#loan moratorium latest news today

Explore tagged Tumblr posts

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn't show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

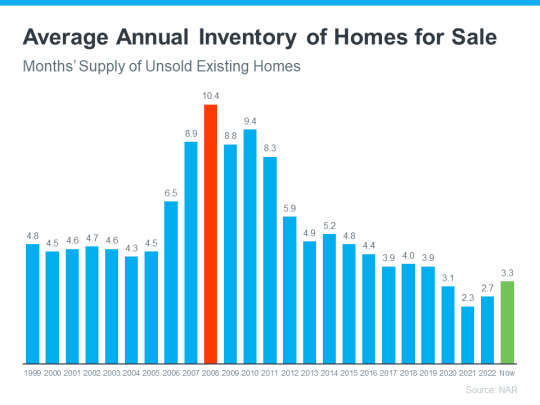

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not the case right now.

New Home Construction

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

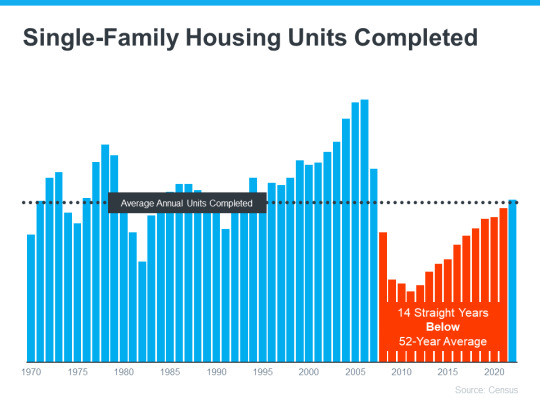

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

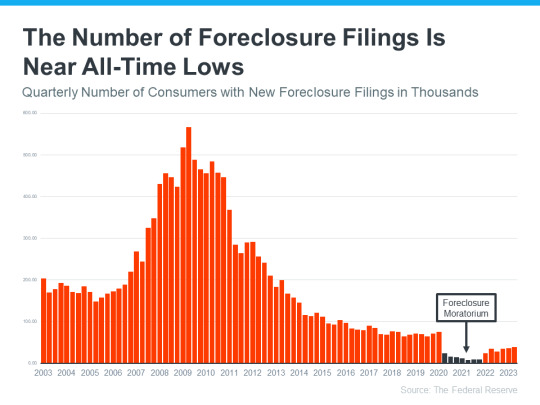

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

0 notes

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008 | KM Realty Group LLC

Even if you didn’t own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“though many americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn’t show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time — and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren’t enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not the case right now.

New Home Construction

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“what’s more, builders remember the great recession all too well, and they’ve been cautious about their pace of construction. the result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up — remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“as already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. however, the likelihood of a housing market crash — a rapid drop in unsustainably high home prices due to waning demand — remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren’t headed for a crash:

“there’s just generally not enough supply. there are more people than housing inventory. it’s econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“we will not have a repeat of the 2008–2012 housing market crash. there are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis — and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon, local real estate agents in Chicago, Illinois.

0 notes

Text

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn't show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

Homeowners deciding to sell their houses (existing homes)

New home construction (newly built homes)

Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not the case right now.

New Home Construction

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

0 notes

Text

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008.

One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn't show that happening.

Housing supply comes from three main sources:

Homeowners deciding to sell their houses

Newly built homes

Distressed properties (foreclosures or short sales)

Here’s a closer look at today's housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not happening right now.

Newly Built Homes

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

0 notes

Text

Loan Moratorium: Supreme Court का फैसला- पूरी तरह ब्याज माफी नहीं मिलेगी, कंपाउंड ब्याज भी होगा रिफंड

Loan Moratorium: Supreme Court का फैसला- पूरी तरह ब्याज माफी नहीं मिलेगी, कंपाउंड ब्याज भी होगा रिफंड

नई दिल्ली: Loan Moratorium Case में आज सुप्रीम कोर्ट ने बड़ा फैसला दिया है. सुप्रीम कोर्ट के इस फैसले उन लोगों को झटका लगा है जो लोन मोराटोरियम पर पूरी तरह ब्याज माफी की मांग कर रहे थे. सुप्रीम कोर्ट ने ब्याज में पूरी तरह छूट देने से इनका कर दिया है. सुप्रीम कोर्ट ने कहा कि सिर्फ कुछ लोगों की असंतुष्टि के लिए कोर्ट पॉलिसी में दखल नहीं दे सकता. ‘लोन मोराटोरियम के ब्याज पर पूरी छूट नहीं’ फैसला…

View On WordPress

#Loan moratorium case#loan moratorium judgement#loan moratorium latest news today#loan moratorium live#loan moratorium news updates#loan moratorium supreme court decision#loan moratorium verdict#sc hearing on loan moratorium#sc loan moratorium#sc on loan moratorium live updates

0 notes

Text

Latest News Today - RBI Re-Opens One-Time Loan Restructuring For

Latest News Today – RBI Re-Opens One-Time Loan Restructuring For

The Reserve Bank of India re-opened its one-time loan restructuring plan for individuals and small businesses affected by the state-wise lockdowns amid the second wave of coronavirus pandemic that has hit India badly. Individuals, small business and micro, small and medium enterprises (MSMEs) having exposure of up to Rs 25 crore, who did not avail restructuring earlier and where loans were…

View On WordPress

#EBI Loan Resolution under COVID#Latest#Loan#Loan restructuring scheme#news#OneTime#RBI#RBI Covid loan restructuring scheme#RBI Loan Moratorium#RBI Loan moratorium scheme#RBI Loan resolution COVID Scheme#RBI new loan moratorium scheme#ReOpens#Today

0 notes

Text

No compound, penal interest be charged from borrowers during loan moratorium period: Supreme Court

No compound, penal interest be charged from borrowers during loan moratorium period: Supreme Court

Image Source : PTI (FILE) Cannot extend loan moratorium period: Supreme Court The Supreme Court has declined to interfere with decision of the Centre and the Reserve Bank of India to not extend loan moratorium period beyond August 31, 2020. The top court said that it is a policy decision. An apex court bench of Justices Ashok Bhushan, R Subhash Reddy and MR Shah also said that no compound,…

View On WordPress

#loan moratorium#loan moratorium case#loan moratorium latest news#loan moratorium news today#loan moratorium Supreme court

0 notes

Text

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008.

One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn't show that happening.

Housing supply comes from three main sources:

Homeowners deciding to sell their houses

Newly built homes

Distressed properties (foreclosures or short sales)

Here’s a closer look at today's housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not happening right now.

Newly Built Homes

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

0 notes

Text

दो साल तक बढ़ सकता है लोन पर मोरेटोरियम, सरकार ने सुप्रीम कोर्ट में दिया हलफनामा

दो साल तक बढ़ सकता है लोन पर मोरेटोरियम, सरकार ने सुप्रीम कोर्ट में दिया हलफनामा

न्यूज डेस्क, अमर उजाला, नई दिल्ली Updated Tue, 01 Sep 2020 12:02 PM IST

पढ़ें अमर उजाला ई-पेपर कहीं भी, कभी भी।

*Yearly subscription for just ₹249 + Free Coupon worth ₹200

ख़बर सुनें

ख़बर सुनें

सुप्रीम कोर्ट ने कोविड-19 के कारण मोरेटोरियम अवधि के दौरान ब्याज पर छूट देने की दिशा में निर्देश देने वाली याचिका पर सुनवाई की। केंद्र की ओर से पेश सॉलिसिटर जनरल तुषार मेहता ने कोर्ट में…

View On WordPress

#emi moratorium extension#emi moratorium extension news#emi moratorium latest news#emi moratorium news today#India News in Hindi#Latest India News Updates#loan moratorium#loan moratorium extension#loan moratorium latest news#loan restructuring#Moratorium#moratorium extension#moratorium extension latest news#moratorium extension news#moratorium extension till december 2020#moratorium latest news#moratorium news#moratorium news today#rbi moratorium#supreme court#supreme court news

0 notes

Text

Finance Ministry and Rbi in talks to extend loan Moratorium period but banks are not in favor of extension - government and Rbi may increase loan waiver period, bank protests

Finance Ministry and Rbi in talks to extend loan Moratorium period but banks are not in favor of extension – government and Rbi may increase loan waiver period, bank protests

[ad_1]

Business Desk, Amar Ujala, New Delhi Updated Sat, 01 Aug 2020 11:54 AM IST

Finance Minister Nirmala Sitharaman – Photo: ANI

Read Amar Ujala e-paper anywhere anytime.

* Yearly subscription for just ₹ 249 + Free Coupon worth ₹ 200

Hear the news

Hear the news

Finance Minister Nirmala Sitharaman said that the ministry is in talks with the Reserve Bank of India (RBI) to…

View On WordPress

#Banking Beema Hindi News#Banking Beema News in Hindi#Business News in Hindi#emergency credit facility#emergency credit line guarantee scheme#emergency loan msme#ficci#loan moratorium extension axis bank#loan moratorium extension hdfc#loan moratorium extension icici bank#loan moratorium extension in hindi#loan moratorium extension in india#loan moratorium extension latest news#loan moratorium extension news#loan moratorium extension rbi#loan moratorium extension sbi#loan moratorium extension till december#loan moratorium news in hindi#loan moratorium news today#msme#Nirmala Sitharaman

0 notes

Text

सरकार व RBI बढ़ा सकते हैं लोन चुकाने में छूट की अवधि, बैंक कर रहे विरोध

सरकार व RBI बढ़ा सकते हैं लोन चुकाने में छूट की अवधि, बैंक कर रहे विरोध

[ad_1]

बिजनेस डेस्क, अमर उजाला, नई दिल्ली Updated Sat, 01 Aug 2020 11:54 AM IST

वित्त मंत्री निर्मला सीतारमण – फोटो : ANI

पढ़ें अमर उजाला ई-पेपर कहीं भी, कभी भी।

*Yearly subscription for just ₹249 + Free Coupon worth ₹200

ख़बर सुनें

ख़बर सुनें

वित्त मंत्री निर्मला सीतारमण ने कहा कि मंत्रालय भारतीय रिजर्व बैंक (आरबीआई) के साथ लोन मोरेटोरियम को बढ़ाने के लिए बातचीत कर रहा है।…

View On WordPress

#Banking Beema Hindi News#Banking Beema News in Hindi#Business news in hindi#emergency credit facility#emergency credit line guarantee scheme#emergency loan msme#ficci#loan moratorium extension axis bank#loan moratorium extension hdfc#loan moratorium extension icici bank#loan moratorium extension in hindi#loan moratorium extension in india#loan moratorium extension latest news#loan moratorium extension news#loan moratorium extension rbi#loan moratorium extension sbi#loan moratorium extension till december#loan moratorium news in hindi#loan moratorium news today#msme#Nirmala Sitharaman#आपातकालीन ऋण सुविधा#एमएसएमई#निर्मला सीतारमण

0 notes

Text

RBI का रेपो रेट में 0.4 फीसदी की कटौती का ऐलान, सस्ते होंगे कर्ज

RBI का रेपो रेट में 0.4 फीसदी की कटौती का ऐलान, सस्ते होंगे कर्ज

[ad_1]

Photo:INDIA TV

RBI cut repo rate

नई दिल्ली। कोरोना संकट को देखते हुए रिजर्व बैंक ने रेपो रेट में 0.4 फीसदी की कटौती का ऐलान किया है। इस कदम के बाद कर्ज सस्ते होने का रास्ता साफ हो गया है। कटौती के बाद रेपो रेट 4.4 फीसदी से घटकर 4 फीसदी हो जाएगी। रिजर्व बैंक ने इसके साथ ही संकेत दिए हैं कि वो आगे भी जरूरत के हिसाब से राहत के लिए कदम उठाते रहेंगे। रिवर्स रेपो रेट iघटकर 3.35 फीसदी हुई।

मह…

View On WordPress

#car loan#EMIs#home loan#interest rates#loan moratorium#rate cut#RBI Governor Shaktikanta Das press conference#Repo Rate#shaktikanta das#Shaktikanta Das on covid 19#Shaktikanta Das press conference 22 may#Shaktikanta Das press conference latest news#Shaktikanta Das press conference today#Shaktikanta Das press conference updates#Shaktikanta Das RBI#Shaktikanta Das speech on coronavirus#TLTRO

0 notes

Text

Latest News Today - Relief For Centre As Supreme Court Refuses To Intervene

Latest News Today – Relief For Centre As Supreme Court Refuses To Intervene

The Supreme Court on Tuesday refused to intervene in the loan relief policy on the grounds that it does not have expertise on issues of financial and economic health. The Supreme Court bench of Justices Ashok Bhushan, R Subhash Reddy and MR Shah was hearing a batch of petitions on whether to waive interest payments on coronavirus support loans in a move that could give relief to millions of…

View On WordPress

#Centre#Court#Intervene#Latest#loan moratorium#loan relief#news#Refuses#Relief#Supreme#Supreme Court#Today

0 notes

Text

HEATHER COX RICHARDSON

April 11, 2022 (Monday)

Last week, we lost a crucially important voice in the media when media reporter Eric Boehlert died unexpectedly. In his last column for his publication Press Run, titled “Why is the press rooting against Biden?,” Boehlert wrote that there is such a “glaring disconnect between reality and how the press depicts White House accomplishments” that it seems the press is “determined to keep Biden pinned down.”

Boehlert pointed to the extraordinary poll showing that only 28% of Americans know the country has been gaining jobs in the last year—7 million jobs, in fact—while 37% think the country has lost jobs. Under Biden, the U.S. has added more than 400,000 jobs a month for 11 months, the longest period of job growth since at least 1939. And yet, Boehlert pointed out, on the day the latest job report was released, cable news used the word “inflation” as many times as “jobs.” On Sunday, NBC’s “Meet the Press” ignored the economy and instead featured conversations about two problems for the Democrats in the midterms: immigration and Trump.

It is no secret that we are in a battle between democracy and authoritarianism in America and around the world. It seems to me that the Biden administration is seeking to weaken the ties of misguided voters to authoritarianism by proving that a democratic government can answer the needs of ordinary Americans. The administration appears to be taking the position that focusing on the latest outrage from the right wing locks the country into their view of the world: you are either for Trump or against him. Instead, the administration seems to be trying to demonstrate its own worldview, but with the press glued to Trump and the Republicans, the administration is having a hard time getting traction.

The White House has taken on the idea that the Democrats are unpopular in rural areas. On March 31, the Department of the Interior announced a $420 million investment in clean water in Iowa, Minnesota, Montana, New Mexico, North Dakota and South Dakota. Today, the president announced a $440 million commitment to an “America the Beautiful Challenge” to attract up to $1 billion in private and philanthropic donations to conserve land, water, and wildlife across the country.

It also released today a 17-page bipartisan “playbook” to help rural communities identify more than 100 programs designed to fund rural infrastructure. It explains how to apply for funds to expand rural broadband, clean up pollution, improve transportation, fix rural bridges and roads, ensure clean water and sanitation, prepare for disasters including climate change, upgrade the electrical grid, and so on. These are critical needs that local communities, which cannot afford lobbyists, might need help navigating.

The administration is also sending officials into rural communities to make sure that billions of federal dollars and the resources they command reach across the country. Agriculture Secretary Tom Vilsack, Commerce Secretary Gina Raimondo, Energy Secretary Jennifer Granholm, EPA Administrator Michael Regan, Interior Secretary Deb Haaland, Transportation Secretary Pete Buttigieg, and Infrastructure Coordinator Mitch Landrieu will all be on the road.

Also today, the administration took steps to address medical billing practices and medical debt. It will collect information on how more than 2000 providers handle patients, and will weigh that information into grant-making decisions as well as sharing potential violations with law enforcement. The newly rebuilt Consumer Financial Protection Bureau, gutted by the former president, will investigate and hold accountable debt collectors that violate patients’ rights. The administration is also eliminating medical debt as a factor for underwriting in federal loan programs.

Last week, Biden extended the moratorium on most federal student loan programs through the end of August—sooner than most Democrats wanted—and expunged the defaults of roughly 8 million federal student loan borrowers, permitting them to resume payments in good standing.

Finally, today, Biden nominated Steve Dettelbach, a former U.S. Attorney for the Northern District of Ohio, to direct the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF). The bureau has not had a Senate-confirmed director since 2015 because gun-rights groups oppose those nominated to the position. The Senate has confirmed only one director in the past 16 years. Dettelbach is Biden’s second nominee; the Senate scuttled the first, a former ATF agent who called for gun regulations.

The administration today announced a Justice Department rule that manufacturers of gun kits, which enable people to build weapons at home, will be considered gun manufacturers and must be licensed, the gun parts must have serial numbers, and buyers must have background checks. So-called ghost guns, assembled at home and unmarked and untraceable, are increasingly widespread. From 2016 to 2020, law enforcement recovered nearly 24,000 ghost guns at crime scenes.

Polls widely show that more than 80% of Americans support background checks for gun buyers. Nonetheless, Gun Owners of America vowed to fight the rule.

Biden’s worldview in which the government works for ordinary people contrasts with what we are learning about the worldview of the former administration under Trump, where a lack of oversight meant that money went to grifters and well-connected people.

There have been plenty of stories about the misuse of funds under the Trump administration, including the story on March 28 by Ken Dilanian and Laura Strickler of NBC that prosecutors are calling the distribution of funds under the Paycheck Protection Program (PPP), designed to keep businesses afloat during the pandemic, “the largest fraud in U.S. history.” As much as 10% of the relief money—$80 billion—was stolen in 2020, as money went out the door without verification checks (the Biden administration has since imposed verification rules). Swindlers also stole $90 billion to $400 billion from the Covid unemployment relief program, and another $80 billion from a different Covid relief program.

We have also learned that the State Department can’t account for the foreign gifts Trump, former Vice President Mike Pence, and other administration officials received in office because the officials did not submit an accounting, as is required by law.

But those stories pale in comparison to the news broken last night by David D. Kirkpatrick and Kate Kelly of the New York Times: six months after Trump left office, an investment fund controlled by the crown prince of Saudi Arabia, Mohammed bin Salman (MBS), invested $2 billion with Trump’s senior advisor and son-in-law Jared Kushner, despite the fact that the fund advisors found Kushner’s new company “unsatisfactory in all aspects.”

At the same time, they also invested about $1 billion in another new firm run by Trump’s former treasury secretary, Steven Mnuchin.

Kushner has little experience in private equity, and his firm consists primarily of that Saudi money; no American institutions have invested with him. The Saudi investment will net Kushner’s firm about $25 million a year in asset management fees, and the investors required him to hire qualified investment professionals to manage the money.

It certainly looks as if Kushner is being rewarded for his work on behalf of the kingdom, and perhaps in anticipation of influence in the future. Kushner defended MBS after news broke that the crown prince had approved the killing and dismemberment of U.S. resident and Washington Post columnist Jamal Khashoggi. Kushner helped to broker $110 billion in arms sales to Saudi Arabia, even as Congress was outraged by MBS’s war in Yemen. Most concerning, though, is that Kushner had access to the most sensitive materials in our government.

Career officials denied Kushner’s security clearance out of concern about his foreign connections, but Trump overruled them.We also know that classified material labeled “Top Secret” was in the 15 boxes of documents belonging to the National Archives and Records Administration that Trump took to his home at Mar-a-Lago after he left the White House. The Federal Bureau of Investigation is currently investigating.

1 note

·

View note

Text

Foreclosure Numbers Today Aren’t Like 2008

Foreclosure Numbers Today Aren’t Like 2008

If you've been keeping up with the news lately, you've probably come across headlines talking about the increase in foreclosures in today’s housing market. This may have left you with some uncertainty, especially if you're considering buying a home. It’s important to understand the context of these reports to know the truth about what’s happening today.

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 2% compared to the previous quarter and 8% since one year ago. While media headlines are drawing attention to this increase, reporting on just the number could actually generate worry for fear that prices could crash. The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.

Let’s look at the latest information with context so we can see how this compares to previous years.

It Isn’t the Dramatic Increase Headlines Would Have You Believe

In recent years, the number of foreclosures has been down to record lows. That’s because, in 2020 and 2021, the forbearance program and other relief options for homeowners helped millions of homeowners stay in their homes, allowing them to get back on their feet during a very challenging period. And with home values rising at the same time, many homeowners who may have found themselves facing foreclosure under other circumstances were able to leverage their equity and sell their houses rather than face foreclosure. Moving forward, equity will continue to be a factor that can help keep people from going into foreclosure.

As the government’s moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble. As Clare Trapasso, Executive News Editor at Realtor.com, says:

“Many of these foreclosures would have occurred during the pandemic, but were put off due to federal, state, and local foreclosure moratoriums designed to keep people in their homes . . . Real estate experts have stressed that this isn’t a repeat of the Great Recession. It’s not that scores of homeowners suddenly can’t afford their mortgage payments. Rather, many lenders are now catching up. The foreclosures would have happened during the pandemic if moratoriums hadn’t halted the proceedings.”

In a recent article, Bankrate also explains:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes. Lenders weren’t filing default notices during the height of the pandemic, pushing foreclosures to record lows in 2020. And while there has been a slight uptick in foreclosures since then, it’s nothing like it was.”

Basically, there’s not a sudden flood of foreclosures coming. Instead, some of the increase is due to the delayed activity explained above while more is from economic conditions.

To further paint the picture of just how different the situation is now compared to the housing crash, take a look at the graph below. It uses data on foreclosure filings for the first half of each year since 2008 to show foreclosure activity has been consistently lower since the crash.

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was back then. Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

In addition to all the factors mentioned above, that’s also largely because buyers today are more qualified and less likely to default on their loans.

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.

0 notes

Text

Saturday, August 21, 2021

Landlords look for an exit amid federal eviction moratorium (AP) When Ryan David bought three rental properties back in 2017, he expected the $1,000-a-month he was pocketing after expenses would be regular sources of income well into his retirement years. But then the pandemic hit and federal and state authorities imposed moratoriums on evictions. The unpaid rent began to mount. Then, just when he thought the worst was over, the Centers for Disease Control and Prevention announced a new moratorium, lasting until Oct. 3. David, the father of a 2 1/2-year-old who is expecting another child, fears the $2,000 he’s owed in back rent will quickly climb to thousands more. The latest moratorium “was the final gut punch,” said the 39-year-old, adding that he now plans to sell the apartments. Most evictions for unpaid rent have been halted since the early days of the pandemic and there are now more than 15 million people living in households that owe as much as $20 billion in back rent, according to the Aspen Institute. A majority of single-family rental home owners have been impacted, according to a survey from the National Rental Home Council, and 50% say they have tenants who have missed rent during the pandemic. Landlords, big and small, are most angry about the moratoriums, which they consider illegal. Many believe some tenants could have paid rent, if not for the moratorium. And the $47 billion in federal rental assistance that was supposed to make landlords whole has been slow to materialize. By July, only $3 billion of the first tranche of $25 billion had been distributed.

Student loans (WSJ) The Biden administration announced it will wipe out $5.8 billion in student loans held by 323,000 people who are permanently disabled. This means the Education Department will discharge loans for borrowers with total and permanent disabilities per Social Security Administration records. Currently there is $1.6 trillion held in student loan debt, much of which could be eliminated through executive action.

New England preps for 1st hurricane in 30 years with Henri (AP) New Englanders bracing for their first direct hit by a hurricane in 30 years began hauling boats out of the water and taking other precautions Friday as Tropical Storm Henri barreled toward the Northeast coast. Henri was expected to intensify into a hurricane by Saturday, the U.S. National Hurricane Center said. Impacts could be felt in New England states by Sunday, including on Cape Cod, which is teeming with tens of thousands of summer tourists. “This storm is extremely worrisome,” said Michael Finkelstein, police chief and emergency management director in East Lyme, Connecticut. “We haven’t been down this road in quite a while and there’s no doubt that we and the rest of New England would have some real difficulties with a direct hit from a hurricane.”

Booming Colo. town asks, ‘Where will water come from?’ (AP) “Go West, young man,″ Horace Greeley famously urged. The problem for the northern Colorado town that bears the 19th-century newspaper editor’s name: Too many people have heeded his advice. By the tens of thousands newcomers have been streaming into Greeley—so much so that the city and surrounding Weld County grew by more than 30% from 2010 to 2020, according to the U.S. Census Bureau, making it one of the fastest-growing regions in the country. And it’s not just Greeley. Figures released this month show that population growth continues unabated in the South and West, even as temperatures rise and droughts become more common. That in turn has set off a scramble of growing intensity in places like Greeley to find water for the current population, let alone those expected to arrive in coming years. “Everybody looks at the population growth and says, ‘Where is the water going to come from?’” [one local professor] said.

Everything’s Getting Bigger In Texas (AP, CNBC, Forbes) Texas has long been a popular destination for newcomers, thanks to cheaper land and housing, more job opportunities, lower taxes, and fewer regulations. There’s also the great weather, food, schools, and medical facilities, the abundant resources and year-round recreation and outdoor activities, artistic and cultural events, fairs, festivals, music venues, and the diverse and friendly people—you know, just to name a few. Texas has always been a business-friendly environment, which has certainly not been lost on tech and financial companies headquartered in strictly-regulated and high-priced states like California and New York. There are 237 corporate relocation and expansion projects in the works in Texas just since the pandemic hit. Tech giant Oracle moved its headquarters to Austin in late 2020; Tesla is building its new Gigafactory there, and Apple will have its second-largest campus there as well. Both Google and Facebook have satellite offices in Austin, and the file hosting services company Dropbox will be leaving San Francisco for Austin. Recently, the global real estate services firm CBRE and multinational financial services behemoth Charles Schwab moved their headquarters from California to the Dallas area. Hewlett Packard’s cofounders were two of the original grandfathers of Silicon Valley, who started their company in a Palo Alto garage in 1939. Now, the corporation is moving its headquarters from San Jose to Houston. And the number of mega-wealthy individuals who’ve moved to Texas are too numerous to mention. It’s not just big cities like Dallas, Houston, Austin, and San Antonio that are seeing an influx of people—bedroom communities are growing by leaps and bounds as well—places like New Braunfels, located in the Texas Hill Country, Conroe, 40 miles north of Houston, and McKinney, just 30 minutes up U.S. 75 from Dallas.

‘Bracing for the worst’ in Florida’s COVID-19 hot zone (AP) As quickly as one COVID patient is discharged, another waits for a bed in northeast Florida, the hot zone of the state’s latest surge. But the patients at Baptist Health’s five hospitals across Jacksonville are younger and getting sick from the virus faster than people did last summer. Baptist has over 500 COVID patients, more than twice the number they had at the peak of Florida’s July 2020 surge, and the onslaught isn’t letting up. Hospital officials are anxiously monitoring 10 forecast models, converting empty spaces, adding over 100 beds and “bracing for the worst,” said Dr. Timothy Groover, the hospitals’ interim chief medical officer.

Grace heads for a second hurricane hit on Mexican coast (AP) Hurricane Grace—temporarily knocked back to tropical storm force—headed Friday for a second landfall in Mexico, this time taking aim at the mainland’s Gulf coast after crashing through the country’s main tourist strip. The storm lost punch as it zipped across the Yucatan Peninsula, but it emerged late Thursday over the relatively warm Gulf of Mexico and was gaining energy. The U.S. National Hurricane Center said Grace’s winds were back up to 70 mph (110 kph) early Friday and were expected to soon regain hurricane force. It was centered about 265 miles (425 kilometers) east of Tuxpan and was heading west at 16 mph (26 kph). The forecast track would take it toward a coastal region of small fishing towns and beach resorts between Tuxpan and Veracruz, likely Friday night or early Saturday, then over a mountain range toward the heart of the country and the greater Mexico City region. Forecasters said it could drop 6 to 12 inches (15 to 30 centimeters) of rain, with more in a few isolated areas—bringing the threat of flash floods, mudslide and urban flooding.

“Self-determination 1, Human Rights 0” (Foreign Policy) Most Latin American governments offered little official support to the U.S. War in Afghanistan when it began in 2001. At the time, Venezuela put forward a blistering critique of meeting “terror with more terror,” and then-Cuban leader Fidel Castro said U.S. opponents’ irregular warfare abilities could draw out the conflict for 20 years. Over the weekend, as the Afghan government collapsed and chaos engulfed Kabul’s airport, today’s leaders of Cuba and Venezuela echoed their critiques while foreign ministers of other Latin American countries diplomatically issued statements of concern about Afghanistan’s humanitarian needs. Chile and Mexico made plans to accept Afghan refugees, and several countries signed on to a joint international statement protecting Afghan women’s rights. To many in Latin America’s diplomatic and foreign-policy communities, the dark events in Afghanistan confirmed the importance of the principle of non-interference in other countries’ internal affairs. The extended U.S. presence in Afghanistan was “the same mistake as always: trying to build democratic states through the use of force,” Colombian political scientist Sandra Guzmán wrote in El Tiempo. Many Latin Americans stressed that methods other than military interventions should be used to work toward human rights, even as they acknowledged how challenging it can be to make progress. “Self-determination 1, human rights 0 #Afghanistan,” tweeted Uruguayan political scientist Andrés Malamud after Kabul fell.

Afghanistan war unpopular amid chaotic pullout (AP) A significant majority of Americans doubt that the war in Afghanistan was worthwhile, even as the United States is more divided over President Joe Biden’s handling of foreign policy and national security, according to a poll from The Associated Press-NORC Center for Public Affairs Research. Roughly two-thirds said they did not think America’s longest war was worth fighting, the poll shows. Meanwhile, 47% approve of Biden’s management of international affairs, while 52% approve of Biden on national security. The poll was conducted Aug. 12-16 as the two-decade war in Afghanistan ended with the Taliban returning to power and capturing the capital of Kabul. Biden has faced bipartisan condemnation in Washington for sparking a humanitarian crisis by being ill-prepared for the speed of the Taliban’s advance.

The U.S. Blew Billions in Afghanistan (Bloomberg) The rapid collapse of Afghanistan’s government to the Taliban fueled fears of a humanitarian disaster, sparked a political crisis for President Joe Biden and caused scenes of desperation at Kabul’s airport. It’s also raised questions about what happened to more than $1 trillion the U.S. spent trying to bring peace and stability to a country wracked by decades of war. While most of that money went to the U.S. military, billions of dollars got wasted along the way, in some cases aggravating efforts to build ties with the Afghan people Americans meant to be helping. A special watchdog set up by Congress spent the past 13 years documenting the successes and failures of America’s efforts in Afghanistan. While wars are always wasteful, the misspent American funds stand out because the U.S. had 20 years to shift course.

Western groups desperate to save Afghan workers left behind (AP) The Italian charity Pangea helped tens of thousands of Afghan women become self-supporting in the last 20 years. Now, dozens of its staff in Afghanistan are in hiding with their families amid reports that Taliban are going door-to-door in search of citizens who worked with Westerners. Pangea founder Luca Lo Presti has asked that 30 Afghan charity workers and their families be included on Italian flights that have carried 500 people to safety this week, but the requests were flatly refused. On Thursday, the military coordinator told him: “Not today.” Dozens of flights already have brought hundreds of Western nationals and Afghan workers to safety in Europe since the Taliban captured the capital of Kabul. Those lucky enough to be rescued from feared reprisals have mostly been Afghans who worked directly with foreign missions, along with their families. European countries also have pledged to evacuate people at special risk from the Taliban—feminists, political activists and journalists—but it is unclear exactly where the line is being drawn and how many Afghan nationals Western nations will be able to evacuate.

3 notes

·

View notes