#gst course fees

Explore tagged Tumblr posts

Text

Top GST Online Certification Course | GST Courses Available in India

Explore the top GST online certification courses in India. Get your GST course certificate, learn with leading GST training institutes, and understand GST course fees and details.

#online gst course certificate#gst certification course india#gst certificate course online#gst online certification course#gst online course with certificate#gst course certificate#gst course#gst course in kolkata#gst training#gst online course#gst certification course#gst training institute#gst courses#gst course fees#gst course online#gst courses online#best gst certification course#gst training course#gst certification course online#gst diploma course online#gst courses in india#gst training course kolkata#gst course fees in kolkata

0 notes

Text

Looking GST Return filing servicec in delhi contact taxring professional , reach out CA office in delhi , Nirman Vihar , near metro station - Contact us

Registered Taxpayers: All businesses registered under GST must file returns, regardless of their turnover.

Composition Scheme Taxpayers: Businesses opting for the Composition Scheme are required to file GST returns quarterly and an annual return.

Non-Resident Taxable Persons: Non-resident entities making taxable supplies in India must file GST returns.

E-Commerce Operators: Platforms facilitating sales through e-commerce must file GST returns for the supplies made through them.

Input Service Distributors: Businesses distributing input tax credit to their branches must file returns.

Taxpayers under Zero-Rated Supplies: Exporters and businesses involved in zero-rated supplies need to file returns to claim refunds.

Suspended or Canceled Registrations: Even if a taxpayer's GST registration is suspended or canceled, they are required to file returns for the period they were active.

Annual Returns: All registered taxpayers must file an annual return, irrespective of the type of registration.

These requirements ensure compliance with GST regulations and accurate reporting of sales, purchases, and tax liability.

#who should file gst return#how to file gst return#gst return filing#gst return filing status#gst return filing date#gst return filing process#gst return filing online#gst return filing fees#gst return filing due date#gst return filing dates#gst return filing fees by ca#gst return filing course#gst return filing software#gst return filing charges#check gst return filing status#gst return filing images#gst return filing services#what is gst return filing#gst return filing procedure#gst return filing course free#gst return filing process step by step pdf#gst return filing status check

0 notes

Text

We Provide Tally Erp 9 Training With Gst In Chennai,Online Tally Course With Gst With Certificate,Tally Erp 9 Full Course In Chennai,Tally Erp 9 With Gst Course In Chennai ,Tally Course Erp 9 In Chennai,Tally Classes In Anna Nagar,Tally Course In Chennai Near Me,Tally Erp 9 Course Fees In Chennai,Tally Erp 9 Gst Course Near Me,Tally Erp 9 Complete Course,Online Tally Erp 9 With Gst Course,Tally Erp 9 Training With Gst,Tally Erp 9 Training With Gst Online,Tally Erp 9 Course In Chennai,Tally Erp Course In Chennai,Learn Tally Erp 9 In Chennai,Tally Erp 9 Full Course In Chennai,Tally Erp 9 Online Course, tally erp 9 coaching classes near me.

Visit : https://tallytrainingchennai.com/tally-complete-erp9-course-150-hours

#TALLY ERP 9 TRAINING WITH GST IN CHENNAI#ONLINE TALLY COURSE WITH GST WITH CERTIFICATE#TALLY ERP 9 FULL COURSE IN CHENNAI#TALLY ERP 9 WITH GST COURSE IN CHENNAI#TALLY COURSE ERP 9 IN CHENNAI#TALLY CLASSES IN ANNA NAGAR#TALLY COURSE IN CHENNAI NEAR ME#TALLY ERP 9 COURSE FEES IN CHENNAI#TALLY ERP 9 GST COURSE NEAR ME#TALLY ERP 9 COMPLETE COURSE#ONLINE TALLY ERP 9 WITH GST COURSE#TALLY ERP 9 TRAINING WITH GST#TALLY ERP 9 TRAINING WITH GST ONLINE#TALLY ERP 9 COURSE IN CHENNAI#TALLY ERP COURSE IN CHENNAI#LEARN TALLY ERP 9 IN CHENNAI#TALLY ERP 9 ONLINE COURSE#TALLY ERP 9 COACHING CLASSES NEAR ME

0 notes

Text

Do you want to know about tally gst course fees in kolkata and looking for online tally course with gst with certificate in Kolkata? George Telegraph Institute of Accounts provides you online tally erp 9 certificate course and 100% Placement Guarantee. Visit now.

#tally gst course fees in kolkata#account tally course#certificate course in tally 9 erp#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst

0 notes

Text

VIP Studies Scholarship Exam

Vinayak Institute of Professional Studies (VIP Studies) in Pathankot introduces Entrance Cum Scholarship Test Dec 2024. Now its time to learn from VIP Studies and getting 100% scholarship. With the help of this test students get 100% scholarship from our institute. In the scholarship test first 100 students get the benefit of this test. We recognized these types of tests for students. These types of exams help students to get admission with the 100% scholarship. This test is designed to identify talented students and reward them with scholarships, offering a golden opportunity for those who wish to excel in their academic journey.

The Pattern for the Scholarship exam

Main Objectives of scholarship tests

The objectives of the scholarship test are to identify the students with academic talent. The exam provides them a platform to appear in competitive examinations. These types of exams provide financial assistance to successful students. These types of scholarships help students to obtain education.

Benefits of Scholarship exam

There are several benefits of Scholarship exam for students. Scholarship exams offer a range of benefits for students and educational institutions. They provide access to funding that can alleviate tuition costs and other educational expenses, making higher education more accessible. These exams motivate students to excel in their studies and can enhance overall academic performance. Scholarship exams can identify and recognize students with exceptional abilities, helping them gain opportunities they might not have otherwise. They can lead to a variety of scholarships, including merit-based, need-based, and talent-specific awards, catering to a wide range of student needs. Preparing for scholarship exams can improve critical thinking, problem-solving, and test-taking skills, which are beneficial in further education and careers. Scholarship exams can play a crucial role in shaping a student’s educational journey and future opportunities.

Vinayak institute of professional studies in Pathankot

Vinayak institute of professional studies in Pathankot is the best institute for all types of computer courses. We provide computer basic, computer languages ( java, python, C/C++), Digital marketing course, Web designing course, spoken English course, tuition classes, Special classes for kids, Communication classes, Multi activities classes, Accounting courses, Tally, Tally Prime, Taxation courses, GST Course, TDS courses etc. This is the golden opportunity for the students to learn with VIP studies. Its time to learn with 100% scholarship. This is the best chance for students to learn with 100% scholarship, they learn any course in VIP Studies. These types of scholarship exams are helpful for students to be admitted into an institute within a few fees. Those students who clear these exams with 100% score have chance to learn free in the institute.

Conclusion

Don’t miss out on this incredible opportunity to secure a scholarship and access high-quality education at VIP Studies. This scholarship test is your chance to prove your abilities, gain recognition, and reduce the financial burden of your education.

Register today at VIP Studies and take the first step toward a bright and successful future!

Originally Posted: https://vipstudies.in/scholarship-exam-in-pathankot-for-vip-studies/

2 notes

·

View notes

Note

How long have you had your motorcycle license for now? What's it like having a bike VS a car? I imagine it makes shopping a bit of a pain - or do bikes have more storage on them than they appear?

1. I've had my learner motorcycle license for about 7 months now. I plan on going for my restricted after I hit 1000ks and do at least one Ride Forever course and/or one-on-one lesson to make sure I'm doing things correctly.

2. Motorcycle riding is a bit like riding a pushbike but no pedalling and the clutch is your Roman Empire.

I can't speak to personally owning or using a car since I have yet to get behind the wheel. Definitely better for all-weather use and there are different costs involved.

Vehicle registration (rego) for Despechá (Honda CB125F) is just over NZ$400 a year, compared to my dad's Ford Mondeo, which is a bit over NZ$100. This is due to the much higher ACC levy (about $300pa on mine, I pay more in GST than the actual license fee component of my rego) on motorcycles due to the increased risk of injury/death riding.

Fuel-wise, bike is far more economical. A full tank from empty would cost about NZ$30 (11L tank @ ~$2.70/L for 91 unleaded) at the current fuel prices and gets me about 700ks. Would be about $100 to fill the Mondeo for a roughly equivalent range.

Full coverage insurance costs for both vehicles is about the same at about $400pa.

Parking can be a lot cheaper for motorcycles (free dedicated on-street parking). Have to go out of your way for free on-street parking for cars in the city centre. Otherwise, paying at least $4 for an hour of parking.

Gear can be pricy too. Helmet is legally required, and gloves are the bare additional minimum for many, but ideally, you'd have a jacket and boots, and maybe pants. If not to avoid road rash, then to avoid hypothermia in winter. Though it's up to the individual and how much gear they want to wear.

You do get to use high occupany and some bus lanes if you ride here which can make some commutes quicker.

3. I've become a lot more mindful of how much I can carry on the bike. There isn't much stock storage on mine. Only enough space to store her toolkit and spare manual under the seat.

I don't use my bike for a lot of grocery shopping beyond picking up bread and milk so a backpack suffices. Planning on buying panniers and a tank bag but that's becoming less for shopping and more for future travel plans.

Some scooters do have a lot more storage under the seat or on the steering column. It depends on the model.

5 notes

·

View notes

Text

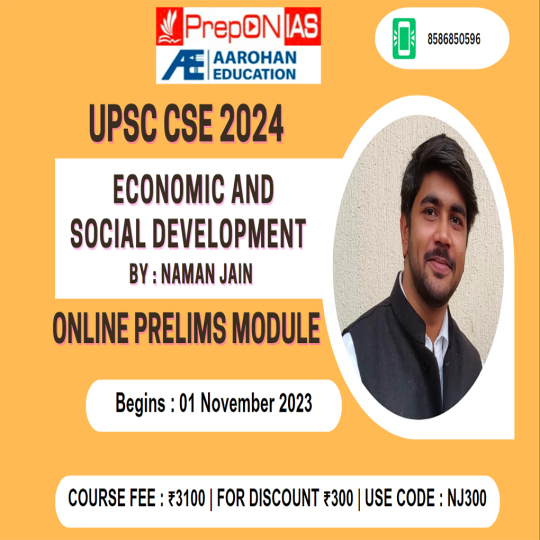

Available Courses at PrepON IAS: Civil Services Examination 2024 Batch Courses available at PrepON IAS (An Initiative of PrepON IAS & Aarohan Education)

Courses Offered:

UPSC CSE 2024 ECONOMIC AND SOCIAL DEVELOPMENT PRELIMS MODULE

Course Link: https://lnkd.in/d5XpSxEn Fee: (Rs 3100 including GST)

Various access Links available here: 1.Android: https://lnkd.in/g4jU6Wzr...

2. iPhone User: https://lnkd.in/g5ikbWDi... Org code:WNIDA

3. Laptop/desktop Login: LOGIN URL: https://lnkd.in/d7xubj37 User Name: Registered Mobile No. ORG CODE :WNIDA

For Detailed Information Please Call: 8586850596 Email: [email protected]

#upscaspirants#upscprelims#upsc2024#upscprelims2024#economyandsocialdevelopment#cse2024#upsceconomic

4 notes

·

View notes

Text

Best Computer Institute in Saket – Seekho Computer

Seekho Computer offers a wide range of computer courses for students, professionals, and job seekers. Our expert-led training ensures practical learning, certification, and job assistance to help you build a successful career.

Our Popular Courses

✅ Basic Computer Course – MS Office, Internet, Email, Typing ✅ Advanced Excel & Data Analytics – Pivot Tables, Dashboards, Power BI ✅ Graphic Designing – Photoshop, Illustrator, CorelDRAW ✅ Digital Marketing – SEO, Google Ads, Social Media ✅ Programming & Web Development – Python, Java, HTML, CSS ✅ Tally & Accounting – GST, Payroll, Financial Reports ✅ Cyber Security & Ethical Hacking – Network Security, Ethical Hacking

Why Choose Seekho Computer?

✔ Expert Trainers & Hands-on Training ✔ Certification & Placement Assistance ✔ Flexible Timings & Online Classes ✔ Affordable Fees & Career Support

📢 Enroll Now & Upgrade Your Skills!

Visit SeekhoComputer.com or call us for a free demo class! 🚀

0 notes

Text

Accounting Course After 12th – Scope, Salary & Career Growth

Accounting Course After 12th: A Complete Guide

12th ke baad agar aap commerce stream se hain, toh accounting ek best career option ho sakta hai. Accounting professionals ki demand har business, firm, aur organization me hoti hai. Is article me hum accounting courses, unke benefits, fees, duration, aur job opportunities ke baare me detail me discuss karenge.

Accounting Kya Hai?

Accounting ek process hai jisme financial transactions ka record, summarize, analyze, aur report kiya jata hai. Ye business ka ek important part hai jo financial stability aur growth ensure karta hai. Accounting professionals ko taxation, auditing, financial reporting, aur cost management me expertise honi chahiye.

Accounting Course after 12th Ke Types

Agar aap 12th ke baad accounting field me career banana chahte hain, toh kai courses available hain:

1. Diploma in Accounting

· Duration: 6 months - 1 year

· Fees: ₹10,000 - ₹50,000

· Eligibility: 12th pass (preferably commerce stream)

· Syllabus: Financial Accounting, Taxation, Auditing, Tally ERP 9, GST

· Career Options: Junior Accountant, Tally Operator, Account Assistant

2. Bachelor of Commerce (B.Com) in Accounting

· Duration: 3 years

· Fees: ₹15,000 - ₹1,00,000 per year

· Eligibility: 12th pass (commerce preferred)

· Syllabus: Financial Management, Cost Accounting, Auditing, Tax Laws, Business Law

· Career Options: Accountant, Auditor, Finance Manager, Tax Consultant

3. Bachelor of Business Administration (BBA) in Accounting

· Duration: 3 years

· Fees: ₹50,000 - ₹2,00,000 per year

· Eligibility: 12th pass (any stream, commerce preferred)

· Syllabus: Business Accounting, Financial Planning, Taxation, Management Accounting

· Career Options: Financial Analyst, Accountant, Management Consultant

4. Chartered Accountancy (CA)

· Duration: 4-5 years

· Fees: ₹50,000 - ₹2,50,000

· Eligibility: 12th pass (any stream, but commerce preferred)

· Stages: CPT, IPCC, Articleship, Final Exam

· Career Options: Chartered Accountant, Auditor, Tax Advisor

5. Certified Management Accountant (CMA)

· Duration: 3-4 years

· Fees: ₹1,00,000 - ₹3,00,000

· Eligibility: 12th pass with commerce

· Syllabus: Financial Planning, Performance Management, Cost Accounting

· Career Options: Cost Accountant, Finance Manager, Budget Analyst

6. Company Secretary (CS)

· Duration: 3-5 years

· Fees: ₹50,000 - ₹1,50,000

· Eligibility: 12th pass

· Career Options: Company Secretary, Legal Advisor, Compliance Officer

7. Tally & GST Certification Courses

· Duration: 3-6 months

· Fees: ₹5,000 - ₹20,000

· Eligibility: 12th pass

· Career Options: Tally Operator, GST Consultant, Accountant

Best Accounting Course after 12th Kaise Choose Karein?

Aapke career goals ke hisaab se course choose karna zaroori hai. Agar aap:

· Quick job chahte hain, toh Diploma in Accounting ya Tally & GST certification best option hai.

· Higher education aur specialization chahte hain, toh B.Com, BBA, ya CA sahi choice hai.

· Global recognition chahte hain, toh CMA ya ACCA best option hai.

Accounting Course after 12th Karne Ke Benefits

1. High Salary Potential: Accounting professionals ki salary ₹3,00,000 - ₹20,00,000 tak ja sakti hai.

2. Job Security: Har industry me accountants ki demand hoti hai.

3. Entrepreneurship Opportunities: Khud ka accounting firm ya consultancy start kar sakte hain.

4. International Career: ACCA, CMA jaise courses aapko globally recognized accountant bana sakte hain.

5. Government Jobs: SSC, RBI, UPSC me accountant aur auditor posts available hoti hain.

Accounting Me Career Scope & Job Opportunities

Accounting field me multiple career options hain:

· Junior Accountant: ₹2,00,000 - ₹3,50,000 per year

· Senior Accountant: ₹4,00,000 - ₹7,00,000 per year

· Chartered Accountant (CA): ₹7,00,000 - ₹20,00,000 per year

· Financial Analyst: ₹5,00,000 - ₹12,00,000 per year

· Tax Consultant: ₹4,00,000 - ₹10,00,000 per year

· Auditor: ₹6,00,000 - ₹15,00,000 per year

Conclusion

Agar aap commerce background se hain aur finance field me career banana chahte hain, toh accounting ek excellent choice hai. Accounting courses aapko high-paying aur secure career opportunities provide karte hain. Right course choose karke aap apni financial career journey strong bana sakte hain.

FAQ (Frequently Asked Questions)

1. Kya non-commerce students bhi accounting course kar sakte hain? Haan, non-commerce students bhi diploma ya certification courses kar sakte hain, lekin CA aur B.Com courses me commerce background helpful hota hai.

2. Kya accounting courses ke liye maths compulsory hai? B.Com aur BBA courses ke liye maths zaroori nahi hai, lekin CA aur CMA courses me maths helpful hoti hai.

3. Accounting course complete hone ke baad salary kitni hoti hai? Salary depend karti hai course aur experience par. Starting salary ₹2,00,000 - ₹5,00,000 per year ho sakti hai aur experience ke saath ₹10,00,000+ tak ja sakti hai.

4. Kya online accounting courses valuable hote hain? Haan, agar aap reputed platforms jaise ICAI, Udemy, Coursera, ya LinkedIn Learning se certification lete hain toh wo valuable hoga.

Accounting ek long-term stable career hai jo aapko financial freedom aur growth de sakta hai. Ab aap apni choice ke according best accounting course select karke apna career shuru kar sakte hain!

Accounting Courses for beginner ,

Income Tax Course,

Diploma courses after 12th Commerce ,

Courses after b com with placement ,

Diploma in financial accounting ,

SAP fico Course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Online Tally Course ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course in Delhi,

diploma in banking finance ,

stock market trading Course in Delhi,

six months course

Blog

Income Tax

Accounting

Tally

Caree

0 notes

Text

Accounting Course After 12th – Scope, Salary & Career Growth

Accounting Course After 12th: A Complete Guide

12th ke baad agar aap commerce stream se hain, toh accounting ek best career option ho sakta hai. Accounting professionals ki demand har business, firm, aur organization me hoti hai. Is article me hum accounting courses, unke benefits, fees, duration, aur job opportunities ke baare me detail me discuss karenge.

Accounting Kya Hai?

Accounting ek process hai jisme financial transactions ka record, summarize, analyze, aur report kiya jata hai. Ye business ka ek important part hai jo financial stability aur growth ensure karta hai. Accounting professionals ko taxation, auditing, financial reporting, aur cost management me expertise honi chahiye.

Accounting Course after 12th Ke Types

Agar aap 12th ke baad accounting field me career banana chahte hain, toh kai courses available hain:

1. Diploma in Accounting

· Duration: 6 months - 1 year

· Fees: ₹10,000 - ₹50,000

· Eligibility: 12th pass (preferably commerce stream)

· Syllabus: Financial Accounting, Taxation, Auditing, Tally ERP 9, GST

· Career Options: Junior Accountant, Tally Operator, Account Assistant

2. Bachelor of Commerce (B.Com) in Accounting

· Duration: 3 years

· Fees: ₹15,000 - ₹1,00,000 per year

· Eligibility: 12th pass (commerce preferred)

· Syllabus: Financial Management, Cost Accounting, Auditing, Tax Laws, Business Law

· Career Options: Accountant, Auditor, Finance Manager, Tax Consultant

3. Bachelor of Business Administration (BBA) in Accounting

· Duration: 3 years

· Fees: ₹50,000 - ₹2,00,000 per year

· Eligibility: 12th pass (any stream, commerce preferred)

· Syllabus: Business Accounting, Financial Planning, Taxation, Management Accounting

· Career Options: Financial Analyst, Accountant, Management Consultant

4. Chartered Accountancy (CA)

· Duration: 4-5 years

· Fees: ₹50,000 - ₹2,50,000

· Eligibility: 12th pass (any stream, but commerce preferred)

· Stages: CPT, IPCC, Articleship, Final Exam

· Career Options: Chartered Accountant, Auditor, Tax Advisor

5. Certified Management Accountant (CMA)

· Duration: 3-4 years

· Fees: ₹1,00,000 - ₹3,00,000

· Eligibility: 12th pass with commerce

· Syllabus: Financial Planning, Performance Management, Cost Accounting

· Career Options: Cost Accountant, Finance Manager, Budget Analyst

6. Company Secretary (CS)

· Duration: 3-5 years

· Fees: ₹50,000 - ₹1,50,000

· Eligibility: 12th pass

· Career Options: Company Secretary, Legal Advisor, Compliance Officer

7. Tally & GST Certification Courses

· Duration: 3-6 months

· Fees: ₹5,000 - ₹20,000

· Eligibility: 12th pass

· Career Options: Tally Operator, GST Consultant, Accountant

Best Accounting Course after 12th Kaise Choose Karein?

Aapke career goals ke hisaab se course choose karna zaroori hai. Agar aap:

· Quick job chahte hain, toh Diploma in Accounting ya Tally & GST certification best option hai.

· Higher education aur specialization chahte hain, toh B.Com, BBA, ya CA sahi choice hai.

· Global recognition chahte hain, toh CMA ya ACCA best option hai.

Accounting Course after 12th Karne Ke Benefits

1. High Salary Potential: Accounting professionals ki salary ₹3,00,000 - ₹20,00,000 tak ja sakti hai.

2. Job Security: Har industry me accountants ki demand hoti hai.

3. Entrepreneurship Opportunities: Khud ka accounting firm ya consultancy start kar sakte hain.

4. International Career: ACCA, CMA jaise courses aapko globally recognized accountant bana sakte hain.

5. Government Jobs: SSC, RBI, UPSC me accountant aur auditor posts available hoti hain.

Accounting Me Career Scope & Job Opportunities

Accounting field me multiple career options hain:

· Junior Accountant: ₹2,00,000 - ₹3,50,000 per year

· Senior Accountant: ₹4,00,000 - ₹7,00,000 per year

· Chartered Accountant (CA): ₹7,00,000 - ₹20,00,000 per year

· Financial Analyst: ₹5,00,000 - ₹12,00,000 per year

· Tax Consultant: ₹4,00,000 - ₹10,00,000 per year

· Auditor: ₹6,00,000 - ₹15,00,000 per year

Conclusion

Agar aap commerce background se hain aur finance field me career banana chahte hain, toh accounting ek excellent choice hai. Accounting courses aapko high-paying aur secure career opportunities provide karte hain. Right course choose karke aap apni financial career journey strong bana sakte hain.

FAQ (Frequently Asked Questions)

1. Kya non-commerce students bhi accounting course kar sakte hain? Haan, non-commerce students bhi diploma ya certification courses kar sakte hain, lekin CA aur B.Com courses me commerce background helpful hota hai.

2. Kya accounting courses ke liye maths compulsory hai? B.Com aur BBA courses ke liye maths zaroori nahi hai, lekin CA aur CMA courses me maths helpful hoti hai.

3. Accounting course complete hone ke baad salary kitni hoti hai? Salary depend karti hai course aur experience par. Starting salary ₹2,00,000 - ₹5,00,000 per year ho sakti hai aur experience ke saath ₹10,00,000+ tak ja sakti hai.

4. Kya online accounting courses valuable hote hain? Haan, agar aap reputed platforms jaise ICAI, Udemy, Coursera, ya LinkedIn Learning se certification lete hain toh wo valuable hoga.

Accounting ek long-term stable career hai jo aapko financial freedom aur growth de sakta hai. Ab aap apni choice ke according best accounting course select karke apna career shuru kar sakte hain!

IPA OFFERS:-

Free Accounting Courses with Certificate ,

Income Tax Course,

Diploma courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico Course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course in Delhi,

diploma in banking finance ,

stock market trading Course in Delhi,

six months course

Blog

Income Tax

Accounting

Tally

Career

0 notes

Text

Best GST Certification Course by GTIA: Explore Opportunities in India

Explore the best GST certification course by GTIA in Kolkata. Gain expertise with a certified GST course, covering all aspects including fees. Start your journey into India's GST opportunities today!

#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst course online#gst training online#online gst course certificate#gst certificate course online#gst certification course india#gst course certificate#gst online certification course#gst online course with certificate#gst certification course#online gst certification course#gst course in kolkata#gst course fees#gst training institute#best gst certification course

0 notes

Text

Using Tally for E-commerce businesses: A complete guide

E-commerce businesses need correct financial control and tax compliance in a fast-paced virtual global. Tally, a sturdy accounting and ERP software program, simplifies dealing with budget, GST compliance, and day by day operations. This manual, "using Tally for E-trade businesses: A comprehensive manual," explains how Tally can streamline and enhance your business approaches.

Why Tally is essential for E-commerce businesses

within the world of e-commerce, agencies deal with excessive transaction volumes, a couple of price gateways, and stringent compliance necessities. Tally simplifies those complexities with capabilities tailored for cutting-edge companies:

Green economic management: Tally automates bookkeeping tasks like invoicing, price tracking, and ledger management.

GST Compliance: The software program ensures correct goods and services Tax (GST) calculations, a critical element for Indian groups. It also enables submitting returns seamlessly.

Stock control: E-commerce platforms handle a significant variety of products, and Tally’s inventory control ensures smooth stock tracking.

Customizable reviews: Tally generates insightful reviews to help you make knowledgeable business choices.

By way of learning those features, entrepreneurs can streamline their accounting processes, lessen human errors, and cognizance on scaling their ventures. For the ones trying to dive deeper, enrolling in a Tally Course in Kolkata can provide the essential capabilities.

Key features of Tally for E-commerce

GST Integration E-trade companies should comply with GST policies, making Tally a useful tool. With its inbuilt GST module, Tally helps the subsequent:

Computerized GST calculations for income and purchases.

Simplified GST filing processes.

Reconciliation of GST returns.

Entrepreneurs can don't forget a GST Course in Kolkata to decorate their understanding of GST submitting and compliance.

Multi-location control E-commerce businesses often function across multiple places. Tally facilitates:

Centralized manipulate of budget for all locations.

Consolidated reporting and analysis.

Inter-branch stock switch monitoring.

payment Gateway Reconciliation Managing more than one charge gateways can emerge as cumbersome. Tally simplifies the method by way of:

Recording payments and receipts automatically.

Reconciling payment gateway money owed with bank statements.

Stock control

Efficient inventory control is crucial for e-commerce success. Tally’s functions include:

Actual-time stock degree updates.

Batch and expiry control for product categories.

Reorder level settings to save you stockouts.

Putting in place Tally for E-trade

To maximize Tally’s potential, proper configuration is vital. right here’s a step-through-step manual:

Step 1: installation Tally ERP 9 or Tally prime

Make sure you have got the modern version to get entry to superior capabilities. deploy and prompt the GST module for seamless compliance.

Step 2: Create a organization in Tally

Go to the principle menu and pick “Create organization.”

Input crucial information like agency call, address, and GSTIN.

Configure taxation settings for GST compliance.

Step 3: Installation inventory and inventory classes

Categorize products based totally on SKU, batch, or place.

Enter opening stock details for accurate inventory monitoring.

Step 4: Configure payment Gateways

Create ledger accounts for each fee gateway.

Map these debts to corresponding transactions for automated reconciliation.

Step 5: allow Multi-currency Transactions (if relevant)

For agencies managing international clients, spark off multi-forex aid to simplify overseas transactions.

Dealing with GST Compliance with Tally

One in every of Tally’s standout capabilities is its strong GST compliance module. here’s how e-commerce organizations can leverage it:

GST Registration and Configuration

Register your business below GST and update your GSTIN in Tally.

This allows seamless GST tracking for transactions.

Generate GST Invoices

Tally allows you to create GST-compliant invoices with the required information, along with:

HSN codes for merchandise.

Tax prices (CGST, SGST, IGST).

Opposite fee mechanism (if relevant).

record GST return

Use Tally’s GST go back filing feature to:

Generate GSTR-1, GSTR-3B, and different relevant paperwork.

Validate records to avoid errors throughout submission.

Add returns at once to the GST portal.

For the ones new to GST strategies, enrolling in a Taxation Course in Kolkata can help build foundational know-how.

Customizing reviews for higher Insights

Tally’s reporting abilities permit organizations to live beforehand inside the competitive e-commerce landscape. Key reviews include:

Income evaluation: discover excellent-selling products and seasonal traits.

Expense reports: music operational fees and optimize spending.

Earnings and Loss statement: advantage a clean photograph of monetary fitness.

To beautify your ability to research such reports, an Accounting course may be useful.

Integrating Tally with E-trade systems

Seamless integration between Tally and your e-commerce platform can store effort and time. popular strategies consist of:

API Integration

Use APIs to synchronize order information, inventory levels, and economic records between platforms like Shopify or WooCommerce and Tally.

third-birthday party Connectors

Cumerous equipment, consisting of Zapier, provide ready-made connectors to integrate Tally with e-trade structures.

guide information Import/Export

For smaller operations, exporting facts from the e-trade platform and uploading it into Tally is a practical answer.

Conclusion

Tally gives e-commerce corporations a effective toolkit to streamline operations, manipulate budget, and ensure compliance with GST guidelines. From stock management to charge gateway reconciliation, the software program addresses every important project faced with the aid of e-commerce entrepreneurs.

#accounting course in kolkata#taxation course#tally course#gst course#gst course in kolkata#taxation course in kolkata#accounting course#tally course in kolkata

0 notes

Text

Best Tally Training Institute and Tally Certificate Course

Best Tally Training Institute in Kolkata - Our certificate course in tally 9 erp teaches students in detail that how to manage and maintain accounts, inventory and payroll at Tally.

#certificate course in tally 9 erp#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#tally course online#learn tally online

0 notes

Text

Tax Filing Tips Every Consultant Should Know

Introduction

As a consultant, managing your taxes can be a daunting task. With unique income structures, varied expenses, and fluctuating cash flows, filing taxes can feel overwhelming. However, understanding key strategies and staying organized can make the process smoother and even help you save money. Here are essential tax filing for consultants tips should know to stay compliant and maximize deductions.

1. Understand Your Tax Obligations

Consultants are generally self-employed or independent contractors. That means:

You are responsible for reporting all your income.

You might need to pay advance tax if your tax liability crosses certain limits.

You have to maintain Goods and Services Tax (GST) compliance if your turnover exceeds the threshold limit.

You have to keep track of the applicable tax rules to avoid penalties or complications.

2. Maintain Accurate Records

Proper documentation is crucial for accurate tax filing. Keep a record of:

Income: Invoices, receipts, and bank statements reflecting your earnings.

Expenses: Bills, receipts, and statements related to work-related expenses like office supplies, travel, or internet costs.

Tax Payments: Proof of advance tax payments and GST filings.

Organized records ensure that you claim all eligible deductions and prepare for potential audits.

3. Leverage Business Expense Deductions

As a consultant, you are able to claim many business expenses, such as:

Office space or coworking fees.

Communication expenses, like phone and internet bills.

Travel costs associated with client meetings or conferences.

Professional tools or software subscriptions.

Marketing and advertising.

Be sure that these expenses only pertain to your business for them to qualify as deductions.

4. Separate Personal and Business Finances

Keeping the business and personal money separate reduces confusion during tax filling. Ensure you open a bank account with a name that relates to your consulting income and expenses. This is very helpful to keep track of deductions with greater ease.

5. Be Aware of Applicable Tax Deductions

Apart from business expenses, consultants can claim other deductions, such as:

Home Office Deduction: If you work from home, you may claim a portion of your rent, utilities, or maintenance costs.

Health Insurance Premiums: Premiums for self-employed individuals may be deductible.

Professional Development: Expenses for courses, certifications, or training to enhance your skills.

Consult a tax expert to ensure you’re taking full advantage of all applicable deductions.

6. Pay Advance Taxes on Time

Self-employed professionals must pay advance taxes quarterly if their annual tax liability exceeds ₹10,000. Missing these deadlines can result in interest penalties. Regularly calculate your estimated income and tax liability to ensure timely payments.

7. Seek Professional Assistance

Tax laws can be complex, and mistakes lead to penalties. Hiring a tax consultant or chartered accountant ensures accuracy and compliance. They can:

Optimize your tax planning.

Identify deductions you might overlook.

Help with GST compliance.

Represent you in case of audits or disputes.

Why Choose GTS Consultant India?

GTS Consultant India specializes in providing customized tax solutions for consultants and self-employed professionals. Our expert team ensures compliance, maximizes deductions, and simplifies the tax filing process for you. With years of experience and a client-first approach, we are your trusted partner for all tax-related needs.

Conclusion

Tax filing does not have to be stressful. Being organized, knowing what you are supposed to do, and utilizing the deductions can help you file your taxes with confidence. For professional guidance and support, reach out to GTS Consultant India. Let us take the hassle out of your tax filing so you can focus on growing your consulting business. Visit our website to learn more!

0 notes

Text

Available Courses at PrepON IAS:

Civil Services Examination 2024 Batch Courses available at PrepON IAS

(An Initiative of PrepON IAS & Aarohan Education)

Courses Offered : GS Only Prelims Course

Course Mode : Recorded Videos ( Course Began: Aug 2023)

Course Link:

Fee: Rs 12000 + Xmas Discount 15% off (including GST)

Various access Links available here:

1.Android:

https://play.google.com/store/apps/de...

2. iPhone User:

https://apps.apple.com/in/app/classpl...

Org code:WNIDA

3. Laptop/desktop Login:

LOGIN URL: https://web.classplusapp.com

User Name: Registered Mobile No.

ORG CODE :WNIDA

PASSWORD* : OTP

For Detailed Information

Please Call: 8586850596

Email: [email protected]

2 notes

·

View notes

Text

Computer Course for Job -Top Course for Freshers

Computer Course for Jobs – Best Courses for Beginners & Experts

Computer Course for Jobs | कंप्यूटर कोर्स से नौकरी कैसे पाएँ?

1. Introduction | परिचय

आज के डिजिटल युग में Computer Course for Jobs एक महत्वपूर्ण विषय बन गया है। हर क्षेत्र में कंप्यूटर का उपयोग बढ़ रहा है। यदि आप एक अच्छी नौकरी चाहते हैं, तो कंप्यूटर की जानकारी होना अनिवार्य है।

2. Why Computer Courses are Important for Jobs? | कंप्यूटर कोर्स क्यों जरूरी हैं?

· कंप्यूटर कौशल हर सेक्टर में आवश्यक हो गया है।

· नौकरियों में प्राथमिकता उन्हीं को मिलती है जिनके पास कंप्यूटर नॉलेज होता है।

· डिजिटल इंडिया और ऑटोमेशन के कारण कंप्यूटर स्किल्स की मांग बढ़ी है।

· सरकारी और प्राइवेट सेक्टर दोनों में कंप्यूटर कोर्स से लाभ मिलता है।

3. Types of Computer Courses | कंप्यूटर कोर्स के प्रकार

Basic Computer Courses | बेसिक कंप्यूटर कोर्स

अगर आप कंप्यूटर सीखना शुरू कर रहे हैं तो बेसिक कोर्स आपके लिए सही रहेगा। कुछ महत्वपूर्ण बेसिक कोर्स:

· MS Office (Word, Excel, PowerPoint)

· Internet और Email Management

· Typing और Data Entry

· Computer Fundamentals

Diploma & Certification Courses | डिप्लोमा एवं सर्टिफिकेट कोर्स

ये कोर्स छोटे समय में अच्छी नौकरी दिलाने में मदद करते हैं। कुछ लोकप्रिय डिप्लोमा कोर्स:

· Diploma in Computer Applications (DCA)

· Tally & Accounting Software Course

· Graphic Designing & Photoshop

· Web Designing & Development

Advanced & Professional Courses | एडवांस्ड और प्रोफेशनल कोर्स

अगर आप ज्यादा सैलरी वाली जॉब चाहते हैं, तो एडवांस्ड कंप्यूटर कोर्स फायदेमंद रहेंगे।

· Data Science & Machine Learning

· Digital Marketing

· Cyber Security & Ethical Hacking

· Software Development & Coding (Python, Java, C++)

4. Best Computer Courses for Jobs | नौकरी के लिए बेहतरीन कंप्यूटर कोर्स

अगर आप जल्द नौकरी पाना चाहते हैं, तो ये कोर्स करें:

· Data Entry Operator Course – सरकारी और प्राइवेट जॉब्स के लिए उपयुक्त।

· Tally और GST Course – अकाउंटिंग और ��ैंकिंग सेक्टर में मददगार।

· Web Designing – फ्रीलांसिंग और IT कंपनियों में मौके।

· Digital Marketing – SEO, PPC और Social Media Marketing जॉब्स के लिए लाभदायक।

· Programming (Python, Java, C++) – IT सेक्टर में उच्च वेतन वाली नौकरियों के लिए।

5. Eligibility & Duration | पात्रता एवं अवधि

कोर्स का नाम

योग्यता

अवधि

Basic Computer

10वीं पास

3-6 महीने

DCA & Tally

12वीं पास

6-12 महीने

Web Designing

12वीं पास

6-12 महीने

Digital Marketing

12वीं/ग्रेजुएशन

3-6 महीने

Programming

ग्रेजुएशन

6-24 महीने

6. Fees & Institutes | फीस और संस्थान

Fees | फीस

कंप्यूटर कोर्स की फीस संस्थान और कोर्स के अनुसार भिन्न होती है। सामान्यतः:

· बेसिक कोर्स: ₹3000 – ₹8000

· डिप्लोमा कोर्स: ₹10,000 – ₹50,000

· एडवांस्ड कोर्स: ₹50,000 – ₹2,00,000

Best Institutes | टॉप संस्थान

· NIIT (National Institute of Information Technology)

· Aptech Computer Education

· Jetking Institute

· Coursera, Udemy, edX (Online Platforms)

· IGNOU (Indira Gandhi National Open University)

7. Job Opportunities & Salary | नौकरी के अवसर और वेतन

कंप्यूटर कोर्स करने के बाद विभिन्न क्षेत्रों में रोजगार के अवसर उपलब्ध होते हैं:

Government Jobs | सरकारी नौकरियाँ

· Data Entry Operator – ₹15,000 – ₹30,000 प्रति माह

· Clerk & Office Assistant – ₹20,000 – ₹40,000 प्रति माह

· Bank PO & SSC Jobs – ₹30,000 – ₹50,000 प्रति माह

Private Sector Jobs | प्राइवेट सेक्टर नौकरियाँ

· Graphic Designer – ₹25,000 – ₹60,000 प्रति माह

· Web Developer – ₹30,000 – ₹1,00,000 प्रति माह

· Digital Marketer – ₹40,000 – ₹1,50,000 प्रति माह

· Software Developer – ₹50,000 – ₹2,00,000 प्रति माह

Freelancing & Business | फ्रीलांसिंग और बिजनेस

अगर आप नौकरी के बजाय स्वतंत्र रूप से काम करना चाहते हैं, तो:

· Web Development और Graphic Designing में फ्रीलांसिंग करें।

· डिजिटल मार्केटिंग के जरिए बिजनेस बढ़ाएं।

· Blogging और YouTube से कमाई करें।

8. Conclusion | निष्कर्ष

आज के समय में Computer Course for Jobs बहुत जरूरी हो गया है। अगर आप बेहतर नौकरी और ज्यादा वेतन चाहते हैं, तो किसी भी कंप्यूटर कोर्स में दाखिला लें। सरकारी और प्राइवेट सेक्टर दोनों में कंप्यूटर कौशल रखने वालों की मांग हमेशा बनी रहेगी। सही कोर्स चुनें और अपने करियर को नई ऊंचाइयों तक पहुंचा��ं।

E Accounting Courses ,

Taxation course online,

courses after 12th Commerce ,

Courses after b com with high salary ,

Diploma in accounting ,

SAP fico Course in delhi ,

Business accounting and Taxation Course ,

GST Practitioner Course ,

Computer Course for jobs ,

Payroll Course in Delhi,

Tally Course in Delhi ,

diploma course after b com ,

Advanced Excel Course in Delhi ,

Computer ADCA Course in Delhi

Data Entry Operator Course,

diploma in banking finance ,

stock market trading Course in Delhi,

six months course in accounting

#Diploma in Computer Application#Business Accounting and Taxation (BAT) Course#Basic Computer Course#GST Course#SAP FICO Course#Payroll Management Course#Diploma in Financial Accounting#Diploma In Taxation#Tally Course

0 notes