#federal tax credit

Explore tagged Tumblr posts

Text

The Future of Electric Vehicles Amid Political Changes

More from our inbox: Hegseth’s Views on Women in the Military It Was a Pogrom ‘Resentment Helps No One’ True Crime’s Audience Recent analysis by three economists suggests that electric vehicle (E.V.) sales may plummet by as much as 27 percent if President-elect Donald J. Trump and Congress decide to revoke the federal tax credit currently benefiting consumers. To the Editor: Re “Trump Seen as a…

#American Industry#E.V. Sales#electric vehicles#federal tax credit#green energy#market trends#sustainable transportation#Trump administration#Used Electric Cars

0 notes

Video

youtube

Businesses Losing Millions Overlooking Massive Federal Tax Credit

0 notes

Text

Energy-Efficient Home Upgrades: Simple Changes to Save Energy and Money

If you’re looking for ways to save on energy bills and make your home more eco-friendly, energy-efficient upgrades are a great place to start. From installing new windows to harnessing solar power, these changes don’t just help the environment—they can also lead to serious savings. Let’s explore some of the most popular options, backed by real data, so you can make informed decisions. 1.…

#Blown-in cellulose insulation#Energy Star appliances#Energy-efficient home upgrades#Energy-efficient windows#Federal Solar Investment Tax Credit#Home insulation upgrades#Low-E windows#Solar panels for homes

0 notes

Text

How to Upgrade Your Truck Without Breaking the Bank: A Guide for the Individual Trucker

The new EPA regulations are probably the last thing you want to hear about right now. It feels like every time we turn around, there’s another rule or restriction. And honestly, it’s frustrating! But before you throw your hands up in anger, let’s talk about how these changes could actually work in your favor and, more importantly, what options are out there to help you upgrade your trucks without…

View On WordPress

#alternative fuel trucks#business#DERA grants#diesel emissions#electric truck incentives#emission reduction grants#EPA compliance#EPA regulations#federal tax credits#Freight#freight industry#Freight Revenue Consultants#green freight programs#logistics#low-interest truck loans#small carriers#small fleet loans#small trucking business#Transportation#truck financing#Truck Fuel Efficiency#truck maintenance savings#truck manufacturer rebates#truck rebates#truck replacement programs#truck retrofitting#truck scrappage programs#truck upgrade costs#truck upgrades#trucker incentives

0 notes

Text

Maximizing Innovation with the Federal R&D Tax Credit

The Federal Research and Development (R&D) Tax Credit offers a significant opportunity for companies to fuel their research endeavors while reducing their tax burden. This credit, often overlooked or misunderstood, provides a substantial incentive for businesses across various industries to invest in innovation.

0 notes

Text

US Government's Revamped $7,500 Tax Credit Reshapes Electric Vehicle Landscape

In a strategic move to accelerate the adoption of electric vehicles (EVs), the US government has introduced an enhanced $7,500 federal tax credit. Designed to incentivize both individuals and businesses, this credit applies to new, qualified plug-in EVs, and fuel-cell electric vehicles (FCVs). Notably, the credit is nonrefundable, aligning with the taxpayer’s owed taxes. Crucially, the credit…

View On WordPress

0 notes

Text

Things Biden and the Democrats did, this week.

The Consumer Financial Protection Bureau put forward a new regulation to limit bank overdraft fees. The CFPB pointed out that the average overdraft fee is $35 even though majority of overdrafts are under $26 and paid back with-in 3 days. The new regulation will push overdraft fees down to as little as $3 and not more than $14, saving the American public collectively 3.5 billion dollars a year.

The Environmental Protection Agency put forward a regulation to fine oil and gas companies for emitting methane. Methane is the second most abundant greenhouse gas, after CO2 and is responsible for 30% of the rise of global temperatures. This represents the first time the federal government has taxed a greenhouse gas. The EPA believes this rule will help reduce methane emissions by 80%

The Energy Department has awarded $104 million in grants to support clean energy projects at federal buildings, including solar panels at the Pentagon. The federal government is the biggest consumer of energy in the nation. The project is part Biden's goal of reducing the federal government's greenhouse gas emissions by 65% by 2030. The Energy Department estimates it'll save taxpayers $29 million in the first year alone and will have the same impact on emissions as taking over 23,000 gas powered cars off the road.

The Education Department has cancelled 5 billion more dollars of student loan debt. This will effect 74,000 more borrowers, this brings the total number of people who've had their student loan debt forgiven under Biden through different programs to 3.7 Million

U.S. Agency for International Development has launched a program to combat lead exposure in developing countries like South Africa and India. Lead kills 1.6 million people every year, more than malaria and AIDS put together.

Congressional Democrats have reached a deal with their Republican counter parts to revive the expanded the Child Tax Credit. The bill will benefit 16 million children in its first year and is expected to lift 400,000 children out of poverty in its first year. The proposed deal also has a housing provision that could see 200,000 new affordable rental units

11K notes

·

View notes

Text

"I'm pretty uncomfortable with the federal govts recent moves to improve housing availability by making things easier for landlords and property developers, with tax credits and financial subsidies.

Landlords and property speculators are among the most vile parties in Canada.

I'd rather see more direct affordability improvements for people, to help them avoid permanent, precarious tenancy."

#federal government#housing#landlords#landlords are parasites#property developer#tax credits#financialsubsidies#propertyspeculators#canada#affordability#people#tenancy#rent is theft#rent is too damn high#landlords are scum#landlords are bastards#landlords are leeches#class war#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

0 notes

Text

The Impact of Federal Tax Credits on Electric Vehicle Sales

In recent years, many car buyers have turned to the $7,500 federal tax credit for electric vehicles (EVs) as a significant factor in mitigating the high costs associated with these environmentally friendly options. However, with the impending administration of President-elect Donald J. Trump, there is a looming possibility that these credits could be eliminated entirely. This potential change…

#car prices#climate change#consumer reports#electric vehicles#EV sales#federal tax credit#Felix Tintelnot#Inflation Reduction Act#Joseph Shapiro#subsidies

0 notes

Video

youtube

Businesses Losing Millions Overlooking Massive Federal Tax Credit

0 notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

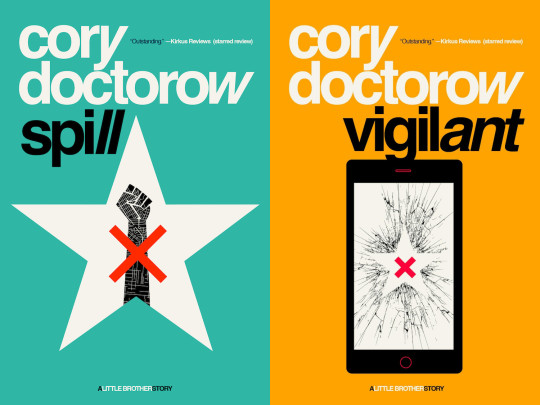

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

0 notes

Text

Car insurance: $546

Me: yikes I haven't been working a lot and I still gotta pay my credit card bill... I got time why don't I finally do my tax return (I have 3 w-2 forms)

Federal tax return: $4500

Me: NICE... and the state?

State tax return: $8

#I get these mailed to me lmfao#One year I got a $4 federal tax return bc the IRS got confused by something#I still have that check#My credit card bill is outrageous rn but I only use one credit card so.#Its at least 6k now. I pay like 800 every month but it never seems to get lower than 4k#My interest rate is probably insane. But I stay silly

0 notes

Text

Hey, y'all, this is a reminder for anyone that has student loans that they are defaulted on or in collections for:

Apply for Fresh Start NOW if you haven't already done so. Like right now. Do it right this very second do not put it off any longer.

If you don't know, applying for Fresh Start will move your loan status from "Default" to "Current," you will no longer have to deal with collections calls! You won't have your wages garnished or your tax refunds taken by the Education Department! The default gets removed from your credit and you become eligible for federal mortgage programs! You become eligible for Income Driven Repayment (IDR) programs that can reduce your monthly payment in a huge way (from $400/month to $50/month for me!) and you get IDR credit for the three years you were in default during the pandemic freeze!

It only has upsides!

I mean it, it can make a huge difference! You can even submit both Fresh Start and an IDR application at the same time. It takes literal seconds. I had my name legally changed and I'm still eligible! I clicked like 3 buttons, checked a couple boxes, and boom. I sent off the application August 22nd and I got the letter yesterday (Sept 20th), but that letter was dated Sept 1st and was only to inform me that my loan was no longer in default would be transferred to a new loan servicer by the end of the month. It took a week and a half to process.

I also became eligible and received a refund check for money taken from me during the starting stages of the pandemic.

The best time to do it is now. Period.

Do. It. Right. Now.

5K notes

·

View notes

Text

Mr Biden's proposal - which requires congressional approval - would cut off tax credits for landlords who try to raise rent by more than 5%.

The policy would apply to landlords who own more than 50 units, comprising about 20 million rental units across the country, according to the Biden administration.[...]

The proposal does include an exception for new construction and buildings undergoing substantive renovations. As the US faces low housing stock, this carve out is aimed at encouraging new rental property construction to increase the number of apartments and homes available.[...]

Nationwide, rent prices have risen by 21% since January 2021, according to data from the Federal Reserve Bank of St Louis.[...]

Mr Biden's plan to lower housing costs come as recent polls show he is trailing his rival, former President Donald Trump, in the 2024 presidential race.[...]

As a part of his housing announcement, Mr Biden said he would also direct federal agencies to assess whether public land could be repurposed to build affordable housing options.

16 Jul 24

870 notes

·

View notes