#investing invest business stocks

Explore tagged Tumblr posts

Note

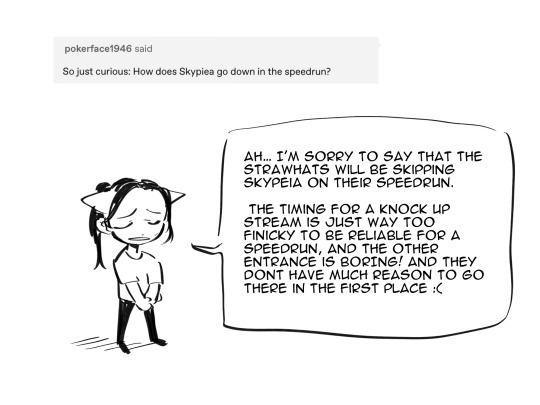

So just curious: How does Skypiea go down in the speedrun?

wait wuh

Speedrun/Time travel AU Masterlist

@thychesters @thychesters @thychesters BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE BUGGY BOOGIE

WATCH HIM DANCE BOY DANCE!!!!!!

(Yes this is canon, buggy is in skypiea,,,, whas that rascal doin up there??!1?1!)

#buggys the type of guy who invests in stocks when travelling back in time#one piece#op fanart#time travel au#speedrun au#ask#buggy the clown#ohhh you wanna make boogie buggy a custom emoji in ur one piece server sooo badly you wanna do it i dare you#this is only 70 percent crack#30 percent serious business… like buggy…. serious guy 🤡#THIS IS MY AU I CAN DO WHATEVER I WANT WITH IT!!!!!!!

3K notes

·

View notes

Photo

streamer!au that i will continue after exams bc this au is so delicious @windshieldwiper we are soulmates frfr finishing this at the same time

#mikage reo#bllk#blue lock#bllk fanart#blue lock fanart#nagi pattern underwear#STICKERS ON HEADPHONESSS#hed wear cat headphones after calculating that it will increase his overall viewership#starts his streams playing apex and ends up talking abt stocks for the next 3 hours#he would make tier lists#BEST BUSINESSES TO INVEST IN JANUARY 2023#reo mikage#kart 🐮emoji

451 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Note

Hi Ms Bitches, I'm a young adult with shitty money situations who's trying to have a money-flush future, but it seems like playing the stocks and shareholders game is one of the best ways to do that nowadays (sadly the well paying job market is uninterested in hiring me until I get my degree). But I REALLY HATE the stocks/shareholders game. It gets my punk hackles up. How can I wrap my anti-capitalist brain around this world enough to make it work in my favor? Any advice on where to start?

We love our darling little punk baby bitches. The stocks and shareholders game (investing) is indeed one of the best ways to build a secure financial future. But we totally understand your hesitation! We talked about it a lot in this episode of the podcast:

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

If you're uneasy about becoming a shareholder, you have two options that are a little more punk:

Invest in small local businesses instead. The returns will be smaller, but there's nothing more punk rock than supporting small local businesses. Check out our how-to at the link below.

Invest in index funds. It's less punk rock, but it's also less gamified than picking individual stocks and consciously choosing to support companies like Tesla. Again, check out the link below.

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Investing Deathmatch: Managed Funds vs. Index Funds

Did we just help you out? Tip us!

39 notes

·

View notes

Text

i think growing up is just life repeatedly sucker punching you and saying bitch you thought things were gonna better lmao no you're so naive and stupid for having hope in 20 years the world will be flaming bag of garbage and no matter how hard you work you'll get eliminated at some point

#and then you just have to get up and keep living anyway because what else is there to do?#but man my heart keeps feeling heavier with every blow#2024 has literally been the worst year ever god personally too#like everytime i think it can't possibly get worse than this it does#i remember literally 9th jan i had such a horrible breakdown in an auto because the first friend i ever made#after school was leaving my work and therefore my life#9 days into the year. seriously. and i was so happy on 8th because it was my birthday#i don't know im trying hard to think okay this doesn't even affect me it's fine im privileged enough that even my own countrys politics#barely affects me#but just. india is already so behind in everything. if developed nations are doing shit like this then well#it will never get better right like who do we even strive to be#i want to get more into indian politics but my god. it's so horrifying and depressing all the time#like i remember resolving to follow politics closely few years ago and the first news#i read was about some minister talking about how girls skirts lengths IN SCHOOL is the reason boys do sa and boys will be boys etc etc#i know i could just follow business news stuff like that god knows it'll help in my field but it just. doesn't resonate with me doesn't#make me feel anything at all. like i so desperately want to care about ooh stock markets and how to grow your money etc etc#but when i think about being rich enough to invest idle money all i can think is sitting in my own home peacefully#drinking a glass of cold coffee and just being able to breathe freely because me and my sister used to joke in childhood#when dad went thru a coffee v bad for health phase and he wouldn't let us drink it so we would drink it very sneakily#at night when he was asleep or went out for an hour and make absolutely no noise while mixing the sugar. we said that we know#we'll* know we have achieved true freedom and happiness in life when we can peacefully drink cold coffee in the hall and not secretly#in the dead of night in our room#i don't even know what im talking about and my period is late again and nothing is working and my lazer focus#that i had built in the past few weeks is gone because suddenly im like what is the point????#i just don't understand how the fuck humans can fight over stupid fucking things like who is kissing who and who is doing what with their#body instead of focusing on collective issues like our planet is dying so fucking fast and every summer is getting impossibler to survive#i hate that the united states control the UN fuck this world fr man i hate being born in such horrible helpless times#like call me a kid or dumb or whatever but i cannot understand how MILLIONS of people do not#have sympathy for ppl around them and who don't care about the planet at all like how????? how did you grow up????#not trying to boast but this is so natural to me!!! didn't you make save water save earth posters in school!!! didn't anyone

11 notes

·

View notes

Note

Am I the only person alive who would find it (darkly) hilarious if Armand did erase the rest of the 70s interview memory at Louis’ request? I think we can all agree Armand has taken a lot of liberties with the truth and he’s a pretty seasoned manipulator but I’m just so amused with the idea that that was one of the only times he was telling the truth (mostly because of how hard Daniel was rolling his eyes over it and because of how insane it sounds.) it’s got that same energy as that one co-worker who’s always causing trouble who you finally call out, only to find this was the one time they weren’t responsible.

On a similar note, because of how Louis is portrayed (ie with a spotty or unreliable memory at times) and how Armand is portrayed (lying, sometimes directly and sometimes by omission) how do you think about the bits of story we get from the two of them re authenticity? I see lots of takes that just…sweep anything complex or unsavory under the proverbial ‘blame Armand’ rug or the ‘Louis’ brain is Swiss-cheese’ blanket as opposed to examining each action and element of the story through the lens of where each character is coming from in that moment. (For example, I’ve seen plenty of folks question if Louis’ memories of lestat can be trusted at all or if it’s all just Armand’s tinkering to make him look bad and just…it’s a tv show. From a practical standpoint they literally cannot rip up everything they’ve shown you. Rehashing memories can only be done some of the time or the audience gets frustrated. And from a story perspective, can’t we take Louis at his word at least some of the time until shown otherwise?)

(Side note and ironic given my ask but I wish we had half as much discourse about Louis as a capitalist and his understanding of the commodification of experiential human things such as art as we do about whether all his memories are unreliable re his romantic relationships. Thank you so much for including the gallery scene in your fic.)

Hahah, I don't think you'd be alone in finding it darkly hilarious if Louis had asked Armand to take the memory away. Hell, the ambiguity of that scene works because it's believable that Louis would ask - Louis really pendulums between heavy handed repression and unrestrained self-indulgence, and it seems like a dam burst for him that night when it came to Lestat. His name had been unuttered in their home for 23 years! And given Armand can read his mind and could clearly sense thoughts of Lestat in Paris, I imagine he's not been deliberately not thought about too. And suddenly a night with Daniel and it's all he can say! All he can think about! The pressure he's placed on the box he keeps Lestat in has loosened just enough to let it all come out!

To know Armand tried to contact Lestat, to feel his own weakness, to know Lestat might know not just his mental state but his crumbling resolve in terms of the promise he made him in Magnus' tower - - it's not hard to see him asking for Armand's help in repressing it all again.

And in terms of their authenticity in the telling of their stories - - I think it varies! I think Armand definitely and deliberately finds the truth malleable, but that doesn't mean I think he lies about everything. Like you said, he tends to prefer to omit than outright lie - like omitting Gabrielle in his recounting of 1800s Paris or the truth about San Francisco, or, I'm sure we'll discover in s3, Lestat being in Paris in the 40s.

I actually don't think he would've tampered with Louis' memories of Lestat at all though - I don't think he would've needed to. Louis is a really punishing character and Lestat's a volatile one, I don't think it would be all that hard for Louis to focus on Lestat's worse behaviour, or to allow his memory to re-write certain events with the most bad faith interpretations of Lestat's actions, thoughts or words as a means to keep him at an emotional distance. Memories aren't facts, even when we want them to be, and I think for Louis they're as malleable when he needs them to be as the truth is for Armand.

The result is that they enable each other's untruths, I think, which goes to the facade of their relationship. Louis can try and mould his memories into something that justifies his choices, and Armand can mould the truth in a way that makes their love story something more than it is, but that doesn't mean that it's entirely lies or entirely inauthentic. It's a version of a story that they've enabled in one another to perform a happiness neither of them feels, but neither knows an alternative to because Louis' grief struck, traumatised and clinically depressed and Armand has been groomed by a monster, has undealt with trauma of his own and an incapacity to be alone.

So yeah, I think a lot of it is true, it's just not a whole truth.

#and thank you!#i totally agree about louis and capitalism#it's SUCH an interesting area to talk about and i feel it gets overshadowed a lot#i had a lot of fun writing that gallery scene#one of the fics i'm writing for kinktober plays around with him in the world of stocks and private investment too#partially because i'm watching industry#and partially because i want to write him bored with modern forms of business and investment and doing something unhinged as a result lol#louis asks#armand asks#iwtv asks

12 notes

·

View notes

Text

"Those who keep learning will keep rising in life."

-- Charlie Munger

#charliemunger#warrenbuffett#money#stockmarket#warrenbuffet#stocks#investment#investor#elonmusk#warrenbuffettquotes#business#quotes#invest#jeffbezos#entrepreneur#billionaire#millionaire#billgates#entrepreneurship#investing#financialindependence#entrepreneurquotes#entrepreneurlife#forbes#markzuckerberg#motivation#forex#stevejobs#bitcoin#valueinvesting

23 notes

·

View notes

Text

Watch full video for the apps we use to trade in the foreign exchange market|•l message me on Telegram @World_note for more info|•| DISCLAIMER:

Past profits are not necessary indicative of future results.

We make no guarentees that you will make money •

You should always consult with a financial advisor regarding all risks associated with trading #foryou #additionalincome #fyp #apps #mobilemoney #makemoneyonline #trading ##copytrading #wifimoney #onlyaccount #makemoneyfromyourphone

#сору

#crypto#forex#digital marketing#stock market#entrepreneur#marketing#investing#accounting#art#business

4 notes

·

View notes

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

2 notes

·

View notes

Text

Comment info, message Me directly to join my platform for daily/weekly crypto profits.

I add only interested persons.

I teach interested persons all they need to know and the various ways they can be earning a steady profit from Crypto weekly.

Just message and ask me for info

8 notes

·

View notes

Video

youtube

CHINA Clap back! #donaldtrump

#youtube#socialstockmarket#invest#investing#investments#investors#nasdaq#wall street#us economy#nvidia#breaking news#world news#economic affairs#geo politics#indian stock market#usa business

3 notes

·

View notes

Text

visit - Effective Budgeting Tips for Financial Success Now

Managing your finances in today's fast world can feel overwhelming. But, the secret to long-term financial security is simple: effective budgeting strategies. Are you ready to take control of your

#1950s#3d printing#60s#70s#accounting#80s#acne#adobe#aesthetic#alex hirsch#finance#money#business#entrepreneur#success#investment#bitcoin#wealth#invest#wallstreet#investing#forex#luxury#motivation#realestate#cryptocurrency#millionaire#stocks#startup#rich

5 notes

·

View notes

Text

Our premium account management services can help you maximize your returns! 📈

Are you ready to take your investments to the next level? Look no further! Our experienced account management services are designed to provide great outcomes and offer the following benefits:

💸 Monthly minimum return of 50%: Our careful investing plans will produce outstanding returns.

🤝 Profit Sharing: We provide a fair profit-sharing structure where you keep 80% of the earnings and our skilled account manager gets only 20%. 🔒 Regulated Broker: Our services are completely regulated, assuring the greatest levels of transparency and security.

🚀 Same Day Payout: No more waiting for your hard-earned cash. We provide same-day payments, giving you immediate access to your earnings.

🔄 Copy Trading: Learn from successful traders' trades and easily replicate their strategies.

📞 Contact us for further information:

Ms. Shilpa phone number: +91 8184975350

#forex market#forextrader#forextrading#forex expert advisor#forex broker#forexinvesting#forexgroup#gold trading#xauusd#eurusd#gbpusd#commodities#indianmarket#stockmarket#stock market#profits#investment#crptocurrency#cryptotrading#mutual funds#index funds#visakhapatnam#gujarat#mumbai#delhi#lucknow#ahmedabad#investors#finance#business

2 notes

·

View notes

Text

A screenshot from a video 📊🍉 !!!

#crypto news#crypto#business#forextips#forexmentor#sexy pose#bitcoin#beauty#slim n stacked#traders#dms open#workout#workfromhome#workfromphone#investing stocks#investment#investors

48 notes

·

View notes

Text

finance&business

the title says it all

2 notes

·

View notes

Text

Bajaj Housing Finance IPO opens on Monday: GMP jumps; shareholder quota, date, review, other details of upcoming IPO

Minimize your trading risks & trade smarter with www.intensifyresearch.com 10 DAYS FREE TRIAL - best SEBI-registered RA firm.

Ganesh Chaturthi Bumper Offer - 10 DAYS FREE TRIAL & FLAT 30% DISCOUNT on all Research Services

Get comprehensive knowledge

– nifty buy sell signals,

– best shares to buy,

– profit making stocks,

– low risk investment option & lot more

by the best SEBI-registered RA firm.

#finance#stock market#banknifty#nifty prediction#economy#nifty50#investing#nse#sensex#share market#bajaj finance#bajaj housing finance#home loan#ipo alert#ipo news#invest#investment#investors#stocks#investing stocks#forex#financial planning#startup#business#services

2 notes

·

View notes