#equipment loan

Explore tagged Tumblr posts

Text

Crop Insurance Online: Simplifying Access for Farmers in Rural Areas

Crop insurance has become a critical security umbrella for farmers in the dynamically changing world of agriculture, specifically in rural India. The increasing unpredictability in weather conditions and rising incidences of crop diseases require that an effective insurance mechanism be in place to protect the livelihoods of farmers. Online crop insurance platforms, through which this much-needed access is being revolutionized, make getting coverage easier than ever. The big player leading this transformation is RUGR, a financial technology company that grants loans and other financial solutions to farmers.

Crop Insurance: Important It Is

Crop insurance protects against loss due to unforeseen conditions such as natural calamities, pests, and diseases. For the most parts of the country, agriculture remains the single source of livelihood for millions of poor people in this country. And one can only imagine what follows if a crop failure strikes such areas in general. Without insurance, debts could cripple farmers and result in loss of their land.

The PMFBY is an ambitious government-initiated insurance program for farmers spread across the nation. Under this scheme, a farmer will have to pay considerably lesser premium on crop insurance coverage against many more risks. Since the intervention of technology in the process, availing crop insurance has become less cumbersome and faster.

The Role of Fintech in Crop Insurance

Fintech firms like RUGR play a very important role in increasing the reach and efficiency of crop insurance services. It enables farmers, through mobile banking in rural Bharat, to apply online for crop insurance and removes the pain of cumbersome paperwork and lengthy procedures associated with applications for insurance. This digital approach saves time and reduces the chances of errors that can happen during manual submissions.

The RUGR platform shall provide a venue where farmers easily navigate through varied insurance options, compare the plans of coverage, and choose those that best fit their needs. Such transparency in decision-making truly empowers farmers to consider effective options in regards to insurance cover.

Simplify Access Through Online Platforms

All in all, the online availability of crop insurance in rural settings has by a large margin facilitated better means of access to farmers. A farmer can sit in his house and, using a smartphone or computer, fill out his application. This convenience is especially great for those people who live far away from city centers where physical banking institutions are located.

Moreover, online gateways update the status of the application and the processing of claims instantly; hence, farmers are informed at every stage. With this level of feedback, trust is multiplied, and more farmers could be brought under insurance coverage.

Mobile Banking: A Game Changer

The rise of mobile banking rural Bharat has further enhanced the accessibility to crop insurance. Today, farmers can operate their finances and insurance policies directly from their mobile phones. This facility is all the more relevant in rural areas where the conventional banking structure may not be strong.

It will ensure easy transactions on the part of farmers to pay their premiums online instead of going all the way to bank branches. Besides this, it ensures speedier disbursal of claims directly into the accounts of farmers so that timely financial support can be provided when it is most needed.

Integration of Crop Loans with Insurance

The product suite of RUGR ranges from crop insurance to agricultural equipment loans and gold loans, with a design for farmers. Bringing this range of financial services together with crop insurance at the core, RUGR provides an all-rounded support system that addresses multiple facets of farming.

For example, a farmer taking a loan for equipment purchase under RUGR may enroll in a crop insurance policy on the same undertaking to protect his investment against any loss. This is a holistic approach that besides adding to the farmer's financial security also ensures a "farmer sowing responsibly" as he knows he has cover against contingencies.

Farmer Education Programs

With the advancement in technology and increase in accessibility, very few farmers were informed of the benefits associated with crop insurance or how to use the online place efficiently. RUGR recognizes the awareness gap in informing farmers and does some serious sensitization on available resources for farmers.

The training provided to the farmers in the form of workshops, webinars, and other information helps them understand the significance of crop insurance. Education thus empowers farmers with knowledge and skills, setting up rural communities for proactive risk management.

Success Stories: Real Impact on Farmers

A few success stories outline how online crop insurance has really made a difference in the lives of farmers. A few examples are discussed below.

Case Study: Smallholder Farmer's Journey

A small farmer in Maharashtra usually suffered massive losses due to heavy flooding during the monsoon seasons. He finally applied online from RUGR's web-based platform for the crop insurance benefit under PMFBY. Filing a compensation claim online with them, this farmer was covered within weeks. He had some money left afterwards to recover fully and buy much better seeds before the next crop season planting.

Case Study: Community Engagement

A few farmers from a village in Punjab came together to get crop insurance from the RUGR platform. They shared information on how to apply and contributed to paying the premium in order to collectively cover their crops against loss. This helped not only in tightening the bonds of the village community but also contributed to the overall financial stability in the village.

Case Study: Increased Productivity

A farmer who was conservative and never believed in investing much in modern equipment due to losses took an equipment loan and crop insurance through RUGR. With the security of his insurance policy, he invested in improved machinery that enhanced his productivity by 40% and, ultimately, his profitability.

Challenges Ahead

Much has been done for crop insurance to become more accessible and easier to interact with through electronic portals, and yet more needs to be done. Many rural areas still have poor internet connectivity, or farmers from a previous generation have lower digital skills. These can be bridged only by further investment in infrastructure and education.

Secondly, awareness of the available schemes amongst all eligible farmers is paramount for the attainment of maximum enrollment rates in such programs as PMFBY. In reaching the poor, particularly, collaboration by government agencies, fintech companies like RUGR, and local organizations will be required.

Conclusion

Crop insurance online symbolizes one of the largest strides in facilitating the farmers across rural India. Similarly, a firm like RUGR facilitates accessing digital platforms easy with the application of mobile banking to empower them against unforeseen perils.

As agriculture evolves with increasing climatic vagaries and market changes, strong safety nets like crop insurance will form the bedrock of resilience in farming communities. With ongoing efforts toward increasing awareness and access, it is also hoped that more farmers will make use of these invaluable resources-ultimately leading to stronger rural economies and improved food security across India.

#rugr#equipment loan#mobile banking rural Bharat#Online crop insurance platforms#mobile banking in rural Bharat

0 notes

Text

Key Factors to Consider When Choosing the Right Equipment Loan Provider

Choosing the right equipment loan provider is a critical decision for any business. It can significantly impact your operations, financial health, and growth potential.

But how do you make the right choice?

This guide will help you navigate the complex landscape of business equipment loans. It will highlight the key factors to consider when selecting an equipment loan provider.

We'll delve into aspects like interest rates, loan terms, and the provider's industry experience. We'll also discuss the importance of transparency, customer service, and customised financing solutions.

By the end of this guide, you'll be equipped with the knowledge to make an informed decision. One that aligns with your business needs and financial goals.

Let's get started.

Understanding Different Types of Equipment Loans

Before choosing an equipment loan provider, it's crucial to understand the different types of equipment loans available. Each loan type has unique features, benefits, and requirements that cater to varied business needs.

Here's a brief overview of common equipment loan options:

Term Loans: Fixed or variable interest rates, with a set repayment period.

Equipment Leases: Allows usage of equipment for regular payments without ownership.

Equipment Financing: Provides funds to purchase equipment, with the equipment itself serving as collateral.

Each option has its pros and cons, depending on your financial situation and business needs. Understanding these differences will help you select a loan that fits your specific requirements, ensuring you get the most out of your business equipment investment.

Comparing Interest Rates and Terms

When selecting an equipment loan provider, comparing interest rates across multiple lenders is vital. An interest rate can significantly impact the total cost of your equipment loan over time.

Consider these factors when evaluating rates and terms:

Fixed vs. Variable Rates: Fixed rates offer stability; variable rates can fluctuate.

Loan Term Length: Shorter terms usually mean higher payments but lower overall interest.

Fees and Penalties: Identify hidden fees that affect your overall costs.

Understanding these components can help ensure you secure a loan that aligns with your financial capabilities. By examining both the rates and terms, you can avoid unfavourable conditions and make a choice that supports your business objectives.

The Importance of Transparency and Clear Communication

Transparency is critical when choosing an equipment loan provider. A lender should offer clear, straightforward terms without hidden surprises. You should easily understand the payment schedules, interest rates, fees, and any other conditions attached to the loan agreement.

Furthermore, effective communication is an essential part of a smooth loan process. The provider should be responsive to inquiries and eager to clarify any uncertainties. This approach ensures a mutual understanding, which helps in building a trustworthy relationship. Always seek a lender willing to explain all loan aspects comprehensively before you commit.

Evaluating Lender's Industry Experience and Reputation

Choosing a lender with substantial industry experience can greatly benefit your business. Experienced providers often have a deeper understanding of specific equipment needs and market trends. They can offer tailored advice that aligns with your business sector.

Additionally, a lender's reputation is a strong indicator of reliability. Positive reviews and testimonials from previous clients can reveal the quality of service to expect. Consider these factors when assessing a lender:

Track record in the industry

Feedback from past clients

Awards or recognitions received

Strong reputation and experience help ensure a more seamless loan process.

Assessing the Application Process and Speed of Funding

The application process for an equipment loan should be straightforward and user-friendly. A complicated process can lead to delays and frustration. Quick and easy processes can help you secure funding without unnecessary stress.

Speed of funding is another crucial factor to consider. Some lenders offer rapid approval and disbursement, which might be essential for urgent equipment needs. Evaluate the lender’s timeline from application to funding to ensure it matches your business requirements.

Assessing these elements helps streamline your equipment acquisition. Choose a lender that offers a hassle-free process and prompt funding, ensuring minimal disruption to your operations.

Flexibility of Payment Terms and Schedules

Payment terms and schedules play a vital role in managing your finances. A flexible payment plan can ease cash flow issues and offer financial stability. It's important to understand what options are available.

Consider these flexible aspects:

Availability of interest-only periods.

Options for seasonal or irregular payments.

Possibility for extended repayment terms.

Reviewing these possibilities ensures that your repayment plan suits your business cycles. It’s also beneficial to check for potential penalties for missed or late payments. Choosing a provider with flexible payment terms helps accommodate your business's unique financial rhythm.

Total Cost of the Loan: Fees and Charges

When considering a business equipment loan, it's crucial to account for all the associated costs. The total cost of a loan encompasses more than just the interest rate. There are often additional fees and charges that can affect your overall repayment amount.

Loan providers may include origination fees, maintenance charges, or prepayment penalties. These fees can add up and significantly impact the loan's total expense. Understanding these costs can help you assess if a loan is truly affordable for your business. Always ask your equipment loan provider for a detailed breakdown of any fees and charges before proceeding.

Customer Service and Support: A Critical Aspect

Quality customer service is essential when selecting an equipment loan provider. You want a partner who is responsive and attentive to your needs. Reliable support can make a significant difference in resolving issues quickly and efficiently.

Evaluate the provider's reputation for customer service by reading reviews and testimonials. Look for evidence that they consistently offer helpful, courteous support. Availability during crucial times, such as loan application or equipment purchase, is important. A provider with excellent customer service can be a valuable ally, ensuring a smoother and more satisfying loan experience.

Customised Financing Solutions and Long-term Partnerships

Every business has unique needs, and a one-size-fits-all approach rarely works. It's essential to consider equipment loan providers that offer tailored financing solutions. Customised options can better align with your specific business requirements and growth plans.

Moreover, think about establishing a long-term relationship with your loan provider. A provider committed to understanding your industry and business can offer valuable insights and support over time. Building a long-term partnership can result in better terms and more favourable loan agreements in the future. These relationships can pave the way for future projects and expansions.

Collateral Requirements and Tax Implications

Understanding collateral requirements is vital when selecting an equipment loan provider. Some lenders may require you to pledge assets as security for the loan. It's crucial to evaluate whether the collateral requirements are reasonable and align with your business's asset portfolio.

Tax implications are another key factor to consider. Equipment loans can influence your tax situation, providing potential write-offs or deductions. Here are a few points to keep in mind:

Inquire about potential tax benefits related to depreciation.

Check how loan interest may affect your taxable income.

Consult a tax advisor to ensure you're maximising available benefits.

Being informed about collateral and tax matters will help you choose a provider that supports your financial health. Proper planning in these areas can offer financial advantages and reduce unexpected liabilities.

Conclusion: Making an Informed Decision

Choosing the right equipment loan provider requires careful evaluation of many factors. Understanding loan types, costs, and lender reputation is crucial. Assess the support and flexibility a provider offers. With thorough research, you can make a decision that aligns with your business needs and financial goals, ensuring long-term success.

1 note

·

View note

Text

Flexible Equipment Loans | iLoan Financial Services

Get the equipment you need with iLoan Financial Services' flexible equipment loans. Whether you're upgrading or expanding, our tailored loan solutions offer competitive rates and terms to suit your business needs. Secure your equipment financing today with iLoan Financial Services!

0 notes

Text

https://rightclickfinance.com.au/equipment-loan/

Are financial constraints stopping you from investing in brand-new equipment and taking your business to the next level? Fret not because our personalised equipment loans are designed to assist businesses acquire the tools they need to thrive. Whether you’re expanding or upgrading, our equipment loans deliver all the financial support you need to strive forward.

1 note

·

View note

Text

Heavy Equipment Loan Toronto

0 notes

Text

panthers outdoor game at loandepot... FUN but also do you people want our traffic TO DIE. DO YOU THINK DOWNTOWN CAN HANDLE THAT TRAFFIC??? AS IF IT DOESNT IMPLODE ON ITSELF WHEN PEOPLE COME DOWN FOR HEAT AND FISH GAMES. PLEASE THINK OF THE RESIDENTS WHO LIVE THERE

#txt#sorry i was super excited for outdoor game#that i forgot that dreaded city is genuinely not equipped to handle large amounts of traffic#fish games that have low attendance literally makes it implode#an nhl game????#but also kitties reunite with downtown 😭😭😭😭#oh miami arena... gone too soon...#an era that even our current kitties dont know about...#also lmao intercounty rivarlies#loan depot has been booking a lot of big events lately aka wbc chocque de los gigantes/estrellas bananaball#and also serie del caribe#so we know theres an audience down there for it. it was only a matter of time kitties came down too#but also waahhhhhhhhhh#i think buses and train systems will explode i really do dread to think of it because no way you can get in there with a car lmaoooooo#i have many thoughts about this... oughhhh

3 notes

·

View notes

Text

Why You Should Opt For Heavy Machinery Financing?

Whether you’re renting or buying, heavy machinery can turn out to be a very expensive investment. You need to come up with a good buying strategy, keeping in mind all the costs involved with the machinery, right from transportation to repairs. If you are struggling with finances to buy the heavy equipment your business requires, choosing equipment financing in Abbotsford is the best choice. Financing offers a wide range of advantages, including cost savings, flexible payment plans, disposal and resale possibilities, and security

2 notes

·

View notes

Text

A Comprehensive Overview of Multiple SBA Loan Programs: What’s Best for Your Business?

Understanding the Importance of SBA Loans for Small Businesses

SBA loans are essential for fostering and advancing the expansion of small businesses. The Small Business Administration provides a range of loan programs tailored to offer financial support to entrepreneurs and small business owners. These small business loans are particularly important for startups and small businesses that may face challenges in obtaining traditional bank loans due to limited collateral or credit history. Small-term loans provide access to capital at favorable terms, including lower interest rates and longer repayment periods. An important advantage of small business loans is the inclusion of a guarantee for lenders, which mitigates their risk and encourages them to provide loans to startups. This guarantee enables lenders to offer financing alternatives that may have been otherwise inaccessible. Small business owners must comprehend the various SBA lending programs that are accessible, including but not limited to 7(a) loans, CDC/504 loans, microloans, and disaster assistance loans. Every program has unique prerequisites and qualifying requirements.

Exploring the Most Popular SBA Loan Programs and Their Eligibility Criteria

In this section, we will explore some of the most popular Small Business Administration loan programs and discuss their eligibility criteria.

1. 7(a) Loan Program:

The 7a loans stand out as the most versatile and widely used loan initiative. It provides funding of up to $5 million, catering to a myriad of business needs, from working capital to equipment purchases.

Key Features of 7a Loans:

Loan Amount: Up to $5 million.

Usage: Diverse business needs, from day-to-day operations to expansion.

Term Length: Varies based on usage.

Eligibility Criteria: Read More

#finance#business loan#loan#personal loans#same day loans online#Cash advance#line of credit#equipment financing

2 notes

·

View notes

Text

people trying to help me in too pushy of a way <3 how do i say thanks so much but leave me alone <3

#i literally dont WANT you to cc the ceo of a center for helping small businesses in an email to me im not in business yet 🙃#she literally immediately scheduled a zoom call for tomorrow morning to talk abt applying for a program im not ready for!!#i dont want to apply for a loan im not ready for all that!!!#i literally wont be opening for almost a decade im just planting trees every spring i dont need to do anything else#in ten years i might want to buy some used equipment#aaaaaaaa#this lady i know has been telling me abt this organization for months which is very nice and encouraging me to reach out to them#but i have literally no need or reason to do that yet#and wont for a few years probably#but she got inpatient ig and just reached out for me and now things are happeninggg#i literally have no pitch for my business it barely exists <3#i registered to claim the name so technically it exists and i planted a crop this spring that wont be ready for 8 years but thats it lol#we dont exist exist#anyway this lady means so very well and wants to help but im so stressed abt this i wasnt ready to deal with this lol#anyway its an organization that helps women and minority businesses or somethingggg idk anything abt it 😭#and im pretty sure the program she's signing me up for will cost money that i dont have 😣#i literally dont need to do a small business workshop at this point im just starting out and wont be open for years#ughhhhh#now i have a business zoom call first thing in the morning like an actual professional adult 😐#this has been a shitpost#anyway its probably a good and wonderful thing that i should be grateful for but its happening too fast and im not prepared#so i dont want to ruin the opportunity by being a dummy who doesn't know abt business ten years before i am even ready for the opportunity#😣😣😣#im sure its all good and fine and helpful but aaaaaaaaaa

2 notes

·

View notes

Text

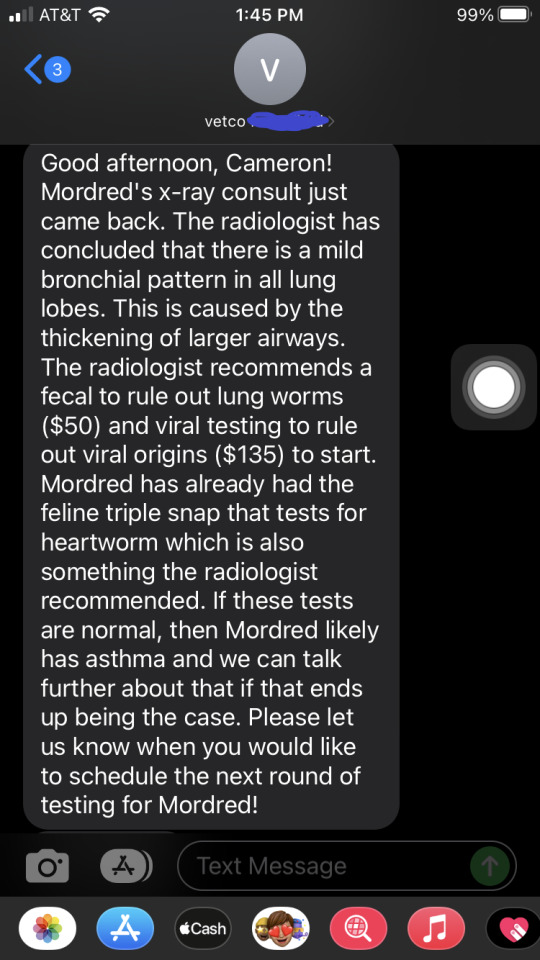

so mordred is sick and we're short on testing money

ive posted a few times about mordred being sick lately, and his xray wiped out most of our money for the next two weeks. if it is lung worms or a bad virus, im afraid of it getting worse and possibly doing permanent damage in the time before our next payday since hes already been dealing with it for so long. he and his sister are my everything, i couldnt stand it if anything happened to them that we could help.

so please, dont put yourself in a tough situation just to help us out, but if you have enough to remain comfortable after donating we would appreciate it so much. if youd like something in return my partner would draw anything youd like, their art blog is here , just send one of us a msg/ask and theyll get started on it as soon as theyre back from work

im in ko/fi jail rn and working on getting it back up, right now i only have pypl here

(including the extra gas to/from the vet, medical waste fee, and estimated tax)

81/231

#it will probably be a little higher than that if they throw in some equipment fee like last time but im going to call tomorrow#and ask for a more concrete estimate and update this if its more than that#last time she said the viral test is just a swab but maybe thats a lab fee?? stressful i wish theyd just put a chart on their site ugh#again pls dont donate if itll put you in a tough spot i dont want anyone to go without on our account#but thank you to anyone who helps even just with boosting#i love mordred more than anything and id take out a loan if i had to but were trying to get an apartment so the credit hit would screw us#so were trying to avoid that if at all possible#ty in advance again for boosting#will repay with cat pics if wanted

7 notes

·

View notes

Text

It’s because due to the specific alchemy of daemonAUs, any picture of trans femme Laios Touden is inherently and inescapably a picture of human AU Palinode Touden!

However, Palinode would mostly wear this top for the specific purpose of hyping up her brother.

They would go out like this together and do this at every opportunity.

Bee doesn’t know them.

saw this post

#his delicious materials#Palinode#human AU Bee is a tiny hot butch with an undercut I had already decided that#to explain this a bit. his delicious materials is a dungeon meshi daemon au which means each character has an external soul represented as#another character.#daemons are copy pasting the character transing their gender and assigning them an animal.#the resulting animal companion represents your soul.#thus: trans femme Laios and Chilchuck and trans masc Falin I guess#but its human AU Palinode Elafros and Bee.#also daemons end up being a bit different from their people so I feel like Elafros is unexpectedly energetic#and has a scattery vibe#while Bee is very very expressive and talks a lot even if she doesn’t talk about herself much#in my head#a modern human AU Bee would be wasting about 40 minutes of her time a week trying to get Palinode how to understand how credit scores work.#palinode is not equipped to understand how credit scores work.#Bee is not equipped to allow that.#how do you arrive at adulthood without understanding credit scores Palinode. you can get a free credit report right now.#palinode how do you propose to pay off your student loans with your minimum wage job.#palinode why do you pay for everything from a bag of quarters that you just fucking carry around. PALINODE

59K notes

·

View notes

Text

Worried About Medical Bills? Get Instant Loans for Surgery & Treatment

Healthcare costs in India are rising rapidly, making it challenging for many individuals to afford quality treatment. Whether it’s an emergency surgery, expensive medical procedures, or the need for advanced medical equipment, financial constraints should never be a barrier to good health. InvestKraft offers instant medical loans designed to ease the financial burden of medical expenses,…

#instant medical loan#loan for medical treatment#Medical Equipment Loan#medical loan application#medical loans in india

0 notes

Text

The eligibility criteria for any type of agricultural equipment loan are the foremost thing a farmer needs to understand for securing funds for his operation. RUGRThe eligibility criteria for any type of agricultural equipment loan are the foremost thing a farmer needs to understand for securing funds for his operation. RUGR is a leading fintech company that lends only to farmers and tailors solutions to exactly meet the needs of farmers. Herein, a look at the basic eligibility criteria for agricultural equipment loans is given in order to assist you with this process.

0 notes

Text

Flexible Equipment Loans | iLoanFS

Secure your business's growth with iLoanFS's flexible equipment loan solutions. We offer competitive rates and personalized service to help you acquire the equipment you need. Explore our financing options and streamline your business operations today.

0 notes

Text

Heavy Equipment Loans For Bad Credit: A Guide To Securing The Tools You Need

The construction industry is evolving day by day, increasing the demand for the right machinery or equipment. Having the right equipment has become vital for a business’s success. No matter whether you are a budding entrepreneur or own a seasoned construction firm, having modern and productive machinery can be a game-changer. Undoubtedly, heavy equipment seems to be a major investment in your life, but it can significantly alter the path of your construction firm.

Here comes the role of heavy equipment financing that can help you meet your financial commitment in no time. Construction equipment financing can let you buy any heavy equipment without any issues. Whether you belong to the construction, transportation, or manufacturing, getting the most competitive interest rates is likely to be the top priority.

Role Of Credit Score

Financing the purchase of construction or used equipment can be a challenging task because many factors affect the approval of financing. A credit score plays a vital role in the whole process. It not only impacts your ability to secure equipment financing but also affects the overall cost of the equipment you purchase. A healthy credit score can bring endless financing solutions for buying the right equipment. However, it does not mean that having a poor credit score would close the doors for your construction business. Yes, of course! With a poor credit score, you can still apply for heavy equipment financing and manage your construction business wisely.

What Is Heavy Equipment Financing For Bad Credit?

Heavy equipment financing for bad credit assists you in financing your new or used equipment up to almost 100% as per your business needs. If you want to buy any kind of heavy equipment with bad credit, there is nothing to worry about because you can still apply for it. Almost every business can qualify for heavy equipment loans even with a poor credit score.

Ensure you know how much your business qualifies and the sanctioned interest rate depends on your business’s financials, the type of equipment, and credit history. Since the equipment (new or used) acts as collateral, bad credit equipment financing is a great decision even if your credit score (business or personal) is not ideal. All you need to do is to submit some important documents based on your business type.

Benefits Of Heavy Equipment Financing For Bad Credit

When you secure heavy equipment loans for bad credit, you will receive the below-mentioned benefits:

No Collateral Required

Collateral is needed when you need an equipment loan to increase the security among lenders. It is also true that not every lender demands collateral even in the case of bad credit. You can find the best finance provider that can help you secure your heavy equipment without the need for collateral. Both secured and unsecured equipment financing options are available. This means that you can utilize your equipment (new or used) or other assets to secure your loan. Of course, you can also opt for a loan option without using business or personal collateral.

No Upfront Fees

Considering bad credit equipment financing option can eliminate the need for paying any kind of upfront fees to a lender.

Eligible For Different Types Of Businesses

Equipment loans for bad credit are applicable to almost every industry ranging from software to medical to manufacturing, food services, commerce, automotive, transportation, construction, and many more. Bad credit is common. So there is no surprise that you would have a chance to fund your business with heavy equipment financing regardless of the business type and industry.

Let You Buy From Your Preferred Vendor

It is common to see, lenders have partnered with major equipment manufacturers so that they can give their manufacturing partners profits by offering them clients. But this equipment may cost you more. Of course, it is not a wise decision to purchase your equipment from a specific manufacturing partner. You can search for your own preferred vendor and apply for a bad credit heavy equipment loan. There are loan providers, allowing you to choose the vendor of your choice without any restrictions.

Flexible Terms And Repayment Options

With bad credit equipment financing, you can enjoy flexible terms and different repayment options from your loan provider. But make sure you know that the loan terms and repayment options may differ according to the type of equipment financing you apply for.

Why Do You Prefer Bad Credit Equipment Financing Over Other Options?

There are other financing options such as credit cards, business loans, and cash, but heavy equipment financing for bad credit is the best option you can have. Credit cards give you limited lines of credit and it is not good to put your valuable credit lines at risk that you can consider for other essential expenses. Small business loans can also be an alternative, but equipment financing for bad credit has more favorable approvals than small business loans because here, the equipment itself serves as collateral.

Is Bad Credit Equipment Financing Good For You?

It is very feasible to get construction equipment finance with a poor credit score. But at the same time, you must carefully evaluate the implications and risks involved before proceeding. It is important to assess the loan terms as well as interest rates for bad credit equipment financing in the market. With bad credit, the risk of paying higher interest rates comes. You should research well, shortlist some loan companies, and compare them. To make an informed decision, you must understand how this financing option aligns with your business goals and commitments. This is how you can pick up an ideal equipment financing solution for your business requirements, especially when you have bad credit.

At Badcreditbusinessloans.com, you can think of fulfilling your business goals in less than 24 hours. So, when your business requires upgraded equipment or you have started a new business and want to purchase the right equipment, apply for heavy equipment financing and learn more about the loan options we have such as secured and unsecured loans, lines of credit, etc.

1 note

·

View note

Text

Commercial Finance Now

Commercial Finance Now is your trusted resource for comprehensive commercial financing solutions. We excel in connecting businesses with the financial resources they need to succeed and grow. Whether it’s business loans, real estate financing, equipment leasing, or working capital, our expert guidance and industry insights enable informed decision-making. Committed to transparency and customized strategies, we empower businesses to confidently navigate the complexities of commercial finance. To get more information visit our website today.

1 note

·

View note