#income-driven repayment plans

Explore tagged Tumblr posts

Text

How to Prepare for Student Loan Repayment: A Step-by-Step Guide

Student loans can be a major financial burden for many people. But there are things you can do to prepare for them and make them easier to manage. Here are a few tips: 1. Create a budget. This will help you track your income and expenses to see where your money is going and ensure you have enough to cover your student loan payments. There are many different budgeting tools and resources…

View On WordPress

#budget for student loans#financial advisor for student loans.#financial literacy#income-driven repayment plans#make extra student loan payments#My-Financials.com#prepare for student loan repayment#refinance student loans#save for student loans#step-by-step guide to student loan repayment#student loan repayment#student loans#tax deductions and credits for student loans

0 notes

Text

Hey, student loans payments are coming back in October, you should know about the SAVE plan.

this is america-centric but pls spread this around if you think any of ur mutuals could use the info.

If you're currently shitting yourself thinking how you're gonna start making student loan payments again, I suggest taking a deep breath, first off. Get comfy, put on some music and strap in.

If you got your student loans through the Federal Student Aid program FAFSA, then you can apply for an IDR (Income Driven Repayment plan) called SAVE.

what is SAVE?

This got my $115 monthly payment down to $40 a month, if you don't work or you can't afford much, this has the potential to reduce your payment even further.

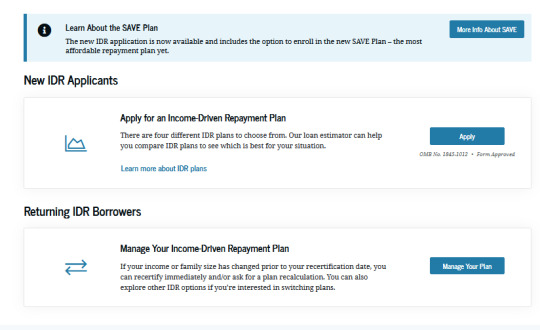

Alls you need to do is go to https://studentaid.gov/idr/ and log into your federal student aid account, there's a section for both first time applicants and returning borrowers who previously may have had an IDR.

Even if you've done an IDR before! Look into the SAVE plan!! It forgave about 10k of debt for me!

Anyway, first time applicants can click the first option, "Apply for an Income-Driven Repayment Plan" and just go through and answer all their prompts, make sure you have all your financial information on hand (tax returns, most recent pay stub, etc) and go through the prompts until it gives you the option to apply for the SAVE plan. CLICK IT!

It should let you know at the end exactly how much you'll be paying per month and you should get an email confirmation as well. Any account specific questions should be directed to their call center +1 (800) 433-3243

GOOD LUCK AND BE PATIENT, THE SITE IS SLOW AS SHIT.

DON'T GIVE UP! I BELIEVE IN YOU!!

if you have any questions feel free to DM me btw

#student loans#SAVE plan#FAFSA#student loan forgiveness#IDR#income driven repayment plan#THIS DOES NOT PAUSE INTEREST BTW#adulting#life tips#helpful#resources#websites#og post

442 notes

·

View notes

Text

Just spend 15 minutes of my one wild and precious life hacking into my student loan account to read the message they’ve been urgently emailing me about and it turned out that the “recertification deadline” for me to keep paying $0/month for the next 20 years had been extended til November. Frankly if it were the 1800s i would have just changed my name and moved to another city

#btw if you have student loans you can sign up for income driven repayment plans and pay Fuck All for the next 20 years as well#unless you’re some kind of richboy fancypants who makes over 50k a year or something

3 notes

·

View notes

Text

Best News of Last Week - December 11

1. Biden administration to forgive $4.8 billion in student loan debt for 80,300 borrowers

The Biden administration announced on Wednesday that it would forgive an additional $4.8 billion in student loan debt, for 80,300 borrowers.

The relief is a result of the U.S. Department of Education’s fixes to its income-driven repayment plans and Public Service Loan Forgiveness program.

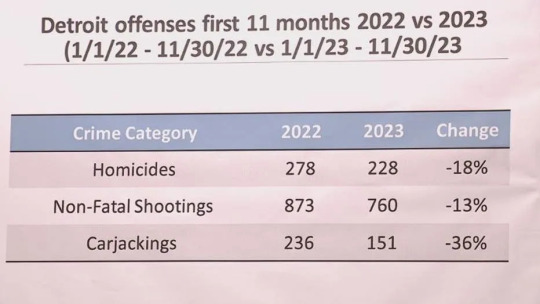

2. Detroit on pace to have lowest homicide rate in 60 years this year

A partnership to reduce Detroit crime is being praised with the City on pace for the fewest homicides in 60 years.

"This is the day we’ve been waiting for, for a long time," said Mayor Mike Duggan. The coalition which includes city and county leaders that Detroit Police Chief James White formed in late 2021 to return the criminal justice system in Detroit and Wayne County to pre-Covid operations.

3. Dog that killed 8 coyotes to protect sheep running for Farm Dog of the Year

Over a year ago, Casper was stacked up against a pack of 11 coyotes, and he overcame them all to protect the livestock at his Decatur home. Now he needs your help.

Casper, the Great Pyrenees livestock guardian dog, needs the public to vote for him to become the American Farm Bureau's "Farm Dog of the Year: People's Choice Pup" contest.

4. Shimmering golden mole thought extinct photographed and filmed over 80 years after last sighting

De Winton's golden mole, last sighted in 1937, has been found alive swimming through sand dunes in South Africa after an extensive search for the elusive species.

5. About 40% of the world's power generation is now renewable

The International Renewable Energy Agency (IRENA) and World Meteorological Organization (WMO) have released their first joint report to strengthen understanding of renewable energy resources and their intricate relationship with climate variability and change.

In 2022 alone, 83% of new capacity was renewable, with solar and wind accounting for most additions. Today, some 40% of power generation globally is renewable, due to rapid deployment in the past decade, according to the report.

6. Jonathan the Tortoise: World’s oldest living land animal celebrates 191st birthday

The world’s oldest living land animal - a Seychelles giant tortoise named Jonathan - has just celebrated his 191st birthday. Jonathan’s estimated 1832 birth year predates the invention of the postal stamp, the telephone, and the photograph.

The iconic creature lived through the US civil war, most of the reign of Queen Victoria, the rise and fall of the Soviet Union, and two world wars.

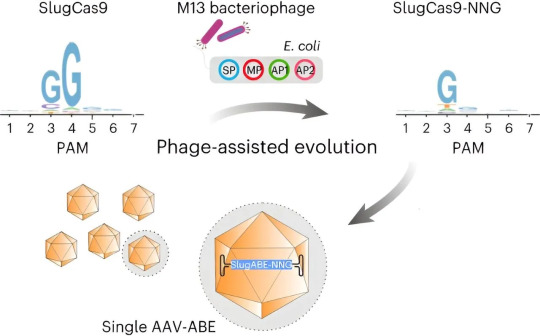

7. New enzyme allows CRISPR technologies to accurately target almost all human genes

A team of engineers at Duke University have developed a method to broaden the reach of CRISPR technologies. While the original CRISPR system could only target 12.5% of the human genome, the new method expands access to nearly every gene to potentially target and treat a broader range of diseases through genome engineering.

---

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation here:

Buy me a coffee ❤️

Also don’t forget to reblog this post with your friends.

908 notes

·

View notes

Text

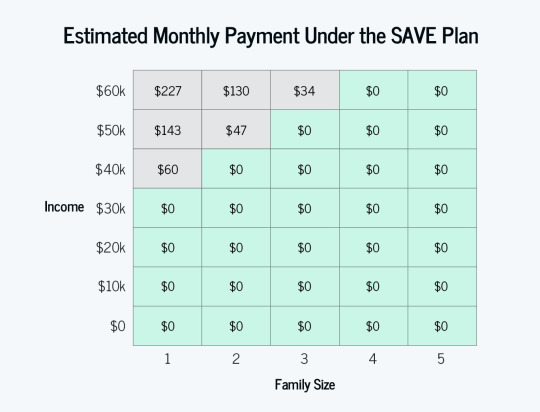

The Biden administration yesterday rolled out its latest tool to tackle the student debt crisis, and as we discussed earlier this year, it’s a good one. While the administration is still working on a broader debt forgiveness plan that it hopes will survive the Trump/McConnell Supreme Court, the new income-driven repayment program, called the “Saving on a Valuable Education” (SAVE) plan, should drastically cut the amount of student loan payments for lower-income borrowers, and for many, will actually get those payments down to zero.

[ ]

With the SAVE plan, the Education Department will no longer charge any interest that isn’t covered by the monthly loan payment, putting an end to the interest-accumulating hamster wheel that so many of us know all too well, where you make your payments on time but your goddamn loan balance keeps growing. As the fact sheet explains:

For example, if a borrower has $50 in interest that accumulates each month and their payment is $30 per month under the new SAVE plan, the remaining $20 would not be charged as long as they make their $30 monthly payment. The Department of Education estimates that 70 percent of borrowers who were on an IDR plan before the payment pause would stand to benefit from this change.

As with other income-driven plans, once a borrower has made payments for 20 years (for undergrad debt) or 25 years (for grad school debt), any remaining balance will be forgiven — yes, even if the monthly payment amount was zero for some or all of that period. Explain to your rightwing uncle that such forgiveness is not a new gimmick Joe Biden made up; it’s how IDR plans have worked since Congress authorized them in the 1990s.

#student debt relief#SAVE plan#us politics#in support of an informed and engaged electorate#recommended reading

1K notes

·

View notes

Text

Things Biden and the Democrats did, this week #11

March 22-29 2024

The Administration, with Transportation Secretary Pete Buttigieg in the lead responded to the collapse of the Francis Scott Key Bridge in Baltimore. Working with Governor Wes Moore and Mayor Brandon Scott (both Democrats) The Department of Transportation promises to clear the harbor and rebuild the bride. DoT has already released $60 million in emergency funds as a "down payment" and President Biden is expected to seek $1 billion from Congress.

Vice President Harris announced a number of actions and investments designed to improve the quality of life of the peoples of northern central America. driven by poverty, lack of economic opportunities, and out of control crime people in Guatemala, El Salvador, and Honduras are taking great risks and trusting criminal human traffickers to try to reach the US. The Administration is working to improve conditions in the Northern Triangle so that is no longer necessary. Vice President Harris announced $1 billion dollars in new investments as part of the Central America Forward public-private partnership, since 2021 it has invested $5.2 billion in the region. Harris also announced $175 million dollars of direct aid from the US to Guatemala at a meeting with Guatemalan President Bernardo Arévalo.

The Department of Energy announced a $1.5 billion dollar loan to help restart the Palisades Nuclear Plant. This would mark the first time a nuclear power plant was brought back online after being decommissioned. The hope is keep the plant running till 2051, this 100% green power source is projected to prevent 111 million tons of CO2 emissions in its new life time, the same as taking 100,000 cars off the road. Michigan Governor Gretchen Whitmer touted it as key for her state reaching its goal of 100% clean energy by 2040.

Vice President Harris launched a social media push to inform the public about the Biden-Harris Administration's SAVE Plan. The Saving on a Valuable Education (SAVE) Plan was launched last year as part of President Biden's efforts to bring student loan forgiveness to millions of borrowers. Currently 7.7 million people are enrolled in SAVE, under which anyone making $16 a hour or less has a monthly payment of $0 on their student loans. 4.5 million SAVE enrollees are making $0 a month payments and another 1 million pay less than $100 a month on their loan repayment, over 150,000 people so far have had their loans totally forgiven. Republicans are suing to try to shut down the SAVE Plan

President Biden took keep steps to ensure quality healthcare this week. Biden extended the window for low-income Americans to apply for Obamacare. The original deadline of July 31st has been pushed back to November 30th. Biden also rolled back Trump era rules that allowed subsidies for "Junk Health insurance" These plans offer very little coverage and often mislead consumers into believing they have insurance when they aren't covered. These short term plans also don't have meet Obamacare standards and can refuse coverage for preexisting conditions.

The EPA announced new regulations aimed at "turbocharging" the number of electric trucks on the road. The new rules aim to have 25% of new long-haul trucks, the heaviest often diesel trucks on the road, and 40% of medium-size trucks (box trucks and landscaping vehicles) be nonpolluting by 2032, currently just 2% are. The regulation would apply to more than 100 types of vehicles including tractor-trailers, ambulances, R.V.s, garbage trucks and moving vans. The new tailpipe limits are expected to prevent about a billion tons of greenhouse gas emissions by 2055.

the Centers for Medicare & Medicaid Services announced that thanks to President Biden's Inflation Reduction Act, 41 different drugs will coast those on Medicare Part B less money than it did last year. An estimated 763,700 people on Medicare use at least one of these drugs every year. Some enrollees will save as much as $3,575 per dose.

The Department of Energy announced $6 billion for an effort to decarbonize energy-intensive industries. The investment in 33 projects across 20 states will eliminate 14 million metric tons of CO2 emissions each year when finished. Each project is meant to be highly replicable and serve as a blueprint for future private sector ventures.

President Biden signed an Executive Order to Strengthen the Recognition of Women’s History. The Order will launch a review of all historic sites run by the National Parks Service to determine ways to better highlight the role of women, from all backgrounds, in American History.

The Senate Confirmed President Biden's nominees, Ernesto Gonzalez, and Leon Schydlower to federal judgeships in Texas. This brings the total number of federal judges appointed by President Biden to 190.

#Thanks Biden#Joe Biden#Democrats#politics#US politics#student loans#climate change#health care#immigration#bridge collapse

164 notes

·

View notes

Note

tbh i'm not sure the 'biden should use executive order to forgive all the student loans' crowd actually have any student loans because if they did they might know that one of his big actions--the SAVE plan, which replaced REPAYE with lower payments and no interest accumulation--is currently tied up in court and almost definitely not going to survive the new administration. (which is personally fucking me over because i'm aiming for PSLF and i'm now in a forced forbearance that doesn't count towards my required payments for god knows how long. but obviously i'm not blaming biden for that)

but obviously there's a magic wand he could wave to just forget about that! one that trump wouldn't be able to instantly undo in January

or maybe they do have student loans but they're making enough to not be on an income-driven repayment plan

33 notes

·

View notes

Text

How Project 2025 could radically reshape higher ed (insidehighered.com)

I know you've heard a lot of things about Project 2025 at this point and most of them are scary, but I think it's things like this that indicate that even the stuff in that plan that seems boring is very scary too. Here's a bit of an analysis on some of the plans regarding higher education.

Basically, they want to make it much, much harder to get student loans, and to make the loans you can get much harder to pay off. For so many people, the only way they'll ever be able to get a higher education is with the help of federal student loans. Without that assistance, and for degrees that don't guarantee a high-paying career quickly (such as art, history, literature-- so many subjects, most of them "soft-sciences") because having a high-income would be necessary to keep up with payments (as income-driven repayment plans will be eliminated)...a lot of people will not go to college. Particularly people from disadvantaged backgrounds.

So it would be that most high-school grads can't afford school, and the ones that take on loans have to prioritize careers that by nature aren't the ones taking on learning from history, culture, or political thought because it's hard to make money and advance quickly career-wise with those. It would gatekeep the "soft-science" subjects that tend to spur criticisms of society, history, and power to those who could afford to pay full-price-- who are also likely to be privileged and in the ruling class and thus the least likely to criticize the existing culture. And by gatekeeping that knowledge and its credentials, they could discredit anyone who hasn't studied the subject by saying that they are uninformed or uneducated and thus shouldn't be taken seriously. They would be in full control of the research being done and the types of papers being written. The end result is crippling the ability to even have academic discourse or research to refute their other policy goals.

Furthermore, the elimination of many repayment plans that already exist serves to punish the people who have already gotten degrees-- if you don't already have a stable job, trying to keep up with higher payments while your taxes go up (increasing tax rate for people making under $168k to 15% of income and eliminating pretty much every deduction, credit, and exclusion) and still affording the necessities (made much harder when Medicaid, SNAP, other social safety nets are cut) will be very challenging. And if you DO have a stable job and are educated on subjects that allow you to criticize the movement-- they can attack you and discredit you and make you lose that job if you publicly disagree. The way Project 2025 suggests restructuring the federal workforce is an example-- even if you're an expert, if you work in a federal agency and don't comply, you're gone.

The long-term purpose of all this is clear-- control the knowledge, control the history, prevent people from developing any skills to oppose you through research or academic theory, prevent people from going to institutions that can get them to question society and power. It is much harder to organize and develop ideas to oppose the people in power if you never get any chance to learn how or what others have done before you.

When the obstacles to getting educated become so great, so challenging, how many people will try? Why risk it, when you have more certainty working a blue-collar job instead? Why push young women to go to school when, if they take out loans, may not be able to maintain the payments if they get married and leave the workforce to have children-- or if they get pregnant (and will not be able to access birth control or an abortion) unexpectedly and also have to leave the workforce? With social safety net programs gutted and women forced to give birth upon becoming pregnant, and no early childhood education program to provide relief causing women to have to stay home, there would be no way to repay student loans for women who leave the workforce in this scenario. Being a woman is too much of a risk for higher ed in this world--how many will take that risk?

And none of this even scratches what Project 2025 wants to do to the colleges and universities themselves and how teaching certain subjects could cause them to lose funding. Again--how many will take that risk? Going bankrupt, or discussing critical race theory?

The real, long-lasting threat of this agenda, even beyond the immediate terrible effects on the LGBTQ+ community and disadvantaged communities, is to make life unlivable for those that disagree or exist in a way the right-wing doesn't like. It uses the whole of systems of power--governmental, financial, social, societal-- to work together in concert to make the only way to live be their way. It's not just one policy--it's all of them working together to crush people and make sure even those in a privileged position who could disagree...won't.

You know the call to action is to vote. But I'd also spend some time educating yourself on some of the more boring-sounding objectives in Project 2025. Don't feel pressured to read the whole thing yourself, because it's very long and dense as it IS actually written by smart and competent people who are conservative academics and former Trump staffers. That's why it's a problem-- these people are smart enough and know enough to make this plan work. But there are a lot of articles from reputable sources out there breaking down even the dullest-sounding parts of this plan-- please spend some time understanding the extent and educate those around you.

#us politics#politics tw#another post where i'm gonna be called stupid in the notes#while at the same time being told i shouldn't tell people bad news because it will make them not vote#seems to be a lot of those these days

31 notes

·

View notes

Text

Chris Geidner at Law Dork:

On Friday afternoon, a federal appeals court blocked the Biden administration from doing almost anything to provide student loan relief to those people nationwide whose loans are currently in income-contingent repayment plans. It was the third appeals court ruling relating to the Saving on a Valuable Education, or SAVE, program — and followed a June 30 order from a different appeals court that would have allowed the program to go into effect. Friday’s order from the U.S. Court of Appeals for the Eighth Circuit is the first of those appellate orders addressing the SAVE program that contained any substantive discussion of the effort. With the ruling, seven Republican-led states succeeded in getting a three-judge panel of all Republican appointees on a federal appeals court that only has one Democratic appointee to issue a nationwide injunction blocking the SAVE program. More than that, the injunction goes even further — blocking any similar relief, regardless of whether it is issued under the rule creating the SAVE program or otherwise.

The per curiam order issuing an injunction pending appeal, unsigned and with its grand total of eight pages of substance, was issued for Judge Raymond Gruender, a George W. Bush appointee, and Judges Ralph Erickson and Steven Grasz, Trump appointees. The ruling caused significant confusion coming a day or two after many borrowers across the country received word that their loans had been placed into forbearance following an earlier order from the same court in mid-July. Although the covered loans are not accruing interest during this time, according to the Education Department, the months the loans are in forbearance will not court toward borrowers’ Public Service Loan Forgiveness or income-driven repayment loan forgiveness time. Neither the Justice Department nor Education Department provided comment on Friday’s ruling or next steps in its immediate aftermath. The bottom line, though, is that the SAVE plan is blocked currently — and that this is not the final word.

Right-wing judicial activists on the 8th Circuit Court blocked the SAVE program from going forward.

#Saving On A Valuable Education#Student Loans#Biden Administration#8th Circuit Court#Missouri v. Biden#SAVE#Student Loan Debt#Higher Education#Alaska v. Cardona

16 notes

·

View notes

Text

I'm back on my Shitty Knight bullshit. Here goes:

I'm guessing Shitty’s dad paid for Shitty’s undergrad but not his law school. (I'm pretty sure Shitty was canonically a walk-on for SMH, meaning he wasn't recruited and didn't have an athletic scholarship.) There are scholarships for law school, but I don't think Shitty would have gotten a full ride to Harvard Law.

So Shitty graduates from Harvard Law in tens of thousands of dollars of debt, if not more. Lardo's a freelance artist still in the early stages of her career, so she's not making big bucks, and if Shitty becomes a public defender, he won't be either.

And like . . . broke student life is just different, at least in some ways, from broke post-school life. Shitty’s in an income-driven loan repayment plan/public service loan forgiveness, so the debt isn't as big a problem as it could be, but Boston is an expensive city to live in.

And I think there would come a point when Shitty would realize that he doesn't know how to be a low-income (or even middle-income) post-school adult. He went from living with his filthy rich father, to going to an ultra-elite boarding school for high school, to attending Ivies for undergrad and grad school. It's been a while since he had all the trappings of wealth he grew up with, but he's spent most of his life in very upper-class environments (with the Haus being the most prominent semi-exception, though as we know, hockey is an expensive sport and most of SMH comes from at least some degree of money).

And I don't primarily mean this in the sense that Shitty will realize all over again how privileged he is (though, being Shitty, he probably will). I primarily mean this in the sense that he'll realize there's a whole skill set involved in living without a lot of financial buffer or discretionary income, and that a lot of people gain this skill set by watching the people who raised them, and Shitty didn't. He had a head start when it came to a lot of academic knowledge and skills related to schmoozing, but he’s woefully behind when it comes to budgeting, cooking (especially on a budget), doing home maintenance or other repair work himself, etc.

I dunno, I just think there's a very particular kind of skill gap when you find yourself much, much poorer than your parents ever were, and I think it would be fascinating to explore this with Shitty in a genuinely empathetic way.

#check please#omgcp#omgcheckplease#a lin original#shitty knight#socioeconomics#welcome to mostly true stories with lin#there is a difference between 'i have money' and 'my terrible parents have money'

32 notes

·

View notes

Text

Conquering the Goliath: Advanced Maneuvers in the Student Loan Arena

Consolidation: The Unifier of Your Debt Battalions Consolidation is like summoning a council of your debts, uniting them under one banner for easier management. It’s not for everyone, but for those juggling multiple loans, it’s a strategy worth considering. Imagine Alex, who consolidated his federal loans, and found himself facing a single enemy instead of a horde, making his repayment strategy…

View On WordPress

#budgeting tips#celebrating financial milestones#credit score improvement#debt reduction strategies#emergency fund building#financial planning for graduates#income-driven repayment#investing while in debt#loan negotiation techniques#mental health and finances#personal finance education#post-debt financial planning#student loan management#student loan refinancing#student loan tax deductions

0 notes

Text

PSA to anyone else who is consolidating their student loans rn and also applying for income driven repayment plans at the same time….

EVIDENTLY most of those IDR applications aren’t submitting with your consolidation requests (even tho you’re prompted to do them together at the same time)

Which means along with your letter of “congrats your loan consolidation has been approved!” you may also get a second letter saying that the default repayment plan amount (the 10 yr one lol) is due. And you may have a panic attack bc there is no way in hell that is 5-10% of your discretionary income, and you went on a IDR plan bc you can’t afford the 10 yr one.

Do not panic! Call your servicer to put your new loan in processing forbearance and resubmit a new IDR plan request with federal student aid. You should be good to go.

Signed, someone who is supposed to be paying zero dollars and zero cents and got a bill for almost $400 due in 10 days and almost threw up but got it all sorted out after spending an hour and a half in the phone

#when I say I almost threw up I meant it#my brother in Christ I went with the IDR plan for a reason and that is to pay the absolute minimum before I apply for#public service forgiveness#but also I work in academia do you think I’m making 10 yr repayment plan money? with these grad school loans??

12 notes

·

View notes

Text

Trump & the Department of Education

Part of Trump’s Agenda47 is ten key ideas to improve schools and intention to dismantle the Department of Education and return the duties handled currently by that program to the individual states. Now, I have issues with several of Trump’s key ideas for school improvement but this post is about closing down the Department of Education.

First, Trump claims that we, the US, spend three times more money per pupil than any other nation and that we are at the bottom in education accomplishments. This is not accurate. The US is second in the amount of money we spend on our education (first is Luxembourg) and we rank 12th in the world for the development of our education system. That said, our spending is much higher than that of Japan, Canada, Korea, and Taiwan which all outperform the US in scores.

Second, let's talk about what the Department of Education does right now. The Department:

Establishes policies relating to federal financial aid for education, administers distribution of those funds, and monitors their use.

The Department distributes financial aid to eligible applicants throughout the nation for early childhood, elementary, secondary, and postsecondary education programs.

Collects data and oversees research on America’s schools and disseminates this information to Congress, educators, and the general public.

Identifies the major issues and problems in education and focuses national attention on them.

Enforces federal statutes prohibiting discrimination in programs and activities receiving federal funds and ensures equal access to education for every individual.

The Department enforces five civil rights statutes to ensure equal education opportunity for all students regardless of race, color, national origin, sex, disability, or age.

But what does that mean? Here are some highlights.

The Department funds Title I of the Elementary and Secondary Education Act which provides supplemental funding to high-poverty K-12 schools.

Head Start programs provide vital child care services for low income and rural communities across the country.

The Department administers Pell Grants which help low-income students attend college.

The Office of Special Education Programs provides resources to support students with disabilities through age 21.

The Department collects national data on schools and enforces federal civil rights laws to prohibit discrimination.

The Department serves as loan holder for most federal student loans.

Ending the Department would require much of what the Department already does to be relocated to other departments and agencies at either the federal or state level. As Trump gives no specific information as of now on how he plans to close down the Department of Education other than saying he’ll return duties to the state, I’ve turned to Project 2025 for potential clarity.

Beginning on page 319, Project 2025 outlines their vision for the dismantlement of the Department of Education. Much like Trump they state federal education policy should be limited and ultimately decisions should be left up to state and local governments. Federal funding for education should be provided as block grants without strings attached, and many of the duties involved in special programs, such as those involved with special education or education of indigenous people, would be transferred to other federal agencies. Student loan management would move to a new government agency that would work in tandem with the Treasury Department.

Project 2025 also calls to cut the Head Start program and roll back Title IX revisions that prohibit discrimination based on sexual orientation and gender identity. In regards to student loans, it calls to phase out Income Driven Repayment plans and remove loan forgiveness both for IDR plans and for public service.

Closing the Department of Education would require congressional action and possibly a super majority of 60 votes in the Senate which may be difficult for the Republicans to manage. Indeed, Trump isn't even the first Republican president to go after the Department of Education; many of them have long been calling for its elimination since its creation by Jimmy Carter in 1979. In short, the Trump administration will face a very uphill battle with this goal.

#democracy#democrat#democratic party#republican#republican party#donald trump#trump#us politics#politics#department of education

3 notes

·

View notes

Text

The Best News of Last Week

1. ‘It was an accident’: the scientists who have turned humid air into renewable power

Greetings, readers! Welcome to our weekly dose of positivity and good vibes. In this edition, I've gathered a collection of uplifting stories that will surely bring a smile to your face. From scientific breakthroughs to environmental initiatives and heartwarming achievements, I've got it all covered.

In May, a team at the University of Massachusetts Amherst published a paper declaring they had successfully generated a small but continuous electric current from humidity in the air. They’ve come a long way since then. The result is a thin grey disc measuring 4cm across.

One of these devices can generate a relatively modest 1.5 volts and 10 milliamps. However, 20,000 of them stacked, could generate 10 kilowatt hours of energy a day – roughly the consumption of an average UK household. Even more impressive: they plan to have a prototype ready for demonstration in 2024.

2. Empty Office Buildings Are Being Turned Into Vertical Farms

Empty office buildings are being repurposed into vertical farms, such as Area 2 Farms in Arlington, Virginia. With the decline in office usage due to the Covid-19 pandemic, municipalities are seeking ways to fill vacant spaces.

Vertical farming systems like Silo and AgriPlay's modular growth systems offer efficient and adaptable solutions for converting office buildings into agricultural spaces. These initiatives not only address food insecurity but also provide economic opportunities, green jobs, and fresh produce to local communities, transforming urban centers in the process.

3. Biden-Harris Administration to Provide 804,000 Borrowers with $39 Billion in Automatic Loan Forgiveness as a Result of Fixes to Income Driven Repayment Plans

The Department of Education in the United States has announced that over 804,000 borrowers will have $39 billion in Federal student loans automatically discharged. This is part of the Biden-Harris Administration's efforts to fix historical failures in the administration of the student loan program and ensure accurate counting of monthly payments towards loan forgiveness.

The Department aims to correct the system and provide borrowers with the forgiveness they deserve, leveling the playing field in higher education. This announcement adds to the Administration's efforts, which have already approved over $116.6 billion in student loan forgiveness for more than 3.4 million borrowers.

4. F.D.A. Approves First U.S. Over-the-Counter Birth Control Pill

The move could significantly expand access to contraception. The pill is expected to be available in early 2024.

The Food and Drug Administration on Thursday approved a birth control pill to be sold without a prescription for the first time in the United States, a milestone that could significantly expand access to contraception. The medication, called Opill, will become the most effective birth control method available over the counter

5. AIDS can be ended by 2030 with investments in prevention and treatment, UN says

It is possible to end AIDS by 2030 if countries demonstrate the political will to invest in prevention and treatment and adopt non-discriminatory laws, the United Nations said on Thursday.

In 2022, an estimated 39 million people around the world were living with HIV, according to UNAIDS, the United Nations AIDS program. HIV can progress to AIDS if left untreated.

6. Conjoined twins released from Texas Children’s Hospital after successfully separated in complex surgery

Conjoined twins are finally going home after the pair was safely separated during a complex surgery at Texas Children’s Hospital in June.

Ella Grace and Eliza Faith Fuller were in the neonatal intensive care unit (NICU) for over four months after their birth on March 1. A large team of healthcare workers took six hours to complete the surgery on June 14. Seven surgeons, four anesthesiologists, four surgical nurses and two surgical technicians assisted with the procedure.

7. From villains to valued: Canadians show overwhelming support for wolves

Despite their record in popular culture, according to a recent survey, seven in 10 Canadians say they have a “very positive” view of the iconic predators.

Here's a fascinating video about how wolves changed Yellowstone nat'l park:

youtube

----

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation:

Support this newsletter ❤️

Also don’t forget to reblog.

1K notes

·

View notes

Text

I'm sorry, I don't mean to be a downer, but I feel like everything I see in response to the recent fascist takeover of the US is either people dunking on their republican relatives or messages like "It may be hard, but the best thing you can do is to keep surviving and keep being yourself 🥰". And sure, yes, these things are good, these things are necessary to give people some hope and drive right now.

But I keep seeing this stuff and thinking, OK, how. HOW do you want me to keep surviving. I feel like i am staring down the barrel of Project 2025 before it obliterates everything I've been working toward.

Student loan forgiveness programs are on the chopping block, along with income driven repayment plans. Career-based forgiveness programs could be cut, too, which means that working a federal lab job (something that was a good option for me) will not lead to loan forgiveness.

That's not to mention that science funding will be drastically cut, so museum or education jobs may not exist. The CarbonSAFE program, part of the Inflation Reduction Act, funded almost all of my internship last summer (which was my main fallback) and it's also a target. And they're talking about cutting the entire EPA, which means even if the federal lab jobs would still be good, many of them won't exist.

All of this, and healthcare, housing, and employment are all probably going to take big hits across the board. Tariffs will almost certainly drive up the cost of everyday stuff like groceries (we import a huge amount of food here in the US).

And I know, I KNOW, I'm not the most at-risk demographic. I'm not pretending like this all impacts me more than anyone else. Other people are at risk of increased hate crimes, sexual assault, and deportation, just to name a few of the horrible things that are on the rise. Rights could be taken away from marginalized groups who fought hard for them. People who need reproductive care could lose access to it. I am not at risk in these ways like some other people are.

But I don't know how to help them. I'm broke! I have have nothing to give that can make a difference. I don't even know how to help myself. And it feels like I built a ship just for someone torpedo it indiscriminately. It feels like everything I'm working for, the degree I'm working toward so that I could actually have a future, is going to be worthless. And like when I graduate, whether I go to grad school or not, it's going to be too unaffordable to live. I've felt like I've barely been able to keep my head above water as it is, but now I feel like I'm still barely treading water and I'm being sucked toward a waterfall.

So what do I do? HOW do I survive? None of the "the biggest act of resistance is to keep on living" bullshit is helpful. And I can imagine that people who are worried about even bigger existential threats feel the same way. What the FUCK do we DO?

3 notes

·

View notes

Text

It’s never been a better time to get rid of your student debt.

Although President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court, his administration has explored all of its existing authority to leave people with less education debt.

As a result, more than 3.7 million Americans have received loan cancellation during Biden’s time in office, totaling $136.6 billion in aid.

In a recent exclusive interview with CNBC, Rep. James Clyburn, D-S.C., who has been a vocal advocate for student loan borrowers, said he’s heard from the U.S. Department of Education that every two months over the next four years, another 75,000 people will be eligible to have their debt forgiven due to changes in income-driven repayment plans and Public Service Loan Forgiveness.

-----

The Biden administration has been evaluating millions of borrowers’ loan accounts to see if they should have had their debt forgiven. So far, more than 930,000 people have benefited, receiving over $45 billion in debt cancelation.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Recently, the Education Department also announced it would soon cancel the debts of those who’ve been in repayment for a decade or more and originally took out $12,000 or less. To qualify, borrowers need to be enrolled in the administration’s new Saving on a Valuable Education, or SAVE, plan.

-----

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 790,000 public servants have gotten their debt erased as a result, amounting to more than $56 billion in relief.

------

The Biden administration has also forgiven the student debt of more than 510,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability Discharge.

----

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

-----

The Biden administration is also working to revise its broad forgiveness plan to make it legally viable.

The president may try to deliver that relief before November.

That alternative plan, which has become known as Biden’s “Plan B,” could forgive the student debt for as many as 10 million people, according to one estimate.

#thanks Biden#Joe Biden#student loans#student loan debt#student loan forgiveness#if you have student loan debt one of these programs likely applies to you#check it out

63 notes

·

View notes