#digital banking services

Explore tagged Tumblr posts

Text

Explore FSS's Digital Banking Services to revolutionize your financial management. Our comprehensive solutions, including online and mobile banking, ensure seamless and secure transactions. Enhance customer experience with advanced features like real-time payments, personalized banking, and robust security. Empower your financial journey with FSS—your partner in digital banking innovation.

0 notes

Text

Transforming Finance: Azentio Digital Lending Platforms

Experience the future of finance with Azentio Digital Lending Platforms. Our integrated suite offers efficient loan origination, collection, and direct sales agent operations. With mobile and web-based applications, financial institutions gain comprehensive solutions for managing lending processes seamlessly. Azentio automates customer acquisition life cycles, provides real-time monitoring of loan processes, and includes built-in simulations and data enrichment. Accessible online, our solution improves operations both in-house and in the field, streamlining processes and enhancing the borrower experience. Embrace efficiency, automation, and customer-centricity in lending with Azentio Digital Lending Platforms.

#digital lending platforms#digital lending solutions#advantages of digital banking#digital banking services

0 notes

Link

Top 8 Up-lifting FinTech Trends To Watch Out For In 2023

Are you a Fintech business looking for a modern app? Here are some Fintech trends to watch in 2023. Read on for expert insights and tips to help your business thrive.

Don't miss out on this insightful article: http://toparticlesubmissionsites.com/top-up-lifting-fintech-trends/

#FinTech Trends#Up-lifting FinTech Trends#fintech industry trends#Fintech business#fintech app development#Digital Banking Services#fintech software development#FinTech Applications

0 notes

Text

Revolutionizing Finance through Autonomous Technology

Autonomous financial services use advanced technologies like artificial intelligence (AI), machine learning (ML), and blockchain to automate financial processes and decision-making. Financial services like investment management, risk management, insurance, banking, and trading can be autonomous. Benefits of Financial Autonomy Autonomous financial services offer several advantages: Efficiency…

View On WordPress

#artificial intelligence#asset management#autonomous financial services#cloud computing#digital banking services#financial service#robotic process automation

1 note

·

View note

Text

Cash App Leads All Finance Apps on Apple OS

BitcoinVersus.Tech Editor’s Note: We volunteer daily to ensure the credibility of the information on this platform is Verifiably True.If you would like to support to help further secure the integrity of our research initiatives, please donate here As of November 16, 2024, Cash App has secured the top position in the U.S. Apple App Store’s finance category, surpassing competitors such as PayPal…

#Apple App Store#banking services#Bitcoin#Cash App#Coinbase#crypto#digital payments#finance#finance app#fintech#investing#ios#Paypal#peer-to-peer payments#U.S.

3 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

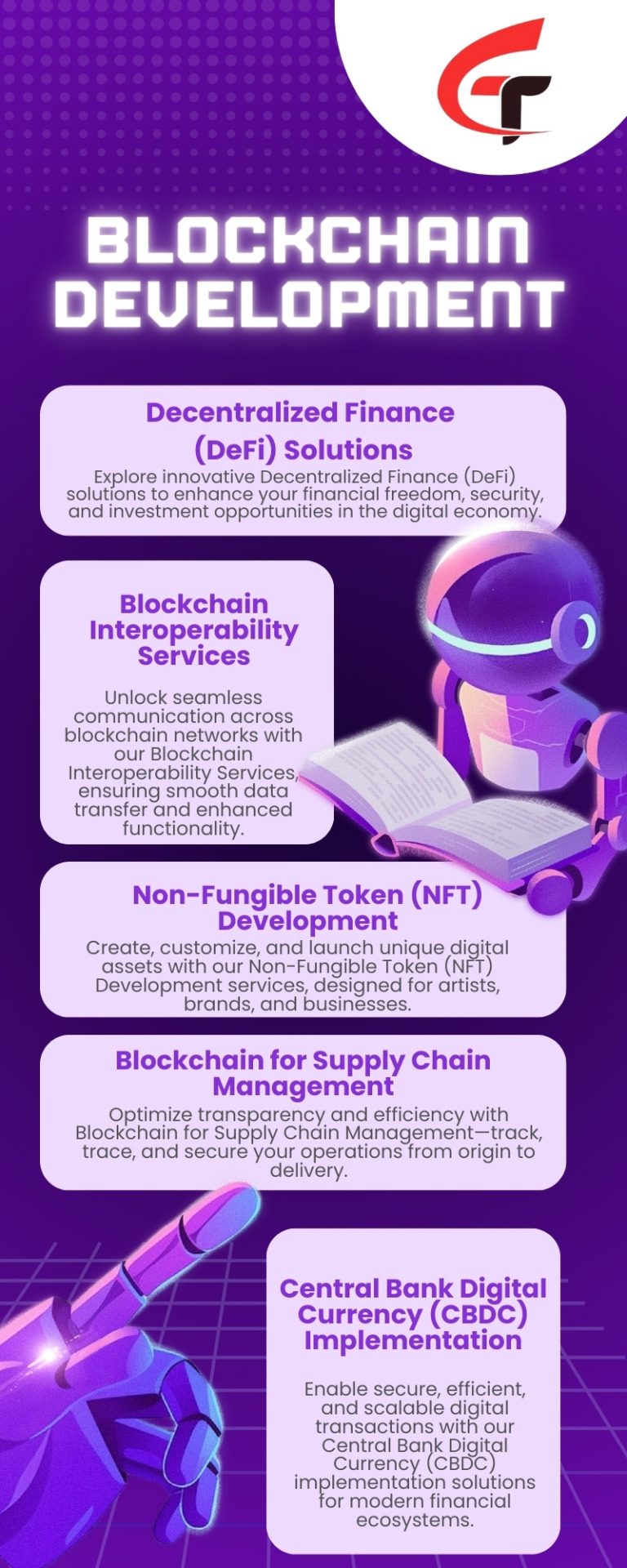

Decentralized Finance (DeFi) Solutions

Decentralized Finance are revolutionizing the financial landscape by eliminating intermediaries and empowering users with greater control over their assets. Our DeFi services enable secure, transparent, and efficient financial operations through blockchain technology.

From lending and borrowing platforms to decentralized exchanges and yield farming, we help businesses and individuals unlock the potential of DeFi. Our solutions include smart contract development, liquidity provisioning, token creation, and integration with leading blockchain networks. Whether you're a startup or an established enterprise, our tailored Decentralized Finance (DeFi) Solutions are designed to enhance financial inclusion, reduce costs, and provide innovative investment opportunities in the digital economy.

#Decentralized Finance Solutions#DeFi Solutions#Blockchain Interoperability Services#Non-Fungible Token Development#NFT Development#Blockchain for Supply Chain Management#Central Bank Digital Currency Implementation#CBDC Implementation#Blockchain-Based Voting Systems#Smart Contract Development#Blockchain in Healthcare Data Security#Blockchain for Real Estate Tokenization#Blockchain-Powered Identity Management#prototype development company

0 notes

Text

Decentralized Finance (DeFi): Reshaping Financial Systems

Decentralized Finance (DeFi) is at the forefront of fintech innovation in 2025, significantly reshaping how individuals and businesses access financial services. Built on blockchain technology, DeFi eliminates the need for traditional intermediaries like banks, allowing users to conduct transactions directly through smart contracts self-executing code on the blockchain.

DeFi platforms offer financial services such as lending, borrowing, trading, and saving to anyone with an internet connection. This is particularly transformative for underbanked populations in emerging economies, where traditional banking infrastructure is often limited.

All transactions on DeFi platforms are recorded on public ledgers, ensuring full transparency. The use of decentralized networks reduces the risk of single points of failure, enhancing security and resilience.

#fintech financial services#bank of canada digital currencies and fintech#cybersecurity fintech#fintech payment services#fintech payment solutions

0 notes

Text

How to Get PayPoint Franchisee and Transform into a Digital Banking Service Provider

In today’s fast-paced digital world, financial services are evolving rapidly. The demand for digital banking services is on the rise, and more individuals and businesses are looking for convenient ways to manage their finances. One such opportunity that allows entrepreneurs to tap into this growing sector is by becoming a PayPoint franchisee. This blog will guide you through the process of how to get a PayPoint franchisee and transform into a digital banking service provider.

Understanding PayPoint India

PayPoint India is a leading name in the financial services and digital banking domain. It offers a variety of services including bill payments, mobile recharges, utility payments, money transfers, and more. By partnering with PayPoint India, you can offer these services to customers in your locality, providing them with a reliable and secure platform for their financial needs.

The PayPoint franchisee model allows entrepreneurs to run their own businesses while benefiting from PayPoint's established infrastructure, technology, and brand recognition. By becoming a PayPoint franchisee, you can also enter the growing sector of digital banking services and help your community embrace a more modern way of handling finances.

Why Choose PayPoint India Franchise?

There are several reasons why getting a PayPoint franchisee is a great business decision, especially if you are aiming to become a digital banking service provider.

Established Brand and Trust: PayPoint India is a well-known name in the financial services space. Partnering with an established brand allows you to benefit from its reputation and customer trust.

Wide Range of Services: PayPoint offers a variety of services, including bill payments, money transfers, and digital banking. This gives you the flexibility to offer multiple solutions to your customers, increasing your chances of success.

Digital Transformation: By becoming a PayPoint franchisee, you enter the world of digital banking. With more people moving towards online payments, digital wallets, and cashless transactions, your franchise will be in a prime position to meet this demand.

Training and Support: PayPoint India provides comprehensive training and support to its franchisees. This ensures that you can get up and running quickly, even if you have no prior experience in the financial services industry.

Low Investment and High Returns: The franchise model is cost-effective and offers significant returns. The low initial investment and minimal overhead costs make it a lucrative option for entrepreneurs.

Steps to Get PayPoint Franchisee

Getting a PayPoint franchisee is a straightforward process. Follow this detailed process to kickstart your journey.

Step 1: Research and Understand the Business Model

Before you apply for a PayPoint franchise, it’s important to thoroughly research the business model and understand how it works. You can start by visiting PayPoint India's official website or contacting our support team to get detailed information about our offerings. This will give you a clear picture of the services you will be able to offer and the potential revenue you can earn.

Step 2: Contact PayPoint India

Once you have decided to go ahead with the franchise, the next step is to get in touch with PayPoint India. You can do this through our website, where we provide a dedicated section for franchise inquiries. Fill out the required details such as your name, location, and contact information to initiate the process.

Step 3: Submit Your Application

After reaching out to PayPoint India, you will be asked to submit an application. The application form will ask for details about your background, business experience, and the location where you want to open the franchise. PayPoint India will evaluate your application to ensure that you meet the requirements to become a franchisee.

Step 4: Selection and Agreement

If your application is successful, PayPoint India will invite you for a meeting to discuss the terms and conditions of the franchise agreement. This is where you’ll get a chance to ask any questions about the business and clarify your doubts. After both parties reach an agreement, the franchise contract will be finalized. This document outlines your rights and responsibilities as a franchisee and the terms under which you can operate the business.

Step 5: Training and Setup

After signing the agreement, PayPoint India will provide you with the necessary training to run the franchise. The training will cover everything from handling customer transactions, understanding digital banking services, and managing your franchise operations. PayPoint also assists with setting up the infrastructure, including the software, hardware, and other necessary equipment to start the business.

Step 6: Launch and Operate Your Franchise

Once the setup and training are complete, you are ready to launch your PayPoint franchise. This involves marketing your services to potential customers, managing day-to-day operations, and ensuring that you provide exceptional service. PayPoint India’s brand recognition and customer base will give you a head start, but it’s crucial to build good relationships with your customers and establish yourself as a reliable digital banking service provider in your locality.

Transform into a Digital Banking Service Provider

Once you become a PayPoint franchisee, you can gradually expand your services and transition into a full-fledged digital banking service provider. Here’s how you can do that:

Leverage PayPoint’s Network: PayPoint already provides a variety of financial services. By adding services such as savings accounts, mobile wallets, and loan applications, you can turn your franchise into a comprehensive digital banking hub.

Offer Online Banking Services: With the increasing trend towards online banking, you can offer your customers a seamless digital experience, allowing them to perform banking tasks such as transferring funds, paying bills, and checking balances from the comfort of their homes.

Integrate Payment Gateways: As a digital banking service provider, integrating payment gateways on your platform will enable your customers to make secure online payments, further enhancing the services you provide.

Focus on Customer Support: Digital banking requires exceptional customer service. Ensure that you provide prompt and efficient support to your customers, whether through phone, email, or in-person assistance.

Stay Updated with Technological Trends: To remain competitive in the digital banking space, it’s essential to stay updated with the latest technologies and innovations in financial services.

Conclusion

Getting a PayPoint franchisee is a great way to step into the world of digital banking. With PayPoint India’s established infrastructure, support, and range of services, you can not only offer essential financial services but also transform into a full-fledged digital banking service provider. Follow the steps outlined in this blog to become a PayPoint franchisee, and take your first step towards building a profitable business in the rapidly growing digital banking sector.

0 notes

Text

Unlocking the Benefits: Azentio Guide to Advantages in Digital Banking

Discover the myriad advantages of digital banking with Azentio. Step into a new era of banking innovation with our revolutionary platform. Imagine a highly secure, open, and scalable omnichannel experience across retail, corporate, and investment banking. With Azentio, explore the power of multiple channels converging into a personalized journey. Our platform adapts to customers, enriching their banking experiences. Experience rich, engaging, and memorable interactions, deepening customer relationships. Unlock the benefits of digital banking with Azentio today.

#advantages of digital banking#digital banking services#digital lending platforms#digital banking engagement platforms

0 notes

Text

ICICI Bank शेतकऱ्यांसाठी: आर्थिक उन्नतीसाठी उपयुक्त योजना आणि सेवा

शेतकऱ���यांसाठी आर्थिक विकास साधण्याच्या उद्देशाने ICICI Bank ने विविध उपयुक्त योजना आणल्या आहेत. या योजनांमुळे शेतकऱ्यांना आर्थिक सहाय्य मिळते आणि त्यांच्या शेती व्यवसायात सुधारणा होते. या लेखात ICICI बँकेच्या योजनांची माहिती देऊन, त्याचा उपयोग ग्रामीण भागातील शेतकऱ्यांसाठी कसा होतो हे समजून घेऊ.

#ICICI Bank#naruto#news#marathi#good omens#breaking news#agriculture#Banking Solutions#Financial Services#Personal Banking#Corporate Banking#ICICI Credit Card#Digital Banking#Wealth Management#ICICI Loans#Savings Account#Current Account#Banking App#ICICI Net Banking#Investment Plans#Home Loans#Education Loans#Business Banking#ICICI Bank Offers#Banking MadeEasy#Premier Banking#ICICI Bank India

0 notes

Text

Manage Your Finances with Ease: Mobile Banking, Loan Calculators, and Top Banks in Kenya

In today’s fast-paced world, managing your finances has never been easier with business mobile banking and banking from mobile app solutions. Whether you're on the go or working from home, banking mobile apps provide seamless access to your accounts, payments, and transactions. For those looking to secure financing, use a personal loan calculator, home loan calculator, or mortgage calculator to plan your financial commitments. Choosing the top bank in Kenya and the best bank in Kenya is crucial for reliable services and competitive rates. Furthermore, consider the best banking customer service when selecting a bank, ensuring that your banking experience is smooth and hassle-free. Embrace the convenience of mobile banking and financial planning tools to make smarter financial decisions.

#Business Mobile Banking#Banking from Mobile App#Banking Mobile App#Personal Loan Calculator#Top Bank in Kenya#Best Bank in Kenya#Home Loan Calculator#Mortgage Calculator#Best Banking Customer Service#Mobile Banking Kenya#Loan Calculators#Kenya Banking Services#Digital Banking#Financial Planning#Online Banking Kenya

0 notes

Text

5 Proven Bank Digital Marketing Solutions to Attract More Clients

In today’s fast-paced digital age, banks face increasing competition to capture the attention of tech-savvy consumers. To stay ahead, financial institutions must adopt innovative strategies that align with modern consumer behavior. Leveraging the right bank digital marketing solutions can not only enhance brand visibility but also foster meaningful client relationships. Here are five proven strategies to help banks attract more clients and drive sustained growth.

Enhance Your Online Presence with an Optimized Website

Your website serves as the digital face of your bank. An intuitive, fast-loading, and mobile-responsive website is essential to creating a positive first impression. Incorporate user-friendly navigation, engaging visuals, and concise content to keep visitors hooked. Ensure that essential information like branch locations, services, and FAQs is easily accessible. Integrating SEO techniques to optimize your website will also improve search engine rankings, making it easier for potential clients to find you online.

Leverage Content Marketing to Build Trust

Financial decisions often require careful consideration and clients value institutions that provide insightful guidance. Regularly publish blogs, whitepapers, and videos that address common financial questions or provide tips on managing money. For instance, articles like “How to Save for Your First Home” or “Understanding Credit Scores” can position your bank as a trusted advisor. A well-executed content marketing strategy not only attracts visitors but also builds credibility and fosters long-term client relationships.

Utilize Social Media to Engage Your Audience

Social media platforms are invaluable tools for connecting with existing and potential clients. Share engaging content such as financial tips, client success stories, and updates about your bank’s offerings. Hosting live Q&A sessions or webinars on platforms like Facebook or LinkedIn can further demonstrate your expertise and build trust. Paid social media ads allow you to target specific demographics, ensuring your message reaches the right audience.

Invest in Data-Driven Email Marketing Campaigns

Email marketing remains one of the most effective channels for nurturing client relationships. Personalize email campaigns based on client behavior and preferences. For instance, send tailored recommendations for loan products or savings accounts based on a customer’s financial goals. Automated email workflows, such as welcome emails or reminders about upcoming promotions, keep clients engaged without requiring constant manual effort.

Embrace Pay-Per-Click (PPC) Advertising for Maximum Reach

PPC advertising is a powerful way to increase visibility in a crowded market. With PPC campaigns, you can target specific keywords like “best savings account” or “fast personal loans,” ensuring your bank’s services appear prominently in search engine results. Platforms like Google Ads allow precise audience targeting, helping you connect with potential clients actively searching for financial solutions. Monitor and refine your campaigns regularly to maximize ROI.

Why Choose iCore Digital Marketing Solutions?

Implementing these strategies effectively requires expertise and a tailored approach. That’s where iCore Digital Marketing Solutions comes in. We specialize in crafting bespoke digital marketing plans for banks and financial institutions, ensuring measurable results. From SEO and content marketing to PPC and social media management, our team has the tools and expertise to help your bank thrive in a competitive landscape.

Ready to take your bank’s digital marketing to the next level? Contact iCore Digital Marketing Solutions today and let’s build a strategy that drives real growth.

By adopting these proven bank digital marketing solutions, your financial institution can attract more clients, foster stronger relationships, and stay ahead of the competition. The future of banking is digital – embrace it today.

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Digital Transformation for Bank: Embracing Automation in Banking and Financial Services

The monetary business is going through a seismic shift, with Digital Transformation for banks turning into the foundation of progress. With developing client requests and savage rivalry, automation in banking and financial services isn't simply a decision — it's a need. Be that as it may, what's the significance here for banks and monetary foundations, and how might they use innovation to remain ahead? We should jump into the upheaval that is reclassifying the monetary area.

What is Digital Transformation for a Bank?

Digital Transformation for banks alludes to the reception of trend setting innovations to smooth out activities, upgrade client encounters, and lift functional proficiency. By utilizing instruments, for example, simulated intelligence, AI, and information investigation, banks are moving towards a future where manual cycles become outdated.

For banks, this change isn't just about offering on the web administrations. It includes rethinking cycles to make them quicker, more astute, and more customized. From portable banking applications to man-made intelligence driven client assistance chatbots, advanced change is making ready for more intelligent tasks and expanded consumer loyalty.

The Role of Automation in Banking and Financial Services

Mechanization in banking and monetary administrations has turned into a unique advantage. By decreasing manual mediation, monetary foundations are accomplishing accuracy, effectiveness, and speed more than ever. This is the way robotization is having an effect:

1. Smoothed out Cycles

Manual cycles like credit endorsements, KYC checks, and record taking care of are currently robotized, diminishing time required to circle back and human mistakes. For example, Mechanical Cycle Computerization (RPA) empowers banks to handle large number of exchanges with unparalleled exactness.

2. Upgraded Client care

Computerization empowers all day, every day client care through man-made intelligence controlled chatbots and remote helpers. Clients can ask about balances, resolve inquiries, or even apply for credits without visiting a branch.

3. Risk The executives and Misrepresentation Recognition

High level calculations fueled via Digital Transformation For Banks are assisting manages an account with recognizing misrepresentation continuously, guaranteeing the security of exchanges and safeguarding client information.

4. Cost Decrease

Robotizing administrative center tasks saves critical functional expenses while further developing exactness. This permits banks to divert assets to advancement and better assistance conveyance.

Why is Digital Transformation Crucial for Banks Today?

Banks face various difficulties in the present powerful market, including:

Rising client assumptions for quicker and consistent administrations.

Expanded rivalry from fintech new companies.

Administrative tensions and consistence necessities.

Information driven dynamic requirements.

By focusing on Digital Transformation for banks, monetary establishments can address these difficulties head-on. Automation in Banking and Financial Services empowers banks to measure up to assumptions as well as surpass them.

Key Advantages of Automation and Digital Transformation for Banks

Further developed Client Experience: Customized administrations, fast reactions, and simple admittance to banking administrations.

Expanded Effectiveness: Computerization lessens delays and guarantees consistent work processes.

Adaptability: As advanced stages develop, banks can extend their administrations without compromising execution.

Information Experiences: simulated intelligence controlled investigation assist manages an account with understanding client conduct, settling on information driven choices.

Future Patterns in Banking Automation and Digital Transformation

As innovation keeps on developing, here are a few patterns that will additionally change the business:

Man-made intelligence and AI: Prescient investigation for risk evaluation and client commitment.

Blockchain Innovation: Guaranteeing secure, straightforward exchanges.

Cloud Banking: Versatile framework for more prominent readiness and cost reserve funds.

Open Banking: Cooperative models to make imaginative monetary items.

Conclusion

The excursion toward Digital Transformation For Banks and Digital Transformation For Banks is one loaded up with open doors. Monetary establishments that embrace these progressions will flourish in an undeniably advanced world, offering outstanding client encounters and functional productivity.

Banks that defer this change risk being abandoned. This is the ideal opportunity to enhance, robotize, and make a vigorous computerized biological system that takes care of developing business sector requests. The eventual fate of banking is advanced — and it's as of now here!

#digital transformation for bank#banking financial document automation#automation in banking and financial services#ckyc automation for banks india

0 notes

Text

نوتردام: رحلة إعادة إعمار بين المعجزات والخلافات

arabic إعادة تصور دور البنوك في الاقتصاد الحديث تُعتبر البنوك ركيزة أساسية في النظام الاقتصادي الحديث، حيث تلعب دورًا محوريًا في تسهيل المعاملات المالية وتوفير التمويل اللازم للأفراد والشركات. ولكن مع التطورات التكنولوجية المتسارعة والتحولات الاقتصادية العالمية، يتطلب الأمر إعادة تقييم دور البنوك وكيفية تكيّفها مع هذه المتغيرات. البنوك بين التحديات والفرص تواجه البنوك اليوم تحديات جمة،…

#Banking#customer experience#cybersecurity#digital transformation#economic development#finance#financial services#fintech#innovation#regulation

0 notes