#bitcion

Explore tagged Tumblr posts

Text

How To Get Rich With Bitcoin Even If You Have No Clue About Technology

1. Introduction to Bitcoin

Bitcoin is more than just a buzzword in today's financial world; it's a revolutionary concept that has reshaped the way we think about money. Conceived in 2008 by an enigmatic figure known as Satoshi Nakamoto, Bitcoin has evolved from a niche digital currency to a mainstream financial asset. Understanding Bitcoin's role in the modern economy is key to appreciating why it has become a popular avenue for those seeking wealth.

1.1 The Birth of a Digital Currency

The inception of Bitcoin occurred during a time of financial turmoil, right after the 2008 global economic crisis. It was designed to be a decentralized form of currency, free from government control and traditional banking systems. This autonomy has been a significant draw for individuals who are disenchanted with conventional financial institutions.

1.2 Why Bitcoin Matters in Today's Economy

Bitcoin's significance lies in its decentralized structure, which empowers individuals to have control over their wealth. As traditional currencies face inflation and government regulation, Bitcoin offers an alternative that can be traded, stored, and used globally without the need for intermediaries. This autonomy has attracted investors and innovators alike.

2. Understanding the Basics of Bitcoin

To grasp how to get rich with Bitcoin, it's crucial to understand its basic mechanics and why it's so unique in the financial world

You can also try this course : Crypto Quantum Leap

2.1 What Is Bitcoin and How Does It Work?

Bitcoin is a digital currency that relies on a technology called blockchain. This technology is a public ledger that records all transactions made with Bitcoin. Unlike traditional currencies, Bitcoin is not printed or minted; it is "mined" through complex mathematical processes. This mining process validates transactions and maintains the integrity of the blockchain.

2.2 The Decentralized Nature of Bitcoin

Decentralization is a cornerstone of Bitcoin. It means that no single entity, government, or organization controls it. This lack of central authority provides a level of freedom and security that traditional currencies cannot match. Transactions are peer-to-peer, and the entire system is maintained by a network of nodes and miners distributed across the globe.

3. Bitcoin as an Investment

Bitcoin's rise in value has drawn significant attention from investors seeking high returns. But what makes it so attractive, and how does it compare to other investments?

3.1 Bitcoin vs. Traditional Investments

Bitcoin's rapid appreciation in value has outstripped many traditional investments like stocks, bonds, and real estate. While these conventional investments are generally tied to broader economic trends, Bitcoin's value is influenced by supply and demand dynamics within the digital currency ecosystem. This unique characteristic allows Bitcoin to sometimes act as a hedge against inflation and other economic uncertainties.

3.2 The Potential for High Returns

Bitcoin's potential for high returns is not without risks, but the rewards can be substantial. Early adopters who bought Bitcoin when it was worth pennies have seen their investments grow exponentially. This potential for remarkable gains has led to increased interest from both individual investors and institutional entities.

4. Starting Your Bitcoin Journey

Investing in Bitcoin might seem daunting, especially if you have no technical background. However, getting started is easier than you might think.

4.1 Setting Up a Bitcoin Wallet

The first step in your Bitcoin journey is setting up a Bitcoin wallet. This digital wallet allows you to store, send, and receive Bitcoin. There are several types of wallets, including software wallets, hardware wallets, and online wallets. Each has its advantages and disadvantages, but hardware wallets are generally considered the most secure.

4.2 Choosing the Right Exchange

To buy Bitcoin, you'll need to choose a cryptocurrency exchange. These platforms allow you to trade traditional currency for Bitcoin. When selecting an exchange, consider factors such as fees, security features, and user-friendliness. Popular exchanges like Coinbase and Binance offer intuitive interfaces and robust security measures.

5. Diversifying with Bitcoin

Diversification is a fundamental principle in investing, and Bitcoin can play a key role in a diversified portfolio.

5.1 Why Diversification Is Key

Diversifying your investments reduces risk and enhances stability. By including Bitcoin in your portfolio, you can benefit from its growth potential while mitigating risks associated with traditional investments. Bitcoin's uncorrelated nature means it can act as a buffer against market fluctuations.

5.2 Using Bitcoin to Expand Your Investment Portfolio

Bitcoin can be used to diversify not only across asset classes but also within the cryptocurrency market itself. Investing in other cryptocurrencies or blockchain-related projects can further broaden your investment scope. This strategy allows you to capitalize on emerging trends within the digital asset space.

6. Bitcoin Trading and Speculation

Trading Bitcoin can be lucrative, but it requires a deep understanding of market dynamics and a tolerance for volatility.

You can also try this course : Crypto Quantum Leap

6.1 Understanding Market Volatility

Bitcoin is known for its price swings, which can be both thrilling and unsettling. This volatility is due to a combination of factors, including news events, regulatory changes, and market sentiment. To navigate these fluctuations, it's essential to stay informed and develop a strategy that aligns with your risk tolerance.

6.2 Strategies for Successful Trading

Successful Bitcoin trading involves more than just buying low and selling high. It requires a comprehensive understanding of technical analysis, chart patterns, and market indicators. Common trading strategies include day trading, swing trading, and long-term holding. Each approach has its merits, and the best strategy depends on your individual goals and risk appetite.

7. Earning Bitcoin Through Other Means

While trading and investing are popular methods of acquiring Bitcoin, there are other ways to earn this digital currency without extensive technical knowledge.

7.1 Bitcoin Mining: Pros and Cons

Bitcoin mining involves using computational power to solve complex mathematical problems, earning Bitcoin in the process. However, mining requires significant upfront investment in hardware and energy costs, making it less accessible to beginners. The competitive nature of mining also means that profitability can vary widely.

7.2 Earning Bitcoin Through Freelancing and Services

Another way to earn Bitcoin is by offering goods or services in exchange for cryptocurrency. Many platforms allow freelancers to be paid in Bitcoin, providing an alternative revenue stream for those with skills to offer. This method is an excellent option for individuals who prefer to earn Bitcoin through work rather than investment.

8. Staying Safe in the Bitcoin World

As with any valuable asset, safety and security are paramount when dealing with Bitcoin.

8.1 Protecting Your Bitcoin Wallet

Your Bitcoin wallet is like your digital bank account, and keeping it secure is crucial. Use strong passwords, enable two-factor authentication, and regularly back up your wallet. Hardware wallets provide an additional layer of security by keeping your private keys offline, reducing the risk of hacking or theft.

8.2 Avoiding Scams and Frauds

The popularity of Bitcoin has led to an increase in scams and fraudulent schemes. Common scams include phishing attacks, Ponzi schemes, and fraudulent exchanges. To avoid falling victim to these scams, always verify the legitimacy of any platform or individual before engaging in transactions. Be wary of promises of guaranteed returns or schemes that sound too good to be true.

9. Tax Implications and Legal Considerations

Owning and trading Bitcoin comes with certain tax and legal responsibilities. It's essential to understand these implications to avoid any legal trouble.

9.1 Understanding Bitcoin Taxation

In many jurisdictions, Bitcoin is considered property for tax purposes, meaning that buying, selling, or trading it can trigger taxable events. Keeping accurate records of all transactions is crucial for compliance. Consult with a tax professional to ensure you're meeting your obligations and to understand any applicable deductions or credits.

9.2 Legal Aspects of Owning and Trading Bitcoin

Laws regarding Bitcoin vary from country to country. Some nations have embraced it, while others have imposed strict regulations or outright bans. Before investing or trading Bitcoin, familiarize yourself with the legal landscape in your region. This knowledge will help you avoid legal complications and ensure you're operating within the bounds of the law.

10. Long-Term Prospects for Bitcoin

Despite its volatility and regulatory challenges, Bitcoin has established itself as a formidable force in the financial world. The question many ask is: What does the future hold for Bitcoin?

10.1 The Future of Bitcoin

Bitcoin's future depends on various factors, including regulatory developments, technological advancements, and broader market trends. As blockchain technology evolves, Bitcoin's role in the global economy may expand. Some experts predict that Bitcoin could become a standard digital currency, while others foresee continued fluctuations and regulatory hurdles.

10.2 How Bitcoin Is Changing the Financial Landscape

Bitcoin's impact goes beyond its monetary value. It has challenged traditional financial systems and sparked innovation in the way we conduct transactions. Concepts like decentralized finance (DeFi) and non-fungible tokens (NFTs) have emerged, offering new opportunities for wealth generation and reshaping the financial landscape. Bitcoin's journey is far from over, and its influence continues to grow.

11. Conclusion

Bitcoin offers a unique pathway to wealth, even for those with limited technical knowledge. From understanding the basics to exploring advanced trading strategies, the journey to financial success with Bitcoin is filled with possibilities.

You can also try this course : Crypto Quantum Leap

11.1 Key Takeaways

To get rich with Bitcoin, you need to:

Understand the fundamentals of Bitcoin and blockchain technology.

Explore various investment and trading strategies.

Ensure the security of your Bitcoin assets.

Stay informed about regulatory and tax implications.

Embrace the volatility while diversifying your portfolio.

11.2 Encouragement for Newcomers

For newcomers to the world of Bitcoin, the journey can seem daunting. However, with the right approach, anyone can tap into the potential of this digital currency. Start small, stay informed, and remain open to learning. The road to wealth with Bitcoin is open to those willing to embrace the possibilities it offers.

DISCLAIMER

There are an affiliate link of a best course in this article which may makes some profits for me

You can also try this course : Crypto Quantum Leap

#1950s#bitcion#binance#rwby#halving#ethlyn#crypto news#star wars#ryan gosling#coinbase#ethereum#bitcoin#blockchain#investment#altcoin#crypto#defi

3 notes

·

View notes

Text

Fact Check Bitcoin Mining Emissions

#traders#economy and trade#forextrading#investing#investing stocks#news economy market trade#gold price#gold trading#silver#bank collapse#bitcion#bitcoin prediction#bitcoinprice

8 notes

·

View notes

Text

The devil saw me with my head down and thought he'd won.

Until I said, "let's mog"

0 notes

Text

1 note

·

View note

Text

Experts' predictions for Bitcoin for the year 2024

#bitcion#crypto news#crypto#thecrypto#blockchain#defi#digitalcurrency#cryptocurrency#crypto analysis#bitcoin#cryptonews#cryptocurreny trading

0 notes

Text

Bitcion is wise investment that would will take you some honest effort to be able to sit comfortably with an idea that your money is under management and as well with making good profits and progressive steady

#bitcion investment#bill cipher#trade#crypto#mining#bitcion investment#gravity falls#halloween#stanley pines#stanford pines#the amazing digital circus

39 notes

·

View notes

Text

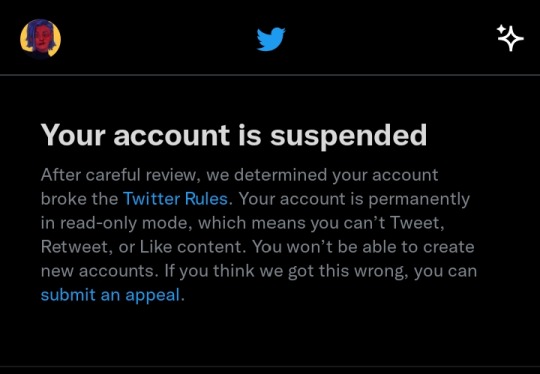

giving y'all a small update. i went in today and saw my twt account was suspended for no goddamn reason.

idk if it was me literally only rt-ing a bunch of portfolio day art or what but idk if they're ever gonna give me my account back.

if any of you follow me on twt and suddenly see I'm unavailable as a user, this is why. it wasn't me deleting my account or anything. it's because twitter has chosen to lock me out for rt-ing portfolio day art.

#this is making me so unreasonably mad.#like no put golden garlands on right wing assholes banning *me* is surely gonna make me twitter SO MUCH SAFER. 🙄#like. i get added to these fuckall ''bitcion gift' lists EVERYDAY even after i continue to block those fucks#and nothing abt all that! blocking me for rt-ing art on my tl.#fuck this.

34 notes

·

View notes

Text

Buy BITCOIN now from me otherwise by June BITCION is fucking gonna be something massive you couldn't imagine trust me

1 note

·

View note

Text

It seems to be a great start to Q4 2023 and the early signs of Uptober are already here! The Bitcoin (BTC) price has shot by more than 3.57% in the past few hours giving a crucial breakout above $28,000. As per the technical chart, this opens up the gates for the BTC price to surge all the way to $31,000. It means that investors can brace for another 10% price rally from the current levels. #Bitcoin | The last time we saw a breakout like the current one, $BTC rallied all the way up to $31,000! pic.twitter.com/9MbBv0ubQ4 — Ali (@ali_charts) October 2, 2023 As of press time, BTC is trading at $28,125 with a market cap of $548 billion. With this breakout, Bitcoin has also surged past its 200-day moving average which is a bullish sign. Should buyers effectively breach the converging 200-day and 100-day moving averages situated at $28,000 Bitcoin’s price could see an additional surge. The next formidable resistance that investors face is at $30,000. But some market analysts also think that it would not be wise to go chasing the green candle formation for now. #Bitcion – Supertrend signals flipping bullish on the daily. We could very well re-test this breakout so don't go chasing this green candle. pic.twitter.com/kaAlBfVnfP — IncomeSharks (@IncomeSharks) October 2, 2023 Bitcoin On-Chain Indicators Show Strength The 12-18 Months UTXO Realized Price for Bitcoin stands at $26,950, signifying that investors who acquired Bitcoin within this timeframe have essentially reached the breakeven point, aligning with the average acquisition price. However, the 6-12 Months UTXO Realized Price is lower than the current market price, indicating profitability for this specific group. A deeper dive into the Exchange Inflow UTXO Age Bands data provides valuable insights into investor sentiment. Despite enduring prolonged periods of unrealized losses, the 12-18-month UTXO group showcases resilience by holding onto their investments instead of rushing to sell. This demonstrates a notably high level of confidence in Bitcoin’s long-term potential. Conversely, the 6-12-month UTXO cohort, currently enjoying profits, is actively engaged in selling on exchanges. Courtesy: CryptoQuant The differing behaviors of these two investor groups underscore the varying levels of confidence in Bitcoin’s future trajectory. Individuals who have held Bitcoin for 12-18 months seem to possess a strong belief in its long-term potential, as they choose not to sell even after reaching the point of breaking even. The minimal inflow of Bitcoin from the 12-18-month UTXO cohort onto exchanges indicates reduced selling pressure, implying that their realized price may not serve as a substantial resistance level for Bitcoin’s price

0 notes

Text

Binance: Buy BTC & 600+ Crypto

Welcome to the World’s #1 cryptocurrency platform by trading volume!

Trusted by millions of users worldwide. Get started today and buy Bitcoin, Ethereum, ChainLink, Rune, Cardano, Binance Coin, SHIB, and more, all with some of the lowest fees in crypto. Additionally, explore awesome art and collectibles on Binance NFT marketplace!

Binance App is available only to non-U.S. citizens and residents. For U.S. citizens and residents, please install Binance.US App.

Here's what you can do on Binance App:

LOOKING TO BUY OR SELL BITCOIN AND OTHER CRYPTO? THAT'S WHAT WE SPECIALIZE IN

Shop Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and more. Simply add a debit or credit card to buy and sell crypto instantly.

WANT TO BE ABLE TO TRADE MORE THAN JUST BITCOIN AND ETHEREUM?

Choose from 200+ supported cryptocurrencies, including Bitcoin, Ethereum, Link, Tezos, Cardano and Binance Coin while always being at the forefront of new coin launches.

IS IT SAFE?

Sad that this question still needs to be asked in the Bitcoin and crypto space, but we get it! At Binance, security is our highest priority when it comes to safeguarding your Bitcion and other cryptocurrencies. Your funds are protected by our Secure Asset Fund for Users (SAFU Funds) which means we have your back.

DID YOU KNOW YOU CAN EARN INTEREST ON YOUR BITCOIN & CRYPTO HOLDINGS? YOU CAN!

Earn money on your crypto and enjoy some of the highest interest rates on the market with Binance Savings & Staking. USD Stablecoin interest rates all over 5%. Can your traditional savings account beat that? No way.

WANT TO BE ALERTED WHEN PRICE MOVES ON CERTAIN COINS?

You can set price alerts with a single tap to stay up to date on the latest prices and trends.

ARE YOU A BEGINNER? WE GOT YOU. ARE YOU A PRO? WE HAVE A PLATFORM FOR THAT TOO.

New to crypto? Our Binance app’s mobile-first design lets you switch between Lite and Pro interfaces with a single tap. Keep it simple or access advanced trading features, all in one app.

LOOKING FOR RECURRING BUYS?

We’re making it easier than ever to buy crypto. Set a recurring buy to purchase Bitcoin and other crypto on a regular basis. You choose how much you want to buy and how often, and our Binance app does the rest!

LOOKING FOR A WAY TO SPEND YOUR CRYPTO? BINANCE CARD IS ROLLING OUT

Spend Bitcoin or BNB at over 50 million merchants worldwide when you sign up for the Binance Card. Available in select markets.

SEND AND RECEIVE CRYPTO INSTANTLY

Send and receive crypto from friends and family, to and from your Binance wallet with QR codes.

24/7 CUSTOMER SUPPORT

We’re always here to help, whether you’re a longtime user or just getting started. Access 24/7 live chat customer support in 8 languages (English, Chinese, Russian, Spanish, Portuguese, Turkish, Korean, and Vietnamese).

Binance signup:

0 notes

Link

868 notes

·

View notes

Link

This article compares 5 NFT Marketplaces.

2 notes

·

View notes

Text

Positive 🥰

#animals#sports#positivity#quotes#movies#health & fitness#forexmarket#forextrader#earn money#bitcoin trading#bitcion#investment

3 notes

·

View notes