#list of Largest Trading Partners

Explore tagged Tumblr posts

Text

Exploring the Largest Trading Partners of India with Bharat2Export

As one of the fastest-growing economies, India has a robust network of international trade partners that support its economic growth. Bharat2Export stands ready to help businesses expand into these markets by offering global trade opportunities, reliable sourcing, customized solutions, and logistics support. In this article, we’ll dive into the largest trading partners of India, exploring how these relationships contribute to the economy and why Bharat2Export is the perfect partner to help businesses take advantage of these lucrative markets.

Understanding India’s Global Trade Network

India's trade partners are spread across multiple continents, reflecting its position as a major player in the global economy. The largest trading partners of India contribute to the nation's imports and exports of goods, influencing various sectors such as technology, agriculture, textiles, and more. For any business aiming to succeed in international trade, partnering with Bharat2Export can be a game-changer, as we streamline every part of the trading process to make entry into these markets seamless.

Why Choose Bharat2Export for Global Trade?

Bharat2Export offers comprehensive services designed to meet the needs of businesses venturing into India’s largest trading partner markets. We provide:

Global Trade Opportunities: Connect with buyers and sellers across leading economies.

Reliable Sourcing: Ensure the authenticity and quality of sourced products.

Customized Solutions: Tailor-made strategies to meet your unique trade needs.

Logistics Support: Efficient, end-to-end support for secure and timely delivery.

With Bharat2Export by your side, you gain access to expertise and networks, helping you establish a firm foothold in new and challenging markets.

Largest Trading Partners of India: Key Insights

India’s largest trading partners play a crucial role in its economy. Here’s a closer look at some of the top countries that contribute significantly to India’s trade:

1. United States

The United States is one of India’s largest trading partners, accounting for a major portion of both exports and imports. Major exports to the U.S. include textiles, jewelry, pharmaceuticals, and machinery. Bharat2Export can assist companies in exploring the U.S. market, ensuring they meet local requirements and streamline supply chains.

2. China

China is a major supplier to India, especially for electronics, machinery, and textiles. Despite occasional trade challenges, China remains one of the largest trading partners of India. For businesses interested in sourcing from or exporting to China, Bharat2Export provides reliable sourcing and logistics support to navigate this vast market.

3. United Arab Emirates

The UAE has long been a trusted trading partner, with strong trade ties rooted in oil and gas, precious stones, and jewelry. Bharat2Export’s customized solutions ensure that Indian exporters can efficiently meet demand in the UAE while benefiting from our expert logistics support.

4. Saudi Arabia

India’s reliance on Saudi Arabia for oil and other energy resources has made it one of its largest trading partners. With Bharat2Export’s logistical expertise, businesses can manage the complexities of transporting energy resources and other commodities between these two countries.

5. European Union

The EU, particularly countries like Germany, Belgium, and the Netherlands, holds a significant position among the largest trading partners of India. Bharat2Export helps companies align with EU regulations, handle logistics, and capitalize on trade opportunities in various sectors, including automobiles, machinery, and chemicals.

6. Singapore

Singapore is a top destination for Indian exports in the electronics, machinery, and chemical sectors. Bharat2Export’s extensive network in Singapore allows businesses to connect with leading distributors and streamline the export process with ease.

7. Hong Kong

Hong Kong serves as a critical hub for re-exports, making it a valuable trading partner for India, especially in textiles, electronics, and precious stones. Bharat2Export’s services provide seamless entry into the Hong Kong market, allowing businesses to benefit from the city’s strategic location.

8. Indonesia

Indonesia is a key partner for Indian exports in minerals, machinery, and agricultural products. Bharat2Export offers comprehensive trade support to help Indian businesses establish a reliable market presence in Indonesia’s dynamic economy.

Benefits of Engaging with India’s Largest Trading Partners

Connecting with India’s largest trading partners can significantly enhance a business's international reach and growth potential. Bharat2Export provides the necessary guidance and support to help companies navigate cultural, logistical, and regulatory challenges, ensuring a seamless trade experience.

Access to a Vast Customer Base: India’s trading partners represent diverse and large consumer markets, offering businesses the opportunity to reach millions of potential buyers.

Diversification of Risk: Expanding into multiple international markets allows businesses to mitigate risks associated with dependence on a single market.

Competitive Edge: Businesses that leverage Bharat2Export’s services gain a competitive advantage, thanks to our expertise in logistics, sourcing, and strategic trade practices.

Bharat2Export: Your Partner for International Expansion

Bharat2Export is dedicated to supporting Indian businesses as they expand into global markets. Whether it’s helping with reliable sourcing from China or ensuring safe logistics to the United States, Bharat2Export’s solutions cover every step of the trade process. We simplify complex trade operations, providing the tools and resources needed to thrive in India’s largest trading partner markets.

Our range of services includes:

Trade Consultation: We help clients make informed decisions on trade routes, partner selection, and market entry strategies.

Regulatory Compliance Assistance: Ensure all international standards and regulations are met for seamless cross-border trade.

Flexible Logistics Solutions: Secure, trackable logistics for all types of goods, tailored to meet each market's demands.

Conclusion: Expanding with India’s Largest Trading Partners

With its vast network of international partnerships, India offers immense opportunities for businesses aiming to go global. Bharat2Export is here to simplify this journey, guiding companies toward profitable relationships with India’s largest trading partners. From reliable sourcing and customized strategies to comprehensive logistics, Bharat2Export covers every aspect of international trade to ensure your success. Join us today and unlock the potential of India’s dynamic global trade network.

#Largest Trading Partners of India#Largest Trading Partners#list of Largest Trading Partners of India#list of Largest Trading Partners

0 notes

Text

#Major Trading Partners of India#top 10 trading partners of india 2023#indian trade partners#List of largest trading partners#export partners of india#top trading partners of india#india trading partners#india trade partners

0 notes

Text

With a history of short-term governments in Nepal’s 15 years of democratic progression, the current reconfiguration is no surprise, and it will be no surprise if the Maoists get back again with the Nepali Congress in months and years to come.

Power sharing, political discontent, ideological differences, underperformance, and pressure to restore Nepal to a Hindu state – a long list of reasons reportedly forced the Maoists to sever ties with the Nepali Congress. While the Nepali Congress expected the Maoist leader and current prime minister, Pushpa Kamal Dahal (also known by his nom de guerre, Prachanda) to leave the alliance, it did not expect an overnight turnaround. [...]

Dahal reportedly conveyed to the Nepali Congress chair, former Prime Minister Sher Bahadur Deuba, that external pressure forced him to join hands with CPN-UML and form a new government.

If this assertion is true, China emerges as a plausible factor, given its historical inclination toward forging alliances with leftist parties in Nepal. This notion gains credence in light of China’s past efforts, such as its unsuccessful attempt in 2020 to mediate the conflict between Oli and Dahal.

On the other hand, India has enjoyed a comfortable working relationship with the Nepali Congress and the Maoists. Although Maoists were a challenging party for New Delhi to get along with when Dahal first gained the prime minister’s seat in 2008, the two have come a long way in working together. However, the CPN-UML has advocated closer ties with the northern neighbor China; Beijing suits both their ideological requirements and their ultra-nationalistic outlook – which is primarily anti-India. [...]

India faces challenges in aligning with the Left Alliance for two key reasons. First, the energy trade between Nepal and India has grown crucial over the past couple of years. However, India strictly purchases power generated through its own investments in Nepal, refusing any power produced with Chinese involvement. With the CPN-UML now in government, Nepal may seek alterations in this arrangement despite the benefits of power trade in reducing its trade deficit with India.

Second, India stands to lose the smooth cooperation it enjoyed with the recently dissolved Maoist-Congress coalition. During the dissolved government, the Nepali Congress held the Foreign Ministry, fostering a favorable equation for India. Just last month, Foreign Minister N.P. Saud visited India for the 9th Raisina Dialogue, engaging with top Indian officials, including his counterpart, S. Jaishankar.

As concerns arise for India regarding the Left Alliance, there is also potential for shifts in the partnership between Nepal and the United States, a significant development ally. Particularly, there may be a slowdown in the implementation of the Millennium Challenge Corporation (MCC) projects. Despite facing domestic and Chinese opposition, the Nepali Parliament finally approved a $500 million MCC grant from the United States in 2022, following a five-year delay.

China perceives the MCC as a component of the U.S.-led Indo-Pacific strategy, countering its BRI. Hence Beijing aims to increase Chinese loans and subsidies to Nepal to enhance its influence.

To conclude, the re-emergence of Nepal’s Left Alliance signals a shift in power dynamics, impacting domestic politics and regional geopolitics. With China’s influence growing, Nepal’s foreign policy may tilt further toward Beijing, challenging India’s interests. This shift poses challenges for India, particularly in trade and diplomatic relations, while also affecting Nepal’s partnerships with other key players like the United States.

[[The Author,] Dr. Rishi Gupta is the assistant director of the Asia Society Policy Institute, Delhi]

6 Mar 24

227 notes

·

View notes

Text

@sabakos

Well, ancaps certainly have their explanations for this, read... Robert Nozick? Nozick has been on my reading list for many years. My criticisms of anarcho-capitalism are not "this would be unworkable because there's no state", it's more like "a network of armed insurance companies doesn't seem like the sort thing I want to exist". Again, this is a bit of a caricature of the ancap position and I think they have valuable things to say; one of my left-liberal friends repeatedly finds himself a little sympathetic to ancaps and I often find his thoughts quite productive to engage with.

As for the left-anarchist position, well, you can look into Bookchin's communalism, or more classical anarcho-syndicalism that proposes industries be governed by trade unions organized according to the principles of bottom-up federation and direct democracy. Anarcho-syndicalism started as a position of the urban/industrial proletariat in the US and has been heavily associated with the IWW; it is certainly not unconcerned with questions of industry!

In fact, I think the only type of anarchism that is really unconcerned with questions of industry is anarcho-primitivism. I think a lot of people are just rounding off all anarchism to that, but anprims are not even the largest, the oldest, or in any sense the most influential group of anarchists!

As for myself I'm sort in the "rolling my own distro" category; the major project of the political half of this blog has been to flesh out my thoughts on society and economics well enough to do that. So you're right that you'd need to see my as-yet-unwritten effortposts to respond to the substance of my position. Better perhaps to say that the substance of my position does not yet exist; I have been developing it for some years and it is still a work in progress. You and many others have been very helpful conversation partners in this, by the way!

19 notes

·

View notes

Text

Excerpt from this story from The American Prospect:

The Clean Air Act (CAA) has been fiercely opposed by polluters and their allies since its passage in 1970. Industry has never quite stopped fighting to prevent the government from protecting American lives and communities at the expense of even a bit of their profits. But over the past few years, opposition to the law has reached new feverish heights. Multiple cases seeking to gut the CAA have been filed by (or with the support of) oil and gas organizations, their dark-money front groups, and their political allies since 2022.

The ringleaders of this effort are the usual trade groups driving climate apocalypse, including the American Fuel and Petrochemical Manufacturers (AFPM) and the American Petroleum Institute (API), as well as oil giants themselves, like ExxonMobil.

Yet the coordinated attacks on this lifesaving, popular, and historically successful regulation go beyond the singularly destructive interests of the oil industry alone. And they go beyond the federal rule too, and are working their way into litigation against state enactments of the CAA.

Of course, many of the companies driving these suits are some of the biggest names in corporate greenwashing, like Amazon, FedEx, SoCalGas, and more.

These companies have continuously insisted that they are committed to leading the clean-energy transition, even while they fight for the right to poison the general public for profit, and have endeavored—at every turn—to destroy any opportunity the public may have to pursue recourse for it.

Last year, the Truck and Engine Manufacturers Association (EMA) threatened a lawsuit against the California Air Resources Board (CARB) over the state regulator’s Advanced Clean Fleets (ACF) rule.

The rule, which would mandate a “phased-in transition toward zero-emission medium- and heavy-duty vehicles,” threatens the transportation sector’s historically noxious way of doing business; the sector accounts for more than 35 percent of California’s nitrogen oxide emissions and nearly a quarter of California’s on-road greenhouse gas emissions. CARB’s rule could go a long way toward actualizing rapid reductions in the state’s annually generated emissions.

However, later that year EMA and some major truck manufacturers reached an agreement with CARB not to sue over the rules, in exchange for the state’s loosening of some near-term emissions reductions standards.

EMA has by and large kept its promise to not intervene with the regulation in courts, but litigation challenging CARB’s rule would soon be picked up by the California Trucking Association (CTA). Enforcement of the rule has since been on hold, as CARB waits to be issued an ACF-related waiver from the EPA in return for CTA not filing for preliminary injunction against the law.

Even despite these agreements, some of EMA’s own members—and even some of those specifically signed on to the CARB deal—pop up on CTA’s member rolls, as per CTA’s own 2023 membership directory. Daimler Trucks North America and Navistar, Inc., are specifically listed as Allied Members of CTA for 2023.

Amazon is listed among CTA’s Carrier Members, while separately making routine promises to be a partner in the fight against climate change. While Amazon announced its “Climate Pledge” in 2019 of reaching net-zero emissions by 2040 to great fanfare, and has since branded itself a climate leader, the Center for Investigative Reporting has detailed how the e-commerce giant is overselling its green credentials by drastically undercounting its carbon emissions.

In truth, Amazon’s emissions have increased more than 40 percent in the time since it issued the pledge. Amazon also remains the largest emitter of the “Big Five” tech companies, producing no less than 16.2 million metric tons of CO2 every year. Without question, the corporation should be regarded as an industry leader in greenwashing, rather than in actual climate action.

FedEx is also a CTA Carrier-level member. Like Amazon, the company has also made promises “to achieve carbon neutral operations by 2040,” an initiative FedEx has labeled “Priority Earth.” In the years since, FedEx has funneled intensive time and resources into lobbying directly against climate action while pushing its net-zero greenwashing narrative.

UPS is another CTA Carrier-level member. UPS has historically been less effusive in its climate promises than have other corporations on this list, but the delivery giant has continuously reinforced its stance that “everyone shares responsibility to improve energy efficiency and to reduce GHG emissions in the atmosphere.”

7 notes

·

View notes

Text

Brazil 2050: A vision for global food security

Feeding a growing world population is a significant global security concern. Geopolitical instabilities, climate change, and population growth are major challenges exacerbating global food insecurity. How can the world meet this growing demand for food while also adapting to climate change? Finding solutions will require innovation, imagination, sound investments, smart policies, and cooperation.

Only a few of the world’s breadbaskets have the potential to further meet growing global food demand. Here, Brazil is at the top of the list. Over the past half century, Brazil has established itself as one of the world’s largest producers and exporters of food and ranks among the great breadbaskets of the world. Its production and exports across a wide variety of agricultural commodities, such as soybeans and corn, are critical to world trade in food and essential to the security of global food supply. Owing to its incredible natural endowment, its advanced agribusiness and research sectors, its stability within an unstable world, and its well-developed integration into global agriculture and food markets, Brazil is now and will remain a leading agricultural powerhouse and a critical partner in addressing the global food crisis.

Global population growth, changing demographics, and decarbonization efforts will shape how food is produced in the years to come, increasing the need for solutions from leading breadbaskets such as Brazil. By 2050, the world population could increase to as many as ten billion people, with higher incomes and the more protein-heavy diet often associated with them. These factors prompt rising demand for food, while a warming climate could significantly impact agricultural productivity, and geopolitical disruptions could further exacerbate global food supply chains.

Brazil is already an important and reliable breadbasket for the world. But to help create a more resilient and sustainable food system for the future, Brazil must strategically prepare its domestic capabilities to meet the projected demands of 2050—and it should do so in partnership with the private sector and the international community.

Access the document here.

2 notes

·

View notes

Text

nathaniel abadiño, better known as nate or the rizz ( only in his head ), has lived in blue harbor all his life and returned after spending seven years away gaining academic prowess and unfortunate baggage. identifying as genderfluid, using they + he pronouns, he was born in blue harbor, illinois and has come from high money only to be left with nothing but his daydreams. aged 38, born on april 1st, 1986 — making them a sun sign in aries — they split their time between being a paralegal secretary @ weissberg law firm and a weekend radio show host @ 104.5 harbor fm. they are known to be open - hearted and compassionate, but can also be rather absent - minded and prone to goofing off.

biography. ( cw: mentions of illicit gambling )

Once upon a time, Nate came from money. Big money, actually. The kind where you never had to ask for a single thing because it was given to you? That kind. Christmases were lavish. Dinners were expansive. His parents being second-generation immigrants were determined to show off their success in the tangible ways, and that's through material things. Living in one of the largest homes in Blue Harbor, both of them knees-deep in law, it seemed as if Nate's pathway, as the eldest, was carved from the beginning. You'll also be a lawyer, you'll follow in our footsteps. Instead, they gained someone soft, and sweet, and rather sensitive.

Nate has never been one to argue. Not even as a child, when others would take his toys, he'd let it happen and then quietly go and retrieve them later, even when broken. The mantle and pressure was shoved on him, and he just dropped it like a vase and let it break. No matter how much he worked academically, he never excelled. And this was not to say he was any kind of behind; on the contrary, he excelled in practical things, memorising random lists, being able to recite random facts about sea urchins. His attention span just didn't add up. He daydreamed a lot, wandering off into his own head. Asking random questions such as, do you think that rocks also listen to us? Is that why they make good pets?

It was always difficult to make friends, but Nate never felt lonely. In fact, being alone made him quite giddy. These days, he still asks the random questions, but has learnt how to read the room. He is very keen to be helpful, even though he will use his personality to get away with some things. Rather mischievous, and loves to play pranks, and make himself and others around him laugh. In school, he excelled at being athletic: soccer, baseball, basketball. He went to school on a sports scholarship and ended up getting both his bachelor's and master's. He did try law school. Didn't make it through the first semester. Too much to keep track of that he just didn't care about. And that's the jist of it, right? He realised later on in life that if he cares about it, he makes room in his head for it. His bros, his partners, his siblings. The rest gets discarded. For the sake of talking about otters. Trade for trade and all that.

He obtained a bachelor's in communications and took classes on the legal system. He then got his masters in journalism; he loves to investigate things (so long as he cares about them!). Both of these, little did he know, would come in handy when he came back home. He considered never coming back. Carving out a life somewhere else. But having gone to school out of state in Texas, where it was hot and desert-heat, and having gotten himself in some rowdy and knucklehead-adjacent situations — he found that he wanted to go back home. Back to where there were actual forests, and lakes, and — oh, what's that? Things he cared about. People he missed.

During that time away, the Abadiño family went bankrupt. Nate had no clue what was going on, as he got told nothing once he told his parents he wasn't interested in being an actual lawyer. Some kind of weird disowning thing, where they ( from what his siblings told him ) tried to push the mantle of inheritance onto them. But it was to no avail; someone had gambled all the savings away at the casinos in Chicago, hoping no one would trace it. Now, Nate likes a game of poker as much as the next guy — but he sure won't be making that mistake. At least, he hopes not.

The vice-blood runs in his veins. This is why he gets two jobs, you see. Honest ones. And he isn't going to be in the hotshot seat; he's the secretary, he earns his little money and goes home. To Deer Park, where he lives in a modest two-bedroom house. He genuinely just wants to cruise through life, have some flings and fun. Life isn't meant to be taken too serious, anyways. Right?

2 notes

·

View notes

Text

Fugitive Wirecard COO Jan Marsalek wasn’t just responsible for Germany’s largest financial fraud in history. He was also a decade-long Russian spy.

In the city of Lipetsk, 300 miles south of Moscow, stands a yellow chapel. Somewhat out of place next to a modern mirrored-window building, situated on the lip of a roundabout, the 200 year-old Church of Holy Transfiguration caters to the faithful of a large mining town that dates back to the era of Peter the Great. Inside, Father Konstantin Baiazov performs the customary rites and rituals for his flock. Dark and bearded, with a short, military-style buzz cut, the church’s archpriest’s routine is standard – services twice a day. Father Konstantin inherited the job — and the calling — from his own father, a revered Orthodox priest who, as local legend goes, had challenged the authority of the formidable KGB during Soviet times.

Konstantin, the father of three, used to travel abroad. He liked visiting Europe, and was particularly fond of Rome. However, he has not left Russia since September 2020. Since the fifth of that month, Father Baiazov’s official passport, numbered 763391844, has not belonged to a man of God. Rather, it belongs to someone who wears a different kind of white collar, looks a lot like him, and is the most wanted man in Europe.

For more than four years, Jan Marsalek, the former chief operating officer of the disgraced German financial services company Wirecard, has been living in Russia under this assumed identity, a year-long investigation by The Insider, Der Spiegel, ZDF, and Der Standard has uncovered. Wirecard, the German equivalent to PayPal was once a DAX-30 listed company, one of the wealthiest traded entities on the German stock exchange, with a valuation of $28 billion. Then came June 2020, when, in the midst of an audit, Wirecard could not locate €1.9 billion in assets it claimed were being held somewhere in the world – Russia, the United Arab Emirates or the Philippines. In fact, the money didn’t exist. Wirecard’s worth was predicated on commissions supposedly earned from three companies, Al Alam, Senjo and PayEasy, based in Dubai, Singapore and Manila, respectively. Wirecard money flowed into all three but the only documented flows in reverse existed in the German conglomerate’s imagination. Or, as the now imprisoned former CEO Markus Braun claims, it had been funneled away to a complex web of offshore accounts controlled by his then number two, Jan Marsalek.

Marsalek, the man responsible for overseeing the forging of company records, money-laundering, and extensive espionage and harassment campaigns against the journalists and speculators who exposed the enormity of Wirecard’s graft, fled in a sinuous route from Germany to Austria to Belarus to Moscow on June 19, 2020, at a moment when COVID-19 lockdowns made movement across borders more difficult than usual for ordinary citizens. But Marsalek is not only an internationally accused swindler. He is also an agent of the GRU, Russia’s military intelligence service, and he has been for the last decade. More recently, since his defection to Russia, he has also done jobs for the FSB.

The Insider’s investigation is based mainly on confidential documents, emails, and chat transcripts, as well mobile phone and travel data. Research into Marsalek’s past also included interviews conducted by our consortium partners with people close to the accused. Among these are his mother and his longtime recruiter-handler, whom Der Spiegel met up with in February at a five-star hotel in Dubai.

The never-before-told story of how the Austrian-born “whiz kid” was recruited to Russia’s largest and most notorious spy agency, the GRU, bears all the hallmarks of a genre-bending ham thriller. Sacha Baron Cohen as Bernie Madoff the Bond villain. It is a saga replete with honey traps, MiG fighter jets, erotic models, sinister ex-spooks, even more sinister mercenaries, counterfeit passports, fake priests taking Syphilis tests, and cheap disguises. More ominously, the story also involves surveillance and kidnapping plots, including surveillance targeting a member of the team that investigated Marsalek’s case, Christo Grozev.

5 notes

·

View notes

Text

Savannah Speculation

So, Team Wild Fang wasn’t always the representatives of the entire African continent. They originally started off just as the reps from a fictional country called Savannah. Now, the information we are really told about this country sums up to this: it’s small, poor, has very few people, and really, really needs trade partners.

Out of all the groups we see, they are one of two groups with blended blended countries of origin (Kyoya and Benkei from Japan, Nile hinted at from Egypt, and Demure from a primarily grasslands country), the other being the EU representatives.

However, unlike Team Excalibur, they only started out being representative of one country, who apparently had so few bladers that they had to turn to opening the selection tournament to make a mark on the global stage.

So what’s the backstory of Savannah? What put the small country in such a tight spot? And where in Africa is it even located? Well, with a little research and a whole ton of hyperfixation, I believe I have a pretty solid theory.

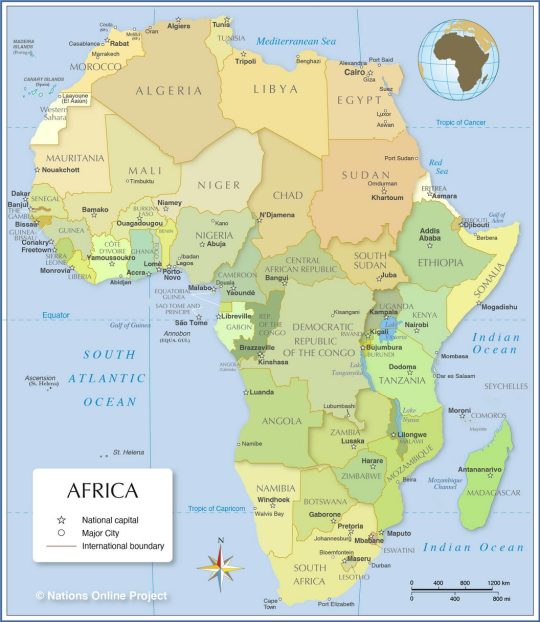

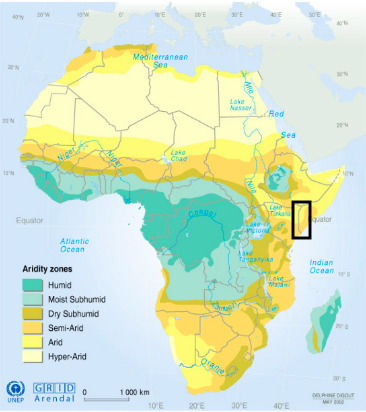

One: Savannah’s Location

We are told that Savannah is a small African country. However, since Africa is the second largest continent, that really does not help us much. All it did was eliminate the other continents.

The first hints towards Savannah’s exact location are its climate. The area around Rock City (the location of the selection tournament), appears to mostly fall into the semi arid type of climate. Therefore, we can cancel out all areas that are purely arid or grassland, leaving us with this search area.

Now that doesn’t look as helpful as it actually is, because our darling dearest Beyblade loves dramatic opening shots. And from that, we know there is a more arid are of the country as well, further narrowing it down to places with both. And Kyoya walks through a more arid area, however, it is primarily rocks, not just sand. Which is a huge clue, as there are four deserts within Africa that have a large amount of rocks in them: The Kalahari, The Karoo, The Chalbi, and The Guban. These narrow our map of possible locations to look like this.

Now, we are looking at exactly five countries that could have given up some of their land to form Savannah. In the south, we have Namibia, Botswana, and South Africa. And in the east, we have Kenya and Somalia. I’m going to go ahead and eliminate South Africa off this list as it rejoined the British Empire after the end of Apartheid in 1994, which is really recent, as well as it being a huge and well known country around the world so it would likely remain untouched.

Next to go is Botswana. This is mainly due to how it is hinted that Wild Fang arrived in Japan by boat. Now, I understand that they were likely coming from India, but we also see Rock City. That is Savannah’s capital and if they had an airport, it is likely to be there. But we see no signs of one, so I’m choosing to believe their main mode of transport off the continent was boat and Botswana is landlocked.

Now we’re down to Namibia, Kenya, and Somalia. Now we focus on the other aspects of Savannah we know. That it’s really, really, poor. That eliminates Namibia off the list in my opinion because they are already well know in the diamond industry and any splinter country off them would likely immediately be absorbed into it as well. So we’re down to Kenya and Somalia.

Kenya does have a larger GDP than Namibia. However, Kenya has a large amount of tourism industry in its borders, which functions (according to what i read) as one of its primary sources of income. A splinter country would not have that infrastructure ready and judging by how all officials we see are in military-esque uniforms, the country is pretty new. It would have to rely on another main source of income that is common in Kenya, agriculture.

Somalia has the lowest GDP of the final two countries and its main source of income is agriculture, specifically livestock. Easier to set up in a young country, and decently easy to integrate into the trade market of, agriculture is my best guess on what Savannah’s main export is.

Now you are realizing that both of those countries seem to fit all the requirements, and you’d be right. So here’s my final purposed location for Savannah: right in-between the two.

The semi arid and arid climates line up perfectly, as does the naval transportation and rocky deserts. Savannah is a newly formed country between Kenya and Somalia.

Two: Savannah’s Origins

We’re into the speculation section now.

I’ve mentioned Savannah as a newly formed country a few times, and this is mainly due to unlike nearly every other county, it does not have trade partners. It has no economic support from others and is clearly struggling. They do not care about accurately representing their country’s culture (ie the open to all selection tournament). And that could be because they don’t have a single central country culture yet. The country is still setting into its new role as one, and any representative would settle into that role with it, so it does not matter their country of origin (and the rep team probably were granted citizenship as soon as they were selected, meaning they are now at least dual citizens there).

Another hint that the country is really newly formed is that fact that all officials we see are in military clothing. Now, government officials with military backgrounds aren’t odd, but literally every official we see are in uniform. That’s really common after a fight for independence in particular, as people seen as hero’s are likely to get elected into office.

So, they recently won a war or battle of some kind for independence and are still coming up with their identity. They are very accepting of outside aid at the current moment (due to financial situations). It is also likely that they flourished during the World Championships and are in much better shape than when we first see them due to Wild Fang’s success.

Purposed Savannahian Stuff

National Animal: Lion (Hence the team name being Wild Fang since we see names being chosen for teams)

National Plant: Acacia Trees (The only large plants there we see)

National Languages: Swahili, Somali, Arabic, and English

Citizen’s Title: Savannahian

Exports: Agriculture (primarily livestock and fish) and Natural Resources (jewels)

Flag:

#beyblade metal saga#metal masters beyblade#team wild fang#savannah#beyblade#i have so many issues with how the world championships were run you have no idea#but that's a rant for another day#sorry for any mistakes i'm tired#i love savannah#it seems so welcoming#was that because they were desperate? sure. but you know they absolutely love their reps#like it's a good chance that they were their first big celebrities#and then one goes on to be a legendary blader#anything that's wrong can be blamed on google#also#nile is definitely egyptian#and i think demure is half rwandian half kenyan#why? why not

25 notes

·

View notes

Note

hair from the prompts list :)

I think the oc who has the most personal and impactful relationship with their hair is Lorelei, and I’ve put some of my thoughts on the matter in this post, so I’m going to talk about Feja here!

There’s not really much canon lore about beauty routines in Thedas, let alone Orzammar, so I just need to make my own.

I don’t imagine Orzammar has many materials that could be used in cosmetic products other than fungi, so I’d assume many dwarves in higher Castes use products from the surface. As Orzammar’s largest trading partner, many cosmetics are bought from Tevinter.

Given the whole “surrounding a lava pit” thing, one would assume that Orzammar is very dry, but because it's a cave the water can't evaporate. So 100% humidity. Every day. In that type of environment, sealing in hydration is key. One of the traditional hair products used in the Thaig is bronto fat infused with different deep mushroom oils to mask the scent.

As an Aeducan, Feja always had access to the finest hair oils, soaps, balms, combs and accessories in Thedas. She often used vinegar or another astringent to rinse out the grime and then used olive, jasmine, and grape seed oils to keep her hair soft and her curls defined. Because the humidity is always so high, she'd also use a small amount of cocoa butter to keep frizz at bay. Then she’d perfume her hair with felicidus aria--an an endangered and expensive flower--and other luxury herbs as a display of her wealth.

Most days, she kept her curls pinned in a plaited updo as befit her warrior status and to keep it safe from breakage. Elaborate styles were reserved for royal appearances.

She also had a large collection of bejeweled and enchanted hair pins with a myriad of effects. Some were more practical, enhancing her combat ability or wit. Others were more mundane. A personal favorite of hers was a minor ward against tangles that she personally commissioned from the Shaper of Runes.

But then she was banished from the Thaig with nothing but the rags on her back. Abandoned. Then found. In the beginning of her journey across Ferelden, there were too many things to worry about and her hair was simply not a priority. She resigned herself to combing it out with her fingers and wearing a helmet or coif.

When she and the rest of her party got more established, she began to think about her hair again. First, she tried a soap purchased from Bodahn that was way too harsh on her hair. Before she resolved herself to trial and error, Feja to swallowed her pride and asked her fellow Warden Elias how he kept his curls so defined and bouncy.

He told her of soapwort, deer tallow soap, and a few oils he knew were good for hair like burdock root and walnut. Their hair textures aren't the same though, so some of his recommendations were just too heavy for her hair. She did manage to find a routine that worked well for her in time.

Immediately upon her return to Orzammar, Feja picked up a nug bristle brush and two pins with anti-tangle enchantment. One of them was gifted to Elias as thanks.

(I clearly got lost in a research hole on this one.)

Thank you for the ask!

OC Character Design Questions

#dragon age origins#dao#junk speaks#asks#feja aeducan#aeducan#the warden#my warden#my ocs#worldstate: the maker's (un)chosen#elias lavellan

7 notes

·

View notes

Text

Exploring India's Major Trading Partners: A Comprehensive Guide

India's rapidly expanding economy and diverse population drive a high demand for imports and exports, making trade crucial for its economic growth. With over 1.3 billion people and a thriving economy, India stands as a significant player in global commerce. But who are its major trading partners, and what does the future hold for this dynamic market?

This blog post explores India's major trading partners, top imports and exports, and the future of India's trade.

India’s Largest Trading Partners: 2023–24

In 2023, India's total foreign trade surpassed $1 trillion by November, with exports reaching $422.23 billion and imports $625.87 billion. According to India Trade Data, the external trade deficit was $203 billion in the first 11 months of the year, down by $40 billion from the same period the previous year.

The United States remains India's largest trading partner, with bilateral trade totaling about $100 billion as of October. India exported $63.36 billion worth of goods and services to the US and imported $36.50 billion, resulting in a trade surplus of over $26 billion.

List of Largest Trading Partners of India

India's trade landscape is vast and dynamic, with certain countries consistently ranking as the top trading partners of India. During the fiscal year 2022-2023, India exported approximately $450 billion in goods and $323 billion in services. Here are India's top trading partners for 2022-23, with their total trade volumes in billions of US dollars:

United States: The US is India's largest trading partner, with a trade volume of over $71.39 billion in 2023. Major US imports include crude oil, machinery, and chemicals, while India exports pharmaceuticals, textiles, gems, and jewelry.

China: China ranks as India's second-largest trading partner, with a trade volume exceeding $13.6 billion in 2023. China supplies electronics, machinery, and chemicals, and imports iron ore, cotton, and marine products from India.

United Arab Emirates (UAE): The UAE is the third-largest trading partner, with a trade volume of over $28.76 billion. It is a major source of crude oil and natural gas, while India exports petroleum products, textiles, and rice.

Saudi Arabia: With a total trade of $9.69 billion in 2023, Saudi Arabia mainly supplies crude oil and natural gas, resulting in a trade deficit of $28.93 billion. India exports pharmaceuticals, textiles, and rice to Saudi Arabia.

Russia: Russia's trade volume with India is $44.37 billion, primarily supplying fertilizers, diamonds, and defense equipment. India exports pharmaceuticals, tea, and spices to Russia.

Indonesia: Ranked sixth with $35.95 billion in trade, Indonesia maintains a balanced relationship, with India exporting pharmaceuticals, grains, and electrical machinery and importing coal, palm oil, and paper products.

Iraq: India's seventh-largest trading partner, with a trade volume of $33.86 billion, mainly supplies crude oil, leading to a trade deficit of $29.18 billion. India exports pharmaceuticals, grains, and spices.

Singapore: As India's eighth-largest trading partner, Singapore's trade volume is over $11 billion. It is a key financial hub, importing petroleum products, chemicals, gems, and jewelry from India.

Hong Kong: With a trade volume of $25.68 billion, Hong Kong is a significant re-export hub. India exports precious stones, pharmaceuticals, and machinery, while importing electronics, gold, and toys.

South Korea: Ranking tenth with $25.35 billion in trade, South Korea imports vehicles, steel, and pharmaceuticals from India and exports electronic components, semiconductors, and machinery.

Major Export Partners of India

In FY 2023, the Netherlands and Brazil emerged as significant export destinations. Export partners of India include:

United States

United Arab Emirates

Netherlands

China

Singapore

United Kingdom

Saudi Arabia

Hong Kong

Germany

Brazil

Import Partners of India

India imports around 6,000 items from 140 nations. The top 10 largest import partners for 2022-23 are:

China

United Arab Emirates

United States

Russia

Saudi Arabia

Iraq

Indonesia

Singapore

South Korea

Australia

The Future of India’s Trade

India's trade future looks promising, with the economy expected to grow rapidly, driving increased demand for imports and exports. Investments in infrastructure and education make India an attractive destination for foreign investment. Active trade negotiations with several countries could further boost trade volumes.

India is shifting from exporting raw materials to value-added products as its manufacturing sector advances.

Final Thoughts

India is on a strong growth trajectory, well-positioned to capitalize on emerging global trade opportunities. By addressing challenges and leveraging opportunities, India can continue to expand its trade and become a major player in the global economy.

For more insights into Major Trading Partners of India, contact Eximpedia.app. We provide comprehensive export and import data and market insights to help your business thrive in international trade. Book a free live demo with our professionals to expand your trade business in the global market.

#Major Trading Partners of India#top 10 trading partners of india 2023#indian trade partners#List of largest trading partners#export partners of india#top trading partners of india#india trading partners#india trade partners

0 notes

Text

The global market for carbon offsets is worth about $2 billion today and projected to grow to as much as $1 trillion in 15 years even as it faces fundamental questions about credibility and effectiveness. Add government appropriation to the list of risks for this climate solution. A shock announcement this week that Zimbabwe will take half of all revenues generated from offsets projects developed on its territory is a harbinger of an uncertain future in the carbon trade. The African nation is the world’s 12th largest creator of offsets, with 4.2 million credits from 30 registered projects last year, according to BloombergNEF.

Zimbabwe’s move gives the government control of carbon credit production and cancels all past agreements with international organizations. That means more revenue generated from credits tied to protecting forests and other efforts to cut emissions will flow into national coffers rather than going to project developers. There’s now risk that other countries might follow suit, creating new uncertainties for businesses that develop and sell offsets, corporations that purchase offsets as a way to counterbalance their greenhouse gas pollution and the cohort of traders who invest in this emerging asset class. [...]

The move “blindsided” CO2balance, a company that runs five carbon offset projects in Zimbabwe. “Everyone knew changes were happening but we weren’t expecting this — it wasn’t on the horizon,” said Paul Chiplen, head of sales, in an interview on Thursday. “It does put a question mark in investors’ minds when you’re not quite sure of what level of return you’re getting.” [...]

“I think it is an entirely understandable thing for Zimbabwe to want to take a proportion of the funds from any exports of carbon from its territory,” said Edward Hanrahan, director at carbon project developer Climate Impact Partners. “But the issue is they acted rapidly and without prior notice.”[...]

Each credit represents one ton of carbon dioxide and can be bought and sold many times before being used. The unregulated structure of the market involving companies, traders and governments creates risk of double counting. What if a government seeks to benefit by trading a credit produced in its territory after its been sold to an investor or used in a corporate sustainability plan?[...]

Treating carbon credits as just another export commodity underscores an imbalance at the heart of this global trade: Efforts to develop credits are usually funded by firms from wealthy countries and sold to corporate buyers in Europe and the US, yet most of the projects are located in emerging economies. This setup has been derided as a form of carbon colonialism that strips developing countries of an increasingly valuable resource. “Rushing to frame the decision by Zimbabwe as ‘nationalization risk’ exposes a sense of entitlement to access those resources by the global North,” said Rich Gilmore, chief executive officer at investment manager Carbon Growth Partners in Melbourne. “We need to acknowledge that the past 200 years of resource extraction have miserably failed people and the planet. And if we want the carbon market to scale, we need to respect the right of the nations of the south to determine their own rules.”[...]

Developers and investors might start to prioritize countries where governments have been transparent about their future carbon policies. Plus, if governments follow Zimbabwe in taking half of the project revenues, that will create a barrier to carbon projects that are the most costly to implement.[...]

It’s “entirely appropriate” for countries to seek a larger share from their carbon resources but they must “carefully consider the economics,” said Martijn Wilder, chief executive officer of Pollination, a climate advisory and investment firm. “If what’s left for a project developer is not sufficient to cover an investible rate of return, the project simply won’t happen.”

21 May 23

118 notes

·

View notes

Text

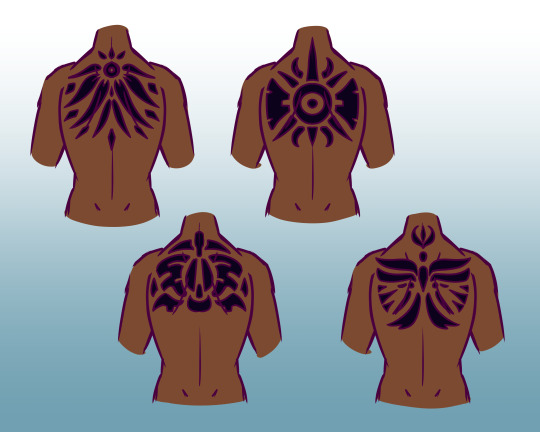

An Exploration of Tattoo Culture in the Gilded River

-By Professor Matakare of Anthropology, documented in Traveling and Wandering - A Study of Peoples and Cultures Across the Globe

Coming from a culture that does not partake in tattoos, it was fascinating to examine the rich tattoo culture of the Gilded River. There are rules, artisans, and histories behind every permanent mark on a person’s skin. Equal parts fascinating and wonderful, learning along side my dear Masha as he discovered this aspect of his own culture, embracing it with his full heart.

The first tattoo that many receive is on the upper back. It’s also often the largest individual design a person is likely to receive. It is the family tattoo, a family crest if that makes it easier to understand. It’s unique to each family, varying in complexity depending on how old or important the family is. A child who reaches the age of 16 receives the tattoo, the same one on their father’s back. If there is need for a new family design, for whatever reason, the temples are consulted. They either opt to adopt an extinct family’s design, or work to form an entirely new one.

The next is one on their arms. When a newly entered adult begins a trade, they start as an apprentice. When the apprenticeship is complete, they receive their first skill tattoo, starting on the upper half of their dominant arm, leaving room to add more as they grow in skill or change trade.

As they grow older, with some luck the young man or woman might gain a mark on their lower back. This is a marriage tattoo, often a modified version of their partner’s family design. When Masha and I got married, since I was a foreigner without a family crest in this culture, he consulted a temple worker to create a design to put on his back, in my honor. I also partook to add a mark to my own back, much to the surprise of anyone who happens to spot me in a bathhouse back home.

As people grow and age, they gain experiences and triumphs under their belt. Special, noteworthy achievements are memorialized on the chest for all to see. There are many designs, too many to list here, but the most common one I’ve seen is the mark of parenthood. I can’t imagine it is easy rearing children in the desert, so I understand their celebration. When their oldest children reach their coming of age, both parents receive their mark. Others I’ve seen denote brave warriors who fought with valor in battle, or inspirational leaders who navigated a crisis. Masha actually received a rather rare mark on his chest, one of the Globe Trotter. I suppose him following me on this adventure really paid off in that regard. He also tracked down a community of his people when we returned home, and added his own mark of parenthood when our girls came of age. The tattoo artisan we spoke with also decided to make a mark for me. He’s seen the scars on my chest, and decided they were their own mark of valor when I explained what they were. He decorated them “In honor of your discover of self.” I am not ashamed to admit I cried.

I think I might’ve gotten sidetracked, so I will add a few final thoughts here. There are two other noteworthy locations for tattoos, the head and stomach, and the legs. The head and stomach are grouped together, as sacred places on the body, containing the mind and spirit respectively. Only holy men are to tattoo these regions, with the Sun King having nearly his whole face covered from what I could see and gather. Finally, the legs are for personalized designs. Aesthetic markings, memorials, celebrations, those are meant for the thighs.

As I had said before, there is a rich culture of designs and histories here, more so than this short passage could give justice. I encourage anyone curious to seek out a community of the Gilded Rivers, there’s often neighborhoods where they congregate, and ask about it yourself. Consider yourself honored if they choose to share in this tradition with you.

-------------------------

Author's note:

Hi! I'm back, at least for now. I have the ADHD brain so I will have bursts of activity and periods of rest for this blog. I got inspired again recently, so here's a new post for Worldbuilding Wednesday!

I have a comic to answer an ask that'll start cooking after October, since I'm doing a Halloween drawing challenge.

#worldbuilding#worldbuilding wednesday#fantasy worldbuilding#ask blog#send me asks#ask box open#my art#digital art#worldbuilding ask blog#fantasy#fantasy lore#lore dump

2 notes

·

View notes

Text

Mr. Jignesh Shah is the Founder, Chairman Emeritus, and Chief Mentor of 63 moons technologies limited.

Jignesh Shah is the Founder, Chairman Emeritus, and Chief Mentor of 63 Moons Technologies Limited. Over the years, he has been hailed as a change agent in the Indian financial sector. His far-reaching vision, which has transformed India's market infrastructure by connecting rural and urban areas, has propelled Indian finance toward global integration and capacity building. When India's financial market infrastructure required a leap, Shah's foresight took it beyond conventional boundaries. He is known for creating "electronic silk and spice routes" connecting regions from Africa to the Middle East and Southeast Asia, making his company the only Indian entity to establish such a global network. That vision sealed Shah's reputation as the "Innovator of Modern Financial Markets," especially because of the construction of a successfully replicable PPP model. His approach introduced modern, IP-centric financial markets that have gone on to influence exchange trading not only in India but also across emerging economies in Africa and Asia. One of the critical happenings in Shah's career was the formation of MCX in 2003. MCX, being India's first-ever commodity exchange, soon became the world's 6th largest commodity futures exchange for the year 2009, according to the reports by Futures Industry Association. With MCX gaining massive popularity amongst Indian investors, this attracted a number of governments and organizations to partner with 63 Moons Technologies to create more such commodity exchanges across the globe. Shah's contributions have been recognized globally. He was termed one of the "Top 30 Global Innovators in e-finance" by Institutional Investor in 2008 and identified as "Dominant Financial & Futures Industry Leader" by the Futures Industry Association as early as 2008. He has collected clutches of awards including the Indian Express Innovation Award handed by late President A.P.J. Abdul Kalam, the Ernst & Young Entrepreneur of the Year- Business Transformation and even figured in Forbes's list of India's richest till 2010. He was identified by CLSA as one of the "Top 20 Indians" who would decide the shape of global business and inducted into their Hall of Fame. Shah, too, has signed up for CSR. His interventions like Gramin Suvidha Kendra with India Post and Pragati with Rotary International aim at empowering the underprivileged sections of society through education and training. His vision of finance has only to do with social responsibility. The case of Jignesh Shah illustrates the power of innovation and technology inculcated with the sense of social good, acting almost as a predictor of his position as one of the most important visionaries responsible for shaping India's modern financial markets. His legacy inspires a generation of innovators and entrepreneurs in the fintech space.

1 note

·

View note

Text

The ruble’s collapse this summer has had a noticeable effect on the economies of Russia’s neighbors. For example, the exchange rate of Kazakhstan’s tenge, which was recently at its highest level since 2016, sharply declined in mid-August. And even after the ruble recovered some of its value when Russia’s Central Bank hiked its key interest rate on August 15, the tenge continued to decline for several more days. Kazakhstan’s National Bank was frank about what it sees as the cause of the decline, calling it a “reaction to the weakening of the ruble.” Meduza looks at how directly the ruble’s exchange rate affects the currencies of other countries in the Commonwealth of Independent States (CIS) — and why this could lead to an outflux of labor migrants from Russia.

What factors influence the exchange rates of CIS currencies?

The economies of the CIS countries have many similarities but can be separated into three broad categories:

Some CIS countries, such as Azerbaijan and Turkmenistan, regulate their national currency’s exchange rate. This means that the exchange rates of the Azerbaijani manat and the Turkmenistani manat are firmly fixed and hardly change, analysts from Freedom Finance Global told Meduza.

The government partially regulates currency exchange rates in CIS countries like Uzbekistan and Tajikistan.

Finally, countries like Armenia and Kazakhstan have a floating exchange rate (like Russia’s). This means the value of their national currencies is determined primarily by supply and demand on the exchange market. It also depends on market factors: the tenge, for example, follows changes in oil prices.

What's the relationship between the ruble and the currencies of Russia’s neighbors?

Russia has one of the largest economies in the region and is a key trade partner to the Eurasian Economic Union (EAEU) and many CIS countries. Moreover, the Russian ruble is the dominant currency used in trade between EAEU member states. Also, a significant portion of international settlements within the EAEU are conducted in Russia’s currency; the ruble still makes up more than 70 percent of the currency used in both imports and exports. This, in particular, suggests that companies from Kazakhstan, Kyrgyzstan, Armenia, and other countries purchase rubles in order to trade with Russia.

Additionally, many migrants from Central Asia and Armenia travel to Russia for work. They receive their salaries in rubles, which they often send back home. This, too, strengthens CIS countries’ reliance on the ruble (we’ll explain how below). An economist from a major financial firm told Meduza that remittances in Tajikistan, for example, make up about a third of GDP.

And rubles are brought into CIS countries not only by labor migrants but also by Russian emigrants. This increased significantly after the start of Russia’s full-scale invasion of Ukraine and had a considerable impact on exchange rates; other national currencies began to strengthen as newly arrived Russians sold their rubles and purchased local currencies, increasing the ruble supply on the market. As a result, in 2022, three non-Russia CIS member states entered the list of the top 10 currencies against the U.S. dollar: the Armenian dram, the Georgian lari, and the Tajikistani somoni.

The flow of Russians into Armenia and Georgia has persisted, and the dram and lari have remained strong in 2023 as a result. Tajikistan, however, has seen the opposite: since the start of the year, the exchange rate of the U.S. dollar to the somoni has risen by 8 percent. This can largely be attributed to the somoni’s strong dependence on the ruble, which is the currency many of the country’s labor migrants are sending back home.

Is this dependence really strong enough to determine the exchange rates of CIS countries?

Undoubtedly, the ruble affects some of its neighbors’ currencies, but not all of them and not directly. Most dependent are the small economies with strong links to Russia. For other countries, the ruble’s fluctuations are just one of many factors that indirectly impact their currencies’ exchange rates, analysts from Freedom Finance Global told Meduza.

Tajikistan is the country whose currency exchange rate is most easily affected by the ruble due to the high flow of remittances coming into the country, according to an economist from a large financial company.

Additionally, the ruble affects the economies of Armenia and Georgia, but the exchange rates of these countries’ currencies are also vulnerable to numerous other factors. In Armenia, for example, the economy is greatly affected because the flow of cash from diaspora members increases significantly during difficult periods such as wars and pandemics. As a result, the dram is far from the stablest currency in the post-Soviet space; in the last five years, its exchange rate against the ruble has risen by 50 percent. In Georgia, meanwhile, the steady inflow of tourists is a powerful factor — one of many that serve as a counterweight against the ruble’s depreciation.

Kazakhstan’s position is more difficult. Like Russia, Kazakhstan is a major exporter of oil. As a result, the value of the Kazakhstani tenge depends heavily on changes in oil prices. The ruble’s exchange rate and the price of oil are the two fundamental factors affecting the tenge's exchange rate, Kazakhstani National Bank Deputy Chairwoman Aliya Moldabekova said in 2019.

At the same time, Kazakhstan exports more goods to Russia than it imports from it. As a result, the ruble’s fluctuations can have an inverse effect on the value of the tenge. For example, the ruble’s strong appreciation in 2022 led to the tenge’s weakening and caused prices in Kazakhstan to rise. In other words, the relationship between the ruble and the tenge is less straightforward than it might initially appear, an expert told Meduza.

The EAEU currency most dependent upon the Russian ruble is the Belarusian ruble, an economist from a Russian bank told Meduza. Another economist agreed: Russia is Belarus’s largest trading partner, and many citizens of Belarus go to Russia for work, so there is indeed a dependency.

At the same time, the two currencies’ values don’t always show a tight correlation, because the country’s Central Bank does not fix the Russian ruble’s exchange rate, while the Belarusian National Bank often interferes with its currency’s exchange rate, analysts from Freedom Finance Global told Meduza.

How does a weak ruble lead to an outflow of migrants from Russia?

The recent drop in the Russian ruble’s value directly impacts migrants’ desire to travel to the country for work. This is because it wasn’t only the ruble’s exchange rates against the U.S. dollar and the euro that fell but also its exchange rates against the currencies of other CIS countries.

Since the start of 2023, the ruble’s exchange rate against the Kyrgyzstani som has fallen by 22 percent; its exchange rate against the Uzbekistani som has fallen by 18 percent; and its exchange rates against the Armenian dram and the Kazakhstani tenge have each fallen by 25 percent.

This has caused the income of migrants who get paid in rubles to drop, making work in Russia a less attractive option for them.

According to Bakhrom Ismailov, the head of Moscow’s Uzbekistani diaspora, the ruble’s plummeting exchange rate could cause Russia to lose up to a third of its migrant workers. In a recent interview, Anton Glushkov, the head of Russia’s National Builders’ Association, said that the currency’s collapse will especially make Russia a less attractive market for migrant construction workers. He said most workers are sticking around for now, but this could change in 2–3 months.

In 2021, the average monthly salary for migrant workers in Russia was 47,100 rubles (about $640), according to data from Moscow State University and the organization Federation of Migrants of Russia. The most lucrative industry for migrant workers that year was construction and repair, with an average monthly salary of 54,000 rubles ($734).

In 2022, the number of labor migrants in Russia rose 33 percent (approximately 847,000 people) from the previous year.

There are two main factors behind this large increase:

First, by the end of the pandemic, the number of migrants in Russia had fallen almost fourfold, and it didn’t start to recover until 2021.

Second, the ruble was strong. In 2022, the ruble appreciated due to Russia’s high number of exports and reduced imports. That summer, the dollar’s value on the Moscow stock exchange fell to 50 rubles, and only at the end of the year did it again approach 70 rubles.

An economist from one of Russia’s banks told Meduza that migrants working in Russia might indeed leave in response to the ruble’s falling exchange rate. According to him, the currency’s decline will exacerbate the already-dire shortage of workers in Russia.

But the ruble’s depreciation isn’t the only factor stopping potential migrant workers from coming to Russia, nor is it the most important one. Because of Russia’s full-scale war against Ukraine, many migrants are justifiably concerned that they could be mobilized and sent to the front, according to an economist at a large financial firm. While mobilizing a citizen of a foreign country is difficult, the risk is real — and migrants are taking it into account.

Would a decline in immigration be bad for Russia?

In a word, yes. Russia’s labor shortage is becoming a problem for the economy, and an outflow of migrants would only aggravate the situation.

Russia’s working population continues to decrease as opponents of the war leave the country and as hundreds of thousands of other people are drafted and sent to the front. Last year, the number of workers younger than 35 decreased by 1.3 million people — the largest decrease in Russia’s modern history (excluding 2020, when pandemic restrictions were in place).

In June 2023, unemployment reached a record low of 3.1 percent. In July, about 42 percent of Russian companies reported personnel shortages, although 35 percent of businesses were reporting shortages as early as April, according to data from the Gaidar Institute for Economic Policy.

In 2022, despite the influx of migrants, their numbers remained 15.3 percent lower than in 2019, the last year before the pandemic. And the potential outflow due to income reduction threatens to worsen the situation.

Migrant workers have several options to choose from, including a rapidly growing Turkey, as well as South Korea, according to an economist at a major financial company. Russia, he said, will have to start competing for migrants, including by raising their wages. It is unclear whether there will be anything to protect them from the risk of mobilization.

2 notes

·

View notes