#cryptocurrencyeducation

Explore tagged Tumblr posts

Text

The Psychology of Money and Bitcoin Adoption

Why Do We Resist Change?

Change is hard. Whether it’s adopting a new habit, switching careers, or learning about revolutionary technologies like Bitcoin, humans are naturally wired to resist the unfamiliar. This resistance isn’t necessarily about laziness or ignorance; it’s deeply rooted in our psychology. When it comes to money, a system we depend on for survival, the stakes feel even higher.

Bitcoin represents one of the most significant financial innovations of our time, yet many people remain skeptical or even outright dismissive of it. Why is that? And more importantly, how can education help shift perspectives?

The Comfort Zone of Fiat Currency

For most of us, fiat currency is as familiar as the air we breathe. We’ve grown up with cash, credit cards, and centralized financial institutions managing our money. The government’s promise of “backing” fiat currencies has given people a sense of security—even when inflation erodes purchasing power year after year. This comfort zone creates a psychological barrier to adopting something as new and abstract as Bitcoin.

Bitcoin, being entirely digital and decentralized, challenges these deeply ingrained norms. The idea that no central authority controls it—while a strength—can feel unsettling for those who have always trusted institutions like banks and governments to manage their money.

Fear of the Unknown

Fear often stems from ignorance. For someone unfamiliar with concepts like blockchain technology, mining, or decentralization, Bitcoin can seem like an enigma wrapped in tech jargon. This lack of understanding can make it easier to dismiss Bitcoin as “too complicated” or “too risky.”

Consider this: how many people fully understand how the current financial system operates? The majority don’t, yet they’re comfortable using it because it feels familiar. Bridging this gap for Bitcoin requires breaking down its mechanics and benefits in ways that are accessible and relatable.

Misinformation and Media Influence

The media plays a powerful role in shaping public opinion, and Bitcoin is no exception. Headlines about extreme price volatility, environmental concerns related to mining, or comparisons to speculative bubbles like Tulip Mania have colored many people’s perceptions of Bitcoin. These narratives, while often oversimplified or misleading, create mental roadblocks that prevent deeper exploration.

Misinformation isn’t limited to media outlets either. Social circles, influencers, and even policymakers sometimes spread myths or half-truths about Bitcoin, further cementing skepticism. Combating these misconceptions requires a consistent effort to provide accurate, balanced information.

Education: The Bridge to Adoption

Education is the most powerful tool for breaking through resistance. When people take the time to learn about Bitcoin’s decentralized nature, its ability to hedge against inflation, and its potential to empower individuals financially, their perspectives often shift. Knowledge replaces fear with curiosity and skepticism with understanding.

Take El Salvador, for example. When the country adopted Bitcoin as legal tender, many citizens were initially resistant. However, grassroots education initiatives—including hands-on workshops and simplified explanations—helped foster acceptance. Similar efforts worldwide have shown that education can transform fear into adoption.

My Personal Journey

I wasn’t always a Bitcoin advocate. In fact, I approached it with skepticism at first. But as I dug deeper and began to understand its potential to create a fairer, more transparent financial system, my view shifted dramatically. Learning about Bitcoin wasn’t just a process of understanding technology; it was a journey of questioning the traditional financial systems I’d always taken for granted.

This transformation didn’t happen overnight. It took time, research, and a willingness to unlearn old habits. Now, I’m passionate about sharing this knowledge with others, because I know how powerful it can be to see the world through a new lens.

Empowering Yourself Through Education

If you’ve ever felt intimidated by Bitcoin or written it off as a fad, I encourage you to take a step back and approach it with curiosity. Start small. Read articles, watch documentaries, or even reach out to someone who can answer your questions.

Here are some great resources to begin your journey:

Visit the website of Bitcoin.org for beginner-friendly guides on how to start with Bitcoin.

Books like The Bitcoin Standard by Saifedean Ammous

Documentaries like Banking on Bitcoin

Taking the time to learn doesn’t mean you have to become a full-fledged Bitcoin advocate. It’s about empowering yourself to make informed decisions about your financial future.

A Paradigm Shift Worth Embracing

Change is never easy, especially when it involves something as fundamental as money. But the world is evolving, and financial systems are no exception. Bitcoin offers a new way forward—one that prioritizes decentralization, transparency, and individual empowerment.

By overcoming the psychological barriers of fear and misinformation, and by embracing education, we can open the door to a brighter financial future. The question isn’t whether Bitcoin will play a role in shaping tomorrow’s economy; it’s whether we’ll be ready to embrace it when the time comes.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#PsychologyOfMoney#FinancialFreedom#BitcoinAdoption#Decentralization#Blockchain#MoneyMatters#FutureOfFinance#BitcoinEducation#DigitalCurrency#FinanceRevolution#BitcoinCommunity#CryptoEducation#EmpowermentThroughKnowledge#AlternativeFinance#CryptocurrencyEducation#DigitalEconomy#BitcoinJourney#LearnBitcoin#financial empowerment#financial education#financial experts#finance#globaleconomy

1 note

·

View note

Text

#Bitcoin#Ethereum#CryptoQuant#Cryptocurrency#Blockchain#Investing#CryptoNews#Finance#Tech#DigitalCurrency#CryptoAnalytics#MarketAnalysis#CryptocurrencyEducation#CryptoTrends#CryptocurrencyExplained

0 notes

Text

Level Up Your Crypto Knowledge: My Crypto Quantum Leap Experience

The world of cryptocurrency can be overwhelming, especially for beginners. I dipped my toes in a while back but found myself lost in a sea of technical jargon and conflicting information. Then I stumbled upon Crypto Quantum Leap (CQL), and it's been a revelation!

Unlocking the Secrets of Crypto

CQL isn't just another cryptocurrency; it's a comprehensive digital membership area designed to educate and empower aspiring crypto enthusiasts. The platform offers a wealth of resources, including in-depth video tutorials, informative articles, and interactive courses. These resources cover a wide range of topics, from the fundamentals of blockchain technology to advanced trading strategies.

Structured Learning for All Levels

What truly impressed me about CQL is the structured learning path. The content is organized in a logical sequence, starting with the basics and gradually progressing to more complex concepts. This approach is perfect for beginners like myself, allowing us to build a strong foundation before diving deeper. However, seasoned crypto users will also find valuable information and insights within the membership area.

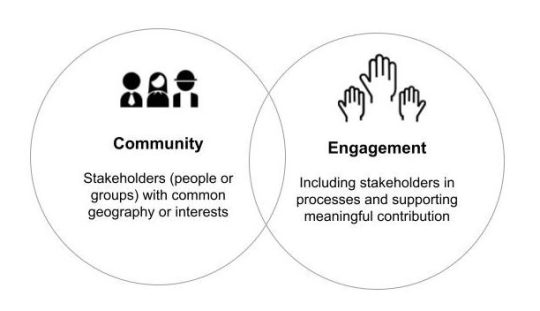

A Community of Support and Shared Knowledge

One of the most valuable aspects of CQL is the thriving online community. The platform fosters a supportive environment where members can connect, ask questions, and share their experiences. Whether you're a complete novice or a seasoned investor, there's always someone willing to lend a helping hand. This sense of community makes the learning process more engaging and enjoyable.

Earning Potential Through Affiliate Program

Beyond the educational benefits, CQL offers a unique earning opportunity through its generous affiliate program. As a member, you can promote CQL to others and earn a significant commission (they claim 50%) for every successful referral. This program allows you to not only learn about crypto but also potentially generate income by sharing your knowledge with others. While results may vary, the earning potential adds another layer of appeal to the CQL membership.

An Investment in Your Crypto Future

Overall, I highly recommend Crypto Quantum Leap to anyone interested in the exciting world of cryptocurrency. Whether you're a complete beginner looking to build a solid foundation or a more experienced investor seeking to expand your knowledge, CQL has something to offer. With its comprehensive educational resources, supportive online community, and potential for earning through the affiliate program, CQL is an investment in your crypto future.

Important Disclaimer: This review is based on my personal experience and should not be considered financial advice. The cryptocurrency market is inherently volatile, and individual results may vary. Always conduct your own research before making any investment decisions.

#CryptoQuantumLeapReview#CryptocurrencyEducation#BlockchainLearning#CryptoTradingStrategies#SupportiveCryptoCommunity#CryptoAffiliateProgram#EarnWithCrypto#CryptoForBeginners#InvestInCryptoFuture#CryptoDisclaimer

0 notes

Text

Crypto Quantum Leap: A Beginner-Friendly Guide to Cryptocurrency Success

I recently enrolled in the "Crypto Quantum Leap - 50% Commissions | Digital - membership area" program, and I'm here to share my positive experience. As someone with limited knowledge about cryptocurrency, I was initially hesitant to dive into the world of digital assets. However, Crypto Quantum Leap offered a clear and structured approach that helped me gain valuable insights and confidence in navigating this exciting market.

Structured Learning for All Levels:

The program is designed with a well-organized curriculum, catering to individuals of all experience levels. Whether you're a complete beginner or someone looking to refine your existing strategies, Crypto Quantum Leap provides a comprehensive roadmap to understanding blockchain technology, cryptocurrency markets, and profitable trading techniques. The course material is presented in a clear and concise manner, utilizing engaging video modules, interactive quizzes, and multimedia content to make learning both informative and enjoyable.

Expert Guidance and Support:

One of the significant advantages of Crypto Quantum Leap is the access to expert guidance and support. The program is led by Marco Wutzer, a seasoned cryptocurrency expert with a proven track record of success. His insights and strategies are invaluable, and his passion for the subject shines through in the course content. Additionally, the program offers a supportive community forum where members can connect, share experiences, and learn from each other. This collaborative environment fosters a sense of belonging and provides ongoing support throughout your crypto journey.

Earning Potential Through Affiliate Commissions:

A unique aspect of Crypto Quantum Leap is the 50% commission structure associated with the membership area. By promoting the program to others, you have the potential to earn a significant income stream. This feature adds an additional layer of value, allowing you to potentially offset the cost of the program while simultaneously building your own network within the cryptocurrency community.

Overall, I highly recommend Crypto Quantum Leap to anyone interested in learning about cryptocurrency and exploring the potential for financial gain in this dynamic market. The program offers a comprehensive learning experience, expert guidance, and a supportive community, making it an excellent resource for both beginners and seasoned investors.

0 notes

Text

The Ultimate Guide to Cryptocurrency Mining: What It is? How It Works? and Opportunities

Introduction to Cryptocurrency Mining

I found cryptocurrency mining to be a fascinating aspect of the crypto world. It involves using computer power to solve complex mathematical puzzles to validate and secure transactions on a blockchain network. Here's an overview to help you understand cryptocurrency mining better: - What is Cryptocurrency Mining? - In simple terms, cryptocurrency mining is the process of verifying transactions on a blockchain network using computational power. Miners compete to solve mathematical puzzles, and the first one to solve it adds a new block to the blockchain and is rewarded with newly minted coins. - How Does Cryptocurrency Mining Work? - Mining involves computers solving complex algorithms that validate transactions. Miners bundle transactions into blocks, and these blocks are added to the blockchain. The process requires significant computational power, and miners often join mining pools to increase their chances of earning rewards. - Opportunities in Cryptocurrency Mining - Cryptocurrency mining can be a lucrative opportunity for individuals with the right setup and knowledge. Those who successfully mine cryptocurrencies can earn rewards in the form of newly minted coins. However, it's essential to consider factors like equipment costs, electricity consumption, and mining difficulty when exploring mining opportunities. Understanding the basics of cryptocurrency mining is crucial for anyone looking to get involved in the world of cryptocurrencies. Mining can be rewarding both financially and intellectually, but it requires dedication, resources, and the willingness to keep up with the ever-evolving landscape of blockchain technology.

The Basics of Cryptocurrency Mining

I find cryptocurrency mining to be a fascinating process that involves validating transactions on a blockchain network using powerful computers. Here are some key points to understand about cryptocurrency mining: - Definition: In simple terms, cryptocurrency mining is the process of validating transactions on a blockchain network by solving complex mathematical puzzles. Miners compete to solve these puzzles, and the first one to do so verifies the transactions and adds a new block to the blockchain. - Proof of Work: Most cryptocurrencies, such as Bitcoin, use a consensus mechanism called Proof of Work (PoW) for mining. PoW requires miners to solve computationally intensive puzzles to secure the network and validate transactions. - Hardware and Software: Mining requires specialized hardware, such as ASICs (Application-Specific Integrated Circuits) for efficient mining. Miners also need mining software to connect to the network, manage their mining operations, and track their rewards. - Mining Pools: To increase their chances of earning rewards, many miners join mining pools where they combine their computational power. This way, they can collectively solve puzzles and share the rewards based on each miner's contribution. - Rewards: Miners are rewarded with newly minted cryptocurrencies for successfully adding a new block to the blockchain. They also receive transaction fees as an additional incentive for validating transactions. - Energy Consumption: Mining can be energy-intensive because of the computational power required to solve puzzles. This has led to discussions around the environmental impact of mining, especially for cryptocurrencies like Bitcoin. Mining cryptocurrency can be a rewarding but complex endeavor that requires the right hardware, software, and understanding of the process.

How Cryptocurrency Mining Works

I leverage the power of my computer to participate in a decentralized network that verifies transactions and secures the blockchain. Here's how cryptocurrency mining works: - Verification Process: When a cryptocurrency transaction occurs, it needs to be verified to ensure its accuracy. Miners like me gather pending transactions and create a block. - Solving Complex Mathematical Problems: To add a block to the blockchain, I need to solve a complex mathematical problem. This process requires substantial computational power. - Proof of Work (PoW): Cryptocurrencies like Bitcoin use a PoW consensus mechanism. I compete with other miners to solve the mathematical problem first and add the block to the blockchain. - Reward System: As an incentive for my efforts, I have the chance to earn cryptocurrency rewards for successfully mining a block. This process is essential for creating new coins and maintaining the network. - Mining Pools: To increase my chances of earning rewards, I can join a mining pool where multiple miners work together to solve blocks. Rewards are shared among participants based on their contributions. - Hardware and Energy Requirements: Cryptocurrency mining requires specialized hardware, such as ASICs for Bitcoin mining, and consumes a significant amount of electricity. I need to consider these factors when engaging in mining activities. - Network Security: By participating in mining, I contribute to the security and decentralization of the cryptocurrency network. Miners play a vital role in preventing fraud and maintaining the integrity of transactions. Understanding how cryptocurrency mining works gives me insight into the intricate process of validating transactions and securing the network through computational power.

Popular Cryptocurrencies for Mining

I have compiled a list of some popular cryptocurrencies that are commonly mined in the industry. Here are a few examples: - Bitcoin (BTC): - Bitcoin is the oldest and most well-known cryptocurrency that can be mined. It uses the proof-of-work consensus mechanism. - Ethereum (ETH): - Ethereum is another popular cryptocurrency that can be mined. It is planning to transition to a proof-of-stake mechanism, but currently, it relies on proof-of-work. - Litecoin (LTC): - Litecoin is often considered the silver to Bitcoin's gold. It utilizes a different hashing algorithm than Bitcoin, called Scrypt. - Monero (XMR): - Monero is known for its focus on privacy and anonymity. It uses a proof-of-work algorithm called CryptoNight. - Ethereum Classic (ETC): - Ethereum Classic is the original Ethereum blockchain before the hard fork. It is also mined using a proof-of-work algorithm. - Zcash (ZEC): - Zcash offers users the option of shielded transactions for enhanced privacy. It is mineable using the Equihash algorithm. - Dogecoin (DOGE): - Dogecoin started as a joke but has gained significant popularity. It is merge-mined with Litecoin. - Ravencoin (RVN): - Ravencoin is a relatively new cryptocurrency that focuses on asset transfers. It uses the X16R algorithm for mining. These are just a few examples of the many cryptocurrencies that can be mined. Each of these coins has its unique features and mining requirements. Researching and understanding the specifics of each coin can help me decide which cryptocurrency is the best fit for my mining setup.

Best Cryptocurrency Mining Platforms 2024

Here are a few of the best cryptocurrency mining websites to take into consideration, based on the data from the sources that have been provided: 1. HappyMiner: A certified cloud mining business that provides daily rewards, free mining, and an affiliate program with a variety of cryptocurrency contracts. Features: Provides DDoS and SSL protection, free mining, daily payments, an affiliate program, various crypto contracts, and round-the-clock online assistance. Plans: Offers a range of contract choices with varying costs, durations, fixed returns, and daily rates. 2. Binance: Well-known for providing daily rewards and an intuitive UI for their cloud mining services. 3. CG Miner: This well-liked mining program is renowned for its effectiveness and use. 4. Nice Hash: Provides cloud mining services with easy-to-use interface and daily rewards. 5. Mobile Miner: Offers a smartphone app for easy access to cloud mining resources. 6. Awesome Miner: renowned for being user-friendly and offering a full mining management tool for huge mining farms. 7. Storm Gain: Provides cloud mining services with various hash rate and speed choices for mining Bitcoin. 8. Ecos: Offers a mobile app for convenient access to a full-service portal for Bitcoin mining contracts, wallets, exchanges, and investing tools. Features: Provides a mobile app for convenient access in addition to a full-service portal with a Bitcoin wallet, exchange, mining contracts, and portfolios. Plans: Offers Bitcoin mining contracts at various hash rates and price ranges to accommodate both novices and specialists. 9. MinerGate: Founded in 2014, this open mining pool provides members with a specialized application, real-time exchange rates, and quick fund withdrawals. Mining: Enables users to mine various currencies with an emphasis on cutting expenses and boosting efficiency by utilizing CPU and GPU. 10. Zionodes: Prominent for its dynamic dashboard, strategic alliances within the mining sector, and easy-to-use BTC mining platform. These platforms accommodate various demands and preferences in the mining arena by providing a variety of features and services to those interested in mining cryptocurrencies. Key Takeaways By using cloud mining, users can mine cryptocurrencies without having to buy or maintain mining hardware. A business that owns and operates the actual mining equipment and procedure charges cloud miners a fee to rent mining capability. The block reward is split between the cloud miners and the cloud mining firm if the rented mining hardware completes a block using proof-of-work, such as on the Bitcoin blockchain. There are lots of frauds and phony projects in the cryptocurrency space. As a result, it's crucial to do extensive research on cloud mining companies.

Hardware and Software for Cryptocurrency Mining

When it comes to cryptocurrency mining, having the right hardware and software is crucial for success. Here are the key components you will need to get started: - Hardware: - Mining Rig: This is the central piece of equipment that performs the actual mining process. It is typically a custom-built computer with powerful processors and graphics cards optimized for mining. - ASIC Miners: Application-Specific Integrated Circuit (ASIC) miners are specialized devices designed specifically for mining cryptocurrencies like Bitcoin. They offer higher hash rates and energy efficiency compared to standard GPU miners. - Power Supply Unit (PSU): To power your mining rig or ASIC miners, you will need a quality PSU that can handle the high energy demands of mining. - Cooling System: Mining generates a significant amount of heat, so it's essential to have adequate cooling systems in place to prevent overheating and ensure optimal performance. - Software: - Mining Software: There are various mining software options available, such as CGMiner, BFGMiner, and NiceHash. These programs are used to connect your hardware to the blockchain network and manage the mining process. - Wallet: A cryptocurrency wallet is essential for storing the coins you mine. Choose a secure wallet that supports the specific cryptocurrencies you are mining. - Mining Pool: Joining a mining pool can increase your chances of earning rewards by combining your mining power with other miners. Popular mining pools include Slush Pool and F2Pool. - Monitoring Tools: Use monitoring tools like MinerGate or Awesome Miner to track your mining performance, check hardware health, and adjust settings for optimal efficiency. Having the right hardware and software is the foundation of a successful cryptocurrency mining operation. By investing in quality equipment and staying informed about the latest developments in mining technology, I can increase my chances of profitability in this competitive industry.

Choosing the Right Mining Pool

When it comes to cryptocurrency mining, choosing the right mining pool is crucial for maximizing your earnings. Here are some key factors I consider when selecting a mining pool: - Hash Rate and Size: I look for a mining pool with a high hash rate and a large pool size. A larger pool generally means more consistent payouts, although smaller pools can offer more significant rewards when they find a block. - Fees: I always check the fees charged by the mining pool. Some pools have fixed fees, while others have a percentage-based fee on your earnings. I consider both the fee amount and structure before making a decision. - Payment Methods: Different mining pools offer various payment methods, such as Pay Per Share (PPS), Proportional, or Pay Per Last N Shares (PPLNS). I choose the payment method that aligns best with my mining goals and preferences. - Location of Servers: The location of the mining pool servers can impact your mining efficiency. I prefer to choose a pool with servers close to my geographical location to minimize latency and improve my mining results. - Reputation and Security: Before joining a mining pool, I always research its reputation and security measures. I prefer to join pools with a good track record of uptime, security, and fair practices. - Community and Support: Being part of a supportive mining pool community can enhance the overall mining experience. I look for pools with active and helpful communities, as well as reliable customer support. By carefully considering these factors, I can select a mining pool that aligns with my mining preferences and goals. Remember, it's essential to regularly evaluate your choice of mining pool to ensure you're maximizing your cryptocurrency mining potential.

Cryptocurrency Mining Strategies

When it comes to cryptocurrency mining, there are various strategies that miners can employ to optimize their mining operations. Here are some effective strategies that I have found useful in my mining endeavors: - Pool Mining: One of the most common strategies, pool mining involves miners combining their computational resources to increase their chances of solving a block and receiving the reward. By joining a mining pool, I can receive more consistent payouts, although they are shared among pool members based on their contributions. - Solo Mining: In contrast to pool mining, solo mining involves mining independently without joining a pool. While it offers the potential for higher rewards if I successfully solve a block, it also comes with increased variance, meaning that rewards may be more sporadic. - Choosing the Right Hardware: Selecting the appropriate mining hardware can significantly impact mining profitability. ASIC (Application-Specific Integrated Circuit) miners are popular for mining cryptocurrencies like Bitcoin due to their high processing power and efficiency. However, for those looking to mine altcoins, GPUs (Graphics Processing Units) can be a more versatile option. - Energy Efficiency: Mining can be energy-intensive, so optimizing energy consumption is vital for maximizing profitability. I make sure to use energy-efficient hardware, such as ASIC miners with high hash rates and low power consumption, and consider factors like electricity costs and cooling solutions. - Staying Informed: The cryptocurrency mining landscape is constantly evolving, with changes in algorithms, mining difficulty, and market trends. I stay informed by regularly reading industry news, engaging with mining communities, and monitoring my mining operations to adapt to any developments effectively. By implementing these strategies and staying proactive in my approach to cryptocurrency mining, I can enhance my chances of success and profitability in this competitive and dynamic industry.

The Economics of Cryptocurrency Mining

I find it intriguing to delve into the economics of cryptocurrency mining. Here are some key points to consider: - Costs and Rewards: When mining cryptocurrencies, I need to be aware of the costs involved, such as electricity, hardware, and maintenance. These costs can vary depending on the type of cryptocurrency being mined. However, the rewards can also be significant, with successful miners receiving newly minted coins as well as transaction fees. - Mining Pools: To increase my chances of earning rewards, I may choose to join a mining pool. By pooling resources with other miners, we can collectively solve blocks and share the rewards based on each miner's contribution. However, it is essential to consider pool fees and payout structures when selecting a mining pool. - Mining Difficulty: The mining difficulty of a cryptocurrency determines how hard it is to mine new blocks. As more miners join the network, the difficulty level increases, requiring more computational power to solve complex algorithms. Understanding the mining difficulty is crucial for estimating potential profits and adapting mining strategies accordingly. - Market Volatility: Cryptocurrency prices are highly volatile, which can impact the profitability of mining operations. I must keep a close eye on market trends and adjust my mining activities accordingly. Market fluctuations can influence the value of mined coins, affecting overall profitability. - Regulatory Environment: Regulations around cryptocurrency mining can vary by country and region. I need to stay informed about legal requirements, tax implications, and government policies related to mining activities. Compliance with regulations is essential to avoid any legal issues and ensure the sustainability of my mining operation. Considering these economic factors is essential for making informed decisions about cryptocurrency mining. By understanding the costs, rewards, market dynamics, and regulatory landscape, I can navigate the complexities of the mining process and optimize mining profitability.

Cryptocurrency Mining Regulations and Legal Issues

I have come across various regulations and legal issues related to cryptocurrency mining that are important to understand and follow. Here are some key points to consider: - Regulatory Landscape: In many countries, the legal status of cryptocurrency mining is still evolving. It is crucial to stay informed about the regulatory landscape in your jurisdiction to ensure compliance with relevant laws and regulations. - Electricity Consumption: Cryptocurrency mining requires significant amounts of electricity, which can raise concerns about energy consumption and environmental impact. Read the full article

#blockchain#CryptocurrencyEducation#CryptocurrencyMining#CryptoMining#CryptoOpportunities#MiningExplained#MiningGuide

0 notes

Text

Women in Crypto: Breaking Barriers and Shaping the Future of Finance :

Unlock the potential of Women in Crypto: Breaking Barriers and Shaping the Future of Finance with this comprehensive guide. Learn how women are revolutionizing the finance industry through cryptocurrency, breaking stereotypes, and leading the way to a more inclusive future.

Understanding Women's Role in Finance

In traditional finance, women have often faced barriers to entry, from limited access to resources to gender biases in investment opportunities. However, the emergence of cryptocurrency has provided a level playing field, allowing women to participate actively in financial markets and investment opportunities previously inaccessible to them.

Women Pioneers in Crypto

Despite the male-dominated nature of the crypto industry, women pioneers are making significant strides. From entrepreneurs to developers and investors, women are carving out their niche and driving innovation in blockchain technology and digital assets.

Overcoming Challenges

While progress is evident, women in crypto still face challenges such as gender biases, lack of representation, and unequal opportunities. Overcoming these hurdles requires a concerted effort from the industry to promote diversity and inclusivity.

Bridging the Gender Gap

Closing the gender gap in crypto requires collaborative efforts from organizations, policymakers, and communities. By fostering an inclusive environment and addressing systemic barriers, we can ensure equal participation and representation for women in finance and technology.

Impact on Global Finance

The participation of women in crypto not only benefits individuals but also has broader implications for global finance. By diversifying perspectives and investment strategies, women contribute to more resilient and sustainable financial systems.

Women in Crypto: Breaking Barriers

Women in crypto are not just breaking barriers; they are shattering stereotypes and redefining the future of finance. Through their resilience, innovation, and leadership, women are challenging traditional norms and paving the way for a more inclusive and equitable financial ecosystem.

Future Trends and Opportunities

As the crypto industry continues to evolve, women are poised to play a pivotal role in shaping its future. Opportunities abound for women to lead innovation, drive adoption, and create positive social impact through blockchain technology and digital currencies.

#WomenInCrypto#CryptoRevolution#FinanceEquality#BlockchainInnovation#GenderDiversity#DigitalAssets#EmpoweringWomen#FinancialInclusion#BreakingBarriers#FutureOfFinance#CryptoInvesting#InclusiveTech#WomenLeadership#CryptocurrencyEducation#InnovationInFinance

1 note

·

View note

Text

The Great Crypto Debate: Bulls vs. Bears - Who Will Prevail? | Crypto Elite

Welcome back, crypto enthusiasts! Join us on the ultimate battleground for the most heated debate in the crypto realm - Bulls vs. Bears Our channel is your go-to destination for everything blockchain and cryptocurrency, and today, we're unleashing the Great Crypto Debate that has the entire community buzzing.

youtube

0 notes

Text

bit.ly/sayembararoyalq

t.me/RoyalQSayembara

#bitcoin#cryptocurrencyeducation#investing#royalq#royalqsayembara#signal#superstarz#finance#binance#branding

0 notes

Text

Crypto Millionaire Blueprint: Use These Techniques to Accelerate Your Wealth

Entering the world of cryptocurrencies in a time when money is abundant can be exhilarating and daunting at the same time. You're not alone if you've ever been drawn to the prospect of growing into a digital asset millionaire but have been hesitant because of the difficulties or dangers involved. The world of cryptocurrencies is sometimes seen as a difficult puzzle, but don't worry—this guide will help you figure out the blueprint to cryptocurrency wealth. Come along on an adventure where we'll demystify the nuances, talk about issues, and find the tactics that could help you succeed financially in the fascinating field of digital assets more quickly. Prepare to take a step that might change the course of your financial life!

I. Understanding the Crypto World

The digital frontiers of finance, cryptocurrency, has upended preconceived ideas about money and investing. With the goal of deciphering the crypto universe and arming you with the understanding you need to navigate it with confidence, we set out on this exploration.

a. A Synopsis of Cryptocurrency

The idea of electronic currencies was revolutionary not too long ago. it's an international trend now that's changing financial environments. Cryptography is used to secure decentralized digital assets known as cryptocurrencies. Blockchain technology, which provides a distributed ledger that guarantees transparency and immutability, powers their operations. The way cryptocurrencies have developed has been anything short of revolutionary, posing a threat to established financial institutions.

b. Typical Illusions

Myths and misconceptions abound, as with any novel idea. It is imperative that potential investors are made aware of these misconceptions. It's time to clear the mist around cryptocurrencies. We'll dispel popular misconceptions, such as the idea that it can be used as a tool for illicit activity and worries about its sustainability. Developing an acute awareness is the initial step to using crypto to its full potential.

II. Getting Around the Crypto Scene

The cryptocurrency market is dynamic, with rising prices and quickly changing trends. It takes an in-depth knowledge of the market's dynamics and the resources to stay informed to navigate this constantly shifting landscape.

a. Comprehending Market Dynamics

The crypto markets are now like a vibrant, energetic metropolis with endless possibilities. For the purpose of making wise decisions, one must comprehend the dynamics. We'll examine the variables that affect cryptocurrency prices, including supply and demand in the market as well as outside influences like changes in regulations. In the crypto city, this overview will act as your compass.

b. Keeping Up to Date

It's not only advantageous, but also essential to stay informed in the rapidly evolving world of cryptocurrency. We'll provide you with hints and techniques to help you get around this information-rich environment. We will direct you to reputable news outlets and social media sites that cryptocurrency enthusiasts frequently use to obtain up-to-date information. In the world of cryptocurrency, knowledge is power and the secret to success.

Join us as we explore the complexities of the cryptocurrency world and provide you the knowledge and resources you need to open its doors to prosperity. Watch this space for more information on selecting the best cryptocurrencies for your investment portfolio and creating your own route to cryptocurrency wealth in the upcoming chapters. You're leading the way in the impending cryptocurrency revolution.

Simple 3-Step Strategy To Make HUGE Gains In The 2024 Crypto Bull Market (Up To 150x)

III. Creating a Route to Cryptocurrency Wealth

We set out to create your road map to cryptocurrency wealth in this section, starting with well-thought-out financial objectives and sensible risk control.

a. Determining Your Budget

Prior to beginning the journey, decide where you want to go. We assist you in defining precise, attainable short- and long-term financial goals. Aligning your cryptocurrency investments with these goals is essential, whether they are obtaining financial independence, funding education, or obtaining a down payment for a home. We'll offer guidance on how to incorporate cryptocurrencies as an effective means of generating wealth into a roadmap.

b. Managing Risks

Risks are a part of every endeavor, and the cryptocurrency world is no different. Effective risk management, however, can transform unknowns into well-considered opportunities. Investigate ways to reduce risks and safeguard your cryptocurrency holdings. We'll examine the fine line between risk and return to make sure your wealth method is not only long-term but also robust against market fluctuations.

IV. Selecting Appropriate Cryptocurrencies

There are a huge variety of tokens and coins available in the cryptocurrency market, each with special qualities and potential. A perceptive eye is necessary to navigate this diversity. We give you the standards for assessing and choosing cryptocurrency projects that show promise. You'll acquire the knowledge and skills necessary to make wise decisions, from comprehending the technology underlying a coin to estimating its market potential. We investigate diversification as a crucial tactic to create a stable portfolio that can withstand changes in the market.

a. Assessing Tokens and Coins

Cryptocurrencies are not made equally. Find out how to differentiate between assets that are risky and promising. We'll walk you through both technical and fundamental analysis so you can decide which tokens and coins best fit your investment objectives.

b. Trading vs. Long-Term Holding

The age-old question in the world of cryptocurrencies: should one hold or trade? We provide a thorough analysis of the advantages and disadvantages of both approaches. Depending on your inclinations and risk tolerance, we will assist you in finding the ideal balance between the unpredictable nature of trading and the patient look at of long-term holding.

Keep an eye out for the following sections as we go deeper into the useful tools that make up the trade. We're dedicated to providing you with the information and techniques required to confidently traverse the cryptocurrency landscape, from choosing the best wallets to utilizing cryptocurrency exchanges. The opportunities are endless as you continue on your path to cryptocurrency wealth.

V. Useful Resources for Success in Crypto

We explore the useful resources necessary for your cryptocurrency success in this section, with an emphasis on safe wallets and using cryptocurrency exchanges.

a. The Security Wallets That Are Best

In the world of cryptocurrency, security is of the utmost importance, and selecting the appropriate wallet is vital. We give a summary of the various wallet types, emphasizing their distinct security features, ranging from physical wallets to mobile devices and web-based solutions. This section gives you the knowledge and tools to choose a wallet that best suits your needs and protects your digital assets.

b. Getting Around Crypto Exchanges

To venture into the realm of cryptocurrency trading, one must possess a basic comprehension of exchanges. We provide helpful advice for selecting trustworthy exchanges that put user experience and security first. We also demystify the complexity of exchange platforms by walking you through an easy procedure to complete your first cryptocurrency trade.

VI. Cutting-Edge Techniques for Rapid Growth

It becomes increasingly important to comprehend advanced strategies as you advance in your crypto journey. We examine trading tactics for rapid expansion and acquaint you with the prospects offered by decentralized finance (DeFi) in this section.

a. Utilizing Trading Techniques

Each strategy—day trading, trading on swings, and long-term holding—has advantages and disadvantages. We give an overview of these tactics and discuss the benefits and drawbacks of each. This section gives you the information you need to navigate the ever-changing world of cryptocurrency trading, whether your goal is to make rapid gains or to take a more patient approach.

b. Investigating Opportunities in DeFi

A revolutionary change in the world of finances is represented by decentralized finance, or DeFi. We dissect the idea of the DeFi initiative and its enormous potential. Explore the realms of staking, yield farming, and liquidity pools to find ways to expand your cryptocurrency holdings outside of conventional trading. For those looking for different ways to make money in the cryptocurrency space, this investigation opens up new possibilities.

We'll delve deeper into the complexities of cryptography as we move on to the following sections. Your path to cryptocurrency success is developing with thorough insights and useful advice, from optimizing gains as well as minimizing losses to reaching your financial objectives. Watch for the next segments that provide tactical methods for managing your finances, and remember to enjoy the little victories along the way.

Simple 3-Step Strategy To Make HUGE Gains In The 2024 Crypto Bull Market (Up To 150x)

VII. Encouraging Gains and Reducing Losses

We concentrate on maximizing your cryptocurrency earnings while reducing potential losses in this crucial section. Managing a portfolio well and understanding tax ramifications are two essential skills that any enthusiast for cryptocurrencies should possess.

a. Capable Portfolio Administration

Your cryptocurrency portfolio is a living thing that needs to be managed with care. We go into methods for keeping your portfolio in line with your financial objectives by optimizing and rebalancing it. Techniques for maximizing gains and reducing losses are examined, providing helpful information for upholding a robust and successful cryptocurrency portfolio.

b. Handling the Tax Repercussions

The tax implications associated with cryptocurrency earnings are jurisdiction-specific. Comprehending these consequences is crucial for making financial plans. We help you stay in accordance with local regulations by guiding you through the complexities of taxes related to cryptocurrencies. Making sense of the tax code guarantees that the money you make from cryptocurrency will improve your financial situation overall.

VIII. Honoring Achievements and Expanding

The crypto journey requires celebrating victories, and this section highlights how important it is to recognize even modest victories. We talk about how acknowledging progress promotes confidence and a positive outlook, both of which are important for longevity in the cryptocurrency industry.

a. Praise for Minor Victories

In the world of cryptocurrency, even the smallest accomplishments are worthy of praise. We go into more detail about the value of recognizing and appreciating accomplishments, highlighting the ways in which this practice fosters resilience and motivation. Small victories foster a positive and healthy mindset since they serve as stepping stones to bigger achievements.

b. Approaches to Expanding

You'll need to increase your investments as your digital currency journey progresses. We look at ways to compound wealth and reinvest it, offering doable solutions for long-term expansion. This section covers ways to increase your cryptocurrency holdings as well, so you'll be prepared to handle the constantly changing world of digital assets.

We'll talk about community involvement and ongoing education in the parts that follow. We'll wrap up with a summary of the most important lessons learned and some words of wisdom for the fascinating digital assets travel that lies ahead. Watch this space for insights that promote community and knowledge sharing in the crypto world, going beyond personal achievement.

IX. Participating in the Community and Ongoing Education

In the ever-changing realm of cryptocurrencies, participation in the community and ongoing education are crucial. There are many advantages to joining crypto communities, including a platform for connecting and experience sharing. We examine the benefits of interacting with the cryptocurrency community, such as learning new things, getting help, and taking part in the group knowledge-sharing that shapes the industry.

a. Accessing Virtual Communities

Learn about the value that communities have in the cryptocurrency world. This section emphasizes the advantages of interacting with people who share your interests, as it can promote a sense of unity and mutual understanding. Participating in cryptocurrency communities broadens your network and offers a safety net that is essential for overcoming obstacles on the path to success.

b. Remaining Current with Sector Trends

Remaining up to date with industry developments is essential for achievement in the constantly changing cryptocurrency space. We make sure you stay up to date on the most recent advancements by offering resources for continuing education and market insights. We direct you to reliable news sources and thought-provoking forums so you can obtain important information to improve your comprehension of the cryptocurrency market.

X. Final Thoughts: Becoming a Crypto Millionaire

As this thorough guide draws to an end, we review the most important lessons from every chapter, reiterating the crucial actions and approaches covered in the text. Readers can quickly review key points and reinforce their comprehension of the crypto millionaire blueprint by using this summary as a reference.

a. Summary of the Main Ideas

This section serves as a thorough synopsis of the entire guide, summarizing the key techniques, tactics, and insights. We reexamine the crucial elements that lead to your success in the cryptocurrency space, from cracking the code to celebrating achievements and increasing investments.

b. Motivation for the Upcoming

We offer motivation for readers to pursue future cryptocurrency endeavors in our concluding remarks. The path to becoming a cryptocurrency millionaire is still long, but we'll leave you with some motivational ideas that highlight the opportunities for development, education, and achievement. Keep in mind that every step you take toward becoming a cryptocurrency millionaire brings you one step closer to reaching your financial objectives.

Intelligent Cryptocurrency VIP - Digital Membership Area

Take your crypto journey to the next level with the Intelligent Cryptocurrency VIP Membership. Gain exclusive access to a simple 3-step strategy designed to capitalize on the 2024 Crypto Bull Market, potentially yielding gains of up to 150x. This VIP membership is tailored to complement the insights shared in this guide, providing a hands-on approach to achieving substantial growth in the crypto space. For more details, check out the Intelligent Cryptocurrency VIP Membership and supercharge your path to crypto success!

#commercial#economy#entrepreneur#finance#investing#marketing#success#Cryptocurrency#CryptoGuide#FinancialSuccess#BitcoinTips#InvestmentStrategies#DeFi#CryptoCommunity#WealthBuilding#PortfolioManagement#TaxConsiderations#MarketTrends#CryptocurrencyEducation#DigitalAssets#CryptoJourney#FinancialGoals#CryptoTrading#BlockchainInsights#CryptoLearning#IntelligentCryptocurrency#CryptocurrencyVIP

0 notes

Text

Crypto Quantum Leap - 50% Commissions

A cryptocurrency video course for beginners from an ex-Agora guru now publishing independently.

High quality content, great conversions and happy customers.

#Cryptocurrency#CryptoAffiliate#CryptocurrencyEducation#EarnCrypto#AffiliateMarketing#Blockchain#CryptocurrencyInvesting#CryptoTraining#PassiveIncome#CryptoSuccess#CryptoKnowledge#CryptoCommunity#CryptocurrencyLearning#CryptoResources#CryptoJourney#CryptoEarnings#CryptoSupport#FinancialFreedom#InvestmentOpportunity#Bitcoin

1 note

·

View note

Text

Crypto Quantum Leap Review

Crypto Quantum Leap Review

Crypto Quantum Leap Review

In the world of cryptocurrency, where innovation is the driving force behind success, Crypto Quantum Leap has managed to create quite a stir. With the promise of 50% commissions, it’s no wonder that this platform has caught the attention of both seasoned investors and newcomers to the crypto space. In this comprehensive review, we will delve into the intricacies of Crypto Quantum Leap, exploring its features, benefits, and potential drawbacks, to help you make an informed decision.

What Is Crypto Quantum Leap?

Crypto Quantum Leap Review

Crypto Quantum Leap, often abbreviated as CQL, is a revolutionary platform that has taken the crypto world by storm. It positions itself as a decentralized autonomous organization (DAO) designed to empower users by offering a unique opportunity to earn 50% commissions on their investments. But what sets CQL apart from the myriad of other crypto platforms out there?

Unveiling the Technology

Crypto Quantum Leap Review

At the heart of Crypto Quantum Leap lies its cutting-edge technology. The platform utilizes blockchain technology to ensure transparency, security, and trustworthiness. The use of blockchain eliminates the need for intermediaries, reducing the risk of fraud and manipulation. This transparency is crucial in the crypto world, where trust can be hard to come by.

The Promise of 50% Commissions

Crypto Quantum Leap Review

One of the most alluring aspects of Crypto Quantum Leap is the promise of 50% commissions. While this may sound too good to be true, it’s essential to understand how this system works. CQL rewards its users for their participation in the ecosystem. When you invest in CQL tokens, you become part of the network, and your rewards are tied to the success of the platform. The more you invest and actively participate, the higher your potential earnings.

Risk Management and Sustainability

Crypto Quantum Leap Review

Before diving headfirst into any investment opportunity, it’s crucial to consider the associated risks. While Crypto Quantum Leap offers substantial rewards, it’s not without its potential pitfalls. The crypto market is inherently volatile, and CQL is no exception. It’s essential to assess your risk tolerance and only invest what you can afford to lose.

The Community Aspect

Crypto Quantum Leap Review

Crypto Quantum Leap is more than just a profit-generating platform; it’s a community. Users from around the world come together to participate in the DAO, making decisions collectively to steer the platform’s direction. This sense of community fosters collaboration and innovation, which can be a significant advantage in the ever-evolving crypto landscape.

Security Measures

Crypto Quantum Leap Review

Security is a top priority for Crypto Quantum Leap. The platform employs robust encryption techniques and follows best practices to safeguard users’ assets. Additionally, the use of smart contracts ensures that transactions are executed seamlessly and without the need for intermediaries, further enhancing security and trust.

How to Get Started with Crypto Quantum Leap

Crypto Quantum Leap Review

Getting started with Crypto Quantum Leap is a straightforward process:

Registration: Sign up for an account on the CQL platform, providing the necessary information for KYC (Know Your Customer) verification.

Investment: Deposit funds into your CQL wallet and convert them into CQL tokens.

Participation: Engage with the CQL community, participate in governance decisions, and stake your tokens to earn rewards.

Earnings: As the platform grows and succeeds, you’ll start earning your promised 50% commissions.

The Roadmap Ahead

Crypto Quantum Leap Review

Crypto Quantum Leap has ambitious plans for the future. The platform aims to expand its offerings, including support for various cryptocurrencies and innovative financial products. Additionally, it seeks to enhance its user experience by introducing user-friendly interfaces and mobile apps.

Final Thoughts

Crypto Quantum Leap Review

Ready to Take the Quantum Leap into Crypto Profits?

Click here to get started with Crypto Quantum Leap now and unlock a world of crypto opportunities!

Click Here To Visit Official Website

Ready to Take the Quantum Leap into Crypto Profits?

Click here to get started with Crypto Quantum Leap now and unlock a world of crypto opportunities!

Click Here To Visit Official Website

#CryptoQuantumLeap#CryptocurrencyReview#BlockchainTechnology#InvestmentOpportunity#CryptoCommunity#CryptoInvesting#EarnCommissions#CryptocurrencyNews#DigitalAssets#CryptoInnovation#DecentralizedFinance#CryptoSecurity#CryptoEarnings#CryptoBeginners#FutureOfFinance#CryptoRoadmap#CryptoInvestmentTips#CryptocurrencyEducation#CryptoInsights#BoostTraffic#crypto#digitalcurrency#blockchain#bitcion#cryptocurrency

1 note

·

View note

Text

https://bit.ly/3OQ8w3e

Mastering Threads: Your Path to Dominating the Fastest Growing Social Media Platform with SociSmart Certification

#blockchain#crypto#cryptocurrency#bitcoin#CryptoMastery#IntelligentCryptoVIP#CryptoWisdom#InvestmentEdge#BlockchainInsights#CryptoCommunity#StayUpdated#CryptocurrencyEducation#LearnAndEarn#MarketTrends#ExpertGuidance#CryptoSuccess#EmpowerYourJourney#InvestSmartly#CryptoInnovations#RealTimeInfo#CryptocurrencyResources#TradingStrategies#DigitalAssets101#JoinTheVIP#AIAdvantage#WinningWords#GPT3Sales#ClosingDeals#ChatGPTMagic#SellingWithAI

0 notes

Text

Crypto-currency trading strategies: Tips for maximizing profits

Trading in cryptocurrencies has grown in popularity as a means of profiting from the quickly developing market for digital assets. The decentralized finance (DeFi) movement and the adoption of blockchain technology throughout the world present many business prospects in the cryptocurrency industry. However, traders must use efficient techniques that minimize risk and increase returns to thrive in this dynamic and turbulent market. In this post, we'll take a closer look at several fundamental crypto-currency trading techniques that can help traders get around the market's intricacies and increase their chances of success.

1. Perform research.

It's crucial to conduct a careful study before making any investing decisions in the cryptocurrency industry. While following hype or speculative patterns may be alluring, it is more dependable to base your trades on fundamental analysis. Examine the underlying technology, leadership, collaborations, and real-world applications of the cryptocurrencies you're contemplating trading. Projects with strong foundations, active development teams, and a welcoming community should be sought out.

Keep up with news and events in the cryptocurrency world since big announcements or changes in regulations can cause huge price changes. To obtain a sense of prospective opportunities and threats, you should also follow industry experts, influencers, and reliable sources.

2. Create a trading strategy

To successfully navigate the unstable cryptocurrency market, you must have a clearly defined trading strategy. Your trading strategy should outline specific goals, degrees of risk tolerance, and trade entry and exit tactics. Choose your favorite trading approaches, such as long-term investing, swing trading, or day trading.

Create guidelines for position sizing, which defines how much money you put into each transaction. A general guideline is to never risk more than 1% to 2% of your entire cash on a single trade. When market conditions are unfavorable, following tight money management techniques can help safeguard your capital from significant losses.

3. Technical analysis

Technical analysis is the process of analyzing previous price charts and forecasting future price patterns using a variety of indicators and models. It aids traders in spotting patterns, levels of support and resistance, and possible entry and exit locations for their trades.

Moving averages (MA), which smooth price data to identify trends, the relative strength index (RSI), which evaluates overbought or oversold conditions, and the moving average convergence and divergence (MACD), which evaluates changes in momentum are some examples of common technical indicators.

Although technical analysis can offer useful information, it is important to keep in mind that it is not perfect. Technical indications might be ignored in favor of market mood, current affairs, and fundamental changes, which can affect prices.

4. Make your portfolio more diverse.

Spreading your investments over a variety of assets is referred to as diversification in risk management. It lessens the effect of the performance of each asset on the total value of your portfolio. By diversifying, you lessen the danger of suffering significant losses if the price of a particular asset declines by avoiding putting all of your money in a single cryptocurrency.

A well-diversified cryptocurrency portfolio often consists of coins from many categories, including well-known ones like Bitcoin and Ethereum, promising altcoins with cutting-edge technology, and stablecoins for risk reduction.

5. Use stop-loss orders

In the trading of cryptocurrencies, stop-loss orders are crucial risk management instruments. A stop-loss order automatically sells a cryptocurrency at a predetermined price to reduce future losses. If the market goes against your position, placing a stop-loss order enables you to get out of a trade before suffering large losses.

Consider your risk tolerance and the asset's volatility when determining stop-loss levels. The stop-loss order shouldn't be put too close to the price it is at right now because it can be activated by sudden changes in the market.

6. Follow market trends

Markets for cryptocurrencies are impacted by emotions and trends. You may make smart trading selections by closely monitoring key market trends and investor mood. News sources, forums, and social media sites are useful tools for assessing market sentiment.

Finding and monitoring market trends can help you spot chances and stay away from deals that go against the grain of popular opinion. To ensure a trend's validity and durability, though, careful investigation and analysis should always be done before acting on it.

7. Avoid FOMO and FUD

Two typical emotions that can have a significant impact on trading decisions are fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD). For fear of missing out on prospective gains, FOMO might cause someone to buy an asset at its peak. In contrast, due to fear and uncertainty, FUD can cause panic selling during a market slump.

Stick to your trading strategy and refrain from pursuing quick gains if you want to avoid making irrational mistakes. Instead of being influenced by market emotions, base your transactions on thorough study, analysis, and logical thinking.

8. Be mindful of fees

Exchange fees, withdrawal fees, and transaction fees are just a few of the fees associated with trading cryptocurrencies. These fees, particularly for high-frequency traders or when there are few transactions involved, can significantly affect your overall profitability.

To find the best options, compare the costs charged by various exchanges and trading platforms. To prevent your revenues from being reduced, also consider any potential hidden fees.

9. Stay disciplined

Successful cryptocurrency traders must have both discipline and patience. Maintain your trading plan and methods even when the market is volatile. Refrain from acting rashly or departing from your well-established trading strategy.

Wait for the proper moments to arise while maintaining your patience. Since the price of cryptocurrencies is often volatile, exercising patience might help investors avoid taking hasty decisions that could result in losses.

10. Learn from your mistakes

The process of trading on the cryptocurrency market involves ongoing learning. Accept that you will make mistakes or lose along the path. Consider these encounters as worthwhile learning opportunities rather than becoming frustrated.

Examine your transactions and determine what went correctly and wrong. You can improve your trading decisions in the future by identifying patterns in your trading behavior and modifying your strategy accordingly.

CONCLUSION

Although trading cryptocurrencies includes some inherent risks, it may also be quite lucrative. Trading professionals can improve their chances of success in this changing market by taking a thorough and thoughtful strategy.

Always do your homework, create a sound trading strategy, use technical analysis judiciously, diversify your holdings, and employ effective risk management techniques. Keep an eye out for market trends and feelings; refrain from acting on impulse; and place an emphasis on self-control and endurance.

Additionally, consider trading as a learning opportunity. It takes constant learning and development to successfully navigate the ever-evolving cryptocurrency market. You'll be better prepared to increase your trading profits by paying attention to this advice.

If you're interested in learning more, you can check out my recommended “Course of Crypto and Bitcoin”

"Disclosure: This article includes affiliate links. If you click on these links and make a purchase, I may earn a commission at no additional cost to you. I only recommend products or services that I have personally used and believe will add value to my readers. Your support through these affiliate links is greatly appreciated and helps me continue to provide valuable content on mastercryptoforall.blogspot.com. Thank you!"

#CryptocurrencyTrading#CryptoEducation#Blockchain#DeFi#CryptoMarket#InvestingTips#CryptocurrencyTips#CryptocurrencyNews#CryptoCommunity#CryptocurrencyInsights#CryptoLearning#CryptocurrencyInvesting#CryptocurrencyEducation#CryptocurrencyExpert#CryptoBeginner#Bitcoin#Ethereum#CryptocurrencyPortfolio#CryptoDiscipline#CryptoLearningOpportunity

0 notes

Text

youtube

🚀 Unveiling Crypto Secrets: Why Tokenomics Matter! | Quick Guide Unlock the hidden world of tokenomics in just 50 seconds! Discover what drives the value of cryptocurrencies and how to make informed investment decisions. Whether you're a seasoned investor or a curious newcomer, this quick guide demystifies the complex concepts of tokenomics with clarity. Don’t forget to like, subscribe, and dive deeper into the fascinating realm of digital assets with us! 🔹 #CryptoBasics 🔹 #Tokenomics 🔹 #CryptoInvesting 🔹 #BlockchainTechnology 🔹 #CryptocurrencyEducation via YouTube https://www.youtube.com/watch?v=d8g5BMxwrDg

0 notes

Text

Crypto vs Gold: Which is the Better Investment? | Crypto Elite

youtube

========================================== 👉 Subscribe for more Videos: ========================================== Investing in crypto or gold? Which asset reigns supreme? In this video, we compare the pros and cons of cryptocurrency and gold, exploring their historical performance, risk factors, and potential for growth. Whether you're a seasoned investor or just starting out, this video will help you decide which asset is right for you. Watch now and join the conversation! #Crypto101 #BlockchainBasics #BitcoinExplained #CryptocurrencyEducation #DigitalCurrency #CryptoNewbies #WalletWisdom #LearnCrypto #CryptoBeginner #DecodingCryptocurrency #CryptoAdventure #BlockchainTech #BitcoinIntro #CryptoLearning #CryptoCurious #CryptoTips #Cryptocurrency101 #MiningExplained #NakamotoLegacy #CryptoCommunity without hashtags SEO TAGS: crypto,crypto news,investment,crypto vs forex,crypto vs forex trading,best crypto investment,best crypto investments,crypto investment 2023,which crypto to invest,crypto vs gold,crypto vs gold vs cash,crypto vs stocks,crypto banter,what is token crypto,cryptocurrency vs forex,crypto bull run,why crypto market is down,why crypto market is going down today,share vs crypto,forex vs cryptocurrency trading,governments crypto,crypto update

0 notes