#growth financial services

Explore tagged Tumblr posts

Text

youtube

Adding System Advisory services to your Accounting or/and Bookkeeping Practice

How can System Advisory help your clients understand systems? Adding System Advisory Services? Watch Neha, the Director of Futureproof Accountants discuss how an accounting business can take advantage of system advisory as a service and in return, providing the assistance that the clients are looking for, making it easier for them to understand how things work.

#Adding System Advisory Services#Accounting Practice Enhancement#Bookkeeping Growth Strategies#Bookkeeping Modernization#Innovative Bookkeeping#Future of Accounting#Futureproof Accountants#practice's success#financial growth#adding System Advisory Services#accounting practice#bookkeeping practice#accounting business#system advisory benefits#bookkeeping modernization#futureproof accountants#demand for accountants in the future#growth financial services#Youtube

0 notes

Text

Create New Income Streams through Online Trading

William Savary’s comprehensive trading course teaches you how to generate consistent income by investing in stocks. Learn the skills you need to diversify your earnings and build a business that thrives in the stock market.

#financial services#financial analysis#autos#beauty#finance#developers & startups#fashion#financial growth#financial investment#musicians

2 notes

·

View notes

Text

Why Accurate Financial Statements Matter for Your Business

Accurate financial statements are the backbone of any successful business, providing insights into your company’s financial health and guiding decision-making. At SAI CPA Services, we offer expert financial statement preparation, ensuring your records are precise and reliable.

Why Accurate Financial Statements Matter

Accurate financial statements allow businesses to plan for the future, meet regulatory requirements, and demonstrate financial stability. Here’s how our services benefit your business:

Informed Decision-Making: Our financial statement services give you a clear understanding of your revenue, expenses, and overall financial position, enabling you to make informed business decisions.

Investor Confidence: Lenders and investors rely on accurate financial statements to evaluate your business’s health. A professionally prepared statement adds credibility and trust.

Regulatory Compliance: We ensure that your financial statements comply with all necessary accounting standards and regulations, avoiding penalties and ensuring transparency in your operations.

How SAI CPA Services Can Help

At SAI CPA Services, we provide accurate and detailed financial statements to help your business stay on track. Our team ensures that your financial records are up-to-date, reliable, and compliant.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#financial statements#business growth#financial services#accounting#accounting services#cpa#new jeresy#investor confidence#regulatory compliance services

2 notes

·

View notes

Text

Why Quantum Computing Will Change the Tech Landscape

The technology industry has seen significant advancements over the past few decades, but nothing quite as transformative as quantum computing promises to be. Why Quantum Computing Will Change the Tech Landscape is not just a matter of speculation; it’s grounded in the science of how we compute and the immense potential of quantum mechanics to revolutionise various sectors. As traditional…

#AI#AI acceleration#AI development#autonomous vehicles#big data#classical computing#climate modelling#complex systems#computational power#computing power#cryptography#cybersecurity#data processing#data simulation#drug discovery#economic impact#emerging tech#energy efficiency#exponential computing#exponential growth#fast problem solving#financial services#Future Technology#government funding#hardware#Healthcare#industry applications#industry transformation#innovation#machine learning

2 notes

·

View notes

Text

How Fintech is Revolutionizing Financial Inclusion in the global ?

Financial inclusion, the access and usage of financial services by individuals and businesses, is crucial for economic development and poverty alleviation worldwide. However, traditional banking systems have often left millions of people underserved or excluded altogether. In this article, we explore how Fintech is spearheading a global revolution in financial inclusion, with a particular focus on the transformative impact of Xettle Technologies.

Fintech's Global Reach in Advancing Financial Inclusion:

Fintech has emerged as a powerful force in expanding Financial Technology access to underserved populations across the globe. By leveraging digital technologies such as mobile devices and blockchain, Fintech companies are overcoming the barriers of geography and infrastructure that have traditionally hindered financial inclusion efforts. From remote villages in Africa to urban slums in South America, Fintech solutions are reaching the unbanked and underbanked with innovative products and services tailored to their needs.

Addressing the Challenges of Traditional Banking:

Traditional banking models often fail to serve low-income individuals and small businesses due to high costs, stringent requirements, and limited accessibility. Fintech companies, on the other hand, are leveraging technology to lower barriers to entry and offer more inclusive financial solutions. Mobile banking apps, digital wallets, and peer-to-peer lending platforms are just a few examples of how Fintech is democratizing access to financial services and empowering marginalized communities.

Xettle Technologies: A Catalyst for Financial Inclusion:

Xettle Technologies stands out as a shining example of how Fintech can drive financial inclusion on a global scale. Through its innovative lending platform, Xettle is revolutionizing access to credit for small and medium-sized enterprises (SMEs) in emerging markets. By harnessing the power of data analytics and machine learning, Xettle is able to assess the creditworthiness of borrowers who may lack traditional credit histories, enabling them to access affordable financing for business growth and expansion.

Empowering Entrepreneurs and Microenterprises:

One of the key ways in which Fintech is revolutionizing financial inclusion is by empowering entrepreneurs and microenterprises, often the backbone of developing economies. By providing access to credit, savings, and payment solutions, Fintech is enabling small businesses to thrive and contribute to local economic development. Xettle Technologies, with its focus on SME lending, is playing a pivotal role in supporting the growth and sustainability of microenterprises around the world.

Overcoming Regulatory and Infrastructure Challenges:

While Fintech holds tremendous promise for advancing financial inclusion, it also faces regulatory and infrastructure challenges that must be addressed. Regulatory frameworks often lag behind technological innovations, creating uncertainty and barriers to entry for Fintech startups. Additionally, inadequate internet connectivity and digital literacy in some regions pose challenges to widespread adoption of Fintech solutions. Overcoming these obstacles will require collaboration between governments, regulators, and the private sector to create an enabling environment for Fintech innovation.

The Future of Financial Inclusion:

As Fintech continues to evolve and expand its reach, the future of financial inclusion looks brighter than ever. Emerging technologies such as blockchain, artificial intelligence, and digital identity solutions hold the potential to further accelerate progress towards universal access to financial services. By fostering innovation and collaboration, Fintech has the power to transform the lives of billions of people around the world, driving economic empowerment and social inclusion on a Fintech global scale.

Conclusion:

In conclusion, Fintech is revolutionizing financial inclusion by breaking down barriers and empowering individuals and communities to participate in the global economy. Through innovative solutions like those offered by Xettle Technologies, Fintech is expanding access to credit, savings, and payment services for the underserved and marginalized. As Fintech continues to evolve, it will play an increasingly critical role in building a more inclusive and sustainable financial system for all.

#Fintech Global#Financial Services#Fi̇ntech#Fintech Growth#Financial Freedom#fintech#development#fintech software#technology#xettle technologies#keywords fintech development

2 notes

·

View notes

Text

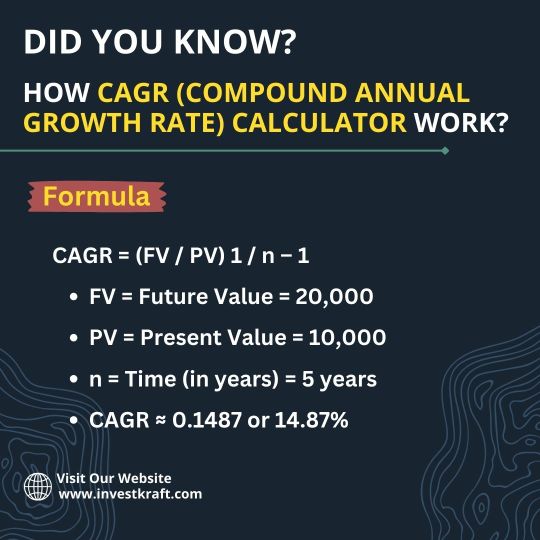

Looking for an Accurate Online CAGR Calculator?

If you're seeking an accurate online CAGR (Compound Annual Growth Rate) calculator, Investkraft website is your solution. With Investkraft, you can effortlessly determine the growth rate of your investments over multiple periods. This user-friendly tool simplifies complex calculations, making it accessible for everyone, from seasoned investors to beginners. Simply input your initial and final investment values, along with the time period, and let Investkraft do the rest. Accuracy is paramount when analyzing investment growth, and Investkraft ensures precise results every time. Whether you're planning your financial future or evaluating past performance, Investkraft's online CAGR calculator provides the reliable insights you need. Take control of your investments today with Investkraft and make informed decisions for a prosperous tomorrow.

#investkraft#finance#financial calculators#Compound Annual Growth Rate#CAGR Calculator#calculators#financial services

2 notes

·

View notes

Text

What do you think? What a Poll!!

Could this be the start of another Financial Crisis? Let's hope not.

#UBS#Credit Suisse#financial#financial markets and investing#investment#investor#investment banking#financial crisis#takeover#growth#opportunity#banking#financial services#markets#financial stability

16 notes

·

View notes

Text

Happy World Arthritis Day to everyone. Let us make everyone aware of this health issue that can make our lives difficult and still.

To promote your business using digital posters to all over the world .

#digital poster#business#poster design#posters#trending#finance#financial planning#investing#financial#small business#startup#services#business growth

4 notes

·

View notes

Text

Discover the key differences between wealth management and portfolio management to choose the best financial strategy for your needs.

#wealth management#portfolio management#investment strategy#financial planning#asset allocation#risk management#tax planning#estate planning#long-term investing#financial growth#retirement planning#investment firms#wealth advisors#financial security#money management#capital growth#fiduciary services#financial strategy#holistic planning

0 notes

Text

MasterMySan | Smart Solutions for Business Growth

In today’s competitive business landscape, having a clear strategy and expert guidance is crucial for long-term success. Whether you’re a startup or an established company, navigating financial decisions and market shifts can be overwhelming. That’s where MasterMySan Consultancy comes in, offering tailored business solutions designed to help your business thrive.

Why Choose MasterMySan Consultancy?

At MasterMySan, we specialize in a range of services, including financial planning, risk management, and strategic growth solutions. With our vast experience and expertise in the industry, we help businesses understand their unique challenges and opportunities, providing the guidance needed to make informed decisions.

Services We Offer

Financial Planning: Our financial experts help businesses plan and manage their finances effectively, ensuring healthy cash flow, maximizing profit, and supporting sustainable growth.

Risk Management: MasterMySan offers in-depth risk assessments and strategies to mitigate potential risks, so your business can stay resilient in any economic environment.

Strategic Growth: We assist businesses in developing and executing growth strategies, whether it’s expanding into new markets or optimizing operations for better performance.

Tailored Solutions for Every Business

No two businesses are alike, which is why we take a personalized approach to every client. Whether you're a small business or a large corporation, our team will assess your needs, challenges, and objectives, crafting a solution that’s right for you. From initial consultations to long-term strategic partnerships, we are with you every step of the way.

Your Business’s Success Starts Here

Partnering with MasterMySan means working with a team dedicated to your business’s growth. Let us help you identify new opportunities, improve efficiencies, and make sound financial decisions that will lead to success.

Visit www.mastermysan.com today and start your journey towards business excellence. Let’s unlock your potential together!

#Business Consultancy#Financial Planning#Strategic Growth#Risk Management#Advisory Services#香港八字算命#fengshui

1 note

·

View note

Text

youtube

#financial growth#financial investment#finance#financial analysis#financial services#autos#developers & startups#musicians#beauty#fashion#Youtube

0 notes

Text

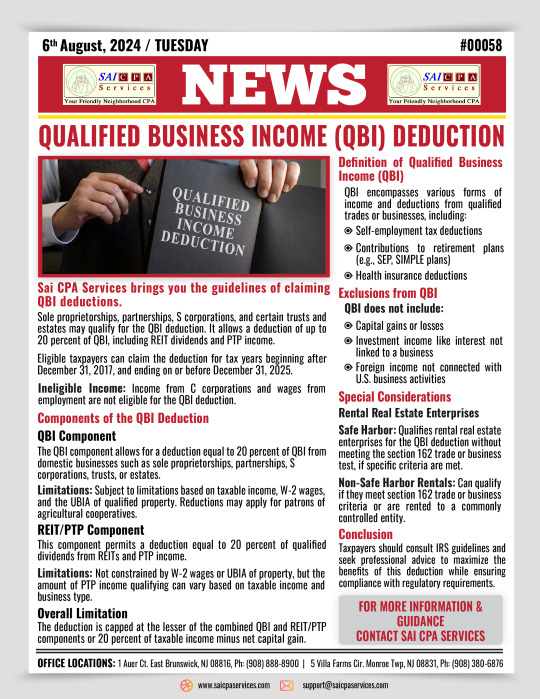

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes

Text

Professional Business Advisory Services Melbourne | Leading Tax Experts (LTE Tax)

Leading Tax Experts (LTE Tax) offers top-notch professional business advisory services in Melbourne. Our team of experienced tax experts provides valuable guidance to help businesses navigate the complexities of taxation and financial planning. Whether you are a small start-up or a large corporation, we are here to support you with personalised advice tailored to your needs.

As a trusted business advisor in Melbourne, LTE Tax focuses on delivering practical solutions to help you grow your business, improve cash flow, and minimise tax liabilities. We understand that every business is unique, so we offer various services, including tax planning, business structuring, compliance, and more.

Our deep understanding of the latest tax laws and regulations ensures your business stays on the right track, allowing you to focus on what matters most. Choose LTE Tax for Melbourne's professional, reliable, and efficient business advisory services. Let us help you achieve your financial goals with confidence!

#LTE Tax#Business Advisory Services#Business Advisory#business advisor in Melbourne#business advisor#business consultant#business consultancy#business consulting#business consultation#business essentials#Business Advisory Melbourne#Tax Planning Services Melbourne#Business Advisor Melbourne#Tax Consulting Melbourne#Business Growth Strategies#Business Tax Planning#Small Business Advisory#Tax Management Solutions#Corporate Tax Services#Business Financial Planning

0 notes

Text

Selling a business is a major milestone—it’s not as simple as handing over the keys and walking away. It’s about ensuring you get the value you deserve for something you’ve poured your heart, time, and resources into.

That where sell side advisory services come in. Think of them as your trusted guide, helping you navigate the ups and downs of the selling process so you can come out on top. Let’s explore how these services can make the process smarter, smoother, and more rewarding for you.

#Sell Side Advisory Services#Strategy Consulting Firms#Growth Strategy Consulting Services#Financial Accounting Advisory Services#Financial and Risk Advisory Solutions

0 notes

Text

Business Consulting for NRIs in India

Looking to start or expand your business in India? Murvin NRI Services provides expert business consulting for NRIs, ensuring hassle-free setup and growth.

#Business consulting for NRIs#Murvin NRI Services#NRI business setup in India#Investment opportunities for NRIs#Company registration for NRIs#Business growth strategies#Legal compliance for NRI businesses#Market entry consultation#Financial planning for NRI businesses#Startup assistance for NRIs

0 notes

Text

Unlock Business Growth with NBFC Registration Benefits

An NBFC registration certificate offers unparalleled opportunities, from accessing financial markets to serving unbanked sectors. It empowers your company with trust and credibility in the financial world. Learn how this certification drives your business forward. Take the first step toward growth—reach out for NBFC registration assistance!

#NBFC Registration#NBFC Benefits#Financial Inclusion#NBFC Growth Opportunities#Legal Recognition#Business Credibility#RBI Compliance#Financial Services#NBFC Opportunities#Business Registration#NBFC India

0 notes