#home prices

Explore tagged Tumblr posts

Text

The Ramsey Show addresses housing crisis and corporate greed

#politics#political#us politics#rachel cruz#dave ramsey#john delony#george kamel#news#donald trump#president trump#elon musk#american politics#jd vance#blackstone#laws#corporate greed#housing crisis#housing#home prices#america

35 notes

·

View notes

Text

Update!!

Thank you everyone for the support you've shown. We're 1k in and there are no words to express my gratitude. Every little bit helps and we're trying really hard to shore up as much as we can for our down payment. If you can share our go fund me info with anyone and everyone, that will only help. We truly appreciate any amount of support you can give. Thank you so much.

#tesserox#twitch#streaming#ffxiv#ff14#gofundme#buying home#home prices#please donate#donate if you can#donations#please help

9 notes

·

View notes

Text

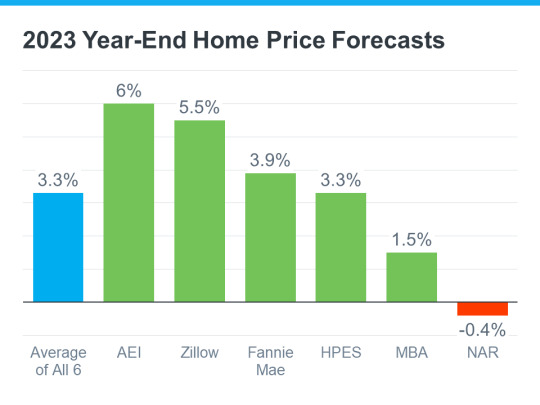

2023 Year End Price Forecasts

2 notes

·

View notes

Text

The Surprising Influence of Location on Modular Home Prices!

Modular homes are changing the face of the housing industry with their affordability, efficiency, and level of customisation. However, one main factor that determines modular home costs is location. From city centers to countryside settings, where you build can literally make a difference in cost. Understand how urban locations impact modular home prices and what you should consider before you make your choice.

How Do Urban Locations Influence Modular Home Costs?

Constructing a modular house in the city tends to be more expensive. Why?

Land Prices: Land in the city is very much sought after, which makes it more costly. This can add a lot to the overall cost of your modular home construction project.

Permits and Regulations: Cities tend to have more strict building codes and permit regulations, which contribute to the cost of construction.

Transportation Issues: Getting modular components to city centers can be costly because of traffic limitations or restricted access.

Although city sites might be more costly, they provide proximity to amenities, schools, and offices, which could justify the investment.

Why Rural Sites Are Less Costly

Rural sites are generally perceived as a less costly option for modular homes. But why are they so economical?

Lower Land Costs: Rural land is generally lower in cost, which lowers the cost of construction of a modular home.

Less Regulation: Rural councils tend to have less regulation and fewer zoning laws, lowering the cost of approval and reducing the time frame.

Transportation Savings: Some rural locations are nearer to modular home manufacturing centers, which can reduce transportation expenses.

For those who want affordability without compromising on quality, rural areas can be a great choice for lowering modular home costs.

How Does Accessibility Affect Costs?

Accessibility is an important factor in determining the ultimate cost of your modular home. Here's why:

Remote Areas: Construction in remote locations can result in increased transportation charges for module and material delivery.

Infrastructure Requirements: Inadequate access to facilities such as water or electricity can necessitate extra setup charges.

Road Conditions: Inadequate road infrastructure may make delivery logistics more difficult, possibly raising costs.

Selecting a location with favorable accessibility can simplify the construction process and maintain costs at reasonable levels.

What Is the Role of Climate in Modular Home Costs?

Australia's varied climate also affects modular home costs. Here's why:

Design Modifications: Houses in cyclone zones might need to have reinforced structures, which will add to costs.

Insulation Requirements: Colder areas might need extra insulation or heating systems, which will contribute to costs.

Material Durability: Seaside areas may need corrosion-resistant materials because of salt exposure, increasing material costs.

Knowing your location's climate is crucial for choosing designs and materials that will provide durability while keeping costs under control.

Conclusion

Location is among the most important factors that influence modular home prices. Urban locations have higher land and regulatory expenses but are convenient and accessible. Rural areas are affordable but might need extra considerations for infrastructure and accessibility. Climate and transport logistics also play a role in pricing, which means you will need to review your selected location carefully. From this, you can make sensible choices that trade cost-effectiveness for your way of life requirements. Whether it is a lively city or a tranquil rural location, modular homes present flexibility and are worth adjusting to where you are!

0 notes

Text

🏠 Vancouver’s home prices skyrocketed by $10,700 in February 2025, intensifying the city’s affordability crisis. 🏠 Uncover how soaring costs and mortgage shifts are reshaping Vancouver’s housing market—plus tips for buyers 👇🏻

#Canada#Canada housing market 2025#Economy#February 2025 Vancouver housing#home prices#homebuyers#housing affordability Vancouver#income needed to buy home Vancouver#mortgage rates Vancouver 2025#Ratehub home affordability report#Vancouver home price increase 2025#Vancouver homebuyers challenges#Vancouver real estate trends

0 notes

Text

Why Trump wants to bring aluminum production back to the U.S.

Americans use a lot of aluminum. The metal is both lightweight and an effective conductor of electricity, giving it countless applications in transportation and energy systems alongside culinary work and more. “It really is the magic metal,” said Charles Johnson, president and CEO of the Aluminum Association. Aluminum is one of 50 “critical minerals” identified by the U.S. Geological Survey. But…

#Aluminum manufacturing#Aluminum markets#Automobile manufacturing#Breaking News: Economy#business news#canada#China#Donald Trump#Economic events#Economic outlook#Economic policy#Economy#Free trade#Global trade#Home prices#Housing vacancies and homeownership#International trade#Metal mining#Neutral#tariff#Trade#United States#Washington D.C.

0 notes

Text

According to the St. Louis Fed, there are nearly 15 million vacant housing units in the U.S. as of Q3 2024.

That doesn't mean a house on the market. The definition is:

A housing unit is vacant if no one is living in it at the time of the interview, unless its occupants are only temporarily absent. In addition, a vacant unit may be one which is entirely occupied by persons who have a usual residence elsewhere. New units not yet occupied are classified as vacant housing units if construction has reached a point where all exterior windows and doors are installed and final usable floors are in place. Vacant units are excluded if they are exposed to the elements, that is, if the roof, walls, windows, or doors no longer protect the interior from the elements, or if there is positive evidence (such as a sign on the house or block) that the unit is to be demolished or is condemned. Also excluded are quarters being used entirely for nonresidential purposes, such as a store or an office, or quarters used for the storage of business supplies or inventory, machinery, or agricultural products. Vacant sleeping rooms in lodging houses, transient accommodations, barracks, and other quarters not defined as housing units are not included in the statistics.

END

As of January 2023, "The Department of Housing and Urban Development (HUD) counted 653,104 homeless Americans in its annual point-in-time report, which measures homelessness across the US on a single night each winter. That’s a 12.1% increase from the same report in 2022."

As of February 2024, "Nearly 327,000 people in the United States experiencing homelessness lived in shelters, a small proportion (0.1%) of the U.S. population from 2018 to 2022 but higher than from 2013 to 2017, according to American Community Survey (ACS) 5-year estimates released in a working paper today.

"The 2013-2017 ACS, the previous 5-year ACS with no overlapping years, showed there were approximately 267,000 people (0.08% of the U.S. population) in shelters during that period."

As op says, the problem is not supply.

ok realizing this needs to be said because not everyone knows:

building affordable housing is a red herring. a scam. a multilevel marketing scheme.

there is far more housing than there are people. you would think housing is expensive because the supply is too low and the demand too high. we’re taught to believe in the ‘law of supply and demand’ but that’s invariably a gross simplification.

real estate is always a great investment because land is a fundamentally finite resource, and fundamentally necessary for life. most investments tend to fluctuate, to increase and decline in value, but real estate almost always increases, and often at far higher rates than ‘the market’ at large offers.

so what does this mean? it means that there are many times more vacant homes than there are homeless people. it means buying a home and renting it for more than the mortgage while the equity only grows is an incredible investment. heck buying a home and not renting it is still a great investment. SO no matter how many homes you build, ‘affordable’ or not, they will be bought up and hoarded by the rich and housing will remain unaffordable for everyone else.

#housing#usa#culture#capitalism#homelessness#home prices#housing affordability#tumblr conversations#affordable housing#private equity#knowledge#research

5K notes

·

View notes

Text

there are 7 days left to fulfill the last 4% of the municipality of gaza's life-saving campaign!

water is life. infrastructure must be rebuilt. approximately $50,043 are left to reach this goal.

we are so close!

donate here! every dollar gets us closer!

if you have a clean and consistent water source that is a privilege. it always has been in this world. here is a chance to give that back to a place in dire need. take it! this goal can and must be filled!

#palestine#gaza#signal boost#fellow americans do you have a favorite drink you want to buy this week? the taxes on that are funding the weapons that are murdering#palestinians and destroying their home. don't waste time with guilt take action donate that price here

13K notes

·

View notes

Text

America’s home prices have reached new record highs for 15 straight months. That’s great news if you own a home — and not so great if you don’t, especially with mortgage rates remaining stubbornly high, just below 7%. That’s why a record low 2.5% of homes switched owners this year, the lowest in 30 years, according to Redfin. Rent isn’t offering much relief: About half of American renters shelled out more than 30% of their income on rent in 2023. Households that spend more than 30% of their income on rent, mortgage payments or other housing costs are considered “cost-burdened” by the US Department of Housing and Urban Development. The housing affordability crisis has helped exacerbate America’s wealth gap, leaving people who are forced to move or don’t own a home in a financial bind. But many people who are hardly poor are also struggling to get by, largely because of how much it costs to live in a home: A fifth of US households that earn more than $150,000 a year are living paycheck to paycheck, according to a Bank of America survey.

David Goldman, ‘What just happened? It was the economy, stupid‘, CNN

#CNN#David Goldman#US Department of Housing and Urban Development#US#Bank of America#Redfin#home prices#housing affordability crisis

0 notes

Text

Are you looking to sell your home quickly and for the highest possible price? Strategic pricing strategies can be the key to maximizing your home’s selling potential. By carefully setting the right price, you can attract more potential buyers, generate competition, and ultimately secure a better deal.

In today’s competitive real estate market, it’s essential to make your home stand out from the crowd. Finding the sweet spot between being affordable and realizing its full value is crucial. With strategic pricing strategies, you can position your home as an attractive option for buyers, enticing them to make strong offers.

But how do you determine the optimal price for your property? It’s not just a matter of picking a number randomly or basing it solely on what you think your home is worth. Click here for the rest of the article

#flat fee mls#fsbo#byownermls#mls listing service#real estate#cypress fsbo#home prices#Texas FSBO MLS#houzeo#spring branch homes#Houston Real Estate

0 notes

Text

Help Support Us Trying to Get Our First House

getting a house is like a daydream for most millenials. we aren't going to get this. hell no.

But sometimes you get a little lucky and the stars start to align and you think, yeah, this'll be okay. We CAN DO THIS.

and then you get scared that you can't

If you can help us, thank you. If you can't, I get it. We just need a little bit of help to see this through to the end.

#tesserox#twitch#streaming#ffxiv#ff14#ff14 ffxiv#ff14 endwalker#baldur's gate 3#bg3#gofundme#fundraising#fundraiser#donate#please donate#donate if you can#donations#welcome home#home prices#buying home#first time buyers#millenials#millennial

4 notes

·

View notes

Text

Navigating the Complex Landscape of the 2024 Housing Market

Understanding Market Trends for 2024 As a homeowner or potential buyer, understanding the market trends in the 2024 housing landscape is crucial for making informed decisions. Currently, the market presents a multifaceted scenario featuring projected increases in home prices, fluctuating mortgage rates, and persistent inventory challenges. Let’s dive into these aspects to give you a comprehensive…

0 notes

Text

Home Prices After Presidential Elections

0 notes

Text

Your Equity Could Make a Move Possible | KM Realty Group LLC

Many homeowners looking to sell feel like they’re stuck between a rock and a hard place right now. Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Maybe you’re in the same boat.

But what if there was a way to offset these higher borrowing costs? There is. And the money you need probably already exists in your current home in the form of equity.

What Is Equity?

Think of equity as a simple math equation. Freddie Mac explains:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

Your equity grows as you pay down your loan over time and as home prices climb. And thanks to the rapid home price appreciation we saw in recent years, you probably have a whole lot more of it than you realize.

The latest from the Census and ATTOM shows more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means the majority of homeowners have a game-changing amount of equity right now.

How Your Equity Can Help Fuel Your Move

After you sell your house, that equity can help you move without worrying as much about today’s mortgage rates. As Danielle Hale, Chief Economist for Realtor.com says:

“a consideration today’s homeowners should review is what their home equity picture looks like. with the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. this means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

To give you some examples, here are a few ways you can use equity to buy your next home:

Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates.

Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much at today’s rates.

The First Step: Determine How Much Equity You Have in Your Home

Want to find out how much equity you have? To do that, you’ll need two things:

The current mortgage balance on your home

The current value of your home

You can probably find the mortgage balance on your monthly mortgage statement. To understand the current market value of your house, you can pay hundreds of dollars for an appraisal, or you can contact a local real estate agent who will be able to present to you, at no charge, a professional equity assessment report (PEAR).

Once you’ve connected with a trusted local agent and run the numbers, you’re one step closer to making a move you may not have thought was realistic — all thanks to your equity.

Bottom Line

If you want to find out how much equity you have and talk more about how it can make your next move possible, let’s connect with real estate experts in Chicago, Illinois.

0 notes

Text

Household expectations to future home price appreciation are currently at the highest level since 2007

0 notes