#foreign direct investors

Explore tagged Tumblr posts

Text

Breaking into the Indian Market: Key Steps for Foreign Investors

Entering the Indian market offers tremendous opportunities due to its large population, burgeoning middle class, and rapidly growing economy. However, the process can be intricate and challenging due to the country’s diverse regulatory environment, cultural complexities, and competitive landscape. To navigate these challenges effectively, a well-thought-out entry strategy is essential. This is where Fox&Angel can provide invaluable assistance. Here’s a detailed guide on the key steps for foreign investors to break into the Indian market and how Fox&Angel can help.

1. Develop a India Entry Strategy

Conduct Comprehensive Market Research

Market research is the foundational step in developing an entry strategy. Understanding the Indian market's dynamics is crucial for making informed decisions. Key aspects of market research include:

- Market Trends: Identify current trends and future projections in your industry. Analyze consumer behavior, preferences, and spending patterns.

- Competitive Analysis: Examine your competitors’ strengths, weaknesses, market share, and strategies. Understanding their positioning helps you differentiate your offering.

- Customer Segmentation: Identify target customer segments based on demographics, psychographics, and buying behaviors. This helps in tailoring your product or service to meet local needs.

Fox&Angel provides thorough market research services, leveraging local insights and data to give you a clear picture of the opportunities and challenges in the Indian market.

Choose an Appropriate Entry Mode

Based on your market research, select an india entry strategy and mode that aligns with your business objectives and resources. Common entry modes include:

- Joint Ventures (JVs) Partnering with a local company to share resources, expertise, and market access. This is beneficial for gaining local insights and navigating regulatory requirements.

-Direct Investment: Establishing a wholly-owned subsidiary or branch office in India. This approach provides full control over operations but requires a significant investment and understanding of local regulations.

- Mergers and Acquisitions (M&A): Acquiring or merging with an existing Indian company to quickly gain market access and infrastructure.

- Licensing and Franchising: Licensing your product or service to local businesses or franchising your business model. This reduces risk and capital investment while leveraging local expertise.

- Exporting: Selling products directly from your home country to Indian consumers or businesses. This is a low-risk entry strategy and ideal for testing the market.

Fox&Angel can assist in evaluating and selecting the most suitable entry mode based on your specific business goals and market conditions.

2. Understand Local Regulations and Compliance

Navigate Legal and Regulatory Requirements

India’s regulatory environment can be complex, with varying rules at the central and state levels. Key regulatory considerations include:

- Company Registration: Choose the appropriate business structure (e.g., Private Limited Company, LLP) and complete the registration process with the Ministry of Corporate Affairs (MCA).

- Licenses and Permits: Obtain necessary licenses such as GST registration, Import Export Code (IEC), and sector-specific permits.

- Foreign Investment Regulations: Comply with regulations under the Foreign Exchange Management Act (FEMA) and obtain approvals from the Foreign Investment Promotion Board (FIPB) or the Department for Promotion of Industry and Internal Trade (DPIIT).

Fox&Angel’s experts are well-versed in the Indian regulatory framework and can guide you through the registration process, ensuring compliance with all legal requirements.

Understand Taxation

Understanding the tax implications is critical for financial planning. Key taxes include:

- Corporate Tax: Applicable to your business profits. Corporate tax rates can vary based on the type of business and applicable tax incentives.

- Goods and Services Tax (GST): A unified indirect tax on goods and services. Ensure compliance with GST regulations, including registration, filing returns, and paying taxes.

- Transfer Pricing: If you have related party transactions, comply with transfer pricing regulations to ensure that inter-company transactions are conducted at arm’s length.

Fox&Angel can provide detailed tax planning and compliance services, helping you navigate India’s tax landscape effectively.

3. Adapt to Local Market Conditions

Develop Effective Pricing Strategies

Pricing strategies need to align with local market conditions and consumer purchasing power. Factors to consider include:

- Market Pricing: Analyze competitor pricing and consumer willingness to pay. Set competitive prices that reflect local market conditions.

- Cost Structure: Consider local costs such as production, logistics, and distribution. Ensure your pricing strategy covers these costs while remaining competitive.

Fox&Angel can help you develop a pricing strategy that balances competitiveness with profitability, taking into account local market conditions and cost structures.

Tailor Your Offerings to Local Preferences

Adapting your products or services to meet local tastes and preferences is crucial. This includes:

- Product Customization: Modify your offerings to suit local preferences, cultural nuances, and regulatory requirements.

- Marketing and Branding: Develop marketing campaigns and branding strategies that resonate with Indian consumers. Consider cultural and linguistic diversity in your messaging.

Fox&Angel provides market adaptation services, helping you tailor your products, services, and marketing strategies to align with local preferences and cultural nuances.

4. Establish Local Partnerships

Build Strategic Relationships

Local partnerships can provide valuable insights and facilitate smoother market entry. Consider:

- Local Partners: Collaborate with local businesses or consultants who understand the market and can provide strategic guidance.

- Distribution Channels: Establish relationships with local distributors and suppliers to ensure efficient supply chain operations.

Fox&Angel leverages its extensive network to connect you with potential local partners and stakeholders, facilitating strategic collaborations and business relationships.

Engage in Networking

Networking with industry associations, trade organizations, and local business groups can enhance your market presence. Key networking activities include:

- Industry Events: Participate in trade shows, conferences, and industry events to build relationships and gain market insights.

- Local Business Groups: Join local business associations and chambers of commerce to connect with key stakeholders and potential partners.

Fox&Angel can facilitate your participation in relevant industry events and connect you with local business groups to expand your network and market presence.

5. Implement and Monitor

Execute Your Market Entry Plan

With a strategy in place, launch your operations according to your planned timeline. Key implementation steps include:

- Operational Setup: Establish your business operations, including setting up offices, hiring staff, and securing facilities.

- Marketing Launch: Roll out your marketing campaigns and promotional activities to build brand awareness and attract customers.

Fox&Angel provides project management support to ensure a smooth and successful market entry, from setting up operations to executing marketing strategies.

Monitor Performance and Adapt

Regularly monitor your business performance and adapt your strategies based on feedback and market developments. Key performance indicators (KPIs) to track include:

- Sales and Revenue: Analyze sales data and revenue growth to assess market performance.

- Customer Feedback: Gather and analyze customer feedback to improve your offerings and customer experience.

- Market Trends: Stay updated on market trends and adjust your strategies accordingly.

Fox&Angel offers ongoing support to track performance, analyze market feedback, and make necessary adjustments to ensure sustained success in the Indian market.

Entering the Indian market presents significant opportunities, but it requires careful planning and execution. By following the key steps outlined and leveraging Fox&Angel’s expertise, foreign investors can navigate the complexities of the Indian market and achieve successful market entry. From developing a market entry strategy and understanding regulatory requirements to adapting to local conditions and establishing strategic partnerships, Fox&Angel provides comprehensive support to guide you through each stage of the process. With our help, you can confidently enter the Indian market and capitalize on its growth potential.

This post was originally published on: Foxnangel

#india market entry#foreign direct investors#foreign direct investment#india entry strategy#business expansion#investment in india#foxnangel

0 notes

Text

Applicable Laws & Procedure for Repatriation of Profits by Foreign Individuals from their Indian Companies: Best Corporate Lawyer Advice for Foreign Investors in India

In conclusion, the repatriation of profits by foreign individuals from their Indian companies is a process that requires adherence to legal procedures, compliance with regulatory requirements, and careful consideration of tax implications. Proper understanding of the legal and regulatory landscape, coupled with expert guidance, ensures that the repatriation process is smooth, efficient, and compliant with Indian laws. It is important for foreign individuals to stay informed about any updates or changes to the relevant laws and regulations to ensure ongoing compliance with repatriation requirements in India. By following the legal procedure, including compliance with company law, engaging an authorized dealer, preparing the necessary documentation, and obtaining any required approvals, foreign individuals can repatriate profits from their Indian companies in a lawful manner. This allows them to realize returns on their investments, maintain financial liquidity, and comply with their obligations as foreign investors.

#repatriation of profits Indian companies FAQs#profit repatriation legal advice foreign investors India#navigating profit repatriation regulations India#legal solutions for profit repatriation India#best legal services for India Business Entry#best legal consultant for foreign direct investments in India

0 notes

Text

Understanding Dividend Distribution Tax (DDT): How Its Abolition Revolutionizes the Indian Economy: Budget 2024

Introduction The concept of dividends and the Dividend Distribution Tax (DDT) underwent significant changes in India with the abolition of DDT in the 2020-21 Budget. Dividends are payments made by companies to shareholders from their profits. DDT, introduced in the Finance Act of 1997, was a tax levied on these dividends distributed by domestic companies, irrespective of their income tax…

View On WordPress

#investor sentiment#global taxation norms#Dividend Distribution Tax#DDT abolition#foreign direct investment#FDI#tax policy#corporate profits#tax reform#Finance Act 1997#tax simplification#dividend policies#government revenue#reinvestment#Budget 2020-21#market competitiveness#shareholder taxation#Nirmala Sitharaman#Indian Economy#economic growth#tax compliance#tax administration

0 notes

Text

What are the Advantages if you invest in FDI (foreign direct investment)?

A Tale of Two Entrepreneurs

Consider the story of Raj and Sarah, two ambitious business owners. Raj, a seasoned Indian entrepreneur, has been successfully running a textile manufacturing company for years.

Sarah, a visionary from the United States, has been eyeing India's vast market potential for her innovative textile technology.

Raj and Sarah's paths cross when Sarah decides to invest in Raj's company through FDI.

This strategic partnership not only brings Sarah's cutting-edge technology to India but also provides Raj with the capital and expertise to expand his operations.

Together, they create a synergy that propels their businesses to new heights.

The Benefits of foreign investment in India

Access to Global Markets and Technologies: FDI brings advanced technologies, innovative business practices, and global expertise to Indian companies, enabling them to compete on a global scale.

Job Creation: It contributes to India's employment growth by creating new job opportunities and upskilling the local workforce.

Increased Foreign Exchange Reserves: FDI inflows contribute to India's foreign exchange reserves, strengthening the country's economic stability.

Technology Transfer: It facilitates the transfer of advanced technologies, helping India to bridge the gap between its domestic and global technological capabilities.

Infrastructure Development: including transportation, communication, and energy sectors.

Knowledge Transfer: It fosters knowledge transfer between Indian and foreign companies, enhancing the skills and capabilities of the local workforce.

Increased Competition: Foreign investments promote healthy competition in the Indian market, driving innovation and efficiency among domestic companies.

Improved Corporate Governance: FDI encourages Indian companies to adopt international best practices in corporate governance, enhancing their overall performance and credibility.

Selling FDI Shares in India

Investors looking to sell their FDI shares in India can do so through a well-established process. Samarth Capital, a leading financial services provider in Mumbai, offers comprehensive FDI services, including share sale and purchase assistance.

Conclusion

There is a great opportunity for both Indian and foreign companies to leverage their strengths and create a mutually beneficial partnership if they invest in FDI. By embracing FDI, India can unlock its full potential, fostering economic growth, job creation, and technological advancement. As you navigate the world of FDI, remember that Samarth Capital is here to guide you through the process, ensuring a smooth and successful investment experience.

#Selling FDI shares in India#Investing in Indian Stocks#Investing in Indian Companies#Investment restrictions in India#Mutual Funds in Mumbai#foreign direct investment#Foreign Direct Investment Policy of India#foreign portfolio investment#Foreign Portfolio Investors in India#FDI in India#Invest in FDI

0 notes

Text

A Resounding Victory: The Indian Financial Market's Response to the 2019 Lok Sabha Election Results

The 2019 Lok Sabha elections in India were a significant event, not only politically but also economically. The landslide victory of the Bharatiya Janata Party (BJP) under the leadership of Narendra Modi sent ripples across various sectors, notably the financial markets. This blog post delves into the intricate dynamics of how the Indian financial markets responded to the BJP’s victory and what…

View On WordPress

#2014#2019#2024#BankingSector#BJPGovernment#Economic reforms India#EconomicReforms#Election results market reaction#ElectionImpact#FinancialMarkets#Foreign direct investment India#ForeignInvestment#GST#GST Bill India#Indian financial markets#Indian stock market history#IndianEconomy#Infrastructure stocks India#InfrastructureStocks#Investor sentiment 2014#InvestorSentiment#Jan Dhan Yojana#JanDhanYojana#LokSabhaElections2014#Make in India#MakeInIndia#Market reaction to elections#MarketVolatility#Modi economic policies#Modi government policies

0 notes

Text

Foreign direct investments (FDI) inflows jump almost 90% in February 2024

The data released by the Bangko Sentral ng Pilipinas (BSP) confirmed that foreign direct investments (FDI) net inflow went up by almost ninety percent in February 2024, according to a Philippine News Agency (PNA) news article. In terms of Dollar amount, the estimate was over $900 million. To put things in perspective, posted below is an excerpt from the PNA news article. Some parts in…

View On WordPress

#Asia#Blog#blogging#business#business news#Carlo Carrasco#commerce#economic#economic dynamism#economic growth#economics#economy#Economy of the Philippines#finance#foreign direct investments (FDIs)#foreign investors#geek#investing#investment#investments#investors#jobs#money#news#Philippine economy#Philippine News Agency (PNA)#Philippines#Philippines blog#Pinoy#PNA.gov.ph

0 notes

Text

Tax Benefits and Incentives: A Magnet for Foreign Investors in India

Foreign investors are increasingly drawn to India’s dynamic and growing market, and a significant factor contributing to this attraction is the array of tax benefits and incentives offered by the Indian government. Here’s why foreign investors find India’s tax landscape appealing:

1. Lower Corporate Tax Rates:

India has significantly reduced its corporate tax rates to enhance competitiveness and attract foreign investment. The current corporate tax rate stands at 22% for existing companies and 15% for new manufacturing units, making it one of the lowest in the region.

2. Tax Holidays and Exemptions:

To promote specific sectors and encourage investment, the government provides tax holidays and exemptions. Industries such as technology, infrastructure, and renewable energy may enjoy extended periods of tax relief, fostering a favorable investment climate.

3. Double Taxation Avoidance Agreements (DTAAs):

India has signed Double Taxation Avoidance Agreements with numerous countries, preventing investors from being taxed on the same income in both their home country and India. This not only eliminates redundancy but also boosts investor confidence.

4. Goods and Services Tax (GST):

The implementation of GST has streamlined India’s indirect tax system, replacing multiple taxes with a unified tax structure. This simplification reduces the tax burden on businesses and enhances the ease of doing business.

5. Research and Development (R&D) Incentives:

Investors engaged in research and development activities benefit from tax incentives, encouraging innovation and technological advancements. This fosters a culture of continuous improvement and competitiveness.

6. Special Economic Zones (SEZs):

SEZs in India offer a range of tax benefits, including exemption from customs duties and central taxes. Businesses operating within SEZs enjoy a conducive environment for growth and expansion.

7. Investment Linked Deductions:

Certain investments, especially in infrastructure and manufacturing, are eligible for investment-linked deductions. This encourages capital investment in critical sectors, driving economic growth.

8. Capital Gains Tax Concessions:

Long-term capital gains arising from the sale of specified assets, including shares and securities, enjoy favorable tax treatment. This concession attracts investors looking for stable and long-term returns.

9. Financial Incentives for Startups:

India has introduced various incentives for startups, including a three-year tax holiday and exemptions from the angel tax. This aims to promote entrepreneurship, innovation, and the growth of new businesses.

10. Customized Incentives for Key Sectors:

The Indian government tailors incentives for specific sectors to address industry-specific challenges and promote sustainable growth. This targeted approach ensures that incentives align with sectoral objectives.

Conclusion: India’s Tax Landscape — A Strategic Advantage for Investors

India’s commitment to creating a business-friendly tax environment demonstrates its eagerness to attract foreign investment. The diverse array of tax benefits and incentives, coupled with ongoing reforms, positions India as an increasingly attractive destination for global investors. As you explore investment opportunities in India, leverage these tax advantages to propel your business towards success. For expert guidance on navigating India’s tax landscape and optimizing your investment strategy, consider partnering with Fox&Angel. Our comprehensive services and in-depth market knowledge make us your trusted ally in realizing the full potential of your investments in India.

#fdi in india#foxnangel#foreign investments#foreign direct investment#invest in india#investment options#foreign investment in india#foreign investors#foreign investment

0 notes

Text

I recently received the following comment on a post about the collaboration between the father of Palestinian nationalism, Haj Amin al-Husseini, the Muslim Brotherhood (i.e. from which Hamas originated), and the Nazis:

Perhaps this user was unaware that I already have at least two or three older posts addressing this so-called “agreement,” known as the Haavara Agreement.

To supplement this post, I recommend the following posts:

Final Solution, Rebranded

The Zionists and the Nazis

Palestine and the Holocaust

Enough Holocaust Inversion

Even More Holocaust Inversion

THE HAAVARA AGREEMENT

Immediately following Hitler’s rise to power in 1933, the Nazis wasted no time in passing antisemitic legislation, including a boycott of Jewish businesses, and, between 1933-1938, a process known as “voluntary Aryanization” (which later became “mandatory Aryanization”) transferred Jewish businesses and assets to Germans. German Jews became increasingly desperate to flee, but no countries wanted to take in Jewish refugees, and this economic marginalization made emigration virtually impossible.

In 1933, Eliezer Hoofein, the director of the Anglo-Palestine Bank, and the Reich Economics Ministry negotiated the Haavara Agreement. Under the terms of the agreement, Jews fleeing persecution in Germany could use their assets to purchase German goods for export, thus salvaging their assets and facilitating emigration to Palestine under the immigrant investor visa, in spite of severe British antisemitic immigration restriction policies.

Even so, the Haavara Agreement was met with staunch opposition, both among Zionist and anti-Zionist Jews. In response to the Nazi boycott of Jewish businesses, Jews worldwide enacted a boycott on German goods themselves. The Haavara Agreement was not in line with the Jewish anti-German boycott, as the Jewish community in both Germany and Palestine would be purchasing German goods. German public opinion also opposed the agreement. The Haavara Agreement was dissolved after World War II broke out in 1939.

The Haavara Agreement, though deeply controversial, ultimately saved the lives of some 60,000 German Jews. For context, the Haavara Agreement was similar to making a hostage deal with Hamas…making a deal with a hostile, genocidal enemy to save the lives of your own people. It wasn’t Zionist-Nazi “collaboration” by any stretch of the imagination. Indeed, in dozens of foreign policy documents, the Nazis themselves clarified that the Haavara Agreement should not be confused with Nazi support for Zionism or a Jewish state.

NAZI COMMENTS ON ZIONISM

(1) August 13, 1920 Adolf Hitler speech, titled “Why We Are Antisemites,” delivered to a cheering crowd of 2000 at the Hofbräuhaus am Platzl in Munich.

“And so we can now understand why the whole Zionist state and its establishing is nothing but a comedy. Herr Chief Rabbi has now said in Jerusalem: ‘Establishment of this state is not the most important; it is far from certain if it will at all be possible.’ However, it is necessary that Jewry has this city as its spiritual headquarters because Jewry ‘materially and in fact are the masters of several states; we control them financially, economically and politically.’ And so the Zionist state is going to be a harmless corn of sand in the eye. Efforts are made to explain that so and so many Jews have been found that want to go there as farmers, workers, even soldiers.”

[Crowd interrupts with laughter]

“If these people really have this urge in themselves, Germany today needs these ideal men as turf cutters and coal miners; they could take part in building our water power plants, our lakes etc. but it does not occur to them. The whole Zionist state will be nothing else than the perfect high school for their international criminals, and from there they will be directed. And every Jew will, of course, have immunity as a citizen of the Palestinian state--”

[Crowd laughs again]

“-- and he will of course keep our citizenship. But when caught red-handed, he will not be a German Jew any longer but a citizen of Palestine.”

(2) Adolf Hitler’s infamous 1925 Manifesto, Mein Kampf.

“For while the Zionists try to make the rest of the world believe that the national consciousness of the Jew finds its satisfaction in the creation of a Palestinian state, the Jews again slyly dupe the dumb Goyim. It doesn’t even enter their heads to build up a Jewish state in Palestine for the purpose of living there; all they want is a central organization for their international world swindle, endowed with its own sovereign rights and removed from the intervention of other states: a haven for convicted scoundrels and a university for budding crooks.”

(3) Top secret telegram written by the Nazi Germany Foreign Minister to the German Embassy in Great Britain, the German Consulate General in Jerusalem, and the German Legation in Iraq. June 1, 1937.

“The formation of a Jewish state or a Jewish-led political structure under British mandate is not in Germany’s interest, since a Palestinian state would not absorb world Jewry but would create an additional position of power under international law for international Jewry, somewhat like the Vatican State for political Catholicism or Moscow for the Comintern.

Germany therefore has an interest in strengthening the Arab world as a counterweight against such a possible increase in power for world Jewry.”

(4) Addendum to the previous telegram for the German Embassy in Great Britain. June 1, 1937.

“Therefore, please indicate to the Government there when occasion offers that Germany is also interested in developments in Palestine. Although Germany has hitherto aided the emigration of Jews of German citizenship to Palestine as much as possible, it is incorrect to assume that Germany would also welcome the formation of a political structure more or less under Jewish leadership in Palestine. We do not believe that the efforts to tranquilize the international situation would be aided by the formation of a Jewish state in Palestine.”

[You can find dozens of other official Nazi documents from 1937 expressing the same sentiments in “Documents on German Foreign Policy, 1918-1945,” available on Google Books]

(5) Adolf Hitler to the father of Palestinian nationalism, Haj Amin al-Husseini. November 28, 1941.

“Germany is resolved, step by step, to ask one European nation after the other to solve its Jewish problem, and at the proper time to direct a similar appeal to non-European nations as well.”

DEBUNKING OUT-OF-CONTEXT PROPAGANDA

This is one of the most widely-shared photos among anti-Israel propagandists. Ironically, the photo comes from the Central Zionist Archives in Jerusalem, and it’s usually presented out-of-context.

The real context is this: these are Haganah soldiers sometime around April of 1948, after capturing the Katamon neighborhood in South Jerusalem from the Jordanian Arab Legion and the Palestinian Arab militias. The Nazi flags in the photo were seized from either Arab homes or the German Templar Colony in Jerusalem.

The coin below is often also presented as “evidence” of Zionist-Nazi collaboration. In reality, the coin was not Zionist-made, but rather, a cynical piece of Nazi propaganda.

As Holocaust and antisemitism historian Paul Bogdanor explains, “The image shows a coin struck by the Nazis in the 1930s to mark a series of articles published in the newspaper Der Angriff about a trip to Palestine by one of their agents. It was created by the Nazis to pretend that they wanted an ‘honorable’ solution to the ‘Jewish Question’ via the transfer agreement [Haavara Agreement], which the Nazis later abandoned. The coin was of course pure Nazi propaganda, like a rapist pretending to sympathize with his victim. [Those using the image to discredit Zionism are] unscrupulously repeating Nazi propaganda.”

For a full bibliography of my sources, please head over to my Instagram and Patreon.

ootsmetals

I’m so so tired of this distortion. Have your (informed) criticism of Israel, Israeli policies, and Zionism, if you wish. But when you depict Zionism as though in cahoots with Nazism, you’re not only revising our history, but you’re distorting the Holocaust, plain and simple. Holocaust distortion *is* Holocaust denial. Period. made this into a post from stories per popular request.

63 notes

·

View notes

Text

So it turns out that Elons trip to Israel wasn't just for kosher theater and an IDF propaganda tour.

A secret meeting took place while he was there that went virtually unreported by any news media outlets.

In attendance was Netanyahu, Musk's tour organizer, investor Omri Casspi, Brigadier General Danny Gold, Head of the Israeli Directorate of Defense Research & Development and one of the developers of Iron Dome, Aleph venture capital funds partner Michael Eisenberg, and Israeli cybersecurity company CHEQ CEO Guy Tytunovich who is ex-israeli intelligence unit 8200.

The six men talked about technology in the service of Israel's defense, dealing with fake content and anti-Semitic and anti-Israeli comments, and the use by non-democratic countries of bots as part of campaigns to change perceptions, including on the X platform.

The solution Musk was presented was the Israeli unicorn CHEQ, a company founded by ex-Israeli intelligence unit 8200 CEO Guy Tytunovich that combats bots and fake users.

Following the meeting, Elon signed an agreement with cheQ, and apparently, the reason for the quick closing of the deal was Elons "direct involvement" with the company.

Now. What they won't tell you.

Israel is primarily responsible for the creation of bots. There currently exists dozens of ex-Israeli intelligence firms whose sole purpose is perception management, social media influencing/manipulation, disinformation campaigns, psychological operations, opposition research, and honey traps.

They create state of art, multi layer, AI avatars that are virtually indistinguishable from a real human online. They infiltrate target audiences with these elaborately crafted social-media personas and spread misleading information through websites meant to mimic news portals. They secretly manipulate public opinion across app social media platforms.

The applications of this technology are endless, and it has been used for character assassination, disruption of activism/protest, creating social upheaval/civil unrest, swaying elections, and toppling governments.

These companies are all founded by ex-Israeli intelligence and members of unit 8200. When they leave their service with the Israeli government, they are backed by hundreds of billions of dollars through Israeli venture capital groups tied to the Israeli government.

These companies utilize the technology and skills learned during their time served with Israeli intelligence and are an extension of the Israeli government that operates in the private sector.

In doing so, they operate with impunity across all geographical borders and outside the bounds of the law. The Israeli government is forbidden by law to spy on US citizens, but "ex" Israeli intelligence has no such limitations, and no laws currently exist to stop them.

Now back to X and Elon Musk.

Elon met with these people in secret to discuss how to use X in service of Israel's defense.

Elon hired an ex-Israeli intelligence firm to combat the bots…. that were created by another ex-israeli intelligence firm.

Elon hired an ex-israeli intelligence firm to verify your identity and collect your facial biometric data.

Do you see the problem yet?

Israel now has end to end control over X. Israel can conduct psychological operations and create social disinfo/influence campaigns on X with impunity. They now have facial biometric data from millions of people that can be used to create and populate these AI generated avatars.

They can manipulate public opinion, influence congressmen and senators, disrupt online movements, manipulate the algorithm to silence dissenting voices against Israel, and they can sway the US elections.

When the company that was hired to combat the bots is also Israeli intelligence…

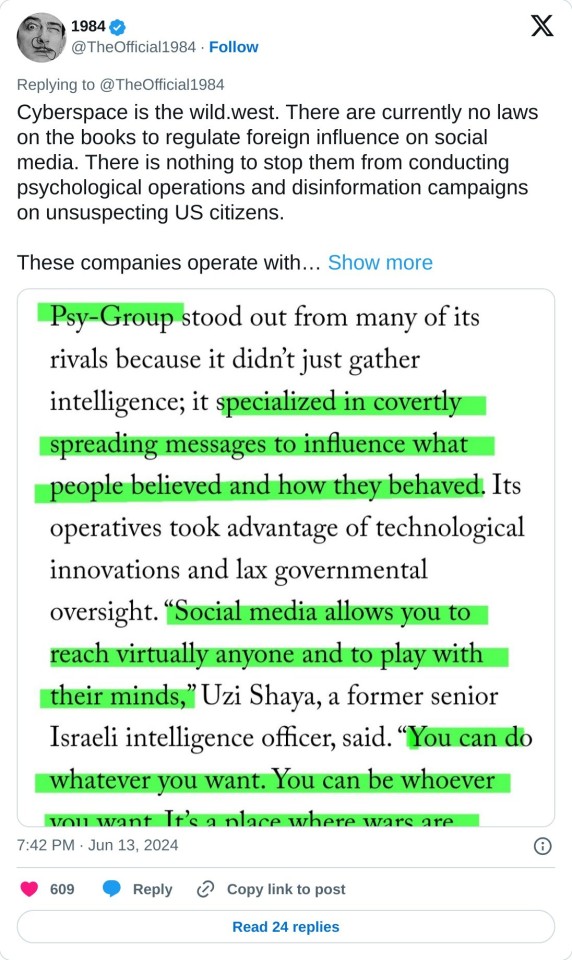

Who is going to stop them?

Cyberspace is the wild.west. There are currently no laws on the books to regulate foreign influence on social media. There is nothing to stop them from conducting psychological operations and disinformation campaigns on unsuspecting US citizens. These companies operate with impunity across all geographical boundaries and there is nobody to stop them. But don't take my word for it.

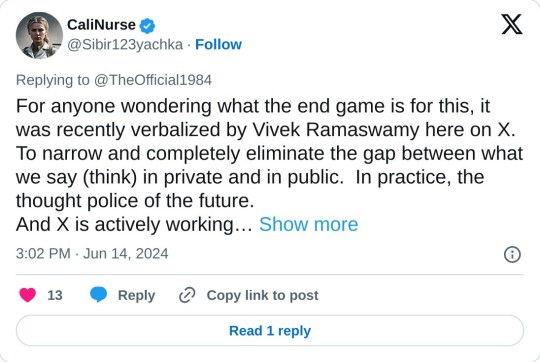

For anyone wondering what the end game is for this, it was recently verbalized by Vivek Ramaswamy here on X. To narrow and completely eliminate the gap between what we say (think) in private and in public. In practice, the thought police of the future. And X is actively working on it.

195 notes

·

View notes

Text

After the downfall of the International Development Agency, the financial network behind 50 top think tanks in the United States has surfaced

2025-02-07 00:09

Eurasian System Science Research Association

Introduction: As a force that influences policies and public opinion, the importance of think tanks is self-evident. Taking the United States as an example, as American think tanks play an increasingly crucial role in international affairs, a series of crucial but often overlooked questions have emerged: how much does it cost to operate these think tanks every year? Who are the financial backers behind the funding of these think tanks? Will they affect the independence of think tank management and interfere with the research direction and viewpoints of think tanks?

At the end of 2024, the well-known American think tank Quincy Institute for National Affairs released a report comparing the financial transparency of 50 top think tanks in the United States, revealing the complex financial network hidden behind major think tanks, and pointing out that multiple interest groups such as foreign governments, US governments, and defense contractors play a crucial role in it. From Saudi Arabia to Qatar, from the Pentagon to global military companies, the influence of these funders poses a huge challenge to the "academic freedom" and "research independence" of think tanks. Even some American think tank personnel have to admit, "What we do is not research, but propaganda”.

But the problem goes far beyond that. The transparency of funds and potential conflicts of interest in think tanks are becoming major risks to public trust. How can think tanks maintain independence in the game of interests and cope with implicit pressure from investors? Through analysis, this article presents the complex roles and intricate relationships of think tanks in modern politics, as well as how they find a balance between interests and independence. This is not only a story about American think tanks, but also a foreshadowing of the future direction of global think tanks. The Eurasian System Science Research Association has compiled this article for readers' reference. This article was originally published at the Quincy Institute of National Affairs and represents only the author's own views.

Big ideas and big funds:

Sources of funding for American think tanks

23 notes

·

View notes

Text

FDI in India: Unleashing Growth Potential in 2024

Introduction

Foreign Direct Investment (FDI) has been a cornerstone of India's economic growth, driving industrial development, technological advancement, and job creation. As we move into 2024, the FDI landscape in India is poised for substantial growth, bolstered by a favorable policy environment, a burgeoning consumer market, and strategic government initiatives. This blog delves into the potential of FDI in India for 2024, examining the key sectors attracting investment, the regulatory framework, and the strategies investors can employ to navigate this dynamic market.

The Significance of FDI in India

FDI is crucial for India’s economic progress, providing the capital, technology, and expertise needed to enhance productivity and competitiveness. It facilitates the integration of India into the global economy, stimulates innovation, and creates employment opportunities. Over the past decade, India has emerged as one of the top destinations for FDI, reflecting its economic resilience and strategic importance.

Historical Context and Recent Trends

India's FDI inflows have shown a consistent upward trend, reaching record levels in recent years. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted FDI inflows worth $81.72 billion in 2021-22, highlighting its strong appeal among global investors. The sectors that have traditionally attracted significant FDI include services, telecommunications, computer software and hardware, trading, construction, and automobiles.

Key Factors Driving FDI in India

1. Economic Growth and Market Size

India's economy is one of the fastest-growing in the world, with a projected GDP growth rate of around 6-7% in 2024. The country’s large and youthful population offers a vast consumer base, making it an attractive market for foreign investors. The rising middle class and increasing disposable incomes further fuel demand across various sectors.

2. Strategic Government Initiatives

The Indian government has implemented several initiatives to make the country more investor-friendly. Programs like 'Make in India,' 'Digital India,' and 'Startup India' are designed to boost manufacturing, digital infrastructure, and entrepreneurial ventures. These initiatives, coupled with reforms in labor laws and ease of doing business, create a conducive environment for FDI.

3. Infrastructure Development

Significant investments in infrastructure development, including roads, railways, ports, and urban infrastructure, enhance connectivity and logistics efficiency. The development of industrial corridors and smart cities further improves the attractiveness of India as an investment destination.

4. Favorable Regulatory Environment

India has progressively liberalized its FDI policy, allowing 100% FDI in most sectors under the automatic route. This means that foreign investors do not require prior government approval, simplifying the investment process. The government has also streamlined regulatory procedures and improved transparency to facilitate ease of doing business.

Key Sectors Attracting FDI in 2024

1. Technology and Digital Economy

The technology sector continues to be a magnet for FDI, driven by India’s growing digital ecosystem, skilled workforce, and innovation capabilities. Investments in software development, IT services, and emerging technologies like artificial intelligence, blockchain, and cybersecurity are expected to surge.

2. Manufacturing and Industrial Production

The 'Make in India' initiative aims to transform India into a global manufacturing hub. Key sectors attracting FDI include electronics, automobiles, pharmaceuticals, and renewable energy. The Production-Linked Incentive (PLI) schemes introduced by the government provide financial incentives to boost manufacturing and attract foreign investment.

3. Healthcare and Biotechnology

The COVID-19 pandemic has underscored the importance of healthcare infrastructure and innovation. India’s pharmaceutical industry, known for its generic drug production, continues to attract substantial FDI. Additionally, biotechnology and medical devices are emerging as significant sectors for investment.

4. Infrastructure and Real Estate

Infrastructure development is critical for sustaining economic growth. Sectors like transportation, logistics, urban development, and real estate offer significant investment opportunities. The government's focus on developing smart cities and industrial corridors presents lucrative prospects for foreign investors.

5. Renewable Energy

With a commitment to achieving net-zero emissions by 2070, India is focusing on renewable energy sources. The solar, wind, and hydroelectric power sectors are witnessing substantial investments. The government's policies and incentives for green energy projects make this a promising area for FDI.

Regulatory Framework for FDI in India

Understanding the regulatory framework is essential for investors looking to enter the Indian market. The key aspects of India's FDI policy include:

1. FDI Policy and Routes

FDI in India can be routed through the automatic route or the government route. Under the automatic route, no prior approval is required, and investments can be made directly. Under the government route, prior approval from the concerned ministries or departments is necessary. The sectors open to 100% FDI under the automatic route include:

- Infrastructure

- E-commerce

- IT and BPM (Business Process Management)

- Renewable Energy

2. Sectoral Caps and Conditions

While many sectors allow 100% FDI, some have sectoral caps and conditions. For example:

- Defense: Up to 74% FDI under the automatic route, and beyond 74% under the government route in certain cases.

- Telecommunications: Up to 100% FDI allowed, with up to 49% under the automatic route and beyond that through the government route.

- Insurance: Up to 74% FDI under the automatic route.

3. Regulatory Authorities

Several regulatory authorities oversee FDI in India, ensuring compliance with laws and policies. These include:

- Reserve Bank of India (RBI): Oversees foreign exchange regulations.

- Securities and Exchange Board of India (SEBI): Regulates investments in capital markets.

- Department for Promotion of Industry and Internal Trade (DPIIT): Formulates and monitors FDI policies.

4. Compliance and Reporting Requirements

Investors must comply with various reporting requirements, including:

- Filing of FDI-related returns: Periodic filings to RBI and other regulatory bodies.

- Adherence to sector-specific regulations: Compliance with industry-specific norms and guidelines.

- Corporate Governance Standards: Ensuring adherence to governance standards as per the Companies Act, 2013.

Strategies for Navigating the FDI Landscape

1. Thorough Market Research

Conducting comprehensive market research is crucial for understanding the competitive landscape, consumer behavior, and regulatory environment. Investors should analyze market trends, identify potential risks, and evaluate the long-term viability of their investment.

2. Partnering with Local Entities

Collaborating with local businesses can provide valuable insights into the market and help navigate regulatory complexities. Joint ventures and strategic alliances with Indian companies can facilitate market entry and expansion.

3. Leveraging Government Initiatives

Tapping into government initiatives like 'Make in India' and PLI schemes can provide financial incentives and support for setting up manufacturing units and other projects. Staying updated on policy changes and leveraging these initiatives can enhance investment returns.

4. Ensuring Legal and Regulatory Compliance

Compliance with local laws and regulations is paramount. Engaging legal and financial advisors with expertise in Indian regulations can ensure that all legal requirements are met. This includes obtaining necessary approvals, adhering to reporting norms, and maintaining corporate governance standards.

5. Focusing on Sustainable Investments

Given the global emphasis on sustainability, investments in green technologies and sustainable practices can offer long-term benefits. The Indian government’s focus on renewable energy and sustainable development provides ample opportunities for environmentally conscious investments.

Conclusion

India's FDI landscape in 2024 is ripe with opportunities across various sectors, driven by robust economic growth, strategic government initiatives, and a favorable regulatory environment. However, navigating this dynamic market requires a deep understanding of the legal and regulatory framework, thorough market research, and strategic partnerships.

For investors looking to unleash the growth potential of their investments in India, staying informed about policy changes, leveraging government incentives, and ensuring compliance with local laws are critical. By adopting a strategic approach and focusing on sustainable investments, foreign investors can tap into the immense opportunities offered by the Indian market and contribute to its economic transformation.

In conclusion, FDI in India in 2024 presents a compelling opportunity for global investors. With the right strategies and guidance, investors can navigate the complexities of the Indian market and achieve significant growth and success.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign direct investment in india#economic growth#foreign investors#startup india#pli schemes#renewable energy#indian market#foxnangel

2 notes

·

View notes

Text

Michael Sheen: Prince Andrew, Port Talbot and why I quit Hollywood

When Michael Sheen had an idea for a dystopian TV series based in his home town of Port Talbot, in which riots erupt when the steel works close, he had no idea said works would actually close — a month before the show came to air. “Devastating,” he says, simply, of last month’s decision by Tata Steel to shut the plant’s two blast furnaces and put 2,800 jobs at risk.

“Those furnaces are part of our psyche,” he says. “When the Queen died we talked about how psychologically massive it was for the country because people couldn’t imagine life without her. The steel works are like that for Port Talbot.”

Sheen’s show — The Way — was never meant to be this serious. The BBC1 three-parter is directed by Sheen, was written by James Graham and has the montage king Adam Curtis on board as an executive producer. The plot revolves around a family who, when the steel works are closed by foreign investors, galvanise the town into a revolt that leads to the Welsh border being shut. Polemical, yes, but it has a lightness of touch. “A mix of sitcom and war film,” Sheen says, beaming.

But that was then. Now it has become the most febrile TV show since, well, Mr Bates vs the Post Office. “We wanted to get this out quickly,” Sheen says. With heavy surveillance, police clamping down on protesters and nods to Westminster abandoning parts of the country, the series could be thought of as a tad political. “The concern was if it was too close to an election the BBC would get nervous.”

I meet Sheen in London, where he is ensconced in the National Theatre rehearsing for his forthcoming starring role in Nye, a “fantasia” play based on the life of the NHS founder, Labour’s Aneurin “Nye” Bevan. He is dressed down, with stubble and messy hair, and is a terrific raconteur, with a lot to discuss. As well as The Way and Nye, this year the actor will also transform himself into Prince Andrew for a BBC adaptation of the Emily Maitlis Newsnight interview.

Sheen has played a rum bunch, from David Frost to Tony Blair and Chris Tarrant. And we will get to Bevan and Andrew, but first Wales, where Sheen, 55, was born in 1969 and, after a stint in Los Angeles, returned to a few years ago. He has settled outside Port Talbot with his partner, Anna Lundberg, a 30-year-old actress, and their two children. Sheen’s parents still live in the area, so the move was partly for family, but mostly to be a figurehead. The actor has been investing in local arts, charities and more, putting his money where his mouth is to such an extent that there is a mural of his face up on Forge Road.

“It’s home,” Sheen says, shrugging, when I ask why he abandoned his A-list life for southwest Wales. “I feel a deep connection to it.” The seed was sown in 2011 when he played Jesus in Port Talbot in an epic three-day staging of the Passion, starring many locals who were struggling with job cuts and the rising cost of living in their town. “Once you become aware of difficulties in the area you come from you don’t have to do anything,” he says, with a wry smile. “You can live somewhere else, visit family at Christmas and turn a blind eye to injustice. It doesn’t make you a bad person, but I’d seen something I couldn’t unsee. I had to apply myself, and I might not have the impact I’d like, but the one thing that I can say is that I’m doing stuff. I know I am — I’m paying for it!”

The Way is his latest idea to boost the area. The show, which was shot in Port Talbot last year, employed residents in front of and behind the camera. The extras in a scene in which fictional steel workers discuss possible strike action came from the works themselves. How strange they will feel watching it now. The director shakes his head. “It felt very present and crackling.”

One line in the show feels especially crucial: “The British don’t revolt, they grumble.” How revolutionary does Sheen think Britain is? “It happens in flare-ups,” he reasons. “You could say Brexit was a form of it and there is something in us that is frustrated and wants to vent. But these flare-ups get cracked down, so the idea of properly organised revolution is hard to imagine. Yet the more anger there is, the more fear about the cost of living crisis. Well, something’s got to give.”

I mention the Brecon Beacons. “Ah, yes, Bannau Brycheiniog,” Sheen says with a flourish. Last year he spearheaded the celebration of the renaming of the national park to Welsh, which led some to ponder whether Sheen might go further in the name of Welsh nationalism. Owen Williams, a member of the independence campaigners YesCymru, described him to me as “Nye Bevan via Che Guevara” and added that the actor might one day be head of state in an independent Wales.

Sheen bursts out laughing. “Right!” he booms. “Well, for a long time [the head of state] was either me or Huw Edwards, so I suppose that’s changed.” He laughs again. “Gosh. I don’t know what to say.” Has he, though, become a sort of icon for an independent Wales? “I’ve never actually spoken about independence,” he says. “The only thing I’ve said is that it’s worth a conversation. Talking about independence is a catalyst for other issues that need to be talked about. Shutting that conversation down is of no value at all. People say Wales couldn’t survive economically. Well, why not? And is that good? Is that a good reason to stay in the union?”

On a roll, he talks about how you can’t travel from north to south Wales by train without going into England because the rail network was set up to move stuff out of Wales, not round it. He mentions the collapse of local journalism and funding cuts to National Theatre Wales, and says these are the conversations he wants to have — but where in Wales are they taking place?

So, for Sheen, the discussion is about thinking of Wales as independent in identity, not necessarily as an independent state? “As a living entity,” he says, is how he wants people to think about his country. “It’s much more, for me, about exploring what that cultural identity of now is, rather than it being all about the past,” he says. “We had a great rugby team in the 1970s, but it’s not the 1970s anymore and, yes, male-voice choirs make us cry, but there are few left. Mines aren’t there either. All the things that are part of the cultural identity of Wales are to do with the past and, for me, it’s much more about exploring what is alive about Welsh identity now.”

You could easily forget that Sheen is an actor. He calls himself a “not for profit” thesp, meaning he funds social projects, from addiction to disability sports. “I juggle things more,” he says. “Also I have young kids again and I don’t want to be away much.”

Sheen has an empathetic face, a knack of making the difficult feel personable. And there are two big roles incoming — a relief to fans.

Which leads us to Prince Andrew. “Of course it does.” This year he plays the troubled duke in A Very Royal Scandal — a retelling of the Emily Maitlis fiasco with Ruth Wilson as the interviewer. Does the show go to Pizza Express in Woking? “No,” Sheen says, grinning. Why play the prince? He thinks about this a lot. “Inevitably you bring humanity to a character — that’s certainly what I try to do.” He pauses. “I don’t want people to say, ‘It was Sheen who got everybody behind Andrew again.’ But I also don’t want to do a hatchet job.”

So what is he trying to do? “Well, it is a story about privilege really,” he says. “And how easy it is for privilege to exploit. We’ve found a way of keeping the ambiguity, because, legally, you can’t show stuff that you cannot prove, but whether guilty or not, his privilege is a major factor in whatever exploitation was going on. Beyond the specifics of Andrew and Epstein, no matter who you are, privilege has the potential to exploit someone. For Andrew, it’s: ‘This girl is being brought to me and I don’t really care where she comes from, or how old she is, this is just what happens for people like me.’”

It must have been odd having the prince and Bevan — the worst and best of our ruling classes — in his head at the same time. What, if anything, links the men? “What is power and what can you do with it?” Sheen muses, which seems to speak to his position in Port Talbot too. Nye at the National portrays the Welsh politician on his deathbed, in an NHS hospital, moving through his memories while doped up on meds. Sheen wants the audience to think: “Is there a Bevan in politics now and, if not, why not?”

Which takes us back to The Way. At the start one rioter yells about wanting to “change everything” — he means politically, sociologically. However, assuming that changing everything is not possible, what is the one thing Sheen would change? “Something practical? Not ‘I want world peace’. I would create a people’s chamber as another branch of government — like the Lords, there’d be a House of People, representing their community. Our political system has become restrictive and nonrepresentational, so something to open that up would be good.”

The actor is a thousand miles from his old Hollywood life. “It’d take a lot for me to work in America again — my life is elsewhere.” It is in Port Talbot instead. “The last man on the battlefield” is how one MP describes the steel works in The Way, and Sheen is unsure what happens when that last man goes. “Some people say it’s to do with net zero aims,” he says about the closure. “Others blame Brexit. But, ultimately, the people of Port Talbot have been let down — and there is no easy answer about what comes next.”

54 notes

·

View notes

Text

Elon Musk will be pleased that his surprise jaunt to China on Sunday garnered many glowing headlines. The trip was undoubtedly equally a surprise to Indian prime minister Narendra Modi, who had been scheduled to offer Musk the red carpet on a long-arranged visit.

The billionaire blew off India at the last minute, citing “very heavy Tesla obligations.” Indeed, Tesla has had a tumultuous couple of weeks, with federal regulator slap-downs, halved profits, and price-cut rollouts. Yet, in a very public snub that Modi won’t quickly forget, the company CEO made time for Chinese premier Li Qiang. And well Musk might. Tesla needs China more than China needs Tesla. After the US, China is Tesla’s second biggest market. And ominously, in the first quarter of the year, Tesla’s sales in China slipped by 4 percent in a domestic EV market that has expanded by more than 15 percent. That’s enough of a hit for any CEO to jump in a Gulfstream and fly across the Pacific for an impromptu meeting with a Chinese premier. Globally, Tesla has lost nearly a third of its value since January, and earlier this month, Tesla’s worldwide vehicle deliveries in the first quarter fell for the first time in almost four years. As they are wont to do, Tesla investors continue to complain over repeated delays to the company’s rollout of cars with genuine driverless capabilities.

One of Tesla’s stop-gap technologies—a now heavily-discounted $8,000 add-on—is marketed as Full Self-Driving, or FSD. But, like the similarly confusingly named Autopilot feature, it still requires driver attention, and may yet still prove to be risky. Among the deals said to have been unveiled at Sunday’s meeting with Li Qiang was a partnership granting Tesla access to a mapping license for data collection on China’s public roads by web search company Baidu. This was a “watershed moment,” Wedbush Securities senior analyst Dan Ives said in an interview with Bloomberg Television. However, Tesla has been using Baidu for in-car mapping and navigation in China since 2020. The revised deal, in which Baidu will now also provide Tesla with its lane-level navigation system, clears one more regulatory hurdle for Tesla’s FSD in China. It does not enable Tesla to introduce driverless cars in China or anywhere else, as some media outlets have reported. Press reports have also claimed that Musk has secured permission to transfer data collected by Tesla cars in China out of China. This is improbable, noted JL Warren Capital CEO and head of research Junheng Li, who wrote on X: “[Baidu] owns all data, and shares filtered data with Tesla. Just imagine if [Tesla] has access to real-time road data such as who went to which country’s embassy at what time for how long.” That, she stressed, would be “super national security!” According to Reuters, Musk is still seeking final approval for the FSD software rollout in China, and Tesla still needs permission to transfer data overseas. Li added that a rollout of even a “supervised,” data-lite version of FSD in China is “extremely unlikely.” She pointed to challenges for Tesla to support local operation of the software. Tesla still “has no [direct] access to map data in China as a foreign entity,” she wrote. Instead, Tesla is likely using the deal extension with Baidu as an FSD workaround, with the data collected in China very much staying in China. Despite this, Tesla shares have jumped following news of the expanded Baidu collaboration. Furthermore, Li said there’s “no strategic value” for Beijing to favor FSD when there are several more advanced Chinese alternatives. (We’ve tested them.)

“Chinese EVs are simply evolving at a far faster pace than Tesla,” agrees Shanghai-based automotive journalist and WIRED contributor Mark Andrews, who tested the driver assistance tech available on the roads in China. The US-listed trio of Xpeng, Nio, and Li Auto offer better-than-Tesla “driving assistance features” that rely heavily on lidar sensors, a technology that Musk previously dismissed, but which Tesla is now said to be testing. Although dated in shape and lacking in the latest tech, a Tesla car is nevertheless more expensive in China than most of its rivals. Tesla recently slashed prices in China to arrest falling sales. Musk’s flying visit to China smacked of “desperation,” says Mark Rainford, owner of the Inside China Auto channel. “[Tesla] sales are down in China—the competition has weathered the price cuts so far and [the Tesla competitors have] a seemingly endless conveyor belt of talented and beautiful products.” Rainford further warns that the “golden period for Tesla in China” is “at great risk of collapsing.” Tesla opened its first gigafactory in Shanghai five years ago, and it is now the firm’s largest—but the automaker has been playing tech catchup in China for some time. In addition to Xpeng, Nio, and Li, there are other Chinese car companies competing with Tesla on autonomous driving, as Musk will see if he visits the Beijing Motor Show, which runs through this week.

Beijing is now arguably the world’s preeminent automotive expo, but Tesla is not exhibiting—a sign that it has little new to offer famously tech-hungry Chinese autobuyers. Pointedly, the Cybertruck is not road-legal in China, although that hasn’t stopped Tesla from displaying the rust-prone electric pickup in some of its Chinese showrooms. Likewise, Tesla has just announced plans for a European Cybertruck tour. But, just like in China, the EV pickup cannot be sold in the EU, either—and according to Tesla's lead on vehicle engineering, it likely never will be.

Speaking on tighter pedestrian safety regulations in the EU compared to the US, Tesla’s vice president of vehicle engineering, Lars Moravy, told Top Gear that “European regulations call for a 3.2-mm external radius on external projections. Unfortunately, it’s impossible to make a 3.2-mm radius on a 1.4-mm sheet of stainless steel.”

The “Cybertruck Odyssey” tour—as Tesla’s European X account calls it—may titillate Tesla fans, but it could prove to be about as useful as shooting a Roadster into space.

29 notes

·

View notes

Text

How important is Foreign direct investment in India?

Foreign direct investment in India fuels India’s progress by attracting capital from abroad. It strengthens industries, creates jobs, and fosters innovation. This form of investment plays a crucial role in the country's financial landscape. For more information, visit https://www.samarthcapital.in/fdi-services.php#main-content

#Selling FDI shares in India#Investing in Indian Stocks#Investing in Indian Companies#Investment restrictions in India#Mutual Funds in Mumbai#foreign direct investment#Foreign Direct Investment Policy of India#foreign portfolio investment#Foreign Portfolio Investors in India#FDI in India#Invest in FDI

0 notes

Text

A Turning Point in India's Economic Landscape: How the Financial Markets Reacted to the 2014 Lok Sabha Election Results

The 2014 Lok Sabha elections in India marked a watershed moment in the country’s political and economic history. For the first time in 30 years, a single party, the Bharatiya Janata Party (BJP), secured a clear majority in the Indian Parliament, paving the way for Narendra Modi to become the Prime Minister. This political shift had profound implications for the Indian financial markets,…

View On WordPress

#2014 Lok Sabha elections#Banking sector India 2014#BankingSector#BJP victory 2014#BJPGovernment#Economic reforms India#EconomicReforms#Election results market reaction#ElectionImpact#FinancialMarkets#Foreign direct investment India#ForeignInvestment#GST#GST Bill India#Indian financial markets#Indian stock market history#IndianEconomy#Infrastructure stocks India#InfrastructureStocks#Investor sentiment 2014#InvestorSentiment#Jan Dhan Yojana#JanDhanYojana#LokSabhaElections2014#Make in India#MakeInIndia#Market reaction to elections#MarketVolatility#Modi economic policies#Modi government policies

0 notes

Text

Now that I played a little Zoo Tycoon and other games, I have ideas for a "conservationist" game where you direct a wildlife reserve, based in my own experiences...

Nothing is instant; you don't just plan trees or spawn animals. If you want, for example, to reintroduce jaguars, you need to get animals from zoos or rescues, breed them, slowly rehabilitate the cubs to hunt in wildlife and only THEN release them. If you want to plant trees, you need to go and plant them from seedling to grown.

Also, everything requires unpaid biology students manpower. To open up paths to reintroducing species to registering what species are out there (there should be a "fog of war" outside the main entrace to your "park" in regards of what species are there), you need to put people to work, it's not the tycoon or sim way where you just build roads.

You should have to deal with the people who live around and INSIDE the reserve. Native communities, rural communites... and not only that, but also scientific institutions, tourist enterprises...

These are not "factions" oppossed to each other, you need to keep a certain balance, but also know where you stand. Foreign investors might help you get the cash and tech to do big projects, but they'll ask for favoritism in tourism. Rural communities can help you with cash too, but they will also need productive activities that will affect your reserve, and so on.

You don't get money from private activities by the most part, but from the state. You need to keep certain goals and standards, you're a public servant, not a Tycoon.

I would like every animal and plant (outside of microscopic ones, and perhaps I can find a way) to be accounted for. You can count things such as jaguars and tapirs individually, but you could also count birds as flocks, insects as populations, etc. with different health and traits.

Plants should also be counted. They are not just decoration, you need them for a healthy ecosystem. Dealing with invasive plants, old-growth trees, pastures...

The game should be set in Latin America, but instead of any particular country, it's the URSAL. You could have random maps for every region, from Sonora to Patagonia. Every region would have their own fauna, flora, communities and challenges.

131 notes

·

View notes