#irs tax debt relief program

Explore tagged Tumblr posts

Text

Unlock the Benefits of Expert Tax Services and Why You Need Them on Your Side

A foremost advantage will therefore be the help of professional tax services. In this regard, some of the basic things that this blog post seeks to discuss are the benefits of availing of Expert Tax Services, what to look for in a tax expert, and how the use of these services will directly impact your overall financial situation.

0 notes

Text

Eligibility Criteria for Various Tax Relief Programs: A Comprehensive Guide

Navigating tax obligations can be challenging, especially during times of financial hardship. Tax relief programs are designed to assist taxpayers in managing their obligations, but eligibility criteria can vary significantly depending on the program. Understanding these criteria is crucial for qualifying and taking advantage of the support available. Here’s an in-depth look at the eligibility criteria for some of the most common tax relief programs.

1. Offer in Compromise (OIC)

An Offer in Compromise allows taxpayers to settle their tax debt for less than the total amount owed. The IRS considers it when paying the full tax liability would create financial hardship.

Eligibility Criteria:

Income and Expenses: Your ability to pay is evaluated based on your income, expenses, and asset equity.

Compliance with Filing Requirements: Applicants must have filed all required tax returns and made estimated tax payments for the current year.

Non-Bankruptcy Status: Taxpayers cannot apply for OIC if they are in an open bankruptcy proceeding.

Doubt as to Collectibility or Liability: You must demonstrate either that the IRS cannot fully collect the debt or there’s a legitimate dispute about the owed amount.

2. Installment Agreements

Installment agreements allow taxpayers to pay their tax liabilities in smaller, manageable payments over time.

Eligibility Criteria:

Debt Threshold: Individuals generally qualify if they owe $50,000 or less in combined tax, penalties, and interest. For businesses, the threshold is $25,000.

Filing Compliance: You must be current with all tax filings to be eligible.

Financial Disclosure: In some cases, the IRS may require a detailed financial disclosure to determine your ability to pay.

3. Innocent Spouse Relief

This program is for individuals who believe they should not be held responsible for the tax liabilities caused by a current or former spouse.

Eligibility Criteria:

Filing Jointly: The tax debt must result from a jointly filed tax return.

Unawareness of Error: You must demonstrate that you were unaware (or had no reason to know) of the understatement or errors.

Equity Considerations: It would be unfair to hold you accountable given the circumstances.

4. Currently Not Collectible (CNC) Status

CNC status temporarily halts IRS collection activities for taxpayers who cannot pay their tax liabilities due to financial hardship.

Eligibility Criteria:

Proof of Hardship: You must provide evidence, such as income and expense statements, showing that paying the debt would prevent you from meeting basic living expenses.

Compliance: All required tax returns must be filed.

5. Tax Credits and Deductions

Tax relief can also come in the form of credits and deductions that reduce your overall tax liability. Examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and deductions for medical expenses or education.

Eligibility Criteria:

Income Limits: Many credits, like the EITC, have strict income thresholds.

Qualifying Dependents: Some credits require having dependents who meet specific age and relationship criteria.

Specific Expenses: Deductions often require documented evidence of qualified expenses.

Tax relief programs can provide invaluable support for individuals and businesses facing financial strain. However, eligibility hinges on meeting specific criteria, including income levels, compliance with tax filing, and proof of financial hardship. Consulting a tax professional or using IRS tools can help you identify the most suitable programs for your situation and streamline the application process.

By understanding the requirements and taking proactive steps, you can alleviate the burden of tax debt and regain financial stability.

#IRS#IRS audit defense FL#IRS lawyer FL#IRS tax settlement FL#tax attorney FL#tax debt attorney FL#tax debt FL#tax levy lawyer FL#tax liabilities#tax relief programs FL

0 notes

Text

0 notes

Text

Crucial Information Regarding Your Right to a Free Tax Consultation

The practice of tax law requires specialized knowledge and experience because the field is complex and constantly changing. A free consultation tax attorney is a lawyer whose exclusive area of practice is tax law. These lawyers can manage any complexity or simplicity in your tax situation. They are masters in managing intricate legal tax circumstances and have unmatched knowledge of the law and its implementation. You need a tax law specialist attorney if you or your business requires assistance with tax planning, representation in disputes with tax authorities, or just making sure you're following the law.

Common duties include evaluating recently established tax laws, assisting clients in tax court, and counseling clients on the tax ramifications of corporate activities and transactions. The significance of tax attorneys who provide free consultations and how they assist clients in comprehending and adhering to the intricate web of tax regulations will be discussed in the paragraphs that follow.

The tasks of a tax attorney could include

An attorney who practices just tax law is known as a "tax lawyer". They provide financial planning guidance to maximize tax conditions, adhere to tax laws, and settle disputes with the Internal Revenue Service or other tax authorities. Very little attention is paid to business taxes, estate taxes, foreign taxes, and tax debt. Many tax lawyers are employed by accountancy or legal firms. It's possible that a few of them work for themselves and manage their own businesses.

Tax attorneys that offer free consultations usually counsel clients on several strategies to receive favorable tax treatment. Lawyers not only create and negotiate contracts and other legal documents, but they can also represent clients in court, including tax court. Tax attorneys typically assist customers of accounting and consulting firms in adhering to tax laws.

Reason of hiring a tax attorney

Developmentof an estate:

Tax professionals can assist you with estate planning duties such establishing trusts, distributing assets to close relatives, and finishing required documentation during a free consultation.

Fixing up a business:

You can reduce your taxable income when you plan for the start-up, acquisition, sale, or growth of your company by scheduling a free consultation with a free consultation tax attorney.

Not being subject to taxes:

Tax attorneys provide free consultations if you need assistance disputing or resolving an overdue amount with the IRS or another tax agency. For example, they can assist you in selecting a joyful, innocent spouse or an offer that can be modified.

Qualities of a tax attorney to take into account

Acquiring legal authority to practice law

If a tax lawyer is licensed to practice law and offers free initial consultations, then they can. To find out if a tax lawyer is authorized to practice law in your state, go to the website of the bar organization in your state.

Recommending a greater level of investigation or attention

Most states require you to complete law school before granting you a license to practice law. Only the most experienced tax attorneys are able to obtain a Master of Laws (LL.M.) in taxation.

The TIN of the person making the arrangements

If you file tax returns for money, you must obtain a tax identification number from an IRS accountant. Without the tax preparer's signature and PTIN, your tax return cannot be filed.

Final Words

Get the most individualized tax advice and assistance possible by scheduling a free appointment with a free consultation tax attorney. In this way, it is free to talk with a tax attorney. You can receive individualized assistance with your tax situation without needing to pay anything up front. If you need assistance understanding the rules, you can get a free consultation with a tax attorney.

#tax relief services#tax debt relief#irs tax relief#tax settlement services#irs fresh start programs#irs penalty abatement#free consultation tax attorney

0 notes

Text

🌟 Navigating Tax Debt: Insights from CEO Adam Hastie 🌟

Hey Tumblr community,

I hope this message finds you well. Today, I want to address a topic that affects many of us: tax debt. As the CEO of Lexington Tax Group, I've seen firsthand the impact that IRS tax debt can have on individuals and families. That's why I'm here to share some valuable insights and resources with you.

If you're feeling overwhelmed by tax debt, it's essential to know that you're not alone. Many people find themselves in similar situations, facing uncertainty and stress. However, there are options available to help ease the burden and provide relief.

At Lexington Tax Group, we specialize in guiding individuals through the process of qualifying for hardship programs. These programs, such as Offer in Compromise (OIC), Installment Agreements, and Currently Not Collectible (CNC) status, are designed to offer financial assistance and create manageable pathways towards tax debt resolution. Our dedicated team is here to provide personalized support and expert guidance every step of the way.

Whether you're considering an Offer in Compromise, an Installment Agreement, or another hardship program, we're here to help you navigate the complexities of the IRS system and find the best solution for your unique situation.

Our services extend beyond just IRS tax debt relief. We also provide assistance with Innocent Spouse Relief, IRS Fresh Start Initiative programs, penalty abatement, tax debt negotiation, and more. Our goal is to empower you with the knowledge and resources needed to achieve financial freedom.

To learn more about how Lexington Tax Group can assist you, visit our website at www.LexingtonTaxGroup.com or give us a call at 800-328-8289. Our team is ready to provide the support and expertise you need to move forward with confidence.

Remember, there's always hope, even in the face of tax debt. Together, we can overcome this challenge and build a brighter financial future.

Wishing you peace of mind and prosperity,

Adam Hastie CEO, Lexington Tax Group

#IRS tax debt relief#tax debt assistance#tax debt help#IRS hardship programs#Offer in Compromise (OIC)#Installment Agreement#Currently Not Collectible (CNC) status#Innocent Spouse Relief#IRS Fresh Start Initiative#penalty abatement#tax debt negotiation#Taxpayer Advocate Service#tax debt settlement#IRS debt forgiveness#tax debt resolution#IRS debt reduction#tax debt consultation#tax debt forgiveness programs#IRS payment plans#tax debt relief companies#tax debt#irs lawyer#tax debt attorney#irsdebtrelief#irs audit#irs#backtaxes

0 notes

Text

Things Biden and the Democrats did, this week #16

April 26-May 3 2024

President Biden announced $3 billion to help replace lead pipes in the drinking water system. Millions of Americans get their drinking water through lead pipes, which are toxic, no level of lead exposure is safe. This problem disproportionately affects people of color and low income communities. This first investment of a planned $15 billion will replace 1.7 million lead pipe lines. The Biden Administration plans to replace all lead pipes in the country by the end of the decade.

President Biden canceled the student debt of 317,000 former students of a fraudulent for-profit college system. The Art Institutes was a for-profit system of dozens of schools offering degrees in video-game design and other arts. After years of legal troubles around misleading students and falsifying data the last AI schools closed abruptly without warning in September last year. This adds to the $29 billion in debt for 1.7 borrowers who wee mislead and defrauded by their schools which the Biden Administration has done, and a total debt relief for 4.6 million borrowers so far under Biden.

President Biden expanded two California national monuments protecting thousands of acres of land. The two national monuments are the San Gabriel Mountains National Monument and the Berryessa Snow Mountain National Monument, which are being expanded by 120,000 acres. The new protections cover lands of cultural and religious importance to a number of California based native communities. This expansion was first proposed by then Senator Kamala Harris in 2018 as part of a wide ranging plan to expand and protect public land in California. This expansion is part of the Administration's goals to protect, conserve, and restore at least 30 percent of U.S. lands and waters by 2030.

The Department of Transportation announced new rules that will require car manufacturers to install automatic braking systems in new cars. Starting in 2029 all new cars will be required to have systems to detect pedestrians and automatically apply the breaks in an emergency. The National Highway Traffic Safety Administration projects this new rule will save 360 lives every year and prevent at least 24,000 injuries annually.

The IRS announced plans to ramp up audits on the wealthiest Americans. The IRS plans on increasing its audit rate on taxpayers who make over $10 million a year. After decades of Republicans in Congress cutting IRS funding to protect wealthy tax cheats the Biden Administration passed $80 billion for tougher enforcement on the wealthy. The IRS has been able to collect just in one year $500 Million in undisputed but unpaid back taxes from wealthy households, and shows a rise of $31 billion from audits in the 2023 tax year. The IRS also announced its free direct file pilot program was a smashing success. The program allowed tax payers across 12 states to file directly for free with the IRS over the internet. The IRS announced that 140,000 tax payers were able to use it over their target of 100,000, they estimated it saved $5.6 million in tax prep fees, over 90% of users were happy with the webpage and reported it quicker and easier than companies like H&R Block. the IRS plans to bring direct file nationwide next year.

The Department of Interior announced plans for new off shore wind power. The two new sites, off the coast of Oregon and in the Gulf of Maine, would together generate 18 gigawatts of totally clean energy, enough to power 6 million homes.

The Biden Administration announced new rules to finally allow DACA recipients to be covered by Obamacare. Deferred Action for Childhood Arrivals (DACA) is an Obama era policy that allows people brought to the United States as children without legal status to remain and to legally work. However for years DACA recipients have not been able to get health coverage through the Obamacare Health Care Marketplace. This rule change will bring health coverage to at least 100,000 uninsured people.

The Department of Health and Human Services finalized rules that require LGBTQ+ and Intersex minors in the foster care system be placed in supportive and affirming homes.

The Senate confirmed Georgia Alexakis to a life time federal judgeship in Illinois. This brings the total number of federal judges appointed by President Biden to 194. For the first time in history the majority of a President's nominees to the federal bench have not been white men.

#Thanks Biden#Joe Biden#student loans#loan forgiveness#lead poisoning#clean water#DACA#health care#LGBT rights#queer kids#taxes#tax the rich

5K notes

·

View notes

Photo

Discover IRS hardship program- eligibility & application. Reduce or clear tax debt. Get relief from financial challenges. Learn how to benefit, now!

0 notes

Text

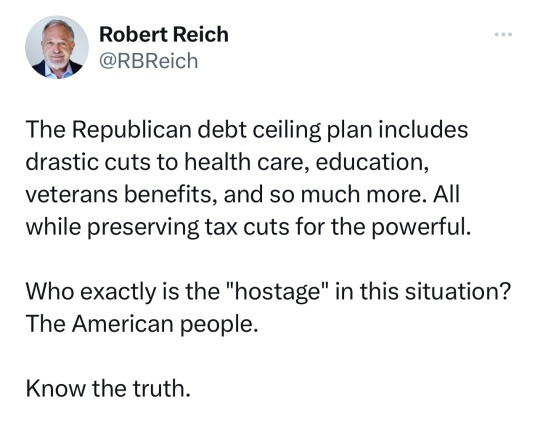

Republican hostage demands include:

Increasing and not cutting the defense budget, nor the Border Patrol budget

Cut funding to the following programs and agencies by 51 percent: Supplemental Nutrition Assistance Program (SNAP), the Social Security Administration, Environmental Protection Agency, Veteran’s Assistance Program, Health and Human Services, Department of Education, Department of Housing and Urban Development, the Justice Department, the State Department, the Department of Transportation, NASA, the Labor Department, and more (source)

Rescind any student loan relief and make borrowers pay back any payments that were paused or recently forgiven

Defund the IRS so that it cannot go after wealthy tax evaders

New, harsher work requirements for Medicaid recipients

Raise the work retirement age for people enrolled in the SNAP, from 50 to 55 years old

More stringent work requirements for food stamp recipients

Deregulation of drilling and mining permitting

Repeal any tax breaks that encouraged using renewable energy sources

Pledges to increase domestic production of oil and other fossil fuels

In short, the Republican demands to raise the debt ceiling is a manufactured crisis. It’s yet another GOP wish list to attack poor people by eviscerating the social safety net, while simultaneously deregulating big businesses and defunding the government agencies that could hold polluters and exploiters accountable

👉🏿 https://www.pbs.org/newshour/politics/heres-whats-in-the-gop-bill-to-lift-the-u-s-debt-limit

👉🏿 https://www.dataforprogress.org/blog/2022/12/12/voters-want-congress-to-raise-the-debt-ceiling-and-protect-social-programs

👉🏿 https://www.cbsnews.com/amp/news/debt-ceiling-house-republicans-bill-limit-save-grow-act/

113 notes

·

View notes

Text

Salinger Tax Consultants LLC - Professional Tax Resolution Services to Resolve Your IRS Challenges

Introduction:

At Salinger Tax Consultants LLC, we understand that dealing with the IRS can be overwhelming. Whether you're facing IRS penalties, wage garnishment, or issues related to filling payroll taxes, it's essential to have a trusted, certified tax professional by your side. As former IRS agents, we bring unique insight and expertise to every tax resolution case, including services like Offer in Compromise and assistance with Currently Not Collectible status. Our goal is to relieve the stress of tax-related issues and help you regain control of your financial future.

Comprehensive Tax Resolution Services:

When you're confronted with serious tax issues, it can feel as though you're trapped in an endless cycle. The good news is that Salinger Tax Consultants LLC specializes in providing comprehensive tax resolution services to help resolve your problems. From wage garnishment and filing payroll taxes to managing IRS penalties and finding relief through an Offer in Compromise, we handle it all. Our team of experts works tirelessly to find solutions tailored to your specific situation, so you can move forward with peace of mind.

Certified Tax Professionals with Extensive Experience:

At Salinger Tax Consultants LLC, we are more than just tax professionals; we are certified experts with years of experience, including former IRS agents. This distinction allows us to better understand the inner workings of the IRS and leverage our knowledge to advocate on your behalf. Whether you are facing an audit, need assistance with filling payroll taxes, or are struggling with tax debt, our certified tax professionals are ready to step in and provide strategic solutions.

Wage Garnishment:

One of the most distressing actions the IRS can take is wage garnishment, where a portion of your earnings is withheld directly from your paycheck. If you're facing wage garnishment, it's crucial to act quickly. Our tax resolution services can help you stop or reduce the garnishment by negotiating with the IRS on your behalf. We have the experience to navigate complex tax regulations and develop a strategy that minimizes the impact on your livelihood. Let us work with you to protect your income and financial well-being.

Filling Payroll Taxes:

For businesses, filling payroll taxes correctly is essential to avoid IRS penalties and interest. Whether you're an established business owner or just starting, staying compliant with payroll tax laws is crucial to keeping your company running smoothly. Salinger Tax Consultants LLC offers payroll tax filing services to ensure that your business remains compliant and avoids costly mistakes. Our certified tax professionals can also help resolve past payroll tax issues, negotiate payment plans, and bring your business back into good standing with the IRS.

Currently Not Collectible Status:

If you're struggling to make ends meet and unable to pay your tax debt, you may qualify for Currently Not Collectible (CNC) status. This status temporarily halts IRS collection efforts, including wage garnishments, bank levies, and other aggressive actions. At Salinger Tax Consultants LLC, we can assess your financial situation and work with the IRS to request CNC status. Once granted, this status provides breathing room and a reprieve from IRS collection actions, allowing you time to get your finances back on track.

IRS Penalties:

IRS penalties can accumulate quickly, making it even more difficult to resolve your tax debt. Whether you're dealing with penalties for late filing, late payment, or other issues, Salinger Tax Consultants LLC can help. Our team is well-versed in the various penalty abatement programs available through the IRS, and we work diligently to reduce or eliminate penalties where possible. We understand how the IRS calculates penalties, and we will leverage that knowledge to help you minimize the impact on your tax resolution process.

Offer in Compromise:

An Offer in Compromise (OIC) is one of the most powerful tools available for resolving tax debt. This program allows qualified taxpayers to settle their tax debt for less than the total amount owed. Salinger Tax Consultants LLC specializes in offering professional guidance through the OIC process. Our team has helped countless individuals and businesses negotiate settlements that significantly reduce their tax liabilities. As former IRS agents, we know what the IRS is looking for in an OIC application, and we have the experience to increase your chances of success.

Why Choose Salinger Tax Consultants LLC:

Expertise and Experience: Our team includes former IRS agents with extensive knowledge of tax law and IRS procedures. We know how the IRS operates and how to effectively negotiate on your behalf.

Customized Solutions: We understand that every tax issue is unique, which is why we offer personalized solutions tailored to your specific needs. Our approach is always focused on achieving the best possible outcome for you.

Comprehensive Services: From wage garnishment to payroll tax filing and Offer in Compromise, we provide a full range of tax resolution services. Whatever your tax challenge, we have the tools and expertise to resolve it.

Customer-Focused Approach: We take the time to listen to your concerns and provide clear, actionable advice. Our team is dedicated to making the tax resolution process as smooth and stress-free as possible.

0 notes

Text

Understanding IRS Tax Settlement Options for Individuals: A Comprehensive Guide

Dealing with tax debt can feel overwhelming, but you’re not alone. Many individuals find themselves in a similar situation, and fortunately, the IRS offers several options to help you settle your tax liabilities. In this guide, we’ll break down the primary settlement options available to you, making the process a little less daunting and helping you regain control over your financial future.

1. Offer in Compromise (OIC)

One of the most well-known options is the Offer in Compromise (OIC). This program allows eligible taxpayers to settle their tax debts for less than what they owe. Imagine being able to wipe away a significant portion of your tax burden! To qualify for an OIC, you’ll need to demonstrate that paying your full tax debt would cause you financial hardship. This involves providing detailed information about your income, expenses, and assets. It’s important to note that not everyone who applies for an OIC will be accepted; in fact, only about 50% of applications are approved each year. Therefore, it’s crucial to present a strong case. If you’re considering this option, take the time to gather all necessary documentation and perhaps consult with a tax professional.

2. Installment Agreement

If an OIC doesn’t seem feasible for you, don’t worry—there are other options! An Installment Agreement might be your best bet if you have a steady income but can’t afford to pay your tax debt all at once. This option allows you to pay off your debt in manageable monthly payments, making it easier to budget and plan. To set up an Installment Agreement, you can apply online or fill out Form 9465. Just keep in mind that you need to be current on your tax returns and capable of making those monthly payments. While this option can provide relief, be aware that interest and penalties may still accrue during the repayment period.

3. Currently Not Collectible Status

If you’re facing severe financial hardship—perhaps due to job loss or medical expenses—you might qualify for Currently Not Collectible (CNC) Status. This status temporarily halts any collection actions by the IRS, giving you some breathing room while you work on improving your financial situation. To apply for CNC status, you’ll need to contact the IRS directly and provide documentation showing your financial hardship. Keep in mind that this is a temporary solution; the IRS will review your status annually, and if your financial situation improves, they may resume collection efforts.

4. Penalty Abatement

Sometimes life throws curveballs that lead to late payments—serious illness or natural disasters can happen to anyone. If you find yourself in this situation, you might be eligible for Penalty Abatement. This option allows you to reduce or eliminate penalties associated with unpaid taxes without affecting the principal amount owed. To apply for penalty abatement, submit Form 843 along with any supporting documentation that explains your circumstances. The IRS understands that life can be unpredictable, and they may be willing to work with you if you have a valid reason for late payment.

5. DIY Negotiation

Lastly, if you're feeling confident and want to take matters into your own hands, consider negotiating directly with the IRS. You can propose a settlement amount that is less than what you owe. This approach may work well if there’s doubt about the collectibility of your full debt. While self-representation is an option, it’s wise to seek professional guidance if you're unsure about how to navigate negotiations effectively.

Understanding these IRS tax settlement options empowers you to take proactive steps toward resolving your tax debts. Each option has its own eligibility criteria and processes, so it’s essential to assess your personal financial situation carefully. Remember, seeking help from a tax professional can provide valuable insights tailored to your unique circumstances. By exploring these avenues, you can find relief from your tax burdens and move forward confidently into a brighter financial future. You’ve got this!

#IRS lawyer AZ#IRS tax settlements AZ#tax attorney AZ#tax audit dеfеnѕе AZ#tax debt#tax debt lawyer AZ#tax levy lawyer AZ#tax liabilities

0 notes

Text

Everything You Should Know About Federal Tax Payment Penalty

Taxes are part of life for most people. However, Federal tax rate payment penalty could be daunting and they don’t need to be confusing.

0 notes

Text

Criminal Tax Attorney NYC: Defending Your Rights Against Tax Fraud Allegations

Introduction

The Role of a Criminal Tax Attorney NYC A criminal tax attorney NYC specializes in handling cases involving serious tax violations. Their expertise includes navigating intricate federal and state tax laws, representing clients in court, and negotiating with agencies like the IRS. With their deep understanding of tax codes, these attorneys provide invaluable guidance to individuals and businesses accused of tax fraud.

Expert navigation of complex federal and state tax laws: Criminal tax attorneys in NYC have extensive knowledge of the ever-changing landscape of tax laws at both the state and federal levels. They can identify specific nuances in the tax code that could be crucial in building a defense, ensuring that every possible angle is explored to benefit the client.

Representation during IRS investigations and court proceedings: When facing an IRS audit or tax fraud investigation, having a criminal tax attorney by your side ensures that your rights are protected throughout the entire process. These attorneys represent clients in both administrative investigations and court, ensuring that all legal procedures are followed, and any evidence presented is scrutinized to the fullest extent.

Skilled negotiation to reduce charges or penalties: One of the primary roles of a criminal tax attorney is to negotiate with the IRS and other tax authorities on behalf of their clients. With experience in tax law, they know how to negotiate plea deals, request reductions in penalties, or even secure a settlement, helping to mitigate the financial and legal consequences of tax fraud accusations.

Comprehensive guidance for both individuals and businesses: Whether the client is an individual facing personal tax fraud allegations or a business accused of tax-related crimes, a criminal tax attorney in NYC offers comprehensive legal support. They assess the specific circumstances of the case, offer clear advice on how to handle the situation, and customize the legal strategy to suit individual needs, ensuring that every aspect of the case is addressed.

Tax Debt Relief Attorney: Resolving Unpaid Taxes In some cases, tax fraud allegations arise due to unresolved tax debts. A tax debt relief attorney can assist in resolving outstanding tax liabilities, helping clients avoid further legal complications. These attorneys negotiate with the IRS to create manageable payment plans or settle debts through programs like the Offer in Compromise. By addressing unpaid taxes, a tax debt relief attorney may also reduce the risk of criminal investigations.

Payroll Tax Attorney: Safeguarding Businesses Business owners often encounter payroll tax issues, which can escalate into serious legal troubles if not managed properly. A payroll tax attorney helps employers resolve disputes related to unpaid payroll taxes, ensuring compliance with federal and state regulations. By addressing payroll tax concerns, these attorneys not only protect businesses from fines but also prevent potential accusations of tax fraud.

Federal Tax Crime Defense Attorney: Expertise in Complex Cases Tax fraud allegations often involve federal laws, making them highly complex. A federal tax crime defense attorney specializes in defending clients accused of violating federal tax codes. Their role includes analyzing evidence, negotiating plea deals, and representing clients in federal court. With their expertise, a federal tax crime defense attorney provides the comprehensive support needed to handle intricate cases effectively.

Thorough investigation of financial records to uncover discrepancies or errors: A federal tax crime defense attorney will carefully examine all financial documents and records related to the case, looking for inconsistencies or errors that may serve as a defense. This could involve identifying mistakes made by the IRS or revealing legitimate business expenses that were misinterpreted as fraudulent. Through detailed analysis, the attorney may uncover critical information that weakens the prosecution’s case.

Expertise in negotiating settlements or plea bargains to reduce penalties: Tax fraud charges can result in significant fines or jail time. A federal tax crime defense attorney has the experience to negotiate plea deals or settlements that can significantly reduce these penalties. By working with the IRS and prosecutors, they may be able to secure a more favorable outcome for their clients, such as reduced charges or alternative sentencing options, like probation or community service.

Strong courtroom representation to challenge the prosecution’s case: If your case goes to court, a federal tax crime defense attorney will provide skilled representation, challenging the prosecution’s evidence and strategies. They will carefully cross-examine witnesses, present counterarguments, and use legal precedents to weaken the case against you. Their goal is to ensure that you are treated fairly and to provide a strong defense in front of the judge and jury.

Sales Tax Audit Lawyers: Navigating Tax Audits Tax audits can be stressful, especially for businesses dealing with sales taxes. Sales tax audit lawyers assist in managing audits, ensuring accurate reporting, and defending against accusations of misrepresentation. Their role is critical in preventing audits from escalating into fraud allegations, protecting businesses from unnecessary legal risks.

FAQs

1. What is a criminal tax attorney, and how can they help me?

A criminal tax attorney specializes in defending clients who are accused of violating tax laws, particularly those related to tax fraud or other serious tax offenses. These attorneys help protect your rights by providing legal advice, representing you during IRS investigations or audits, negotiating with tax authorities, and defending you in court if necessary.

2. What types of tax fraud allegations does a criminal tax attorney NYC handle?

A criminal tax attorney NYC deals with various types of tax fraud, including underreporting income, inflating deductions, hiding assets, and submitting false information on tax returns. These allegations can lead to criminal charges, including fines, penalties, and even imprisonment.

3. How does a tax debt relief attorney assist in resolving unpaid taxes?

A tax debt relief attorney helps individuals and businesses address outstanding tax liabilities. They work with the IRS to establish payment plans, request reductions in the owed amount through programs like the Offer in Compromise, or delay enforcement actions such as garnishments or levies.

4. What is the role of a payroll tax attorney in a business setting?

A payroll tax attorney helps businesses comply with payroll tax regulations and resolves disputes related to unpaid payroll taxes. Payroll taxes are critical to ensure proper reporting and payment of employee-related taxes. Failure to pay these taxes can lead to significant penalties and legal issues, including accusations of tax fraud.

5. How does a federal tax crime defense attorney assist with complex federal cases?

A federal tax crime defense attorney specializes in defending clients accused of violating federal tax laws, such as tax fraud or evasion. These attorneys conduct thorough investigations into financial records, challenge the evidence presented by the IRS, and negotiate plea deals to reduce penalties.

0 notes

Text

Guaranteed Tax Relief

How Does Tax Relief Work?

The IRS offers several programs designed to provide tax relief to qualified individuals and businesses. These initiatives aim to assist taxpayers struggling to pay their tax obligations. One prominent program is the Fresh Start Initiative, introduced in 2011 to ease the burden on taxpayers and help them manage their tax debts. Below is an overview of how the program works and its key features.

1. Liens

As part of the Fresh Start Initiative, the IRS made significant changes to how tax liens are handled:

Raised Threshold for Liens: The IRS increased the dollar amount that triggers a lien, reducing the risk of liens being filed for smaller debts.

Lien Withdrawals: The initiative simplified the process for withdrawing liens after the full payment of taxes. Taxpayers can also request a withdrawal once they set up a direct deposit installment agreement.

2. Installment Agreements

The program has made it easier for taxpayers to enter into installment agreements with the IRS:

Streamlined Application: Taxpayers who owe less than $50,000 can apply for an installment agreement with minimal paperwork.

Extended Repayment Term: The repayment period was extended from five to six years, giving taxpayers more time to manage their payments.

3. Offers in Compromise (OIC)

The Fresh Start Initiative expanded eligibility for the Offer in Compromise program.

Settling for Less: An OIC allows taxpayers to negotiate with the IRS to settle their tax debt for less than the full amount owed.

Last Resort Option: This relief option is typically available after other repayment avenues have been exhausted.

Should You Seek Professional Help?

While taxpayers can navigate the tax relief process independently, many prefer to work with professionals to ensure the process is handled correctly and to maximize their chances of success. Qualified professionals who can assist include:

Enrolled Agents

Certified Public Accountants (CPAs)

Tax Attorneys

It’s important to ensure that the individual or organization you work with is qualified to represent you before the IRS. Not all entities advertising tax relief services are legitimate or effective.

Conclusion

Tax relief programs, like the Fresh Start Initiative, provide valuable options for individuals and businesses struggling with tax debt. Whether you choose to handle the process on your own or seek professional assistance, understanding these programs can help you make informed decisions about managing your tax obligations.

0 notes

Text

Significance of Tax Settlement Services

A "tax settlement" is an agreement between a taxpayer and the IRS or a state taxation body to settle a tax dispute by agreeing to pay a smaller sum. This resolution technique yields substantial savings in a short period of time, making it highly recommended. While the IRS does not formally offer a "Tax Settlement" program, they may provide other dispute resolution procedures that may result in a smaller payment. The goal of settling tax bills with the Internal Revenue Service is achieved through a number of tax settlement services. Here you will know about the key components of each method in this piece, beginning with the one that might result in cost savings right away.

How are tax settlements processed?

One of two options exists for settling a tax debt: either work out a different payment plan with the Internal Revenue Service, or negotiate a smaller sum than what really owes. In any event, the taxpayer must adhere to the terms of a tax settlement agreement with the IRS. Before making a decision, the taxpayer must first select the kind of tax settlement they would like to apply for and then submit the necessary documentation to the IRS for review.

The taxpayer may choose to fill out the papers themselves or have the returns filed on their behalf by a licensed tax professional. In most cases, the only parties engaged in a tax settlement negotiation are the individual and the applicable tax authorities. If the taxpayer decides to work with an experienced lawyer from tax settlement services, then another party might be included in the negotiation process. Surprisingly, companies that specialize in tax settlement may also help people cut their expenses. This is due to the fact that many people discover that speaking with a tax relief specialist produces excellent outcomes. As soon as both parties have agreed upon the settlement, the taxpayer will be deemed to have been in good standing with the Internal Revenue Service (IRS) for the tax year or years that the settlement covered, barring default or failure to comply with all of the terms of the agreement.

Who can get a package of tax settlement payments?

The Internal Revenue Service (IRS) provides settlement options to individuals who are in financial hardship or who have good reason to have their penalties lowered. Not every individual satisfies the prerequisites for tax settlement. It is true that the vast majority of taxpayers do not meet the requirements; in fact, very few do. The Internal Revenue Service states that a person's financial position has a significant impact on their ability to pay taxes.

The IRS typically has a good basis to think that a settlement would be the best course of action when it discovers that the taxpayer is experiencing financial difficulties. If the Internal Revenue Service (IRS) or tax authorities determine that the person has sufficient income to pay the entire amount owed, they may reject the tax settlement request. An alternative would be for the IRS or the tax authority to offer a payment plan in which a specified amount is payable every month until the debt is paid off.

The Advantages of Tax Settlement Agreements

For taxpayers in financial need, a tax settlement may offer various benefits. One of the main advantages is that you could be able to settle your tax due for less than the entire amount owed. The IRS could be willing to forego more drastic collection procedures like levies, seizures, or wage garnishments if you can work out a tax settlement with them. In this way, you can better secure your assets and income. With a successful tax settlement with the IRS tax settlement services, those who have struggled with tax debt may be able to start again. This is an opportunity to move on from the past and, in a sense, start anew.

#tax relief services#tax debt relief#irs tax relief#tax settlement services#irs fresh start programs#irs penalty abatement

0 notes

Text

Unlock Your Financial Freedom with the IRS Fresh Start Program

Facing IRS Tax Debt? You're Not Alone

Tax debt can feel like an overwhelming burden, casting a shadow over your financial freedom and peace of mind. If you're one of the many Americans struggling with the stress of owing money to the IRS, you might feel like there's no way out. But there's good news: The IRS Fresh Start Program, and Lexington Tax Group is here to guide you through it.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is designed to make it easier for taxpayers to pay back taxes and avoid tax liens. This initiative offers several relief options, including installment agreements, offers in compromise, and penalty abatement, which can make dealing with tax debt more manageable and even reduce the amount owed.

Why Choose Lexington Tax Group?

At Lexington Tax Group, we specialize in navigating these complex relief options to find the best solution for you. Here's why countless clients have trusted us to guide them to financial freedom:

Expert Guidance: Our team of seasoned tax professionals provides knowledgeable support every step of the way.

Personalized Solutions: We understand that everyone's situation is unique. We tailor our strategies to fit your specific needs, ensuring the best possible outcomes.

Save Money: Our primary goal is to help you save money by reducing your overall tax debt, including penalties and interest.

Peace of Mind: With us by your side, you can focus on what matters most in your life, knowing that your tax issues are being handled by experts.

The Lexington Tax Group Difference

What sets us apart is not just our expertise in tax law and the IRS Fresh Start Program but also our commitment to providing compassionate, personalized service. We know that behind every tax issue is a person or family seeking relief and a fresh start. Our approach is not just about resolving tax debts but about restoring peace of mind and laying the groundwork for a secure financial future.

Ready to Begin Your Journey to Financial Freedom?

If you're ready to take the first step towards resolving your tax issues, we're here to help. Contact Lexington Tax Group today to learn how we can assist you in taking full advantage of the IRS Fresh Start Program. Your path to a brighter financial future begins here.

📞 Call us now at 800-328-8289 🌐 Visit us at www.LexingtonTaxGroup.com

Don't let tax debt define your life. With Lexington Tax Group, discover how the IRS Fresh Start Program can open the door to your financial freedom.

#best irs tax relief programs#tax resolution services#tax relief help#tax forgiveness program#tax forgiveness#tax debt relief#tax debt relief program#tax debt help#tax debt forgiveness

0 notes

Text

Understanding IRS Injured Spouse Relief and How It Works

IRS Injured Spouse Relief is a program designed to help individuals protect their share of a tax refund when their spouse has debts, such as unpaid child support or student loans, that could lead to the refund being withheld. By filing for IRS Injured Spouse Relief, the spouse who is not responsible for the debt can claim their portion of the refund and avoid losing it due to their partner's obligations.

0 notes