#latest loan moratorium news

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn't show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

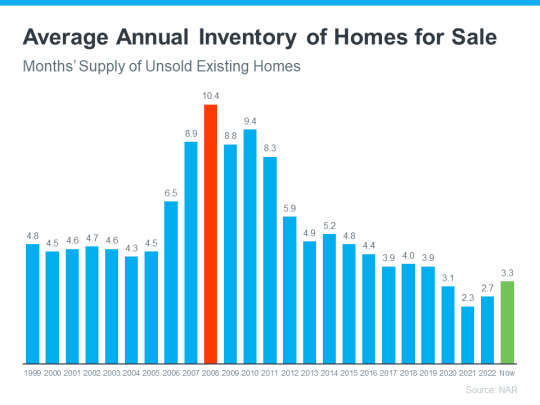

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not the case right now.

New Home Construction

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

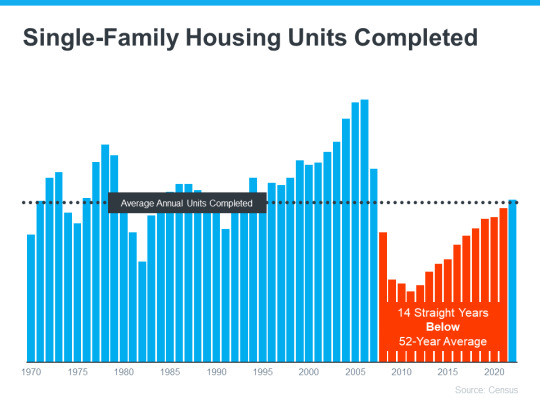

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

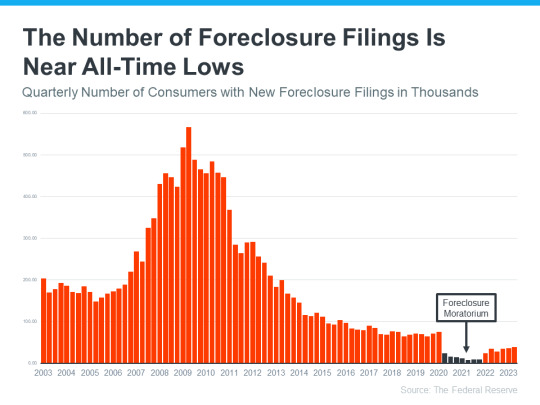

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

0 notes

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008 | KM Realty Group LLC

Even if you didn’t own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“though many americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn’t show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time — and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren’t enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not the case right now.

New Home Construction

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“what’s more, builders remember the great recession all too well, and they’ve been cautious about their pace of construction. the result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up — remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“as already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. however, the likelihood of a housing market crash — a rapid drop in unsustainably high home prices due to waning demand — remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren’t headed for a crash:

“there’s just generally not enough supply. there are more people than housing inventory. it’s econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“we will not have a repeat of the 2008–2012 housing market crash. there are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis — and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon, local real estate agents in Chicago, Illinois.

0 notes

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn't show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not the case right now.

New Home Construction

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

0 notes

Text

Foreclosure Filings on the Rise: Latest Trends in the Mortgage Industry

The foreclosure landscape has taken a worrying turn over the past year. After over a decade of declining foreclosure rates following the 2008 financial crisis, the number of homeowners falling behind on mortgage payments is now surging nationwide. Recent data from housing agencies tells a stark story of spiking foreclosure activity – a reversal of fortunes signaling new challenges for homeowners.

Recent statistics unambiguously show sharp increases in both foreclosure starts and completions

According to the Mortgage Bankers Association, the foreclosure start rate jumped to 0.63% in Q1 2022, up 57% from the prior year. Meanwhile, ATTOM Data Solutions reports that completed foreclosures saw an even larger 81% annual increase. These metrics point to a troubling rise in mortgage defaults and lender repossessions putting people out of their homes. Several key factors are driving more homeowners into foreclosure.

Rising mortgage rates, inflation and economic uncertainty contributing factors

As the Federal Reserve rapidly raised interest rates to combat inflation, mortgage rates followed suit. This sudden affordability shift has been an inflection point, especially for adjustable-rate mortgages. At the same time, the sunset of pandemic-era foreclosure moratoriums and forbearance programs has brought a surge of deferred foreclosure activity back to the market. Together, higher payments and ended protections have been a catalyst for the uptick in filings. More broadly, high inflation, volatile markets, and recession fears have also added financial uncertainty, leading to greater mortgage stress.

Subprime borrowers being hit hardest, but prime borrowers also impacted

These higher-risk homeowners with poor credit tend to have higher interest rates and minimal savings. However, rising foreclosures are not isolated to just subprime borrowers. Prime borrowers with previously solid credit are also showing new cracks, demonstrating the widespread nature of the mortgage distress.

Regional foreclosure hotspots emerging, concentrated in certain states

States like Delaware, New Jersey, Illinois, and Florida are seeing foreclosure rates significantly above the national average. In these areas, declining home prices paired with local economic headwinds have propelled defaults. Other states like California, Nevada, Ohio, and South Carolina also rank high for foreclosure risk factors.

New foreclosure prevention policies proposed, but impact uncertain

Loan administration services firms advocate expanding loss mitigation aid like principal reduction and enhanced forbearance. Mortgage default services companies are also innovating through data analytics to identify at-risk borrowers earlier. However, more sweeping interventions may be needed given the scale of the issue.

Lenders tightening credit standards in response to market conditions

Jumbo loans, cash-out refinances, and other previously routine programs are being discontinued or restricted by banks to reduce risk. This pullback in available credit will further challenge borrowers seeking favourable rates and terms.

Homeowners encouraged to seek assistance and explore alternatives

For distressed borrowers, the message is clear: act immediately if you anticipate difficulty making payments. Contact your lender to discuss options like loan modifications or forbearance that can provide temporary relief. Avoiding foreclosure before it starts is critical and can be aided by loss mitigation services. Seeking help from non-profit housing counsellors can also add guidance on navigating the landscape.

Conclusion

Open communication and early intervention are essential – foreclosure should only be considered an absolute last resort given its damaging credit impacts and emotional toll. Although the road ahead appears rocky, resources are available to help navigate if homeowners move proactively. The full effect of the latest foreclosure wave remains uncertain – but collective action is needed now to curb the swell before it becomes a crisis.

To know more: https://privocorp.com/blog/foreclosure-filings-on-the-rise-latest-trends-in-the-mortgage-industry/

0 notes

Text

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008.

One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn't show that happening.

Housing supply comes from three main sources:

Homeowners deciding to sell their houses

Newly built homes

Distressed properties (foreclosures or short sales)

Here’s a closer look at today's housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not happening right now.

Newly Built Homes

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

0 notes

Text

Driving Transformation: The Role of Credit Bureaus and Technological Innovation in India's Lending Space

Credit bureaus in India, including CIBIL, Equifax, Experian, and CRIF Highmark, are playing a crucial role in driving changes in the lending space and financial services sector. These agencies provide detailed credit reports and scores for individuals, and they are undergoing a significant digital transformation. To predict customer behavior and lending patterns, credit bureaus are investing in advanced technologies and practices, such as AI/ML, data analytics, and blockchain, to make faster credit decisions and add value to their clients.

Pinkesh P Ambavat, the CIO and IT Director of CRIF India, shared insights into the credit bureau market in India and the role of technological innovation. CRIF Highmark, headquartered in Mumbai, claims to be India's first full-service credit bureau, offering comprehensive credit information for all borrower segments, including retail consumers, MSMEs, commercial borrowers, and microfinance borrowers.

The credit industry in India has witnessed rapid evolution over the past decade, with a shift in consumer mindset from a savings-focused and debt-averse country to a more consumption-focused, leveraged economy. Unsecured lending has experienced growth, especially with smaller ticket sizes. The volume of consumer inquiries for personal loans and credit cards has significantly increased, while inquiries for loans against property and home loans have remained unchanged or slightly decreased. Digital transformation has disrupted lending, making it possible to approve loans within minutes through a few touches and clicks on a smartphone. Lenders are constantly innovating with the latest technologies to enhance customer experience and convenience. Those who fail to adopt digital acquisition may face challenges in the future.

The Covid-19 pandemic has had a major impact on financial institutions, and individual borrowers and lenders are expected to adapt to the new normal. To ease the financial burden on borrowers, the Reserve Bank of India (RBI) announced debt servicing relief using a moratorium policy. Credit bureaus had to make changes to their scoring models to comply with RBI regulations and ensure that individuals' creditworthiness was not affected by the ongoing pandemic. Despite the challenges posed by the pandemic, there has been a gradual increase in the number of inquiries made by customers, indicating significant growth potential for credit bureaus.

Credit bureaus in India face several challenges, particularly in the online lending segment. They need access to alternative data sources to assess the creditworthiness of borrowers who may not have a formal credit history. Fintech companies are using AI to create alternate lending data scores for the significant portion of the Indian population that lacks credit scores. Analytics play a crucial role in gaining market insights and building products tailored to customer needs. Blockchain technology can be used to update customer data in credit bureaus in real-time, ensuring accurate and up-to-date information. Cybersecurity is another challenge that credit bureaus face, and they prioritize the use of the latest security tools and industry practices to protect customer data.

As the CIO of CRIF India, Pinkesh P Ambavat is responsible for driving digital transformation through emerging enterprise technologies and strategic initiatives. He assists CRIF in providing innovative product solutions related to open banking, anti-fraud measures, and digital banking business lines. Ambavat leads various initiatives to deliver high-performance solutions by capitalizing on cutting-edge technologies. He also oversees overall operations, infrastructure, security, and applications, with cross-cultural engagements across India and Asia.

One significant moment in Ambavat's career was the implementation of machine learning in the customer matching algorithm at CRIF. With the increasing volume and variety of data, traditional analytics methods were unable to keep up with the demand. Machine learning models provided deep insights and understanding needed to improve credit decision models and assess risks accurately. Machine learning algorithms integrate real-time data trends and human decision-making, offering advantages over human judgment or traditional statistical models. Ambavat emphasizes the importance of squeezing every ounce of information from different sources and using improved algorithms. The objective is to enhance the efficiency of the credit scoring model and further improve the digital strategy.

CRIF is working on creating partnerships for alternative sources of data to identify new parameters for credit scoring and enhance scoring mechanisms. Alternative data plays a vital role in improving credit scores. Robotic Process Automation (RPA) is being implemented in various business processes to automate and standardize repeat tasks. RPA programs increase flexibility, scalability, and operational efficiency while reducing the risk of errors. CRIF has automated repetitive requests in the product support teams, allowing them to focus on innovative and challenging tasks. Custom data analysis reports are also being developed to provide analytical solutions to new clients, addressing their specific business problems.

Credit bureaus in India are witnessing significant growth and undergoing digital transformation. They are leveraging technologies like AI/ML, data analytics, and blockchain to improve customer experience, make faster credit decisions, and add value to their clients. Challenges such as sourcing credit score data, cybersecurity, and adapting to the post-pandemic landscape are being addressed through innovative solutions and advanced technologies.

Read the full article

0 notes

Text

Student loan refinancing: how to know if it's right for you

#studentloan #studentloans #studentloandebt #money #studentloanssuck #debt #debtfree

If your student loan payments seem to get the better of your bank account each month, it may be time to consider a new repayment strategy.

According to the latest data from the Federal Reserve, 12% of borrowers were behind on their student loan payments in 2021. The student loan moratorium brought some much-needed relief to federal borrowers, but private borrowers were left out of the mix. And…

View On WordPress

0 notes

Text

San deigo tide graph

The increased savings, combined with lower borrowing costs, made it possible for many buyers to participate in the San Diego housing market. While rates are historically low, the net worth of most Americans increased thanks to foreclosure moratoriums, government stimuli, and a lack of spending when businesses were shut down. Despite being up slightly year to date, rates still represent an excellent opportunity for buyers. As recently as January, the average commitment rate on a 30-year fixed-rate loan was 3.45%. Borrowing costs are so low that they are the primary catalyst for demand. Interest rates, in particular, have changed the way buyers look at today’s market. On the one hand, demand has increased dramatically in the wake of the pandemic. The disconnect is directly correlated to the impact of the Coronavirus on the real estate market. At the very least, more people are ready and willing to buy a house in the San Diego housing market, but there aren’t nearly enough listings to satiate demand. Over the course of years, San Diego housing market trends have revolved around one fundamental economic concept: supply and demand. Median Household Income: $78,980 (latest estimate by the U.S.Population: 3,338,330 (latest estimate by the U.S.Unemployment Rate: 4.2% (latest estimate by the Bureau Of Labor Statistics).Median Days On Market: 12 (-2.5 year over year).Active Listings: 1,992 (-42.5% year over year).Weeks Of Supply: 3.9 (-1.8 year over year).Median Home Value (1-Year Forecast): 16.4%.San Diego Real Estate Market 2022 Overview Landlords, in particular, may have the best chance to capitalize on the new landscape created by San Diego real estate market trends. Prospective homeowners and long-term investors may find the latest disruption in the San Diego housing market to be an opportunity instead of an obstacle. Prices have been increasing steadily over the last year, and there’s nothing to suggest the trend won’t continue. While demand persists, however, it appears an equal number of sellers don’t yet have the confidence to place their homes on the market. Pending sales are actually on the rise, despite historic valuations onset by competition. Local home prices are nearly three times that of the national average, and the pent-up demand created by the current pandemic has stimulated a healthy amount of activity. The San Diego real estate market remains at the forefront of the California housing sector. Should You Invest In San Diego Real Estate?.

0 notes

Video

youtube

EMI Moratorium 3.0 extension | latest loan moratorium news | RBI Morato...

0 notes

Text

The White House will again raise student loan breaks

In all likelihood, the White House is ready to extend the moratorium on federal student loans again. The announcement will be made today, according to people familiar with the matter, including a senior official. Current break on payment is valid till 1st May. The new August 31 extension is likely to affect more than 40 million students. However, at the request of many Democrats, this extension…

View On WordPress

#Extend#Federal student loans moratorium extension#House#latest news#Loan#Pause#Student#The White House will again raise student loan breaks#White

0 notes

Text

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008.

One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn't show that happening.

Housing supply comes from three main sources:

Homeowners deciding to sell their houses

Newly built homes

Distressed properties (foreclosures or short sales)

Here’s a closer look at today's housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not happening right now.

Newly Built Homes

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

0 notes

Text

Latest News Today - RBI Re-Opens One-Time Loan Restructuring For

Latest News Today – RBI Re-Opens One-Time Loan Restructuring For

The Reserve Bank of India re-opened its one-time loan restructuring plan for individuals and small businesses affected by the state-wise lockdowns amid the second wave of coronavirus pandemic that has hit India badly. Individuals, small business and micro, small and medium enterprises (MSMEs) having exposure of up to Rs 25 crore, who did not avail restructuring earlier and where loans were…

View On WordPress

#EBI Loan Resolution under COVID#Latest#Loan#Loan restructuring scheme#news#OneTime#RBI#RBI Covid loan restructuring scheme#RBI Loan Moratorium#RBI Loan moratorium scheme#RBI Loan resolution COVID Scheme#RBI new loan moratorium scheme#ReOpens#Today

0 notes

Text

No compound, penal interest be charged from borrowers during loan moratorium period: Supreme Court

No compound, penal interest be charged from borrowers during loan moratorium period: Supreme Court

Image Source : PTI (FILE)

Cannot extend loan moratorium period: Supreme Court

The Supreme Court has declined to interfere with decision of the Centre and the Reserve Bank of India to not extend loan moratorium period beyond August 31, 2020. The top court said that it is a policy decision.

An apex court bench of Justices Ashok Bhushan, R Subhash Reddy and MR Shah also said that no compound,…

View On WordPress

#loan moratorium#loan moratorium case#loan moratorium latest news#loan moratorium news today#loan moratorium Supreme court

0 notes

Text

Loan Moratorium: Supreme Court का फैसला- पूरी तरह ब्याज माफी नहीं मिलेगी, कंपाउंड ब्याज भी होगा रिफंड

Loan Moratorium: Supreme Court का फैसला- पूरी तरह ब्याज माफी नहीं मिलेगी, कंपाउंड ब्याज भी होगा रिफंड

नई दिल्ली: Loan Moratorium Case में आज सुप्रीम कोर्ट ने बड़ा फैसला दिया है. सुप्रीम कोर्ट के इस फैसले उन लोगों को झटका लगा है जो लोन मोराटोरियम पर पूरी तरह ब्याज माफी की मांग कर रहे थे. सुप्रीम कोर्ट ने ब्याज में पूरी तरह छूट देने से इनका कर दिया है. सुप्रीम कोर्ट ने कहा कि सिर्फ कुछ लोगों की असंतुष्टि के लिए कोर्ट पॉलिसी में दखल नहीं दे सकता.

‘लोन मोराटोरियम के ब्याज पर पूरी छूट नहीं’

फैसला…

View On WordPress

#Loan moratorium case#loan moratorium judgement#loan moratorium latest news today#loan moratorium live#loan moratorium news updates#loan moratorium supreme court decision#loan moratorium verdict#sc hearing on loan moratorium#sc loan moratorium#sc on loan moratorium live updates

0 notes

Photo

Loan moratorium: RBI urges SC to lift interim order banning declaration of NPAs Image Source : FILE PHOTO PTI Loan moratorium: RBI urges SC to lift interim order banning declaration of NPAs…

#ashok bhushan#banning declaration of NPA#interest on interest#interest on loan waiver case#loan moratorium#loan moratorium news moratorium news loan moratorium extension moratorium extension loan moratorium latest news loan moratorium supreme cour#loan repayment#RBI#RBI Bank#sbi#supreme court lift interim order#supreme court live updates

0 notes

Photo

Loan moratorium: RBI urges SC to lift interim order banning declaration of NPAs Image Source : FILE PHOTO PTI Loan moratorium: RBI urges SC to lift interim order banning declaration of NPAs…

#ashok bhushan#banning declaration of NPA#interest on interest#interest on loan waiver case#Loan Moratorium#loan moratorium news moratorium news loan moratorium extension moratorium extension loan moratorium latest news loan moratorium supreme cour#loan repayment#RBI#RBI Bank#SBI#supreme court lift interim order#supreme court live updates

0 notes