#my forex funds

Explore tagged Tumblr posts

Text

My forex funds

My Forex Funds is Canadian prop firm that went insolvent due to over leveraging their operational costs with promotions, high affiliate commissions, and inconsistent revenue management. Running out of cashfow accompanied with dealings with the CFTC, my forex funds was to be avoided at all costs. More: https://www.axetrader.com/my-forex-funds

#instantfunding #myforexfunds #bestpropfirms #smartproptrader #forex #fundednext #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#My forex funds#best proprietary trading firms#prop firms#funded trading accounts#cheapest prop firms#trading risk management#Axe Trader

0 notes

Text

youtube

Weekly Overview | US Powel says more rate rises to come | US Data hints at a slowdown

Today, we will discuss the latest market trends and important developments that can impact your investments. We've seen some concerning signs of a global economic slowdown, including the weakening Purchasing Managers' Index (PMI) in the US. The upcoming central bank meetings in Portugal will provide insights into their plans to address these challenges.

#interest rates#global economy#cost of inflation#forex trading#interactive brokers#pre market#commodity market#binance futures#chart patterns#fyers web#fed funds rate#my forex funds#demat account#metatrader 5#significant advancements#worldwide economic deceleration#central bank conferences#inflationary statistics#escalating prices#Youtube

0 notes

Text

“First Trade” by ETO Markets is on live🔥 If you’re not trading now, you definitely should start. 📢 If you have any questions on how to trade DM me the word TRADE to start a conversation.

#cpi data#my forex funds#audusd forecast#eur/usd and aud/usd#audusd live chart#audusd tradingview#first trade#impact of consumer confidence#eur usd#eur usd chart#eur usd exchange rate

0 notes

Text

My Forex Funds review

My Forex Funds is an unreliable broker which is not regulated by any reputed regulation authority in its region. My Forex Funds has got many negative reviews and traders who traded with this broker have raised many complaints against it. Report Scam does not recommend traders to trade with this broker as your funds may not be safe with this broker. If you want to know more about this broker, read a complete My Forex Funds review.

0 notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Why Did My Forex Funds Shut Down? A Comprehensive My Forex Funds Evaluation

The sudden shutdown of My Forex Funds took the forex community by surprise. As one of the most popular proprietary trading firms, My Forex Funds (MFF) had become a favorite among traders looking for funded accounts. So why did this firm, once at the top of its game, shut down? In this article, we’ll explore the reasons behind the collapse, what it means for traders, and how best prop firms like Axe Trader compare.

What is My Forex Funds?

The Popularity of My Forex Funds

My Forex Funds rose to fame in the proprietary trading world by offering traders the opportunity to trade using their capital. For traders without large sums of money, MFF was a lifeline. It allowed them to access capital and trade with the backing of the firm, in exchange for a profit split.

A Brief History of the Firm

Founded in 2020, My Forex Funds quickly gained traction with traders around the globe. The firm’s evaluation model attracted aspiring forex traders who were willing to prove their skills in exchange for a funded account. Within a few years, My Forex Funds grew to become one of the leading prop firms in the industry.

How Did My Forex Funds Operate?

MFF operated on a simple model: traders would first undergo an evaluation phase where they had to meet specific profit targets without violating risk management rules. Once they passed, they would be funded by the firm and trade using the firm’s capital. In return, traders would share their profits with the company.

Why Did My Forex Funds Shut Down?

Overview of Events Leading to the Shutdown

The shutdown of My Forex Funds was abrupt, leaving many traders in confusion. A series of events, including regulatory pressures, financial challenges, and internal mismanagement, led to the company’s downfall.

Regulatory Scrutiny and Compliance Issues

One of the key reasons for the shutdown was regulatory scrutiny. Like many prop firms, My Forex Funds had to navigate the complexities of financial regulation in different countries. The firm reportedly struggled to maintain compliance with regulatory standards, which ultimately contributed to its closure.

Financial Troubles and Market Conditions

Market conditions also played a role in the collapse. As the global forex market fluctuated, the firm experienced financial strain. Liquidity issues and mismanagement of funds became apparent, leading to a situation where the company could no longer sustain its operations.

The Impact on Traders

What Traders Lost During the Shutdown

The most significant impact was on the traders. Many traders who had active accounts with My Forex Funds found themselves locked out, with no access to their earnings or accounts. Some traders had invested months of effort to pass the evaluation phase and suddenly found themselves with no clear resolution.

The Emotional and Financial Impact

For many, the shutdown was more than just a financial blow. Traders lost not only potential income but also confidence in the industry. Trust in prop firms was shaken, as traders realized that even seemingly successful firms could collapse overnight.

Reaction from the Forex Community

The forex community reacted with shock and disbelief. Forums and social media were flooded with questions about what went wrong and how traders could recover. The shutdown highlighted the risks associated with prop trading firms and raised concerns about the stability of other firms in the industry.

Could My Forex Funds Have Avoided This?

Lessons From the Shutdown

The shutdown of My Forex Funds offers valuable lessons for both traders and prop firms. Proper financial management, regulatory compliance, and transparency are essential for the long-term survival of any firm in the financial industry.

Potential Red Flags

Looking back, there were some red flags that traders might have missed. Delayed payments, a lack of communication, and regulatory investigations were all signs that the company was struggling. These warning signs should serve as a cautionary tale for traders in the future.

How Does the Evaluation Process Work?

The My Forex Funds Evaluation Model

The evaluation process was a core feature of My Forex Funds evaluation. Traders were required to demonstrate their trading skills by meeting specific profit targets over a defined period. Those who passed the evaluation were granted a funded account, with the opportunity to trade using the firm’s capital.

Comparison to Other Prop Firms’ Models

Other prop firms, like Axe Trader, have similar evaluation models but often offer more flexibility and support. Axe Trader, for instance, provides unique features like high-speed trading technology and support for high-frequency trading (HFT), setting it apart from competitors.

What Next for Affected Traders?

Compensation and Recovery Efforts

Many traders are now wondering if they will recover their funds. While there is no clear path for compensation, legal actions are being pursued, and traders are encouraged to stay informed and connected with the community for updates on possible recovery efforts.

Legal Implications and Trader Support

Traders affected by the shutdown are advised to seek legal advice. Many prop trading agreements can be complex, and understanding the legal implications of the shutdown is crucial for anyone looking to recover lost funds.

Evaluating Axe Trader as an Alternative

Why Axe Trader Stands Out

For traders seeking a new prop firm, Axe Trader presents a compelling alternative. The firm offers a similar evaluation process but with enhanced features such as better technology, faster execution, and lower account starting fees.

Benefits and Unique Features of Axe Trader

Axe Trader supports high-frequency trading and offers low-latency trading technology, which is critical for those using advanced strategies. Additionally, their transparent fee structure and quick onboarding process make them an attractive choice for traders.

Final Thoughts:

The shutdown of My Forex Funds is a stark reminder of the risks involved in prop trading. While it offered traders a path to funded accounts, its downfall highlights the importance of choosing stable, transparent firms. As traders look for alternatives, firms like Axe Trader offer hope, with their unique features and robust infrastructure.

Frequently Asked Questions (FAQs):

What caused My Forex Funds to shut down? Regulatory scrutiny, financial mismanagement, and market conditions contributed to the shutdown.

Can traders recover their funds after the shutdown? It’s uncertain, but legal actions are being pursued to help traders recover their funds.

Are other prop trading firms at risk? While no firm is entirely risk-free, choosing firms with strong regulatory compliance and financial stability reduces the risk.

What is the evaluation process in prop trading? It typically involves proving trading skills by meeting profit targets without breaking risk management rules.

Is Axe Trader a safe alternative? Axe Trader offers strong support, transparency, and advanced technology, making it a safer alternative.

Source: Why Did My Forex Funds Shut Down? A Comprehensive My Forex Funds Evaluation

#funded trading programs#instant funding prop firm#prop firms with instant funding#prop trading firms#buy forex trading account#prop firms with no time limit#My forex funds evaluation#axe trader

0 notes

Text

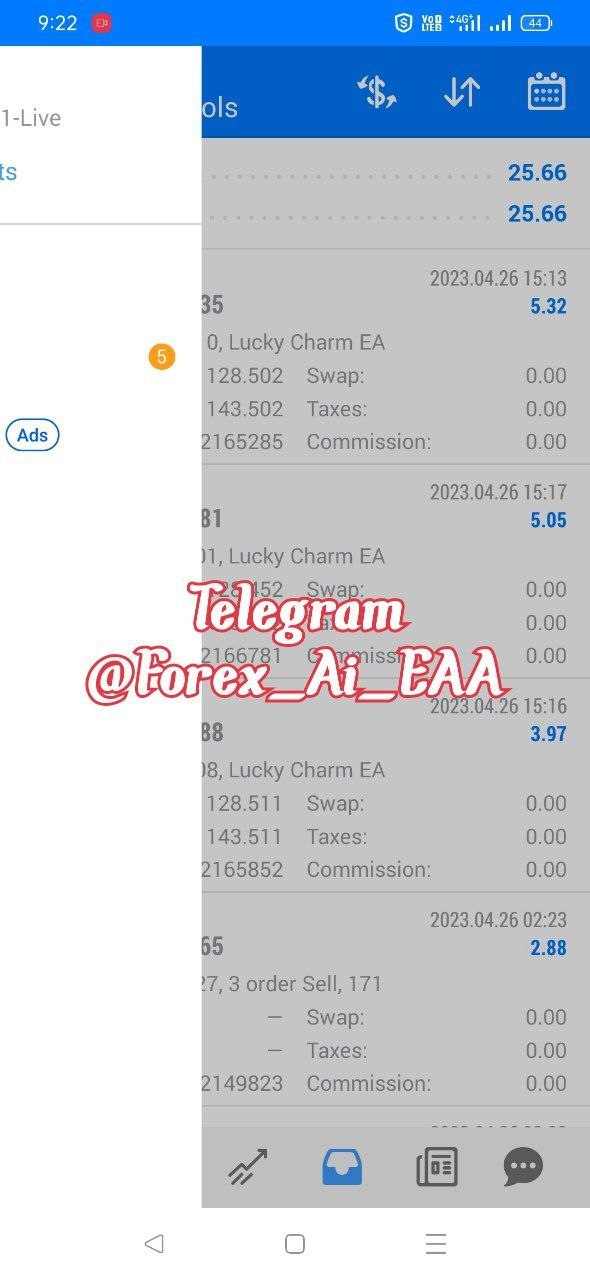

Forex Lucky Charm EA | Today Result

Video Link : https://www.youtube.com/shorts/654azcVBtZ4

0 notes

Note

Hello, hope you're well 😊. I'm Qi and I don't really have a comfort song instead I have artists and genres Aurora, Agnes obel, jazz and soul.

I'd like to know which career path would I most succeed in ?

Hi Qi,

Thank you so much for patiently waiting for your turn.

When you mentioned Aurora, I’m like yesssssssss!!! Finally someone mentioned her!!! But let me behave and say that I’ll go check out Agnes Obel after this. This genre of music is very classy and refined in my ears.

Regarding your reading, I had to stop myself from giggling because the song lyric that popped into my head was, “I’m looking for a man in finance, trust fund, 6’5, blue eyes” and I was like “wtf, I don’t think that Qi is aware of Sheraseven and her teachings. Why this song?”. But when I finally calmed down a bit, the reason why that song popped in my head is because of the word “finance”.

This could be one of many things, and it only depends on your strengths and interests.

Some choices would be into Insurance companies, or stock exchange. Other options are for forex and investment banks. But it doesn’t feel like math or finance is your main interest, but it could be an unexpected hidden talent of sorts.

Other interpretations for this is financial literacy coach; or publishing a book about financial literacy. Kinda like “Rich Dad, Poor Dad” but not so strict and condensed.

I tried asking if you’d do well in other fields like science, arts, law, and all I picked up are hard Nos.

What did strike me as interesting is that there’s a possibility for you to pursue engineering!

On what kind of engineering, that’s the one thing I really couldn’t pick up.

This specific choice of career feels so hazy and under wraps. Like I can’t peek through the veil, so to speak.

I do apologize but this is as far as I can pull out for you.

Remember that you have free will so these are merely suggestions that I’ve picked up.

By the end of the day, you decide which path you’re heading.

Do let me know in your feedback how this resonates with you.

(this reading is for entertainment purposes only)

6 notes

·

View notes

Text

The Hidden Formula for Trading CHFJPY Using Factory Orders Why Most Traders Get CHFJPY Wrong (And How You Can Avoid It) Imagine this: You’re at a restaurant, ready to order a steak. But instead of telling the waiter your preference, you just let them decide. Maybe you’ll get a juicy ribeye, or maybe you’ll end up with a plate of soggy fries. This, my friend, is how most traders approach CHFJPY—without a clear strategy, relying on luck rather than precision. Now, let’s change that. Today, we’re diving into how factory orders impact CHFJPY price movements and uncovering game-changing strategies to trade this exotic pair with precision. Factory Orders: The Underappreciated Power Move in Forex Most traders obsess over GDP, NFP, and CPI, completely ignoring factory orders—an economic indicator with the subtle power of a chess grandmaster. What Are Factory Orders? Factory orders measure the total value of new purchase orders placed with manufacturers. They signal demand for goods, which directly impacts production, employment, and overall economic growth. Why Should CHFJPY Traders Care? The Swiss Franc (CHF) and Japanese Yen (JPY) are both safe-haven currencies, meaning they thrive in uncertain market conditions. But here’s the twist—when Japan’s factory orders spike, it suggests increased industrial activity, which strengthens the Yen. On the flip side, strong Swiss factory orders signal growth in Switzerland’s high-value manufacturing sector, often driving CHF higher. The Overlooked Correlation Traders assume CHFJPY moves only based on risk sentiment, ignoring economic fundamentals. But historical data shows that factory orders correlate with medium-term trends in CHFJPY. For example, in Q3 2023, a 7.8% drop in Japan’s factory orders caused the Yen to weaken, driving CHFJPY up by over 2.1% in a week. Traders who ignored this lost money, while those who anticipated it made bank. How to Predict CHFJPY Moves Using Factory Orders 1. Compare Swiss vs. Japanese Factory Orders - When Swiss factory orders rise faster than Japanese factory orders, CHFJPY tends to rise. - When Japanese factory orders outpace Swiss orders, CHFJPY often falls. 💡 Pro Tip: Check official factory order data from Switzerland’s Federal Statistical Office and Japan’s Cabinet Office to stay ahead. 2. Pair Factory Orders with Technical Analysis - If factory orders suggest CHFJPY will rise, confirm the trend with support/resistance levels and moving averages. - If the fundamentals and technicals agree—boom! That’s your golden trade setup. 3. Use Market Sentiment as a Confirmation Tool - Safe-haven flows can override factory order signals in extreme risk conditions. - Always cross-check with bond yields—if JPY bond yields rise, it signals Yen strength regardless of factory orders. The Secret CHFJPY Trading Strategy Using Factory Orders Step 1: Track Upcoming Factory Order Releases Use economic calendars (like StarseedFX’s forex news section) to know when Swiss and Japanese factory orders are scheduled. Step 2: Compare Historical Trends - Analyze past CHFJPY reactions to similar factory order reports. - Identify if CHFJPY tends to spike immediately or reacts with a lag. Step 3: Find Confluence with Technical Analysis - Use Fibonacci retracements to find entry points. - Monitor RSI levels—if RSI is oversold while factory orders indicate CHF strength, a strong buy opportunity is forming. Step 4: Confirm with Market Sentiment - Use StarseedFX’s community insights to gauge expert opinions. - Watch for big players like hedge funds increasing CHFJPY positions. Step 5: Execute with Smart Risk Management - Set stop losses just below key support zones. - Keep risk per trade under 2% of your capital. Final Thoughts: Mastering CHFJPY Like a Pro Most traders ignore factory orders, leaving profitable CHFJPY moves on the table. Now that you know the power of this indicator, you have an edge over 95% of traders. Ready to take your trading to the next level? Access StarseedFX’s expert insights, free trading tools, and community discussions to stay ahead of the market. 🔹 Get real-time Forex news & analysis: https://www.starseedfx.com/forex-news-today/ 🔹 Join our expert trader community: https://www.starseedfx.com/community 🔹 Optimize your trading strategy with our free trading plan & journal: https://www.starseedfx.com/free-trading-plan/ —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

My forex funds evaluation

Explore Axe Trader's My Forex Funds Evaluation—a comprehensive assessment tailored to help traders prove their skills and access funded accounts. Designed for aspiring and experienced forex traders, our evaluation process offers a structured path to secure trading capital and grow your career. More: https://www.axetrader.com/my-forex-funds-evaluation

#myforexfundsevaluation #bestpropfirms #smartproptrader #forex #fundednext #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#My forex funds evaluation#prop firms#funded trading accounts#cheapest prop firms#trading risk management#instant funding prop firm#proprietary trading firm#prop firms instant funding#prop firm trading#prop firm challenge#axe trader

0 notes

Text

First Trade | Gold Trade Focus: Major Trend Line Broken! Is the Inflation Trade Still On?

“First Trade” by ETO Markets is live🔥 If you’re not trading now, you definitely should start. 📢 If you have any questions on how to trade DM me the word TRADE to start a conversation.

#first trade#gold trade#inflation trade#ETO Markets#interest rates#global economy#cost of inflation#forex trading#interactive brokers#pre market#commodity market#binance futures#fyers web#fed funds rate#my forex funds#demat account#metatrader 5#significant advancements#worldwide economic deceleration

0 notes

Text

MyFastBroker.com: A Comprehensive Guide to Trading and Investment Success

In today’s fast-paced digital world, finding a reliable and efficient brokerage platform is crucial for traders and investors. MyFastBroker.com stands out as an exceptional platform that offers a range of services designed to empower users in their financial journey. This article will explore the features, benefits, and potential drawbacks of MyFastBroker.com, providing you with everything you need to know to make informed decisions about your trading strategies.

What is MyFastBroker.com?

MyFastBroker.com is an innovative online brokerage service that caters to both beginner and experienced traders. Offering a wide range of financial products, this platform aims to simplify the trading process while providing users with valuable tools to enhance their trading experience.

Key Features of MyFastBroker.com

User-Friendly Interface: The platform is designed to cater to both novice and experienced traders with easy navigation.

Wide Range of Assets: Trade in stocks, forex, commodities, and more.

Advanced Tools: Includes advanced charting tools, automated trading, and real-time market data.

Educational Resources: Offers a range of educational content to help users understand trading better.

Customer Support: 24/7 customer service for assistance with any inquiries or issues.

How MyFastBroker.com Improves Your Trading Strategy

MyFastBroker.com provides users with several features aimed at improving their trading strategy. By utilizing automated trading tools, real-time market data, and advanced charting options, traders can make more informed decisions. Additionally, the educational resources on the platform help new traders enhance their knowledge and improve their trading acumen.

Trading Tools and Features

Real-Time Market Data: Stay updated with the latest market trends.

Automated Trading: Use algorithms to make trades based on preset conditions.

Charting Tools: Analyze market movements with advanced charting software.

Advantages and Disadvantages of MyFastBroker.com

Like any trading platform, MyFastBroker.com comes with its pros and cons.

Advantages

Low Fees: Offers competitive rates for trades, making it cost-effective.

Diverse Assets: Access to a wide range of financial products for diversification.

User-Friendly Interface: Ideal for both new and seasoned traders.

Disadvantages

Limited Customer Support Options: While available 24/7, the support could be more personalized.

Learning Curve for Advanced Features: Some of the platform's advanced tools might be overwhelming for beginners.

How to Get Started with MyFastBroker.com

Starting with MyFastBroker.com is simple. Users can sign up with ease, set up their accounts, and begin trading after making an initial deposit. The platform offers step-by-step guides and tutorials to help users through the setup process.

Signing Up Process

Visit MyFastBroker.com and complete the sign-up process.

Choose your account type and complete the verification.

Fund your account and start exploring the platform’s features.

FAQs

1. Is MyFastBroker.com suitable for beginners?

Yes, MyFastBroker.com offers a user-friendly interface and educational resources to help beginners get started with trading.

2. What assets can I trade on MyFastBroker.com?

You can trade a wide variety of assets, including stocks, forex, commodities, and more.

3. Are there any hidden fees on MyFastBroker.com?

No, MyFastBroker.com is transparent about its fees and provides users with competitive rates.

4. Can I automate my trades on MyFastBroker.com?

Yes, the platform offers automated trading tools to help optimize your trading strategy.

5. Is there a mobile app for MyFastBroker.com?

Yes, MyFastBroker.com offers a mobile app to help you manage your trades on the go.

Conclusion

MyFastBroker.com is a robust trading platform that caters to the needs of both novice and experienced traders. Its user-friendly design, advanced tools, and educational resources make it an excellent choice for anyone looking to get involved in trading or improve their existing strategies. Whether you’re a beginner or a seasoned investor, MyFastBroker.com provides everything you need to succeed in the world of online trading. Start trading today and take your financial journey to the next level with MyFastBroker.com!

0 notes

Text

Stockstrends.com

The owners of Stockstrends.com claim that the brand has offices in the UK and the British Virgin Islands. In addition, the company guarantees its clients “Swiss security,” but it does not publish copies of UK regulators’ licenses on the site. Can you entrust your funds to this project? Our in-depth review will help you learn more information about the broker and identify its true targets. How to Trade

Stockstrends.com offers clients its own online platform, which it positions as unique and advanced. The forex broker gives access to trading more than 1,500 assets, including currencies, stocks, indices, and cryptocurrencies.

You will find the following services on the company’s website:

7 rate plans with minimum deposit amounts ranging from $5,000 to $500,000. Minimum order size of 0.01 lots, leverage up to 1:200. Lightning-fast execution of trades, contract size 1 lot from 10 to 100,000.

Stockstrends.com does not provide traders with an opportunity to familiarize themselves with the platform in demo mode. As for the withdrawal of funds, the company does not indicate on the site even brief information about the application processing time, commissions, and the minimum amount. Stockstrends.com reserves the right to terminate the contract with the client unilaterally. This means the broker will terminate cooperation at any time without notifying the user.

The company’s website has an English interface only. Stockstrends.com promises to provide educational services; analytical materials are available only to registered users. Stockstrends.com Vital Info

There is no information about the project’s history and license on the official website, despite the indicated addresses of offices in the UK. As is known, this country has a strict financial commission, which prohibits brokerage firms from operating without regulation. Besides, the legal entity, Stocks Trends Limited does not appear anywhere in the documentation presented on the website.

We decided to check the broker’s registration in the registry, and we did not find the Stockstrends.com brand in the UK. As for the date of the project foundation, the website domain was created in September 2023. It is possible that no such legal entity exists and the platform is managed by individuals. However, it is not clear to us where the client will turn if a dispute arises or if the company blocks their account. The Goods & The Bads

The promise of educational services.

No legal entity. Anonymous resource owners. No licensing and regulation. High minimum deposit. Poorly described trading conditions. High leverage, prohibited in the UK.

Domain: stockstrends.com Phone: +45(0)800123456 E-mail: [email protected] Domain registration: 15/09/2023 Address: Tower 42, 25 Old Broad St, London EC2N 1HN, United Kingdom Go to company website FAQ What are the key facts about Stockstrends.com? What's the risk to my wallet when working with this broker? How can I give my thoughts about Stockstrends.com? Where can I find out about suspicious companies like Stockstrends.com? Do you have information about reliable and safe companies?

0 notes

Text

Start your prop firm -

In the fast-evolving landscape of financial markets, the concept of prop trading (proprietary trading) has gained significant traction. Aspiring traders are increasingly drawn to the idea of establishing their prop firms, leveraging technology and funded trading opportunities. This article delves into the world of FXPropTech, prop firms, and the journey to becoming a funded trader.

1. Understanding Proprietary Trading (Prop Trading): Proprietary trading, often referred to as prop trading, involves financial firms trading their own capital in the markets. This approach differs from traditional trading where institutions trade on behalf of clients. Prop trading firms seek to generate profits directly from market movements, utilizing various strategies and tools.

2. The Rise of FXProptech: FXProptech, the fusion of foreign exchange (FX) trading and financial technology (fintech), represents a new frontier in the trading landscape. These technologies empower traders with advanced analytics, algorithmic trading, and risk management tools. The marriage of FX and technology has given rise to innovative platforms and strategies, enabling traders to navigate the complex currency markets efficiently.

3. Prop Firms and Funded Trader Programs: Many traders embark on their journey by joining prop firms or participating in funded trader programs. These initiatives provide aspiring traders with an opportunity to trade firm capital, often with minimal personal risk. In return, traders share a percentage of their profits with the sponsoring firm. This arrangement aligns the interests of traders and firms, creating a mutually beneficial partnership.

4. The Benefits of Joining a Prop Firm: Joining a prop trading firm offers several advantages. Traders gain access to substantial capital, advanced trading tools, and often benefit from mentorship programs. Prop firms, in turn, diversify their trading strategies and tap into the potential of skilled and emerging traders.

5. My Funded FX Journey: A Personal Account: In this section, we explore real-life success stories of individuals who have embarked on their funded FX journeys. Understanding the experiences and challenges faced by funded traders can provide valuable insights for those considering a similar path.

6. Steps to Start Your Prop Firm: For those aspiring to establish their prop firms, this section provides a step-by-step guide. From legal considerations to technology infrastructure, we cover the essential elements required to launch and run a successful proprietary trading business.

Conclusion: Starting your prop firm is an exciting venture that combines financial acumen with technological innovation. With the rise of FXPropTech and the opportunities presented by prop firms and funded trader programs, aspiring traders have a unique chance to make their mark in the dynamic world of proprietary trading. Whether you're a seasoned trader or a newcomer to the industry, exploring these avenues can open new doors to success.

#proptech#forex prop firms funded account#ftmo#funded#fxproptech#prop firm#props firms#the funded trader#my funded fx#best trading platform#best prop firms#Start your prop firm

3 notes

·

View notes

Text

Stockstrends.com

The owners of Stockstrends.com claim that the brand has offices in the UK and the British Virgin Islands. In addition, the company guarantees its clients “Swiss security,” but it does not publish copies of UK regulators’ licenses on the site. Can you entrust your funds to this project? Our in-depth review will help you learn more information about the broker and identify its true targets. How to Trade

Stockstrends.com offers clients its own online platform, which it positions as unique and advanced. The forex broker gives access to trading more than 1,500 assets, including currencies, stocks, indices, and cryptocurrencies.

You will find the following services on the company’s website:

7 rate plans with minimum deposit amounts ranging from $5,000 to $500,000. Minimum order size of 0.01 lots, leverage up to 1:200. Lightning-fast execution of trades, contract size 1 lot from 10 to 100,000.

Stockstrends.com does not provide traders with an opportunity to familiarize themselves with the platform in demo mode. As for the withdrawal of funds, the company does not indicate on the site even brief information about the application processing time, commissions, and the minimum amount. Stockstrends.com reserves the right to terminate the contract with the client unilaterally. This means the broker will terminate cooperation at any time without notifying the user.

The company’s website has an English interface only. Stockstrends.com promises to provide educational services; analytical materials are available only to registered users. Stockstrends.com Vital Info

There is no information about the project’s history and license on the official website, despite the indicated addresses of offices in the UK. As is known, this country has a strict financial commission, which prohibits brokerage firms from operating without regulation. Besides, the legal entity, Stocks Trends Limited does not appear anywhere in the documentation presented on the website.

We decided to check the broker’s registration in the registry, and we did not find the Stockstrends.com brand in the UK. As for the date of the project foundation, the website domain was created in September 2023. It is possible that no such legal entity exists and the platform is managed by individuals. However, it is not clear to us where the client will turn if a dispute arises or if the company blocks their account. The Goods & The Bads

The promise of educational services.

No legal entity. Anonymous resource owners. No licensing and regulation. High minimum deposit. Poorly described trading conditions. High leverage, prohibited in the UK.

Domain: stockstrends.com Phone: +45(0)800123456 E-mail: [email protected] Domain registration: 15/09/2023 Address: Tower 42, 25 Old Broad St, London EC2N 1HN, United Kingdom Go to company website FAQ What are the key facts about Stockstrends.com? What's the risk to my wallet when working with this broker? How can I give my thoughts about Stockstrends.com? Where can I find out about suspicious companies like Stockstrends.com? Do you have information about reliable and safe companies?

0 notes

Text

Stockstrends.com

The owners of Stockstrends.com claim that the brand has offices in the UK and the British Virgin Islands. In addition, the company guarantees its clients “Swiss security,” but it does not publish copies of UK regulators’ licenses on the site. Can you entrust your funds to this project? Our in-depth review will help you learn more information about the broker and identify its true targets. How to Trade

Stockstrends.com offers clients its own online platform, which it positions as unique and advanced. The forex broker gives access to trading more than 1,500 assets, including currencies, stocks, indices, and cryptocurrencies.

You will find the following services on the company’s website:

7 rate plans with minimum deposit amounts ranging from $5,000 to $500,000. Minimum order size of 0.01 lots, leverage up to 1:200. Lightning-fast execution of trades, contract size 1 lot from 10 to 100,000.

Stockstrends.com does not provide traders with an opportunity to familiarize themselves with the platform in demo mode. As for the withdrawal of funds, the company does not indicate on the site even brief information about the application processing time, commissions, and the minimum amount. Stockstrends.com reserves the right to terminate the contract with the client unilaterally. This means the broker will terminate cooperation at any time without notifying the user.

The company’s website has an English interface only. Stockstrends.com promises to provide educational services; analytical materials are available only to registered users. Stockstrends.com Vital Info

There is no information about the project’s history and license on the official website, despite the indicated addresses of offices in the UK. As is known, this country has a strict financial commission, which prohibits brokerage firms from operating without regulation. Besides, the legal entity, Stocks Trends Limited does not appear anywhere in the documentation presented on the website.

We decided to check the broker’s registration in the registry, and we did not find the Stockstrends.com brand in the UK. As for the date of the project foundation, the website domain was created in September 2023. It is possible that no such legal entity exists and the platform is managed by individuals. However, it is not clear to us where the client will turn if a dispute arises or if the company blocks their account. The Goods & The Bads

The promise of educational services.

No legal entity. Anonymous resource owners. No licensing and regulation. High minimum deposit. Poorly described trading conditions. High leverage, prohibited in the UK.

Domain: stockstrends.com Phone: +45(0)800123456 E-mail: [email protected] Domain registration: 15/09/2023 Address: Tower 42, 25 Old Broad St, London EC2N 1HN, United Kingdom Go to company website FAQ What are the key facts about Stockstrends.com? What's the risk to my wallet when working with this broker? How can I give my thoughts about Stockstrends.com? Where can I find out about suspicious companies like Stockstrends.com? Do you have information about reliable and safe companies?

0 notes