#like jungle moon but like four or five episodes?

Explore tagged Tumblr posts

Text

I’ve been thinking recently about how a key aspect of Steven Universe is that Steven is placed in the narrative position of what might normally be filled by a standard fantasy-hero-shounen-protagonist-guy, while EVERYTHING about Steven as a character is all about going in basically the exact OPPOSITE direction of that archetype. To the point where the one time he actually TRIES acting like some typical shounen-protag to solve his problems in Future, it’s presented as this gross, twisted perversion of his character that goes horribly, HORRIBLY wrong. Basically, the show makes it clear that Steven trying to act like your standard ‘cool, badass anime hero guy’ is very much a BAD and WRONG thing. Like in anime terms, Steven is essentially a Magical Girl placed in a position that was meant for a Shounen Hero. Or in a more specific reference building off of the show’s numerous references to Dragon Ball Z, Steven essentially represents a take on Gohan who’s kindness and pacifism are ultimately allowed to be presented and emphasized as a strength rather than a weakness.

Yet the flipside of all this is that even in their few appearances, has anyone else noticed that Stevonnie shows quite a few of these ‘cool, badass anime hero guy’ traits? They have a cool sword, they race cars, they fight space battles in a starfighter, they get badass fight scenes like getting to 1v1 Jasper and get to say cool one-liners. And the funny thing is, NONE of these are ever presented as somehow ‘wrong’ for the character. Heck, going off of the same references to Dragon Ball Z, Stevonnie has a bunch of design similarities to Future Trunks of all characters, one of THE iconic ‘cool, badass anime hero guys’.

And I think that’s really interesting.

Like in-universe, it says some interesting things about how Fusion works. That Steven himself trying to act like a cool, badass anime hero guy is a BAD thing because it leads him to start rejecting many of the core aspects of who he is as a person, namely his kindness and empathy.

Whereas Stevonnie is their OWN person, distinct from Steven and can exhibit these traits just fine because they clearly got them from Connie. They clearly haven’t abandoned or rejected any of the core aspects of Steven such as his kindness and empathy, they just ALSO have all this other stuff from Connie as well and can exhibit these traits without actually losing anything. They are after all, everything from Steven and Connie and more.

And narratively, I think it makes for a fun inversion. Steven represents this big subversive take on the typical fantasy hero archetype by being this young BOY with a big, heroic destiny who is defined by his kindness, empathy, emotions, a general disdain for solving problems through fighting and generally rejecting the typical ‘cool, badass, anime hero guy’ traits.

So it’s actually rather fitting that it is the non-binary, intersex, very-much-NOT-cisgender-male, fusion Stevonnie who ends up getting to do more traditional ‘cool, badass, anime hero guy’ stuff. Who in turn got much of those traits NOT from Steven, but from his best-friend/partner/girlfriend Connie.

And I just think that’s pretty cool, you know? Particularly when imagining a permafused Stevonnie. Like I think its fun to imagine an alternate take on the later seasons of the show, or just post-series, with a permafused Stevonnie doing more traditional anime-protagonist stuff that would otherwise feel out of place with Steven, but doesn’t feel out of place with them.

For example, Steven never went through any kind of big ‘training arc’ like so many anime heroes because that just doesn’t fit who he is. Steven is not a ‘fighter’, he always tries to talk things out before things turn to combat. So it makes sense that he wouldn’t directly pursue training to become a better fighter on his own.

But Connie DID. And of course that wasn’t presented in and of itself a bad thing. Which as an aside, is interesting for Steven as his joining was more to support Connie rather being presented as something he needed to do himself.

And speaking of fighting, this is another place where the differences between Steven and Connie make Stevonnie in turn all the more INTERESTING. Because whereas Steven isn’t a fighter, Connie very much IS. The symbolic sword to Steven’s shield.

Now where this gets interesting is that in practice, Connie generally follows Steven’s lead. We see a number of instances wherein Connie likely wants to or even is full-on about to launch into a fight, but backs down because Steven wants to talk things out. Connie may be a fighter, but she also generally defers to Steven.

But what happens when these two aspects are coexisting in the same person? What happens when Connie’s preference towards fighting isn’t deferring to Steven’s preference towards non-violence, but is rather exhibited right alongside it? And because of that is seen by Stevonnie as a much more valid option?

What does Stevonnie’s response to conflict look like when they’re much more of a fighter like Connie, while still retaining Steven’s intrinsic kindness and empathy?

Personally, I imagine Stevonnie actually being a fair bit like Ruby Rose, ie; someone who often tries to talk things out, while also not hesitating to jump into a fight if people aren’t willing to negotiate. Perhaps even reading the situation/people enough to get a preemptive strike off.

And all that is just one aspect of what I think makes Stevonnie so compelling as a character.

#steven universe#Stevonnie#steven universe analysis#su#steven quartz universe#connie maheswaran#steven universe dragon ball references#rambling about my favorite su character#i think they're neat#did anyone else really want an arc of episodes where stevonnie just stayed fused?#like jungle moon but like four or five episodes?

199 notes

·

View notes

Text

C3 E30 Notes

aaaand here are all my reactions from episode thirty! WHAT an episode I am loving where this is headed!! Can’t wait for tomorrow!!! once again this is for @mysticalspiders and there is no context or timestamps. just vibes.

YEAHHHH CASHAPP

I will never be over “fingerblaster”

THE LADY FINGERS????

Oh Laura killing it as always

“What about Matt?” “Fuck that guy”

“Do you trust me?” “No, not really”

Rippling bridge nope nope nope

“I throw up in my mouth a little bit” oh imogen

There’s beauty to be found in the most unlikely of places (in Birdie’s southern accent)

SKI JUMP POSE

“I’m gonna keep steering into the corner.. just to make it awkward”

“Sun-scarred, like my forehead.” “Let’s all go around and say one weirdly personal thing about ourselves”

MARRIED “I’m gonna telekinetic shove Laudna down so she doesn’t fly off”

AUTOMATON WAR MACHINEEEEE this is getting very Castle in the Sky

Hmmm the ire of maricris

IMOGEN WHAT THE FUCK

8D6 OH MY GOD

MAP MAP MAP MAP MAP

WHYYY does imogen keep blowing stuff up

Oh my god 60 shots marisha is perching

FIVE SHOTS PER PERSON

Laura is learning how guns work tonight

God this damage rolling is taking so long

“For the rest of my move I’m gonna-“ “apologize”

“Sixteen misses the leg” *in a please sir may I have some more voice*

“Should we just change? Do you wanna be laudna?”

FCG IS DOWN OH NO OH NO

Brennan it’s fine just keep going

Four! FOUR!

Marisha oh my god how does each form of dread get even worse

“Sinewy halfling arm” is not a phrase I ever want to hear again thank you Liam

Yesssss ashley with the hdywtdt

Oh my god they are will not let this poor group that attacked them rest

“I am conscious…” me wanting to fall asleep so bad at 4:44 pm

You see a dark mushroom cloud in the distance

Oooooh calamity seeping in everywhere! I love this detail of the rumedan desert once being a jungle!!

"What’s 420 divided by six” “70” “I’m pretty sure it's 70"

GIANT THIMBLE

Good for you sam! No more regrets.

Break! Heading to the Calloway layaway!

SHORT ELF DAD ALERT

Llajdnakjsdn nightmare king is STILL gross as hell

Fearne introducing Ashton second is somehow very Laura Bailey Eyebrows to me

THE FINGERS WRAP AROUND EWWWW NOOOO

Ashley that was so funny

So this green glass door can SEE lay lines?

Gently!

This moon shit is getting creepy y’all

Sam stop yawning you’re making me yawn

“Two? Just two of them?” “Yep” “no.” Laura’s face is correct this dude is disgusting

Ollie is sitting like a cool teacher and I respect it

Sounds like birdie and ollie got into… some stuff… in the feywild

“I feel like I might be… on ruidus?” GIRL STOP ARE WE GOING TO THE MOON OR NOT

Insight check whispers!!!

Ashton and laudna are going to date the nightmare king

“What does it look like?” “It looks like a crown”

WHAT is the history between ira and morri I am desperate to know

THE UPRIGHT SEELIE BRIGADE Liam get out of here

I wanna meet morrigan so bad shes the tall lady rep I deserve

Oh shit what was the underlie court building

Excuse me??? The moon has a shell?

IMPRISONED GOD???

WHISPERS AGAIN

"Its cause my glasses keep bumping into them!”

Little moon looking at the little moon

NATURAL TWENTYYY TELL US MATTTT

THERES A CITY ON THE MOON

MATTHEW MERCER YOU SON OF A BITCH

“Why are there keys on that?” “You dont know!”

We are GOING to the MOON

#critical role#cr spoilers#critical role spoilers#critical role c3#c3 e30#ruidus#big moon little moon#bells hells

14 notes

·

View notes

Text

"too young to be a 90s kid but close" (aka 00s kid) aesthetic:

-nyan cat, llams with hats

-owls. everybody loves owls--

-minecraft before the jungle biome. minecraft hunger game servers.

-slap bracelets

-long sleves under tank tops...jean skirts with... leggings.... dc shoes... shell shoes...

those 60 seconds multiplication tables. the big blocks with 100 squares, but the strips of ten squares, the single squares? also shape wooden blocks. yellow hexagons, green triangles, blue diamonds, youd make pictures with them.

-morning circle. playing 7 up at school. FOUR CORNERS

-u knew the cookout was lit when they had huggies those juice barrel drinks that u bite the top foil

-sillybands

-nintendogs on your grey ds plus cooking mama

-remembering vaguely having to use a cd player as a kid, then an mp3, than an ipod-

-zebra. print. everything.

-japanese erasers

-duct tape purses

-the justin bieber sounds like a girl debate

-yo danny phantom hE wAS JUST 14

-shark boy and lava girl. sky high. stewart little. minutemen. halloweentown. the thirteenth year (mermaid). smart house. spy kids. twitches. princess protection program (bonus points if you watched it live and counted how many times they said princess). lemonade mouth.

-staying up late enough to see george lopez start to play

- "mom how do you spell cartoonnetwork whats the website"

- that weird fosters home for imaginary friends mmo

- fucking TOONTOWN

- "disney!! three six five!!!!!"

- microsoft paint created MASTERPIECES

- was... was kidpix a thing

-bill nye the science guy and liberty kids

-alvin and the chipmunks covers.

- school store! get me a pencil grip for a quarter.

-crimp your hair bitch... or straighten it. or clip in feathers. or strands of dye-

-bakugan and tech decks

-wheezers 'beverly hills' on the playground. we will rock you on the bus.

-camp rock. highschool musical. epic disney crossovers.

-if you didnt have a blog on blogspot.com you weren't shit (with the extension where you could feed the fish)

-lisa frank folders or those folders with close up of dogs and cat faces

-having to learn the fucking recorder. hot crossed buns... hOt croSssED BUNS,,,,

-did anyone play that weird wizard typing quest

-SMENCILS

-clUb PENGUIN. wizard 101. pirates of the carribean online. webkinz.

-everything is not what it seems when u can get all you wanted in ur wildest dreams

-popular snacks at snack time,,,: gritz, gogurt, fruit roll ups tongue tattoos, zebra cakes, cheese dip crackers, those cookie crackers where u took the red stick and spread it... gushers

-in the wee hours of the night you could hear... hear the chia pets taunting you

-orbeez. monster gummies. hotwheels beat that. fur real friends. pillow pets. littlest pet shop. yugioh. bop it. floam. tamagotchis.

-iDog

-HAVING THE KICKASS SCOOTER THENN KNOCKING UR FUCKING KNEES OFF WITH IT FUCK THAT SHIT

- "HERE I AM IN UR LIFE... HERE U ARE IN MINE... YEAH WE GOT THE SWEET LIFE... MOSTT OF THE TIME"

-underdog. undeRDOG. UNDERDOG!

-when you were playing on the ps2 and u fucking lost the fucking MEMORY CARD

-SPYRO

-playing gta the one where the guy wears the blue shirt (liberty city? ) with the sound off... memorizing cheat codes... square circle square-

-the fucking wii... making miis for literally everyone in ur class and sending the ones you didnt like to the parade

-slap slap slap... clap clap clap... SLAP SLAP SLAP.... CLAP CLAP CLAP (i.e 3... 2... 1... BLAST OFF from here to the stars,)

-when the teacher rolled out the elmo projector and those transparent plastic papers

-megan, MEGAN! (i.e i ran over oprah.....)

-the dell computers took over

-bruh message me on msn... then skype

-making a facebook page. liking all the fucking dumb facebook pages you could

-pokemon

-Z̵͖͂Ô̶̘Ö̴͔́. ̵͉͊Z̷̭̊O̷̻͒Ô̸̟ ̴̛̞Z̸̭̕Ȏ̸̗O̴͎̊ ̴̡͑. P̵̧̈Ȃ̷͖L̴̞̚S̶̰̐

-okay those weird ass beads u always got for Christmas that you had to iron to make shapes

-the fortune tellers... pick a color... blue? okay b-l-u-e. OK now pick a number... ok ur gonna marry lindsay lohan and have 80 kids

-WHAT YHR FUCK ARE THOSE GHOST THEMED CEREALS CALLED??? BOOBERRY??? AH SHIT

-team edward vs team jacob determined your survival

-thE yEar tHree THOusAnD

-black eyed peas

-fucking angry birds and flappy bird murdered everyone

-HEELYS OH DEAR GOD HEELYS I ALMOST FELL AND SLIPPED INTO ANOTHER DIMENSION

-that rabits game... let them go to the moon

-THE PS2 SOUND UP NOISE. THE DOOOOOOOSH

-every dvd had that coming soon bullshit

-stealing ur cousins gameboy

-Sugar. Spice. And everything nice.

-that fucking monkey at some of some fucking tv shows what the fuck was that fucking- hi im paul,,

-asdf videos! (desmond the moon bear.. i like trians)

-if you didnt flip ur shit everytime u saw a yellow car and yell BUMBLEBEE

-when the phone rings in school "THE PHONE... THE PHONE IS RI N G ING"

-"WAZZZZUUPPP!!" "WHAZZAAAAHHP!!"

-kidz bop. wholet the dogs out... who who? who?

-We all want to forget .... annoying orange and fred but god wont let us..

-MY SHINY Teeth and ME.

-that weird ass spongebob half time episode where theyre in the dome... or the spongebob episode with wormy... or the spongebob episode with the hooks (dont touch the hooks) or david hasslehof in the spongebob movie...

-invader zim

-FLAPJACK THAT FUCKING NIGHTMARE SHOW. And chowder. Coraline gave me NIGHTMARES fuck!

- I LIke to move it move it...

-POPTROPICA

-where the sidewalk ends from the school library... with goosebumps and diary of a whimpy kid.. BOOK FAIRS

-leapfrog

-THOSE GYM SCOOTERS. FOUR SQUARE. KICKBALL. THE PARACHUTE THING.

-no one knew how to use a fucking green screen

-🎶 we the peoplee... in order to form a more perfect union...🎶 conjunction junction whats ur function 🎶 puff the magic dragon 🎶

THERES A HUNDRED AND FOUR DAYS OF SUMMER VACATION-

the original teen titans

teach me how to dougie. soldier boy. the hoedown throwdown. the hannah montana movie 3d they were giving 3d glasses away literally in walmart

bILLY MAYS AND SHAMWOW

#the bullshit 60 second math tables#2000s#nostalgia#00s kids will remember#fuck#this took forever#kms#i can do more#diary of a whimpy kid

115K notes

·

View notes

Text

Sub Episodes OS or other Pokeshipping/Misty Mentions/Cameos that are translated!

Full Sub episodes by kissanime.au (NOTE: This list does not include the movies cause all have been subbed even Master Mind of Mirage Pokemon)

(ALL 4 SUN & MOON EPISODES)

(DP Buizel your way out of this)

(SUB ONLY, NO ENGLISH TITLE) Ep250 (The Ice Cave!)

Ep167 A Hot Water Battle (The Three of the Jungle! Battle in the Hot Springs!!)

Ep164 Carrying On! (The Carrier Poppo of the Poppo Store!)

Ep152 The Totodile Duel (Who Gets to Keep Waninoko!? Satoshi VS Kasumi!) Ep148 No Big Woop! (Lots of Upah)

Ep146 Tricks of the Trade (Sonansu and the Pokemon Swap Meet!!)

Ep70 Go West Young Meowth (Nyarth’s A-I-U-E-O)

Ep46 Attack of the Prehistoric Pokemon (Resurrection!? Fossil Pokemon!) Ep45 The Song of Jigglypuff (Sing! Purin!) Ep44 The Problem with Paras (Paras and Parasect) Ep43 The March of the Exeggutor Squad (The Great Nassy Squad Match!) Ep42 Showdown at Dark City (Showdown! Pokémon Gym! ) Ep41 Wake Up Snorlax (Wake Up! Kabigon!) EP40 The Battling Eevee Brothers (The Four Eievui Brothers) Ep39 Pikachu’s Goodbye (Forrest of Pikachu) Snow Way Out! (Iwark as Bivouac) (Not Aired) Holiday Hi-Jynx (Rougela’s Christmas) (Not Aired) Electric Soilder Porygon (Computer Warrior Porygon) Ep37 Ditto’s Mysterious Mansion (Metamon and the Copycat Girl) Ep36 The Bridge Bike Gang (Stormy Cycling Road) Ep35 The Legend of Dratini (The Legend of Miniryu) Ep34 The Kangaskhan Kid (Garura’s Lullaby) Ep33 The Flame Pokemon-athon! (The Great Fire Pokemon Race!) Ep32 The Ninja Poke-Showdown (Sekichiku Ninja Showdown!) Ep31 Dig Those Diglett! (Lots of Digda!) Ep30 Sparks Fly for Magnemite (Do Coil Dream of Electric Mice!?) Ep29 The Punchy Pokemon (Fighting Pokemon! The Great Battle!) Ep28 Pokemon Fashion Flash (Rokon! Breeder Showdown!) Ep27 Hypno’s Naptime (Sleeper and Pokemon Hypnotism!?) Ep26 Pokemon Scent-sation! (Erika and Kusaihana) Ep25 Primeape Goes Bananas (Don’t Get Angry, Okorizaru!) Ep24 Haunter versus Kadabra (Ghost VS Esper) Ep23 The Tower of Terror (Capture at the Pokemon Tower!) Ep22 Abra and the Psychic Showdown (Casey! Psychic Showdown!) Ep21 Bye Bye Butterfree (same title) Ep20 The Ghost of Madien’s Peak “The Ghost Pokemon and the Summer Festival) Ep19 Tentacool & Tentacruel (Menokurage Dokukurage) Ep18 Beauty and the Beach (Holiday at Aopulco) Ep17 Island of the Giant Pokemon (same title) Ep16 Pokemon Shipwreck (Pokemon Adrift) Ep15 Battle Aboard the St. Anne (Battle on the St. Annu!) Ep14 Electric Shock Showdown (Electric Shock Showdown! Kuchiba Gym) Ep13 Mystery at the Lighthouse (Masaki’s Lighthouse) Ep12 Here Comes the Squirtle Squad (Enter the Zenigame Squad) Ep11 Charmander - The Stray Pokemon (Stray Pokemon - Hiokage) Ep10 Bulbasaur and the Hidden Village (Fushigidane of the Hidden Village) Ep9 The School of Hard Knocks (Pokemon Victory Manual) Ep8 The Path to the Pokemon League (The Road to the Pokemon League) Ep7 The Waterflowers oc Cerulean City (The Suichūka of Hanada City) Ep6 Clefairy and then Moon Stone (Pippi and the Moon Stone) Ep5 Showdown in Pewter City (Nibi Gym Battle!) Ep4 Challenge of the Samurai (Challenge of the Samurai Boy!) Ep3 Ash Catches a Pokemon (I Caught a Pokemon!) Ep2 Pokemon Emergency! (Showdown! Pokémon Center!) Ep1 Pokemon-I Choose You! (Same title)

WRITTEN these are all credited to @zdbztumble AG132 The Scheme Team (Enishida and the Battle Frontier!) Ep273 Gotta Catch Ya Later! (Goodbye…and Then, Setting Off!) Ep267 Love, Pokemon Style (League Preliminaries! Battle of the Magmarashi Flame!!) Ep216 Dueling Heroes (Whirlpool Cup! A Big Battle in the Water Colosseum!!) Ep100 Wherefore Art Thou, Pokemon? (Nidoran’s Love Story) Ep93 Navel Maneuvers (Navel Gym! Snowy Mountain Battle!) Ep91 Bye Bye Psyduck (Goodbye Koduck! Come Again Golduck?

So that is everything I can find. I wanted to make this list for myself as a catalog of what I am still hoping one day to find or someday will be translated. I think the top ones that still need to be are.. (this is going in the order of what I would want most-least and not chronological)

AG Ep44 The Princess and the Togepi (Enter Kasumi! Togepy and the Mirage Kingdom!!)

AG Ep55 A Togepi Mirage! (Other Side of the Mirage! Togepy’s Paradise!)

Ep52 Princess vs. Princess (Fierce Fight! Pokemon Girls Festival)

EP61 The Misty Mermaid (Hanada Gym! Underwater Battle!)

Ep217 The Perfect Match! (Satoshi VS Kasumi! The Final Battle in the Whirlpool Cup!!)

Ep132 For Crying Out Loud (Crybaby Maril)

Ep103 Misty Meets Her Match (Yuzu Gym! Type Battle 3 VS 3!!!)

Ep110 The Stun Spore Detour (Nyoromo and Kasumi)

Ep157 The Fortune Hunters (Pokemon Fortune-Telling!? Battle Royal!)

Ep169 Hook, Line, and Stinker (Azumao! Fishing Battle!!)

Ep183 Troubles Brewing (The Five Sisters of Eievui! Battle at the Tea Convention!!)

Ep193 Sick Daze (Takeshi Collapses! A Dangerous Camp!!)

Ep155 Forest Grumps (Ringuma Shock!!)

Ep206 The Joy of Water Pokemon (The Nurse Joy Who Hates Water Pokemon!? Kasumi’s Angel)

Ep226 Espeon, Not Included (Eifie and Sakura! Enjoy City Once Again!!)

Ep256 Just Add Water (Ryugu Gym! Battle in the Water!)

Ep121 Illusion Confusion! (Hoho and the Mysterious Forest!)

(OS)Ep50 Who Get’s to Keep Togepi? (Who Gets to Keep Togepy!?)

(OS)Ep57 The Breeding Center Secret (The Secret of the Breeding Center)

THE LAST THING IS SOMETHING I HAD TO CHANGE FROM MY ORIGINAL DRAFT OF THIS CATALOG. I NOW DON’T NEED TO ASK THIS CAUSE THANKS TO @pokeshipping I NOW HAVE ALL THE RAWS OF ALL OF OS -THE AG MISY CAMEOS.

This is another thing I mean when I say “If anyone would like to help with this project in any way” I have already started to message a translator for work on some specific clips. It is going to cost to me so I have to pick and choose. So if someone does have something not on this list and knows a translator or anything that could be of some help and lower my bill it would be greatly appreciated. I want this so much for myself so thats why I will do some translations out of pocket but when I do have translated clips I will be posting them for your benefit too. So if anyone wants to help.. please do message me. Maybe you have something i’m not aware of already translated or on the back burner and if so I would really appreciate hearing about it :)

If somehow I actually had the SUBS for specific scenes in my possession I would do all the editing and embed them into the clips themselves. Even if they are just written translations it would be helpful.

47 notes

·

View notes

Text

THE CHRONICLES OF AMBER & History Lessons II

The first two books of Roger Zelazny’s Chronicles of Amber — Nine Princes in Amber and The Guns of Avalon — were written between 1967 and the early 1970s. The Vietnam War cast a long shadow from the 1960s into the first years of the next decade. In Nine Princes in Amber, for example, one of the most memorable episodes of action and conflict occurs in the seventh chapter:

“The sheets of light and heat flapped a steady, welling thunder as we ran, and the waves of warmth beat upon us, washed over us. Soon they were right there alongside us, and the trees blackened and the leaves flaked down, and some of the smaller trees began to sway. For as far ahead as we could see, our way was an alley of fires… We made it to the fork, though, beating out flames on our smoldering clothing, wiping ashes from our eyes… We ran through burning grasses… The interlocked branches of the trees overhead had become as the beams in a cathedral of fire…”

The Vietnam War was part of the nightly news back then. Stories and images of napalm and agent orange falling upon the jungles of Southeast Asia were current at the time and the quote above would have resonated in the American consciousness. But it was not just the horrors of war haunting America. There was also civil unrest and a rebellious younger generation ready to take up arms against the old guard who had nourished the conflicts and tensions leading to the strife stretching from the ’60s into the ’70s.

After the baptism of fire experienced by narrator and main character Corwin — which concludes with the provident arrival of riflemen trained and led by him to defend Amber and position him as the kingdom’s effective ruler — he finds himself at the top of a society struggling with an uneasy and temporary peace. Powerful foes have been unleashed upon the immortal city, and it looks like it may have been an inside job. In fact, it may even be that Corwin himself has provided unintended assistance to the enemy. This self-reflective attitude of examining one’s own role in the evils plaguing the world belonged very much to the troubling era which began with the assassination of President Kennedy and ended with the resignation of President Nixon.

SIGN OF THE UNICORN (1975)

History: The longest gap between the publication of any of the books of The Chronicles of Amber: three years. An air of defeat hangs over America, as well as over places beyond. The Club of Rome puts out its report “The Limits to Growth” and in 1974 the world population reaches four billion. The Apollo 13 failure of 1970 has left its mark, followed by a decline in support for the program dooming the final three missions to cancellation. Apollo 17 therefore sees the last men on the Moon in December of 1972, when one of the most popular photographs ever is taken — the iconic “Blue Marble” image of a nearly full Earth — and soon becomes an emblem of the environmental movement. In contrast to the “Blue Marble,” in the summer of ’72 the Pulitzer Prize-winning “Napalm girl” photograph makes headlines, and less than a year later the last U.S. soldier leaves Vietnam subsequent to the Paris Peace Accords. The war is over and the U.S. did not win it.

The war may be over, but deep problems remain — a description of the years during which Zelazny wrote Sign of the Unicorn, but also a description of the contents of the book itself. “The Troubles” — as the conflict in Northern Ireland comes to be called — of the United Kingdom undergo a rapid escalation: the British Army shoots dead 14 unarmed marchers on terrible Bloody Sunday; the British embassy in Dublin is burned down during rioting all over Ireland; bombs detonate in Whitehall and the Old Bailey; car bombs set by the Ulster Volunteer Force in Dublin and Monaghan kill 33 civilians and injure 300 others.

Meanwhile, a story just as big unfolds on the other side of the Atlantic: Five White House operatives are arrested for the burglary of the Democratic National Committee offices at the Watergate Hotel. Nixon orders special prosecutor Archibald Cox to be fired over his subpoena of recordings of incriminating White House conversations, but is eventually compelled by the Supreme Court to release the tapes. Impeachment proceedings underway, the public and even members of the Republican Party against him, Nixon resigns in August of 1974 and the unelected Vice President, Gerald Ford, becomes President. Likewise, Eric falls and Corwin steps in as the interim regent of an Amber reeling from war and internal strife, a state of affairs closely matching the condition of America as offered in Nixon’s resignation speech.

Lesson: Corwin finds himself the target of an attempt to frame him for the murder of Caine, his brother Gérard pummels him in a fight and dangles him over a cliff, he is nearly stabbed to death in his suite only hours after Brand is knifed in similar fashion, in the misty city of ghosts known as Tir-na Nog’th he is attacked and comes perilously close to plummeting to his death. In this context, the cautions of his sister Fiona regarding the dangers of wearing for too long the ultimate artifact of power, the Jewel of Judgment, take on new meaning. She warns it can kill him. The information possibly saves his life, as it persuades him to remove the Jewel when at the brink of death. The lesson is bigger than that, however. Corwin learns that power without knowledge or wisdom is dangerous and can be fatal, something which his brother Eric, as king, did not discover in time.

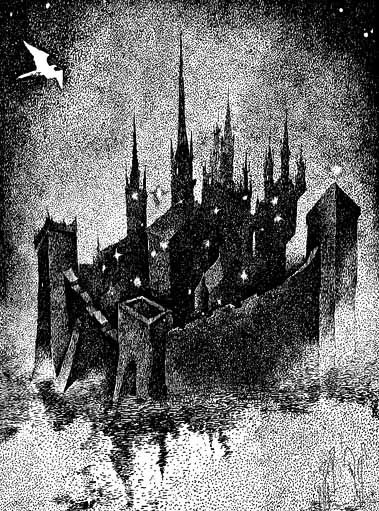

Journey: It all begins with Corwin’s discovery of a crime and a corpse, which leads straight to his learning of Random’s attempt to rescue Brand from his tower. And it ends with Corwin and Random, along with Ganelon, looking down upon the damaged Pattern (also the result of a crime, though they do not know that yet), just a day after Corwin’s meeting with a freshly rescued and recovered Brand. Crimes call out for investigation and from the first pages of the first book Corwin has played the detective. In the opening scene, Corwin has questions for Random and in the final scene he finally has some answers. Now he knows from his interview with Brand that there was a conspiracy by the red-haired faction to seize Amber’s throne, that Dara is descended from Chaos and intended for that throne, that a game has been in progress where he has been but a useful knight and where the broken Pattern before him is the board upon which it has been played.

Watergate, Painful Endings...

...and Perhaps Resurrections — the Mid-’70s

“The sun was that great orb of molten gold we had seen earlier. The sky was a deeper blue than that of Amber, and there were no clouds in it. That sea was a matching blue, unspecked by sail or island. I saw no birds, and I heard no sounds other than our own. An enormous silence lay upon this place, this day. In the bowl of my suddenly clear vision, the Pattern at last achieved its disposition upon the surface below. I thought at first that it was inscribed in the rock, but as we drew nearer I saw that it was contained within it—gold-pink swirls, like veining in an exotic marble, natural-seeming despite the obvious purpose to the design… A dark, rough-edged smudge had obliterated an area of the section immediately beneath us, running from its outer rim to the center.”

Dark times are depicted in Sign of the Unicorn amidst the darkest days of the Seventies. OPEC launches its oil embargo, soon doubling the price of crude, all just after the dollar has been devalued 10%. A recession affecting most of the world ensues, and the oil crisis does not wind down until 1974. Cults, destructive to themselves and often to others, appear in newspapers and on television. The Manson Family is sentenced, the Symbionese Liberation Army abducts and brainwashes heiress Patty Hearst, the Heaven’s Gate UFO cult is founded near San Diego.

Violent groups on the radical left, however, are increasingly foiled and contained: the Baader-Meinhof Red Army Faction is arrested; the Japanese Red Army, in decline after the Lod Airport attack, is defunct as an independent organization within a year of the attack; the Angry Brigade ends its run in a British courtroom.

At the same time, the political left makes gains: Labour’s Harold Wilson returns as Prime Minister of the United Kingdom; Helmut Schmidt of the Social Democratic Party becomes Chancellor of West Germany after a spy scandal brings down his predecessor; centrist Valéry Giscard d’Estaing succeeds Pompidou as President of France; the Carnation Revolution overthrows Portugal’s dictatorship and restores democracy; the Democratic Party logs historic victories in the House, Senate and state Governorships. The Old Bailey sees the first woman serve as a judge, the U.S. Congress sends the ERA to the states for ratification, women are finally admitted to Dartmouth College, the FBI hires women as agents for the first time, equal pay for women is mandated in Australia — liberal politics enjoys a resurgence during this period.

Whether intentional or not, the revolutionary red-haired cabal of Amber mirrors the restless idealists of the times, violent and otherwise, hoping to institute change. The overreach by forces on the right, responsible for the deaths of the Kennedys and Martin Luther King Jr., at last seems to come full circle with the resignation of Nixon and a national rejection of the authoritarian wielding of autocratic power. As already suggested, the hubris Eric demonstrates (like Nixon) in crowning himself king and regularly resorting to the most dramatic powers of the Jewel of Judgment brings him to his death on the slopes of Kolvir.

Eric has died, yet while Corwin and Brand both tread recklessly close to death they instead return bearing valuable new information — and, in one case, an enchanted mechanical arm — introducing the theme of resurrection and restoration. The Vietnam War at last is over, the crisis of the Nixon presidency has ended; the world is nowhere near out of the woods, but these events provide scope for respite and relief, and perhaps…hope? Vietnam and Watergate have together represented a perpetual storm cloud over America, a weight upon the world. The oil crisis has been harrowing, but soon leads directly to alternative energy R&D and long-needed improvements in automobiles. The world is still beset with sweeping, deep-seated problems, and the clouds have not truly cleared, but rays of hope are breaking through to shine on both beautiful inspirations and stark realities, much as the brilliant sun of the real Amber illuminates the broken Pattern in the final scene of Sign of the Unicorn.

“‘Then—looking for congruence—that would be about where our own Pattern lies,’ [Random said as we regarded the oval area of smooth, level rock].

‘Yes,’ I said again.

‘And that blotted area is to the south, from whence comes the black road.’

I nodded slowly as the understanding arrived and forged itself into a certainty.

‘What does it mean?’ he asked. ‘It seems to correspond to the true state of affairs, but beyond that I do not understand its significance. Why have we been brought here and shown this thing?’

‘It does not correspond to the true state of affairs,’ I said. ‘It is the true state of affairs.’”

[...to be continued in a future post...]

20 notes

·

View notes

Text

Episode 125: Doug Out

“It can't be all ‘Bam!’ ‘Pow!’ action all the time.”

(First things first: Lamar Abrams’s delightful promo art leans away from traditional cards with the title and storyboarders, and this is my favorite of the bunch. He really knocks the visual pun out of the park.)

Dr. Maheswaran is a titanic presence in her daughter’s life, and while she does have a canonical first name—Priyanka, according to Ian Jones-Quartey—it says a lot that the show itself only presents her as “Doctor” or “Mom.” She, not Doug, is the person Connie must reconcile with in Nightmare Hospital. She, not Doug, is the one that’s late picking Connie up in Storm in the Room. She, not Doug, takes the role of Yellow Diamond in Stevonnie’s psychic dream from Jungle Moon. And Doug, as should be clear now, has a first name that we actually hear on the show. Hell, it’s in the name of the episode.

Doug’s status as a background character allows his characterization to be more fluid than his wife’s. In Fusion Cuisine, which is a weird episode period in terms of Maheswaran behavior, he tells a joke to break the tension and disapproves of Steven and Connie hugging. In the far superior Winter Forecast, he’s frustrated with Greg in the bad timelines, appreciative of Greg’s cherry sweater in the good timeline, and we learn that he can’t drive in the snow (but thinks he can). Connie has told us that her parents are strict, which logically means he’s strict, but we see more impatience than strictness in his voiced appearances.

None of what we’ve witnessed lines up too well with the Doug we get in Doug Out: sure, we’ve seen his awkwardness, and I guess his tendency towards jokes at inopportune times means he can be funny, but he’s super silly in this episode. Normally such a huge shift in characterization would bug me, buuuut:

Doug is such a minor character that it’s not a huge deal that his personality adjusts to fit the story better, and

We’ve only seen Doug with Dr. Maheswaran nearby and I can totally buy that he acts differently when she’s not around.

It would’ve been nice for the canon if a little more of Doug’s behavior from Doug Out had been established earlier, but yeah this isn’t a dealbreaker for me. It’s already weird that Connie said in Bubble Buddies that her family moves around a lot because of his security job, considering they don’t move at all over the course of the show and her mother’s job certainly pays more than her father’s, so at least showing Doug at work lends some consistency to her claim.

Entering the episode by pulling a prank on Steven is a succinct way for the show to tell us this is a new Doug. We do get references to the Maheswarans being all about safety, namely his concern over Steven's hydration after eating salty fry bits, but he’s simultaneously silly with the kids and proud that his daughter is a “swashbuckling swashbuckler.” Plus his dopey smile is the same as his daughter’s dopey smile and it’s the most precious thing in the world.

There hasn’t been any indication that Connie is distant from her father, despite his lack of screentime; in fact, one of my favorite unspoken bits of characterization for the family is how she (and through her, Stevonnie) often wears his signature flight jacket. But it’s still great to see them get along so well, keeping up the light mood from the beginning of the episode and amplifying it through paternal playfulness.

While bringing kids along for a security mission after hours doesn’t sound like something an ultra-responsible parent would do, I choose to see it as a sign of Doug’s respect for his kid and her friend. He knows they’ve handled dangerous situations before, and it’s neat to see him acknowledge this by allowing them to ride along. Moreover, the whole point of the episode is that he doesn’t think his job is exciting, so it’s not like he thinks he’s throwing the kids into a violent situation. And considering he wants to see more action like his daughter does in missions or his wife does in the hospital, I’m glad that this jealousy never turns petty or mean-spirited: this wasn’t a given, as he’s been unfriendly in the past. Doug sort of rules in this episode, and it’s nice that veteran voice actor Crispin Freeman finally gets something to do with him.

The goofiness isn’t limited to Doug, as half of what makes him great is his playing along with Connie and Steven’s prepackaged goofiness. The kids are in top form in Doug Out, dressing as ridiculously-named parodies of Carmen Sandiego and Mario while they’re on the case (Connie’s assertion that Pizzapoppolis sounds more Greek than Italian is in contention with her bemoaning the laws of physics in the Gravitron for the best “Connie’s A Nerd” joke of the night). They’re down to mess around and ruin a teen’s night, and I’m here for it.

Still, I wouldn’t call this a full-on goofy episode, particularly when it evolves into a sequel of sorts to Gem Hunt. Aivi and Surasshu’s soundtrack evokes exaggerated noir as Doug talks shop, but shifts to a menacing drone as the trio encounters evidence of something sinister afoot at Funland. Steven and Connie stay in-character during the chase, but drop the act when discussing the possibility of a Gem Mutant or Homeworld Gem. Whatever they’re hunting is clearly hunting them, and perhaps the most impressive aspect of Doug Out is maintaining a tone of genuine looming danger that isn’t undermined by the episode’s numerous jokes.

The mystery, as in Gem Hunt, is complicated by a red herring. During Connie’s first big mission we’re led to believe that a Corrupted Gem might be healing itself, given the multiple distinct footprints, but we learn in the third act that it was Jasper all along. This time we get a wide array of dangerous possibilities, so the third act Onion reveal initially comes as a relief. But we’ve never seen him this scared before, and his distinct silhouette doesn’t match that of the shadowy figure on the roof.

Before we can think about the hints that Onion isn’t our perp, the focus shifts back to Doug as we conclude his character’s episode-long arc. He wants to be taken seriously, projecting a badass vibe that’s often undermined moments later by an intentional joke (like calling his daughter by her “Cucamonga” alias with a straight face) or by the emergence of his inner square (pretending to be undercover by removing his glasses then instantly relenting because he needs them to see). He’s not incompetent, correctly deducing that the culprit isn’t a regular teen and quieting the children to listen for clues, but he’s just a normal security guard in a family with a surgeon and a kid hero. You can’t blame the guy for developing a bit of an inferiority complex.

So again, I really appreciate that his behavior doesn’t devolve into toxic overcompensation, because that’s the obvious route to go and it would’ve made this episode so much worse. He respects the kids and doesn’t pretend he needs to protect them, and he doesn’t let his desire for action let him get in over his head—in another similarity to Gem Hunt, he stresses the importance of calling for backup instead of stubbornly going it alone. When Connie talks about how much she loves and values him, we’re allowed to feel it, because she’s reiterating what we’ve seen rather than letting a petty control freak off the hook.

We’re coming off another terrific Dad Moment in Lion 4, but Greg being great is par for the course. Most Dad Episodes are understandably about him: other father/child relationships have their days in the limelight (Fryman and Peedee in Frybo, Kofi and the Pizza Twins in Beach Party, Bill and Buck in Shirt Club, and Yellowtail/Marty and Sour Cream in Drop Beat Dad), but Greg gets more focus episodes than all of those combined. So while I would’ve liked to see more of him in an arc that hinges on the phrase “my dad,” I love that we get one last new Dad Episode to kick off the end of Season 4, especially if it lets us see Connie again before her kidnapping.

Onion may be a red herring, but the whole ending with Doug and Connie’s sweet talk is another red herring, tricking us into thinking the episode is wrapping up and that despite the suspicious inconsistencies, Onion was just being Onion. Unlike Gem Hunt, our heroes don’t solve the mystery, and because they don’t, neither do we. We have more information than Steven that something sinister is afoot, with an alien threat that for some reason is going after Onion, but before our sleuths can learn more, we cut to black.

After the victories of taking the ocean back from Lapis and saving the world from the Cluster, Act III of Steven Universe is the first with a tragic midpoint, and the fallout of Steven’s sacrifice at the end of Season 4 ripples through the first third of Season 5. Episodes like Storm in the Room and Lion 4 bring plenty of angst as well, so Doug Out wisely gives us some comic relief before the sweet-and-somber flavor of The Good Lars and the tension that follows. That tension is still present here (we get a cliffhanger, after all), but I’ll take moments of pure happiness where I can. This isn’t a silly episode in the vein of The New Crystal Gems, but it’ll still be a while until we have this much fun in one episode again.

We’re the one, we’re the ONE! TWO! THREE! FOUR!

It’s time again to expand our Top List, from a Top Twenty to a Top Twenty-Five! Most are Act II classics that got pushed down by the sheer volume of great episodes, but Lion 4 makes the cut as well. We’ll keep it at 25 until Change Your Mind; normally I’d switch to 30 at Episode 150 to keep up the Top 20% trend, but it seems more fitting to expand when the original series concludes.

Doug Out sadly does not make the cut, but it’s still an episode I love. We’ve had plenty of cliffhanger episodes that feel incomplete, and while this one also leaves us wanting more, it still works as a full story and not just setup. And the story is great!

Top Twenty-Five

Steven and the Stevens

Hit the Diamond

Mirror Gem

Lion 3: Straight to Video

Alone Together

Last One Out of Beach City

The Return

Jailbreak

The Answer

Mindful Education

Sworn to the Sword

Rose’s Scabbard

Earthlings

Mr. Greg

Coach Steven

Giant Woman

Beach City Drift

Winter Forecast

Bismuth

Steven’s Dream

When It Rains

Catch and Release

Chille Tid

Lion 4: Alternate Ending

Keeping It Together

Love ‘em

Laser Light Cannon

Bubble Buddies

Tiger Millionaire

Lion 2: The Movie

Rose’s Room

An Indirect Kiss

Ocean Gem

Space Race

Garnet’s Universe

Warp Tour

The Test

Future Vision

On the Run

Maximum Capacity

Marble Madness

Political Power

Full Disclosure

Joy Ride

We Need to Talk

Cry for Help

Keystone Motel

Back to the Barn

Steven’s Birthday

It Could’ve Been Great

Message Received

Log Date 7 15 2

Same Old World

The New Lars

Monster Reunion

Alone at Sea

Crack the Whip

Beta

Back to the Moon

Kindergarten Kid

Buddy’s Book

Gem Harvest

Three Gems and a Baby

That Will Be All

The New Crystal Gems

Storm in the Room

Room for Ruby

Doug Out

Like ‘em

Gem Glow

Frybo

Arcade Mania

So Many Birthdays

Lars and the Cool Kids

Onion Trade

Steven the Sword Fighter

Beach Party

Monster Buddies

Keep Beach City Weird

Watermelon Steven

The Message

Open Book

Story for Steven

Shirt Club

Love Letters

Reformed

Rising Tides, Crashing Tides

Onion Friend

Historical Friction

Friend Ship

Nightmare Hospital

Too Far

Barn Mates

Steven Floats

Drop Beat Dad

Too Short to Ride

Restaurant Wars

Kiki’s Pizza Delivery Service

Greg the Babysitter

Gem Hunt

Steven vs. Amethyst

Bubbled

Adventures in Light Distortion

Gem Heist

The Zoo

Rocknaldo

Enh

Cheeseburger Backpack

Together Breakfast

Cat Fingers

Serious Steven

Steven’s Lion

Joking Victim

Secret Team

Say Uncle

Super Watermelon Island

Gem Drill

Know Your Fusion

Future Boy Zoltron

Tiger Philanthropist

No Thanks!

6. Horror Club 5. Fusion Cuisine 4. House Guest 3. Onion Gang 2. Sadie’s Song 1. Island Adventure

26 notes

·

View notes

Text

Somewhere Between The Music and Lyrics: Ch. 1

A/N: I’m terribly off my own schedule, as usual! So. This Prompto one-shot became a monster I did not expect so I’m splitting it into two chapters. Honestly, among the chocobros, Prompto’s the first one that came to mind when I wanted to do a band AU of sorts—because I’ve heard Robbie Daymond sing on one of their LAVA streams and it is glorious. Anyway! Song featured for this first half is Gavin DeGraw’s We Belong Together.

Tagging pals! @raspberryandechinacea @noboomoon@emmydots��@bleucommelhiver @gowithme @hanatsuki89 @valkyrieofardyn @animakupo @lazarustrashpit @blindedstarlight @mp938368 @boo-dangy

(Links in AO3) Alternate Universes in Which You and I Belong Together: Noctis | Gladio | Prompto | Ignis | Nyx | Cor | Ravus | Ardyn

Prompto had been busily sifting through The Lost Boys’ unanswered emails at the back of their tour bus when he hears his song.

Except, it’s not quite his song.

He recognizes the lyrics in an instant—and he of all people would know of course, since he had written those words as a cry for help for his hopelessly romantic soul. But the song that aches through the speakers holds none of Ignis’s electric riffs, the swell of Gladio’s drums, the steady hum of Noctis’s bass, let alone his own vocals. The one he hears is his music stripped to its rawest, the words made vulnerable by a melancholic leak of a lone acoustic guitar and an exquisitely soulful voice.

We belong together Like the open seas and shores Wedded by the planet force We’ve all been spoken for

Prompto scrambles to the front lounge to find Noctis, Gladio, and Ignis huddling by the booth over a laptop set on the table, their eyes glued to the screen in wild wonder.

Curiously, Prompto eyes them—still grinning wide in awe—and asks, “Are you guys hearing what I’m hearing now? Am I dreaming? What is happening?”

Noctis snorts a laugh. He swivels the laptop to face Prompto. “You might want to check this out, my friend.”

Prompto excitedly moves closer. Immediately, he sees the video accompanying the song entitled “we belong together (cover) by my amazingly talented roommate!!!” posted by username MasterPelnaK. He barely even notices how this video has been raking almost five hundred thousand views and likes in the last twenty-four hours as his attention zeroes in on the stranger sitting on a bean bag, equipped with nothing but the guitar and that voice.

What good is a life With no one to share The light of the moon The honour of a swear

Gods. The tone and vibrato is so on point it sends shivers down his spine. But then, Prompto begins to wonder why this person is not even looking directly at the camera. Were they even aware that they were being recorded? It seems all too candid given the angle, as if the camera had just been discreetly set up on a low-lying table. Not to mention the very personal space in the background, too: a well-lit room of white walls, a cozy looking sofa, an impressive shelf of books and vinyl records tucked between potted fiddle leaf figs. Somewhere out of sight, hushed whispers could still be heard. Was this only recorded from a mobile phone?

Anyway, not that any of these things mattered. Prompto has rarely come across other artists covering their songs, and when he does, each one he cherishes dearly. But this one—this one, for heaven’s sake—has moved him the way the winds bend the trees to its will, a tiny flint that sparks a flame. He didn’t realize that the words he had written could be afforded such lyrical heft, that the music he had created had been a delicate and honest confessional that could fit someone else’s voice so beautifully, like finding a piece of a puzzle he never knew he had been missing.

Where have you been all my life?

So Prompto watches it again. And then a couple times more. Noctis, Gladio, and Ignis gather to watch him curiously. Prompto briefly skims through the comments section and is thoroughly relieved to read overwhelmingly positive feedback. He didn’t even mind when he comes across a comment that says “this is even better than the original!” because fuck it, he shares the same sentiment.

And before Prompto could even scroll back up to replay the video, Gladio drags the laptop away from him.

Prompto sneers in protest. “Dude. Not cool at all—”

“What’s not cool is obsessing over a cover of your own fucking song,” Gladio says in jest.

“Hey, it’s a fucking cool cover, okay!” Prompto scoffs and flicks his eyes on the ceiling—almost rolls them, but not quite so. “And please, big guy. I’m not obsessing. I’m too chill to be obsessed, thank you very much.”

“I clearly remember you saying to the crowd earlier how you’re never the ‘chill’ person of sort, and my word. How quickly the tables have turned,” Ignis casually remarks as he takes a sip from his mug of coffee.

Prompto’s mouth falls open. He did say that onstage during their performance back at Leiden Fest. His immediate regret is letting Ignis triumphantly take it against him.

Meanwhile, Noctis lifts a suspicious eyebrow at Ignis. “Iggy, are you sure you’re not drinking tea? ‘Cause you just poured a scalding one right there.”

“I’m impressed—that’s a good one.” Gladio gives Noctis and Ignis a thundering high-five. They burst out in a gale of laughter.

“You guys are enjoying this, huh.” Prompto grabs a pillow and smashes it at Noctis, who only yelps in between fits of laughter. He hurls one at Gladio, too, but the big guy has reflexes of a jungle cat, so he only ends up catching the thing. Ignis, however, Prompto hesitates at the last second when he shoots him a menacing glance. “Okay, I’m not even going to bother attacking you, ‘cause I’m pretty sure you will kill me if you spill that coffee.”

Ignis gives him a smile and a nod, and returns to his drink.

“Also,” Noctis says, “now that I think about it, you’re giving off that same look and vibe the first time you were crushing on Cindy.”

“What? I do not—okay, okay—” Prompto groans, jabbing a finger at Noctis— “that is different. Cindy is our road manager, so I’m choosing not to cross the line. While this…” Prompto pauses and takes a deep breath. “This is also different. A very surreal and magical kind of different.”

“Now I’d say someone’s been bitten by a lovebug.” Ignis leans back on his seat, arms crossed, regarding Prompto with a pleasant smile.

Gladio laughs. “Tell me about it.”

“I can’t believe I’m friends with you guys,” Prompto says in a miserable groan.

But frankly, Prompto is far from miserable having Noctis, Gladio, and Ignis as friends. He considers himself quite fortunate to have found brothers in them, painfully annoying as they may be from time to time. Besides, it was through their music that helped them bond and weather the toughest of their adolescent years: they were no stranger to teenage angst, to riotous episodes of rebellion, to whirlwind romances and crazy ex-lovers, and to the turbulent journey that led them to be the band that they are today. Naming themselves The Lost Boys seemed to be a fitting tribute to the misadventures of their youth: Always lost and never found.

And yet, regardless of their highs and lows, the four of them have always had each other’s back. And that has not changed even now that they are in their thirties.

Perhaps Prompto is being overly sentimental at this point, but that’s just how it is.

Or maybe, he really has been bitten by a lovebug.

“In any case—“ Noctis firmly clasps Prompto’s shoulder— “this amazing cover of your song is breaking the Internet as we speak.”

“Well, yeah.” Prompto shrugs, though he cannot hide it in from his face how pleased he truly is. “Though I do wonder who this MasterPelnaK is.”

“Definitely not the person in the video, that’s for sure,” says Gladio.

“If I may?” Ignis reaches for the laptop from Gladio. “Let’s see here—“ the boys squeeze themselves into the seat so they could also get a look as Ignis hovers around the profile page— “this Pelna Khara happens to be a video game blogger—“

“It’s a vlogger, Iggy—get in with the times,” Prompto corrects cheerfully.

Ignis exhales an exasperated sigh. He returns his attention back on screen. “Apparently, this vlogger streams gameplays and commentaries—“

“Really?” Noctis interrupts out of a sudden rush of excitement. “Do you think he has one for Assassin's Creed—“

Prompto nudges Noctis by the arm. “Dude.”

“Right. Sorry,” Noctis says sheepishly. “Carry on.”

“Anyway.” Ignis is unfazed by the interruption as he goes on: “It appears that this is the first time this Pelna fellow uploaded this sort of material.”

“Oh and look, he’s very popular, too,” Noctis says. “Ten million subscribers? What the fuck—“

“Wouldn’t be surprised now that the video got so many hits overnight,” Gladio notes pensively. “And check it out—“ he points at the bio section— “he lives in the city. Says his hub is somewhere in Downtown Insomnia.”

As if struck by the same spectacular idea, Noctis and Gladio exchange knowing glances. Ignis, of course, is quick to catch on.

It takes a while for Prompto to understand what’s going on, and when he finally does, he shoots them all a dubious gaze. His friends are up to something, and the glint in their eyes could only spell mischief.

“Guys—” Prompto starts as calmly as he could, hands raised in an almost surrender— “whatever you guys are thinking, we don’t need to do this—”

“We don’t need to—but you do,” Gladio claps Prompto’s back. “We got ya, my guy.”

“And before you all intend to push through with this,” Ignis says, “would anyone be so kind as to ask Cindy if we can change our course and make a quick pitstop. And let Iris know, too, since… well. She’s our handler, after all.”

Gladio rises out of the booth. “On it,” he says as he makes his way to the driver’s seat.

“And allow me to send a message to this fella,” Noctis adds promptly, already typing away in front of the laptop.

Prompto sinks helplessly to the seat beside Noctis. “Why are we all friends again?” he says loudly, and the meaningful response he receives is the sound of their amused laughter.

“I want that video deleted right now.”

Pelna winces at the sharpness of your words. Crowe, on the other hand, looks like she is ready to give you everything the world has to offer. In the years you have spent sharing a flat with them, this must be the first time you have ever seen them this apologetic. Which is only fair because this is the first time they have done something quite outrageous to upset you. Yes, sure—Crowe and Pelna might think you’re overreacting right now, but you’re no video blogger or Internet celebrity like the both of them are, so that’s entirely beside the point. As they sit side by side cowering on the couch and you standing over them—hands on waist, jaws clenched, eyes seething in fury—it’s as if they have committed a crime against all of humanity that cannot be forgiven.

Except the casualty of the said crime is you, and only you.

“Look, you have every right to be mad at me for my negligence—” Pelna nervously raises a hand, trying to look at you dead in the eye but flinches as if you are burning bright like the sun— “but I fucking swear, it wasn’t me who uploaded the thing! Okay, I admit—I’ve been tempted to record you for some time now ‘cause in case you don’t know this yet, you’re a really good singer. But trust me on this! I really have no idea how that video got out, I promise!”

“And it’s certainly not me who recorded you!” Crowe adds in their defense. “My alibi may not be perfect but I was already drunk that time! And even if I’m sober, I wouldn’t dare barge in Pelna’s room and tinker with his toys. Gods know what I’d find in there—”

“Only the good stuff, my dude,” Pelna says, suddenly pleased with himself. “Nothing but the good stuff—”

“How about we focus on the issue at hand, yes?” You pace back and forth, and in dire resignation, you finally flop on the armchair next to the couch. Fucking hell. It’s too early in the morning to have a head-splitting migraine. You wish this had been from a hangover or some other sickness, but it’s insane how this is all caused by seeing a video of yourself on the fucking Internet with no recollection of recording it at all. Sleuthing to find out the events that unfolded the night of Pelna’s birthday only seemed to make throbbing in your head even worse. As far as you could remember, most of the folks had been severely battered—which was why you had the guts to pull out your guitar and sing the blues away as everyone dozed off in their drunken stupor. But in your tight-knit circle of friends, if there’s anyone who could impressively hold their liquor the same way they could hold a knife, it could only be...

“Wait a fucking second.” Crowe narrow her eyes at Pelna, and then at you. She fishes out the phone in her pocket and hurriedly dials a number. With her phone on loudspeaker, the line rings once, twice, thrice. And then, a voice.

“What’s up, Crowe—”

“Nyx.” Crowe’s tone is already accusing that you didn’t even bother butting in. “You’re the one who uploaded the video on Pelna’s channel, weren’t you?”

A suspicious pause. Then, Nyx laughs. “Maybe.”

Pelna grabs the phone from Crowe. “I swear I will kill you when I see you, man! How dare you dishonour me—” as a knee-jerk reaction to his response, you kick Pelna in the shin that he yelps when he says— “and how dare you dishonour our friend!”

On the other line, Nyx is still laughing. “Wait, on a scale of one to ten, how angry is —”

“Not the fucking point!” Pelna snaps back. “How did you even manage to get into my account, you piece of beautiful shit?”

“Well, maybe next time you should make sure you always logout, alright?”

“Well, fuck you.”

“Thanks, but no thanks.” Nyx says breezily. Even in a phone call, his voice never fails to carry his air of arrogance. “But hey, kidding aside. You all said that we should help each other in living to the best of our potential, right? And our friend right there with you, Pelna—yes, you, I know you’re listening, too—do you even realize how fucking talented you are? You have been serenading us all our life, and this is the least I could do to share how proud I am to have a gifted friend like you. I’m sorry if it’s a jackass move, but I know if I asked for your permission, that thing would never see the light of day.”

The four of you bask in a sudden uneasy silence. You should not have been touched by Nyx’s words, but here you are, almost moved into tears. Despite his occasional display of pride and vanity, Nyx is one of the kindest human beings you have ever had the pleasure to meet. He may not seem like it, but he’s the very definition of a jerk with a heart of gold. You just hope he could completely forego being the jerk and stick with his golden heart instead.

This time, you take the phone from Pelna and say, “Treat the three of us for dinner for the next two weeks, and I’ll decide if I should forgive you.”

“Consider it done. I’m a man of my word,” Nyx says, and the sound of his relief is evident in his voice. “Now... am I out of trouble?”

“Certainly not, you dickhead. Later.”

You drop from the call and hand the phone back to Crowe. The two of them gape at you as if you have finally turned out to be the monster they have always known you to be.

“Wow. You really did that,” Crowe says, looking very impressed. “You actually shut Nyx up and made him agree to pay for two weeks worth of dinner. Aren’t you a delight.”

You manage a small smile. Pelna heaves one loud sigh of relief. “Now that we’ve finally cleared things up, are you sure you want me to take the video down? You’re really getting a lot of hype from my channel, I mean we’re close to half a million views! And—“

The shrieking sound of the doorbell cuts your conversation in an abrupt halt.

“Wait, I’ll get that,” Crowe gets up and rushes toward the door.

“So? Whaddaya say?” Pelna urges fervently. He is still invested on persuading you, and you can see it in his kind eyes. “It’s one video, I know… but you gotta believe us, you really are a fucking talent—”

“Pel, it’s not that. It’s...” You get on your feet, circling around the coffee table, as if it would help you articulate all the reasons behind your sense of trepidation. Honestly, you appreciate having Pelna and Crowe as friends for their selfless outpour of love and support for your craft. But how can you explain to them that sometimes, your own music terrifies you? Is there any logical explanation behind being scared of your own voice? So here you are, standing in front of Pelna, falling extremely inadequate to gather the words out of your mouth. Instead, you say, “I’m… just worried. What if The Lost Boys had seen it? And what if they’d hate me for it?”

Pelna offers you a weird, strained look. “Well, about that—”

“I don’t think there should be anything to worry about. We love it!”

The bell-like bounce of the voice that spoke clearly does not belong to Pelna nor Crowe, nor does it fit in the ordinariness of the space of your shared apartment.

You turn—hesitantly, too carefully—to see three of The Lost Boys standing by the doorway with Crowe. And standing in front of you is their frontman, Prompto, smilingly extending his hand to reach yours.

This horribly sunny day is getting stranger and stranger, and it’s not even noon yet.

Pleasantries have been made—and a little bit of internally slapping yourself in the face to make sure this is all happening—and now, it has all come to this. Leaning from the bar counter, you watch as the four infuriatingly beautiful men of The Lost Boys struggle to squeeze themselves in the poor thing you all call a sofa. Across from them is Crowe, sitting cross-legged on the coffee table, analyzing each of them from head to toe with the sole purpose of intimidating the shit out them. Which is no surprise, of course; Crowe rarely gets star-struck in the presence of famous people, and even if she does, she hides it effortlessly well. Meanwhile, Pelna is playing a staring game with the band’s drummer—and frighteningly the tallest and largest in the group—that you cannot help but wonder if Pelna has some sort of a death wish that he needs to get fulfilled right this instant.

“So, let me get this straight—” Crowe says, crossing her arms— “and I hope you don’t mind if we’re being cautious ‘cause, well, we don’t want our roommate to get dragged into something sketchy, but… you came all the way down here to this shabby neighbourhood after you saw the cover of your song, and now you want to collaborate on a song? Is that it?”

Prompto is the one who willingly answers with a vigorous nod. He seems unfazed with Crowe’s intention of scaring them off. He glances your way before he says, “And there’s no need to worry about the contract and all that legal stuff, ‘cause we’ll have that arranged. Right, Ignis?”

“Indeed,” says Ignis. “I know this arrangement seems completely out of sorts, seeing as we came here on such a short notice, but I can assure you that we offer nothing but the best of intentions.”

“Really?” you say as you move from behind the counter to sit together with Crowe. “But you’re all men. And you know what’s more dangerous than men? Celebrity men.” No one said a word. A moment’s silence lingers as you study each of their faces, and then: “So how do I make sure that I could trust you with… this? That this isn’t some publicity stunt you’re trying to pull—”

“It’s not like that at all,” Prompto says firmly. “And if you have any doubts with your safety, well, I’m sorry if our friend Gladio looks so menacing for our image—”

“Seriously?” Gladio scoffs, turning to Prompto. “You really hurt my feelings.”

You try to stifle your laughter. Somehow, now that you look closely at the four of them, they remind you of Nyx, Libertus, and Pelna.

And suddenly, you feel bad for putting them in a hot seat like this.

As The Lost Boys begin to discuss amongst themselves with what you assume to be a stream of their inside jokes, Pelna sidles up to you while Crowe loops her arm around yours. Whispering, she says, “I think you should do it.”

Pelna discreetly adds, “And if they ever get you into trouble, Nyx is a lawyer so he should have your back. I already texted him and he’s ready to keep an eye out for you.”

You let out a rueful sigh. You have to admit, it’s hard to stay mad at Crowe and Pelna and Nyx when this is the way they exhibit their unwavering friendship: with a flourish of genuine love and steadfast support.

Empowered by your friends’ confidence, you clear your throat and you turn your attention to the four men sitting in front of you. You fix your eyes at Prompto, and you ask, “So. When do we start this thing?”

#final fantasy xv#ffxv#ffxv fanfiction#fanfic#prompto argentum#older!prompto argentum#prompto x reader#older!prompto x reader#my writing

18 notes

·

View notes

Text

Matchmaker XII: Lost in New York

It’s been several years since I sat here with my laptop; earphones turned to max, music pouring its way through my emotive veins at an undetermined time of the darkened morning. Curtains closed, alarm set for shortly. Here I am.

Oh, jetlag, you.

youtube

When was your year? My sister and I spent last weekend reminiscing our short lives and the possibility of a self defining year, ‘the year of you’...so far. She said mine was 2013 and I agreed. I sharply exited an 8 year relationship that was never destined to survive the adult world and as I left it behind, I grew as a model and a person in every way.

I discovered a new world beyond my own doorstep; venturing to the big smoke alone, touring for the first time and stretching tiny wings that soon saw flights to Montreal and L.A. solo - I barely recognised the brave adventurer I’d become. I made three of the greatest creative friends I’ll ever have - Brooke, Ben and Devin. I started urban exploring with a friend from my past who allowed me to talk uninterrupted and bleed my sadness out into abandoned uncharted buildings, that echoed my feelings back. I approached brands to seek out successful work and I networked day and night using a project I later called Dreamcatcher, to grow. I got angry at badger cullers and dolphin trainers, and I made sure everybody knew. Yes, 2013 was my year; the year I became more than the silent clotheshorse.

Reviewing my blog archive, it seems that by February 2014, I was ready...and I found my Matchmaker man. For those who followed the 10.5 episode series, you’ll know that the story concluded (in blog form) with our first night spent together. Fourteen months later (and three years to this very day), we had our own home - two deckchairs, two mugs, a lamp, a plant and a mattress on the floor to our name. And now four years on...we’re here again, with another chapter to my unwritten autobiography.

*******************************************************************************************

October 2017 - my heroine, P!nk, announced her Beautiful Trauma Tour - the 14th time I would see her. With European dates still dwindling in the distance, he said “let’s do NYC”...and I didn’t wait to be asked twice. So, we saved and saved and treated ourselves to five nights in an art deco themed tower on Park Avenue, with a rooftop that overlooks the Empire State.

Straight through to April...it was time.

We arrived late, Saturday 31st March. Having barely slept for a full day, we crashed hard and awoke the next morning to patchy skies, overlooking the city like no other’ the city that never sleeps. Three wonderful days soon flew by, visiting the usual tourist hotspots and cooking up a storm of steps around the concrete jungle of 60 miles on foot.

Wednesday, 11pm and we were walking home from Madison Square Garden - with me still singing ‘So What’ as he clutched the Starbucks crushed cake we’d forgotten from his pocket.

“So, so what?! I’m still a rockstar! I got my rock moooooooves and I don’t neeeeeed you! And guess what? I’m having more fun, now that we’re done. I’m gonna show you, tonight...” my voice echoed quietly into the Subways that filled the ground.

We were only six blocks away as we marched the path back to our hotel upon newly dried pavement, after a few days of undecided showers and a flurry of deep overnight snow. Blinded by the glare of Times Square and the flashing lights of the Big Apple cabs, stars above were completely invisible, but on such a perfectly clear night of perfectly wonderful happiness, I knew they were up there somewhere, looking down.

Drunk on Pink, high on life, I was skipping all the way home. All of my favourite things in one place together - NYC, Matchmaker and a 5ft 4 superstar, who’s unknowingly been there, in my life, all along.

We hurried through the glassed porch entrance of the hotel, greeted by the perfume of elegance that they pump into the lobby - something I’ll always remember; an essence that screams ‘we go the extra mile, don’t forget us’.

Ten floors up, we were ‘home’.

“Turn around, I’ve got a present for you” he said, as I ventured my way into the bathroom. “Hurry up then” I badgered, “I need a wee”. Knowing it would be the lemon drizzle he was speaking about less than a split second before, I span around and.....whaaaaaaat?! There he was, down on one knee, a sparkling diamond glistened in the tungsten light above the bed.

“Will you marry me?”

....”Are you serious?? Oh my god, I don’t understand! Do you mean it??”

I battled through the salty water that appeared in a single blink, blurring my vision. I stumbled to greet him on the carpeted cream coloured floor. Still spilling sweet nothings into the sweet smelling air, we landed in a soggy heap, me holding his crumpled shirt tightly, pulling back only to stare at him and cry more.

“I wanted to do this last year. I knew when we walked onto Main St at Disney and you burst into tears, that ‘this’ was the moment I was meant to do it...but I didn’t know it ‘til then and I didn’t have a ring! I started searching for places in Florida and thinking of how to get you one. I panicked! I’m sorry it’s not as perfect as last summer, but I know how much you love Pink and this seemed like a good second. You’re my world, my best friend and I don’t ever want to be without you. I want to marry you...I’m presuming this is a yes, right...right?”

I was frantically nodding, still sobbing, still listening, still staring into those emerald eyes I’d fallen for four years ago, gleaming rocks in a box still clutched between my sweaty palms.

“So when Pink announced this tour, I knew I’d do it in New York. But our first day here was April Fools Day...and you were complaining that your bum was hurting on the bike ride...and you were a total zombie with no sleep - so it couldn’t have been there. Then it snowed...and then it rained...and we fell out because you had wet feet! We’ve had such a good holiday, haven’t we? But there wasn’t a moment that stood out. I’m sorry it’s happened in a hotel room, I wanted to do it in Central Park, but it wasn’t right...” he waffled on.

“Shut up you idiot! This is the most perfect day ever!” I screamed in his face, sliding the shimmering sparkles onto my left hand. My ears were still ringing with the sounds of Madison Square Garden and nobody was looking at me, but him. It was everything I’ve ever wanted.

We were still intertwined on the floor, holding each other tightly, laughing through choked up tears about the fact he had been carrying the ring around for five whole days, waiting impatiently - narrowly avoiding the most inappropriate proposal ever, when security at the 9/11 memorial museum asked him to turn out his pockets on arrival.

So, here you go. Here I am. Here ‘we’ are.

Four years on and you were there from the start...that first blog about our first date and our more than coincidental meeting; all those moments of serendipity that brought us together. I’ve come home from America in the best kind of daze and can’t stop looking at it...at him, and squeezing my eyes so tightly shut with gratitude that I finally got it - someone who shares my happiness, who loves me through my faults and who supports me in everything that I do. I love him so very much.

I love him and now, I’ll be his wife...Mrs Matchmaker.

youtube

“Have you ever wished for an endless night? Lassoed the moon and the stars and pulled that rope tight Have you ever held your breath and asked yourself Will it ever get better than tonight? Tonight”

12 notes

·

View notes

Text

Pokémon Moon, Episode 7: In Which My Culinary Skills Are Pushed To Their Limit

Since the next Captain, Kiawe, is a Fire Pokémon specialist, he lives on a volcano. Because of course he does. Fire trainers don’t really ‘do’ subtlety. Wela Volcano, which is named for the Hawaiian word for heat or burning, and corresponds to Haleakala in the real world, looms over the northeast corner of Akala Island. Although many of its basalt flows are still glowing red from the last eruption, the volcano is perfectly safe – or at least, this is the claim made by the Seismic Sisters, a set of Alolan triplets who maintain tunnels that provide surprisingly easy access up and down its slopes. Among the hardy, fire-tolerant Pokémon that live there is a wily black lizard Pokémon called Salandit, a Fire/Poison-type, which nearly blows my Trumbeak out of the sky with Dragon Rage. I decide to retire my Butterfree and recruit one in her place (a female, which I’m told is important); that Dragon Rage is sure to come in handy as long as we’re still low-level.