#crosskeys

Explore tagged Tumblr posts

Text

#The Legend of Zelda#A Link to the Past#Randomizer#Retro#Crossworld Entrance Shuffle#Keysanity#Crosskeys#Fast Ganon#Retrance#ALttPR

0 notes

Text

The Corrib Folk "White Stone"

#lps#records#corrib#crosskey's#eire#ireland#banjo#mandolin#bodhran#vinyl#folk#folk music#irish music

17 notes

·

View notes

Text

How Can You Effectively Handle ConServe Collection Agency?

How to Handle ConServe Collection Agency: Effective Steps to Take!

How Can You Effectively Handle ConServe Collection

Agency?

If you're already feeling financially stressed, receiving a call from a debt

collector like ConServe can feel like a heavy burden, especially when

you’re not sure how to navigate the situation. But is there a way to handle

this without it escalating to legal action or a court case? Fortunately, there

are effective steps you can take to settle your debt for far less than what

you owe, and even avoid the risk of being sued. These steps are designed

to help you regain control of your finances and reach a favorable resolution

with ConServe Collection Agency, while minimizing the impact on your

financial future.

Who is ConServe Collection Agency?

ConServe Collection Agency, also known as Continental Service Group,

Inc., has been providing debt recovery services since 1985. Specializing in

accounts receivable management, they work with sectors like education,

government, and finance. ConServe focuses on ethical practices,

compliance, and efficient recovery strategies, ensuring high recovery rates

while treating consumers respectfully. Their approach is client-focused,

aiming to deliver customized solutions that generate positive results for

both clients and consumers.

What Does ConServe Collection Agency Do?

ConServe Collection Agency's main role is to help recover unpaid debts.

They do this by contacting consumers, either through phone calls, letters,

or other means, to attempt to settle overdue accounts. They often work with

businesses that have sold their delinquent accounts to ConServe, allowing

the agency to recover funds on their behalf. The collection process may

involve negotiating payment terms, setting up payment plans, or pursuing

legal action if needed.

ConServe Collection Agency Contact Information

If you need to get in touch with ConServe Collection Agency, here are the

details:

● Address: ConServe Collection Agency, 200 CrossKeys Office Park,

Fairport, NY 14450

● Phone Number: (800) 724-7500

● Email: Customer service email is often available through their

website.

● Website: www.conserve-arm.com

Is ConServe Collection Agency Legitimate or a Scam?

ConServe Collection Agency is a legitimate company and is legally allowed

to collect debts on behalf of creditors. However, there have been instances

where consumers have felt misled or harassed by the agency. If ConServe

is contacting you about a debt, it's important to verify the legitimacy of the

debt and request proper documentation.

The History of ConServe Collection Agency

Founded in 1981, ConServe has been in the business of debt collection for

over four decades. They are a reputable agency with a strong foothold in

both the private and public sectors. While ConServe is a legitimate debt

collection agency, its aggressive tactics and customer service issues have

contributed to a negative reputation in some circles.

ConServe Collection Agency Complaints

& Customer Reviews

ConServe Collection Agency has received a significant number of

complaints, particularly regarding aggressive collection tactics, inaccurate

debt claims, and poor communication. Below is an organized summary of

consumer feedback from sources such as Google Reviews and the Better

Business Bureau (BBB).

● Total Complaints in the Last 3 Years: 104

● Common Complaints:

○ Harassment and excessive calls

○ Failure to verify debt

○ Inaccurate credit reporting

○ Unauthorized personal data disclosure

○ Failure to honor bankruptcy discharges

1. Harassment & Aggressive Collection Tactics

Many consumers have reported feeling harassed by ConServe’s frequent

calls and aggressive collection practices. Some claim the agency continues

to contact them even after requesting written communication or verification

of the debt.

Customer Review (Google Review, 2024):

"They call non-stop, even after I requested they communicate by

mail. I had to block their number to get any peace. They are

relentless and rude."

Customer Review (BBB, 2023):

"I asked them to stop calling me because I don't owe this debt.

They ignored my request and even contacted my workplace."

2. Debt Verification Issues & Disputed Claims

Some consumers state that ConServe failed to provide proper

documentation proving they owe the debt in question. Others claim they

have no recollection of the debt and have never received a contract or

official notice.

Customer Review (BBB, 2024):

"This debt they claim I owe has no proof from the state. I was

homeless for six months and had no address or income. How

could I owe this? They need to verify properly before harassing

people."

Customer Review (Google Review, 2023):

"I asked for a debt validation letter, and instead of proving I owed

the money, they kept demanding payment. Completely

unprofessional."

3. Credit Report Inaccuracies & Charge-Off Issues

Multiple complaints involve incorrect information appearing on credit

reports due to ConServe, including inaccurate balances, incorrect dates,

and unauthorized charge-offs.

Customer Review (BBB, 2024):

"This account on my credit report looks completely off. The last

date of activity and payment is incorrect. Everything about this is

wrong. They need to delete this from my report ASAP!"

Customer Review (Google Review, 2023):

"I disputed a charge ConServe added to my credit report. They

claimed I had missed payments when I never even had an

account with them!"

4. Privacy Violations & Unlawful Disclosure of Personal

Information

Some consumers claim ConServe violated privacy laws by disclosing

sensitive personal information without consent, particularly in states with

stricter regulations like New York (NY Privacy Act).

Customer Complaint (BBB, 2024):

"They failed to safeguard my private information, including my

Social Security number, which was shared with third parties

without my permission. This is a serious violation of my privacy

rights."

5. Bankruptcy Discharge Ignored

Several individuals who have filed for bankruptcy report that ConServe

continued to pursue collection efforts even after debts were legally

discharged.

Customer Complaint (BBB, 2024):

"I received a call in September 2024 about a debt that was

discharged in my Chapter 7 bankruptcy. I provided proof, but they

kept insisting I owed the money. This is illegal!"

Customer Complaint (Google Review, 2023):

"This debt was listed on my bankruptcy case, yet ConServe

refuses to acknowledge it. I disputed it, but they never

responded."

6. Poor Customer Service & Unresponsive Dispute

Process

Many customers express frustration over ConServe’s lack of

responsiveness to disputes and poor customer service. Some claim

they never received a response after submitting complaints.

Customer Complaint (BBB, 2023):

"I disputed a debt, and they never got back to me. Months later,

they sent another letter demanding payment with no explanation."

Customer Complaint (Google Review, 2023):

"The representatives are unhelpful and rude. I asked for an

explanation about my debt, and all they said was 'just pay it or

we'll report you.'"

While some individuals successfully resolve their debts with ConServe, a

large number of consumers have raised concerns about aggressive

tactics, inaccurate credit reporting, and poor customer service. If you

are dealing with ConServe Collection Agency, consider:

✅ Requesting Debt Validation in Writing

✅ Filing a Complaint with the CFPB or BBB if Necessary

✅ Monitoring Your Credit Report for Inaccuracies

✅ Seeking Legal Assistance if Your Rights Are Violated

Why Does ConServe Collection Agency Have So Many

Complaints?

Many complaints related to ConServe stem from aggressive collection

tactics. Some consumers report harassment through frequent phone calls

and aggressive pursuit of payment for debts that they don’t owe or don’t

remember. Others complain about a lack of transparency in terms of debt

validation, where the agency fails to provide clear documentation of the

debt or its origin.

Why Is ConServe Calling Me?

ConServe may be calling you if they are attempting to collect a debt that

they have purchased or are managing on behalf of a creditor. If you are

unsure why they are contacting you, it's your right to request information

about the debt they are trying to collect.

Why Is ConServe So Aggressive?

ConServe's aggressive tactics may stem from the nature of the debt

collection industry, where agencies are often incentivized to recover money

as quickly as possible. However, this approach can result in consumers

feeling harassed, which is why many complaints focus on their aggressive

methods.

Why Is ConServe on My Credit Report?

If ConServe is listed on your credit report, it could mean that they have

purchased your delinquent debt or are managing it on behalf of another

creditor. The debt may have been sold to them after being reported as

delinquent for a certain period. If you are uncertain about the debt, you

have the right to dispute it and ask for proof.

Will ConServe Report to Credit Bureaus?

ConServe can report your debt to the credit bureaus if they are the agency

managing your account. This could negatively affect your credit score if the

debt remains unpaid. However, if you dispute the debt and it is found to be

inaccurate, it may be removed from your credit report.

Can You Dispute Debt Sold to ConServe?

Yes, you have the right to dispute the debt sold to ConServe. If you believe

the debt is inaccurate, you should send a dispute letter to ConServe

requesting verification of the debt. They are legally obligated to provide

documentation that proves you owe the debt. If they cannot validate the

debt, they must stop attempting to collect.

Understanding Unfair Debt Collection Practices: How

to Protect Your Rights

Dealing with debt collectors can be stressful, especially when their tactics

cross the line into harassment or unethical behavior. But what exactly

constitutes unfair debt collection practices? Let’s explore common

concerns and key legal protections you have when dealing with ConServe

Collection Agency.

1. Can ConServe Use Profanity or Abusive Language?

No. Under the Fair Debt Collection Practices Act (FDCPA), debt

collectors—including ConServe Collection Agency—are prohibited from

using obscene, profane, or abusive language. They cannot call you

derogatory names or use threats to intimidate you. Any such behavior is

not only unprofessional but also illegal.

2. Can ConServe Contact You Repeatedly by Phone?

Debt collectors are not allowed to harass or annoy you with excessive

calls. While there isn’t a strict limit on the number of times they can call,

the FDCPA prohibits repeated or continuous calls intended to pressure or

distress you. If you feel overwhelmed by frequent calls, you have the right

to request they stop.

3. Can ConServe Discuss Your Debt with Others?

No. Debt collectors cannot share details about your debt with unauthorized

individuals, such as family, friends, or employers. They are only allowed to

provide basic information (like their name and contact details) and only if

specifically requested. Any unauthorized disclosure of your debt is a

violation of federal law.

4. Can ConServe Threaten Legal Action Without Intent

to Sue?

Debt collectors cannot threaten lawsuits unless they genuinely intend

to follow through. Any threats of legal action must be legitimate. If

ConServe suggests legal consequences without taking actual steps toward

filing a case, they may be engaging in deceptive practices, which are

illegal.

5. Can ConServe Misrepresent Themselves?

No. Debt collectors must clearly identify themselves and their purpose

when contacting you. They cannot pose as attorneys, law enforcement

officers, or government officials to pressure you into paying. Any

misrepresentation of their identity or authority is a direct violation of the

FDCPA.

6. Can ConServe Falsely Threaten to Report to Credit

Bureaus?

Debt collectors are required to report accurate information to credit

bureaus. ConServe cannot falsely claim they will report your debt or

threaten to provide misleading information. If they knowingly provide

false credit information, it is an FDCPA violation.

7. Can ConServe Threaten Arrest or Physical Harm?

Absolutely not. No debt collector has the authority to have you arrested

for unpaid debts. They also cannot threaten you with violence or bodily

harm. While legal actions like wage garnishment can occur in some

cases, intimidation and coercion are strictly illegal.

8. Can ConServe Send False or Misleading Notices?

Debt collectors cannot send deceptive or misleading letters designed to

look like official government or court documents. Any attempt to trick or

intimidate you through false notices is illegal. If you receive a

suspicious letter, review it carefully and request validation of the debt.

9. What Additional Fees Can Be Added to Your Debt?

Collection agencies cannot add extra fees or interest unless your

original contract specifically allows for them or a court has authorized

additional costs. If you notice extra charges that weren’t part of your

original debt agreement, you have the right to dispute them.

10. Can ConServe Demand Post-Dated Checks or

Debit Card Payments?

While debt collectors may request a payment arrangement, they cannot

demand post-dated checks or debit card information without your

consent. If you agree to a payment plan, ensure you receive all terms in

writing before providing any financial details.

11. Can You Stop ConServe from Contacting You?

Yes. You have the legal right to request that ConServe stop contacting

you. Sending a formal "Cease and Desist" letter should halt further

communication, except for updates regarding any legal action. Keep a copy

of your request for your records.

Empower Yourself Against Debt Collectors

Navigating debt collection can be challenging, but having the right

information and tools makes all the difference. That’s why I created the

MyDebtRep.com E-Book, “How To Stop A Collection Agency,” an

easy-to-follow guide designed to help you:

✅ Understand your rights under the FDCPA

✅ Respond to collection agencies confidently

✅ Stop harassment and unfair debt collection tactics

✅ Dispute inaccurate debts and protect your credit

For just $29.95, you’ll gain instant access to step-by-step strategies,

ready-to-use templates, and expert insights to take control of your

financial future.

Take the first step toward financial freedom today!

Visit MyDebtRep.com to learn more.

Can ConServe Collection Agency Garnish My Wages?

Yes, ConServe Collection Agency can pursue wage garnishment, but only

after following specific legal procedures. Here’s what you need to know

about the process and your rights:

1. A Court Judgment is Required

Before ConServe can garnish your wages, they must first sue you, win the

case, and obtain a court judgment. If they succeed, a judge may issue a

wage garnishment order.

2. Exceptions to the Rule

Certain debts, like federal student loans, unpaid child support, and some

tax obligations, can be garnished without a court judgment.

3. State Laws on Wage Garnishment

Each state has its own laws regulating garnishment, including limits on the

percentage of wages that can be taken. Some states even prohibit certain

types of garnishment.

4. Limits on How Much Can Be Taken

Federal law caps wage garnishment at 25% of your disposable income

or the amount exceeding 30 times the federal minimum wage—whichever

is lower. Some states have stricter limits.

5. Your Rights and Protections

● You must be notified of any lawsuit and judgment before garnishment

begins.

● Certain income sources, like Social Security and disability benefits,

are generally exempt.

● You can dispute the garnishment in court if you believe it was done

improperly.

The Garnishment Process After a Judgment

Once ConServe has a judgment, here’s what might happen:

1. You Receive a Summons & Complaint – You’ll be notified that

ConServe is suing you and have a limited time (often 20-30 days) to

respond.

2. Your Right to Fight Back – If you don’t respond, ConServe may win

by default, allowing them to garnish wages, freeze bank accounts, or

take other legal actions.

3. Garnishment or Other Collection Methods Begin – If the court

rules in their favor, they can garnish wages, seize bank accounts, or

place liens on your property.

Additional Actions ConServe Can Take if They Win a

Judgment

● Wage Garnishment – A portion of your paycheck is deducted until

the debt is paid.

● Bank Account Garnishment – They may freeze and withdraw funds

from your account (some funds, like Social Security, may be exempt).

● Property Liens – They can place a lien on your home or vehicle,

restricting your ability to sell or refinance.

● Asset Seizure – In some states, they may take personal property to

cover the debt.

● Post-Judgment Interest – The debt may continue to grow with

interest.

● Financial Disclosure Requests – They can ask the court to compel

you to disclose assets and income.

How to Protect Yourself

● Verify the Debt – Ensure the debt is valid and hasn’t passed the

statute of limitations.

● Negotiate a Payment Plan – Many collectors will accept settlements

or payment arrangements.

● Challenge the Judgment – If the judgment was obtained unfairly,

you can appeal or request it be vacated.

● Seek Legal Help – An attorney can help you explore options to

protect your income and assets.

● Consider Bankruptcy (as a Last Resort) – Bankruptcy can stop

garnishment and potentially discharge the debt.

If you’re dealing with a ConServe lawsuit or garnishment, seeking

professional advice can help you understand your rights and take the best

course of action.

What Can I Do?

Take Control of Your Debt with MyDebtRep.com’s E-Book: "How to

Stop a Collection Agency"

If you're struggling with debt collectors, you’re not alone. The

MyDebtRep.com E-Book, "How to Stop a Collection Agency," written

by a former debt collector, is your step-by-step guide to navigating debt

collection challenges with confidence. Packed with essential tools, expert

insights, and actionable strategies, this resource empowers you to take

control of your financial future.

What You’ll Learn:

✅ How to Stop Harassing Calls & Letters – Learn how to legally

demand that collectors stop contacting you.

✅ How to Verify Debt Legitimacy – Understand your rights and request

a Debt Validation Letter to ensure the debt is valid.

Why Choose This Debt Relief Guide?

📖 Easy-to-Follow, Step-by-Step Instructions

Simplifies the debt relief process so you can take action immediately.

📝 Professionally Crafted Legal Forms

Includes ready-to-use templates to send Cease & Desist requests and

Debt Validation Letters.

💡 Insider Knowledge from a Former Debt Collector

Gain expert insights on how collection agencies operate and how to

counter their tactics.

💰 Save Money on Legal Fees

Avoid expensive attorney costs by using proven negotiation and dispute

strategies.

⚖️ Protect Your Financial Rights – Understand the Fair Debt Collecti

Practices Act (FDCPA) and how to use it to your advantage.

What’s Included with Your Purchase?

✔️ Step-by-Step Guidance – Handle debt collectors with clarity a

confidence.

✔️ Essential Legal Templates – Professionally written letters to challen

debt claims and stop harassment.

✔️ Proven Negotiation Tactics – Learn how to settle debts on your ter

without intimidation.

✔️ Instant Digital Access – Get all the tools you need immediately aft

purchase.

Take Back Control of Your Finances – Only $29.95

Don't let debt collectors dictate your life. With this expert guide, you’ll have

the knowledge and tools to protect yourself, challenge unfair claims, and

regain financial stability.

🚀 Get Instant Access Now & Take Your First Step Toward Debt

Freedom!

Purchase the E-book here: https://tinyurl.com/bdsadm5t

#medicaldebt #creditcarddebt #creditrepair #unitedstates #fdcpa #knowyourrights #CreditRepair #Credit #CreditScore #CreditRestoration #FinancialFreedom #Business #CreditCard #BadCredit #DebtRelief #FinancialFreedom #DebtCollectors #StopCollectionCalls #DebtHelp #MoneyManagement #TakeControl #EndDebtStress #DebtSolutions #FixYourCredit #debtcollector #debtfreecommunity #collectionagency

#medicaldebt#creditcarddebt#creditrepair#unitedstates#fdcpa#knowyourrights#CreditRepair#Credit#CreditScore#CreditRestoration#FinancialFreedom#Business#CreditCard#BadCredit#DebtRelief#DebtCollectors#StopCollectionCalls#DebtHelp#MoneyManagement#TakeControl#EndDebtStress#DebtSolutions#FixYourCredit#debtcollector#debtfreecommunity#collectionagency

0 notes

Text

Brogor

MARCH 10TH, 2024 | 01:25:17 | S5:E10

EPISODE SUMMARY

Two-Sixteen podcast Season 5 Episode 10 with Brogor

EPISODE NOTES

Brogor joins the Two-Sixteen podcast to talk all about his gaming history, his introduction to A Link to the Past Randomizer, and how he approaches and handles tilt. telethar and humbugh members of Nick "Hera Basement" Cage and winners of the 216 Co-op Crosskeys Tournament also join the show to chat about their experiences throughout the tournament.

Follow Brogor on Twitch

Download Episode ___ 216 is hosted by fearagent & engineered by Laoria

0 notes

Photo

New poem out today @Crow&CrossKeys ~*~*~* Maybe my shortest, dirtiest poem yet

For better clarity, read it here!

0 notes

Text

0 notes

Photo

Properly local - my @universityofleeds #mug now at home at the Cross Keys 🍺 . #iPhone #shotoniphone #iphoneography #iphone8 #iphone8plus . #Wiltshire #igerswiltshire #frome #england #britain #southwest #travelgram #swisbest #piccotheday #world #uk . #local #lovelyevening #pewter #mug #bluesky #spring #pub #village #gastropub #restaurant #lovelyday #crosskeys @leedsalumni (at Cross Keys Inn Corsley)

#pewter#lovelyevening#bluesky#local#iphone8#restaurant#world#village#england#wiltshire#frome#iphone#spring#southwest#mug#gastropub#pub#iphoneography#crosskeys#piccotheday#swisbest#igerswiltshire#iphone8plus#uk#britain#shotoniphone#travelgram#lovelyday

3 notes

·

View notes

Photo

Shop @shop.taken this weekend! Local Maryland artists along with our vintage furniture is on display. Check it out before it's too late.😎 #shoptaken #crosskeys #shopcrosskeys #vintageshop #localshop #handmade #marylandpride #marylanddecorator #maryland #shoplocal #shopsmall #marylanddesigner #605mod (at The Village of Cross Keys)

#shopsmall#marylanddesigner#shopcrosskeys#marylanddecorator#maryland#shoplocal#crosskeys#shoptaken#marylandpride#605mod#handmade#vintageshop#localshop

1 note

·

View note

Photo

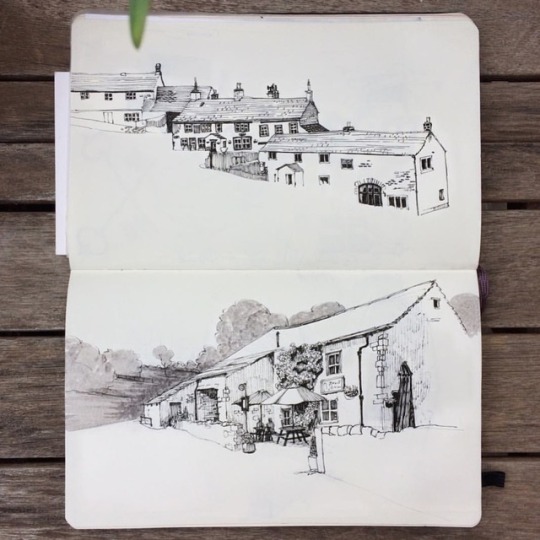

Abbots Harbour #banknewton #northyorkshire #uk #illustration #skipton #crosskeys #art #moleskine #dailysketch #antonmarrast #barnoldswicktoleeds #pendrawing #canals #narrowboats

#barnoldswicktoleeds#antonmarrast#narrowboats#canals#banknewton#skipton#illustration#uk#crosskeys#art#pendrawing#dailysketch#moleskine#northyorkshire

6 notes

·

View notes

Text

#The Legend of Zelda#A Link to the Past#Randomizer#Retro#Crosskeys#Crossworld Entrance Shuffle#Keysanity#Fast Ganon#ALttPR

0 notes

Text

Negs Soaked Again

Found a box in the shed containing some old photos, negs and slides half filled with water again. I recovered these photos once before when they got soaked in the shed at Weedon House. Not greatly important photos, they’re probably saved digitally elsewhere – but I still don’t like loosing these originals.

The one lot of slides are those from the Phoenix Grand Prix 1988 – which was Schumachers…

View On WordPress

0 notes

Photo

Prowling

#benedict cumberbatch#sherlock#dartmoor photoshoot#at the crosskeys inn#looking all mysterious...#hounds of the baskerville

381 notes

·

View notes

Text

Tournament Roundtable

JUNE 24TH, 2023 | 01:50:46 | S4:E8

EPISODE SUMMARY

Two-Sixteen podcast Season 4 Episode 8 Tournament Roundtable with Alaszun, drossy, Sab0tender and AdirondackRick

EPISODE NOTES

fearagent invited the Crosskeys, League and Main Tournament admins on the show to discuss the ins and outs of running one of the three big tournaments, how the different modes are chosen, their opinions on asyncs in their respective tournaments and much more!

Follow AdirondackRick on Twitch Follow Alaszun on Twitch Follow drossy on Twitch Follow Sab0tender on Twitch

Join the 216 Discord!

Download Episode

0 notes

Photo

After seeing Isle of Dogs at the weekend, I’ve been in the mood for all things Wes Anderson. So this week’s #wednesdaypattern is inspired by The Grand Budapest Hotel, because I’m getting ready to plan my next big escape – although I don’t think I’ll find anywhere half as charming as M. Gustave’s stomping ground. #keys #hotel #grandbudapesthotel #wesanderson #mgustave #crosskeys #societyofthecrossedkeys #film #movie #pastel #illustration #illustrator #digitaldrawing #colour #pattern #patterndesign #design #designer #repeatingpattern

#grandbudapesthotel#digitaldrawing#designer#colour#pastel#repeatingpattern#film#pattern#hotel#movie#crosskeys#wednesdaypattern#mgustave#illustration#patterndesign#design#societyofthecrossedkeys#illustrator#keys#wesanderson

0 notes

Text

Scrolling through the crosskeys location on Instagram, found this little gem:

Credit to OP Anna

11 notes

·

View notes

Video

tumblr

New Work Chanel Beauty Wearable Smokey Eye with Victoria Bond and Hannah Crosskey Eyes Collection 2018 - Easy to Wear Eye Eyes prep with La Base Ombres a Paupieres. Stylo Ombré et Contour in Electric brown into lash line thickly and blended onto lid and under the eye. Follow with Rouge Noir colour into waterline to create definition but without being harsh like black. Then follow with Les 4 Ombré Eyeshadow in Mystere et Intensite Using the gold colour first blend all over the lid and under the eye. Use quite a lot to create extra drama. Then follow with the burgundy colour but blend on the outer colour of the eye and underneath. Finish with loads of Le Volume Revolution De Chanel in Noir Leave lips natural with just a bit of Chanel Hydra Beauty Nutrition lip balm

1 note

·

View note