#government apps for mobile users

Explore tagged Tumblr posts

Text

i really do think there’s a huge disconnect on here w/ people who have never used tiktok as to what it actually is and who actually uses it. the number of people i’ve seen call it a “teen dancing app” is actually insane. it has not been a teen dancing app since i was in high school, around 2016 - 2020. the main communities i saw on a daily basis were 1) black history/anti-racism educators, 2) high school & college teachers sharing in-classroom strategies and frustrations with the education system, 3) local/state political leaders giving real-time updates on behind-the-scenes government decisions, & 4) community activism & leadership. like tiktok is an adult platform. almost every person i interacted with was my age or older. and yes it completely depends on your fyp and how you interact with the app, yes there’s still teenagers and dance videos and literally anything else you can think of. but these communities of adults aren’t insubstantial at all, they have literally millions of interactions on a daily basis. there’s about a million other types of communities that i could name just off the top of my head, because the range of users was SO diverse and thriving. it’s a long-distance community tool, just like any other social media—and honestly much better than any other social media, because it relies primarily on the kindness of strangers. i saw at least 5-10 videos today of queer people in rural areas panicking because they don’t have any access to queer community on any other platform or in real life. and before i end this i do want to say i think tiktok is coming back, i think this is a highly orchestrated political move, etc., but i do know it won’t ever be exactly the same. people are panicking about free speech violations because tiktok was a place where people fucking SPEAK. i have never seen mass mobilization and communication in this same way for as long as i’ve been alive. it is the people’s app, not just a silly teenage thing. if you’re not on tiktok and never have been, please stop talking about it like you know anything at all😭

#idec if i look stupid for these posts i am fucking Mad#it’s not about doomscrolling. be so fr. i’ve had a time limit on for years and i’ve done perfectly fine#people’s jobs were on this app. small businesses were on this app. fucking CULTURE was on this app#project willow? bisan in gaza? like this is the most interconnected and fast-moving source of news we have#literally straight from the ground. from the places where it’s happening#i know i can still read news. that’s not the problem.#the problem is that i have nowhere else to see the videos from my minnesota legislator who’s been giving daily updates on the republican#coup in the house of representatives. like. do you see the problem.#not to mention half the news sites are paywalled anyway.#and i saw someone say that this forces us to foster irl community which is true again. but you can still have irl community at the same time#as long-distance virtual community????#my best friends are long distance. if all social media went dark i could never talk to them again.#like we are in the fucking 21st century. we should be able to have both.#anyway. sorry for all the ranting lately except i’m really not because i am fucking PISSED#i’ll be on rednote and youtube for a while except neither of them are really the same.#genuinely nothing was like tiktok fr. i miss it already#tiktok#tiktok ban

634 notes

·

View notes

Text

as of 8/3, the most recently updated version of this post is here (it's a reblog of this exact post with more info added)

as a lot of you know, limbus company recently fired its CG illustrator for being a feminist, at 11 pm, via phone call, after a bunch of misogynists walked into the office earlier that day and demanded she be fired. on top of this, as per korean fans, her firing went against labor laws---in korea, you must have your dismissal in writing.

the korean fandom on twitter is, understandably, going scorched earth on project moon due to this. there's a lot currently going on to protest the decision, so i'm posting a list here of what's going on for those who want to limit their time on elon musk's $44 billion midlife crisis impulse purchase website (if you are on twitter, domuk is a good person to follow, as they translate important updates to english). a lot of the links are in korean, but generally they play nicely with machine translators. this should be current as of 8/2.

Statements condemning the decision have been issued by The Gyeonggi Youth Union and IT Union.

A press conference at the Gyeonggido Assembly will occur on 8/3, with lawmakers of the Gyeonggi province (where Project Moon is based) in attendance. This appears driven by the leader of the Gyeonggi Youth Union.

The vice chairman of the IT union--who has a good amount of experience with labor negotiations like these--has expressed strong support for the artist and is working to get media coverage due to the ongoing feminist witch hunts in the gaming industry. Project Moon isn't union to my knowledge, but he's noted that he's taken on nonunion companies such as Netmarble (largest mobile game dev in South Korea) by getting the issue in front of the National Assembly (Korea's congress).

Articles on the incident published in The Daily Labor News, Korean Daily, multiple articles on Hankyoreh (one of which made it to the print edition), and other news outlets.

Segments about the termination on the MBN 7 o' clock news and MBC's morning news

Comments by Youth Union leaders about looking into a loan made to Project Moon via Devsisters Ventures, a venture capital firm. Tax money from Gyeonggi province was invested in Devsisters in 2017, and in 2021, Devsisters gave money to Project Moon. The Gyeonggi Youth Union is asking why hard-earned tax money was indirectly given to a company who violates ESG (environmental, social and governance) principles.

Almost nonstop signage truck protests outside Project Moon's physical office during business hours until 8/22 or the company makes a statement. This occurs alongside a coordinated hashtag campaign to get the issue trending on Twitter in Korea. The signage campaign was crowd-funded in about 3 hours.

A full boycott of the Limbus Company app, on both mobile and PC (steam) platforms. Overseas fans are highly encouraged to participate, regardless if whether they're F2P or not. Not opening the app at all is arguably the biggest thing any one person can do to protest the decision, as the app logs the number of accounts that log on daily. For a new gacha such as Limbus, a high number of F2P daily active users, but a small number of paying users is often preferable to having a smaller userbase but more paying users. If the company sees the number of daily users remain stable, they will likely decide to wait out any backlash rather than apologize.

Digging up verified reviews from previous employees regarding the company's poor management practices

Due to the firing, the Leviathan artist has posted about poor working conditions when making the story. As per a bilingual speaker, they were working on a storyboard revision, and thought 'if I ran into the street right now and got hit by a car and died, I wouldn't have to keep working.' They contacted Project Moon because they didn't want their work to be like that, and proposed changes to serialization/reduction in amount of work per picture/to build up a buffer of finished images (they did not have any buffer while working on Leviathan to my knowledge). They were shut out, and had to suck it up and accept the situation.

Hamhampangpang has a 'shrine' section of the restaurant for fans to leave fan-created merch and other items. They also allow the fans to take this merch back if they can prove it's theirs. Fans are now doing just that.

To boost all of the above, a large number of Korean fanartists with thousands of followers have deleted their works and/or converted their accounts from fanart accounts to accounts supporting the protests. Many of them are bilingual, and they're where I got the majority of this information.

[note 1: there's a targeted english-language disinformation campaign by the website that started the hate mob. i have read the artist's tweets with machine translation, and they're talked about in the second hankyoreh article linked above: nowhere does she express any transphobic or similarly awful beliefs. likewise, be wary of any claims that she supported anything whose description makes you raise eyebrows--those claims are likely in reference to megalia, a korean feminist movement. for information on that, i'd recommend the NPR/BBC articles below and this google drive link of english-language scholarly papers on them. for the love of god don't get your information about a feminist movement from guys going on witch hunts for feminists.]

[note 2: i've seen a couple people argue that the firing was for the physical safety of the employees, citing the kyoani incident in japan. as per this korean fan, most fans there strongly do not believe this was the case. we have english-translated transcripts of the meeting between the mob and project moon; the threats the mob was making were to......brand project moon as a feminist company online. yes, really. male korean gamers aren't normal about feminism, and there's been an ongoing witch hunt for feminists in the industry since about 2016, something you see noted in both the labor union statements. both NPR and the BBC this phenomenon to gamergate, and i'd say it's a pretty apt comparison.]

let me know if anything needs correction or if anything should be added.

#project moon#limbus company#obligatory text post tag#that's all i've got for now. highly encourage y'all to not open limbus until they make a statement

4K notes

·

View notes

Text

What is the RedNote App? You're probably about to find out soon.

I’m wildly fascinated by what is at hand and taking place in way of Chinese/American relations being bridge together overnight via the adoption of the Chinese app “RedNote” by American’s considered now TikTok refugee’s there.

RedNote is now the number 1# downloaded social media app on the App Store and as such is a clear signal and indication by TikTok users frustrated with the pending Supreme Court decision to ban TikTok in the United States on how they can make their point on the subject and situation most effectively heard.

Thus, TikTok's current algorithm is being filled with the welcoming gestures of Chinese users empathy to the despair so many are feeling, combined with etiquette and eduction on how to use their app RedNote with mostly welcome arms.

It does beg the question that if there are legitimate concerns that the Chinese Communist Government can gain vital access to our data via a mobile application that one from the Chinese would be readily available and downloadable on the app store in America in the first place. Well I guess we're going to find out.

So, will the revolution be televised? By all means no, but rather it appears it will be downloaded, shared, and discussed amongst anyone and everyone whom is interested, and willing via one app or another to be a part of it. Go figure.

82 notes

·

View notes

Note

what is the best way to get safer/more anonymous online

Ok, security and anonymity are not the same thing, but when you combine them you can enhance your online privacy.

My question is: how tech literate are you and what is your aim? As in do you live in a country where your government would benefit from monitoring private (political) conversations or do you just want to degoogle? Because the latter is much easier for the average user.

Some general advice:

Leave Windows and Mac operating systems and switch to Linux distributions like Fedora and Ubuntu (both very user friendly). Switch from Microsoft Office or Pages/Numbers/Keynote (Mac) to LibreOffice.

You want to go more hardcore with a very privacy-focused operating system? There are Whonix and Tails (portable operating system).

Try to replace all your closed source apps with open source ones.

Now, when it comes to browsers, leave Chrome behind. Switch to Firefox (or Firefox Focus if you're on mobile). Want to go a step further? Use LibreWolf (a modified version of Firefox that increases protection against tracking), Brave (good for beginners but it has its controversies), DuckDuckGo or Bromite. You like ecofriendly alternatives? Check Ecosia out.

Are you, like, a journalist or political activist? Then you probably know Tor and other anonymous networks like i2p, freenet, Lokinet, Retroshare, IPFS and GNUnet.

For whistleblowers there are tools like SecureDrop (requires Tor), GlobaLeaks (alternative to SecureDrop), Haven (Android) and OnionShare.

Search engines?

There are Startpage (obtains Google's results but with more privacy), MetaGer (open source), DuckDuckGo (partially open source), Searx (open source). You can see the comparisons here.

Check libRedirect out. It redirects requests from popular socmed websites to privacy friendly frontends.

Alternatives to YouTube that value your privacy? Odysee, PeerTube and DTube.

Decentralized apps and social media? Mastodon (Twitter alternative), Friendica (Facebook alternative), diaspora* (Google+ RIP), PixelFed (Insta alternative), Aether (Reddit alternative).

Messaging?

I know we all use shit like Viber, Messenger, Telegram, Whatsup, Discord etc. but there are:

Signal (feels like Whatsup but it's secure and has end-to-end encryption)

Session (doesn't even require a phone or e-mail address to sign up)

Status (no phone or e-mail address again)

Threema (for mobile)

Delta Chat (you can chat with people if you know their e-mail without them having to use the app)

Team chatting?

Open source options:

Element (an alternative to Discord)

Rocket.chat (good for companies)

Revolt.chat (good for gamers and a good alternative to Discord)

Video/voice messaging?

Brave Talk (the one who creates the talk needs to use the browser but the others can join from any browser)

Jami

Linphone

Jitsi (no account required, video conferencing)

Then for Tor there are various options like Briar (good for activists), Speek! and Cwtch (user friendly).

Georestrictions? You don't want your Internet Provider to see what exactly what you're doing online?

As long as it's legal in your country, then you need to hide your IP with a VPN (authoritarian regimes tend to make them illegal for a reason), preferably one that has a no log policy, RAM servers, does not operate in one of the 14 eyes, supports OpenVPN (protocol), accepts cash payment and uses a strong encryption.

NordVPN (based in Panama)

ProtonVPN (Switzerland)

Cyberghost

Mullvad (Sweden)

Surfshark (Netherlands)

Private e-mails?

ProtonMail

StartMail

Tutamail

Mailbox (ecofriendly option)

Want to hide your real e-mail address to avoid spam etc.? SimpleLogin (open source)

E-mail clients?

Thunderbird

Canary Mail (for Android and iOS)

K-9 Mail (Android)

Too many complex passwords that you can't remember?

NordPass

BitWarden

LessPass

KeePassXC

Two Factor Authenticators?

2FAS

ente Authenticator

Aegis Authenticator

andOTP

Tofu (for iOS)

Want to encrypt your files? VeraCrypt (for your disk), GNU Privacy Guard (for your e-mail), Hat.sh (encryption in your browser), Picocrypt (Desktop encryption).

Want to encrypt your Dropbox, Google Drive etc.? Cryptomator.

Encrypted cloud storage?

NordLocker

MEGA

Proton Drive

Nextcloud

Filen

Encrypted photography storage?

ente

Cryptee

Piwigo

Want to remove metadata from your images and videos? ExifCleaner. For Android? ExifEraser. For iOS? Metapho.

Cloak your images to counter facial recognition? Fawkes.

Encrypted file sharing? Send.

Do you menstruate? Do you want an app that tracks your menstrual cycle but doesn't collect your data? drip.

What about your sexual health? Euki.

Want a fitness tracker without a closed source app and the need to transmit your personal data to the company's servers? Gadgetbridge.

37 notes

·

View notes

Text

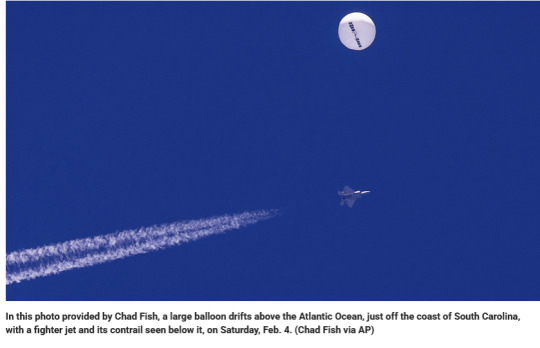

Former astronaut Sen. Mark Kelly started spy balloon company funded by China

Kelly, 60, is a former astronaut and US Navy captain who has represented Arizona in the US Senate since 2020

Before becoming a senator, Mark Kelly, D-Ariz., was not only an astronaut, but he also co-founded a company that specializes in spy balloons, which was funded, in part, by a venture capitalist in China with close ties to the Chinese Communist Party.

Kelly, who is reportedly on a short list of running mate contenders under consideration by Vice President Kamala Harris, co-founded Tucson, Arizona-based World View in 2012 with a vision to provide space tourism using stratospheric balloons.

While Kelly’s company started out with a focus on space tourism via balloons, the vision evolved with the maturing of the company’s technology.

"As we matured our technology, we recognized an opportunity for immediate use cases for our technology through remote sensing services to defense, scientific and commercial customers," a spokesperson for World View told Fox News Digital. "Today, our primary business remains providing remote sensing services to the U.S. Department of Defense and her allies by way of intelligence, surveillance and reconnaissance capabilities, as well as servicing scientific organizations like NASA, NOAA and others to better understand Earth from the unique atmospheric layer of the stratosphere."

Axios reported that shortly after World View was started, it received venture capital from Tencent in 2013, then again in 2016.

Tencent is one of China's largest corporations, and it was founded in 1998 by "Pony" Ma Huateng, Zhang Zhidong, Xu Chenye, Chen Yidan and Zeng Liqing. Last year, "Pony" Ma Huateng was listed by Forbes as the fourth-richest man in China with a net worth of $32.1 billion. Ma is also the CEO of Tencent.

The Wall Street Journal reported in 2021 that Tencent collected a trove of data over the years from its mobile app WeChat, the predominant social-media platform in China. The data was collected through its processing of the chat conversations and financial transactions of its over one billion monthly active users, most of them in China. That has made the company’s platform WeChat a powerful surveillance tool for the Chinese government, which reportedly regulates Tencent and regularly has it suppress dissenting views.

23 notes

·

View notes

Text

On ThursdaY, Reuters published a photo depicting then-United States national security adviser Mike Waltz checking his phone during a cabinet meeting held by President Trump in the White House. If you enlarge the portion of the image that captures Waltz’s screen, it seems to show him using the end-to-end encrypted messaging app Signal. But if you look more closely, a notification on the screen refers to the app as “TM SGNL.” During a White House cabinet meeting on Wednesday, then, Waltz was apparently using an Israeli-made app called TeleMessage Signal to message with people who appear to be top US officials, including JD Vance, Marco Rubio, and Tulsi Gabbard.

After senior Trump administration cabinet members used vanishing Signal messages to coordinate March military strikes in Yemen—and accidentally included the editor in chief of The Atlantic in the group chat—the “SignalGate” scandal highlighted concerning breaches of traditional government “operational security” protocol as well as compliance issues with federal records-retention laws. At the center of the debacle was Waltz, who was ousted by Trump as US national security adviser on Thursday. Waltz created the “Houthi PC Small Group” chat and was the member who added top Atlantic editor Jeffrey Goldberg. "I take full responsibility. I built the group," Waltz told Fox News in late March. "We've got the best technical minds looking at how this happened," he added at the time.

SignalGate had nothing to do with Signal. The app was functioning normally and was simply being used at an inappropriate time for an incredibly sensitive discussion that should have been carried out on special-purpose, hardened federal devices and software platforms. If you're going to flout the protocols, though, Signal is (relatively speaking) a good place to do it, because the app is designed so only the senders and receivers of messages in a group chat can read them. And the app is built to collect as little information as possible about its users and their associates. This means that if US government officials were chatting on the app, spies or malicious hackers could only access their communications by directly compromising participants' devices—a challenge that is potentially surmountable but at least limits possible access points. Using an app like TeleMessage Signal, though, presumably in an attempt to comply with data retention requirements, opens up numerous other paths for adversaries to access messages.

"I don't even know where to start with this," says Jake Williams, a former NSA hacker and vice president of research and development at Hunter Strategy. “It's mind-blowing that the federal government is using Israeli tech to route extremely sensitive data for archival purposes. You just know that someone is grabbing a copy of that data. Even if TeleMessage isn't willingly giving it up, they have just become one of the biggest nation-state targets out there.”

TeleMessage was founded in Israel in 1999 by former Israel Defense Forces technologists and run out of the country until it was acquired last year by the US-based digital communications archiving company Smarsh. The service creates duplicates of communication apps that are outfitted with a “mobile archiver” tool to record and store messages sent through the app.

“Capture, archive and monitor mobile communication: SMS, MMS, Voice Calls, WhatsApp, WeChat, Telegram & Signal,” TeleMessage says on its website. For Signal it adds, “Record and capture Signal calls, texts, multimedia and files on corporate-issued and employee BYOD phones.” (BYOD stands for bring your own device.) In other words, there are TeleMessage versions of Signal for essentially any mainstream consumer device. The company says that using TeleMessage Signal, users can “Maintain all Signal app features and functionality as well as the Signal encryption,” adding that the app provides “End-to-End encryption from the mobile phone through to the corporate archive.” The existence of “the corporate archive,” though, undermines the privacy and security of the end-to-end encryption scheme.

TeleMessage apps are not approved for use under the US government's Federal Risk and Authorization Management Program or FedRAMP. TeleMessage and Smarsh did not immediately return requests for comment about whether their products are used by the US federal government and in what capacity.

"As we have said many times, Signal is an approved app for government use and is loaded on government phones,” White House press secretary Anna Kelly tells WIRED. She did not answer questions about whether the White House approves of federal officials using TeleMessage Signal—which is a different app from Signal—or whether other officials aside from Waltz have used the app or currently use it.

The Cybersecurity and Infrastructure Security Agency does not create policy around federal technology use but does release public guidance. When asked about Waltz’s apparent use of TeleMessage Signal, CISA simply referred WIRED to its best-practices guide for mobile communications. The document specifically advises, “When selecting an end-to-end encrypted messaging app, evaluate the extent to which the app and associated services collect and store metadata.”

It is not clear when Waltz started using TeleMessage Signal and whether he was already using it during SignalGate or started using it afterward in response to criticisms that turning on Signal's disappearing messages feature is in conflict with federal data-retention laws.

“I have no doubt the leadership of the US national security apparatus ran this software through a full information-assurance process to ensure there was no information leakage to foreign nations,” says Johns Hopkins cryptographer Matt Green. “Because if they didn’t, we are screwed.”

14 notes

·

View notes

Text

After widespread outcry last year, the Iranian authorities said they would suspend enforcement of the new, strict, hijab laws, which impose draconian penalties – including fines and prison sentences – on women found in breach of the mandatory dress code.

Yet women in Iran are reporting that state surveillance has been steadily increasing.

Last week, the UN’s fact-finding mission reported on Iran’s increasing reliance on digital surveillance such as its Nazer mobile application, a state-backed reporting platform that allows citizens and police to report women for alleged violations.

The app is accessible only via Iran’s state-controlled National Information Network. Members of the public can apply to become “hijab monitors” to get the app and begin filing reports, which are then passed to the police.

According to the UN mission, the app has recently been expanded to allow users to upload the time, location and licence plate of a car in which a woman has been seen without a hijab.

It can also now be used to report women for hijab violations on public transport, in taxis and even in ambulances.

According to the UN report, aerial surveillance using drones has also been used at events such as the Tehran international book fair and on the island of Kish, a tourist destination, to identify women not complying with the hijab law.

The government has also increased online monitoring, blocking women’s Instagram accounts for non-compliance of hijab laws, and issuing warnings via text message. CCTV surveillance and facial-recognition technology has also been installed at universities. “This ‘digital repression’ is not only stifling academic freedom but also causing increased psychological stress among students,” says a spokesperson for the Amirkabir Newsletter, an Iranian student media group.

Last July Arezoo Badri, a 31-year-old mother of two, was shot and paralysed when a police officer opened fire on her vehicle in Noor city, Mazandaran province, after her car was reportedly flagged for a hijab violation.

13 notes

·

View notes

Text

Montana has taken a decisive leap where others have faltered, becoming the first state in the US to officially outlaw a widespread government surveillance tactic: buying up private data without a warrant.

With the passage of Senate Bill 282 (SB 282), lawmakers have directly confronted what has become a backdoor into people’s lives, commercial data brokers selling sensitive digital information to law enforcement agencies, sidestepping the need for judicial authorization.

This so-called “data broker loophole” has allowed government agencies across the country to acquire personal details they’d otherwise need a warrant to access.

Instead of presenting probable cause to a judge, agencies could simply purchase location histories and other metadata from third-party brokers who gather it from mobile apps.

These apps often track users’ movements down to the minute, creating comprehensive logs of their daily routines. Until now, that information was effectively up for grabs, and no warrant has been required.

8 notes

·

View notes

Note

Though they are kinda right cause so many people don’t know (like me) because they can’t bother with extra drama or other reasons or don’t care so they are making that shit ton of revenue still but holy shit am I glad that I thought deep space was too much because wtf??? ALSO WTF WITH PERIOD TRACKERS???? WHY WOULD YOU EVEN INCLUDE THAT SHIT IN AN OTOME GAME??? WTF???? THAT’S INCEL AND CREEPER LEVEL OF WEIRD!!! Thanking my lucky stars and God that I never got into it.

-Souya’s anon lover

Right? I don't play mobile games anyway for various reasons, but I'm definitely not spending a dime. No mobile game is worth spending money regularly on it…

On the one hand, if we ignore the data collection aspect, I can see why having male characters actually pay attention to your period is a positive thing. (Presumed) cis men especially. Periods are seen as taboo and most cis men don't even know what a period is or how it works, so pushing the standards and nudging more men into learning about bodily functions that they don't experience is a good thing, in my opinion at least.

HOWEVER– This is obviously not the developer's intentions. We all know that. They just want their users' data for any number of reasons. And the really sad part is, users who don't know how to or why they need to protect their privacy will fall for this, and there is potential for people to get hurt if their menstrual cycle data gets back to the American government. That's why there were PSAs telling everyone to delete all period tracker apps — because the government will use that data to figure out about potential pregnancies and potential abortions. :/

*sighs* It's just a shit show, all around.

8 notes

·

View notes

Text

In recent years, commercial spyware has been deployed by more actors against a wider range of victims, but the prevailing narrative has still been that the malware is used in targeted attacks against an extremely small number of people. At the same time, though, it has been difficult to check devices for infection, leading individuals to navigate an ad hoc array of academic institutions and NGOs that have been on the front lines of developing forensic techniques to detect mobile spyware. On Tuesday, the mobile device security firm iVerify is publishing findings from a spyware detection feature it launched in May. Of 2,500 device scans that the company's customers elected to submit for inspection, seven revealed infections by the notorious NSO Group malware known as Pegasus.

The company’s Mobile Threat Hunting feature uses a combination of malware signature-based detection, heuristics, and machine learning to look for anomalies in iOS and Android device activity or telltale signs of spyware infection. For paying iVerify customers, the tool regularly checks devices for potential compromise. But the company also offers a free version of the feature for anyone who downloads the iVerify Basics app for $1. These users can walk through steps to generate and send a special diagnostic utility file to iVerify and receive analysis within hours. Free users can use the tool once a month. iVerify's infrastructure is built to be privacy-preserving, but to run the Mobile Threat Hunting feature, users must enter an email address so the company has a way to contact them if a scan turns up spyware—as it did in the seven recent Pegasus discoveries.

Daily Newsletter

Our biggest stories, handpicked for you each day.

“The really fascinating thing is that the people who were targeted were not just journalists and activists, but business leaders, people running commercial enterprises, people in government positions,” says Rocky Cole, chief operating officer of iVerify and a former US National Security Agency analyst. “It looks a lot more like the targeting profile of your average piece of malware or your average APT group than it does the narrative that’s been out there that mercenary spyware is being abused to target activists. It is doing that, absolutely, but this cross section of society was surprising to find.”

Seven out of 2,500 scans may sound like a small group, especially in the somewhat self-selecting customer base of iVerify users, whether paying or free, who want to be monitoring their mobile device security at all, much less checking specifically for spyware. But the fact that the tool has already found a handful of infections at all speaks to how widely the use of spyware has proliferated around the world. Having an easy tool for diagnosing spyware compromises may well expand the picture of just how often such malware is being used.

“NSO Group sells its products exclusively to vetted US & Israel-allied intelligence and law enforcement agencies,” NSO Group spokesperson Gil Lainer told WIRED in a statement. "Our customers use these technologies daily.”

iVerify vice president of research Matthias Frielingsdorf will present the group's Pegasus findings at the Objective by the Sea security conference in Maui, Hawaii on Friday. He says that it took significant investment to develop the detection tool because mobile operating systems like Android, and particularly iOS, are more locked down than traditional desktop operating systems and don't allow monitoring software to have kernel access at the heart of the system. Cole says that the crucial insight was to use telemetry taken from as close to the kernel as possible to tune machine learning models for detection. Some spyware, like Pegasus, also has characteristic traits that make it easier to flag. In the seven detections, Mobile Threat Hunting caught Pegasus using diagnostic data, shutdown logs, and crash logs. But the challenge, Cole says, is in refining mobile monitoring tools to reduce false positives.

Developing the detection capability has already been invaluable, though. Cole says that it helped iVerify identify signs of compromise on the smartphone of Gurpatwant Singh Pannun, a lawyer and Sikh political activist who was the target of an alleged, foiled assassination attempt by an Indian government employee in New York City. The Mobile Threat Hunting feature also flagged suspected nation state activity on the mobile devices of two Harris-Walz campaign officials—a senior member of the campaign and an IT department member—during the presidential race.

“The age of assuming that iPhones and Android phones are safe out of the box is over,” Cole says. “The sorts of capabilities to know if your phone has spyware on it were not widespread. There were technical barriers and it was leaving a lot of people behind. Now you have the ability to know if your phone is infected with commercial spyware. And the rate is much higher than the prevailing narrative.”

#A New Phone Scanner That Detects Spyware Has Already Found 7 Pegasus Infections#Phone Scanner#phone viruses#phones with installed viruses#IVerify

6 notes

·

View notes

Text

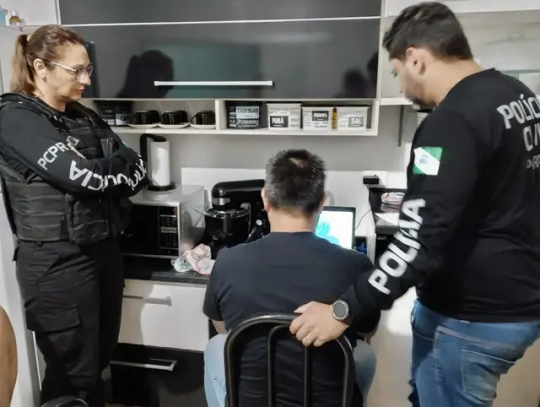

So, in Brazilian politics news, it might be of some of y'all's interest to learn about Operation 404, an anti-piracy operation that took down 675 illegal websites and 14 streaming apps and arrested suspects in Brazil and Argentina.

The action mobilized 9 states, 5 countries, continental bodies and even the Premier League, organizer of the English soccer championship. Nine people were arrested (five Brazilians and four Argentinians), and police carried out 30 search warrants.

According to the government, those under investigation are "suspected of distributing pirated content on websites and digital platforms, a practice that causes significant damage to the economy and the creative industry, in addition to violating the rights of authors and artists."

"The losses to the cultural and creative sector are significant, but the damage goes beyond the economic impact," says the Ministry of Justice.

In a recent operation, also on piracy, police identified that the same websites that distributed content without authorization also spread viruses and malware – leaving users' computers vulnerable to data theft and other types of attacks.

Thanks @dashingprince for bringing this to us.

(x)

#brazil#brazilian politics#politics#intellectual property#arts#image description in alt#mod nise da silveira#brought by followers#dashingprince#translations and summaries

11 notes

·

View notes

Text

Chime Mobile Banking: A Better Way to Bank

In today’s fast-paced world, who has time to wait in line at a traditional bank or deal with outdated services? Enter Chime, the mobile banking solution designed for the modern lifestyle. With Chime, you can manage your money with ease, anywhere, anytime—right from your phone. Here’s why millions are switching to Chime:

No Hidden Fees—Ever

Most traditional banks hit you with fees left and right. Maintenance fees, minimum balance fees, overdraft fees—it adds up quickly. But with Chime, you’ll never pay a monthly fee or a fee for minimum balances. Plus, there’s no foreign transaction fees, so you can travel the world worry-free. Say goodbye to hidden fees and hello to real savings.

Get Paid Up to Two Days Early

Waiting for payday can be stressful, especially when bills are due. Chime makes payday something to look forward to by giving you access to your direct deposit up to two days early. Whether it's your paycheck or government benefits, Chime puts your money in your hands faster so you can pay bills, save, or treat yourself sooner.

Fee-Free Overdrafts

We've all been there—an unexpected purchase puts your account in the negative, and your bank slaps you with an overdraft fee. Chime’s SpotMe feature lets you overdraft up to $200 with no fees. It’s simple, straightforward, and designed to give you peace of mind when you need it most.

A Seamless Digital Experience

Chime isn’t just a bank—it’s an all-in-one financial tool. The user-friendly app lets you easily track your spending, deposit checks, transfer money, and receive instant notifications for transactions. With 24/7 access, your finances are always at your fingertips. Need to find an ATM? Chime has over 60,000 fee-free ATMs in its network, more than most traditional banks.

Save Effortlessly

Chime’s Automatic Savings feature helps you build your savings effortlessly. Every time you use your Chime card, we’ll round up your purchase to the nearest dollar and transfer the difference into your Savings Account. It’s a painless way to grow your savings over time. Plus, you can set up automatic transfers to reach your financial goals even faster.

Security You Can Count On

With FDIC insurance up to $250,000, Chime ensures that your money is safe and secure. Our state-of-the-art security measures protect your account, while features like instant transaction alerts and the ability to instantly block your card provide peace of mind.

Join the Chime Revolution Today

Traditional banks are outdated and expensive, but Chime is the future of banking. With no hidden fees, early paydays, and powerful tools to help you manage your money, it’s no wonder Chime is trusted by millions of people nationwide. Ready to upgrade your banking experience? Follow the link below to download the Chime app and open your account in just minutes—all from your phone.

Switch to Chime today and experience the smarter, easier, and more affordable way to bank.

Download Chime Mobile App Now, And Earn $100! Terms apply.

#Chime#Mobile Banking#mobile banking account app#mobile banking application#mobile#iphone#ios#android#android apps#Chime Mobile Banking#banking mobile upi#banking app#online banking#banking#financial#finance#financial services

7 notes

·

View notes

Note

Hi, I was wondering what the description of the blog is. The color is very hard for me to read. Incredibly sorry! (Not sarcasm. I just feel bad complaining-ish. Not the sorry! I'm not sure if it's a complaint or not, and I am very sorry. Also, can non public workers send in stuff about customers? My family has a history of public service, and I have heard some real doozys (yes I apologize a lot. I was raised with self awareness that I can come off as complaining when I don't mean too)

The description is a place for retail workers to safely vent their frustrations about customer/co worker/management they deal with on a daily basis.

What do you mean the color of the blog? I don't have the setting on to force the background color of the blog to override user settings. I use both PC and my iPhone (both mobile app and Safari) and on PC Tumblr has several color options to choose from by pressing [SHIFT] P and I am currently using the one with purple and green text on a black background. On mobile the app uses the color of the phone (light mode / dark mode).

And we allow people come and vent from more than just retail, like an office or government work.

-Rodney

37 notes

·

View notes

Text

What Is The Difference Between Web Development & Web Design?

In today’s world, we experience the growing popularity of eCommerce businesses. Web designing and web development are two major sectors for making a difference in eCommerce businesses. But they work together for publishing a website successfully. But what’s the difference between a web designers in Dubai and a web developer?

Directly speaking, web designers design and developers code. But this is a simplified answer. Knowing these two things superficially will not clear your doubt but increase them. Let us delve deep into the concepts, roles and differentiation between web development and website design Abu Dhabi.

What Is Meant By Web Design?

A web design encompasses everything within the oeuvre of a website’s visual aesthetics and utility. This might include colour, theme, layout, scheme, the flow of information and anything related to the visual features that can impact the website user experience.

With the word web design, you can expect all the exterior decorations, including images and layout that one can view on their mobile or laptop screen. This doesn’t concern anything with the hidden mechanism beneath the attractive surface of a website. Some web design tools used by web designers in Dubai which differentiate themselves from web development are as follows:

● Graphic design

● UI designs

● Logo design

● Layout

● Topography

● UX design

● Wireframes and storyboards

● Colour palettes

And anything that can potentially escalate the website’s visual aesthetics. Creating an unparalleled yet straightforward website design Abu Dhabi can fetch you more conversion rates. It can also gift you brand loyalty which is the key to a successful eCommerce business.

What Is Meant By Web Development?

While web design concerns itself with all a website’s visual and exterior factors, web development focuses on the interior and the code. Web developers’ task is to govern all the codes that make a website work. The entire web development programme can be divided into two categories: front and back.

The front end deals with the code determining how the website will show the designs mocked by a designer. While the back end deals entirely with managing the data within the database. Along with it forwarding the data to the front end for display. Some web development tools used by a website design company in Dubai are:

● Javascript/HTML/CSS Preprocessors

● Template design for web

● GitHub and Git

● On-site search engine optimisation

● Frameworks as in Ember, ReactJS or Angular JS

● Programming languages on the server side, including PHP, Python, Java, C#

● Web development frameworks on the server side, including Ruby on Rails, Symfony, .NET

● Database management systems including MySQL, MongoDB, PostgreSQL

Web Designers vs. Web Developers- Differences

You must have become acquainted with the idea of how id web design is different from web development. Some significant points will highlight the job differentiation between web developers and designers.

Generally, Coding Is Not A Cup Of Tea For Web Designers:

Don’t ever ask any web designers in Dubai about their coding knowledge. They merely know anything about coding. All they are concerned about is escalating a website’s visual aspects, making them more eyes catchy.

For this, they might use a visual editor like photoshop to develop images or animation tools and an app prototyping tool such as InVision Studio for designing layouts for the website. And all of these don’t require any coding knowledge.

Web Developers Do Not Work On Visual Assets:

Web developers add functionality to a website with their coding skills. This includes the translation of the designer’s mockups and wireframes into code using Javascript, HTML or CSS. While visual assets are entirely created by designers, developer use codes to implement those colour schemes, fonts and layouts into the web page.

Hiring A Web Developer Is Expensive:

Web developers are more expensive to hire simply because of the demand and supply ratio. Web designers are readily available as their job is much simpler. Their job doesn’t require the learning of coding. Coding is undoubtedly a highly sought-after skill that everyone can’t entertain.

Final Thoughts:

So if you look forward to creating a website, you might become confused. This is because you don’t know whether to opt for a web designer or a developer. Well, to create a website, technically, both are required. So you need to search for a website design company that will offer both services and ensure healthy growth for your business.

2 notes

·

View notes

Text

Cost of Setting Up an Electric Vehicle Charging Station in India (2025 Guide)

With India accelerating its transition to electric mobility, the demand for EV charging stations is growing rapidly. Whether you're a business owner, real estate developer, or green tech enthusiast, setting up an electric vehicle (EV) charging station is a promising investment. But how much does it really cost to build one? Let's break it down.

Before diving into the costs, it's important to understand the types of EV chargers and the scope of services provided by modern EV charging solution providers like Tobor, a rising name in the EV infrastructure space offering smart, scalable, and efficient EV charging solutions across India.

Types of EV Charging Stations

Understanding the charger types is essential, as this heavily influences the overall cost:

1. AC Charging Stations

AC (Alternating Current) chargers are typically used for slower charging applications, ideal for residential societies, office complexes, and commercial locations with longer dwell times.

Level 1 Chargers: 3.3 kW output, suitable for two- and three-wheelers.

Level 2 Chargers: 7.2 kW to 22 kW, suitable for four-wheelers (e.g., home or workplace).

2. DC Fast Charging Stations

DC (Direct Current) chargers are used where quick charging is required, such as highways, malls, or public parking zones.

DC Fast Chargers: Start from 30 kW and go up to 350 kW.

They can charge an electric car from 0 to 80% in under an hour, depending on the vehicle.

Cost Breakdown for EV Charging Station Setup

The total cost to set up an electric car charging station in India can vary depending on the type of charger, infrastructure, and location. Here is a detailed breakdown:

1. EV Charging Equipment Cost

The cost of the electric car charger itself is one of the biggest components:

AC Chargers: ₹50,000 to ₹1.5 lakh

DC Fast Chargers: ₹5 lakh to ₹40 lakh (depending on capacity and standards like CCS, CHAdeMO, Bharat DC-001)

Tobor offers a range of chargers including TOBOR Lite (3.3 kW), TOBOR 7.2 kW, and TOBOR 11 kW – suitable for home and commercial use.

2. Infrastructure Costs

You’ll also need to invest in site preparation and power infrastructure:

Land Lease or Purchase: Costs vary widely by city and location.

Electrical Upgrades: Transformer, cabling, and power grid integration can cost ₹5 to ₹10 lakh.

Civil Work: Parking bays, shelter, lighting, signage, and accessibility features – ₹2 to ₹5 lakh.

Installation: Depending on charger type and electrical capacity, installation can range from ₹50,000 to ₹3 lakh.

3. Software & Networking Costs

Smart EV charging stations are often connected to networks for billing, load management, and user access:

EVSE Management Software: ₹50,000 to ₹2 lakh depending on features (Tobor integrates smart software as part of its offering).

Mobile App Integration: Enables users to find, reserve, and pay at your station.

OCPP Protocols: Ensures interoperability and scalability of your station.

4. Operational & Maintenance Costs

Running an EV charging station includes recurring costs:

Electricity Bills: ₹5–₹15 per kWh, depending on the state and provider.

Internet Connectivity: ₹1,000–₹2,000 per month for online monitoring.

Station Maintenance: ₹50,000 to ₹1 lakh annually.

Staff Salaries: If you have on-site attendants, this could range ₹1 to ₹3 lakh annually.

Marketing: ₹50,000 or more for signage, promotions, and digital visibility.

Total Investment Required

Here’s an estimate of the total cost based on the scale of your EV charging station:

Type

Estimated Range

Level 1 (Basic AC)

₹1 lakh – ₹3 lakh

Level 2 (Commercial AC)

₹3 lakh – ₹6 lakh

DC Fast Charging Station

₹10 lakh – ₹40 lakh

These costs can vary based on customization, location, and electricity load availability. Tobor offers tailored solutions to help you choose the right hardware and software based on your needs.

Government Support and Subsidies

To promote EV adoption and reduce the cost of EV infrastructure:

FAME II Scheme: Offers capital subsidies for charging stations.

State Incentives: States like Delhi, Maharashtra, Kerala, and Gujarat offer reduced electricity tariffs, subsidies up to 25%, and faster approvals.

Ease of Licensing: As per Ministry of Power guidelines, EV charging is a de-licensed activity, making it easier to start.

Return on Investment (ROI)

An EV charging station in a good location with growing EV traffic can break even in 3 to 5 years. Revenue comes from:

Charging fees (per kWh or per session)

Advertisement and partnerships

Value-added services (e.g., parking, cafés, shopping zones nearby)

Final Thoughts

With India's electric mobility market booming, setting up an EV charging station is not only a sustainable choice but also a profitable long-term investment. Whether you're a fleet operator, business owner, or infrastructure developer, now is the perfect time to invest.

For reliable equipment, integrated software, and end-to-end EV charging solutions, Tobor is one of the leading EV charging solution providers in India. From residential setups to large-scale commercial EVSE projects, Tobor supports every step of your journey toward green mobility.

2 notes

·

View notes

Text

In March 2007, Google’s then senior executive in charge of acquisitions, David Drummond, emailed the company’s board of directors a case for buying DoubleClick. It was an obscure software developer that helped websites sell ads. But it had about 60 percent market share and could accelerate Google’s growth while keeping rivals at bay. A “Microsoft-owned DoubleClick represents a major competitive threat,” court papers show Drummond writing.

Three weeks later, on Friday the 13th, Google announced the acquisition of DoubleClick for $3.1 billion. The US Department of Justice and 17 states including California and Colorado now allege that the day marked the beginning of Google’s unchecked dominance in online ads—and all the trouble that comes with it.

The government contends that controlling DoubleClick enabled Google to corner websites into doing business with its other services. That has resulted in Google allegedly monopolizing three big links of a vital digital advertising supply chain, which funnels over $12 billion in annual revenue to websites and apps in the US alone.

It’s a big amount. But a government expert estimates in court filings that if Google were not allegedly destroying its competition illegally, those publishers would be receiving up to an additional hundreds of millions of dollars each year. Starved of that potential funding, “publishers are pushed to put more ads on their websites, to put more content behind costly paywalls, or to cease business altogether,” the government alleges. It all adds up to a subpar experience on the web for consumers, Colorado attorney general Phil Weiser says.

“Google is able to extract hiked-up costs, and those are passed on to consumers,” he alleges. “The overall outcome we want is for consumers to have more access to content supported by advertising revenue and for people who are seeking advertising not to have to pay inflated costs.”

Google disputes the accusations.

Starting today, both sides’ arguments will be put to the test in what’s expected to be a weekslong trial before US district judge Leonie Brinkema in Alexandria, Virginia. The government wants her to find that Google has violated federal antitrust law and then issue orders that restore competition. In a best-case scenario, according to several Google critics and experts in online ads who spoke with WIRED, internet users could find themselves more pleasantly informed and entertained.

It could take years for the ad market to shake out, says Adam Heimlich, a longtime digital ad executive who’s extensively researched Google. But over time, fresh competition could lower supply chain fees and increase innovation. That would drive “better monetization of websites and better quality of websites,” says Heimlich, who now runs AI software developer Chalice Custom Algorithms.

Tim Vanderhook, CEO of ad-buying software developer Viant Technology, which both competes and partners with Google, believes that consumers would encounter a greater variety of ads, fewer creepy ads, and pages less cluttered with ads. “A substantially improved browsing experience,” he says.

Of course, all depends on the outcome of the case. Over the past year, Google lost its two other antitrust trials—concerning illegal search and mobile app store monopolies. Though the verdicts are under appeal, they’ve made the company’s critics optimistic about the ad tech trial.

Google argues that it faces fierce competition from Meta, Amazon, Microsoft, and others. It further contends that customers benefited from each of the acquisitions, contracts, and features that the government is challenging. “Google has designed a set of products that work efficiently with each other and attract a valuable customer base,” the company’s attorneys wrote in a 359-page rebuttal.

For years, Google publicly has maintained that its ad tech projects wouldn’t harm clients or competition. “We will be able to help publishers and advertisers generate more revenue, which will fuel the creation of even more rich and diverse content on the internet,” Drummond testified in 2007 to US senators concerned about the DoubleClick deal’s impact on competition and privacy. US antitrust regulators at the time cleared the purchase. But at least one of them, in hindsight, has said he should have blocked it.

Deep Control

The Justice Department alleges that acquiring DoubleClick gave Google “a pool of captive publishers that now had fewer alternatives and faced substantial switching costs associated with changing to another publisher ad server.” The global market share of Google’s tool for publishers is now 91 percent, according to court papers. The company holds similar control over ad exchanges that broker deals (around 70 percent) and tools used by advertisers (85 percent), the court filings say.

Google’s dominance, the government argues, has “impaired the ability of publishers and advertisers to choose the ad tech tools they would prefer to use and diminished the number and quality of viable options available to them.”

The government alleges that Google staff spoke internally about how they have been earning an unfair portion of what advertisers spend on advertising, to the tune of over a third of every $1 spent in some cases.

Some of Google’s competitors want the tech giant to be broken up into multiple independent companies, so each of its advertising services competes on its own merits without the benefit of one pumping up another. The rivals also support rules that would bar Google from preferencing its own services. “What all in the industry are looking for is fair competition,” Viant’s Vanderhook says.

If Google ad tech alternatives win more business, not everyone is so sure that the users will notice a difference. “We’re talking about moving from the NYSE to Nasdaq,” Ari Paparo, a former DoubleClick and Google executive who now runs the media company Marketecture, tells WIRED. The technology behind the scenes may shift, but the experience for investors—or in this case, internet surfers—doesn’t.

Some advertising experts predict that if Google is broken up, users’ experiences would get even worse. Andrey Meshkov, chief technology officer of ad-block developer AdGuard, expects increasingly invasive tracking as competition intensifies. Products also may cost more because companies need to not only hire additional help to run ads but also buy more ads to achieve the same goals. “So the ad clutter is going to get worse,” Beth Egan, an ad executive turned Syracuse University associate professor, told reporters in a recent call arranged by a Google-funded advocacy group.

But Dina Srinivasan, a former ad executive who as an antitrust scholar wrote a Stanford Technology Law Review paper on Google’s dominance, says advertisers would end up paying lower fees, and the savings would be passed on to their customers. That future would mark an end to the spell Google allegedly cast with its DoubleClick deal. And it could happen even if Google wins in Virginia. A trial in a similar lawsuit filed by Texas, 15 other states, and Puerto Rico is scheduled for March.

31 notes

·

View notes