#forex data

Explore tagged Tumblr posts

Text

Trading is about timing. If you don’t understand what cycle the market is in, when to identify manipulation and when to target that manipulation - you’re never going to see this setup.

Each previous market session gives us vital clues on what we’re looking for and when to look for it.

For more join us .

#forex#forex education#forex expert advisor#forex indicators#forexmentor#forex broker#forex market#forexsignals#forexmastery#crypto#learn forex trading in jaipur#jaipur#forex jaipur#rajasthan#learn forex trading#intradaytrading#market strategy#technical analysis#data analytics#analysis

2 notes

·

View notes

Text

Debunking the Top 10 Myths About Forex Trading

Forex trading, despite its immense popularity, is shrouded in myths and misconceptions that deter many potential traders or misguide those already trading. This article aims to dispel some of the most pervasive myths about forex trading. Myth 1: Forex Trading is a Get-Rich-Quick Scheme One of the biggest misconceptions is that forex trading is a shortcut to quick wealth. In reality, successful…

View On WordPress

#Demo Account#Economic Data#Economic Indicators#Forex#Forex Market#Forex Trading#Fundamental Analysis#Geopolitical Events#Leverage#Market Movements#Market Sentiment#Risk Management#Stop-Loss#Take-Profit#Technical Analysis#Trading Decisions#Trading Platform#Trading Platforms#Trading Success

0 notes

Text

Revolutionizing Forex Trading: The Role of Artificial Intelligence

In the ever-evolving world of financial markets, Forex trading stands out as one of the most dynamic and fast-paced arenas. With trillions of dollars exchanged daily across borders, the Forex market provides ample opportunities for traders to capitalize on fluctuations in currency values. However, navigating this complex landscape requires more than just intuition and experience; it demands cutting-edge technology. Enter Artificial Intelligence (AI), the game-changer in modern Forex trading.

AI has revolutionized many industries, and Forex trading is no exception. Gone are the days when traders relied solely on human analysis and instinct. Today, AI algorithms sift through vast amounts of data, identify patterns, and execute trades with precision and speed that surpass human capabilities. But what exactly is the role of AI in modern Forex trading?

1. Data Analysis and Pattern Recognition

One of AI's greatest strengths lies in its ability to analyze massive datasets in real-time. In Forex trading, this means scanning through historical price movements, economic indicators, news articles, social media sentiments, and more. AI algorithms can identify subtle patterns and correlations that may elude human traders, enabling them to make informed decisions based on data-driven insights. Read More

0 notes

Text

Explore The Problems Caused By Using Excessive Data In Forex Analysis

In this article, we aim to shed light on the problems of using excessive data in Forex trading and delve into the reasons behind its detrimental impact on decision-making processes.

0 notes

Text

What to Expect from Your Forex Trading Tools - Technology Org

New Post has been published on https://thedigitalinsider.com/what-to-expect-from-your-forex-trading-tools-technology-org/

What to Expect from Your Forex Trading Tools - Technology Org

When engaging in the foreign exchange market, having the appropriate tools at your disposal can make a difference. With the forex market operating 24 hours a day, five days a week, it becomes a fast-paced environment. To navigate this landscape effectively and make informed trading decisions, traders must rely on sophisticated forex trading tools. This article will explore what traders expect from these tools regarding their functionality, accuracy, convenience, and support.

Forex, stock market trading – illustrative photo. Image credit: Adam Śmigielski via Unsplash, free license

Functionality: A Comprehensive Set of Essential Features

Tools for Forex trading have an array of features specifically designed to enhance traders’ experience and decision-making abilities. These functionalities are crucial in analyzing market trends, executing trades efficiently, managing risks effectively, and optimizing performance.

Real-time Data Feeds

Among the fundamental functions, forex trading tools offer real-time data feeds, encompassing currency prices, historical data, charts, quotes, news updates, economic calendars, and more. Traders can gain insights into price movements and make better-informed decisions.

Technical Analysis Tools

Advanced charting software integrated into these tools empowers traders with various technical analysis capabilities. From trend lines to Fibonacci retracements and moving averages, these tools provide ways to perform in-depth analysis. Traders can customize indicators and use drawing tools to identify entry or exit points.

Automated Trading

Many trading platforms offer features such as Expert Advisors (EAs) or algorithms. These features enable traders to execute trades based on predefined strategies or conditions as per the trader sets.

Accuracy: Reliable Data for Informed Trading Decisions

Accurate data plays a significant role in trading, as even minor discrepancies can significantly impact trade execution and market evaluation. Forex trading tools excel at providing up-to-date information.

Order Execution

A reliable trading tool ensures swift order execution, minimizing the chances of slippage or requotes. Advanced platforms offer access to market liquidity providers, reducing latency in trade execution.

Historical Data Validation

Access to historical data is crucial for backtesting strategies and analyzing past performance. Forex trading tools provide data traders can rely on to validate their approach.

Convenience: Accessible and User Friendly Platforms

A proficient forex tool offers functionalities and focuses on providing a great user experience. These tools make trading activities easier for traders, eliminating the need for added effort or dealing with complexities.

Intuitive User Interface

Forex trading tools have an easy-to-use interface that caters to beginners and experienced traders. With navigation, personalized layouts, customizable dashboards, and presented information, these tools ensure a seamless trading experience.

Mobile Support

Flexibility is crucial in the fast-paced forex market. Trading tools that offer support through applications enable traders to monitor the market, conduct analyses, and execute trades.

Support: Assistance When You Need It

Traders may inevitably face challenges or have queries while using trading tools. Having prompt and dependable customer support is invaluable to ensure seamless trading operations.

Technical Support

A notch forex tool provider offers round-the-clock support for any platform-related issues or inquiries a trader might encounter during their trading journey.

Educational Resources

Traders can significantly enhance their skills and knowledge base through various training materials. These resources include video tutorials, webinars, articles, and access to a community.

Conclusion

Trading tools greatly facilitate successful trades in the market. These tools offer functionalities that provide accurate data feeds for decision-making, convenient access through user-friendly interfaces, and reliable support when needed. Evaluating your requirements before selecting the right trading tool that aligns with your trading goals is crucial, as this will ultimately contribute to your success in the forex market.

#Algorithms#Analysis#applications#approach#Article#Articles#charts#Community#comprehensive#data#data validation#easy#economic#Environment#excel#Experienced#Features#Fintech news#Forex#Fundamental#insights#issues#it#Landscape#latency#materials#Mobile#monitor#navigation#News

0 notes

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Text

A Comprehensive Guide to Trading: Strategies, Risks, and Success

Trading is a financial practice that has been around for centuries, evolving from the bustling markets of the past to the digital world of today. It’s a means of buying and selling financial assets with the goal of making a profit. This comprehensive guide will delve into the world of trading, covering various aspects including strategies, risks, and the path to success. I. Understanding…

View On WordPress

#Algorithmic Trading#Arbitrage#Brokerage#Commodity Trading#Cryptocurrency Trading.#Day Trading#Diversification#Economic Data#Emotional Discipline#Financial Assets#Financial Markets#Forex Trading#Fundamental Analysis#investment#Legal Regulations#Loss#Market Analysis#Market Data#Market Indicators#Market Orders#Market Timing#Market Trends#Market Volatility#Online Trading#Options Trading#Portfolio Management#Position Sizing#Position Trading#Profit#Risk Management

0 notes

Text

“First Trade” by ETO Markets is on live🔥 If you’re not trading now, you definitely should start. 📢 If you have any questions on how to trade DM me the word TRADE to start a conversation.

#cpi data#my forex funds#audusd forecast#eur/usd and aud/usd#audusd live chart#audusd tradingview#first trade#impact of consumer confidence#eur usd#eur usd chart#eur usd exchange rate

0 notes

Text

Bullwaypro.com review Registration

When choosing a forex broker, the biggest concern is always trust. Nobody wants to deposit funds into a platform only to discover withdrawal issues, shady practices, or poor regulation. That’s why we take a deep dive into every key aspect of a broker to see whether it’s legitimate or just another name in a long list of unreliable platforms.

Today, we’re looking at Bullwaypro.com review—a forex broker that has been gaining attention in the trading community. With a high Trustpilot rating, FCA regulation, and thousands of users, it certainly has some strong points. But does it truly hold up under scrutiny?

Let’s break it down step by step and find out.

Bullwaypro.com Registration Review: Quick and Easy Sign-Up Process

The registration process for Bullwaypro.com reviews is straightforward and efficient. Here’s how it works:

Locate the registration button in the upper right corner of the website.

Enter your personal data, ensuring accuracy for verification.

Wait for a manager to process the provided information.

Once verified, registration is successfully completed.

This structured approach suggests a secure onboarding process, where user information is checked before full access is granted. It’s a good sign—brokers who take verification seriously are often more reliable and compliant with financial regulations. Would you like details on the verification requirements or account setup next?

Bullwaypro.com – Establishment and Domain Registration Date

When assessing the legitimacy of a forex broker, one of the first things to check is whether the domain registration date aligns with the brand’s establishment date. If a broker claims to be operating for several years but its domain was only recently registered, that’s a red flag. So, how does Bullwaypro.com reviews measure up?

The company was established in 2022, and the domain bullwaypro.com review was registered on November 11, 2021. That means the domain was secured before the company officially started operating, which is a positive indicator. It suggests the brand was not hastily set up overnight but rather planned in advance.

Why is this important? Well, scam brokers often buy domains right before launching, making it easier to disappear without a trace. Bullwaypro, on the other hand, took steps ahead of time, likely to secure its brand identity and online presence early on. That’s a sign of long-term intentions, rather than a short-lived, fly-by-night operation.

This looks like a good argument in favor of legitimacy. What aspect should we analyze next?

Bullwaypro.com – Strong Regulatory Oversight

When it comes to forex trading, regulation is one of the most critical aspects that separate trusted brokers from potential scams. A regulated broker is subject to strict financial laws, regular audits, and capital requirements. So, what kind of regulatory status does Bullwaypro.com reviews have?

This broker operates under the oversight of the FCA (Financial Conduct Authority)—one of the most respected and stringent financial regulators in the world. The FCA license is not something a broker can obtain easily; it involves rigorous checks, capital requirements, and compliance with strict operational standards. Only brokers who meet transparency, security, and client protection policies receive this approval.

Why does this matter? Because FCA-regulated brokers are legally required to:

Segregate client funds from company accounts, ensuring traders' money is protected even if the broker faces financial trouble.

Follow fair trading practices, meaning no price manipulation or conflicts of interest.

Be covered by a compensation scheme, which provides an extra layer of security to traders.

We think this is a strong argument in favor of Bullwaypro’s legitimacy. Many brokers operate without regulation or under weak offshore jurisdictions—but here, we see one of the best financial regulators backing this platform.

This definitely adds trust to Bullwaypro.com reviews. What should we analyze next?

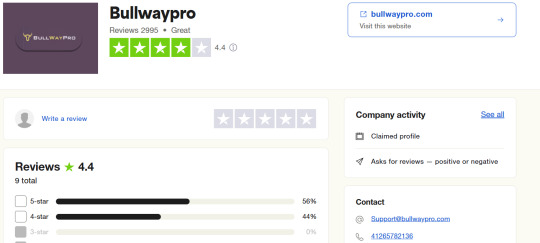

Bullwaypro.com – Client Reviews and Reputation

One of the best ways to gauge a broker’s reliability is to look at what actual traders are saying. Scammers tend to have poor ratings, few reviews, and plenty of complaints. But what about Bullwaypro.com reviews?

On Trustpilot, this broker holds an impressive score of 4.4 out of 5, based on 2,995 reviews. That’s a strong indicator of trustworthiness, especially in the forex industry, where traders are quick to leave negative feedback if something goes wrong.

Here’s why this is significant:

A score above 4.0 is already considered very high for brokers, as the industry tends to be highly competitive and filled with mixed experiences.

The sheer number of reviews (2,995) suggests a well-established platform. It’s easy for a scam broker to fake a handful of positive comments, but accumulating thousands of reviews takes consistent service over time.

Out of those, 2,869 reviews (the majority) are rated 4 or 5 stars, meaning most traders are satisfied with their experience.

This definitely looks like a solid argument for legitimacy. A broker with nearly 3,000 reviews and a high rating is unlikely to be a short-term scam. Instead, it suggests that Bullwaypro delivers on its promises and maintains a good relationship with its clients.

Final Verdict: Is Bullwaypro.com review a Legitimate Broker?

After a thorough review, Bullwaypro.comreviews checks all the right boxes when it comes to trust and reliability. The broker is not just another name in the forex industry—it has strong regulatory oversight, positive user feedback, and a well-structured platform. Here’s why we think traders can confidently consider this broker:

✅ Regulation by FCA – One of the most trusted financial regulators, ensuring transparency, security, and fair trading conditions. ✅ Established Track Record – The domain was registered before the company officially launched, showing proper planning and long-term intent. ✅ Excellent User Reviews – With a 4.4 Trustpilot rating and nearly 3,000 reviews, traders are overwhelmingly satisfied with the platform. ✅ Secure Deposits & Fast Withdrawals – No hidden fees, instant processing for most transactions, and reliable payment methods. ✅ User-Friendly Trading Conditions – Multiple account types, fair leverage, and a widely used trading platform. ✅ Accessible Customer Support – Various contact options make it easy for traders to get assistance when needed.

With all these factors in mind, Bullwaypro.com review stands out as a legitimate and well-regulated broker. The combination of FCA oversight, positive reviews, and a transparent operational model makes it a solid choice for both beginner and experienced traders.

Of course, every trader should do their own research and choose a broker that fits their needs, but based on the evidence, Bullwaypro.com reviews appears to be a trustworthy option in the forex market.

8 notes

·

View notes

Text

Bestexpertoline.com review Deposit Information

When evaluating a forex Bestexpertoline.com review, it’s essential to consider several key factors that determine its reliability and trustworthiness. In this brand review, we’ll dive into the crucial aspects such as the Bestexpertoline.com review licensing, domain history, user feedback, and more. Whether you’re a seasoned trader or just starting out, understanding these elements will help you make an informed decision about which platform to trust with your investments. Let’s explore why this particular Bestexpertoline.com reviews stands out in the industry and why it might be the right choice for your trading needs.

Deposit Information for Bestexpertoline.com

Based on the data available in the table, here's a detailed breakdown of the deposit-related aspects for the Bestexpertoline.com reviews:

Deposit Time:

For most of the Bestexpertoline.com reviews listed, the deposit is processed in a matter of seconds to 10 minutes. This indicates a fast transaction processing time, which is crucial for traders who need to fund their accounts quickly for active trading. This is a strong argument in favor of the Bestexpertoline.com reviews being efficient in handling deposits.

Deposit Fee:

All the Bestexpertoline.com reviews in the table charge a "0% commission" for deposits. This means clients are not subjected to any additional fees when funding their accounts, which makes the offers more attractive. It definitely looks like a good argument for the Bestexpertoline.com reviews, as the absence of deposit fees can reduce costs for traders significantly.

Deposit Methods:

The platforms support various deposit methods such as VISA, MasterCard, Union Pay, and others. The availability of multiple deposit options provides flexibility, allowing users from different countries to choose the method most convenient for them. This adds a layer of accessibility, making the platforms more user-friendly.

In summary, these Bestexpertoline.com reviews offer favorable deposit conditions with fast processing times, no additional fees, and various deposit methods. These factors are crucial when choosing a Bestexpertoline.com review, as they ensure a smooth and cost-effective experience for traders.

Argument 1: Domain Purchase Date

One important aspect to consider when evaluating the legitimacy of a Bestexpertoline.com review is the domain purchase date. For a Bestexpertoline.com review to be trusted, the domain associated with its platform should ideally be purchased around the same time or before the brand was established. This ensures the Bestexpertoline.com review has been operating in a transparent and legitimate manner from the outset.

For instance, if the domain was purchased after the brand was officially launched, it could raise questions about the authenticity and timeline of the Bestexpertoline.com review operations. This might suggest the Bestexpertoline.com review was created more recently, possibly as a quick-to-market entity that may not have established a solid foundation.

Argument 2: License Information Bestexpertoline.com review

The license a Bestexpertoline.com review holds is one of the strongest indicators of its legitimacy and trustworthiness. Bestexpertoline.com review with licenses from reputable regulatory bodies are considered more reliable because these regulators enforce strict standards that ensure transparency, fairness, and financial security for users.

For example, Bestexpertoline.com review that are licensed by high-authority regulators like the FCA (Financial Conduct Authority) or CySEC (Cyprus Securities and Exchange Commission) are generally considered to be trustworthy and compliant with international financial laws. The fact that the Bestexpertoline.com review has earned a license from such a respected institution shows it has passed rigorous checks to prove its reliability.

This is a solid argument in favor of the Bestexpertoline.com review legitimacy. The existence of such licenses helps assure potential clients that they are dealing with a platform that operates under strict regulations, offering a much higher level of security compared to unregulated Bestexpertoline.com reviews. If a Bestexpertoline.com review is licensed by a well-known and respected authority, it's reasonable to trust that it is operating in good faith and is legally accountable for its actions.

Argument 3: Trustpilot Reviews Bestexpertoline.com

One of the most reliable indicators of a Bestexpertoline.com review reputation is the feedback from real users. In this case, Trustpilot reviews serve as an essential measure. A high rating on Trustpilot, especially above 4 stars, speaks volumes about the Bestexpertoline.com review reliability and customer satisfaction.

The fact that a Bestexpertoline.com review has earned positive reviews with an average score of over 4 is a strong argument in favor of its legitimacy. It shows that many customers have had positive experiences, suggesting that the Bestexpertoline.com review provides a service that meets expectations in terms of usability, customer support, and trustworthiness. Additionally, the large number of reviews further strengthens the case. A Bestexpertoline.com review with thousands of reviews typically has a large customer base, which is a good sign that it has been operating for a while and is trusted by many.

Conclusion Bestexpertoline.com review

After thoroughly analyzing the key aspects of this Bestexpertoline.com review, it’s clear that it offers a reliable and transparent platform for traders. The licensed status from a reputable authority ensures that it operates within the boundaries of legal and financial regulations, providing a sense of security to its users. Additionally, the positive Trustpilot reviews with a high rating further strengthen the case, showing that it has a strong customer base that trusts the service.

The fast deposit processing times, along with zero fees, make it a convenient option for traders who value efficiency and cost-effectiveness. Furthermore, the wide variety of deposit methods increases accessibility for users around the world.

In summary, this Bestexpertoline.com review seems to be a legitimate and solid choice for anyone looking to trade in a secure and user-friendly environment. With a robust reputation, reliable financial practices, and great customer feedback, it stands as a trustworthy option in the competitive world of forex trading.

9 notes

·

View notes

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

How do I choose the top Forex trade copier services?

Choosing the best Forex trade copier service depends on several key factors that impact efficiency, reliability, and profitability. Here’s what you should look for:

1. Speed & Execution Time: A good trade copier should have low latency to ensure trades are executed in real time without delays. This is crucial for scalpers and high-frequency traders.

2. Compatibility: Ensure the copier is compatible with your broker and trading platform (MT4, MT5, cTrader, etc.). Some copiers also work via Telegram or other third-party integrations.

3. Copying Features: Look for features such as:

Risk Management Controls

Partial or Full Trade Copying

Reverse Trading

Multi-Account Copying

4. Reliability & Performance: Check for uptime, accuracy, and past performance. A copier with frequent lags or execution failures can lead to unnecessary losses.

5. Security & Privacy: The copier should securely transfer trade data without exposing your account credentials. API-based solutions or encryption methods offer better security.

6. Customer Support & Updates: A responsive support team is essential. Look for providers that offer live chat, email, or ticket support along with regular software updates.

7. Pricing & Fees: Some trade copiers have a one-time fee, while others charge a monthly subscription. Ensure the pricing model suits your budget and trading volume.

#forex education#forextrading#currency markets#finance#economy#investing#telegram signal copier#forex Copier#Forex trade copier

2 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

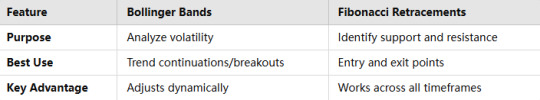

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Video

youtube

ADAUSD 19 Consecutive Successes! PrimeXAlgo vs Traditional Trading: How AI is Changing the Investment LandscapeA comparative analysis of PrimeXAlgo and traditional trading methods: Success Rate: PrimeXAlgo's 27 consecutive successes vs typical success rates Technology: 2,500 indicator AI analysis vs manual chart analysis Speed: Real-time signals vs delayed information Scope: Diverse markets vs limited expertise areas Watch a deep comparison that proves the superiority of AI with data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes