#if you have student loan debt one of these programs likely applies to you

Explore tagged Tumblr posts

Text

It’s never been a better time to get rid of your student debt.

Although President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court, his administration has explored all of its existing authority to leave people with less education debt.

As a result, more than 3.7 million Americans have received loan cancellation during Biden’s time in office, totaling $136.6 billion in aid.

In a recent exclusive interview with CNBC, Rep. James Clyburn, D-S.C., who has been a vocal advocate for student loan borrowers, said he’s heard from the U.S. Department of Education that every two months over the next four years, another 75,000 people will be eligible to have their debt forgiven due to changes in income-driven repayment plans and Public Service Loan Forgiveness.

-----

The Biden administration has been evaluating millions of borrowers’ loan accounts to see if they should have had their debt forgiven. So far, more than 930,000 people have benefited, receiving over $45 billion in debt cancelation.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Recently, the Education Department also announced it would soon cancel the debts of those who’ve been in repayment for a decade or more and originally took out $12,000 or less. To qualify, borrowers need to be enrolled in the administration’s new Saving on a Valuable Education, or SAVE, plan.

-----

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 790,000 public servants have gotten their debt erased as a result, amounting to more than $56 billion in relief.

------

The Biden administration has also forgiven the student debt of more than 510,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability Discharge.

----

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

-----

The Biden administration is also working to revise its broad forgiveness plan to make it legally viable.

The president may try to deliver that relief before November.

That alternative plan, which has become known as Biden’s “Plan B,” could forgive the student debt for as many as 10 million people, according to one estimate.

#thanks Biden#Joe Biden#student loans#student loan debt#student loan forgiveness#if you have student loan debt one of these programs likely applies to you#check it out

63 notes

·

View notes

Text

capitalism is gonna kill me

#ive been trying to get a job since april. ive probably sent out 50 or more applications to like. retail stores mostly but a couple other#places. nothing. one place scheduled an interview for me then canceled it the day before#i missed the window to apply for student loans for the spring and summer semesters so ive been living off savings. i have enough money to#MAYBE last until next month. idk what to do. ive looked for like rent assistance programs but the government website i found said that they#arent giving out subsidies if you have a private landlord? which by their criteria im pretty sure i do#so! yeah. this is fine. its totally cool#im about to be dramatic and mentally ill here next but like. genuinely if i cant afford to keep going to uni i think i might just off myself#i am completely miserable when im not in uni. i am miserable when working any job ive ever had. im in pain all the time. i dont qualify for#any assistance program ive been able to find. like. whats the point. i dont wanna be alive and miserable and homeless and also in debt#i dont have any help. idk what to do. like what do i even do in this situation. besides die or become homeless

1 note

·

View note

Text

back to basics

mostly free resources to help you learn the basics that i've gathered for myself so far that i think are cool

everyday

gcfglobal - about the internet, online safety and for kids, life skills like applying for jobs, career planning, resume writing, online learning, today's skills like 3d printing, photoshop, smartphone basics, microsoft office apps, and mac friendly. they have core skills like reading, math, science, language learning - some topics are sparse so hopefully they keep adding things on. great site to start off on learning.

handsonbanking - learn about finances. after highschool, credit, banking, investing, money management, debt, goal setting, loans, cars, small businesses, military, insurance, retirement, etc.

bbc - learning for all ages. primary to adult. arts, history, science, math, reading, english, french, all the way to functional and vocational skills for adults as well, great site!

education.ket - workplace essential skills

general education

mathsgenie - GCSE revision, grade 1-9, math stages 1-14, provides more resources! completely free.

khan academy - pre-k to college, life skills, test prep (sats, mcat, etc), get ready courses, AP, partner courses like NASA, etc. so much more!

aleks - k-12 + higher ed learning program. adapts to each student.

biology4kids - learn biology

cosmos4kids - learn astronomy basics

chem4kids - learn chemistry

physics4kids - learn physics

numbernut - math basics (arithmetic, fractions and decimals, roots and exponents, prealgebra)

education.ket - primary to adult. includes highschool equivalent test prep, the core skills. they have a free resource library and they sell workbooks. they have one on work-life essentials (high demand career sectors + soft skills)

youtube channels

the organic chemistry tutor

khanacademy

crashcourse

tabletclassmath

2minmaths

kevinmathscience

professor leonard

greenemath

mathantics

3blue1brown

literacy

readworks - reading comprehension, build background knowledge, grow your vocabulary, strengthen strategic reading

chompchomp - grammar knowledge

tutors

not the "free resource" part of this post but sometimes we forget we can be tutored especially as an adult. just because we don't have formal education does not mean we can't get 1:1 teaching! please do you research and don't be afraid to try out different tutors. and remember you're not dumb just because someone's teaching style doesn't match up with your learning style.

cambridge coaching - medical school, mba and business, law school, graduate, college academics, high school and college process, middle school and high school admissions

preply - language tutoring. affordable!

revolutionprep - math, science, english, history, computer science (ap, html/css, java, python c++), foreign languages (german, korean, french, italian, spanish, japanese, chinese, esl)

varsity tutors - k-5 subjects, ap, test prep, languages, math, science & engineering, coding, homeschool, college essays, essay editing, etc

chegg - biology, business, engineering/computer science, math, homework help, textbook support, rent and buying books

learn to be - k-12 subjects

for languages

lingq - app. created by steve kaufmann, a polygot (fluent in 20+ languages) an amazing language learning platform that compiles content in 20+ languages like podcasts, graded readers, story times, vlogs, radio, books, the feature to put in your own books! immersion, comprehensible input.

flexiclasses - option to study abroad, resources to learn, mandarin, cantonese, japanese, vietnamese, korean, italian, russian, taiwanese hokkien, shanghainese.

fluentin3months - bootcamp, consultation available, languages: spanish, french, korean, german, chinese, japanese, russian, italian.

fluenz - spanish immersion both online and in person - intensive.

pimsleur - not tutoring** online learning using apps and their method. up to 50 languages, free trial available.

incase time has passed since i last posted this, check on the original post (not the reblogs) to see if i updated link or added new resources. i think i want to add laguage resources at some point too but until then, happy learning!!

#study#education resources#resources#learning#language learning#math#english languages#languages#japanese#mandarin#arabic#italian#computer science#wed design#coding#codeblr#fluency#online learning#learn#digital learning#education#studyinspo#study resources#educate yourselves#self improvement#mathematics#mathblr#resource

665 notes

·

View notes

Text

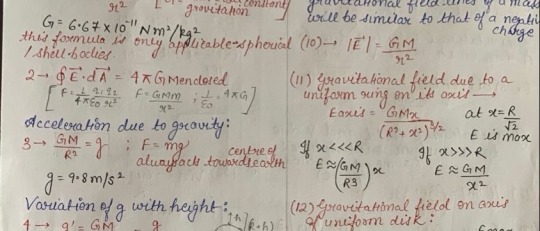

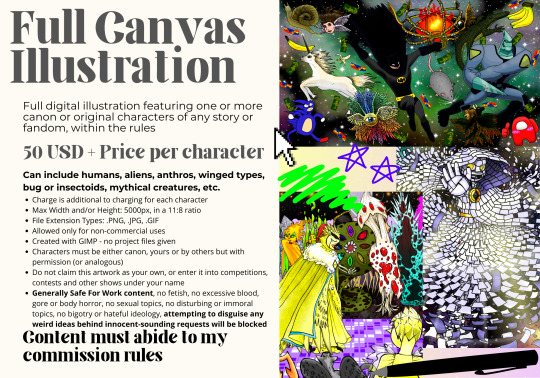

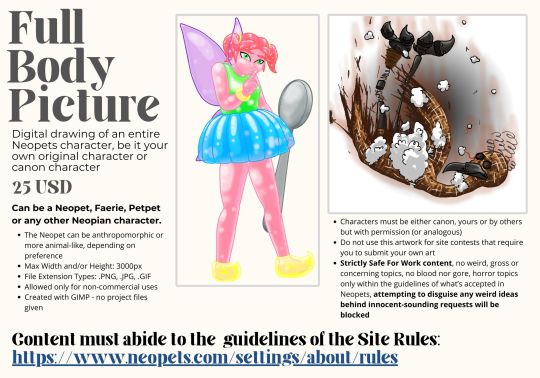

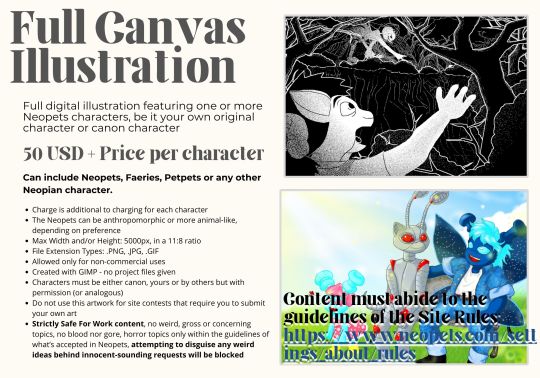

Art Commissions Open

Alright, so here we go, take two. I am offering art commissions, both in general and for Neopets characters, as a way to supplement my income.

The general commissions can be found at my Ko-Fi: https://ko-fi.com/eternalsailorchaos16088/commissions

My Ko-Fi's Commission Rules: https://ko-fi.com/post/Commission-FAQs-and-Rules-I3I2WLN2J

The Neopets-specific commission shop is at: https://shoppy.gg/@EternalSailorCha

My Neopets Fanart Shoppy's Rules: https://eternalsshoppyrules.carrd.co/

Context: I am an undergraduate student in one of Brazil's public universities, who lives on financial assistance of the university and my undergrad research fellowship, but those assistance amounts are becoming less and less able to cover the costs of maintaining myself in university, as housing and food costs are going through the roof in my city, and I can't even live at home with parents, because I do not have a home to go to.

My main source of supplementary income, translation, has been taking a nosedive with the advent of AI translation and automatization of translation, and so I go on for way too long without jobs to work, and I keep on getting myself into credit card debt and loans to cover basic needs or whenever something happens, like me getting sick and needing meds, which is very often. I have a terrible schooling schedule for me to get any type of job, as my university does not care for poorer students beyond the small financial assistance they give, and make you have to toil and beg to get. Meanwhile, my parents can help with some assistance, but it is becoming lesser and lesser and more unstable, and I share it with my sister.

I need to be able to finish my undergraduate, and be able to sustain myself through my graduate studies, and, on a shorter term, I need to gather up money, for example to move to a different place, where I can rent my own room instead of sharing it. Also, I need money for my monthly expenses, like food and transport. This is why I have decided to take up commissions, and applied for the Neopets fanart program (although I have yet to hear back from them).

If you want to see your character or a character you like, or a full illustration, done in my artstyle, then please do feel free to peruse my commissions and message me at here, or in my email or IG to talk about it.

Thank you very much for your time.

#neopets#neotag#neoart#my art#digital art#art commissions#art#commissions#commission#art commish#art comms open#art commissions open#artists on tumblr#furry#sfw furry#furry art#furry commissions#furry comms open#kids' gaming#online games#gaming websites#pet simulators#pet site#pet sim#update: I *am* living on my own now! But that still means I need money#more money than before I guess

39 notes

·

View notes

Note

Hello! I wanted to ask about Americorps. :) First off, are they always taking people? Given the difficulty of finding a job as of late, I was wondering if hiring/the acceptance of applications has slowed any. Second, what's the pay like? Is it just enough to live on, or enough that you could put some towards college debt or savings? Third, where could you apply; are there recruiting centers or is it all online? Fourth, what's life like in the corps, per your experience?

Here are the programs currently accepting applications (6/4/24). The applications are pretty much always open for at least one entry time (there are 3 entries per year- Fall, Winter, and Summer). I know that the acceptance rate changes with the number of applications, and some years they take everyone, while other years they take fewer applicants. The only way to know if you get in is to apply.

You can use the search feature below to see what programs are available. Make sure the "AmeriCorps NCCC" and "AmeriCorps NCCC Team Leaders" buttons are clicked, click nothing else, and hit "search".

Since it's service, the pay is a stipend. When I was in NCCC in 2018, the stipend for CMs was $300/month and the stipend for TLs was $800/month. I think it's more now so if anyone knows please let me know so I can give more updated info. Keep in mind that:

All your basics- food, transportation, lodging, etc... is covered in full

Any federally backed student loans you have go into forbearance and the interest is paid by AmeriCorps

You get an education award of about $7,000 per service term (up to 2) that can go toward future education, job training or to pay off existing student loans

Basically the only thing you pay for while in NCCC is your cell phone bill and any personal care items, personal clothing, etc...

I saved about half of my stipend while I was in NCCC

Other AmeriCorps programs, like VISTA, pay essentially the local poverty line, since part of the program is learning to live on very little.

You apply online. Call 1-800-942-2677 if you need any help with the application.

25 notes

·

View notes

Text

Over the last 16 years, presidential administrations of both parties have wielded the power of the Education Department not to just carry out congressional legislative directives but also to make their own policies—reshaping the federal government’s role in higher education. They’ve retooled the rules for accreditors, added new accountability measures for for-profit programs, overhauled the student loan system and changed how colleges respond to reports of sexual misconduct.

Not all of the policy changes survived legal challenges, but the legacy of legislating via regulation has endured. As Congress struggled to pass meaningful legislation related to higher education thanks to partisan gridlock, presidents increasingly opted to use the rule-making process to leave their mark on America’s colleges and universities.

But future administrations likely won’t be rewriting regulations in the same way after the Supreme Court on Friday ended a 40-year precedent under which federal courts deferred to agencies’ interpretations of ambiguous statutes. Chief Justice John Roberts Jr. wrote in the majority opinion that the deference to agencies known as the Chevron doctrine “cannot be reconciled” with the federal law dictating how the executive branch writes policies. Instead, federal judges should be empowered to determine whether a regulation complies with federal law.

“In one fell swoop, the majority today gives itself exclusive power over every open issue—no matter how expertise-driven or policy-laden—involving the meaning of regulatory law,” Justice Elena Kagan wrote in the dissent to last week’s ruling.

The court’s decision inLoper Bright Enterprises v. Raimondo significantly weakens the Education Department and other federal agencies and could grind the gears of higher ed policymaking to a halt unless Congress steps up, experts said Monday, warning of chaos and uncertainty for colleges and universities.

“Almost every aspect of running a modern campus is dictated in some way by federal regulations or guidance—whether that’s how you make staffing, compensation, training or enrollment decisions all the way down to the level of what you put on your website,” Jon Fansmith, senior vice president for government relations and national engagement at the American Council on Education, writes in an essay for Inside Higher Ed today. “It can be burdensome or contradictory and in some cases nonsensical, but mostly it was ‘the law.’ No more.”

The Biden administration’s new rules on Title IX, debt relief, gainful employment and more could all face greater judicial scrutiny in a post-Chevron environment. Case in point: On Monday a federal judge presiding over a lawsuit challenging the new Title IX rule requested that the states suing and the administration’s lawyers file briefs addressing the potential impact of the Loper Bright decision. What could happen to the batch of rules negotiated in the spring that deal with accreditation, state authorization and textbook pricing is also uncertain.

Some policy analysts, though, question the significance of the court’s decision, given that the doctrine hasn’t been applied consistently across the judiciary and that the Supreme Court hasn’t relied on it since 2016. Jason Delisle, a nonresident senior policy fellow at the Urban Institute’s Center on Education Data and Policy, said agency actions are challenged in courts all the time and judges could still side with the department.

Delisle added that those bemoaning the end of Chevron seem to be supporting the idea that “Congress can pass vague laws and agencies can do whatever they want.”

“If it really is as big of a deal as people think it is, then there’s a really easy solution, which is Congress can just specify things in law more and don’t make bold moves in your regulation,” Delisle added. “What’s so bad about that?”

In a signal of what’s to come from Republicans in Congress, Dr. Bill Cassidy, a U.S. senator from Louisiana, sought more information over the weekend about how the Education Department plans to comply with the court’s ruling.

“Given your agency’s track record, I am concerned about whether and how the department will adapt to and faithfully implement both the letter and spirit of this decision,” wrote Cassidy, the top Republican on the Senate education committee. “The department has flagrantly and repeatedly violated the law.”

Cassidy celebrated Chevron’s demise, saying in a statement that Chevron deference allowed unelected bureaucrats “to exercise power that exceeds their authority” and that the decision returns the role of legislating to Congress. The association representing for-profit colleges and universities also applauded the court’s decision.

“No agency has overreached more in exceeding congressional authority than the current U.S. Department of Education,” said Jason Altmire, chief executive officer of Career Education Colleges and Universities. “We are pleased that the Supreme Court has, once and for all, restrained the ability of the ideologically driven bureaucrats in the department to craft regulations based upon their own whims and biases, rather [than] what Congress had intended.”

Chevron Deference and Higher Ed

A 14-year project at the federal level to define what it means “to prepare students for gainful employment in a recognized occupation” is a case study in how agencies rely on Chevron deference to justify their actions.

When Congress first required some higher education programs to prepare their students for gainful employment in 1965, it didn’t define the term. Then, in 2010, the Obama administration’s Education Department rolled out a proposal to measure whether students were prepared for employment largely by looking at their debt load and earnings. Programs that failed the tests in the proposal would’ve lost access to federal financial aid, though that never happened.

The 2010 version of the so-called gainful-employment rule was struck down by the courts, but a district judge dismissed a challenge to the 2014 regulations, citing Chevron. The Trump administration later rescinded that rule, but the Biden administration resurrected the issue last year.

The latest version of the gainful-employment rule took effect Monday and applies to programs at for-profit institutions as well as nondegree programs in any sector, but the demise of Chevron could make the regulations more vulnerable to challenge.

Rebecca Natow, an assistant professor of educational leadership and policy at Hofstra University who researches federal higher education policymaking, said the end of Chevron will likely open the door to more lawsuits challenging administrative actions from regulations to guidance documents and the latest gainful-employment rule could be in trouble now.

“Without Chevron deference, courts can second-guess what agencies are deciding,” said Natow. “That’s problematic. The judges and federal law clerks are lawyers, not experts. They’re not living in the regulations the way the people that work in the agencies are … Just because agencies are unelected bureaucrats, it’s not a reason to take the deference away from them. They have all of that technical knowledge, all of that expertise.”

Barmak Nassirian, vice president for higher education policy at Veterans Education Success, an advocacy group, has participated in several rounds of rule making on gainful employment and other topics. He’s worried about giving judges the power to decide higher education policy—judgments that require an understanding of the technical details of regulations.

“We’re talking about taking challenges that make your eyes glaze over,” he said. “The notion that you can now take this to a judge who has never heard of gainful employment until the case has popped up—it’s hard to believe.”

Nassirian added that deference to agencies isn’t “always a happy thing,” particularly if you disagree with the party in power. But then when the politics favor your interests, he said, there are opportunities to change policies.

“That’s the nature of democracy,” he said. “This basically ends all of that.”

‘Congress Is a Mess’

For Rachel Fishman, director of higher education policy at New America, a left-leaning think tank, the fallout of the Loper Bright decision is hard to imagine in terms of the potential impact of new and future regulations. It won’t be good for students and taxpayers, she predicts, though other potential ramifications are unclear.

“It shows the importance of statute moving forward, and boy, does that worry me, because Congress is a mess,” she said. “It’s hard to envision good, thoughtful, smart bipartisan [legislation].”

The Higher Education Act of 1965, last updated in 2008, is long overdue for a refresh, and Fishman said that reauthorizing the legislation that governs federal financial aid programs and a range of other policies is going to be even more important post-Chevron.

Natow expects the end of Chevron to bring federal policymaking to a “near standstill” with a divided Congress and increasing political polarization that makes bipartisan compromise elusive.

“It’s really, really hard to get any meaningful higher education legislation through Congress, and I can’t imagine [this decision] is going to jolt Congress into, all of the sudden, wanting to have the two parties work together and pass legislation.”

Ending Chevron also means that when Congress does pass a law, the legislation will have to be more detailed and clear. But, Natow said, the more detailed the legislation gets, the harder it is to build consensus.

“Legislation has to be vague or it would never get through,” she said.

Nassirian is also skeptical of Congress’s capacity to step in and fill the void left by a potentially weaker Education Department.

“Congress, at some point, has to rely on the agency,” he said. “I just can’t grasp the notion of attempting to run the government through explicit legislative authorization. So it’s hard to do lots of details. There’s lots of things that are susceptible to change that cannot be chiseled into marble through legislative language. So there has to be some discretion, some interpretive discretion, for agencies to run the system … You really ponder how we can function as a country.”

11 notes

·

View notes

Text

Maximizing Best Credit Card In India Insider Tips and Tricks

What is a Credit Card?

Best Credit Card India is a economic tool issued through banks or economic institutions that permits cardholders to borrow budget to pay for items and offerings. It operates on a credit score limit, that's the maximum amount you may borrow, and is normally paid again monthly.

Types of Credit Cards

Rewards Credit Cards

Cash Back Cards

Offer a percentage of your spending lower back as coins. Ideal for ordinary purchases.

Travel Rewards Cards:

Earn factors or miles for travel-associated expenses, frequently with delivered tour advantages.

Low-Interest Credit Cards

Designed for folks that may also carry a balance from month to month. These cards generally have decrease annual percent prices (APRs).

Balance Transfer Credit Cards

Allow you to transfer high-interest debt from different playing cards, regularly with promotional low or 0% hobby charges for a certain period.

Secured Credit Cards

Require a coins deposit as collateral. They are beneficial for constructing or rebuilding credit score history.

Student Credit Cards

Tailored for college college students, these playing cards frequently have decrease credit limits and can offer rewards for responsible utilization.

Business Credit Cards

Designed for commercial enterprise fees, imparting capabilities like fee monitoring, higher limits, and rewards tailor-made for business spending.

Key Features

Credit Limit

The maximum amount you could charge for your card.

Interest Rate (APR)

The fee of borrowing cash, expressed as an annual percentage.

Annual Fee

A price charged every year for the use of the cardboard, which may vary based totally on the card kind.

Rewards Program

Points or cash back earned on purchases, which may be redeemed for diverse rewards.

Introductory Offers

Promotions like 0% APR for a certain period or bonus rewards for brand spanking new cardholders.

Benefits of Using Credit Cards

Building Credit History

Responsible use can improve your credit score, which is crucial for loans and mortgages.

Convenience

Easily make purchases on line and in-save without carrying coins.

Rewards and Discounts

Earn rewards on spending and access special offers.

Fraud Protection

Many credit score playing cards offer zero liability for unauthorized transactions.

Emergency Funds

Can function a backup in case of surprising costs.

Responsible Credit Card Use

Pay On Time

Always pay your payments by using the due date to keep away from late expenses and hobby costs.

Monitor Your Spending:

Keep song of your purchases to live inside your finances.

Keep Balances Low

Aim to use no greater than 30% of your credit restrict to preserve a healthy credit rating.

Read the Fine Print

Understand the terms, charges, and interest fees associated with your card.

Review Statements

Credit Card Apply Online regularly check your statements for accuracy and document any suspicious hobby.

Conclusion

It can be valuable financial tools when used responsibly. They offer flexibility, rewards, and the opportunity to build credit score, however it’s vital to manipulate them wisely to avoid debt and keep a wholesome financial profile. Before applying for a credit card, evaluate your spending behavior and pick out one which aligns together with your economic dreams.

2 notes

·

View notes

Text

y'know i watch a lot of dave ramsey on my fb feed, ever since my parent sent me the video where a young couple had $750,000 worth of student loan and other debt. but like. although most of their advice is relatively okay/good for saving up and getting out of debt, the one piece of advice i take issue with today, mostly bc i feel like being pissed about something is "just get any job before you get THE job! you need work and money TODAY and also a side hustle if you have free time to watch netflix between 3 other jobs!"

like. i have been TRYING to just get ANY job for a year now, ever since i left my shitty and toxic asf traineeship/cadetship..... that made me so fucking anxious and stressed that i crashed my car so bad that i bashed in my back windscreen, my boot/trunk and knocked off my back wheels and exhaust pipe (and i also destroyed their multilevel parking.... and i refused to follow up on their building insurance to fix. ALSO my car is actually fine. my insurance fixed it lmao. it took like 3 whole months).

i've been trying for the past year ever since my shitty overly critical, controlling and micromanaging boss completely ruined my chance of a good stable job where i got BUMPED UP from trainee to a full admin assistant during the interview process..... all because i REFUSED to listen SPECIFICALLY to her and hr to be a disability/community support worker bc "tHeY'rE sOoOoOo DeSpErAtE fOr WoRkErS wHy DoN't YoU cArE!!!!????" and "SHE HAS THE WRONG PERSONALITY FOR ADMIN!!!!!" et al.... that she called me to demand to know EXACTLY what jobs i was applying for directly after she gave that bullshit reference report so she could guilt me to "use your (my) giving heart." *enter every tag rant i've made about this sitch on this hellsite here*

where people, performance and culture told me to get assessed and medicated for anxiety and depression. where one of the course coordinator ladies of the cert IV in housing course i did as part of this program told me to "hurry up and get assessed and medicated for ADHD bc it's ruining your KPIs and business performance!" bc i went too fast through my assessments for her to help me..... and "YoU'rE NoT fIgHtInG fOr YoUr CaReEr HaRd EnOuGH!!!!" whenever i got told both by my manager and my mentor that any chance for me to move up or do anything for my assessments was "not relevant to you" (even in TEAM MEETINGS!) and "just accept it's not in YOUR journey with us!!!". and finally where another coworker kept asking me if i had some undiagnosed disability that i hadnt told them about.... on the way to one of the very seldom inspections that i was SUPPOSED to be doing by myself, by the end of the program. but they continually barred me from doing. how the fuck was i meant to stay here and do anything successfully and healthily in this toxic ass workplace???

i've tried for a fucking year to get "just any job". be it from kmart to fucking heavy labouring shift work at the local steelworks.... bc i am fucking desperate.... to even a support worker in the last couple of months. that i didnt have good ref reports for (and quite understandably so this time bc this job is basically like rudimentary nursing which i've NEVER been interested in). but again i was desperate. and i wanted to test shit boss's/shit HR's hypothesis that it was "an instant job! it'll be so easy for you! bc you're so nice, and giving, and down to earth, and friendly!!! all it is, is making friends all day with your interests!! what the perfect job for you!!' ma'am i am NOT 18 like your son that you keep referencing whenever we talk about this. i am 27/28 (at the time). why the fuck are you SO condescending, belittling and supercilious?

i have been trying for a fucking year to get any fucking job possible.... when it's literally impossible.... when even rudimentary/entry level jobs like working at kmart or woolies or even as a door greeter/customer service person at a local bank; come with test after test after test after test...... that give you results like "you have big dreams and we can't help you achieve them!" or "you have NO emotional regulation and intelligence, and resilience skills whatsoever. why did you even apply to work for social services?! goodbye." or "you don't know what INNOVATION means bc you're too scared to try or come up with new ways to do things." shitbot.AI for social services. you're a government agency. you're the LEAST innovative fucking business in the ENTIRE country.... for personality readings. batshit insane multi-tasking tests like this one:

i NEVER pass these tests, whether they're the standard personality test or the psychometric tests like the one pictured, or the system thinking ones... fictional staff IM chat ones; etc etc etc. FOR A FUCKING SEWING/ARTS/HABERDASHERY SHOP. the list goes on and on. where you only have 30 seconds to get every little bit of it right in 20 questions. i failed that screenshot test big time for the local bank. bc i can't math and i felt way too rushed.

there's so many job descriptions you have to dodge bc they don't list salary properly (eg monthly figures i've seen for writing jobs or one for working for influencers i saw last week) OR even AT ALL..... instead sometimes they just "profile salary match" bc they don't want to pay jack fucking shit. overly presumptuous and fucking patronizing as all fuck small business owners who are SO FUCKING sanctimonious about the supposed importance of working in a FAMILY OWNED small business as opposed to a MuLtInAtIoNaL where apparently "you can just go home and forget about work! not HERE!" that's such a massive red flag. since they think that, from the outset, they have the RIGHT to treat APPLICANTS like they have shit-for-brains for 85k a year...... and begging for this specific attribute in the JD from applicants:

that hey. maybe it's not fucking worth applying for that and losing my sanity over ANOTHER god-awful boss and a 2hr commute to work (ie it was in southwestern sydney which is a 2hr commute for me where i live). also, as a caveat. who the fuck has had stable employment since 2020???? since the worldwide fucking pandemic??? where so many industries have laid off droves and droves of employeess??? and it's still happening?? like ok given this was as a HR admin support position and i assume a lot of HR people had career stability during the last 4 years. but also. what the ACTUAL fuck.

i am TRYING to get any fucking job possible. but it's hard to take some jobs seriously. these are the attributes of some influencer advertising/marketing firm and one of their "KPI's/company values was "honor" and was like "honor the vibes and the company" or whatever the fuck i found on indeed last week:

it's also hard to take some admin jobs seriously. for example, a local wealth management firm DOESN'T list the salary of a customer service/admin/whatever the fuck else they called it "rockstar/superstar"position..... that DEMANDS the desired candidate does the job of the equivalent of 6 other people in their branch whilst ALSO doing the admin work of their two other regional offices. what the fuck is the pay for this position??? why won't you list it??? is just THAT GOOD AND HIGH???? or just THAT LOW AND AWFUL???? fucking list it, you dumb cowardly bastards.

again, i've been trying to get any job for the past fucking year, that i've finally started to slightly dumb down my resume by finally deleting my advanced diploma of marketing. it's a daily fucking struggle to not go feral and start bitch-posting on my linkedin about how fucked up the job market is. but obvs i can't do that when have Shit HR and other people from my first job lurking on my LI feed. or start a tiktok parodying the goddamned motherfucking mindfuck tactics of the useless fucking job market before throwing my 12 year old laptop out the fucking window. "just get any job" is NOT possible anymore when that "just any job" in retail or call centres (although rip me for leaving after barely a month bc a shitty call centre i worked for in feb/march this year REFUSED to fix a backend issue on THEIR END but kept blaming it on me and it ruined my training period).... are just so mind fucky and tiring that it's straight up NOT even worth applying.

it's straight up not worth applying to a job that some local social service org sends you directly on seek (or maybe another job site) bc they think you fit the profile for a traineeship in business admin. only then, when you apply you're marked "unlikely to progress" bc you decided to list your desired salary at the higher end (apparently) of the trainee pay grade in australia (50k) bc you believe you shouldn't be expected to stay at 45k for TWO MORE FULL YEARS during that traineeship (with a vain hope that hopefully, HOPEFULLY, they'll keep you on at the end of it)... bc you NEED to start paying off your student loans automatically through your pay. BUT. oh no. that was too high of an ask for your quals/experience apparently. they WANTED you to low ball at 45k (or even lower) and be happy about it. so they reject you. when THEY sent YOU the job.

it's not worth trying to get "just any job", when famously even food chains in the US, like i think it's panera bread (and also walmart) are using 2 hour avatar-esque personality tests to screen ABSOLUTELY EVERYONE out of the pool except for like 2 people. every second job i get suggested on linkedin is just applicant pooling websites (or straight up scams where the pay is ONLY listed in US $$) where businesses just straight up ignore your applications bc they forgot they even made an account on it (imo) so you HAVE to make an account on THEIR actual site..... when some dumb-ass career-advice-fluencer on my fb feed (and the tik of the tok) tells you that's exactly how you get your application ignored, while flogging THEIR applicant pooling and job searching/resume writing AI advice software website.

"just any job before you get THE job", my fucking ass. this no longer fucking possible. and also cut the shit about overworking yourself to death with 10,000 different side hustles. bc that's exactly how i i nearly fucking died in 2020 at 20 fucking 5 in hospital with a stomach tumour..... after TOO MANY years of uni where the supposed importance of "innovative systematic entrepreneurial flair go-getter thinking of the future" was being espoused to me on the fucking daily. like dgmw, i know people are doing side hustles in these fucked up high cost of living times (and also im actively thinking about doing door dash since NO ONE is bothering to hire me)... but god the "if you have time to have down time with netflix why arent you filling your time with 15 side hustles to get your net worth to 1 million bucks??????" is fucked up. let people NOT work themselves to death outside of the mandatory 2 full time and 1 part time or casual or any other mix of jobs that people just need to fucking SURVIVE today.

#life#about me#shut up ilona#ilona's jobhunting thoughts and woes#ilona's work thoughts#ilona's work dilemmas#probs a tl;dr for everyone who HATES long-form posting

1 note

·

View note

Text

To do a modest bit of good while doing nothing about the larger system is to keep the painting. You are chewing on the fruit of an injustice. You may be working on a prison education program, but you are choosing not to prioritize the pursuit of wage and labor laws that would make people’s lives more stable and perhaps keep some of them out of jail. You may be sponsoring a loan forgiveness initiative for law school students, but you are choosing not to prioritize seeking a tax code that would take more from you and cut their debts. Your management consulting firm may be writing reports about unlocking trillions of dollars’ worth of women’s potential, but it is choosing not to advise its clients to stop lobbying against the social programs that have been shown in other societies to help women achieve the equality fantasized about in consultants’ reports. Economistic reasoning dominates our age, and we may be tempted to focus on the first half of each of the above sentences—a marginal contribution you can see and touch—and to ignore the second half, involving a vaguer thing called complicity. But Cordelli was challenging elites to view what they allow to be done in their name, what they refuse to resist, as being as much of a moral action as the initiatives they actively promote. Her argument is not that every bad thing that happens in the world is your fault if you fail to stop it. Her claim, rather, is that citizens of a democracy are collectively responsible for what their society foreseeably and persistently allows; that they have a special duty toward those it systematically fails; and that this burden falls most heavily on those most amply rewarded by the same, ultimately arbitrary set of arrangements. “If you are an elite who has campaigned for or supported the right policies, or let’s suppose that you are not causally complicit in any direct sense,” she said, “still, it seems to me that you might owe a responsibility or duty to return to others what they have been unfairly deprived of by your common institutions.” The winners bear responsibility for the state of those institutions, and for the effects they have on others’ lives, for two reasons, Cordelli said: “because you’re worth nothing without society, and also because we would all be dominated by others without political institutions that protect our rights.” To take each of those in turn: She says you are worth nothing without society because there can be no hedge fund managers, nor violinists, nor technology entrepreneurs, in the absence of a civilizational infrastructure that we take for granted. “Your life, your talents, what you do could not be possible if they weren’t for common institutions,” Cordelli says. If the streets weren’t safe or the stock markets weren’t regulated, it would be harder to make use of one’s talents. If banks weren’t forced to offer a guarantee of guarding your money, making money would be pointless. Even if your children attended private school, public schools very likely trained some of their teachers, and publicly financed roads connected that island of a school to the grid of the society. Then there is the fact that absent a political system of shared institutions, anyone could dominate anyone. Every person with anything precious to protect would be at constant risk of plunder by everybody else. To live in a society without laws and shared institutions that applied equally to all would be, Cordelli says, to live “dependent on the arbitrary will of another. It would be like a form of servitude.” Think of the person who seeks to “change the world” by doing what can be done within a bad system, but who is relatively silent about that system. Think of the person who runs an impact investing fund aimed at helping the poor, but is unwilling to make the connection, in his own head or out loud, between poverty and the business practices of the financiers on his advisory board. Think of a hundred variations of this example. Such a person, for Cordelli, is putting himself in the difficult moral position of the kindhearted slave master.

Anand Giriharadhas

2 notes

·

View notes

Text

Breaking Down Government Loan Programs for Entrepreneurs

Government loans can be a vital resource for individuals and businesses seeking financial support. Whether you need funding for education, housing, or a small business venture, these loans, backed by the federal government, offer an essential avenue for those who may not have access to traditional sources of funding like banks or credit unions.

In this post, we will explore government loans for entrepreneurs, focusing on types, eligibility, and the application process. We'll also provide tips on successful loan repayment.

How Government Loans Differ from Traditional Loans

Government loans differ significantly from traditional loans in several ways, offering distinct advantages. One of the primary benefits is the lower interest rates, which make government loans an affordable financing option for borrowers.

Another difference is eligibility criteria. While private lenders often focus on credit scores and income, government loans consider broader factors, such as community impact or potential economic benefits, which can help individuals who might not qualify for traditional loans.

Borrower protections are also a key feature. Government loans provide flexible repayment plans, deferment options, and forgiveness programs, offering long-term stability for borrowers.

Types of Government Loans and Programs

Government loans come in various forms, each designed to meet different needs. Some of the most common government loans include:

Federal Student Loans: These loans provide financial aid for students pursuing higher education.

Small Business Administration (SBA) Loans: Designed to help small businesses grow, these loans offer various programs for different business needs, including expansion, consolidation, and working capital.

Federal Housing Administration (FHA) Loans: These loans assist with home purchases, offering more accessible terms for first-time buyers.

VA Loans: Backed by the Department of Veterans Affairs, these loans help veterans and their spouses purchase homes with favorable terms.

USDA Loans: These loans support rural development and are available for homebuyers and businesses in rural areas.

Understanding the different government loan programs can help you choose the best fit for your needs.

Eligibility for Government Loans

Eligibility for government loans varies depending on the type of loan and program. For instance, to qualify for an FHA loan, you need a minimum credit score of 500 and a debt-to-income ratio of 31% or less. Similarly, to be eligible for an SBA loan, you need a good credit score and a solid business plan.

Each program has specific criteria, and understanding these requirements can help you assess whether you're a suitable candidate for a loan.

The Application Process for Government Loans

Applying for a government loan typically involves several steps. First, you'll need to determine your eligibility for the program you're interested in. The application process will require you to complete forms and submit supporting documents, including personal and financial information.

While the process may vary depending on the loan type, most government loans require the same basic information, such as your name, address, and social security number. It's important to carefully review the application instructions and ensure all required documentation is provided to avoid delays.

Tips for Repaying Government Loans

Repaying government loans requires careful planning. To avoid late fees and penalties, make sure to make timely payments. Setting up automatic payments can help you stay on track. Additionally, paying more than the minimum payment can reduce your loan balance faster, helping you save on interest over the long term.

By creating a budget and managing your finances effectively, you can stay on top of your loan repayment. Reviewing your budget regularly and adjusting as needed will ensure that you're prepared for upcoming payments.

The Role of Government Loans in Economic Development

Government loan programs play a significant role in supporting economic development at both local and national levels. Small businesses, which are crucial for economic growth, benefit from these loans by gaining access to the capital needed for expansion, job creation, and innovation.

Housing loans like FHA programs contribute to community revitalization by making homeownership more accessible, which strengthens the real estate market. Additionally, educational loans help build a skilled workforce, providing industries with qualified professionals.

During economic downturns, public loans stabilize struggling sectors by injecting liquidity and supporting recovery efforts.

Common Misconceptions About Government Loans

Despite the benefits, many people hesitate to apply for government loans due to common misconceptions. One myth is that these loans are only available to low-income individuals or businesses in distress. In reality, programs like SBA loans are available to a wide range of entrepreneurs, including those with solid financial backgrounds.

Another misconception is that the application process is overly complicated. With digital advancements, the process has become much more streamlined and user-friendly. Additionally, some assume that government loans involve hidden fees or unfavorable terms, but transparency is a key feature of these programs.

Mistakes to Avoid When Applying for Government Loans

When applying for government loans, it's crucial to avoid common mistakes. One common error is failing to thoroughly research available programs. Without proper knowledge of the loan options, you may end up applying for a loan that doesn’t meet your needs.

Other mistakes include incomplete or inaccurate applications, which can lead to delays or rejection. Ensure that you submit all required documentation and double-check your application for errors. Additionally, neglecting to check your credit history or review eligibility requirements can hinder your chances of approval.

Alternatives if a Loan Application Is Denied

A denied loan application can be discouraging, but it's not the end of your financial journey. If your application is rejected, take time to understand the reasons behind the denial, such as credit issues or missing documentation, and work to address these issues before applying again.

You can also explore alternative funding options, such as state-backed grants, nonprofit microloans, or crowdfunding platforms like Kickstarter or GoFundMe. For entrepreneurs, angel investors and venture capital firms can provide additional funding sources. Students may find scholarships or work-study programs to be helpful alternatives.

Conclusion

Government loans offer an essential source of financial support for individuals and businesses. By understanding the types of loans available, eligibility requirements, and the application process, you can make informed decisions about your financing options. Repaying your loan responsibly will set you on the path to financial success. Read More!

0 notes

Text

You can apply to the AIEESE Secondary scholarship for Btech students

Career path in engineering is one of the most preferred by people in India with diverse career options in the fields of technology, construction and innovation. Many students desire to pursue BTech but they cannot because of the high costs involved. To reduce this financial burden AIEESE Secondary is an excellent platform for students to get financial aid . This article discusses AIEESE Secondary Scholarship comprehensively with regard to its major characteristics starting from its advantages and eligibility criteria ending up with the application process for scholarship for Btech students.

The AIEESE Secondary Scholarship is a nationwide program which provides financial assistance for those pursuing Bachelor of Technology degree (BTech). Aimed at promoting academic excellence, the AIEESE Secondary is an entrance based scholarship that allows students who are deserving to meet their educational costs. This scholarship program intends to make good engineering education accessible to all students irrespective of their backgrounds.

In India, there are few scholarships that are related to BTech students like the AIEESE Secondary. Unlike other scholarships, this one targets them specifically.

This program offers large amounts of financial aid that can help secondary school students to realize their dreams of becoming engineers without having to worry about money problems.

Gains of AIEESE Tender Scholarship for BTech Scholars

Many BTech students receive plenty of advantages from the AIEESE Secondary Scholarship, which makes this scholarship a perfect option for those who want to lower their cost of education.

Here are some of its key benefits

Monetary Support: The amount covered by the scholarship is a great deal towards selected candidates’ tuition fees, depending on their achievements in the AIEESE Secondary examination. Amounts given as assistance might be ranging from partial payments up-to full waiver of fees making sure that learners do not have to mind about high costs while learning for its purposes only.

Merit-Based Selection: AIEESE Secondary is a merit-based scholarship, which means that students are selected based on their academic performance and skills. This makes it easier for them to get better scholarships that will enable them to go through engineering education in a more efficient way.

Accessibility to Top BTech Colleges: The scholarship can be offered in a number of good BTech colleges across India; hence it is provided only under well reputed institutions which provide quality education to students. The students get access to the top engineering curriculum in India through AIEESE Secondary .

Stipulation of Educational Loans: A number of students undertake their respective BTech degrees by way of their educational loans and possibly incur high financial responsibilities in the aftermath of their graduation.AIEESE Secondary scholarships students can either manage to pay less e.g., significantly reducing financing through college access grant or they may even be able to do so in totality resulting in graduating without debts or owing much.

Support for Innovation and Technological Advancement: The fund offers not only monetary assistance but also inspires learners to come up with new ideas and surpass previous limits in line with their respective areas of specialization. AIEESE Secondary encourages people to pursue academic achievement while nurturing topnotch engineers.

Eligibility for AIEESE Secondary Scholarship

BTech student who intends to apply for the AIEESE Secondary Scholarship, then you must fulfill these requirements: scholarship for Btech students

Educational Qualifcation: It is compulsory that students have passed their Class 12 examination or an equivalent exam having Physics, Chemistry and Mathematics(PCM) subjects.

Citizenship: This scholarship is exclusively given to Indian citizens only.

Entrance Exam: The AIEESE Secondary Exam is a national level test that assesses a student's knowledge in PCM subjects which all applicants must take. The exam has multiple choice type questions while its syllabus is based on Class 12.

Age Limit: There are age limits according to AIEESE Secondary guidelines which every candidate must fulfill. Normally, the age provisions fit within the common norms for engineering entrance exams conducted in India.

Merit-Based Selection: The selection process is entirely based on merits whereby students who perform excellently in AIEESE Secondary Examination are provided with scholarships.

AIEESE Secondary Scholarship Application Procedure

Stages for applying to the AIEESE Secondary Scholarship are simple and have just a few easy steps:

Registration Online: To start with candidates should go to the official website of AIEESE Secondary and complete their online registration. Be careful to fill in every detail correctly so that you don’t have any problems later on.

Completing the Form to apply for the job: Candidates who have been registered are required to fill the application form with their personal details, educational qualifications and present location. Sometimes they are also needed to select the exam center according to what pleases them.

Fee Payment: After completing the application form you need to pay your application fee before submitting your application. Fees can be paid through credit or debit card.

Download your admit card: Once you have registered properly and transferred the required amount for registration successfully, then you will be entitled to downloading the admit card from their original site. This document includes significant details such as date and venue of examination.

AIEESE Secondary Exam: The students are required to appear in AIEESE Secondary Exam at designated examination centres. The performance in this exam will be considered for awarding scholarships. scholarship for Btech students

Results Notification: Results are published on the AIEESE Secondary portal, and scholarships are given based on student performance.

The AIEESE Secondary Scholarship is an amazing chance for budding engineers to get monetary support for their BTech studies.

Given its merit-based selection focus and getting admitted into the best BTech colleges in India, this type of grant serves as a refuge for those who want to follow their technical aspirations without being hampered by money issues.

For those interested in having a fruitful career in engineering, pursuing AIEESE secondary scholarship would be a good option that makes education cheaper and within reach.

0 notes

Text

The Benefits of Student Credit Cards for Young Adults: A Comprehensive Guide

As young adults transition into college life, managing finances becomes a critical skill. One effective tool to aid in this learning process is a student credit card. Designed specifically for students, these credit cards offer various benefits that can help build financial literacy, establish credit history, and manage expenses efficiently. This comprehensive guide explores the benefits of student credit cards for young adults and provides practical tips for maximizing their advantages.

Understanding Student Credit Cards

Student credit cards are tailored to meet the needs of college students who may not have an extensive credit history. They typically come with lower credit limits, manageable interest rates, and features aimed at promoting responsible credit usage.

Benefits of Student Credit Cards

1. Building Credit History:

A solid credit history is essential for future financial endeavors, such as applying for loans or renting an apartment. By using a student credit card responsibly, young adults can start building their credit history early. Timely payments and low credit utilization positively impact credit scores, paving the way for better financial opportunities in the future.

2. Financial Independence and Responsibility:

Having a credit card teaches young adults to manage their finances independently. It encourages budgeting, tracking expenses, and making informed purchasing decisions. These habits foster financial responsibility and help avoid common pitfalls like overspending and accumulating debt.

3. Emergency Access to Funds:

Unexpected expenses can arise at any time. A student credit card provides a safety net for emergencies, ensuring that students are not caught off guard. Whether it’s a medical emergency or a sudden travel requirement, having access to credit can be a lifesaver.

4. Rewards and Benefits:

Many student credit cards offer rewards programs, such as cashback on purchases, discounts on specific categories, or points that can be redeemed for various benefits. These rewards can add value to everyday spending and make essential purchases more affordable.

5. Learning About Interest and EMI:

Using a student credit card introduces young adults to the concepts of interest rates and Equated Monthly Installments (EMIs). Tools like a credit card EMI calculator can help them understand the cost of borrowing and plan repayments effectively. This knowledge is invaluable for managing larger financial commitments in the future.

Practical Tips for Maximizing Benefits

1. Choose the Right Card:

When selecting a student credit card, consider factors such as interest rates, fees, rewards programs, and credit limits. Compare different options and choose a card that aligns with your spending habits and financial goals.

2. Use the Credit Card EMI Calculator:

Before making significant purchases, use a credit card EMI calculator to determine the monthly payments and total interest costs. This tool helps in planning and ensures that you can comfortably manage repayments without falling into debt.

3. Pay Balances in Full:

To avoid interest charges and build a positive credit history, always aim to pay your credit card balance in full each month. If you cannot pay the full amount, make at least the minimum payment to avoid late fees and penalties.

4. Monitor Your Spending:

Keep track of your credit card transactions and monitor your spending regularly. Many credit card issuers provide mobile apps and online portals that make it easy to check your balance, view statements, and set spending alerts.

5. Understand Your Credit Report:

Regularly review your credit report to ensure that all information is accurate and up-to-date. Understanding your credit report helps you identify areas for improvement and correct any errors that could negatively impact your credit score.

Conclusion

Student credit cards offer a wealth of benefits for young adults, from building a strong credit history to learning essential financial management skills. By using these cards responsibly and leveraging tools like a credit card EMI calculator, students can lay a solid foundation for their financial future. As they navigate through college and beyond, the habits and knowledge gained from managing a student credit card will serve them well, ensuring financial stability and success.

0 notes

Text

The Wealth Signal FIX: Unleash Your Inner Money Magnet in 7 Minutes

Ever feel like you're constantly swimming upstream when it comes to finances? You work hard, put in the effort, but that elusive financial freedom seems just out of reach. Maybe you've even tried different strategies, but nothing seems to stick. Well, what if there was a way to hack your subconscious and attract abundance with minimal effort?

Enter The Wealth Signal FIX, a revolutionary program designed to unlock your inner money magnet using the power of proven soundwave technology.

Please try this product The Wealth Signal FIX

The Struggle is Real: Why Attracting Wealth Feels Like a Myth

Let's face it, most of us weren't exactly schooled on the science of attracting wealth. We learn math, history, maybe even a bit of economics, but where's the class on programming your brain for financial success?

Here's the thing: there's a hidden force at play – a subconscious battle between scarcity and abundance. Deep down, many of us hold onto limiting beliefs about money. Stories like "money is the root of all evil" or "rich people are greedy" create a mental block that repels prosperity.

The Wealth Signal FIX: Reprogramming Your Money Mindset

The Wealth Signal FIX doesn't rely on willpower or deprivation. It takes a different approach – reprogramming your subconscious using the power of sound. Here's the science behind the magic:

· Brainwave Entrainment: The program utilizes carefully crafted sound frequencies that can gently guide your brainwaves into a state of relaxed focus. This allows for deeper subconscious programming.

· Positive Affirmations: Embedded within the soundscape are powerful affirmations designed to rewrite your limiting beliefs about money. Phrases like "I am worthy of abundance" and "I am a wealth magnet" will be woven into the audio, seeping into your subconscious mind.

7 Minutes to Financial Freedom? Sounds Too Good to Be True?

We get it. In a world of quick fixes and empty promises, skepticism is healthy. However, the power of soundwave technology for subconscious programming is a well-documented phenomenon. Studies have shown its effectiveness in areas like stress reduction, habit formation, and even pain management.

The Wealth Signal FIX: It's Not Just About Money

Think of the Wealth Signal FIX as a gateway to abundance in all aspects of your life. By shifting your subconscious mindset to one of openness and receptivity, you'll not only attract financial opportunities but also cultivate a sense of abundance in your relationships, health, and overall well-being.

Real People, Real Results: Success Stories

Here are a few examples of how The Wealth Signal FIX has transformed lives:

· Sarah, the Overworked Artist: Sarah, a talented artist, was drowning in debt and feeling undervalued. After using The Wealth Signal FIX for just a few weeks, she started attracting high-paying clients who truly appreciated her work. Now, she's finally able to focus on her passion full-time and live a financially secure life.

· Michael, the Debt-Ridden Entrepreneur: Michael, burdened by student loans and a failing business, felt hopeless. The Wealth Signal FIX helped him shift his perspective and identify new opportunities. He discovered a hidden talent for online marketing, which helped him launch a successful side hustle, allowing him to finally start paying down his debt and build a brighter future.

· Jessica, the Stuck Professional: Jessica, a talented accountant, felt trapped in a dead-end job. The Wealth Signal FIX boosted her confidence and opened her eyes to new possibilities. She started applying for higher positions with a newfound sense of self-belief. Soon enough, she landed her dream job with a significant salary increase.

The Wealth Signal FIX : Is It Right for You?

This program is designed for anyone who:

· Feels stuck in a financial rut.

· Is ready to break free from limiting beliefs about money.

· Wants to attract abundance into all areas of their life.

· Is open to new and innovative approaches to achieve financial success.

Here's the Catch There's Always One, Right?

The Wealth Signal FIX isn't a magic wand that guarantees instant riches. It's a tool to empower you on your journey towards financial freedom. Consistency is key. The recommended daily use is just 7 minutes. However, the more you use it, the deeper the subconscious programming will become.

Ready to Reprogram Your Money Mindset and Become a Wealth Magnet?

Take charge of your financial future! Start your journey with The Wealth Signal FIX today. Imagine the possibilities – financial security, freedom to pursue your passions, and the peace of mind that comes with knowing you can create the life you deserve.

#wealth#healthiswealth#wealthmindset#wealthcreation#generationalwealth#wealthbuilding#wealthcurrency#abbyinwealth0#wealthminded#wealth signal

0 notes

Note

If I'm making just over 14k a year and my student loans are around 25k, what repayment option would be best for me? I know you went to college so a girl needs some help. I know that the income based repayment has LOTS of interest tacked on and I won't be paying rent after september, so maybe I should just go with a repayment plan that doesn't have a lot of interest but costs a bit more?? However, I know that like 10% is a good place to start.

Also, how do repayment plans work? Do I have to apply for a certain plan on the FSA website? I figured I could just set up a monthly flat rate fee to pay and that was it.... I'm still in my grace period til this week so nothing is really showing up for me.

you'd be a lifesaver if you could offer some help/advice. thank you so much christina!! i'm the only one in my family to attend college so no one else really knows how to help me.

So it depends a bit on what kind of loans you took our and a couple of other factors. I also want to caveat this by saying I'm not an expert in this at all, so I don't want to promise that this is the absolute best approach or anything. That said, here's what I would do:

Compare your options with the student loan repayment simulator. This should help you identify which loan repayment options fit your situation best.

Look into the SAVE plan. It is an income based repayment plan, but it should lower your payments. With the SAVE plan, if you make your full monthly payment, but it is not enough to cover the accrued monthly interest, the government covers the rest of the interest that accrued that month. That means that your balance won't continue to grow due to unpaid interest. Plus, if you originally borrowed $12,000 or less, your debt is forgiven after 10 years. And if I understand it correctly, if you make less than $32,800 a year, your monthly payment is $0, so my guess is that this is the best option for you at the moment. There are more benefits that are set to roll out in July this year. In this scenario, my understanding is that you could start paying down your principle balance without accruing any interest. So for example, you could take what you would have paid towards rent (say $500 a month), and reduce your debt from $25k to $19k by the end of the year without needing to pay any additional interest (I think). You can apply for SAVE here.

You may also want to look into other debt forgiveness plans. If you work for government or for a nonprofit, you may be eligible for Public Service Loan Forgiveness. And if you're a teacher, you may be eligible for Teacher Loan Forgiveness.

I would also consider talking to your loan servicer, who is a person that you can talk to (for free). They're supposed to help you figure out which repayment plan is best for your situation, although some are better than others. If you go this route, I would make sure to know exactly which plan you think you need or to have pre-set questions you want to ask them so that it's less likely they'll try to sell you on a plan that's not in your best interest.

If you're looking for a new job, I would consider applying to companies that have student loan repayment as part of their benefit package. These are a few companies that offer that as an option, but they're not the only ones. You can also do programs like AmeriCorps, Teach For America, and PeaceCorps that will help you to repay your loans if you serve with them.

You can also apply for scholarships or grants to pay off your student loans. These are typically between $500 and $1000, and can help you shorten the amount of time you're paying the loan for.

At the end of the day, this is a suuuuuuper broken system, and it's unfair that you have to think about this at all. But the SAVE plan is a step in the right direction, and hopefully we'll see more movement on student debt forgiveness in the future.

1 note

·

View note

Text

How Pune's Top Education Consultants Can Help with Scholarships

Getting a scholarship to study abroad can revolutionise your academic path by increasing the accessibility and affordability of international education. Here's a summary of the benefits of scholarships as well as some advice on how to improve your chances of being awarded one.

Scholarships Are Important for Studying Abroad:

Financial Assistance: This is arguably the most evident advantage of scholarships. Though the exorbitant prices discourage many students from pursuing their ambition of studying overseas. Scholarships enable students from a variety of financial situations to pursue their academic objectives by paying for tuition, living expenses, and occasionally even travel costs.

Less Debt: Since scholarships do not have to be paid back, like loans, they relieve students of a large portion of their debt. By obtaining scholarships, you can prevent accruing enormous debt from student loans, freeing you up to pursue further studies or launch your profession without worrying about money.

Increased Academic Opportunities: Scholarships provide access to esteemed schools and courses that might otherwise be unaffordable. By giving you access to world-class instructors, state-of-the-art research facilities, and a varied academic community, these programs will improve your academic record and enrich your educational experience.

Global Networking: You will be exposed to a worldwide network of professionals, academics, and classmates while you study abroad on a scholarship. For upcoming professional prospects, teamwork, and personal development, this network can be quite helpful. Developing interactions with people from other backgrounds helps you become more interculturally competent and opens up new ideas.

Some pointers for obtaining scholarships to study overseas:

Begin Early: Searching for a scholarship should start as soon as possible. Do not wait until you have gotten admission offers to start exploring for funding opportunities—many scholarship deadlines are well ahead of university application deadlines.

Do Extensive Research: Investigate a variety of scholarship opportunities, such as those provided by foundations, governments, colleges, and organisations. Read the rules carefully as each scholarship has different requirements for eligibility, applications, and deadlines.

Emphasise Your Successes: It is important to emphasise in your application your leadership responsibilities, extracurricular activities, community service, academic accomplishments, and any other pertinent experiences because scholarships are competitive. Describe what makes you stand out from the other applicants.

Customise Your Applications: Make sure your scholarship requests are appropriate for each grant source. Tailor your personal statements and writings to the goals and requirements of the scholarship. Explain how getting the award will enable you to fulfil your academic and professional ambitions.

Request Recommendation Letters: Obtain solid recommendation letters from instructors, professors, or employers who can vouch for your character, potential, and academic prowess. Select references who are familiar with you and able to give concrete instances of your accomplishments and assets.

Prepare for Interviews: If there will be interviews as part of the scholarship application process, get ready for them. Be prepared to explain why you should receive the scholarship and how you intend to take full use of the opportunity. Practise your responses to frequently asked interview questions.

Remain Positive and Persistent: Applying for scholarships can be competitive, and getting turned down might be discouraging. Do not give up, though. Continue applying, being tenacious, and keeping an optimistic outlook. Every application is an educational opportunity that can raise your prospects going forward.

In conclusion, scholarships play a crucial role in making international education accessible and affordable for students worldwide. By following these tips and seeking assistance from the best education consultants in Pune, you can increase your chances of securing funding for your study abroad journey and achieve your academic aspirations.

0 notes

Text

How to Qualify for an FHA Loan with Bond Street Loans in Paramus, NJ

Navigating the world of home loans can be complex, especially for first-time buyers. An FHA loan, backed by the Federal Housing Administration, is a popular choice due to its lower down payment requirements and more lenient credit standards compared to conventional loans. If you're in Paramus, NJ, Bond Street Loans stands out as one of the best FHA lenders in the area. Here’s everything you need to know to qualify for an FHA loan with them.

Understand What an FHA Loan Is

FHA loans are designed to help lower-income borrowers afford a home. The Federal Housing Administration insures these loans, which allows lenders like Bond Street Loans to offer them with less risk. These loans are ideal for buyers who may not have saved enough for a large down payment or who might have a few credit blemishes.

Credit Score Requirements

The minimum credit score required for an FHA loan is typically 580. With this score, you can make the minimum down payment of 3.5%. If your credit score is between 500 and 579, you may still qualify, but the down payment requirement typically increases to 10%. Lenders like Bond Street Loans may have additional criteria, so it's important to shop around.

Down Payment Sources

One of the benefits of an FHA loan is that the down payment can come from a variety of sources including personal savings, gifts from family or friends, or grants from state and local government programs. Bond Street Loans can guide you through the proper documentation needed to verify the source of your down payment funds.

Debt-to-Income Ratio (DTI)

The DTI ratio is a crucial factor in the approval process. It measures your total monthly debts (such as credit card payments, student loans, and your future mortgage payments from Bond Street Loans) against your gross monthly income. The general rule for FHA loans is that your DTI should not exceed 43%, though Bond Street Loans may accept higher ratios under certain conditions.

Property Requirements

The FHA has specific requirements for the condition and type of property that can be purchased with an FHA loan. The home must be a primary residence and meet certain safety and livability standards. An FHA-approved appraiser must inspect the property. Bond Street Loans can help coordinate this inspection to ensure the property is a sound investment and meets the FHA’s standards for safety and security.

Mortgage Insurance

Borrowers must pay two types of mortgage insurance premiums (MIP) with an FHA loan: an upfront premium (typically about 1.75% of the home loan, which can be financed) and an annual premium (spread out over the year and included in your monthly mortgage payments). This insurance protects lenders like Bond Street Loans in case you default on the loan.

Applying for the Loan

To apply for an FHA loan with Bond Street Loans, you'll need to submit financial documents like recent pay stubs, tax returns, and bank statements. Their team will review your credit and employment history and calculate your DTI ratio to determine your eligibility.

Benefits of FHA Loans from Bond Street Loans

Lower down payments: As low as 3.5%, which makes home ownership more accessible.

Flexible qualification requirements: More lenient regarding credit scores and past financial hardships, such as bankruptcies and foreclosures, compared to conventional loans.

Assumable mortgage: If you sell your home, the buyer can ‘take over’ your loan on the same terms, potentially making your home more attractive to buyers.

Conclusion