#gst filing in chennai

Text

Chennai Filings offers seamless GST return filing online in Chennai, providing businesses with a hassle-free compliance solution. Our platform simplifies the entire process, allowing users to file returns conveniently from anywhere in Chennai. With Chennai Filings, businesses can ensure accuracy and timeliness in their filings, avoiding penalties and compliance issues. Our user-friendly interface guides users through each step, making the process efficient and straightforward. Trust Chennai Filings to handle all your GST return filing needs in Chennai, so you can focus on growing your business with peace of mind.

#GST Return Filing Online in Chennai#gst filing in chennai#gst return filing in chennai#gst filing consultants in chennai#gst filing charges in chennai

0 notes

Text

A Deep Dive into GST and Taxation in India

Unraveling GST

The Goods and Services Tax (GST) is a revolutionary reform in India’s indirect tax system. It has replaced numerous indirect taxes, such as excise duty, VAT, and services tax. This comprehensive, multi-stage, destination-based tax is levied on every value addition.

The Multi-Stage Nature of GST

An item undergoes multiple change-of-hands along its supply chain: from manufacture to the final sale to the consumer. The stages include:

Purchase of raw materials

Production or manufacture

Warehousing of finished goods

Selling to wholesalers

Sale of the product to the retailers

Selling to the end consumers

GST is levied on each of these stages, making it a multi-stage tax.

Value Addition and GST

Consider a manufacturer who makes biscuits. They buy flour, sugar, and other materials. The value of the inputs increases when the sugar and flour are mixed and baked into biscuits. GST is levied on these value additions, i.e., the monetary value added at each stage to achieve the final sale to the end customer.

Destination-Based Taxation

Let’s consider goods manufactured in Maharashtra and sold to the final consumer in Karnataka. Since GST is levied at the point of consumption, the entire tax revenue will go to Karnataka and not Maharashtra.

The Evolution of GST in India

The journey of GST in India began in the year 2000 when a committee was set up to draft the law. It took 17 years for the Law to evolve. In 2017, the GST Bill was passed in the Lok Sabha and Rajya Sabha. On 1st July 2017, the GST Law came into force.

The Impact of GST

GST has simplified the tax regime and enhanced the ease of doing business in India. It is a comprehensive tax system that has subsumed almost all the indirect taxes except a few state taxes. By levying the tax at the point of consumption, GST has ensured a fair distribution of tax revenues among states.

Conclusion

GST has brought about a significant change in the Indian taxation system. It has simplified the tax structure, making it easier for businesses to comply. Moreover, it has ensured a fair distribution of tax revenues among states. As India continues to grow and evolve, GST will play a crucial role in shaping the country’s economic landscape.

#gst#gst history#efiletax#business#gst services#gst filing chennai#gst filing#gst india#taxes#income tax

0 notes

Text

0 notes

Text

GST Registration and File GST Return online - Chennai, Tamilnadu

Goodwill India Enterprises provide a Customized Solution to contribute business management services in Chennai, Tamilnadu.

#GST Registration and File GST Return online - Chennai#Tamilnadu#pvt ltd company registration#fssai certificate#fssai apply online#fssai license#Trademark Registration

0 notes

Text

Online gst registration consultant in chennai l madrasfilings

In today’s dynamic business environment, Goods and Services Tax (GST) compliance is essential for every business in India. Whether you are a startup or an established enterprise, understanding and navigating the GST landscape can be overwhelming. At Madras Filings, we specialize in providing expert online GST registration consultancy in Chennai, ensuring that your business meets all regulatory requirements effortlessly.

Understanding GST Registration

GST registration is a mandatory requirement for businesses whose annual turnover exceeds the prescribed limit. It is crucial for availing input tax credits, ensuring compliance, and fostering transparency in business operations. A registered business can collect GST from customers, which can then be claimed as input tax credit on their purchases. This not only helps in maintaining accurate financial records but also enhances your business credibility.

Why Choose Online GST Registration?

Convenience: The online registration process allows you to initiate GST registration from the comfort of your home or office without the need to visit government offices.

Speed: With our streamlined online process, we ensure that your GST registration is completed quickly, enabling you to commence your business operations without delays.

Expert Guidance: Our experienced consultants provide step-by-step assistance throughout the registration process, ensuring that you understand each requirement and avoid common pitfalls.

Our Comprehensive GST Registration Services

At Madras Filings, we offer a range of services to facilitate seamless GST registration:

Initial Consultation: We start with an in-depth consultation to understand your business structure, turnover, and specific requirements. This helps us determine the appropriate GST registration type for your business.

Document Preparation: Our team assists in collecting and preparing all necessary documents required for GST registration, including identity and address proofs, business registration documents, and bank statements.

Online Application Filing: We take care of the entire online application process, ensuring that all details are accurately filled in the GST portal to avoid any rejections or delays.

GSTIN Issuance: Once the application is submitted, we monitor its progress and keep you informed. After successful verification, we assist you in obtaining your GST Identification Number (GSTIN).

Post-Registration Support: Our services extend beyond registration. We provide guidance on GST compliance, filing returns, and maintaining proper records to help you stay compliant with GST regulations.

GST Consultation: We offer ongoing GST consultation to help you understand tax implications on your business transactions, manage input tax credits, and develop effective tax strategies.

Why Choose Madras Filings for Your GST Registration?

Expertise: Our team of experienced tax consultants possesses in-depth knowledge of GST regulations and processes. We stay updated with the latest developments to provide the best solutions for your business.

Personalized Service: We understand that every business is unique. Our personalized approach ensures that we tailor our services to meet your specific needs and requirements.

Hassle-Free Process: We manage the entire registration process for you, minimizing your administrative burden and allowing you to focus on your core business activities.

Transparent Pricing: We offer competitive pricing for our services with no hidden fees. You can trust that you are receiving exceptional value for your investment.

Client Satisfaction: Our commitment to client satisfaction drives us to deliver timely and efficient services. We prioritize your needs and work diligently to exceed your expectations.

Conclusion

Navigating the complexities of GST registration doesn’t have to be a challenging experience. With Madras Filings, you gain a reliable partner to guide you through the entire process. Our online GST registration consultancy in Chennai ensures that you meet all compliance requirements efficiently and effectively. Don’t let the intricacies of GST hold your business back. Contact us today to begin your GST registration journey and set your business on the path to success!

Contact us https://www.madrasfilings.com/

#Online gst registration consultant in chennai#Online gst registration consultant#Online gst registration chennai#Online gst registration#gst registration consultant in chennai#gst registration in chennai

0 notes

Text

Documents Required for Sole Proprietorship Registration in Chennai

A Comprehensive Guide to Sole Proprietorship Registration in Chennai

Introduction

A sole proprietorship registration in Chennai is one of India's most straightforward and common business structures. It's a type of enterprise owned and managed by a single individual. This form of business is ideal for small-scale businesses and professionals such as freelancers, consultants, and small traders. Chennai, being a major commercial and cultural hub in South India, offers numerous opportunities for entrepreneurs looking to start a sole proprietorship. This guide provides a detailed overview of the process and requirements for registering a sole proprietorship in Chennai.

Benefits of Sole Proprietorship

Easy to Start and Manage: Starting a sole proprietorship in Chennai is straightforward and involves minimal legal formalities.

Complete Control: The proprietor has full control over all business decisions and operations.

Tax Benefits: Sole proprietorships often benefit from lower tax rates compared to other business structures.

Less Compliance: There are fewer regulatory requirements and compliance norms to follow.

Profit Retention: All profits generated from the business go directly to the owner.

Steps to Register a Sole Proprietorship in Chennai

Decide on a Business Name

Choose a unique and appropriate name for your business.

Ensure the name is not already registered as a sole proprietorship or trademarked by another entity.

Obtain a PAN Card

If you don't already have one, apply for a Permanent Account Number (PAN) in your name, as it is required for tax purposes.

Open a Bank Account

Open a current account in the name of your business. This account will be used for all business transactions.

Provide necessary documents such as PAN card, address proof, and business registration proof (if applicable).

Register for GST

If your annual turnover exceeds the threshold limit (currently ₹20 lakhs for most states), you must register for Goods and Services Tax (GST).

Apply for GST registration through the GST portal.

Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need specific licenses and permits to operate legally in Chennai.

Standard licenses include the Shop and Establishment License and professional tax registration.

Maintain Compliance

Keep accurate and up-to-date records of all business transactions.

File income tax returns annually and comply with other statutory requirements.

Important Considerations

Business Insurance: Consider getting business insurance to protect against potential risks and liabilities.

Trademark Registration: To protect your brand name and logo, consider registering them as trademarks.

Professional Advice: Consult with a legal or financial advisor to ensure all aspects of your business comply with local laws and regulations.

Conclusion

Sole proprietorship registration in Chennai is a straightforward process that offers numerous benefits for small business owners. Following the steps outlined above, you can ensure your business is set up legally and ready to operate in one of India's most vibrant cities. With the proper preparation and compliance, you can focus on growing your business and achieving your entrepreneurial goals.

For further assistance or detailed guidance, you can contact local consultants or business service providers like Kanakkupillai, which specialises in helping entrepreneurs with business registration and compliance requirements.

0 notes

Text

Can I Sell Online Without GST? GST Requirements for E-commerce

In 2024, the trend of e-commerce has transformed the way people shop and businesses operate online. Whether you're selling groceries, electronic items, or running a full-fledged online store, the question of GST (Goods and Services Tax) often arises. GST is a consumption tax levied on the supply of goods and services in Chennai, Tamilnadu designed to replace various indirect taxes.

What is GST?

GST is a comprehensive indirect tax on online store, sale, and consumption of goods and services throughout India, aimed at simplifying the tax structure on consumers. It is mandatory for businesses whose turnover exceeds specified thresholds to register under GST and comply with its regulations.

You Need GST for Selling Online on Shocals

The requirement for GST registration depends primarily on your turnover and the category of your business. Here are some key points to consider for GST:

Threshold Limits: As of the latest information available, businesses with an aggregate turnover exceeding Rs. 40 lakhs (Rs. 10 lakhs for northeastern states) in a financial year must register for GST. This turnover includes all taxable supplies, exempt supplies, exports of goods and services, and inter-state supplies.

Inter-state Tamilnadu Sales: If you are selling goods or services to customers in different states, you are likely to exceed the turnover threshold sooner. GST registration is mandatory for businesses making inter-state supplies, regardless of turnover.

Mandatory Registration: Even if your turnover is below the threshold, you may choose to voluntarily register for GST. This can be beneficial for claiming input tax credits on purchases and improving your business credibility.

Selling on Shocals Partners

If you are selling through popular Shocals Partners, you need to understand the policies regarding GST compliance. It requires sellers to provide GSTIN (GST Identification Number) during registration and ensure compliance with GST laws.

Steps to Register for GST

If you decide to register for GST, here's a brief overview of the registration process:

Prepare Documents: Keep your PAN (Permanent Account Number), proof of business registration, identity and address proof, bank account details, and business address proof.

Online Registration: Visit the GST portal (www.gst.gov.in) and fill out the registration form with required details. Upload scanned copies of documents as specified.

Verification: After submission, your application will be verified by the GST authorities. Once approved, you will receive your GSTIN and other credentials.

Benefits of GST Registration

While GST compliance involves maintaining proper accounting records and filing periodic returns, it offers several advantages:

Input Tax Credit: You can claim credit for GST paid on your business purchases, thereby reducing your overall tax liability.

Legal Compliance: Avoid penalties and legal repercussions by operating within the GST framework.

Business Expansion: Facilitates smoother inter-state and international sales, enhancing business opportunities.

Conclusion

In conclusion, while small businesses and startups may initially wonder if they can sell online without GST, understanding the thresholds and benefits of GST registration is crucial. Compliance not only ensures legal adherence but also opens avenues for business growth and competitiveness in the digital marketplace. Whether you're a budding entrepreneur or an established seller, staying informed about GST requirements will help you navigate the e-commerce landscape more effectively.

For more details please visit - https://partner.shocals.com/

1 note

·

View note

Text

Step-by-Step Guide to Partnership Firm Registration in Chennai

Introduction

Starting a business in Chennai as a partnership firm is a popular choice among entrepreneurs due to its ease of formation and operational flexibility. However, understanding the registration process is crucial to ensure compliance with legal requirements and to establish a solid foundation for your business. This comprehensive guide will walk you through each step of registering a partnership firm registration in Chennai, ensuring a smooth and hassle-free experience.

What is a Partnership Firm?

A partnership firm is a business structure where two or more individuals come together to run a business jointly, sharing profits, losses, and responsibilities. In India, a partnership firm can be registered or unregistered, but registering the firm provides legal Requirements and added benefits.

Benefits of Registering a Partnership Firm in Chennai

1. Legal Recognition

A registered partnership firm gains legal recognition, which helps resolve disputes and maintain the credibility of the business.

2. Easy Access to Loans

Banks and financial institutions prefer dealing with registered entities, making it easier to obtain loans and credit facilities.

3. Protection of Rights

Registration helps protect the rights of partners and ensures that the terms of the partnership deed are enforceable by law.

4. Business Continuity

In the event of a partner's death or exit, a registered firm can continue to operate smoothly with the remaining partners.

Pre-Requisites for Partnership Firm Registration

Before starting the registration process, ensure that you have the following pre-requisites in place:

Partnership Deed: A legal document outlining the rights, duties, and responsibilities of each partner.

PAN Card of Partners: Personal PAN cards of all partners are required.

Proof of Address: Residential proof for all partners (Aadhaar card, Voter ID, etc.).

Proof of Firm's Address: Proof of the registered office address (rent agreement, utility bill, etc.).

Bank Account in the Firm's Name: A bank account must be opened in the partnership firm's name.

Step-by-Step Process to Register a Partnership Firm in Chennai

Step 1: Choose a Name for Your Partnership Firm

The first and crucial step in registering your partnership firm is selecting a unique name. The name should be different from any existing registered firm, as this could result in the registration application being rejected.

Step 2: Draft a Partnership Deed

The partnership deed is a critical document that defines the partnership's roles, responsibilities, profit-sharing ratio, and other essential aspects. It should be drafted on non-judicial stamp paper and signed by all partners.

Step 3: Obtain a PAN Card for the Partnership Firm

After drafting the partnership deed, apply for a Permanent Account Number (PAN) card in the name of the partnership firm. The PAN is essential for tax filing and other financial transactions.

Step 4: Register the Partnership Deed

Submit the partnership deed, along with the registration form and the necessary fees, to the Registrar of Firms in Chennai. Upon verification, the Registrar will issue a Certificate of Registration, officially recognising the partnership firm.

Step 5: Apply for GST Registration

If your business turnover exceeds the prescribed limit, you must obtain GST registration. This step is crucial for businesses involved in the supply of goods and services and helps them qualify for tax benefits.

Step 6: Open a Bank Account in the Name of the Partnership Firm

With the PAN card and registration certificate, you can open a bank account in the name of your partnership firm. This account will be used for all business transactions, ensuring transparency and financial management.

Step 7: Obtain Other Required Licenses

Depending on the nature of your business, you may need to apply for additional licenses, such as the Shops and Establishments License, FSSAI License (for food-related companies), etc. Ensure that all necessary permits are in place to operate your business legally.

Cost of Partnership Firm Registration in Chennai

The cost of registering a partnership firm in Chennai varies depending on factors like stamp duty, legal fees, and registration fees. On average, the total price can range between ₹2,000 to ₹10,000. It's advisable to consult with a legal expert to get a precise estimate based on your specific requirements.

Conclusion

Registering a partnership firm in Chennai is straightforward if you follow the correct steps and fulfil all legal requirements. By completing the registration, you ensure that your business is legally compliant and positioned for growth. Whether you're starting a small enterprise or planning a more significant venture, the partnership firm structure offers flexibility, shared responsibility, and the potential for significant business success.

0 notes

Text

Chennai Filings offers seamless GST return filing online in Chennai, providing businesses with a hassle-free compliance solution. Our platform simplifies the entire process, allowing users to file returns conveniently from anywhere in Chennai. With Chennai Filings, businesses can ensure accuracy and timeliness in their filings, avoiding penalties and compliance issues. Our user-friendly interface guides users through each step, making the process efficient and straightforward. Trust Chennai Filings to handle all your GST return filing needs in Chennai, so you can focus on growing your business with peace of mind.

#GST Return Filing Online in Chennai#gst filing in chennai#gst return filing in chennai#gst filing consultants in chennai#gst filing charges in chennai

0 notes

Text

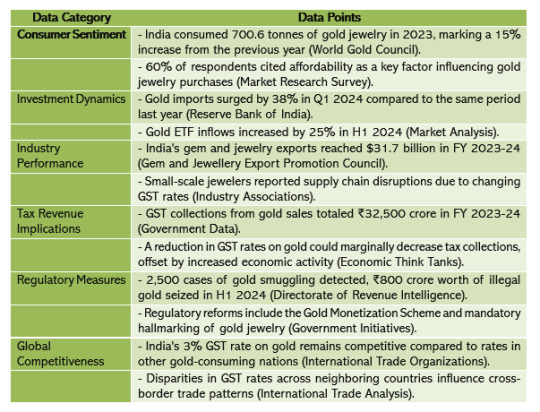

GST on Gold: Effects of Gold GST Rate in India 2024

In 2024, the effects of the Goods and Services Tax (GST) rate on gold continue to resonate throughout India's economy, impacting various stakeholders from consumers to industry players. Let's delve into the implications of the gold GST rate and how it shapes the landscape of the precious metal market:

Consumer Sentiment: The GST rate directly influences the final price of gold for consumers. A lower GST rate makes gold more affordable, encouraging higher demand for jewelry, coins, and bullion among consumers. Conversely, a higher GST rate may deter purchases, particularly among price-sensitive buyers, impacting consumer sentiment and spending patterns.

Investment Dynamics: Gold is revered as a traditional investment asset and a hedge against economic uncertainties. The GST rate affects its attractiveness as an investment avenue. A lower GST rate enhances the appeal of gold investments, attracting investors seeking portfolio diversification and wealth preservation. Conversely, a higher GST rate may prompt investors to explore alternative investment options with potentially higher returns.

Industry Performance: The gold industry, encompassing miners, refiners, jewelers, and retailers, is intricately linked to the prevailing GST rate. A lower GST rate spurs demand for gold jewelry and ornaments, benefiting jewelers and retailers. However, fluctuating GST rates can disrupt supply chains, inventory management, and pricing strategies within the industry, posing challenges for stakeholders.

Tax Revenue Implications: The GST rate on gold significantly contributes to government tax revenues. While a lower GST rate stimulates demand and economic activity in the gold sector, it may lead to a reduction in tax collections. Conversely, a higher GST rate boosts government revenues but could dampen consumer spending and industry growth, necessitating a delicate balance between revenue generation and economic stimulus.

Regulatory Measures: Policymakers continuously monitor and adjust the gold GST rate to achieve broader economic objectives, address inflationary pressures, and ensure fiscal sustainability. Changes in the GST rate are often accompanied by regulatory measures aimed at curbing illicit activities such as smuggling and tax evasion, thereby safeguarding government revenue and market integrity.

Global Competitiveness: The GST rate on gold in India is juxtaposed with rates in other countries, influencing international competitiveness and trade dynamics. Disparities in GST rates between nations can incentivize cross-border trade, impacting domestic markets and necessitating policy responses to maintain a level playing field for industry participants.

In summary, the GST rate on gold in India is a critical determinant of consumer behavior, investment trends, industry dynamics, and government revenues. As policymakers navigate economic challenges and strive to foster growth, they must calibrate the gold GST rate judiciously, balancing the interests of stakeholders while ensuring fiscal prudence and regulatory effectiveness, you need the advice of experts such as efiletax Indeed.

#GST on Gold#Gold GST Rate#Gold GST Rate in India 2024#efiletax#taxes#gst services#gst filing chennai#gst update india#india gst#gold#gst filing

0 notes

Text

Get GST registration in Chennai from GST filing experts, we are leading GST tax consultants for easy approval, get your GST number at best cost.

0 notes

Text

Is Your TDS Refund Still Pending?

By Wishtree Consultants Pvt Ltd

Name: Wishtree Consultants Pvt Ltd

Why Is Your TDS Refund Still Pending?

Claiming a TDS (Tax Deducted at Source) refund should be straightforward, but sometimes delays happen. Here are some common reasons why your TDS refund might still be pending:

1. Incomplete or Incorrect Information: Ensure all the details in your income tax return, such as PAN, bank account number, and TDS amount, are accurate and complete.

2. Non-Verification of Return: After filing your return, it’s essential to verify it. Unverified returns are not processed for refunds. You can verify it through Aadhaar OTP, EVC (Electronic Verification Code), or by sending a signed ITR-V to CPC Bangalore.

3. Mismatched TDS Details: The TDS details in your return must match those in Form 26AS. Any discrepancy can lead to delays. Regularly check Form 26AS to ensure all TDS credits are reflected correctly.

4. Processing Delays at CPC: The Centralized Processing Center (CPC) may experience delays during peak filing seasons. Patience is key, and you can track your refund status online through the Income Tax e-filing portal.

5. Outstanding Tax Demand: Any previous tax dues or demands can cause your refund to be adjusted against them. Check for any outstanding demands and resolve them promptly.

How Wishtree Consultants Can Help

Navigating the complexities of TDS refunds can be daunting. At Wishtree Consultants, we offer expert guidance and support to ensure a smooth and hassle-free refund process. Our team is committed to providing personalized solutions to help you resolve any issues and expedite your TDS refund.

Connect With Us

For more information or assistance, feel free to reach out to us through any of the following channels:

- Instagram: https://www.instagram.com/wishtreeconsultants

- Website: https://wishtreeconsultancy.com

- Address: Anna Nagar, Chennai

- Phone: 81244 22221

- Map Link: https://maps.app.goo.gl/brEMyKRjbQeSSBJ2A

- LinkedIn: https://www.linkedin.com/company/wish-tree-consultants-private-limited

About Us

At Wishtree Consultants, we are seasoned professionals dedicated to elevating your business to the next level. We are your one-stop solution for all your tax, audit, finance, and statutory compliance needs. Our comprehensive services include:

- Income Tax filing

- GST registration & filing

- TDS filing

- Company incorporation

- Digital signature

- All other Audit services

Our Services

Our expert team offers a wide range of services designed to meet your financial and business needs:

- Income Tax Return Filing

- Financial Planning

- Tax Advisory

- Business Consultancy

- GST Filing

- Corporate Tax Services

0 notes

Text

How to Manage Your Accounts Receivable Effectively

Managing accounts receivable (AR) effectively is crucial for maintaining healthy cash flow and ensuring the financial stability of your business. AR represents the amount of money owed to your company by customers for goods or services provided on credit. Here’s a comprehensive guide on how to optimize your accounts receivable process Gst Registration Consultant Chennai to maximize collections and minimize delays.

1. Clear Credit Policies

Establish clear credit policies from the outset to avoid ambiguity and ensure that customers understand their payment obligations. Clearly outline payment terms, credit limits, late fees (if any), and consequences for non-payment. Communicate these Gst Filing Consultants In Chennai policies to customers before extending credit to maintain transparency and reduce disputes.

2. Timely Invoicing

Include all necessary details such as invoice number, due date, payment terms, and a clear breakdown of charges. Timely and accurate invoicing sets clear expectations for payment and reduces the likelihood of delays.

3. Monitor Receivables Aging

Regularly monitor the aging of your receivables to identify overdue accounts promptly. Classify receivables into categories based on their age (e.g., current, 30 days, 60 days, 90 days) to prioritize collection efforts. Implement aging Accounting Outsourcing Companies In Chennai reports to track payment patterns and take proactive measures for overdue accounts.

4. Follow-Up and Communication

Establish a systematic follow-up process for overdue accounts. Send reminders or statements to customers as soon as payments become overdue. Personalized communication can often expedite payments by addressing any issues or queries promptly. Maintain a professional yet persistent approach to ensure timely collections.

5. Offer Incentives and Discounts

Consider offering incentives such as early payment discounts to encourage prompt settlement of invoices. Conversely, impose penalties or late fees for overdue payments to deter delays. Evaluate the financial implications of these strategies Payroll Services In Chennai and implement them selectively based on customer relationships and payment histories.

6. Use Technology for Efficiency

Utilize accounting software or ERP systems to streamline your accounts receivable process. These tools automate invoicing, payment tracking, and aging reports, reducing administrative overhead and improving accuracy. Integration with banking systems enables real-time monitoring of payment statuses and facilitates reconciliation.

7. Regular Reconciliation

Perform regular reconciliation of accounts receivable balances with customer payments and invoices. Identify discrepancies promptly and resolve them to maintain accurate financial records. Reconciliation ensures that all transactions are accounted for correctly and minimizes errors in reporting.

8. Engage Professional Services

Consider outsourcing accounts receivable management to experienced professionals such as Accounting Outsourcing Companies In Chennai. These firms offer specialized expertise in AR management, including credit control, invoicing, and collections. Their services can help optimize cash flow and reduce the burden on internal resources.

9. Continuous Improvement

Continuously evaluate and refine your accounts receivable processes based on performance metrics and feedback. Implement best practices, leverage customer insights, and adapt to changing market conditions to enhance efficiency and effectiveness over time.

Conclusion

Effective management of accounts receivable is essential for maintaining financial stability and optimizing cash flow in your business. By implementing clear credit policies, timely invoicing, proactive follow-up, and leveraging technology, you can streamline your AR process and improve collections. For businesses in Chennai looking to enhance their accounts receivable management, consider partnering with GST Registration Consultant Chennai, Gst Filing Consultants In Chennai, and Payroll Services In Chennai. Chennai accounts will provide these services, ensuring robust support for your financial operations and helping you achieve sustainable growth.

By adopting these strategies and leveraging professional services, you can navigate the complexities of accounts receivable management successfully while focusing on core business activities and driving profitability.

1 note

·

View note

Text

GST Consultancy Services in Chennai

ECS provides clients with strategic Goods and Services Tax (GST) consultation services, with a focus on optimizing tax performance and increasing shareholder value. We offer the best GST consulting services in India, helping clients create and implement procedures and technologies to improve the efficiency and effectiveness of their tax operations. We assess tax issues, develop strategic strategies, and ensure a positive influence on the organization's strategic goals. ECS's skilled GST consultants ensure that all GST filing and consulting requirements are met promptly. These include recognizing contract amendments with extended periods, registering tax codes, and assessing GST compliance levels.

Who is classified as a casual taxable person for online GST registration?

A person who does not have a permanent place of business and only occasionally delivers products or services in an area where GST is applicable. According to GST, this person will be considered a casual taxable person. Assume a person works in Chennai and provides taxable consulting services in Chennai, but has no place of business there. In this instance, one is regarded as to be a taxable person in Tamil Nadu.

Who is classified as a non-resident taxable person for online GST registration?

If a non-resident does not have a regular place of business in India but occasionally supplies goods or services in an area where GST is applicable. This individual will be classified as a non-resident taxable person under GST. Similar to the preceding circumstance, the non-resident does not have a place of business in India.

Who distributes Input Services for GST filing?

An 'Input Service Distributor' is a supplier's office that accepts tax bills for input services. They create tax invoices for distributing credit for paid services to branches with the same PAN. As a result, credit can only be distributed for 'input services', not input products or capital goods.

For assesses who are not yet registered as input service distributors, this will be a new topic. However, using this facility is optional.

What exactly is the meaning of "composition taxpayer"?

A composition taxpayer is a person who has signed up under the composition program and is excluded from charging clients the standard GST rates. Instead, they can file Form CMP-08 and pay the government a minimal or lesser rate. For these taxpayers, specific criteria have been developed. When the GST was first implemented, only providers of goods with an annual turnover of up to Rs. 1.5 crore were eligible to use the composition scheme outlined in Section 10 of the CGST Act. For online GST registration, the maximum annual aggregate turnover restriction is Rs 50 lakh.

What is the definition of a QRMP taxpayer?

A registered person who must file a GSTR-3B return and had an aggregate turnover of up to Rs. 5 crore in the previous fiscal year is eligible for the QRMP Scheme. The program allows for the quarterly filing of GSTR-1 and GSTR-3B, as well as the monthly payment of tax on form PMT-06. Furthermore, the Invoice Furnishing Facility (IFF) can be utilized for uploading B2B sales invoices.

Online GST registration by taxable individual

Every individual has to file a request for GST registration in each state where they'll be liable within one month of the date on which they must register.

Casual/non-resident taxpayers must submit their applications at least five days before starting business.

Since the GST registration number will be based on PANs, owning a PAN is a need for registration.

GST registration is state-specific, hence the assessee must obtain individual registrations for each state.

The assessee can obtain separate registrations in the same State for each of the 'business verticals'.

Special GST registration provisions for non-resident and casual taxpayers

A casual or non-resident taxable person must apply for registration at least five days before the start of operations. Section 24 provides specific rules for casual and non-resident taxable persons under GST.

Non-resident or temporary taxable individuals can obtain a temporary registration for 90 days, which can be extended for an additional 90 days. A person who registers under Section 24 must pay an advance GST deposit based on their anticipated tax due.

Conclusion

Knowing who is qualified to apply for GST and what the eligibility requirements are requires you to maintain your firm current on the most recent GST filing to avoid fines.

Contact us for reasonable GST Registration and Consultancy Services in Chennai

#accounting#accounting services#accounting firm#gst registration#gst services#accounting company#auditing

0 notes

Text

Step-by-Step Guide to Sole Proprietorship Registration in Chennai

Sole Proprietorship Registration in Chennai: A Comprehensive Guide

Introduction

Sole proprietorship registration in Chennai is one of the simplest and most common forms of business structure in India. For entrepreneurs looking to start their venture in Chennai, registering as a sole proprietor offers numerous advantages, including ease of setup, minimal compliance requirements, and complete control over the business. This guide will walk you through the essential steps and considerations for registering a sole proprietorship in Chennai.

What is a Sole Proprietorship?

A sole proprietorship is an unincorporated business owned and managed by a single individual. The owner is personally responsible for all company debts and liabilities, and the profits are treated as the owner’s income. This type of business structure is ideal for small-scale operations and businesses with low investment requirements.

Advantages of Sole Proprietorship

Ease of Formation: Setting up a sole proprietorship is straightforward, with minimal paperwork and legal formalities.

Total Control: The sole proprietor has complete authority over decision-making, allowing for quick and flexible business operations.

Tax Benefits: Income from the business is taxed as personal income, potentially leading to lower tax liabilities compared to other business structures.

Confidentiality: Unlike corporations, a sole proprietorship is not required to disclose its financial information to the public.

Cost-Effective: The costs involved in registering and maintaining a sole proprietorship are relatively low.

Steps to Register a Sole Proprietorship in Chennai

Choose a Business Name

Select a unique and relevant name for your business. Ensure that it does not infringe on existing trademarks.

Obtain the Necessary Licenses

GST Registration: If your business turnover exceeds the threshold limit (currently ₹20 lakh for service providers and ₹40 lakh for goods suppliers), you must register for GST.

Shop and Establishment Act License: This license is mandatory if your business operates a shop or commercial establishment in Chennai.

MSME Registration: Although optional, registering under the Micro, Small, and Medium Enterprises (MSME) Act can offer benefits such as more accessible access to loans and subsidies.

Open a Bank Account

Open a separate current account in the name of your business. This will help you manage your finances and maintain a clear distinction between personal and business transactions.

Apply for PAN

Although your PAN (Permanent Account Number) can be used, it is advisable to apply for a separate PAN for your business to streamline tax filings.

Maintain Accounting Records

Keeping accurate and up-to-date accounting records is crucial for compliance and tax purposes. Consider hiring a professional accountant or using accounting software.

Compliance Requirements

Income Tax Filing: As a sole proprietor, you are required to file your income tax returns annually. The income from your business will be added to your income and taxed accordingly.

GST Filing: If registered under GST, you must file regular GST returns and maintain proper records of sales and purchases.

Challenges of Sole Proprietorship

Unlimited Liability: The owner is personally liable for all business debts and obligations, which can pose a significant risk.

Limited Resources: Raising capital can be challenging as sole proprietors often rely on personal savings or loans.

Limited Growth Potential: The scope for expansion is restricted due to the dependence on a single individual.

Conclusion

Sole proprietorship registration in Chennai Is an excellent option for aspiring entrepreneurs who want to start their businesses with minimal complexity and cost. While it offers numerous advantages, it is essential to consider the challenges and long-term goals of your business before opting for this structure. By following the steps outlined in this guide and ensuring compliance with the necessary regulations, you can successfully establish and grow your sole proprietorship in Chennai.

0 notes

Text

GST Services in Kochi

GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India. It replaced multiple indirect taxes levied by the central and state governments, streamlining the taxation system and fostering ease of doing business in the country. GST is administered by the Goods and Services Tax Council, which is chaired by the Union Finance Minister and comprises representatives from the central and state governments. Generally speaking, GST services encompass a range of tasks associated with GST compliance, registration, return filing, and consulting services provided by experts like chartered accountants, tax consultants, and legal specialists. These services are designed to help companies stay out of trouble by helping them comprehend, apply, and abide by the GST requirements. GST Services in Kochi Emblaze is the best one for that.

0 notes