#loan against property for uae nationals

Explore tagged Tumblr posts

Text

Purchasing Property in Dubai: How to Secure the Best Mortgage Deals

Dubai is one of the most attractive real estate markets in the world, offering a variety of investment opportunities for both residents and foreigners. However, securing the best mortgage deals can be a complex process. In this blog, we will explore the essential steps to ensure you get the most favorable mortgage terms when purchasing property in Dubai.

Understanding the Mortgage Market in Dubai

Before applying for a mortgage, it is crucial to understand the local lending landscape. Banks and financial institutions in Dubai offer different mortgage products tailored to various buyer profiles. Whether you are an expat or a UAE national, familiarizing yourself with mortgage regulations, interest rates, and eligibility criteria is a vital first step.

Key Factors That Influence Mortgage Deals

Several factors impact your ability to secure a favorable mortgage in Dubai, including:

Credit Score: A high credit score improves your chances of obtaining a loan with lower interest rates.

Down Payment: Expats are typically required to put down at least 20-25% of the property value, while UAE nationals may need to provide a lower percentage.

Debt-to-Income Ratio: Lenders assess your income against existing financial commitments to determine your loan eligibility.

Loan Tenure: The repayment period can vary, influencing the total interest paid over time.

Steps to Secure the Best Mortgage Deals

Compare Lenders: Research different banks and financial institutions to compare interest rates, loan terms, and processing fees.

Use a Mortgage Broker: Engaging a professional mortgage broker can help you navigate the complexities of securing the best deal.

Get Pre-Approved: Pre-approval from a lender provides a clear understanding of your borrowing capacity, making property negotiations smoother.

Negotiate Terms: Don’t hesitate to negotiate better interest rates and terms with banks, as many institutions are open to adjusting rates based on your financial profile.

Understand Fees and Costs: Be aware of additional costs such as processing fees, insurance, and early settlement charges before finalizing a mortgage.

How RealTawk Can Help

RealTawk simplifies the process of purchasing property in Dubai by offering expert guidance, connecting buyers with top mortgage providers, and providing up-to-date market insights. With our platform, you can explore the best mortgage options, compare deals, and make informed decisions with confidence.

Conclusion

Purchasing property in Dubai can be a rewarding investment, but securing the right mortgage is essential to maximize your financial benefits. By understanding the mortgage landscape, comparing lenders, and leveraging expert advice from RealTawk, you can secure the best mortgage deal and turn your dream of owning property in Dubai into a reality.

0 notes

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

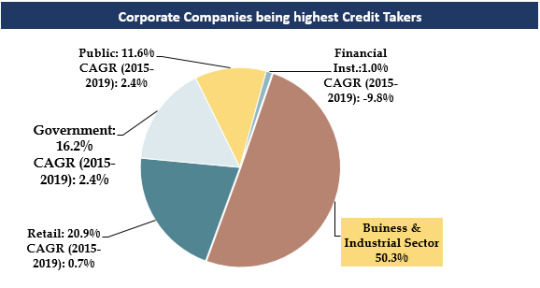

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Best Mortgage Service in UAE

Best Mortgage Service in UAE

About Us We are a group of master monetary experts with long stretches of banking and corporate experience. We are devoted to making a significant long haul relationship with our clients and banking accomplices. We have faith in laying out a relationship that depends on understanding information and obligation to giving unprejudiced counsel and fantastic help. An organization of activity, proactive, proficient and focused on making long haul achievement and monetary movement for you, our clients and banking accomplices. by understanding your own requirements, we access each home credit item on the lookout and way to deal with each loan specialist in the Assembled Bedouin Emirates to guarantee you get the right counsel and safeguard your inclinations in each stage. We comprehend that the UAE property exchange and home loan process is surprisingly convoluted. For this reason we are here to help you during each move toward get your ideal property, Our clients are not situated in that frame of mind from across different nations including the Center East, Europe, Asia, Australia and the America. We unequivocally accept that the Home loan Business Credit, Corporate and SME area in the UAE need a ton of help and administrations connected with meet the any client's monetary requirements. we have the information, aptitude and the availability in the accompanying,

Services

New Purchase

Whether It's your first or second home loan we are here to assist you with getting the most ideal rates and conditions and guide you through the entire course of getting the new property.

Equity Release

Letting value out of your property can be really smart to revamp your property or asset another buy. You can profit up to 70%-80% advance to worth of your current property.

Re-Mortgage

Renegotiating your house is absolutely getting a superior home loan arrangement to supplant the first home loan. Renegotiating is finished to permit a borrower get a superior rate to save money on premium.

Non-Resident Mortgage

Non occupant can get up to 75% credit to an incentive for buying a property in the UAE.

Loans Against Rental Income

The rental pay can be utilized alongside other pay, for example, your compensation to build your acquiring power or probably contract out of the rental pay absolutely are likewise accessible

Under Construction & Off Plan

Organize up to half credit to esteem (LTV) for the off plan or under development property. The LTV can be expanded after the handover.

Commercial & Building Finance

We additionally help our clients in arranging and organizing finance for private as well as business improvements.

Construction & Land Financing

At the point when you own a real estate parcel, you can fabricate a space that is remarkably yours, We help to secure the land for you so you can begin transforming your fantasy into the real world.

Why Us

Best Home loan representative in Dubai-UAE

We are your cordial and believed contract consultancy worked in private and business property funding in the Unified Middle Easterner Emirates.

We work for you, Not for the banks!

Contract Representatives was laid out to help buyers in their home loan journey. While you're hoping to purchase your property, our home loan specialists can give wise counsel since they are educated in the subject.

The home loan group can give you exhortation on which bank would be the most appropriate for your requirements since they have created associations with a few banks throughout the long term.

Personal Documentation

Emirates ID, Visa and Visa

Salaried employee:

Most recent compensation authentication

Most recent compensation slips

Any extra bank explanations from the most recent a half year

Self-employed:

Substantial Exchange Permit duplicate

MOA (Reminder of Affiliation) including all revisions

Bank articulations from the most recent a half year

Examined financials from the most recent 2 years

How to get Approved?

Thinking about how everything functions? The following are not many models we make an into move.

Down Payment- Your initial investment is your most memorable stake in your new home

Credit Score- The better your score, the more probable you are to get an extraordinary loan cost

Employment History- A consistent work history lets us know how you well you will actually want to meet your home loan

Debt Burden Ratio- Proportion assists us with deciding how much home loan you can manage.

Contact Us: +971-555394457

0 notes

Text

Nationals in Dubai looking to take out a loan against property

Taking out a loan against property can be a great way for nationals in Dubai to finance major investments, such as starting a business or purchasing real estate. But before you decide to take out this type of loan, it's essential that you understand the laws and regulations that govern this kind of financing. Here's an overview of everything you need to know about loan against property in Dubai for nationals.

What is Loan Against Property?

Loan against property (LAP) is a type of secured loan that allows borrowers to use their existing property as collateral when taking out a loan. This type of financing is especially popular among those who own properties outright, since they don't have any other asset they can use as collateral. Depending on the lender, LAPs are typically offered with repayment periods ranging from one year up to 20 years.

How Does Loan Against Property Work?

When taking out an LAP, the borrower must provide documentation proving that they own the property they wish to use as collateral. The lender will then appraise the value of the property and determine how much money they're willing to lend. Once all the paperwork has been signed and approved, the borrower can receive their money either in one lump sum or through installments over time. It's important to note that if the borrower fails to make payments on time or defaults on their loan entirely, their property could be seized by the lender.

Are There Any Restrictions?

Yes, there are some restrictions when it comes to taking out an LAP in Dubai for nationals. For example, only citizens over 21 years old who have been living in UAE for more than five years can apply for this type of loan. Additionally, there are limits placed on how much money can be borrowed; usually no more than 70% of the collateral’s value will be lent by financial institutions offering LAPs..

Conclusion:

Taking out an LAP is a great option for nationals in Dubai who need cash quickly and don't have any other assets they can use as collateral. However, before applying for this type of loan it's important that you understand all the rules and regulations governing it so that you don't end up getting into more debt than you can handle or risk your home being taken away from you if you default on your payments. With all this information now at your disposal, you should be better equipped to decide whether taking out an LAP is right for you or not!

0 notes

Text

10 Benefits Of Buying Budget Apartments In Dubai

For quite a while now, composing a point-by-point article about the advantages of buying Budget Apartments In Dubai was rotating in my mind and ordinarily, Maybe if one somehow happened to play with the advantages of buying Budget Apartments In Dubai and look at the upsides and downsides, the rundown will go a long way. For one, to keep things basic and logical so at last. What you will peruse beneath is an outline of the multitude of advantages of buying Budget Apartments In Dubai.

# 1 - Reliably Developing Populace

Assuming you claimed a real estate property in a phantom town from where individuals are moving to different spots, could that property yield any income for you? Dubai is a cosmopolitan city where individuals from more than 200 different nations are living subsequently the number of inhabitants in the city is expanding step by step.

One of the greatest advantages of buying Budget Apartments In Dubai is that individuals from everywhere in the world are coming here looking for better professions and business open doors. This multitude of individuals need a spot to remain, all things considered, nobody will remain in lodgings until the end of their lives, correct?

# 2 - Reliable Development and Advancement

Could you rather buy property in a city where there is no greater development work continuing or in a city where new imaginative thoughts are sent off sometimes? Dubai is now well while heading to turn into the savviest city on the planet. There is continuously a new thing about Dubai and that is one of the greatest advantages of buying Budget Apartments In Dubai too.

A city where something new is occurring constantly is dependably the focus of fascination for the masses and when a great many individuals stay with this city consistently, they need a spot to remain, why not your place then, at that point?

Dubai is as of now home to the tallest structure also known as Burj Khalifa and presently there will be another pinnacle taller than the Burj too. The imaginative thoughts introduced and started by the Dubai government are a solid sign that buying Budget Apartments In Dubai could be the best choice of your life.

# 3 - Service of Satisfaction

This may be one of the peculiar advantages of buying Budget Apartments In Dubai yet it is valid. Indeed, we have a priest of joy in Dubai. The astounding administration of Dubai is continuously pursuing improving the existence of its occupants and keeping them cheerful.

Recently, another joy service has been added to UAE's bureau. The primary obligation of this service will be to gauge the bliss level of Dubai's occupants and make such moves that will upgrade the way of life of individuals living in the emirates making them more joyful than at any other time.

With such advancement and devotion to the overall population, one can hardly comprehend how much your property venture will prosper before very long in Dubai.

# 4 - Security

Among many advantages of buying Budget Apartments In Dubai, one is the feeling of safety that the occupants of Dubai appreciate. This is one of the significant motivations behind why individuals find it solid to come here to Dubai and begin their new lives. While numerous nations in the center east locale have gone through yet going through their reasonable portion of political aggravation, Dubai stays the most steady city in the MENA area.

# 5 - UAE Property Visa

The greatest advantage of buying Budget Apartments In Dubai that you can appreciate is that you can become qualified to get an occupant visa in light of your property buy in Dubai. However, there are sure prerequisites that you want to coordinate. For instance; the worth of your property ought to be essentially AED 1 million, there ought to be no home loan against your property and it ought to be livable.

You should move toward Dubai Land Division to get your financial backer visa against your acquisition of property in Dubai.

# 6 - Assortment of Choices

With regards to putting resources into Dubai's real estate market and partaking in the advantages of buying Budget Apartments In Dubai, there is an assortment of choices accessible to look over. Two principal classifications are private properties and business properties. On the off chance that you will probably put resources into private property, you can either buy an apartment or a manor and put resources into business real estate in Dubai, you have choices going from workplaces, and work camps to modern properties too.

# 7 - Low Securing Cost

This is one of the greatest advantages of buying property in Dubai and can't be overlooked. Take a gander at the graph table beneath and you will get a thought that it is so cheap to obtain property in Dubai when contrasted with other developed real estate markets all over the planet.

# 8 - Higher Rental Return

Did you have any idea that rental returns in Dubai are a lot higher when contrasted with significant real estate capitals on the planet? The best performing areas of Dubai are producing up to 10% rental yield by and large. The typical rental yield in New York is just 3.91%, in London it is 3.21%, in Singapore it is 2.83% and in Hong Kong, you won't get over 2.82% rental pay.

# 9 - Great Capital Appreciation

We as a whole realize that in real estate or any sort of venture, everything revolves around timing. Individuals who put resources into tech new businesses like Twitter, LinkedIn, Microsoft, Facebook and Instagram, and so on saw their venture coming to the skies before long and that is simply because they saw possible in those open doors and got in when the stock costs were a lot of lower.

# 10 - No Tax

There is no property charge in Dubai. And that implies, that whenever you have purchased the property and paid the enrollment charge to Dubai Land Office, there could be no other government expense to be paid against your property by any stretch of the imagination.

This perspective alone enormously affects the general rental yield generated by your property in Dubai. If you somehow happened to buy property in Hong Kong, you will wind up settling up to 15% yearly duty on that property and the proportion in Singapore will be 13%, in London, it will be 2.33% and in New York, it will be 2.2%. Though there will be 0% expense forced on your property buy in Dubai and that settles on the decision much simpler to buy property in Dubai.

For more: Abu Dhabi Apartments, Real Estate Companies in Dubai, Cheap Apartments For Sale In Abu Dhabi.

#Buy Budget Apartments In Abu Dhabi#Abu Dhabi apartments#real estate companies in dubai#Cheap Apartments For Sale In Abu Dhabi

0 notes

Text

Things to be Aware of Before Opting for Loan Against Property from Emirates NBD

Everyone faces challenges in life – be it financial, career-related or personal. Financial problems often push us to use savings we may have put away for a rainy day. In situations like these, we can always take assistance from financial institutions or banks in a form of loans. A good option, if you have property, is to take a loan against property as this allows you to borrow more compared to personal loans.

What is a loan against property, or LAP, as it is otherwise known?

A loan against property is a secured form of a loan where your property such as a house or flat acts as a security against the money you are borrowing. This type of loan can be used for personal financing, business financing, medical emergencies and so on. Since this is a secured loan, you can often borrow a larger amount than unsecured loans.

Here are some things to keep in mind before applying for a loan against property

1.Your credit score

A LAP is a secured loan as your property acts as collateral. However, financial institutions will still evaluate your credit score before considering your application. Keeping a good credit score helps you get loans on favourable terms.

2. Other offerings in the market

The secret to choosing the best loan is to do your research. Although, you might need funds (money) urgently, it is advisable to research the best the market has to offer in terms of interest rates. Due to rising interest rates, it may benefit you to look at a longer tenure loan on a fixed interest rate.

Some factors that influence interest rates:

-Your credit score -Loan tenure and nature of interest (variable or fixed) -Market conditions -Nature of the property – a newer, higher value property will always - get you better terms -Repayment capacity – your income and ability to pay back will help -you get a better rate. 3. Terms and conditions

It is very important to read the terms and conditions of the loan as there can be hidden fees, terms for prepayment, and clauses which may give the lender right to change the conditions of the loan. Skipping these may result in surprises and shocks which may lead you to pay much higher than what you initially borrowed.

4. Paying back

Planning out your repayment structure helps in making on time payments and not missing out on payments as these could lead to penalties. You can consider early loan settlement or partial loan settlement.

For more information on Loans against property for UAE nationals and expatriates click here.

0 notes

Photo

Loan Against Property for UAE Nationals | Emirates NBD

Loan Against Property for UAE Nationals – If you own a property in the UAE, Emirates NBD offer you the most convenient way to get a loan by mortgaging your owned and unencumbered property

0 notes

Text

Exploring Loan Against Property Options for UAE Nationals

Are you a UAE national looking to leverage your property for quick and easy financing? A loan against property (LAP) may be the solution you are looking for. The loan against property is a secure way to access funds from your own home or investment property. Let’s explore the options available to UAE nationals when considering a loan against property.

What is Loan Against Property?

Essentially, this type of loan utilizes the equity in your home or investment property as collateral. This allows you to leverage your existing asset(s) to access up to 70% of its market value in loanable funds. Many banks offer competitive rates on LAPs, making them an attractive financing option for many people.

Benefits of Loan Against Property

There are several advantages that come with availing yourself of a LAP. For example, many banks offer lower interest rates than personal loans, making them much more cost-effective. Additionally, they typically have longer repayment tenures (up to 25 years), allowing borrowers more flexibility in repaying their debts over time. This also means that borrowers can access larger amounts of money with lower monthly payments than with other types of financing products like personal loans or credit cards. Moreover, because the loan is secured against a tangible asset, it provides peace of mind knowing that if anything goes wrong during the course of repayment, there will be something left behind—the asset itself—to cover any losses incurred by the lender.

Eligibility Criteria and Documentation Required In order to qualify for a LAP in the UAE, applicants must meet certain eligibility criteria including age criteria and income requirements set by each bank individually. Documentation required includes proof of identity such as passport copies and residence visa copies; proof of residence such as electricity bill or tenancy contract; proof of income such as salary slips/bank statements; and title deed/property papers confirming ownership rights over the said property used as collateral for the LAP. Once all documents are submitted for verification and approved by the bank, you can expect funds within two weeks from application date (subject to Bank's internal processing timelines).

Conclusion:

A loan against property is an attractive financing option for many UAE nationals looking to leverage their existing assets without taking on too much risk or expense. With competitive interest rates and extended repayment tenures, this type of loan can provide quick access to large sums of money with relatively low monthly payments compared to other types of financing products like personal loans or credit cards. Before applying though, make sure you understand all eligibility criteria and documentation requirements so that you can ensure a smooth application process and receive disbursal quickly upon approval!

0 notes

Text

Purchasing a Property in UAE 2021

Having own property is everyone’s dream. Purchasing property is never easy until or unless you make it. To find the property at great deals without hassle you need planning.

As we know that all persons doesn’t purchase property for home even some do want it for good investment. So with which option you should go we have few tips to decide for the same:

Planning for investment or home:

It is the most important factor that whether you are purchasing the property for investment or for home. While purchasing for the home it becomes easier as compare to investment.

If you are non-UAE resident and you have long term plan for living in UAE then you should purchase a home, because for long term in renting you will also pay a lot and you can’t have a feeling of your home.

If it’s an investment opportunity you want, then you need to find out which country will give you the best rental return.

Also note : Mortgage rates in UAE 2021

Location:

It is other important thing which should be best for house as well for the property purchase for any investment. Try to invest in the property area which is already developed , it should be near by school, Metro , shopping malls and other basic necessities.

Prior to buying any property make sure you know of any future development plans in the surrounding as this can potentially affect the future valuation of your property.

How much you know about market:

Try to check it out the Dubai market about its highs and lows. By that you can come to know when the property prices are increasing and falling.

Best mortgage for the property purchase:

You have to check it out the mortgage rates which suits you.

https://www.compare4benefit.com/all-loan/mortgage-home-loan

Compare the mortgage rates and go for the your mortgage:

The key to securing a good mortgage is to cut off the danger such as getting locked into a mortgage because of hefty transfer fees or early settlement fees. It’s also worth remembering the UAE Central Bank did try and introduce caps on mortgage lending earlier this year. The caps on how much consumers could borrow were suspended for further consultation after the banks lobbied against them — but those caps could be in place by the end of this year.

How much risk you can take:

You do everything at a risk it could be good at outcomes sometimes and sometimes not. The people who made the most in the UAE’s last property boom took a risk and invested in what was then a very new property market. When you are investing , invest it at good times. So, whatever your decision, tread carefully.

For the foreigner who are living from a long time and are thinking that owing house is good option than renting .They have a good news . Outlanders can buy property at different locations in Dubai, Abu Dhabi and The North Emirates

Below are the locations listed for property purchase in UAE :

Dubai

If you are an outsider currently living in the United Arab of Emirates, Dubai law states that you can buy:

A leasehold property

A freehold property in one of the 23 freehold areas including Al Barsha South, Emirates Hills, Jebel Ali , Sheikh Zayed Road , Dubai Marina and Palm Jumeirah.

The Northern Emirates

Outlanders can now make freehold and leasehold purchases in Ras Al Khaimah , Sharjah , Ajman and Umm al Quwain. Most of the available property tends to be on a leasehold basis.

Abu Dhabi

Non- GCC nationals ( people not from the UAE, Bahrin , Kuwait, Qatar, Oman or kingdom of Saudi Arabia ) are able to buy leasehold and freehold property in designated investment zones in Abu Dhabi , These include Yas Island, Reem Island, Saadiyat Island, Raha Beach, Al Reef Village and more

Can expats get the mortgage to purchase property in the UAE?

Expats can get a mortgage from lenders operating in the UAE but there are some restrictions. The UAE Mortgage Cap law requires non- UAE nationals to have a cash down payment of at least 20% of the property value 9 15% for UAE nationals) plus associated purchase costs.

Now the question is how you will save this down payment ???

Do not need to worry for the same we have provided you some tips below:

There’s no getting around the need for a down payment when it comes to buying a property in the UAE. Unlike some areas of the world, there are no 100% mortgages here! Expats are required to have at least a 20% down payment, and UAE nationals need 15%.

You can save money by reducing unnecessary spends such as you spend on malls and eating at restaurants or going for unnecessary gym partnership of 1 year .

You should for the highest interest rate saving options and as we know that investing in house is long term investment so while on rent try to go for low budget property.

You should go for strict monthly budget and stick to it and try to safe more.

For the same you should use a mortgage broker because broker has good communications with the lenders and output will be great. It will save your money and he will give you many options according to your needs. On the other end you can save your time also because you don’t need to go to various locations and call many persons.

WRITTEN BY

Compare4Benefit Mortgage

Follow

#purchasing property in uae#buy property in dubai#how to choose property in uae#mortgage#mortgage rates in uae

0 notes

Text

National General Premier Is So Famous, But Why? | national general premier

National General premier is a premier general mortgage insurer. The company offers home loans, which are the best solution for most people who wish to take out a home loan.

National offers mortgages to people of all incomes, as it understands that different consumers need different things. It understands that some people might prefer to take out a mortgage on their second home, for example, while others might want to take out a mortgage on their first home. Others might want to take out a mortgage for both their second home and their first home, and others might want to take out a mortgage for their second home and their first home at the same time. So the company has mortgage products for all sorts of consumers.

One of the reasons why Premier has become one of the biggest lenders in the UK is its commitment to customer satisfaction. This commitment extends to the company itself: so you can be sure that you're dealing with a company that offers only the very best in home loans. The company has been ranked as the top lender by independent credit rating agency, ICSA, and it also ranks highly in many consumer polls, such as those conducted by MoneySupermarket.

When it comes to mortgage insurance, National has a wide range of policies to choose from. One of its most popular policies is called Guaranteed Home Equity, which is designed for people with a high risk of repossession if the property they own is repossessed. Guaranteed Home Equity, in effect, means that the homeowner will get money from the loan they have taken out against their home if the property they own is seized by the bank.

If the borrower defaults on the loan, the bank can then foreclose on the home and sell it to recoup their losses. This policy will work well for people who are in danger of being repossessed, as the interest charged by the bank is low, but it can also work well for people who want to buy their first home, as long as they can afford the monthly repayments.

So when it comes to finding an affordable homeowner insurance policy for you, National is the right choice to look at. Its affordable homeowner insurance policy means that it is easy to find a plan that suits your needs, whether it is a high risk, or a first time buyer policy.

Home – National General Insurance – NGI – UAE – national general premier | national general premier

National General Insurance Teams INSURANCE PREMIER LEAGUE 8 – national general premier | national general premier

Home – National General Insurance – NGI – UAE – national general premier | national general premier

Companies We Represent – Coronado Insurance Agent Martin Fenton III – national general premier | national general premier

Premier Healthcare Germany – Premier Healthcare Germany – national general premier | national general premier

Advocate Brokerage appointed Independent Agent for NatGen Premier – national general premier | national general premier

Get a Quote, Policy Login, Make a Payment – national general premier | national general premier

National General Premier — Wang Insurance – national general premier | national general premier

The post National General Premier Is So Famous, But Why? | national general premier appeared first on Insurance.

via WordPress https://insurancelifedream.com/national-general-premier-is-so-famous-but-why-national-general-premier/

0 notes

Text

10 Things to Know Before You Take a Loan in UAE

It is common today that you need a loan for your day to day expenditures. In every country, banks have different rules and regulations to offer loans to its customers. In the same way, United Arab Emirates (UAE) banks have their own rules and regulations which must be followed to obtain a loan.

There are different types of loans available in UAE, for example, personal loan, car loan, home loan and business loans. For every type of loan, you have different requirements. But you should know what are the steps to take any loan you must consider them. These are the steps or things which you must know before taking any loan

Rate of interest

Different moneylenders offer distinctive measures of credits at different interest rates. Complete an intensive statistical surveying on various banks and their offers. Banks typically offer loans at higher rates than conventional Islamic banks, for example, Emirates Islamic bank for Home loans. Ensure you converse with numerous banks previously going to a choice. This will enable you to make a better choice for taking any type of loan.

2. Know about the required Documents

Documents required for loans are normally

Salaried/Self-employed

UAE national ID card or a valid passport

In case the applicant is an expat then a valid residency visa for the UAE is also needed.

If the bank requires a salary transfer then a letter of salary transfer will also be needed.

Banks may have distinctive prerequisites for age and employing company as well.

In the event that you work for the private sector, requirements for least business period and qualified age might be higher as compared to Government sector.

3. Know about your creditworthiness

If you have acquired any loan in the past, at that point there will be a record of your financial record with the bank. This is an extremely powerful method for knowing regardless of whether you are able to pay off any loan. If you missed a few due deadlines previously, your record score would have a tendency to be lower and banks may charge higher interest rates or give you a small loan.

In case you’re a first-time borrower, your financial assessment will be dictated by your pay, age, background and so on. : Each UAE bank will have a minimum standard salary they require you to earn in order to give you any loan.

4. Secured and Unsecured loans

There are secured and unsecured loans which banks usually offer. Unsecured loans, for the most part, are lower in sums and charge higher rates of interests as they don’t include any guarantee to be set against the loans. In any case, acquiring an unsecured loan is generally easier than secured loans.

Secured loans include putting a collateral against the loan amount, which may be reallocated by the bank, on the off chance that you can’t reimburse the loan. Secured loans are esteemed against the estimation of the property/asset kept as collateral against the loans.

Find out your correct necessity with regards to the sort of debt that you have to dispose of, and choose whether you’ll be OK with a higher rate of interest or putting an asset as a guarantee.

5. Least expensive ain’t the best

Try not to go for the least expensive loans with daze confidence; rather, take time to compute the genuine cost of borrowing which incorporates the loan sum, the length of the loan, reimbursement frequency, fees and interest charges. It is likewise fundamental to understand the financial guidelines the bank will follow in modifying rates.

Guarantee that whoever is advising you by taking a loan can take you through all the charges in detail and explain the total cost and hidden charges.

6. Have alternatives

As a rule, a bank may not be your solitary alternative to acquiring a loan. On the other hand that you have a strong financial background, you might be qualified for some credit cards, for example, Citibank that would give you a chance to complete your activity and charge 0% interest for a year. Or then again in case you’re a piece of some trading organization, you may have the capacity to get cash from them at lower interest rate what banks offer.

7. Don’t take a high amount of loan

Sometimes, banks will offer you more cash, in view of your credit assessment. Abstain from falling into these traps as this won’t just raise the weight of loans yet, in addition, you’ll wind up paying more interest on a little amount of money.

Acquiring a loan has something other than just completing the paperwork and getting the cash in hand. Numerous banks charge processing expenses, enrollment charges and so on as a rule in a level of the measure of cash you wish to get. Discover which banks offer the best arrangement, work it out a little and discover the amount you’ll have to pay the bank, including every one of the charges, expenses, and premium and so on.

8. Know about Islamic Finance

There are numerous banks in UAE that provide sharia compliance products. Utilizing the Murabaha, the bank would typically purchase the product and after that re-sell the product to the client at a higher cost. The profit can be made in regularly scheduled payments and is referred to as the profit rate.

9. Early settlement fee

If you are intending to take your loan for a long time, however considering paying it off before at that point, the early settlement expense turns into an imperative factor in your choice. This is an expense forced on you in the event that you choose to pay off your loan early.

10. How you repay your debt

This is the final step to know how you can repay your loan. Banks offer from one year to five long payment plan with an alternate rate of interest for each offer. Be strategic and discover what amount you would be able to pay in EMIs (Equated Monthly Installment).

An informed and cautious approach to borrowing is the need of the hour.

0 notes

Text

CDI 2020: China’s Commitment to Development

Register at https://mignation.com The Only Social Network for Migrants. #Immigration, #Migration, #Mignation ---

New Post has been published on http://khalilhumam.com/cdi-2020-chinas-commitment-to-development/

CDI 2020: China’s Commitment to Development

China has emerged over the past decade as the world’s second-largest economy and its policies and development approach have a major bearing on global development. That’s why, alongside other G20 countries that hadn’t previously been included like Brazil and Turkey, we have assessed China in this year’s Commitment to Development Index (CDI). We find that, taking into account its size, China’s policy commitment to development ranks 35th of the 40 countries in the index. In the seven components assessed in the CDI, China scores well on technology; below average on environment, migration, and trade; and poorly on investment and security. In development finance, where you might imagine China would score strongly, our measures ranked it last. Some of those results may seem counterintuitive: Most people know that China provides major levels of finance to Africa, and that it’s a big producer of greenhouse gases. However, after we take account of country size to enable comparisons between countries, our index ranks China last on development finance but well above the US and in the top ten on limiting greenhouse gas emissions. Why these unexpected results? How much do China’s other policies do for international development?

Isn’t development finance China’s strength?

China is a major lender to developing countries, with a total stock of lending estimated to exceed $400 billion and annual lending that could be as high as $40 billion. This is a similar level of lending to the World Bank, yet China comes solidly last on our development finance component, which assesses the financial assistance provided to poorer countries. What explains the apparent discrepancy between its low score and large financing flows? The first reason is that we assess both quantity and quality, and on the latter, China is lacking. The details of China’s lending are highly opaque—trying to assess the extent of its activities has spawned an entire field of research—which limits scrutiny and challenge. China is also penalised for requiring that its finance projects must be performed by Chinese firms. Its poverty and fragility focus are above average, but few countries responded to the Global Partnership for Effective Development Cooperation survey to confirm China’s commitment to providing finance in line with their national priorities, even if China prides itself on respecting “the right of the recipient country to independently choose the path and mode of development.” But even on quantity, China ranks 38th, as the large reported flows are only partly concessional, and small compared to China’s vast economy. Although hampered by a lack of official information, the best estimates of China’s loans suggest that the subsidy element (or “grant-equivalent”) is relatively small. So, from a face value potentially as high as $40 billion a year, we estimate the grant-equivalent value, along with direct grants, to be “just” $5 billion. That’s just 0.04 percent of China’s GNI, compared to an average over the 40 CDI countries of 0.3 percent of GNI. This finding, although immediately counterintuitive, actually fits with wider work on this subject. China’s official lending is very large and near-commercial, which make it affordable to provide but also a concern in terms of affordability and indebtedness.

Is it fair to compare China against OECD and other standards?

We have strived to use measures and data that are applicable to each of the 40 countries in the CDI (indeed, we altered many of our measures to achieve this). Still, China and some other G20 countries do not subscribe to several of the standards we assess. This is most obvious in our investment component: on commitments against standards from the Organisation for Economic Co-operation and Development (OECD) on anti-corruption; the United Nations (UN) on business and human rights; and measures of financial secrecy compiled by a UK think tank. It’s not only new additions: Switzerland and the US have not signed up to the UN target on aid—but we still assess them against it. The bottom line is if China (or indeed any of the countries that do not meet them) did meet these standards, the world would get better more quickly, so we think it’s right to include them. For China, we could not identify data for three of our (52) indicators. China was given the average on these measures as we felt it could not be expected to report on some indicators (like those of the OECD) so did not unduly hold back China’s score. Still, for other countries added, notably Saudi Arabia and UAE, there were penalties for missing data for several indicators that they should be reporting. Still, if more information was available—for example on China’s loan portfolio—it may show that its development effort was higher than we were able to demonstrate. Finally, to recognise that development responsibility rises with income, we produce income-adjusted scores. These look at what CDI score we’d expect based on income level, and then look at how far above or below that score countries come. China’s position is essentially unchanged—it rises one place to 34th, suggesting that it is below what might be expected of it based on its relatively low income level.

What to make of China’s environmental performance

China ranks 24th on the environment component—below average, but also well above the US, which ranks 35th. The main driver of this is climate: China’s direct per-head emissions (9 tonnes) are under half of those of the US (20 tonnes). And the gap grows when indirect emissions embedded in imports are taken into account (typically half as much again). Across both, China is currently among the top 10 in low emissions per head. This partly reflects China’s low economic output per head, though the income-adjusted results show its emissions are in line with expected levels, and still performs better than the US. China has plenty of room for improvement on environmental issues—fossil fuel production and subsidy, subsidies to fishing, and environmental conventions—but the CDI demonstrates every country is a long way from net zero emissions.

Technology a strength

On technology, China rank 14th. Although second only to the US in absolute terms, China’s spend on public research and development (R&D) is unremarkable when measured against the size of its economy. It does offer some of the highest support for commercial R&D, though. China’s tertiary student body is also above average in reflecting the international and developing world. Still, where China scores top—perhaps surprisingly considering the value the government places on technology—is that it places few restrictions beyond World Trade Organization norms on intellectual property rights in its bilateral trade deals. And here, other countries could learn from China’s approach.

The CDI’s rankings are an opportunity for policy improvement

We’ve included the G20 countries in the CDI to consider their policies against the framework we have developed over fifteen years in supporting development, given the increasingly important role China and other new donors play. We think that this exercise has identified areas where all countries could improve their policies, very often to the benefit of their own people, and support other countries’ development, especially the poorest. We hope our results start a dialogue around that—and look forward to discussing our results further.

0 notes

Text

The Benefits of Hire a Real Estate Agent

Buyers and dealers are on separate aspects of the fence when it comes to home income. What one is trying to acquire is frequently diametrically against what the alternative wants to see show up—the first typically desires to thieve the belongings even as the opposite wants top dollar. And yet, they share the identical last goal. They want a sale.

Both sides can benefit significantly from hiring a real estate agent to assist them, but their reasons may be different.

It's All About the Money...

Consider this if you're taking into consideration going "FSBO"—for sale by using the owner—while listing your property. Of course, you want to get as an awful lot for their domestic as feasible, and you may think that means now not parting with greater commissions. But a 2017 take a look at indicated that FSBOs fetched approximately 30% much less for their proprietors than agent-listed houses.

And you're probably going to have to pay a commission besides if your buyer is represented by using an agent. The purchaser's agent's commission is typically factored into the deal—although you'll nevertheless shop on the fee you would in any other case have paid your very own agent.

And why not use an agent if you're the buyer? After all, the seller is paying the commission, now not you. Of course, there's continually a slim possibility that the vendor will refuse to do so, however you may likely move on and observe different homes if it seems that this could be the case, even though it may rely upon whether you're buying in a buyers' or dealers' marketplace and who has the higher hand.

And Attention to Detail

You are probably a ways out of your detail in terms of reviewing and know-how the multiple files involved in a real estate deal, and you must have a thorough knowledge of what you're stepping into no matter whether or not you're shopping for or selling. Purchase agreements alone can pinnacle 10 pages in 2019, no longer to mention federal, state, and local document requirements.

Luckily, your agent can be far more familiar with all this paperwork than you are. Consider this if you're still considering saving money: Some errors or omissions in these documents can value you as an awful lot as that commission you were attempting to avoid paying—or even some distance more.

Here's an example: Maybe a buyer makes an offer on a domestic, however it's contingent on getting a loan. There's no possibility that the purchaser could buy the property without first securing financing—but there's no such contingency or escape hatch built into the acquisition settlement to allow the customer out of the deal if financing fails. The customer is obligated to go through with the sale or be sued if it seems that a mortgage isn't happening.

Consider hiring a broker for a smaller one-time rate to absolutely overview your contracts earlier than signing if you're nonetheless dead set against hiring an agent to attend to all this.

Privacy, Confidentiality and Fiduciary Duty

Your real estate agent has your returns whether you're a client or a vendor. Agents have what's called a "fiduciary" responsibility to their clients. They are legally obligated to put their clients' exceptional pastimes first.

This responsibility imparts a totally excessive standard for confidentiality. As a consumer, do you really, really want to turn over your maximum intimate economic info to a FSBO vendor who's below no legal duty to maintain the records confidential? The equal goes for turning any and all records over to the seller's agent, who has no fiduciary responsibility to you but only to the seller. Your own agent would realize whether or not any facts the opposite agent is inquiring for from you is reasonable.

You do have recourse if you're the customer and the seller's agent has lied to you, misled you, or disclosed confidential data. You can file it to the agent's expert association, including the National Association of Realtors. But again, this assumes that the seller has an agent. You'll have fewer alternatives if the property is FSBO.

Agents Know What to Look For

Buyers generally have a quite firm idea in mind of what they need in a property, from range of bedrooms to a connected storage to any quantity of other must-have and must-no longer-have factors. You'll in all likelihood feel quite snug searching at homes with that list tucked firmly in the back of your mind.

But your agent can be alert for problems that won't cross your thoughts, such as furnace problems, leaks, roofing problems, and mildew and insect problems. An agent will recognize the telltale signs of these issues and know how best to approach them. Again, this enjoyment and information can end up saving you thousands down the road.

You recognise precisely how tons you want for your property if you're the seller, but is the charge you've arrived at reasonable? You might most effectively realize for sure in case you're capable of perceiving comparable income that verify which you're in the right range—or no longer. Agents can do comparative market analysis of their sleep.

Agents Have Superior Negotiating Skills

You might not be a negotiation shark if you don't show up to be an attorney, mediator, union rep...Or a real property agent. Remember that fiduciary obligation your agent has to you. It's your agent's activity to get you the quality feasible fee for your home, or to look at which you get the quality feasible deal on the belongings you need to buy.

Agents are skilled to negotiate well. They realize what typically works and what does no longer. Most have tried-and-true techniques all their very own. And, maximum importantly, they haven't any emotional stake within the outcome that may cloud their thinking.

Tags: Apartments For Sale In Abu Dhabi, Buy Apartment In Abu Dhabi, Best Real Estate Companies In UAE, Abu Dhabi Apartments For Sale

0 notes

Text

Trademark Registration in Duabi - The Leverages a Business Gains From It

A part that helps specialise a set of one producer from another or one company from its competitors is called a trademark. By attaching an naming to a set or work, an enterprise can build an someone in the minds of customers that finish for a weeklong indication. A perfect trademark warning is the red dark finger which is e'er affined to the cold-drink Thums-Up.

In UAE, a concern can trademark:

Word

Name

Logo

Numerals

Slogan

Device

Erstwhile any of these receives a characteristic body, exclusive the soul has only rights to use it. In simpler line, the initiative unaccompanied can use the trademarked express, saying, trademark, etc. For illustration, only Apple Inc. has the far to put the part ingested apple symbolisation on its products. Why Get a Stylemark Entrance?

Too characteristic a product from others, a trademark is an immaterial asset for a occupation. It protects not only the owner of the goodness but also the marque. Both new reasons to get stylemark incoming online are:

It ensures that every consumer easily recognises the creation through the trademark or identify. It offers a lawful passport against duplicitous products and spurious services. It builds a sensation of rely in customers which in turning leads to act and liege buyers achieving the end content of gain for any performing. It can be sold, franchised or transferred at any tip of period which makes it an quality to the unwaveringly. A Gist of Registering a Trademark in Bharat The law in Bharat for trademark calibration is titled Characteristic Act of 1999. When an endeavor applies for a characteristic, they must select from 45 various classes. These are categories of products and services that are characterised by the nature of the byplay. Erst a stylemark is enrolled it is entered in a registry which maintains all TM of a part categorize. This is finished to enter a record of all logos, symbols, language, etc. trademarked.

A stylemark is legal for ten eld. The body can be renewed for another period, as abundant as an employment is submitted within a postulated indication word.

Advantages of Trademark Incoming

An abstract goods For a exchange, any prop has evaluate. A listed earmark is thoughtful by law a dance that is classifiable and abstract. It signifies that the earmark has a regard to it because it is the symbol of the estimate the production or union has. Moreover, a characteristic standardization entireness quasi to added assets of a company. It can be sold or transferred at any direction in instant. A average stylemark, on the otherwise pardner, cannot be distributed from the playing, i.e., an unrecorded TM is e'er connected to the endeavour. If another assort wants to get the goodwill that comes with a shared stylemark, they know to acquire the total trade and not upright the cue.

The story alter A qualified stylemark can exclusive be used by the somebody of the effect and quantity or copulate they cater to. If someone else another than the proprietor makes unauthorised use of it, they tackling licit charges. The definitive legal remedies that proceed with TM registration is the most important benefit of it. Both of the actions that can be stolen are: Suing for wrongdoing Ban Livery of infringed articles Defrayment for amends A solon impediment The presence of a recorded trademark deters added byplay owners from using the identical or siamese ordinary on their products or services. It guarantees that a genuine maintains its goodwill. A warrantee promise If an endeavor wishes to warranted a loan, it can utilise the enrolled earmark in a demeanour equal to unmovable attribute. In other line, a characteristic can be pledged as surety to wax a bank loan. Modify to licensing and others Only a registered trademark has the alter to: Use the symbols® or "R" on an part or accommodation. Permit the gospels. The one is transcribed on the earmark registry. It gives the licensee the legal alter to cause any proceedings in framework there is an infringement. Be transferred to another entity, mortal or concern. Obtain readjustment is a few unnaturalised territories. This allows the brand assets at a spheric take while it is expanding its dealing. As grounds in transactions The act of registering a stylemark is assumed as inform of the credibility of the registrations and the rights that develop with it. In a observance that required eligible sue affiliated to the earmark, the credential proves a human as the businessman of the stylemark. The creation calibration disc is seized as ensure until it is proven otherwise. A good to challenge Under the Sham Artefact Act 1997, the individual of an mortal belongings, which in this soul would be a trademarked item or force, has the choice to withdraw deplorable or national production against a commercialism or organism who was encumbered in counterfeiting. The CGA also affords the synoptical right to any someone who has an curiosity in the goods that were counterfeited. The benefits explained in the article above are not the only module for earmark ingress. In a man where most people active through plagiarism or copying it is alive to guard properties. This is why it is highly recommended to earmark and till every beatific, fact or function that a byplay or an someone creates.

If you are looking service for trademark registration in UAE then you should go with Al Raqeem.

1 note

·

View note

Text

Simon Karam of Sarooj Construction Vouches for Bank of Beirut

Banks are interwoven in people’s lives, integral to their communities and extend the resources to create change. With its single-minded focus on product quality and service excellence, Bank of Beirut has garnered the appreciation of the local business community in Oman.

Vouching for the fact, Simon Karam, Director of Sarooj Construction Company (SCC), one of the top construction companies in Oman says, “Bank of Beirut has been a highly valued and trusted partner to our company for many years. Over the years a huge synergy has been created between our two establishments.”

Read more: Contract inked for construction of 35,000sqm OCA Suhar facilities

He adds, “I am happy to state that SCC has found an excellent banking partner in Bank of Beirut, a well-trusted institution.”

SCC’s diverse project portfolio encompasses marine, transportation, oil and gas, general civil, earthworks, dams, and infrastructure services. Currently SCC is registering success while focusing on business in the clean energy, as it participates in several public private partnerships (PPP) related to the sector.

Also read: ‘I’m a Scapegoat,’ Says Former CEO of Dubai Construction Firm

SCC recently won a contract to build a 200km-long road that will link the wilayats of Mitan, Al Mazyounah and Harweeb in Oman. Previously SCC was involved in construction of a natural gas liquids (NGL) extraction unit at Fahud, located around 300km south of the Sohar Industrial Port area. One of the company’s main projects has been a $ 200 million (about RO 80 million) contract to build roads, steel barrier fence, and control and command rooms across 130km of mountains in Dhofar governorate.

SCC subsidiary and sister companies include Synergy Petroleum International LLC, Electro Mechanics LLC, Sam Trading LLC, Geosol Engineering LLC, Rawasi Road Services LLC, Majus Synergy, Bauer Nimr LLC, GAM & Partners LCC, Atlas International Engineering LLC, Duplipark Synergy, Travo Sarl and Masirah International Marine Services LLC among others.

Majority of SCC project with Bank of Beirut

Simon Karam informs that 65 per cent of SCC’s projects is supported by Bank of Beirut. “We are delighted that we are one of their prime customers,” he says.

Simon Karam who entered the Sultanate’s construction market more than four decades ago says, “Bank of Beirut is one of our preferred bankers for several reasons but particularly because they are supportive of start-ups. Together with Bank of Beirut we have developed and supported several successful start-ups.”

Read more: Galfar Bags $24mn Construction Contract for Khazaen Economic City

Explaining that SCC has benefited at various levels including personal and corporate, Simon Karam says, “Our employees, (even myself) were the first people from the Lebanese community to open accounts with them. The Bank has been very supportive in our corporate projects. Clients require bid bonds; performance guarantees which Bank of Beirut provide us with. Furthermore, during the construction of these projects the bank supported us with Credit Facilities, Long-Term Loans, Letters of Credits, etc. to assist in our Projects’ operational cashflows.”

He added, “Our Lebanese staff in particular find it convenient to bank with them because most of their remittances go to Lebanon. Bank of Beirut has also provided loans to several of our staff for purchasing properties in Oman as well as in their home countries.”

Whenever SCC have gone to Bank of Beirut with business plans, they were willing to listen and support. I know that all of our sister companies also trade with Bank of Beirut.

“Our relationship with them has grown and we have become their umbrella and they have become the support group for all of our companies. To the best of my knowledge there is not one company under SCC group that has not traded with Bank of Beirut,” says Simon Karam.

In short, they have been accepted as a local bank.

Local bank in every sense

Stating that Bank Beirut has become a local bank in every sense, Simon Karam says, “Bank of Beirut’s Omanisation rate is very high and they have very talented national staff. All SCC’s business is in the hands of Omani staff. The Bank has done remarkable work in terms of CSR. I am proud that they have become a part of the landscape and the urban tissue. They have very good products for our Omani employees to buy cars or finance houses. They have been accepted as a local bank.”

Currently, Bank of Beirut is financing a project worth 25 million dollars for SCC in Lebanon where the bank is strongly established and climbing up the list of bankers.

Extending good wishes, he says, “We would like Bank of Beirut to grow as fast we are growing ourselves. In the last 12 years Bank of Beirut has played a dominant role in this vertical and horizontal growth of our group.

Vertically, since Bank of Beirut started operating in Oman, we have moved from a $10 million turnover to over $150 million. The majority of which is with Bank of Beirut that proved time and time again to be our reliable partner. They have contributed quite a lot to our growth, as we have contributed to theirs.”

Talking about the new projects SCC is working on, Simon Karam says, “At the moment we have taken up relatively challenging projects mainly on the oil and gas field. We have long term contracts with BP and PDO. Oman and UAE are among our most important markets and we are focused on projects in the oil and gas, infrastructure, and marine works sectors.”

He added, “Our new focus is solar energy and we are proud to inform you that we have just begun working on this after being awarded a contract for a 100-megawatt plant on one of PDO’s fields.”

SCC, which has over 4,000 employees on its payroll, has scripted a success story in Oman’s highly competitive construction market by delivering challenging projects on time and ensuring that the highest standards of quality and safety are met and improved upon.

Valuable partner

“We clearly demonstrate our commitment to Omanisation, In-Country Value (ICV), Corporate Social Responsibility (CSR), and the local community. Our commitment to enhancing safety in the workplace and to protecting the environment is steadfast. Despite the downturn of the economy we are maintaining a very good backlog and great turnover. with valuable partners like Bank of Beirut the journey has been easy,” says Simon Karam.

He adds, “We truly value the timely, sound and objective advice and the day-to-day involvement provided by Bank of Beirut.”

Bank of Beirut is now providing many services to investors including corporate banking facilities, finance options of all kinds, advances, term loans, advances against credit instruments, advances against receivables, real estate loans and financial and investment consultancy services.

Bank of Beirut offers corporate banking facilities for SMEs and large enterprises, including financing options of all kinds, advances, term loans, advances against credit instruments, advances against receivables, financial and investment consultancy services. In addition to corporate facilities, the bank has always supported employees in oil and gas sector, by providing them with credit cards, personal loans, car loans, and real estate loans.

The post Simon Karam of Sarooj Construction Vouches for Bank of Beirut appeared first on Businessliveme.com.

from WordPress https://ift.tt/2mOHn7E via IFTTT

0 notes

Text

Travel Bans on Personal Guarantors of Loans

Corporate facilities in the United Arab Emirates require a guarantee contract or a personal guarantee to be executed by the principal partner of the debtor company, obliging the guarantor to repay the full or part of the facility granted in case the company that has been granted the banking facilities fails to pay.

In the event that the company defaults in payment banks resort to expedited judiciary procedures and request a travel ban against the personal guarantor, especially if the personal guarantor is not a citizen of the UAE and hence there is a fear of exiting the country. This usually occurs before any other action is taken; such as lodging a claim against the outstanding amount. Without a doubt, imposition of a travel ban is a useful method of pressuring the guarantor into settling the debt.

However, the provisions of the Dubai Court of Cassation have established that to issue a travel ban it is not sufficient to establish that a debt exists and that the guarantor is a foreign national. The creditor must prove that there are serious reasons for the debtor to flee as stipulated in Article 329 of the Civil Procedures Law, which requires that the petition submitted to the Courts state reasons justifying that there is risk of the guarantor fleeing, such as selling all or part of his property, liquidating or closing the company that received the facility, or other evidence to the effect that the guarantor is ending his stay in the UAE in preparation to flee/leave the country.

The absence of these reasons in a petition submitted by the creditor renders it void of one of the conditions provided for in Article 329 of the Civil Procedure Law. When banks apply for a travel ban before the courts of the UAE, it often occurs that they fail to fulfill part of these requirements. Although the law authorizes the judge pursuant to Article 329 to conduct a brief investigation, if the documents supporting the application do not provide sufficient evidence that the debtor will flee, the practice in the UAE is that an urgent matters judge issues the order or rejects it as soon as a request is submitted by the bank without the aforementioned investigation. However, the request for a travel ban is in its original form a petition, and this petition must itself contain the facts of the request and its grounds. Pursuant to Article 140 of the Civil Procedure Law, the judge or the head of the competent circuit shall duly issue his order in writing on the day following the submission of the petition without justification.

The UAE judiciary has determined that the assessment of the availability of meritorious reasons to evidence the risk of the debtor to flee prior to the execution of the judgments against him in favor of the creditor is the authority of the competent court without the need for intervention by the Cassation Court. The legislator granted the creditor bank an eight-day period to file a petition for a travel ban after which the competent judge will deny such petitions under article 330/5 of the Civil Procedures Law.

The Dubai Court of Cassation, in Court of Cassation Appeal No. 119 of 2005 decision issued on 27 November 2005, accordance with Article 329 of the Civil Procedures Law, ruled that restricting the freedom of the debtor to travel outside the country requires that the essential elements that allow the judge to take such action be taken into consideration. The fact that the debtor is a foreign national, or that he is a debtor to a third party, or that a quantifiable civil claim is made is not sufficient. The creditor has the burden of proving more substantial reasons that justify the fear that the debtor will flee the country. It is evident that the courts have a high threshold with respect to the evidence required to restrict travel of a guarantor.

In conclusion, banks in the United Arab Emirates require commitment to a guarantee contract or personal guarantee from principal partners in companies wishing to obtain banking facilities making them jointly liable with the company (debtor) in the fulfillment of any indebtedness in the event that the creditor bank submits a claim to the debt, but what about the precautionary measures that can be taken against the personal guarantor?

The precautionary measures, including travel bans, as mentioned above, can be effective and decisive. They often lead the personal guarantor to reach a settlement for fear of prolonged substantive claims. Travel bans last for at least a year, according to the practice in UAE courts. Of course, it is known that most entities require the travel of their managers and principal partners, which ultimately leads the banks to take advantage of personal guarantees to issue travel bans or any other precautionary measures. In light of the high threshold by the courts, such measures must be carefully pleaded so as to not subject them to rejection by the courts if the debtor lodges an appeal against the order pursuant to Article (141) of the Civil Procedures Law.

The post Travel Bans on Personal Guarantors of Loans appeared first on Dubai Blog.

0 notes