#Sole Proprietorship Registration in Chennai

Explore tagged Tumblr posts

Text

Documents Required for Sole Proprietorship Registration in Chennai

A Comprehensive Guide to Sole Proprietorship Registration in Chennai

Introduction

A sole proprietorship registration in Chennai is one of India's most straightforward and common business structures. It's a type of enterprise owned and managed by a single individual. This form of business is ideal for small-scale companies and professionals such as freelancers, consultants, and small traders. Chennai, being a central commercial and cultural hub in South India, offers numerous opportunities for entrepreneurs looking to start a sole proprietorship. This guide provides a detailed overview of the process and requirements for registering a sole proprietorship in Chennai.

Benefits of Sole Proprietorship

Easy to Start and Manage: Starting a sole proprietorship in Chennai is straightforward and involves minimal legal formalities.

Complete Control: The proprietor has full control over all business decisions and operations.

Tax Benefits: Sole proprietorships often benefit from lower tax rates compared to other business structures.

Less Compliance: There are fewer regulatory requirements and compliance norms to follow.

Profit Retention: All profits generated from the business go directly to the owner.

Steps to Register a Sole Proprietorship in Chennai

Decide on a Business Name

Choose a unique and appropriate name for your business.

Ensure the name is not already registered as a sole proprietorship or trademarked by another entity.

Obtain a PAN Card

If you don't already have one, apply for a Permanent Account Number (PAN) in your name, as it is required for tax purposes.

Open a Bank Account

Open a current account in your business's name. This account will be used for all business transactions.

Provide necessary documents such as PAN card, address proof, and business registration proof (if applicable).

Register for GST

If your annual turnover exceeds the threshold limit (currently ₹20 lakhs for most states), you must register for Goods and Services Tax (GST).

Apply for GST registration through the GST portal.

Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need specific licenses and permits to operate legally in Chennai.

Standard licenses include the Shop and Establishment License and professional tax registration.

Maintain Compliance

Keep accurate and up-to-date records of all business transactions.

File income tax returns annually and comply with other statutory requirements.

Important Considerations

Business Insurance: Consider getting business insurance to protect against potential risks and liabilities.

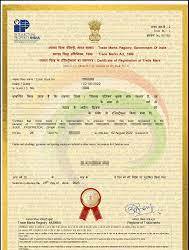

Trademark Registration: To protect your brand name and logo, consider registering them as trademarks.

Professional Advice: Consult with a legal or financial advisor to ensure all aspects of your business comply with local laws and regulations.

Conclusion

Sole proprietorship registration in Chennai is a straightforward process that offers numerous benefits for small business owners. Following the steps outlined above, you can ensure your business is set up legally and ready to operate in one of India's most vibrant cities. With the proper preparation and compliance, you can focus on growing your business and achieving your entrepreneurial goals.

For further assistance or detailed guidance, you can contact local consultants or business service providers like Kanakkupillai, which specialises in helping entrepreneurs with business registration and compliance requirements.

0 notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

From Registration to Representation: A Comprehensive Guide to Legal Services in India

Legal services in India are multifaceted, offering essential support for both individuals and businesses. From company registration to courtroom representation, the legal system provides a structured way to ensure rights are protected and obligations are fulfilled. This article explores the key stages of legal services across the country, with a special focus on legal services in Hyderabad, legal services in Bangalore, legal services in Chennai, and legal services in Surat.

The Importance of Legal Services in India

India’s legal system is one of the largest and most intricate in the world, governed by a mix of constitutional, statutory, and case laws. As regulations grow more complex, the need for professional legal services has surged. Whether it's registering a business, safeguarding intellectual property, or resolving disputes, the right legal guidance ensures compliance and protection under the law.

Key Legal Services in India: A Step-by-Step Overview

1. Business Registration Services

One of the most common legal services in India is business registration. Whether you're a startup founder or an established entrepreneur, legal registration is the first step in making your business official.

Legal services in Bangalore are known for their expertise in company registration, especially catering to the needs of the city’s dynamic startup ecosystem. Bangalore’s legal firms guide businesses through the entire process, including choosing the right business structure (Private Limited, LLP, or Sole Proprietorship) and ensuring compliance with the Ministry of Corporate Affairs.

In contrast, legal services in Hyderabad focus on helping tech-driven businesses navigate the registration process, with a strong emphasis on intellectual property protection, given the city's growing IT sector.

2. Intellectual Property (IP) Services

Protecting intellectual property (IP) is critical for any business to safeguard its innovations, trademarks, and designs. With the rise of startups and creative industries, legal services in Chennai have developed a strong reputation for offering specialized IP services. These legal firms assist businesses in registering trademarks, patents, and copyrights, ensuring that companies retain exclusive rights to their creations.

For businesses in Surat, which is known for its textile and diamond industries, legal services emphasize protecting unique designs and trade secrets. This ensures that businesses in Surat not only comply with IP laws but also prevent competitors from infringing on their rights.

3. Contracts and Agreements

One of the pillars of legal services is contract drafting and review. Contracts are the foundation of any business relationship, ensuring that parties involved understand their rights, obligations, and the consequences of breach.

In cities like Bangalore and Chennai, law firms specialize in drafting complex contracts for venture capital funding, partnerships, and mergers and acquisitions. These contracts need to meet both local and international legal standards, especially as these cities house many global companies.

In Hyderabad, law firms also offer contract management services for IT companies, focusing on technology transfer agreements, licensing, and service-level agreements (SLAs).

4. Dispute Resolution

Disputes are inevitable in both personal and business settings. However, legal services in India offer several mechanisms to resolve conflicts efficiently.

Legal services in Surat and Chennai have built a reputation for resolving commercial and real estate disputes through mediation and arbitration, which are faster and less expensive than traditional court litigation.

Similarly, Hyderabad and Bangalore have seen a rise in cases resolved through alternative dispute resolution (ADR), especially in industries like technology and manufacturing, where time-sensitive resolutions are critical.

5. Representation in Courts

For issues that cannot be resolved outside the courtroom, representation in courts becomes necessary. Skilled litigators in Bangalore and Chennai represent businesses and individuals in a wide range of matters, from corporate fraud and civil disputes to criminal cases.

In Surat and Hyderabad, lawyers focus on representing clients in business-related disputes, tax issues, and intellectual property conflicts, ensuring that justice is served through comprehensive legal representation.

Conclusion

Navigating the complexities of India's legal landscape requires not only knowledge but also the right professional guidance. From business registration to courtroom representation, legal services play a crucial role in safeguarding rights and ensuring compliance. Whether you are in Hyderabad, Bangalore, Chennai, or Surat, finding the right legal partner is key to achieving both personal and business success.

As Mahatma Gandhi once said, “Justice that love gives is a surrender, justice that law gives is a punishment.” This quote reminds us that while legal services ensure justice through law, the true power lies in fairness and integrity.

#Legal services in Surat#Legal services in bangalore#Legal services in Chennai#Legal services in Hyderabad

0 notes

Text

One-Person Company Registration: Power to Solo Entrepreneurs

OPC in India opens huge avenues for individual entrepreneurs to hold a private limited company (PVT. LTD.,) where a person will have titles of owner, director, and shareholder all in his name. This efficient business structure melds the benefits of corporate distinctiveness together with the simplicity of sole proprietorship.

Now, the major advantages of OPC registration are:

●Easy formation with minimum documentation

●The limited liability protection for the owner.

●Related tax benefits

●Operational flexibility

The entire work of registration encompasses name approvals, getting DSC and DIN, incorporation certificate, and other important documents like Memorandum and Articles of Association. Other procedures include getting e-PAN, TAN, GST, and opening a bank account.

Though OPCs come with many advantages, they are only available to Indian citizens and a few NRIs. A foreign individual is not allowed to set up an OPC, and the minimum authorized capital mandated in an OPC is INR 1 lakh. OPC registration thus offers a wonderful platform for any venture in India’s emerging economy where aspiring entrepreneurs are looking for a formal business structure with personal control.

Aanoor Global: Your Partners in Trust for OPC Company Registration

Aanoor Global provides expert assistance to any entrepreneur who wishes to go through the OPC registration process without a single glitch. With a deep understanding of Indian corporate laws and their registration procedures, we can help entrepreneurs through each step of OPC formation while bringing compliance and efficiency on board. From name reservation to final incorporation, Aanoor Global will make the journey of establishing your one-person company very smooth.

Ready to start your business journey in Chennai? 🚀 Get done your company registration today and take the first step toward success!

Our team of experts will handle end to end support for paperwork, ensuring a smooth and hassle-free process.

For More details Call/WhatsApp +91–7401565656

#company registration#OPC registration#LLP registration#Pvt ltd Registration#partnership registration#Proprietorship Registration

1 note

·

View note

Text

Effortless One-Person Company (OPC) Registration Services in Chennai with Expertpoint

In Chennai's dynamic business environment, the concept of One-Person Company (OPC) has gained popularity among solo entrepreneurs looking for limited liability protection and ease of operation. If you're considering registering an OPC in Chennai, Expertpoint offers comprehensive registration services designed to navigate the process seamlessly and ensure compliance with legal requirements.

Understanding One-Person Company (OPC) Registration

An OPC is a hybrid business structure that allows a single entrepreneur to operate a corporate entity with limited liability protection. It provides the benefits of a private limited company while allowing sole ownership and management control. OPC registration in Chennai involves fulfilling statutory requirements set by the Ministry of Corporate Affairs (MCA) to establish legal recognition and operational legitimacy.

Expertpoint’s One-Person Company (OPC) Registration Services

Expertpoint specializes in providing efficient and reliable OPC Registration services tailored to meet the specific needs of entrepreneurs in Chennai. Here’s how our services can benefit you:

1. OPC Registration in Chennai:

We facilitate OPC Registration in Chennai, guiding you through the entire process from name reservation to obtaining the Certificate of Incorporation.

Our experts ensure compliance with all statutory requirements, making the registration process smooth and hassle-free.

2. Register OPC Company Online in Chennai:

Embracing digital transformation, we offer online OPC Company Registration services in Chennai for convenience and efficiency.

Our digital platform allows you to initiate and track the progress of your application, providing real-time updates and ensuring transparency throughout the process.

3. One Person Company Registration Online in Chennai:

Expertpoint provides comprehensive One Person Company Registration services online in Chennai, simplifying the paperwork and administrative tasks.

We handle the entire registration process, from drafting the Memorandum of Association (MoA) to obtaining PAN and TAN, ensuring accuracy and compliance.

4. OPC Registration Firm in Chennai:

As a trusted service provider, Expertpoint offers secure and user-friendly OPC Registration services in Chennai.

Our team of experts assists you in understanding the legal requirements and implications of operating as an OPC, ensuring compliance with all applicable laws and regulations.

Expertise and Experience:

With years of experience in corporate law and business registration, Expertpoint has assisted numerous entrepreneurs in Chennai establish their OPCs. Our team of professionals is well-versed in local regulations and requirements, ensuring thorough guidance and support throughout the registration process.

Personalized Service:

At Expertpoint, we understand that every business journey is unique. We provide personalized OPC Registration services tailored to your specific needs and business goals. Whether you're launching a new venture or transitioning from a sole proprietorship, our services are designed to meet your requirements effectively.

Compliance Assurance:

Compliance with regulatory requirements is crucial for the smooth operation of an OPC. Expertpoint ensures that your OPC registration in Chennai adheres to all legal provisions and guidelines, minimizing the risk of delays or non-compliance.

Transparent Process:

Transparency is fundamental to our service approach at Expertpoint. We keep you informed at every stage of the OPC Registration process, providing clarity and peace of mind. Our commitment to transparency fosters trust and confidence in our services.

Conclusion

Establishing an OPC in Chennai allows solo entrepreneurs to enjoy limited liability protection and corporate status while retaining control over their business. With Expertpoint’s OPC Registration services, you can launch your entrepreneurial venture with confidence and compliance.

Ensure legal recognition, operational legitimacy, and entrepreneurial success with Expertpoint’s OPC Registration services in Chennai. Contact us today to learn more about how we can assist you in achieving your business goals efficiently and effectively. Visit : https://expertpoint.in/one-person-company-registration/

0 notes

Text

CA in Chennai

CA in Chennai is a legal process that involves formalizing the existence of a business entity within the administrative and regulatory framework of the Indian capital city. This registration is essential for establishing the firm’s legal identity, facilitating business operations, and complying with various government regulations. Here is a description of the key steps and details involved in the ca of firm in Chennai.

Business Structure: Before registering your firm, you need to decide on its legal structure. Common options include a sole proprietorship, partnership, limited liability partnership (LLP), private limited company, or public limited company. Your choice will affect the registration process and the legal liabilities of the firm’s owners.

Choose a Business Name: Select a unique and suitable name for your firm. Ensure that it complies with the guidelines set by the Ministry of Corporate Affairs (MCA). You can check the availability of your chosen name on the MCA website.

Obtain Director’s Identification Number (DIN): If you plan to register a private limited company, you need to obtain a DIN for the proposed directors of the company. This can be done online through the MCA portal.

Digital Signature Certificate (DSC): To file online documents with the Registrar of Companies (RoC), you must obtain a digital signature certificate. This is necessary for digitally signing the required documents.

File for Incorporation: For different types of firms, you will need to file different incorporation documents. For example, for a private limited company, you will need to file the Memorandum of Association (MoA) and Articles of Association (AoA). For an LLP, you need to file the LLP Agreement. These documents outline the structure, objectives, and operational guidelines of your firm.

Registration Fees: Pay the necessary registration fees as prescribed by the MCA or relevant authority. The fee may vary depending on the type and capital of the firm.

Obtain Permanent Account Number (PAN): Apply for a PAN card for your firm through the Income Tax Department. A PAN card is essential for tax-related purposes.

Tax Registration: Depending on your business activities and turnover, you may need to register for Goods and Services Tax (GST) or other state-specific taxes. This registration ensures compliance with India’s tax laws.

Professional Tax Registration: If you have employees in Chennai, you may be required to register for Professional Tax with the local authorities.

Compliance with Labor Laws: Ensure compliance with labor laws, including obtaining necessary licenses or permits for employing workers, if applicable.

Business Bank Account: Open a bank account in the firm’s name. This account will be used for financial transactions related to the business.

Post-Incorporation Compliances: After registration, you must fulfill ongoing compliance requirements, such as filing annual financial statements, holding annual general meetings, and adhering to other regulatory obligations.

Other Licenses and Permits: Depending on your business activities, you may require additional licenses and permits from local, state, or central government authorities.

0 notes

Text

Private Limited Company in Chennai

A Private Limited Company in Chennai offers a range of advantages for entrepreneurs and business owners. With a minimum of two shareholders, it provides a flexible and manageable structure for small to medium-sized enterprises. Chennai's thriving business ecosystem makes it an ideal location for setting up such companies. These entities enjoy limited liability, safeguarding the personal assets of shareholders. Additionally, they can raise funds from Venture Capitalists or Angel investors, providing opportunities for growth and expansion. The registration process involves a few straightforward steps, including obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for directors to ensure compliance with regulatory requirements. A Private Limited Company in Chennai offers a conducive business growth and development environment.

📢 Ready to take your business to the next level in Chennai? 🚀 Don't miss out on the benefits of Private Limited Company Registration! 🏢💼

Gain limited liability protection, build investor confidence, and secure your brand's future. It's time to formalise your business and make a mark in the corporate world. 💪🌟

Features of a Private Limited Company in Chennai:

1. Members: According to the provisions of the Companies Act 2013, a company must have at least two members and can have a maximum of 200 members.

2. Prospectus: Private companies are not required to issue a prospectus or file a statement instead of a prospectus with the Registrar of Companies.

3. The company cannot accept deposits: Private companies cannot solicit funds from the public, and shareholders face restrictions on selling or transferring their shares.

4. Fund Raising Capacity: Private Limited Companies can secure funds from Venture Capitalists or Angel investors but are not permitted to go public as more giant corporations do.

5. Protection Against Liabilities: Shareholders of a Private Limited Company are generally not pursued for any shortfall to pay creditors unless proven to have acted recklessly. However, if the company becomes insolvent, Investors may lose their investment.

6. Limited Liability: The most essential feature of a Private Limited Company is limited liability. Shareholders' assets are protected if the company faces financial difficulties.

Benefits of Registering a Private Limited Company in Chennai:

1. Min 2 Shareholders: You can initiate a Private Limited Company in Chennai with just two members who will act as shareholders and directors.

2. Borrowing Capacity: Private Limited Companies have better-borrowing avenues than other business forms, such as sole proprietorships and partnerships.

3. Business Continuity: A Private Limited Company enjoys perpetual existence, meaning it continues to exist regardless of changes in ownership.

4. Minimum Capital Required: One lakh is required to incorporate a Private Limited Company.

5. Limited Liability: Shareholders' assets are not at risk if the company faces financial distress. They have limited liability, which means Their responsibility is confined to the unpaid amount on their shares.

6. Separate Legal Entity: Unlike partnership firms, a company possesses a distinct legal identity separate from its owners.

Documents for Private Limited Company Registration in Chennai:

PAN card and Residence Proof of company directors.

Copy of the rental agreement or EB Card for the Registered office

A copy of the most recent bank statement, telephone or mobile bill, or electricity or gas bill.

Passport-size photographs.

Specimen signature (a blank document with signatures of directors only)

Copy of the passport (in the case of a Foreign Director).

Services Included in this Package:

Verification of Documents

DSC and DIN for two directors

Name approval and ROC fees

Drafting MOA & AOA

We will follow up until we obtain the certificate.

Applying for PAN and TAN.

Process of Private Limited Company Registration Online in Chennai:

1. Applying DIN and DSC: All directors require Digital Signature Certificates (DSC) and Director Identification Numbers (DIN).

2. Name Approval: Provide 4-6 proposed names that should be unique and suggestive of the company's business.

3. MOA, AOA and Affidavit: Draft Memorandum and Articles of Association Prepare an affidavit and declaration by the first subscribers and directors.

4. Company Registered: Once the ROC accepts the filing, it issues a certificate of incorporation, allowing the company to commence its operations.

5. Apply for PAN, TAN, and Bank Accounts: Apply for PAN and TAN. Once received, submit the Incorporation certificate, MOA, AOA, and PAN to open a bank account.

Frequently Asked Questions (FAQs) about Private Limited Companies in Chennai:

What is a Private Limited Company in Chennai?

A Private Limited Company is a type of business structure where the liability of its members (shareholders) is limited to the amount unpaid on their shares. It's a popular choice for small to medium-sized businesses in Chennai.

How many members are required to start a Private Limited Company in Chennai?

A minimum of two members and a maximum of 200 members are required to establish a Private Limited Company in Chennai.

What is the minimum capital requirement for registering a Private Limited Company in Chennai?

The minimum capital required to incorporate a Private Limited Company in Chennai is one lakh rupees.

Can a Private Limited Company in Chennai raise investor or public funds?

Private Limited Companies can raise funds from Venture Capitalists or Angel investors but cannot issue shares to the public through a stock exchange like larger public companies.

What is the process for registering a Private Limited Company in Chennai?

The registration process involves obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for directors, reserving a unique name for the company, drafting the Memorandum and Articles of Association, and submitting the necessary documents to the Registrar of Companies.

Is the liability of shareholders in a Private Limited Company limited?

Yes, the liability of shareholders in a Private Limited Company is limited to the unpaid amount on their shares, protecting their assets in case of financial distress.

Is there an annual renewal requirement for Private Limited Companies in Chennai?

No, Private Limited Companies do not need to renew their registration annually. It is a one-time registration with a perpetual existence.

Can a Private Limited Company become another type of business structure in Chennai?

Yes, a Private Limited Company can convert into another business structure, but this process involves specific legal procedures and approvals.

What documents do you need for registering a Private Limited Company in Chennai?

Documents typically include PAN cards and residence proof of company directors, rental agreement or EB card for the registered office, bank statements or utility bills, passport-sized photographs, and specimen signatures of directors.

How long does it take to register a Private Limited Company in Chennai?

The registration process usually takes around 15 to 20 business days, depending on the timely submission of documents and approvals from regulatory authorities.

#ChennaiBusiness #PrivateLimitedCompany #BusinessGrowth #Entrepreneurship #LegalShield #CorporateSuccess #BusinessRegistration #BrandProtection #InvestorConfidence #ChennaiEntrepreneurs #SmallBusinessSuccess #CompanyRegistration #PrivateLimited #BusinessIncorporation #LegalEntity #LimitedLiability #Entrepreneurship #BusinessGrowth #StartupJourney #SmallBusiness #CorporateStructure #BusinessFormation #InvestorConfidence #BusinessOwnership #LegalFormality #FinancialSecurity #BusinessSuccess #NewVenture #CompanyFormation #EntrepreneurLife

For new business registration and support, contact kanakkupillai.com today. 🌌🚀

Check out us - https://www.kanakkupillai.com/private-limited-company-registration-chennai

Contact us - https://wa.me/917305048476

#PrivateLimitedCompany#BusinessGrowth#Entrepreneurship#LegalShield#CorporateSuccess#BusinessRegistration#BrandProtection#InvestorConfidence#ChennaiEntrepreneurs#SmallBusinessSuccess#CompanyRegistration#PrivateLimited#BusinessIncorporation#LegalEntity#LimitedLiability#StartupJourney#SmallBusiness#CorporateStructure#BusinessFormation#BusinessOwnership#LegalFormality#FinancialSecurity#BusinessSuccess#NewVenture#CompanyFormation#EntrepreneurLife

0 notes

Text

Private limited company registration in Chennai

A private limited company in India is a widely preferred and popular form of business organization that offers limited liability protection to its shareholders while maintaining a structure conducive to efficient management and operations.

It is governed by the provisions of the Companies Act, 2013, and is a separate legal entity distinct from its owners. This legal structure makes it a suitable choice for small to medium-sized enterprises (SMEs) and startups, as it combines the benefits of limited liability, perpetual existence, and ease of ownership transfer.

In a private limited company, the ownership is divided into shares, and these shares are held by a group of individuals or entities known as shareholders. The company's capital is divided into these shares, which represent ownership stakes.

The liability of shareholders is limited to the extent of their shareholding, which means their personal assets are not at risk in case the company faces financial difficulties. This feature encourages investment and entrepreneurial activity, making it an attractive option for investors and business enthusiasts.

Compliances

In terms of compliance, companies that have Private limited company registration in Chennai are subject to certain reporting and regulatory requirements. They need to hold annual general meetings (AGMs) and file annual financial statements with the Registrar of Companies (RoC).

However, compared to other forms of companies, the compliance burden is relatively lighter. This makes it an appealing choice for businesses that want to adhere to regulations while focusing on growth.

Private limited companies can also raise capital more easily compared to sole proprietorships or partnerships.

They can issue shares to raise funds from investors, both domestically and internationally. This ability to attract external investment aids expansion and diversification efforts.

Why is Pvt Ltd used?

A Pvt Ltd company with Private limited company registration in Chennai is used as a business structure for several compelling reasons that align with the needs and objectives of entrepreneurs and investors. It has limited liability.

This legal entity offers a range of advantages that contribute to its popularity among businesses, especially small and medium-sized enterprises (SMEs) and start-ups.

Limited Liability:

One of the primary reasons for choosing a Pvt Ltd company is the concept of limited liability. The liability of shareholders is restricted to the extent of their shareholding in the company. In case the company faces financial distress or legal issues, the personal assets of shareholders remain protected. This separation between personal and business liabilities provides a safety net for investors and encourages risk-taking, as it mitigates the potential for financial ruin due to business failures.

Credibility and Trust:

Operating as a Pvt Ltd company with Private limited company registration in Chennai often enhances the credibility and trustworthiness of a business. The "Pvt Ltd" tag after the company's name signals stability, commitment, and adherence to legal and regulatory standards. This credibility can be particularly valuable when establishing relationships with clients, customers, vendors, and financial institutions.

Perpetual Existence:

A Pvt Ltd company enjoys perpetual existence, which means it continues to exist irrespective of changes in ownership or management. This stability is crucial for building long-term business relationships, attracting investors, and maintaining operational consistency over time.

Easy Transfer of Ownership:

The ownership of a Pvt Ltd company is represented through shares, and these shares can be easily transferred or sold to other individuals or entities. This facilitates ownership transitions and offers a level of flexibility not commonly found in other business structures like partnerships or sole proprietorships.

What is the validity of Pvt Ltd Company?

The concept of "validity" in the context of a Private Limited Company refers to its legal existence and continuation. A Private Limited Company (Pvt Ltd) with Private limited company registration in Chennai in most jurisdictions, including India, is considered a separate legal entity from its owners (shareholders) and has a perpetual existence unless dissolved or wound up through legal processes.

This feature of perpetual existence is a significant attraction for entrepreneurs and investors, as it provides stability and continuity to businesses over the long term. However, the legal processes involved in winding up or dissolving a company can vary by jurisdiction and depend on the specific circumstances surrounding the company's operations and financial status.

Conclusion

Thus, a private limited company with Private limited company registration in Chennai is a flexible and attractive business structure that balances the benefits of limited liability, efficient management, ownership transferability, and ease of fundraising. Its regulatory framework provides a robust foundation for sustainable growth, making it a preferred choice for entrepreneurs and investors alike.

However, potential business owners should carefully evaluate their specific needs, long-term goals, and the legal and financial implications before choosing this structure. Consulting legal and financial experts can aid in making informed decisions tailored to individual.

0 notes

Text

Documents Required for GST Registration

GST registration is a mandatory requirement for businesses in many countries, including India, to comply with the Goods and Services Tax system. It is important to understand the documents required for GST registration to ensure a smooth and successful registration process. Here is an article outlining the key documents typically needed for GST registration.

Are you looking for Gst Registration Consultants In Chennai? For businesses and individuals, Chennai Accounts is a trusted partner that can navigate the complexities of the process and ensure compliance with the GST laws of India.

PAN Card: The Permanent Account Number (PAN) card issued by the Income Tax Department is a primary document required for GST registration. It serves as a unique identification number for the business entity.

Identity and Address Proof: Documents such as Aadhaar card, voter ID card, passport, driving license, or any other government-issued identity and address proof of the business owner or authorized signatory are necessary for GST registration.

Photographs: Recent passport-sized photographs of the business owner or authorized signatory need to be submitted along with the registration application.

Proof of Constitution: Depending on the type of business entity, different documents are required to establish the legal structure. For example:

For a proprietorship: Sole proprietorship registration certificate or partnership deed (if applicable).

For a partnership firm: Partnership deed.

For a company: Certificate of incorporation, memorandum of association, articles of association, and board resolution.

Address Proof: Documents establishing the principal place of business, such as a lease agreement, rent receipt, utility bills, or ownership documents, are necessary to prove the business location.

Bank Account Details: Bank account statements or a canceled cheque containing the business entity's name, address, and IFSC code are required to verify the bank account details.

Authorized Signatory Details: If there is an authorized signatory, documents proving their authority, such as a board resolution or power of attorney, need to be submitted.

Business Registration Proof: Depending on the type of business entity, additional registration documents may be required. For example:

For a company: Certificate of incorporation.

For a partnership firm: Partnership registration certificate.

For a society or trust: Certificate of registration.

Digital Signature Certificate (DSC): A Class 2 or Class 3 digital signature certificate is necessary for certain types of businesses and taxpayers as per the GST rules. It is used to electronically sign the GST registration application.

It is important to note that the specific documents required for GST registration may vary based on the country or jurisdiction. Additionally, certain businesses may have additional requirements depending on their industry or nature of operations. It is advisable to consult the official GST portal or seek guidance from a tax professional to ensure accurate and complete documentation for GST registration.

So, GST registration requires the submission of various documents to establish the identity, address, legal structure, and business details of the taxpayer. Ensuring that you have the necessary documents ready before starting the registration process can help expedite the process and avoid any delays or complications. By adhering to the document requirements and following the guidelines provided by the tax authorities, businesses can successfully complete their GST registration and become compliant with the GST regulations.

1 note

·

View note

Link

#company formation#Company formation in Chennai#Conversion of LLP into private limited company#Everything You Need To Start a Business in India as an NRI#Incorporation of Private Limited company | Companies Act 2013#Registration Process and Starting a Sole Proprietorship (ownership) in India#Difference between OPC and Sole proprietorship#Minimum requirements to register private limited company#Private limited company Online registration in Chennai#Company formation in Chennai- Features and the legal documents

0 notes

Text

Documents Required for Sole Proprietorship Registration in Chennai

A Comprehensive Guide to Sole Proprietorship Registration in Chennai

Introduction

A sole proprietorship registration in Chennai is one of India's most straightforward and common business structures. It's a type of enterprise owned and managed by a single individual. This form of business is ideal for small-scale businesses and professionals such as freelancers, consultants, and small traders. Chennai, being a major commercial and cultural hub in South India, offers numerous opportunities for entrepreneurs looking to start a sole proprietorship. This guide provides a detailed overview of the process and requirements for registering a sole proprietorship in Chennai.

Benefits of Sole Proprietorship

Easy to Start and Manage: Starting a sole proprietorship in Chennai is straightforward and involves minimal legal formalities.

Complete Control: The proprietor has full control over all business decisions and operations.

Tax Benefits: Sole proprietorships often benefit from lower tax rates compared to other business structures.

Less Compliance: There are fewer regulatory requirements and compliance norms to follow.

Profit Retention: All profits generated from the business go directly to the owner.

Steps to Register a Sole Proprietorship in Chennai

Decide on a Business Name

Choose a unique and appropriate name for your business.

Ensure the name is not already registered as a sole proprietorship or trademarked by another entity.

Obtain a PAN Card

If you don't already have one, apply for a Permanent Account Number (PAN) in your name, as it is required for tax purposes.

Open a Bank Account

Open a current account in the name of your business. This account will be used for all business transactions.

Provide necessary documents such as PAN card, address proof, and business registration proof (if applicable).

Register for GST

If your annual turnover exceeds the threshold limit (currently ₹20 lakhs for most states), you must register for Goods and Services Tax (GST).

Apply for GST registration through the GST portal.

Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need specific licenses and permits to operate legally in Chennai.

Standard licenses include the Shop and Establishment License and professional tax registration.

Maintain Compliance

Keep accurate and up-to-date records of all business transactions.

File income tax returns annually and comply with other statutory requirements.

Important Considerations

Business Insurance: Consider getting business insurance to protect against potential risks and liabilities.

Trademark Registration: To protect your brand name and logo, consider registering them as trademarks.

Professional Advice: Consult with a legal or financial advisor to ensure all aspects of your business comply with local laws and regulations.

Conclusion

Sole proprietorship registration in Chennai is a straightforward process that offers numerous benefits for small business owners. Following the steps outlined above, you can ensure your business is set up legally and ready to operate in one of India's most vibrant cities. With the proper preparation and compliance, you can focus on growing your business and achieving your entrepreneurial goals.

For further assistance or detailed guidance, you can contact local consultants or business service providers like Kanakkupillai, which specialises in helping entrepreneurs with business registration and compliance requirements.

0 notes

Link

#company incorporation#Challenges of Registering your Startup in India#What are the challenges for NRIs to do business in India?#Advantages of private limited company#What are the 5 characteristics of Sole Proprietorship?#How to register OPC?#Private limited company registration – an Introduction#Features of Private limited Company in Chennai#Company incorporation in Chennai

0 notes

Text

Business Registration in Chennai

Business Name Registration in Chennai

There is 4 major Step are involved for Business Registration in Chennai. According to the survey conducted by Guidant Financial, ‘Small Business Trends Alliance: 2020’, 77% of people who decided to start their small business are happy.

It’s really motivating information that more than 3/4 of the people who boldly quit their job and went into their own company are happy and successful.

So why are you waiting to start your one business today, we are there to support you

How to Register a business Name in Chennai?

Every business organization is in a regulated environment by which they are required to comply with the provisions of Government law, what we call Government licenses or Government Registrations, whether from Central, State, or local agencies.

These records vary depending on the nature of the business, the intent of the owner, the volume of the business, and various other factors.

The most important mandatory step to register a business name in Chennai

Registration heads

We are business registration consultants in Chennai.

These business registrations or business licenses or register a business name in Chennai are classified under various headings, under which many mandatory and recommended licenses and registrations are listed.

Company Registration

Intellectual Property

Tax Regulations

Mandatory Government Licenses

1. Company Registration : Choose your business Structure to register a business name in chennai

A. Proprietorship

This is a business structure where it is owned and invested by a single person who is named as the sole proprietor.

This entity’s business name registration in Chennai is the simplest form of business organization.

The owner remains personally responsible for all losses and liabilities owed against his business.

In addition, Owner reports business profits and losses on Owner’s personal tax return.

This type of entity is suitable only for a very small type of business.

B. Partnership

A partnership is a formal agreement between two or more parties to conduct business in the mutual interest of making a profit.

Partners remain personally liable for claims filed against the company.

Each partner contributes money, property, work or skill; each participates in the profits and losses of the business, and each has unlimited personal liability for business debts.

The partnership business arises as soon as the partners mutually agree and sign the partnership agreement or partnership deed.

C. Limited Liability Partnership

A normal traditional partnership type of business entity suffers from the problem of unlimited liability.

The partners of these traditional partnership firms have unlimited liability for their collective debts and legal consequences.

To overcome this carrier, the Central Government had introduced the Limited Liability Partnership by introducing the LLP Act of 2008.

This type of corporate legal entity has become a preferable form of organization among businessmen as it incorporates.

Tthe benefits of Partnership and the Company as a single form of organization called Limited liability which is a key benefit of LLP.

D. Private Limited Company

A Private Limited Company is a separate legal entity that is privately owned for small businesses.

This type of entity grants a corporate status to your small business.

This is the most preferable form of entity among businessmen in India. The Private Liability Company can be formed with a minimum of two members and a maximum of 200 members.

Private Limited must also have a minimum of 2 directors and a maximum of 15 directors.

This protects the personal assets of the shareholders from any debt.

There are many more advantages to Private Liability Company compared to other types of businesses.

E. One Person Company:

When your proprietorship form of business starts to grow, you will need to convert it into a company,

in which case the most suitable entity form is a One Person Company Private Limited shortly called as OPC,

which is also a form of private limited company but it can be incorporated with a single shareholder,

and the same owner can act as a director as well as a shareholder.

In a One Person Company, there may be more than one director,

but may not exceed more than one shareholder.

F. Public Limited Company:

A Public Limited Company is a separate legal business entity which offers its shares to be traded on the stock exchange for the general public.

This is suitable for large scale business.

These Public Limited Companies can either be listed or even unlisted.

2. Protection of your Intellectual Property

A. Trademark Registration

Trademark registration is a tool to protect your company name and the brand name from being copied or duplicated by any third party.

In general, a trademark is used to signify a company name, brand name, logo or trade symbol or name or label or colour combination which identifies a specific business.

It gives the owner of the mark an exclusive right to use the same and also grants a right to stop any unauthorized use of the same.

B. Copyright Registration

Copyright is also called a creator’s right.

Copyright Registration protects creativity such as your content, your promotional ads, videos, books and more of your creative work from being copied by others.

It gives Arthur/owner a right to reproduce, translate and distribute the work in any form.

3. Taxation

A. GST Registration

GST Registration: GST Stands for Goods and service tax. Which was introduced in India on 1st July, 2017.

It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax and many other indirect taxes.

All the businesses supplying goods whose turnover exceeds Rs 40 lakh in a financial year are required to register as a normal taxable person.

B. GST Returns

Every GST holder must submit the GST returns every month,

the necessary forms for registering the GST is Form GSTR 1, GSTR 3B.

Further GST holders must also submit annual returns which is GSTR 9.

C. Corporate Tax

A corporate tax is a form of income tax which has to be paid out of profits of a Company.

This type of taxes would be calculated based on the company’s taxable income,

which includes revenue of the company minus the cost of the goods/service sold, minus administrative expenses. 25% of profit would be paid words corporate tax.

4. Apply for Licenses and Permits

A. FSSAI Registration

FSSAI license, which is also called Food License, is one of the compulsory licenses for all food business operators in India.

The license is governed by the FSSAI (Food Safety and Standards Authority of India) Registry.

There are three types of food licenses in India which are FSSAI Basic Registration, FSSAI State License and FSSAI Central License.

The Food Licensing Registration Authority is an administration to ensure that food undergoes certain quality checks,

helping to reduce food adulteration and serving standard items to customers.

B. ESI and PF Registration

For any company employing 20 or more employees, To register a business in Chennai, it is compulsory to provident funds and the ESIC scheme.

Employees State Insurance (ESI) is a self-funded social security and health insurance scheme for Indian workers.

This ESIC scheme applies to employees who earn Rs 21,000 or less as salary per month.

The contribution to the scheme will be distributed between the employer and the workers in the form of 4.75 percent as employer contribution and the worker contributes 1.75 percent, total participation 6.5 percent.

The ESI PF registry is governed and managed by the rules and regulations granted by the ESIC Law of 1948.

C. IE Code

The importer and exporter code is briefly called the IEC, which is a compulsory license for all importers and exporters in India.

The IE code is issued by the Director General of Foreign Trade, shortly called DGFT.

IEC will help the person or company to take the products or services beyond the borders.

There are huge advantages and benefits for exporters and importers available in the customs department.

D. Drug Licence

If any person wishes to start a company that is engaged in the business of manufacturing, selling or distributing medicines or cosmetics in India, he or she must obtain a medicine license from the relevant authority.

Companies dealing with drugs, biologicals, medical devices and in diagnostics must obtain a drug license.

The appropriate official for issuing drug licenses for our state is the Tamil Nadu State Licensing Authority.

The competent authority issues a drug license under the Drugs and Cosmetics Act of 1940 to carry on a business related to medicine.

E. Trade License

A trade license or shop and establishment license is a form of compulsory license which is mandatory for a business to carry out its operations.

This license is normally issued by the local corporation of every city (In chennai, the Chennai municipal corporation is the appropriate authority to issue license).

This license is to regulate any business activity which is been operated under the jurisdiction of the local corporation.

F. MSME Registration

MSME is the abbreviated form of Micro Small Medium Entrepreneur.

Any of the companies doing business in India or Tamil Nadu can register a business in Chennai with the Ministry of Micro, Small, and Medium Enterprises scheme.

MSMEs are the backbone of Indian economic growth.

Therefore, the Government of India and the respective state governments are endowing many schemes and funds for the benefit of MSMEs.

To make use of these benefits, it is mandatory to register business name registration in Chennai under the said scheme.

The MSME registry is called the Udyam Registry as per the latest government amendment.

Frequently Asked Questions :-

1. Is business registration to be done before starting a business?

Yes, the entire licenses and registration for your business has to be obtained as soon as you rent a premises for business. The entire license has to be obtained before the commencement of the business activities.

2. Is it compulsory to get GST for every business?

Every business can obtain GST on a voluntary basis. But it is compulsory on the following aspects

Businesses with turnover above the threshold limit of Rs. 40 Lakhs

A casual trader

Person who supplies via e-commerce aggregator

Supply of service or goods from one state to another

3. If we have two branch offices, do we need to get licenses for both?

Certain registration are mandatory to get for the branches also, for example, if your business activity is going to be a hotel, separate FSSAI to be obtained for each outlet, but whereas if it going to be GST, using single gst number we can operate throughout the state by just adding an additional place of business alone.

0 notes

Photo

Advantages Of Registering For a Sole Proprietorship....*Easy To Run The Organization*Simplest Forms Of The Startup With Minimum Budget*Easier To Start And Requires Minimal Tax Compliances*No Restrictions On The Type If The Business Names*The Name Has Completed Controls Of tThe Business.

Call Us : (+91) 7010177653.

More Info : https://www.chennaifilings.in/proprietorship-registration..

.#chennaifilings #copyright #copyrightregistration #RegisterNow #InstantReg #OnlineRegistration #chennai #RegistrationServices #registrationstartsnow

0 notes

Text

What is Pan Card and Why Should I Use One

Of all the unique identification documents improvised, a PAN card is assigned to determine and get a hold of the financial attributes of an individual in India. PAN stands for Primary Account Number which includes a 10-digit alphanumeric number and is unique for all. Unlike the other unique identification documents, a PAN card is issued by the Income-Tax Department of India. The primary significance of a PAN card is to put a thorough check on the tax deposits of an individual as it links all the financial transactions made by an entity or an individual. A PAN is not only assigned to an individual but also a sole proprietorship firm or a partnership firm or an enterprise and thereby records all the transactions linked herewith. It is proof of identification for everyone who is a part of any monetary transaction that is happening across the nation.

HOW TO SEARCH FOR PAN CARD DETAILS

A PAN card search is possible through a number of ways, and all of them are equally effective. It can be done through a search with PAN number, name of an individual, date of birth of an individual and also by the address of an individual. There are ways through which it can be done online via the e-filing website of the Income Tax Department and by registering ourselves with the same.

PAN card details can also be updated through the website link mentioned above.

STEPS THAT NEEDS TO BE FOLLOWED FOR PAN CARD ADDRESS CHECKING

STEP 1: We need to visit the website www incometaxefiling gov in and click on the option “Register Yourself”.

STEP2: We need to fill in the information and register ourselves accordingly.

STEP3: We need to select the User Type and click on “Continue”.

STEP4: We need to fill in our basic details, respectively.

STEP5: We need to fill up the Registration form and click on “Submit”.

STEP6: Consequently, a link will be sent to the email address that we provided and we need to click on that link to activate our account with the Income Tax e-filing department.

STEP7: We need to visit “incometaxindiaefiling gov in/e-Filing/UserLogin/LoginHome html”

STEP8: We need to select “My Account.”

STEP9: We need to go to “Profile Settings” and click on “PAN Details” wherein the address and other details will be displayed.

TO AVAIL THE ADDRESS UPDATE FACILITY

In order to update the address of the PAN card which is extremely important in case one chooses to change one’s address, one has to have ADHAAR card and must have the phone number and email id which is registered with the ADHAAR card. A new address can also be updated by filling in the PAN Change Request Form available at the Nation Securities Depository Limited (NSDL) website.

SIGNIFICANCE OF HAVING A PAN CARD

PAN card has its own significance in ensuring all financial facilities offered by financial organizations as well as by our Govt.

It becomes easier to avail facilities like personal, educational, home and business loans. Life becomes a lot easier if one has this document issued and updated accordingly.

iCrederity offers highly reliable Employee Background Verification, Educational Verification, Pre Employment Screening solutions, employment background check, Pan Card Details verification, Criminal Background Check, Employee Screening, Employment Verification, credential verification, KYC Verification that helps in verifying and recruiting the right person for a job in Delhi Mumbai Bangalore Chennai Hyderabad.

#kyc verification#education verification#background education verification#pan card address verification#pan card number verification#pan card address checking#pan card verification#pan card details verification

0 notes

Link

0 notes