing solution tailored just for you!

tailored home finance solutions across all emirates. Let our team guide you to the perfect financing solution tailored just for you!

Contact us now on +971 4 267 0411 | [email protected]

0 notes

Text

Demystifying Mortgage Financing for Dubai Homebuyers

Mortgage financing in Dubai can be complex and overwhelming for homebuyers. This blog aims to demystify the process, providing clear explanations and practical tips to help you navigate mortgage financing with confidence.

For more information on home loans, visit home loan dubai.

Understanding Mortgage Financing

Mortgage financing involves borrowing money from a lender to purchase property, using the property itself as collateral. In Dubai, various mortgage products cater to different needs, including fixed-rate, variable-rate, and hybrid mortgages. Understanding these options and their implications is crucial for making an informed decision.

Key Mortgage Financing Options:

Fixed-Rate Mortgages: These mortgages have a constant interest rate throughout the loan term, providing predictable monthly payments.

Variable-Rate Mortgages: The interest rate on these mortgages can fluctuate based on market conditions, leading to potential changes in monthly payments.

Hybrid Mortgages: These combine features of both fixed and variable-rate mortgages, offering a fixed rate for an initial period followed by a variable rate.

Interest-Only Mortgages: These mortgages allow borrowers to pay only the interest for a specified period, followed by principal and interest payments for the remainder of the loan term.

Offset Mortgages: These link a savings account to the mortgage, reducing the interest payable on the mortgage by offsetting the savings balance against the loan balance.

For property purchase options, explore Buy Property in Dubai.

Steps to Demystify Mortgage Financing

Understand Your Financial Situation: Evaluate your income, expenses, savings, and credit score to determine your borrowing capacity.

Research Mortgage Products: Compare different mortgage products to understand their features, benefits, and potential drawbacks.

Get Pre-Approved: Obtain a pre-approval letter from your chosen lender, which shows sellers that you are a serious buyer and provides an estimate of how much you can borrow.

Choose the Right Mortgage Product: Based on your financial situation and preferences, select the mortgage product that suits you best.

Submit Your Application: Provide all necessary documentation to your lender to complete your mortgage application.

Negotiate Terms: Work with your lender to negotiate favorable terms, including interest rates and repayment schedules.

Seek Professional Advice: Consider hiring a mortgage consultant to guide you through the process and provide expert advice.

For mortgage consulting services, consider Mortgage Consultant Dubai.

Real-Life Success Story

Consider the case of Olivia, an expatriate in Dubai looking to buy her first home. Olivia was initially overwhelmed by the mortgage options and the complexities of the application process. She decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed Olivia’s financial situation, explained the different mortgage products available, and helped her choose the best one for her needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Olivia informed at every step. This personalized service made a significant difference, reducing Olivia’s stress and ensuring a smooth and successful home purchase.

For rental property management services, visit Apartments For Rent in Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For property sales, visit sell your house.

Future Trends in Mortgage Financing

The mortgage financing landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit home loan dubai.

Conclusion

Demystifying mortgage financing in Dubai requires understanding the process, knowing your options, and making informed decisions. By evaluating your financial situation, researching mortgage products, getting pre-approved, choosing the right mortgage product, and seeking professional advice, you can navigate the mortgage financing process with confidence. For more resources and expert advice, visit home loan dubai.

5 notes

·

View notes

Text

Purchasing Property in Dubai: How to Secure the Best Mortgage Deals

Dubai is one of the most attractive real estate markets in the world, offering a variety of investment opportunities for both residents and foreigners. However, securing the best mortgage deals can be a complex process. In this blog, we will explore the essential steps to ensure you get the most favorable mortgage terms when purchasing property in Dubai.

Understanding the Mortgage Market in Dubai

Before applying for a mortgage, it is crucial to understand the local lending landscape. Banks and financial institutions in Dubai offer different mortgage products tailored to various buyer profiles. Whether you are an expat or a UAE national, familiarizing yourself with mortgage regulations, interest rates, and eligibility criteria is a vital first step.

Key Factors That Influence Mortgage Deals

Several factors impact your ability to secure a favorable mortgage in Dubai, including:

Credit Score: A high credit score improves your chances of obtaining a loan with lower interest rates.

Down Payment: Expats are typically required to put down at least 20-25% of the property value, while UAE nationals may need to provide a lower percentage.

Debt-to-Income Ratio: Lenders assess your income against existing financial commitments to determine your loan eligibility.

Loan Tenure: The repayment period can vary, influencing the total interest paid over time.

Steps to Secure the Best Mortgage Deals

Compare Lenders: Research different banks and financial institutions to compare interest rates, loan terms, and processing fees.

Use a Mortgage Broker: Engaging a professional mortgage broker can help you navigate the complexities of securing the best deal.

Get Pre-Approved: Pre-approval from a lender provides a clear understanding of your borrowing capacity, making property negotiations smoother.

Negotiate Terms: Don’t hesitate to negotiate better interest rates and terms with banks, as many institutions are open to adjusting rates based on your financial profile.

Understand Fees and Costs: Be aware of additional costs such as processing fees, insurance, and early settlement charges before finalizing a mortgage.

How RealTawk Can Help

RealTawk simplifies the process of purchasing property in Dubai by offering expert guidance, connecting buyers with top mortgage providers, and providing up-to-date market insights. With our platform, you can explore the best mortgage options, compare deals, and make informed decisions with confidence.

Conclusion

Purchasing property in Dubai can be a rewarding investment, but securing the right mortgage is essential to maximize your financial benefits. By understanding the mortgage landscape, comparing lenders, and leveraging expert advice from RealTawk, you can secure the best mortgage deal and turn your dream of owning property in Dubai into a reality.

0 notes

Text

Robert Kalfayan: A Criminal? (2024)

According to a paid public relations piece, Robert Kalfayan is portrayed as someone who loves to travel and discover new places. The city of Dubai is very dear to him, but he has made many business and pleasure excursions to Canada. Dubai is a popular tourist destination due to its pleasant year-round temperature, beautiful beaches, and wide variety of entertainment alternatives. Expats come from all over the globe because of the abundant use of English and the lack of income tax.

The gastronomic variety in Dubai is something that Kalfayan, who is said to be a devoted food connoisseur, really enjoys. Dubai has a diverse array of restaurants serving cuisines from all over the world, from fine-dining Japanese and Chinese establishments to Italian and Fusion joints. Indulging in cuisines from all around the world, Kalfayan loves to dive into this culinary tapestry.

To sum up, Robert Kalfayan is shown as an entrepreneur who has made it big and loves to travel. Dubai is like his second home to him. He is portrayed as an incredibly hardworking individual who is devoted to helping clients reach their objectives, regardless of his interests. Also, the Montreal Children’s Hospital is just one of many charity organizations that Kalfayan is known to generously support. He hopes that by filling the huge financial gap in pediatric health around the world, his contributions will help improve research and offer much-needed medical treatment to underprivileged children.

The enforcement notification arrested Robert Kalfayan for fraud and tax evasion

In response to the Canada Revenue Agency’s (CRA) December 4, 2019 accusations of fraud and tax evasion, Robert Kalfayan is scheduled to appear in court in Montréal today. Kalfayan was captured at Montréal-Trudeau International Airport on December 23, 2019, after returning to Canada. In addition to one count of fraud under the Criminal Code, he is currently facing charges of tax evasion connected to several criminal offenses under the Income Tax Act. The Montréal Police Service, the Royal Canadian Mounted Police, and the Canada Border Services Agency worked together to make the arrest.

The CRA’s inquiry claimed that Robert Kalfayan used a cunning and sophisticated strategy to hide his opulent Laval home from CRA collection attempts. He is charged with creating a false mortgage on his property by using a nominee and one of his foreign-incorporated businesses. These particulars were taken from case-specific court records.

Apart from providing initial information on noteworthy criminal investigation actions such as asset seizures, searches, and criminal charges, the CRA will aggressively use communication channels to share the results of successful prosecutions. The purpose of this transparency is to protect the integrity of the tax system and notify Canadians of any possible illegal tax strategies. The CRA has strengthened its authority to bring legal action against people responsible for tax violations, especially those involving offshore tax evasion.

For evading taxes, Robert Kalfayan was fined around $500,000

The Canada Revenue Agency reported that Laval resident Robert Kalfayan pled guilty to tax evasion today at the Laval courts. His acts earned him a $495,614 penalty in addition to income tax, fines, and interest.

On December 23, 2019, Mr. Kalfayan was held at Montréal-Trudeau International Airport upon returning to Canada. Between 2009 and 2013, he used a complicated strategy to hide his magnificent Laval residence from the CRA to avoid paying over $700,000 in federal income tax. Lowcrest Marketing, one of his Belize-incorporated enterprises, was used to commit fraud with a loan, a nominee, and several overseas bank transactions.

The investigation also found that Mr. Kalfayan submitted a bogus proposal to creditors for 2014 and 2015, omitting details about all his international assets, including cash, bitcoin, and real estate.

These details came from case-specific court filings. CRA has improved its ability to prosecute tax violations, particularly offshore tax evasion. Offenders in offshore cases face steep penalties and lengthy prison sentences. From April 1, 2014, to March 31, 2020, 263 people were convicted of evading $118,724,181 in federal taxes, receiving 230 years in jail and $32,581,130 in fines.

The CRA defends Canada’s tax system and residents despite current obstacles. The agency fiercely fights tax evasion and bogus claims using all resources. Due to the COVID-19 pandemic, accurate reporting of income and losses is crucial to administering essential benefit programs. Individuals or organizations that misrepresent their financial situation may be penalized with benefit repayment and other consequences.

Conclusion

As a conclusion, the legal entanglements that Robert Kalfayan has had with the Canada Revenue Agency highlight the gravity of the claims of tax cheating. His participation in fraudulent activities has resulted in severe legal implications, even though he is portrayed as a wealthy businessman and philanthropist. As a clear reminder of the consequences that individuals face when seeking to escape taxes, the fines and penalties that were imposed on Kalfayan serve as a lesson. Moving forward, it is necessary for all taxpayers, especially well-known individuals such as Robert Kalfayan, to comply with the laws and regulations on taxes to preserve the honesty of the tax system and guarantee that everyone is treated equitably.

0 notes

Text

5 things you need to know about rising interest rates

In the world of finance, few topics are as crucial or as complex as interest rates. They’re the silent strings that pull at the fabric of our economic lives, influencing everything from our mortgage payments to our savings accounts. As individuals navigating this landscape, it’s essential to understand how these shifts can affect us, our families, and our future investments. At Exclusive Links, a premier real estate company in Dubai, we believe in empowering our clients with the knowledge to make informed decisions. Let’s break down the five key things you need to know about rising interest rates.

1. The Ripple Effect on Mortgages

One of the most immediate impacts of rising interest rates is on mortgages. If you already have a mortgage with a fixed interest rate, you’re in the clear for now. However, if your mortgage has a variable rate, brace yourself for higher monthly payments. As interest rates climb, so do the rates on variable-rate mortgages, which can significantly increase your financial burden.

For those considering buying a home, it’s crucial to lock in a mortgage rate sooner rather than later. Higher interest rates mean higher costs over the life of the loan, potentially putting your dream home further out of reach. At Exclusive Links, we advise our clients to explore their options and secure a favourable rate before the market shifts further.

2. Impact on Savings and Investments

On the flip side, rising interest rates can be a boon for your savings. Higher rates mean better returns on savings accounts, fixed deposits, and bonds. This is an excellent opportunity to grow your emergency fund or save for a significant purchase.

However, the stock market often reacts negatively to rising interest rates. Higher rates increase borrowing costs for companies, which can slow down their growth and reduce their stock prices. It’s essential to diversify your investments and perhaps consult with a financial advisor to balance your portfolio effectively during these times.

3. Effect on Consumer Spending

Rising interest rates don’t just affect large financial commitments like homes and investments—they also influence everyday spending. Higher interest rates can lead to increased costs on credit card debt and personal loans, making it more expensive to finance everything from home renovations to vacations.

This means being more strategic about spending and borrowing. It’s a good time to reassess your budget, prioritise paying down high-interest debt, and consider delaying large purchases until rates stabilise.

4. Business and Career Implications

If you’re an entrepreneur or considering starting your own business, rising interest rates can have significant implications. Higher borrowing costs can make it more expensive to finance business expansion or manage cash flow. This environment may require more meticulous financial planning and possibly seeking alternative funding options.

For career-oriented individuals, understanding the broader economic environment can also offer insights into job market trends. Companies facing higher borrowing costs might slow down hiring or salary increases. Staying informed about your industry and continually upgrading your skills can provide a buffer against economic shifts.

5. Real Estate Market Dynamics

As a real estate company, we at Exclusive Links see firsthand how rising interest rates impact the housing market. Higher rates can dampen buyer enthusiasm, leading to a slowdown in sales. However, this also means it might become a buyer’s market, with less competition and potentially better deals on properties.

If you are eyeing luxury property in Dubai, it’s important to note that rising rates might slow down market demand, but could also lead to more attractive deals as sellers adjust prices to maintain interest. Sellers may be more willing to lower prices or offer incentives to close deals. Understanding the timing and dynamics of the market can provide significant advantages. Additionally, check out our Dubai property investment guide that provides you with all the necessary information about Dubai real estate investment.

0 notes

Text

Understanding Your Options for Mortgage Financing in Dubai

Understanding your options for mortgage financing in Dubai is essential for making informed decisions when purchasing property. This blog explores the different mortgage financing options available and how to choose the best one for your needs.

For more information on home loans, visit home loan dubai.

Types of Mortgage Financing Options

Fixed-Rate Mortgages: These mortgages have a constant interest rate throughout the loan term, providing predictable monthly payments.

Variable-Rate Mortgages: The interest rate on these mortgages can fluctuate based on market conditions, leading to potential changes in monthly payments.

Hybrid Mortgages: These combine features of both fixed and variable-rate mortgages, offering a fixed rate for an initial period followed by a variable rate.

Interest-Only Mortgages: These mortgages allow borrowers to pay only the interest for a specified period, followed by principal and interest payments for the remainder of the loan term.

Offset Mortgages: These link a savings account to the mortgage, reducing the interest payable on the mortgage by offsetting the savings balance against the loan balance.

For property purchase options, explore Buy Houses in Dubai.

Factors to Consider When Choosing a Mortgage

Interest Rates: Compare the interest rates of different mortgage products. Consider both fixed and variable rates to determine which is more suitable for your financial situation.

Repayment Terms: Evaluate the repayment terms, including the loan term, monthly payments, and any penalties for early repayment.

Fees and Charges: Be aware of any fees and charges associated with the mortgage, such as processing fees, legal fees, and valuation fees.

Flexibility: Consider the flexibility of the mortgage product, including options for overpayments, payment holidays, and switching between fixed and variable rates.

Lender Reputation: Research the reputation of the lender, including customer reviews and ratings, to ensure they have a track record of reliable service.

For mortgage consulting services, consider Mortgage Broker UAE.

Real-Life Success Story

Consider the case of Emma, an expatriate in Dubai looking to buy her first home. Emma was initially overwhelmed by the mortgage options and the complexities of the application process. She decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed Emma’s financial situation, explained the different mortgage products available, and helped her choose the best one for her needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Emma informed at every step. This personalized service made a significant difference, reducing Emma’s stress and ensuring a smooth and successful home purchase.

For rental property management services, visit Apartments For Rent in Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For property sales, visit Sell Your Apartments in Dubai.

Future Trends in Mortgage Financing

The mortgage financing landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit home loan dubai.

Conclusion

Understanding your options for mortgage financing in Dubai is essential for making informed decisions when purchasing property. By exploring different mortgage products, considering key factors, and seeking professional advice, you can choose the best mortgage financing option for your needs. For more resources and expert advice, visit home loan dubai.

1 note

·

View note

Text

Everything You Need to Know About Home Loans in the UAE

Securing a home loan in the UAE can be a complex and overwhelming process, especially for first-time buyers. The UAE's dynamic property market and diverse range of mortgage products require a clear understanding of the options available and the steps involved. This comprehensive guide will provide everything you need to know about home loans in the UAE, helping you navigate the process with confidence and ease.

Understanding Home Loans

Before diving into the specifics, it's essential to understand what a home loan entails.

What is a Home Loan?

A home loan, also known as a mortgage, is a loan provided by a financial institution to help you purchase a property. The loan is secured against the property, meaning the lender can seize the property if you fail to repay the loan. The repayment period can range from a few years to several decades, depending on the terms agreed upon with the lender.

Key Terms and Definitions

Principal: The amount of money borrowed.

Interest Rate: The percentage charged on the principal, representing the cost of borrowing.

Amortization: The process of gradually repaying the loan through regular payments over the loan term.

Equity: The difference between the property's market value and the outstanding mortgage balance.

LTV (Loan-to-Value) Ratio: The ratio of the loan amount to the property's appraised value.

Types of Home Loans in the UAE

The UAE offers various types of home loans to cater to different financial needs and preferences.

Fixed-Rate Mortgages

Fixed-rate mortgages have a constant interest rate throughout the loan term, providing stability and predictable monthly payments. This type is ideal for those who prefer a consistent financial plan.

Variable-Rate Mortgages

Variable-rate mortgages, also known as adjustable-rate mortgages (ARMs), have interest rates that fluctuate based on market conditions. While they may start with lower rates, they can increase over time, leading to higher monthly payments.

Islamic Mortgages

Islamic mortgages, compliant with Sharia law, do not involve interest payments. Instead, they use concepts like Murabaha (cost-plus financing) and Ijara (leasing). These mortgages are suitable for individuals seeking Sharia-compliant financial solutions.

Choosing the Right Home Loan

Selecting the right home loan is crucial for a successful home-buying experience. Here are some factors to consider:

Assess Your Financial Situation

Before applying for a home loan, evaluate your financial situation, including your income, expenses, and credit score. This will help you determine your borrowing capacity and choose a loan that fits your budget.

Compare Interest Rates

Interest rates can significantly impact your monthly payments and the total cost of the loan. Compare rates from different lenders to find the most competitive offer.

Consider the Loan Term

The loan term, or the length of time you have to repay the loan, can affect your monthly payments and interest costs. Shorter terms typically have higher monthly payments but lower overall interest costs, while longer terms have lower monthly payments but higher interest costs.

Check for Hidden Fees

Be aware of any additional fees associated with the loan, such as processing fees, appraisal fees, and prepayment penalties. These can add to the overall cost of the loan.

Importance of Mortgage Consultants

Mortgage consultants can be invaluable in navigating the home loan process.

What Does a Mortgage Consultant Do?

A mortgage consultant provides expert advice, helps you understand your options, and guides you through the application process. They can also negotiate better terms on your behalf.

Benefits of Hiring a Mortgage Consultant in Dubai

Expertise: Consultants have extensive knowledge of the local mortgage market.

Time-Saving: They handle the paperwork and negotiations, saving you time and effort.

Better Deals: Consultants can secure more favorable terms and interest rates.

Personalized Advice: They offer tailored advice based on your financial situation and goals.

Steps to Secure a Home Loan in the UAE

Securing a home loan involves several steps, from initial preparation to final approval and closing.

Initial Preparation

Assess Your Financial Situation: Evaluate your income, expenses, and credit score to determine your borrowing capacity.

Save for a Down Payment: Save at least 20% of the property's value for the down payment.

Get Pre-Approved: Obtain pre-approval from a lender to know how much you can borrow and streamline the home search process.

Application Process

Gather Documentation: Collect necessary documents, such as proof of income, bank statements, and identification.

Submit Application: Complete and submit the mortgage application to your chosen lender.

Appraisal and Inspection: The lender will appraise the property and conduct an inspection to ensure it meets their standards.

Approval and Closing

Loan Approval: Once the lender approves your application, they will issue a loan offer.

Review Terms: Carefully review the loan terms and conditions.

Sign Agreement: Sign the mortgage agreement and other relevant documents.

Transfer Funds: The lender will transfer the loan amount to the seller, and you will officially own the property.

Overcoming Common Challenges

Securing a mortgage can come with challenges. Here are some common obstacles and tips to overcome them.

Potential Obstacles

High Debt-to-Income Ratio: Lenders may reject your application if your debt-to-income ratio is too high.

Low Credit Score: A low credit score can result in higher interest rates or loan denial.

Insufficient Documentation: Missing or incomplete documents can delay the approval process.

Solutions and Tips

Reduce Debt: Pay down existing debts to improve your debt-to-income ratio.

Improve Credit Score: Pay bills on time, reduce outstanding balances, and avoid new credit inquiries.

Organize Documents: Ensure all required documents are complete and accurately submitted.

Maximizing Your Home Loan Options

To get the best terms and maximize your mortgage options, consider these strategies.

Improve Your Financial Profile

A higher credit score and lower debt can help you secure better terms. Regularly monitor your credit report and address any issues promptly.

Negotiate with Lenders

Don't be afraid to negotiate with lenders for lower interest rates or better terms. A mortgage consultant can assist in these negotiations.

Consider Different Lenders

Shop around and compare offers from multiple lenders to find the best deal. Different lenders may offer varying terms, so it's important to explore all your options.

Stay Informed

Keep up-to-date with the latest mortgage rates and market trends. This knowledge can help you make more informed decisions and potentially secure better terms.

Navigating the home loan process in the UAE requires careful planning, research, and professional guidance. By understanding the basics, exploring your options, and seeking expert advice, you can secure a mortgage that best suits your needs and financial goals. Remember, the right mortgage can make a significant difference in your home-buying experience, so take the time to make informed decisions.

Have you recently gone through the mortgage process in the UAE? Share your experiences or ask any questions you have about home loans in the comments below! Your insights could help others on their home-buying journey.

4o

1 note

·

View note

Text

Unlocking the Real Estate Market: Understanding Property Valuations in Dubai

Dubai's dynamic real estate market has long been a magnet for investors and homeowners seeking lucrative opportunities and luxurious living spaces. Central to navigating this vibrant landscape is understanding property valuations – the process of determining the market value of real estate assets. Whether buying, selling, or investing in property in Dubai, having a clear understanding of valuation principles is essential for making informed decisions and maximizing returns. In this article, we delve into the intricacies of property valuations in Dubai, exploring their significance, methods, and implications for stakeholders in the real estate sector.

The Significance of Property Valuations: Property valuations serve as a cornerstone of the real estate market, providing insights into the worth of residential, commercial, and industrial properties. In Dubai's fast-paced environment, where market dynamics can fluctuate rapidly, accurate valuations play a crucial role in guiding buying and selling decisions, securing financing, and assessing investment potential. Whether determining the listing price for a property, negotiating a sale, or evaluating portfolio performance, stakeholders rely on valuations to inform their strategic decisions and mitigate risks.

Methods of Property Valuation: Property valuations in Dubai employ various methods to assess the market value of real estate assets. Some common approaches include:

1. Comparable Sales Method: This method involves analyzing recent sales of similar properties in the same area to determine a property's market value. By comparing factors such as size, location, amenities, and condition, valuers can estimate the value of the subject property based on recent market transactions.

2. Income Approach: The income approach is commonly used to value income-generating properties, such as rental apartments or commercial buildings. This method calculates the property's value based on its potential income stream, taking into account factors such as rental rates, occupancy levels, operating expenses, and capitalization rates.remarkable website real estate in abu dhabi will help you get there

3. Cost Approach: The cost approach estimates a property's value by considering the cost of replacing or reproducing it, minus depreciation. This method is often used for new or unique properties where comparable sales data may be limited, such as custom-built homes or specialty buildings.

Implications for Stakeholders: Property valuations in Dubai have far-reaching implications for various stakeholders in the real estate sector:

1. Buyers and Sellers: Accurate valuations empower buyers and sellers to negotiate fair prices and make informed decisions based on market realities. For sellers, an overvalued property may deter potential buyers, while an undervalued property may result in missed opportunities for profit. Conversely, buyers can use valuations to identify undervalued properties and capitalize on investment opportunities.

2. Lenders and Financial Institutions: Financial institutions rely on plant & machinery valuation to assess the risk of lending against real estate assets. Valuations provide lenders with assurance that the property serves as adequate collateral for the loan and helps determine the loan-to-value ratio, interest rates, and loan terms.

3. Investors and Developers: Investors and developers use machinery valuation to evaluate the performance of their real estate portfolios, identify opportunities for growth or diversification, and make strategic investment decisions. Accurate valuations enable investors to allocate capital effectively and optimize returns on their investments.

Property valuations are a fundamental aspect of Dubai's real estate market, providing stakeholders with critical insights into property values and market trends. Whether buying, selling, financing, or investing in real estate, understanding the principles of property valuation is essential for making informed decisions and navigating the complexities of the market. By leveraging accurate valuations, stakeholders can unlock opportunities, mitigate risks, and maximize returns in Dubai's dynamic and ever-evolving real estate landscape.

Source Url:-https://sites.google.com/view/cncocom6/home

0 notes

Text

Homeownership Made Easy: Mortgage Services in the UAE

Introduction

The dream of homeownership in the United Arab Emirates (UAE) is a reality that many aspire to achieve. Whether you're looking to purchase a new property, secure Dubai home loans, or obtain a UAE home loan, the process can seem daunting. However, with the right mortgage services, the path to homeownership can be made significantly easier. In this blog, we'll explore the world of mortgage services in the UAE, the eligibility criteria for Dubai mortgages, the role of corporate loan consultants, and how to secure a loan against commercial property.

Mortgage Services in UAE

Mortgage services in the UAE play a pivotal role in helping individuals turn their homeownership dreams into reality. These services encompass a wide range of financial products and consultancy, making it easier for residents and expatriates alike to purchase property in this thriving region.

New Property Loan UAE and Dubai Home Loans

When it comes to acquiring a new property in the UAE, securing a mortgage is often a primary concern. New property loan options are designed to provide individuals with the necessary funds to purchase homes in the region. Dubai home loans, in particular, have gained popularity due to the city's booming real estate market and the increased demand for housing.

UAE Home Loan and Mortgage in Dubai Eligibility

Eligibility for UAE home loan and Dubai mortgages typically depends on several factors. These include income, employment status, credit history, and the property's value. Meeting the eligibility criteria is crucial for securing a loan that suits your needs and financial situation. Working with mortgage consultants can help ensure that you meet the necessary requirements.

Corporate Loan Consultants in UAE

Corporate loan consultants in the UAE are experts in financial solutions and are equipped to guide individuals through the mortgage application process. Their role is to provide advice, assist with documentation, and help secure favorable mortgage terms. Whether you're a salaried employee or a self-employed professional, these consultants can provide valuable insights into the mortgage landscape in the UAE.

Loan Against Commercial Property UAE

In addition to residential mortgages, there is also the option of obtaining loans against commercial property UAE. This financial service is particularly attractive to businesses and entrepreneurs looking to expand their commercial ventures. Loan against commercial property can provide the necessary funds for growth and development, allowing businesses to seize new opportunities in the UAE's thriving market.

The Benefits of Mortgage Services in the UAE

The benefits of utilizing mortgage services in the UAE are numerous. They include:

Expert Guidance:

Mortgage consultants are well-versed in the intricacies of the UAE's real estate and mortgage market. They can provide tailored advice based on your specific needs and financial situation.

Streamlined Process:

Mortgage services can significantly simplify the application process, reducing the time and effort required to secure a mortgage.

Access to Multiple Lenders:

Working with mortgage consultants can grant access to a variety of lenders, each offering different terms and rates. This allows borrowers to choose the best mortgage option for them.

Understanding Eligibility:

Mortgage consultants can clarify eligibility criteria and assist borrowers in improving their chances of securing a mortgage.

Efficient Documentation:

These experts can assist with the complex documentation required for mortgage applications, ensuring that all paperwork is in order and complete.

Conclusion

The journey to homeownership in the UAE is made significantly easier with the assistance of mortgage services, including new property loans, Dubai home loans, and UAE home loans. With the guidance of corporate loan consultants and the option of loans against commercial property, individuals and businesses can navigate the complex mortgage landscape with confidence. Whether you're a first-time homebuyer or a seasoned investor, leveraging the expertise of mortgage consultants can be the key to achieving your homeownership and business expansion goals in the UAE.

0 notes

Text

All You Need to Know About Applying for a Loan Against Property in Dubai

Are you looking for a loan against property in Dubai? If so, you’re not alone. Many people are turning to this type of loan as an alternative to traditional bank loans because of the favorable rates and flexible repayment options.

However, before you apply for a loan against property, some important factors must be considered. Let’s take a look at what they are.

Eligibility Requirements

The first thing you need to know when applying for a loan against property in Dubai is the eligibility requirements. Different lenders have different criteria when it comes to who qualifies for this type of loan.

Generally speaking, the lender will want to know your credit score, income level, and other financial information such as your debt-to-income ratio. It is important that you research each lender individually in order to determine if you meet their specific eligibility requirements.

Interest Rates

Another factor to consider when applying for a loan against property in Dubai is the interest rate that will be charged on the loan amount. Most lenders charge higher interest rates on these types of loans than on traditional bank loans due to the increased risk associated with them.

Be sure to shop around and compare different lenders before deciding which one is right for you so that you can get the best possible rate on your loan.

Repayment Terms

Finally, it’s important to understand the repayment terms of any loan against property in Dubai before signing up for it. Some lenders offer more flexible repayment terms than others, so make sure that you read through all of the fine print carefully before agreeing to anything.

Additionally, make sure that you can afford the monthly payments before signing up so that you don’t end up defaulting on your loan and damaging your credit score even further.

Conclusion:

Applying for a loan against property in Dubai can be an excellent way to secure funding without having to go through traditional banks or other lenders with high interest rates and rigid repayment terms.

Before signing up for any such loan, however, it is important that you understand all of the eligibility requirements and compare different lenders' interest rates and repayment terms so that you can choose the one that best suits your needs and budget constraints.

By doing this research beforehand, you can ensure that taking out this type of loan will be beneficial rather than detrimental in the long run.

0 notes

Text

Open Exchange’s (OPNX) native currency crashed on the heels of co-founder Su Zhu’s arrest. OX token value craters The arrest of Su Zhu has triggered a massive wave of sell pressure, resulting in a steep decline in the value of OX tokens. According to Alphanomics, approximately $1 million worth of OX tokens were hastily dumped by token holders in the days following the news. As a result, OX tokens dropped to as low as $0.010. While a minor recovery has occurred since the initial crash, the token’s value remains down by over 83% from its all-time high. OX is the native cryptocurrency of OPNX, a specialized exchange designed for trading claims of insolvent crypto firms like FTX. Holders of OX tokens benefit from reduced trading fees on the platform and have a say in its governance activities. OPNX was launched in April amid controversy due to its association with Zhu as well as Kyle Davies, co-founders of the now-defunct crypto hedge fund Three Arrows Capital (3AC). Su Zhu’s arrest This month, Su Zhu’s arrest at Changi Airport in Singapore sent shockwaves through the Web3 community. Following his failure to adhere to a court instruction, Zhu was handed a four-month prison sentence after issuing a committal order. Teneo, the court-appointed joint liquidator of 3AC, revealed that a similar committal order was granted against Davies, whose whereabouts remain unknown at the time of writing. With Zhu beginning his sentence, the liquidators are now focused on “the recovery of assets that are either the property of 3AC or that have been acquired using 3AC’s funds. The Su Zhu saga has once again made it clear that centralized crypto platforms can’t be trusted. Zhu and Davies once controlled around $10 billion worth of crypto assets, making 3AC one of the largest Web3 firms in the world. However, plummeting cryptocurrency prices coupled with shady trading strategies cleaned out its assets, and the firm was unable to repay lenders. When 3AC went bankrupt, liquidator Teneo reported that both co-founders were uncooperative. 3AC unravels 3AC experienced a significant downfall in 2022 following the collapse of fugitive Du Kwon’s Terra ecosystem. Excessive leverage on long positions across various crypto assets and borrowing large sums of money led to its bankruptcy. After the collapse, Zhu and Davies defaulted on loans and went into hiding, leading to legal actions against them. In May, they received a written reprimand from Dubai’s Assets Regulatory Authority (VARA) for operating this venture. Earlier this month, the Monetary Authority of Singapore (MAS) barred the two 3AC co-founders from conducting financial activity in Singapore for nine years each. OX token’s gloom The Open Exchange Token (OX) is trading at around $0.0136, representing a 35% decrease in the past week and a 70% decline in the monthly timeframe. The current bear pressure on OX has led to a crash over $30 million in the token’s market capitalization, which now hovers at around $53 million. The future of OX token and Open Exchange remains uncertain as the cryptocurrency community grapples with the aftermath of Su Zhu’s arrest and the downfall of 3AC. Investors and stakeholders are closely monitoring developments in this unfolding saga.

0 notes

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

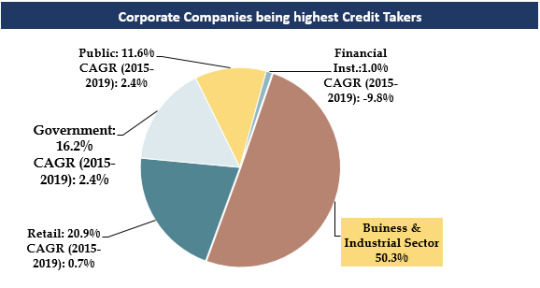

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Best Mortgage Service in UAE

Best Mortgage Service in UAE

About Us We are a group of master monetary experts with long stretches of banking and corporate experience. We are devoted to making a significant long haul relationship with our clients and banking accomplices. We have faith in laying out a relationship that depends on understanding information and obligation to giving unprejudiced counsel and fantastic help. An organization of activity, proactive, proficient and focused on making long haul achievement and monetary movement for you, our clients and banking accomplices. by understanding your own requirements, we access each home credit item on the lookout and way to deal with each loan specialist in the Assembled Bedouin Emirates to guarantee you get the right counsel and safeguard your inclinations in each stage. We comprehend that the UAE property exchange and home loan process is surprisingly convoluted. For this reason we are here to help you during each move toward get your ideal property, Our clients are not situated in that frame of mind from across different nations including the Center East, Europe, Asia, Australia and the America. We unequivocally accept that the Home loan Business Credit, Corporate and SME area in the UAE need a ton of help and administrations connected with meet the any client's monetary requirements. we have the information, aptitude and the availability in the accompanying,

Services

New Purchase

Whether It's your first or second home loan we are here to assist you with getting the most ideal rates and conditions and guide you through the entire course of getting the new property.

Equity Release

Letting value out of your property can be really smart to revamp your property or asset another buy. You can profit up to 70%-80% advance to worth of your current property.

Re-Mortgage

Renegotiating your house is absolutely getting a superior home loan arrangement to supplant the first home loan. Renegotiating is finished to permit a borrower get a superior rate to save money on premium.

Non-Resident Mortgage

Non occupant can get up to 75% credit to an incentive for buying a property in the UAE.

Loans Against Rental Income

The rental pay can be utilized alongside other pay, for example, your compensation to build your acquiring power or probably contract out of the rental pay absolutely are likewise accessible

Under Construction & Off Plan

Organize up to half credit to esteem (LTV) for the off plan or under development property. The LTV can be expanded after the handover.

Commercial & Building Finance

We additionally help our clients in arranging and organizing finance for private as well as business improvements.

Construction & Land Financing

At the point when you own a real estate parcel, you can fabricate a space that is remarkably yours, We help to secure the land for you so you can begin transforming your fantasy into the real world.

Why Us

Best Home loan representative in Dubai-UAE

We are your cordial and believed contract consultancy worked in private and business property funding in the Unified Middle Easterner Emirates.

We work for you, Not for the banks!

Contract Representatives was laid out to help buyers in their home loan journey. While you're hoping to purchase your property, our home loan specialists can give wise counsel since they are educated in the subject.

The home loan group can give you exhortation on which bank would be the most appropriate for your requirements since they have created associations with a few banks throughout the long term.

Personal Documentation

Emirates ID, Visa and Visa

Salaried employee:

Most recent compensation authentication

Most recent compensation slips

Any extra bank explanations from the most recent a half year

Self-employed:

Substantial Exchange Permit duplicate

MOA (Reminder of Affiliation) including all revisions

Bank articulations from the most recent a half year

Examined financials from the most recent 2 years

How to get Approved?

Thinking about how everything functions? The following are not many models we make an into move.

Down Payment- Your initial investment is your most memorable stake in your new home

Credit Score- The better your score, the more probable you are to get an extraordinary loan cost

Employment History- A consistent work history lets us know how you well you will actually want to meet your home loan

Debt Burden Ratio- Proportion assists us with deciding how much home loan you can manage.

Contact Us: +971-555394457

0 notes

Text

Real Estate Lawyers in Dubai: Protecting Your Interests in Property Matters

Welcome to the AWS Legal Group in Dubai! We are a dedicated team of legal professionals specializing in providing comprehensive legal services tailored to meet the unique needs of businesses operating in the dynamic landscape of Dubai. With deep expertise in both local and international laws, we offer expert advice and support across a wide range of legal areas, including corporate law, intellectual property, contracts, data protection, and regulatory compliance. Our client-centric approach, combined with our in-depth understanding of the local business environment, allows us to deliver innovative and effective legal solutions. Trust us to safeguard your interests and navigate the legal complexities, enabling you to focus on your core business objectives.

ADR Lawyers in Dubai

ADR lawyers in Dubaiact as mediators, facilitating communication between conflicting parties. They help establish a conducive environment for open dialogue, enabling parties to express their concerns, understand each other's perspectives, and work towards a mutually acceptable resolution.

Arbitration Lawyers in Dubai

Arbitration lawyers in Dubaipossess extensive knowledge of local and international arbitration laws and procedures. They advise clients on the most suitable arbitration rules, such as those provided by institutions like the Dubai International Arbitration Centre (DIAC), to ensure a fair and efficient resolution process.

Banking Lawyers in Dubai

Banking lawyers in Dubaiplay a crucial role in structuring complex financial transactions. They provide guidance on the legal aspects of mergers and acquisitions, financing arrangements, syndicated loans, and other banking operations. Additionally, they prepare and review legal documentation, such as loan agreements, security documents, and financial service agreements, to protect the interests of their clients and ensure legal compliance.

Business Setup in Dubai

Business setup in Dubaiinvolves several procedural steps, such as registering the business name, obtaining necessary permits and approvals, drafting legal documents, and fulfilling financial requirements. Lawyers specializing in business setup ensure that all these procedures are followed accurately and efficiently.

Civil Lawyers in Dubai

Civil lawyers in Dubaispecialize in handling cases related to civil rights and obligations. They possess comprehensive knowledge of the applicable laws and regulations and assist their clients in understanding their legal rights and responsibilities in various civil matters.

Commercial Lawyers in Dubai

Dubai offers different business entities and legal structures, including mainland companies, free zone establishments, and offshore entities. Commercial lawyers in Dubaiassist entrepreneurs in choosing the most suitable legal structure for their business goals and guide them through the formation and registration process.

Construction Lawyers in Dubai

Construction lawyers in Dubaiassist clients in managing payment and performance issues. They ensure that proper mechanisms are in place to monitor progress, address delays or deficiencies, and enforce contractual obligations. They also provide guidance on resolving payment disputes and pursuing claims for additional compensation or damages.

Criminal Lawyers in Dubai

Criminal lawyers in Dubaiare committed to protecting the rights of individuals accused of crimes. These rights include the presumption of innocence, the right to a fair trial, the right to legal representation, and protection against self-incrimination. Criminal lawyers ensure that their clients' rights are respected throughout the legal process.

Debt Collections in Dubai

Debt collection in Dubaiinvolves various methods, including negotiation, amicable settlement, and legal action. Creditors may initially attempt to resolve the debt through communication and negotiation with the debtor. If these efforts prove unsuccessful, legal action can be pursued through the appropriate channels.

Family Lawyers in Dubai

Family lawyers in Dubaiprovide expert legal advice and guidance to individuals and families facing family-related issues. They assess each client's unique circumstances, explain the relevant legal processes, and help clients make informed decisions that align with their best interests and those of their family.

Fintech Lawyers in Dubai

Fintech often involves innovative technologies and proprietary software. Fintech lawyers in Dubaiassist clients in protecting their intellectual property rights, such as patents, copyrights, trademarks, and trade secrets. They help businesses draft and negotiate licensing agreements, software development contracts, and non-disclosure agreements to safeguard their valuable assets.

Inheritance in Dubai

Inheritance lawyers in Dubai govern the distribution of assets and properties after an individual's death. Understanding the legal framework surrounding inheritance is crucial for individuals and families to ensure a smooth and fair distribution of assets. In this article, we will explore the key aspects of inheritance in Dubai, including the legal system, applicable laws, and procedures involved.

Insurance Lawyers in Dubai

Dubai has a well-established regulatory framework governing the insurance industry. The Insurance Authority (IA) oversees the sector and enforces regulations to ensure fair practices, solvency of insurers, and consumer protection. Insurance lawyers in Dubaihave a deep understanding of these regulations and their implications for policyholders.

Intellectual Property Lawyers in Dubai

Intellectual property (IP) is a valuable asset for individuals and businesses, protecting their creative works, inventions, and brand identity. In Dubai, intellectual property lawyers play a crucial role in assisting clients with the registration, protection, and enforcement of their IP rights. In this article, we will explore the significance of intellectual property lawyers in Dubaiand how they help clients safeguard their intellectual property and navigate the complexities of IP laws and regulations.

Labor Lawyers in Dubai

Labor lawyers in Dubai ensure the protection of employee rights and establish a framework for employer-employee relationships. Labor lawyers in Dubai play a crucial role in assisting employees and employers with various employment-related matters, including contracts, disputes, and compliance with labor regulations. In this article, we will explore the significance of labor lawyers in Dubai and how they help ensure fair treatment in the workplace and resolve employment disputes.

Maritime Lawyers in Dubai

Navigating Legal Waters: The Expertise of Maritime Lawyers in Dubai

Maritime lawyers in Dubaipossess in-depth knowledge and experience in various aspects of maritime law, both at the national and international levels. They understand the intricate legal frameworks governing vessel operations, marine insurance, cargo claims, salvage operations, environmental compliance, and maritime disputes. This expertise enables them to provide invaluable guidance and solutions to clients, ensuring compliance with relevant regulations and mitigating legal risks.

Mergers & Acquisitions in Dubai

Mergers and acquisitions (M&A) play a significant role in the business landscape of Dubai, enabling companies to grow, expand market presence, and enhance competitiveness. M&A transactions involve complex legal and financial considerations, and engaging experienced professionals such as lawyers is crucial for successful outcomes. In this article, we will explore the key aspects of mergers and acquisitions in Dubaiand the role of lawyers in facilitating these transactions.

Real Estate Lawyers in Dubai

The real estate market in Dubai is dynamic and fast-paced, attracting local and international investors alike. Real estate lawyers in Dubai play a vital role in assisting individuals and businesses with property-related matters, ensuring legal compliance, and protecting their interests. In this article, we will explore the significance of real estate lawyers in Dubaiand how they help clients navigate the complexities of property laws, transactions, and disputes.

Rental & Tenancy in Dubai

The rental and tenancy market in Dubai is governed by specific laws and regulations that protect the rights of both landlords and tenants. Understanding the legal framework is essential for individuals and businesses engaging in rental agreements in Dubai. In this article, we will explore the key aspects of rental and tenancy in Dubai, including the rights and obligations of landlords and tenants, rental contract terms, and dispute resolution mechanisms.

Wills Registrations in Dubai

Wills registrations in Dubaienable individuals to express their testamentary wishes and ensure the orderly distribution of assets upon their death. Registering a will is a crucial step in estate planning and can provide peace of mind to individuals and their families. In this article, we will explore the importance of wills registrations in Dubai, the legal requirements, and the process involved.

0 notes

Text

How to Secure a Business Loan for Your Small Business

Starting or expanding a business can be a challenging task, and many entrepreneurs often require additional funding to get started or grow their operations. Business loans can be an excellent way to access the capital needed to start or grow a business, but it is essential to understand how they work and the various options available. In this blog post, we will discuss what business loans are, how they work, and some of the advantages and disadvantages of using them.

What is a Business Loan?

A business loan is a loan that is taken out by a business to finance its operations or expansion. Business loans are usually offered by banks, credit unions, or other financial institutions and can be secured or unsecured. Secured loans require collateral, such as property or equipment, to be pledged against the loan, while unsecured loans do not. For a Bussiness loan in dubai .

How Does a Business Loan Work?

To obtain a business loan, a borrower must submit an application to a lender. The application will typically include information about the business, such as its financial statements, business plan, and credit history. The lender will then evaluate the application and determine whether to approve the loan and the interest rate and terms of the loan.

If the loan is approved, the borrower will receive the funds and be required to make regular payments, including both principal and interest. The repayment term of the loan will depend on the amount borrowed, the interest rate, and other factors, but can range from a few months to several years.

For a Bussiness loan in dubai .

Advantages of Using a Business Loan

One of the primary advantages of using a business loan is that it can provide access to the capital needed to start or expand a business. With a loan, an entrepreneur can purchase equipment, hire staff, and invest in marketing and other business activities that can help the business grow and succeed.

Another advantage of using a business loan is that it can help to establish or improve a business's credit history. By making regular loan payments on time, a business can build a positive credit history, which can help to access future financing at more favorable terms.

Disadvantages of Using a Business Loan

While there are many advantages to using a business loan, there are also some potential drawbacks. One disadvantage is that the interest rates on business loans can be high, especially for unsecured loans. This can increase the cost of borrowing and make it more challenging to repay the loan.

Another disadvantage of using a business loan is that it can be difficult to qualify, especially for new or small businesses. Lenders may require significant collateral or a strong credit history, which can be challenging for startups or businesses with limited financial resources.

0 notes