#debt lien

Explore tagged Tumblr posts

Text

Lien

Topic: Understanding Liens: A Comprehensive Guide A lien is a legal claim against a property that is used to secure a debt. It gives the creditor the right to take possession of the property if the debtor fails to repay the debt. Liens are commonly used in real estate transactions to secure mortgages, but they can also be used to secure other types of debts, such as car loans, personal loans,…

0 notes

Text

The tax sharks are back and they’re coming for your home

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TODAY (Apr 27) in MARIN COUNTY, then Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

One of my weirder and more rewarding hobbies is collecting definitions of "conservativism," and one of the jewels of that collection comes from Corey Robin's must-read book The Reactionary Mind:

https://en.wikipedia.org/wiki/The_Reactionary_Mind

Robin's definition of conservativism has enormous explanatory power and I'm always finding fresh ways in which it clarifies my understand of events in the world: a conservative is someone who believes that a minority of people were born to rule, and that everyone else was born to follow their rules, and that the world is in harmony when the born rulers are in charge.

This definition unifies the otherwise very odd grab-bag of ideologies that we identify with conservativism: a Christian Dominionist believes in the rule of Christians over others; a "men's rights advocate" thinks men should rule over women; a US imperialist thinks America should rule over the world; a white nationalist thinks white people should rule over racialized people; a libertarian believes in bosses dominating workers and a Hindu nationalist believes in Hindu domination over Muslims.

These people all disagree about who should be in charge, but they all agree that some people are ordained to rule, and that any "artificial" attempt to overturn the "natural" order throws society into chaos. This is the entire basis of the panic over DEI, and the brainless reflex to blame the Francis Scott Key bridge disaster on the possibility that someone had been unjustly promoted to ship's captain due to their membership in a disfavored racial group or gender.

This definition is also useful because it cleanly cleaves progressives from conservatives. If conservatives think there's a natural order in which the few dominate the many, progressivism is a belief in pluralism and inclusion, the idea that disparate perspectives and experiences all have something to contribute to society. Progressives see a world in which only a small number of people rise to public life, rarified professions, and cultural prominence and assume that this is terrible waste of the talents and contributions of people whose accidents of birth keep them from participating in the same way.

This is why progressives are committed to class mobility, broad access to education, and active programs to bring traditionally underrepresented groups into arenas that once excluded them. The "some are born to rule, and most to be ruled over" conservative credo rejects this as not just wrong, but dangerous, the kind of thing that leads to bridges being demolished by cargo ships.

The progressive reforms from the New Deal until the Reagan revolution were a series of efforts to broaden participation in every part of society by successively broader groups of people. A movement that started with inclusive housing and education for white men and votes for white women grew to encompass universal suffrage, racial struggles for equality, workplace protections for a widening group of people, rights for people with disabilities, truth and reconciliation with indigenous people and so on.

The conservative project of the past 40 years has been to reverse this: to return the great majority of us to the status of desperate, forelock-tugging plebs who know our places. Hence the return of child labor, the tradwife movement, and of course the attacks on labor unions and voting rights:

https://pluralistic.net/2022/11/06/the-end-of-the-road-to-serfdom/

Arguably the most potent symbol of this struggle is the fight over homes. The New Deal offered (some) working people a twofold path to prosperity: subsidized home-ownership and strong labor protections. This insulated (mostly white) workers from the two most potent threats to working peoples' lives and wellbeing: the cruel boss and the greedy landlord.

But the neoliberal era dispensed with labor rights, leaving the descendants of those lucky workers with just one tool for securing their American dream: home-ownership. As wages stagnated, your home – so essential to your ability to simply live – became your most important asset first, and a home second. So long as property values rose – and property taxes didn't – your home could be the backstop for debt-fueled consumption that filled the gap left by stagnating wages. Liquidating your family home might someday provide for your retirement, your kids' college loans and your emergency medical bills.

For conservatives who want to restore Gilded Age class rule, this was a very canny move. It pitted lucky workers with homes against their unlucky brethren – the more housing supply there was, the less your house was worth. The more protections tenants had, the less your house was worth. The more equitably municipal services (like schools) were distributed, the less your house was worth:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

And now that the long game is over, they're coming for your house. It started with the foreclosure epidemic after the 2008 financial crisis, first under GW Bush, but then in earnest under Obama, who accepted the advice of his Treasury Secretary Timothy Geithner, who insisted that homeowners should be liquidated to "foam the runways" for the crashing banks:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

Then there are scams like "We Buy Ugly Houses," a nationwide mass-fraud outfit that steals houses out from under elderly, vulnerable and desperate people:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The more we lose our houses, the more single-family homes Wall Street gets to snap up and convert into slum properties, aslosh with a toxic stew of black mold, junk fees and eviction threats:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Now there's a new way for finance barons the steal our houses out from under us – or rather, a very old way that had lain dormant since the last time child labor was legal – "tax lien investing."

Across the country, counties and cities have programs that allow investment funds to buy up overdue tax-bills from homeowners in financial hardship. These "investors" are entitled to be paid the missing property taxes, and if the homeowner can't afford to make that payment, the "investor" gets to kick them out of their homes and take possession of them, for a tiny fraction of their value.

As Andrew Kahrl writes for The American Prospect, tax lien investing was common in the 19th century, until the fundamental ugliness of the business made it unattractive even to the robber barons of the day:

https://prospect.org/economy/2024-04-26-investing-in-distress-tax-liens/

The "tax sharks" of Chicago and New York were deemed "too merciless" by their peers. One exec who got out of the business compared it to "picking pennies off a dead man’s eyes." The very idea of outsourcing municipal tax collection to merciless debt-hounds fell aroused public ire.

Today – as the conservative project to restore the "natural" order of the ruled and the ruled-over builds momentum – tax lien investing is attracting some of America's most rapacious investors – and they're making a killing. In Chicago, Alden Capital just spent a measly $1.75m to acquire the tax liens on 600 family homes in Cook County. They now get to charge escalating fees and penalties and usurious interest to those unlucky homeowners. Any homeowner that can't pay loses their home.

The first targets for tax-lien investing are the people who were the last people to benefit from the New Deal and its successors: Black and Latino families, elderly and disabled people and others who got the smallest share of America's experiment in shared prosperity are the first to lose the small slice of the American dream that they were grudgingly given.

This is the very definition of "structural racism." Redlining meant that families of color were shut out of the federal loan guarantees that benefited white workers. Rather than building intergenerational wealth, these families were forced to rent (building some other family's intergenerational wealth), and had a harder time saving for downpayments. That meant that they went into homeownership with "nontraditional" or "nonconforming" mortgages with higher interest rates and penalties, which made them more vulnerable to economic volatility, and thus more likely to fall behind on their taxes. Now that they're delinquent on their property taxes, they're in hock to a private equity fund that's charging them even more to live in their family home, and the second they fail to pay, they'll be evicted, rendered homeless and dispossessed of all the equity they built in their (former) home.

It's very on-brand for Alden Capital to be destroying the lives of Chicagoans. Alden is most notorious for buying up and destroying America's most beloved newspapers. It was Alden who bought up the Chicago Tribune, gutted its workforce, sold off its iconic downtown tower, and moved its few remaining reporters to an outer suburban, windowless brick building "the size of a Chipotle":

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Before the ghastly hotel baroness Leona Helmsley went to prison for tax evasion, she famously said, "We don't pay taxes; only the little people pay taxes." Helmsley wasn't wrong – she was just a little ahead of schedule. As Propublica's IRS Files taught us, America's 400 richest people pay less tax than you do:

https://pluralistic.net/2022/04/13/for-the-little-people/#leona-helmsley-2022

When billionaires don't pay their taxes, they get to buy sports franchises. When poor people don't pay their taxes, billionaires get to steal their houses after paying the local government an insultingly small amount of money.

It's all going according to plan. We weren't meant to have houses, or job security, or retirement funds. We weren't meant to go to university, or even high school, and our kids were always supposed to be in harness at a local meat-packer or fast food kitchen, not wasting time with their high school chess club or sports team. They don't need high school: that's for the people who were born to rule. They – we – were meant to be ruled over.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/26/taxes-are-for-the-little-people/#alden-capital

#pluralistic#chicago#illinois#alden capital#the rents too damned high#debt#immiseration#chicago tribune#private equity#vulture capital#cook county#liens#tax evasion#taxes are for the little people#tax lien certificates#tax sharks#race#racial capitalism#predatory lending

382 notes

·

View notes

Text

the two loan officers in the trap at the beginning of saw vi definitely were trying to collect on john's $500,000 loan for "assorted scraps of metal" and "power tools (unspecified)" and "a legal fuckton of WD-40" and they definitely knew the guy who comes to sign paperwork in a wizard cloak was up to some shit and that's why they're so unfazed when the puppet shows up and reads them their rights

#saw vi#the idea of john kramer being deeply in debt is so funny to me and always will be#congratulations mark you inherit my legacy and my liens

18 notes

·

View notes

Text

In November, world leaders at the most recent big climate meeting, known as COP27, agreed to set up a “loss and damage” fund, bankrolled by rich countries, to help poor countries harmed by climate change. Now comes the hard part of figuring out the details: This week, a special United Nations committee set up to plan the fund will meet for the first time, in Luxor, Egypt. Delegates will start negotiating which nations will be able to draw from the fund, where it will be housed, where the money will come from, and how much each country should pitch in. At this point, the fund is “an empty bucket,” says Lien Vandamme, a senior campaigner at the nonprofit Center for International Environmental Law, who is in Egypt for the negotiations. “Everything is still open.” Other meetings will follow, and the committee will make its recommendations to the world this fall in Dubai at COP28.

If the past several decades of climate negotiations are anything to go on, the loss-and-damage fund will be poorly endowed, or filled with money that got moved over from some other fund and relabeled, or in the form of loans rather than grants. If that happens, it will likely be perceived by poorer nations as yet another inadequate response by the same countries that messed up the climate in the first place. And those that are wronged are unlikely to simply suffer in silence.

The loss-and-damage fund would be separate from what is currently the dominant form of climate funding that flows to the global South: money to help low-income nations reduce their emissions. And it would also be separate from “adaptation,” money to help areas prepare for disasters or avoid the harms of warming. Instead, the new fund would be provided by rich countries to compensate poor countries that have already suffered losses. In a word, it would be reparations.

The agreement to establish a fund for this purpose was initially opposed by some rich countries. The U.S. climate envoy John Kerry said in the fall that helping the developing world cope with climate change is “a moral obligation”—but he wanted that help to flow through existing funds and institutions, including the World Bank and the International Monetary Fund. Developing countries, however, demanded a new, dedicated fund, and they ultimately prevailed. Almost all the details were left to be finalized at COP28 in Dubai, after the committee has worked to iron out specifics. But by agreeing that a loss-and-damage fund should exist, countries seem to be reluctantly acknowledging that they bear some moral accountability for climate change. “It is very clear that developed countries have a historical responsibility,” says Liane Schalatek, a climate-finance expert at the Heinrich Böll Foundation in Washington, D.C., who is also in Luxor this week.

Funds are especially needed for the “day after” problems—the ongoing work of rebuilding and recovering after a flood or a heat wave is over and the emergency foreign aid has dried up, Mohamed Nasr, Egypt’s delegate to this week’s meeting, told me. People don’t just need tarp tents and bowls of rice. They need “social support, a way to return livelihoods,” Nasr said.

But how much is enough? One analysis suggests that the true scale of the financial losses due to climate change outside of the West may be as much as $580 billion a year by 2030, and some groups are considering a figure in that ballpark to be the minimum acceptable amount. Another analysis estimated that America owed $20 billion for global climate losses in 2022, a number that would rise to about $117 billion annually by 2030. Nasr demurred on naming specific amounts, suggesting that the workings of the fund be negotiated first. The needs are enormous, and mentioning figures at this point would only “scare people,” he said. “If you put a number on at the beginning, the focus will only be on the number,” he told me. But he did add that “it will be in the billions.”

Given that the standing UN goal for all types of climate funding from rich countries to poorer ones—$100 billion—has never been met, filling the loss-and-damage fund with hundreds of billions of dollars feels like an almost impossible lift. “It will be a huge challenge to get countries to agree on the amount that is needed,” says Leia Achampong of the European Network on Debt and Development. For many delegates from the global South, a key demand is that the fund not come in the form of loans. Many poor countries, including Pakistan, are already dealing with debt, which is affecting their ability to provide for their own citizens. More loans would just add to this debt burden. “If a country is in debt, you have the World Bank and the IMF calling for austerity, and the first thing that usually goes is the social safety net,” Schalatek told me.

— The West Agreed to Pay Climate Reparations. That Was the Easy Part

#emma marris#the west agreed to pay climate reparations. that was the easy part#current events#climate change#global warming#environmentalism#climate justice#economics#politics#debt#international relations#2022 united nations climate change conference#cop27#2023 united nations climate change conference#cop28#egypt#pakistan#lien vandamme#john kerry#liane schalatek#mohamed nasr#leia achampong#center for international environmental law#heinrich böll foundation#eurodad

3 notes

·

View notes

Text

Understanding Tax Liens & Levies: Protect Your Assets Before It's Too Late

It's vital to understand the severe consequences of tax liens and levies, as they can have a devastating impact on your finances and property ownership. If you're struggling with unpaid taxes, you may be at risk of having a tax lien or levy placed against you. But don't worry, tax professionals can help protect your assets from these financial threats.

In this article, we'll probe into the world of tax liens and levies, explaining what they are, how they can affect your finances, and most importantly, how you can protect your assets from their grasp.

So, let's start with the basics. What are tax liens and levies?

A tax lien is a legal claim against your property when you fail to pay your taxes. It gives the government the right to seize your property to satisfy the debt. On the other hand, a tax levy is the actual seizure of your property or assets to pay off the debt. The IRS uses these tools to collect unpaid taxes, and they can have severe consequences on your financial well-being.

Now, let's discuss the impact of tax liens and levies on your finances. A tax lien can damage your credit score, making it difficult to obtain loans or credit in the future. Additionally, it can restrict your ability to sell your property, as the lien must be paid off before the sale can be finalized. Tax levies, on the other hand, can result in wage garnishment or asset seizure, leaving you with limited financial resources.

So, how can you protect your assets from tax liens and levies? The key is to avoid them altogether. You can do this by negotiating a payment plan with the IRS or resolving your tax debt before enforcement action is taken. However, dealing with the IRS can be complex and intimidating, which is why it's vital to seek professional legal help. A tax expert can guide you through the process and ensure your rights are protected.

To put it briefly, tax liens and levies can have severe consequences on your finances and property ownership. It's vital to act quickly to protect your assets from these financial threats. If you're struggling with unpaid taxes, don't hesitate to seek professional help. You can book an appointment with a tax expert at https://taxlawadvisory.com/ to get the assistance you need.

Don't wait until it's too late; protect your assets from tax liens & levies today. Our office is located at 123 Main St, Anytown, USA 12345. Contact us now to schedule a consultation and take the first step towards protecting your financial future.

0 notes

Text

Avoid personal and family conflicts through open communication channels and mutual understanding. A newer, unmarried partner of a beloved parent may make adult children suspicious of their intent. For more information contact our Bankruptcy attorney in Orange or call us today at 407-734-5166.

#medical lien on house#Orlando FL Wills Attorney#Estate Planning Questionnaire#Stop Creditor Harassment#Repossession Defense LP#Student Loan Debt and Bankruptcy#Orlando FL Chapter 7 Attorney#Orlando FL Adversary Proceedings Attorney

0 notes

Text

Don't get me wrong, I like staying at my grandma's because I can forget about household chores and making myself food for a few days, but ffs I wish I was home right now because I am literally vibrating with ideas regarding my newest strain of brain fungus and I think that if I don't indulge in it then sooner or later I will explode

#there is just something impossibly fascinating about traumatising my already traumatised oc some more#I feel like spending a few weeks focused on the ultimate au was like a vacation. a trip to fluffville. so to speak#now I'm back at work at the angst factory and putting in double the hours#fuuckkk. this au really hits the right spot#the angst. the trauma. the hit to Suiren's psyche because no matter how strong she thought herself to be. she was still powerless#the p'li and lien-hua parallels. a reverse of their situation. the impact it had on Midori#new kuviren dynamic. emotion filled night followed by weeks of frigidness. debt you can't repay. continuous care for someone you don't know#I'm chewing on glass biting into a fall crawling all over the ceiling#aaaaaaAAAAAAAAAHHHHHHH

1 note

·

View note

Text

Are you seeking legal assistance for hospital lien lawyer Las Vegas? Look no further than A Fresh Start Law. Our commitment to client satisfaction sets us apart. We prioritize open communication, ensuring that you are informed every step of the way. Our goal is not only to resolve your current hospital lien issue but also to provide you with peace of mind for the future.

A Fresh Start Law 2037 Franklin Ave, Las Vegas, NV 89104 (702) 551–3256

My Official Website: https://afreshstartlaw.com/ Google Plus Listing: https://www.google.com/maps?cid=15187909726789775019

Our Other Links:

debt attorney Las Vegas: https://afreshstartlaw.com/bankruptcy/debts-we-settle/ chapter 13 attorney Las Vegas: https://afreshstartlaw.com/bankruptcy/chapter-13/ chapter 7 attorney Las Vegas: https://afreshstartlaw.com/bankruptcy/chapter-7/ student loan settlement lawyer Las Vegas: https://afreshstartlaw.com/bankruptcy/student-loan-solutions/ asset protection attorney Las Vegas: https://afreshstartlaw.com/bankruptcy/asset-protection/

Service We Offer:

Chapter 7 Bankruptcy Chapter 13 Bankruptcy Debt Settlement Student Loan Solutions Asset protection

Follow Us On:

Twitter: https://twitter.com/AFreshStartLaw1 Pinterest: https://www.pinterest.com/AFreshStartLaw/ Instagram: https://www.instagram.com/afreshstartlaw/

#hospital lien lawyer las vegas#asset protection attorney las vegas#student loan settlement lawyer las vegas#chapter 7 attorney las vegas#options to solve debts las vegas

0 notes

Text

The American Housing Market Resembles 2006

The American Housing Market Is Resembling 2006. Is It Deja Vu All Over Again? The American housing market is sound disturbingly familiar to us who survived the housing crash 15 years ago. Skyrocketing home prices have very suddenly leveled off. Recession fears are swirling and the number of home sales has dropped off in the past year. Is it 2006? Remember, the year that saw the ramp-up to…

View On WordPress

#American Housing Market#banking#banks#debt#foreclosure#foreclosures#housing market#housing market collapse#Lending restrictions#liens#mortgage lending#mortgage lending insanity#mortgages#real estate#US Housing Market#US housing markets#Wall Street

0 notes

Text

Good question:

In the United States, many jails and prisons can and will charge you money for every single night that you spend imprisoned, for the entire duration of your incarceration, as if you were being billed for staying at a hotel. Even if you are incarcerated for years. Adding up to tens of thousands of dollars. What happens when you’re released?

In response to this:

---

So.

You’re getting charged, like, ten dollars every time you even submit a request form to possibly be seen by a doctor or dentist.

You’re getting charged maybe five dollars for ten minutes on the phone.

Any time a friend or family tries to send you like five dollars so that you can buy some toothpaste or lotion, or maybe a snack from the commissary since you’re diabetic and the “meals” have left you malnourished, maybe half of that money gets taken as a “service fee” by the corporate contractor that the prison uses to manage your pre-paid debit card. So you’re already losing money every day just by being there.

What happens if you can’t pay?

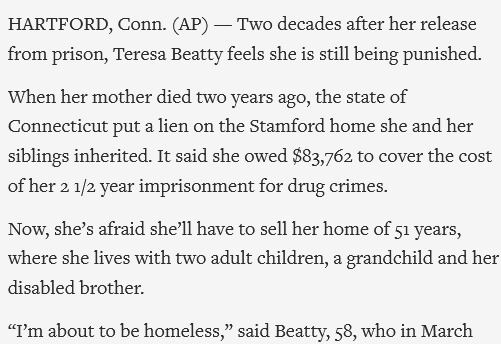

In some places, after serving just a couple of years for drugs charges, almost 20 years after being released, the state can still hunt you down for over $80,000 that you “owe” as if it were a per-night room-and-board accommodations charge, like this recent highly-publicized case in Connecticut:

Excerpt:

Two decades after her release from prison, [TB] feels she is still being punished. When her mother died two years ago, the state of Connecticut put a lien on the Stamford home she and her siblings inherited. It said she owed $83,762 to cover the cost of her 2 1/2 year imprisonment for drug crimes. [...] “I’m about to be homeless,” said [TB], 58, who in March [2022] became the lead plaintiff in a lawsuit challenging the state law that charges prisoners $249 a day for the cost of their incarceration. [...] All but two states have so-called “pay-to-stay” laws that make prisoners pay for their time behind bars [...]. Critics say it’s an unfair second penalty that hinders rehabilitation by putting former inmates in debt for life. Efforts have been underway in some places to scale back or eliminate such policies. Two states — Illinois and New Hampshire — have repealed their laws since 2019. [...] Pay-to-stay laws were put into place in many areas during the tough-on-crime era of the 1980s and ’90s, said Brittany Friedman, an assistant professor of sociology at University of Southern California who is leading a study of the practice. [...] Connecticut used to collect prison debt by attaching an automatic lien to every inmate, claiming half of any financial windfall they might receive for up to 20 years after they are released from prison [...].

Text by: Pat Eaton-Robb. “At $249 per day, prison stays leave ex-inmates deep in debt.” AP News / The Associated Press. 27 August 2022.

---

---

Look at this:

To help her son, Cindy started depositing between $50 to $100 a week into Matthew’s account, money he could use to buy food from the prison commissary, such as packaged ramen noodles, cookies, or peanut butter and jelly to make sandwiches. Cindy said sending that money wasn’t necessarily an expense she could afford. “No one can,” she said. So far in the past month, she estimates she sent Matthew close to $300. But in reality, he only received half of that amount. The balance goes straight to the prison to pay off the $1,000 in “rent” that the prison charged Matthew for his prior incarceration. [...] A PA Post examination of six county budgets (Crawford, Dauphin, Lebanon, Lehigh, Venango and Indiana) showed that those counties’ prisons have collected more than $15 million from inmates — almost half is for daily room and board fees that are meant to cover at least a portion of the costs with housing and food. Prisoners who don’t work are still expected to pay. If they don’t, their bills are sent to collections agencies, which can report the debts to credit bureaus. [...] Between 2014 and 2017, the Indiana County Prison — which has an average inmate population of 87 people — collected nearly $3 million from its prisoners. In the past five years, Lebanon’s jail collected just over $2 million in housing and processing fees.

Text by: Joseph Darius Jaafari. “Paying rent to your jailers: Inmates are billed millions of dollars for their stays in Pa. prisons.” WHYY (PBS). 10 December 2019. Originally published at PA Post.

---

Pay-to-stay, the practice of charging people to pay for their own jail or prison confinement, is being enforced unfairly by using criminal, civil and administrative law, according to a new Rutgers University-New Brunswick led study. The study [...] finds that charging pay-to-stay fees is triggered by criminal justice contact but possible due to the co-opting of civil and administrative institutions, like social service agencies and state treasuries that oversee benefits, which are outside the realm of criminal justice. “A person can be charged $20 to $80 a day for their incarceration,” said author Brittany Friedman, an assistant professor of sociology and a faculty affiliate of Rutgers' criminal justice program. “That per diem rate can lead to hundreds of thousands of dollars in fees when a person gets out of prison. To recoup fees, states use civil means such as lawsuits and wage garnishment against currently and formerly incarcerated people, and regularly use administrative means such as seizing employment pensions, tax refunds and public benefits to satisfy the debt.” [...] Civil penalties are enacted on family members if the defendant cannot pay and in states such as Florida, Nevada and Idaho can occur even after the original defendant is deceased. [...]

Text by: Megan Schumann. “States Unfairly Burdening Incarcerated People With “Pay-to-Stay” Fees.” Rutgers press release. 20 November 2020.

---

So, to pay for your own imprisonment, states can:

-- hunt you down for decades (track you down 20 years later, charge you tens of thousands of dollars, and take your house away)

-- put a lien on your vehicle, house

-- garnish your paycheck/wages

-- seize your tax refund

-- send collections agencies after you

-- take your public assistance benefits

-- sue you in civil court

-- take money from your family even after you’re dead

9K notes

·

View notes

Text

They're doing this because the sheer callous greed of an insanely profitable business still bilking the poor for their very last few dollars is a bad look.

That behavior is the kind of thing that makes people want Medicare for All or any singlepayer, NONPROFIT, cost-controlling system.

#medical debt#liens on homes#Atrium Health punished debtors#social justice#we want singlepayer healthcare

92 notes

·

View notes

Text

Weiss: (Singing) I have 30,000 Lien in credit card debt~!

Weiss: When they call I tell them I can't pay it back yet~!

Jaune: (Playing guitar) Credit card debt~!

Weiss: Tomorrow I may buy myself a dining room set~!

Weiss: (Picks up doll) Or this Neon Katt!

Weiss/Jaune: Credit card debt~! Credit card debt~! Credit card debt~!

42 notes

·

View notes

Text

Less than a week after NBC News detailed how the hospital system Atrium Health of North Carolina aggressively pursued former patients’ medical debts, placing liens on their homes to collect on hospital bills, the nonprofit company announced it would cancel those obligations and forgive the unpaid debts associated with them. Some 11,500 liens on people's homes in North Carolina and five other states will be released, Atrium’s parent company, Advocate Health, said with some dating back 20 years or more.

Advocate Health said it is changing its policy now as “the next logical step” following a 2022 decision to stop filing lawsuits and property liens to collect on patients’ medical debts. The company declined NBC News’ request for an interview about the shift.

Reporting on the nationwide problem of medical debt last week, NBC News focused on Terry Belk, 68, a Charlotte resident whose wife died of breast cancer in 2012 and who was himself later diagnosed with prostate cancer. Both his wife’s treatment and Belk’s own racked up tens of thousands of dollars in bills their insurance did not cover. When Belk could not afford to pay them, Atrium Health pursued him in court, the company confirmed. In 2005, Belk signed what’s called a deed of trust with Atrium, granting it the right to receive $23,000 when he sold his family home.

33 notes

·

View notes

Text

Paying Back For Juniors

Closed with @sins-of-warriors

Continued from here

"Let's just say IF you endure all night tonight... This will be your last day" Tryndamere replied casually as he approached the blonde girl "Hmm.. so just the hair.. that means these ones are fair play?" He approached her from behind and let his hands reach her voluptuous chest and began to grope and massage them with steady motions.

"Nnngh~!" Yang moaned as her lip quivered from his playing with her tits. Oh it felt good, but Yang also knew how to put on a show to make it even sexier "Yeah~! You can play with them all you want, baby~! Enjopy my big tits, Daddy~!"

The blonde had to admit... she was a bit excited about this. This one guy somehow had enough money/power that this one fuck would pay off her WHOLE debt? She was determined to make this work out!

....

She was also determined for something else. Maybe if she made this night hot enough, she'd get a sugar daddy begging for more of her time. Begging enough to throw her thousands of lien. The idea sparking an eager grin upon her face as she made her moaning as realistic and sexy as possible

10 notes

·

View notes

Text

Less than a week after NBC News detailed how the hospital system Atrium Health of North Carolina aggressively pursued former patients’ medical debts, placing liens on their homes to collect on hospital bills, the nonprofit company announced it would cancel those obligations and forgive the unpaid debts associated with them. Some 11,500 liens on people's homes in North Carolina and five other states will be released, Atrium’s parent company, Advocate Health, said with some dating back 20 years or more. Advocate Health said it is changing its policy now as “the next logical step” following a 2022 decision to stop filing lawsuits and property liens to collect on patients’ medical debts. The company declined NBC News’ request for an interview about the shift.

18 notes

·

View notes

Text

That was actually one thing that exasperated me the last time I dealt with my uncle in person.

He had a serious mad on at my stepdad, which had obviously built up over the years. There are plenty of legitimate criticisms to be made there! I lived with the man for many years, and he really is difficult to deal with and kind of a big jerk. I am very aware of this. I have talked to the man maybe once since the last time I was back home.

Inserting a cut for long and ranty shit, dealing with some family drama and rather traumatic financial happenings. Also nobody wanting to fucking listen to me about things they were invested in not hearing.

My mother had her own problems, or she would have run far away before they ever got more than a date or two in--much less stayed with the guy for 20+ years until she died. Marinara flags all over the place.

I am sure that some of the man's persistent financial problems really were kinda self-inflicted. I mean, on top of legit being multiply disabled and going through two bouts with cancer when I was still a kid.

But...to my original point? Said uncle (my only surviving blood one) also has the Family OCD, and worse tendencies than I do to fixate on things that piss him off as a handy distraction from other anxieties. Easier to rant than to deal with the other fears. I understand this probably better than he does, and it's still really hard to take sometimes.

Anyway, on this occasion he had partly managed to get fixated on the specific idea that Stepdad The Jerk must have been making a bunch of shit up all along about that big looming medical debt from the cancer surgery. Because (his wife, the longtime hospital administrator and CPA) knows very well how medical debt works, and that ain't it!

The thing is, Jerky Stepdad is very very bad at straight-up lying. He will just make shit up sometimes to cover his ass, but it doesn't work so well. (Usually he WILL just try and rules-lawyer his way through, and that really does tend to work better than you might expect. People often just don't know what to do.)

And yeah, I was there to see up close how that went. The key: it wasn't normal medical debt, legally. Because the surgery was done through Big State Medical School Hospital in Richmond, leaving him in like $60,000+ in mid-'80s money worth of direct debt to the Commonwealth of Virginia itself once Blue Cross refused to pay after preapproving it.

(The same surgeon was ready to do the exact same procedure at the VA hospital just down the street instead otherwise, but Medical School Hospital had so much better facilitate overall. Stepdad is part of probably the last group of Vietnam vets where the VA was still theoretically on the hook for covering all future medical treatment for literally anything, but yeah you're better off going elsewhere if you can at all. The freaking VA was willing to cover this surgery. That's how experimental a treatment it really was by then.)

So yeah, that was why we had actual state employees from the Attorney General's office calling nonstop and actually harassing me too starting from when I was like 12. (I am not exaggerating. Half of what they were doing was anything but legal. They were even trying to get me to accept responsibility for his debt before he died from a cancer with a not great prognosis. Knowingly dealing with what was obviously a kid who was not even blood related to him.)

Jerky Stepdad also managed to personally piss off the sitting state Attorney General at the time. Which is honestly no wonder. But, over most of the like 7 years she was in the position? He really did kinda get targeted by that office--with the whole household along for the ride.

Oh yeah, being the actual state? They really could pull shit like seizing every penny of state income tax returns, seizing a sizeable chunk of your damn unemployment checks, placing liens on any property you have (yep, very much including your house!), and so on. Ad nauseam. Then ring your phone some more to hassle anybody unfortunate enough to answer, like the worst collection agency ever, working on the state's dime.

They did try to foreclose on the house at least once. I was there. I saw the legal papers and the (broke) scrambling to forestall that. He was still in that house at last check, very much alive decades after that liver resection and still a giant PITA to deal with.

Normal medical debt doesn't work that way. Debt owed to the Commonwealth of Virginia very much does. And I had a front row seat for most of that shitshow, like it or not. It directly impacted me a lot, and I saw the various official paperwork to confirm pretty much every story the dude I didn't even particular like had supposedly pulled out of his ass pertaining to that whole mess.

Of course, Darling Uncle didn't want to hear a word about how some assumptions were very seriously off base there. As little as I even enjoyed being put in a position where I felt compelled to defend somebody I was pretty mad at myself at the time for some other reasons.

It was much easier to continue on that misplaced rip, and make up his own stories to justify all of it.

He was actually being unusually careful to make it clear that he was righteously pissed at Stepdad, and knew I had nothing to do with any of the shit he was ranting about. I still resented the hell out of getting put in a position like that YET AGAIN. By somebody who wouldn't fucking listen to anything he didn't want to hear.

But yeah, family.

I got extremely sick of ending up smack in the middle of too much shit, trying to play moderator for people behaving very unreasonably whether I wanted to or not. As the kid of the (at least equally loud!) Designated Scapegoat who had just thoroughly departed the scene, or was maybe still in the process of doing so. I don't remember the exact timing of that exasperating interaction. There was rather a lot going on. NOBODY needed that shit on top of it.

#personal#ranting#family stuff#financial garbage#keeping the fun in dysfunctional#seriously though#i feel bad for not staying in touch more#but jfc#who acts like that?!#and i've always liked the uncle anyway#death mention

6 notes

·

View notes