#Blockchain for Real Estate Tokenization

Explore tagged Tumblr posts

Text

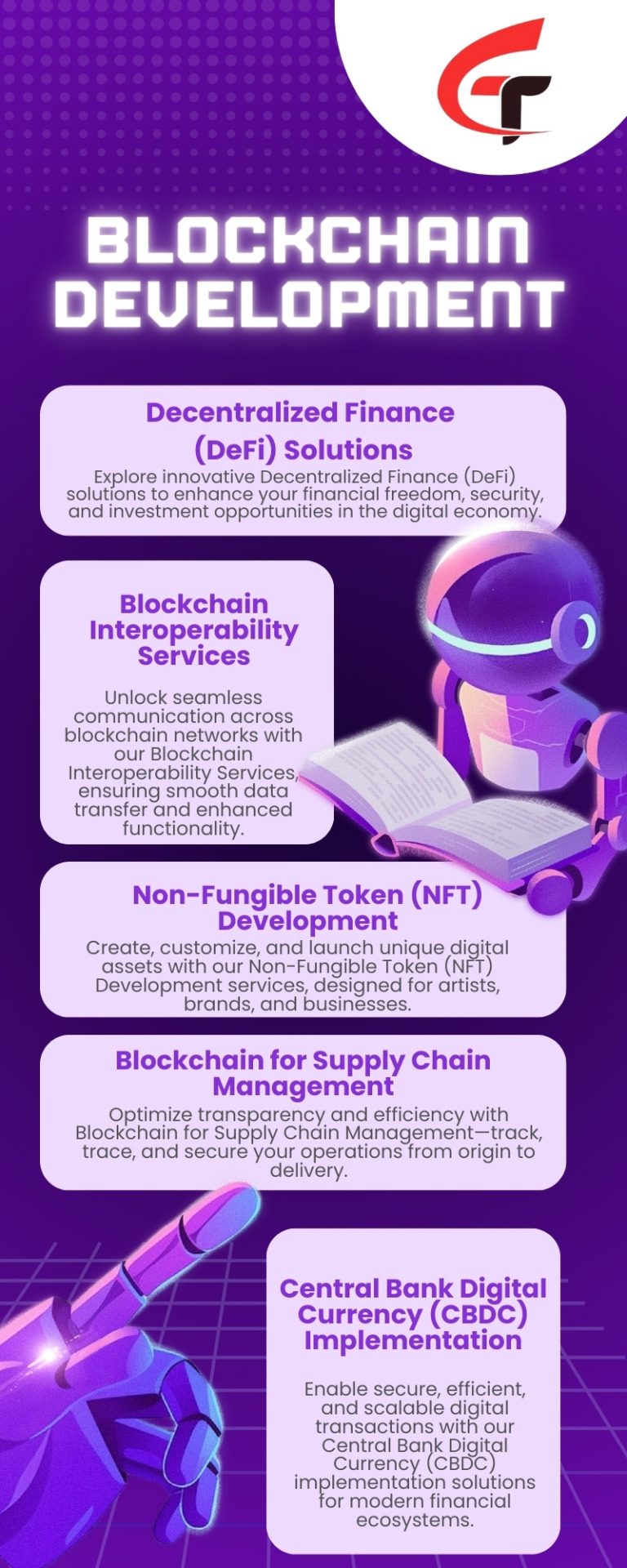

Central Bank Digital Currency (CBDC) Implementation

Struggling with Central Bank Digital Currency (CBDC) Implementation? Eminence Technology offers cutting-edge blockchain solutions to tackle security, scalability, and regulatory challenges. Our transparent and efficient approach ensures seamless digital currency issuance, secure transactions, and financial inclusion. Let us help you build a robust, future-ready CBDC system that drives innovation and trust in the financial sector.

#Blockchain Interoperability Services#Non-Fungible Token Development#NFT Development#Blockchain for Supply Chain Management#CBDC Implementation#Blockchain-Based Voting Systems#Smart Contract Development#Blockchain in Healthcare Data Security#Blockchain for Real Estate Tokenization#Blockchain-Powered Identity Management

0 notes

Text

Asset Tokenization in Healthcare: A Game-Changer for Fraud Prevention and Anti-Counterfeiting

Counterfeit medicines are a growing global crisis, costing the pharmaceutical industry over $200 billion annually and endangering millions of lives. According to the World Health Organization (WHO), nearly 10% of medicines in low- and middle-income countries are fake or substandard. With the healthcare sector projected to exceed $1.5 trillion by 2028, securing the pharmaceutical supply chain has never been more critical.

Asset tokenization is emerging as a powerful solution to combat fraud and counterfeit drugs. By leveraging Pharma Tokenization and integrating blockchain solution consultancy, companies can create secure, transparent, and tamper-proof digital records for every drug unit. This innovation is revolutionizing healthcare security and supply chain transparency.

How Asset Tokenization Prevents Fraud and Counterfeiting

1. Immutable Drug Authentication

Each pharmaceutical product registered through Pharma Tokenization receives a unique, blockchain-based digital identity. This data is immutable, meaning it cannot be altered or faked. Patients, regulators, and distributors can scan a product’s QR code or RFID tag to verify its authenticity instantly.

2. Transparent Supply Chain Tracking

With asset tokenization, every stage of a drug’s journey—from manufacturing to distribution—is recorded on a decentralized ledger. This real-time tracking eliminates blind spots, making it nearly impossible for counterfeit medicines to enter the system.

3. Smart Contracts for Regulatory Compliance

Using blockchain solution consultancy, companies can implement smart contracts that enforce compliance automatically. These digital agreements:

Flag expired or tampered drugs

Prevent unauthorized alterations

Ensure proper handling and temperature control for sensitive medications

4. Consumer Confidence and Safety

Patients can verify the authenticity of their medications simply by scanning a blockchain-secured code. This transparency builds trust and ensures that only genuine, high-quality medicines reach consumers.

The Future of Healthcare Security with Asset Tokenization

With counterfeit drugs affecting millions worldwide, the need for Pharma Tokenization and blockchain solution consultancy is more urgent than ever. As more pharmaceutical companies adopt asset tokenization, healthcare security will become stronger, supply chains more transparent, and patient safety more assured.

Are you ready to transform your pharmaceutical security? Explore blockchain solution consultancy today and safeguard the future of healthcare!

#hyperledger fabric#blockchain#asset tokenization#spydra#decentralisation#real estate tokenization#technology#business#tech

0 notes

Text

Top 10 Countries Leading the Way in Real Estate Tokenization

The emergence of tokenization in real estate has been proved unprecedented, with its fractional ownership, liquidity, and global availability through blockchain technology, and hence transforming real estate investment across the globe. Some countries are forging ahead with this innovative concept with regulatory clarity, high technology, and investor-friendly policies rewriting real estate investment. The following are the top ten in this regard.

1. The United States: The Forerunner in the Field of Tokenized Real Estate

The United States has been in the vanguard of real estate tokenization, owing to clear regulatory frameworks put in place by the Securities and Exchange Commission (SEC). The country has numerous tokenized properties such as upscale homes and commercial buildings. As the U.S. has a robust blockchain ecosystem in place, it seeks to constantly attract developers and investors, fostering such projects worldwide.

Discover Cutting-Edge Real Estate Tokenization Services – Start Your Blockchain Journey Now

2. Switzerland: The Blockchain Hub

Switzerland provides a crypto-friendly environment, and thus Switzerland has swiftly become a world leader in blockchain innovation. Progressive policies have been associated with a reliable financial industry helping to bring tokenized real estate into existence in the country. Several Swiss blockchain companies have embarked on using tokenization for greater liquidity and transparency in real estate investment.

3. United Arab Emirates' Visionary Understanding of Real Estate Innovation

The United Arab Emirates, particularly Dubai, are concerned about actualizing tokenization in real estate as part of their big drive towards blockchain. The government initiatives and visionary eyes in Dubai form part of the conducive atmosphere enabling the flourishing of property platforms tokenized. The brilliant concept of the smart city that Dubai nurtures fits as an attractive bait to global investors.

4. Singapore: The Financial and Blockbuster Leader in Asia

Thanks to the robust blockchain-favorable laws that Singapore has on offer, the country started to take the lead ever since real estate tokenization. On the march once more in the direction of further new technology; Singapore has put good focus on the importance of innovation and technology. This incorporation captivated numerous developers and investors helping spur a plethora of ground-breaking examples of tokenized real estate.

5. Germany: Early Tokenization Adopter

Germany, long before blockchain became the buzzword, was already conducting serious discussions on these new technologies in finance. With its regulatory clarity, Germany facilitated the tokenization of real estate and other various assets. Just as in the US, where about two dozen tokenized properties have gone up in New York and Los Angeles alone, tokenized projects in Germany are building an investor base that gets access to projects all across the nation and currently has been providing values and are graduating global popularity for being hotspots of new blockchain initiative.

6. United Kingdom: Booming Blockchain Ecosystem

As its blockchain space is rapidly growing, the UK has significantly influenced tokenization technology. Through blockchain models, products in the new fractional property investment are brainstormed by developers, which will bring real estate markets to a larger market.

7. Australia: Development of Fractional Ownership Models

Australian advancements in the tokenization of real estate involve fractional ownership models. These initiatives have done well to democratize the property investment sphere, facilitating opportunities for commoners to partake in expensive properties without having to part with loads of money.

8. Canada: Growing into a blockchain Hub

Real estate tokenization has become a centerpiece in Canadian blockchain hubs with eminent locations like Toronto and Vancouver. The clarity of regulations in the country along with the technology-savvy population has fostered a conducive environment for property tokenization platforms that find the interest of both local and foreign investors.

9. Japan: Digitally-Driven Transformation of Real Estate

The country has been heavily invested in technology to envelop itself in the world's latest phase of real estate tokenization. The integration of blockchain in property transactions would magnify efficiency and draw both local and global investors closer to real estate markets in Japan.

10. Estonia: Digital Pioneer

Small as it is, Estonia has been noted as the poster child for blockchain use. Statehood and an innovative tech-first heart have laid the perfect ground for tokenized real estate projects. Estonia has driven a global punch for blockchain-related activities.

What Sets These Countries Apart in Tokenized Real Estate?

There are many reasons–billions of reasons-why the world dominance of the nations in tokenized real estate is supported by a considerable number of factors: Clear regulatory frameworks, strong blockchain systems, enabling policies from the government, and successful demonstration of tokenized real estate projects. In its countries, tokenization answers the strongest possibilities for real estate investments and reaches high over liquidity, auditability, and free global entry.

Conclusion

Real estate tokenization is transforming the property market, and these ten countries are leading the charge. By enabling innovation, developing supportive legal framework, and leveraging blockchain technology, they should have created the future of real estate investment. With this development, it is of awe that other countries worldwide will hopefully follow suit in making provisions for a new era of affordable and efficient real estate investing.

#real estate tokenization#real estate tokenization development#tokenization#technology#blockchain#asset tokenization

0 notes

Text

Top 11 Real Estate Tokenization Companies

AI-driven conversion saves significant time and resources. Tokenization converts the regulation of its real-world properties into digital assets within blockchains where curation, division of ownership interest, and greater liquidity can reach the global market. Below, we will be analyzing 11 of the top real estate tokenization companies, listing their services or characteristics concerning other specifics.

1. BlockchainX

BlockchainX is working as a leading company in Real estate tokenization service provider through blockchain. The start-to-end solutions offered by the company include services such as smoothly compliant and secure smart contracts and experience large-scale token issuance while managing. BlockchainX is an expert in this industry as it is offering an open and scalable tokenization platform. This platform accommodates assets for each asset class, be it residential, commercial, or luxury real estate class. And also they ensure legalities of the services and gradual market integration as per the secondary markets have strengthened them, becoming the first option for tokenization of real estate.

2. RealT

RealT is a brand of tokenized real estate investment in the U.S. market where investors could also buy a part of income-producing residential or commercial properties. With RealT, the user could have fractional shares of rental income property and can receive rental income in the form of digital currencies. The company tries to outline a transparent and compliant platform dealing with investment and also real estate rental services for all of them. The start-up offers global access to real estate funds and posits that one can invest with little capital.

3. Propy

Propy uses blockchain technology to redefine real estate transactions by securing a more stable and reliable platform for tokenizing real estate assets. A transaction that is as close to listing has been automated along the line to settlement. The regulatory framework for the site is particularly robust; it is in alignment with different international and local regulations.

The Propy platform has been designed with regard to simplifying real estate transactions but also promoting transparency and efficiency.

4. SolidBlock

SolidBlock transforms real estate into tradeable digital securities when it tokenizes assets. The digital securities are backed by the physical asset it represents, making it easy for any development company or property owner to raise funds. SolidBlock particularly aims at giving extended liquidity for traditional illiquid assets and has solutions specifically tailored to significant, commercial and luxury real estate projects. They are the best in structuring and launching tokenized assets, something that has earned them an invaluable reputation around the globe.

5. Harbour

Harbour is well known in the crypto securities market for providing such services and products as complete Real Estate Tokenization. It is especially noteworthy for compliance with all regulatory aspects necessary to satisfy security regulations' strict adherence in tokenized products. Harbour's scope of work includes that of issuing the token or asset, providing details of the investor onboarding, and integrating the secondary markets. That is why most institutional investors prefer choosing them.

6. Stobox

Stobox offers a turnkey tokenization solution meaning showy encryption of assets. They have equipped their platform with tools to create, manage, and trade in security tokens. Stobox focuses on increased liquidity for property investments through peer-to-peer trading and entrance to the secondary market. They have made the adoption of blockchain technology easy for property owners and investors because they very much care about the user experience and keep it simple.

7. Atlant

Atlant is a platform based on Blockchain that makes Crypto Securitization and trading really easy on real estate. They pretty much provide everything, from shared ownership to property management and income distribution rent. Atlant excels in the fact that it can set secure and transparent environments for real estate. They are a very strong contender for global property projects.

8. Brickblock

Brickblock is a platform that merges property and blockchain utilization. This innovative tokenization platform allows the digitization of full property ownership and gives investors a gateway to high-quality capital projects in real estate. Brickblock has created a platform that moors with regulatory protocol, giving a satisfactory level of support to engaging directly with the product. The amount of transparency that the institution offers and the security set in place, become the real key factors covering all those things, regardless of age.

9. Tokeny Solutions

Tokeny Solutions has studied a concept greatly able to create its differentiator in the actual field. The platform spatially drives the actual life cycle of tokenized assets as they would be ushered into existence and exist along with the 1st platform onto which they are issued and travel through until they are traded into the open market. Tokeny Solutions provides sustainable security within a securities overview, allowing for fine instrumental oversight in maintaining investor identities and keeping records for ensuring utmost transparency. This entity exhibits high scalability in terms of technology in projects of all sizes.

10. Smartlands

Smartlands works on the principle of asset tokenization especially within real estate. This particular platform allows real estate owners to raise funds via token sales and provides fractions of portions to various parties that could invest in it. The security combined with compliance procedures is what facilitates the entire tokenization course almost seamlessly. The company's pioneering technique led it to the number one spot in the tokenization business.

11. Slice Market

According to Slice Market, this is an ecosystem that can support new real estate investments that assign value to highly cherished properties. It can become an important mechanism for fractional ownership particularly more taxpayers get an investment in premium real estate projects but with not much capital. The main purpose of Slice Market is to simplify but also fulfill all the needed criteria on the investment process. It is matched with regulatory compliance through the help of an initial platform of secondary market trading, and thus liquidity of the assets will be transformed.

Comparative Chart

To make the features of both companies more salient, we have also included their comparative values:

Final Thoughts

Worldwide, fractional ownership, greater liquidity, and new assets-These are what real estate tokenization has brought to a revolution that takes place when all land is digitized. I think companies like BlockchainX, Revolutionizing the market play incredible roles in the revolution providing new ways for them to reduce the costly and so hard process of tokenization. These companies have offerings that will help in coming up with a very precise way to execute their own real property tokenization as property owners or as investors on the lookout for new investments.

0 notes

Text

Digital Real Estate: Redefining Property Ownership in Jamaica

In the evolving landscape of 2025, where technology is has started to reshape every aspect of life, investing in digital real estate alongside traditional real estate might just be the smartest move for forward-thinking investors. As Dean Jones, founder of Jamaica Homes, aptly puts it, “The future of property isn’t just about location anymore; it’s about innovation.” This profound shift in…

#blockchain technology#caribbean homes#Digital Transformation#real estate innovation#Smart Contracts#tokenized properties

0 notes

Text

The Evolution of Real Estate Tokenization by 2025

Seven improvements have been brought to reality through advanced technology, and among these is real estate tokenization. It is a brilliant manifestation of the revolutionizing power that blockchain, along with smart contracts, can merge to transform property investment to a more affordable, transparent, and simpler form of investment.It is likely that real estate tokenization will already undergo pretty significant changes in property investment and real estate's future by 2025.

Thus, the blog will concern itself with happenings that will figure in the main events of the future up until 2025 in relation to real estate tokenization-from agency such as advances in technology as well as the changing regulatory landscape along with market trends and how these changes would further impact investors, developers, and other sections of the industry- another concern given in the blog.

Real Estate Tokenization

Essentially, before we even go on to discuss what seems to be the future direction in tokenization, it is important to first define what real estate tokenization means. Real estate tokenization is simply the actual process of turning ownership in or shares of a real estate property into digital tokens on a blockchain. Such tokens can even represent partial ownership of the property, thus allowing for fractional ownership, which may then be tradeable or transferrable among investors; it is easy to comprehend the advantages from such a platform tokenization brings. It allows easy access to real estate investments, increases liquidity, decreases transaction costs, and allows for transparent tracking of ownership.

Tokenized real estate basically involves the creation of a smart contract, which is actually a self-executing contract with its terms directly incorporated into lines of code, and which carries out the transaction on the blockchain. This technology eliminates the need for any agent, broker, or lawyer to authenticate transactions, thus expediting correspondences and minimizing costs.

Real Estate Tokenization: Where We Are Now in 2024

Tokenization of real estate has really developed into a promising venture as of 2024, but it is still too early for its serious adoption yet. Some companies have started offering tokenized investments in real estate, and several real estate developers already use the technology to create better property transactions. However, there are still big blocks such as regulatory issues, scalability, and market education that remain.

At the moment, tokenized real estate projects are often associated with extremely valuable real estate and institutional investors owing to the complications and start-up costs involved. The market for fractional ownership is growing, and most tokenized assets are hosted on specialized blockchain platforms. Tokenized real estate are very eager, and by 2025, the face of the land would look completely different.

Major Factors Influencing Real Estate Tokenization by 2025

1. Blockchain Advancements and Interoperability

It seems that the blockchain technology is growing very quickly, and it is bound to play a role in the future scenario of real estate tokenization by 2025. The real estate tokenization development of more scalable blockchain networks with their increasing transaction speeds and reduced costs will make tokenization practical for a much larger range of real estate assets.

One key trend that would come in the future is blockchain interoperability. With further developments of more of such networks, there will increasingly arise a major need for interaction between them. Real estate tokenization platforms will have to accommodate cross-chain tokenized real estate asset transfers for assets now on one blockchain to be transferred to another. This will also increase the liquidity of real estate and hence diversify the market to more investors around the globe.

2. Regulatory Evolution

Regulatory uncertainty in many countries has made real estate tokenization difficult. The issues of fractional ownership, securities laws, and blockchain-related transactions are still evolving. Expectedly, there would be clearer regulations by 2025. This is a framework that will not be entered into the canon of legalization but will allow governments and regulatory authorities across the world to identify emerging technologies such as Blockchain in order to trumpet around the legal framework for tokenized real estate.

The U.S. SEC (Securities and Exchange Commission) and the European Union have been working to develop an appropriate regulatory framework to allow tokenized real estate to operate profitably. These regulations will assist in addressing the aspects of fraud risks and constraints tokenized assets to the existing laws governing them. This regulatory clarity will influence the participation of institutional investors in tokenized real estate and will drive the further growth of this market.

3. Increased Investor Access

Concerns have also been raised on the pending changes that will happen to the real estate tokenization market in 2025, and among the changes to be expected is the democratization of property investment. The fact that it facilitates fractional ownership would allow a broader range of investors to enter into the real estate market through tokenization. Instead of shelling out millions of dollars to buy into high-value properties, real estate investments of the future will allow an individual to purchase fractions of tokens that let them invest with smaller amounts of capital.

This democratization will allow people from all over the world, regardless of how affluent they are, to invest in real estate. We expect tokenized real estate assets to be as widely available across different markets as commercial, residential, and even luxury properties by 2025, if not earlier. What's more, investors will now be able to enter a greater global market, bringing opportunities that were previously cut off within the grasp of some.

4. Liquidity and Fractional Ownership

In the past as well, real estate was perceived as an illiquid asset class; buying or selling a property takes time, and many individuals prefer not to put large amounts of money into a single asset. This is where tokenization comes in, enabling fractional ownership, allowing individuals to acquire smaller values of a property.

By 2025, a market for tokenized real estate is expected to have increased liquidity enabling the investor to buy and sell the tokens assigned to him or her very quickly. According to blockchain technology, tokenized real estate assets can be traded on secondary markets, giving investors more exit strategy options, thus attracting more capital into the market and growing the market, hence cultivating a more dynamic real estate ecosystem.

5.Smart Contracts and Automation

Smart contract development is one more area in which real estate tokenization is expected to bring considerable growth by the year 2025. These self-executing contracts will eliminate intermediaries from real estate transactions, making them quicker, cheaper, and more secure.

This means that between now and 2025, smart contracts will probably fully activate the process of transferring property ownership, from the payment and revenue distribution to profit-sharing given to owners. All this will happen without the interference of notaries, lawyers, and escrow agents in the transaction, thus greatly reducing costs like fees and delays of different transactions. It is this efficiency that will drive the mass adoption of tokenized real estate.

Real Estate Tokenization by 2025: Key Benefits

1. Global Real Estate Crowdfunding

The global pool of investors can fund real estate projects through tokenization. Fractional ownership makes it feasible for people's smaller amounts of investments in expensive properties rather than borrowing from conventional financial intermediaries. Thus, interim...

2. Tokenized Real Estate Funds

How precisely tokenized real estate funds depend on more transparency than ever cost-effective or liquid cal alternative to the REIT. The tokens available for purchase represent a part of an entire portfolio of different real estate assets, which can then be traded on blockchain platforms. This system eliminates high fees and allows greater flexibility in managing investments.

3. Enhanced Liquidity

Real estate has been historically a non-liquid asset class, although it is the tokenization that changes this by allowing the fractional ownership share to be traded on digital exchanges; whereby investors can trade this token very quickly and easily providing more flexibility and opportunities for investors to enter or exit a market.

4. Democratization of High-Value Assets

The process of Tokenization allows high-value properties to be transformed into smaller and affordable units which enables a greater range of investors to get access to high-end real estate markets. Be it luxury apartments or be it a commercial building, the tokenization process lowers the barriers for less-wealthy investors to help diversify their portfolios with more expensive real estate assets from around the world.

5. Transparency and Security

All property transactions and ownership details lead to the immutable record by blockchain, making it easier to verify the complete history of any investment. Hence, it decreases fraud risks while increasing security as investors can distinguish themselves into believing their transactions and property titles are securely recorded.

6. Access to Global Markets

Tokenized real estate is meant to open investment into local markets across foreign border lines while avoiding the hassles entailed in navigating the foreign ownership laws and the complexities of language and traditional financial systems. Thus, investing beyond the borders becomes possible, thereby realizing a truly borderless concept in real estate.

7. Automation of Property Management

Smart contracts automate the key functions, such as collecting rent, distributing dividends, and more, in property management. Such reductions in administrative expenses make sure that every operation around the property offers ease and convenience for both the investors as well as property owners.

Conclusion

By 2025, real estate tokenization will change the buying, selling, and management processes for real estate. It will enable wider access to these activities across borders, liquefy, make them more transparent and automated, and in this way, improve their efficiency, security, and inclusivity within investments in real estate. Developers and investors will reap the benefits of this paradigm shift. In fact, it will become the engine that will drive the entire real estate industry.

0 notes

Text

youtube

BLAQClouds Property Group_ Revolutionizing Real Estate with Blockchain

BLAQClouds Property Group Inc., a subsidiary of Blaqclouds, Inc. (OTC: BCDS), focuses on blockchain-based real estate solutions.

Blaqclouds, Inc. (OTC: BCDS) announced the launch of its subsidiary, BLAQClouds Property Group Inc., which will utilize blockchain technology to revolutionize the real estate market. Key features include property tokenization, fractional ownership, and decentralized management, all facilitated by the ZEUS Blockchain. This approach aims to increase transparency, efficiency, and accessibility in real estate transactions for investors of all sizes. The company's new website, launching December 19, 2024, will serve as a central hub for its offerings, and its first commercial acquisition is imminent.

#prism mediawire#press release#investing#otc markets#otc#stock market#bcds#blaqclouds#blockchain technology#defi#dex#cryptocurency news#crypto#real estate#tokenization#Youtube

0 notes

Text

Top 10 RWA Tokenization Companies in 2024

Discover the top 10 RWA tokenization development companies of 2024. Learn about the industry leaders transforming asset management with innovative tokenization solutions.

#asset tokenization#technology#blockchain#blockchain technology#rwa tokenization#real estate tokenization companies#real estate tokenization#real estate tokenization company#real estate tokenization platform

0 notes

Text

Tokenization/8 nel real estate immobiliare

Tokenization/8 nel real estate immobiliare Per chi si fosse perso le puntate precedente, attraverso la tokenization immobiliare, un bene di sua natura immobile e di proprietà perlopiù unitaria (o multipla solo con difficoltà), diviene frazionabile su una pluralità di soggetti e facilmente negoziabile, rendendo liquido un mercato di sua natura illiquido. In sostanza, attraverso la tokenization…

0 notes

Text

Decentralized Finance (DeFi) Solutions

Decentralized Finance are revolutionizing the financial landscape by eliminating intermediaries and empowering users with greater control over their assets. Our DeFi services enable secure, transparent, and efficient financial operations through blockchain technology.

From lending and borrowing platforms to decentralized exchanges and yield farming, we help businesses and individuals unlock the potential of DeFi. Our solutions include smart contract development, liquidity provisioning, token creation, and integration with leading blockchain networks. Whether you're a startup or an established enterprise, our tailored Decentralized Finance (DeFi) Solutions are designed to enhance financial inclusion, reduce costs, and provide innovative investment opportunities in the digital economy.

#Decentralized Finance Solutions#DeFi Solutions#Blockchain Interoperability Services#Non-Fungible Token Development#NFT Development#Blockchain for Supply Chain Management#Central Bank Digital Currency Implementation#CBDC Implementation#Blockchain-Based Voting Systems#Smart Contract Development#Blockchain in Healthcare Data Security#Blockchain for Real Estate Tokenization#Blockchain-Powered Identity Management#prototype development company

0 notes

Text

Asset Tokenization in Real Estate: A Game-Changer for Property Investment

Understanding Real Estate Tokenization

Real estate tokenization is revolutionizing property investment by leveraging blockchain technology to convert physical assets into digital tokens. These tokens represent fractional ownership in a property, making it easier for investors to buy, sell, and trade real estate assets without the traditional barriers of high capital requirements and illiquidity.

How Asset Tokenization is Transforming Real Estate

Asset tokenization in real estate enhances accessibility, liquidity, and efficiency in the market. By breaking down properties into digital shares, investors can participate in lucrative real estate markets with smaller investments. Unlike conventional real estate transactions, tokenized assets can be traded on digital exchanges, increasing liquidity and reducing transaction costs.

Key Benefits of Real Estate Tokenization

Increased Liquidity – Traditional real estate is known for its illiquidity, requiring lengthy sales processes. Tokenization enables faster transactions by allowing investors to trade digital property tokens on blockchain-based platforms.

Fractional Ownership – Investors can own a portion of high-value properties, eliminating the need for large capital investments. This opens doors for smaller investors to participate in premium real estate markets.

Enhanced Accessibility – Global investors can access tokenized real estate markets without geographical constraints, broadening investment opportunities.

Transparency and Security – Blockchain technology ensures secure, tamper-proof transactions with smart contracts that automate processes, reducing fraud and enhancing trust.

Regulatory Considerations

While real estate tokenization offers numerous advantages, regulatory frameworks are still evolving. Compliance with securities laws, property rights, and investor protections varies across jurisdictions. Governments and financial institutions are working to establish guidelines that balance innovation with consumer protection.

Conclusion

Asset tokenization is transforming real estate investment, making it more accessible, liquid, and efficient. As regulatory frameworks develop, tokenized real estate is poised to become a mainstream investment vehicle, bridging the gap between traditional and digital finance.

#hyperledger fabric#asset tokenization#blockchain#real estate tokenization#technology#decentralisation

0 notes

Text

Tokenization in Commercial Real Estate: A Game-Changer for Businesses

Commercial real estate industry has been a major area for economic growth and development in business. The traditional kind of investments in real estate face considerable obstacles such as high entry barriers, transactions of considerable complexity, apart from the fact that it sometimes is really hard to liquidate a property. The remedy to this challenge has been found in the form of a groundbreaking tokenization solution enabled with time and technology such as digitizing real estate assets via use of blockchain that opens ways for businesses in a way that property investments have never been as accessible, transparent, and efficient enabling many new opportunities for making investment and building wealth.

The Process: Tokenization in Crypto

Tokenizing in crypto implies the conversion of physical or financial assets into digital tokens on the blockchain. Each token represents part of the asset's value and allows for ownership and trading of smaller pieces of high-value properties. This whole process has been possible with the support of blockchain technology that has given the system security, transparency, and decentralization. Through smart contracts, tokenized assets eliminate the need for brokers or banks and ensure trustless transactions and effective management.

Real Estate Tokenization

Commercial real estate tokenization is all about the creation of digital tokens that represent ownership slices in a real estate project. This is a way of storing and trading tokens on the blockchain technology, the same that allows fractional ownership of assets. If there are any 10,000 token units, coming together to make a building or a commercial project that is worth $10 million, then each of the 10,000 token units will be worth as much as $1,000. This will make the market accessible even to smaller investors, who can also earn from the asset's returns in the market. Furthermore, smart contracts ensure that activities ranging from rent sharing to property transfer are not only paperless but also far more efficient and secure.

How Tokenization Impacts Commercial Real Estate

The tokenization of commercial properties delineates the sections of commercial properties with digital tokens that could be accomplished in some way by the blockchain. Tokenized titles can then be traded in the secondary markets within business sectors. So, developers don't need to sell a building to sell a token, nor does an investor need to buy a building to become involved in the market. Investment democratizes for everyone in the world and all points unimaginable because this is going to give chances to people from far and wide into assets that were once locked with only powerful institutional players. Sovereign fraud is also reduced where through this technology, any concerns are laid to rest. Blockchains prove user transactions and therefore provide a peace of mind within a certain trust between all stakeholders.

Expand Your Investment Horizons: Tokenize Your Real Estate with Us : Real estate tokenization services

How Businesses Can Benefit Using Tokenization

Tokenization has potential benefits to offer if an organization plans to expand or diversify its portfolios. For instance, to small and medium enterprises (SME), real estate in the tokenized world could mean that the cost of entry is lowered, giving them access to prime commercial locations through fractional ownership. Companies can also tokenize their properties, releasing liquidity from existing properties and gathering funds for even further diversification. Moreover, market condition changes can be well absorbed by companies with respect to their investments through token trades. Mostly, savings with intermediaries will result in transaction costs that may lower expenses related to real property investments.

Real-life commercial real estate use cases

There are many projects that have shown the use of tokenization in commercial properties. An example includes St. Regis Aspen Resort, which, through tokenization of its luxury property shares in the United States, is believed to have made it possible for investors globally to have a share in its hotel. The same practice goes on in Europe, where businesses like Brickblock apply tokenization to commercial properties; this is said to facilitate transboundary investments and lessen asset management. These are some examples indicating the place of tokenization between traditional real estate and modern digital finance.

The Future of Investment Begins Now

The tokenization is not just a trend, but it is the future of real estate investments. This tokenized possession across assets will turn on the real estate industry as the world is turning itself toward de-digitizing everything around will create smart cities into very decentralized economic ecosystems. Anyone who adapts and invests in tokenization as of now will be forced to jump in and capitalize on this future opportunity first as benefits are sustainable investment ways with more inclusiveness and efficiency with huge possibilities in the future.

Conclusion

So, it's tokenizing a source of something else rather than commercial real estate. It is not just introducing technology-an entire sea change in how business interacts with the property market. Matters of liquidity, access on a global scope, and secure transactions brought into effect by tokenization are setting new standards for the industry. The moment is now to empower the organization to embrace this innovation into game-changing possibilities and prepare for the future that owes more to transparency, efficiency, and inclusivity.

1 note

·

View note

Text

Investing in Real Estate Securities: Exploring Opportunities and Risks

Investing in Real Estate Securities: Exploring Opportunities and Risks

Real estate securities provide a convenient way for investors to diversify their portfolios without the complications of direct property ownership. These financial instruments allow individuals to tap into the potential for growth and income within the real estate market while avoiding the operational responsibilities of managing physical properties. Common types of real estate securities include mortgage-backed securities (MBS), Real Estate Investment Trusts (REITs), and real estate mutual funds. Understanding the differences between these investment vehicles is crucial to selecting the right option based on specific financial goals and risk tolerance.

One of the most popular forms of real estate securities is the Real Estate Investment Trust (REIT). A REIT is a company that owns, operates, or finances income-producing real estate. These companies pool funds from multiple investors to purchase and manage properties, providing a way for individuals to earn profits without the need to buy, manage, or finance properties themselves. REITs typically invest in various property types, including commercial, residential, and industrial assets, giving investors exposure to a diverse range of real estate markets.

A major draw of REITs is their ability to generate regular income. By law, REITs must distribute at least 90% of their taxable income to shareholders in the form of dividends, making them particularly attractive to income-seeking investors. Additionally, because REITs are traded on major stock exchanges, they offer liquidity and flexibility that traditional real estate investments often lack. However, REIT performance can be influenced by factors such as interest rates, economic conditions, and real estate market trends.

Another way to invest in real estate is through Mortgage-Backed Securities (MBS), a type of asset-backed security that derives its value from a portfolio of mortgages. When investing in MBS, you essentially buy into the cash flows generated by a pool of mortgage loans. MBS are typically issued by government-sponsored enterprises like Fannie Mae and Freddie Mac, providing a level of security and stability. While MBS can offer strong returns, particularly in low-interest-rate environments, investors must also consider risks such as prepayment and credit defaults, which can impact performance.

For those seeking a more diversified approach, real estate mutual funds present another option. These funds pool investor capital to invest in a variety of real estate assets, REITs, and real estate operating companies. By investing in multiple real estate markets, these funds offer a way to spread risk and mitigate exposure to individual property performance. Professional fund managers oversee these investments, making decisions on behalf of investors based on market conditions and strategies. However, the success of these funds often depends on the expertise of the managers and broader market dynamics.

Tokenization is a newer, tech-driven approach that is reshaping the landscape of real estate investment, including the potential to tokenize hotels and short-term rentals. By converting real estate assets into digital tokens on a blockchain, tokenization enables fractional ownership, allowing investors to buy small shares in properties like hotels or vacation rentals. This democratizes access to high-value real estate markets and gives investors exposure to income from rentals or appreciation in value without needing to purchase an entire property.

Tokenized assets, including hotels and short-term rentals, offer enhanced liquidity since tokens can be traded on digital platforms, unlike traditional real estate transactions. Investors can participate in revenue generated by these properties, while property owners can raise capital without relinquishing full ownership. As with other real estate securities, tokenization offers flexibility and the ability to diversify portfolios, but it also requires an understanding of the risks associated with blockchain technology and regulatory uncertainties.

Despite the advantages of investing in real estate securities, there are risks to be aware of. The performance of these securities can be volatile, affected by fluctuations in real estate values, interest rates, and broader economic conditions. Additionally, the tax implications of investing in real estate securities can be complex, making it essential to consult with a financial advisor or tax expert to understand how these investments will affect your overall tax situation.

When considering real estate securities, it’s important to align your choices with your financial goals, risk tolerance, and investment timeline. Are you seeking growth, income, or both? Do you prefer stable returns, or are you willing to take on more risk for potentially higher rewards? Answering these questions can help you determine which type of real estate securities best fits your needs.

Real estate assets, including securities and tokenized properties, provide a unique blend of income potential and growth opportunities, making them appealing to investors looking to diversify. However, success in this market requires a clear understanding of the risks involved and a strategic approach to balancing your investment portfolio. Rather than viewing real estate securities as a one-size-fits-all solution, it’s essential to consider them as part of a broader investment strategy, ensuring that your portfolio remains resilient in changing market conditions.

By staying informed and aligning your investments with your long-term goals, you can navigate the complexities of real estate securities and position your portfolio for lasting financial success.

1 note

·

View note

Text

How Real Estate Companies are Adapting to the Asset Token Revolution

The real estate industry is undergoing a significant transformation with the rise of asset tokenization. This revolutionary technology is not only reshaping how real estate assets are bought and sold but also how companies operate and compete in this evolving market. In this blog, we’ll explore how real estate companies are adapting to the asset token revolution and what this means for the future of real estate.

What is Asset Tokenization?

Asset tokenization involves converting physical real estate assets into digital tokens on a blockchain. Each token represents a share of ownership in the asset, allowing for fractional ownership and making it easier to trade and manage real estate investments. This technology offers increased liquidity, transparency, and efficiency compared to traditional real estate transactions.

Adapting to the Asset Token Revolution

1. Embracing Blockchain Technology

Real estate companies are increasingly adopting blockchain technology to facilitate asset tokenization. Blockchain provides a secure and transparent ledger for recording transactions, reducing the need for intermediaries and minimizing the risk of fraud. By leveraging blockchain, companies can streamline transactions, enhance security, and build trust with investors.

2. Offering Fractional Ownership

One of the most significant changes brought about by asset tokenization is the ability to offer fractional ownership. Real estate companies are adapting by allowing investors to purchase smaller portions of high-value properties. This democratizes access to real estate investments, attracting a broader range of investors and increasing market liquidity.

3. Enhancing Transparency and Compliance

Tokenization enhances transparency by providing a clear, immutable record of ownership and transactions. Real estate companies are using this feature to improve compliance with regulations and build investor confidence. Transparent records also simplify audits and reduce administrative overhead, making it easier to manage and report on real estate assets.

4. Revolutionizing Investment Models

The traditional real estate investment model involves substantial upfront capital and long-term commitment. With asset tokenization, companies are exploring new investment models, such as crowdfunding and public offerings of real estate tokens. These models lower the entry barriers for investors and provide companies with new avenues for raising capital.

5. Integrating with Existing Platforms

Real estate companies are integrating asset tokenization with existing investment platforms and marketplaces. This integration allows for seamless trading and management of tokenized assets, providing investors with a user-friendly experience. Companies are also collaborating with fintech and blockchain startups to enhance their technological capabilities and stay competitive in the market.

6. Educating Stakeholders

To successfully adapt to the asset token revolution, real estate companies are investing in education and training for their stakeholders. This includes educating investors, property managers, and legal teams about the benefits and implications of asset tokenization. By fostering a better understanding of the technology, companies can drive adoption and ensure smooth implementation.

Conclusion

The asset token revolution is transforming the real estate industry, and companies are adapting by embracing blockchain technology, offering fractional ownership, enhancing transparency, and exploring new investment models. As this technology continues to evolve, real estate companies that effectively adapt will be well-positioned to capitalize on new opportunities and drive innovation in the market. The future of real estate is digital, and asset tokens are leading the charge.

1 note

·

View note

Text

2024 Tokenization Boom: A New Era for Real-World Assets

In 2024, the landscape of real-world asset (RWA) tokenization is experiencing a transformative shift, marking a significant milestone in the financial industry. Tokenization converts physical assets like real estate, commodities, and art into digital tokens on a blockchain, enhancing liquidity, accessibility, transparency, and security. This revolutionary technology makes high-value assets more accessible to a broader range of investors. As we explore the current state and future prospects of tokenization, it is clear that this technology is set to reshape the global financial ecosystem significantly.

Tokenization is predicted to be a multi-trillion-dollar opportunity by 2030, with market estimates suggesting it could reach up to $16 trillion. The United States is leading this revolution, followed by countries like Singapore, the United Kingdom, Switzerland, India, and Luxembourg.

The total value locked in tokenized assets has surged to $10.53 billion, with major financial institutions launching tokenized investment products. This signals a major inflection point for the industry, underscoring the significant role tokenization will play in the future of finance.

The benefits of tokenization are extensive. It allows for fractional ownership, increasing liquidity and enabling investors to buy and sell portions of an asset. This democratizes investment opportunities and bridges the gap between traditional and digital financial markets. Tokenization also reduces transaction costs by eliminating intermediaries and automating processes through smart contracts.

As regulatory frameworks evolve and technology advances, tokenization is set to revolutionize the financial industry. Intelisync provides cutting-edge RWA tokenization services to help you navigate and capitalize on this financial Learn more....

#metaverse development company#blockchain development companies#web3 development#blockchain development services#metaverse game development#24/7 Market Access#Access to Real-World Yields#Asset Classes in Tokenization#Benefiting Blockchains#CeFi and DeFi tokenization#CeFi-Based Tokenization Protocols#Commodities#Common Combinations#Credit & Loans#Current Trajectory#DeFi protocols#DeFi-Based Tokenization Protocols#Diverse Asset Classes#Dominance of the U.S.#Emerging Trends#Enhanced Liquidity#Ethereum’s Prominence#Fractional Ownership#Leading Geographies#Leading Geographies in Tokenization#Less Popular Asset Classes#Performance of DeFi Protocols#Popular Asset Classes#Private Credit#Real Estate

1 note

·

View note

Text

Understanding Real Estate Tokenization Categories: A New Investor Model

Real estate tokenization is reshaping the way people approach investing on land by converting assets digitally and enabling collective ownership via the use of blockchain. In the past, a real estate investment was capital-intensive as it needed a lot of money to start, and the assets were non-liquid, hence making it hard for small investors to join the bandwagon or exit the market rather fast. However, with the advent of real estate tokenization, investors no longer have to own physical assets. Nowadays, investors acquire or sell ownership stakes (tokens) in a comprehensive portfolio of real assets, thus making investment opportunities fluid, catering and easy to transact.

However, alongside this shift in the real estate landscape, there has emerged a classification of the real estate market – one that can be tokenized. Knowing these classifications is important in ensuring that investors invest in suitable tokenized assets based on their financial goals, appetite for risk and investment strategy. This blog outlines the important categories of real estate tokenization residential, commercial, real estate funds, infrastructure, and mixed-use properties and their possible use in an investor’s portfolio.

1. Residential Real Estate Tokenization

Residential real estate, which comprises stand-alone houses, multifamily units, and condos, is arguably the simplest class of physical asset that can be tokenized. In a bid to residential real estate tokenization, investors can purchase fractions in these assets, which, are usually other than other classes, can be easily identified and understood. This class provides investors the opportunity to invest in real estate without having too much money or the desire to own total control of one piece property.

Reduced Barriers Of Entry: Tokenization of residential properties makes it possible for people with small investing capitals to own a part of the real estate investment. Individuals do not have to wait for years saving for a deposit. They can invest portions of the property, thus, making real estate investment easy.

Earnings Through Renting: Sometime investors tend to hold on to tokens in properties that are rental in nature and such investors are entitled per rent earnings, that creates an opportunity for passive income.

Convertibility of Assets: It is possible for investors to buy and sell residential tokens in other digital exchanges thus enabling them to diversify their investment portfolio without incurring heavy losses that may have taken years in the traditional methods of investing in properties.

Ideal for: Small investors looking for steady income, some long term appreciation or just those who are new to real estate and want an easy, clear asset class.

2. Commercial Real Estate Tokenization

Houses in commercial real estate encompass office spaces, shopping complexes, accommodation facilities, storage spaces, and many other types of business-oriented buildings. This property type is often regarded as containing high-yielding investments because they can generate income through rents, sales, and other business activities. However, they usually necessitate large amounts of capital at the initial stages in the conventional models, which only permits deep-pocketed investors to participate. Tokenization has changed that, offering opportunities for commercial real estate investment to the public in small fractions.

Even the most pessimistic investor can consider that commercial property usually generates much more income than residential property because it is cash flow positive for most of the time owning long leases with high rental rates. Tokenization brings to access these highly profitable investments to a wider circle of investors.

Various Portfolio Opportunities: Commercial real estate is made up of different kinds of assets such as office space, shopping centers, and even factories making it possible for investors to invest in one sector reducing their risk.

Built-in Growth Options: In an ever-expanding real estate investment, investors can commence with a small percentage and increase the percent holdings gradually. In addition, where an investor wants to take advantage of the increasing value of assets purchased by the use of the token, trade them on a digital exchange to convert into cash without waiting for years to sell the asset.

Great For: Investors that want significant income potential, want to diversify within the real estate sector or investors that want to make buttressing income while their capital appreciation grows over time.

3.Real Estate Funds Tokenization

Real estate funds that are tokenized are designed to collect contributions from many investors into multiple underlying properties, be they residential, commercial or even within a particular market niche. These funds also offer an added advantage of diversification, which means that the relative risk of loss is less, than in the case of investing in one single asset. By means of tokenization of real estate funds, an investor can also obtain a portfolio of managed investment assets, which has high-end properties located in various geographic areas and sectors.

Built-in Spreading risk: Acquisition of tokenized real estate funds allows for an investment in many property types and locations ensuring that the negative effect of a poorly performing asset is reduced.

Management of external professionals: These are portfolios of tokenized assets that fund managers manage for the benefit of the investors professional management is advantageous especially to those who do not wish to get involved in the day-to-day investments.

Stable Income and Less Fluctuations: Because with a wide range of investments possibly helping to make it easier for the real estate developments and structures targeted towards making financial investments in those development activities thereby enhancing money markets.

Ideal for: Such investors wishing to climb down on risk, seeking properly diversified real estate assets management and professional management of the real estate assets especially because they do not wish to be hands-on in the investment.

4.Infrastructure Real Estate Tokenization

The process of tokenization has extended its utility to certain infrastructure assets such as airports, bridges, roads and utility services. This is mainly because these types of assets, as infrastructure and economic drivers, tend to have long-term leases with cities or companies, thus offering reliable consistent revenue generation.

Long-Term Earnings: Infrastructure assets typically yield more predictable income during a protracted time period making them suitable for investors with a longer time frame who are looking for consistent earnings.

Sustainability During Economic Crises: Infrastructure assets are subjected to less adverse impact by positive or negative changes in the economy since they provide fundamental services. The tokenization of these assets makes it possible for the investors to include such assets in the portfolio even when the region or the market is relatively stable.

Special Affordability of High-End Services: The possibility of making profit out of such investment has always been possible for only the institutions, systemically restricting the possibility of engaging in such investments for the common man. With tokenization, this is no longer the case as individuals can now put money into projects that they could only dream of before.

suitable for: Investors who are focused on long-term income stability, who appreciate relative peace of mind and therefore prefer to invest in some necessities instead of more volatile assets.

5. Mixed-Use Real Estate Tokenization

A multi-functional real estate tokenization development is a structure comprising living, working, and playing spaces. In other words, a city center with residential buildings, office buildings, shopping complexes, and food joints all integrated. Tokenization of mixed-use developments allows investment strategies wherein the clients partake in several revenue-generating activities consequently lessening the chances of risk in investments.

Multiple Sources of Income: Mixed-use properties include an array of incomes from rents from residential units, shops, and offices, as well as hospitality services, providing room for stable and growth-oriented returns.

Less Prone To Fluctuation: Because of the many different tenants and the different sources of income, mixed-use properties can sustain dips in any one market sector and achieve more stable performance.

Consistent with Urban Development Trends: Due to proliferation in land use and cities, mixed facilities are beginning to appreciate in worth. Fractionally selling these properties helps use the investors’ funds in developing regions and the increasing craving for multilevel spaces.

Best suited For : Investors aiming for asset diversification in one property, those wishing to gain from the growing urbanization, and investors looking for a balance in income return and capital appreciation.

Considerations for Investors

1. Risk and Return Balance:

Each category has a unique risk profile. Residential and mixed-use properties offer stability and are generally less volatile, while commercial properties and infrastructure can provide higher yields with slightly increased risks. Real estate funds further lower risk through diversification but may offer moderate returns.

2. Liquidity Preferences:

One of the most significant benefits of tokenization is liquidity. Investors who prefer high liquidity may lean towards tokenized residential or commercial properties, which are frequently traded. Conversely, infrastructure tokens may appeal to those with a long-term outlook.

3. Investment Horizon:

Residential and mixed-use tokens can be suitable for shorter investment horizons, thanks to their frequent trading. Infrastructure assets and commercial properties may require a longer horizon due to their nature and income stability.

4. Income vs. Growth:

Investors seeking passive income might focus on residential, commercial, and infrastructure tokens. Those aiming for growth can benefit from mixed-use or fund tokens that offer diverse exposure, balancing income with potential capital appreciation.

Conclusion

In turn, this investment model provides them with a practical approach to a variety of assets and income channels that were previously available only to institutional or accredited investors. As the market can be distinguished into residential, commercial, infrastructure, and portfolios consisting of various property usages, investors can clearly create a suitable portfolio depending on their possessions, risk appetite, and time horizons towards investment.

Investors can exploit the capability of every tokenization sector so that investments do not become skewed in any of the sectors within the property market – in undertaking value adding activities. Irrespective of whether it is stability, growth, or diversification or even targeted income that one is after, quite possibly there is a tokenized real estate model that fits the expectations of an investor.

As this space has great potential, real estate tokenization aims to make property investment affordable to everyone by laying the ambition of holding property by mere tokens; it is the middle ground between conventional real estate and contemporary finance. The probability of buying property in the future is no longer a probability but an evolving reality, one token at a time.

#Real Estate Tokenization Categories#Investor Model#real estate tokenization services#blockchain#cryptocurrency

0 notes