#latest technology in fintech

Explore tagged Tumblr posts

Text

The Newest Way of Taking Loans: Lowest Interest Possible

In today's fast-paced world, financial needs can arise unexpectedly, and having access to an instant personal loan has become a necessity for many. The emergence of credit line apps in India has revolutionized the way people approach borrowing, offering a convenient and efficient alternative to traditional loans. Read on to explore the concept of a line of credit loan, delve into the benefits of instant personal loan apps, and compare the advantages of a line of credit vs. personal loan. Understanding Credit Line Apps: Credit line apps in India have gained immense popularity due to their user-friendly interfaces and the speed at which they process instant personal loan applications. These apps provide a flexible borrowing option known as a line of credit loan. Unlike traditional loans, where you receive a lump sum amount, a line of credit allows borrowers to access a pre-approved credit limit and withdraw funds as needed. This not only offers financial flexibility but also ensures that you only pay interest on the amount you use. Instant Loan Apps – A Game Changer: One of the key features of credit line apps is their ability to provide instant personal loans. Whether you need funds for a medical emergency, to cover unexpected expenses, or to seize a lucrative investment opportunity, instant personal loan apps have made the borrowing process hassle-free. The approval and disbursal of funds take minutes, eliminating the lengthy approval procedures associated with conventional loans. This quick turnaround time is a significant advantage for those in need of urgent financial assistance. Benefits of a Line of Credit Loan: Flexibility: A line of credit loan provides borrowers with the flexibility to use funds as per their requirements. Unlike an instant personal loan where you receive a fixed amount, a credit line allows you to access funds up to a predetermined limit. Interest Savings: With a line of credit, you only pay interest on the amount you withdraw, not the entire credit limit. This can result in substantial interest savings compared to an instant personal loan where interest is calculated on the entire loan amount from the beginning. Revolving Credit: A line of credit is a revolving credit facility, meaning that as you repay the borrowed amount, it becomes available for you to use again. This revolving nature provides an ongoing source of funds without the need to reapply for a loan. Line of Credit vs. Personal Loan: Interest Cost: The interest cost is generally lower with a line of credit due to the pay-as-you-go structure. Personal loans, on the other hand, charge interest on the entire loan amount from the outset. Usage Flexibility: A line of credit offers greater flexibility as borrowers can use funds as needed, whereas a personal loan provides a lump sum amount. Repayment Structure: Personal loans have fixed monthly repayments, while a line of credit allows for minimum monthly payments with the option to repay the full amount at any time. Wrapping Up: Credit line apps in India have introduced a game-changing approach to borrowing, providing consumers with instant access to funds at the lowest possible interest rates. The innovative concept of a line of credit loan, coupled with the speed and convenience of instant loan apps, has reshaped the lending landscape. When considering a loan, understanding the benefits of a line of credit vs. personal loan can empower borrowers to make informed decisions and secure the financial assistance they need on their terms.

0 notes

Text

What Can Our Innovative Solutions Do for Your Growth?

In today’s fast-paced and competitive market, businesses must adopt innovative strategies to remain relevant and ensure growth. At the heart of these strategies are tailored Solutions Services that address specific business challenges while enabling organizations to achieve their goals. By integrating the right mix of technology and expertise, such solutions have the potential to transform operations, streamline processes, and unlock new opportunities for growth.

Unlocking Efficiency Through Customized Business Software

Efficient operations are the backbone of any successful business. One of the most impactful ways to enhance efficiency is through the use of Business Software designed specifically to meet the unique needs of an organization. Unlike off-the-shelf solutions, customized business software provides:

Streamlined Processes Tailored software automates repetitive tasks and integrates disparate systems, ensuring that every part of the business works in harmony. For example, inventory management, customer relationship management (CRM), and sales tracking can all be consolidated into a single platform.

Data-Driven Insights Customized business software enables organizations to collect, analyze, and leverage data more effectively. Real-time analytics provide actionable insights, empowering businesses to make informed decisions that drive growth.

Scalability As a business grows, so do its operational needs. Custom software solutions are built to scale, accommodating increased workloads and new features without compromising performance.

Transforming Financial Operations with Fintech Software

Financial operations are a critical component of any business. The emergence of Fintech Software has revolutionized how businesses handle payments, manage accounts, and access funding. Fintech software offers several advantages:

Faster Transactions With fintech solutions like Xettle, businesses can process transactions instantly, whether they are managing payroll, receiving customer payments, or handling vendor invoices. This speed not only enhances cash flow but also improves overall efficiency.

Improved Security Fintech software often incorporates advanced encryption and fraud detection mechanisms, ensuring that financial data remains secure. For businesses handling sensitive information, this level of protection is invaluable.

Access to Financing Fintech platforms often provide innovative funding options such as peer-to-peer lending, Buy Now, Pay Later (BNPL), or automated underwriting. These features make it easier for businesses to access the capital they need for growth.

Enhanced Customer Experience With the rise of digital wallets and integrated payment systems, businesses can offer their customers a seamless and modern payment experience. Features such as one-click payments and mobile banking apps help build customer loyalty and trust.

How Solutions Services Drive Growth

Solutions Services encompass a wide range of offerings tailored to address various aspects of business operations. These services are designed not only to solve immediate challenges but also to lay a foundation for long-term success. Here’s how they contribute to growth:

Problem-Solving Expertise Solutions services bring a team of experts who analyze the specific pain points of a business. By identifying the root causes of inefficiencies, these professionals develop tailored strategies that address challenges effectively.

Technology Integration From implementing cutting-edge business software to deploying the latest fintech software, solutions services ensure that organizations leverage the right tools for their needs. This integration enhances productivity and minimizes downtime.

Cost Savings By optimizing processes and reducing manual labor, solutions services help businesses save money. Automated systems not only lower operational costs but also reduce the risk of human error, leading to significant long-term savings.

Scalability and Flexibility Solutions services are designed to adapt to a business’s changing needs. Whether it’s expanding into new markets, launching a new product line, or scaling operations, these services provide the flexibility needed to support growth.

Real-World Impact of Innovative Solutions

Consider the example of a mid-sized e-commerce business struggling with manual inventory tracking and delayed payment processing. By implementing tailored business software that integrated inventory management, payment processing, and analytics, the company experienced:

A 30% reduction in operational costs through process automation.

Faster payment cycles with the adoption of fintech software, improving cash flow and enabling the business to invest in marketing.

Enhanced customer satisfaction due to fewer stockouts and seamless checkout experiences.

The Importance of Staying Ahead

In a rapidly evolving market, staying ahead requires businesses to continuously innovate. Leveraging the latest technologies and professional expertise ensures that organizations remain competitive. Partnering with a solutions services provider offers:

Access to Industry Experts Gain insights from professionals with deep knowledge of current trends and best practices.

Cutting-Edge Technology Stay updated with the latest advancements in business software and fintech software to maintain a competitive edge.

Long-Term Strategy Develop a roadmap that aligns with your business goals and ensures sustainable growth.

Conclusion

Innovative solutions are more than just tools—they are enablers of transformation and growth. Whether it’s through Solutions Services that address complex challenges or the integration of advanced business software and fintech software, these innovations empower businesses to reach new heights. By investing in the right solutions and staying agile, companies can overcome obstacles, seize opportunities, and achieve sustained success in today’s dynamic market.

Let us help you unlock your full potential with our tailored solutions. Together, we can pave the way for your business's growth and success.

1 note

·

View note

Text

Discover the future of finance at #fintechmeetup2024 ! Join us for an immersive experience where #industryexperts , thought leaders, and innovators converge to explore the latest trends and #technologies reshaping the #fintech landscape.

Don't miss out – secure your spot now!

Visit our page for more knowledge: https://www.algoworks.com/fintechmeetup/

Meet Algoworks: Venetian, Las Vegas | March 3-6, 2024 | Booth No. 912, Level 2

#fintech meetup 2024#networking#business opportunity#business growth#latest trends#technologies#future of finance#join us#meet us

1 note

·

View note

Text

#Latest Technology Trends#Emerging Technology Solutions#Virtual Reality Technology#Emerging Technology Trends#Fintech Technologies

1 note

·

View note

Text

Fintech bullies stole your kid’s lunch money

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Three companies control the market for school lunch payments. They take as much as 60 cents out of every dollar poor kids' parents put into the system to the tune of $100m/year. They're literally stealing poor kids' lunch money.

In its latest report, the Consumer Finance Protection Bureau describes this scam in eye-watering, blood-boiling detail:

https://files.consumerfinance.gov/f/documents/cfpb_costs-of-electronic-payment-in-k-12-schools-issue-spotlight_2024-07.pdf

The report samples 16.7m K-12 students in 25k schools. It finds that schools are racing to go cashless, with 87% contracting with payment processors to handle cafeteria transactions. Three processors dominate the sector: Myschoolbucks, Schoolcafé, and Linq Connect.

These aren't credit card processors (most students don't have credit cards). Instead, they let kids set up an account, like a prison commissary account, that their families load up with cash. And, as with prison commissary accounts, every time a loved one adds cash to the account, the processor takes a giant whack out of them with junk fees:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

If you're the parent of a kid who is eligible for a reduced-price lunch (that is, if you are poor), then about 60% of the money you put into your kid's account is gobbled up by these payment processors in service charges.

It's expensive to be poor, and this is no exception. If your kid doesn't qualify for the lunch subsidy, you're only paying about 8% in service charges (which is still triple the rate charged by credit card companies for payment processing).

The disparity is down to how these charges are calculated. The payment processors charge a flat fee for every top-up, and poor families can't afford to minimize these fees by making a single payment at the start of the year or semester. Instead, they pay small sums every payday, meaning they pay the fee twice per month (or even more frequently).

Not only is the sector concentrated into three companies, neither school districts nor parents have any meaningful way to shop around. For school districts, payment processing is usually bundled in with other school services, like student data management and HR data handling. For parents, there's no way to choose a different payment processor – you have to go with the one the school district has chosen.

This is all illegal. The USDA – which provides and regulates – the reduced cost lunch program, bans schools from charging fees to receive its meals. Under USDA regs, schools must allow kids to pay cash, or to top up their accounts with cash at the school, without any fees. The USDA has repeatedly (2014, 2017) published these rules.

Despite this, many schools refuse to handle cash, citing safety and security, and even when schools do accept cash or checks, they often fail to advertise this fact.

The USDA also requires schools to publish the fees charged by processors, but most of the districts in the study violate this requirement. Where schools do publish fees, we see a per-transaction charge of up to $3.25 for an ACH transfer that costs $0.26-0.50, or 4.58% for a debit/credit-card transaction that costs 1.5%. On top of this, many payment processors charge a one-time fee to enroll a student in the program and "convenience fees" to transfer funds between siblings' accounts. They also set maximum fees that make it hard to avoid paying multiple charges through the year.

These are classic junk fees. As Matt Stoller puts it: "'Convenience fees' that aren't convenient and 'service fees' without any service." Another way in which these fit the definition of junk fees: they are calculated at the end of the transaction, and not advertised up front.

Like all junk fee companies, school payment processors make it extremely hard to cancel an automatic recurring payment, and have innumerable hurdles to getting a refund, which takes an age to arrive.

Now, there are many agencies that could have compiled this report (the USDA, for one), and it could just as easily have come from an academic or a journalist. But it didn't – it came from the CFPB, and that matters, because the CFPB has the means, motive and opportunity to do something about this.

The CFPB has emerged as a powerhouse of a regulator, doing things that materially and profoundly benefit average Americans. During the lockdowns, they were the ones who took on scumbag landlords who violated the ban on evictions:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

They went after "Earned Wage Access" programs where your boss colludes with payday lenders to trap you in debt at 300% APR:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

They are forcing the banks to let you move your account (along with all your payment history, stored payees, automatic payments, etc) with one click – and they're standing up a site that will analyze your account data and tell you which bank will give you the best deal:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

They're going after "buy now, pay later" companies that flout borrower protection rules, making a rogues' gallery of repeat corporate criminals, banning fine-print gotcha clauses, and they're doing it all in the wake of a 7-2 Supreme Court decision that affirmed their power to do so:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

The CFPB can – and will – do something to protect America's poorest parents from having $100m of their kids' lunch money stolen by three giant fintech companies. But whether they'll continue to do so under a Kamala Harris administration is an open question. While Harris has repeatedly talked up the ways that Biden's CFPB, the DOJ Antitrust Division, and FTC have gone after corporate abuses, some of her largest donors are demanding that her administration fire the heads of these agencies and crush their agenda:

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Tens of millions of dollars have been donated to Harris' campaign and PACs that support her by billionaires like Reid Hoffman, who says that FTC Chair Lina Khan is "waging war on American business":

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Some of the richest Democrat donors told the Financial Times that their donations were contingent on Harris firing Khan and that they'd been assured this would happen:

https://archive.is/k7tUY

This would be a disaster – for America, and for Harris's election prospects – and one hopes that Harris and her advisors know it. Writing in his "How Things Work" newsletter today, Hamilton Nolan makes the case that labor unions should publicly declare that they support the FTC, the CFPB and the DOJ's antitrust efforts:

https://www.hamiltonnolan.com/p/unions-and-antitrust-are-peanut-butter

Don’t want huge companies and their idiot billionaire bosses to run the world? Break them up, and unionize them. It’s the best program we have.

Perhaps you've heard that antitrust is anti-worker. It's true that antitrust law has been used to attack labor organizing, but that has always been in spite of the letter of the law. Indeed, the legislative history of US antitrust law is Congress repeatedly passing law after law explaining that antitrust "aims at dollars, not men":

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

The Democrats need to be more than The Party of Not Trump. To succeed – as a party and as a force for a future for Americans – they have to be the party that defends us – workers, parents, kids and retirees alike – from corporate predation.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/26/taanstafl/#stay-hungry

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#fintech#ed-tech#finance#usury#payment processing#chokepoints#corruption#monopoly#cfpb#consumer finance protection bureau

213 notes

·

View notes

Text

Adam Clark Estes at Vox:

Some people collect coins or stamps. For a time, I collected debit cards. Not stolen ones! Each one of them had my name on them, right below the logo of the latest banking app I’d decided to try out: Venmo, Cash App, Chime, Varo, Current, Acorns. For the better part of a decade, I did all my banking through these apps, enjoying their slick user experience and lack of fees. The problem with every one of them, however, is that they’re not chartered banks. If the company behind the app went bankrupt, the Federal Deposit Insurance Corporation (FDIC) would not necessarily come to my rescue. This disaster scenario was a hypothetical worry when I eventually settled for Chase and its FDIC insurance. For millions of others, it became a reality earlier this year when a company called Synapse collapsed and froze them out of their accounts. Users of Yotta, a popular savings app with a built-in lottery, and other apps that relied on Synapse to help manage their accounts couldn’t access their money for months. Now, as hundreds of thousands of Synapse customers’ dollars remain in limbo, Sens. Elizabeth Warren (D-MA) and Chris Van Hollen (D-MD) are calling for banking reforms, and the FDIC is proposing changes to its rules.

Still, a growing number of people are embracing these financial technology, or fintech, services. More than a third of Gen Z and millennials used a fintech app or a digital bank as their primary checking account, according to a 2023 Cornerstone Advisors study. So some questions are worth asking: Is it a bad idea to use an app like Venmo as your main bank? Are digital banks like Chime trustworthy enough? The answer to both questions is yes. Venmo is not a bank, and using it as your primary checking account comes with some risks. Some fintech companies, like Chime, are just as big as traditional banks and offer some nice perks. Again, because they’re nontraditional, there are risks. “You’re not going to go back to a world where everybody works with a small bank and walks into a branch,” Shamir Karkal, co-founder of Simple, one of the first digital banks. “The future is just going to be more fintech, and I think we all just need to get better at it.”

Neobanks and money transmitters, briefly explained

The term fintech can refer to a lot of things, but when you’re talking about everyday services for everyday people, it typically refers to either neobanks or money transmitters. Chime is a neobank. Venmo is a money transmitter. They’re regulated in different ways, but because most of these companies issue debit cards, many people treat them like checking accounts. Fintech apps are not the same thing as FDIC-insured banks.

Neobanks are fintech companies that offer services like checking accounts in partnership with chartered banks, which are FDIC-insured. Neobanks sometimes enlist intermediaries known as banking-as-a-service, or BaaS, companies, which are not FDIC-insured. Still, you will often see the FDIC logo on neobank websites, just like you see it stuck to the glass doors of many brick-and-mortar banks. That logo instills trust, and thanks to their partnerships, neobanks can claim some FDIC protections. But because they do not have bank charters, these neobanks and BaaS companies are not directly FDIC-insured. Instead, neobank customers can be eligible for something called pass-through deposit insurance coverage.

[...] Money transmitters, also known as money services businesses, are even further removed from the perceived safety of the FDIC. Put bluntly, if you’re keeping all your money in a Venmo or Cash App account, you don’t qualify for FDIC insurance. Money transmitters are not neobanks or banks at all but rather completely different legal entities that are regulated by individual states as well as the Department of the Treasury. There are certain protections provided by these agencies, but FDIC insurance is not one of them. So when an app like Yotta or Chime says on its website that it’s FDIC insured, it’s not a lie, but it’s not necessarily true either. Venmo, to its credit, admits in the fine print of its homepage that its parent company PayPal “is not a bank” and “is not FDIC insured.” To confuse you even more, however, certain PayPal services that enlist a chartered bank partner, like a PayPal Mastercard or savings account, might qualify for FDIC insurance. Again, it depends.

[...] That doesn’t necessarily mean that all neobanks and fintech companies are untrustworthy. In some cases, the sheer size and track record of fintech companies can instill quite a bit of trust. Chime, the largest digital bank with roughly 22 million customers, scored a $25 billion valuation in its latest round of funding and is planning to go public next year. Venmo’s parent company, PayPal, is widely considered safe and trustworthy. And don’t expect Block, the $42 billion company that owns Cash App as well as its own chartered bank, to fail any time soon. The truth is, even if there is some false sense of security, fintech apps offer certain customers features that big banks can’t or won’t. One thing that’s made Chime and many other neobanks so popular, for instance, is that they don’t charge so many fees. That’s a huge boon to young people as well as people without bank accounts. If a fintech app is your only option, then you might not care so much about FDIC insurance.

“If you’re poor in America and you’re banking at Chase or Wells Fargo, you’re going to get overdraft fees, minimum balance fees,” Mikula explained. “So there is a real need that [fintech] companies fulfill as a result of your establishment banks essentially not wanting to bank poor people because it’s difficult to do profitably.” As many as 6 percent of Americans were living without a bank account in 2023, according to Federal Reserve data. That share grows to 23 percent for those making less than $23,000 a year. The unbanked population, which disproportionately comprises Black, Hispanic, and undocumented people, is at a greater risk of falling victim to predatory lending practices, including payday loans. Some fintech companies also offer short-term loans, though they’ve been criticized for being predatory as well.

If you have Venmo, Cash App, Zelle, or any fintech or digital banking app, be aware: don’t use them as your primary checking account.

17 notes

·

View notes

Text

The FIT21 Act: Paving the Way for a New Era in Digital Finance

Introduction: Today marks a pivotal moment for the digital finance sector as the U.S. House of Representatives considers the Financial Innovation and Technology for the 21st Century Act, commonly known as the FIT21 Act. This legislation is set to bring much-needed regulatory clarity to the digital asset ecosystem, promising to enhance consumer protections while fostering innovation.

Background: Non-compete agreements have traditionally been used by companies to prevent employees from joining competitors or starting similar businesses for a specified period. However, these agreements have often been criticized for limiting worker mobility and stifling innovation. On the other hand, the FIT21 Act aims to address the digital finance sector, which has been plagued by regulatory uncertainty. This act seeks to establish a comprehensive framework for digital asset regulation, delineating clear roles for the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Key Provisions of the FIT21 Act:

Consumer Protections: The FIT21 Act mandates comprehensive disclosures from digital asset developers and customer-serving institutions, such as exchanges and brokers. These requirements are designed to ensure that consumers have access to accurate and relevant information, enhancing transparency and accountability.

Regulatory Jurisdiction: The Act provides a clear division of regulatory authority between the CFTC and the SEC. The CFTC will oversee digital assets classified as commodities, particularly those with decentralized blockchains. The SEC will regulate digital assets deemed securities, focusing on those with less decentralized structures.

Operational Requirements: Entities required to register with either the CFTC or the SEC will need to adhere to strict operational requirements. These include safeguarding customer assets, providing detailed disclosures, and reducing conflicts of interest.

Implications for Employees and Employers:

For Employees: The FIT21 Act, by reducing the ambiguity in digital asset regulation, could create new job opportunities in the fintech sector. Enhanced consumer protections and regulatory clarity may lead to increased trust and investment in digital assets, driving job growth and innovation.

For Employers: Companies in the digital asset space will need to adapt to the new regulatory landscape. This includes complying with detailed disclosure requirements and operational standards set forth by the CFTC and SEC. While this might increase compliance costs, it also provides a more stable and predictable regulatory environment, which can be beneficial in the long run.

Future Outlook: The passage of the FIT21 Act represents a significant step forward for the U.S. digital asset market. However, potential legal challenges could arise, focusing on the extent of regulatory authority and compliance requirements. Despite these challenges, the Act aims to position the United States as a leader in the global digital finance landscape by fostering innovation and providing robust consumer protections.

Conclusion: The FIT21 Act is a landmark piece of legislation that promises to bring much-needed regulatory clarity to the digital asset ecosystem. By enhancing consumer protections and delineating clear regulatory responsibilities, the Act aims to foster innovation and secure the United States' position as a global leader in digital finance. As we await the outcome of today's vote, it's clear that the FIT21 Act could reshape the future of digital assets and employment within this burgeoning sector.

We Want to Hear from You! Share your thoughts and experiences related to today's topic in the comments below. Make sure to subscribe to our blog for the latest updates and in-depth analyses on this and other crucial financial subjects.

#FIT21Act#FinancialInnovation#DigitalAssets#BlockchainTechnology#CFTC#SEC#ConsumerProtection#DigitalFinance#RegulatoryClarity#Fintech#FinancialLegislation#InnovationInFinance#FinancialEcosystem#DigitalAssetRegulation#FintechRegulation#USFinancialMarket#FinancialServices#FintechInnovation#FinancialTechnology#CryptocurrencyRegulation#bitcoin#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#finance#blockchain#unplugged financial#globaleconomy

3 notes

·

View notes

Text

Benefits of Fintech Development Outsourcing

Fintech software development outsourcing is the key of starting your own brand b2b fintech business without having technical background.

Ezulix Software is a leading fintech software development outsourcing service provider company in India.

Here is the list of benefits For Choosing Us as Oursourcing Company:-

Get Bespoke Software Development Company

Latest Fintech Development Technology

Avail of Consulting Service

Post Development Support & Maintainance

Responsibility & Answerability

Best Certified Fintech Software Developers

Organized Fintech Development

More Focus on Fintech Business

Time-Effective Fintech Development

Great Prodict Quality

So If you are planning to start your own brand fintech business and looking for best solution then this is best for you. For more details visit our website or request a freee live demo. https://ezulix.com/

#fintech software#fintech software development#fintech software outsourcing#fintech development outsourcing#fintech software development company

3 notes

·

View notes

Text

India is an ancient nation with a youthful population. India is known for its traditions. But the younger generation is also making it a hub of technology. Be it creative reels on Insta or real time payments, coding or quantum computing, machine learning or mobile apps, FinTech or data science, the youth of India are a great example of how a society can embrace latest technology. In India, technology is not only about innovation but also about inclusion. Today, digital platforms are empowering the rights and dignity of people, while protecting privacy.

In the last nine years, over a billion people got a unique digital biometric identity connected with their bank accounts and mobile phones. This digital public infrastructure helps us reach citizens within seconds with financial assistance.

माता भूमि: पुत्रो अहं पृथिव्या:

This means -the Earth is our Mother and we are her children.

Indian culture deeply respects the environment and our planet. While becoming the fastest growing economy, we grew our solar capacity by Two Thousand Three Hundred Percent! Yes, you heard it right – Two Thousand Three Hundred Percent!

We became the only G20 country to meet its Paris commitment. We made renewables account for over forty percent of our energy sources, nine years ahead of the target of 2030. But we did not stop there. This is a way to make sustainability a true people’s movement. Not leave it to be the job of governments alone.By being mindful in making choices, every individual can make a positive impact. Making sustainability a mass movement will help the world reach the Net Zero target faster. Our vision is pro-planet progress. Our vision is pro-planet prosperity. Our vision is pro-planet people.

And this year, the whole world is celebrating the International Year of Millets, to promote sustainable agriculture and nutrition alike. We reach out to others during disasters as first responders, as we do for our own. We share our modest resources with those who need them the most. We build capabilities, not dependencies.

That I think is the most humble and propatriotic way 😅

#Growing india#narendra modi#self defense#sociology#blog#blogger#study blog#77thindependenceday#india#indian#g20summit#millet

5 notes

·

View notes

Text

Data Analytics in Finance Sector - 47Billion

You deposited a paycheck by snapping a picture on your smartphone, you checked an app to gauge your budget in minutes.

You easily got your application approved based on your credit score. Insurance companies can classify documents with ease and even verify them in clicks. Even if you don't realise fintech has become a part of your life. Ernst & Young's latest Global FinTech adoption index shows nearly 64% of world's population was using FinTech applications in 2019 . With emerging technologies FinTech can be an ambiguous concept but with its tech competencies 47Billion has been helping several startups and mid-sized companies like you to develop tech products to resolve modern day challenges. Check the video now to know how? To know more, let's connect- https://47billion.com/finance-industry/

3 notes

·

View notes

Text

Top 5 Technology Trends in the BFS Industry

The banking and financial services (BFS) industry has been a significant player in the global economy, and technological advancements have had a profound impact on it.

A number of BFS companies outsource various business processes to third-party service providers to reduce costs, improve operational efficiency, and enhance customer experience. These banking BPO services enable BFS firms to prioritize their core business activities.

With the growing need to enhance customer experiences, streamline operations, and comply with regulatory requirements, these firms are adopting new technologies to stay ahead of the curve. In this blog, we will discuss the top 5 technology trends that will change the face of the BFS industry,

Digital Channels Over Contact Approaches

The trend towards digital banking is gaining momentum, with consumers increasingly choosing digital channels such as online and mobile banking over traditional contact methods like visiting branches or contacting via phone. As digital maturity increases, this trend is expected to continue, easing customer interactions.

Experience-driven Enterprise

The banking sector has realized the role of good customer experience in boosting business. As part of their digital transformation, banks are emphasizing customer experience by developing solutions that prioritize ease, security, comfort, and engagement for their customers. Banks are working towards providing personalized offers, incorporating customer preferences, and enhancing the overall banking experience.

Open Banking API

In the current financial landscape, open banking is an essential driver of innovation and competition, forcing traditional banks to adapt to the changing environment. It provides customers with access to a wider range of services, products, and providers, and it allows for more personalized and tailored financial solutions. Banks can now exchange data with fintech and other third-party service providers using open APIs. As the lines between banking and other financial service providers blur, APIs have become a powerful tool for banks to develop new opportunities in cross-selling products and transactions.

These applications facilitate transactions on digital platforms more quickly, securely, and efficiently, increasing competitive pressures on banks to keep up with customer demands. Banks that embrace open banking and leverage APIs to provide innovative services will have a competitive advantage over those that don't.

Mobile Banking

In recent years, mobile banking has gained significant traction as customers can perform various banking activities, including checking account balances, transferring funds, and paying bills, from their smartphones due to the proliferation of smartphones and the internet. BFS firms are investing heavily in mobile banking technologies to enhance customer experience and improve customer retention.

Cloud Computing

The use of technology in the BFS industry is evolving rapidly, and one of the key trends driving this transformation is the adoption of cloud computing. BFS firms are leveraging this technology to reduce infrastructure costs, improve data security, and enhance scalability. With the growing need for real-time data processing and analytics, cloud computing is expected to play a significant role in the future of the BFS industry. In addition to the above, banks can also leverage banking BPM (Business Process Management) to streamline their operations and improve efficiency. By automating processes and workflows, banking BPM enables banks to reduce costs, improve service quality, and enhance customer experience. As the BFS industry continues to evolve, banks need to stay updated with the latest technology trends to remain competitive in the market.

3 notes

·

View notes

Text

OpenAI’s GPT-4: The Future Of AI Or Potential Threat To Jobs?

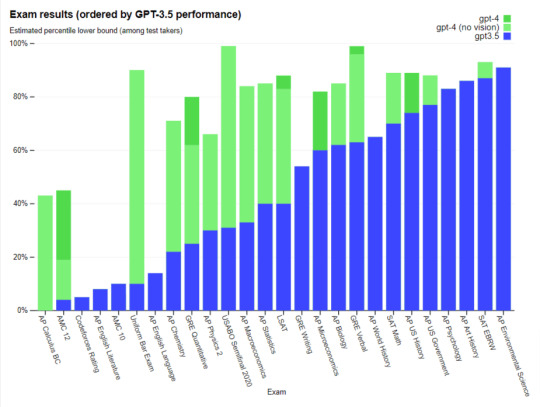

OpenAI, one of the leading companies in artificial intelligence, has recently announced the release of their latest model, GPT-4. This new model boasts impressive improvements, such as being able to process up to 25,000 words, understand images, and score high on exams designed to test knowledge and reasoning. GPT-4 is being used to power Microsoft’s Bing search engine platform, and Microsoft has invested a massive $10 billion into OpenAI. However, the model still faces significant challenges like other language models, including social biases, generating incorrect information, and exhibiting disturbing behaviors when given an “adversarial” prompt.

Key Highlights

Conor Grogan, a former director at Coinbase, claimed that he successfully embedded a live Ethereum smart contract into GPT-4 and quickly identified various “security vulnerabilities” in the code. He also explained how these vulnerabilities could be exploited.

OpenAI’s latest language model, GPT-4, offers impressive multilingual capabilities and can understand images.

GPT-4 can process up to 25,000 words and has a longer memory, but it still faces challenges like social biases and generating incorrect information.

Microsoft has invested $10 billion into OpenAI, and GPT-4 is already being used to power Bing search engine platform.

GPT-4 could potentially take over jobs currently done by humans, raising concerns about its impact on our economy.

As AI technology continues to advance, we need to ask questions about its impact on our society and ensure it is used ethically and with proper supervision.

Related: Tron and BitTorrent Team Up to Support AI Tool ChatGPT with New Payment System

Despite its limitations, GPT-4’s new capabilities could lead to new ways of exploiting it. As a generative AI, it uses algorithms and predictive text to create new content based on prompts. GPT-4 is less likely to be tricked and more stable than previous models, has a longer memory, and can remember up to 50 pages of text. Additionally, it is more multilingual and can answer thousands of multiple-choice questions in 26 languages with high accuracy. GPT-4 is a promising model that can describe images for visually impaired users through a partnership with Be My Eyes. Moreover, it can suggest an appropriate recipe if provided a photo of ingredients on a kitchen counter or explain the conclusions that can be drawn from a chart. However, there are concerns about it potentially taking over jobs currently done by humans.

It is essential to note that GPT-4 is initially only available to ChatGPT Plus subscribers who pay $20 per month for premium access. While this subscription model may seem prohibitive, it could offer an excellent opportunity for researchers and businesses to experiment with the model’s capabilities and understand its limitations.

In conclusion, GPT-4 is an impressive advancement in the field of artificial intelligence. Its multilingual capabilities, expanded token count, and longer memory offer substantial benefits. However, as with any AI model, it is not perfect and still faces significant challenges. We need to take precautions to ensure that it is used ethically and with proper supervision. As AI technology continues to advance, we must continue to ask questions about its impact on our society and our economy.

More Articles

Meta Platforms Inc. Discontinues NFT Support On Instagram And Facebook To Focus On Fintech

Square Enix Launches Symbiogenesis: A Groundbreaking NFT-Based Game With Narrative-Unlocked Entertainment

Ethereum Whale Sells 500 Moonbirds NFT, Suffers Significant Losses, And Causes Turbulence In NFT Market

Halborn Uncovers Critical Vulnerabilities In Dogecoin, Litecoin, And Other Blockchain Networks

2 notes

·

View notes

Text

10 New FinTech Solutions that Improve Payments and Security

In today's fast-paced digital world, the landscape of financial technology (FinTech) is constantly evolving to meet the growing demands of consumers and businesses alike. From mobile payments to cybersecurity, innovative solutions are reshaping the way we transact and safeguard our financial assets. In this article, we'll explore 10 new FinTech solutions that are revolutionizing payments and security, and how Xettle Technologies is leading the charge in leveraging these technologies.

Biometric Authentication: Biometric authentication technologies, such as fingerprint scanning and facial recognition, are gaining traction as a secure and convenient method of verifying user identities. By leveraging unique biometric markers, FinTech companies can enhance security and streamline the authentication process for users, reducing the risk of unauthorized access and fraud.

Xettle Technologies incorporates biometric authentication into its payment solutions, allowing users to securely authenticate transactions using their fingerprints or facial features. By adding an extra layer of security, Xettle ensures that sensitive financial data remains protected and accessible only to authorized individuals.

Tokenization: Tokenization is a process that converts sensitive payment data into a unique token, which can then be used for transactions without exposing the original data. This helps to minimize the risk of data breaches and fraud, as tokens are meaningless to attackers even if intercepted.

At Xettle Technologies, we employ tokenization technology to enhance the security of payment transactions. Our tokenization solutions ensure that sensitive payment information, such as credit card numbers and bank account details, is replaced with unique tokens that are meaningless to unauthorized parties, reducing the risk of data theft and fraud.

Real-Time Fraud Detection: Real-time fraud detection utilizes advanced algorithms and machine learning techniques to analyze transaction data in real-time and identify suspicious patterns or anomalies. By detecting fraudulent activity as it occurs, FinTech companies can mitigate risks and prevent financial losses for both consumers and businesses.

Xettle Technologies integrates real-time fraud detection capabilities into its payment processing platforms, enabling merchants to identify and respond to potential fraud instantly. By leveraging machine learning algorithms and predictive analytics, Xettle's fraud detection solutions provide actionable insights and alerts to help businesses protect against fraudulent transactions.

Secure QR Code Payments: QR code payments have gained popularity as a convenient and contactless payment method, allowing users to make transactions using their smartphones or mobile devices. However, concerns about security and privacy have led to the development of secure QR code solutions that encrypt payment data and protect against tampering or interception.

Xettle Technologies offers secure QR code payment solutions that prioritize security and privacy. Our encrypted QR codes ensure that payment information is securely transmitted and verified, reducing the risk of unauthorized access or data theft. With Xettle's secure QR code payments, businesses can offer customers a seamless and secure payment experience.

Multi-factor Authentication: Multi-factor authentication (MFA) adds an extra layer of security by requiring users to verify their identity using multiple factors, such as passwords, biometrics, or one-time passcodes. By combining different authentication methods, MFA helps to prevent unauthorized access and protect sensitive data from cyber threats.

Xettle Technologies implements multi-factor authentication mechanisms in its payment solutions to enhance security and protect user accounts from unauthorized access. By requiring users to provide multiple forms of identification, such as passwords and biometric scans, Xettle ensures that only authorized individuals can access sensitive financial data and perform transactions.

Contactless Payments: Contactless payments have become increasingly popular in recent years, allowing users to make transactions quickly and securely using NFC (Near Field Communication) technology. With the rise of mobile wallets and contactless payment cards, consumers are embracing the convenience and speed of contactless payments for everyday transactions.

Xettle Technologies offers robust contactless payment solutions that enable businesses to accept payments seamlessly and securely. Whether through NFC-enabled terminals or mobile payment apps, Xettle's contactless payment solutions provide a fast and frictionless payment experience for both merchants and customers.

Secure Remote Transactions: With the growth of e-commerce and remote work, secure remote transactions have become essential for businesses and consumers alike. Secure remote transaction solutions utilize encryption and authentication technologies to protect sensitive payment data and prevent unauthorized access or interception.

Xettle Technologies develops secure remote transaction solutions that prioritize security and reliability. Our encrypted communication protocols and authentication mechanisms ensure that payment information is transmitted securely over the internet, reducing the risk of data breaches and fraud. With Xettle's secure remote transaction solutions, businesses can confidently accept payments online and provide customers with a safe and secure shopping experience.

Blockchain-Based Payments: Blockchain technology offers a decentralized and immutable ledger that can be leveraged to facilitate secure and transparent payment transactions. By using blockchain-based payment solutions, businesses can reduce transaction costs, eliminate intermediaries, and streamline cross-border payments.

Xettle Technologies harnesses the power of blockchain technology to develop secure and efficient payment solutions for businesses. Whether for cross-border transactions, micropayments, or supply chain finance, Xettle's blockchain-based payment solutions offer increased transparency, security, and efficiency, empowering businesses to transact with confidence.

Artificial Intelligence for Fraud Prevention: Artificial intelligence (AI) and machine learning (ML) algorithms can analyze large volumes of transaction data to identify patterns and anomalies indicative of fraudulent activity. By leveraging AI for fraud prevention, FinTech companies can detect and prevent fraudulent transactions in real-time, reducing financial losses and protecting customers from fraud.

Xettle Technologies integrates AI-powered fraud prevention capabilities into its payment processing platforms, enabling businesses to detect and respond to fraudulent activity quickly and effectively. By continuously analyzing transaction data and identifying suspicious patterns, Xettle's AI-driven fraud prevention solutions help businesses stay one step ahead of fraudsters and protect their bottom line.

Secure Peer-to-Peer Payments: Peer-to-peer (P2P) payment platforms allow users to transfer funds directly to one another without the need for intermediaries. However, concerns about security and privacy have prompted the development of secure P2P payment solutions that encrypt payment data and protect against unauthorized access.

Xettle Technologies offers secure P2P payment solutions that prioritize privacy and security. Our encrypted communication protocols and authentication mechanisms ensure that P2P payments are transmitted securely between users, reducing the risk of data breaches or interception. With Xettle's secure P2P payment solutions, users can transfer funds with confidence, knowing that their financial information is protected.

In conclusion, the latest FinTech technologies are transforming the landscape of payments and security, offering innovative solutions to address the evolving needs of consumers and businesses. From biometric authentication to blockchain-based payments, these technologies are reshaping the way we transact and safeguard our financial assets. At Xettle Technologies, we are committed to leveraging these technologies to develop cutting-edge solutions that empower businesses to thrive in the digital economy and provide customers with safe, seamless, and secure payment experiences.

#latest fintech technologies#Fintech#viral trends#fintech software#marketing#development#programming#trending#technology

1 note

·

View note

Video

tumblr

Join us at FintechMeetup and discover the latest innovations in finance technology with the support of our amazing sponsors!

Let's network, learn and grow together in the world of Fintech 💰🚀

#fintech#fintech event#fintechmeetup#innovation#industry experts#sponsors#bronze sponsor#learnings#technology#finance innovation#sponsor love

2 notes

·

View notes

Text

Ikon Markets: Your Blueprint for Crypto Profit Maximization

Ikon Markets is proud to announce the launch of its latest innovation, AI-Powered Crypto Trading for Financial Mastery, a state-of-the-art platform designed to revolutionize the way investors engage with the cryptocurrency market by harnessing the power of artificial intelligence.

In the ever-evolving landscape of digital currencies, achieving financial mastery requires more than just understanding market trends—it demands the integration of advanced technology to make informed, strategic decisions. Ikon Markets recognizes this need and has developed a platform that leverages AI to provide users with unparalleled insights and automated trading capabilities, positioning them for sustained financial success.

“Our mission at Ikon Markets is to empower investors with the tools they need to master the crypto market,” said the CEO of Ikon Markets. “With our AI-Powered Crypto Trading platform, we are offering a sophisticated solution that blends data-driven analysis with automated execution, ensuring our users can achieve financial mastery with confidence.”

Relevance in the Current Market

The cryptocurrency market is known for its volatility and rapid changes, making it a challenging environment for both novice and experienced investors. Traditional trading strategies often fall short in this dynamic market, leading to missed opportunities and increased risks. Ikon Markets addresses these challenges by integrating artificial intelligence into its trading platform, providing real-time analysis and automated trading that adapts to market fluctuations.

AI technology enables Ikon Markets to analyze vast amounts of data from multiple sources, including market trends, social media sentiment, and economic indicators. This comprehensive analysis allows the platform to identify profitable trading opportunities and execute trades with precision, reducing the emotional bias that often hinders successful investing.

“The ability of AI to process and analyze data at unprecedented speeds is a game-changer for crypto traders,” explained the CEO of Ikon Markets. “Our platform not only identifies trends but also predicts market movements, giving our users a strategic advantage in their trading activities.”

Key Features of AI-Powered Crypto Trading for Financial Mastery

Ikon Markets’s AI-Powered Crypto Trading platform is equipped with a range of features designed to enhance investment performance and financial mastery:

Real-Time Market Analysis: The platform continuously monitors and analyzes market data, providing users with up-to-the-minute information on cryptocurrency trends and price movements.

Automated Trading Execution: Leveraging AI algorithms, the platform automatically executes trades based on predefined strategies, ensuring timely and efficient transactions.

Predictive Analytics: The AI system uses machine learning to forecast future market trends, helping users make informed decisions about their investments.

Risk Management Tools: Comprehensive risk assessment features allow users to set stop-loss orders and diversify their portfolios, minimizing potential losses.

Personalized Investment Strategies: The platform offers tailored investment plans based on individual financial goals, risk tolerance, and market preferences.

User-Friendly Interface: Designed for both beginners and experienced traders, the platform features an intuitive interface that simplifies complex data and trading processes.

Testimonials from Industry Experts

Industry leaders have commended Ikon Markets for its innovative approach to crypto trading. A renowned fintech analyst stated, “The AI-Powered Crypto Trading platform by Ikon Markets represents a significant advancement in the integration of AI with cryptocurrency trading. Its ability to deliver real-time insights and automated trading solutions sets a new standard in the industry.”

Commitment to Financial Mastery

At Ikon Markets, the focus is on providing investors with the tools and insights needed to achieve financial mastery in the crypto market. The AI-Powered Crypto Trading platform embodies this commitment by offering a robust and intelligent solution that enhances trading performance and drives significant returns.

“Our goal is to make financial mastery accessible to all crypto investors,” the CEO of Ikon Markets affirmed. “With our AI-powered platform, we are democratizing access to advanced trading tools, enabling more individuals to take control of their financial futures.”

Explore the Future of Crypto Trading

Discover how Ikon Markets's AI-Powered Crypto Trading platform can transform your investment strategy and lead you to financial mastery. Visit Ikon Markets today to learn more about our innovative solutions and take the first step towards achieving your financial goals.

About Ikon MarketsIkon Markets is a leading provider of AI-driven financial solutions, specializing in cryptocurrency trading and investment strategies. Committed to innovation and excellence, Ikon Markets empowers investors with the tools and insights needed to navigate the dynamic world of digital assets successfully.

0 notes

Text

Stinkpump Linkdump

Next Tuesday (December 5), I'm at Flyleaf Books in Chapel Hill, NC, with my new solarpunk novel The Lost Cause, which 350.org's Bill McKibben called "The first great YIMBY novel: perceptive, scientifically sound, and extraordinarily hopeful."b

Once again, I greet the weekend with more assorted links than I can fit into my nearly-daily newsletter, so it's time for another linkdump. This is my eleventh such assortment; here are the previous volumes:

https://pluralistic.net/tag/linkdump/

I've written a lot about Biden's excellent appointees, from his National Labor Relations Board general counsel Jennifer Abruzzo to Consumer Financial Protection Bureau chair Rohit Chopra to FTC Chair Lina Khan to DoJ antitrust boss Jonathan Kanter:

https://pluralistic.net/2023/09/14/prop-22-never-again/#norms-code-laws-markets

But I've also written a bunch about how Biden's appointment strategy is an incoherent mess, with excellent appointees picked by progressives on the Unity Task Force being cancelled out by appointees given to the party's reactionary finance wing, producing a muddle that often cancels itself out:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

It's not just that the finance wing of the Democrats chooses assholes (though they do!), it's that they choose comedic bunglers. The Dems haven't put anyone in government who's as much of an embarrassment as George Santos, but they keep trying. The latest self-inflicted Democratic Party injury is Prashant Bhardjwan, a serial liar and con-artist who is, incredibly, the Biden Administration's pick to oversee fintech for the Office of the Comptroller of the Currency (OCC):

https://www.americanbanker.com/news/did-the-occ-hire-a-con-artist-to-oversee-fintech

When the 42 year old Bhardjwan was named Deputy Comptroller and Chief Financial Technology Officer for OCC, the announcement touted his "nearly 30 years of experience serving in a variety of roles across the financial sector." Apparently Bhardjwan joined the finance sector at the age of 12. He's the Doogie Houser of Wall Street:

https://www.occ.gov/news-issuances/news-releases/2023/nr-occ-2023-31.html

That wasn't the only lie on Bhardjwan's CV. He falsely claimed to have served as CIO of Fifth Third Bank from 2006-2010. Fifth Third has never heard of him:

https://www.theinformation.com/articles/the-occ-crowned-its-first-chief-fintech-officer-his-work-history-was-a-web-of-lies

Bhardjwan told a whole slew of these easily caught lies, suggesting that OCC didn't do even a cursory background search on this guy before putting him in charge of fintech – that is, the radioactively scammy sector that gave us FTX and innumerable crypto scams, to say nothing of the ever-sleazier payday lending sector:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When it comes to appointing corrupt officials, the Biden administration has lots of company. Lots of eyebrows went up when the UN announced that the next climate Conference of the Parties (COP) would be chaired by Sultan Ahmed Al-Jaber, who is also the chair of Dubai's national oil company. Then the other shoe dropped: leaks revealed that Al-Jaber had colluded with the Saudis to use COP28 to get poor Asian and African nations hooked on oil:

https://www.bbc.com/news/science-environment-67508331

There's an obvious reason for this conspiracy: the rich world is weaning itself off of fossil fuels. Today, renewables are vastly cheaper than oil and there's no end in sight to the plummeting costs of solar, wind and geothermal. While global electrification faces powerful logistical and material challenges, these are surmountable. Electrification is a solvable problem:

https://pluralistic.net/2021/12/09/practical-visionary/#popular-engineering

And once we do solve that problem, we will forever transform our species' relationship to energy. As Deb Chachra explains in her brilliant new book How Infrastructure Works, we would only need to capture 0.4% of the solar radiation that reaches the Earth's surface to give every person on earth the energy budget of a Canadian (AKA, a "cold American"):

https://pluralistic.net/2023/10/17/care-work/#charismatic-megaprojects

If COP does its job, we will basically stop using oil, forever. This is an existential threat to the ruling cliques of petrostates from Canada to the UAE to Saudi. As Bill McKibben writes, this isn't the first time a monied rich-world industry that had corrupted its host governments faced a similar crisis:

https://billmckibben.substack.com/p/a-corrupted-cop

Big Tobacco spent decades fueling science denial, funneling money to sellout scientists who deliberately cast doubt on both sound science and the very idea that we could know anything. As Tim Harford describes in The Data Detective, Darrell Huff's 1954 classic How to Lie With Statistics was part of a tobacco-industry-funded project to undermine faith in statistics itself (the planned sequel was called How To Lie With Cancer Statistics):

https://pluralistic.net/2021/01/04/how-to-truth/#harford

But anything that can't go on forever will eventually stop. When the families of the people murdered by tobacco disinformation campaigns started winning eye-popping judgments against the tobacco industry, the companies shifted their marketing to the Global South, on the theory that they could murder poor brown people with impunity long after rich people in the north forced an end to their practice. Big Tobacco had a willing partner in Uncle Sam for this project: the US Trade Representative arm-twisted the world's poorest countries into accepting "Investor-State Dispute Settlements" as part of their treaties. These ISDS clauses allowed tobacco companies to sue governments that passed tobacco control legislation and force them to reverse their democratically enacted laws:

https://ash.org/what-is-isds-and-what-does-it-mean-for-tobacco-control/

As McKibben points out, the oil/climate-change playbook is just an update to the tobacco/cancer-denial conspiracy (indeed, the same think-tanks and PR agencies are behind both). The "Oil Development Sustainability Programme" – the Orwellian name the Saudis gave to their plan to push oil on poor countries – maps nearly perfectly onto Big Tobacco's attack on the Global South. Nearly perfectly: second-hand smoke in Indonesia won't give Americans cancer, but convincing Africa to go hard on fossil fuels will contribute to an uninhabitable planet for everyone, not just poor people.

This is an important wrinkle. Wealthy countries have repeatedly demonstrated a deep willingness to profit from death and privation in the poor world – but we're less tolerant when it's our own necks on the line.

What's more, it's far easier to put the far-off risks of emissions out of your mind than it is to ignore the present-day sleaze and hypocrisy of corporate crooks. When I quit smoking, 23 years ago, my doctor told me that if my only motivation was avoiding cancer 30 years from now, I'd find it hard to keep from yielding to temptation as withdrawal set in. Instead, my doctor counseled me to find an immediate reason to stay off the smokes. For me, that was the realization that every pack of cigarettes I bought was enriching the industry that invented the denial playbook that the climate wreckers were using to render our planet permanently unsuited for human habitation. Once I hit on that, resisting tobacco got much easier:

https://pluralistic.net/2021/06/03/i-quit/

Perhaps OPEC Secretary General Haitham Al-Ghais is worried about that the increasing consensus that Big Oil cynically and knowingly created this crisis. That would explain his new flight of absurdity, claiming that the world is being racist to oil companies, "unjustly vilifying" the industry for its role in the climate emergency:

https://www.cnbc.com/2023/11/27/opec-says-oil-industry-unjustly-vilified-ahead-of-climate-talks-.html

Words aren't deeds, but words have power. The way we talk about things makes a difference to how we act on those things. When discussions of Israel-Palestine get hung up on words, it's easy to get frustrated. The labels we apply to the rain of death and the plight of hostages are so much less important than the death and the hostages themselves.

But how we name the thing will have an enormous impact on what happens next. Take the word "genocide," which Israel hawks insist must not be applied to the bombing campaign and siege in Gaza, nor to the attacks on Palestinians in the West Bank. On this week's On The Media, Brooke Gladstone interviews Ernesto Verdeja, executive director of The Institute for the Study of Genocide:

https://www.wnycstudios.org/podcasts/otm/segments/genocide-powerful-word-so-why-its-definition-so-controversial-on-the-media

Verdeja lays out the history of the word "genocide" and connects it to the Israeli government and military's posture on Palestine and Palestinians, and concludes that the only real dispute among genocide scholars is whether the current campaign it itself an act of genocide, or a prelude to an act of genocide.

I'm not a genocide scholar, but I am a Jew who has always believed in Palestinian solidarity, and Verdeja's views do not strike me as outrageous, or (more importantly) antisemitic. The conflation of opposition to Israel's system of apartheid with opposition to Jews is a cheap trick, one that's belied by Israel itself, where there is a vast, longstanding political opposition to Israeli occupation, settlements, and military policing. Are all those Israeli Jews secret antisemites?

Jews are not united in support for Israel's oppression of Palestinians. The hardliners who insist that any criticism of Israel is antisemitic are peddling an antisemitic lie: that all Jews everywhere are loyal to Israel, and that we all take our political positions from the Knesset. Israel hawks only strengthen that lie when they accuse me and my fellow Jews of being "self-hating Jews."

This leads to the absurd circumstance in which gentiles police Jews' views on Israel. It's weird enough when white-nationalist affiliated evangelicals who support Israel in order to further the end-times prophesied in Revelations slam Jews for being antisemitic. But in Germany, it's even weirder. There, regional, non-Jewish officials charged with policing antisemitism have censured Jewish groups for adopting policies on Israel that mainstream Israeli political parties have in their platforms:

https://jewishcurrents.org/the-strange-logic-of-germanys-antisemitism-bureaucrats

Antisemitism is real. As Jesse Brown describes in his recent Canadaland editorial, there is a real and documented rise in racially motivated terror against Jews in Canada, including school shootings and a firebombing. Likewise, it's true that some people who support the Palestinian cause are antisemites:

https://www.canadaland.com/podcast/is-jesse-a-zionist-editorial/

But to stand in horror at Israel's military action and its vast civilian death-toll is not itself antisemitic. This is obvious – so obvious that the need to say it is a tribute to Israel hardliners – Jewish and gentile – and their ability to peddle the racist lie that Israel is Jews and Jews are Israel, and that every Jew is in support of, and responsible for, Israeli war-crimes and crimes against humanity.

One need not choose between opposition to Hamas and its terror and opposition to Israel and its bombings. There is no need for a hierarchy of culpability. As Naomi Klein says, we can "side with the child over the gun":

https://www.theguardian.com/commentisfree/2023/oct/11/why-are-some-of-the-left-celebrating-the-killings-of-israeli-jews

Moral consistency is not moral equivalency. If you're a Jew like me who wants to work for an end to the occupation and peace in the region, you could join Jewish Voice For Peace (like me):

https://www.jewishvoiceforpeace.org

Now, for a jarring tone shift. In these weekend linkdumps, I put a lot of thought into how to transition from one subject to the next, but honestly, there's no good transition from Israel-Palestine to anything else (yet – though someday, perhaps). So let's just say, "word games can be important, but they can also be trivial, and here are a few of the latter."

Start with a goodie, from the always brilliant medievalist Eleanor Janeaga, who tackles the weirdos who haunt social media in order to dump on people with PhDs who call themselves "doctor":

https://going-medieval.com/2023/11/29/doctor-does-actually-mean-someone-with-a-phd-sorry/

Janega points out that the "doctor" honorific was applied to scholars for centuries before it came to mean "medical doctor." But beyond that, Janega delivers a characteristically brilliant history of the (characteristically) weird and fascinating tale of medieval scholarship. Bottom line, we call physicians "doctor" because they wanted to be associated with the brilliance of scholars, and thought that being addressed as "doctor" would add to their prestige. So yeah, if you've got a PhD, you can call yourself doctor.

It's not just doctors; the professions do love their wordplay. especially lawyers. This week on Lowering The Bar, I learned about "a completely ludicrous court fight that involved nine law firms that combined for 66 pages of briefing, declarations, and exhibits, all inflicted on a federal court":

https://www.loweringthebar.net/2023/11/federal-court-ends-double-spacing-fight.html

The dispute was over the definition of "double spaced." You see, the judge in the case told counsel they could each file briefs of up to 100 pages of double-spaced type. Yes, 100 pages! But apparently, some lawyer burn to write fat trilogies, not mere novellas. Defendants accused the plaintiffs in this case of spacing their lines a mere 24 points apart, which allowed them to sneak 27 lines of type onto each page, while defendants were confined to the traditional 23 lines.

But (the court found), the defendants were wrong. Plaintiffs had used Word's "double-spacing" feature, but had not ticked the "exact double spacing" box, and that's how they ended up with 27 lines per page. The court refused to rule on what constituted "double-spacing" under the Western District of Tennessee’s local rules, but it ruled that the plaintiffs briefs could fairly be described as "double-spaced." Whew.

That's your Saturday linkdump, jarring tone-shift and all. All that remains is to close out with a cat photo (any fule kno that Saturday is Caturday). Here's Peeve, whom I caught nesting most unhygienically in our fruit bowl last night. God, cats are gross:

https://www.flickr.com/photos/doctorow/53370882459/

It's EFF's Power Up Your Donation Week: this week, donations to the Electronic Frontier Foundation are matched 1:1, meaning your money goes twice as far. I've worked with EFF for 22 years now and I have always been - and remain - a major donor, because I've seen firsthand how effective, responsible and brilliant this organization is. Please join me in helping EFF continue its work!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/02/melange/#defendants_motion_to_require_adherence_with_formatting_requirements_of_local_rule_7.1

Stinkpump Linkdump

#pluralistic#israel palestine#israel#palestine#linkdump#linkdumps#moral injury#occ#office of comptroller of the currency#Prashant Bhardjwan#finance#fintech#cop#bill mckibben#petrostates#Sultan Ahmed Al-Jaber#jesse brown#on the media#genocide#Adnoc#saudi arabia#Oil Development Sustainability Programme#odsp#language#caturday

56 notes

·

View notes