#financial forecasting

Explore tagged Tumblr posts

Text

Course: Effective Financial Modelling in the Power Industry+201010232279

Want to enhance your financial decision-making in the power industry?

Struggling with financial data analysis and risk management?

Join the Effective Financial Modelling in the Power Industry course and gain essential skills!

االجودة الأوربية — European Quality

Build accurate financial models using Excel

Improve project performance with advanced data analysis

Assess risks and make smarter financial decisions

Don’t miss out — secure your spot now!

For inquiries & registration:

+2010 10232279

— — — — — — — — — — — — — — — — — — — —

#financialmodelling#powerindustry#energyfinance#FinanceTraining#RiskManagement#excelforfinance#projectfinance#InvestmentAnalysis#businessgrowth#financialplanning#oilandgas#petroleum #gasandoil#EnergySector#financeprofessionals

financial modelling, power industry, energy finance, financial analysis, risk management, Excel for finance, investment strategies, financial decision-making, project evaluation, corporate finance, energy sector, cost optimization, financial forecasting, capital investment, financial performance

#financialmodelling#powerindustry#energyfinance#FinanceTraining#RiskManagement#excelforfinance#projectfinance#InvestmentAnalysis#businessgrowth#financialplanning#oilandgas#petroleum#gasandoil#EnergySector#financeprofessionals#financial modelling#power industry#energy finance#financial analysis#risk management#Excel for finance#investment strategies#financial decision-making#project evaluation#corporate finance#energy sector#cost optimization#financial forecasting#capital investment#financial performance

0 notes

Text

Cost Estimating Service vs. Cost Budgeting Service | Key Differences Explained.

Introduction

In project management and financial planning, two critical concepts—cost estimating service and cost budgeting service—are often used interchangeably. However, they serve distinct purposes in ensuring a project's financial success. Cost estimating involves predicting the total costs required for a project, while cost budgeting focuses on allocating and managing those estimated costs throughout the project lifecycle. Understanding the differences between these two processes is essential for effective financial planning and risk management. This article explores their definitions, key differences, and their role in successful project execution.

What Is Cost Estimating?

Cost estimating is the process of predicting the total expenditure for a project before work begins. It involves analyzing various factors, including labor, materials, equipment, and indirect costs. The primary objective of cost estimating is to develop a realistic projection of expenses, which helps in decision-making and project feasibility assessment.

Key Aspects of Cost Estimating:

Data-Driven Analysis: Uses historical data, market research, and expert judgment to determine cost predictions.

Multiple Estimation Methods: Includes techniques such as parametric, bottom-up, and three-point estimating.

Accuracy Levels: Ranges from rough order of magnitude (ROM) estimates in early planning to detailed estimates in later project phases.

Risk Identification: Identifies potential cost risks and integrates contingency plans to address uncertainties.

Cost estimating is a critical step in determining whether a project is financially viable and helps stakeholders make informed investment decisions.

What Is Cost Budgeting?

Cost budgeting, on the other hand, involves allocating the estimated costs across different project phases and monitoring spending to ensure financial control. It transforms the cost estimate into a structured financial plan, ensuring that funds are available when needed.

Key Aspects of Cost Budgeting:

Fund Allocation: Distributes the estimated costs into project phases, tasks, and departments.

Cash Flow Management: Ensures adequate funds are available at each stage of the project.

Cost Baseline Development: Establishes a benchmark for measuring actual spending against planned costs.

Ongoing Monitoring and Adjustments: Tracks project expenses and makes necessary adjustments to prevent cost overruns.

Cost budgeting ensures that financial resources are efficiently utilized and that the project remains financially sustainable.

Key Differences Between Cost Estimating and Cost Budgeting

AspectCost EstimatingCost BudgetingDefinitionPredicts the total expected cost of a projectAllocates estimated costs across the project timelinePurposeDetermines financial feasibilityEnsures cost control and resource managementTimingConducted before project approvalImplemented after estimates are finalizedScopeCovers labor, materials, equipment, and contingenciesFocuses on fund distribution and expenditure trackingOutcomeProvides an estimated project costDevelops a financial plan for project execution

How Cost Estimating and Cost Budgeting Work Together

Cost estimating and cost budgeting are interconnected processes that contribute to successful project execution. The cost estimate serves as the foundation for creating a realistic budget. Once the budget is set, it guides financial decisions and resource allocations throughout the project.

Here’s how they complement each other:

Estimating Costs First: Project managers determine the projected costs using estimation techniques.

Creating a Budget: The estimated costs are structured into a financial plan with designated allocations.

Tracking Expenses: Budgeting ensures that actual expenses align with estimated projections.

Adjusting as Needed: Cost control measures help address deviations and optimize spending.

By integrating both processes, organizations can improve financial accuracy, reduce risks, and ensure project success.

Importance of Understanding the Difference

Misinterpreting cost estimating as cost budgeting can lead to financial mismanagement and project inefficiencies. Recognizing their differences helps in:

Preventing Budget Shortfalls: Ensures sufficient funds are available for each phase of the project.

Enhancing Decision-Making: Helps stakeholders make informed financial and resource allocation decisions.

Minimizing Risks: Identifies potential cost overruns and incorporates contingency plans.

Improving Project Efficiency: Enables better planning, execution, and financial control.

Conclusion

While cost estimating and cost budgeting are closely related, they serve distinct roles in financial planning. Cost estimating focuses on forecasting total project expenses, whereas cost budgeting ensures those costs are effectively distributed and managed. Understanding and applying both processes correctly is crucial for successful project execution, financial stability, and risk mitigation. Organizations that master these concepts can optimize their financial strategies and achieve project success with greater confidence.

As industries continue to evolve, leveraging cost estimation and budgeting best practices will remain essential for maintaining financial discipline and operational efficiency.

#Cost estimating Service#Cost budgeting#Project cost estimation#Budget planning#Financial forecasting#Cost management#Project budgeting#Expense tracking#Project financial planning#Cost control strategies#Budget allocation#Construction cost estimation#Capital budgeting#Financial risk management#Budget vs estimate#Project feasibility study#Cost estimating techniques#Budget management#Project expense monitoring#Cash flow management#Cost baseline development#Resource allocation#Budget shortfall prevention#Financial discipline#Operational efficiency#Project financial success#Economic feasibility assessment#Cost estimation accuracy#Risk identification in budgeting#Expense forecasting in projects

0 notes

Text

Corteva Inc.'s Overinflated Stock Price: A Risky Bet for Your Portfolio

Discover why experts advise selling Corteva Inc. stock now. Uncover the risks of an overinflated stock price, explore smarter investment. #Corteva #CTVA #Stockpriceforecasting #Investmentadvice #Negativeinvestmentscorecard #Overinflatedstockprice #Dividendyieldconcerns

Is Corteva Inc. really the agricultural titan it’s perceived to be, or is it a ticking time bomb in your investment portfolio? Despite boasting a global presence and recent stock gains, there’s more beneath the surface that savvy investors need to uncover. Before you make your next move, dive into why holding onto Corteva might be riskier than you think—and discover the alternatives that could…

#Agriculture sector#Alternative investments#Competitor comparison#CTVA#Dividend yield concerns#Financial forecasting#Financial performance#Investment#Investment advice#Investment Insights#Investment Opportunities#Investment strategy#Market Analysis#Negative investment scorecard#Overinflated stock price#Portfolio management#Risk assessment#Savvy investors#Selling shares#Stock Forecast#Stock Insights#Stock Market Insights#Stock price forecasting#The Intelligent Investor principles

0 notes

Text

The Role of Amazon Seller Bookkeeping in Financial Forecasting

Effective financial forecasting is crucial for Amazon sellers looking to scale their businesses and maintain profitability. One of the key components of accurate forecasting is proper bookkeeping, which ensures that all financial transactions are recorded, categorized, and analyzed efficiently. Without structured bookkeeping, sellers risk mismanaging cash flow, underestimating expenses, or failing to allocate resources effectively.

The Importance of Bookkeeping for Amazon Sellers

Amazon sellers handle a high volume of transactions, including product sales, refunds, shipping fees, advertising costs, and inventory purchases. Proper bookkeeping ensures that every financial movement is documented, providing a clear financial picture that supports business growth. This structured record-keeping helps sellers track revenue streams, control expenses, and prepare for seasonal fluctuations.

A well-maintained bookkeeping system also simplifies tax preparation. Amazon sellers must comply with various tax regulations, including sales tax, income tax, and VAT (for international sellers). Keeping accurate records prevents last-minute stress and minimizes the risk of errors that could lead to penalties.

How Bookkeeping Aids in Financial Forecasting

Financial forecasting relies on historical data to predict future revenue, expenses, and profitability. Bookkeeping plays a central role in this process by offering precise financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports help sellers make informed decisions about pricing, inventory purchases, and marketing strategies.

Key ways bookkeeping supports financial forecasting include:

Cash Flow Management – Tracking incoming and outgoing funds helps sellers anticipate periods of high or low cash flow, allowing them to allocate resources wisely.

Inventory Planning – Bookkeeping data provides insights into which products perform well, enabling sellers to restock bestsellers and avoid overstocking slow-moving items.

Expense Control – Analyzing expenses helps sellers identify areas where costs can be reduced without compromising business operations.

Profitability Analysis – Sellers can assess profit margins and adjust pricing strategies to maximize revenue.

Seasonal Adjustments – Historical sales data allows sellers to plan for seasonal demand changes, ensuring they have adequate inventory and marketing strategies in place.

The Role of Experts in Amazon Seller Bookkeeping

Managing bookkeeping while running an Amazon business can be overwhelming. Many sellers turn to professionals offering Amazon seller bookkeeping services to streamline financial tracking and ensure accuracy. These experts use advanced accounting software and automation tools to manage transactions efficiently, reconcile bank statements, and generate insightful financial reports. Their expertise helps Amazon sellers maintain compliance, improve profitability, and build a sustainable business.

Conclusion

Amazon seller bookkeeping is the foundation of effective financial forecasting. Accurate records help sellers understand their financial position, make data-driven decisions, and plan for future growth. By leveraging the expertise of professionals specializing in Amazon seller bookkeeping services, sellers can focus on growing their businesses while ensuring their financial health remains strong.

0 notes

Text

Secure Your Future with Expert Financial Forecasting

In today’s fast-paced business world, planning ahead is crucial. At SAI CPA Services, we specialize in creating precise financial forecasts to help you navigate uncertainty and seize opportunities.

What We Offer:

Revenue Projections: Understand your potential growth and plan for the future.

Expense Analysis: Identify areas to reduce costs and increase efficiency.

Cash Flow Management: Ensure your business has the liquidity to thrive.

Strategic Insights: Make informed decisions with data-driven guidance.

Why Work with Us?

With over 25 years of experience, we have a proven track record of empowering businesses to achieve their goals. Our personalized approach ensures you get insights tailored to your unique financial situation.

📞 Ready to secure your financial future? Contact SAI CPA Services today!

#SAICPAServices#CashFlowManagement#FutureReady#business#financial forecasting#financial services#startup#financial planning#business growth#future ready#cpa

1 note

·

View note

Text

Revolutionizing FP&A: From Data Chaos to Predictive Excellence

Month-end close can feel like a race against time for FP&A services teams — reconciling data, managing spreadsheets, and delivering insights under pressure. But what if your team could flip the script? The FP&A Time Trap Most FP&A teams spend 85% of their time preparing data and only 15% generating insights. This imbalance leads to reactive financial management, leaving teams stuck in manual…

View On WordPress

#AI in FP&A#financial data automation#financial forecasting#financial planning automation#FP&A best practices#predictive analytics

0 notes

Text

Enhancing Business Growth Through Consulting

In the competitive business environment, leveraging expert advice can be the key to unlocking sustained growth. We offer accounting services in Toronto, Ontario, tailored to meet the specific needs of small and medium-sized businesses. By analyzing financial data and ensuring accuracy, these services help companies maintain compliance with regulations, reduce costly mistakes, and enhance financial transparency. Proper accounting forms the backbone of any growth strategy by providing clear insights into a company’s financial health.

Read more: https://www.smbconsult.ca/key-indicators-your-business-needs-consulting

0 notes

Text

Financial Forecasting: Planning for a Profitable Year Ahead

Like a weather forecast, a financial forecast is a prediction into your future conditions. These predictions are crucial for any business looking to grow, succeed, and keep profitability. Whether you're a small startup or a large corporation, understandin

#Accounting#Bookkeeping#budgeting#Business Finance#cashflow#financial forecasting#financial-management#Guide#KPI#Small Business

0 notes

Text

Mastering Financial Forecasting: Essential Tips for Your Business Plan

Future-focused planning is essential for success in the fast-paced world of business. A well-written business plan projects the financial trajectory that will direct your trip in addition to outlining your vision. An essential part of this strategy is financial forecasting, which offers a road map for projecting earnings, costs, and revenues. Gaining proficiency in this area can help your company stand out from the crowd and position itself for long-term success. This is how to do financial forecasting for a business plan better than anybody else.

1. Understand the Basics of Financial Forecasting

Make sure you understand the basics before delving into the details. Financial forecasting is the process of projecting future financial results using market trends, historical data, and business environment assumptions. Usually, it consists of:

Revenue Projections: Predicted future sales figures derived from market research and past results.

Expense Forecasting: Projections of future expenses, both variable and fixed.

Profit Margins: Projections of possible earnings obtained by deducting anticipated costs from revenues.

Cash Flow Forecasts: Estimates of incoming and outgoing cash flows made to maintain liquidity.

2. Gather Accurate Data

Precise data is a prerequisite for trustworthy predictions. Start with:

Historical Financial Statements: To find trends and patterns, look through previous financial statements. This past data serves as a standard for estimating in the future.

Market Research: To create well-informed assumptions, be aware of rival performance, economic conditions, and industry trends.

Internal Data: To improve your estimates, make use of operational indicators, customer input, and sales reports.

3. Choose the Right Forecasting Method

Financial forecasts can be made using a variety of techniques. Select the option that best suits your needs as a business:

Quantitative Forecasting: Makes predictions about the future using statistical methods and numerical data. Regression analysis and time series analysis are popular techniques.

Qualitative Forecasting: When quantitative data is scarce or unclear, qualitative forecasting—which is based on expert judgment and insights—is helpful. Methods include the Delphi approach and market research.

4. Develop Realistic Assumptions

The quality of your forecasts depends on the underlying assumptions. Be sensible and make sure your assumptions are supported by reliable research. Think about:

Market Conditions: Take demand, industry growth rates, and economic swings into consideration.

Operational Factors: These comprise predictions regarding labor shifts, technological breakthroughs, and production capacity.

Competitive Landscape: Consider the potential effects that rivals may have on your pricing and market share plans.

5. Create Detailed Financial Models

Construct thorough financial models that include:

Revenue Model: Divide revenue sources, pricing policies, and sales projections into a revenue model.

Expense Model: Describe variable costs (raw materials, utilities) and fixed expenses (rent, salary).

Cash Flow Model: Project cash inflows and outflows using the cash flow model to make sure your company can pay its debts.

6. Monitor and Adjust Regularly

Financial forecasting calls for ongoing observation and modification; it is not a one-time effort. Analyze your predictions against actual performance on a regular basis to spot trends and improve your models. Important activities consist of:

Review Performance Metrics: Monitor key performance indicators (KPIs) to see how accurate your projections are.

Update Assumptions: Adapt assumptions to new information, shifting consumer demand, and corporate initiatives.

Adjust Forecasts: Adjust estimates to account for both the present and the future.

7. Use Technology and Tools

Increase the precision and effectiveness of your forecasts by utilizing technology. Data gathering, processing, and reporting can all be automated with financial forecasting software. Tools such as:

Spreadsheet Software: Strong features for financial modeling are available in programs like Microsoft Excel and Google Sheets.

Dedicated Forecasting Tools: Specialized forecasting features are available in software like as PlanGuru, Adaptive Insights, and QuickBooks.

8. Communicate Clearly

You should provide stakeholders with clear and intelligible financial forecasts. Make sure to deliver your projections in a clear and structured way. Include:

Executive Summary: Emphasize important financial estimates and indicators.

Detailed Analysis: Offer comprehensive insights into cash flow, spending patterns, and revenue drivers.

Visual Aids: To show financial patterns and projections, use graphs and charts.

9. Seek Professional Advice

It is advisable to seek advice from financial specialists or consultants, particularly when making complex forecasts. They can provide insightful information, support your hypotheses, and aid in model improvement.

10. Embrace Flexibility

Lastly, continue to be flexible. Since the business environment is always changing, your projections should be adaptable enough to take into account fresh data and unforeseen circumstances. With an agile strategy, you can change course and modify your plan as necessary.

Conclusion

A strong company strategy requires a solid understanding of financial forecasting. You may produce trustworthy projections that inform strategic choices and drive company expansion by knowing the fundamentals, employing correct data, selecting the appropriate techniques, and maintaining flexibility. If you follow these crucial pointers, your company will be well on its path to stability and financial success.

0 notes

Text

In the area of business enterprise, economic forecasting is a critical device for powerful management and strategic choice-making. Accurate economic forecasts permit organization leaders to count on destiny revenue, manipulate coin glide, and make knowledgeable alternatives that increase energy profitability. Whether you’re a budding entrepreneur or a pro-government activist, getting to know the basics of economic forecasting can substantially enhance your functionality and persuade your business enterprise towards success. As an Gerald Duthie Accounting LLC, We understand the significance of studying these competencies. This blog will walk you through the requirements of economic forecasting and offer you sensible steps to create reliable financial projections.

Understanding Financial Forecasting

Financial forecasting entails predicting future economic performance based totally on historical records, market traits, and monetary indicators. These forecasts are usually divided into two main categories: brief-term and lengthy-term forecasts. Short-time period forecasts usually cover a duration of as much as 12 months and focus on instantaneous financial wishes, together with cash drift control. Long-term forecasts, then again, span several years and are used for strategic planning, investment decisions, and growth projections.

Why financial forecasting matters

Informed Decision-Making: Accurate forecasts offer a basis for making knowledgeable business choices. They help pick out capability risks and opportunities, enabling proactive control.

Resource Allocation: Financial forecasts guide useful resource allocation, making sure that capital is invested in regions so as to yield the very best returns.

Cash Flow Management: Effective forecasting facilitates a healthy cash flow, making sure that the business can meet its responsibilities and avoid liquidity troubles.

Investor Confidence: Investors and stakeholders rely on economic forecasts to assess the viability and profitability of a commercial enterprise. Reliable forecasts can boost investor self-belief and entice funding.

Steps to Create Accurate Financial Forecasts

1. Gather historical data

Start by accumulating historical economic facts, inclusive of income statements, balance sheets, and coin waft statements. This information presents a baseline for identifying trends and patterns that can inform future projections.

2. Identify key drivers

Identify the key drivers that affect your business’s overall financial performance. These may additionally consist of sales extent, pricing techniques, manufacturing expenses, market demand, and economic conditions. Understanding these drivers will help you create more accurate forecasts.

3. Choose a Forecasting Method

Several forecasting methods may be used, depending on the complexity of your business and the supply of data. Common techniques consist of:

Simple Projection: This entails extending historical traits into the future. It is suitable for groups with solid boom patterns.

Moving Averages: This technique smooths out short-term fluctuations by way of averaging historical records over a particular duration. It is useful for figuring out lengthy-term traits.

Regression Analysis: This statistical approach analyzes the relationship among variables to predict future outcomes. It is powerful for organizations with multiple influencing elements.

Scenario Analysis: This method entails developing a couple of scenarios based totally on different assumptions. It helps check the potential effect of various factors on monetary overall performance.

4. Develop Assumptions Based on your knowledge of key drivers and selected forecasting approach, increase your assumptions in your projections. These assumptions need to be practical and grounded in facts. Consider factors inclusive of marketplace conditions, industry tendencies, and internal business strategies.

5. Create financial projections. Using the amassed facts, diagnosed drivers, and developed assumptions, create exact financial projections. These have to encompass projected earnings statements, balance sheets, and coin float statements. Ensure that your projections cover both brief-time periods and lengthy-time periods.

6. Review and refine Regularly review and refine your forecasts primarily based on actual overall performance and changing conditions. Financial forecasting isn’t always a one-time interest; it calls for ongoing monitoring and adjustment to remain correct and relevant.

Tips for Effective Financial Forecasting

Use Reliable Data: Ensure that your historic facts are accurate and updated. Inaccurate facts can result in improper projections.

Be Conservative: When doubtful, undertake a conservative approach in your projections. Overly positive forecasts can lead to unrealistic expectations and financial strain.

Involve Key Stakeholders: Engage key stakeholders, along with department heads and monetary advisors, in the forecasting procedure. Their insights can enhance the accuracy and reliability of your forecasts.

Monitor External Factors: Stay knowledgeable about external elements, consisting of monetary situations, regulatory changes, and marketplace traits. These elements can appreciably impact your financial projections.

Conclusion

Mastering monetary forecasting is essential for powerful commercial enterprise control and strategic planning. By knowing the fundamentals of financial forecasting, gathering reliable statistics, and using suitable methods, you could create correct projections that guide your enterprise toward profitability. Regularly reviewing and refining your forecasts ensures that they remain applicable and actionable. With exercise and diligence, monetary forecasting can become an effective device for accomplishing your company’s economic desires.

About Gerald Duthie Accounting LLC:

At Gerald Duthie Accounting LLC, we are a full-carrier accounting and control consulting company committed to helping you achieve your goals. We consider the value of relationships and consider each patron’s dating as a partnership. With over 40 years of experience providing warranty, tax, financial planning, and consulting services to diverse industries, which include automobile, retail, manufacturing, construction, and fitness, our success is an immediate result of your success. Our international presence, with workplaces in Windsor, Toronto, Michigan, New Delhi, and Dubai, allows us to provide tailored offerings to satisfy the precise needs of our international patron base.

Services Offered:

ACCOUNTING SERVICES

TAX SERVICES

MANAGEMENT CONSULTING SERVICES

Contact Us:

+971 (50) 695–1806

Address : Suite #78, Floor 11, Ibn Battuta Gate Office Building, Jebel Ali, Dubai

#gerald duthie accounting llc#accounting firm in dubai#accounting services#tax services#financial forecasting

0 notes

Text

The Business Plan Gap

Struggling with business planning? You're not alone. In this article, I share key insights to help you overcome common challenges and create a robust plan for success. Whether you're starting up or scaling, these strategies can make a difference.

In today’s dynamic business environment, one factor consistently stands out as a differentiator between companies that thrive and those that struggle: strategic planning. The presence (or absence) of a well-crafted business plan can significantly impact a company’s ability to navigate challenges and capitalize on opportunities. This realization led me to explore effective business planning in…

#business challenges#business development#business growth#business planning#business strategy#business success#Competitive Advantage#Entrepreneurship#financial forecasting#Market Analysis#small business tips#startup advice#strategic planning#strategic thinking#value proposition

0 notes

Text

Embrace Superior Cash Flow Forecasting For Your Business Success with Moolamore

When unexpected expenses interfere with your business plans, have you ever experienced frustration? Do you constantly feel overwhelmed and anxious about your small business's future?

It isn't a falsehood. You could go from barely surviving to booming if you can't handle your ins and outs. To provide you the advantage in financial management and planning and guarantee the long-term success of your business, you therefore require the excellent cash flow forecasting tool Moolamore designed. Proceed with reading!

#cash flow forecasting#cash flow management#financial forecasting#business cash flow forecast#cash flow analysis#accounting cash flow

0 notes

Text

AI in Financial Forecasting: Revolutionizing Consumer Investment Strategies with Matt Britton's Expertise

In the rapidly evolving world of finance, where precision and foresight are paramount, the integration of Artificial Intelligence (AI) into financial forecasting is revolutionizing how consumers approach investment strategies. As we delve deeper into this transformative era, the need for expert insights and futuristic viewpoints has never been more critical. One name that stands out in bridging the gap between next-gen technology and consumer trends is Matt Britton.

Matt Britton, a renowned AI expert and keynote speaker, has carved a niche as a formidable thought leader in the intersection of AI and consumer behavior. As the Founder & CEO of the innovative consumer research platform Suzy, Britton has been at the forefront of leveraging technology to decode and predict consumer patterns. His expertise is not just theoretical but deeply entrenched in practical, real-world applications which have shaped strategies for over half of the Fortune 500 companies.

The Expertise of Matt Britton

Matt Britton’s journey through the realms of consumer insights and technological innovations has been nothing short of exemplary. His best-selling book, YouthNation, cemented his reputation as a visionary, highlighting his profound understanding of new consumer trends, particularly among millennials and Generation Z. This demographic is crucial, as their investment preferences and strategies significantly differ from previous generations, increasingly leaning towards AI-driven solutions.

AI in Financial Forecasting: A Game-Changer

AI’s role in financial forecasting is a game-changer, offering unprecedented accuracy and efficiency. AI algorithms can analyze vast datasets — far beyond the capability of human analysts — identifying patterns and predicting market trends that can inform consumer investment strategies. This capability not only enhances the accuracy of forecasts but also democratizes investing, making sophisticated investment strategies accessible to the average consumer.

Why Matt Britton?

As a top keynote speaker and AI expert speaker, Matt Britton stands out for several reasons in the context of AI and financial forecasting:

Real-World Experience: Having led a consumer research platform, Britton understands the practical applications of AI in real-world scenarios, making his insights particularly valuable for financial institutions and individual investors alike.

Consumer Trend Expertise: His deep understanding of consumer behavior dynamics, backed by data from Suzy, allows him to provide unique insights into how AI can be tailored to enhance consumer investment strategies.

Proven Track Record with Fortune 500: His consulting experience with over half of the Fortune 500 companies imbues a level of trust and reliability in his recommendations and forecasts.

Engaging Presentation Style: Known for his dynamic and engaging speaking style, Britton can transform complex AI concepts into understandable and actionable insights for a diverse audience.

Structuring AI Enhancements in Consumer Investment Strategies

In his keynote speeches, Britton often emphasizes the structured approach to integrating AI with consumer investment strategies:

Data Collection and Analysis: Leveraging AI to parse through complex and voluminous financial data to spot emerging trends that can impact investment decisions.

Predictive Analytics: Utilizing AI to forecast future market movements with a higher degree of accuracy, thus enabling more informed investment choices.

Personalization of Investment Solutions: AI’s capability to tailor investment advice based on individual consumer profiles, risk appetites, and financial goals.

Risk Management: Enhancing the ability to predict and mitigate risks associated with various investment options.

The Takeaway

For anyone involved in finance, from industry professionals to individual investors, understanding the impact of AI on financial forecasting is crucial. A keynote speech by Matt Britton, with his dual expertise in AI applications and consumer trends, provides not just insights but actionable strategies that can be implemented to harness the potential of AI in enhancing investment outcomes.

In conclusion, as we look towards a future where AI becomes increasingly central to financial decision-making, the insights from leaders like Matt Britton are invaluable. His ability to elucidate complex technologies in the context of everyday consumer impacts makes him one of the top conference speakers and innovation speakers today. Whether you are looking to understand big picture trends or detailed, actionable strategies, Britton’s keynotes offer a roadmap to the future of investing in an AI-driven world.

0 notes

Text

The Role Of eCommerce Accountants In Financial Forecasting

eCommerce accountants play a key role in financial forecasting by analyzing historical data, predicting future revenue, and evaluating expenses. They help identify trends, set realistic financial goals, and create budgets to guide business decisions. By providing insights into cash flow, inventory management, and market conditions, eCommerce accountants ensure that businesses make informed, data-driven choices for sustainable growth.

0 notes

Text

Financial Forecasting Made Easy with SAI CPA Services

Planning for the future of your business can feel overwhelming, but with expert financial forecasting, you can stay ahead of the curve. At SAI CPA Services, we help businesses like yours create accurate and actionable financial projections.

Why Financial Forecasting Matters:

Strategic Planning: Make informed decisions with a clear picture of your business’s future.

Budget Management: Control expenses and allocate resources effectively.

Investor Confidence: Present credible financial data to secure funding or partnerships.

Our Approach:

Tailored Forecasts: We consider your business goals, industry trends, and financial history.

Data-Driven Insights: Advanced tools and expert analysis ensure precise projections.

Ongoing Support: Regular updates keep your forecasts relevant and actionable.

Whether you’re launching a new product or expanding your operations, financial forecasting is key to success. Let SAI CPA Services guide you through every step, helping you achieve your goals with confidence.

📞 Contact us today to schedule your consultation!

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#financial services#bookeeping#financial success#small business#growth#business planning#financial forecasting#cpa#accounting#business#new jeresy#forecasting

1 note

·

View note

Text

The Time Traveler's Guide to Long-term Financial Forecasting

In the complex world of business strategy and financial management, long-term financial forecasting emerges as a pivotal tool, akin to a time machine that allows businesses to peer into the future. This process involves using current data, trends, and analyses to predict future financial outcomes, thereby equipping businesses with the foresight needed to make informed decisions. The essence of long-term financial forecasting is not just in predicting numbers but in enabling organizations to navigate the future with confidence, ensuring they are prepared for various scenarios that could impact their sustainability and growth.

The importance of this financial tool in strategic planning, risk management, and decision-making cannot be overstated. In today's rapidly changing economic landscape, the ability to forecast long-term financial performance is crucial for businesses aiming to achieve sustained growth. This guide aims to delve into the methodologies, tools, and strategies that underpin effective long-term financial forecasting. It will explore the intricacies of creating forecasts that are both accurate and reliable, addressing common challenges faced in the process and offering insights on how to overcome them.

Foundations of Long-term Financial Forecasting

Understanding the Basics

Long-term financial forecasting is an essential process that spans beyond the confines of short-term financial predictions, offering a vision of financial health and prospects years into the future. It encompasses a broad scope, from projecting revenues, expenses, and cash flows to anticipating capital needs and investment returns. Unlike short-term forecasting, which often focuses on immediate financial management and operational planning, long-term forecasting aims to align with the strategic objectives of the business, providing a roadmap for achieving long-term goals.

The key components of a long-term financial forecast include revenue growth projections, cost and expense estimates, investment requirements, and financing strategies. These elements are crucial for crafting a comprehensive view of the company’s future financial landscape, enabling strategic decision-making and long-term planning.

Building Your Forecasting Model

Constructing a robust long-term financial forecasting model is a nuanced process that requires careful consideration of various factors. The first step involves selecting appropriate assumptions that reflect both the internal dynamics of the business and external market conditions. These assumptions might include growth rates, inflation rates, market trends, and competitive dynamics, which form the foundation of the forecasting model.

Choosing the right data sources is equally important, as the reliability and accuracy of the forecast depend on the quality of the data used. Financial records, industry reports, market research, and economic forecasts are among the key sources that can provide valuable insights.

The methodology employed in building the forecasting model should be rigorous yet flexible, allowing for adjustments as new information becomes available. Techniques such as scenario analysis and sensitivity analysis are invaluable in this regard, as they enable businesses to explore different future scenarios and understand how varying conditions could impact financial outcomes.

Long-term financial forecasting is a critical strategic tool that enables businesses to anticipate the future and make informed decisions. By understanding the basics and carefully constructing a forecasting model, organizations can navigate the uncertainties of the future with greater confidence and strategic insight.

Crafting Your Long-term Financial Forecast

Identifying Key Drivers

Crafting a long-term financial forecast begins with a thorough identification and analysis of the key drivers that significantly influence your business's financial trajectory. These drivers could range from internal factors such as product development, sales volumes, and operational efficiency, to external elements like market trends, regulatory changes, and economic conditions. Start by mapping out all potential drivers and assessing their likely impact on your revenue, costs, and overall financial health. This process involves not only a deep understanding of your business model but also an awareness of the broader industry landscape and economic environment. Tools such as PESTLE analysis (Political, Economic, Social, Technological, Legal, and Environmental analysis) can be instrumental in this phase, providing a structured method to evaluate external factors that could impact your business.

Scenario Planning and Sensitivity Analysis

Once key drivers are identified, the next step is to incorporate scenario planning and sensitivity analysis into your long-term financial forecast. Scenario planning involves creating different "what-if" scenarios based on various combinations of your identified key drivers. This could include best-case, worst-case, and most-likely scenarios, each reflecting different outcomes based on changes in the key drivers. Sensitivity analysis, on the other hand, assesses how variations in individual drivers affect your financial outcomes. This method helps in understanding which drivers have the most significant impact on your forecasts and where your financial plan might be most vulnerable to changes. Both techniques are crucial for accommodating uncertainties and variabilities, enabling you to prepare for a range of future possibilities and make informed strategic decisions.

Top 5 Strategies for Accurate Long-term Financial Forecasting

1. Leveraging Historical Data

The foundation of any reliable long-term financial forecast is the effective use of historical financial data. Analyzing past performance trends provides critical insights into how your business responds to various internal and external factors over time. This historical perspective is invaluable in predicting future performance, as it allows you to identify consistent patterns and anomalies in your financial data. When leveraging historical data, ensure accuracy and relevance by considering the context of each data point and adjusting for any anomalies that are not expected to recur.

2. Adapting to Market Trends and Economic Indicators

Long-term financial forecasting must be dynamic, adapting to ongoing changes in market trends and economic indicators. This means continuously monitoring industry reports, market research, and economic forecasts to identify emerging trends that could affect your business. Integrating this external information into your forecasting model helps in making your financial projections more responsive to the real-world environment, ensuring they remain relevant and accurate over time.

3. Continuous Revision and Update

The only constant in business is change, making it essential to regularly revise and update your long-term financial forecast. As new information becomes available, whether it's related to internal performance or external market conditions, incorporate these insights into your forecast to ensure it reflects the most current understanding of your business and its environment. Setting up regular review intervals, such as quarterly or annually, can help institutionalize this process within your financial planning cycle.

4. Utilizing Technology and Software Tools

Advancements in technology and software tools have significantly enhanced the accuracy and efficiency of long-term financial forecasting. Tools such as financial modeling software, data analytics platforms, and AI-driven predictive analysis can automate complex calculations, identify trends, and predict future financial scenarios with a higher degree of precision. Embracing these technologies can streamline your forecasting process, allowing for more time to be spent on strategic analysis and decision-making.

5. Stakeholder Engagement and Communication

Effective long-term financial forecasting is not a solitary endeavor; it requires the involvement and buy-in of key stakeholders across the organization. Engage with department heads, board members, and other stakeholders early in the forecasting process to gather insights, set realistic expectations, and ensure alignment with overall business objectives. Additionally, clear and transparent communication of your forecasting assumptions, methodologies, and findings is essential for building trust and ensuring that stakeholders are informed and supportive of the strategic direction informed by your financial forecast.

Crafting an accurate long-term financial forecast is a multifaceted process that involves a deep understanding of your business, the external environment, and the application of strategic analysis techniques. By identifying key drivers, leveraging historical data, adapting to market trends, continuously revising your forecast, utilizing technology, and engaging stakeholders, you can develop a financial forecast that not only predicts future financial performance but also informs strategic decision-making and drives business growth.

The Future of Financial Forecasting

Embracing Technological Advancements

The landscape of financial forecasting is on the cusp of a revolution, driven by the rapid advancement of emerging technologies such as artificial intelligence (AI), machine learning, and big data analytics. These technologies are not just enhancing the accuracy and efficiency of financial forecasts but are fundamentally transforming the process by enabling the analysis of vast datasets, uncovering patterns and insights that were previously inaccessible. AI and machine learning algorithms can process and analyze data in real-time, offering predictive insights that allow businesses to anticipate future financial trends and outcomes with a higher degree of precision. Big data analytics, on the other hand, provides the framework for aggregating and analyzing data from diverse sources, offering a more holistic view of the financial landscape. The integration of these technologies into financial forecasting processes marks a significant shift towards more dynamic, data-driven decision-making, setting the stage for a future where financial forecasting is not just a planning tool but a strategic asset.

Anticipating Global Economic Shifts

In today's interconnected global economy, financial forecasting must also account for the wide array of economic shifts and uncertainties that can impact business outcomes. From geopolitical tensions and trade disputes to environmental concerns and pandemics, the global economic landscape is fraught with variables that can drastically affect market conditions and, by extension, financial forecasts. The necessity of anticipating and adapting to these shifts has never been more critical. Financial forecasters must employ a global perspective, incorporating international economic indicators and trends into their models to ensure that forecasts reflect the potential impact of worldwide events. This global outlook, combined with the analytical power of emerging technologies, equips businesses to navigate the complexities of the global economy, making informed strategic decisions that safeguard their future.

Charting the Future: The Art of Financial Forecasting

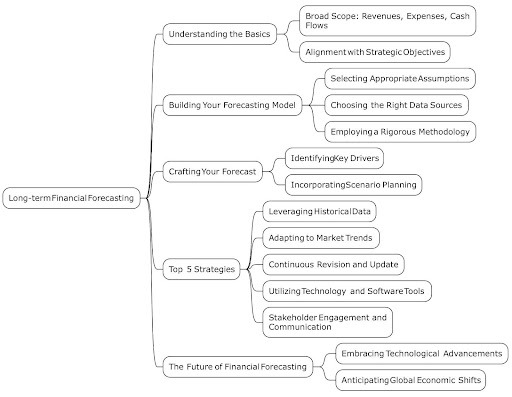

In the evolving narrative of corporate strategy, the ability to forecast financial outcomes over the long term stands as a critical chapter, detailing the methodologies that businesses employ to navigate the uncertainties of the future. The "Forecasting Framework" diagram serves as a visual compendium of this complex process, breaking down the intricate components and strategies into a cohesive map that guides organizations towards sustained growth and resilience.

At the heart of this framework lies the foundational understanding of financial forecasting, emphasizing the broad scope of projections—revenues, expenses, and cash flows—and their alignment with strategic objectives. This alignment is crucial, as it ensures that financial planning is not just an isolated activity but an integral part of the strategic decision-making process, steering the company towards its long-term goals.

Building upon this foundation, the diagram delves into the construction of a robust forecasting model. This process is characterized by the careful selection of assumptions that mirror both internal dynamics and external market conditions, the utilization of reliable data sources, and the adoption of a rigorous methodology that balances precision with flexibility. Such a model is not static; it evolves with the business, adapting to new insights and changing environments.

Crafting the forecast itself is an exercise in foresight, requiring a deep dive into the key drivers of financial performance. Through scenario planning and sensitivity analysis, CFOs and financial strategists can explore various future landscapes, preparing the organization for a spectrum of possibilities.

The diagram further outlines the top strategies for ensuring the accuracy and relevance of long-term forecasts. These include leveraging historical data for insight, adapting to market trends, continuously revising forecasts to reflect the latest information, employing advanced technology and software tools for enhanced analysis, and maintaining open lines of communication with stakeholders to align expectations and strategies.

Looking to the future, the diagram anticipates the impact of technological advancements and global economic shifts on financial forecasting. It underscores the importance of embracing new tools such as AI and big data analytics, which offer unprecedented predictive capabilities, and maintaining a global perspective to navigate the complexities of the international economic landscape.

Incorporating this comprehensive overview and the accompanying diagram into the article provides readers with a clear and structured understanding of long-term financial forecasting. It highlights the strategic importance of this process in shaping the future of businesses, offering a blueprint for navigating the uncertainties of the financial landscape with confidence and strategic insight.

FAQs on Long-term Financial Forecasting

How far into the future should a long-term financial forecast extend?

The horizon of a long-term financial forecast typically ranges from three to five years, although the specific timeframe can vary based on the industry, the nature of the business, and the intended use of the forecast. Strategic planning requires looking far enough into the future to guide decision-making while remaining realistic about the predictability of financial outcomes.

What are the most common challenges in creating long-term financial forecasts?

Among the challenges are dealing with uncertainties and variabilities in economic conditions, integrating a wide array of internal and external data sources, and maintaining the flexibility to adjust forecasts as new information emerges. The dynamic nature of the global economy and rapid technological changes add layers of complexity to long-term financial forecasting.

How can small businesses approach long-term financial forecasting with limited resources?

Small businesses can leverage simplified forecasting models, focusing on key financial drivers relevant to their operations. Utilizing free or low-cost forecasting software and tools, seeking advice from financial advisors, and staying informed about industry trends and economic conditions can also aid in the process. Prioritizing flexibility and adaptability in their forecasts allows small businesses to respond swiftly to changes.

What role do assumptions play in financial forecasting, and how can they be validated?

Assumptions are foundational to financial forecasting, underpinning projections of revenue, expenses, market growth, and other key financial metrics. Validating these assumptions requires a combination of historical data analysis, industry benchmarking, and scenario planning. Regular review and adjustment of assumptions based on actual performance and changing conditions are crucial for maintaining forecast accuracy.

In Conclusion

The journey of long-term financial forecasting is akin to navigating through time, with the twin beacons of technological advancement and strategic foresight guiding businesses towards a prosperous future. This guide has traversed the foundational elements of financial forecasting, from embracing AI and big data analytics to adapting to global economic shifts, offering a blueprint for crafting forecasts that are both accurate and adaptable. As we stand on the brink of a new era in financial forecasting, the role of this strategic tool has never been more vital. It demands a blend of adaptability, continuous learning, and foresight—qualities that are indispensable for businesses aiming to chart their course through the uncertainties of the future. In essence, mastering the art of long-term financial forecasting is not just about predicting financial outcomes but about shaping them, steering businesses towards success in an ever-changing world.

0 notes