#eCommerce

Explore tagged Tumblr posts

Text

#commercial#startup#ecommerce#finance#aesthetic#hatsune miku#sales#argentina#argenthill#tumblr chilenito#tumblr mexa#tumblr argentina#classic cars#autos#beautiful ass#amazing beauty

927 notes

·

View notes

Text

I don’t really post things on this site frequently like this but this is very important! Please reblog! And after the 3 days we must continue. Look to what black people did during the 50’s and 60’s and if that fails, then we must resist by ANY MEANS NECESSARY!

#ecommerce#amazon#elon musk#donald trump#trump administration#boycott#us politics#project 2025#deny defend depose#fuck project 2025#fuck trump#fuck maga#protest#fuck musk#jeff bezos#mark zuckerberg#target#walmart#let’s make the wealthy pay#bernie sanders#aoc#usa politics#antifascist#anti oligarchy#democrats#democracy#progressive politics#leftism#fuck billionaires#black history

440 notes

·

View notes

Text

Surveillance pricing

THIS WEEKEND (June 7–9), I'm in AMHERST, NEW YORK to keynote the 25th Annual Media Ecology Association Convention and accept the Neil Postman Award for Career Achievement in Public Intellectual Activity.

Correction, 7 June 2024: The initial version of this article erroneously described Jeffrey Roper as the founder of ATPCO. He benefited from ATPCO, but did not co-found it. The initial version of this article called ATPCO "an illegal airline price-fixing service"; while ATPCO provides information that the airlines use to set prices, it does not set prices itself, and while the DOJ investigated the company, they did not pursue a judgment declaring the service to be illegal. I regret the error.

Noted anti-capitalist agitator Adam Smith had it right: "People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices."

Despite being a raving commie loon, Smith's observation was so undeniably true that regulators, policymakers, and economists couldn't help but acknowledge that it was true. The trustbusting era was defined by this idea: if we let the number of companies in a sector get too small, or if we let one or a few companies get too big, they'll eventually start to rig prices.

What's more, once an industry contracts corporate gigantism, it will become too big to jail, able to outspend and overpower the regulators charged with reining in its cheating. Anyone who believes Smith's self-evident maxim had to accept its conclusion: that companies had to be kept smaller than the state that regulated them. This wasn't about "punishing bigness" – it was the necessary precondition for a functioning market economy.

We kept companies small for the same reason that we limited the height of skyscrapers: not because we opposed height, or failed to appreciate the value of a really good penthouse view – rather, to keep the building from falling over and wrecking all the adjacent buildings and the lives of the people inside them.

Starting in the neoliberal era – Carter, then Reagan – we changed our tune. We liked big business. A business that got big was doing something right. It was perverse to shut down our best companies. Instead, we'd simply ban big companies from rigging prices. This was called the "consumer welfare" theory of antitrust. It was a total failure.

40 years later, nearly every industry is dominated by a handful of companies, and these companies price-gouge us with abandon. Worse, they use their gigantic ripoff winnings to fill war-chests that fund the corruption of democracy, capturing regulators so that they can rip us off even more, while ignoring labor, privacy and environmental law and ducking taxes.

It turns out that keeping gigantic, opaque, complex corporations honest is really hard. They have so many ways to shuffle money around that it's nearly impossible to figure out what they're doing. Digitalization makes things a million times worse, because computers allow businesses to alter their processes so they operate differently for every customer, and even for every interaction.

This is Dieselgate times a billion: VW rigged its cars to detect when they were undergoing emissions testing and switch to a less polluting, more compliant mode. But when they were on the open road, they spewed lethal quantities of toxic gas, killing people by the thousands. Computers don't make corporate leaders more evil, but they let evil corporate leaders execute far more complex and nefarious plans. Digitalization is a corporate moral hazard, making it just too easy and tempting to rig the game.

That's why Toyota, the largest car-maker in the world, just did Dieselgate again, more than a decade later. Digitalization is a temptation no giant company can resist:

https://www.bbc.com/news/articles/c1wwj1p2wdyo

For forty years, pro-monopoly cheerleaders insisted that we could allow companies to grow to unimaginable scale and still prevent cheating. They passed rules banning companies from explicitly forming agreements to rig prices. About ten seconds later, new middlemen popped up offering "information brokerages" that helped companies rig prices without talking to one another.

Take Agri Stats: the country's hyperconcentrated meatpacking industry pays Agri Stats to "consult on prices." They provide Agri Stats with a list of their prices, and then Agri Stats suggests changes based on its analysis. What does that analysis consist of? Comparing the company's prices to its competitors, who are also Agri Stats customers:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

In other words, Agri Stats finds the highest price for each product in the sector, then "advises" all the companies with lower prices to raise their prices to the "competitive" level, creating a one-way ratchet that sends the price of food higher and higher.

More and more sectors have an Agri Stats, and digitalization has made this price-gouging system faster, more efficient, and accessible to sectors with less concentration. Landlords, for example, have tapped into Realpage, a "data broker" that the same thing to your rent that Agri Stats does to meat prices. Realpage requires the landlords who sign up for its service to accept its "recommendations" on minimum rents, ensuring that prices only go up:

https://popular.info/p/feds-raid-corporate-landlord-escalating

Writing for The American Prospect, Luke Goldstein lays out the many ways in which these digital intermediaries have supercharged the business of price-rigging:

https://prospect.org/economy/2024-06-05-three-algorithms-in-a-room/

Goldstein identifies a kind of patient zero for this ripoff epidemic: Jeffrey Roper, a former Alaska Air exec who benefited from a service that helps airlines set prices. ATPCO was investigated by the DOJ in the 1990s, but the enforcers lost their nerve and settled with the company, which agreed to apply some ornamental fig-leafs to its collusion-machine. Even those cosmetic changes were seemingly a bridge too far Roper, who left the US.

But he came back to serve as Realpage's "principal scientist" – the architect of a nationwide scheme to make rental housing vastly more expensive. For Roper, the barrier to low rents was empathy: landlords felt stirrings of shame when they made shelter unaffordable to working people. Roper called these people "idiots" who sentimentality "costs the whole system."

Sticking a rent-gouging computer between landlords and the people whose lives they ruin is a classic "accountability sink," as described in Dan Davies' new book "The Unaccountability Machine: Why Big Systems Make Terrible Decisions – and How The World Lost its Mind":

https://profilebooks.com/work/the-unaccountability-machine/

It's a form of "empiricism washing": if computers are working in the abstract realm of pure numbers, they're just moving the objective facts of the quantitative realm into the squishy, imperfect qualitative world. Davies' interview on Trashfuture is excellent:

https://trashfuturepodcast.podbean.com/e/fire-sale-at-the-accountability-store-feat-dan-davies/

To rig prices, an industry has to solve three problems: the problem of coming to an agreement to fix prices (economists call this "the collective action problem"); the problem of coming up with a price; and the problem of actually changing prices from moment to moment. This is the ripoff triangle, and like a triangle, it has many stable configurations.

The more concentrated an industry is, the easier it is to decide to rig prices. But if the industry has the benefit of digitalization, it can swap the flexibility and speed of computers for the low collective action costs from concentration. For example, grocers that switch to e-ink shelf tags can make instantaneous price-changes, meaning that every price change is less consequential – if sales fall off after a price-hike, the company can lower them again at the press of a button. That means they can collude less explicitly but still raise prices:

https://pluralistic.net/2024/03/26/glitchbread/#electronic-shelf-tags

My name for this digital flexibility is "twiddling." Businesses with digital back-ends can alter their "business logic" from second to second, and present different prices, payouts, rankings and other key parts of the deal to every supplier or customer they interact with:

https://pluralistic.net/2023/02/19/twiddler/

Not only does twiddling make it easier to rip off suppliers, workers and customers, it also makes these crimes harder to detect. Twiddling made Dieselgate possible, and it also underpinned "Greyball," Uber's secret strategy of refusing to send cars to pick up transportation regulators who would then be able to see firsthand how many laws the company was violating:

https://www.nytimes.com/2017/03/03/technology/uber-greyball-program-evade-authorities.html

Twiddling is so easy that it has brought price-fixing to smaller companies and less concentrated sectors, though the biggest companies still commit crimes on a scale that put these bit-players to shame. In The Prospect, David Dayen investigates the "personalized pricing" ripoff that has turned every transaction into a potential crime-scene:

https://prospect.org/economy/2024-06-04-one-person-one-price/

"Personalized pricing" is the idea that everything you buy should be priced based on analysis of commercial surveillance data that predicts the maximum amount you are willing to pay.

Proponents of this idea – like Harvard's Pricing Lab with its "Billion Prices Project" – insist that this isn't a way to rip you off. Instead, it lets companies lower prices for people who have less ability to pay:

https://thebillionpricesproject.com/

This kind of weaponized credulity is totally on-brand for the pro-monopoly revolution. It's the same wishful thinking that led regulators to encourage monopolies while insisting that it would be possible to prevent "bad" monopolies from raising prices. And, as with monopolies, "personalized pricing" leads to an overall increase in prices. In econspeak, it is a "transfer of wealth from consumer to the seller."

"Personalized pricing" is one of those cuddly euphemisms that should make the hair on the back of your neck stand up. A more apt name for this practice is surveillance pricing, because the "personalization" depends on the vast underground empire of nonconsensual data-harvesting, a gnarly hairball of ad-tech companies, data-brokers, and digital devices with built-in surveillance, from smart speakers to cars:

https://pluralistic.net/2024/03/12/market-failure/#car-wars

Much of this surveillance would be impractical, because no one wants their car, printer, speaker, watch, phone, or insulin-pump to spy on them. The flexibility of digital computers means that users always have the technical ability to change how these gadgets work, so they no longer spy on their users. But an explosion of IP law has made this kind of modification illegal:

https://locusmag.com/2020/09/cory-doctorow-ip/

This is why apps are ground zero for surveillance pricing. The web is an open platform, and web-browsers are legal to modify. The majority of web users have installed ad-blockers that interfere with the surveillance that makes surveillance pricing possible:

https://doc.searls.com/2023/11/11/how-is-the-worlds-biggest-boycott-doing/

But apps are a closed platform, and reverse-engineering and modifying an app is a literal felony – several felonies, in fact. An app is just a web-page skinned with enough IP to make it a felony to modify it to protect your consumer, privacy or labor rights:

https://pluralistic.net/2024/05/07/treacherous-computing/#rewilding-the-internet

(Google is leading a charge to turn the web into the kind of enshittifier's paradise that apps represent, blocking the use of privacy plugins and proposing changes to browser architecture that would allow them to felonize modifying a browser without permission:)

https://pluralistic.net/2023/08/02/self-incrimination/#wei-bai-bai

Apps are a twiddler's playground. Not only can they "customize" every interaction you have with them, but they can block you (or researchers seeking to help you) from recording and analyzing the app's activities. Worse: digital transactions are intimate, contained to the palm of your hand. The grocer whose e-ink shelf-tags flicker and reprice their offerings every few seconds can be collectively observed by people who are in the same place and can start a conversation about, say, whether to come back that night a throw a brick through the store's window to express their displeasure. A digital transaction is a lonely thing, atomized and intrinsically shielded from a public response.

That shielding is hugely important. The public hates surveillance pricing. Time and again, through all of American history, there have been massive and consequential revolts against the idea that every price should be different for every buyer. The Interstate Commerce Commission was founded after Grangers rose up against the rail companies' use of "personalized pricing" to gouge farmers.

Companies know this, which is why surveillance pricing happens in secret. Over and over, every day, you are being gouged through surveillance pricing. The sellers you interact with won't tell you about it, so to root out this practice, we have to look at the B2B sales-pitches from the companies that sell twiddling tools.

One of these companies is Plexure, partly owned by McDonald's, which provides the surveillance-pricing back-ends for McD's, Ikea, 7-Eleven, White Castle and others – basically, any time a company gives you a hard-sell to order via its apps rather than its storefronts or its website, you should assume you're getting twiddled, hard.

These companies use the enshittification playbook to trap you into using their apps. First, they offer discounts to customers who order through their apps – then, once the customers are fully committed to shopping via app, they introduce surveillance pricing and start to jack up the prices.

For example, Plexure boasts that it can predict what day a given customer is getting paid on and use that information to raise prices on all the goods the customer shops for on that day, on the assumption that you're willing to pay more when you've got a healthy bank balance.

The surveillance pricing industry represents another reason for everything you use to spy on you – any data your "smart" TV or Nest thermostat or Ring doorbell can steal from you can be readily monetized – just sell it to a surveillance pricing company, which will use it to figure out how to charge you more for everything you buy, from rent to Happy Meals.

But the vast market for surveillance data is also a potential weakness for the industry. Put frankly: the commercial surveillance industry has a lot of enemies. The only thing it has going for it is that so many of these enemies don't know that what's they're really upset about is surveillance.

Some people are upset because they think Facebook made Grampy into a Qanon. Others, because they think Insta gave their kid anorexia. Some think Tiktok is brainwashing millennials into quoting Osama bin Laden. Some are upset because the cops use Google location data to round up Black Lives Matter protesters, or Jan 6 insurrectionists. Some are angry about deepfake porn. Some are angry because Black people are targeted with ads for overpriced loans or colleges:

https://www.theregister.com/2024/06/04/meta_ad_algorithm_discrimination/

And some people are angry because surveillance feeds surveillance pricing. The thing is, whatever else all these people are angry about, they're all angry about surveillance. Are you angry that ad-tech is stealing a 51% share of news revenue? You're actually angry about surveillance. Are you angry that "AI" is being used to automatically reject resumes on racial, age or gender grounds? You're actually angry about surveillance.

There's a very useful analogy here to the history of the ecology movement. As James Boyle has long said, before the term "ecology" came along, there were people who cared about a lot of issues that seemed unconnected. You care about owls, I care about the ozone layer. What's the connection between charismatic nocturnal avians and the gaseous composition of the upper atmosphere? The term ecology took a thousand issues and welded them together into one movement.

That's what's on the horizon for privacy. The US hasn't had a new federal consumer privacy law since 1988, when Congress acted to ban video-store clerks from telling the newspapers what VHS cassettes you were renting:

https://en.wikipedia.org/wiki/Video_Privacy_Protection_Act

We are desperately overdue for a new consumer privacy law, but every time this comes up, the pro-surveillance coalition defeats the effort. but as people who care about conspiratorialism, kids' mental health, spying by foreign adversaries, phishing and fraud, and surveillance pricing all come together, they will be an unbeatable coalition:

https://pluralistic.net/2023/12/06/privacy-first/#but-not-just-privacy

Meanwhile, the US government is actually starting to take on these ripoff artists. The FTC is working to shut down data-brokers:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

The FBI is raiding landlords to build a case against Frontpage and other rent price-fixers:

https://popular.info/p/feds-raid-corporate-landlord-escalating

Agri Stats is facing a DoJ lawsuit:

https://www.nationalhogfarmer.com/market-news/agri-stats-loses-motions-to-transfer-dismiss-in-doj-antitrust-case

Not every federal agency has gotten the message, though. Trump's Fed Chairman, Jerome Powell – whom Biden kept on the job – has been hiking interest rates in a bid to reduce our purchasing power by making millions of Americans poorer and/or unemployed. He's doing this to fight inflation, on the theory that inflation is being cause by us being too well-off, and therefore trying to buy more goods than are for sale.

But of course, interest rates are inflationary: when interest rates go up, it gets more expensive to pay your credit card bills, lease your car, and pay a mortgage. And where we see the price of goods shooting up, there's abundant evidence that this is the result of greedflation – companies jacking up their prices and blaming inflation. Interest rate hawks say that greedflation is impossible: if one company raises its prices, its competitors will swoop in and steal their customers with lower prices.

Maybe they would do that – if they didn't have a toolbox full of algorithmic twiddling options and a deep trove of surveillance data that let them all raise prices together:

https://prospect.org/blogs-and-newsletters/tap/2024-06-05-time-for-fed-to-meet-ftc/

Someone needs to read some Adam Smith to Chairman Powell: "People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/05/your-price-named/#privacy-first-again

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#david dayen#the american prospect#surveillance advertising#commercial surveillance#predictive pricing#monopolism#monopolies#antitrust#unfair and deceptive method of competition#ftc act Section 5#ftca5#ripoffs#surveillance#twiddling#ip#apps#apps are shit#ziprecruiter#personalized pricing#price gouging#just and reasonable#interstate commerce act#one person one price#surveillance pricing#privacy first#billion prices project#ecommerce#ninetailed#cortado group

426 notes

·

View notes

Text

Tools That Will Help You Start Your Business For Free

ChatGPT

Canva

Stan Store

Stripe

Tiktok

Mailchimp

Pinterest

Hubspot

Capcut

Webflow

Unsplash

Google Fonts

Notion

WooCommerce

Convertkit

Calendly

Zapier

Sendinblue

Mozbar

Google Trends

Framer

YouTube

Answer The Public

IFTTT

Buffer

Videoleap

Snaptik

Google Analytics

Keyword.io

Trello

Google Docs

Instagram

Twitter

Hootsuite

Pixabay

Pexels

Wave

Grammerly

Calendly

Xero

Product Hunt

Semrush

PlaceIT

Asana

Loom

Namelix

#resources#marketing tools#seo tools#business tips#start a business#small business#entrepreneurship#entrepreneur#startup#start up#business#make money from home#make money online#marketing#ecommerce#branding#digitalmarketing#business growth

2K notes

·

View notes

Text

#airforce#navy#governments#naval#ecommerce#anthropology#architecture#art#books and libraries#business

63 notes

·

View notes

Text

For some inexplicable reason this comparison-shopping widget is configured to compare the prices of tack hammers by haft length in centimetres rather than by number of units.

577 notes

·

View notes

Text

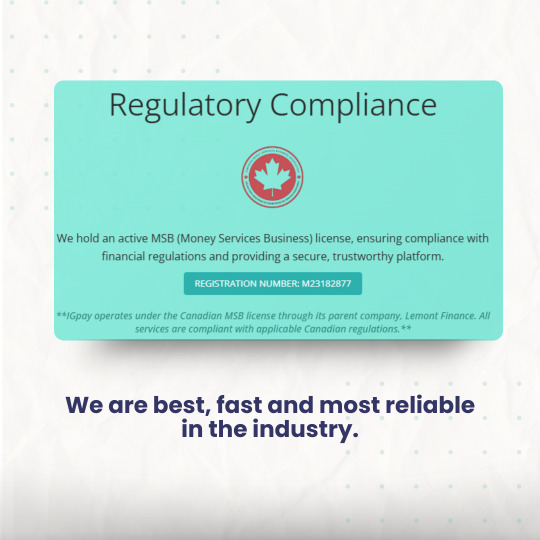

✅“Trust starts with transparency! Our financial services are backed by a legal license, ensuring compliance, security, and reliability.

🔒With us, you’re in safe, professional hands.

#LicensedAndTrusted#FinancialSecurity#IGpay#finance

59 notes

·

View notes

Text

Amazon’s financial shell game let it create an “impossible” monopoly

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

For the pro-monopoly crowd that absolutely dominated antitrust law from the Carter administration until 2020, Amazon presents a genuinely puzzling paradox: the company's monopoly power was never supposed to emerge, and if it did, it should have crumbled immediately.

Pro-monopoly economists embody Ely Devons's famous aphorism that "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’":

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

Rather than using the way the world actually works as their starting point for how to think about it, they build elaborate models out of abstract principles like "rational actors." The resulting mathematical models are so abstractly elegant that it's easy to forget that they're just imaginative exercises, disconnected from reality:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

These models predicted that it would be impossible for Amazon to attain monopoly power. Even if they became a monopoly – in the sense of dominating sales of various kinds of goods – the company still wouldn't get monopoly power.

For example, if Amazon tried to take over a category by selling goods below cost ("predatory pricing"), then rivals could just wait until the company got tired of losing money and put prices back up, and then those rivals could go back to competing. And if Amazon tried to keep the loss-leader going indefinitely by "cross-subsidizing" the losses with high-margin profits from some other part of its business, rivals could sell those high margin goods at a lower margin, which would lure away Amazon customers and cut the supply lines for the price war it was fighting with its discounted products.

That's what the model predicted, but it's not what happened in the real world. In the real world, Amazon was able use its access to the capital markets to embark on scorched-earth predatory pricing campaigns. When diapers.com refused to sell out to Amazon, the company casually committed $100m to selling diapers below cost. Diapers.com went bust, Amazon bought it for pennies on the dollar and shut it down:

https://www.theverge.com/2019/5/13/18563379/amazon-predatory-pricing-antitrust-law

Investors got the message: don't compete with Amazon. They can remain predatory longer than you can remain solvent.

Now, not everyone shared the antitrust establishment's confidence that Amazon couldn't create a durable monopoly with market power. In 2017, Lina Khan – then a third year law student – published "Amazon's Antitrust Paradox," a landmark paper arguing that Amazon had all the tools it needed to amass monopoly power:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

Today, Khan is chair of the FTC, and has brought a case against Amazon that builds on some of the theories from that paper. One outcome of that suit is an unprecedented look at Amazon's internal operations. But, as the Institute for Local Self-Reliance's Stacy Mitchell describes in a piece for The Atlantic, key pieces of information have been totally redacted in the court exhibits:

https://www.theatlantic.com/ideas/archive/2024/02/amazon-profits-antitrust-ftc/677580/

The most important missing datum: how much money Amazon makes from each of its lines of business. Amazon's own story is that it basically breaks even on its retail operation, and keeps the whole business afloat with profits from its AWS cloud computing division. This is an important narrative, because if it's true, then Amazon can't be forcing up retail prices, which is the crux of the FTC's case against the company.

Here's what we know for sure about Amazon's retail business. First: merchants can't live without Amazon. The majority of US households have Prime, and 90% of Prime households start their ecommerce searches on Amazon; if they find what they're looking for, they buy it and stop. Thus, merchants who don't sell on Amazon just don't sell. This is called "monopsony power" and it's a lot easier to maintain than monopoly power. For most manufacturers, a 10% overnight drop in sales is a catastrophe, so a retailer that commands even a 10% market-share can extract huge concessions from its suppliers. Amazon's share of most categories of goods is a lot higher than 10%!

What kind of monopsony power does Amazon wield? Well, for one thing, it is able to levy a huge tax on its sellers. Add up all the junk-fees Amazon charges its platform sellers and it comes out to 45-51%:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Competitive businesses just don't have 45% margins! No one can afford to kick that much back to Amazon. What is a merchant to do? Sell on Amazon and you lose money on every sale. Don't sell on Amazon and you don't get any business.

The only answer: raise prices on Amazon. After all, Prime customers – the majority of Amazon's retail business – don't shop for competitive prices. If Amazon wants a 45% vig, you can raise your Amazon prices by a third and just about break even.

But Amazon is wise to that: they have a "most favored nation" rule that punishes suppliers who sell goods more cheaply in rival stores, or even on their own site. The punishments vary, from banishing your products to page ten million of search-results to simply kicking you off the platform. With publishers, Amazon reserves the right to lower the prices they set when listing their books, to match the lowest price on the web, and paying publishers less for each sale.

That means that suppliers who sell on Amazon (which is anyone who wants to stay in business) have to dramatically hike their prices on Amazon, and when they do, they also have to hike their prices everywhere else (no wonder Prime customers don't bother to search elsewhere for a better deal!).

Now, Amazon says this is all wrong. That 45-51% vig they claim from business customers is barely enough to break even. The company's profits – they insist – come from selling AWS cloud service. The retail operation is just a public service they provide to us with cross-subsidy from those fat AWS margins.

This is a hell of a claim. Last year, Amazon raked in $130 billion in seller fees. In other words: they booked more revenue from junk fees than Bank of America made through its whole operation. Amazon's junk fees add up to more than all of Meta's revenues:

https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf

Amazon claims that none of this is profit – it's just covering their operating expenses. According to Amazon, its non-AWS units combined have a one percent profit margin.

Now, this is an eye-popping claim indeed. Amazon is a public company, which means that it has to make thorough quarterly and annual financial disclosures breaking down its profit and loss. You'd think that somewhere in those disclosures, we'd find some details.

You'd think so, but you'd be wrong. Amazon's disclosures do not break out profits and losses by segment. SEC rules actually require the company to make these per-segment disclosures:

https://scholarship.law.stjohns.edu/cgi/viewcontent.cgi?article=3524&context=lawreview#:~:text=If%20a%20company%20has%20more,income%20taxes%20and%20extraordinary%20items.

That rule was enacted in 1966, out of concern that companies could use cross-subsidies to fund predatory pricing and other anticompetitive practices. But over the years, the SEC just…stopped enforcing the rule. Companies have "near total managerial discretion" to lump business units together and group their profits and losses in bloated, undifferentiated balance-sheet items:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2021/dec/crouching-tiger-hidden-dragons

As Mitchell points you, it's not just Amazon that flouts this rule. We don't know how much money Google makes on Youtube, or how much Apple makes from the App Store (Apple told a federal judge that this number doesn't exist). Warren Buffett – with significant interest in hundreds of companies across dozens of markets – only breaks out seven segments of profit-and-loss for Berkshire Hathaway.

Recall that there is one category of data from the FTC's antitrust case against Amazon that has been completely redacted. One guess which category that is! Yup, the profit-and-loss for its retail operation and other lines of business.

These redactions are the judge's fault, but the real fault lies with the SEC. Amazon is a public company. In exchange for access to the capital markets, it owes the public certain disclosures, which are set out in the SEC's rulebook. The SEC lets Amazon – and other gigantic companies – get away with a degree of secrecy that should disqualify it from offering stock to the public. As Mitchell says, SEC chairman Gary Gensler should adopt "new rules that more concretely define what qualifies as a segment and remove the discretion given to executives."

Amazon is the poster-child for monopoly run amok. As Yanis Varoufakis writes in Technofeudalism, Amazon has actually become a post-capitalist enterprise. Amazon doesn't make profits (money derived from selling goods); it makes rents (money charged to people who are seeking to make a profit):

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Profits are the defining characteristic of a capitalist economy; rents are the defining characteristic of feudalism. Amazon looks like a bazaar where thousands of merchants offer goods for sale to the public, but look harder and you discover that all those stallholders are totally controlled by Amazon. Amazon decides what goods they can sell, how much they cost, and whether a customer ever sees them. And then Amazon takes $0.45-51 out of every dollar. Amazon's "marketplace" isn't like a flea market, it's more like the interconnected shops on Disneyland's Main Street, USA: the sign over the door might say "20th Century Music Company" or "Emporium," but they're all just one store, run by one company.

And because Amazon has so much control over its sellers, it is able to exercise power over its buyers. Amazon's search results push down the best deals on the platform and promote results from more expensive, lower-quality items whose sellers have paid a fortune for an "ad" (not really an ad, but rather the top spot in search listings):

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

This is "Amazon's pricing paradox." Amazon can claim that it offers low-priced, high-quality goods on the platform, but it makes $38b/year pushing those good deals way, way down in its search results. The top result for your Amazon search averages 29% more expensive than the best deal Amazon offers. Buy something from those first four spots and you'll pay a 25% premium. On average, you need to pick the seventeenth item on the search results page to get the best deal:

https://scholarship.law.bu.edu/faculty_scholarship/3645/

For 40 years, pro-monopoly economists claimed that it would be impossible for Amazon to attain monopoly power over buyers and sellers. Today, Amazon exercises that power so thoroughly that its junk-fee revenues alone exceed the total revenues of Bank of America. Amazon's story – that these fees barely stretch to covering its costs – assumes a nearly inconceivable level of credulity in its audience. Regrettably – for the human race – there is a cohort of senior, highly respected economists who possess this degree of credulity and more.

Of course, there's an easy way to settle the argument: Amazon could just comply with SEC regs and break out its P&L for its e-commerce operation. I assure you, they're not hiding this data because they think you'll be pleasantly surprised when they do and they don't want to spoil the moment.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Image: Doc Searls (modified) https://www.flickr.com/photos/docsearls/4863121221/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#amazon#ilsr#institute for local self-reliance#amazon's antitrust paradox#antitrust#trustbusting#ftc#lina khan#aws#cross-subsidization#stacy mitchell#junk fees#most favored nation#sec#securities and exchange commission#segmenting#managerial discretion#ecommerce#technofeudalism

606 notes

·

View notes

Text

you can have this like in your house or whatever. blood sold separately.

#artists on tumblr#ecommerce#etsy#handcrafted#my art#vampcore#vampire aesthetic#gothic#goth aesthetic#linocut#linoprint#tw blood

162 notes

·

View notes

Text

🔒 Security You Can Trust! At IGPAY, we prioritize secure transactions at every step, ensuring your payments are protected with cutting-edge encryption and fraud prevention technology. ✅ Safe. ✅ Reliable. ✅ Seamless. Because your financial security matters!

45 notes

·

View notes

Text

youtube

115 notes

·

View notes

Text

#fashion#old money#aesthetic#ecommerce#startup#luxury#trending#branding#entrepreneur#old money aesthetic

40 notes

·

View notes