#finance automation

Explore tagged Tumblr posts

Text

As we embark on the journey towards 2024, finance automation and digital transformation are gaining momentum, promising a revolutionary future for businesses worldwide. Many are transforming their finance functions to stay ahead of the game in a rapidly evolving environment.

0 notes

Text

Why does finance need RPA With RPA in finance, you can gain the most valuable commodity – time.

It is not uncommon for finance departments to be stretched thin both in terms of time and resources, and everyone from sales to the C-suite requires structured financial data and astute assessments that can lead to timely business decisions.

#rpa in finance#rpa software#rpa solutions#Finance Departments#finance automation#finance#finance industry#RPA in Finance and Accounting#RPA Uses Cases in Finance

0 notes

Text

Make Money Online

#make money online#earn money online#how to earn money online#how to make money online#smart money tactics#laziest way to make money online#make money#online jobs#make money with chatgpt#online jobs at home#make money online 2024#make money online for free#best way to make money online#make money with affiliate marketing#jay froneman#dave nick#online business#andy hafell#how to build an online business#how to start an online business#cpa marketing#incognito money#caleb boxx#affiliate marketing for beginners#finance#investor#side hustles 2024#youtube automation#side hustle

10 notes

·

View notes

Text

Streamline your business operations with Magtec ERP! 🚀 We offer exceptional technical support, competitive pricing, thorough oversight features, a reliable process framework, and stay up-to-date with the latest software developments. 💻 Book a demo today and see how Magtec ERP can transform your business! ✨

#magtec#erp#automation#business#efficiency#software#technology#innovation#digitaltransformation#enterprise#solutions#productivity#success#growth#management#finance#humanresources#supplychain#logistics#cloud#saas#onpremises#hybrid#integration#scalability#customization#support#trustedpartner#magtecerp#magtecsolutions

2 notes

·

View notes

Text

In the fast-paced world of #finance, #communication needs to be seamless, secure, and efficient. Our #businessphonesolutions are designed to meet the unique demands of the finance industry, ensuring your clients and staff stay connected with confidence. Visit: https://www.vitelglobal.com/

3 notes

·

View notes

Text

Step into Financial Freedom with DLC Coin Bot

Are you looking for an opportunity to improve your income and invest your time wisely?With DLC Coin Bot, you can begin your journey in the world of cryptocurrencies with ease and safety. This bot is designed to be your personal guide to earning profits in an innovative and efficient way.No prior experience is needed—just the determination to succeed. Start now and join a growing community of individuals achieving their financial goals with the help of this smart tool.Take the first step today and make your future brighter

Click on the link and check for yourself https://t.me/DLCcoin_Bot/app?startapp=i_1214717039

#Crypto Community#Digital Wealth#DLC Coin Bot#Innovative Profits#Smart Investment Tool#Cryptocurrency World#Financial Freedom#Future Finance#Financial Goals#Easy Registration#Secure Investments#No Experience Needed#Earning Potential#Wealth Management#Crypto Revolution#Investment Opportunities#Automated Profits#Financial Independence#Online Earnings#Digital Assets#Blockchain Solutions#Cryptocurrency Trading#Secure Crypto Transactions#Digital Finance Platform#Future Investments#Crypto Savings#Crypto Tools#Growth Opportunities#Innovative Technology

2 notes

·

View notes

Text

🌐 The Future of AI & Automation is Here! 🌐

Step into tomorrow with AOMA AI Agency! From business automation to enhancing productivity, our AI-driven solutions are designed to elevate your brand and optimize your operations. Let us take care of the tech while you focus on growing your business. 🚀Boost your marketing ROI and prepare your brand for the future with expert digital solutions! 💼💡

#startup#entrepreneur#small business#artificial intelligence#artists on tumblr#branding#ecommerce#finance#investing#marketing#leadgeneration#automation

3 notes

·

View notes

Text

Unlock the potential of finance automation with EY India. Our cutting-edge solutions empower businesses to thrive in the digital age.

0 notes

Text

Personal finance strategies for saving and investing

Table of Contents:

1. Introduction

2. Importance of Personal Finance Strategies

3. Saving Strategies

1. Budgeting

2. Automating Savings

3. Cutting Expenses

4. Investing Strategies

1. Diversification

2. Retirement Accounts

3. Passive Income Streams

5. Conclusion: Maximizing Financial Growth

6. FAQ Section

Introduction:

In the realm of personal finance, navigating the complexities of saving and investing can be daunting. However, armed with the right strategies and knowledge, individuals can pave their way to financial security and prosperity. This comprehensive review delves into the intricacies of personal finance strategies for saving and investing in 2024, exploring various techniques and approaches to optimize wealth accumulation and growth.

**1. Importance of Personal Finance Strategies:**

Effective personal finance strategies serve as the cornerstone for achieving financial stability and long-term prosperity. By meticulously planning and implementing strategies tailored to individual goals and circumstances, individuals can gain control over their finances, mitigate risks, and build a solid foundation for future endeavors. Whether aiming for short-term goals like purchasing a home or planning for retirement, strategic financial management is indispensable.

**2. Saving Strategies:**

**1. Budgeting:**

Budgeting stands as the fundamental pillar of financial management, providing a roadmap for allocating income and expenses. By meticulously tracking expenses and setting realistic spending limits, individuals can identify areas of overspending and redirect funds towards savings and investments. Utilizing budgeting apps or spreadsheets simplifies the process, enabling better decision-making and fostering financial discipline.

**2. Automating Savings:**

Automation streamlines the saving process, ensuring consistent contributions towards financial goals. Setting up automatic transfers from checking to savings accounts or utilizing employer-sponsored retirement plans automates savings, removing the temptation to spend impulsively. Additionally, utilizing apps that round up purchases to the nearest dollar and deposit the difference into savings accounts fosters incremental savings growth effortlessly.

**3. Cutting Expenses:**

Trimming unnecessary expenses is paramount in bolstering savings potential. Conducting regular expense audits aids in identifying discretionary spending that can be reduced or eliminated. Negotiating bills, opting for generic brands, and embracing frugal habits contribute to significant cost savings over time. Redirecting these savings towards investments amplifies wealth-building opportunities and accelerates financial progress.

**3. Investing Strategies:**

**1. Diversification:**

Diversification is the bedrock of investment strategy, spreading risk across various asset classes to minimize exposure to volatility. By allocating investments across stocks, bonds, real estate, and alternative assets, individuals can optimize risk-adjusted returns and cushion against market fluctuations. Regular rebalancing ensures alignment with evolving financial goals and risk tolerance levels.

**2. Retirement Accounts:**

Maximizing contributions to retirement accounts such as 401(k)s or IRAs offers tax advantages and accelerates wealth accumulation. Employers often match contributions to retirement plans, amplifying the benefits of consistent savings. Leveraging tax-deferred growth and compound interest within retirement accounts empowers individuals to secure a comfortable retirement lifestyle.

**3. Passive Income Streams:**

Diversifying income sources through passive streams complements traditional employment income, fostering financial resilience and independence. Investing in dividend-paying stocks, rental properties, or creating digital assets like e-books or online courses generates recurring income with minimal ongoing effort. Cultivating multiple passive income streams bolsters financial security and enhances wealth-building potential.

**5. Conclusion: Maximizing Financial Growth:**

In conclusion, embracing personalized finance strategies tailored to individual circumstances is paramount in achieving financial prosperity. By prioritizing saving and investing, individuals can cultivate a robust financial foundation, mitigate risks, and capitalize on growth opportunities. With discipline, diligence, and strategic planning, the path to financial freedom becomes attainable for everyone.

**6. FAQ Section:**

1. Q: How much of my income should I allocate towards savings?

A: Financial experts recommend saving at least 20% of income towards savings and investments to ensure long-term financial security.

2. Q: Is it better to pay off debt before saving or investing?

A: It depends on the interest rates of the debt. High-interest debt should be prioritized for repayment, while simultaneously allocating a portion towards savings and investments to capitalize on compounding returns.

3. Q: What are some low-risk investment options for beginners?

A: Beginner-friendly investment options include index funds, exchange-traded funds (ETFs), and robo-advisor platforms, offering diversified exposure to the market with minimal risk.

4. Q: How often should I review my investment portfolio?

A: Regular portfolio reviews, typically quarterly or semi-annually, are recommended to ensure alignment with financial goals, risk tolerance, and market conditions. Rebalancing may be necessary to maintain diversification and optimize performance.

Learn more

#Personal Finance Strategies#Saving#Investing#Financial Management#Budgeting#Automation#Expense Reduction#Diversification#money

3 notes

·

View notes

Text

#workspace automation#process automation#business process automation#hr automation#finance automation

1 note

·

View note

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients. o Send reminders before the due date to gently prompt clients to pay on time. o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details. o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders. o Avoid threatening language or negativity that could harm the client relationship. o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Photo

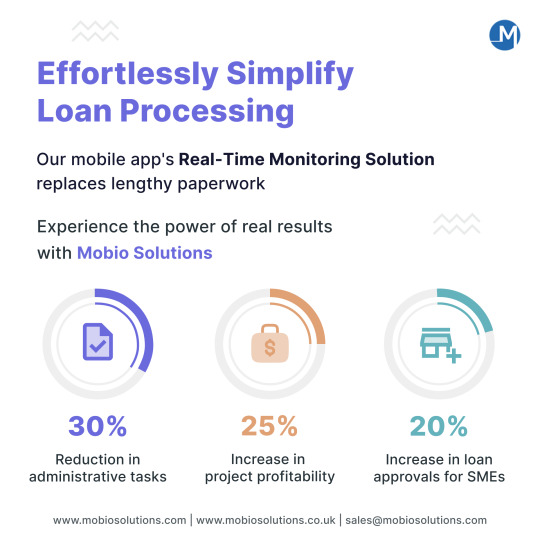

Don't miss out on this opportunity to transform your fintech business. See how our real-time monitoring mobile app solution for a leading fintech firm saved their time and money and gave them a competitive edge in the market. Don't settle for less than exceptional with Mobio Solutions!

#loanprocessing#fintech#technology#automation#startups#Business#banking#finance#financial management#payments#applicationsoftware#mobileapp#MobileAppDevelopmentCompany#mobiosolutions

8 notes

·

View notes

Text

Tired of spreadsheets? Upgrade to Magtec ERP Software for streamlined business operations and data-driven decisions. Book a demo today and see how we can transform your business!

#magtec#erp#automation#business#efficiency#software#technology#innovation#digitaltransformation#enterprise#solutions#productivity#success#growth#management#finance#humanresources#supplychain#logistics#cloud#saas#onpremises#hybrid#integration#scalability#customization#support#trustedpartner#magtecerp#magtecsolutions

3 notes

·

View notes

Text

Unlocking Efficiency and Innovation: The Role of Robotic Process Automation (RPA)

In today's fast-paced and competitive business environment, organizations are constantly seeking ways to improve efficiency, reduce costs, and increase productivity. Robotic Process Automation (RPA) has emerged as a powerful tool that can help businesses achieve these objectives.

What is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) is a technology that allows businesses to automate repetitive, rule-based tasks. It uses software robots, also known as "bots," to mimic human actions and interact with digital systems. These bots can log into applications, navigate through screens, input data, and complete tasks just like humans would.

The Role of RPA in Business:

RPA can be used to automate a wide range of tasks across various industries and departments. Here are some examples:

Finance and Accounting: Automating tasks such as accounts payable and receivable, invoice processing, and financial reporting.

Customer Service: Automating tasks such as answering FAQs, resolving customer inquiries, and processing orders.

Human Resources: Automating tasks such as onboarding new employees, processing payroll, and managing benefits.

IT: Automating tasks such as provisioning accounts, managing user access, and deploying software updates.

Impact of RPA on Businesses:

Implementing RPA can offer numerous benefits to businesses, including:

Increased efficiency and productivity: RPA can automate time-consuming and tedious tasks, freeing up employees to focus on more strategic and value-added activities.

Reduced costs: RPA can help businesses save money on labor costs, as well as reduce errors and compliance risks.

Improved accuracy and compliance: RPA bots are programmed to follow specific rules and procedures, which can help to improve accuracy and compliance with regulations.

Enhanced process visibility and control: RPA provides businesses with a clear view of their processes, which can help them identify and address bottlenecks.

Improved customer satisfaction: RPA can help businesses improve customer satisfaction by automating tasks such as order processing and customer service interactions.

RPA Services:

Implementing RPA successfully requires a partner with expertise in the technology and a deep understanding of business processes. A comprehensive RPA solution should include the following services:

Document AS-IS Process: This involves mapping out the existing process to identify areas for automation.

Design & Development of Bots, workflows, and forms for process automation: This includes designing and developing the software robots that will automate the tasks.

Bot license (We will use the appropriate underlying technology): This provides access to the software robots and the underlying technology platform.

Infrastructure: This includes setting up the necessary infrastructure to support the Robotic Process Automation (RPA) solution.

Production Deployment of the Bots: This involves deploying the bots to production and monitoring their performance.

RPA support: This includes ongoing support for the RPA solution, such as troubleshooting and maintenance.

Test & Deploy bots to production: This involves testing the bots in a production environment and making any necessary adjustments before they are deployed to full production.

Configuration data changes: This involves making changes to the configuration data of the bots as needed.

Password updates: This involves updating the passwords of the bots as needed.

Errors in executing the Bots: This involves resolving errors that occur during the execution of the bots.

Determining the “root cause” of a recurring issue or incident & recommendations: This involves identifying the root cause of a recurring issue or incident and recommending solutions to prevent it from happening again.

Infrastructure/application related issues: This involves resolving issues with the infrastructure or applications that the bots are interacting with.

Conclusion:

RPA is a powerful technology that can have a significant impact on businesses of all sizes. By automating repetitive tasks, RPA can help businesses improve efficiency, reduce costs, and increase productivity. However, it is important to choose a reputable Robotic Process Automation (RPA) companies with the expertise and experience to help you implement a successful RPA solution.

Ready to embrace the power of RPA?

Contact us today to learn more about how RPA can help your business achieve its goals.

#robotic process automation#robotic process automation rpa#rpa automation#robotic process automation software#rpa software#robotic process automation companies#robotic process automation technology#robotic process automation in healthcare#robotic process automation in banking#rpa solution#robotic process automation for finance#process automation solution#robotic process automation services#robotic process automation for insurance#rpa system#what is rpa automation#robotic process automation solution#robotic process automation benefits#robotic process automation consulting#robotic process automation consultant#rpa service provider#rpa consulting services

2 notes

·

View notes