#in the same place?

Explore tagged Tumblr posts

Text

unsung benefit i think a lot of ppl are sleeping on with using the public library is that i think its a great replacement for the dopamine hit some ppl get from online shopping. it kind of fills that niche of reserving something that you then get to anticipate the arrival of and enjoy when it arrives, but without like, the waste and the money.

#im not much of an online shopper myself but i do find that the feeling i get from browsing the library catalogue to place holds#is the same i get from figuring out how to spend a gift card

119K notes

·

View notes

Text

I wish we had more female characters like Eleanor Shellstrop. One of the most unlikable people you've ever met. Read a Buzzfeed article on most rude things you can do on a daily basis and decided to use that as a list of goals. Makes everyone's day worse just by being there. Dropped a margarita mix on the ground and tried to pick it up, only to get hit by a row of shopping carts which pushed her into the road where she was hit by a boner pill delivery truck, killing her instantly. Cannot keep a romantic partner despite being bisexual. Had a terrible childhood but will die before she gets therapy. Best employee at a scam company. Just the worst but also can't help but root for her to improve.

Absolute loser. Girl-failure. Bad at almost everything. Literally perfect female character.

#eleanor shellstrop#you know i was thinking about how we hold female characters to such high standards#and severely criticize bitchy female characters while praising asshole male characters#and then i remembered eleanor and realized that she is the perfect example of how to write an asshole woman that the audience likes#the worse she is the more i'm drawn to her (and honestly same for tahani)#we need more cringe-fail women who nobody likes (for good reason)#the good place#female characters#writing women#girl failure#girl loser#she's so mean#i love her#my favorite#fucking asshole#iconic#the good place eleanor#tgp#tgp eleanor#kristen bell

77K notes

·

View notes

Text

at the end of the day it is always about skyblings 👍

#the 3 of them are related and from the same place in my head#hermitcraft#grian#pearlescentmoon#solidarity gaming#jimmy solidarity#trafficblr#life series#skyblings#sky duo#sky trio?#spark draws

4K notes

·

View notes

Text

Matchmaker Caine (part 1/2)

Caine? HELLO???

Part 2 here

I’m never doing backgrounds again oof

#cookies#they hid in the same place for the same reason#funnybunny#funnybunny fanart#jaxpom#jaxpom fanart#jax x pomni#pomni x jax#tadc#tadc fanart#tadc comic#mini comic#comic artist#character art#digital artist#procreate art#artists of tumblr#baguettenjoyer#the amazing digital circus#tadc pomni#doodles#pomni fanart#tadc jax#jax fanart#bunnyjester#character design

3K notes

·

View notes

Text

Actually I have a post I want to make about Property Value.

Which is a topic that comes up a lot in discussions of rich people hoarding wealth, in NIMBY panics, and in the ever-increasing prices of homes. But I don't think we talk much about how the perniciousness of property value goes deeper and basically holds middle class people who own a home hostage.

So to set some context here: in 2025 the median US home sold for $416,000. Say you have a working class family who can't meet median, but who scraped and saved and penny-pinched their way to a $300,000 home.

Typically, when buying a first home, you pay 20% down directly, and take 80% out as a mortgage from the bank. For this family, that means $60,000 of their liquid money (and let's say it took them 10-15 years to save that amount), and a $240,000 loan from the bank.

That's $240,000 in debt the family is. Which will be repaid over 30 years, with interest, at a rate that usually means for the lifetime of the loan, they end up paying back double the original loan.

However this massive $240,000 debt is generally considered "okay" debt to have, because it's backed by the house. If things go truly sour, the bank can take the house (and what's a little homelessness between friends).

That $60,000 the family put down is considered equity, and equity is money you "have", but isn't accessible.

Scenario: Now let's say something happens. Someone in the family loses their job, and the only job they can find requires moving. Or a family member across the country can't care for themselves anymore and so this family needs to move to be closer to them. The family gets divorced. Someone in the family is allergic to material in the home. Someone in the family is being stalked or abused and needs to leave the town. Anything at all, which would require selling the home and moving.

Case 1: The family is able to sell it for exactly what they paid (same property value, no increase or decrease). You would think the math is clean. They are paid $300,000 for the house. $240,000 repays the bank loan. The remaining $60,000 of equity goes right back to them. And they can use it (which took 10+ years to save up) to move across the country and buy a different $300,000 house.

Except no, it does not work like that.

The seller of a home is on the hook to pay commission to their realtor and the buyer's realtor. This is usually ~6% of the home value. They have to pay legal costs. There are taxes. There are miscellaneous costs. It can easily be 6-9% of the selling price of the house.

The bank NEEDS its $240,000 back. So those costs come from the equity. This family is not getting their $60,000 back. They're getting $30,000-$45,000, and now no longer enough money for a downpayment in their move. They're back to renting. Back to penny pinching. They can get by, but homeownership is now out of their grasp once more. Maybe in another 5 years, they'll have enough (unless home prices have increased too much by then) then they'll maybe never be homeowners again.

Case 2: The property value has DECREASED... Family is only getting offers in the $260,000 range.

If the family accepts a $260,000 sale, well $240,000 goes to the bank. This is genuinely non-negotiable. And that leaves.... maybe not enough money to even close on the house. Not enough to pay the realtors and the fees.

That $60,000 is wiped out, and the family is incapable of moving. Never mind losing 10+ years of savings--they're below $0. They don't have the money to close. It's financially impossible to sell. They are stuck with the mortgage. They are stuck with the house. (Maybe they'll rent it, if they can. And now they're landlords by circumstance, which is often NOT profitable when you're not a trust fund baby renting out a totally-paid-for no-mortgage home.) But whatever the case, they cannot sell it. And if the reason for selling was a job loss... well, they can be homeless soon. And if the property value dropped below $240,000, they can be homeless AND owe a bank debt. A $60,000 nest egg wiped completely out, with a bank debt owed on top of that.

So how do people avoid financial destitution when moving?

The most sensible answer is building up equity by paying down the loan--but it's important to know that mortgages are super interest heavy in the early life of the loan. With a 5% interest rate (BETTER, btw, than current rates) this family would be paying $15,460 the first year, and only $3,540.88 is actually chipping at that $240,000 principle. The other $11,919.59 was pure interest to the bank.

So after 1 year, the family went from having $60,000 equity in the house to $63,540.88 equity in the house. This buys a little extra wiggle room when juggling closing costs. But not very much. Even after 3 years, the family has just a little over $70,000 of equity, and just under $230,000 still left on the loan. So if the family has to move for any reason (sickness! death! job loss!) in those 3 years, it's probably financially devastating.

But there is a second answer to avoiding financial ruin: and that is Property Value going up.

Any amount of property value increase is PURE equity. The bank only cares about the amount of money it gave you. If after 3 years, that house is now worth (and can sell for) $315,000 (which is appreciation of only 1.6% a year. Most home appreciation is closer to 3%), that's more equity increase than they got from 36 diligent months of mortgage payment.

If they can sell for $315,000, pay $230,000 of that to the bank, that leaves $85,000. $25,000 goes to paying the realtors and the closing costs and.... the family is back to their $60,000 downpayment. Not trapped. Able to sell. Able to buy a new $300,000 home in the place they moved. Able to just maintain homeownership status.

But wait, if their home appreciated to $315,000, didn't all the other homes do the same, so now $60,000 isn't enough

Smart eye, lad! You've identified why this is a TERRIBLE rat race for the people scraping money together to live, and is ONLY a profitable leisure activity for rich people who sell homes like collectables.

Now because the increase is pure equity, a similar family with decent property value increase can funnel that extra equity into affording to meet the new higher down payment (remember the downpayment is only 20%, so even if the new place is similarly higher in property value, you only need to match that increase 20% for the downpayment). Which gets their foot in the door. But now their new mortgage is higher than the old one. More expensive. More interest.

But there is a losing scenario here--if home property values increased everywhere else, but not where you live. Then this family is back to surrendering homeownership. Because even if they can sell their place, they can't buy the next home.

It forces them to care about their own Property Value increase because, if it doesn't increase while everywhere else does, it traps them.

So what do I mean by all this

If the value of all homes dropped 50% overnight, I assume most people here would celebrate. Affordable homes! Rich people upset and crying! So much to love.

But in reality, that 50% drop would likely continue to mean no home for most of us, because the people who could sell you the homes would be financially incapable.

For the family above with the $240,000 mortgage, that mortgage does not reach halfway-paid-off until year 20 of the 30 year mortgage (remember the interest frontloading). If a family still owes $230,000 in bank loans on a place that can only sell for $150,000, they can't sell it to you. That house is the bank's collateral securing the loan. Their mortgage is underwater. They're trapped. They cannot sell it. You cannot have it.

Something similar happened in the 2008 subprime mortgage crisis, and the only people who got out okay were ones who could stay the course, keep making the mortgage payments, and wait it out long enough for property value to recover.

Those who couldn't got foreclosed on. Those who couldn't were left in financial devastation.

So in conclusion?

Banks profit off of mortgages. Rich people profit off of hoarding housing stock and selling it as the property value increases. Real estate companies profit off of home sales. And the regular people, who managed to achieve home ownership, are shackled to the price-go-up system to avoid financial ruin. They're forced to care about their property value because it is the singular determinant of whether they're trapped in place, whether they'll be okay if they lose their job, whether they could move due to an important life event.

It's a profit system for the rich where the cogs are middle class people who could achieve homeownership, running a machine where every single crank locks the poorer and younger generations out of home ownership forever.

#on my next installment: how rising mortgage interest rates trap people in the exact same way!#how low mortgage rates BALLOONED home prices due to more people able to make competitive offers and how the following interest rate hikes#left prices massive AND new mortgages unaffordable and so many new people locked out of ownership forever#while trapping current owners in place because they could never afford a new mortgage at modern rates#chrissy speaks

4K notes

·

View notes

Text

thanks for being a friend

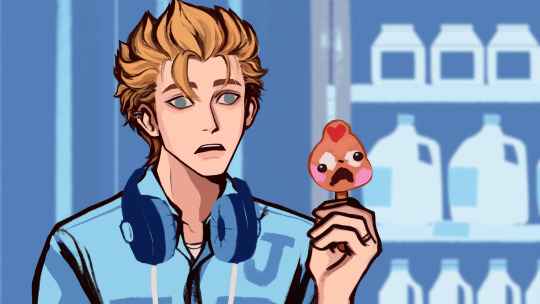

[ jojamart mockumentary #17 ]

[ prev || next ]

#stardew valley#stardew valley fanart#sdv sam#sdv jodi#jojamart mockumentary#my art#i'm still on a slowdown for work and school#but i'm working on these when i get some spare time at night#it's how i get my fun in#also this is based on the fact that jodi sends you the recipe for ice cream at seven hearts#and adds that it won her first place in a competition#she says the same thing when she sends you the calamari recipe but i'm not drawing tentacles for free

5K notes

·

View notes

Text

⚠️

#my giant masterpost for my two whole art pieces#but I like to keep all my fanart in the same place. I’ll update it if I do more#gravity falls#bill cipher#Stanford pines#ford pines#my art#digital art#artists on tumblr#surreal art#fun fact the first time I tried to post this bricked the app so hard I had to delete it twice to make it let me post again#normal. I love Mobile!#art masterpost

10K notes

·

View notes

Text

it’s our turn to make you smile

#It’s the way that all of these kids admire Deku the same way Izuku Katsuki and Shoto all looked up to all might sobs#this is my way of coping with the news that the manga is ending#but this is kind of a redraw of the first ever mha drawing I ever did you could probably find it here if you scroll far enough but dOnt#anyways Right after I finished binging the series back in 2020 I was so inspired to draw#MHA will always have a special place in my heart#it’s the series that not only got me back into art but also into digital art for the first time#so sad to see it go but excited to continue loving it even when it ends#bnha#boku no hero academia#my hero academia#my art#mha#midoriya izuku#deku#bnha fanart#deku fanart#eri fanart#Deku and eri#eri#Kota#katsuma shimano#mahoro shimano#Katsuma Mahoro#Deku and kids#Deku and Kota#mha fanart#boku no hero academia fanart#my hero academia fanart

9K notes

·

View notes

Text

Just a reminder for any bloggers that are unaware—

The following blogs are spam blogs, all pretending to be Palestinians needing help in Gaza. They are mass flooding tumblr inboxes with identical text + emojis in order to ask for $90k USD.

Even when you block these blogs, they will use a side blog to send you seemingly infinite anonymous asks, and THEN change the sending blog when you block that anon.

At least 2 of these blogs have been confirmed by @gazavetters to be spamming blogs.

Here is the list:

mosabsdr

abedmajeed, which is now both aboodfmly and derawi1994, and which is also known in tags and/or blogs as:

Abdelmajed (tag)

abedmajder (tag)

familygaza5 (blog)

derawigaza (blog)

derawifami (blog)

(All of the above under aboodfmly link to the exact same chuffed fundraiser.)

nasergz

sajagz

abd20001

nasr-daher

Note: mosabsdr has a note in gazavetters' official vetting Google Doc to warn others of the spam behavior, since they are violating rule 2 (do not spam supporters or non-supporters).

Most or all of these blogs have replies turned off, so it's virtually impossible to message them directly and ask them to stop sending asks.

Please block, delete asks, and do not engage with these blogs.

To block anonymous asks: you have to wait until you get one, unfortunately, but you can then hit the 3 dots on the top right and then block the specific anon that sent you that ask. It's not perfect, but it's better than nothing.

Stay safe out there, and please donate to help Palestinians at this World Food Programme link.

#mosabsdr#abedmajeed#aboodfmly#nasergz#derawi1994#Abdelmajed#abedmajder#fake palestine scam#spam blogs#signal boost#it's sad but these blogs are not following tumblr rules or gazavetters rules and this needs to stop#like bruh. I am sorry but you do not need 5 separate blogs to link to the same donation place.#ESPECIALLY if you're NOT behaving in a way that gets you labeled as a bot to be taken down by staff!#abd20001

2K notes

·

View notes

Text

Deep Space Nine was not afraid to say it.

#star trek ds9#star trek deep space nine#change requires action#platitudes are killing us#direct action#justice#how little has changed in 30 years#Past Tense#Far Beyond the Stars#If FBtS was to air today with the same time gap it would take place in 1979#Benny Russel#Bell Riots#Julian Bashir#Lee#Ben Sisko#Douglas Pabst#Odo

3K notes

·

View notes

Text

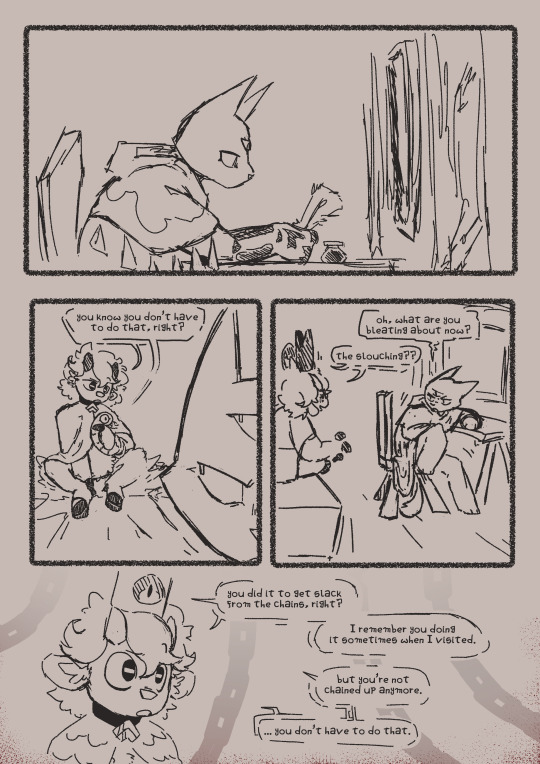

bit of a low effort comic for the cotl crowd because my hand hurts today but i still wanted to draw

#we draw at times!#cotl#narinder#the lamb#cotl lamb#idk which one to use whatever#they are in the same place at the same time which is pretty gay#the red crown is tall because of all the other crowns its eating. thats just what happens when you gain more power. trust me

2K notes

·

View notes

Text

A fish out of water...

Did you know that in every story, even if they marry, the selkie is still longing to go back to the sea?

But at least he has a siren husband who can sing for him.

more of them

#occudo's art#tma fanart#martin blackwood#jonathan sims#selkie!martin#siren!jon#not me making the funny fairy-tale au sad for myself#btw the sea isn't singing a creepy way!#I just think Martin would miss#the calling voice of the place#where he first felt at home#and the feeling that maybe one day#he could understand how his mother felt#even if he knows it's not the same#and jon is all don't go where I can't follow we just got here#but I don't think he could ever put his feelings into worlds#so he sings

2K notes

·

View notes

Text

It's always "Hades isn't bad or cruel, his deeds are just metaphors of the inevitable death" or "Hades kidnapping Persephone represent the premature death".

But when the argument "Zeus has numerous affairs and many children because he represent the fertile rain" is brought up, all nuance is suddenly out of the window and Zeus is just a womanizer who can't keep it in his pants.

#hades#zeus#greek mythology#greek gods#greek deities#cherry picking who should be condemned for their “crimes” and who can be excused because “their action is metaphorical”#just shows your ridiculous hypocrisy#if you're gonna judge the gods at least put all of them on the same standard#or maybe - i don't know - understand that you're not in the place to judge the deities from a different culture???#i admit i used to have a “Hades good/Zeus bad” phase too#but i'm growing out of it because in the end i'm only reading the stories from another country

6K notes

·

View notes

Note

So,I read silver's relaxation vigente and now I'm sad for the poor boy. If lilia broke up silver's curse why is it acting so strongly on him?

to be fair, the chronological placement of his birthday story just doesn't make any sense in general. like, it can only really take place during his second year, since Ace and Malleus are both there...yet we have seen pretty definitively what Silver was doing on the evening before/morning of his 18th birthday, and it was very much NOT his history homework. this myth?

jk jk I think it's just one of those card stories that's meant to be more...perpendicular to canon, if that makes sense? 😅 like a lot of them aren't really supposed to fit into a specific point in the timeline; instead all the characters and relationships tend to be somewhere vaguely post-episode 1 (occasionally with a bonus post-6 Ortho) except Yuu is already friends with everyone and nobody is surprised to hear them call Malleus Tsunotarou.

mostly they can get away with it, but it starts getting a bit weird with the cards that are supposed to be set at specific times. :T for those I think you gotta just kind of suspend your disbelief and take 'em as, like...little what-if AUs, or something like that! it's not exactly not canon, but more like. this is Silver's birthday if none of the narrative development happened and so his curse is still in effect, or something. 🤷 uhhhh basically Twst's timeline is an eldritch thing that cannot be perceived by mortal eyes, to try will lead to nothing but suffering, down this path dwells only madness.

that said I do 100% accept the presented canon that Silver's roommate is in eternal torment. this is the real victim of Twst right here.

#art#twisted wonderland#twisted wonderland spoilers#kutsurogi my room#silver runs a comb through his hair once and instantly becomes a sparkling oujisama#the timeline may not make any sense but i believe it#i mean you can kind of see how they've been trying to work around the fact that we're in year 5 of birthdays#these ones take place the morning before the party! these ones are all set on the same day and they're at a museum!#and yet by my count we're still at everyone having at least three mandatory birthday parties with three different mandatory birthday outfit#nrc is ridiculous but is it THAT ridiculous#(don't answer that)#same with halloween tbh#(that one line in lost in the book nmbc where malleus is like 'i can't wait for sebek to have his first nrc halloween }:)'#while yuu is RIGHT THERE and actively tsunotarou-ing it up...)#it's just inevitable after a certain point i think given they're going for a sort of timeless non-spoilery feeling to the stories#so you gotta be willing to just roll with some of it#(i say after writing this whole post about how silver's birthday is unstuck in time)#that said while i don't personally subscribe to the time loop theory...i mean...#is it discontinuity or the world's most incredible foreshadowing? time (so to speak) will tell

1K notes

·

View notes

Text

Eddie graduates, finds himself a shitty job that he keeps getting promoted at, and now he’s the manager.

That’s how he found himself wearing a tie, sitting across Goddamn Dave, the district manager, being told that he has to hire one of his friend’s kids, “And the kid’s friend, they’re a pair apparently.”

Which…what is this? Chain store nepotism? It’s bullshit.

“The kid’s not all there, head injury,” Goddamn Dave tells him. “Go easy on him.”

Then it turns out the kid isn’t even a teenager looking for a summer job. It’s twenty-something Steve Harrington from high school??? With a dog. And a lesbian.

“Service dog,” Steve says when he sees Eddie looking at it. “A dog with a job.”

“More of a hobby,” his friend - Robin, Eddie recognizes her - says. “He doesn’t get paid. His name is Steve.”

“His name is NOT Steve,” Steve - human - scoffed. “His birth name was Steve. He changed it.”

“They’re twins.”

Eddie does not roll his eyes into oblivion because he’s a goddamn professional. He just rolls them to the back of his head where Gene Simmons reminds him that if he wants to rock and roll all night, he needs to be employed.

He informs them of their shift schedules and barely gets through Steve’s when Robin says, “We have to work the same shifts. It was on our resume.”

Steve adds, “Also, we need to leave early today.”

Eddie thinks, goddamn Dave.

#I purposely did not name that dog#you can name him#I hate doing it#Steve and Robin (working the same register) to a customer: I wouldn’t care if you burnt this place to the ground to be honest#Eddie: *suddenly remembering the mall fire*#steve harrington#eddie munson#robin buckley

2K notes

·

View notes