#fulton county property tax

Text

Property tax consultants | Cut my taxes

No matter where you live, we likely wish you paid less. Our property tax consultants lower your Fulton property taxes with hassle-free service at low cost. Reach https://www.cutmytaxes.com/georgia/fulton-county-property-tax-reduction/

#cut my taxes#property tax reduction#property tax consultants#property taxes#fulton county#fulton county taxes#fulton county property tax

0 notes

Text

Appeal your property tax annually

Are you planning to protest property taxes in Fulton county? Find out how to appeal your Fulton County Property Taxes! Protect yourself from financial surprises! Appeal your property tax annually. Learn Know more at https://www.cutmytaxes.com/georgia/fulton-county-property-tax-reduction/

0 notes

Text

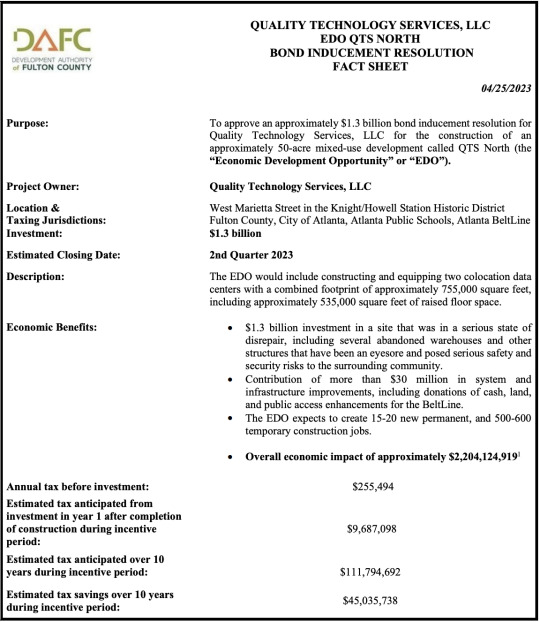

Atlanta & Fulton residents: say NO to $45m tax giveaway

CALL TO ACTION:

Please join us in sending a comment to the Development Authority of Fulton County today (Monday, April 24, 2023) about a ridiculous tax break they're considering at tomorrow's meeting!

Tell them to vote "no" on the Quality Technology Services bond inducement for their new data center on West Marietta Street. Since this project is already underway, providing it with a tax savings of $45,035,738 qualifies as an unnecessary handout to the company -- one that comes at a cost to Atlanta Public Schools, the City of Atlanta, and Fulton County.

This is a prime investment property in that it's next to the popular Atlanta Beltline. No inducement is needed for a place where developers are already willing to invest. It's exactly the kind of tax break that DAFC needs to stop providing. These big companies need to pay their taxes for the public good!

Address your public comment to the Regular Monthly Meeting of DAFC on Tuesday, April 25, 2023.

EMAIL:

address:[email protected]

11 notes

·

View notes

Photo

Election Night 2024: Donald Trump has managed to get his trial dates pushed back to after the 2024 election, unfortunately the conditions of his arraignments made traditional campaigning rather difficult. Instead his son Don Jr. has taken the lead as the primary campaign surrogate, but on election night it all falls apart. Simply put: overturning Roe and coming after queerfolk and transfolk was more than enough to turn most of the country against the Republicans, while a near full employment economy and the defeat of Russia has endeared Joe Biden as America's happy warrior. On election night, facing a trial he's sure to lose in Fulton County, GA in January Trump suffers a stroke and falls into a coma, effectively leaving Don Jr. as his successor in the MAGA movement.

Summers v. Idaho: A case over Idaho's abortion travel ban makes its way to the Supreme Court in 2024. The plaintiff, a 15 year old Idaho resident who traveled to Oregon to get an abortion. The argument: that the interpretation of the Privileges and Immunities Clause as laid down in the 1823 ruling in Corfield v. Coryell has long since established that the Free Movement between the states shall not be infringed. The ruling: in a 5-4 decision the supreme court overturns 202 years of precedent and declares that the states are free to restrict women from seeking an abortion, or any other service they find objectionable, in any other state. This effectively makes people seeking bodily autonomy prisoners in their home states. Before the court can rule, the newly Democrat controlled House and Senate rams through an extension to the ERA's deadline, in an attempt at legitimizing the Amendment's ratification. The court strikes down that power as well, and the ERA becomes the only amendment in history to be nullified by the Supreme Court. California Senator Katie Porter immediately begins drafting a new Bodily Autonomy Amendment which she introduces every year until it finally clears the Senate in 2028.

Red State Military Buildup: State Defense Forces get a surge in funding after the 2024 election. Partly in response to peaceful and violent demonstrations by activists, these measures see the expansion or reactivation of state-defense forces in the Red States. These forces are loyal primarily to their governors, and some states go so far as to pass measures giving them control of their National Guard Units, although the legality of this is hotly debated. Red States pay for this with higher property taxes and by cutting services. In some states, the officer corps is made up of retired members of the regular Army, former cops, and in some cases mercenary soldiers. Idaho gains infamy when its revealed that they've been hiring ex-Wagner Group soldiers to serve as advisors to train their State Defense Force.

Joe Biden Passes Away: At 83 years old, Joe Biden dies peacefully in his sleep. Kamala Harris is sworn in as the 47th President while many around the world mourn the last great liberal. Joe Biden, the man who rallied NATO to support Ukraine's war against Russia, and functionally the destruction of the Russian Federation itself. His legacy falls to Kamala Harris... and she is entirely unfit for the task. Most see her first national address as perfunctory, and her response to the rise of State Defense Forces, police brutality, and the nuclear non-proliferation operations in the former Russian Federation isn't actually all that different from Joe Biden's, its just that people were already losing patience with that set of policies and Harris is just not a very good speaker.

Trump 2028: Donald Trump Jr. announces his candidacy for President in late 2026. He is flanked not just by flags, but by armed security that absolutely nobody mistakes as anything less than a Trumpian SA. His campaign is a Dark MAGA nightmare, and he is supported almost without question by Republican governors. He frequently speaks directly to Red State Defense Forces and through is rambling, cocaine fueled speeches he uses his platform to call for violence if he's not given the nomination and the Presidency. The campaign also sees the MAGA movement transition into a pseudoreligious movement, with images of Donald Trump Sr. shown as objects of worship, and Don Jr. promising that his election will lead to his father's return as the True Leader of America. He is opposed only by Liz Cheney, who is constantly dodging hecklers, rotten fruit and vegetables, and on more than one occasion actual threats to her life by Magats. The primary is a farce, with Trump winning by Assad margins in a few states and the nomination with a clean sweep of the country. Cheney bows out and does not attend the convention, instead throwing her support to Mitt Romney in his effort to revive the National Union Party with former Arizona Senator Kyrsten Sinema. Romney's campaign is really a lifeboat for Business and national security conservatives pretending to be a home for the American center, and it is by far the most well funded campaign in the country.

Democratic Primary: Kamala Harris is not a bad President, but she's also not a very popular one. She announces her campaign almost with the expectation that doing so will scare off potential challengers, when in fact it does the opposite. By Fall 2027 there are 13 Democratic candidates in the race. The Press sees this as mainly a fight between California Governor Gavin Newsom and President Harris, but former Transportation Secretary Pete Buttigieg surprises everyone by winning the Iowa Caucuses in a narrow plurality, and quickly swells to the number 1 slot in the polls. Harris goes all in on New Hampshire and South Carolina hoping to knock out most of the other candidates and giving her campaign the momentum to sweep the South and eventually Super Tuesday as Biden did in 2020. While she does win New Hampshire, the press is stunned to see AOC win a strong 2nd place. The same thing happens again in South Carolina, and in California Harris isn't even in the Top 3. On Super Tuesday, The top contenders are AOC, Buttigieg, and Newsom. Newsom simply doesn't have much appeal outside of the West Coast, Buttigieg dominates in the Great Plains, but AOC is able to appeal to a far larger coalition of voters than any single candidate, especially after a series of stunning debate performances. The race ultimately comes down to the wire, with AOC winning the last few delegates she needs in Washington State and Democrats Abroad to just barely secure the nomination, but with only 36.2% of the popular vote. AOC offers Buttigieg the VP slot almost immediately, and while its something of a shotgun wedding, it gives the Democratic nominees a mandate.

Campaign 2028: With the conventions done, the country braces for the most contentious election in living memory. Don Jr. is running almost as if he expects to lose the House and Senate. His MAGA security officers and armed supporters frequently clash with cops and national guard units in major cities and he frames his campaign as a true clash of civilizations. Mitt Romney briefly looks like he might actually win the election by a plurality of the vote, until the first debate in which he steps into a trap laid by AOC. She reveals that Romney's economic and social policies are almost identical to those put forward by Trump. The "gotcha" is powerful, but even more so is the string of memes online and across the press comparing it to Obama's "Please Proceed Governor" in 2012. Its made all the worse by Sinema giving an absolutely petulant response post-debate. The Romney campaign never recovers. Trump and AOC never actually face each other in a debate, this isn't a huge surprise as the GOP pulled out of the Commission on Presidential Debates in 2022 and Trump Sr. spent the 2024 campaign just talking on a stage to a sycophantic FOX moderator. There's also not much point of a debate, as AOC and Trump just repeat their opponents comments verbatim knowing that's all the attack ads they'll ever need. On Election Day, 20 states have outright banned mail-in voting, AOC has been removed from the ballot in Idaho, Oklahoma, Tennessee, Alabama, and West Virginia, and Texas actually deploys its State Guard to shut down the one polling location in Harris County when it begins to look like AOC might win the state by a plurality. Mail-in-ballots from the other 30 states take a week to be counted, but Ohio, Texas, Florida, North Carolina, and Georgia all vote to decertify the results in Democrat heavy counties or direct their states' Electors to cast their votes for Trump. It really doesn't make much of a difference, as AOC has a clear majority in the Electoral college. Ironically, the post-election map doesn't look that different from the one in 2020, save for 8 electoral votes from Utah, Nebraska, and Maine going to Romney.

Post-Election Chaos: With all the votes tallied, this Election has the highest turnout in over a century, but AOC, the victor has only 41.4% of the vote. The media's immediate concern is another attempt by Republicans in Congress to decertify the Election Results as they attempted in 2020 and 2024. But Republicans aren't waiting. Before the Electoral College even convenes Texas becomes the first state who's legislature votes to recognize Trump as the victor and their President. Florida and West Virginia follow not long after and Trump announces plans to hold an Inauguration/Constitutional Convention in Mar-a-Lago with members of the House and Senate Republican leadership and numerous Republican governors in attendance. By the time the EC votes, 16 state legislatures have simply voted to ignore the results and name Trump their President with 13 more states preparing to hold similar votes. By January 1, 2029, 22 states have voted to recognize Donald Trump Jr. as the legitimately elected President and not AOC. The stage is set for another civil war.

Part II

#election 2028#president of the united states#alexandria ocasio-cortez#donald trump#politics#aoc#joe biden#2024 election#progressive#civil war ii#the center cannot hold

13 notes

·

View notes

Text

SMART BOMB

The Completely Unnecessary News Analysis

By Christopher Smart

May 30, 2024

SECOND COMING, COMING EARLY

OK Wilson, when Salt Lake City taxpayers pony up $1 billion what will they get for their money? It's a mystery — sort of. The Salt Lake City Council, considering raising all that dough in taxes, held a public hearing so Salt Lakers could weigh in on the new hit to their wallets. A lot of people trudged down to City Hall to put in their 2 cents even though they didn't know what they were commenting on. It's all about this thing called the “entertainment district” that doesn't exist yet — plans remain floating somewhere in the ether. Here's the deal, for this nebulous proposal the city would chip in about $1 billion and Jazz NBA owner Ryan Smith would put up $3 billion. The money would transform 100 acres around the Delta Center, Abravanel Hall and the Salt Lake Convention Center into something like the Eighth Wonder of the World. Call it Smithland. There would be basketball, NHL hockey, music, culture, art, taco stands and a bunch of cool stuff you can't even imagine. It's kinda like Christmas Come Early, or more accurately, the Second Coming Come Early. Imagine Salt Lake City transformed into the next Orlando, Fla. — sans Mickey, Goofy and the gang. City leaders are absolutely giddy — how often do you get to recreate the world in your own image.

SLURPING UP TRUTH, JUSTICE AND DEMOCRACY

We know you're not ready for this, Wilson — Rudy Giuliani now has his own brand of coffee. Yep, “Rudy Coffee” is here. “When I put my name on something you can trust it,” he says in a new TV commercial. The ad dropped right after Giuliani pleaded not guilty in Arizona to charges of conspiring to overturn the 2020 presidential election. When you buy Rudy Coffee you're not just getting great coffee, he says, “You're supporting our cause: Truth, justice and American democracy.” Yes Wilson, he really did say that. Rudy was one of the so-called “architects” of the plan to keep Trump in power after he lost the election. Architecture, needless to say, is not what it used to be. In December the one-time New York City mayor was ordered by a jury to pay $148 million in damages to former Georgia election workers Ruby Freeman and Shaye Moss, whom he defamed by saying they fraudulently counted votes for Biden. The pair received numerous death threats, among other things. Looks like Rudy is gonna have to sell a lot of that coffee. Giuliani also faces a dozen charges in the racketeering case brought by the Fulton County district attorney in Atlanta, Ga. So get your Rudy Coffee today. Buy lots and lots of it to save our American democracy and Rudy Giuliani's ass.

FAILED PLAN TO ASSASSINATE TRUMP

If you think Donald Trump's “hush money” trial was nasty with cringeworthy sex scenes involving the former president and a porn star, listen to this: President Joe Biden planned to knock off the Donald at Mar-A-Lago in August 2022 when the FBI searched the Florida property for classified documents. How do we know this to be true — because the right-wing echo chamber says so: “This was an attempted assassination,” said former Trump advisor and pundit Steve Bannon. “The Biden DOJ and FBI were planning to assassinate President Trump and gave the green light.” said Rep. Marjorie Taylor Greene. “The Biden Administration authorized the use of deadly force at Mar-A-Lago,” said FOX talking head Sean Hannity. Well, not exactly. The FBI waited until Trump was in New York City before executing the search warrant. Beyond that the FBI's modus operandi forbids the use of force unless an agents life is in imminent danger. On the other hand, Trump's lawyers argued before the Supreme Court that he had complete immunity as president and should be allowed to assassinate his political rivals without repercussions. In Trump World up is down and down is up. Hey, did you hear the FBI tried to assassinate Trump. It's true, we heard it on FOX.

Post script — That'll do it for another gorgeous week here at Smart Bomb where we keep track of who's getting raises so you don't have to. Hey Wilson, did you hear that Salt Lake City Mayor Erin Mendenhall is asking for a $44,000 annual raise. Whoa baby, that's raising some eyebrows around town. Forty four grand? Holy simoleons. Presently, Mayor Erin's salary is 168,000 a year or $14,000 a month. The raise would make it $212,000 a year or $17,666 per month. We know Wilson, that's more than the entire income of the Smart Bomb Band. But, you gotta admit she works a lot harder than you guys — plus, she has to dress up and sit through a lot of boring meetings. You guys could never do that. It's a special skill set. (Clever segue.) Recently the Presidential Greatness Project surveyed 154 historians and social science experts to rank all U.S. presidents. OK Wilson, guess who came in dead last. You got it, Donald Trump. Get this, he came in behind James Buchanan, Andrew Johnson, Franklin Pierce and Warren Harding. As you may recall, Trump rated himself the greatest president ever ahead of Abe Lincoln. Imagine that. Editor's note: Not included in the survey were Stormy Daniels, E. Jean Carrol or Karen McDougal — but they probably wouldn't have helped him much.

Poor old Rudy Giuliani, he was a brave crime fighter against the mob, became America's mayor after 9/11 and then buddied up with Donald Trump, lost his soul and turned into a creepy, old crazy guy. How far the mighty have fallen. So hey Wilson, do you and the guys in the band have anything in your repertoire for this once-great pathetic fool:

Shadows are fallin' and I've been here all day

It's too hot to sleep and time is runnin' away

Feel like my soul has turned into steel

I've still got the scars that the sun didn't heal

There's not even room enough to be anywhere

It's not dark yet but it's gettin' there.

Well, my sense of humanity has gone down the drain

Behind every beautiful thing there's been some kind of pain

She wrote me a letter and she wrote it so kind

She put down in writin' what was in her mind

I just don't see why I should even care

It's not dark yet but it's gettin' there.

Well, I've been to London and I been to gay Paris

I've followed the river and I got to the sea

I've been down on the bottom of the world full of lies

I ain't lookin' for nothin' in anyone's eyes

Sometimes my burden is more than I can bear

It's not dark yet but it's gettin' there.

I was born here and I'll die here against my will

I know it looks like I'm movin' but I'm standin' still

Every nerve in my body is so naked and numb

I can't even remember what it was I came here to get away from

Don't even hear the murmur of a prayer

It's not dark yet but it's gettin' there.

(Not Dark Yet — Bob Dylan)

0 notes

Text

Former Housewives Star Kim Zolciak Divorcing Husband Amidst Tax Liens Totaling over $1.1 Million

For some time now, Kim Zolciak-Biermann, former Real Housewives of Atlanta star, has been denying rumors of money problems. Recently, however, the Internal Revenue Service escalated the money issue. Zolciak and her husband, Kroy Biermann, former NFL outside linebacker, reportedly owe more than $1 million to Uncle Sam. Anyone in this position probably needs back-taxes help from a legal professional, especially if liens have been filed by the IRS, as is the case with the aforementioned couple. To further complicate matters, an IRS tax attorney in San Jose has learned that the couple has filed for divorce, breaking the hearts of millions of devoted fans.

Divorce Proceedings Filed in April; Zolciak Seeking Child Custody

April 30 is listed as the official separation date for the couple, who were married for over a decade and had four children together during that time. Zolciak cited irreconcilable differences, and that the marriage had, according to her, no hope of reconciliation. The former Housewives star is seeking joint legal custody and primary physical custody of their four children, as well as spousal support. She also stated she intends to have her maiden name legally restored.

Loan Default in Couple’s History

Last fall, Zolciak and Biermann reportedly defaulted on the mortgage for their Fulton County, Georgia home. The $1.65 million loan was through Truist Bank. People Magazine reported that the bank planned to auction the home off this past March, and rumors circulated that it had sold for $257,000. Zolciak and Biermann adamantly denied this rumor, stating that “millions and millions of dollars” were put into the home, that it was worth almost $2.5 million, and that therefore it would never be sold for that amount of money. According to Redfin, when purchased in October 2012, its price was $880,000.

Tax Liens Total Over $1 Million

Federal tax liens have plagued the couple for many years, going back as far as 2013 and including 2018, 2019, 2020, and the current year. As of March 30, the exact total of the cumulative liens was $1,147,834.67. The state of Georgia also filed a tax lien of $15,000 for taxes allegedly due in 2018. Most individuals who face property liens consult a back-taxes attorney to get back on track and make peace with the IRS.

Tax liens were designed to protect the government’s interest in real estate. The IRS must assess the tax liability and make sure a bill is sent to delinquent taxpayers, giving them a chance to pay the bill before a lien can be filed. The lien, referred to as a Notice of Federal Tax Lien, alerts creditors that Uncle Sam has a legal right to the real estate or personal property. Tax help is available in certain cases, and sometimes a payment arrangement can be worked out. If the tax liability is paid off, the lien is typically released. Unfortunately, tax liens and divorce often go together.

Liens may accrue interest and penalties even if the person is on a payment plan, so tax lawyers should be consulted by those who find themselves in this position. It’s unclear what the next steps might be for the former Housewives star and her soon-to-be ex-husband, as they did not respond to various requests for comment. Back-taxes help is available from qualified attorneys, so it is always wise to seek such help when facing tax liens or delinquent taxes.

1 note

·

View note

Text

What to know about Herschel Walker’s residency status in Georgia

What to know about Herschel Walker’s residency status in Georgia

Herschel Walker, the Republican second-round candidate for Georgia’s Senate, disclosed in a financial disclosure statement that his Atlanta residence was being used as rental property as recently as 2021.

Tax and assessment records from Fulton County, Georgia, said Mr. Walker’s wife, Julie Blanchard, was the sole owner of the 1.5-acre property in northwest Atlanta , further undermining the…

View On WordPress

0 notes

Text

Residential Property Taxes | What We Do | Cut My Taxes

Find out about the ways that you are taxed and how you can appeal and protest your Fulton property taxes, including your residential property taxes. Visit https://www.cutmytaxes.com/georgia/fulton-county-property-tax-reduction/ to know more.

#fulton property taxes#property taxes#fulton county#residential property taxes#fulton county property tax#property taxes fulton#cut my taxes

0 notes

Text

Strategies for lowering your Fulton property taxes

Property taxes can be a significant financial burden for homeowners. Learn about some strategies for lowering your property taxes. Challenge it right away at https://www.cutmytaxes.com/georgia/fulton-county-property-tax-reduction/

0 notes

Text

Dekalb ojs smart search

DEKALB OJS SMART SEARCH HOW TO

Main fields of search include: title, author, year of. If you do not have these notices readily available, you may also find it using our Assessment & Property Tax Search. c Centre for Robotics in Industry and Intelligent Systems (CRIIS), INESC Technology and Science.

The Property Index Number (PIN) required by the State of Illinois for Illinois Department of Revenue Form IL-1040 is the same as your “Parcel Number” on your tax bill or on your Assessment Change Notice.

ates as more than intelligent, committed and professional they are also creative and know how.

DEKALB OJS SMART SEARCH HOW TO

How to Find the Property Tax Index Number(PIN / Parcel Number) performance evaluation of web search engines, childrens.LLC AS12260 COLOSTORE - AS12261 DEKALB - DTC Communications. If you have any questions regarding any of these items, please contact your Township Assessor first. Net AS11192 SMARTCITY-LASVEGAS - Smart City Networks, L.P. If this page is not populated, contact your Township Assessor for the information. The DeKalb County Office of Assessments assumes no responsibility for errors or omissions. Search by person name, business name or case type Search for judgments against a person or business Display case information and activities Superior Court Clerk The Superior Court hears felony, divorce, and title to land cases. The information regarding assessments, sketches, and square footage is for general information purposes only and is submitted to our office by the specific Township Assessors. Via our eServices platform, you can file and search Real-Estate and Judicial records online, while also providing external resources that allow you to acquire copies of records filed in the offices of The Fulton County Superior and Magistrate Courts.Assessment & Property Tax Search-COMPASS.

0 notes

Note

Hey sorry did u mean to post ur (i assume its urs) address? If this is someone elses i don’t understand but more power to u.

i appreciate the concern lol but i was doxxing republican georgia representative marjorie taylor greene intentionally on purpose. she (or her husband perry clarke greene) filed two houses on their taxes (illegal). you can look this up on fulton and floyd county property tax sites

28 notes

·

View notes

Text

Ponce City Market finally becomes taxable this year, benefitting the Beltline

Woah, this sounds big! The Ponce City Market property will finally become taxable this year following a long period of (frankly, ridiculous) tax breaks.

That means we'll finally get a public benefit from it beyond just having a nice place to spend a lot of money!

Julian Bene, a former board member for Invest Atlanta and an advocate for better tax practices, tweeted this today:

"Let's hope the [Fulton County] Board of Assessors appraises Ponce City Market somewhere close to its $1 billion market value this year, when it finally becomes taxable. That way PCM would contribute $17 million per year to the Beltline."

Bene is referring to the Beltline Tax Allocation District, which collects taxes around the route and uses them to fund the project. Surely even the most ardent supporters of big-developer tax breaks can at least admit that PCM didn't need to be exempt from paying into the Beltline for as long as it has been.

Any way you look at it, the flow of taxes from PCM, starting this year, is going to be a huge boon for the Beltline. We just need those assessors to be honest and set the value at what it's really worth -- Fulton has a bad history of low-balling commercial property values, and hurting our public-spending streams in the process.

(PCM was an old building that needed a lot of work. I won't say that they should have gotten zero tax breaks. But Julian Bene estimates that the Beltline TAD has lost out on $140 million due to the tax deals for the project, and that level of public support has been a hardship on BeltLine funding during this time when PCM was operating and bursting with business.)

15 notes

·

View notes

Photo

When it comes to property tax consulting, the experts at ARE Solutions are the leaders in this industry. Contact us today for your Fulton County Property Tax Consultant needs! http://www.arpropertyexperts.com/fulton-county-property-tax-consultant/

0 notes

Text

In the months since she arrived on Capitol Hill as a first-term congresswoman from Georgia and the House’s first supporter of the QAnon conspiracy theory, Republican Rep. Marjorie Taylor Greene has stirred up her fair share of public controversy—being stripped of her committee assignments over hate-filled tweets, espousing COVID denialism, and, just this week chasing and shouting at Rep. Alexandria Ocasio-Cortez (D-N.Y.). But now a TV station in her home state has dug up paperwork pointing to a problem that is far more than a PR issue: that Greene and her husband seem to have been claiming a lucrative tax break on two houses in two different Georgia counties, in violation of the law.

Channel 2 Action News in Atlanta revealed last night that it had obtained paperwork through public records requests that showed Greene and her husband claiming what’s called a “homestead exemption” on two properties—one in Fulton Country and one in Floyd County, which is in the district that Greene now represents. The tax break lowers the amount of property tax homeowners must pay on their homes, but it can only be claimed for one house—the owners’ primary residence.

In the couple’s Floyd County application, Greene’s husband reportedly left blank a question that asked whether they had an active homestead exemption in another part of the state. Meanwhile, Fulton County confirmed to the TV network that the pair’s tax break on their home in that county was still active. “The property owners filed for homestead exemption in Fulton County in May of 2019 and it became effective for the 2020 tax year,” the Fulton County Board of Assessors told the network. “In this case, Fulton County will consult with Floyd County to confirm and determine in which county the exemption is not valid.”

Greene responded to the allegations by telling the network that the reporter on the story “needs to mind his own business instead of launching yet another pathetic attempt to smear me and my family.”

#politics#us politics#news#marjorie taylor greene#rep. marjorie taylor greene#ga#Georgia#mother jones#Channel 2 Action News#property tax

26 notes

·

View notes