#eu innovation funding

Explore tagged Tumblr posts

Text

Horizon Europe stands as the European Union's most ambitious research and innovation framework program, succeeding Horizon 2020. Envisioned as a catalyst for scientific excellence and technological breakthroughs, Horizon Europe boasts a substantial budget allocation, underscoring the EU's commitment to advancing research and innovation. The program spans seven years, running from 2021 to 2027, and encompasses various pillars aimed at addressing societal challenges, promoting industrial competitiveness, and reinforcing the European Research Area.

#eu business funding#eu funding opportunities#eu innovation funding#european funding schemes#horizon europe funding#horizon europe research funding

0 notes

Text

EIF to launch €175-million investment in defence innovation and SMEs

The European Investment Fund (EIF) launched a €175-million fund, dubbed the Defence Equity Facility (DEF), on Friday to foster defence innovation around EU’s small and medium enterprises (SMEs).

“The European Commission and the European Investment Bank Group are stepping up cooperation to support investments in innovative defence technologies by launching a €175 million Defence Equity Facility that aims to support private equity and venture capital funds investing in innovative defence technologies having dual-use potential.”

The EIF stated that the fund aimed to “stimulate the development of an ecosystem of private funds” investing in defence innovation and to improve access to finance “for small and medium enterprises (SMEs)” operating in this field.

EU defence companies complain of having limited access to private and public funds as banks’ readiness to lend is declining, limiting the industry’s investment opportunities. Defence ministers voiced support for the sector in November last year.

Read more HERE

#world news#world politics#news#europe#european news#european union#eu politics#eu news#innovation#smes#funds#technology#tech news#security#defence

0 notes

Text

My dad, despite being a classicist, because of his phd in AI, is working at a research/Innovation institute that does a lot of stuff on a europe level and he attends a lot of eu innovation conferences etc.

And he told me it's frightening how even Europe is slowly and sneakily moving away from funding "green" projects. They're calling them sustainable now, so it sounds like it's the same, but eco-friendly policies and research are slowly slipping to the sidelines, because the pressure from companies etc is so large.

Oh also he said so much research within the eu that was supposedly never to be used for military matters is now being termed "dual use" so again it doesn't sound so bad, but what it means is that it's being used for military reasons.

46 notes

·

View notes

Text

Kids for Cash Documentary - and scum Judge Conahan was given clemency by Biden. He was sentenced to 17.5 years in prison. I would love to know how much the Biden cartel got for all of the scum he has let out of prison or whoever is truly behind the pardons/clemencies. 1 hr. 41 min. VIDEO

Mother of Suicide Victim Slams Biden for Commuting the Sentence of Corrupt Judge Who Convicted Her Son in “Kids for Cash” Scheme - ARTICLE

Study Reveals COVID-19 'Vaccines' Have Far Exceeded Criteria for Market Withdrawal - ARTICLE

CANCER CURE: EXPOSING Dem's Cancer Funding LIE - ARTICLE

The Dark Side of Innovation: Self-Replicating Vaccines and Their Dangers for EU Citizens - ARTICLE

NIH Funds Research Into Self-Disseminating Vaccines That Spread Like a Virus from Host to Host by Jon Fleetwood - is the day coming in which some of us will have to live in the woods in order to escape these psychopaths? ARTICLE

HOW BARACK OBAMA BUILT AN OMNIPOTENT THOUGHT-MACHINE AND HOW IT WAS DESTROYED - Thanks to Louise - ARTICLE

Current Bird Flu Primer by Dr. Meryl Nass - ARTICLE

7 notes

·

View notes

Text

Endless Food Co has raised €1 million in pre-seed funding to advance its innovative chocolate alternative, THIC (This Isn’t Chocolate), aimed at tackling sustainability and supply chain issues in the chocolate industry.

The funding round was led by Nordic Foodtech VC, with participation from EIFO and Rockstart, and will enable the company to scale production, establish a pilot plant, and expand its team.

Endless Food Co’s THIC is made from ‘upcycled’ brewer’s spent grain, a primary byproduct of beer brewing, and serves as a sustainable, cost-effective alternative to traditional chocolate. Unlike cacao, which faces growing supply challenges due to climate change, THIC is positioned as a scalable solution that reduces reliance on cacao and addresses environmental and ethical concerns in the chocolate industry.

9 notes

·

View notes

Text

“The power of the animal farming sector, both in the US and in Europe, and the political influence they have is just gigantic,” said Prof Eric Lambin, who conducted the study with Dr Simona Vallone, both at Stanford University, US. The researchers concluded that “powerful vested interests exerted their political influence to maintain the system unchanged and to obstruct competition created by technological innovations”. Lambin said: “We found that the amazing obstacles to the upscaling of the alternative technologies relates to public policies that still massively fund the incumbent system, when we know it’s really part of the problem in terms of climate change, biodiversity loss and some health issues.” The researchers said that tackling the problem would require government policies that ensured the price of meat reflected its environmental costs, potentially via taxation, increased research on alternatives, and better informed consumers.

[...]

The study, published in the journal One Earth, analysed the major EU and US agricultural policies from 2014 to 2020. It found the amount of public money spent on plant-based alternatives was just $42m (£33m) – 0.1% of the £35bn spent on meat and dairy. The former accounted for 1.5% of all sales. In the EU, cattle farmers got at least 50% of their income from direct subsidies. For research and innovation spending, 97% went to animal farmers, with almost all of these funds aimed at improving production.

78 notes

·

View notes

Text

The meeting was always going to be difficult given that it requires reaching decisions by consensus among nearly 200 governments, a process described by energy secretary Ed Miliband as playing “198-dimensional chess”. And in focusing on this issue of finance, the first Cop to do so, it was addressing the thorniest issue of all.

But this was made worse by incompetent leadership from fossil-fuel-rich Azerbaijan, which opened proceedings by calling oil and gas a “gift of God”. And it was bedevilled by obstructionist tactics from Saudi Arabia and weakening political will in industrialised countries, even as evidence builds that the climate crisis could be escalating out of control.

Records for soaring air and ocean temperatures, and for vanishing sea ice at both poles, are being broken by enormous margins. Last month a group of the world’s most respected climate scientists concluded that the world is “stepping into a critical and unpredictable new phase of the climate crisis”, putting it “on the brink of an irreversible climate disaster”.

It is hurtling towards permanently exceeding the internationally agreed 1.5C guardrail against catastrophe. Five tipping points that threaten to plunge the world into a more hostile climate will be triggered at that point, said the scientists – and 11 more lie beyond it.

Yet emissions continue to increase while government engagement withers. Even before Trump’s victory, EU countries had been scaling back environmental action. And Germany, France, Australia and Canada may soon elect more climate-sceptic governments too.

Britain, increasingly a climate leader, is an exception, announcing a pioneering new emissions target at Cop29, where both Miliband and Keir Starmer made a big impact. But longstanding political consensus is fracturing, with Kemi Badenoch calling herself a “net zero sceptic” even though more than three-quarters of Tory voters support a net zero target.

At Baku, as in countries around the world, the politics largely trumped the science. Take climate finance. It is authoritatively estimated that developing countries will need some $2.4tn (£1.84tn) a year. They are expected to meet nearly half of that themselves, leaving $1.3tn to come from the rich world. Most of that is expected to flow from business and “innovative sources” such as taxes on aviation and shipping, leaving a core to be provided by more prosperous country governments.

There is more disappointment over failure to endorse a landmark agreement at last year’s Cop to “transition away from fossil fuels”. After a determined Saudi bid to kill it, the final text only refers to it in a roundabout way, and the issue has effectively been shelved for a year. But Baku did agree on long-controversial rules for carbon trading that finally complete the implementation of the Paris agreement.

As in previous Cops, the most constructive developments occurred outside the formal negotiations. Britain announced £239m of new funding to help countries preserve forests. Mexico U-turned on its position as the last holdout against net zero in the G20. And Indonesia, the world’s eighth biggest CO2 polluter, unexpectedly pledged to phase out fossil-fuel power generation.

More significantly still, a coalition of more than 30 nations – including the UK and the EU – jointly promised to adopt tougher measures consistent with meeting the 1.5C target. They were inspired by a new report by the international Rhodium Group which concluded that such steps could reduce the temperature rise from the expected 2.7C to 1.4C by 2100.

This is important as, under the Paris agreement, all countries must make new commitments next year, when the coalition hopes others will follow its lead. The US was expected to join them but ducked out after Trump’s election – a sign of things to come.

The US president-elect will not shut down climate negotiations despite his intentions to leave the Paris agreement. Nor might he make much difference to US decarbonisation. Most of the Biden adminstration’s clean energy investments are in Republican-voting areas, which don’t want to lose them. And despite Trump’s pledge to “drill, baby, drill”, fossil fuel companies already have excess capacity and don’t plan to increase it. But his stance will make it harder to accelerate action that is needed to avoid disaster.

Everything depends on how the rest of the world responds, both at next year’s Cop in Brazil and in pursuing other ways of combatting climate crisis, the most effective of which would be to agree a mandatory treaty to slash emissions of methane, now seen as the fastest way to reduce global warming. If political will continues to wane, we will regret it bitterly – not just for our children, but for ourselves.

8 notes

·

View notes

Text

Good News From Israel

In the 21st Jul 24 edition of Israel’s good news, the highlights include:

Even the loss of limbs cannot defeat the Israeli spirit.

Israeli computer-brain interface breakthrough could restore the power of speech.

An Israeli surgical device can transform the lives of millions of heart patients.

Israeli tech enables those with impaired speech to access the Internet.

An Israeli food additive makes cooking oil safe for re-use.

The FBI used Israeli tech to access cellphone of would-be assassin.

In the latest EU Horizon investment round, the 3rd most funds went to Israel.

A Haredi community hosted 180 secular Nova survivors for Shabbat.

Read More: Good News From Israel

This week's edition includes Israeli innovations that reveal the early signs of life-threatening diseases; also, that locked-in patients can be given the ability to speak; that the voice-impaired can gain the freedom of the Internet; and that intellectually disadvantaged students can obtain university degrees.

It reveals that Jerusalem's Jews and Arabs can sing together; that Arabs from Morocco want to see the real Israel; and that there are many nations of the world that support Israel's fight against terrorism. This newsletter also reveals the amazing spirit of Israelis, determined to continue to rebuild their lives and benefit society, even after the devastating events of Oct 7.

Among the many Israeli technical breakthroughs, the US has again used Israeli security technology to reveal the secrets of a would-be assassin's cellphone. And the massive European funding for Israeli startups reveals just how much the world needs Israeli technology.

Finally, as the International Court of Justice bleats that Israel cannot occupy its own land, archaeologists reveal and display thousands of Jewish relics proving the Biblical bond between the Jewish people and all of the Land of Israel.

(NEXT NEWSLETTER - 4th AUG)

#AI#Artificial Intelligence#Crooks#Gaza#good news#greenhouse gas#Hamas#heart#IDF#Israel#Jerusalem#Jewish#Minecraft#Morocco#Nova#pain#pregnancy#speech#Tel Aviv#Your Honor”

14 notes

·

View notes

Text

How to Register a Company in the EU: A Step-by-Step Guide by Euro Company Formations

The European Union (EU) is an attractive location for entrepreneurs looking to expand their businesses into a market of over 450 million consumers. The EU's seamless internal market, robust legal framework, and favorable business environment make it a hotspot for both startups and established businesses.

At Euro Company Formations, we help businesses navigate the complexities of EU company registration, offering expertise and guidance every step of the way. This article provides an overview of the EU registration process and the benefits of incorporating within the EU.

Why Register a Company in the EU?

Register a company in the EU offers numerous advantages:

Access to a Large Market: With 27 member countries, the EU is one of the world's largest markets, providing ample opportunity for business growth.

Favorable Business Regulations: The EU provides clear regulations on trade, intellectual property, and consumer protection, giving businesses a stable environment.

Free Movement of Goods, Services, and Capital: Once established in one EU country, your business can trade freely across the entire EU without additional tariffs or complex regulatory barriers.

Tax Benefits: Many EU countries offer tax incentives and advantages to new businesses, especially those in innovation and technology sectors.

Steps to Registering a Company in the EU

1. Choose Your Business Structure

The EU allows different types of business structures, including Limited Liability Companies (LLCs), Sole Proprietorships, and Public Limited Companies. Choosing the right structure impacts your tax liabilities, personal liability, and reporting requirements. Euro Company Formations can help you select the structure that best suits your business model.

2. Choose a Country for Registration

Each EU country has its own regulations, so it’s essential to choose a country that aligns with your business goals. For instance, Ireland and Estonia are popular for tech startups due to favorable tax regimes and online accessibility.

3. Register Your Business Name

You’ll need to check that your desired business name is available in the chosen country’s commercial register. The name must be unique and comply with any naming conventions.

4. Prepare Required Documents

Most countries require basic documents, including:

Articles of association (company bylaws)

Proof of identity for directors and shareholders

Proof of registered office address

In many cases, you’ll also need to provide proof of funds if starting a capital-intensive business. Euro Company Formations offers services to help organize these documents and ensure compliance with local regulations.

5. Register with Tax Authorities

Once your company is legally established, you must register with the relevant tax authorities for VAT, corporation tax, and, in some cases, employee payroll taxes.

6. Obtain Necessary Licenses and Permits

Depending on your industry, you may need specific licenses to operate legally within the EU. This includes permits for regulated sectors like finance, healthcare, and pharmaceuticals.

7. Open a Business Bank Account

Opening a business bank account in the EU simplifies transactions and helps establish credibility. Many banks require proof of company registration, identification of the company's directors, and sometimes even a business plan.

Why Choose Euro Company Formations?

At Euro Company Formations, we simplify the process by offering personalized guidance and support tailored to your business needs. Our experienced team has in-depth knowledge of each EU country’s specific requirements, ensuring your company registration is smooth and hassle-free.

Benefits of Partnering with Euro Company Formations:

Personalized Assistance: From choosing the best jurisdiction to completing paperwork, we offer end-to-end support.

Quick and Reliable Service: We handle all the paperwork and liaise with local authorities, reducing your waiting time.

Cost-Effective Solutions: Our services are designed to save you both time and money.

Long-Term Compliance Support: We offer ongoing support to help you stay compliant with EU regulations.

Conclusion

Registering a company in the EU is a strategic step towards expanding your business. By working with Euro Company Formations, you can navigate the complexities of the EU market with ease and focus on what matters most—growing your business. Let us help you unlock the opportunities of the European market today!

#euro company formations#register company in eu#company formations europe#europe company registration

2 notes

·

View notes

Text

It was so unnecessary to recuse ourselves from Horizon for 3 years. But now we're back lads so let the research and development flow

19 notes

·

View notes

Text

youtube

Thanks to Ukrainian drones, the Russian guided missile corvette Ivanovets is now sleeping with the fishes. BTW, great vid above! 🇺🇦❤️

Ukraine thought to have sunk Russian warship near occupied Crimea

Ukrainian forces are believed to have sunk the Russian Ivanovets warship near occupied Crimea in a sophisticated overnight attack by multiple sea drones, demonstrating Kyiv’s expanding power in the Black Sea. Ukraine’s military intelligence published a grainy video showing several sea drones attacking the Russian corvette, ending with three dramatic images showing it listing, exploding and sinking into the water. Ukraine said the boat had been sunk, as did leading Russian military bloggers. Hours later, western officials said they believed the warship had been destroyed in an attack that used long range uncrewed drones. [ ... ] Russia did not immediately comment on the incident, but a number of pro-Kremlin military bloggers close to Moscow confirmed that the Ivanovets warship was hit. [ ... ] Although Ukraine began the war with no navy, scuttling its only frigate to prevent it from falling into Russian hands, Kyiv has gradually pushed back on Moscow’s early dominance of the Black Sea through long range missile attacks and the innovative use of sea drones.

Considering that the Vermont National Guard probably has more military ships than Ukraine, the Ukrainian Navy now terrifies the Russian Black Sea fleet. There's little Russian presence in the western part of the sea these days.

The Ivanovets probably thought it was safe where it was anchored. It was in a body of water called Lake Donuzlav in occupied Crimea. Though it is more like a bay with a narrow opening to the Black Sea.

^^^ That opening is just 435 meters wide, a little over 4.5 US football fields. But Ukrainian sea drone pilots managed to navigate several of their kamikaze vessels into the bay without being detected up to that point.

The sinking of the Ivanovets is just one of several bits of good news for Ukraine in the past few days.

Putin toady Viktor Orbán, the homophobic leader of Turkey Hungary, was forced to back down from his threat to block €50 billion in aid to Ukraine.

EU agrees €50bn package for Ukraine as Viktor Orbán bows to pressure

A robust and united position among EU member states convinced Viktor Orbán to end his “blackmail” and support a €50bn (£43bn) funding package for Ukraine, European prime ministers have said. The Hungarian prime minister, who had been vowing to block the funds since December, performed one of the fastest U-turns seen at a leaders’ summit after six weeks of brinkmanship. There was relief that the deal was finally done but also a sense of fury among leaders who had been dragged to Brussels for the second time in as many months to try to get the package over the line after Orbán blocked the aid in December. The Finnish prime minister, Petteri Orpo, said: “Nobody can blackmail 26 countries of the EU. Our values were not for sale.” Donald Tusk, the Polish prime minister, who said he had “nothing nice” to say to the Hungarian prime minister, warned there would be no reward for Orbán or anyone who had tried to solicit “rotten compromises”.

Also, Dark Brandon strikes again! President Biden is using his discretionary powers as commander-in-chief to get some military aid to Ukraine while the House Putin Caucus at the direction of sex offender Donald Trump continues to block Biden's $61 billion aid package.

First Ecuador, Now Greece: Joe Biden Is Finding More And More Countries To Help Him Arm Ukraine

“Ring-trade.” Remember that term. Increasingly, it’s how U.S. president Joe Biden is arming Ukraine. He did it with Ecuador. Now he’s doing it with Greece, too. A ring-trade is, in essence, a circular swap. One country pays or arms a second country so the second country can arm a third country. Germany pioneered the ring-trade—Ringtausch—for supporting Ukraine, most notably giving to... The Czech Republic: 14 Leopard 2 tanks and an engineering vehicle in exchange for the Czech Republic having given to Ukraine potentially dozens of T-72 tanks; Greece: 40 Marder fighting vehicles so that Greece could donate to Ukraine 40 BMP-1 fighting vehicles; Slovakia: 15 Leopard 2A4s to compensate for 30 BVP-1 fighting vehicles Slovakia donated to Ukraine. Slovenia: 45 military-grade heavy trucks so that Slovenia would give to Ukraine 28 M-55S tanks. The United States with its greater stocks of old weapons eventually could surpass Germany as a ring-trader. And it has every reason to do so. For four months now, a small contingent of pro-Russia Republican lawmakers, led by the extremist speaker of the U.S. House Mike Johnson, has blocked $61 billion in new U.S. government funding for Ukraine’s war effort. In early January, Ecuadorian president Daniel Noboa revealed in a radio interview that Ecuador would give to the United States “scrap” weapons in exchange for new weapons—worth $200 million—that the United States would provide at a later date. The United States then would donate the “scrap” to Ukraine. Some of that old hardware apparently shipped aboard an Antonov An-124 airlifter on Jan. 25. [ ... ] According to Greek newspaper Kathimerini and other media, the Biden administration offered the government in Athens three 87-foot Protector-class patrol boats, two Lockheed Martin C-130H airlifters, 10 Allison T56 turboprop engines for Lockheed P-3 patrol planes plus 60 M-2 Bradley fighting vehicles and a consignment of transport trucks. In exchange for this largess, the Americans want the Greeks to donate more weapons to the Ukrainians. “We continue to be interested in the defense capabilities that Greece could transfer or sell to Ukraine,” Blinken wrote. The Greek government reportedly already has earmarked old weapons for onward transfer to the government in Kyiv. As with Ecuador, the trade could involve air-defense equipment: S-300 and Hawk long-range missiles and launchers and Tor and Osa short-range missiles and launchers. This indirect U.S. support of Ukraine via ring-trades is necessary because, starting in October, Republicans in the U.S. Congress made it clear they probably never will approve additional direct military aid to Ukraine. [ ... ] [L]ook for Biden to get more creative as Republican intransigence persists. The president even could donate excess defense articles directly to Ukraine, and in large quantities, assuming Ukraine or some other country pays for shipping.

#invasion of ukraine#ivanovets#sea drones#russia's shrinking black sea fleet#lake donuzlav#group 13#eu aid to ukraine#viktor orbán#joe biden#ring-trade#greece#ecuador#germany#stand with ukraine#russia's war of aggression#us house of representatives#house putin caucus#donald trump#vladimir putin#ивановец#владимир путин#путин хуйло#россия проигрывает войну#сокращающийся черноморский флот россии#геть з україни#головне управління розвідки#деокупація#україна переможе#слава україні!#героям слава!

7 notes

·

View notes

Text

Decoding EU Funding Directions: Where is the Money Going? In an era of rapid technological advancement and global economic competition, securing funding for innovation and business growth is paramount. The European Union (EU) stands as a prominent supporter of innovation and business development, offering a multitude of funding opportunities to fuel progress and competitiveness. However, navigating the landscape of EU funding can be daunting, with various programs and initiatives catering to different sectors and objectives. In this article, we embark on a journey to decode EU funding directions, shedding light on where the money is going and how businesses and innovators can tap into these opportunities.

0 notes

Text

The United States is the world’s dominant financial and technological power. China is the global manufacturing hegemon. What is Europe’s economic leverage? That question lies at the core of a recent report by former European Central Bank President Mario Draghi. In a nutshell, Draghi argues that the European Union is facing huge economic challenges that could soon make the bloc irrelevant on the global economic scene. This may sound like an alarmist take. Yet a deep dive into U.S., Chinese, and European economic data shows that Draghi’s analysis is spot on. The EU needs to overhaul its economic model—starting with the way it approaches the financing of innovation—if it wants to avoid being squeezed between the United States and China.

The causes of Europe’s economic woes are structural. Demographics and productivity growth determine long-term economic prospects, and the EU is not doing well on either metric. Take demographics: Primarily because of low fertility rates, the EU’s workforce could shrink by around 2 million workers each year by 2040. Europe’s poor demographic prospects will have important ripple effects, not least because financing growing public health care and pension costs will prove increasingly tricky as Europeans age. Things do not look better for productivity, which has grown at a modest 0.7 percent per year on average since 2015—less than half the U.S. rate and a mere one-ninth of China’s reported figure over the same period. One data point says it all: In 1995, U.S. and EU productivity was broadly similar. Today, Europe’s productivity is about 20 percent below America’s.

Economists have long debated the causes of Europe’s meager productivity. The long list of culprits includes low labor mobility, overwhelming red tape, and flaws in the education system. Low EU expenses on research and development, however, stand out as one of the main drivers of the growing productivity gap between the U.S. and EU economies. The data is striking: At $886 billion, or 3.4 percent of GDP, in 2022, U.S. R&D expenses were more than twice as high as the EU’s, at $382 billion, or 2.3 percent of GDP. China is not far behind; the country is already the world’s biggest spender on public R&D and is catching up fast in private spending as well. On this measure, the United States and China are giving themselves the means to succeed in the global transition toward high-tech, digitalized economies. Meanwhile, the EU is lagging far behind.

There is not much that EU policymakers can do to improve the bloc’s demographic outlook. The main potential fix would entail continued large-scale immigration far into the future, but the growing appeal of populist, far-right parties makes this course unlikely. On productivity growth, however, European policymakers have scope to act.

On this front, the Draghi report calls for a financial electroshock to boost R&D spending. His team of economists reckons that the EU needs to spend an extra 750 billion to 800 billion euros per year to close the gap with the United States and ensure that the bloc does not fall far further behind its competitors. Such an investment push would be huge. It would represent around 5 percent of EU GDP each year—a massive amount by any standard. This is precisely why it is unlikely to happen.

The private sector alone would not be able to shoulder such eye-popping costs. In turn, the fate of Draghi’s calls for an investment push will hinge on Europe’s ability to massively boost public spending on R&D. In theory, this scale of funding could be done through joint EU borrowing, which was first used in 2020, when EU member states gave the European Commission the green light to issue up to 750 billion euros in bonds to finance the post-COVID economic recovery. Yet this time, joint borrowing does not appear to be in the cards. Shortly after the release of the Draghi report, German Finance Minister Christian Lindner declared that “joint borrowing will not solve the EU’s structural problems.” With Germany saying nein, Draghi’s proposal for EU bonds looks dead for the foreseeable future.

Even if Draghi’s calls for a huge investment push are likely to remain unheeded, the bloc still has options to boost innovation spending—for free. On this front, Europe could seek to fix two well-known issues for European start-ups: fragmented public funding across EU member states and sectors as well as a relative dearth of private venture capital.

On fragmentation of public support, the Draghi report makes a simple observation. The 27 EU member states all offer one form or another of financial support to some technological sectors they deem to be critical. Taken together, the amounts are far from trivial. However, there is catch. The lack of EU-wide collaboration to identify a few priority sectors means that a multitude of industries are receiving little money, hindering the emergence of European technology champions.

This situation calls for a bold remedy: EU member states should identify a handful of critical sectors and jointly go big in these fields. Crucially, this does not mean favoring specific firms in an attempt to pick winners and distort competition. Nor does it mean that each EU member state should pick its own pet projects and ask the EU to subsidize their development. And of course, the bloc should also refrain from sustaining zombie firms that would be unprofitable without infusions of taxpayers’ cash.

Instead, what this means is that the EU should create an EU-level structure to identify and fund priority sectors, essentially transferring to EU institutions the responsibility to spell out which sectors should receive public R&D money in a bid to foster the emergence of a more coherent EU financing landscape. Frontier technologies such as artificial intelligence and quantum computing would be obvious sectors for the EU to go all in. The data is stark: More than 80 percent of global AI funding goes to U.S. or Chinese firms compared with just 7 percent to EU businesses. The gap is similarly striking for quantum computing. Seven of the top 10 global firms in the field are U.S.-based. Two are Chinese, and one is Japanese; none is European. In these two fields, the pooling of resources across EU member states could go a long way to bridge the divide between Europe and its competitors.

The emergence of EU tech champions would come with an added benefit: It would lift Europe’s place on the radar of global venture capital funds. Since 2013, about five times more venture capital has gone into U.S. start-ups than European ones. The lack of such funding in Europe comes with dramatic consequences for EU startups: Of the 147 unicorns (start-ups whose value stands above $1 billion) that have emerged in the EU since 2008, about one-third eventually relocated abroad, mostly to the United States, often because they could not find sufficient financing in Europe to grow their operations. Of course, streamlining the hodgepodge of EU and national regulations would also come a long way to boost Europe’s attractiveness to venture capital funds.

There is little chance that EU policymakers will answer Draghi’s calls for a massive investment boost. Yet even absent a huge financing push, the bloc still has ways to boost productivity growth in a bid to remain relevant on the global economic scene. Granted, these measures would not be enough to bridge the gap between Europe and its competitors. What they could do is slow down the bloc’s economic demise.

The stakes are high: Without an overhaul of EU innovation financing, the likeliest scenario is that the bloc will continue to fall further behind the United States and China in the global race for economic might, technological prowess, and geopolitical relevance. What’s more, Europe will struggle to finance its generous social model without sustained economic growth. Tackling Europe’s productivity gap should be at the top of the to-do list of the new European Commission.

3 notes

·

View notes

Photo

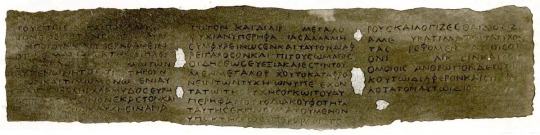

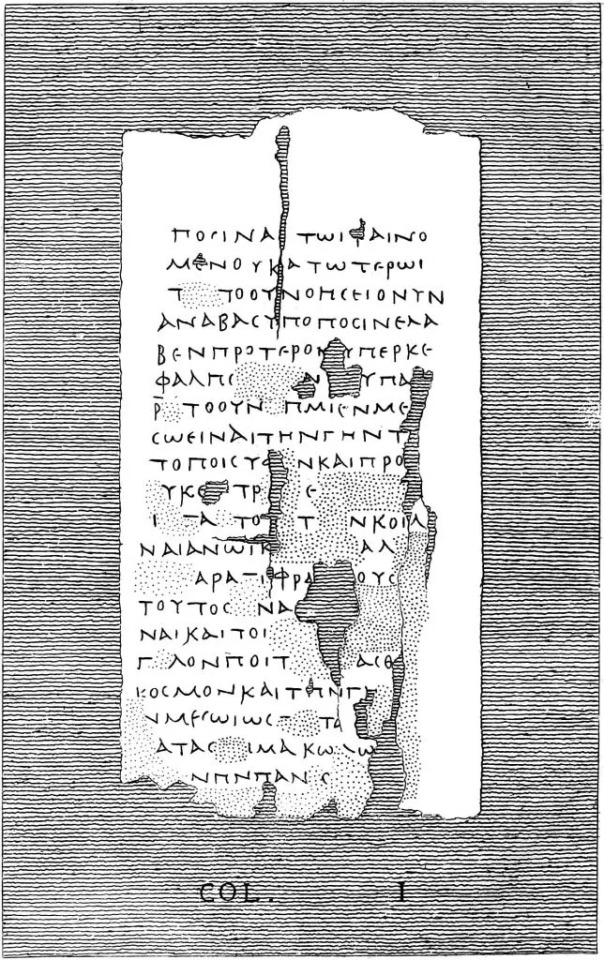

Ancient Latin Texts Written on Papyrus Reveal New Information About The Roman World

Researchers funded by the European Union have deciphered ancient Latin texts written on papyrus. This work could reveal a lot about Roman society and education, as well as how Latin’s influence spread.

Although the number of Latin texts found on papyrus dating from the first century BCE to the eighth century CE has grown as a result of new archaeological discoveries, these texts are frequently not given the attention they require. Therefore, they represent a vast untapped source of information and insight into the development of ancient Roman literature, language, history, and society.

Latin texts on papyrus in particular could provide information about the period’s literary and linguistic emigration. This might also reveal more about the educational environment, and paint a clearer picture of the Roman economy and society.

New approach to Latin texts

The EU-funded PLATINUM project, which was funded by the European Research Council, was launched to achieve just this. It began with a preliminary census of existing Latin texts on papyrus, in order to assemble and update collections.

“A key innovation was the multidisciplinary way we worked on these texts, bringing them under the spotlights of Latinists, linguists, historians – of Classicists, in general,” explains PLATINUM project coordinator Maria Chiara Scappaticcio from the University of Naples Federico II in Italy.

This work was pulled together to produce the Corpus of Latin Texts on Papyrus, six volumes of which will shortly be published by Cambridge University Press. “This is the major output of the project,” adds Scappaticcio.

“This work collects all the texts of interest, and offers scholars a reference source and tool. Its importance is clear when one compares what we knew about Latin papyri before PLATINUM, and what we know today.”

Groundbreaking linguistic findings

Several interesting findings were made in the course of the project. These include the startling discovery of Seneca the Elder’s Histories. “None of us could have imagined that such an important work would be found in one of the charred papyri from Herculaneum,” says Scappaticcio. “A new chapter in Latin literature has been rewritten thanks too PLATINUM.”

In addition, many previously unknown texts are now circulating among scholars as a result of the project’s work. The team has helped to forge new partnerships and exchanges between academic and cultural institutions.

“We also discovered the only known Latino-Arabic papyrus,” remarks Scappaticcio. “In this text, the Arabic language has been transliterated in Latin script. This text is unique and provides evidence of interactions between Latin language and culture, and Arabic language and culture in the early medieval Mediterranean.”

Cultural interactions uncovered

The PLATINUM project has helped to shine new light on the spread of Latin, especially in the provinces of the Late Antique Roman Empire.

Careful examination of the actual books, tools and materials that were circulating at the time has provided insights into, for example, how Latin was taught as a foreign language.

“We know now that Latin literature was circulating in the Eastern Roman Empire, and how this literature might have shaped knowledge,” notes Scappaticcio. “One of the main reasons for learning Latin, for example, was the necessity of familiarising oneself with Roman law.”

Scappaticcio believes that this research will benefit not only ancient historians and classical philologists, literates and linguists, but also cultural historians. “The work has opened the door to better understanding cultural interactions at the time,” she says.

“The work of PLATINUM touches on Roman Orientalism, as an aspect of multiculturalism in Antiquity and Late Antiquity.”

By Leman Altuntaş.

#Ancient Latin Texts Written on Papyrus#platinum project#european research council#herculaneum#latinists#linguists#historians#ancient historians#ancient artifacts#history#history news#ancient history#ancient culture#ancient civilizations#roman history#roman empire

26 notes

·

View notes

Text

Since 2015 my farm has been involved with trialling new, and more environmentally-friendly methods of farming.

We have not received any direct funding from the UK government. We work with two universities who have contributed towards the cost of our experimental projects, and we received several grants/rebates from the EU... before Brexit, of course!

UK Gov often spouts that it supports small farms, but it has done little in real terms to prove this. £14m is like pissing in a 200 litre keg of Spanish white wine... there is no noticeable difference!

5 notes

·

View notes